Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REGIONS FINANCIAL CORP | d8k.htm |

Exhibit 99.1

*

*

* |

Forward-Looking

Statements 1

This presentation may include forward-looking statements which reflect Regions’ current views

with respect to future events and financial performance. The Private Securities Litigation Reform Act of 1995

(“the Act”) provides a “safe harbor” for forward-looking statements which are

identified as such and are accompanied by the identification of important factors that could cause actual results to differ

materially from the forward-looking statements. For these statements, we, together with our

subsidiaries, claim the protection afforded by the safe harbor in the Act. Forward-looking statements are not

based on historical information, but rather are related to future operations, strategies, financial

results or other developments. Forward-looking statements are based on management’s expectations as well

as certain assumptions and estimates made by, and information available to, management at the time the

statements are made. Those statements are based on general assumptions and are subject to

various risks, uncertainties and other factors that may cause actual results to differ materially from

the views, beliefs and projections expressed in such statements. These risks, uncertainties and other

factors include, but are not limited to, those described below:

›

The Dodd-Frank Wall Street Reform and Consumer Protection Act became law on July 21, 2010, and a

number of legislative, regulatory and tax proposals remain pending. Additionally, the U.S. Treasury

and federal banking regulators continue to implement, but are also beginning to wind down, a number of

programs to address capital and liquidity in the banking system. All of the foregoing may have

significant effects on Regions and the financial services industry, the exact nature and extent

of which cannot be determined at this time.

›

The impact of compensation and other restrictions imposed under the Troubled Asset Relief Program

(“TARP”) until Regions repays the outstanding preferred stock and warrant issued under the TARP,

including restrictions on Regions’ ability to attract and retain talented executives and

associates.

›

Possible additional loan losses, impairment of goodwill and other intangibles, and adjustment of

valuation allowances on deferred tax assets and the impact on earnings and capital.

›

Possible changes in interest rates may increase funding costs and reduce earning asset yields, thus

reducing margins.

›

Possible changes in general economic and business conditions in the United States in general and in

the communities Regions serves in particular, including any prolonging or worsening of the current

unfavorable economic conditions including unemployment levels.

›

Possible changes in the creditworthiness of customers and the possible impairment of the

collectability of loans.

›

Possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of

governments, agencies, and similar organizations, including changes in accounting standards, may

have an adverse effect on business.

›

The current stresses in the financial and real estate markets, including possible continued

deterioration in property values.

›

Regions' ability to manage fluctuations in the value of assets and liabilities and off-balance

sheet exposure so as to maintain sufficient capital and liquidity to support Regions' business.

›

Regions' ability to achieve the earnings expectations related to businesses that have been acquired or

that may be acquired in the future.

›

Regions' ability to expand into new markets and to maintain profit margins in the face of competitive

pressures.

›

Regions' ability to develop competitive new products and services in a timely manner and the

acceptance of such products and services by Regions' customers and potential customers.

›

Regions' ability to keep pace with technological changes.

›

Regions' ability to effectively manage credit risk, interest rate risk, market risk, operational risk,

legal risk, liquidity risk, and regulatory and compliance risk.

›

Regions’ ability to ensure adequate capitalization which is impacted by inherent uncertainties in

forecasting credit losses.

›

The cost and other effects of material contingencies, including litigation contingencies, and any

adverse judicial, administrative or arbitral rulings or proceedings.

›

The effects of increased competition from both banks and non-banks.

›

The effects of geopolitical instability and risks such as terrorist attacks.

›

Possible changes in consumer and business spending and saving habits could affect Regions' ability to

increase assets and to attract deposits.

›

The effects of weather and natural disasters such as floods, droughts and hurricanes, and the effects

of the Gulf of Mexico oil spill.

›

Regions’ ability to maintain favorable ratings from rating agencies.

›

Potential dilution of holders of shares of Regions’ common stock resulting from the U.S.

Treasury’s investment in TARP.

›

Possible changes in the speed of loan prepayments by Regions’ customers and loan origination or

sales volumes.

›

The effects of problems encountered by larger or similar financial institutions that adversely affect

Regions or the banking industry generally.

›

Regions’ ability to receive dividends from its subsidiaries.

›

The effects of the failure of any component of Regions’ business infrastructure which is provided

by a third party.

›

The effects of any damage to Regions’ reputation resulting from developments related to any of

the items identified above. The foregoing list of factors is not exhaustive; for discussion of these and other risks that may

cause actual results to differ from expectations, please look under the caption “Risk Factors” in Regions’ Annual

Report on Form 10-K for the year ended December 31, 2009 and Forms 10-Q for the quarters ended

June 30, 2010 and March 31, 2010, as on file with the Securities and Exchange Commission. The words "believe," "expect," "anticipate," "project," and

similar expressions often signify forward-looking statements. You should not place undue reliance on any forward-looking statements, which speak

only as of the date made. Regions assumes no obligation to update or revise any forward-looking

statements that are made from time to time. |

Business Overview

Grayson Hall

*

*

*

* |

Agenda

and Introductions Grayson Hall

Business Overview

David Turner

Financial Review

Bill Wells

Credit Quality

BREAK

John Owen

Consumer Services

John Asbury

Business Services

John Carson

Morgan Keegan

Regional Presidents Panel

Regional Updates

LUNCH

Grayson Hall/David Turner

Break Out Session

John Owen/John Carson/John Asbury

Break Out Session

Regional Presidents/Bill Wells

Break Out Session

2 |

Overview

›

Environmental factors impacting industry

›

Key issues impacting Regions

›

Strategic priorities driving results

3 |

Environmental Factors Impacting Industry

›

Economy

›

Low consumer and business confidence

›

High unemployment forecasted to continue

›

Home price stabilization is mixed

›

Financial Reform

›

Impacts consumers, industry and economy

›

Implementation process just beginning

›

Gulf Oil Spill

›

Monitoring crisis closely

›

Following a proven disaster recovery plan

4 |

Key

Issues Impacting Regions ›

Morgan Keegan Regulatory Matters

›

Capital Purchase Program Repayment

5 |

Strategic Priorities Achieving Results

›

Keep Business Focused on the Customer

›

Strong deposit base and more active customers

›

Customer loyalty well above industry norms

›

Protect Our Future

›

Smarter risk management

›

Strong capital and liquidity positions

›

Restore Financial Performance

›

Improving net interest margin

›

Rigorous expense control

›

Execute with Excellence

›

Clear goals and accountability

›

Right plans, right people and laser sharp focus

6 |

Financial Update

David Turner

*

*

*

* |

Earnings: Improving trends in PPNR and LLP

Q2

Q3

Q4

Q1

Q2

($ in millions)

2009

2009

2009

2010

2010

Stable and Improving PPNR

Net Interest Income

$ 831

$ 845

$ 850

$ 831

$ 856

Core Non-Interest Income*

761

764

744

734

756

Core Revenue*

1,592

1,609

1,593

1,565

1,612

Net Interest Margin

2.62%

2.73%

2.72%

2.77%

2.87%

Core Non-Interest Expense*

1,099

1,199

1,207

1,168

1,126

Core Pre-Tax Pre-Provision Net Revenue*

493

409

386

397

486

Improving Credit / LLP Trends

Loan Loss Provision

912

1,025

1,179

770

651

Net Charge Offs / Avg Loans

2.06%

2.86%

2.99%

3.16%

2.99%

Improving Results

Core EPS*

$ (0.35)

$ (0.35)

$ (0.46)

$ (0.21)

$ (0.11)

*Non-GAAP, refer to Appendix for non-GAAP reconciliation

2 |

Margin: Declining deposit costs drive net

interest margin improvement

Loan

Yields

Net

Interest

Margin

Deposit

Costs

3 |

Credit: Net charge offs stabilized

and NPLs

declined

ALLL / NPLs

0.87x

0.82x

0.89x

0.86x

0.92x

4 |

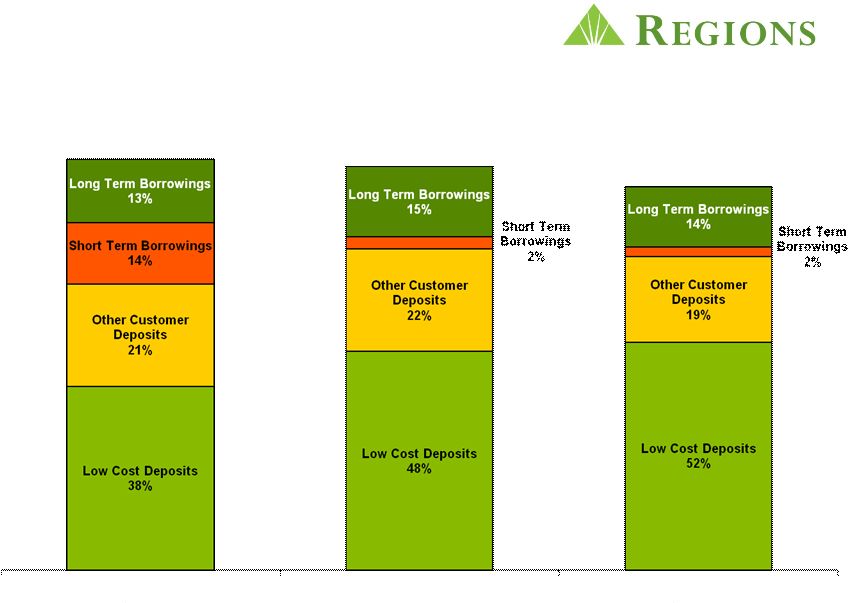

Total Wholesale funding

$33.6B

$22.8B

$17.9B

% of Total Funding

27%

18%

15%

December 31, 2008

December 31, 2009

June 30, 2010

Improved Funding Mix

5 |

Capital Update

2Q 2009

3Q 2009

4Q 2009

1Q 2010

2Q 2010*

Tier 1 Common Ratio

8.1%

7.9%

7.1%

7.1%

7.7%

Tangible Common Equity Ratio

6.6%

6.6%

6.0%

6.1%

6.3%

Tier 1 Capital Ratio

12.2%

12.2%

11.5%

11.7%

12.0%

Total Capital Ratio

16.2%

16.3%

15.8%

15.8%

15.9%

Tangible Book Value per Share

$7.58

$7.40

$6.89

$6.71

$6.45

* Estimate

6 |

Capital Update: Capital vs. Peers

Peers include BAC, BBT, CMA, FITB, KEY, MI, MTB, PNC, STI, USB, WFC

7 |

We Are

Lending and Remain Focused on Meeting Our Customers’

Needs

›

$92 billion in new / renewed loan commitments to

more than over 244k customers in the last 18 months

›

Regions Customer Assistance Program

›

Assisted more than 30,000 homeowners and

restructured $2.3 billion in mortgages

›

US Treasury’s Home Affordable Modification Program

›

Investing in new products and services for our

customers

8 |

We

Have Strengthened Our Core Franchise Through Productivity and Efficiency

Initiatives ($ in millions)

2007

2008

2009

Branches

1,965

1,900

1,895

›

Further reduced branch

count by 120 in 1Q10

Employees

33,161

30,784

28,509

›

Headcount declined 4,652

or 14%

Core

Expenses*

$3,991

$3,936

$3,704

›

Total core expenses

declined $287MM or 7%

* Excludes FDIC expense, other real estate expense, legal and professional fees,

credit investigations, credit support expense, unfunded commitments, MSR

impairment, loss on early extinguishment of debt, branch consolidation costs,

VISA settlement and securities impairment

9 |

›

Core profitability focus

›

Leaner, more efficient franchise

›

Single platform

›

Reduced headcount

›

Consolidated branch network

›

Invest where profitability hurdles are achieved

›

Effective expense management

›

Solid position in diversified footprint

›

Great branch coverage

›

Broad product offerings

›

Strong brand and customer loyalty

›

Solid capital and liquidity

Focused on Profitability and Well Positioned

For the Long Run

10 |

Credit Quality

William C. Wells II

*

*

*

* |

Credit

Process Improvements Through the Cycle

›

Complete cover-to-cover review of credit policy

›

Strengthened credit authorities

›

Refined portfolio concentration limits

›

Enforced consistent and sound underwriting

standards

›

Lowered the risk profile of the loan portfolio

›

Focused on resolution of problem assets

›

Actively work with customers in need of

financial support

2 |

Total

Loan Portfolio $85.9B

Investor Real Estate $18.9B

Commercial

and Industrial

$21.1B / 25%

Owner

Occupied

Real Estate

$12.5B / 15%

Investor

Real Estate

$18.9B

22%

Residential

First Mortgage

$15.6B / 18%

Indirect

$1.9B / 2%

Direct and

Other

$1.1B

1%

Home

Equity

$14.8B

17%

Land

$2.3B / 12%

Single Family

$1.6B / 9%

Condo -

$0.4B / 2%

Hotel -

$1.0B / 5%

Industrial -

$1.3B / 7%

Office

$2.8B / 15%

Retail

$3.6B / 19%

Multi Family

$4.8B / 25%

Other -

$1.1B / 6%

3 |

Investor Real Estate Portfolio is Diversified

22% of Total Portfolio

Other*

$3.1B / 17%

FL

$4.4B / 23%

TX

$2.1B / 11%

GA

$1.9B / 10%

TN

$1.7B / 9%

AL

$1.6B / 9%

NC

$1.1B / 6%

LA -

$0.9B / 4%

MO -

$0.6B / 3%

SC -

$0.6B / 3%

AR -

$0.5B / 3%

Loan Size

Geography

* Other includes states with exposure of less than 2%

0

5,000

10,000

15,000

20,000

25,000

30,000

<$1MM

$1MM-

10MM

$10MM-

25MM

$25MM+

$806 Thousand Average Loan Balance

20,540

2,551

341

74

# of Loans

VA -

$0.4B / 2%

4 |

Credit

Metrics are Stabilizing but the Portfolio Remains Stressed

›

Non-performing asset migration has continued

to moderate

›

Charge-offs have moderated

›

Another solid quarter in disposing of problem assets

›

Allowance for Loan and Lease Losses remained level

5 |

Net

Charge-offs Moderating (in millions)

2Q09

3Q09

4Q09

1Q10

2Q10

Net Charge-offs

IRE Valuation Losses

$129

$191

$215

$198

$142

Investor Real Estate (IRE)

39

45

55

59

74

Commercial

99

136

107

128

117

Consumer Real Estate

164

150

168

177

167

Other Consumer

24

30

32

28

19

Net Charge-offs excluding

charge-offs from Sales /

Transfers to HFS

455

552

577

590

519

Sales/Transfer to HFS

36

128

115

110

132

Total Net Charge-offs

$491

$680

$692

$700

$651

6 |

($500)

$0

$500

$1,000

$1,500

$2,000

2Q09

3Q09

4Q09

1Q10

2Q10

0%

5%

10%

15%

20%

25%

30%

35%

40%

Gross Additions

Dispositions

Net NPA Change

Charge-Offs

Discount on Disposition Activity

NPA Migration Moderates

1,758

1,667

1,404

1,306

281

554

643

689

1,122

662

376

221

(297)

887

779

491

680

692

700

651

Dispositions

includes

OREO

Sales,

Problem

Loan

and

HFS

Sales

and

Transfers

to

HFS

7 |

Provision Stabilized and Matched Charge Offs

491

680

692

700

651

345

487

70

421

$0

$200

$400

$600

$800

$1,000

$1,200

2Q09

3Q09

4Q09

1Q10

2Q10

Net Charge Offs

Provision over Net Charge Offs

$912

$1,025

$1,179

$770

$651

Loan Loss Provision

8 |

Total TDRs -

$1.6B*

$0

$400

$800

$1,200

$1,600

$2,000

2Q09

3Q09

4Q09

1Q10

2Q10

Accruing

Non-Accruing

$ millions

›

Modifications are a result of our proactive outreach efforts

›

Any concession to a customer experiencing financial difficulty

creates a TDR

Residential Mortgage -

65%

Home Equity -

20%

Other Consumer -

4%

Commercial -11%

Consumer TDRs -

$1.4B*

95% are accruing interest

*Includes accruing loans, non-accruing loans and loans 90+ days past due

9 |

Customer Assistance Program

›

To ensure that customers who encounter financial

difficulty know there is help available and we want

to work with them

Achievements

›

Helped over 30,000 people stay in their homes

›

Proactively made over 400,000 outreach calls

›

Recidivism rate is 20%

›

Foreclosure rate is less than half the national average

10 |

Gulf

Oil Spill Update ›

Closely monitoring loans across the Gulf and

reaching out to customers

›

The number of customers affected remains a small

subset of the overall portfolio

›

Customer Assistance Program (CAP) continues to

assist customers in need of financial support

11 |

Second Quarter Summary

›

Non-performing Asset Migration has continued

to moderate

›

Charge-offs moderated

›

Provision expense moderated

›

Allowance for Loan and Lease Losses

remained level

›

Investor Real Estate reduced from $26.1B

at 12/31/07 to $18.9B at 6/30/2010

›

Construction loans down $3.8B from $11.8B

at 12/31/07

12 |

Consumer Services

John Owen

*

*

*

* |

Consumer Services Overview

Diversified Offerings

Multi Channel Delivery

Deposits

Mortgage

Consumer

Lending

Insurance

Credit/Debit

Cards

Focused on the Customer

2 |

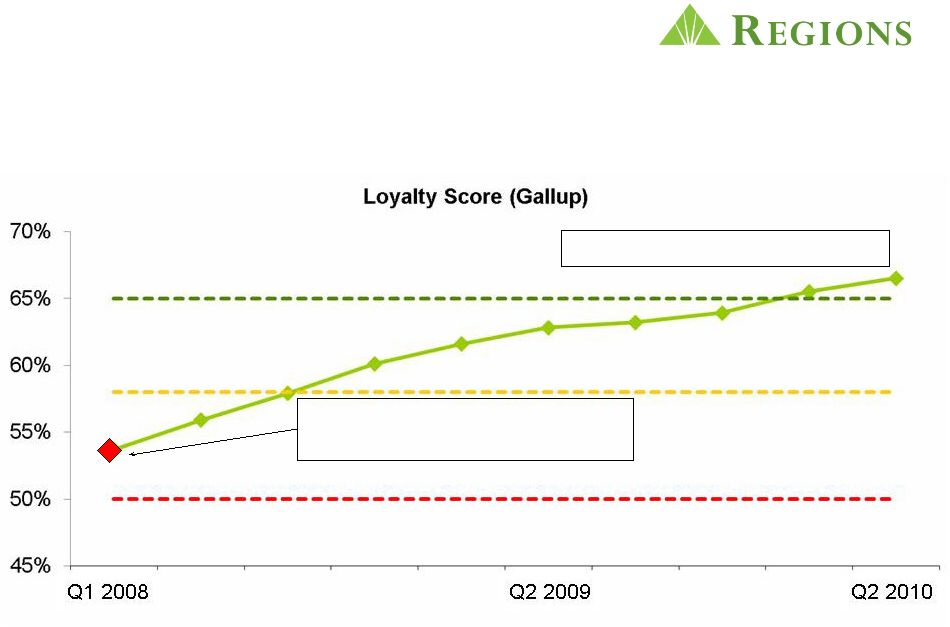

Customer Loyalty is the Foundation for Growth

Regions –

Q1 2008

Ranked in Middle of the Pack

Regions Ranked in Top 10%

Excellent -

Gallup 90th percentile

Average -

Gallup 50th percentile

Good -

Gallup 75th percentile

3 |

Branch Customer Experience At An All-Time High

Excellent -

Gallup 90th percentile

Average -

Gallup 50th percentile

Regions Reached Top 20%

Regions –

Q1 2008

Ranked in Middle of the Pack

Good -

Gallup 75th percentile

4 |

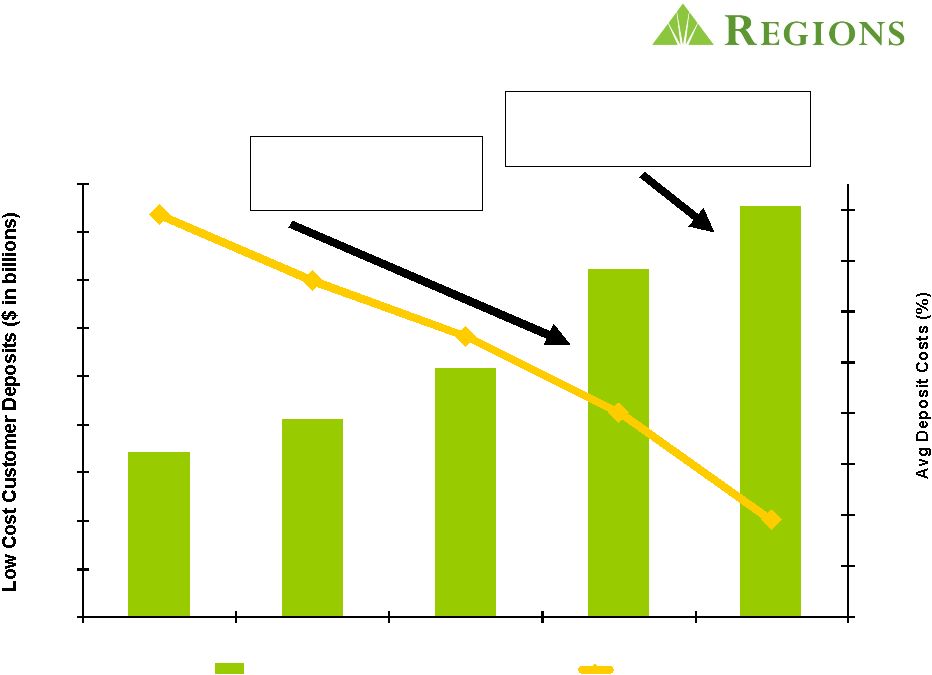

$60.9

$62.2

$64.3

$68.5

$71.1

0.6%

0.7%

0.8%

0.9%

1.0%

1.1%

1.2%

1.3%

1.4%

54.0

56.0

58.0

60.0

62.0

64.0

66.0

68.0

70.0

72.0

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

Low Cost Customer Deposits

Deposit Costs

Strong Low Cost Deposit Growth

While Driving Lower Deposit Costs

June balances are 17%

higher than prior year

60 bps reduction

since 2Q09

139 bps

79 bps

5 |

Peer

Bank Deposit Rate Analysis 1Q 2010 vs 2Q 2010

0.35%

0.50%

0.40%

0.76%

0.79%

1.17%

0.78%

0.90%

1.04%

0.54%

0.39%

0.29%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

Wells

BofA

US

PNC

Comerica

M&T

SunTrust

5/3

Regions

BBT

M&I

Key

1Q

2Q

-0.02%

-0.07%

-0.08%

-0.08%

-0.03%

-0.05%

-0.21%

-0.05%

-0.05%

-0.15%

-0.04%

-0.02%

-0.30%

-0.20%

-0.10%

0.00%

Rate change from 1Q to 2Q

Regions Continues Improving Deposit Costs

Regions

6 |

Improving Deposit Mix Driving Lower Deposit Costs

36% Time Deposits

27% Time Deposits

Q2 2009

Q2 2010

Reduced Time Deposit

Concentration by 25%

$95.0B

$98.1B

7 |

Strong Year Over Year Checking

Account Growth

Exceeded Road to 1 Million Goal in 2009

On Target to Do It Again

488,200 Opened YTD

8 |

Continue Rebalancing Profit Pools

›

Early Adopter –

moving away from Free Checking

›

Increased existing hurdle levels for LifeGreen Accounts

to be Free in 2Q 2010

›

Moving over 1.1 Million Free Accounts to LifeGreen in

3Q 2010

›

Product changes will not impact LifeGreen for Seniors

or Students

›

Completed launch of Relationship Rewards –

improving

customer loyalty and deepening wallet share

›

Launching Regions Cashback Rewards in August

9 |

Regions Mortgage –

Expertise, Speed, Simplicity

and Exemplary Service Our Customers Count On

PORTFOLIO

SERVICING

PRODUCTION

CROSS-SELL

•

$15.6 Billion June 2010

Portfolio Yield 4.9%

•

$15.6 Billion June 2009

Portfolio Yield 5.5%

•

Forecasting $6.8 Billion in 2010

•

Second Best Retail

Production year

•

Record year in 2009,

$9.6 Billion of Production

•

Deposit Cross-sell penetration

>50% for Mortgage Only

Customers

•

Strong Title Insurance

penetration for Refi’s

•

$40 Billion in Servicing Balances

•

316,000 Loans

•

Foreclosure rates are less than

half the Industry Average*

* Mortgage Bankers Association of America Foreclosure Rate –

Q1, 2010

10 |

Regions Mortgage vs. Peer Group Average

Revenue per Loan

Cost per Loan

Income per Loan

Regions

$5,586

$3,331

$2,255

Peer Group Average

$5,248

$3,662

$1,586

$5,586

$3,331

$2,255

$5,248

$3,662

$1,586

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

Highly Profitable Mortgage Production Unit

Market

Share*

–

Opportunity

to

Grow

In-Footprint

Regions

18

16

14

Profitability

Q3 2009

Q4 2009

*Q4 2009 National Market News Survey

Q3 2008

11 |

Demand Remains Soft for Home Equity Lending

›

Demand will improve as

unemployment and

consumer confidence

improve

›

Current Book of Business is

80% Variable Rate

Portfolio Yield vs. Going-on Rate

Production

Q2 2009

Home Equity Balances

Q2 2010

14,802

15,796

16000

14000

Q2 2009

Q2 2010

350

330

346.6

339.2

12 |

Targeting Growth in Consumer Lending

BRANCH SMALL BUSINESS

DIRECT TO CONSUMER LOANS

INDIRECT AUTO

UNDERSERVED CONSUMER

•

Targeting small businesses

between $250,000 and

$2 Million

•

Targeted industries

•

Targeted geographies

•

Re-entering Indirect Auto in

September

•

Cost efficient –

Low Risk

Business Model

•

Demand improving

•

Growing segment that is not

served well by Banks today

•

Developing Short Term Loan

products –

Targeting rollout

April 2011

•

Demand improving

•

Pre-approval at New Account

Opening to launch in 3Q2010

Growth

Growth

Growth

Growth

13 |

In

Summary ›

Strong Core Deposit Growth Year Over Year

›

Improved Deposit Cost 60 Basis Points since 2Q2009 –

more to come

›

Focused on Rebalancing Profit Pools –

Deposit Mix

Changes, Free Checking, Relationship Rewards,

Cash Rewards

›

Focused on Prudent Loan Growth –

Mortgage, Direct,

Indirect Auto and Branch Small Business

›

Achieved Top 10% in Term of Customer Loyalty (Gallup)

14 |

Business Services

John Asbury

*

*

*

* |

We Are

Executing the Plan and Positioned for Growth

›

Managing risk

›

Diversification of revenue stream

›

Acquiring and expanding client relationships

›

Loan growth with pricing discipline

›

Low cost deposit gathering

›

Client satisfaction and loyalty

2 |

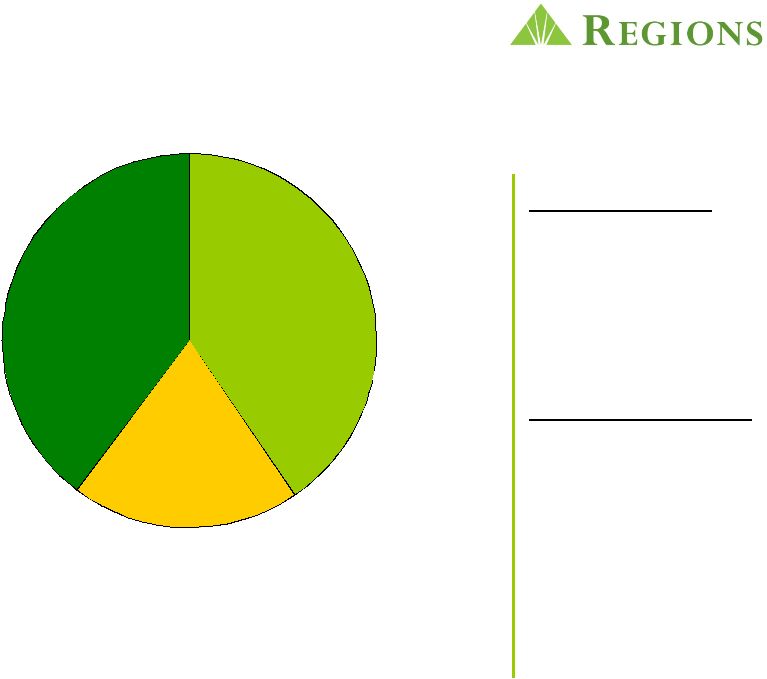

We

Are Remixing our Loans Dec –

2013

Commercial

50%

Owner

Occupied

Real Estate

25%

Investor

Real Estate

25%

Commercial

40%

Owner

Occupied

Real Estate

24%

Investor

Real Estate

36%

Commercial

38%

Owner

Occupied

Real Estate

23%

Investor

Real Estate

39%

Jun –

2010

Dec –

2009

3 |

Revenue Is Well-Diversified by Line of Business

Product Groups

›

Treasury Management

›

Capital Markets /

Syndications

(Morgan Keegan)

›

Equipment Finance

Specialized Groups

›

Business Capital

(ABL)

›

Healthcare

›

Transportation

›

Public, Institutional,

Non-profit

›

Franchise Restaurant

Middle Market

›

C&I

›

Specialized

Groups

Commercial Real Estate

›

Professional income property

developers, owners and operators

›

Public real estate companies

›

Homebuilders

›

Affordable housing tax credits

Small Business

›

Business Banking

›

Community

Banking

›

Branch Small

Business

40%

20%

40%

4 |

We

Have a Game Plan for Growing Loans ›

New client acquisition

›

Growing C&I Syndications with a lead and

relationship focus

›

Leverage specialty lending groups

›

Business Capital

›

Equipment Finance

›

Healthcare

›

Lending to targeted industries

›

Branch Small Business focus

›

Transportation

›

Franchise Restaurant

5 |

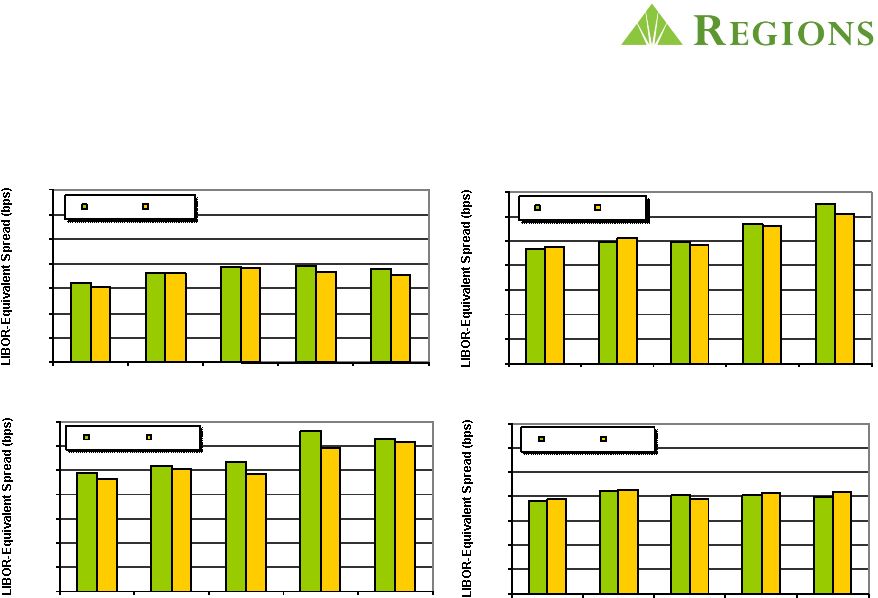

Loan

Pricing Compares Favorably to Market Data Source: Standard &

Poor’s Risk Adjusted New and Renewed Credit Spread Trends (excluding fees)

6

100

150

200

250

300

350

400

450

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

LIBOR

-

C&I

Regions

Market

100

150

200

250

300

350

400

450

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

LIBOR

-

Community Banking

Regions

Market

100

150

200

250

300

350

400

450

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

LIBOR

-

Business Banking

Regions

Market

100

150

200

250

300

350

400

450

Q2 2009

Q3 2009

Q4 2009

Q1 2010

Q2 2010

LIBOR

-

CRE

Regions

Market |

An

Intense Focus on Relationship Banking Results in Stable, Low-Cost

Deposits June 2010

61% of all deposits are checking

Interest

Checking

17%

Savings

1%

Money Market

excl Euro

26%

CDs

6%

Interest-Free

Checking

44%

Eurodollar

Sweeps

2%

Repo Sweeps

4%

7 |

We

Have Continued to Reduce Interest Bearing Deposit Costs

2.55%

0.89%

0.60%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

1Q '08

2Q '09

2Q '10

8 |

J.D.

Power Ranks Regions Small Business Customer Satisfaction Among Industry

Best Source:

J.D.

Power

and

Associates

2009

Small

Business

Banking

Satisfaction

Study

SM

9 |

Regions Middle Market and Small Business

Stand Alone Among Major Banks in Our

Footprint by Growing Marketshare in 2009

“Regions is the only major provider in its segment to

capitalize on the opportunity and grow marketshare

during this challenging time.”

~ Greenwich & Associates

10 |

Morgan Keegan & Company, Inc.

John Carson

*

* |

Morgan

Keegan Business Model ›

Relationships, Expertise, Execution

›

“Glass-Steagall”

Model

›

Low Leverage

›

No Credit-Related Losses

›

No Proprietary Trading

›

Diversified Portfolio of Businesses

›

Key Activities

›

Investment Banking

›

Institutional Sales, Trading, and Research

›

Retail Brokerage

›

Personal and Corporate Trust

2 |

Historical Performance

0%

5%

10%

15%

20%

25%

30%

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

1,400,000

1,600,000

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

Revenue

Operating Margin

3 |

Business Units

›

Private Client Group

›

Fixed Income Capital Markets

›

Equity Capital Markets

›

Investment Banking

›

Regions Morgan Keegan Trust

›

Regions Capital Markets*

›

Regions Private Banking*

*New Divisions

4 |

Legal

and Regulatory Environment ›

Fin Reg as currently defined: Minimal impact

›

No prop trading

›

Fiduciary standard?

›

RMK and a “Tale of Two Cities”

›

Regulatory actions

5 |

Strategies and Opportunities

›

Business Model Works!

›

Low Cost

›

Low Risk

›

Steady Growth

1.Maximize

profitability from Fixed Income and Trust

2.Capitalize

on Retail Wealth Management opportunities

3.Leverage

Industry Expertise to build a Universal Bank to the Middle

Markets ›

Healthcare

›

Energy

›

Public Finance

›

Real Estate

›

Transportation

6 |

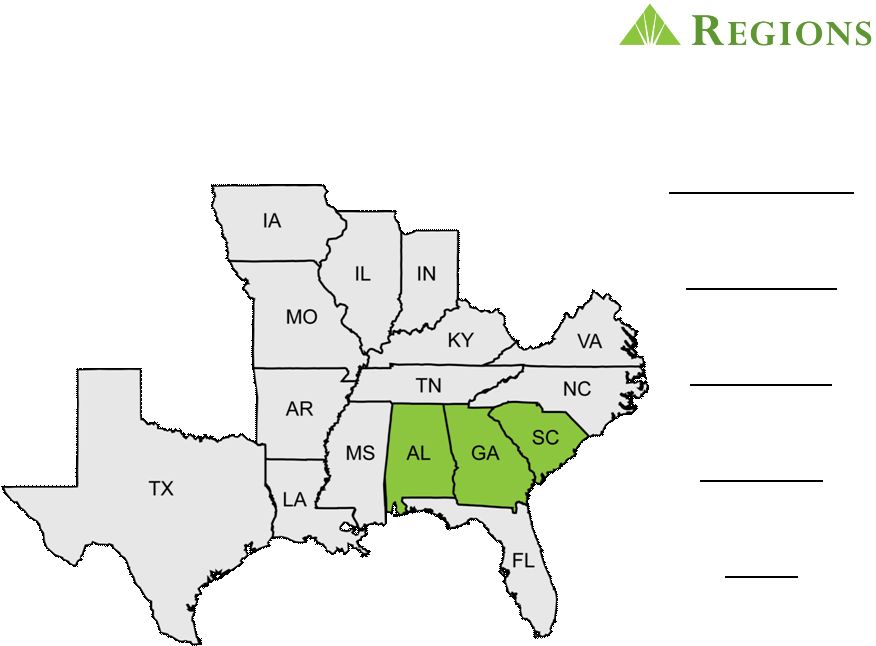

Geography Review: Bill Ritter

Total Deposits

$24.0B

Total Loans

$17.6B

Associates

4,017

Branches

422

ATMs

519

1 |

Market Composition

Industry Drivers

›

Manufacturing

›

Healthcare –

Specialty and Research

›

Aerospace/Defense

Economic Stats

›

High Population Growth –

Young, educated workers in

Atlanta and military/civilian in Huntsville

›

Low costs of living and of doing business

2

Dominant Market Share in Alabama

Growth Opportunity in Atlanta |

Opportunities

Accelerate growth in our Atlanta Market

›

Upgraded talent in all Lines of Business

›

Increase Market Penetration –

Branches and ATMs

Capitalize on Market Disruption

›

Bank Mergers: Wells/Wachovia and BB&T/Colonial

›

Bank Failures: 44 in 2009 and 2010

Develop Government Contracting Business

›

Full banking relationship with privately held defense contractor

Continue to Leverage Partnerships

›

Regions Morgan Keegan Trust

›

Regions Business Capital

3 |

Geography Review: Brett Couch

Total Deposits

$18.8B

Total Loans

$16.2B

Associates

3,121

Branches

397

ATMs

440

1 |

Market Composition

Industry Drivers

›

Professional / Business Services

›

Education

›

Healthcare

›

Retail Trade

›

Leisure/Hospitality

Economic Stats

›

11.7% unemployment rate is 5th highest in the country, down last

two months

›

Home values down 46% from the 2006 peak, flat four consecutive months

›

20th largest economy in the world

›

21 commercial airports, 14 deep water sea ports, proposed high speed rail

2

Migration of consumers and businesses to Florida (climate, low taxes)

RF 4.4% market share and 7.4% outlet share…growth opportunity

|

Opportunities

Accelerate Small Business Growth

›

1.6 million in Florida…

4th in country

›

Stability, expertise, and personal service

›

Emphasis in branches

Increase Consumer Market Share

›

Population of 18 million…

4th in country

›

Market deposits…

$400 billion

›

Market share opportunity

Leverage Morgan Keegan Partnership

›

592,000 HHs with $500M+ investable assets

3 |

Geography Review: Keith Herron

Total Deposits

$26.9B

Total Loans

$17.1B

Associates

4,239

Branches

514

ATMs

684

1 |

Market Composition

Industry Drivers

›

Healthcare

›

Agriculture

›

Transportation

›

Manufacturing

Economic Stats

›

Home to 78 Fortune 500 Companies

›

Relocations and Expansions remain steady

2

#1 Market Share in Tennessee

Dominant Nashville Bank –

“City on the Move”

Midsouth

footprint brings economic diversity to Regions |

Opportunities

Accelerate Growth in Midwest Markets

›

St. Louis (Gateway Initiative) and Indianapolis (Indy Initiative)

›

Expand agricultural banking into markets with Regions presence

Healthcare

›

Nashville is home to over 20 publically traded healthcare companies

›

Capture Nashville healthcare market share

›

Build out healthcare throughout the Midsouth

Deepen Existing Relationships

›

Morgan Keegan partnership

›

Tennessee cross-sell

3 |

Geography Review: Ronnie Smith

Total Deposits

$21.4B

Total Loans

$12.4B

Associates

3,565

Branches

441

ATMs

518

1 |

Market Composition

Industry Drivers

›

Water Ports / Waterways

›

Petro Chemical

›

Energy / Oil and Gas

Economic Stats

›

Ten Metro Markets across Footprint

›

Home to 70 Fortune 500 Companies

›

Unemployment below National Average

›

Agriculture

›

Healthcare

2

Natural Resource Focus |

Opportunities

Leverage Top 3 Market Share in Mississippi, Arkansas and Louisiana

›

75% of revenue growth in these markets comes from existing client base

›

Stronger focus on Business to Business selling through established

branch network

Growth Market in Texas

›

Attacking market through strategic acquisition of Business Services teams

focused in Dallas, Houston and Austin

Natural Resource Focus

›

Waterways, Agriculture and Oil and Gas

›

Leverage proven industry expertise throughout the region

Leverage Strategic Partnerships Throughout Region

›

Morgan Keegan

›

Regions Mortgage

›

Regions Insurance

›

Specialty Lending

3 |

Appendix

*

*

*

* |

Appendix

–

Non-GAAP Financial Measures

Note: The following tables in the next two slides illustrate the

method of calculating the non-GAAP

financial measures used in this slide presentation:

2

Q2

Q3

Q4

Q1

Q2

($ in millions)

2009

2009

2009

2010

2010

Net Interest Income (GAAP)

$ 831

$ 845

$ 850

$ 831

$ 856

Non-Interest Income (GAAP)

1,199

772

718

812

756

Less Adjustments:

Securities gains (losses), net

108

4

(96)

59

Gain on sale of Visa shares

80

-

-

-

-

Leveraged lease termination gains

189

4

71

19

-

Gain on early extinguishment of debt

61

-

-

-

-

Core Non-Interest Income (non-GAAP)

761

764

743

734

756

Core Revenue (non-GAAP)

1,592

1,609

1,593

1,565

1,612

Non-Interest Expense (GAAP)

1,231

1,243

1,219

1,230

1,326

Less Adjustments:

Loss on early extinguishment of debt

-

-

-

53

-

FDIC special assessment

64

-

-

-

-

Securities impairment, net

69

3

-

1

-

Branch consolidation costs

-

41

12

8

-

Regulatory charge

-

-

-

-

200

Core Non-Interest Expense (non-GAAP)

1,098

1,199

1,207

1,168

1,126

Core Pre-Tax Pre-Provision Net Revenue (non-GAAP)

494

410

386

397

486 |

Appendix –

Non-GAAP Financial Measures

3

Q2

Q3

Q4

Q1

Q2

($ amounts in millions, except per share data)

2009

2009

2009

2010

2010

Net income (loss) available to common shareholders (GAAP)

(244)

(437)

(606)

(255)

(335)

Adjusted Items, Net of Tax

(65)

25

(55)

2

200

Net income (loss) available to common shareholders, excluding

adjusted items (non-GAAP)

(309)

(412)

(551)

(253)

(135)

Weighted-average diluted shares

876

1,189

1,191

1,194

1,200

Earnings (loss) per common share -

diluted (GAAP)

$ (0.28)

$ (0.37)

$ (0.51)

$ (0.21)

$ (0.28)

Earnings (loss) per common share, excluding adjustments -

diluted (non-GAAP)

$ (0.35)

$ (0.35)

$ (0.46)

$ (0.21)

$ (0.11) |