Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - SemiLEDs Corp | a2199761zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on August 9, 2010

Registration No. 333-168624

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SEMILEDS CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

3674 (Primary Standard Industrial Classification Code Number) |

20-2735523 (I.R.S. Employer Identification Number) |

3F, No.11 Ke Jung Rd., Chu-Nan Site,

Hsinchu Science Park, Chu-Nan 350,

Miao-Li County, Taiwan, R.O.C.

+886-37-586788

(Address, Including Zip Code, and Telephone Number, Including Area

Code, of Registrant's Principal Executive Offices)

National Corporate Research Ltd.

Process Agent

615 South DuPont Highway

Dover, DE 19901

1-(800)-483-1140

(Name, Address Including Zip Code, and Telephone Number Including Area Code, of Agent for Service)

| COPIES TO: | ||

Mark J. Lee Thomas H. Tobiason Harold M. Yu |

Jeffrey D. Saper Steven V. Bernard Eva H. Wang |

|

ORRICK, HERRINGTON & SUTCLIFFE LLP 43/F., Gloucester Tower, The Landmark 15 Queen's Road Central, Hong Kong |

WILSON SONSINI GOODRICH & ROSATI Professional Corporation 650 Page Mill Road Palo Alto, California 94304 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o _______________

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o _______________

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o _______________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title Of Each Class Of Securities To Be Registered |

Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee |

||

|---|---|---|---|---|

Common Stock, par value $0.0000004 per share |

$172,500,000 | $12,299.25(3) | ||

|

||||

- (1)

- Estimated

solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as

amended.

- (2)

- Includes

shares which the underwriters have the option to purchase to cover overallotments, if any.

- (3)

- Previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The sole purpose of this amendment is to fix a formatting error. No other changes have been made to the registration statement, except to reflect that this is an amendment to the registration statement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated , 2010.

PROSPECTUS

Shares

Common Stock

This is SemiLEDs Corporation's initial public offering. We are selling shares of our common stock and the selling stockholders are selling shares of our common stock. We will not receive any proceeds from the sale of shares to be offered by the selling stockholders.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for the shares. After pricing of the offering, we expect that the shares will trade on the NASDAQ Global Market under the symbol "LEDS."

Investing in the common stock involves risks that are described in the "Risk Factors" section beginning on page 9 of this prospectus.

| |

Per Share

|

Total

|

|||||

|---|---|---|---|---|---|---|---|

| Public offering price | $ | $ | |||||

| Underwriting discount | $ | $ | |||||

| Proceeds, before expenses, to us | $ | $ | |||||

| Proceeds, before expenses, to the selling stockholders | $ | $ | |||||

The underwriters may also purchase up to an additional shares from us, and up to an additional shares from the selling stockholders, at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2010.

| BofA Merrill Lynch | Barclays Capital | Jefferies & Company |

| Canaccord Genuity | Caris & Company, Inc. |

The date of this prospectus is , 2010.

You should rely only on the information contained in this prospectus and any free writing prospectus we may specifically authorize to be delivered or made available to you. We have not, and the selling stockholders and the underwriters have not, authorized anyone to provide you with additional or different information. The information contained in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus is an offer to sell only the shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. No action has been or will be taken in any jurisdiction by us or any underwriter that would permit a public offering of our common stock or the possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to this offering and sale of our common stock and the distribution of this prospectus outside the United States.

i

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including our consolidated financial statements and the related notes and the information set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations," in each case included elsewhere in this prospectus.

Company Overview

We develop, manufacture and sell LED chips and LED components that we believe are among the industry leading LED products on both a lumens per watt and cost per lumen basis. Our products are used primarily for general lighting applications, including street lights and commercial, industrial and residential lighting. We sell blue, green and ultraviolet (UV) LED chips under our MvpLED brand, primarily to customers in China, Taiwan and other parts of Asia. We sell our LED chips to packaging customers or to distributors, who in turn sell to packagers. In addition, we package a portion of our LED chips into LED components which we sell to distributors and end-customers in selected markets.

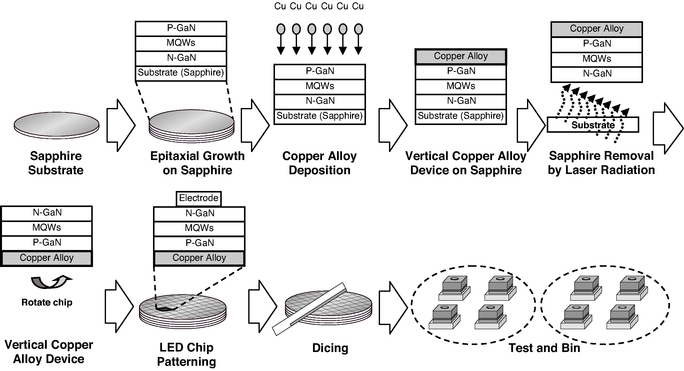

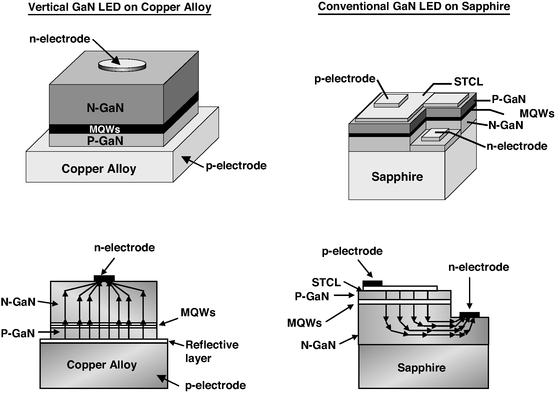

Our operations include both LED chip and LED component manufacturing. We grow our epitaxy materials on sapphire by applying our patented and proprietary process technology based on gallium nitride, or GaN, and related compounds. We then process these materials to create individual chips. We also package a portion of these chips to create LED components.

We have developed advanced capabilities and proprietary know-how in sapphire reclamation, GaN epitaxial growth, copper alloy technology, nanoscale surface engineering and vertical LED structure technology, which enable us to produce LED chips that when packaged are capable of providing greater than 100 lumens per watt. We believe these capabilities and know-how also allow us to reduce our manufacturing costs and our dependence on sapphire, a costly raw material used in the production of sapphire-based LEDs. In addition, we believe these technologies will help facilitate our migration to larger wafer sizes.

Our manufacturing operations are located in Taiwan. We intend to expand our manufacturing capabilities in Taiwan to meet the expected demand for our products. In addition, we have established Xurui Guangdian Co., Ltd., or China SemiLEDs, a joint venture in Foshan, China to manufacture and sell LED chips in China. We hold a 49% ownership interest in China SemiLEDs. China SemiLEDs has begun constructing manufacturing facilities which we expect to be operational after January 2011.

Industry Background

Light emitting diodes, or LEDs, are solid-state electronic components that emit light in a variety of brightness levels and colors. LEDs are increasingly used in a growing number of applications ranging from consumer electronics, such as backlighting for handsets, laptops and televisions, to general lighting, such as outdoor and indoor lighting.

LEDs have recently begun penetrating the general lighting market, which includes applications for architectural, replacement lamp, retail display, commercial, industrial, outdoor area and residential uses. According to the Freedonia Group, an independent market research firm, the general lighting market, including sales of the light fixtures and bulbs, is estimated to be approximately $100 billion.

Currently LED lighting accounts for a small portion of the general lighting market. However, we believe that increased LED performance, reduced LED cost, growing awareness of the advantages of LEDs and government policies that discourage the use of some traditional lighting technologies and support LED adoption will continue to drive the adoption of LEDs in the general lighting market. LED lighting consists of the LED components, optics, heat sinks, power supplies and fixtures. An LED

1

component is an LED chip that has been packaged. According to Strategies Unlimited, an independent market research firm, revenues attributable to LED components for general lighting applications were $665 million in 2009 and are estimated to grow to $4.3 billion by 2014, which represents a compound annual growth rate of 45%.

However, to increase penetration of the general lighting market, LED chip and package manufacturers must continue to reduce the total cost of ownership of LED lighting. Total cost of ownership primarily includes: (i) the upfront cost of the LED device, which includes the LED chip costs and the cost of packaging the LED chips; (ii) the lifetime energy cost; and (iii) the frequency of replacement, which is in part a function of the product lifespan. Although energy cost and lifespan tend to favor LED lighting over some traditional lighting technologies, currently the upfront cost of an LED device is significantly higher than that of traditional lighting technologies.

Our Strengths

We believe that the following strengths will enable us to compete effectively and to capitalize on the expected growth of the LED general lighting market:

- •

- Patented Vertical Copper Alloy Chip

Structure. Our patented copper alloy device structure combined with our proprietary process technologies generate less heat and allow

for increased heat removal compared to sapphire-based LED devices thereby increasing the lumens per watt, or efficacy, and lifespan of our LED chips. In addition, we manufacture our LED

chips using a vertical structure which reduces light output losses through the substrate and allows us to perform nanoscale surface engineering that we believe results in higher efficacy.

- •

- Competitive Manufacturing Cost

Structure. Our proprietary manufacturing technologies and know-how enable us to maintain a competitive manufacturing cost

structure. We have developed advanced capabilities and proprietary know-how in sapphire reclamation, which is a key part of our manufacturing cost savings as we recycle and

re-use sapphire wafers multiple times. In addition, we believe our manufacturing technologies, including sapphire reclamation and the use of copper alloy, will facilitate our transition to

larger wafer sizes.

- •

- Efficient Operating and Business

Model. Our operating and business model is focused on price competitiveness through our low-cost operating structure. We

believe locating our facilities in Taiwan provides us with operating cost advantages including reduced labor, rental, material, construction, and borrowing costs as well as favorable tax treatment.

When operational, we anticipate that China SemiLEDs' manufacturing facilities in Foshan, China will provide it with similar benefits.

- •

- LED Research and Development Expertise. Our research and development team, including members of our senior management, has significant experience in the LED and semiconductor industries. The application of this expertise has allowed us to increase the performance of our highest performing LED chips when packaged, from approximately 60 lumens per watt in 2006 to over 140 lumens per watt in 2010, using vertical LED technology.

Our Strategy

Our goal is to be the leading developer and manufacturer of LED chips and LED components that meet the performance requirements demanded by LED lighting customers, while providing the

2

best value proposition on both a lumens per watt and cost per lumen basis. Key elements of our strategy include the following:

- •

- Remain on the Forefront of Innovation of LED Chip and LED Component

Technologies. We intend to continue to innovate in product design and process technologies through our research and development efforts. Our continued innovation is intended to

ensure that our products continue to perform at industry-leading efficacies for a variety of end-customer applications, in particular for general lighting applications.

- •

- Reduce Cost Through Technology and Manufacturing

Improvements. We plan to increase our investment in research and development to improve our manufacturing processes and increase our

production yields to reduce the per-unit cost of our products. In particular, we are developing new technologies to enable us to produce LED chips using larger size wafers.

- •

- Drive Our Growth in China and Grow Our Net Income Through China

SemiLEDs. The China market represented 46.1% of the LED lighting revenues in 2009 according to Strategies Unlimited. We intend to

continue our growth in China through China SemiLEDs, which we expect will have operational manufacturing capabilities after January 2011.

- •

- Expand Our Manufacturing Capacity in

Taiwan. As a result of improving economic conditions resulting in increased demand for our products, while we have continued to expand

capacity and optimize our manufacturing processes to improve utilization of our equipment, beginning in March 2010 we have been operating our manufacturing facilities at or near full capacity. To

address continuing improvement in market conditions, we intend to expand our production in Taiwan by further improving utilization of our equipment and by adding additional MOCVD reactors, equipment

and tools.

- •

- Target Markets and Customers Where Our Technologies Create a Competitive

Advantage. We will continue to focus our development and sales efforts in markets where customers place a premium on innovation, product performance and cost. In particular, in

the near-term we will focus on outdoor street lighting in China and applications where we believe the environmental benefits and lower total cost of ownership will play a larger role in the purchasing

decision.

- •

- Leverage Government Incentive Funding for LED Development, Facility Expansion and Market

Expansion. We have been awarded a mix of grants from local and national government agencies in Taiwan to support our research and development efforts. China SemiLEDs has also

been awarded a mix of grants from local government agencies in China to support manufacturing. We intend to apply for additional government grants and incentives in Taiwan and China.

- •

- Pursue Strategic Relationships and Acquisitions. We plan to pursue strategic relationships, such as joint ventures, and acquisitions that expand our business. We plan to identify, execute and integrate acquisitions and enter into joint ventures to build scale, acquire intellectual property and enter into new geographic and product markets to enhance our reach and diversify our sales.

Risks Associated With Our Business

We believe the following are some of the major challenges, risks and uncertainties that may materially affect us:

- •

- if LEDs fail to achieve widespread adoption in the general lighting market, or if alternative technologies gain market acceptance, our prospects will be materially adversely impacted and we may be unable to maintain our profitability;

3

- •

- we operate in highly competitive markets that are characterized by rapid technological changes and declining average

selling prices, and competitive pressures from existing and new companies may harm our business and operating results;

- •

- the market for LEDs has historically been, and we expect will continue to be, highly volatile, which could harm our

business and result in significant fluctuations in the market price of our common stock;

- •

- intellectual property claims against us or our customers could subject us to significant costs and materially damage our

business and reputation;

- •

- our operating results may fluctuate from quarter to quarter, which could make our future performance difficult to predict

and could cause our operating results for a particular period to fall below expectations, resulting in a severe decline in the price of our common stock;

- •

- we may not be able to effectively expand production capacity or do so in a timely or cost-effective manner, which could

prevent us from achieving increased sales, margins and market share;

- •

- we may have difficulty managing our future growth and the associated increased scale of our operations, which could

materially and adversely affect our business and operating results;

- •

- growth of our business in China is substantially dependent on the success of our China joint venture, China SemiLEDs,

which was formed in January 2010, which is not yet operational and of which we do not hold a majority of the shares; and

- •

- as China SemiLEDs commences and expands its business, it may compete with us for sales in China.

Corporate Information and Structure

We were incorporated in Delaware on January 4, 2005. Our principal executive offices are located at 3F, No.11 Ke Jung Rd., Chu-Nan Site, Hsinchu Science Park, Chu-Nan 350, Miao-Li County, Taiwan, R.O.C. Our telephone number is +886-37-586788. Our website address is www.semileds.com. The information on or accessible through our website is not part of this prospectus.

We are a holding company for various wholly owned subsidiaries and holdings in joint ventures. Our most significant subsidiary is our wholly owned operating subsidiary, SemiLEDs Optoelectronics Co., Ltd., or Taiwan SemiLEDs, where substantially all of our assets are held and our operations are located. Taiwan SemiLEDs owns a 100% equity interest in Silicon Base Development, Inc., or SBDI. SBDI packages LED chips into LED components. We also sell a majority of our LED components through the Taiwan branch office of Helios Crew Corporation, or Helios Crew, our wholly owned Delaware subsidiary.

We have a 49% interest in China SemiLEDs, a joint venture entity that was established in China in January 2010 to manufacture and sell LED chips. We also own a 50% interest and a 49% interest in joint ventures in Malaysia and Taiwan, respectively. Each of our joint ventures, including China SemiLEDs, is an unconsolidated entity that is still in early development stage and has not had any material operations to date. Such entities are accounted for using the equity method of accounting, and as such, we recognize our portion of the net income or loss from such entities under income (loss) from unconsolidated entities.

4

Common stock offered by us. |

shares | |

Common stock offered by the selling stockholders |

shares | |

Common stock to be outstanding after this offering |

shares | |

Overallotment option |

The underwriters have an option to purchase a maximum of additional shares of common stock from us and the selling stockholders to cover overallotments. Of the shares subject to the option, shares would be sold by us, and shares would be sold by the selling stockholders. The underwriters may exercise this option at any time within 30 days from the date of the prospectus. | |

Use of proceeds |

We intend to use the net proceeds received by us from this offering to expand production capacity, to build a test line for research and development related to LED chip production based on 6" wafers and for general corporate purposes, including working capital and capital expenditures. We may also use a portion of the net proceeds to acquire or invest in complementary technologies, solutions or businesses or to obtain rights to such complementary technologies, solutions or businesses. There are no agreements, understandings or commitments with respect to any such acquisition or investment at this time. | |

|

We will not receive any proceeds from the sale of shares by the selling stockholders. See "Use of Proceeds." | |

Directed share program |

At our request, the underwriters have reserved for sale, at the initial public offering price, up to shares offered by this prospectus for sale to some of our directors, officers, employees, distributors, dealers, business associates and related persons. If these persons purchase reserved shares, this will reduce the number of shares available for sale to the public. Any reserved shares that are not so purchased will be offered by the underwriters to the public on the same terms as the other shares offered by this prospectus. | |

Risk factors |

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 9 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. | |

Proposed NASDAQ Global Market symbol |

"LEDS" |

The number of shares of our common stock to be outstanding after this offering is based on 293,588,236 shares outstanding as of May 31, 2010, and excludes:

- •

- 9,668,775 shares of common stock issuable upon the exercise of options outstanding as of May 31, 2010 under our 2005 Equity Incentive Plan, as amended, at a weighted average exercise price of $0.05 per share;

5

- •

- 354,610 shares of common stock as of May 31, 2010 reserved for issuance under our 2005 Equity Incentive

Plan; and

- •

- shares of common stock, subject to automatic increases on September 1 of each year from September 2011 to September 2017 of the smallest of shares, % of the shares of common stock outstanding at the time or the number of shares to be determined by our board, reserved for issuance under our 2010 Equity Incentive Plan, which we plan to adopt in connection with this offering.

Except as otherwise indicated, information in this prospectus reflects or assumes the following:

- •

- that our amended and restated certificate of incorporation and our amended and restated bylaws, which will be in effect

upon the completion of this offering, are in effect;

- •

- the automatic conversion of 5,859,950 shares of Class B common stock into 5,859,950 shares of Class A common

stock effective upon the completion of this offering;

- •

- the automatic conversion of 192,064,223 shares of convertible preferred stock into 192,064,223 shares of Class A

common stock effective upon the completion of this offering;

- •

- no exercise of the underwriters' overallotment option to purchase up

to additional shares of our common

stock;

- •

- a : 1 reverse stock split effective of our outstanding Class A common stock effected in

, 2010; and

- •

- the amendment of our certificate of incorporation such that we will no longer have Class A and Class B common stock but only one class of undesignated common stock issued and outstanding effective upon the closing of this offering.

Unless the context otherwise requires in this prospectus, "we," "us," "our company," "our," and "SemiLEDs" refer collectively to SemiLEDs Corporation and its consolidated subsidiaries; "China" or "PRC" refers to the People's Republic of China, excluding Taiwan, Hong Kong and Macau; "Korea" refers to the Republic of Korea; "$" or "U.S. dollars" refers to the legal currency of the United States; "NT dollars" refers to New Taiwan dollars, the legal currency of Taiwan; "RMB" or "Renminbi" refers to the legal currency of China; and convertible preferred stock refers collectively to our Series A, B, C, D and E convertible preferred stock.

This prospectus contains translations of certain RMB and NT dollar amounts into U.S. dollar amounts at specified rates. All translations from RMB and NT dollars to U.S. dollars were made at the noon buying rate as set forth in the H.10 statistical release of the Federal Reserve Board. Unless otherwise stated, the translations of RMB and NT dollars into U.S. dollars have been made at the noon buying rate in effect on May 28, 2010, which was RMB6.83 to US$1.00 and NT$32.00 to US$1.00. We make no representation that the RMB, NT dollar or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars, RMB or NT dollars, as the case may be, at any particular rate or at all. On July 30, 2010, the noon buying rates were RMB6.77 to US$1.00 and NT$31.95 to US$1.00.

6

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize the consolidated financial data for our business. You should read this summary consolidated financial data in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements, related notes thereto and other financial information included elsewhere in this prospectus.

We have derived the summary consolidated statement of operations data for the years ended August 31, 2007, 2008 and 2009 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the summary unaudited consolidated statement of operations data for the nine months ended May 31, 2009 and 2010 and the consolidated balance sheet data as of May 31, 2010 from our unaudited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated financial statements have been prepared on a basis consistent with the audited consolidated financial statements appearing elsewhere in this prospectus and, in the opinion of management, include all adjustments, consisting only of normal recurring adjustments, necessary for fair presentation of such data. Our historical results are not necessarily indicative of results to be expected for any future periods.

| |

Years Ended August 31, | Nine Months Ended May 31, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2007 | 2008 | 2009 | 2009 | 2010 | |||||||||||||

| |

|

|

|

(unaudited) |

||||||||||||||

| |

(in thousands, except share and per share amounts) |

|||||||||||||||||

Consolidated Statement of Operations: |

||||||||||||||||||

Revenues, net |

$ | 6,860 | $ | 14,749 | $ | 11,551 | $ | 7,010 | $ | 24,275 | ||||||||

Cost of revenues(1) |

4,484 | 11,681 | 11,019 | 6,536 | 14,230 | |||||||||||||

Gross profit |

2,376 | 3,068 | 532 | 474 | 10,045 | |||||||||||||

Operating expenses: |

||||||||||||||||||

Research and development(1) |

902 | 1,935 | 2,452 | 1,591 | 1,490 | |||||||||||||

Selling, general and administrative(1) |

1,704 | 2,320 | 2,568 | 1,600 | 2,244 | |||||||||||||

Total operating expenses |

2,606 | 4,255 | 5,020 | 3,191 | 3,734 | |||||||||||||

Income (loss) from operations |

(230 | ) | (1,187 | ) | (4,488 | ) | (2,717 | ) | 6,311 | |||||||||

Other income (expense): |

||||||||||||||||||

Loss from unconsolidated entities(2) |

— | — | — | — | (169 | ) | ||||||||||||

Interest income (expense), net |

97 | 41 | 215 | 209 | (21 | ) | ||||||||||||

Other income, net |

— | 37 | — | — | — | |||||||||||||

Foreign currency transaction gain (loss) |

234 | 295 | 580 | 424 | (325 | ) | ||||||||||||

Total other income (expense), net |

331 | 373 | 795 | 633 | (515 | ) | ||||||||||||

Income (loss) before provision for income taxes |

101 | (814 | ) | (3,693 | ) | (2,084 | ) | 5,796 | ||||||||||

Provision for income taxes |

— | — | — | — | 271 | |||||||||||||

Net income (loss) |

$ | 101 | $ | (814 | ) | $ | (3,693 | ) | $ | (2,084 | ) | $ | 5,525 | |||||

Net income (loss) attributable to common stock: |

||||||||||||||||||

Basic |

$ | — | $ | (814 | ) | $ | (3,693 | ) | $ | (2,084 | ) | $ | 460 | |||||

Diluted |

$ | — | $ | (814 | ) | $ | (3,693 | ) | $ | (2,084 | ) | $ | 487 | |||||

Net income (loss) per share attributable to common stock: |

||||||||||||||||||

Basic |

$ | 0.00 | $ | (0.01 | ) | $ | (0.04 | ) | $ | (0.02 | ) | $ | 0.00 | |||||

Diluted |

$ | 0.00 | $ | (0.01 | ) | $ | (0.04 | ) | $ | (0.02 | ) | $ | 0.00 | |||||

Shares used in computing net income (loss) per share attributable to common stock: |

||||||||||||||||||

Basic |

57,342,749 | 75,530,727 | 92,404,576 | 91,146,507 | 98,029,563 | |||||||||||||

Diluted |

57,892,748 | 75,530,727 | 92,404,576 | 91,146,507 | 107,899,182 | |||||||||||||

7

| |

As of May 31, 2010(3) | |||||||

|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma | Pro Forma as Adjusted |

|||||

| |

(unaudited) (in thousands) |

|||||||

Consolidated Balance Sheet Data: |

||||||||

Cash and cash equivalents |

$ |

14,157 |

$ |

14,157 |

$ |

|||

Working capital(4) |

23,725 |

23,725 |

||||||

Total assets |

76,307 |

76,307 |

||||||

Long-term debt, net of current portion(5) |

3,964 |

3,964 |

|

|||||

Total stockholders' equity |

$ |

65,867 |

$ |

65,867 |

$ |

|||

- (1)

- Stock-based compensation expenses are included in our cost of revenues, research and development expenses and selling, general and administrative expenses as follows:

| |

Years Ended August 31, | Nine Months Ended May 31, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2007 | 2008 | 2009 | 2010 | ||||||||||||

| |

|

|

|

(unaudited) |

||||||||||||

| |

(in thousands) |

|||||||||||||||

Stock-based compensation expenses included in: |

||||||||||||||||

Cost of revenues |

$ |

— |

$ |

— |

$ |

— |

$ |

29 |

||||||||

Research and development |

— |

— |

— |

18 |

||||||||||||

Selling, general and administrative |

3 |

8 |

16 |

53 |

||||||||||||

Total stock-based compensation expenses |

$ | 3 | $ | 8 | $ | 16 | $ | 100 | ||||||||

- (2)

- Includes

our proportionate share of loss from our unconsolidated joint venture entities, including China SemiLEDs. Our investments in these entities are

initially stated at cost on our consolidated balance sheets and adjusted for our portion of equity in these investees' income or loss.

- (3)

- Our

consolidated balance sheet data as of May 31, 2010 is presented:

- •

- on an actual basis;

- •

- on a pro forma basis to give effect to the conversion of 5,859,950 Class B common stock into Class A common

stock and the conversion of 192,064,223 shares of convertible preferred stock, which represents all of the issued and outstanding shares of convertible preferred stock, into shares of Class A

common stock on a one-for-one basis; and

- •

- on a pro forma as adjusted basis to reflect the pro forma adjustments stated above and the sale by us of

shares of common stock offered by this prospectus at the initial public offering price of $ per share (the mid-point of the price range set forth on the cover page of this

prospectus) after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

- (4)

- Working

capital represents short-term assets less short-term liabilities.

- (5)

- Long-term debt includes long-term notes with a maturity of greater than 12 months.

8

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information contained in this prospectus before making an investment decision. Our business, prospects, financial condition or operating results could be materially and adversely affected by any of the risks set forth herein as well as other risks not currently known to us. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In assessing the risks described below, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and the related notes thereto, before deciding to purchase any shares of our common stock.

Risks Related to Our Business

We have a limited operating history which makes it difficult for you to evaluate our business, financial condition, operating results and prospects and which impairs our ability to accurately forecast our future performance.

We were incorporated in January 2005 and our first sales of LED chips occurred in November 2005. Our revenue to date has not been significant and we have only recently generated net income. Our limited operating history, combined with the rapidly evolving nature of the LED industry in which we compete, may not provide an adequate basis for you to evaluate our operating and financial results and business prospects. In addition, we only have limited insight into emerging trends that may adversely affect our business, prospects and our operating results. As such, our limited operating history may impair our ability to accurately forecast our future performance.

We have incurred net losses and although we have recorded moderate net income in recent periods, we may again incur net losses in the future and no assurance can be given that we will be able to maintain our recent revenue and net income growth.

We incurred net losses of $0.8 million and $3.7 million for the fiscal years ended August 31, 2008 and 2009, respectively, and we recorded only moderate net income of $0.1 million for the fiscal year ended August 31, 2007. As a result, our financial statements for the year ended August 31, 2009 include a note that there is substantial doubt about our ability to continue as a going concern, which note does not give effect to the receipt by us of the net proceeds of this offering. As of May 31, 2010, we had an accumulated deficit of $4.2 million. Although we recorded net income of $5.5 million for the nine months ended May 31, 2010, no assurance can be given that we can maintain such profitability and we may incur substantial net losses in the future. Our revenue and net income may decline for a variety of reasons, some of which are beyond our control and include:

- •

- general economic downturns, including an onset of a major financial or economic crisis similar to the one which occurred

beginning in late calendar year 2008;

- •

- adverse economic developments in Taiwan or China;

- •

- slower or less than expected, or negative, growth of the LED general lighting market;

- •

- oversupply in the LED industry;

- •

- our inability to innovate products at the pace of the market and our inability to execute our business strategies; or

- •

- our inability to produce our products due to production interruptions or delays.

You should not rely on the revenue or net income growth of any prior quarterly or annual periods as an indication of our future performance. In the past, we have experienced revenue declines and incurred increased net losses. If our future growth fails to meet investor or analyst expectations, it

9

could have a severe adverse impact on the trading price of our common stock and could have a material adverse effect on our business, financial condition and results of operations.

We derive a substantial portion of our revenues from the sale of our LED chips. Our inability to grow or maintain our revenues generated from the sales of LED chips would have a negative impact on our financial condition and results of operation.

A substantial portion of our revenues to date have been derived from the sale of LED chips, our core product. Revenues attributable to the sale of our LED chips represented 94.6%, 88.0%, 77.6% and 78.8% of our revenues in the years ended August 31, 2007, 2008 and 2009 and the nine months ended May 31, 2010, respectively. Revenues attributable to the sale of our LED components represented substantially all of the remaining portion of our revenues for those periods. We expect to continue to derive a substantial portion of our revenues from the sale of LED chips for the foreseeable future. As such, the continued market acceptance of our LED chips is critical to our continued success, and our inability to grow or maintain our revenues generated from the sales of LED chips would have a negative impact on our business, financial condition and results of operations.

If LEDs fail to achieve widespread adoption in the general lighting market, or if alternative technologies gain market acceptance, our prospects will be materially adversely impacted and we may be unable to maintain our profitability.

Our products are primarily sold for use in LED general lighting applications. Our financial condition, results of operations and prospects substantially depend on increased market acceptance of LEDs in general lighting globally, and in particular in Asia. Although LED lighting has grown rapidly in recent years, adoption of LEDs for general lighting has only recently begun, is still limited and faces significant challenges.

If LED lighting does not achieve widespread acceptance and adoption, or if demand for LED products does not grow as we anticipate, our revenues may decline and our prospects for growth and profitability will be limited. Moreover, if existing sources of light other than LED devices, such as organic light emitting diodes (OLEDs), achieve adoption, or if new sources of light are developed, our current products and technologies could become less competitive or obsolete.

Potential customers for LED general lighting systems may not adopt LED lighting as an alternative to traditional lighting technology because of LEDs' higher upfront cost. In addition, manufacturers of general lighting systems may have substantial investments and know-how related to their existing lighting technologies, such as traditional incandescent, fluorescent, halogen and high intensity discharge, or HID, lighting devices, and may perceive risks relating to the complexity, reliability, quality, usefulness and cost-effectiveness of LED products. Incumbents in the light fixture industry may view LEDs as a threat and disfavor them. Even if LED lighting continues to achieve performance improvements and cost reductions, limited customer awareness of the benefits of LEDs, lack of widely accepted standards governing LED lighting and customer unwillingness to adopt LEDs in favor of entrenched solutions could significantly limit the demand for LED products. Additional factors that may limit the adoption of LEDs for general lighting include, among others:

- •

- availability of government regulations that discourage the use of some traditional lighting technologies and government

incentives and regulations to promote the development of the LED industry;

- •

- changes in economic and market conditions that affect the viability of some traditional lighting technologies, for example declining energy prices that favor existing lighting technologies; and

10

- •

- capital expenditures for new and replacement lighting systems by end users of LED products, which may decline during economic downturns.

We operate in highly competitive markets that are characterized by rapid technological changes and declining average selling prices. Competitive pressures from existing and new companies may harm our business and operating results.

Competition in the markets for LED products is intense, and we expect that competition will continue to increase. Increased competition could result in increased pricing pressure, reduced profit margins, increased sales and marketing expenses, and failure to increase, or the loss of, market share, any of which would likely seriously harm our business, operating results and financial condition.

We compete with many LED chip manufacturers and, to a lesser extent, LED packaging manufacturers. With respect to our LED chips and LED components, we primarily compete with Citizen Electronics Co., Ltd., Cree, Inc., Epistar Corporation, Everlight Electronics Co., Ltd., Nichia Corporation, Philips (Lumileds), Siemens (Osram) and Showa Denko. We have a number of competitors that compete directly with us and are much larger than us, including, among others, Cree, Inc., Epistar Corporation, Nichia Corporation, Philips (Lumileds), and Siemens (Osram). Several substantially larger companies compete against us with a relatively small segment of their overall business. In addition, several large and well-capitalized semiconductor companies, such as Micron Technology, Inc., Samsung Electronics Co., Ltd., Sharp Ltd. and Taiwan Semiconductor Manufacturing Co., have recently announced their plans to enter into the LED chip and lighting market. These potential competitors have extensive experience in developing semiconductor chips, which is similar to the manufacturing process for LED chips. We are also aware of a number of well-funded private companies that are developing competing products. We will also compete with numerous smaller companies entering the market, some of whom may receive significant government incentives and subsidies pursuant to government programs designed to encourage the use of LED lighting and to establish LED-sector companies. For example, Korea has programs to encourage the use of LED lighting and to establish LED-sector companies, which could result in new competitors.

Our existing and potential competitors may have a number of significant advantages over us, including greater financial, technical, managerial, marketing, distribution and other resources, more long-standing and established relationships with our existing and potential customers, greater name recognition, larger customer bases and greater government incentives and support. In addition, some of our competitors have been in operation much longer than we have and therefore may have more long-standing and established relationships with our current and potential customers.

The larger companies with which we compete, or may compete in the future with, may have greater capital resources which may put them in a better position to substantially increase their manufacturing capacity and expend resources on research and development efforts or to withstand any significant market downturns. Such larger companies typically have broader product lines and market focus and thus are not as susceptible to downturns in a particular market. These competitors have in the past reduced their average selling prices, and the resulting competitive pricing pressures have caused us to similarly reduce our prices, accelerating the decline in the gross margin of our products. We expect our competitors will implement such competitive strategies again in the future.

We compete primarily on the basis of our products' performance, price, quality, and reliability and on our ability to customize products to meet customer needs. However, our competitors may be able to develop more competitive products, respond more quickly to new or emerging technologies, or bring new products to the market earlier. Moreover, our existing or potential customers could develop, or acquire companies that develop, products or technologies that may render our products or technologies obsolete or noncompetitive. Our continued success depends on our ability to develop and introduce new, technologically advanced and lower cost products, such as more efficient, higher

11

brightness LED chips. If we are unable to achieve technological breakthroughs, introduce new products that are commercially viable and meet rapidly evolving customer requirements, and keep pace with evolving technological standards and market development, we may experience reduced market share. Any failure to respond to increased competition in a timely or cost-effective manner could have a material adverse effect on our business, financial condition and results of operations and prospects.

The market for LEDs has historically been, and we expect will continue to be, highly volatile, which could harm our business and result in significant fluctuations in the market price of our common stock.

Fluctuations in supply and demand for LEDs pose serious risks to our prospects, business and results of operations. Our industry, akin to the semiconductor industry, is highly cyclical and characterized by rapid technological change, rapid product obsolescence, declining average selling prices and wide fluctuations in supply and demand. Our industry's cyclicality results from a complex set of factors, including, but not limited to:

- •

- fluctuations in demand for end-products that incorporate LED chips and LED components;

- •

- ongoing reductions in the number of LED chips and LED components required per application due to performance improvements;

and

- •

- fluctuations in the unutilized manufacturing capacity available to produce LED chips and LED components.

As market demand increases, if we are not able to increase our capacity or if we experience delays or unforeseen costs associated with increasing our capacity levels, we may not be able to achieve our financial targets. Alternatively, as market demand decreases or as market supply surpasses demand, we may not be able to reduce manufacturing expenses or overhead costs proportionately. We believe that many of our competitors are, like us, adding MOCVD reactors and related equipment to increase manufacturing capacity. We expect a significant number of MOCVD reactors and related equipment will come on line in the next 12 months and increase LED chip supply. If the expected increase in supply outpaces any increases in future market demand, or if demand decreases, the resulting oversupply could adversely impact our sales and cause us to reduce our prices, which would lower our margins and adversely impact our financial results.

Intellectual property claims against us or our customers could subject us to significant costs and materially damage our business and reputation.

Trademark, patent, copyright and other intellectual property rights are critical to our business and the business of our competitors. Our industry is characterized by frequent intellectual property litigation involving patents, trade secrets, copyrights, and mask designs among others. Competitors of ours and other third parties have in the past and will likely from time to time in the future allege that our products infringe on their intellectual property rights. Other companies, including our primary competitors, have been for several years, and continue to be, devoting substantially greater resources than us in filing for and obtaining patents that potentially affect many aspects of our LED chips and LED components and our business. Any intellectual property claim against us, regardless of the validity or outcome, could have a material adverse effect on our business, financial condition, reputation and competitive position. The risk that an infringement claim, with or without merit, will be asserted against us will increase as our visibility within the LED market increases as a result of this offering.

Litigation to determine the validity and scope of any claim against us for infringement, mis-appropriation, mis-use or other violation of third-party intellectual property rights can be highly uncertain because of the complex scientific, legal and factual questions and analyses involved. Defending against intellectual property infringement claims, whether they are with or without merit or are determined in our favor, would likely result in costly litigation, diversion of the attention and

12

efforts of our technical and management personnel or the inability to manufacture, use or sell products found to be infringing. As a result of any such dispute, we may be required to develop non-infringing technology, pay substantial damages, enter into royalty or licensing agreements to use third-party technology, cease selling certain products, adjust our marketing and advertising activities or take other actions to resolve the claims. These actions, if required, may be costly or unavailable on terms acceptable to us. If we are unable to obtain sufficient rights or develop non-infringing intellectual property or otherwise alter our business practices on a timely basis, our business and competitive position may be adversely affected. Moreover, some of our distribution agreements require us to indemnify our distributors for third-party intellectual property infringement claims, which could increase the cost to us of an adverse ruling in such an action.

The intellectual property rights related to packaging LEDs with phosphors to make white light LED components are particularly complex and characterized by aggressive enforcement of those rights. Many of our competitors and other third parties hold patents or licenses or cross-licenses that relate to phosphors and the use of phosphors in LED packages to make white light LED components. We have sought to minimize the risk that one of our competitors or another third party will assert a claim related to our packaged LED components by marketing these products only in certain countries in which we believe enforcement of intellectual property rights has historically been more limited. We cannot assure you that our belief with respect to the enforcement of rights within those markets is accurate. In addition, if the products we sell in a particular country are subsequently shipped or resold to another country, the intellectual property laws of the country of final destination may also apply to our products. Further, we may be subject to claims if our packaging customers for our LED chips lack sufficient intellectual property rights with respect to their packaging process and related packaging materials. We cannot assure you that our competitors or others will not claim that our LED components or our LED chips infringe their intellectual property rights or that, if such claims are made, we will be able to successfully dispute such claims.

In addition, our customers may be subject to infringement claims involving our customers' products that incorporate our technologies or products, and any unfavorable result could impair such customers' continued demand for our products. For example, Nichia Corporation, or Nichia, filed a lawsuit in Japan against a Japanese subsidiary of Seoul Semiconductor Co., Ltd., or Seoul Semiconductor, which is one of our customers, and another lawsuit in Korea against Seoul Semiconductor. In those two lawsuits, Nichia asserted that our LED chips infringed two patents in Japan and one in Korea. While we were not named as a defendant in either of those lawsuits, we intervened as independent or supplementary parties. Although the Japanese lawsuit was settled, it is still possible for Nichia to file a new lawsuit on the two patents originally at issue in the action in Japan. In addition, although the Korean district court found the patent at issue to be invalid, Nichia's subsequent appeal and Seoul Semiconductor's related invalidation action were both withdrawn after the parties entered into a cross-licensing agreement. As such, the invalidity finding by the district court was vacated.

In May 2010, Bluestone Innovations Texas LLC filed a complaint in the United States District Court for the Eastern District of Texas against Osram GmbH, a major German lighting systems manufacturer, as well as other major players in the LED industry. The complaint also names SemiLEDs as a defendant. Bluestone alleges infringement of a U.S. patent and seeks injunctive relief and damages. Although we have not yet been served, we believe that we have meritorious defenses to the infringement allegations and intend to defend this lawsuit vigorously. However, there can be no assurance that we will be successful in our defense and, even if we are successful, we may incur substantial legal fees and other costs in defending the lawsuit. See "Business—Legal Proceedings."

13

Our operating results may fluctuate from quarter to quarter, which could make our future performance difficult to predict and could cause our operating results for a particular period to fall below expectations, resulting in a severe decline in the price of our common stock.

Our quarterly operating results are difficult to predict and may fluctuate significantly in the future. We have experienced seasonal and quarterly fluctuations in the past. However, given that we are an early-stage company operating in a rapidly growing industry, those fluctuations may be masked by our recent growth rates and as a result may not be readily apparent from our historical operating results. As such, our past quarterly operating results may not be good indicators of future performance.

In addition to the other risks described in this "Risk Factors" section, the following factors could cause our operating results to fluctuate:

- •

- general global economic and financial conditions;

- •

- our production capacity, average selling prices and manufacturing yields;

- •

- our ability to retain existing customers, attract new customers and successfully enter new geographic markets;

- •

- changes in supply and demand and other competitive market conditions, including pricing actions by our competitors and our

customers' competitors;

- •

- timing of orders from and shipments to major customers and end-customers, including as part of LED

project-based orders, and our ability to forecast demand and manage lead times for the manufacturing of our products;

- •

- seasonal fluctuations in our customers' purchasing patterns;

- •

- the cyclical nature of the LED industry;

- •

- fluctuations in the currency exchange rates of the U.S. dollar, NT dollar and RMB; and

- •

- natural disasters, such as floods, typhoons and earthquakes, that result in interruptions in power supply resulting from such events or due to other causes.

For these or other reasons, the results of any prior quarterly or annual periods should not be relied upon as indications of our future performance, and our actual revenue and operating results in future quarters may fall short of the expectations of investors and financial analysts, which could have a severe adverse effect on the trading price of our common stock.

We may not be able to effectively expand production capacity or do so in a timely or cost-effective manner, which could prevent us from achieving increased sales, margins and market share.

We plan to continue to expand production capacity at Taiwan SemiLEDs' manufacturing facilities. In addition, our strategy to capitalize on the potential growth of the LED market in China includes China SemiLEDs. China SemiLEDs is currently constructing manufacturing facilities in Foshan, China and is not yet operational. There are many events that could delay, prevent or impact our ability to increase our capacity in accordance with our plans, or otherwise increase our costs, including shortages or late delivery of building materials and facility equipment, delays in governmental approval, consents, licenses, permits and certifications, labor disputes, availability of space for further build-out or earthquakes or other natural disasters, among others.

Any unanticipated delays in completion of planned expanded facilities at Taiwan SemiLEDs or China SemiLEDs or cost overruns may result in a loss of customers and will have a negative impact on our and China SemiLEDs' reputation.

14

Upgrading or expanding existing facilities could also result in manufacturing problems that reduce our yields. For example, in the third fiscal quarter of 2009, we suffered a temporary decrease in our yields after we moved our manufacturing facilities in Taiwan to a new location to increase manufacturing capacity. Yields and utilization rates below our target levels could negatively impact our gross profit.

Our plan to expand production capacity requires a significant amount of fixed cost as it will require us to add and purchase manufacturing lines, equipment and additional raw materials and other supplies. If we are not able to recoup these costs through increased sales and profits, our business, financial condition and results of operations could be materially and adversely affected.

We may have difficulty managing our future growth and the associated increased scale of our operations, which could materially and adversely affect our business and operating results.

We have experienced a period of significant growth over the past few years and expect to continue to expand our business and operations. Since our inception in 2005, our revenues grew from $0.7 million for the year ended August 31, 2006 to $11.6 million for the year ended August 31, 2009 and $24.3 million for the nine months ended May 31, 2010. In addition, China SemiLEDs will have to complete the build-out of the manufacturing facilities, purchase equipment and hire technical and managerial personnel, install LED chip manufacturing lines, install financial and administrative equipment and software and commence operations and begin to market and sell products.

Our future expansion plans, in particular those in China, may place a significant strain on our managerial, administrative, operational, technological and financial resources. In order to manage our growth, we must continue to hire, recruit and manage our workforce effectively as well as implement adequate controls and reporting systems and procedures in a timely manner. If we fail to manage our growth, we may encounter, among other things, delays in production and operational difficulties. Moreover, additional capital investments will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by offsetting expense reductions in the short term.

In order to effectively support our growth and meet customer demand, we must also continue to:

- •

- maintain adequate manufacturing facilities and equipment;

- •

- secure and maintain sufficient and stable supplies of raw material;

- •

- continue to expand our research and development, sales and marketing, technological and distribution capabilities;

- •

- enhance the skills and capabilities of our key personnel and hire additional experienced senior level managers and

technical personnel; and

- •

- attract and retain qualified employees.

If we are unable to effectively manage our growth and the associated increased scale of our operations, our financial results, financial condition, business or prospects could be harmed significantly.

Sales of our products are concentrated in Asia, particularly in China and in Taiwan. Adverse developments in these markets could have a material and disproportionate impact on us.

Our revenues are highly concentrated in markets in Asia, particularly in China and Taiwan. Revenues generated from sales of our LED chips and LED components to China (including Hong Kong) accounted for 23.2%, 47.2% and 41.6% of our revenues for the years ended August 31, 2008 and 2009 and the nine months ended May 31, 2010, respectively, and revenues generated from sales of our LED chips and LED components to Taiwan accounted for 42.2%, 31.8% and 41.3% of our revenues for the years ended August 31, 2008 and 2009 and the nine months ended May 31, 2010, respectively. As a result of our revenue concentration in these two markets, economic downturns, changes in governmental policies and increased competition in China or Taiwan could have a material and disproportionate impact on our revenues, operating results, business and prospects.

15

We may not succeed in cost-effectively producing LED chips using larger wafer sizes.

To lower our per unit production costs and to compete effectively, we expect to have to continually develop new technologies that allow us to produce LED chips using larger wafer sizes. We are currently producing chips based on 2.5" wafer sizes. Although we have plans to migrate to commercial production based on 4" wafers and to commence research and development or testing for the manufacture of 6" wafers in the next 12 months, we do not have any experience in the commercial production of LED chips using 4" and 6" wafers.

Larger wafers are significantly more expensive to manufacture than smaller wafers and generally have physical attributes and properties that make it materially more difficult to process efficiently for the manufacture of LED chips with yield and consistency that may not justify the high cost of the wafer. While we have invested and will continue to invest in process technologies and know-how to manufacture LED chips using 4" wafers and we expect to commence research and development to manufacture chips using 6" wafers, no assurance can be given that we will be successful in doing so. Several of our competitors have begun manufacturing LED chips based on 4" wafers. If we are unable to cost-effectively migrate to larger wafer sizes, or if these and other manufacturers succeed in developing cost-effective 4" and 6" wafer technology before we do, our financial condition, results of operations, competitiveness and prospects will be materially and adversely affected.

Variations in our production yields and limitations in the amount of process improvements we can implement could impact our ability to reduce costs and could cause our margins to decline and our operating results could suffer.

Our products are manufactured using technologies that are highly complex. The number of usable chips, or yield, from our production processes may fluctuate as a result of many factors, including but not limited to the following:

- •

- variability in our process repeatability and control;

- •

- contamination of the manufacturing environment;

- •

- equipment failure, variations in the manufacturing process, or power outages;

- •

- lack of consistency and adequate quality and quantity of components and raw materials;

- •

- losses from broken wafers, inventory damage or human errors;

- •

- defects in packaging either within our facilities or at our subcontractors; and

- •

- any transitions or changes in our production process, planned or unplanned.

Introduction of new products and manufacturing processes are often characterized by lower yields in the initial commercialization stage. In the past, we have experienced difficulties in achieving acceptable yields when introducing new products or new manufacturing processes, which has adversely affected our operating results. We may experience similar problems in the future, and we cannot predict when they may occur or the severity of such difficulties and the impact on our business.

In some instances, we may offer products for future delivery at prices based on planned yield improvements or increased cost efficiencies from other production advances. Failure to achieve these planned improvements or advances could significantly affect our margins and operating results.

If we are unable to implement our product innovation strategy effectively, our business and financial results could be materially and adversely affected.

As part of our growth strategy, we plan to continue to be innovative in product design, to deliver new products and improve our manufacturing efficiencies. In particular, as the LED industry

16

develops and technical specifications and market standards change, we must continue to innovate and develop competitive products that are accepted by the marketplace. We have also made significant investments in technologies intended to enhance our LED component capabilities. If we are unable to execute our product innovation strategy effectively, we may not be able to take advantage of market opportunities as they arise, execute our business plan or respond to competition.

We may not be successful in expanding our sales of LED components in certain markets, and some of our packaging customers may reduce orders if they perceive us as competing with them.

We have recently expanded our sales of LED components and plan to continue to focus on increasing such sales in the future. As we continue to expand our LED components business, some of our packaging customers may perceive us as a competitor and may reduce or cease purchasing our LED chips. If such reduction in orders occurs faster than our growth in our LED components business or if future demand for these products does not grow, our business, financial condition and results of operations could be materially and adversely affected.

In addition, we face challenges in further expanding our LED components business because it involves processes and technologies that are significantly different from our manufacturing processes for LED chips, which has been our core product to date. For example, we are developing advanced level LED component techniques, such as wafer level packaging, which is in early stages of development. We have not yet produced wafer level packaging commercially or in any significant volumes, and may not be able to do so. If we are not able to further develop our LED components business or if competitors create or adopt more advanced packaging technologies than ours, then our business, financial condition and results of operations could be materially and adversely affected.

In addition, the intellectual property rights related to LED components are particularly complex and characterized by aggressive enforcement of those rights. To minimize the likelihood that one of our competitors or another third party will assert a claim, regardless of the merit, related to our LED components, we have sought to market these products only in certain countries in which we believe enforcement of intellectual property rights has historically been more limited. As a result, sales of our LED components have been limited to a small number of countries, and, given our strategy to minimize litigation risk, we may not be able to identify additional countries that we find to be suitable markets for these products. In addition, if the countries in which we currently sell our LED components increase their enforcement of intellectual property rights, our ability to continue to sell our LED components in our current markets may be materially adversely affected. Sales of our LED components and our other products may also be limited in the event that they are subsequently shipped or otherwise resold in a country, and a claim is brought against us or our customer pursuant to the intellectual property laws of the country of final destination.

We derive a substantial portion of our revenues from a limited number of customers and generally do not enter into long-term customer contracts. The loss of, or a significant reduction in purchases by, one or more of these customers could adversely affect our operating results and financial condition.

We derive a significant portion of our revenues from a limited number of customers. For the years ended August 31, 2007, 2008 and 2009, our top ten customers represented 77.7%, 73.0% and 57.3% of our revenues, respectively, and 63.8% for the nine months ended May 31, 2010. Some of our largest customers have changed from year to year primarily as a result of our limited operating history, rapid growth, broadening customer base, and the timing of discrete, large project-based purchases. In addition, for the year ended August 31, 2009 and the nine months ended May 31, 2010, one distributor customer, Shenzhen Noah OPT-ELE Co., Ltd., or Shenzhen Noah, accounted for 32.2% and 25.6%, respectively, of our revenues. Shenzhen Noah purchases products from us through one-time purchase orders and does not have any long-term purchase commitments.

17

The sales cycle from initial contact to confirmed orders with our customers is typically long and unpredictable. We typically enter into individual purchase orders with large customers, which can be altered, reduced or cancelled with little or no notice to us. We do not generally enter into long-term commitment contracts with our customers. As such, these customers may alter their purchasing behavior and reduce or cancel orders with little or no notice to us. Consequently, any one of the following events may cause material fluctuations or declines in our revenues:

- •

- reduction, delay or cancellation of orders from one or more of our major customers;

- •

- loss of one or more of our major customers and our failure to identify additional or replacement customers; and

- •

- failure of any of our major customers to make timely payment for our products.

We rely on certain key personnel. The loss of any of our key personnel, or our failure to attract, assimilate and retain other highly qualified personnel in the future, could harm our business.

Our future success depends on the continued service and performance of our key personnel, including in particular Trung T. Doan, our chief executive officer, and Dr. Anh Chuong Tran, our chief operating officer. We do not maintain key man insurance on any of our officers or key employees.

If any of Mr. Doan, Dr. Tran or others of our key personnel were unable or unwilling to continue in their present positions, we may not be able to replace them readily or on terms that are reasonable, if at all. As such, the loss of Mr. Doan, Dr. Tran or other key personnel, including other key members of our management team and certain of our key marketing, sales, product development or technology personnel, could significantly disrupt our operations and prevent the timely achievement of our development strategies and growth, which would likely have an adverse effect on our financial condition, operating results and prospects. Moreover, we may lose some of our customers if any of our officers or key employees were to join a competitor or form a competing company. The loss of the services of our senior management for any reason could adversely affect our business, operating results and financial condition.

In addition, competition for experienced employees in our industry can be intense, and we may not be successful in recruiting, motivating or retaining sufficiently qualified personnel on terms that are reasonable, or at all. In particular, China SemiLEDs may face difficulties recruiting and retaining suitable employees in sufficient numbers and it may need to invest significant time and resources to train personnel to perform the necessary manufacturing, senior management and administrative functions.

The marketing and distribution efforts of our third-party distributors may not be effective, which could negatively affect our ability to expand our business outside of Taiwan and China and damage our brand reputation.

We market and sell our products through third-party distributors in certain markets such as China, Japan and South Korea. For the years ended August 31, 2008 and 2009 and the nine months ended May 31, 2010, 40.0%, 54.8% and 45.5% of our revenues were from sales to distributors. We rely on these distributors to service end-customers, and our failure to maintain strong working relationships with such distributors could have a material adverse impact on our operating results and revenues from such countries and damage our brand reputation.

We do not control the activities of our distributors with respect to the marketing and sales of and customer service support for our products. Therefore, the reputation and performance of our distributors and the ability and willingness of our distributors to sell our products, uphold our brand reputation for quality, by providing, for example, high quality service and pre- and post-sales support, and their ability to expand their businesses and their sales channels are essential to the future growth

18

of our business and has a direct and material impact on our sales and profitability in such jurisdictions. Also, as with our individual customers, we do not have long-term purchase commitments from our distributor customers, and they can therefore generally cancel, modify or reduce orders with little or no notice to us. As a result, any reductions or delays in, or cancellations of, orders from any of our distributors may have a negative impact on our sales and budgeting process.

In addition, we have entered and may from time to time enter into exclusivity or other restrictions or arrangements of a similar nature as part of our agreements with our distributors. Such restrictions or arrangements may significantly hinder our ability to sell additional products, or enter into agreements with new or existing customers or distributors that plan to sell our products, in certain markets, which may have a material adverse effect on our business, financial condition and results of operations.

Moreover, we may not be able to compete successfully against those of our competitors who have greater financial resources and are able to provide better incentives to distributors, which may result in reduced sales of our products or the loss of our distributors. The loss of any key distributor may force us to seek replacement distributors, and any resulting delay may be disruptive and costly.

We are highly dependent on our customers' ability to produce and sell products incorporating our LED products. If our customers are not successful, our operating results could be materially and adversely affected.

Our customers incorporate our LED products into their products. As such, demand for our products is dependent on demand for our customers' end-products that incorporate our LED products and our customers' ability to sell these products. The general lighting market has only recently begun to develop and adopt standards for fixtures that incorporate LED devices. If the end-customers for our products are unable to manufacture fixtures that meet these standards, our customers' sales, and consequently our sales, will suffer.