Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ELANDIA INTERNATIONAL INC. | d8k.htm |

1

PROJECT

AMPER

-

AMÉRICA

Acquisition of eLandia International, Inc. (USA)

Communication to Analysts and Investors

Exhibit 99.1

July 2010 |

2

Safe Harbor

This presentation and other statements to be made by Amper contain certain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act, including but not

limited to statements relating to projections and estimates of earnings, revenue, cost-savings,

expenses, or other financial items; statements of management’s plans, strategies, and objectives

for future operations, and management’s expectations as to future performance and

operations and the time by which objectives will be achieved; statements concerning proposed new

products and services; and statements regarding future economic, industry, or market conditions or

performance. Forward-looking statements are typically identified by words or phrases

such as “believe,” “expect,” “anticipate,” “project, “ ”estimate”, and “conditional verbs such as “may,”

“could,” and “would,” and other similar expressions. Such

forward-looking statements reflect management’s current expectations, beliefs,

estimates, and projections regarding Amper, its industry and future events, and are based upon certain

assumptions made by management. These forward-looking statements are not guarantees of

future performance and necessarily are subject to risks, uncertainties, and other factors (many

of which are outside the control of Amper) that could cause actual results to differ materially from those anticipated. These risks and

uncertainties include the satisfaction of closing conditions for the transaction, including obtaining

regulatory approvals; the satisfaction of the financial assumptions identified in this press

release; the possibility that the transaction will not be completed; our ability to successfully integrate

the operations of eLandia; general industry conditions and competition; and business and economic

conditions. More information about potential risk, uncertainties and other are included in

eLandia’s filings with the U.S. Securities and Exchange Commission. In light of these risks and

uncertainties, any forward-looking statements may not prove to be accurate. Accordingly, you

should not place undue reliance on any forward- looking statements, which only reflect the

views of our management as of the date of this press release. We undertake no obligation and do not

intend to update, revise or otherwise publicly release any revisions to these forward-looking

statements to reflect events or circumstances after the date of this press release or to reflect

the occurrence of any unanticipated events. |

3

The

content

of

this

presentation

is

the

result

of

work

performed

by Amper for its analysis on the

integration of eLandia and Medidata, working on the development and execution of

this transaction with the technical support of the Corporate Finance

department of KPMG Asesores, S.L., as financial advisors. To reach the

conclusions contained in this document, they have used as a base information

provided by:

Management team of Elandia International Inc.

Management team of Medidata

Commercial Due Diligence performed by Amper

Financial,

Legal,

Labor,

and

Tax

Due

Diligence

performed

by

KPMG

y KPMG Abogados, S.L.

Introduction/Disclaimers |

4

The purchase of US based eLandia

International Inc. by Amper

represents an opportunity to

acquire a $190 million USD (2010 estimate) business, which is complementary to the

existing Amper

business and provides a platform for growth in 17 emerging markets throughout Latin

America and the South Pacific.

The

combination

of

eLandia

and

Amper

Brazil

creates

the

regional

leader

in

Latin

America

for networking integration and solutions available to the major private and public

telecommunications service providers.

The acquisition fits clearly with Amper’s overall business strategy of

expanding globally, growing topline revenue, and entry into high growth

markets. américa

Project Amper América: Summary of eLandia Group acquisition

|

5

Present in 14 emerging markets in Latin America

High potential for growth

Access to 16 service and communications providers and over 3,000 clients

Estimated, combined, pro forma revenue greater than $300MM USD

High potential for synergies

Complementary and experienced management teams

Able to leverage existing multi-national organization, structures and systems

Principal Cisco partner in the region (9% of Latin America quota)

Leader in the design and implementation of network integration and

communications systems for both public and private communications providers

throughout Latin America

Perfect fit with Amper’s multi-national strategy

The acquisition of eLandia creates the regional leader of network integration

and communications integration throughout Latin America

Medidata

and

eLandia’s

complementary

fit

will

allow

the

combined

entity

to

become

the

leader

in our

sector in Latin

America by having

the

most

regional presence

and

the

most

complete offering

of

products

and

services |

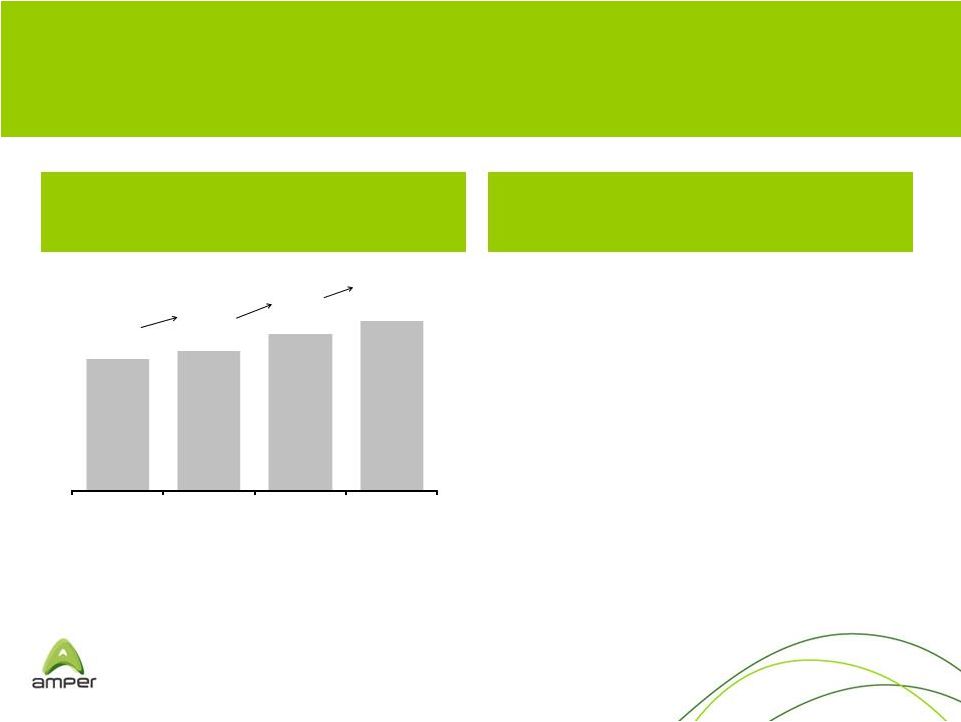

eLandia is a multi-national company well poised to achieve revenue

growth and profit…

Source: Elandia

Historical growth rate

Revenue ($ m)

70

117

161

174

67.1%

37.6%

8.1%

2006

2007

2008

2009

eLandia has two major businesses: Desca

(network integration) (91%) in Latin America;

and the South Pacific (telecommunications)

(9%)

* Telecommunications include: mobile, cable,

undersea cable) in American Samoa and

other countries

pro forma (does not include discontinued operations)

6 |

7

EBITDA 2009 = <$14,817>

Reduction at the business unit level of $5 to $6MM

Non-recurring Venezuela expenses $6.5 to $7MM

EBITDA 2009 = <$23.8MM>

One-time adjustments of $4.5 to $5.5MM

Reduction of corporate expenses of $4.5 to $5MM

Amount in (m) US $

Source: Elandia

Severance

One-time legal expenses

One-time obsolescence charge

One-time expenses for cable and TV

cable

Personnel reduction

Reduction in Audit and Consulting expenses

Reduction in investor relations

…

subsequent to undergoing a major restructuring in 2009

Personnel reduction

Reduction

other

operating

expenses

Sale of a South Pacific asset

Reduction of 300 personnel (25% of

workforce)

Changes in SWAP rate

CADIVI expenses and taxes

Accounting adjustments |

8

1st QTR,

30.9

1st QTR,

38.5

Full Year,

173.5

Full Year*; 190

2009

2010e

Q1 2010 has shown significant improvement when compared

to Q1 2009…

Source: Elandia

Q1 2009

Q1 2010

Revenues

30.9

38.5

24.6%

EBITDA

(5.3)

(0.2)

96.2%

EBIT

(19.8)

(2.5)

87.4%

Net Loss

(21.3)

(3.2)

85.0%

Workforce

1,235

850

2009 –

2010

Amount in (m) US $

* Forecast

2

QTR,

25.4

2

QTR,

34 to 36

Quarter over quarter revenue growth

Significant improvement H1 2010 over H1 2009

EBITDA improvement partly due to opex restructuring

Well poised to meet its 2010 revenue objectives

pro forma (2009 does not include discontinued operations)

Sales Seasonality

nd

nd |

9

eLandia has a solid base of more than 3,000 clients,

including 16 major telecommunications providers…

Source: Elandia |

10

…

and a solid business with visibility to achieving its 2010

business objectives

Source: Elandia

(*) Projects in process which will be invoiced before the end of

2010

eLandia Group. June 2010. Amounts in (m) US $

As of June 2010, eLandia’s pipeline was over

$600MM USD

Revenue through June

2010

Backlog*

Pipeline

Total 2010e

72 a 74

38

76-78

186-190

Seasonality

38%

32%

62%

68%

2007-

2009

2010e

1er

Sem

2

Sem |

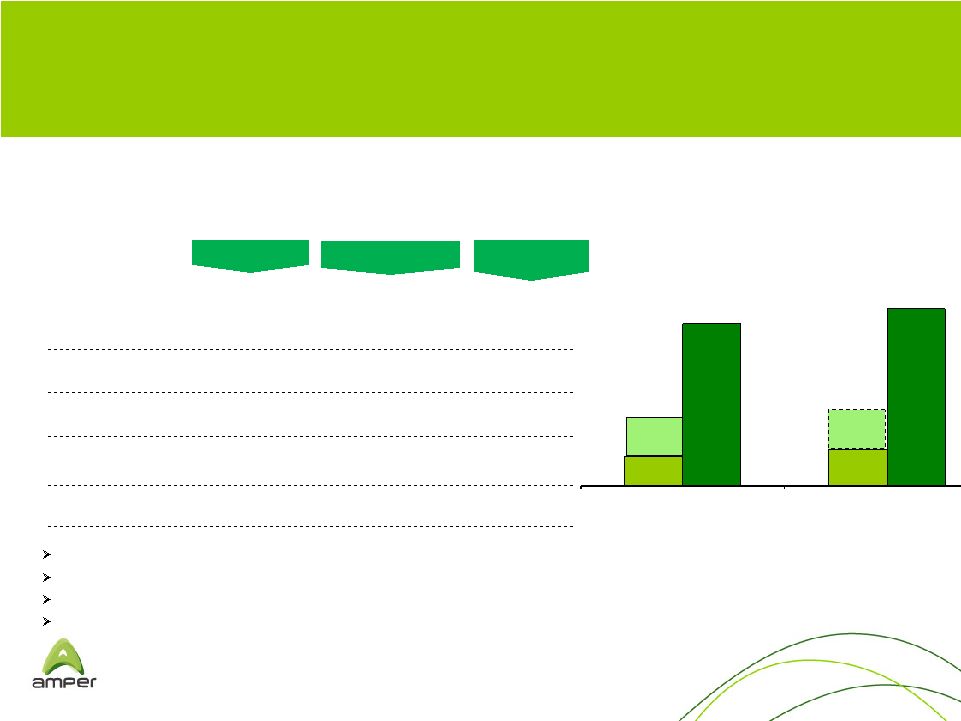

-23,8

EBITDA performance should continue to improve due to organic growth and

improved operating margins…

Source: Elandia

Revenues

($ m)

EBITDA

($ m)

174

186-190

210-220

2009

2010e

2011e

2009

2010e

2011e

+ 10

+ 5

11.5%

9.2%

100 %

pro forma (2009 does not include discontinued operations)

11 |

12

…

in line with the growth rates for the region (IDC)…

Source: International Data Corporation

Average growth estimate:

10-14: 7.6%

Average growth estimate

10-13: 9.5%

Growth in the Network

Integration Market

Growth in Technical

Outsourcing Support

Market |

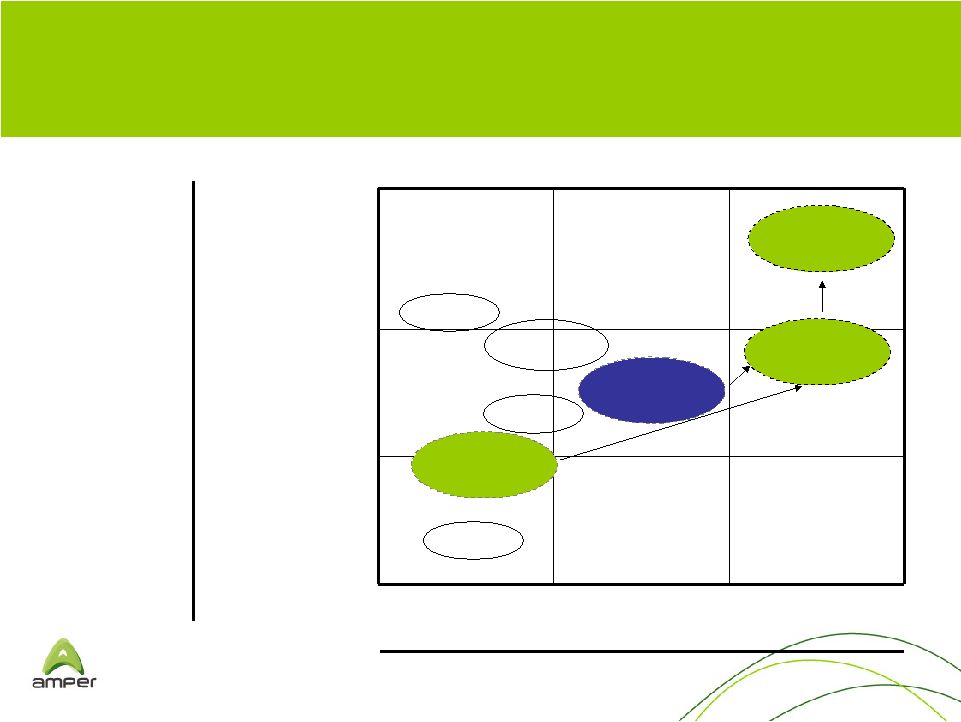

13

…

the combined entity has the capability of achieving regional leadership

position in the market

Products

and

services

offered

Geographic Coverage

Final Goal

Amper

América

eLandia

Medidata

Complete

Middle

Limited

Local

Multilocal

Regional |

14

Participating in the expected overall regional

growth of Latin America

More than 3,000 clients / 16 providers

Focus on services offering (currently 30% of

revenues)

Gross margins are superior to Medidata (29%

eLandia and 24% Desca) as a result of less

competitive markets as compared to Brazil

Operating expenses running at: (24% Elandia

and 20% Desca):

Excellent relationship with Cisco

Commercial force with vast training

Contributes

commercial

processes

and

clients

Both companies have complementary business models and the potential

to increase margins

Source: Elandia

eLandia

(Desca)

Medidata

Participating in the overall growth of the

Brazilian market

Less focused on services than eLandia (24% of

revenues) and maintenance of product /

services mix

Gross margins lower than eLandia (20%) due to

increased competitiveness and diffusion of

clients in Brazil

More efficient handling of operating expenses

(11%)

Contributes efficiency and products |

15

70%

30%

76%

24%

Medidata

Services

Products

Medidata

Education

Maintenance and support services

Installation

23%

77%

43%

14%

44%

42%

53%

65%

33%

2%

Products and Services Mix

(2009)

Partner Distribution (2009)

Services (2009)

4%

Sun

Cisco

Otros

Medidata

Complementary

mix of

technology

partners, products

and

services.

eLandia

Latam

eLandia

Latam

eLandia

Latam |

16

Leveraging Amper’s technical capabilities and products to provide

greater coverage of the market and clients in Latin America.

Network

integration

•Complex solutions

•Processes y

applications

Access

Equipment

•Products

•Efficient model

•Manufacturer alliances

Homeland

Security

•Products / services

•Experienced

•International alliances

AMPER

•

Access to 14 countries, 16

operators and 3,000 clients

•

eLandia’s commercial strength

•

Service regional leaders

•

Access to 126 providers

•

High growth potential for

adoption of high bandwidth in

Latin America

•

High demand for Homeland

Security products and services

•

Emergency control centers and

border controls

America opportunity |

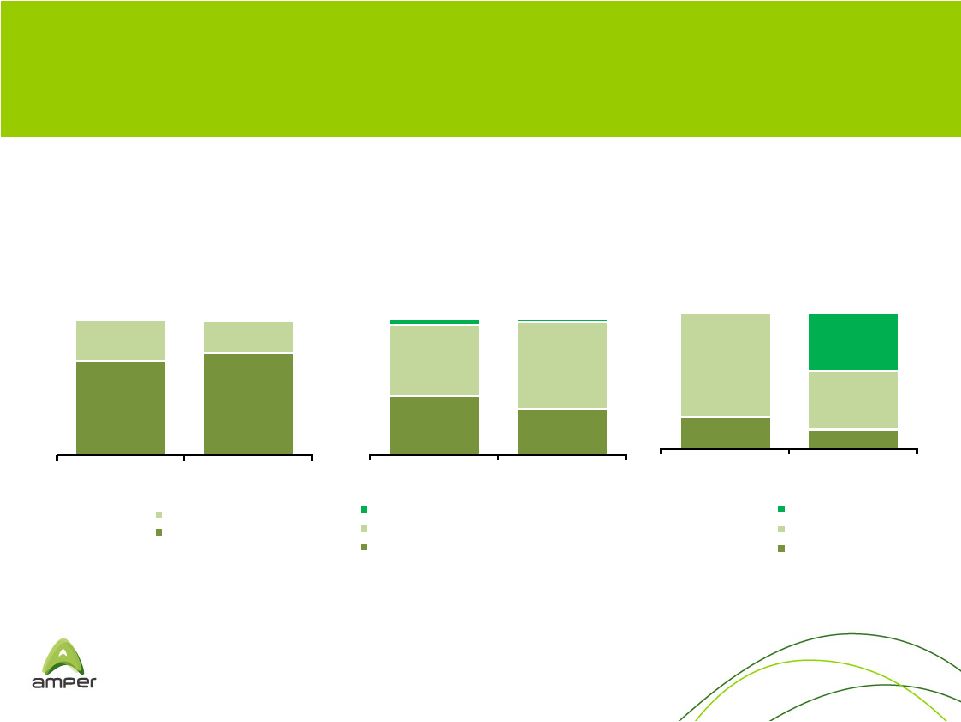

17

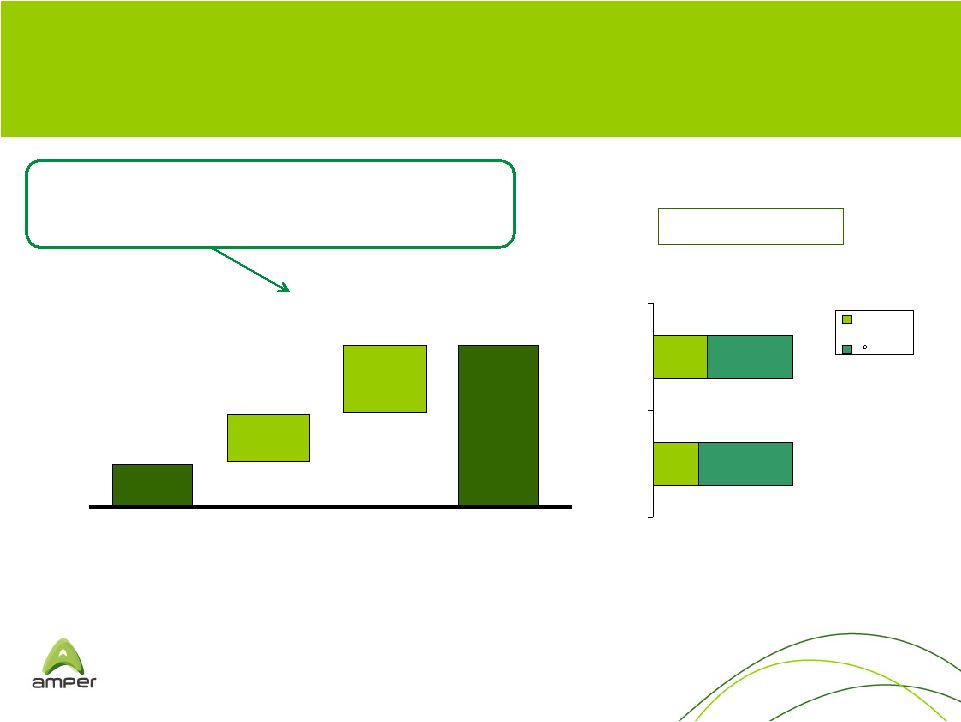

In 2011, the combined entity will have estimated revenues of $360MM

USD and EBITDA between $20 and $25MM USD...

14,1%

9,7%

31,23%

290

320-340

350-370

-17

16-18

20-25

Source: Amper y Elandia

Revenue

($ m)

EBITDA

($ m)

2009

2010e

2011e

2009

2010e

2011e |

18

Key Concepts

Effect on EBITDA 2011-2012

Revenue

Synergies

Accretive sales

5 Mill. US$

Cost

Synergies

Personnel

Financing costs (*)

Corporate expenses

6 Mill. US$

(*) Direct impact on net income

11 Mill. US $

TOTAL

Source: Amper, Elandia

Additionally, the

combined

entity

could

materialize

into

important

synergies

which

is

the

objective

of

the

100 Day integration

plan |

19

In 2010 and 2011, the debt ratio could show significant improvement

Elandia

32,0

Medidata

-5

Elandia+Medidata

27,0

12

2010

2011

Elandia

6,0

Medidata

11,0

Elandia+Medidata

17

24

Net Debt

EBITDA

estimate(**)

Debt Ratio

1.6x

-0.5x

Amounts in (m) US $ |

20

In summary, the transaction makes great strategic, financial and

operating

sense for Amper

Strategic

•Increase in scale

•Globalization

•Client base

•

+50%

•

14 countries (dollar Int. De 35% a 50%)

•

3,000 (16 service providers)

Financial

•Fundamentals

•Synergies

•Debt

•

EBITDA 2011 (e): $20-$25 million

•

10 -11 million $ 2011-2012

•Net debt / EBITDA (2011 e) < 0.5x

Operational

•Products mix

•Business Integration

•Management team

•Complementary

•100 Day Plan

•Highly qualified |

21

This document contains statements about future intentions, expectations or

predictions of the Company or its management as of the date created, which

relate to various aspects, including, the growth of different business lines

and the global business, the market share, the Company’s results and other

aspects of the activity and status of the same.

Analysts and investors should be aware that such intentions, expectations or

estimates do not imply any guarantees about what will be the behavior and

future performance of the Company and assume risks and uncertainties regarding

relevant aspects, so that the results and the actual future behavior of the Company

may differ materially from what is derived from these forecasts and

estimates. The information given in this statement should be taken into

account by all persons or entities who may have to make decisions, prepare

or disseminate opinions regarding securities issued by the Company and, in particular, by the

analysts who review this document. All are invited to consult the documentation and

public information communicated or filed by the Company before the National

Securities Market. The financial information contained in this document has

been prepared under International Financial Reporting Standards (IFRS). This

financial information has not been audited and, accordingly, is susceptible to potential future

modifications.

This document is not an offer or invitation to investors to buy or subscribe shares

of any kind and, in no way, constitutes the basis of any document or

commitment. |

22 |