Attached files

| file | filename |

|---|---|

| EX-31.1 - Datone, Inc | v191370_ex31-1.htm |

| EX-32.1 - Datone, Inc | v191370_ex32-1.htm |

| EX-31.2 - Datone, Inc | v191370_ex31-2.htm |

| EX-32.2 - Datone, Inc | v191370_ex32-2.htm |

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

x Annual Report Pursuant To Section 13

or 15(d) of the Securities Exchange Act of 1934

For the

fiscal year ended: December 31, 2009

£ Transition Report Under

Section 13 or 15(d) of the Securities Exchange Act of 1934

For the

transition period from ______ to_______

Commission

File Number: 000-53075

QINGDAO

FOOTWEAR, INC.

(Formerly

Datone, Inc.)

(Exact

name of registrant as specified in its charter)

|

Delaware

|

16-1591157

|

|

(State or other jurisdiction of incorporation or

organization)

|

(I.R.S. Employer Identification Number)

|

Qingdao

Footwear, Inc.

269

First Huashan Road

Jimo

City, Qingdao, Shandong, PRC

(Address

of principal executive office and zip code)

86-0532-86595999

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act: None.

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, par value

$0.0001

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes x No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large

accelerated filer o

|

Accelerated

filer o

|

Non-accelerated

filer o

|

Smaller

reporting

company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Act). Yes o No x

As of

June 30, 2009, the aggregate market value of the shares of the Registrant’s

common stock held by non-affiliates (based upon the closing price of such shares

as reported on the Over-the-Counter Bulletin Board) was approximately $65,233.

Shares of the Registrant’s common stock held by each executive officer and

director and by each person who owns 10 percent or more of the outstanding

common stock have been excluded in that such persons may be deemed to be

affiliates of the Registrant. This determination of affiliate status is not

necessarily a conclusive determination for other purposes.

As of

August 2, 2010, there were 10,000,000 shares of the Registrant’s common stock

outstanding.

Explanatory

Note

The

purpose of this Annual Report on Form 10-K/A is to amend Items 1, 5, 10, 11 and

13 of our Annual Report on Form 10-K for the fiscal year ended December 31,

2009, which was filed with the Securities and Exchange Commission (the “SEC”) on

March 30, 2010 (the “2009 10-K”).

Items 1,

5, 10, 11 and 13 of our 2009 10-K have been amended and restated in their

entirety. Except as stated herein, this Form 10−K/A does not reflect events

occurring after the filing of the Form 10-K on March 30, 2009 and no attempt has

been made in this Annual Report on Form 10-K/A to modify or update other

disclosures as presented in the 2009 10-K. Accordingly, this Form 10−K/A should

be read in conjunction with our filings with the SEC subsequent to the filing of

the Form 10−K.

Throughout

this report, the terms “we,” “us,” “our company,” “our” and “Qingdao Footwear”

refer to the combined business of Qingdao Footwear, Inc., formerly Datone, Inc.,

and its wholly owned direct and indirect subsidiaries, (i) Glory Reach

International Limited, or “Glory Reach,” a Hong Kong limited company; and (ii)

Qingdao Hongguan Shoes Co., Ltd., a PRC limited company, or “QHS,” as the case

may be.

2

QINGDAO

FOOTWEAR, INC.

(Formerly

Datone, Inc.)

FORM

10-K/A

For

the Fiscal Year Ended December 31, 2009

|

Page

|

|||

|

PART

I

|

|||

|

Item

1.

|

Business

|

4

|

|

|

PART

II

|

|||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

17

|

|

|

PART

III

|

|||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

19

|

|

|

Item

11.

|

Executive

Compensation

|

22

|

|

|

Item

13.

|

Certain

Relationships and Related Party Transactions, and Director

Independence

|

23

|

3

PART

I

|

ITEM

1.

|

BUSINESS

|

Overview

We are a

designer and retailer of branded footwear in Northern China. We were organized

to service what we believe is an unmet and increasing demand for high quality

formal and casual footwear throughout the PRC. As urbanization and individual

purchasing power has increased in China, the demand for leather footwear has

also grown.

Our

principal business includes (1) designing and selecting designs for men’s and

women’s leather shoe lines; (2) sourcing and purchasing contract-manufactured

footwear; and (3) selling these lines of footwear under our proprietary brand,

“Hongguan” (sometimes presented as “HonGung”). We do not manufacture or assemble

any shoes. We operate a number of flagship stores throughout greater

Qingdao. Our products are also brought to market through our extensive

distribution network of authorized independent distributors as well as through

third party retailers selected to operate exclusive Hongguan brand stores on our

behalf. Our company headquarters and main sales office is located in Shandong

province in northern China, in the city of Jimo, less than 25 miles from the

major urban center of Qingdao.

Corporate

History and Background

Qingdao

Footwear was originally incorporated as Datone, Inc. on August 9, 2000 under the

laws of the State of Delaware. The Company operated as a wholly-owned subsidiary

of USIP.com, Inc., a Utah corporation. On August 24, 2006, USIP.com,

Inc. spun-off its subsidiary companies, one of which was Datone, Inc. On

February 1, 2008, Datone, Inc. filed a Form 10-SB registration statement that

was declared effective on November 13, 2008.

Datone,

Inc. was a provider of both privately owned and company owned payphones and

stations in New York. The Company generates revenues from the collection of the

payphone coinage, a portion of usage of service from each payphone and a

percentage of long distance calls placed from each payphone from the

telecommunications service providers. In addition, the Company also generated

revenues from the service and repair of privately owned payphones and sales of

payphone units.

On

February 12, 2010, the Company completed a reverse acquisition transaction

through a share exchange with Glory Reach International Limited, a Hong Kong

limited company (“Glory Reach”), the shareholders of Glory Reach (the

“Shareholders”), Greenwich Holdings LLC and QHS, whereby the Company acquired

100% of the issued and outstanding capital stock of Glory Reach in exchange for

10,000 shares of our Series A Convertible Preferred Stock. These

shares of our Series A Convertible Preferred Stock constituted 97% of our issued

and outstanding capital stock on an as-converted to common stock basis as of and

immediately after the consummation of the reverse acquisition. As a result of

the reverse acquisition, Glory Reach became our wholly-owned subsidiary and the

former shareholders of Glory Reach became our controlling stockholders. The

share exchange transaction with Glory Reach was treated as a reverse

acquisition, with Glory Reach as the acquirer and Datone, Inc. as the acquired

party for accounting and financial reporting purposes.

Immediately

following the closing of the reverse acquisition of Glory Reach, one of the

Shareholders transferred 337 of the 874 shares of Series A Convertible Preferred

Stock issued to him under the share exchange to certain persons who provided

services to Glory Reach’s subsidiaries, pursuant to share allocation agreements

that the Shareholder entered into with such service providers. We

have accounted for such transfers as compensation expenses.

4

Upon the

closing of the reverse acquisition, Craig H. Burton, our president and director,

Joseph J. Passalaqua, our secretary and director, and Joseph Meuse, our

director, submitted resignation letters pursuant to which they resigned from all

offices that they held effective immediately and from their position as our

directors that became effective on the tenth day following the mailing by us of

an information statement to our stockholders that complies with the requirements

of Section 14f-1 of the Exchange Act, was mailed out on March 8, 2010. In

addition, our board of directors on February 12, 2010 appointed Tao Wang

(Chairman), Renwei Ma and Lanhai Sun to fill the vacancies created by such

resignations, which appointments became effective upon the effectiveness of the

resignation of Craig H. Burton, Joseph J. Passalaqua and Joseph Meuse on March

18, 2010, the tenth day following the mailing by us of the information statement

to our stockholders on March 8, 2010. (Subsequent to the resignation of these

individuals, our company retained Mr. Meuse as its Chief Financial Officer on

July 12, 2010.) In addition, our executive officers were replaced by

QHS’ executive officers upon the closing of the reverse acquisition as indicated

in more detail below.

As a

result of our acquisition of Glory Reach, we now own all of the issued and

outstanding capital stock of Glory Reach, which in turn owns all of the

outstanding capital stock of QHS.

QHS was

established in the PRC on May 11, 2003 for the purpose of engaging in the

development and sales of shoe products. Prior to the acquisition described in

the following paragraph, Mr. Tao Wang owned 80% of the equity interests of

QHS.

Glory

Reach was established in Hong Kong on November 18, 2009 to serve as an

intermediate holding company. Mr. Tao Wang controls and has the right

to receive sole ownership of Swift Dynamic, the majority owner of Glory Reach,

pursuant to the Incentive Option Agreement and Entrustment Agreement entered

into with Renhuan Shi, a Korean passport holder. See “Risk Factors – Our

business and financial performance may be materially adversely affected if the

PRC regulatory authorities determine that our acquisition of QHS constitutes a

Round-trip Investment without MOFCOM approval.” As a result of Mr.

Wang’s ownership of QHS and his control of Glory Reach, the entities are

considered to be under common control.

On

February 8, 2010, pursuant to the restructuring plan and upon issuance of the

Enterprise Corporation Business License by the Jinmo City Administration for

Industry and Commerce, Glory Reach acquired 100% of the equity interests in QHS

from Mr. Tao Wang, our Chief Executive Officer, and other minority shareholders,

who are all PRC residents. On February 4, 2010, the local government of the PRC

issued the certificate of approval regarding the change in shareholding of QHS

and its transformation from a PRC domestic company to a wholly-foreign owned

enterprise.

Since

there is common control between the Glory Reach and QHS, for accounting

purposes, the acquisition of QHS has been treated as a recapitalization with no

adjustment to the historical basis of its assets and liabilities. The

restructuring has been accounted for using the “as if” pooling method of

accounting and the operations were consolidated as if the restructuring had

occurred as of the beginning of the earliest period presented in our

consolidated financial statements and the current corporate structure had been

in existence throughout the periods covered by our consolidated financial

statements.

Immediately

following the acquisition of Glory Reach, under an Agreement of Conveyance,

Transfer and Assignment of Assets and Assumption of Obligations (the “Conveyance

Agreement”), we transferred all of our pre-acquisition assets and liabilities to

our wholly-owned subsidiary, DT Communications, Inc. The spinoff to

DT Communications, Inc. occurred immediately before the

acquisition. Because the surviving entity for accounting purposes was

the operating company, Glory Reach, the spinoff had no impact on our accounting

for the reverse merger.

On March

1, 2010, Swift Dynamic, being the record holder of 6,495 shares of our Series A

Preferred Stock, constituting 63.0% of the voting power of our issued and

outstanding shares of our Common Stock and Series A Preferred Stock, voting

together as a single class, consented in writing to an amendment to our

certificate of incorporation to change our name to “Qingdao Footwear,

Inc.”

5

Our

Corporate Structure

All of

our business operations are conducted through our Hong Kong and Chinese

subsidiaries. The chart below presents our corporate structure.

Our

Industry and Principal Market

China is

the largest producer of footwear in the world, with at least 25,000 enterprises

employing more than 10 million employees who manufacture more than 10 billion

pairs of shoes per annum. China’s annual production accounts for nearly 70% of

the 14.3 billion pairs of shoes produced worldwide. In 2008, roughly 75% of PRC

production capacity was exported while the remaining 25% were consumed

domestically. Chinese consumption of footwear reached 2.5 billion pairs in 2008.

(Global Footwear, 2nd Edition, www.researchandmarkets.com) We anticipate stable

growth in the domestic footwear market for the next several

years. Beginning with the deterioration in the global economy in 2008

and the collapse of the Chinese textile and footwear export market, a material

number of low margin manufacturers were forced out of business. Domestic

consumption and retail sales within China, however, remained robust throughout

the export downturn and global financial crisis. As we have intentionally

avoided the manufacturing sector, we were able to capitalize on the economic

conditions and maintain our profit margin and by capitalizing on overcapacity in

our sourcing market and growing consumer demand.

6

PRC

Domestic Consumption

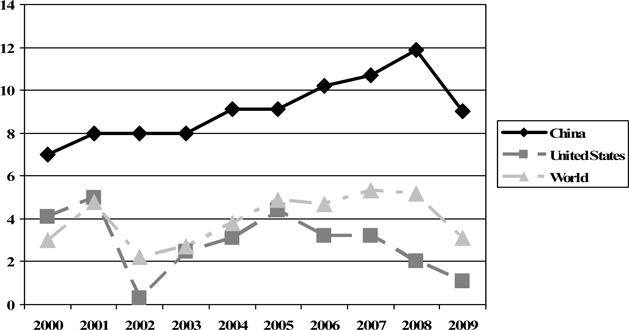

According

to the CIA World Factbook, China’s gross domestic product (“GDP”) growth rate

has exceeded both the United States’ and the world’s GDP growth rate over the

past ten years:

Along

with growth in the economy as a whole, Chinese domestic consumption has

increased in line with rapid urbanization and increases in disposable income

over the past 15 years. Per capita urban disposable income has increased by an

annualized rate of 12.9% over the 5 years ending in 2008, and is anticipated to

top $2,000 in 2012. The urban population as a percentage of the total population

increased from 40.6% in 2003 to 46.6% at the end of 2009, and this trend is

expected to continue into the future. (National Bureau of Statistics of China,

www.stats.gov.cn) The United

Nations estimates that China’s population is likely to be evenly split between

rural and urban areas by 2015. (“Urbanization in the People’s Republic of

China,” www.wikipedia.org)

7

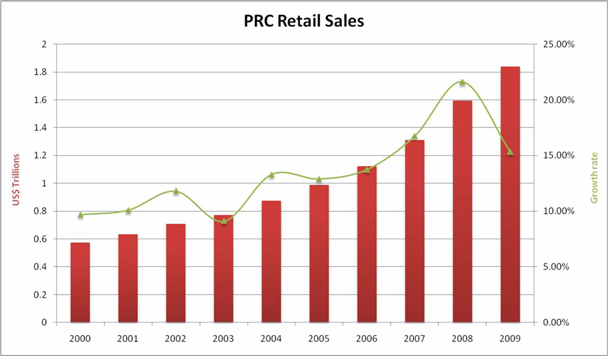

These

trends have driven a boom in retail sales in the PRC, which has grown at an

annual rate ranging from 9.7 to 21.6% over the past ten year

period. It is estimated that retail sales will grow 47% from

2009 to 2014. (China Retail Report Q1 2010,

www.companiesandmarkets.com)

The

retail sales according to the China Statistical Yearbook are displayed

below:

The

PRC Footwear Market

China’s

footwear market generated total revenues of approximately $11.7 billion dollars

in 2008. According to Datamonitor, from 2004 through 2008, revenues

grew at a cumulative annual growth rate of approximately 10.7%. (“Footwear in

China,” www.datamonitor.com)

8

China’s

footwear market accounts for approximately 34% of the entire Asia-Pacific

footwear market’s value, and China is expected to continue to grow in future

periods by over 8% per year through 2013, while the most valuable market, Japan,

which holds approximately 35.8% of the footwear market value in the region, is

expected to decrease by approximately 0.8% per year over the same period.

(“Footwear in China,” www.datamonitor.com)

9

While

Chinese per capita footwear consumption is lower than a number of other

countries, China surpassed the United States in 2008 as the country that

purchases the most pairs of footwear in the aggregate. Because the

average Chinese consumer purchases an average of two pairs of shoes annually,

far fewer than consumption levels in Korea, Japan or the West, shoe consumption

are expected to approach levels of other nations with similar cultural

consumption characteristics if China’s consumer wealth continues to grow.

(“Footwear in China,” www.datamonitor.com) For this reason, we expect

the market is likely to continue to grow for the foreseeable

future.

Our

Growth Strategy

We

believe that the market for affordable, high quality footwear in China provides

us with attractive and sustainable growth opportunities. We

intend to pursue the following strategies to achieve our goal:

|

(1)

|

Continue our aggressive

marketing and advertising campaigns in order to gain brand

awareness. We currently

advertise and market our products throughout Shandong province in general

and the greater Qingdao region in particular, using a combination of

advertising across a variety of media, sales fairs, and billboard

displays. We expect to continue to focus these

efforts.

|

|

(2)

|

Expand distributor and third

party operator stores in prime locations to maximize

profits. We seek to place stores in locations we

consider attractive from a business perspective. Potential attractive

locations are typically in areas that are likely to have a sufficient

population of “window shoppers” in the Registrant’s target demographic

(generally, consumers seeking business casual and formal leather shoes

appropriate for an office setting). We do not currently plan to

expand our geographic footprint beyond what we view as our core market,

Shandong province. In addition, we expect that we will continue

to strengthen our presence in the Qingdao

region.

|

|

(3)

|

Bring more self owned stores

online to increase higher margin sales. Although we have

not established a timeline to increase the number of self owned stores we

will open in the near future, we expect that we will open more self owned

stores (and at a faster rate) if we complete this offering than we will

open if we rely only on organic growth to fund such

openings. The reason for this is that we have found that

expanding our distributor network allows us to leverage our resources more

effectively, even though we earn higher margins on our self owned

stores. In the event we complete this offering, however, we

would have free cash available to devote to opening self owned stores. In

our experience, establishing a new sales point such as a company-owned

flagship store in Qingdao typically requires approximately three months

and costs approximately $120,000.

|

|

(4)

|

Continue to strive for

excellence in quality, customer service and design in order to attract new

and retain repeat customers. We have an in-house product

design team, which is responsible for designing our product

lines. We have worked with this team and our advertising team

to develop an image for our Hongguan brand that we believe will continue

to attract customers in our target demographic of office

workers. We recognize employees on a regular basis to encourage

a concerted effort of high quality customer

service.

|

|

(5)

|

Leverage our growing

purchasing power with manufacturers to lower costs. At

present, we have found that Chinese shoe manufacturers have unused

manufacturing capacity. To the extent we have demand from

customers for our branded shoes, we believe we benefit from a favorable

market in which to purchase from such manufacturers. If we

continue to grow, we will be able to use our increased purchasing power

and the desire of manufacturers to make use of such untapped capacity to

reduce our costs to purchase

footwear.

|

Our

Products

Our

products consist of men and women’s footwear. Our designs are on the whole

targeted at consumers seeking business casual and formal leather shoes

appropriate for an office setting. Each year we design or commission designs for

more than 200 unique styles. We do not manufacture our products, but instead

outsource manufacturing to third parties. Our designs are split roughly evenly

between men’s and women’s products. Designs are made based on collaboration

between our sales department and design department regarding market demand and

assessment of what will designs be fashionable in the upcoming season. As of

March 31, 2010, men’s footwear constituted approximately 60% of revenue and

women’s footwear the remainder. Approximately 40% of sales were formal shoes,

and the remainder is attributed to casual footwear.

10

Sourcing

and Purchase of Products

We are a

retailer and designer of footwear products, and as such we fully outsource

production of our footwear to third party manufacturers. Due to excess capacity

in the footwear manufacturing industry in the PRC, we have historically been

able to source our products at competitive prices that allow us to maintain

strong margins in comparison with our competitors. In this way, we avoid what we

perceive to be the risks and lower margins associated with manufacturing

footwear and are able to focus our energies on our brand building and retail

business.

Our

suppliers are selected for their ability to meet our high quality standards,

timely execution of our orders and competitive pricing. As of March 31, 2010, we

had contractual relationships with 60 footwear manufacturers. None of our

suppliers accounted for more than 10% of the total cost of our goods sold in

2009. Our suppliers are mainly located in Wenzhou, Chongqing and various towns

in Jiangsu.

Our

contracts with suppliers are on an as ordered basis, with payment due at the end

of the month of delivery, and are usually for a term of one year. Prices are

negotiated based on a by design basis by our sourcing team. All of our suppliers

are subject to our strict quality control standards, and we are entitled to

return product without payment if it is not according to the quality set forth

in our agreement.

During

the year ended December 31, 2007, purchases from one vendor accounted for 13.2%

of the total merchandise purchases of the Company. There is no such

concentration for the year ended December 31, 2008 and year ended December 31,

2009.

11

Sales

Channels

The

following diagram details our current distribution channels:

As of

March 31, 2010, we had 12 flagship stores, 11 exclusive third party managed

retail outlets, and 192 outlets managed by distributors.

The

majority of our sales come through distributors stores. The table

below provides a breakdown of sales by sales channel:

|

Channel

|

2009 Sales

|

%

|

2008 Sales

|

%

|

||||||||||||

|

Self

Owned Stores

|

$ | 2,792,146 | 16 | % | $ | 2,049,529 | 15 | % | ||||||||

|

Wholesale

(Third party

Stores

and Distributors)

|

$ | 15,071,745 | 84 | % | $ | 11,854,785 | 85 | % | ||||||||

|

Total

Revenue

|

$ | 17,863,891 | 100 | % | $ | 13,904,314 | 100 | % | ||||||||

12

We have

experienced rapid growth in our retail presence in the past two

years. The following table details the locations and historical

growth of our sales network:

|

Flagship Stores

|

Distributors

|

3rd Party Operators

|

Total

|

||||||||||||||||||||||||||||||

|

2008

|

2009

|

2010

Q1

|

2008

|

2009

|

2010

Q1

|

2008

|

2009

|

2010

Q1

|

2008

|

2009

|

2010

Q1

|

||||||||||||||||||||||

|

Shandong

(excluding

Qingdao)

|

0 | 0 | 0 | 42 | 155 | 155 | 0 | 6 | 6 | 42 | 161 | 161 | |||||||||||||||||||||

|

Qingdao

city

(including

Jimo)

|

8 | 11 | 12 | 44 | 26 | 26 | 0 | 4 | 4 | 52 | 41 | 42 | |||||||||||||||||||||

|

Xinjiang

|

0 | 0 | 0 | 1 | 1 | 3 | 0 | 1 | 1 | 1 | 2 | 4 | |||||||||||||||||||||

|

Shanxi

|

0 | 0 | 0 | 2 | 3 | 2 | 0 | 0 | 0 | 2 | 3 | 2 | |||||||||||||||||||||

|

Tianjiang

|

0 | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 1 | 1 | |||||||||||||||||||||

|

Heilongjiang

|

0 | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 1 | 1 | |||||||||||||||||||||

|

Hebei

|

0 | 0 | 0 | 0 | 2 | 1 | 0 | 0 | 0 | 0 | 2 | 1 | |||||||||||||||||||||

|

Liaoning

|

0 | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 1 | 1 | |||||||||||||||||||||

|

Henan

|

0 | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 1 | 1 | |||||||||||||||||||||

| 8 | 11 | 12 | 89 | 191 | 191 | 0 | 11 | 11 | 97 | 213 | 214 | ||||||||||||||||||||||

Shandong

Province

Shandong

Province is China’s second largest province (after Guangdong), with a population

of approximately 94 million people. The province is also China’s

second most densely populated province (after Jiangsu), with 587 people per

square kilometer, more than four times the average population density in

China. Gross domestic product (“GDP”) attributable to Shandong ranks

it second among China’s provinces, accounting for more than ten percent of

China’s GDP in 2008. (“List of Administrative Divisions by Population

Density,” en.wikipedia.org; “World Bank Supports Skills Development in Two

Chinese Provinces,” go.worldbank.org)

Qingdao

City

Qingdao

is a sub-provincial city in China comprised of seven districts and five

county-level cities. It is one of China’s twenty largest cities and

one of the two largest cities in Shandong province, with approximately 200,000

more people living in Jinan city than in Qingdao city but more than 1.7 million

more people living in the greater Qingdao administrative area than in Jinan’s

administrative region. Qingdao has a population of approximately 8

million residents, of whom approximately 3.8 million live in the urban

area.

Qingdao’s

per-capita GDP (approximately $7,616 in 2008) is above average in China

(approximately $3,290 in 2008), in part due to the Chinese government’s decision

in 1984 to designate Qingdao as a special economic and technology development

zone. For this reason, Qingdao’s local economy features a variety of

foreign investment, with South Korea and Japan investments being particularly

prominent in the area. (“Qingdao,” en.wikipedia.org)

Flagship

Stores

We

directly own or lease and operate all of our flagship stores. All located in

Jimo or greater Qingdao. Each store has an individual sales team and managers

that report to our central office in Qingdao. All sales staff are compensated on

a commission based pay scale. Locations are selected according to management’s

estimation of market opportunity. Our flagship stores bear the Hongguan brand

name and exclusively retail Hongguan brand footwear.

During

the years ended December 31, 2009 and 2008, the sales generated by the Company’s

flagship stores accounted for 16% and 15% of total sales,

respectively.

13

Hongguan

Flagship Outlets in Jimo:

Stores

Managed by Third Party Operators

In order

to meet consumer demand for our products and efficiently expand of our business,

we also select certain third parties to operate Hongguan (sometimes presented as

“HonGung,” as in the above image) branded outlets. We have literature and rules

regarding the location, size, store layout, interior design and product display

of their Hongguan retail stores. All potential third party operators require

prior approval before opening new stores. We visit potential locations for new

outlets and consider the suitability of such locations before approval.

Furthermore, all third party operators must personally operate their

stores.

These

operators are chosen based on the following criteria:

-

Management experience in retail operations and our confidence in their ability

to effectively meet our sales targets and high standards of

conduct.

- Good

credit and sufficient capital.

-

Proposed store location, size and condition.

14

After

approval, the third party operators must purchase a fixed amount of footwear

stock at wholesale prices and Hongguan branded decorations for proper interior

and exterior design. Third party operators then continue to pay wholesale prices

for footwear on an on demand basis. Contracts with third party operators are

typically for a period of two years.

Distributors

We

identify suitable distributors and enter into distributorship agreements,

usually for a term of two years. Distributors purchase wholesale priced shoes

and vend them at sales points throughout China. We require our distributors to

implement, monitor compliance with and enforce our retail store guidelines. Our

distributors are independent third parties that do not pay us any fee other than

the purchase price for the purchase of our products, nor do we pay them any

incentives or fees.

Our

distribution contracts usually contain the following terms:

Geographic limitation —

Distributors must sell our Hongguan branded footwear within a specific

authorized location(s).

Wholesale price —

Distributors pay a discounted wholesale price for our products.

Payment and credit terms —

Payment and credit terms are on a case by case basis. The credit period is

usually one month, and 25% percent of our distributors prepay for their

stock.

Performance — QHS typically

retains the right to end the agreement if a distributor does to meet sales

turnover levels comparable to other distributors.

Exclusivity — We work with

nearly 200 distributors, so the types and sizes of distributor outlets vary

significantly. Many of these outlets are independent shoe stores, but

we are open to the prospect of cooperating with department stores and larger

established retailers. The distributorship agreements allow our

distributors to sell our products under the Hongguan brand on an exclusive

basis. If there are other brands featured at the distributor’s outlet, Hongguan

brand shoes must constitute a certain percentage, generally a majority, of

product on display. Furthermore, the products must be displayed according to our

standards.

Training — Training and

instructional materials are provided to all of our distributers regarding

product display, decoration, and sales techniques.

Renewal and termination — We

can renew contracts at our discretion and can terminate contracts if contractual

conditions including sales targets are not met.

We do not

have a return policy with our distributors, other than a general right to return

defective merchandise. In the event a distributor is unable to sell its stock,

we will attempt—but are not obligated—to help it relocate such stock to a nearby

QHS outlet.

Purchasing

and Sales Prices

We have

historically organized one sales fair per year in which distributors and third

parties operators can view and select upcoming designs. We also maintain several

showrooms in our head office in Jimo with the current and future product lines

which our sales force visits on a regular basis.

We intend

to keep the pricing of our products at reasonable levels in the foreseeable

future in order to stay competitive and maintain product demand. Our wholesale

prices are generally not more than a 50% discount to the sales

price.

15

Employees

The table

below details the various departments and number of employees in

each. All of these employees are full-time employees.

|

Management

and Sales

|

9 | |||

|

Design

& Purchasing

|

3 | |||

|

Accounting

|

5 | |||

|

Warehouse

|

8 | |||

|

Administration

|

7 | |||

|

Sales

|

30 | |||

|

Total

|

62 |

We

believe we are in material compliance with all applicable labor and safety laws

and regulations in the PRC, including the PRC Labor Contract Law, the PRC

Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity

of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC

Interim Regulation on the Collection and Payment of Social Insurance Premiums

and other related regulations, rules and provisions issued by the relevant

governmental authorities for our operations in the PRC. According to the PRC

Labor Contract Law, we are required to enter into labor contracts with our

employees and to pay them no less than local minimum wage.

Intellectual

Property

Our

products are sold under the Hongguan brand name, which is a registered trademark

in the PRC.

|

Trademarks (Mandarin)

|

Trademarks

|

Certificate #

|

Valid Term

|

|||

|

|

Hongguan

|

3483788

|

March

14, 2005 to March 13, 2015

|

Under

current Chinese laws, we may renew our trademark upon expiration for an

unlimited number of successive ten year terms.

Advertising

and Marketing Efforts

Our sales

and marketing department is responsible for the organization of sales fairs,

selection, review, execution and management of contracts with third parties and

distributers, and operation of our own retail outlets. We utilize television,

print media, radio, the internet and outdoor billboard displays to build brand

awareness. Since 2006, Chinese popular television star Ren Quan has been the

face of QHS’ advertising campaign. In 2006, we entered into a contract with Ren

Quan and purchased the rights to use his image for our marketing purposes. We

are contractually obligated to maintain confidentiality as to the terms at which

we acquired his rights. More recently, we have entered into a contract with

another Chinese popular television star, Liu Xiaohu and purchased the rights to

use his image for our marketing purposes, and he is featured in our television

commercials and our various advertisements beginning in 2010. We

expect to focus more heavily on advertisements featuring Liu Xiaohu in the

future.

Competition

The

retail and in particular the footwear retail industry are highly competitive in

the PRC. Our competitors are a number of international and domestic enterprises

with shoe sales operations in our target market, including but not limited to

Jinhou Footwear Company, Liangda Leather Company, Haining Leather Footwear

Company and Fude Leather Shoe Company. We expect the competition to become more

intensified due to the entry of new footwear retailers in the PRC and as a

result we may be subject to competitive pricing pressures in the future.

Quality, cutting edge style, brand awareness, customer service, highly motivated

sales force and affordable footwear prices are vital cornerstones to success in

our industry.

16

Our

market share is small in comparison with the entire China footwear market, which

is a multibillion-dollar industry. According to the recent census

taken in 2008, the cities of Jimo and Qingdao have approximately 1.10 million

and 8 million residents, respectively. While we lack readily

available market research on the footwear market in Qingdao and Jimo, our

management estimates that our products collectively represent a market share of

roughly 20% in Jimo and 6% in Qingdao. This market share is based on

our target market of business casual and formal leather shoes for office

workers.

Design

Team

Our

design team consists of three full time designers that are engaged in creating

new fashionable designs for upcoming seasons. They are also engaged in the

review, selection and alteration of designs proposed by contract manufacturers.

On average, our design team is responsible for the selection or creation 200

models of footwear per year.

PART

II

|

ITEM

5.

|

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

Market

Information

The CUSIP

number for our common stock is 23816A103. Our common stock is quoted under the

symbol “QING” (previously “DATI”) on the Electronic Bulletin Board maintained by

the Financial Industry Regulatory Authority; however, there have only been

limited or sporadic quotations and only a very limited public trading market for

our common stock. Indeed, our common stock has been traded publicly

on less than 20% of the trading days in 2010. The Electronic Bulletin Board is a

significantly more limited market than established trading markets such as the

New York Stock Exchange or NASDAQ.

The

closing bid price for our common stock on June 22, 2010 was $5.00 per share, as

reported by www.quotemedia.com. The common stock has not traded

publicly since that date.

The

following table sets forth, for the periods indicated, the high and low closing

prices of our common stock. These prices reflect inter-dealer prices, without

retail mark-up, mark-down or commission, and may not represent actual

transactions. The trading price for all days prior to the completion

of our reverse split and conversion of preferred stock into common stock has

been adjusted to account for such events.

|

Closing Bid Prices

|

||||||||

|

High

|

Low

|

|||||||

|

Year

Ended December 31, 2010

|

($)

|

($)

|

||||||

|

First

Quarter

|

16.20 | 2.16 | ||||||

|

Second

Quarter

|

14.85 | 5.00 | ||||||

|

Third

Quarter (no trading since June 22, 2010)

|

N/A | N/A | ||||||

|

Year

Ended December 31, 2009

|

||||||||

|

First

Quarter (from March 30, 2009)

|

0.27 | 0.27 | ||||||

|

Second

Quarter

|

1.62 | 0.27 | ||||||

|

Third

Quarter

|

1.35 | 1.35 | ||||||

|

Fourth

Quarter

|

1.35 | 1.35 | ||||||

Approximate

Number of Holders of Our Common Stock

As of

July 26, 2010, there were approximately 275 stockholders of record of our

common stock. This number does not include shares held by brokerage clearing

houses, depositories or others in unregistered form.

17

Dividend

Policy

The

holders of shares of our common stock are entitled to dividends out of funds

legally available when and as declared by our board of directors. Our board of

directors does not anticipate declaring a dividend in the foreseeable future.

Should we decide in the future to pay dividends, as a holding company, our

ability to do so and meet other obligations depends upon the receipt of

dividends or other payments from our operating subsidiary and other holdings and

investments. In addition, our operating subsidiary in the PRC, from time to

time, may be subject to restrictions on their ability to make distributions to

us, including as a result of restrictive covenants in loan agreements,

restrictions on the conversion of local currency into U.S. dollars or other hard

currency and other regulatory restrictions. Although none of our current loan

agreements prohibit the payment of dividends, we cannot guarantee that any

future loan agreements will permit such payments. Payments of

dividends by WFOE to our company are subject to the requirement that foreign

invested enterprises may only buy, sell and/or remit foreign currencies at those

banks authorized to conduct foreign exchange business. Further, such remittances

would require WFOE to provide an application for remittance that includes, in

addition to the application form, a foreign registration certificate, board

resolution, capital verification report, audit report on profit and stock

bonuses, and a tax certificate. In the event of our liquidation, dissolution or

winding up, holders of our common stock are entitled to receive, ratably, the

net assets available to shareholders after payment of all

creditors. See “Risk Factors – Restrictions under PRC law on

our PRC subsidiary’s ability to make dividends and other distributions could

materially and adversely affect our ability to grow, make investments or

acquisitions that could benefit our business, pay dividends to you, and

otherwise fund and conduct our businesses” and “- Under the New EIT Law, we may

be classified as a “resident enterprise” of China. Such classification will

likely result in unfavorable tax consequences to us and our non-PRC

shareholders.”

Securities

Authorized for Issuance Under Equity Compensation Plans

We do not

have in effect any compensation plans under which our equity securities are

authorized for issuance and we do not have any outstanding stock

options.

Recent

Sales of Unregistered Securities; Use of Proceeds from Registered

Securities

During

the year ended December 31, 2009, we did not have any sales of securities that

were not registered under the Securities Act of 1933, as amended.

On

February 10, 2010, we issued 3,136,768 shares of common stock to our landlord to

extinguish approximately $47,052 of debt owed to Callaway Properties, our pre

reverse acquisition landlord. Callaway Properties’ sole shareholder is Mary

Passalaqua, wife of the Company’s former director and former secretary Joseph

Passalaqua.

On

February 12, 2010, we issued 10,000 shares of our Series A Convertible Preferred

stock (“Series A Preferred Stock”) to the shareholders of Glory Reach. The total

consideration for the 10,000 shares of our Series A Convertible Preferred stock

was 10,000 ordinary shares of Glory Reach, which is all the issued and

outstanding capital stock of Glory Reach. The number of our shares issued to the

shareholders of Glory Reach was determined based on an arms-length

negotiation. The issuance of our shares to these shareholders was

made in reliance on the exemption provided by Section 4(2) of the Securities Act

for the offer and sale of securities not involving a public offering and

Regulation D promulgated thereunder.

We issued

securities on February 10 and 12, 2010 in reliance upon Rule 506 of Regulation D

of the Securities Act. These shareholders who received the securities in such

instances made representations that (a) the shareholder is acquiring the

securities for his, her or its own account for investment and not for the

account of any other person and not with a view to or for distribution,

assignment or resale in connection with any distribution within the meaning of

the Securities Act, (b) the shareholder agrees not to sell or otherwise

transfer the purchased shares unless they are registered under the Securities

Act and any applicable state securities laws, or an exemption or exemptions from

such registration are available, (c) the shareholder has knowledge and

experience in financial and business matters such that he, she or it is capable

of evaluating the merits and risks of an investment in us, (d) the

shareholder had access to all of our documents, records, and books pertaining to

the investment and was provided the opportunity ask questions and receive

answers regarding the terms and conditions of the offering and to obtain any

additional information which we possessed or were able to acquire without

unreasonable effort and expense, and (e) the shareholder has no need for

the liquidity in its investment in us and could afford the complete loss of such

investment. Management made the determination that the investors in instances

where we relied on Regulation D are accredited investors (as defined in

Regulation D) based upon management’s inquiry into their sophistication and net

worth. In addition, there was no general solicitation or advertising for

securities issued in reliance upon Regulation D.

18

In

instances described above where we indicate that we relied upon Section 4(2) of

the Securities Act in issuing securities, our reliance was based upon the

following factors: (a) the issuance of the securities was an isolated

private transaction by us which did not involve a public offering;

(b) there were only a limited number of offerees; (c) there were no

subsequent or contemporaneous public offerings of the securities by us;

(d) the securities were not broken down into smaller denominations; and

(e) the negotiations for the sale of the stock took place directly between

the offeree and us.

On June

10, 2010, we effected a 1-for-27 reverse split of our outstanding common stock,

which resulted in 8,100,000 shares of common stock being converted into 300,000

shares of common stock, representing 3% of our currently outstanding common

stock. After the completion of the reverse split, shares of our

Series A Preferred Stock automatically converted into shares of common stock on

the basis of 1 share of Series A Preferred Stock for 970 shares of common stock.

This resulted in the automatic conversion of the 10,000 outstanding shares of

Series A Preferred Stock into 9,700,000 shares of common stock, constituting 97%

of our currently outstanding common stock.

Purchases

of Our Equity Securities

No

repurchases of our common stock were made during the fourth quarter of our

fiscal year ended December 31, 2009.

PART

III

|

ITEM

10.

|

DIRECTORS,

EXECUTIVE OFFICERS AND CORPORATE

GOVERNANCE

|

Directors

and Executive Officers

Prior to

the consummation of the share exchange with Glory Reach, our board of directors

consisted of three directors, Craig H. Burton, Joseph J. Passalaqua, and Joseph

Meuse (the “Former Directors”). On February 12, 2010, the Former Directors

submitted a letter of resignation and Tao Wang, Renwei Ma, and Lanhai Sun have

been appointed to our board of directors (the “Directors”). The resignation of

the Former Directors and appointment of the Directors both became effective on

March 18, 2010.

Former

Directors

Craig Burton, Mr. Burton

served as President and director of Datone, Inc. from August 2000 until March

18, 2010. On February 12, 2010 Mr. Burton tendered his resignation as President

of Datone. Mr. Burton attended the University of South Carolina-Coastal and was

a licensed real estate agent in the State of New York. He began working in

marketing for a long distance carrier in 1996 and in 1999, Mr. Burton became

Director of Marketing for Datone Communications, Inc., an owner of payphones and

distributor of prepaid calling cards. Datone was acquired by USIP in January,

2000. Mr. Burton served as President and a director of USIP.Com from January

2000-2006. Additionally, Mr. Burton was secretary and director of NB Telecom,

Inc. from December 2005-2008.

Joseph J. Passalaqua, Mr.

Passalaqua served as our secretary and director from August 2000 until March 18,

2010. On February 12, 2010 Mr. Passalaqua tendered his resignation as Secretary

of Datone. Since 1999, Mr. Passalaqua has worked as a trainer at Sports Karate

and fitness training company located in Cicero, New York. Mr. Passalaqua is a

high school graduate.

19

Joseph Meuse, Mr. Meuse served

as a director of Datone from January 25, 2010 through March 18. 2010. Mr. Meuse

founded several companies in the financial services and securities industries,

which he continues to operate. In 2002, Mr. Meuse founded PacWest

Stock Transfer LLC and is a majority partner in Pacific Stock Transfer Company,

an independent stock transfer agent that serves over 1,000 clients, including a

number of publicly traded companies that do business in China. In

2003, Mr. Meuse founded Belmont Partners, LLC, an international financial

consulting firm that provides public shell companies for use in reverse merger

transactions. In 2006, Mr. Meuse founded Belmont Financial Services

and Belmont IT Services, two companies that provide accounting and information

technology services to small businesses in the Northern Virginia

area. Additionally, Mr. Meuse maintains a position as a board member

of the following public companies: Action

Industries, Inc.; All State Properties Holdings, Inc.; Blue Gem Enterprise;

Cinnabar Ventures, Inc.; Blue Fish Clothing, Inc.; Brite-Strike Tactical

Illumination Productions, Inc.; Comprehensive Healthcare Solutions, Inc.;

Contracted Services, Inc.; Firstar Exploration Corp.; Fresca Worldwide Trading

Company; Geopulse Explorations, Inc.; Hudson’s Grill International, Inc.;

IDcentricx, Inc.; Intercontinental Resources, Inc.; Ivecon Corp.; Jamaica Jim,

Inc.; Jasper Ventures, Inc.; King Resources, Inc.; Lions Petroleum, Inc.;

Madrona Ventures, Inc.; Michael Lambert, Inc.; Miller Diversified Corp.; Network

Capital, Inc.; Recycle Tech, Inc.; Rockport Healthcare Group; Shimmer Gold,

Inc.; Smart Holdings, Inc.; SpectraSource, Inc.; 3DShopping.com, Inc.;

Springfield Company, Inc.; Unidigital, Inc.; Volcanic Gold; WES Consulting,

Inc.; XRG, Inc.; Yzapp International, Inc.; Data Storage Consulting Services,

Inc.; Cienega Creek Holdings, Inc.; and Luke Entertainment,

Inc. Mr.

Meuse attended the College of William and Mary.

Current

Board of Directors and Officers

Through

July 11, 2010, Ms. Fang Sui served as our Chief Financial Officer, at which time

she resigned from such role but continues to work with our

company. From July 12, 2010 through present, Mr. Joseph Meuse has

served as our Chief Financial Officer. Our board of directors and

executive officers are currently as listed below.

|

NAME

|

AGE

|

POSITION

|

|

Tao

Wang

|

39

|

Director

and Chief Executive Officer

|

|

Renwei

Ma

|

43

|

Director

and General Counsel

|

|

Joseph

Meuse

|

40

|

Chief

Financial Officer

|

|

Wenmao

Shi

|

39

|

Chief

Operating Officer

|

|

Lanhai

Sun

|

39

|

Director

|

Tao Wang. Mr. Wang

founded QHS in 2003 and has served as its chief executive officer since

March 10, 2003. Mr. Wang served as our Chief Executive Officer

and as Chairman of our Board of Directors since our inception. Before

founding QHS, Mr. Wang was engaged in variety of capacities involving branding,

strategic marketing and sales of footwear since 1992. Mr. Wang has over 18

years’ experience in China’s footwear industry. We have selected Mr.

Wang to serve as a director and as Chairman of the Board because he is our

majority shareholder and has a rich background in the footwear

industry.

Renwei Ma. Mr. Ma

has been QHS’ legal representative since the founding of QHS in March 2003, and

was an initial investor in the Company. Prior to becoming QHS’s legal

representative, he was self-employed, and was engaged in various entrepreneurial

endeavors in the footwear industry. In 1991 he obtained an associate’s degree in

marketing from Yantai Trade and Industry University. We have selected Mr. Wang

to serve as a director and as Chairman of the Board because he is our legal

representative and a founding investor in the company.

Wenmao Shi. Mr. Shi

has been served as our Chief Operating Officer since inception in 2003 and is

responsible for QHS advertising, marketing and sales efforts. Prior

to joining QHS, Mr. Shi was a director of sales at Qingdao Double Star Group, a

leading PRC footwear manufacturer. Mr. Shi has over 18 years of sales

experience, and obtained a bachelors degree in economics in 1992 from Wuhan

Southeast University of Economics and Law.

Lanhai Sun. Mr. Sun has been

working as the Company’s financial consultant since 2005, and he has invested in

and owns several QHS outlets. He served as the general manager at Shandong Huibo

Import & Export Co., Ltd. (2006 through 2008) and Qingdao Xingguang Import

& Export Co., Ltd. (2009 through present) apparel trading companies, as well

as serving as the CEO of SK Investment Group Ltd, a financial consulting firm

(2008 through present). We have selected Mr. Sun to serve as a

director because of his experience in financial consulting and pivotal role

assisting with our listing in the United States.

Family

Relationships

There is

no family relationship among any of our officers or directors.

Board

of Directors and Board Committees

Our board

of directors currently consists of three (3) directors. There are no family

relationships among any of our executive officers and directors. Our directors

are currently elected each year at the annual shareholder

meeting.

20

A

director may vote in respect of any contract or transaction in which he is

interested; provided, however that the nature of the interest of any director in

any such contract or transaction shall be disclosed by him at or prior to its

consideration and any vote on that matter. A general notice or disclosure to the

directors or otherwise contained in the minutes of a meeting or a written

resolution of the directors or any committee thereof of the nature of a

director’s interest shall be sufficient disclosure and after such general notice

it shall not be necessary to give special notice relating to any particular

transaction. A director may be counted for a quorum upon a motion in respect of

any contract or arrangement which he shall make with our company, or in which he

is so interested and may vote on such motion.

There are

no membership qualifications for directors. Further, there are no share

ownership qualifications for directors unless so fixed by us in a general

meeting.

The Board

of Directors intends in the future to maintain a majority of independent

directors who are deemed to be independent under the definition of independence

provided by NASDAQ Listing Rule 5605(a)(15).

There are

no other arrangements or understandings pursuant to which our directors are

selected or nominated.

Mr. Tao

Wang currently holds both the positions of Chief Executive Officer and Chair of

the Board. These two positions have not been consolidated into one position;

Mr. Wang simply holds both positions at this time. We do not have a lead

independent director because of the foregoing reason and also because we believe

our independent directors are encouraged to freely voice their opinions on a

relatively small company board. We believe this leadership structure is

appropriate because we are a smaller reporting; as such we deem it appropriate

to be able to benefit from the guidance of Mr. Wang as both our principal

executive officer and Chair of the Board.

Our Board

of Directors plays a key role in our risk oversight. The Board of Directors

makes all relevant Company decisions. As such, it is important for us to have

both our Chief Executive Officer and General Counsel serve on the Board as they

play key roles in the risk oversight or the Company. As a smaller reporting

company with a small board of directors, we believe it is appropriate to have

the involvement and input of all of our directors in risk oversight

matters.

Board

Committees

Currently,

three committees have been established under the board: the audit committee, the

compensation committee and the nominating committee; however, we do not yet have

board members on these committees, as we do not yet have independent directors.

The audit committee is responsible for overseeing the accounting and financial

reporting processes of our company and audits of the financial statements of our

company, including the appointment, compensation and oversight of the work of

our independent auditors. The compensation committee of the board of directors

reviews and makes recommendations to the board regarding our compensation

policies for our officers and all forms of compensation, and also administers

our incentive compensation plans and equity-based plans (but our board retains

the authority to interpret those plans). The nominating committee of the board

of directors is responsible for the assessment of the performance of the board,

considering and making recommendations to the board with respect to the

nominations or elections of directors and other governance issues. The

nominating committee considers diversity of opinion and experience when

nominating directors.

Executive

and Director Compensation Determination

Prior to

our reverse acquisition of Glory Reach, our operating subsidiaries were private

limited companies organized under the laws of the PRC, and in accordance with

PRC regulations, the salary and bonus of our executive officers was determined

by our shareholders.

The

compensation committee of the board of directors annually reviews the

performance and total compensation package for the Company’s executive officers,

including the Chief Executive Officer; considers the modification of existing

compensation, and the adoption of new compensation plans; and recommends

appropriate changes to the board of directors, which votes on such

recommendations.

21

Section

16(A) Beneficial Ownership Reporting Compliance

Section

16(a) of the Securities Exchange Act of 1934 requires the Company’s directors

and executive officers and persons who own more than ten percent of a registered

class of the Company’s equity securities to file with the SEC initial reports of

ownership and reports of changes in ownership of common stock and other equity

securities of the Company. Officers, directors and greater than ten percent

shareholders are required by SEC regulations to furnish the Company with copies

of all Section 16(a) forms they file. To the Company’s knowledge,

none of the required parties are delinquent in their Section 16(a)

filings.

Involvement

in Certain Legal Proceedings

The

Company is not aware of any legal proceedings in which any director, officer, or

any owner of record or beneficial owner of more than five percent of any class

of voting securities of the Company, or any affiliate of any such director,

officer, affiliate of the Company, or security holder, is a party adverse to the

Company or has a material interest adverse to the Company.

|

ITEM

11.

|

EXECUTIVE

COMPENSATION

|

Summary

Compensation Table

The

following table sets forth information concerning all cash and non-cash

compensation awarded to, earned by or paid to the named persons for services

rendered in all capacities during the noted periods. No other executive officer

received total annual salary and bonus compensation in excess of

$100,000.

|

Name and Principal Position

|

Year

|

Salary ($)

|

Bonus ($)

|

Total ($)

|

||||||||||

|

Tao

Wang, Chief Executive Officer

|

2008

|

8,088 | 3,676 | 11,764 | ||||||||||

|

2009

|

8,088 | 3,676 | 11,764 | |||||||||||

|

Craig

Burton, former President

|

2008

|

40,040 | 0 | 40,040 | ||||||||||

|

2009

|

40,040 | 0 | 40,040 | |||||||||||

|

(1)

|

On

February 12, 2010, we acquired Glory Reach in a reverse acquisition

transaction that was structured as a share exchange and in connection with

that transaction, Mr. Tao Wang became our Chief Executive Officer. Prior

to the effective date of the reverse acquisition, Mr. Craig Burton served

as President of Datone.

|

Summary

of Employment Agreements and Material Terms

Prior to

our reverse acquisition of Glory Reach, our operating subsidiaries were private

limited companies organized under the laws of the PRC, and in accordance with

PRC regulations, the salary and bonus of our executives was determined by the

shareholders of QHS. Upon the formation of QHS, Mr. Wang’s salary was

determined by Mr. Wang (as the majority shareholder) in conjunction with Renwei

Ma, the legal representative of QHS. Business and living expenses as well as

market rates were taken into consideration. Once we appoint directors

to our compensation committee, our compensation committee will consider

compensation decisions and will determine market-based salaries for officers and

directors commensurate with their positions with our company.

Other

than the salary and necessary social benefits required by the government, we

currently do not provide other benefits to the officers at this time. Our

executive officers are not entitled to severance payments upon the termination

of their employment agreements or following a change in control.

We have

not provided retirement benefits (other than a state pension scheme in which all

of our employees in China participate) or severance or change of control

benefits to our named executive officers.

Employment

Agreement – Craig Burton

We

retained our previous present, Craig Burton, without an employment

agreement. Mr. Burton served at will in this position until his

resignation from the position on February 12, 2010. Mr. Burton

received no compensation other than a cash salary of $40,040 in each of 2008 and

2009 and received no payment in 2010.

22

Employment

Agreement – Tao Wang

Effective

February 12, 2010, we retained Mr. Wang to serve as Chief Executive Officer of

Qingdao Footwear. Mr. Wang currently serves in this capacity without

a written employment agreement. Mr. Wang has, however, served as the

chief executive officer of QHS since March 10, 2003. Mr. Wang’s

employment agreement with QHS provides for an employment period beginning on

March 11, 2003 and terminating on March 10, 2023. Mr. Wang’s

compensation is set by QHS and is expected to be between RMB 3,000 and RMB

10,000 (approximately $440 to $1,467) per month. In addition, Mr.

Wang is eligible to receive such performance bonuses as QHS may

determine. QHS is obligated to pay pension funds and applicable

reserves and social insurance as may be required from time to time under Chinese

law. Upon termination of employment, Mr. Wang is entitled only to

those benefits as are required to be paid under Chinese law.

Under

Chinese law, we may only terminate employment agreements without cause and

without penalty by providing notice of non-renewal one month prior to the date

on which the employment agreement is scheduled to expire. If we fail to provide

this notice or if we wish to terminate an employment agreement in the absence of

cause, then we are obligated to pay the employee one month’s salary for each

year we have employed the employee. We are, however, permitted to terminate an

employee for cause without penalty to our company, where the employee has

committed a crime or the employee’s actions or inactions have resulted in a

material adverse effect to us.

We

anticipate that we will enter into a written employment agreement with Mr. Wang

to serve as our chief executive officer prior to completion of this offering and

that such agreement will include customary terms, including confidentiality and

non-competition language, and will be for a period of at least three

years.

Outstanding

Equity Awards at Fiscal Year End

For the

year ended December 31, 2009, no director or executive officer has received

equity compensation from us pursuant to any compensatory or benefit plan. There

is no plan or understanding, express or implied, to pay any compensation to any

director or executive officer pursuant to any compensatory or benefit plan,

although we anticipate that we will compensate our officers and directors for

services to us with stock or options to purchase stock, in lieu of

cash.

Compensation

of Directors

No member

of our board of directors received any compensation for his services as a

director during the year ended December 31, 2009 and currently no compensation

arrangements are in place for the compensation of directors.

|

ITEM

13.

|

CERTAIN

RELATIONSHIPS AND RELATED PARTY

TRANSACTIONS

|

Transactions

with Related Persons

The

following includes a summary of transactions since the beginning of 2007, or any

currently proposed transaction, in which we were or are to be a participant and

the amount involved exceeded or exceeds the lesser of $120,000 or one percent of

the average of our total assets at year end for the last two completed fiscal

years, and in which any related person had or will have a direct or indirect

material interest (other than compensation described under “Executive

Compensation”). We believe the terms obtained or consideration that we paid or

received, as applicable, in connection with the transactions described below

were comparable to terms available or the amounts that would be paid or

received, as applicable, in arm’s-length transactions.

Related

Parties

Since

2007, we have entered into transactions with the following people who are

considered related persons on the respective bases listed next to their

names:

|

Related Person Name

|

Related Party Basis

|

|

|

Tao

Wang

|

Director,

executive officer and five percent shareholder

|

|

|

Renwei

Ma

|

Director

and general counsel

|

|

|

Weidong

Liang

|

Brother-in-law

of Tao Wang

|

|

|

Siyou

Wang

|

Brother

of Tao Wang

|

23

Due

from related party

Due from

related party at December 31, 2008 consisted of receivables from Mr. Tao Wang in

the amount of $4,373,588. These borrowings bear no interest and were repaid in

2009. As of December 31, 2009, the recorded balance of due from related parties

was $0. Since

January 2007, the maximum amount of the loan was

approximately$7,531,618.

Due

to related party

We

borrowed money from Mr. Tao Wang, which borrowings bear no interest and contain

no repayment terms but are due on demand. As of December 31, 2009 and December

31, 2008, the balances of such loans are $104,511 and $0 respectively. These

borrowings were paid off in the first quarter of 2010. Since

January 2007, the maximum amount of the debt was approximately

$104,511.

We

declared a distribution and paid dividends to the shareholders in

2009.

During

2009, we advanced to Mr. Tao Wang a total amount of $5,723,550.

During

2009, we distributed $9,432,810 to our shareholders, Mr. Tao Wang and Mr. Renwei

Ma, in which $4,063,590 was distributed in cash, $5,251,860 was used to offset

advances to Mr. Tao Wang and the remaining $117,360 was the dividend payable to

Mr. Renwei Ma. This amount was paid off in the first quarter of

2010.

Other

related party transactions

We lease

one of our stores from Mr. Tao Wang under a four-year operating lease expiring

August 2011. For the years ended December 31, 2009 and 2008, related

party rent expense of $17,593 and $17,298, respectively, was included in total

rent expense of the year. For the three months ended March 31, 2010 and 2009,

related party rent expense of $4,400 and $4,395, respectively, was included in

total rent expense of the year.

We lease

one of our warehouse buildings to Weidong Liang. This lease is for a

period of three years starting May 2008. Per the agreement, Mr. Liang shall pay

equal amount of advertising expense on behalf of the lessor as the lease

payment. For the year ended December 31, 2009 and 2008, the Company recorded

other income of $87,966 and $57,660, respectively, from leasing the

aforementioned building and advertising expense of the same amount respectively.

For the three months ended March 31, 2010 and 2009, we recorded other income of

$21,998 and $21,977 respectively, from leasing the aforementioned building and

advertising expense of the same amount respectively.

Mr. Tao

Wang entered into the contract with our company to assume fiscal

responsibilities for all unpaid tax liabilities recorded and potential penalties

relating to all tax liabilities before December 31, 2009. As of December 31,

2008 and 2007, the assumed amount was $3,799,872 and $2,620,236, respectively,

which mainly included VAT tax payable and income tax payable. As of September

30, 2009 the assumed amount was $3,464,650. According to PRC tax law, late or

deficient tax payment could subject to significant tax penalty. On December 25,

2009, the local tax authority in Jimo City issued a “Tax Review Report”, stating

that the tax authority reviewed the Company’s income tax, VAT tax, stamp tax and

invoices for the period between June 2006 and November 2009 and noted that the

Company had paid off all its tax liability by December 21, 2009.

A

long-term loan for $249,390, was issued in December 2009 by JiMo Rural Bank,

with a 2 year repayment period and annual interest rate of 7.02%. The

loan is guaranteed by Siyou Wang and is collateralized by Mr. Wang's

property.

Insider

Transactions Policies and Procedures

The

Company does not currently have an insider transaction policy.

24

Director

Independence

We

currently do not have any independent directors, as the term “independent” is

defined by the rules of the Nasdaq Stock Market. We intend to add

independent directors in the near future.

Promoters

and Certain Control Persons

We did

not have any promoters at any time during the past five fiscal years. Additionally, we are not

a shell company for which control persons need be disclosed.

25

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act

of 1934, the Company has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

DATONE,

INC.

|

|

|

By:

|

/s/ Tao Wang

|

|

Tao

Wang

|

|

|

Chief

Executive Officer

|

|

|

Date: August

2, 2010

|

|

Pursuant

to the requirements of the Securities Exchange Act of 1934, this report has been

signed below by the following persons on behalf of the Company in the capacities

and on the dates indicated.

|

Signature

|

Capacity

|

Date

|

||

|

/s/ Tao Wang

|

Chief

Executive Officer and Director

|

August 2,

2010

|

||

|

Tao

Wang

|

(Principal

Executive Officer)

|

|||

|

/s/ Joseph Meuse

|

Chief

Financial Officer (Principal Financial

|

August

2, 2010

|

||

|

Joseph

Meuse

|

Officer

and Principal Accounting Officer) and authorized representative in the

United States

|

|||

|

*

|

Director

|

August

2, 2010

|

||

|

Renwei

Ma