Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 1, 2010

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-07323

FRISCH’S RESTAURANTS, INC.

(Exact name of registrant as specified in its charter)

| State of Ohio | 31-0523213 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification Number) |

2800 Gilbert Avenue

Cincinnati, Ohio 45206

(Address of principal executive offices)

(513)-961-2660

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each Exchange on which registered | |

| Common Stock of No Par Value | NYSE Amex |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of voting common stock held by non-affiliates of the registrant on December 15, 2009 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $71,940,000, based upon the closing sales price of the registrant’s common stock as reported on NYSE Amex on that date. The registrant does not have any non-voting common equity.

As of July 23, 2010, there were 5,123,053 shares of registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its Annual Meeting of Shareholders to be held October 6, 2010 are incorporated by reference into Part III of this Form 10-K.

Table of Contents

Table of Contents

Cautionary Statement Regarding Forward-Looking Information

Forward-looking statements are contained throughout this Annual Report on Form 10-K. Such statements may generally express management’s expectations with respect to its plans, or its assumptions and beliefs concerning future developments and their potential effect on the Company. There can be no assurances that such expectations will be met or that future developments will not conflict with management’s current beliefs and assumptions, which are inherently subject to risks and other uncertainties. Factors that could cause actual results and performance to differ materially from anticipated results that may be expressed or implied in forward-looking statements are included in, but not limited to, the discussion in this Form 10-K under Part I, Item 1A. “Risk Factors.” Risk factors and other uncertainties may also be discussed from time to time in the Company’s press releases, public statements or other filings with the Securities and Exchange Commission.

Sentences that contain words such as “should,” “would,” “could,” “may,” “plan(s),” “anticipate(s),” “project(s),” “believe(s),” “will,” “expect(s),” “estimate(s),” “intend(s),” “continue(s),” “assumption(s),” “goal(s),” “target” and similar words (or derivatives thereof) are generally used to distinguish “forward-looking statements” from historical or present facts.

All forward looking information is provided by the Company pursuant to the safe harbor established under the Private Securities Litigation Reform Act of 1995 and should be evaluated in the context of all risk factors. Except as may be required by law, the Company disclaims any obligation to update any of the “forward-looking statements” that are contained in this Form 10-K.

References to fiscal years used in this Form 10-K

In this Annual Report on Form 10-K, the Company’s fiscal year that ended June 1, 2010 may be referred to as fiscal year 2010. The Company’s fiscal year is the 52 week (364 days) or 53 week (371 days) period ending on the Tuesday nearest to the last day of the month of May. Fiscal year 2010 consisted of 52 weeks.

Also in this Annual Report on Form 10-K, the Company’s fiscal years that ended June 2, 2009, June 3, 2008, May 29, 2007 and May 30, 2006 may be referred to as fiscal years 2009, 2008, 2007 and 2006, respectively. All of these years consisted of 52 weeks, except for fiscal year 2008, which was a 53 week year. In addition, it should be noted that fiscal year 2006 included an additional two days (366 days) to effect a change in the fiscal year end from the Sunday nearest to the last day of May to the nearest Tuesday. References to fiscal year 2011 refer to the 52 week year that began on June 2, 2010 and will end on Tuesday, May 31, 2011.

The first quarter of each fiscal year presented herein contained sixteen weeks while the last three quarters contained twelve weeks, except for the fourth quarter of fiscal year 2008 which contained thirteen weeks and the fourth quarter of fiscal year 2006 which consisted of twelve weeks plus two days.

1

Table of Contents

PART I

(Items 1 through 4)

Background

The registrant, Frisch’s Restaurants, Inc. (together with its wholly owned subsidiaries, referred to as the “Company” or the “Registrant”), is a regional company that operates full service family-style restaurants under the name “Frisch’s Big Boy.” The Company also operates grill buffet style restaurants under the name “Golden Corral” pursuant to certain licensing agreements. “Big Boy” restaurants operated by the Company during the last five years have been located entirely in various regions of Ohio, Kentucky and Indiana. In addition to Ohio, Kentucky and Indiana, “Golden Corral” restaurants have been operated in small portions of Pennsylvania and West Virginia during the last five years.

Incorporated in the state of Ohio in 1947, the Company’s stock has been publicly traded since 1960. The Company’s executive offices are located at 2800 Gilbert Avenue, Cincinnati, Ohio 45206. The telephone number is (513) 961-2660. The Company’s web site is www.frischs.com.

The Company’s vision is to be the best large owner/operator of franchised, multi-location restaurant concepts within 500 miles of Cincinnati. As of June 1, 2010, the Company’s operations consisted of 91 family-style restaurants using the “Big Boy” trade name and 35 “Golden Corral” restaurants. Additionally, 25 “Big Boy” restaurants were in operation under licensing rights granted by the Company to other operators. All of the restaurants licensed to other operators are located in various markets within the states of Ohio, Kentucky and Indiana.

The Company owns the trademark “Frisch’s.” The rights to the “Big Boy” trademark, trade name and service mark are exclusively and irrevocably owned by the Company for use in the states of Kentucky and Indiana, and in most of Ohio and Tennessee. The Company has development rights with Golden Corral Franchising Systems, Inc. allowing the Company to develop up to twelve additional “Golden Corral” restaurants by December 31, 2011.

Financial information for both the “Big Boy” and “Golden Corral” operating segments as of and for the three fiscal years in the period ended June 1, 2010 appears in Note G—Segment Information – to the Consolidated Financial Statements included in Part II, Item 8 of this Form 10-K.

Big Boy Restaurant Operations

Big Boy restaurants are full service family-style restaurants offering quick, friendly service, which the Company operates under the name “Frisch’s.” All of the restaurants offer “drive-thru” service. The restaurants are generally open seven days a week, typically from 7:00 a.m. to 11:00 p.m. with extended weekend evening hours. Standardized menus offer a wide variety of items at moderate prices, featuring well-known signature items such as the original “Big Boy” double-deck hamburger sandwich, freshly made onion rings and hot fudge cake for dessert. Menu selections also include many other sandwiches, pasta, roast beef, chicken and seafood dinners, desserts, non-alcoholic beverages and many other items. In addition, a full breakfast menu is offered, and all of the restaurants contain breakfast bars that are easily converted to soup and salad bars for lunch and dinner hours. Drive-thru and carryout menus emphasize combo meals that consist of a popular sandwich packaged with french fries and a beverage and sold at a lower price than if purchased separately. Although customers have not shown any significant preference for highly nutritional, low fat foods, such items are available on the menu and salad bars. In addition, customers are not discouraged from ordering customized servings to meet their dietary concerns (a sandwich can be ordered, for example, without the usual dressing of cheese and tartar sauce).

Operations in the Big Boy segment are vertically integrated. The Company operates a commissary and food manufacturing plant near the Company’s Cincinnati headquarters, which manufactures and prepares foods, and stocks food and beverages, paper products and other supplies for distribution to Big Boy restaurants. Some companies in the restaurant industry operate commissaries, while others purchase directly from outside sources. Raw materials, principally consisting of food items, are generally plentiful and may be obtained from any number of reliable suppliers. Quality and price are the principal determinants of source. The Company believes that its Big

2

Table of Contents

Boy operations benefit from centralized purchasing and food preparation through its commissary operation, which ensures uniform product quality, timeliness of distribution (two to three deliveries per week) to restaurants and ultimately results in lower food and supply costs. The commissary does not supply the Company’s Golden Corral restaurants.

Substantially all licensed Big Boy restaurants regularly purchase products from the commissary. Sales of commissary products to Big Boy restaurants licensed to other operators were $8.6 million in fiscal year 2010 (2.9% of consolidated sales), $9.0 million fiscal year 2009 (3.0% of consolidated sales) and $9.3 million in fiscal year 2008 (3.1% of consolidated sales).

System-wide Frisch’s Big Boy restaurant gross sales, which include sales generated by restaurants that the Company licenses to others, were approximately $215 million in fiscal year 2010, $216 million in fiscal year 2009, and $218 million in fiscal year 2008.

The Big Boy marketing strategy—“What’s Your Favorite Thing?” – has been in place for more than ten years. Results from ongoing market research lead the Company to believe its effectiveness has not diminished. Television commercials are broadcast on local network affiliates and local cable programming that emphasize Big Boy’s distinct and signature menu items and unique dining experience.

Newly produced television commercials, which continued to incorporate the customer’s “Favorite Thing” as well as their dining experience, debuted during the first half of fiscal year 2010. In the second half of fiscal year 2010, new television commercials debuted that promote specific products and were paired with the “Favorite Thing” commercials. The result was an increase in sales for the specific product advertised.

Radio, outdoor and targeted online advertising were used throughout fiscal year 2010 to complement the media plan, primarily to introduce and promote new menu items throughout the year. The Company also utilized social media as a means to develop two-way communication directly with the customer. Targeted social media communities are a cost effective way to reach a wide range of customers, but are a particularly important means to reach younger audiences.

The Company currently expends for advertising an amount equal to two and one-half percent of Big Boy gross sales, plus fees paid into an advertising fund by restaurants licensed to other operators.

Designed with longevity in mind while also appealing to younger customers, newly constructed Big Boy restaurants are marked with bold colors and bright environments, featuring sleek lines, cherry colored paneling and wood trim, accented with abundant natural light and company memorabilia covering much of the wall space. On average, the approximate cost to build and equip a typical Big Boy restaurant currently ranges from $2,500,000 to $3,400,000, depending on land cost and land improvements, which can vary greatly from location to location. Costs also depend on whether the new restaurant is constructed using basic plans for the original newer building prototype (used since 2001) or its smaller adaptation that was developed in fiscal year 2010 for use in smaller trade areas.

As part of the Company’s commitment to serve customers in clean, pleasant surroundings, the Company renovates approximately one-fifth of its Big Boy restaurants each year. The renovations are designed to not only refresh and upgrade the interior finishes, but also to synchronize the interiors and exteriors of older restaurants with that of newly constructed restaurants. The current average cost to renovate a typical older restaurant ranges from $120,000 to $150,000. Newer prototype restaurants that reach five years of age also receive renovations, which on the average currently range from $80,000 to $90,000 per restaurant.

In addition, certain high-volume Big Boy restaurants are regularly evaluated to determine a) whether their kitchens should be redesigned for increased efficiencies and b) if an expansion of the dining room is warranted. At least one older Big Boy restaurant is typically razed each year and replaced with a new building.

The following tabulation recaps Big Boy restaurant openings and closings for restaurants operated by the Company for the five most recent fiscal years:

3

Table of Contents

| Fiscal Year | ||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||

| Big Boy Restaurants Operated by the Company |

||||||||||||||

| In operation beginning of year |

88 | 90 | 87 | 87 | 88 | |||||||||

| Opened |

1 | 2 | 2 | 2 | 3 | |||||||||

| Opened replacement building |

1 | — | 1 | 1 | 1 | |||||||||

| Closed to make way for new buildings |

— | (1 | ) | — | (1 | ) | (1 | ) | ||||||

| Closed |

— | (4 | ) | (3 | ) | (1 | ) | — | ||||||

| End of year - total operated Big Boy restaurants |

90 | 87 | 87 | 88 | 91 | |||||||||

The three new Big Boy restaurants opened in fiscal year 2010 were: 1) November 2009 near Hamilton, Ohio (Cincinnati market), 2) April 2010 in Independence, Kentucky (Cincinnati market), and 3) May 2010 in Shepherdsville, Kentucky (Louisville market). The replacement restaurant opened in September 2009 in Lawrenceburg, Indiana (Cincinnati market).

Two other sites were under construction as of June 1, 2010: one to open in Louisville, Kentucky in July 2010, and the other is scheduled to open near Dayton, Ohio in August 2010. Three other sites were acquired in fiscal year 2010 – one each in the Louisville, Columbus and Cincinnati markets - on which construction should begin in fiscal year 2011, two of which should open before the end of fiscal year 2011. Several other sites are currently being evaluated for future acquisition and development.

With respect to Big Boy restaurants licensed to other operators, the following tabulation recaps openings and closings for the five most recent fiscal years:

| Fiscal Year | ||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||

| Big Boy Restaurants Licensed to Others |

||||||||||||

| Licensed to others beginning of year |

28 | 28 | 28 | 28 | 26 | |||||||

| Opened |

— | — | — | — | — | |||||||

| Closed |

— | — | — | (2 | ) | (1 | ) | |||||

| End of year - total Big Boy restaurants licensed to others |

28 | 28 | 28 | 26 | 25 | |||||||

Franchise fees are charged to licensees for use of trademarks and trade names and licensees are required to make contributions to the Company’s general advertising account. These fees and contributions are calculated principally on percentages of sales. Total franchise and other service fee revenue earned by the Company from licensees was $1.1 million in fiscal year 2010, $1.1 million in fiscal year 2009 and $1.1 million in fiscal year 2008. Other service fees from licensees include revenue from accounting and payroll services that four of the licensed restaurants currently purchase from the Company.

The license agreements with licensees are not uniform, but most of the licenses for individually licensed restaurants that were in effect as of June 1, 2010 are covered by agreements containing the following provisions:

| 1. | The Company grants to the Licensee the right to use the name “Frisch” and/or “Frisch’s,” “Big Boy” and related trademarks and trade names in connection with the operation of a food and restaurant business, in return for which the Licensee pays a monthly license fee equal to three and three-quarters percent of its gross sales. In addition, an initial license fee of $30,000 is generally required. |

4

Table of Contents

| 2. | The Company provides local and regional advertising through publications, radio, television, etc., in return for which the Licensee pays a monthly fee equal to two and one-half percent of its gross sales. |

In addition, Licensees are required to conduct business on a high scale, in an efficient manner, with cleanliness and good service, all to the complete satisfaction of the Company. Licensees are required to serve only quality foods and must comply with all food, sanitary and other regulations.

Long standing area license agreements granted to other operators in northern Indiana and northwestern Ohio differ in various ways from license agreements covering individual restaurants. The most notable differences are significantly lower license and advertising fee percentages and lower initial fees paid by the area operators. Provisions for these lower fees have been perpetually in place since the 1950’s.

Golden Corral Restaurant Operations

In 1998, the Company entered into an area development agreement with Golden Corral Franchising Systems, Inc. of Raleigh, North Carolina (“Franchisor”), under which development rights were granted to the Company to establish and operate 26 Golden Corral restaurants in certain markets in Ohio, Kentucky and Indiana, principally the greater metropolitan areas of Cincinnati and Dayton, Ohio and Louisville, Kentucky. In 2000, the Company entered into a second area development agreement with the Franchisor, which granted development rights to the Company to establish and operate fifteen additional Golden Corral restaurants in certain defined markets in the Cleveland and Toledo, Ohio Designated Market Areas. In July 2004, the Company entered its third area development agreement under which rights were received to develop an additional 22 Golden Corral restaurants by December 31, 2011, including markets in western Pennsylvania, southern Michigan, northern Indiana, the northwest portion of West Virginia and certain areas of Ohio, including Columbus. The Company does not have the right to sub-license others to use the Golden Corral system or proprietary marks.

The July 2004 development agreement was amended in April 2008 to delete sixteen restaurants from development plans, which were to be located in western Pennsylvania, southern Michigan, and northern Indiana. Accordingly, the Company now has the right to develop twelve additional Golden Corral restaurants through December 31, 2011.

The Company opened its first Golden Corral restaurant in January 1999. Twenty-nine more opened over the course of the following six years. Pursuant to the July 2004 development agreement, the Company entered certain markets in Pennsylvania and West Virginia in fiscal year 2006, followed by the entry into the Columbus, Ohio market when the Company opened its 35th Golden Corral restaurant in July 2007.

The following tabulation recaps Golden Corral restaurant openings for the five most recent fiscal years:

| Fiscal Year | ||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||

| Golden Corral Restaurants Operated by the Company |

||||||||||

| In operation beginning of year |

30 | 34 | 34 | 35 | 35 | |||||

| Opened |

4 | — | 1 | — | — | |||||

| End of year - total operated Golden Corral restaurants |

34 | 34 | 35 | 35 | 35 | |||||

Depending on land cost and land improvements, which can vary greatly from location to location, and whether land is purchased or leased, the cost to build and equip a Golden Corral restaurant is currently estimated to range from $3,200,000 to $4,000,000. There is no active search for sites on which to build.

On June 4, 2008, the Company announced that management had concluded that certain assets in the Golden Corral segment were impaired under applicable accounting rules. As a result, a non-cash pretax charge to earnings

5

Table of Contents

approximating $4.7 million dollars was taken to record the impairment in the fourth quarter of fiscal year 2008. The impairment charge lowered the carrying values of three Golden Corral restaurant locations to their estimated fair values, as required when the expected future cash flows from the operation of individual restaurants is less than the carrying values of the operating assets. The three restaurants with impaired values remain in operation.

Golden Corral is a grill-buffet style family restaurant concept offering a wide variety of buffet items. The buffet line features a large charbroil grill that is placed directly on the buffet line. This format allows customers to be served grilled-to-order steaks directly from the buffet line as part of the regular buffet price. The buffet also features many other varieties of meat including fried and rotisserie chicken, meat loaf, pot roast, fish, shrimp and a carving station that serves a rotation of hot roast beef, ham and turkey. The buffet also includes fresh fruits and vegetables, other hot and cold buffet foods, a salad bar, desserts, an in-store display bakery that offers made-from-scratch bakery goods, and many beverage items, none of which contains alcohol. Most of the food is prepared in full view of customers in order to emphasize its freshness and quality. The restaurants have distinctive exterior and interior designs, and are open seven days a week for lunch and dinner, providing prompt, courteous service in a clean and wholesome family atmosphere. Typical operating hours are 11:00 a.m. to 9:00 p.m. The restaurants open at 7:30 a.m. on weekends to provide the “Golden Sunrise Breakfast” buffet. The Company has sole discretion as to the prices charged to its customers.

The nature of buffet style dining easily affords every customer vast control in tailoring a meal to meet individual dietary needs, in terms of portion sizes and in selection from the wide variety of items that may be consumed from the buffet, including several foods that are low in fat. In addition, fried foods are fried only in trans fat-free shortening.

The Company may only sell such products, food, beverages and other menu items that meet the Franchisor’s standards of quality and quantity, as expressly approved and have been prepared in accordance with the Franchisor’s specifications. Except for items such as bread, produce and dairy products that are purchased from any number of local suppliers, the Company currently purchases substantially all other raw material for menu items and other supplies from the same vendor that the Franchisor uses for its operations. Deliveries are made two times per week. Other vendors are available to provide products that meet the Franchisor’s specifications at comparable prices should the Company wish or need to make a change.

Under the terms of the area development agreements, each Golden Corral restaurant operated by the Company is governed by an individual franchise agreement. The term of each franchise granted is for fifteen years from the date the restaurant opens for business. Renewal privileges include two additional consecutive five year terms provided that the terms are the same as the then-current form of renewal required by the Franchisor.

In consideration of the granting of each individual franchise agreement, an initial franchise fee of $40,000 is required. Additionally, a royalty fee is required in an amount equal to four percent of the restaurant’s gross sales, and the Company is required to expend or contribute for advertising an amount not less than two percent of the restaurant’s gross sales up to a maximum of six percent of the restaurant’s gross sales. Royalty fees have always been paid to the Franchisor weekly.

Prior to January 1, 2009, the Company was permitted to retain and expend advertising fees at its direction, at the rate of two percent of gross sales. This system was replaced on January 1, 2009, when the Franchisor initiated a national advertising program under which all Golden Corral restaurants were required to begin contributing their advertising fees each week to the Franchisor, continuing at the rate of two percent of gross sales. On January 1, 2010, advertising fees were increased to 2.4 percent of gross sales, allowing additional national media buying by the Franchisor, which effectively expanded cable television spots in all the Company’s market areas. Marketing strategy and creative direction originates from the Franchisor. The campaign during fiscal year 2010 focused on Golden Corral’s value in comparison to competition and a wide range of available dining options.

A renovation program for Golden Corral restaurants has been tailored to replicate the highly successful Big Boy renovation program. Each Golden Corral restaurant is renovated after five years of operation and every five years thereafter. Eleven Golden Corral restaurants were renovated in fiscal year 2010. Nine are scheduled to be renovated in fiscal year 2011 at a cost of approximately $140,000 each.

6

Table of Contents

Human Resources

The Company provides equal opportunity employment without regard to age, race, religion, color, sex, national origin, disability, veteran status or any other legally protected class. The Company’s Equal Opportunity Employment Policy provides and maintains a work environment that is free from all forms of illegal discrimination including sexual harassment. The philosophy of the policy stresses the need to train and to promote the person who becomes the most qualified individual to do a particular job. The Company is committed to promoting “Diversity” in the workplace in order to enhance its Equal Opportunity Employment Policy.

The Company remains committed to providing employees with the best training possible, as management believes that investing in people is a strategic advantage. Comprehensive recruiting and training programs are designed to maintain the food and service quality necessary to achieve the Company’s goals for operating results. A management recruiting staff is maintained at the Company’s headquarters. Corporate training centers for new Big Boy managers are operated in Cincinnati, Ohio and Covington, Kentucky, and certified (by the Franchisor) training centers for new Golden Corral managers are located throughout the markets in which the Company operates Golden Corral restaurants. The training includes both classroom instruction and on-the-job training. A full time recruiter is on staff to attract high quality hourly-paid restaurant workers.

The Company’s incentive-based compensation program for restaurant managers, area supervisors and regional directors (collectively, operations management) ties compensation of operations management directly to the cash flows of their restaurant(s), which allows incentive compensation to be more consistently earned. The incentive compensation that operations management can earn under the program is at a level the Company believes is above the average for competing restaurant concepts. The Company believes the program has reduced turnover in operations management, and has resulted in a strong management team that continues to focus on building same store sales and margins.

Employee selection software helps lower hourly employee turnover rates; an employee validation website is in place that measures employee job satisfaction; and an interactive employee training program uses training videos and quizzes. These digital videos are loaded directly onto the hard drive of a PC located at each restaurant that is networked to the point-of-sale system, allowing headquarters to access the interactive results.

Information Technology

Each of the Company’s restaurants is managed through standardized operating and control systems anchored by a point-of-sale (POS) system that allows management to instantly accumulate and utilize data for more effective decision making, while allowing restaurant managers to spend more time in the dining room focusing on the needs of customers. The system generates the guest check and provides functionality for settling the customer’s check using cash, credit or debit card, or gift card. The system provides a record of all items sold, the service time, and the server responsible for the customer. Employee time keeping is also kept on the POS system. Back office functionality provides employee master file data, employee scheduling, inventory control, sales forecasting, product ordering and many other management reports.

To provide more consistent and secure reporting, a plan was launched in May 2009 to merge the POS systems of Big Boy and Golden Corral into one integrated solution through the implementation of new software that provides both ‘front of the house’ and ‘back of the house’ functionality. As of June 1, 2010, the new software had been successfully installed in all Golden Corral restaurants, each of which also received new POS register equipment and back office hardware. Approximately 30 of the Big Boys had been completed as of June 1, 2010, each of which also received new back office hardware. The plan calls for completing the Big Boy installations by November 2010. A five-year plan to replace POS register equipment in all Big Boy restaurants was completed during fiscal year 2008.

The implementation of the integrated solution includes improved security measures derived through the installation of biometric sign-on devices to access the POS systems, replacing card swipe technology. The system will be upgraded to meet the Payment Card Industry (PCI) Security requirements that must be in place by July 2011.

7

Table of Contents

Standardized operating and control systems also include an automated drive-thru timer system in all Big Boy restaurants that measures the time from when a customer’s car first enters the drive-thru station until the order is received and the customer exits the drive-thru. This information is provided to the restaurant manager in a real time environment, which reduces the amount of time required to serve customers. To replenish restaurant inventories, a “suggested order” automated system analyzes current inventory balances and sales patterns and then “suggests” a replenishment order from the commissary operation. This process optimizes in-store inventory levels, which results in better control over food costs, identifies waste and improves food quality.

Digital Subscriber Lines (DSL) were installed in all Big Boy restaurants in fiscal year 2008, replacing satellite broad band connectivity between headquarters and the restaurants. DSL installation in Golden Corral restaurants began in fiscal year 2009 and was completed during fiscal year 2010. The changeover has eliminated periodic disruptions of service associated with satellite technology.

To enhance the highly successful issuance of Frisch’s Big Boy gift cards, a program was launched in fiscal year 2009 to begin selling Big Boy gift cards in certain grocery store outlets. During fiscal year 2010, Big Boy gift cards became available online through the Company’s corporate web site (www.frischs.com). Golden Corral gift cards became the standard within the Golden Corral franchise system in fiscal year 2007.

Electronic signature capture devices that process debit and credit card transactions, which have been in place in all Big Boy restaurants for several years, will be added in all Golden Corral restaurants during fiscal year 2011. Other paperless systems in restaurants include a) employee payroll advices that can be either emailed directly to the employee or provided electronically to each restaurant where the employees may print them on demand if desired, b) signatures have been captured on key employment documents such as Form W-4 and acknowledgements regarding employee handbooks, and c) an online employment application has been added to the Company’s corporate web site (www.frischs.com) that provides direct feeds into the POS system and the enterprise reporting system at headquarters.

Originally installed in 2004, the enterprise reporting system that supports the Company’s information needs has twice been successfully upgraded to new environments, most recently in September 2009. A complete headquarters network upgrade (wiring and equipment) was completed in the spring of 2007. The headquarters telephone system was replaced with a Voice Over Internet Protocol (VOIP) system in March 2007.

Raw Materials

The sources and availability of food and supplies are discussed above under Big Boy Restaurant Operations and Golden Corral Restaurant Operations. Other raw materials used in food processing include equipment for cooking and preparing food, refrigeration and storage equipment and various other fixtures. The Company currently purchases its restaurant equipment principally from two vendors, one of which supplies Big Boy restaurants, the other supplies Golden Corral restaurants. Other reliable restaurant equipment suppliers are available should the Company choose to change vendors. In addition, no significant disruptions in the supply of electricity and natural gas used in restaurant operations have been experienced to date.

Trademarks and Service Marks

The Company has registered certain trademarks and service marks on the Principal Register of the United States Patent and Trademark Office, including “Frisch’s,” “Brawny Lad,” “Buddie Boy,” “Frisch-ly Made,” “Pie Baby,” “Fire & Ice” and the tag line “What’s Your Favorite Thing?” These registrations are considered important to the Company’s Big Boy operations, especially its primary mark “Frisch’s” and the tag line “What’s Your Favorite Thing?” The duration of each registration varies depending upon when registration was first obtained. The Company currently intends to renew all of its trademarks and service marks when each comes up for renewal.

Pursuant to a 2001 agreement with Big Boy Restaurants International, LLC, the Company acquired limited ownership rights and a right to use the “Big Boy” trademarks and service marks within the states of Indiana and Kentucky and in most of Ohio and Tennessee. A concurrent use registration was issued October 6, 2009 on the Principal Register of the United States Patent and Trademark Office, confirming these exclusive “Big Boy” rights.

The “Golden Corral” trademarks and service marks are registered trademarks of Golden Corral Corporation.

8

Table of Contents

The Company is not aware of any infringements on its registered trademarks and service marks, nor is the Company aware of any infringement on any of its territorial rights to use the proprietary marks that are owned by or licensed to the Company.

Seasonality

The Company’s business is moderately seasonal for both the Big Boy and Golden Corral operating segments, with the third quarter of the fiscal year (mid-December through early March) normally accounting for a smaller share of annual revenues. Additionally, severe winter weather can have a marked negative impact upon revenue during the third quarter. Occupancy and other fixed operating costs have a greater negative impact on operating results during any quarter that may experience lower sales. Results for any quarter should not be regarded as indicative of the year as a whole, especially the first quarter, which contains sixteen weeks. Each of the last three quarters normally contains twelve weeks. The fourth quarter of fiscal year 2008 contained a thirteenth week that was necessary to complete the 53 week accounting year.

Working Capital

Restaurant sales provide the Company’s principal source of cash. Funds from both the Big Boy and Golden Corral operating segments are immediately available to meet the Company’s working capital needs, as substantially all restaurant sales are received in cash or cash equivalents such as debit and credit cards. Other sources of cash may include borrowing against credit lines, proceeds from stock options exercised by employees and occasional sales of real estate. The Company uses its positive cash flows for debt service, capital spending and cash dividends.

As there is no need to maintain significant levels of inventories or receivables, the Company maintains a strategic negative working capital position, which is not uncommon in the restaurant industry. The working capital deficit was $18,152,000 as of June 1, 2010. As significant, predictable cash flows are provided by operations, the deployment of a negative working capital strategy has not and will not hinder the Company’s ability to satisfactorily retire any of its obligations when due. Additionally, a working capital revolving line of credit is readily available if needed.

Customers, Backlog and Government Contracts

Because all of the Company’s retail sales are derived from food sales to the general public, neither the Big Boy nor the Golden Corral operating segments have any material dependence upon a single customer or any group of a few customers. No backlog of orders exists and no material portion of the business of either segment is subject to re-negotiation of profits or termination of contracts or subcontracts at the election of government authorities.

Competition

The restaurant industry is highly competitive and many of the Company’s competitors are substantially larger and possess greater financial resources than does the Company. Both the Big Boy and Golden Corral operating segments have numerous competitors, including national chains, regional and local chains, as well as independent operators. None of these competitors, in the opinion of the Company, is dominant in the family-style sector of the restaurant industry. In addition, competition continues to increase from supermarkets and other non-traditional competitors, as home meal replacement continues to grow in popularity. The principal methods of competition in the restaurant industry are brand name recognition and advertising; menu selection and prices; food quality and customer perceptions of value, speed and quality of service; cleanliness and fresh, attractive facilities in convenient locations. In addition to competition for customers, sharp competition exists for qualified restaurant managers, hourly restaurant workers and quality sites on which to build new restaurants.

Research and Development

The Company’s corporate staff includes a manager of research and development for its Big Boy restaurants whose responsibilities entail development of new menu selections and enhancing existing products. From time to time, the Company also conducts consumer research to identify where future restaurants should be built, along with emerging industry trends and changing consumer preferences. While these activities are important to the Company, these expenditures have not been material during the three fiscal years in the period ending June 1, 2010 and are not expected to be material to the Company’s future results.

9

Table of Contents

Government Regulation

The Company is subject to licensing and regulation by various federal, state and local agencies, including vendors’ licenses, health, sanitation, safety and hiring and employment practices including compliance with the Fair Labor Standards Act and minimum wage statutes. All Company operations are believed to be in material compliance with all applicable laws and regulations. All of the Company’s restaurants substantially meet local and state building and fire codes, and the material requirements of the Americans with Disabilities Act. Although the Company has not experienced any significant obstacles to obtaining building permits, licenses or approvals from governmental bodies, increasingly rigorous requirements on the part of state, and in particular, local governments, could delay or possibly prevent expansion in desired markets.

The federal health care reform package that was recently signed into law will require the Company to post calorie counts and other nutritional information on its menus. The final rules are expected to be issued by the Food and Drug Administration in March 2011. The increase in operating costs to effect these changes is not expected to be material. However, sales and profitability may be adversely affected if customers significantly alter their behavior as a result of this information being available to them.

The Company is subject to the franchising regulations of the Federal Trade Commission and the franchising laws of Ohio, Kentucky and Indiana where it has licensed Big Boy restaurants to other operators.

Environmental Matters

The Company does not believe that various federal, state or local environmental regulations will have any material effect upon the capital expenditures, earnings or competitive position of either the Big Boy or Golden Corral operating segments. However, the Company cannot predict the effect of any future environmental legislation or regulations.

Employees

As of June 1, 2010, the Company and its subsidiaries employed approximately 8,400 active employees, approximately 2,400 of whom work in Golden Corral restaurants. Approximately 4,300 of the Company’s employees are considered part-time (those who work less than 30 hours per week). Although there is no significant seasonal fluctuation in employment levels, hours worked may vary according to sales patterns in individual restaurants. None of the Company’s employees is represented by a collective bargaining agreement. Management believes that employee relations are excellent and employee compensation is comparable with or better than competing restaurants.

Geographic Areas

The Company has no operations outside of the United States of America. The Company’s revenues, consisting principally of retail sales of food and beverages to the general public and certain wholesale sales to and license fees from restaurants licensed to other operators, were substantially generated in various markets in the states of Ohio, Kentucky and Indiana during each of the three fiscal years in the period ended June 1, 2010. In addition, two Golden Corral restaurants are operated in western Pennsylvania and a third restaurant operates in the northwest part of West Virginia. Substantially all of the Company’s long-lived assets were deployed in service in the same states during the same periods stated above.

Available Information

The Securities Exchange Act of 1934, as amended, requires the Company to file periodic reports with the Securities and Exchange Commission (SEC) including its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Definitive 14A Proxy Statements, and certain other information. The Company’s periodic reports (and any amendments thereto) can be viewed by visiting the SEC’s internet site (http://www.sec.gov). In addition, the SEC makes the Company’s periodic reports available for reading and copying in its Public Reference Room located at 100 F. Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

10

Table of Contents

The Company makes available the periodic reports that it files with the SEC through its corporate web site (www.frischs.com) via a hyperlink directly to the Company’s filings on the SEC’s web site. New information available through the hyperlink is generally provided within a few minutes from the time a report is filed. Information contained on or available through the Company’s website is not a part of, nor is it being incorporated into, this Annual Report on Form 10-K. In addition, printed copies of the reports the Company files with the SEC may be obtained without charge by writing to Donald H. Walker, Vice President and Chief Financial Officer of Frisch’s Restaurants, Inc., 2800 Gilbert Avenue, Cincinnati, Ohio 45206-1206. Email requests may be sent to cfo@frischs.com.

Copies of the Company’s corporate governance documents are also available on the Company’s corporate web site (www.frischs.com). The documents include the Company’s Code of Regulations, Corporate Governance Guidelines, Code of Conduct, Code of Ethics for Chief Executive Officer and Financial Professionals, Insider Trading Policy, Related Person Transaction Policy, the Charter of the Disclosure Controls and Risk Management Committee, and various charters of committees of the Board of Directors, including that of the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, the Strategic Planning Committee and the Finance Committee.

The Audit Committee has established a procedure for the confidential, anonymous submission by employees and other concerned parties regarding the Company’s accounting, internal accounting controls or auditing matters. The toll free Corporate Governance Hotline number is 800-506-6424. The Hotline is managed by an independent third party and is available 24 hours a day, seven days a week. Messages are transcribed and referred electronically to the Audit Committee.

11

Table of Contents

Executive Officers of the Registrant

The following table sets forth the names and certain information concerning the executive officers of the Company:

| Name |

Age | Current Principal Occupation or Employment and Five Year Employment History | ||

| Craig F. Maier (a) | 60 | President and Chief Executive Officer of the Company (since 1989) | ||

| Rinzy J. Nocero | 56 | Vice President and Chief Operating Officer of the Company (since February 2007); Private Investor (from November 2004 to February 2007); Senior Vice President - Operations, Bob Evans Farms, Inc. (from 1993 to November 2004) | ||

| Donald H. Walker | 64 | Vice President and Chief Financial Officer (since 1996) and Treasurer of the Company (since 1982) | ||

| Michael E. Conner, Sr. | 58 | Vice President - Human Resources of the Company (since 2000) | ||

| Michael R. Everett | 56 | Vice President - Information Services of the Company (since June 2006); Director of Information Services of the Company (from May 2005 to June 2006); Director, Haverstick Consulting, Inc. (from May 2002 to May 2005) | ||

| James I. Horwitz | 53 | Vice President – Real Estate and Franchising of the Company (since March 2008); Director of Leasing and Development, Cincinnati United Contractors (from February 2007 to March 2008); Director of Real Estate, Alderwoods Group (from December 2005 to January 2007); Broker, Re/Max Preferred Group / The Clay Group (from 1997 to December 2005) | ||

| Karen F. Maier (a) | 58 | Vice President - Marketing of the Company (since 1983) | ||

| Stephen J. Hansen | 45 | Vice President - Commissary of the Company (since June 2010); Plant Manager, Klosterman Baking Company (from March 2009 to June 2010); Operations Manager, General Mills (from October 2008 to March 2009); Plant Manager, Campos Foods LLC (from 1996 to June 2008) | ||

| William L. Harvey | 56 | Regional Director of the Company (since 1995) and formerly held positions within the Company of Area Supervisor and Executive Store Manager | ||

| Lindon C. Kelley | 55 | Regional Director of the Company (since 2000) and formerly held positions within the Company of Area Supervisor and Executive Store Manager | ||

| Louie Sharalaya | 60 | Regional Director of the Company (since 2001) and formerly held positions within the Company of Area Supervisor and Executive Store Manager | ||

| (a) | Craig F. Maier is the brother of Karen F. Maier. |

12

Table of Contents

The Company continually takes reasonable preventive measures to reduce its risks and uncertainties. However, the nature of some risks and uncertainties provides little, if any, control to the Company. The materialization of any of the operational and other risks and uncertainties identified herein, together with those risks not specifically listed or those that are presently unforeseen, could result in significant adverse effects on the Company’s financial position, results of operations and cash flows, which could include the permanent closure of any affected restaurant(s) with an impairment of assets charge taken against earnings, and could adversely affect the price at which shares of the Company’s common stock trade.

In addition to operating results, other factors can influence the volatility and price at which the Company’s common stock trades. The Company’s stock is thinly traded on the NYSE Amex market. Thinly traded stocks can be susceptible to sudden, rapid declines in price, especially when holders of large blocks of shares seek exit positions. Rebalancing of stock indices in which the Company’s shares are placed such as the Russell 2000 Index can also influence the price of the Company’s stock.

Food Safety

Food safety is the most significant risk to any company that operates in the restaurant industry. It is the focus of increased government regulatory initiatives at the local, state and federal levels. To limit the Company’s exposure to the risk of food contamination, management rigorously emphasizes and enforces the Company’s food safety policies in all of the Company’s restaurants, and at the commissary and food manufacturing plant that the Company operates for Big Boy restaurants. These policies are designed to work cooperatively with programs established by health agencies at all levels of government authority, including the federal Hazard Analysis of Critical Control Points (HACCP) program. In addition, the Company makes use of ServSafe Training, a nationally recognized program developed by the National Restaurant Association. The ServSafe program provides accurate, up-to-date science-based information to all levels of restaurant workers on all aspects of food handling, from receiving and storing to preparing and serving. All restaurant managers are required to be certified in ServSafe Training and are required to be re-certified every five years.

Failure to protect the Company’s food supplies could result in food borne illnesses and/or injuries to customers. Publicity of such events in the past has caused irreparable damages to the reputations of certain operators in the restaurant industry. If any of the Company’s customers become ill from consuming the Company’s products, the affected restaurants may be forced to close. An instance of food contamination originating at the commissary operation could have far reaching effects, as the contamination would affect substantially all Big Boy restaurants.

Economic Factors

Economic recessions can negatively influence discretionary consumer spending in restaurants and result in lower customer counts, as consumers become more price conscious, tending to conserve their cash as unemployment and economic uncertainty mount. The effects of higher gasoline prices can also negatively affect discretionary consumer spending in restaurants. Increasing costs for energy affect profit margins in many other ways. Petroleum based material is often used to package certain products for distribution. In addition, suppliers may add surcharges for fuel to their invoices. The cost to transport products from the commissary to restaurant operations will rise with each increase in fuel prices. Higher costs for electricity and natural gas result in higher costs to heat and cool restaurant facilities and to refrigerate and cook food.

Inflationary pressure, particularly on food costs, labor costs (especially associated with increases in the minimum wage) and health care benefits, can negatively affect the operation of the business. Shortages of qualified labor are sometimes experienced in certain local economies. In addition, the loss of a key executive could pose a significant adverse effect on the Company.

Future funding requirements of the two qualified defined benefit pension plans that are sponsored by the Company largely depend upon the performance of investments that are held in trusts that have been established for the plans. Equity securities comprise 70 percent of the target allocation of the plans’ assets. Poor performance in equity securities markets can significantly lower the market values of the plans’ investment portfolios, which, in turn, can result in a) material increases in future funding requirements, b) much higher net periodic pension costs to be

13

Table of Contents

recognized in future years, and c) the plans reaching underfunded status, requiring reductions in the Company’s equity to be recognized.

Competition

The restaurant industry is highly competitive and many of the Company’s competitors are substantially larger and possess greater financial resources than does the Company. Both the Big Boy and Golden Corral operating segments have numerous competitors, including national chains, regional and local chains, as well as independent operators. None of these competitors, in the opinion of the Company’s management, presently dominates the family-style sector of the restaurant industry in any of the Company’s operating markets. That could change at any time due to:

| • | changes in economic conditions |

| • | changes in demographics in neighborhoods where the Company operates restaurants |

| • | changes in consumer perceptions of value, food and service quality |

| • | changes in consumer preferences, particularly based on concerns with nutritional content of food on the Company’s menus |

| • | new competitors that enter the Company’s markets from time to time |

| • | increased competition from supermarkets and other non-traditional competitors |

| • | increased competition for quality sites on which to build restaurants |

Development Plans and Financing Arrangements

The Company’s business strategy and development plans also face risks and uncertainties. These include the inherent risk of poor quality decisions in the selection of sites on which to build restaurants, the ever rising cost and availability of desirable sites and increasingly rigorous requirements on the part of local governments to obtain various permits and licenses. Other factors that could impede plans to increase the number of restaurants operated by the Company include saturation in existing markets and limitations on borrowing capacity and the effects of higher interest rates.

In addition, the Company’s loan agreements include financial and other covenants with which compliance must be met or exceeded each quarter. Failure to meet these or other restrictions could result in an event of default under which the lender may accelerate the outstanding loan balances and declare them immediately due and payable.

The Supply and Cost of Food

Food purchases can be subject to significant price fluctuations that can considerably affect results of operations from quarter to quarter and year to year. Price fluctuations can be due to seasonality or any number of factors. The market for beef, in particular, continues to be highly volatile due to import and export restrictions. Beef costs can also be affected by bio-fuel initiatives and other factors that influence the cost to feed cattle. The Company depends on timely deliveries of perishable food and supplies. Any interruption in the continuing supply would harm the Company’s operations.

Litigation and Negative Publicity

Employees, customers and other parties bring various claims against the Company from time to time. Defending such claims can distract the attention of senior level management away from the operation of the business. Legal proceedings can result in significant adverse effects to the Company’s financial condition, especially if other potentially responsible parties lack the financial wherewithal to satisfy a judgment against them or the Company’s insurance coverage proves to be inadequate. Also, see “Legal Proceedings” elsewhere in Part I, Item 3 of this Form 10-K.

In addition, negative publicity associated with legal claims against the Company, whether or not such complaints are valid, could harm the Company’s reputation, which, in turn, could adversely affect operating results. The Company’s reputation and brand can also be harmed by operational problems experienced by other operators of Big Boy and Golden Corral restaurants, especially from issues relating to food safety. Other negative publicity such as

14

Table of Contents

that arising from rumor and innuendo spread through social internet media and other sources can create adverse effects on the Company’s results of operations.

Governmental and Other Rules and Regulations

Governmental and other rules and regulations can pose significant risks to the Company. Examples include:

| • | general exposure to penalties or other costs associated with the potential for violations of numerous governmental regulations, including: |

| • | immigration (I-9) and labor regulations regarding the employment of minors |

| • | minimum wage and overtime requirements |

| • | employment discrimination and sexual harassment |

| • | health, sanitation and safety regulations |

| • | restaurant facility issues, such as meeting the requirements of the Americans with Disabilities Act of 1990 or liabilities to remediate unknown environmental conditions |

| • | changes in existing environmental regulations that would significantly add to the Company’s costs |

| • | any future imposition by OSHA of costly ergonomics regulations on workplace safety |

| • | climate change legislation that adversely affects the cost of energy |

| • | legislative changes affecting labor law, especially increases in the federal or state minimum wage requirements |

| • | compliance with recently enacted legislation to reform the U.S. health care system could adversely affect the Company’s health care costs |

| • | nutritional labeling on menus - compliance with recently enacted legislation requiring nutritional labeling on menus and the Company’s reliance on the accuracy of information obtained from third party suppliers |

| • | nutritional labeling on menus – potential effect on sales and profitability if customers’ buying habits change |

| • | legislation or court rulings that result in changes to tax codes that are adverse to the Company |

| • | changes in accounting standards imposed by governmental regulators or private governing bodies could adversely affect the Company’s financial position |

| • | estimates used in preparing financial statements and the inherent risk that future events affecting them may cause actual results to differ markedly |

Catastrophic Events

Unforeseen catastrophic events could disrupt the Company’s operations, the operations of the Company’s suppliers and the lives of the Company’s customers. The Big Boy segment’s dependency on the commissary operation in particular could present an extensive disruption of products to restaurants should a catastrophe impair its ability to operate. Examples of catastrophic events include but are not limited to:

| • | adverse winter weather conditions |

| • | natural disasters such as earthquakes or tornadoes |

| • | fires or explosions |

| • | widespread power outages |

| • | criminal acts, including bomb threats, robberies, hostage taking, kidnapping and other violent crimes |

| • | acts of terrorists or acts of war |

| • | civil disturbances and boycotts |

| • | disease transmitted across borders that may enter the food supply chain |

Technology and Information Systems

The strategic nature of technology and information systems is of vital importance to the operations of the Company. Events that could pose threats to the operation of the business include:

| • | catastrophic failure of certain information systems |

| • | difficulties that may arise in maintaining existing systems |

15

Table of Contents

| • | difficulties that may occur in the implementation of and transition to new systems |

| • | financial stability of vendors to support software over the long term |

In addition, security violations of any unauthorized access to information systems could result in the loss of proprietary data; consumer confidence may be lost if protection of consumer privacy should be compromised.

Golden Corral Operations

Notwithstanding significant improvements during fiscal years 2009 and 2010, Golden Corral same-store sales declines have been experienced for 21 of the last 27 quarters, during which cash flows from Golden Corral operations have sometimes deteriorated. The ability of the Company to reverse the downturn and permanently restore sales and margin growth poses a significant risk to the Company.

Item 1B. Unresolved Staff Comments

None

All of the Company’s restaurants are freestanding, well-maintained facilities. Older Big Boy restaurants are generally located in urban or heavily populated suburban neighborhoods that cater to local trade rather than highway travel. A few of these restaurant facilities are now approximately 40 years old. Big Boy restaurants opened since the early 1990’s have generally been located near interstate highways. The average Big Boy restaurant in operation as of June 1, 2010 contained approximately 5,600 square feet with seating capacity for 156 guests. A second prototype debuted in fiscal 2010 for use in smaller trade areas. Its footprint approximates 5,000 square feet and has 146 dining room seats. Golden Corral restaurants constructed in earlier years contained 9,952 square feet with seating for 348 guests. Newer restaurants have 10,300 square feet with 372 seats.

Most new restaurant construction requires approximately eighteen weeks to complete, depending on the time of year and weather conditions. A competitive bidding process is used to award contracts to general contractors for all new restaurant construction. The general contractor selects and schedules sub-contractors, and is responsible for procuring most building materials. A Company project manager is assigned to coordinate all construction projects.

The following table provides certain operating segment information with respect to the number and location of all restaurants in the Company’s system as of June 1, 2010:

| Big Boy | ||||||

| Company Operated |

Operated by Licensees |

Golden Corral | ||||

| Cincinnati, Ohio market |

50 | 4 | 11 | |||

| Dayton, Ohio market |

18 | — | 5 | |||

| Columbus, Ohio market |

10 | 1 | 1 | |||

| Louisville, Kentucky market |

8 | 2 | 4 | |||

| Lexington, Kentucky market |

5 | 3 | — | |||

| Cleveland, Ohio market |

— | — | 8 | |||

| Toledo/Lima/Findlay, Ohio market |

— | 13 | 3 | |||

| Pittsburgh, Pennsylvania market |

— | — | 3 | |||

| Other |

— | 2 | — | |||

| Total |

91 | 25 | 35 | |||

Sites acquired for development of new Company operated restaurants are identified and evaluated for potential long-term sales and profits. A variety of factors is analyzed including demographics, traffic patterns, competition and other relevant information. Because control of property rights is important to the Company, it is the Company’s policy to own its restaurant locations whenever possible.

16

Table of Contents

In recent years, it has sometimes become necessary to enter ground leases to obtain desirable land on which to build. In addition, many of the restaurants operated by the Company that opened prior to 1990 were financed with sale/leaseback transactions. Most of the leases are for fifteen or twenty years and contain multiple five-year renewal options. All of the leases generally require the Company to pay property taxes, insurance and maintenance. As of June 1, 2010, 21 restaurants were in operation on non-owned premises, all of which are classified as operating leases.

The following table sets forth certain operating segment information regarding the type of occupancy of Company-operated restaurants:

| Big Boy | Golden Corral | |||

| Land and building owned |

77 | 28 | ||

| Land or land & building leased |

14 | 7 | ||

| Total |

91 | 35 | ||

Nine (all of which are Big Boy restaurants) of the 21 leases will expire during the next five years, as detailed in the list below. Five of the nine leases have remaining options to renew for five or more years. Current plans call for four of the nine leases to be vacated upon expiration.

| Fiscal year ending in |

Number of leases expiring | |

| 2011 | 1 | |

| 2012 | 3 | |

| 2013 | 1 | |

| 2014 | 1 | |

| 2015 | 3 | |

During fiscal year 2010, the Company entered a capital lease for land in Louisville, Kentucky on which construction of a Big Boy restaurant was in progress as of June 1, 2010. Under the terms of the lease, the Company is required to acquire the land in fee simple estate after the tenth year. Construction of a Big Boy restaurant was also in progress at June 1, 2010 on land near Dayton, Ohio that is owned by the Company. Three other sites - one each in the Cincinnati, Columbus and Louisville market areas - were acquired by the Company in fee simple estate during fiscal year 2010 on which construction of Big Boy restaurants is expected in fiscal year 2011.

None of the real property owned by the Company is currently encumbered by mortgages or otherwise pledged as collateral. With the exception of certain delivery and other equipment utilized under capital leases expiring during periods to fiscal year 2013, the Company owns substantially all of the furnishings, fixtures and equipment used in the operation of the business.

The Company owns a 79,000 square foot building that houses its commissary in Cincinnati, Ohio. It is suitable and adequate to supply Company operated Big Boy restaurants and the needs of Big Boy restaurants licensed to others in all the Company’s Big Boy market areas. As the facility normally operates one shift daily, additional productive capacity is readily available if needed. The Company maintains its headquarters in Cincinnati on a well-traveled street in a mid-town business district. This administrative office space approximates 49,000 square feet and is occupied under an operating lease expiring December 31, 2012, with a renewal option available through December 31, 2022. During the term of the lease and the period covered by its renewal option, the Company has been granted the right of first refusal should the lessor receive a bona fide offer to purchase from a third party. The Company has an option to purchase the property at the end of the renewal option period.

Five surplus land locations owned by the Company were listed for sale with brokers as of June 1, 2010, three of which are located in the Columbus, Ohio market, the fourth is in Toledo, Ohio and the fifth is located in the Louisville, Kentucky market area. Two former Big Boy restaurants owned by the Company are also listed for sale with brokers, one in the Cincinnati market, and the other in the Dayton, Ohio market. No specific plans have been made for three other sites owned by the Company, two of which are located in the Cincinnati market with the third one being located in the Dayton, Ohio market area. Finally, the Company owns one former restaurant building in the Cincinnati market that it leases to a third party.

17

Table of Contents

The Company is contingently liable for the performance of a ground lease (of property located in Covington, Kentucky on which a hotel once operated by the Company is built) that has been assigned to a third party. The annual obligation of the lease approximates $48,000 through 2020. Should the third party default, the Company has the right to re-assign the lease.

| A. | In April 2008, the Company filed five separate lawsuits against 7373 Corporation (“7373”). 7373 was the lessor of five properties on which the Company operates five Big Boy restaurants. The Company’s complaints claimed breach of contract and asked for declaratory relief and specific performance. In May 2008, 7373 filed its Answers and Counterclaims. The Company maintained that it should be allowed to purchase the five underlying properties for certain amounts that were specified in the Lease Agreements, which taken together amounted to $2,471,540. 7373 claimed that the Company must purchase the properties for a larger amount based upon alternative values in the Lease Agreements and market appraisal values. |

7373 filed a lawsuit against the Company in April 2008 that asked for declaratory relief and specific performance as to the same disputed leases. In May 2008, the Company filed a Motion to Dismiss for Lack of Personal Jurisdiction, Or, In the Alternative, Motion to Abate.

The parties entered into a Settlement Agreement effective August 24, 2009, settling all claims and counterclaims that had been asserted in the six lawsuits, which are listed below:

| • | Case No. 08-CI-1079 was filed by the Company on April 2, 2008 in Kenton County Circuit Court, Kenton County Kentucky. |

| • | Case No. 08-CI-609 was filed by the Company on April 2, 2008 in Franklin County Circuit Court, Franklin County Kentucky. |

| • | Case No. 08-CI-1374 was filed by the Company on April 25, 2008 in Kenton County Circuit Court, Kenton County Kentucky. |

| • | Case No. 08-CI-4671 was filed by the Company on April 25, 2008 in Jefferson County Circuit Court, Jefferson County Kentucky. |

| • | Case No. 08CV71318 was filed by the Company on April 25, 2008 in Warren County Court of Common Pleas, Warren County, Ohio. |

| • | Case No. 50-2008 CA009950XXXXMB was filed by 7373 on April 2, 2008 in Palm Beach County, Florida, Circuit Court of the Fifteenth Judicial Circuit. |

Pursuant to the settlement agreement, the parties filed with the respective courts an Agreed Order of Dismissal, with prejudice, of all claims and counterclaims. As consideration for the Settlement Agreement, 7373 agreed to sell, and the Company agreed to purchase, the five properties for the total sum of $4,000,000. The real estate transactions were closed on September 1, 2009.

| B. | The Company is subject to various other claims and suits that arise from time to time in the ordinary course of business. Management does not presently believe that the resolution of any claims currently outstanding will result in a material effect on the Company’s earnings, cash flows or financial position. Exposure to loss contingencies from pending or threatened litigation is continually evaluated by management, which believes that adequate provisions for losses have been included in the consolidated financial statements. |

Item 4. (Removed and Reserved)

18

Table of Contents

PART II

(Items 5 through 9)

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company’s common stock is traded on NYSE Amex under the symbol “FRS.” The closing price of the Company’s common stock as reported by NYSE Amex on July 23, 2010 was $19.99. There were approximately 1,650 shareholders of record as of July 23, 2010. The following table sets forth the high and low sales prices for the common stock and the cash dividend declared for each quarter within the Company’s two most recent fiscal years:

| Fiscal Year Ended June 1, 2010 | Fiscal Year Ended June 2, 2009 | |||||||||||||||||

| Stock Prices | Dividend | Stock Prices | Dividend | |||||||||||||||

| High | Low | per share | High | Low | per share | |||||||||||||

| 1st Quarter |

$ | 32.21 | $ | 23.12 | 12 | ¢ | $ | 26.95 | $ | 19.44 | 12 | ¢ | ||||||

| 2nd Quarter |

26.79 | 22.07 | 13 | ¢ | 23.54 | 16.00 | 12 | ¢ | ||||||||||

| 3rd Quarter |

25.61 | 22.17 | 13 | ¢ | 22.45 | 18.43 | 12 | ¢ | ||||||||||

| 4th Quarter |

24.10 | 19.91 | 13 | ¢ | 28.87 | 19.26 | 12 | ¢ | ||||||||||

Dividend Policy

Through July 9, 2010, the Company has paid 198 consecutive quarterly cash dividends during its 50 year history as a public company. The Company currently expects that quarterly cash dividends will continue to be paid for the foreseeable future at rates comparable with or slightly higher than those shown in the above table.

Equity Compensation Plan Information

Information regarding equity compensation plans under which common stock of the Company is authorized for issuance is incorporated by reference to Item 12 of this Form 10-K.

Issuer Purchases of Equity Securities

On January 6, 2010, the Board of Directors authorized a new repurchase program under which the Company may repurchase up to 500,000 shares of its common stock in the open market or through block trades over a two-year period that will expire January 6, 2012. The new authorization replaced a similar program that had expired in January 2010. The following table shows information pertaining to the Company’s repurchases of its common stock during its fourth quarter that ended June 1, 2010:

| Period |

Total Number Of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | |||||

| March 10, 2010 to April 6, 2010 |

— | $ | — | — | — | ||||

| April 7, 2010 to May 4, 2010 |

23,601 | $ | 22.17 | 23,601 | 476,399 | ||||

| May 5, 2010 to June 1, 2010 |

22,867 | $ | 21.24 | 22,867 | 453,532 | ||||

| Total |

46,468 | $ | 21.71 | 46,468 | 453,532 | ||||

19

Table of Contents

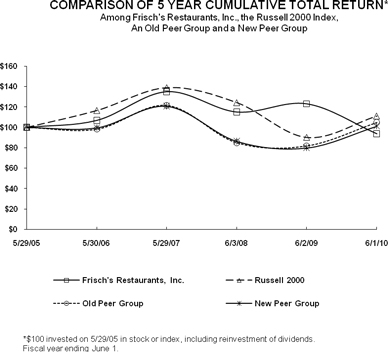

Performance Graph

The following graph compares the yearly percentage change in the Company’s cumulative total stockholder return on its Common Stock over the five year period ending June 1, 2010 with the Russell 2000 Index and two groups of the Company’s peer issuers, selected by the Company in good faith. The graph assumes an investment of $100 in the Company’s Common Stock, in the Index and in the common stock of each peer group on May 30, 2005 and reinvestment of all dividends.

The Old Peer Group consists of the following issuers: Bob Evans Farms, Inc., Biglari Holdings Inc. (formerly known as The Steak n Shake Co.), CBRL Group, Inc. (Cracker Barrel Old Country Store), and DineEquity, Inc. (IHOP and Applebee’s).

The New Peer Group consists of the four peers in the old peer group plus Denny’s, Inc., which was added to expand the number of publicly traded family style restaurant companies in the peer group. Over the years, the peer group has shrunk as other family style companies have gone private.

20

Table of Contents

Item 6. Selected Financial Data

FRISCH’S RESTAURANTS, INC. AND SUBSIDIARIES

SUMMARY OF OPERATIONS

| (in thousands, except per share data) | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Sales |

$ | 292,872 | $ | 297,861 | $ | 299,562 | $ | 289,934 | $ | 290,968 | ||||||||||

| Cost of sales |

||||||||||||||||||||

| Food and paper |

99,651 | 105,860 | 106,895 | 101,401 | 102,106 | |||||||||||||||

| Payroll and related |

97,919 | 97,678 | 98,347 | 95,501 | 96,098 | |||||||||||||||

| Other operating costs |

64,988 | 66,082 | 66,383 | 64,043 | 64,338 | |||||||||||||||

| 262,558 | 269,620 | 271,625 | 260,945 | 262,542 | ||||||||||||||||

| Gross profit |

30,314 | 28,241 | 27,937 | 28,989 | 28,426 | |||||||||||||||

| Administrative and advertising |

15,127 | 14,638 | 14,131 | 14,301 | 13,976 | |||||||||||||||