Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - GENTIVA HEALTH SERVICES INC | d8k.htm |

Exhibit 99.1

FORWARD-LOOKING STATEMENTS

This exhibit contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 based on our current expectations, assumptions, and estimates about us and our industry. These forward-looking statements involve risks and uncertainties. Words such as “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “will,” “may” and other similar expressions identify forward-looking statements. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. All statements other than statements of historical facts, including, among others, statements regarding our future financial position, business strategy, projected levels of growth, projected costs and projected financing needs, are forward-looking statements. These forward-looking statements are based on our current expectations, are not guarantees of future performance, are subject to a number of risks, uncertainties, assumptions and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those anticipated in such forward-looking statements. Important factors that could cause actual results to differ materially from those in forward-looking statements include, but are not limited to:

| • | general economic and business conditions; |

| • | demographic changes; |

| • | changes in, or failure to comply with, existing governmental laws and regulations; |

| • | impact of recently passed healthcare reform legislation and its subsequent implementation through government regulations; |

| • | changes in Medicare, Medicaid and commercial payer reimbursement levels; |

| • | effects of competition in the markets in which the Company operates; |

| • | liability and other claims asserted against the Company; |

| • | ability to attract and retain qualified personnel; |

| • | availability and terms of capital; |

| • | loss of significant contracts or reduction in revenues associated with major payer sources; |

| • | ability of customers to pay for services; |

| • | business disruption due to natural disasters, pandemic outbreaks or terrorist acts; |

| • | ability to successfully integrate the operations of Odyssey HealthCare, Inc. and other acquisitions the Company may make and achieve expected synergies and operational efficiencies within expected time-frames; |

| • | effect on liquidity of the Company’s debt service requirements; |

| • | the amount of costs, fees, expenses and charges related to the transactions described in this exhibit; |

| • | changes in estimates and judgments associated with critical accounting policies and estimates; and |

| • | the other factors referenced in this exhibit, including, without limitation, under “Risk Factors” and those risk factors set forth in our Annual Report on Form 10-K, for the year ended January 3, 2010, as supplemented in our Quarterly Report on Form 10-Q for the quarter ended July 4, 2010. |

1

We believe these forward-looking statements are reasonable; however, you should not place undue reliance on any forward-looking statements, which are based on current expectations. If any of the foregoing risks or uncertainties materialize, or if any of our underlying assumptions are incorrect, our actual results may differ significantly from the results that we express or imply by any of our forward-looking statements. The forward-looking statements made in this exhibit relate only to events as of the date on which the statements are made. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon forward-looking statements as predictions of future events. Except as required by applicable law, including the securities laws of the United States, and the rules and regulations of the SEC, we do not plan and assume no obligation to publicly update or revise any forward-looking statements contained herein after the date of this exhibit, whether as a result of any new information, future events or otherwise.

2

SUMMARY

Gentiva Health Services, Inc., a Delaware corporation (“Gentiva”), entered into an Agreement and Plan of Merger (the “Plan of Merger”), dated as of May 23, 2010, with GTO Acquisition Corp., a wholly-owned subsidiary of Gentiva (“Merger Sub”), and Odyssey HealthCare, Inc., a Delaware corporation (“Odyssey”). Upon the terms and subject to the conditions set forth in the Plan of Merger, Merger Sub will merge (the “Merger”) with and into Odyssey with Odyssey continuing as the surviving corporation and a wholly-owned subsidiary of Gentiva. Upon consummation of the Merger, each issued and outstanding share of Odyssey common stock will be exchanged for the right to receive $27.00 in cash, without interest.

Unless the context requires otherwise, references in this exhibit to “Gentiva,” the “Company,” “we,” “us,” and “our” prior to the consummation of the Merger refer to Gentiva and its consolidated subsidiaries, and, following the consummation of the Merger and the other transactions described herein, such references refer to Gentiva and its consolidated subsidiaries, including Odyssey and its consolidated subsidiaries. Unless otherwise stated herein, our pro forma financial information reflects the effects of the consummation of the transactions described under “The Proposed Odyssey Acquisition and Financing.”

Our Company

We are a leading provider of home health services throughout most of the United States, and we are a provider of hospice services in the southeastern United States. We conduct direct home nursing and therapy services operations through licensed and Medicare-certified agencies at approximately 340 locations in 39 states. We generate our revenues through reimbursement sources that include government programs, such as Medicare and Medicaid, and private sources, such as health insurance plans, managed care organizations, long term care insurance plans and personal funds.

Our home health services include skilled nursing; skilled rehabilitation services, including physical, occupational and speech therapy; and social work, nutrition, disease management education, home health aide and homemaker services. Our direct home nursing and therapy services operations also deliver services to our customers through focused specialty programs, which include Gentiva Orthopedics, Gentiva Safe Strides®, Gentiva Cardiopulmonary, Gentiva Senior Health and Gentiva Neurorehabilitation. Additionally, through our Rehab Without Walls® unit, we provide home and community-based neurorehabilitation therapies for patients with traumatic brain injury, cerebrovascular accident injury and acquired brain injury, as well as a number of other complex rehabilitation cases. We also provide consulting services to home health agencies, including operational support, billing and collection activities, and on-site agency support and consulting. Home health contributed 93% of our net revenues for the twelve-month period ended July 4, 2010.

Our hospice services programs provide healthcare services and products needed by terminally ill hospice patients and their families through the use of interdisciplinary teams. Depending on his or her needs, each hospice patient is assigned a team composed of a physician, nurse(s), home health aide(s), medical social

3

worker(s), chaplain, dietary counselor and bereavement coordinator, as well as other care professionals. We provide hospice services primarily in the patient’s home or other residence, such as an assisted living facility, a nursing home or a hospital. Hospice services represented 7% of our net revenues for the twelve-month period ended July 4, 2010.

On May 23, 2010, we entered into an agreement to acquire Odyssey HealthCare, Inc., a publicly-owned hospice company. Our acquisition of Odyssey will significantly expand the footprint of our hospice services. Like Gentiva’s hospice operations, Odyssey’s hospice service programs are designed to provide a wide range of care and services to terminally ill patients and their families, including palliative (or comfort) services, such as counseling and psychosocial services for terminally ill patients and their families. Odyssey has grown significantly since 2005, both organically and through acquisitions, and is now one of the largest providers of hospice care in the United States in terms of both average daily patient census and number of Medicare-certified hospice programs. Odyssey commenced operations in 1996 with a single hospice program, and, at June 30, 2010, it provided care through 90 Medicare-certified hospice programs in 30 states and achieved an average daily patient census of 12,493 for the twelve months ended June 30, 2010.

Hospice services are typically paid for through the Medicare hospice benefit, which covers virtually all expenses related to caregiving, medical equipment, supplies and drugs for Medicare beneficiaries who are hospice-appropriate and elect to receive hospice care. Services provided under the Medicare hospice program represented approximately 93% of Gentiva’s hospice revenues for the twelve months ended July 4, 2010 and 93% of Odyssey’s net patient service revenue for the twelve months ended June 30, 2010.

Upon consummation of the Merger, we will become the largest combined home health and hospice services provider in the United States based on revenue. For the twelve-month period ended July 4, 2010, pro forma for our acquisition of Odyssey and the other transactions described in “The Proposed Odyssey Acquisition and Financing,” we would have generated net revenues and Adjusted EBITDA of $1,882 million and $271 million, respectively. See “The Proposed Odyssey Acquisition and Financing” and “Unaudited Pro Forma Condensed Consolidated Financial Information.”

We believe our acquisition of Odyssey will:

| • | Complement our product portfolio by expanding our hospice footprint. The combination of Gentiva and Odyssey will form the largest combined home health and hospice services provider in the United States based on revenue. Although we currently provide hospice services, the acquisition of Odyssey will allow us to fully integrate hospice into our national home health footprint and offer our services across a broader continuum of care. |

| • | Realize revenue synergies by extending the services we offer our home health patients and leveraging referral sources cross our business lines. As the acuity level of many of our home health patients increase, they may ultimately choose hospice as their end-of-life care solution. By offering hospice services across our national footprint of home health offices, we anticipate that referral sources may be more likely to refer to us due to our ability to provide healthcare services across a broader continuum of care than most of our competitors. In addition, many general physicians, specialty physicians, and discharge planners that refer home health patients also refer potential hospice patients. Offering our services across a broader continuum of care will allow us to leverage our existing relationships with referral sources across both our home health and hospice businesses. |

| • | Diversify our revenue sources across both the home health and hospice sectors. As illustrated in the charts below, on a standalone basis, our home health and hospice services constituted 93% and 7% of our net revenues for the twelve-month period ended July 4, 2010, respectively. Upon consummation of the proposed acquisition of Odyssey, home health services and hospice services will constitute 59% and |

4

| 41% of our pro forma net revenues, respectively, thereby reducing the impact of any potential Medicare reimbursement reductions to either sector. |

| • | Increase the geographical coverage of our hospice services. Our hospice segment has minimal geographic overlap with Odyssey’s operations, while our home health locations have a strategic geographic fit with Odyssey’s hospice locations. Increasing the geographic diversity of our services reduces our exposure to demographic changes in any one state or region and expands our base of referral sources. |

| • | Realize cost synergies by consolidating redundant corporate overhead and leveraging existing overhead. We believe we will be able to generate substantial cost savings by eliminating duplicative corporate overhead, back office and overlapping regional office functions. |

| • | Allow us to further capitalize on positive demographic trends across our two industries. Because hospice and home health services provide a more cost-effective form of treatment as compared to traditional facility-based care, we anticipate these services will continue to grow in importance as the healthcare industry evolves to meet the needs of the aging U.S. population. |

| • | Enhance our existing hospice business by leveraging Odyssey’s leading management team and systems. Odyssey’s proprietary IT systems and operational staff provide an ideal platform to integrate our existing hospice services and position our hospice service offerings for future growth. |

Our Strengths

Leading market positions in home health and hospice. Following our acquisition of Odyssey, we will be the largest combined home health and hospice services provider in the United States based on revenue. We will have broad geographic diversification with more than 400 combined locations in 41 states including 16 states that require a certificate of need (“CON”) to provide either or both home health and hospice services. We believe our significant scale, diverse healthcare service offerings and broad geographic coverage will provide us with a strong platform to drive profitable growth across diverse economic cycles and changing regulatory environments. Additionally, our leading presence in 16 CON states provides us with significant regulatory advantages over potential competitors seeking to enter those markets.

Diversified revenue sources across healthcare services, geography and patient population. Pro forma for the Transactions, our home health and hospice businesses would have accounted for 59% and 41% of our net revenue for the twelve-month period ended July 4, 2010, respectively. We expect that our diversified revenue sources will increase our revenue growth and stability by increasing our hospice business mix while decreasing our exposure to regulatory changes in either the home health or hospice sector. Additionally, our diversified

5

geographic base and national scale decrease our exposure to demographic changes in any one state and expands our base of referral sources. We also believe that our diversified geographic base creates future growth opportunities due to the fragmented nature of both the home health and hospice industries.

Proven ability to integrate acquisitions and extract synergies. We have a strong track record of successfully integrating acquisitions. Since the beginning of 2006, we have completed 14 acquisitions representing aggregate annualized revenues of approximately $400 million. Our acquisition of The Healthfield Group, Inc. (“Healthfield”) in 2006 for a purchase price of $466 million and our financial performance since closing that acquisition illustrate our ability to successfully integrate a transformational acquisition and achieve projected synergies. Since our acquisition of Healthfield in 2006, we have focused our business on servicing the geriatric population and leveraging our operating and corporate overhead. The successful integration of Healthfield and other acquisitions and our focus on improving operating results have contributed to an expansion of our Adjusted EBITDA margins from 4.1% in 2005 to 12.6% for twelve-month period ended July 4, 2010, and an increase in our cash flow from operations from $22 million in 2005 to $104 million for the twelve-month period ended July 4, 2010.

Differentiated specialty therapeutic offerings. We have developed several areas of specialized care to enhance and differentiate our service offerings from those of our home health and hospice competition. Our specialty programs in home health include orthopedics, Safe Strides®, cardiopulmonary, senior health and neurorehabilitation. Following our acquisition of Odyssey, our specialty programs in hospice will include CareBeyond® programs for cardio obstructive pulmonary disease, or COPD, dementia, congestive heart failure and cancer. Our home health specialty programs are generally focused on patients with chronic diseases who typically require extended or multiple therapies or other services. Using unique outcome measures from these programs, we are able to provide referral sources with information that allows us to treat patients who may otherwise not be considered for home health or hospice by their care provider or treat additional needs from this complex patient base.

Industry leading clinician retention and labor efficiency. We have been dedicated to growing and retaining our clinician base as illustrated by our net addition of approximately 700 clinicians in 2009 and our clinician turnover of approximately 21% in 2009, which we believe is among the lowest in the home health industry. We believe that our specialty programs and our compensation model attract and retain high quality nurses and therapists due to our dedication and commitment to quality patient care outcomes and the clinical protocols of our specialty programs. Additionally, our pay-per-visit compensation model both rewards clinician productivity and allows us to effectively manage our gross margins.

Well positioned to benefit from favorable industry and demographic dynamics. The aging U.S. population provides significant underlying demand for both home health and hospice services. Individuals aged 65 years and older are the fastest growing segment of the population with an estimated compound annual growth rate, or CAGR, of 3.1% over the next 10 years. The segment of the population aged 65 years and older accounts for approximately 69% of the home health population and represents 82% of the current hospice population. According to Centers for Medicare & Medicaid Services (“CMS”), the home healthcare industry is projected to grow 7.7% annually from 2009 to 2015, outpacing total annual healthcare spending growth projections of 6.4%. Additionally, hospice has become more readily accepted as a therapeutic choice for end-of-life care as illustrated by its historical Medicare expenditure growth CAGR of 18.4% from 2000 to 2008. Both hospice and home health are expected to increase in importance going forward due to their ability to reduce healthcare costs when compared to traditional facility-based treatments.

Proven ability to generate profitable growth and strong cash flows. We have consistently generated profitable growth as illustrated by our ability to grow our Adjusted EBITDA, excluding CareCentrix, from $80 million in 2007 to approximately $150 million for the twelve months ended July 4, 2010 during a difficult macroeconomic environment. We also generated strong cash flows during the same time period as illustrated by

6

our growth of cash flow from operations from $63 million in 2007 to approximately $104 million for the twelve months ended July 4, 2010. Additionally, our relatively low capital expenditure requirements facilitate significant free cash flow generation. We also have a proven track record of reducing our leverage through a combination of EBITDA growth and debt reduction as illustrated by the decrease in our ratio of total debt/Adjusted EBITDA from 4.2x at the end of fiscal year 2005 as adjusted for the acquisition of Healthfield in February 2006 to 1.5x as of July 4, 2010.

Experienced and committed management team. Our senior management team led by Chief Executive Officer, Tony Strange; Chief Financial Officer, Eric Slusser; General Counsel, John Camperlengo; and Senior Vice President, Chief Clinical Officer, Charlotte A. Weaver, has substantial experience in the home health and hospice industries with a combined tenure of more than 35 years. Our management team has a strong record of integrating acquisitions, pioneering our specialty therapeutic services and generating profitable growth and strong cash flows.

Our Strategy

Our mission is to provide industry leading, cost-effective home health and hospice services to the growing geriatric population in the United States. In addition, we strive to improve our market position and utilize our core strengths to improve patient outcomes, increase profitability and maximize cash flows. We intend to accomplish these objectives through the following actions:

Complete the successful integration of Odyssey. We are focused on providing the highest quality clinical care in home health and hospice services in the United States. Our acquisition of Odyssey continues our strategic focus on diversifying our home care business and extending our services across a broader continuum of care. We began our diversification efforts in 2006 with the acquisition of Healthfield, and our acquisition of Odyssey represents the next major building-block in our strategy of transforming Gentiva into a fully-integrated national health care service provider in both hospice and home health programs. As we focused on our core businesses of providing home health and hospice services, we have divested non-core assets, such as a controlling interest in CareCentrix in 2008, offices primarily specializing in pediatric services in 2009 and our home medical equipment and infusion therapy (“HME and IV”) businesses in 2010. We intend to continue to pursue a disciplined approach in making capital investments that generate a high return on investment.

Maximize full range of revenue and cost synergies from combined operations. We expect to extract significant cost and revenue synergies through the acquisition of Odyssey, and we anticipate that the strategic combination of home health and hospice services, coupled with strategic geographic overlap of our existing home health locations and Odyssey’s hospice locations, as well as limited overlap with our existing hospice locations, will allow us to offer a more diversified range of healthcare services to our broad geographic base of referral sources. We believe that we will be able to extract both cost and revenue synergies by:

| • | eliminating redundant corporate overhead and leverage existing overhead across a wider range of services; |

| • | selectively consolidating overlapping hospice locations; |

| • | cross-selling combined service offerings across referral sources in our enhanced national footprint; |

| • | continuing to diversify across home health and hospice services to best position us for profitable growth in any reimbursement environment; and |

| • | leveraging our size, scale and geographic reach to position us for market share expansion due to anticipated market consolidation. |

7

Continue to increase the breadth and penetration of specialty programs. We intend to continue to expand our specialty home health and hospice offerings and increase the penetration rate of those services across our existing customer base. In order to extend the reach and penetration rates of our specialty programs, we intend to both cross-sell our services to our existing referring physicians while also increasing the marketing of our services to both new discharge planners and physician specialists.

Capitalize on strong industry fundamentals. The home health and hospice industries have experienced strong growth over the past several years due to patients’ preference for receiving care at home and the lower cost of home health and hospice when compared to more traditional facilities-based settings. Both the patient and the Medicare system benefit when a patient can be cared for in his or her own home versus a more costly institutional setting. With the clinical and technological enhancements made over the past several years, home health care is able to deliver a wider range of services and increasingly sophisticated solutions to our patients in the home. According to CMS, the home health care industry, including hospice, is projected to grow 7.7% annually from 2009 to 2015, outpacing total annual healthcare spending growth projections of 6.4%. Individuals aged 65 years and older are the fastest growing segment of the U.S. population with an estimated CAGR of 3.0% over the next 10 years. Because of the aging U.S. population, we anticipate that the medical industry will continue to focus on treatment of patients in the later stages of life. This is expected to continue to drive growth in the use of home health and hospice services.

Deleverage balance sheet. Historically, we have generated strong and stable cash flows which have allowed us to fund our growth-related investments while maintaining reasonable leverage levels. Both the home health and hospice industry have low capital expenditure requirements, which have allowed us to generate strong cash flows. We have a strong historical track record of reducing leverage. As adjusted for the Healthfield acquisition in February 2006, our total debt/Adjusted EBITDA was 4.2x at the end of fiscal year 2005, but we successfully reduced our leverage ratio to 1.5x as of July 4, 2010 through EBITDA growth, free cash flow generation and divestitures of non-core assets. We grew our Adjusted EBITDA, excluding CareCentrix, from $80 million in 2007 to approximately $150 million for the twelve months ended July 4, 2010 while also increasing our cash flow from operations from $63 million in 2007 to approximately $104 million for the twelve months ended July 4, 2010. Pro forma for the Odyssey acquisition, Adjusted EBITDA would have been $271 million for the twelve-month period ended July 4, 2010. Following the Odyssey transaction, we plan to continue our strategy of utilizing cash flows from our combined operations to reduce our leverage and to fund any future organic growth initiatives.

Our Industries

Home Health

According to CMS, home health consists of medically necessary care ordered by a physician, including intermittent skilled nursing, skilled physical therapy, occupational therapy and/or speech-language therapy. Home health services are provided to patients recovering in their homes, often following care in hospitals, nursing homes or other post-acute care facilities. Patients requiring home health care include those who are disabled, frail and elderly, or chronically or terminally ill and in need of medical, nursing or therapeutic treatment and/or assistance with the essential activities of daily living. In order to be eligible for Medicare home health benefits, patients must require intermittent skilled care to treat their illness or injury and must be unable to leave their homes without a taxing effort. Services provided by home health agencies include skilled nursing, skilled physical, occupational and speech therapy, and antibiotic therapy, infusion and chemotherapy, pain management, medication management, skilled observation and assessment, parenteral and enteral nutrition, social work, patient education and training, and wound care.

There are several types of home care providers, including home health care agencies, home care aide organizations and hospices. Some of these providers are Medicare-certified and eligible to receive reimbursement for care and services provided to Medicare beneficiaries.

8

According to CMS, total national health expenditures on home healthcare were $72 billion in 2009, across all payor classes, and are forecasted to grow 7.7% annually from 2009 to 2015. With the aging U.S. population, driven by the baby-boomer generation, the demand and necessity for senior care and services is expected to increase dramatically. In 2009, the U.S. Census Bureau estimated there were 39.6 million people over the age of 65, which accounted for approximately 12.9% of the population. This number is expected to grow to 40.2 million people by 2010, and by 2020, it is estimated to reach 54.8 million people. The American Association of Homes and Services for the Aging (“AAHSA”) estimates that 69% of people over 65 will need some type of long-term care.

There is a significant cost advantage to utilizing home health services as compared to in-facility care. Home healthcare average cost per day is only 3% of the cost of a hospital ($50 vs. $1,479 according to CMS). Similarly, home healthcare cost per day is only 17% of the cost of a skilled nursing facility ($50 vs. $303 according to CMS).

The home health care industry is highly fragmented, with 90% of providers privately owned and 10% publicly owned based on revenue. While there are several large for-profit public companies in the home health industry, the bulk of the industry is made up of thousands of relatively small, regional and local providers. This represents significant potential for consolidation, which we believe would benefit us and other large providers in the industry.

Hospice

Hospice care agencies provide supportive and palliative care to people at the end-of-life. Hospice agencies focus on comfort and quality of life, rather than curative treatments. The first hospice provider in the United States, the Connecticut Hospice, began providing services in 1974.

Hospices rely on the combined knowledge and skill of an interdisciplinary team of professionals (e.g. physicians, nurses, medical social workers, therapists, counselors, home care aides and volunteers) to coordinate an individualized plan of care for each patient and family. Services, which are provided primarily in clients’ homes, include medical, emotional and spiritual care for terminally ill patients and their families. These are designed to bring comfort, peace and a sense of dignity at a very trying time. Hospice reaffirms the right of every patient and family to participate fully in the final stage of life.

The hospice industry has grown significantly over the last ten years due in part to the following key growth drivers:

| • | a growing appreciation for end-of-life services; |

| • | an aging U.S. population; |

| • | a better understanding of hospice services; |

| • | a growing, underserved market (one third of terminally ill patients who can benefit from hospice do so); |

| • | the cost-effectiveness of hospice services as compared to facility-based care, which helps decrease long-term healthcare costs; and |

| • | a reduction in Medicare costs through hospice use, averaging $2,309 per patient in the last year of life (according to CMS). |

9

We believe that the following trends in hospice utilization and the aging population are positive indicators for the hospice industry:

| • | Increase in Hospice Use: The number of Medicare beneficiaries electing hospice care has increased approximately 106% from 2000 to 2008, according to the Medicare Payment Advisory Commission’s (“MedPAC”) publication, “Report to Congress: Medicare Payment Policy — March 2010” or the March 2010 MedPAC Report. Medicare spending for hospice care has grown from approximately $2.9 billion in 2000 to approximately $11.2 billion in 2008. Hospice use has also increased considerably among Medicare patients with non-cancer diagnoses. According to the March 2010 MedPAC Report, patients with non-cancer diagnoses accounted for 69% of all hospice patients in 2008, up from 47% in 1998. |

| • | Length of Stay: After several consecutive years of increase in average length of stay, the average length of stay for hospice providers appears to have leveled off. According to the March 2010 MedPAC Report, the average length of stay for Medicare hospice beneficiaries was 83 days in 2008, an increase of 3 days from 2007. The average length of stay for 2008 and 2007 represents a significant increase over the average length of stay for 2000 of 54 days. |

| • | Similar to the home health industry, the hospice industry is highly fragmented. According to MedPAC, in 2008, there were 3,389 Medicare-certified hospice programs, an increase of 4.0% over 2007. Approximately 35% of existing hospice programs are not-for-profit programs. Many hospice programs are small and medium-sized programs, and approximately 13% of the market is held by Odyssey and Vitas, the two largest hospice providers based on revenue. Due to the fragmented nature of the markets and our size and scale, we believe that there will be consolidation opportunities in the hospice industry. |

Certain Information About Us

Gentiva Health Services, Inc. was incorporated under the laws of the State of Delaware on August 6, 1999. Our principal executive offices are located at 3350 Riverwood Parkway, Suite 1400, Atlanta, Georgia 30339-3314, and our telephone number is (770) 951-6450. We maintain a website at http://www.gentiva.com. Information contained or linked on our website is not a part of this exhibit.

10

The Proposed Odyssey Acquisition and Financing

On May 23, 2010, we entered into the Plan of Merger with Merger Sub and Odyssey. Upon the terms and subject to the conditions set forth in the Plan of Merger, Merger Sub will merge with and into Odyssey with Odyssey continuing as the surviving corporation and a wholly-owned subsidiary of Gentiva. Upon consummation of the Merger, each issued and outstanding share of Odyssey common stock will be exchanged for the right to receive $27.00 in cash, without interest.

Consummation of the Merger is subject to customary conditions, including adoption of the Plan of Merger by Odyssey’s stockholders, the absence of legal restraints and the receipt of requisite antitrust approval. Each party’s obligation to consummate the Merger is also subject to the accuracy of the representations and warranties of the other party (subject to certain exceptions) and the performance in all material respects of the other party’s covenants under the Plan of Merger.

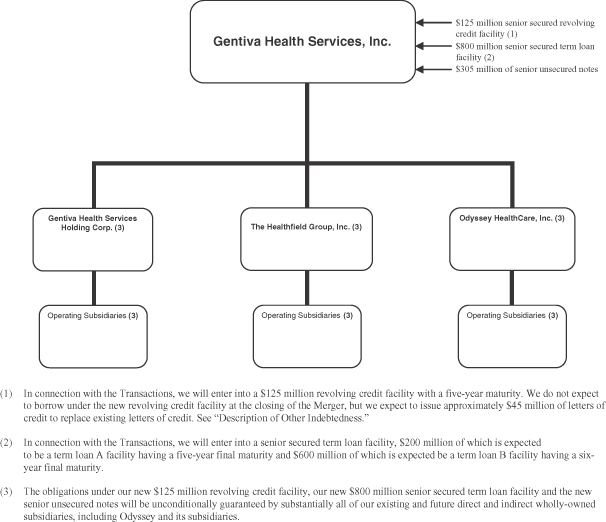

The consummation of the Merger, our entering into a new $125 million revolving credit facility, our entering into an $800 million senior term loan facility, our issuance of $305 million aggregate principal amount of senior notes and the payment of the related fees and expenses, and the repayment upon consummation of the Merger of (x) all amounts outstanding under our existing senior credit facility and (y) all amounts outstanding under Odyssey’s existing senior credit facility are collectively referred to in this exhibit as the “Transactions.” For a more complete description of the Transactions, see “—Corporate Structure,” “The Proposed Odyssey Acquisition and Financing” and “Description of Other Indebtedness.”

The estimated sources and uses of funds for the Transactions, assuming the Transactions had closed on July 4, 2010, are shown in the table below. Actual amounts will vary from estimated amounts depending on several factors, including differences between estimated and actual fees and expenses and differences between our cash and cash equivalents balances at July 4, 2010 and at the closing of the Transactions.

| ($ in millions) Sources of Funds |

Uses of Funds | |||||||

| Cash and cash equivalents(1) |

$ | 295.4 | Merger consideration(4) |

$ | 963.5 | |||

| New revolving credit facility(2) |

— | Repayment of existing Gentiva senior credit facility(5) |

232.7 | |||||

| New senior secured term loan facility(3) |

800.0 | Repayment of existing Odyssey senior credit facility(6) |

112.7 | |||||

| New senior unsecured notes |

305.0 | Estimated fees and expenses(7) |

91.5 | |||||

| Total sources of funds |

$ | 1,400.4 | Total uses of funds |

$ | 1,400.4 | |||

| (1) | Reflects a portion of the cash and cash equivalents balances of Gentiva and Odyssey. |

| (2) | In connection with the Merger, we will enter into a $125 million revolving credit facility with a five-year maturity. We do not expect to borrow under the new revolving credit facility at the closing of the Merger, but we expect to issue up to approximately $45.0 million of letters of credit to replace existing letters of credit. See “Description of Other Indebtedness.” |

| (3) | In connection with the Merger, we will enter into a senior secured term loan facility, $200 million of which is expected to be a term loan A facility having a five-year final maturity and $600 million of which is expected to be a term loan B facility having a six-year final maturity. The entire amount of the new senior term loan facility will be drawn at the closing of the Merger. See “Description of Other Indebtedness.” |

11

| (4) | Reflects amounts payable to holders of Odyssey common stock and to holders of options and restricted stock units granted under Odyssey’s compensation plans. |

| (5) | Reflects the face amount of Gentiva’s existing indebtedness, plus accrued interest. |

| (6) | Reflects the face amount of Odyssey’s existing indebtedness, plus accrued interest, together with the amount payable to terminate the related interest rate swaps. |

| (7) | Reflects our estimate of fees and expenses associated with the Transactions, including placement and other financing fees (including upfront fees and original issue discount on the credit facility, if any) and other transaction costs and professional fees. |

12

Corporate Structure

The following diagram illustrates our expected corporate structure immediately following consummation of the Transactions.

13

Summary Unaudited Pro Forma Condensed Consolidated Financial Data

The following table sets forth our summary unaudited pro forma condensed consolidated financial data at the dates and for the periods indicated. The summary unaudited pro forma statement of income, balance sheet and other financial data for the year ended January 3, 2010, the six months ended June 28, 2009 and July 4, 2010 and the twelve-month period ended July 4, 2010 give effect to the Transactions as if they had occurred on December 29, 2008 (the first day of fiscal 2009), and the summary unaudited pro forma condensed consolidated balance sheet data give effect to the Transactions as if they had occurred on July 4, 2010. The pro forma adjustments are based upon available information and certain assumptions that we believe are reasonable. The summary unaudited pro forma condensed consolidated financial data are for informational purposes only and do not purport to represent what our results of operations or financial position actually would have been if the Transactions had occurred at any date, and such data do not purport to project our financial position as of any date or our future results of operations for any future period.

We derived the summary unaudited pro forma condensed consolidated statement of income data for the twelve months ended July 4, 2010, by adding the summary unaudited pro forma condensed consolidated statement of income data for the year ended January 3, 2010 to the summary unaudited pro forma condensed consolidated statement of income data for the six months ended July 4, 2010 and subtracting the summary unaudited pro forma condensed consolidated statement of income data for the six months ended June 28, 2009. See “Unaudited Pro Forma Condensed Consolidated Financial Information” for a complete description of the adjustments and assumptions underlying these summary unaudited pro forma condensed consolidated financial data.

The unaudited pro forma condensed consolidated financial data should be read in conjunction with “The Proposed Odyssey Acquisition and Financing,” contained in this exhibit and the historical consolidated financial statements and related notes of Gentiva and Odyssey included in their respective most recently-filed Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

| ($ in thousands) |

Year ended January 3, 2010 |

Six months ended June 28, 2009 |

Six months ended July 4, 2010 |

Twelve months ended July 4, 2010 |

||||||||||||

| Statement of Income Data: |

||||||||||||||||

| Net revenues |

$ | 1,838,898 | $ | 899,029 | $ | 941,953 | $ | 1,881,822 | ||||||||

| Cost of services sold |

950,304 | 465,924 | 470,272 | 954,652 | ||||||||||||

| Gross profit |

888,594 | 433,105 | 471,681 | 927,170 | ||||||||||||

| Selling, general and administrative expenses |

(713,348 | ) | (351,339 | ) | (373,114 | ) | (735,123 | ) | ||||||||

| Gain (loss) on sale of assets, net |

5,588 | 5,747 | 100 | (59 | ) | |||||||||||

| Interest income |

3,516 | 1,905 | 1,484 | 3,095 | ||||||||||||

| Interest expense and other |

(101,035 | ) | (51,383 | ) | (50,383 | ) | (100,035 | ) | ||||||||

| Income from continuing operations before income taxes and equity in net earnings of affiliate |

83,315 | 38,035 | 49,768 | 95,048 | ||||||||||||

| Income tax expense |

(31,013 | ) | (12,883 | ) | (19,818 | ) | (37,948 | ) | ||||||||

| Equity in net earnings of affiliate |

1,072 | 541 | 763 | 1,294 | ||||||||||||

| Income from continuing operations |

53,374 | 25,693 | 30,713 | 58,394 | ||||||||||||

| Income attributable to noncontrolling interests |

(613 | ) | (217 | ) | (482 | ) | (878 | ) | ||||||||

| Income from continuing operations attributable to Gentiva shareholders |

$ | 52,761 | $ | 25,476 | $ | 30,231 | $ | 57,516 | ||||||||

14

| ($ in thousands) |

Twelve months ended July 4, 2010 | ||

| Other Financial Data: |

|||

| EBITDA(1) |

$ | 222,270 | |

| Depreciation and amortization |

30,282 | ||

| Adjusted EBITDA(1) |

271,068 | ||

| Net cash interest expense(2) |

87,301 | ||

| Capital expenditures(3) |

20,002 | ||

| Ratio of Adjusted EBITDA to net cash interest expense |

3.1x | ||

| Ratio of total debt to Adjusted EBITDA |

4.1x | ||

| Balance Sheet Data (at period end): |

|||

| Cash and cash equivalents |

$ | 60,167 | |

| Accounts receivable |

271,525 | ||

| Working capital |

86,944 | ||

| Total assets |

2,124,580 | ||

| Total debt |

1,105,000 | ||

| Shareholders’ equity |

580,970 | ||

| (1) | EBITDA, a measure used by management to evaluate operating performance, is defined as income from continuing operations plus net interest expense, income tax expense, and depreciation and amortization, less equity in net earnings of affiliates. EBITDA is not a recognized term under GAAP and does not purport to be an alternative to income from continuing operations or net income as a measure of operating performance or cash flows from operating activities as a measure of liquidity. Additionally, EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. Our presentation of EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported in accordance with GAAP. Management believes EBITDA is helpful in highlighting trends because EBITDA excludes items that are outside management’s immediate control and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, tax jurisdictions in which companies operate and capital investments. Management uses non-GAAP financial measures to supplement, and not as a substitute for, GAAP results to provide a more complete understanding of the factors and trends affecting the business. |

Adjusted EBITDA is defined as EBITDA as adjusted to exclude restructuring, legal settlement and merger and acquisition costs and other adjustments as set forth below. We believe that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about certain material non-cash items, unusual items that we do not expect to continue at the same level in the future, net cost savings projected to be realized as a result of initiatives taken by management, and the Odyssey acquisition.

Because not all companies use identical calculations, our presentation of EBITDA and Adjusted EBITDA may not be comparable to other similarly titled measures of other companies, including those of Odyssey.

In addition, our pro forma Adjusted EBITDA should not be taken as representative of our future combined results of operations or financial position. See “Risk Factors—Risks Related to Our Business and Industry—We may not be able to achieve the benefits that we expect to realize as a result of the Merger or other future acquisitions. Failure to achieve such benefits could have an adverse effect on our financial condition and results of operations.”

15

The following table provides a reconciliation from our pro forma income from continuing operations, the most directly comparable GAAP measure, to pro forma EBITDA and pro forma Adjusted EBITDA (in thousands):

| Twelve Months Ended July 4, 2010 |

||||

| Pro forma Income from continuing operations |

$ | 58,394 | ||

| Less: Equity in net earnings of affiliates |

(1,294 | ) | ||

| Plus: Income tax expense |

37,948 | |||

| Pre-Tax Income |

95,048 | |||

| Plus: Net interest expense |

96,940 | |||

| Plus: Depreciation and amortization |

30,282 | |||

| Pro forma EBITDA |

222,270 | |||

| Plus: Net loss on sale of assets(a) |

59 | |||

| Plus: Stock-based compensation |

10,892 | |||

| Plus: Restructuring, legal settlement and merger and acquisition costs(b) |

18,856 | |||

| Plus: Cost savings(c) |

18,991 | |||

| Pro forma Adjusted EBITDA |

$ | 271,068 | ||

| (a) | Represents loss on disposal of Odyssey property and equipment ($413,000) offset by gain on sale of assets associated with two branch offices in upstate New York which provided home health services under the New York Medicaid programs and assets associated with a home health branch operation in Iowa ($354,000). |

| (b) | Restructuring, legal settlement and merger and acquisition costs are composed of the following: |

| Twelve Months Ended July 4, 2010 | |||

| Restructuring costs(i) |

$ | 2,246 | |

| Legal settlements(ii) |

13,693 | ||

| Costs relating to merger and acquisition activities(iii) |

2,917 | ||

| Total |

$ | 18,856 | |

| (i) | Represents costs associated primarily with the relocation our corporate headquarters from Melville, New York to Atlanta, Georgia. These costs relate primarily to severance costs in connection with the termination of personnel and facility lease and other costs. These costs also included a non-cash charge of approximately $0.6 million associated with the acceleration of compensation expense relating to future vesting of stock options under severance agreements for certain of our executive officers. |

| (ii) | Represents legal settlements consisting of (a) settlement costs and legal fees of $4.2 million related to a three-year old commercial contractual dispute involving our former subsidiary, CareCentrix, and (b) incremental charges of $9.5 million in connection with an agreement in principle, subject to final approvals, between the Company and the federal government to resolve the matters that were subject to a 2003 subpoena relating to the Company’s cost reports for the 1998 to 2000 periods. |

| (iii) | Represents merger and acquisition costs incurred in connection with the proposed Odyssey acquisition ($2.0 million) and various prior acquisitions ($0.9 million). These costs consisted of legal, accounting and other professional fees and expenses as well as costs of obtaining required regulatory approvals. |

16

| (c) | Expected cost savings by type are as follows: |

| Twelve Months Ended July 4, 2010 | |||

| Salaries, bonus and benefits (i) |

$ | 12,243 | |

| Legal and audit related fees (ii) |

2,400 | ||

| Dues and fees (iii) |

1,035 | ||

| Insurance (iv) |

739 | ||

| Lease (Dallas corporate center) (v) |

500 | ||

| Other (vi) |

2,074 | ||

| Total cost savings (vii) |

$ | 18,991 | |

| (i) | Represents the elimination of salaries, bonus and benefits of certain senior executives of Odyssey and certain administrative and back office employees who are in redundant positions with positions currently existing at Gentiva. These positions will be eliminated following the acquisition. |

| (ii) | Represents reduction in outsourced internal audit services, recurring audit fees and certain duplicate legal fees. |

| (iii) | Represents the elimination of fees paid to national hospice organizations for which Gentiva maintains membership, investor relations expenses and various other fees. |

| (iv) | Represents reduction in costs for duplicate insurance coverage paid by Odyssey that is currently maintained by Gentiva. |

| (v) | Represents savings resulting from consolidation of office space in Odyssey’s Dallas corporate center prior to the lease termination in July 2013. |

| (vi) | Represents the reduction of employee travel related expenses and other miscellaneous costs. |

| (vii) | Total cost savings does not include Odyssey’s stock-based compensation expense of approximately $6.0 million which is included in the stock-based compensation add-back set forth above. |

| (2) | Net cash interest expense is defined as net interest expense, adjusted for certain non-cash items. Cash interest expense is not a recognized term under GAAP and does not purport to be an alternative to interest expense as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. We believe that the inclusion of cash interest expense is appropriate to provide additional information to investors about the Company’s liquidity. Pro forma net cash interest expense represents pro forma net interest expense, less amortization of deferred financing costs of $10.3 million. |

| (3) | Reflects capital expenditures for the twelve months ended July 4, 2010 of $14.9 million for Gentiva’s continuing operations and $5.1 million for Odyssey. |

17

Summary Historical Consolidated Financial Data of Gentiva Health Services, Inc.

The following table states our summary historical consolidated financial data, which, for the years ended December 30, 2007, December 28, 2008 and January 3, 2010, is derived from our audited consolidated financial statements and notes thereto, and, for the six months ended June 28, 2009 and July 4, 2010, is derived from our unaudited consolidated financial statements and notes thereto. The historical consolidated financial data for the twelve months ended July 4, 2010 is derived from both our audited consolidated financial statements and our unaudited consolidated financial statements and the respective notes thereto. The historical consolidated statement of income data, statement of cash flows data and balance sheet data for each fiscal year in the three-year period ended January 3, 2010 included in the following table have been derived from our audited consolidated financial statements. The summary historical consolidated financial data as of and for the six months ended June 28, 2009 and July 4, 2010 and the twelve months ended July 4, 2010 reflects all normal and recurring adjustments that, in the opinion of management, are necessary for a fair presentation of our results of operations and financial position. Results for the six months ended July 4, 2010 are not necessarily indicative of the results to be expected for the full year. The historical results indicated below and elsewhere in this exhibit are not necessarily indicative of our future performance. The following summary historical consolidated financial data should be read together with our consolidated financial statements and notes thereto as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Annual Report on Form 10-K for the year ended January 3, 2010 and our Quarterly Report on Form 10-Q for the quarter ended July 4, 2010.

18

| Fiscal Year Ended | Six Months Ended | Twelve Months Ended |

||||||||||||||||||||||

| ($ in thousands) |

December 30, 2007 |

December 28, 2008 |

January 3, 2010 |

June 28, 2009 (unaudited) |

July 4, 2010 (unaudited) |

July 4, 2010 (unaudited) |

||||||||||||||||||

| (52 weeks) | (52 weeks) | (53 weeks) | (53 weeks) | |||||||||||||||||||||

| Statement of Income Data: |

||||||||||||||||||||||||

| Net revenues |

$ | 1,171,349 | $ | 1,239,536 | $ | 1,152,460 | $ | 561,202 | $ | 594,230 | $ | 1,185,488 | ||||||||||||

| Cost of services |

671,154 | 682,024 | 553,530 | 268,025 | 275,839 | 561,344 | ||||||||||||||||||

| Gross profit |

500,195 | 557,512 | 598,930 | 293,177 | 318,391 | 624,144 | ||||||||||||||||||

| Selling, general and administrative expenses |

(422,526 | ) | (468,582 | ) | (490,866 | ) | (240,033 | ) | (264,771 | ) | (515,604 | ) | ||||||||||||

| Gain on sale of assets, net |

— | 107,933 | 5,998 | 5,747 | 103 | 354 | ||||||||||||||||||

| Interest income |

3,204 | 2,290 | 3,037 | 1,618 | 1,314 | 2,733 | ||||||||||||||||||

| Interest expense and other |

(27,285 | ) | (19,377 | ) | (9,211 | ) | (5,880 | ) | (3,514 | ) | (6,845 | ) | ||||||||||||

| Income from continuing operations before taxes and equity in net earnings of affiliate |

53,588 | 179,776 | 107,888 | 54,629 | 51,523 | 104,782 | ||||||||||||||||||

| Income tax expense |

(22,002 | ) | (28,295 | ) | (39,164 | ) | (19,634 | ) | (21,757 | ) | (41,287 | ) | ||||||||||||

| Equity in net earnings of affiliate |

— | (35 | ) | 1,072 | 541 | 763 | 1,294 | |||||||||||||||||

| Income from continuing operations |

31,586 | 151,446 | 69,796 | 35,536 | 30,529 | 64,789 | ||||||||||||||||||

| Discontinued operations, net of tax |

1,242 | 2,004 | (10,614 | ) | (419 | ) | (2,285 | ) | (12,480 | ) | ||||||||||||||

| Net income |

$ | 32,828 | $ | 153,450 | $ | 59,182 | $ | 35,117 | $ | 28,244 | $ | 52,309 | ||||||||||||

| Statement of Cash Flows Data: |

||||||||||||||||||||||||

| Cash flows provided by operating activities |

62,671 | 70,700 | 105,108 | 49,462 | 47,979 | 103,625 | ||||||||||||||||||

| Cash flows (used in) provided by investing activities |

(34,809 | ) | 38,684 | (17,232 | ) | (6,434 | ) | (5,317 | ) | (16,115 | ) | |||||||||||||

| Cash flows (used in) provided by financing activities |

(24,591 | ) | (54,350 | ) | (4,667 | ) | (12,759 | ) | (4,006 | ) | 4,086 | |||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||||||

| Cash and cash equivalents |

14,167 | 69,201 | 152,410 | 99,470 | 191,066 | 191,066 | ||||||||||||||||||

| Working capital |

128,527 | 125,400 | 198,250 | 159,393 | 232,801 | 232,801 | ||||||||||||||||||

| Total assets |

882,233 | 973,497 | 1,067,935 | 1,007,564 | 1,098,731 | 1,098,731 | ||||||||||||||||||

| Total debt |

310,000 | 251,000 | 237,000 | 237,000 | 232,000 | 232,000 | ||||||||||||||||||

| Shareholders’ equity |

323,429 | 494,971 | 571,163 | 535,923 | 604,770 | 604,770 | ||||||||||||||||||

| Common shares outstanding |

28,046 | 28,864 | 29,470 | 29,011 | 29,754 | 29,754 | ||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| EBITDA(1) |

92,433 | 213,178 | 130,949 | 67,194 | 62,530 | 126,285 | ||||||||||||||||||

| Adjusted EBITDA(1) |

80,376 | 101,352 | 132,526 | 66,417 | 83,585 | 149,694 | ||||||||||||||||||

| Capital expenditures(2) |

18,841 | 18,880 | 19,034 | 9,736 | 5,613 | 14,911 | ||||||||||||||||||

| Depreciation and amortization(2) |

14,764 | 16,315 | 16,887 | 8,303 | 8,807 | 17,391 | ||||||||||||||||||

| Operating Data: |

||||||||||||||||||||||||

| Segment revenue |

||||||||||||||||||||||||

| Home Health |

||||||||||||||||||||||||

| Episodic |

$ | 578,515 | $ | 701,209 | $ | 861,776 | $ | 415,504 | $ | 457,229 | $ | 903,501 | ||||||||||||

| Other revenue |

247,812 | 245,436 | 216,350 | 109,837 | 96,475 | 202,988 | ||||||||||||||||||

| Total Home Health |

826,327 | 946,645 | 1,078,126 | 525,341 | 553,704 | 1,106,489 | ||||||||||||||||||

| Hospice |

57,837 | 61,857 | 74,334 | 35,861 | 40,526 | 78,999 | ||||||||||||||||||

| CareCentrix |

290,785 | 232,717 | — | — | — | — | ||||||||||||||||||

| Intersegment revenues |

(3,600 | ) | (1,683 | ) | — | — | — | — | ||||||||||||||||

| Total revenue |

$ | 1,171,349 | $ | 1,239,536 | $ | 1,152,460 | $ | 561,202 | $ | 594,230 | $ | 1,185,488 | ||||||||||||

| Number of episodes |

216,800 | 246,000 | 274,200 | 134,300 | 142,600 | 282,500 | ||||||||||||||||||

| Revenue per episode |

$ | 2,670 | $ | 2,860 | $ | 3,140 | $ | 3,090 | $ | 3,210 | $ | 3,200 | ||||||||||||

19

| (1) | EBITDA, a measure used by management to evaluate operating performance, is defined as net income excluding discontinued operations, net of tax, plus net interest expense, income tax expense, and depreciation and amortization, less equity in net earnings of affiliate. EBITDA is not a recognized term under GAAP and does not purport to be an alternative to income from continuing operations or net income as a measure of operating performance or cash flows from operating activities as a measure of liquidity. Additionally, EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. Our presentation of EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Management believes EBITDA is helpful in highlighting trends because EBITDA excludes items that are outside management’s immediate control and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, tax jurisdictions in which companies operate and capital investments. Management uses non-GAAP financial measures to supplement, and not as a substitute for, GAAP results to provide a more complete understanding of the factors and trends affecting the business. |

Adjusted EBITDA is defined as EBITDA further adjusted to exclude restructuring, legal settlement and merger and acquisition costs and other adjustments set forth below. We believe that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about certain material non-cash items, unusual items that we do not expect to continue at the same level in the future, net cost savings projected to be realized as a result of initiatives taken by management, and the Odyssey acquisition.

Because not all companies use identical calculations, our presentation of EBITDA and Adjusted EBITDA may not be comparable to other similarly titled measures of other companies, including those of Odyssey.

The following table provides a reconciliation from our net income (as reported) to EBITDA and Adjusted EBITDA:

| Fiscal Year Ended | Six Months Ended | Twelve Months Ended |

||||||||||||||||||||||

| ($ in thousands) |

12/30/2007 | 12/28/2008 | 1/3/2010 | 6/28/2009 | 7/4/2010 | 7/4/2010 | ||||||||||||||||||

| Net Income |

$ | 32,828 | $ | 153,450 | $ | 59,182 | $ | 35,117 | $ | 28,244 | $ | 52,309 | ||||||||||||

| Plus: Discontinued operations, net of tax |

(1,242 | ) | (2,004 | ) | 10,614 | 419 | 2,285 | 12,480 | ||||||||||||||||

| Less: Equity in net earnings of affiliate |

— | 35 | (1,072 | ) | (541 | ) | (763 | ) | (1,294 | ) | ||||||||||||||

| Plus: Income tax expense |

22,002 | 28,295 | 39,164 | 19,634 | 21,757 | 41,287 | ||||||||||||||||||

| Pre-Tax Income |

53,588 | 179,776 | 107,888 | 54,629 | 51,523 | 104,782 | ||||||||||||||||||

| Plus: Net interest expense |

24,081 | 17,087 | 6,174 | 4,262 | 2,200 | 4,112 | ||||||||||||||||||

| Plus: Depreciation and amortization |

14,764 | 16,315 | 16,887 | 8,303 | 8,807 | 17,391 | ||||||||||||||||||

| EBITDA |

92,433 | 213,178 | 130,949 | 67,194 | 62,530 | 126,285 | ||||||||||||||||||

| Less: Gain on sale of assets, net(a) |

— | (107,933 | ) | (5,998 | ) | (5,747 | ) | (103 | ) | (354 | ) | |||||||||||||

| Plus: Stock-based compensation(b) |

6,812 | 5,757 | 5,182 | 3,466 | 3,191 | 4,907 | ||||||||||||||||||

| Plus: Special charges(c) |

2,433 | 2,702 | 2,393 | 1,504 | 17,967 | 18,856 | ||||||||||||||||||

| Adjusted EBITDA, including CareCentrix |

101,678 | 113,704 | 132,526 | 66,417 | 83,585 | 149,694 | ||||||||||||||||||

| Less: CareCentrix EBITDA(d) |

(21,302 | ) | (12,352 | ) | — | — | — | — | ||||||||||||||||

| Adjusted EBITDA, excluding CareCentrix |

$ | 80,376 | $ | 101,352 | $ | 132,526 | $ | 66,417 | $ | 83,585 | $ | 149,694 | ||||||||||||

20

| (a) | For fiscal 2008, gain on sale of assets reflects a pre-tax gain of approximately $107.9 million in connection with the disposition of 69% of its equity ownership interest in the Company’s CareCentrix ancillary care benefit management business. |

For the six months ended June 28, 2009 and fiscal 2009, the Company recorded a gain on sales of assets of $5.7 million and $6.0 million, respectively, related to (i) sale of assets and certain branch offices that specialized primarily in pediatric home care services ($5.7 million) and (ii) for the fiscal 2009 period, sale of assets associated with two branch offices in upstate New York providing home health service under New York Medicaid programs ($0.3 million).

For the six months and twelve months ended July 4, 2010, the Company recorded gains on sales of assets of $0.1 million and $0.4 million, respectively relating to (i) assets associated with a home health branch operation in Iowa ($0.1 million) and (ii) for the twelve month period, sale of assets associated with two branch offices in upstate New York providing home health service under New York Medicaid programs ($0.3 million).

| (b) | Represents historical non-cash compensation charges associated with equity based awards. |

| (c) | Selling, general and administrative expenses for fiscal 2007 and fiscal 2008 included special charges of $2.4 million and $2.7 million, respectively, in connection with integration activities relating to the Healthfield acquisition. Charges consisted primarily of severance costs and other costs related to back office and system integration as well as professional fees and other costs associated with the Company’s merger and acquisition activities. |

Selling, general and administrative expenses for the six months ended June 28, 2009 and fiscal 2009 included special charges of $1.5 million and $2.4 million, respectively, in connection with restructuring and integration activities, as well as professional fees and other costs associated with the Company’s merger and acquisition activities.

Selling, general and administrative expenses for the six months and twelve months ended July 4, 2010 included special charges of $18.0 million and $18.9 million, respectively. These charges included for both periods (a) legal settlements of $13.7 million consisting of (i) settlement costs and legal fees of $4.2 million related to a three-year old commercial contractual dispute involving the Company’s former subsidiary, CareCentrix and (ii) incremental charges of $9.5 million in connection with an agreement in principle, subject to final approvals, between the Company and the federal government to resolve matters which were subject to a 2003 subpoena relating to the Company’s cost reports for the 1998 to 2000 periods and (b) restructuring and merger and acquisition costs of $4.3 million and $5.2 million for the six month and twelve month periods ending July 4, 2010, respectively.

| (d) | Effective September 25, 2008, the Company completed the disposition of 69 percent of its equity ownership interest in the Company’s CareCentrix ancillary care benefit management business. For the third quarter and first nine months of 2008, the Company recorded a pre-tax gain of approximately $107.9 million, net of transaction-related costs of approximately $6.5 million, in connection with the sale. The Company’s fiscal 2008 results of operations include the CareCentrix operating results through September 24, 2008 and include the Company’s equity in the net earnings of CareCentrix Holdings for all subsequent periods. |

| (2) | Capital expenditures and depreciation and amortization expense exclude the following amounts of capital expenditures and depreciation and amortization expense related to the Company’s discontinued operations: |

| Fiscal Year Ended | Six Months Ended | Twelve Months Ended | ||||||||||||||||

| ($ in thousands) |

12/30/2007 | 12/28/2008 | 1/3/2010 | 6/28/2009 | 7/4/2010 | 7/4/2010 | ||||||||||||

| Capital expenditures |

$ | 5,223 | $ | 5,124 | $ | 5,823 | $ | 2,667 | $ | — | $ | 3,156 | ||||||

| Depreciation |

5,020 | 5,501 | 5,681 | 2,728 | — | 2,953 | ||||||||||||

| Amortization |

229 | 228 | 229 | 114 | — | 115 | ||||||||||||

| Total depreciation and amortization |

$ | 5,249 | $ | 5,729 | $ | 5,910 | $ | 2,842 | $ | — | $ | 3,068 | ||||||

There were no capital expenditures or depreciation and amortization expense for the first six months of 2010 as the assets were treated as held for sale as of January 3, 2010.

21

Summary Historical Consolidated Financial Data of Odyssey HealthCare, Inc.

The following table states summary historical consolidated financial data of Odyssey HealthCare, Inc., which, for the years ended December 31, 2009, 2008 and 2007, is derived from its audited consolidated financial statements and notes thereto, and, for the six months ended June 30, 2009 and 2010, is derived from its unaudited consolidated financial statements and notes thereto. The historical consolidated financial data for the twelve months ended June 30, 2010 is derived from both its audited consolidated financial statements and its unaudited consolidated financial statements and the respective notes thereto. The historical consolidated statement of income data, statement of cash flows data and balance sheet data for each fiscal year in the three-year year period ended December 31, 2009 included in the following table have been derived from Odyssey’s audited consolidated financial statements. The summary historical consolidated financial data as of and for the six months ended June 30, 2009 and 2010 and the twelve months ended June 30, 2010 reflects all normal and recurring adjustments that, in the opinion of Odyssey’s management, are necessary for a fair presentation of our results of operations and financial position. Results for the six months ended June 30, 2010 are not necessarily indicative of the results to be expected for the full year. The historical results indicated below and elsewhere in this exhibit are not necessarily indicative of Odyssey’s future performance. The following summary historical consolidated financial data should be read together with Odyssey’s consolidated financial statements and notes thereto as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in Odyssey’s Annual Report on Form 10-K for the year ended December 31, 2009 and Odyssey’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2010.

22

| Year Ended | Six Months Ended | Twelve Months Ended |

||||||||||||||||||||||

| ($ in thousands) |

December 31, 2007 |

December 31, 2008 |

December 31, 2009 |

June 30, 2009 (unaudited) |

June 30, 2010 (unaudited) |

June 30, 2010 (unaudited) |

||||||||||||||||||

| Statement of Income Data: |

||||||||||||||||||||||||

| Net patient service revenue |

$ | 398,232 | $ | 616,050 | $ | 686,438 | $ | 337,827 | $ | 347,723 | $ | 696,334 | ||||||||||||

| Operating expenses: |

||||||||||||||||||||||||

| Direct hospice care |

233,664 | 361,445 | 396,774 | 197,899 | 194,433 | 393,308 | ||||||||||||||||||

| General and administrative |

131,788 | 199,292 | 199,069 | 100,577 | 99,518 | 198,010 | ||||||||||||||||||

| Provision for uncollectible accounts |

5,344 | 10,907 | 11,490 | 4,869 | 2,410 | 9,031 | ||||||||||||||||||

| Depreciation and amortization |

5,723 | 7,868 | 6,725 | 3,001 | 3,514 | 7,238 | ||||||||||||||||||

| Total operating expenses |

376,519 | 579,512 | 614,058 | 306,346 | 299,875 | 607,587 | ||||||||||||||||||

| Income from continuing operations before other income (expense) |

21,713 | 36,538 | 72,380 | 31,481 | 47,848 | 88,747 | ||||||||||||||||||

| Other income (expense): |

||||||||||||||||||||||||

| Interest income |

2,509 | 1,968 | 479 | 287 | 170 | 362 | ||||||||||||||||||

| Interest expense |

(208 | ) | (7,430 | ) | (6,574 | ) | (3,491 | ) | (2,872 | ) | (5,955 | ) | ||||||||||||

| Income from continuing operations before provision for income taxes |

24,014 | 31,076 | 66,285 | 28,277 | 45,146 | 83,154 | ||||||||||||||||||

| Provision for income taxes |

8,001 | 11,141 | 24,583 | 10,347 | 17,090 | 31,326 | ||||||||||||||||||

| Income from continuing operations |

16,013 | 19,935 | 41,702 | 17,930 | 28,056 | 51,828 | ||||||||||||||||||

| Loss from discontinued operations, net of income taxes |

(3,888 | ) | (5,252 | ) | (498 | ) | (475 | ) | (197 | ) | (220 | ) | ||||||||||||

| Net income |

12,125 | 14,683 | 41,204 | 17,455 | 27,859 | 51,608 | ||||||||||||||||||

| Less: net income attributable to noncontrolling interests |

14 | 257 | 613 | 217 | 482 | 878 | ||||||||||||||||||

| Net income attributable to Odyssey stockholders |

$ | 12,111 | $ | 14,426 | $ | 40,591 | $ | 17,238 | $ | 27,377 | $ | 50,730 | ||||||||||||

| Statement of Cash Flows Data: |

||||||||||||||||||||||||

| Cash flows provided by operating activities |

12,814 | 21,049 | 81,650 | 21,530 | 25,565 | 85,685 | ||||||||||||||||||

| Cash flows provided by investing activities |

4,391 | (97,187 | ) | (4,083 | ) | (3,556 | ) | 10,630 | 10,103 | |||||||||||||||

| Cash flows provided by financing activities |

(12,391 | ) | 119,795 | (4,978 | ) | (3,310 | ) | (326 | ) | (1,994 | ) | |||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||||||

| Cash and cash equivalents |

12,386 | 56,043 | 128,632 | 70,707 | 164,501 | 164,501 | ||||||||||||||||||

| Working capital |

75,275 | 82,429 | 100,280 | 91,406 | 147,178 | 147,178 | ||||||||||||||||||

| Total assets |

275,209 | 460,951 | 503,004 | 468,927 | 520,775 | 520,775 | ||||||||||||||||||

| Total debt |

1 | 123,075 | 115,202 | 119,878 | 110,468 | 110,468 | ||||||||||||||||||

| Total Odyssey stockholders’ equity |

182,837 | 200,071 | 248,751 | 219,221 | 282,979 | 282,979 | ||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| EBITDA(1) |

27,436 | 44,406 | 79,105 | 34,482 | 51,362 | 95,985 | ||||||||||||||||||

| Adjusted EBITDA(1) |

39,040 | 56,823 | 84,598 | 36,937 | 54,722 | 102,383 | ||||||||||||||||||

| Capital expenditures, net |

9,628 | 4,428 | 6,638 | 3,351 | 1,804 | 5,091 | ||||||||||||||||||

| Depreciation and amortization |

5,723 | 7,868 | 6,725 | 3,001 | 3,514 | 7,238 | ||||||||||||||||||

| Operating Data (Unaudited): |

||||||||||||||||||||||||

| Number of Medicare-certified hospice programs(2) |

72 | 94 | 90 | 92 | 92 | 92 | ||||||||||||||||||

| Admissions(3) |

32,757 | 46,772 | 49,513 | 25,233 | 25,213 | 49,493 | ||||||||||||||||||

| Days of care(4) |

2,791,780 | 4,212,771 | 4,518,617 | 2,213,112 | 2,254,575 | 4,560,080 | ||||||||||||||||||

| Average daily census(5) |

7,649 | 11,510 | 12,380 | 12,227 | 12,456 | 12,493 | ||||||||||||||||||

23

| (1) | EBITDA, a measure used by management to evaluate operating performance, is defined as net income excluding discontinued operations, net of tax, plus net interest expense, provision for income taxes, and depreciation and amortization. EBITDA is not a recognized term under GAAP and does not purport to be an alternative to net income as a measure of operating performance or cash flows from operating activities as a measure of liquidity. Additionally, EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. Our presentation of EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Management believes EBITDA is helpful in highlighting trends because EBITDA excludes items that are outside management’s immediate control and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, tax jurisdictions in which companies operate and capital investments. Management uses non-GAAP financial measures to supplement, and not as a substitute for, GAAP results to provide a more complete understanding of the factors and trends affecting the business. |

Adjusted EBITDA is defined as EBITDA further adjusted to exclude special charges and other adjustments set forth below. We believe that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about certain material non-cash items, unusual items that we do not expect to continue at the same level in the future and net cost savings projected to be realized as a result of initiatives taken by management.

Because not all companies use identical calculations, our presentation of EBITDA and Adjusted EBITDA may not be comparable to other similarly titled measures of other companies, including those of Gentiva.

| Six Months Ended | Twelve months ended | ||||||||||||||||||

| Year Ended | June 30, | June 30, | June 30, | ||||||||||||||||

| (in thousands) |

December 31, 2007 |

December 31, 2008 |

December 31, 2009 |

2009 (unaudited) |

2010 (unaudited) |

2010 (unaudited) | |||||||||||||

| Net income |

$ | 12,125 | $ | 14,683 | $ | 41,204 | $ | 17,455 | $ | 27,859 | $ | 51,608 | |||||||

| Plus: Discontinued operations, net of tax |

3,888 | 5,252 | 498 | 475 | 197 | 220 | |||||||||||||

| Plus: Provision for income taxes |

8,001 | 11,141 | 24,583 | 10,347 | 17,090 | 31,326 | |||||||||||||

| Pre-Tax Income |

24,014 | 31,076 | 66,285 | 28,277 | 45,146 | 83,154 | |||||||||||||

| Plus: Net interest expense |

(2,301 | ) | 5,462 | 6,095 | 3,204 | 2,702 | 5,593 | ||||||||||||

| Plus: Depreciation and amortization |

5,723 | 7,868 | 6,725 | 3,001 | 3,514 | 7,238 | |||||||||||||

| EBITDA |

27,436 | 44,406 | 79,105 | 34,482 | 51,362 | 95,985 | |||||||||||||

| Plus: Loss on disposal of assets (a) |

211 | 150 | 410 | — | 3 | 413 | |||||||||||||

| Plus: Stock-based compensation |

3,829 | 4,347 | 5,083 | 2,455 | 3,357 | 5,985 | |||||||||||||

| Plus: Special charges (b) |

7,564 | 7,920 | — | — | — | — | |||||||||||||

| Adjusted EBITDA |

$ | 39,040 | $ | 56,823 | $ | 84,598 | $ | 36,937 | $ | 54,722 | $ | 102,383 | |||||||

| (a) | Represents the write-off of various property and equipment. |

| (b) | Represents excess facility lease costs, costs relating to Certificates of Need, severance costs and training and system conversion costs in 2007. Represents wind-down of VistaCare’s corporate office and integration of VistaCare’s operation ($5.7 million) and other nonrecurring expenses ($2.2 million) in 2008. |

| (2) | Number of Medicare-certified hospice programs at end of the respective year. |

| (3) | Represents the total number of patients admitted into Odyssey’s hospice programs during the period. |

| (4) | Represents the total days of care provided to Odyssey’s patients during the period. |

| (5) | Represents the average number of patients for whom Odyssey provided hospice care each day during the period and is computed by dividing days of care by the number of days during the period. |

24

RISK FACTORS

Risks Related to Our Business and Industry

We may not be able to successfully integrate Odyssey and other businesses that we may acquire in the future with Gentiva.

Our ability to successfully implement our business plan and achieve targeted financial results is dependent on our ability to successfully integrate Odyssey and other businesses that we may acquire in the future with Gentiva. The process of integrating Odyssey, or any other acquired businesses, involves risks. These risks include, but are not limited to:

| • | demands on management related to the significant increase in the size of our business; |

| • | diversion of management’s attention from the management of daily operations; |

25

| • | difficulties in the assimilation of different corporate cultures and business practices; |

| • | difficulties in conforming the acquired company’s accounting policies to ours; |