Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KOPIN CORP | d8k.htm |

Kopin

Corporation

Enabling the Evolution of Mobile Media

Exhibit 99.1 |

Forward-looking

Statements This presentation includes forward-looking statements within

the meaning of the United States Private Securities Litigation Reform Act of 1995. These

statements relate to our expected future financial and operating performance, growth in the

markets in which our products are sold, our market share for our products, and our significant

customers. We may use words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “could,” “seeks,” “estimates,” and variations

of such words and similar expressions in identifying forward-looking statements. In

addition, any statements which refer to expectations, projections, our stock value multiple,

the value of Golden-i products, or other characterizations of future events or

circumstances are forward-looking statements. These statements are not guarantees of

future performance and involve certain risks, uncertainties and assumptions which are difficult

to predict. Actual outcomes and results may differ materially from what is expressed or

forecasted in such forward-looking statements, whether as a result of new information,

future events or otherwise. We refer you to the documents the Company files from time to

time with Securities and Exchange Commission, and specifically the “Risk Factors”

section of the Company’s Form 10-K for the period ended December 26, 2009 and Form

10-Q for the six months ended June 26, 2010. We do not undertake to update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise.

|

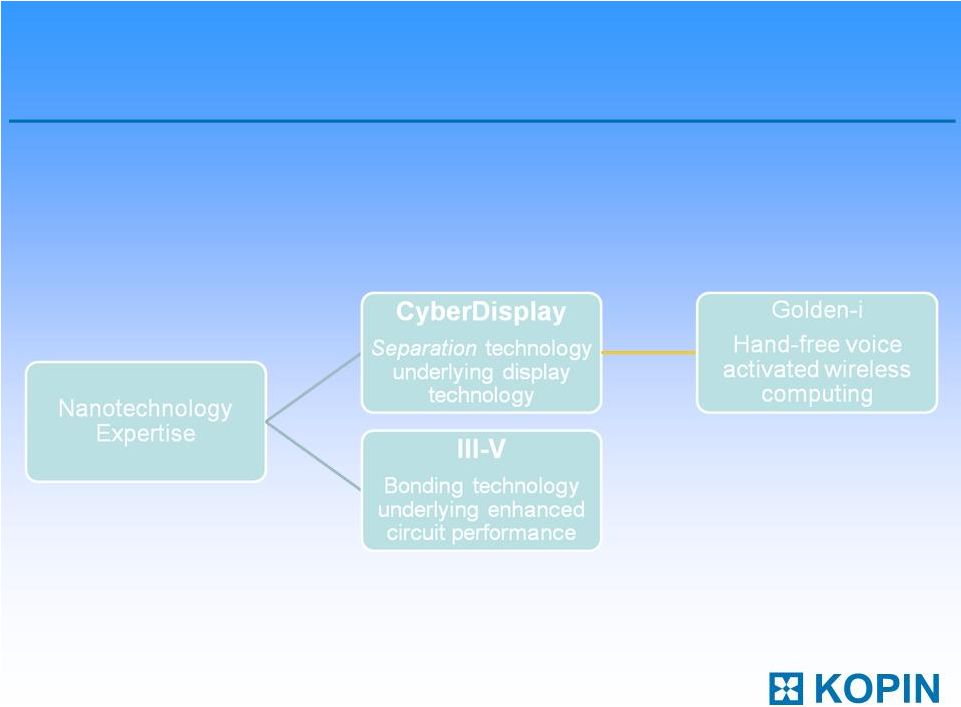

Kopin

Material Science Platform |

Mobile

Media Convergence 1990

2000

2010

2012 and Beyond

III-V Performance |

III-V TECHNOLOGY

ENABLING MOBILE MEDIA CONVERGENCE |

III-V Proprietary Technology

•

HBT -

Power amplifying transistors in mobile phones

•

Stacked III-V GaAs-based layers

–

7-14 Layers of semiconductor materials, Going to Over 30 Layers

•

Manufacturing a uniform product in high volume key to customer

retention

•

Next Generation of chips (HBT BiPHEMT)

–

Leading to industry consolidation

–

Added capacity in new Taiwan facility

–

Requires greater production

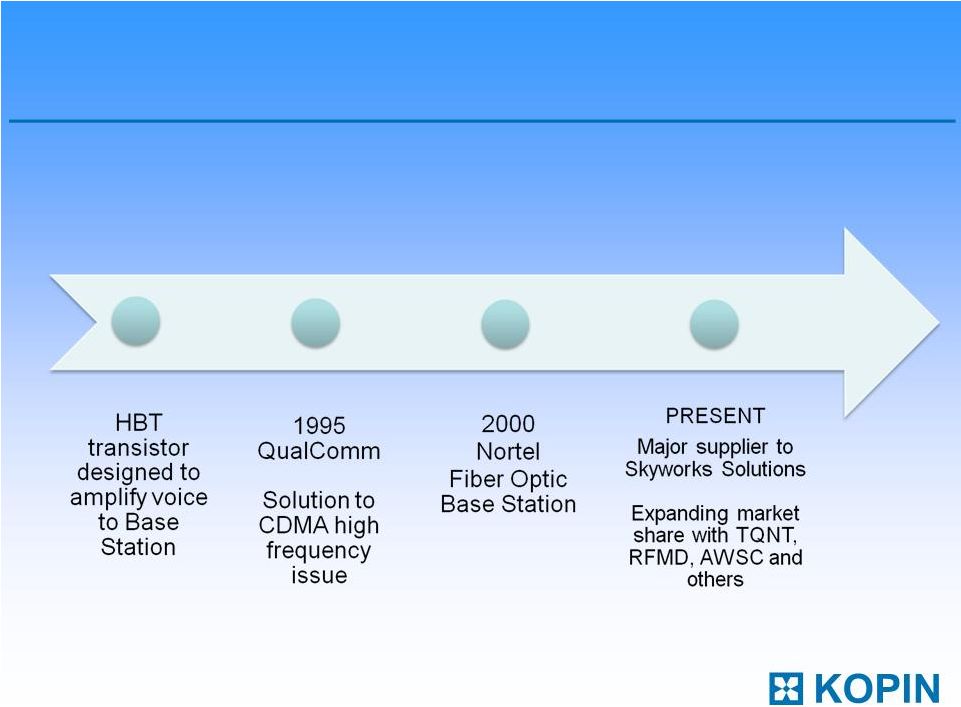

#1 Worldwide Supplier |

Customer & Product Time-Line

Today Kopin is 45% of Merchant Market in HBT transistors.

Product

AIGaAs

InGaP

BiFET

Evolution

HBT

HBT

BiPHEMT |

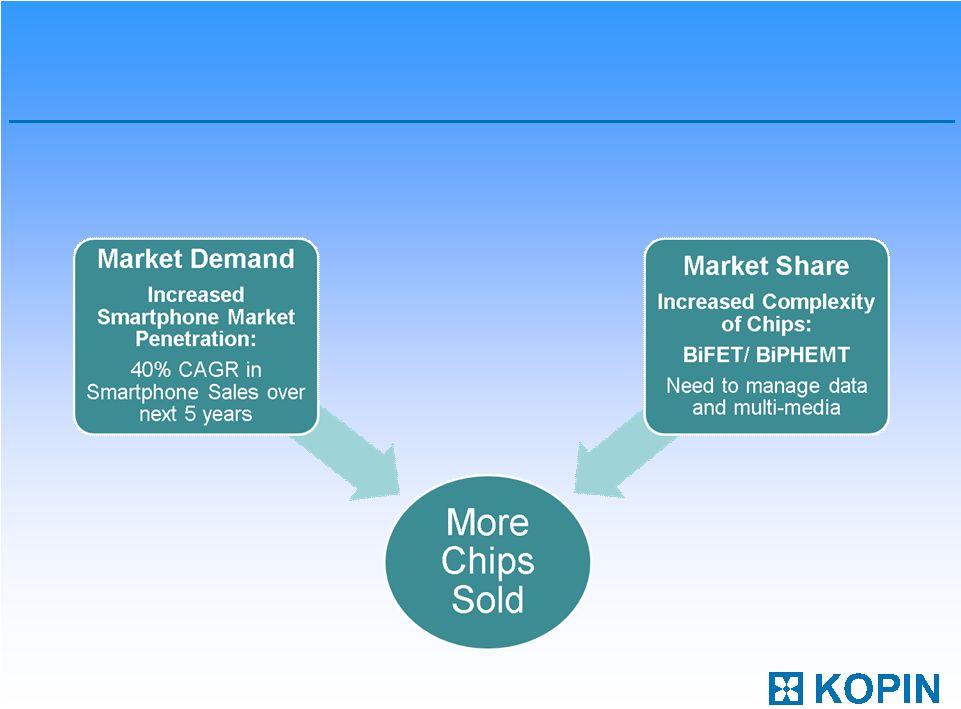

Revenue Growth Drivers for HBT

Source: Morgan Stanley Research |

HBT

Comparable Valuation Company

Ticker

Price

MC

EV

BV/

Share

Rev

EBITDA

MC/Rev

EV/

EBITD

A

Price/

BV

Semiconductor -

Wireless and III-V

Anadigics

ANAD

$ 4.51

294.1

213.4

$ 2.87

152.5

(19.2)

1.9

-11.1

1.6

RF Micro Devices

RFMD

$ 4.13

1,119.3

1,180.2

$ 1.97

978.4

201.8

1.1

5.8

2.1

Skyworks

SWKS

$ 18.34

3,218.5

2,903.0

$ 6.96

986.7

217.5

3.3

13.3

2.6

Triquint

TQNT

$ 6.98

1,083.3

925.7

$ 3.89

716.2

98.4

1.5

9.4

1.8

Avago

AVGO

$ 21.59

5,151.8

5,131.8

$ 5.03

1,760.0

451.0

2.9

11.4

4.3

AXT, Inc.

AXTI

$ 4.89

151.6

116.3

$ 3.04

66.4

9.5

2.3

12.3

1.6

Averages

2.2

6.9

2.3

KOPIN INC

KOPN

$ 3.64

242.4

123.4

$ 2.47

118.6

17.4

2.0

7.1

1.5 |

CYBERDISPLAY

A Union of Technology |

World

Leader in Microdisplays •

Proprietary production process

•

Single crystal silicon transistors

–

Highest pixel density

–

Sharpest resolution

•

Digital Vision™

for Mobile Video Apps

•

Shipped 30 million displays to date |

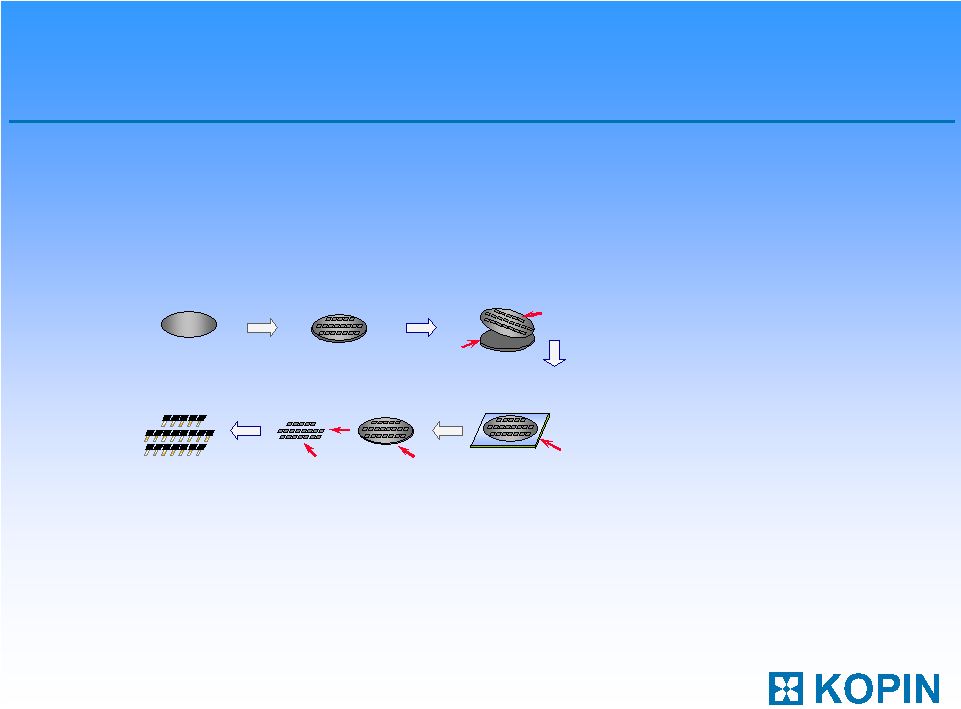

Leveraging Nanotechnology

•

Patented materials separation process

–

display IC backplane fabrication outsourced

–

Transfer very thin IC layer to glass

•

High performance single crystal Si transistor

•

Fab-less foundry model

–

Keeps costs low by leveraging investments

–

Maintains flexible capacity

Start with

SOI Wafers

Standard CMOS

IC Fab

Adhesive

Write

Silicon

Wafer

IC’s

Liftoff Circuits from

Silicon Substrate...

Add Front Glass

and Fill

Wafer Level

Transfer to Glass

IC’s

on Glass

Bond,

Package, & Test

Scribe ,Break

and Fill |

Kopin

CyberDisplay Advantage •

Highest pixel density Active Matrix LCD

•

Color filter-type transmissive LCD (like LCD TV)

•

Ultra-Compact size –

0.16”

–

0.97”

diagonal

•

Wide range of resolutions for variety of Apps

•

Low power consumption

•

Module products for easy design-in |

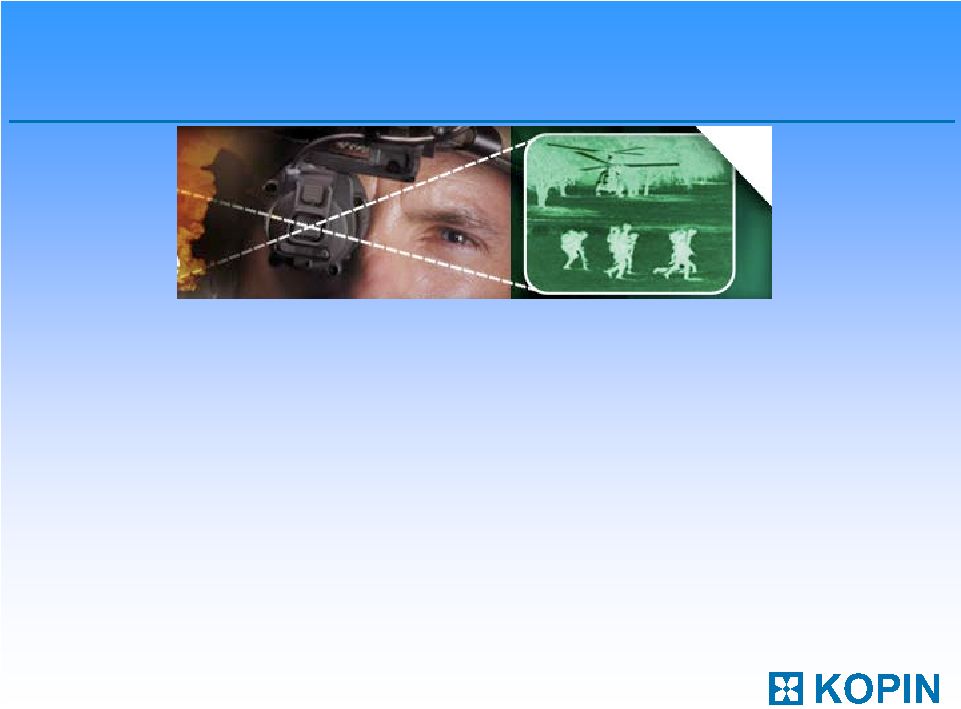

Applications for Cyber Display

•

Military

–

Thermal Weapon Sights

•

M1 rifles, tripod rocket launcher, tanks

•

Consumer

–

Movie Viewing, 3-D viewing, Gaming |

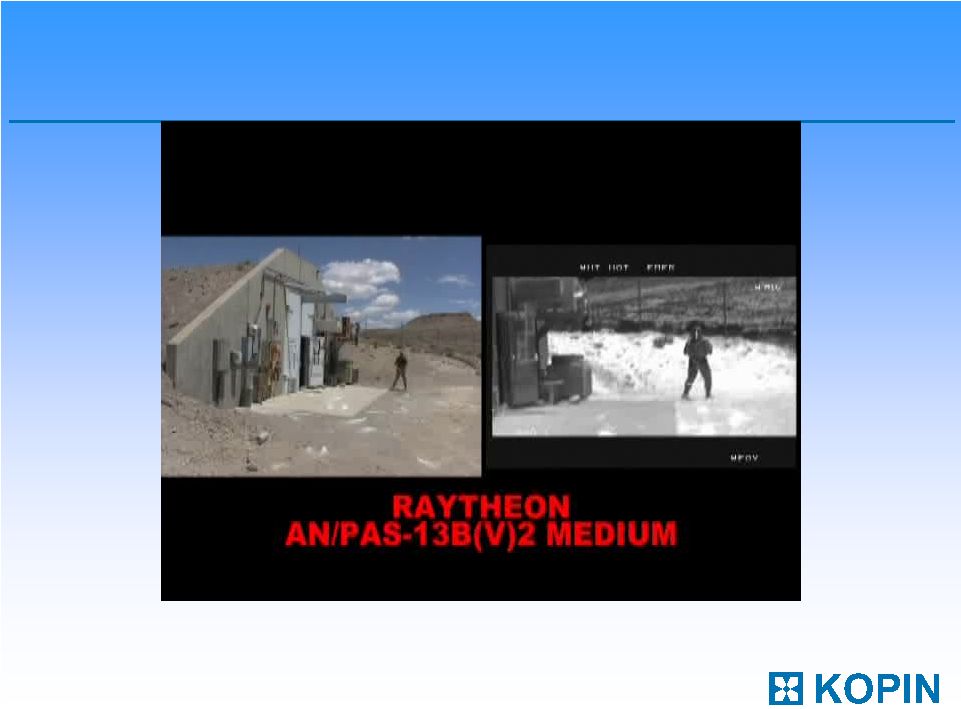

Military Applications

•

Leading provider of displays and high-level assemblies to

the U.S. military Thermal Weapons Site Program

–

BAE Systems –

displays

–

DRS –

Modules= display + electronics

–

RTN –

eyepieces

•

Ruggerdized to withstand extreme field conditions

•

Manufacturing Testing key competitive advantage

–

Shock & Vibe Chambers

–

Thermal |

Cyber

Display TWS |

Cyberdisplay Pipeline

•

Enhanced Night Vision Goggles

–

Overlay thermal imaging on night vision technology

–

Introduced 2009, awards anticipated Q4 2010

•

Ultra-compact 3-D displays

–

compact eyewear that shows vivid color in 3D

–

854 x 480 full-color resolution in fingernail size screen

–

targeted at emerging high-end applications advanced night vision,

virtual reality and 3D HD gaming |

Display Comparable Valuation

Company

Ticker

Price

MC

EV

BV/

Share

Rev TTM

EBITDA

TTM

MC/Rev

EV/

EBITDA

Price/

BV

Display & Optoelectronics

eMagin

EMAN

$ 3.19

62.7

56.6

$ 0.64

24.6

5.2

2.6

11.0

5.0

Universal Display

PANL

$ 20.30

764.3

701.3

$ 1.57

17.0

(14.7)

44.9

-47.6

12.9

Microvision

MVIS

$ 2.79

247.6

212.4

$ 0.38

3.6

(38.9)

69.7

-5.5

7.3

Real ID

RLD

$ 17.62

435.0

516.1

$(2.79)

149.9

(25.9)

2.9

-20.0

-6.3

FLIR Systems

FLIR

$ 29.68

4,585.3

4,300.8

$ 8.56

1,220.0

399.2

3.8

10.8

3.5

Averages

30.3

10.9

4.4

KOPIN INC

KOPN

$ 3.64

242.4

123.4

$ 2.47

118.6

17.4

2.0

7.1

1.5 |

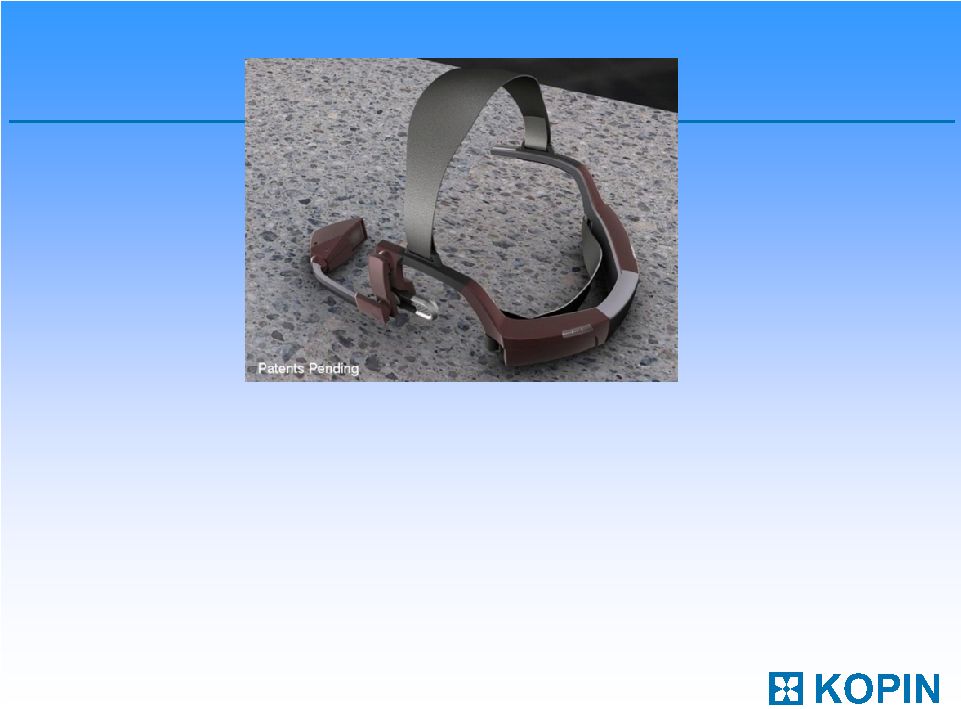

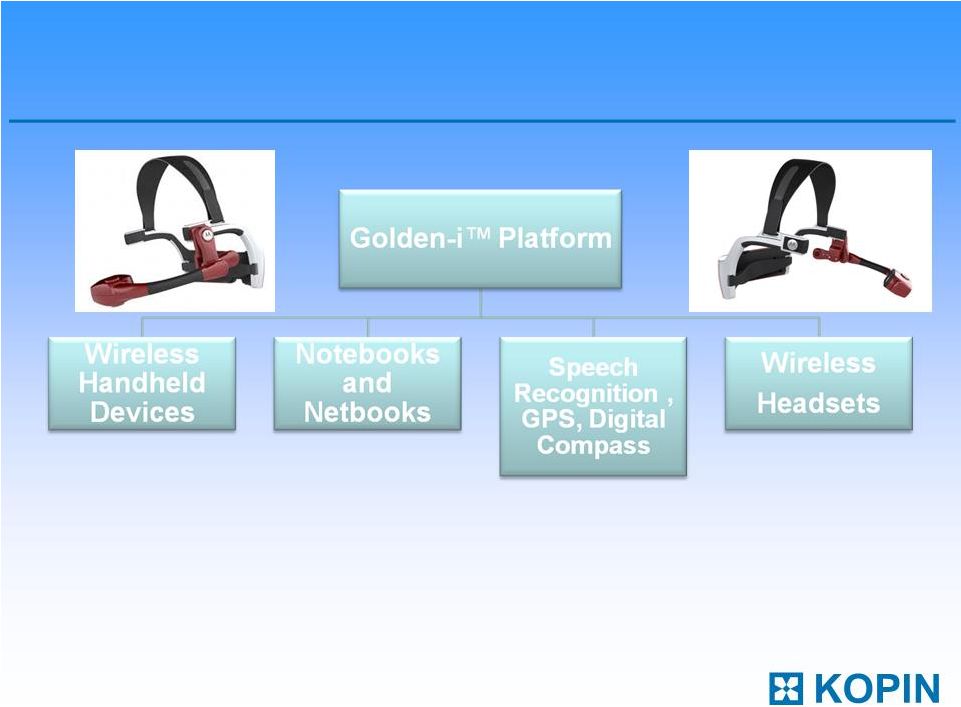

GOLDEN –

i ™

Hands-Free Voice Activated Wireless Computing System

|

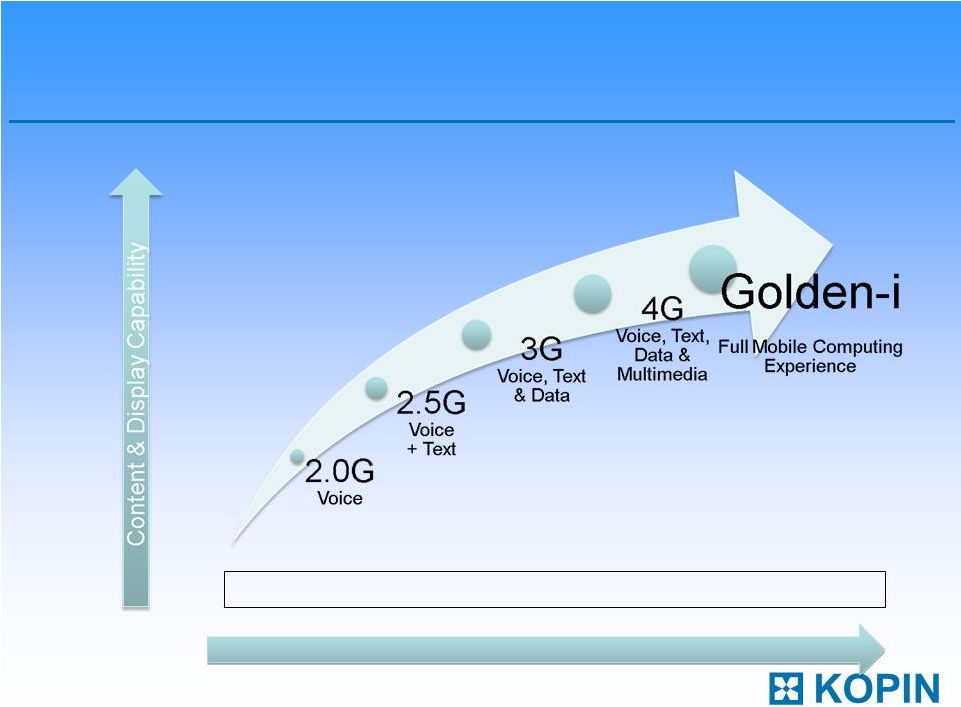

Extends Mobile Computing

Convergence •

Early computing products lacked mobility

•

Recent mobile solutions use small form factor

Golden-i

™

Next-gen Mobile Computing Solution

•

Wireless cloud computing communications system

•

Hands-free real time streaming video

•

Equivalent 15"

PC display virtually 18"

from eye

•

Access to all digital information when mobile |

Broader Technology Platform

Partners:

Microsoft,

Motorola,

Micron

Technology,

Nuance,

Texas

Instruments, and Hill Crest Labs

Status:

Currently

shipping

software

development

kits

to

partners |

Feature-Rich Mobile Experience

•

Bluetooth/WiFi headset, 15-inch virtual display, hands-free,

natural- speech-recognition interface

–

Hands free –

voice & gesture control

–

Wireless Control up to 7 devices & systems

–

Natural speech recognition

–

MS Windows CE 6.0

–

Full e-mail / Word / Excel / PowerPoint

–

Docs update by dictation or keyboard |

Golden-i

™

Industrial TAM $11B

*add Flash Video clip

•

Telecommunications

–

service

technicians

•

Distribution

–

warehousing

and

postal

services

•

Industrial

–

nuclear

power,

oil

field

services

and

transportation

•

Medical

–

physicians,

nurses

and

records

departments

•

Construction

–

architects,

onsite

developers

and

contractors

•

Police, Fire, Emergency Response, Customs, Public Safety

|

FINANCIAL OVERVIEW |

($

in millions except per share data)

Q2 2010

Q2 2009

YTD Q2

2010

YTD Q2

2009

Total revenues

$30.2

$28.2

$55.6

$49.7

Cost of product revenues

21.9

19.4

39.4

34.0

Gross Margin

25.0%

25.7%

25.7%

27.2%

R&D

4.9

3.8

9.2

6.9

SG&A

4.2

2.6

7.9

7.0

Income from operations

(0.7)

2.5

(0.7)

1.7

Net income

1.9

3.7

2.9

5.6

Income per share

$0.03

$0.05

$0.04

$0.08

Weighted average shares o/s

67.4

67.5

67.3

68.0

Income Statement Highlights |

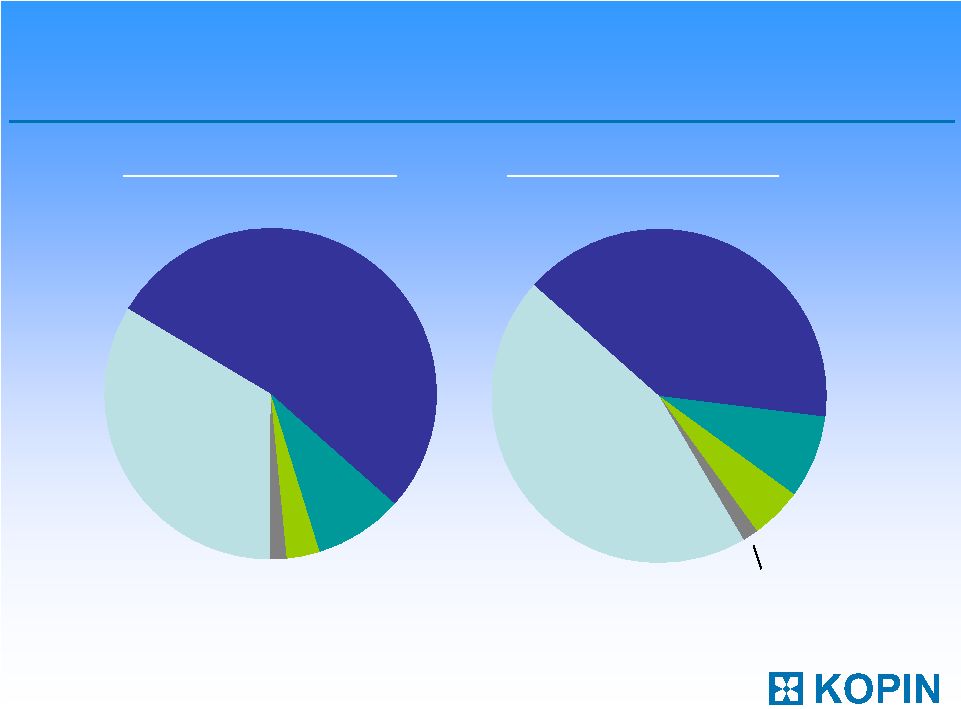

% of

Total Revenues by Category YTD 2010 ($55.6 Million)

III-V

52.8%

Military

33.6%

Consumer

Electronics

9.0%

Eyewear

1.7%

R&D

2.9%

FY 2009 ($114.7 million)

Military

44.9%

Consumer

Electronics

8.0%

R&D

5.7%

Eyewear

1.6%

III-V

39.8% |

Balance

Sheet Highlights June 26, 2010

($ in millions)

Cash and marketable securities

$115.3

A/R and inventory

38.3

Other current assets

3.3

PP&E

21.3

Other assets

7.1

Total assets

$185.3

Current liabilities

$17.4

Other

Noncontrolling

interest

0.9

4.1

Equity

163.0

Total liabilities and equity

$185.3 |

Target Operating Model

Revenue

100%

Gross Margin

35-45%

R&D

15-20%

SG&A

12-14%

Operating Income

8-12% |

Overall Valuation Perspective

•

Kopin deserves higher multiple with higher

Growth Rates and ability move into bigger

markets

–

Semi comps are older, slower growth companies with lower

multiples

•

Kopin’s display business has solid financial

results and opportunity to move into bigger

markets hence deserves a higher multiple

–

Display comps are either limited market opportunities (military)

or “pie-in-the sky”

scenarios (LED TVs) |

Sum of the Parts

Analysis Kopin

stock

price

undervalued,

even

without

Golden-i™

warrant

Sum of the Parts Analysis

Share price of Semiconductor segment:

(Reference slide 8)

$1.85

Share price of display segment:

$50M (display revs) x 10 (group MC/Rev) = $500M

(Reference slide 16)

$8.00

Cash per share

$1.79

Implied Valuation for KOPN

$12.64 -

$16.14

Golden-i upside

$??? |

Kopin

Investment Highlights •

Expanding market share with leading III-V & display customers

•

40% CAGR in smart phone sales expected over next 5 years

•

Over 200 issued/pending patents

•

$115 million in cash and marketable securities with no debt

•

Golden-i™

very large TAM of $11B

•

Display and Golden-i

™

not properly reflected in valuation |

Kopin Corporation

Enabling the Evolution of Mobile Media |