Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LOOKSMART LTD | d8k.htm |

Jean-Yves

Dexmier Executive Chairman & CEO

Steve Markowski, CFO

August 2010

1

Exhibit 99.1 |

This

presentation contains forward-looking statements, such as references to our

business prospects.

These

statements,

including

their

underlying

assumptions, are

subject to risks and uncertainties and are not guarantees of future performance. Results

may differ due to various factors such as the possibility that our efforts to control

expenses may not be successful, that our efforts to increase revenue and improve gross

margin may not succeed, that we may be unable to gain or maintain customer

acceptance of our publisher solutions or ad backfill products, that existing and potential

customers for our products may opt to work with, or favor the products of, others due

to more favorable products or pricing terms, that we may be limited in our ability or

unable to retain and grow our ad and customer base, and that we may be limited in our

ability to,

or

be

unable

to,

enhance

our

products

or

our

network

of

distribution

partners.

Additional risks that could cause actual results to differ materially from those projected

are discussed in our Quarterly Report on Form 10-Q for the quarter ended June 30,

2010, our Annual Report on Form 10-K for the year ended December 31, 2009, and

other documents we file with the Securities and Exchange Commission from time to

time (available at www.sec.gov).

The statements presented in this presentation speak only as of today’s date. Please

note that except as required by applicable law we undertake no obligation to revise or

update publicly any forward-looking statements for any reason.

2

Safe Harbor |

3

Non-GAAP Information

This presentation includes non-GAAP financial information. LookSmart provides

“non-GAAP net income (loss),” and “Operating Expense excluding

impairment charges,” which are non-GAAP financial measures. Non-GAAP net

income (loss) consists of net income (loss) before (a) income (loss) from discontinued

operations; (b) impairment charges; and (c) share-based compensation expense.

Non-GAAP Operating Expenses exclude impairment charges, as noted on Slide

14. The Company believes these non-GAAP financial measures provide important supplemental

information to management and investors. These non-GAAP financial measures reflects

an additional way of viewing aspects of the Company’s operations that the Company

believes, when viewed with the GAAP results and the accompanying reconciliation to

corresponding GAAP financial measures, provides useful information regarding factors and trends

affecting the Company’s business and results of operations.

For the non-GAAP financial measures non-GAAP net income (loss) and non-GAAP

operating expenses, the adjustments provide management with information about

LookSmart’s operating performance that enables comparison of its operating

financial results in different reporting periods. Additionally, our management uses

non-GAAP net income (loss) and non-GAAP operating expenses as supplemental measures in

the evaluation of our business, and believes that non-GAAP net income (loss) and

non-GAAP operating expenses provide visibility into our ability to meet our future

capital expenditures and working capital requirements.

These non-GAAP financial measures are used in addition to, and in conjunction with,

results presented in accordance with GAAP and should not be relied upon to the

exclusion of GAAP financial measures. Management strongly encourages investors to

review the Company’s consolidated financial statements in their entirety and to

not rely on any single financial measure. Because non-GAAP financial measures are not

standardized, it may not be possible to compare these financial measures with other

companies’ non-GAAP financial measures having the same or similar names. In

addition, the Company expects to continue to incur expenses similar to the non-GAAP

adjustments described above, in particular stock based compensation expense, and exclusion of

these items from the Company’s non-GAAP measures should not be construed as an

inference that these costs are unusual, infrequent or non-recurring.

Reconciliations of Non-GAAP information to GAAP information are provided elsewhere in this

presentation. |

4

Company Overview

•

LookSmart

is an online search advertising network

solutions company

–

Operates in the Tier 2 segment of the online paid search

advertising market

–

Aggregates traffic from large number of publishers

–

Delivers traffic to a large number of advertisers

•

LookSmart

at a glance

–

Founded in 1997; IPO in 1999

–

2009 Revenues: $52M

–

Employees: 65

–

Headquarters in San Francisco; sales in NYC

–

Market capitalization: $26M (as of August 9

, 2010)

th |

5

Focus on Fundamentals

•

Strong Market Opportunity

•

Diversified customer base –

Needs further expansion

•

Significant competitive advantage: AdCenter Platform

•

Must improve Traffic Delivery and Optimization

•

Must expand distribution network |

US Online

Advertising Spend, 2008-2014 .

Source: eMarketer, December 2009

6

We believe search advertising will grow as the largest segment in online

advertising.

$23.6B

$22.4B

$25.2B

$28.3B

$31.0B

$34.0B

$23.4B |

7

A Diversified Customer Base

•

Intermediaries –

Our Largest Category

–

Search Arbitrage reselling to large search engines

–

Backfill Customers with direct and arbitrage accounts

•

Direct Advertisers and Agencies

–

Transaction-based: CPA (cost-per-acquisition)

–

Page view-based: CPV (cost-per-view)

•

Self-service

–

Search Arbitrage

–

Transaction-based advertisers

–

Page view-based advertisers |

8

The Ad Center Platform –

A Competitive Advantage

•

Long-standing technology investment

–

Operating platform since 2002

–

Developed with MSN and Ask.com until in-sourcing

–

Currently available for licensing on an opportunistic basis

•

A very strong feature set

–

Granular campaign setting similar to large search engine platforms

–

Unique granular setting of traffic selection within the network

–

Considered as a leading platform in the Tier 2 network segment

•

Self-service

–

Increased processing capability without degradation of latency

–

Linear scalability, currently processing about 2B queries/day |

9

Optimizing Traffic Acquisition Costs (TAC)

•

Quest for quality drives focus on high quality traffic

–

High quality traffic can be acquired at higher TAC

–

Effort undertaken over the past year resulted in significant

increase of TAC and resulting lower Gross Margin

•

Continuing focus on traffic quality

–

Separate LookSmart from the rest of the Tier 2 network market

–

Click rating techniques to measure individual click quality

–

Implementing these techniques in the Ad Center platform to

automate click filtering and improve real time quality

–

Recently released “quality streaming”

•

TAC optimization algorithms

–

Implemented algorithms to optimize Traffic Acquisition Cost at the

individual click level

–

Ad Network Gross Margin grew from 32% in Q1 to 42% in Q2 |

10

Increasing “Throughput”

Will Drive Revenues

•

Traffic Optimization

–

Deliver the “right”

traffic at the “right”

price to Search Arbitrage

clients, CPA advertisers and Impression advertisers

–

As traffic delivery meets client performance, increase volume until

reaching traffic limits

–

Stability and predictability are paramount

•

Methods

–

Developing data analytic techniques dedicated to each type of traffic

–

Real-time traffic selection based on specific account requirements

–

Price/volume optimization to deliver to customer performance

metrics (profitability, CPA, unique page views, …)

–

Techniques under development

–

Further integration in the Ad Center platform

•

Human capital focused on analytics and traffic optimization |

11

Planning Distribution Network Expansion

•

Focus on quality and customer requirements

–

Continuing quest for quality drives search for premium traffic

–

Optimize traffic for both page view and CPA customers

•

Traffic optimization will test distribution Network limits

•

Developing leading Distribution Network group

–

Requires dedicated human capital

–

Evaluating diversified traffic sources and media |

12

Targeting Sustainable Profitability

•

Sustainable profitability will result from:

–

Continuing tight control of operating expenses

–

Continuing focus on Traffic Acquisition Costs (TAC) optimization

in order to maintain Gross Margin levels

–

Controlled Revenue Growth through implementation of data

analytic techniques under development |

13

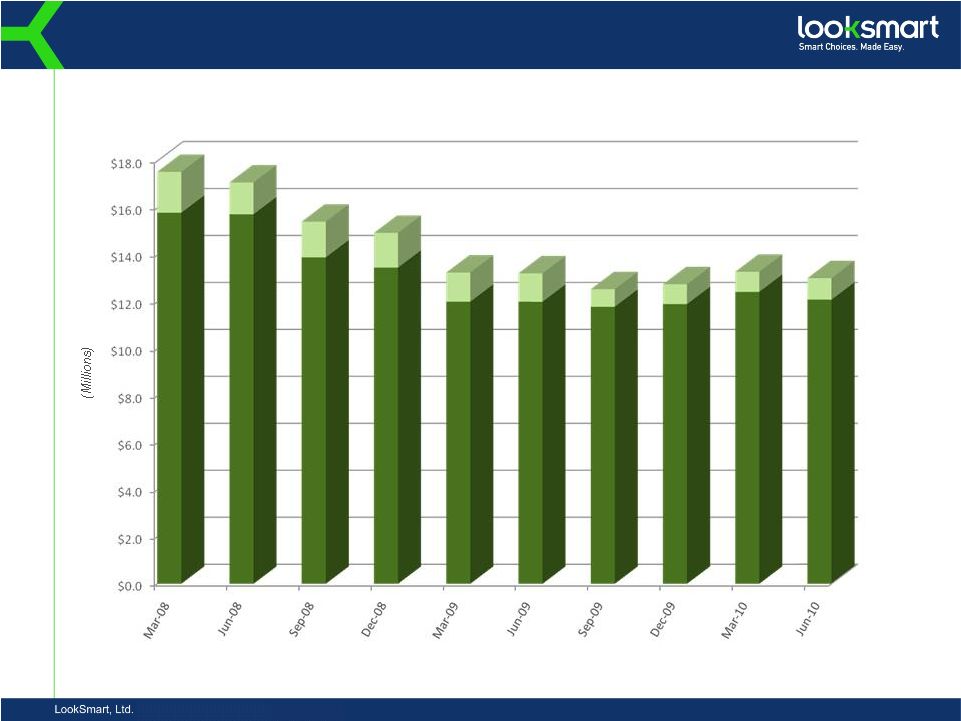

GAAP Operating Expenses *

*Includes impairment charges of $9.8M in Q408, $0.2M in Q209, and $0.1M in Q409

|

14

Non-GAAP Operating Expenses *

*Excludes impairment charges of $9.8M in Q408, $0.2M in Q209, and $0.1M in Q409

Tight Control of Operating Expenses |

15

Gross Margin and TAC

Optimizing TAC to materially improve Gross Margin |

16

Revenue |

17

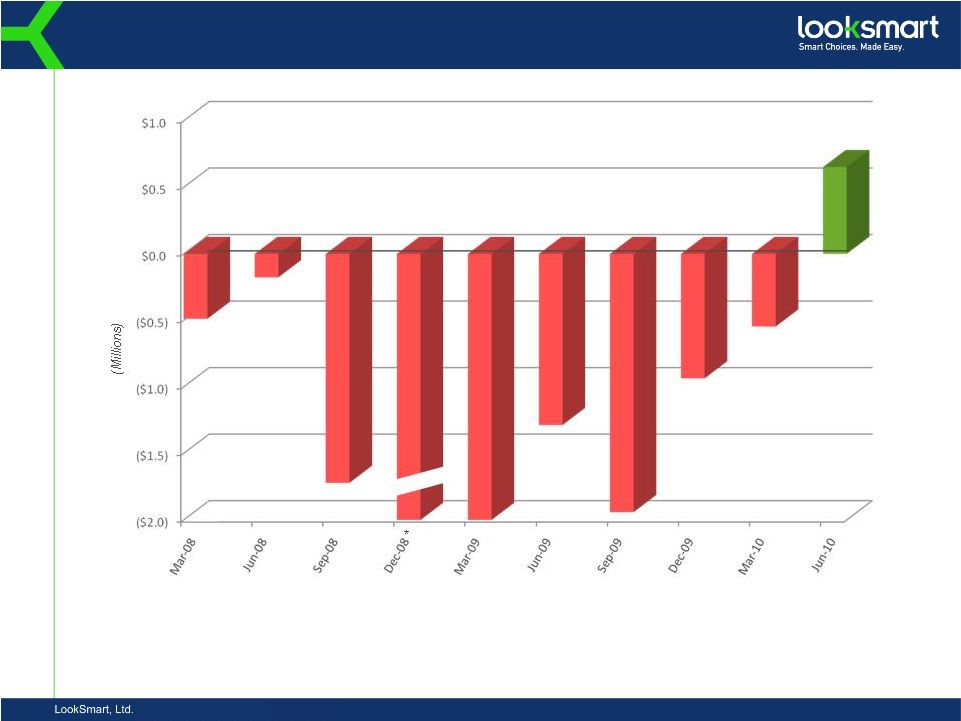

GAAP Net Income (Loss)

* Dec-08 not drawn to scale ($12.45M loss)

* |

18

Non-GAAP Net Income (Loss) *

* Without FAS 123R, impairment and discontinued operations

Targeting Sustainable Non-GAAP Net

Income |

19

GAAP to Non-GAAP Reconciliations

Operating Expenses

Mar-08

Jun-08

Sep-08

Dec-08

FY2008

Mar-09

Jun-09

Sep-09

Dec-09

FY2009

Mar-10

Jun-10

GAAP Operating expenses

7,993

7,054

8,146

16,892

40,085

7,347

6,671

5,972

5,330

25,320

4,837

4,945

Less: Impairment charges

-

-

-

9,810

9,810

-

180

-

100

280

-

-

Non-GAAP operating

expenses

7,993

$7,054

$8,146

$7,082

$30,275

$7,347

$6,491

$5,972

$5,230

$25,040

$4,837

$4,945

Net Income

Mar-08

Jun-08

Sep-08

Dec-08

FY2008

Mar-09

Jun-09

Sep-09

Dec-09

FY2009

Mar-10

Jun-10

GAAP net income (loss)

(488)

(176)

(1,721)

(12,449)

(14,834)

(2,040)

(1,286)

(1,941)

(935)

(6,202)

(517)

652

Add: Stock based

compensation from continuing

operations

1,013

559

683

479

2,734

517

515

359

226

1,618

169

163

Add: (Income) loss from

discontinued operations

307

136

5

1,073

1,521

(109)

(130)

(132)

(93)

(464)

(93)

(85)

Add: Impairment charges

-

-

-

9,810

9,810

-

180

-

100

280

-

-

Non-GAAP net income (loss)

832

$519

($1,033)

($1,087)

($769)

($1,632)

($721)

($1,714)

($702)

($4,768)

($441)

$730 |

20

Tangible Net Worth

TANGIBLE NET WORTH PER SHARE

$1.43

June 30, 2010

Tangible

Net Worth

ASSETS

Current assets:

Cash and cash equivalents

$ 24,457

Short-term investments

1,000

Total cash, cash equivalents and short-term investments

25,457

Trade accounts receivable, net

4,929

Prepaid expenses and other current assets

756

Total current assets

31,142

31,142

Property and equipment, net

3,873

3,873

Capitalized software and other assets, net

1,990

142

Total assets

$ 37,005

LIABILITIES & STOCKHOLDERS' EQUITY

Current liabilities:

Trade accounts payable

$ 2,821

Accrued liabilities

4,088

Deferred revenue and customer deposits

1,022

Current portion of long-term obligations

1,267

Total current liabilities

9,198

Capital lease and other obligations, net of current portion

1,398

Total liabilities

10,596

(10,596)

Stockholders' equity:

Common stock

17

Additional paid-in capital

261,337

Accumulated other comprehensive gain

-

Accumulated deficit

(234,945)

Total stockholders' equity

26,409

Total liabilities and stockholders' equity

$ 37,005

Tangible net worth

24,561

Fully diluted shares outstanding at June 30, 2010

17,192 |

21

Summary

•

PPC Search Advertising is a growing market

•

We are improving the business fundamentals to

fully leverage our market opportunity

•

We have returned to profitability through a

combination of tight expense control and gross

margin improvement

•

We are now targeting sustained profitability |

Questions

22 |