Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K RE INVESTOR PRESENTATION 07.27.10 - JUNIPER PHARMACEUTICALS INC | form8k.htm |

1

Corporate Presentation August 2010

Frank Condella, President and CEO

Larry Gyenes, CFO

2

This presentation contains forward-looking statements, which statements are indicated by the words

“may,” “will,” “plans,” “believes,” “expects,” “anticipates,” “potential,” and similar expressions. Such

forward-looking statements involve known and unknown risks, uncertainties, and other factors that may

cause actual results to differ materially from those projected in the forward-looking statements.

“may,” “will,” “plans,” “believes,” “expects,” “anticipates,” “potential,” and similar expressions. Such

forward-looking statements involve known and unknown risks, uncertainties, and other factors that may

cause actual results to differ materially from those projected in the forward-looking statements.

Factors that might cause future results to differ include, but are not limited to, the following: the

successful marketing of CRINONE® (progesterone gel) by Watson Pharmaceuticals, Inc., in the United

States; the successful marketing of CRINONE by Merck Serono outside the United States; the timely

and successful completion of the ongoing Phase III PREGNANT (PROCHIEVE® (progesterone gel)

Extending Gestation A New Therapy) Study of PROCHIEVE 8% to reduce the risk of preterm birth in

women with a short cervix at mid-pregnancy; successful development of a next-generation vaginal

progesterone product; success in obtaining acceptance and approval of new products and new

indications for current products by the United States Food and Drug Administration and international

regulatory agencies; the impact of competitive products and pricing; the timely and successful

negotiation of partnerships or other transactions; the strength of the United States dollar relative to

international currencies, particularly the euro; competitive economic and regulatory factors in the

pharmaceutical and healthcare industry; general economic conditions; and other risks and

uncertainties that may be detailed, from time-to-time, in Columbia’s reports filed with the SEC.

successful marketing of CRINONE® (progesterone gel) by Watson Pharmaceuticals, Inc., in the United

States; the successful marketing of CRINONE by Merck Serono outside the United States; the timely

and successful completion of the ongoing Phase III PREGNANT (PROCHIEVE® (progesterone gel)

Extending Gestation A New Therapy) Study of PROCHIEVE 8% to reduce the risk of preterm birth in

women with a short cervix at mid-pregnancy; successful development of a next-generation vaginal

progesterone product; success in obtaining acceptance and approval of new products and new

indications for current products by the United States Food and Drug Administration and international

regulatory agencies; the impact of competitive products and pricing; the timely and successful

negotiation of partnerships or other transactions; the strength of the United States dollar relative to

international currencies, particularly the euro; competitive economic and regulatory factors in the

pharmaceutical and healthcare industry; general economic conditions; and other risks and

uncertainties that may be detailed, from time-to-time, in Columbia’s reports filed with the SEC.

All forward-looking statements contained herein are neither promises nor guarantees. Columbia does

not undertake any responsibility to revise or update any forward-looking statements.

not undertake any responsibility to revise or update any forward-looking statements.

3

} Frank C. Condella, Jr. - President and CEO, Director

◦ Chairman of SkyePharma

◦ Formerly CEO of SkyePharma; European President of IVAX Corporation;

CEO of Faulding Pharmaceutical Co.; Vice President, Roche Laboratories

CEO of Faulding Pharmaceutical Co.; Vice President, Roche Laboratories

} Lawrence A. Gyenes - SVP, CFO & Treasurer

◦ Formerly CFO at Acusphere, Zila, Savient & Reliant; 15 years at Searle

} Michael McGrane - SVP, General Counsel and Secretary

◦ Formerly General Counsel, The Liposome Co.; Novartis Consumer Health

} George W. Creasy, MD - VP, Clinical Research & Development

• Fellow of the American College of Obstetricians and Gynecologists

• Formerly spent 16 years Johnson & Johnson

4

} Successful specialty pharmaceutical company

leveraging our bioadhesive drug delivery system and

clinical expertise to develop proprietary products

leveraging our bioadhesive drug delivery system and

clinical expertise to develop proprietary products

} Marketed products:

◦ CRINONE® 8% progesterone vaginal gel

– Sold worldwide for use in infertility treatments

– Marketed by Watson (US) and Merck Serono (RoW)

◦ STRIANT® testosterone buccal system

– Testosterone replacement for hypogonadal men

– Marketed by Columbia (US), The Urology Company (UK) &

Sandoz (Italy)

Sandoz (Italy)

5

} Concurrent transactions closed 7/2/2010

} Watson acquired:

◦ CRINONE/PROCHIEVE and related progesterone assets

◦ 11.2 million shares CBRX common stock

◦ Watson assumed responsibility for all US sales,

marketing & distribution activities

marketing & distribution activities

◦ Next generation development activities

} $56m debt retired

◦ $16m secured loan note

◦ $40m convertible notes

6

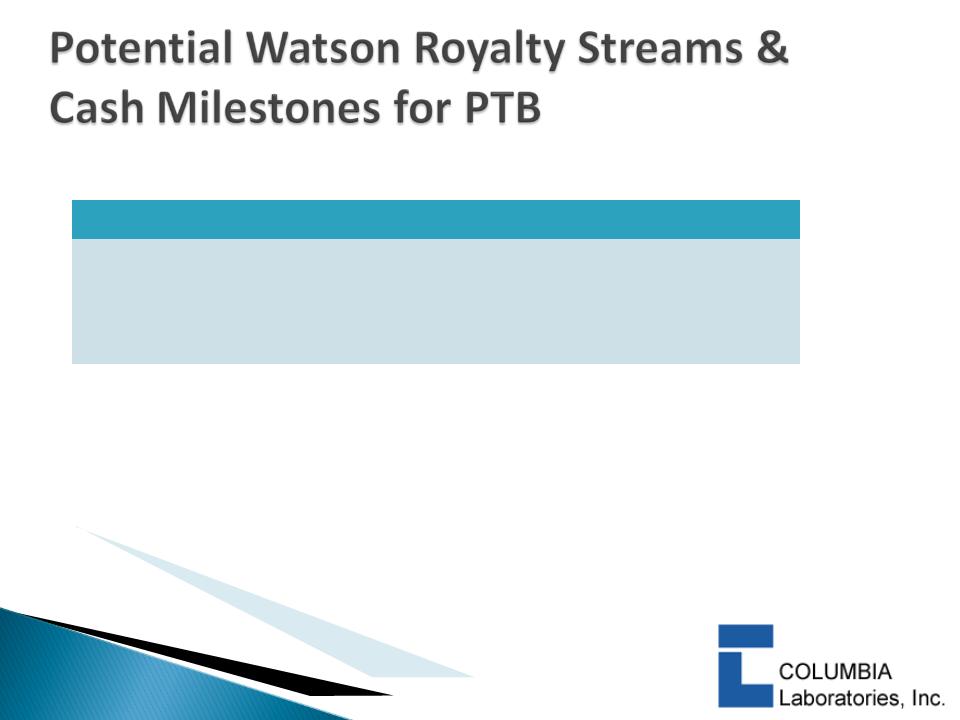

} Watson Transaction:

◦ $62m upfront for assets

◦ Royalties:

– 10% on sales up to $150m

– 15% on sales between $150m and $250m

– 20% on sales above $250m

◦ Pre-term Birth Study milestones:

– $6m or $8m on successful PREGNANT study outcome

– $5m on FDA acceptance of NDA

– $30m on U.S. commercial launch for preterm birth

– $2.5m on European regulatory submission and launch

◦ Watson will fund life-cycle management program

7

} $16m PharmaBio secured note:

◦ Paid with cash

} $40m 8% Notes Convertible @ $5.25 per share

◦ $26m of cash

◦ 7.4m shares of CBRX common stock issued @ $1.35*

◦ 7.75m warrants exercisable @ $1.35 per common share

*Repurchased 3.3m of 7.4m common shares on 8/9/10 @ $0.90

per share

per share

8

9

|

Nasdaq: CBRX

|

|

|

Recent market price (8/09/2010)

|

$1.06

|

|

Shares Outstanding

|

80.8 million

|

|

Market capitalization

|

$85.6 million

|

|

Cash and equivalents (8/09/2010)

|

$22.0+ million

|

|

Debt (8/09/2010)

|

$0.00

|

10

11

|

|

|

|

Revenues

|

$16.0

|

|

Cost of Revenues

|

5.6

|

|

Gross Profit

|

$10.4

|

|

S, G & A

|

7.6

|

|

R & D

|

2.8

|

|

Operating Inc

|

$0.0

|

|

Other Inc/Tax Benefits

|

0.4

|

|

Net Inc (Loss)

|

$0.5

|

|

|

|

12

Cash Milestones:

Ø$6m or $8m on successful PREGNANT study outcome

Ø$5m on FDA acceptance of NDA

Ø$30m on commercial launch for preterm birth

Ø$2.5 for European regulatory submission and launch

|

|

$50M

|

$100M

|

$250M

|

$500M

|

|

Royalties

@ Different Sales Levels |

$5M

|

$10M

|

$30M

|

$80M

|

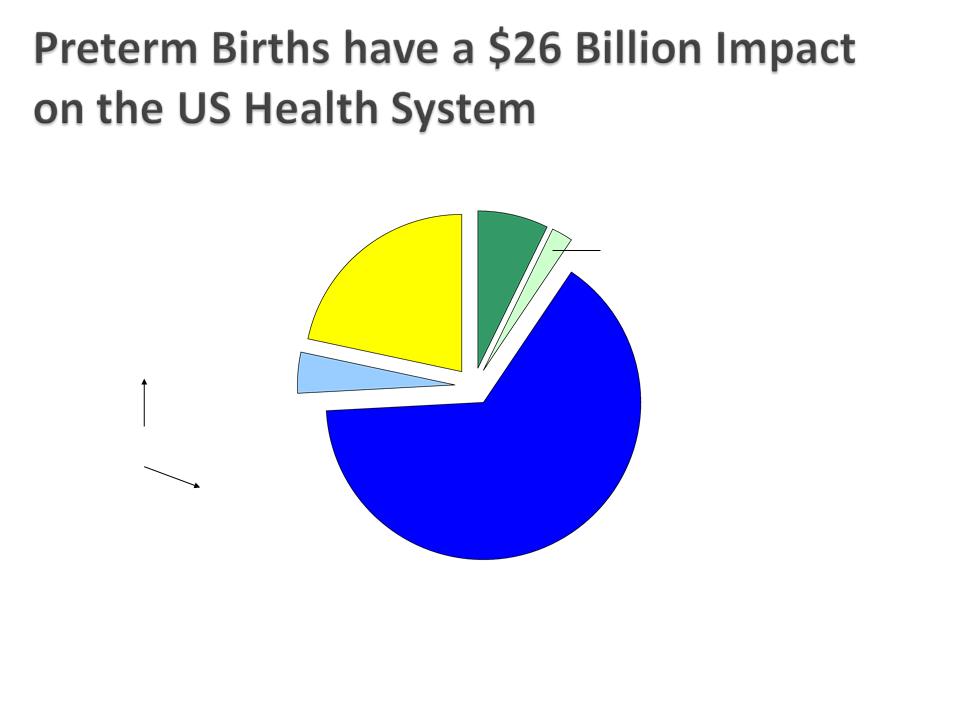

13

Behrman RE et al. in: Behrman RE, Butler AS, eds. Preterm Birth: Causes, Consequences,

and Prevention. Washington, DC: The National Academies Press; 2006:329-354.

and Prevention. Washington, DC: The National Academies Press; 2006:329-354.

Lost household and

market productivity

market productivity

$5.7 billion

Maternal delivery costs

$1.9 billion

Children’s early intervention

services

services

$611 million

Infant Costs

Special education services

$1.1 billion

Medical care services

$16.9 billion

~$51,600 per Preterm Infant

15

} Studies have shown that “short cervix” is the most

powerful predictor of preterm birth

powerful predictor of preterm birth

◦ The risk of spontaneous preterm delivery increases as

cervical length (CL) decreases

cervical length (CL) decreases

} To assess risk, cervical length measurements must

be taken at mid-pregnancy (18-22 weeks)

be taken at mid-pregnancy (18-22 weeks)

◦ Transvaginal ultrasound

} A cervical length of <3.0cm is considered “short”

} The shorter the cervix at mid-pregnancy, the higher

the risk of PTB

the risk of PTB

16

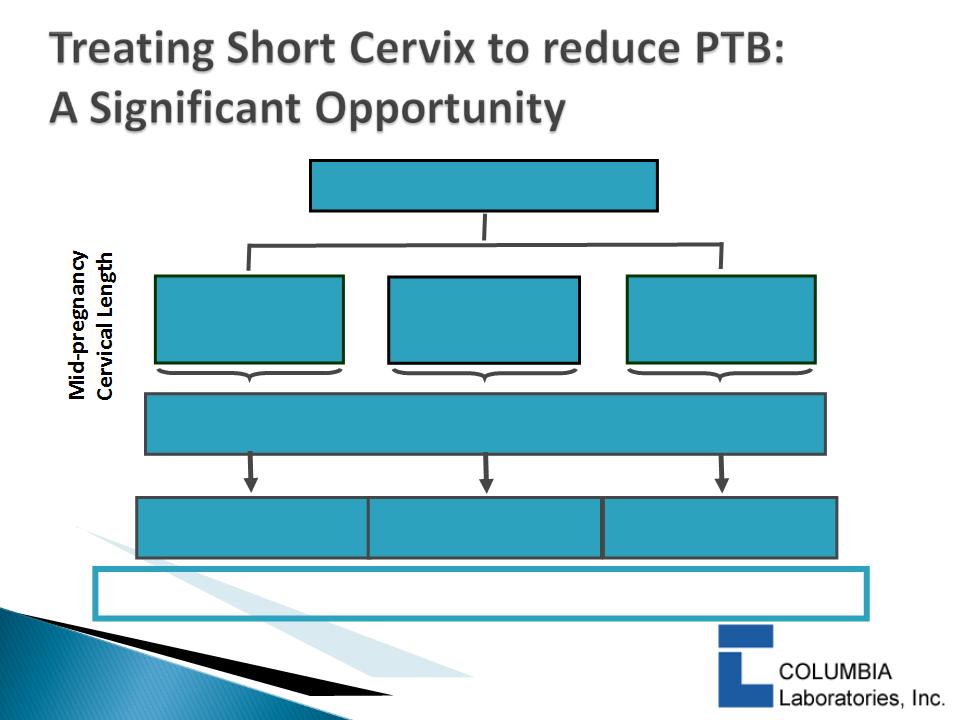

$1.7+ Billion Total US Market Opportunity

$225+ million market

potential

potential

4.3 Million Births Annually

>2.5 - 3.0 cm

(20%)

(20%)

$1.1+ billion

market potential

> 2.0 - 2.5 cm

(6%)

(6%)

1.0 - 2.0 cm

(4%)

(4%)

$340+ million market

potential

potential

16 weeks X $83.31 week =

$1,333 per patient (at current price levels)

17

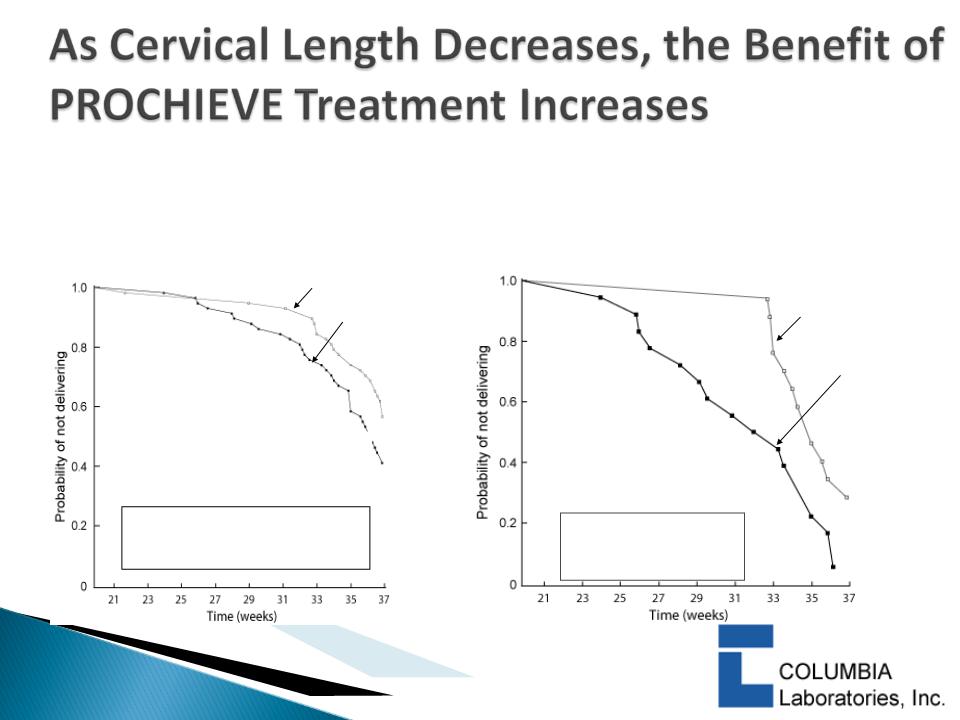

} To & Nicolaides 2006: Short cervix is the most important single

predictor of PTB

predictor of PTB

} Fonseca & Nicolaides 2007: Women with a short cervix

responded to vaginal progesterone therapy

responded to vaginal progesterone therapy

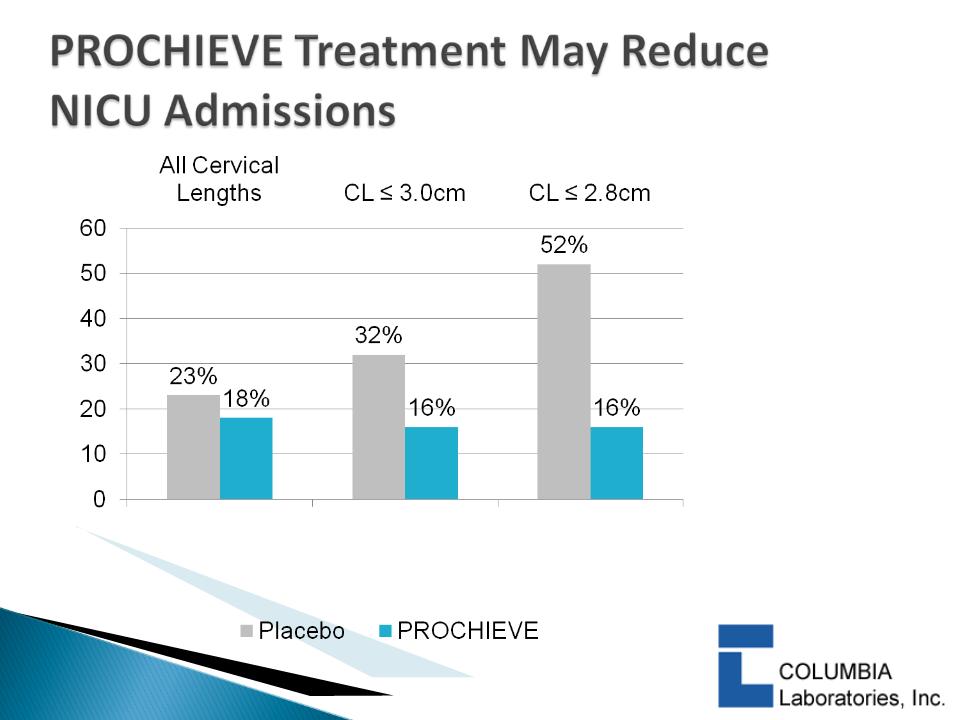

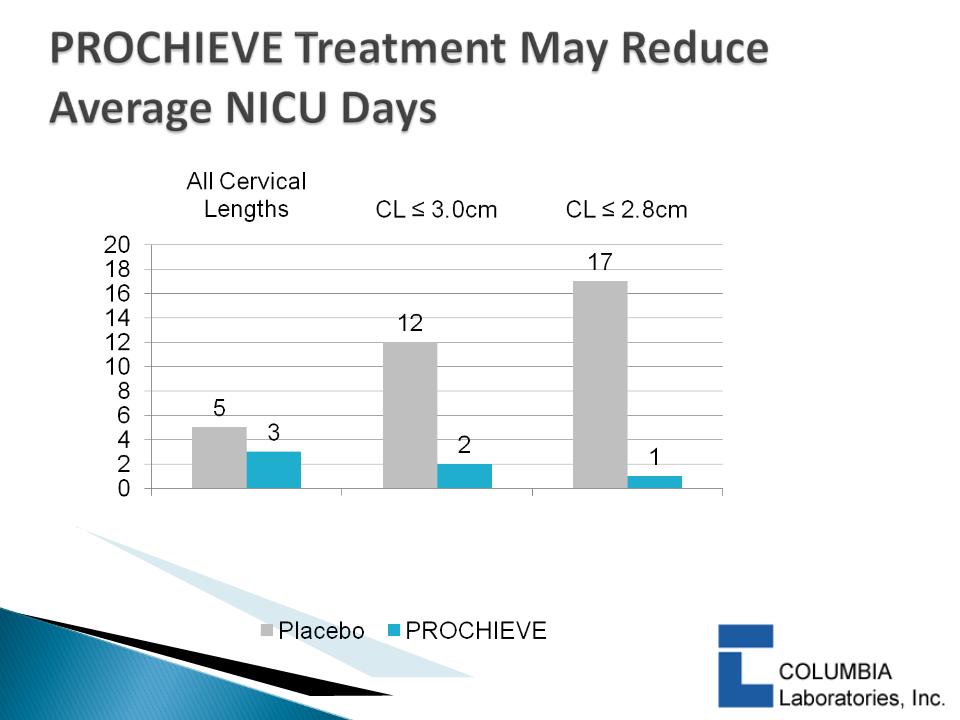

} DeFranco 2007:

◦ PROCHIEVE 8% use was associated with a statistically significant

reduction in PTB in women with CL ≤ 3.0 cm & < 2.8 cm

reduction in PTB in women with CL ≤ 3.0 cm & < 2.8 cm

◦ PROCHIEVE 8% improved infant outcomes1 in women with

baseline CL < 2.8 cm

baseline CL < 2.8 cm

– Statistically significant reduction in Neonatal Intensive Care Unit

(NICU) admissions

(NICU) admissions

– Statistically significant reduction in average NICU days

1 First study to show this

18

progesterone

placebo

33 investigators

n=116 (58 Prochieve, 58 Placebo)

Baseline Cervical Length ≤ 3.0 cm

Baseline Cervical Length < 2.8 cm

progesterone

placebo

22 Investigators

N=46 (19 Prochieve, 27 Placebo)

Fishers Exact Test

at <32 weeks*:

at <32 weeks*:

(p = 0.014)

At ≤ 32 Weeks no Preterm Births were seen with PROCHIEVE® vs. 29.6% on Placebo

The Kaplan-Meier method was

used for calculation; (Wilcoxon

P = 0.043).

used for calculation; (Wilcoxon

P = 0.043).

DeFranco et al, Ultrasound Obstet

Gynecol. 2007; 30: 697-705.

Gynecol. 2007; 30: 697-705.

19

p=0.016

p=0.077

p=0.16

DeFranco et al, Ultrasound Obstet

Gynecol. 2007; 30: 697-705.

Gynecol. 2007; 30: 697-705.

20

p=0.013

p=0.026

p=0.05

DeFranco et al, Ultrasound Obstet

Gynecol. 2007; 30: 697-705.

Gynecol. 2007; 30: 697-705.

21

} Phase III clinical trial with PROCHIEVE 8%

◦ Double-blind, placebo controlled

◦ Enrolled 465 pregnant women with cervical length 1.0-2.0cm

◦ 40+ centers (US & abroad)

◦ Primary endpoint: a reduction in preterm births at ≤32 6/7

weeks vs. placebo

weeks vs. placebo

◦ Improved infant outcomes important secondary endpoint

} NIH co-sponsor

◦ Validates science and design of trial

22

} Enrollment complete June 2010

} Last infant is born Q4 2010

} Report study outcomes Around Y/E 2010

} File with FDA* 2011

} FDA decision* 2011/2012**

*Assuming positive outcome

**PDUFA limits review time to 10 months;

could shorten to 6 months if granted

priority review

could shorten to 6 months if granted

priority review

23

24

} Solid track record in development of women’s health

products:

products:

◦ Bioadhesive products

◦ Vaginal delivery systems

} Unique expertise in clinical development in PTB

} Proven ability to design and successfully manage

complex global development projects, including

collaboration with NIH

complex global development projects, including

collaboration with NIH

} Expertise in utilizing technology platform in multiple

therapeutic areas

therapeutic areas

25

} Progesterone delivery (2013)*

} Progressive hydration for extended release (2019)

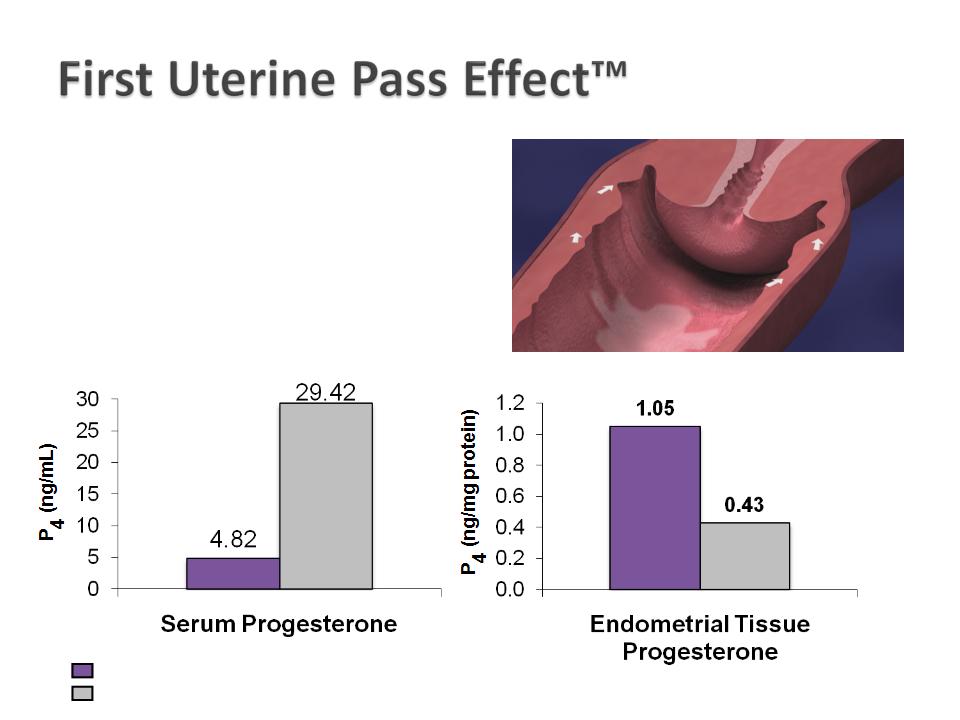

} First Uterine Pass Effect (2018)

} pH buffering to prevent preterm labor (2018)

} Treatment of endometriosis/infertility with β-adrenergic agonists (2020)

} Carbamide peroxide for bacterial vaginosis (2022)

} Local anesthetic for chronic pelvic pain (2022) pending

} Extended release ionic treating agents (2023) pending

} Progesterone for treatment of preterm (2028) pending*

*Progesterone-specific patents were transferred to Watson

following the close of the Watson Transactions

following the close of the Watson Transactions

26

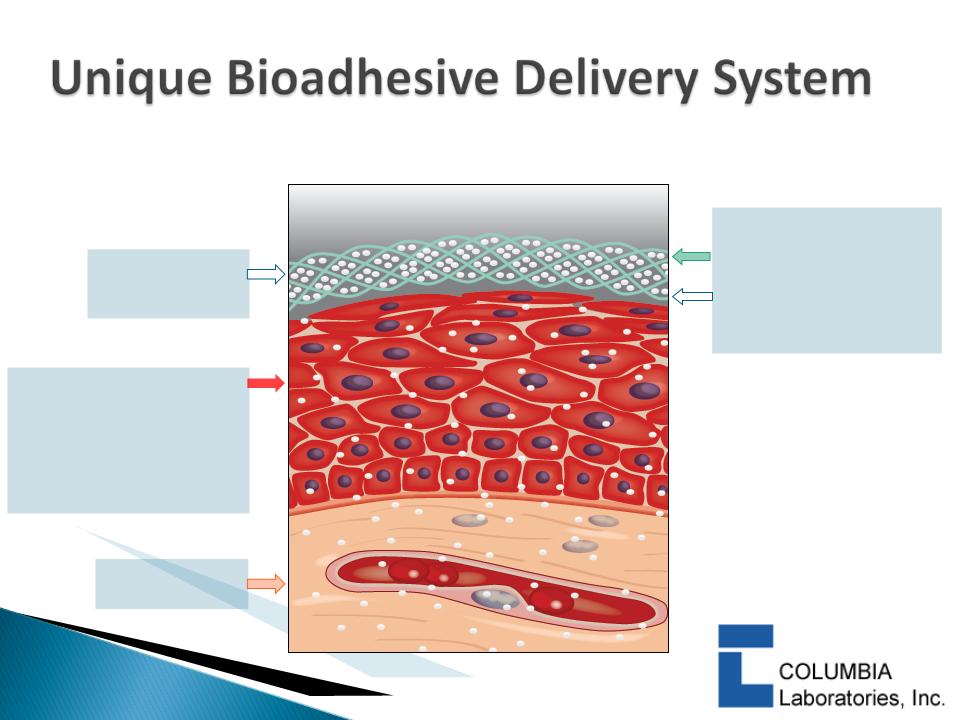

Polycarbophil:

hydrogen bonding

with the cell surface

hydrogen bonding

with the cell surface

Active entrapped in

the cross-linked polymer

polycarbophil

Bioadhesive gel,

tablet or system

with active

tablet or system

with active

Adheres to mucosal surface

Discharged upon normal cell

turnover:

turnover:

Oral mucosa up to 24

hours

hours

Vaginal epithelium 72+

hours

hours

Subcutaneous

tissue

tissue

Results in drug delivery

directly to the endometrium

with minimal systemic levels

directly to the endometrium

with minimal systemic levels

CRINONE® 8% (progesterone gel) (90 mg)

IM progesterone (50 mg)

Cicinelli E et al. Obstet Gynecol. 2000; 95: 403-406.

28

|

Product

|

Indication

|

Clinical Stage

|

Market

Opportunity |

|

Crinone/Prochieve 8%

Vaginal Gel

|

Reduce risk of preterm birth in

women with a short cervix in mid -pregnancy |

Pivotal Phase III

|

$1.7 billion (US)

|

|

Crinone/Prochieve 8%

Next generation

|

Lifecycle management program:

ART (Infertility) |

Phase I underway

|

$300+ million

(US) |

|

Crinone/Prochieve 8%

Next generation

|

Lifecycle management program:

Preterm Birth |

Phase I underway

|

$1.7 billion (US)

|

|

COL-2401

Vaginal Tablet

|

Treatment and prevention of

bacterial vaginosis (BV) |

Preclinical work

in-process |

$200+ million

(US) |

|

COL-1777

Vaginal delivery |

Fibroid reduction

|

Phase I work

underway |

$1.2 billion (US)

|

|

COL-1077

Vaginal Gel

|

Treatment of chronic pelvic pain

(CPP) |

Pilot clinical work

complete |

$1.5 billion (US)

|

29

} Most common bacterial infection for women of

childbearing years

childbearing years

◦ 7.4 million new cases annually (US est.)

} Involves an imbalance in the vaginal bacterial ecosystem,

such that natural flora are diminished

such that natural flora are diminished

} Current treatments: antibiotics given orally or intravaginally

◦ Significant side effects from oral forms

◦ Patients report greater satisfaction with intravaginal forms

} Risk factor for preterm birth

} High recurrence rate

30

} Facilitates restoration of normal, protective bacteria

} Maintains normal pH to prevent growth of harmful

bacteria

bacteria

} Vaginally administered

} Natural bacteriostatic agent

} $200+ million US market opportunity

} Patent protection to 2022

31

} Symptoms include excessive vaginal bleeding, pelvic

pressure and anemia

pressure and anemia

◦ Increased risk of infertility and pregnancy complications

} Affects 30 million women (up to 20%) in US

} Most common indication for hysterectomy

} Health care costs >$2 billion in 1997 for surgical

management of uterine fibroids

management of uterine fibroids

} $1.2 billion market opportunity

32

} Current treatment options

◦ Medications such as GnRH agonists

– Side effects: menopausal symptoms & bone loss

– Short-term therapy only

◦ Surgical hysterectomy or myomectomy

– Hysterectomy not an option for women who want to preserve

childbearing capacity

childbearing capacity

} COL-1777 could

◦ Avoid menopausal side effects caused by GnRH agonists

◦ Avoid costs and side effects of surgery

◦ Preserve childbearing ability

} Patent protection to 2019

33

} Strong balance sheet; healthy cash position; debt free

} Ongoing royalty revenues from Watson & Merck

Serono

Serono

} STRIANT sales

} Potential milestone payments

} Significantly lower operating expenses

} Cash burn rate ~ $1 million/quarter through YE 2010

} With successful PREGNANT Study outcome CBRX

will be cash flow & earnings positive on an annual

basis from that point forward

will be cash flow & earnings positive on an annual

basis from that point forward

34

|

Investor Relations Contacts

|

|

|

Larry Gyenes

Chief Financial Officer,

Columbia Laboratories, Inc.

|

Seth Lewis

Vice President,

The Trout Group

|

|

T: (973) 486-8860

|

T: (646) 378-2952

|

|

lgyenes@columbialabs.com

|

slewis@troutgroup.com

|

|

www.columbialabs.com

|

www.columbialabs.com

|