Attached files

| file | filename |

|---|---|

| 8-K - HELIX ENERGY SOLUTION FORM 8-K DATED 7-28-10 - HELIX ENERGY SOLUTIONS GROUP INC | form8k.htm |

| EX-99.1 - PRESS RELEASE DATED 7-28-10 - HELIX ENERGY SOLUTIONS GROUP INC | exh99-1.htm |

July 29, 2010

Second Quarter 2010 Conference Call

Helix Producer I operating at BP Macondo spill site

Changing the way you succeed.

Forward-Looking Statements

2

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934. All such statements, other than statements of

historical fact, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, including, without limitation, any projections of financial items; future production volumes, results of

exploration, exploitation, development, acquisition and operations expenditures, and prospective reserve levels of

properties or wells; any statements of the plans, strategies and objectives of management for future operations; any

statements concerning developments, performance or industry rankings; and any statements of assumptions

underlying any of the foregoing. These statements involve certain assumptions we made based on our experience

and perception of historical trends, current conditions, expected future developments and other factors we believe

are reasonable and appropriate under the circumstances. The forward-looking statements are subject to a number

of known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially.

The risks, uncertainties and assumptions referred to above include the performance of contracts by suppliers,

customers and partners; employee management issues; local, national and worldwide economic conditions;

uncertainties inherent in the exploration for and development of oil and gas and in estimating reserves; complexities

of global political and economic developments; geologic risks, volatility of oil and gas prices and other risks described

from time to time in our reports filed with the Securities and Exchange Commission (“SEC”), including the Company’s

Annual Report on Form 10-K for the year ended December 31, 2009, and any subsequent quarterly report on Form

10-Q. You should not place undue reliance on these forward-looking statements which speak only as of the date of

this presentation and the associated press release. We assume no obligation or duty and do not intend to update

these forward-looking statements except as required by the securities laws.

1933 and Section 21E of the Securities Exchange Act of 1934. All such statements, other than statements of

historical fact, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, including, without limitation, any projections of financial items; future production volumes, results of

exploration, exploitation, development, acquisition and operations expenditures, and prospective reserve levels of

properties or wells; any statements of the plans, strategies and objectives of management for future operations; any

statements concerning developments, performance or industry rankings; and any statements of assumptions

underlying any of the foregoing. These statements involve certain assumptions we made based on our experience

and perception of historical trends, current conditions, expected future developments and other factors we believe

are reasonable and appropriate under the circumstances. The forward-looking statements are subject to a number

of known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially.

The risks, uncertainties and assumptions referred to above include the performance of contracts by suppliers,

customers and partners; employee management issues; local, national and worldwide economic conditions;

uncertainties inherent in the exploration for and development of oil and gas and in estimating reserves; complexities

of global political and economic developments; geologic risks, volatility of oil and gas prices and other risks described

from time to time in our reports filed with the Securities and Exchange Commission (“SEC”), including the Company’s

Annual Report on Form 10-K for the year ended December 31, 2009, and any subsequent quarterly report on Form

10-Q. You should not place undue reliance on these forward-looking statements which speak only as of the date of

this presentation and the associated press release. We assume no obligation or duty and do not intend to update

these forward-looking statements except as required by the securities laws.

References to quantities of oil or gas include amounts we believe will ultimately be produced, and may include

“proved reserves” and quantities of oil or gas that are not yet classified as “proved reserves” under SEC definitions.

Statements of oil and gas reserves are estimates based on assumptions and may be imprecise. Investors are urged

to consider closely the disclosure regarding reserves in our 2009 Form 10-K.

“proved reserves” and quantities of oil or gas that are not yet classified as “proved reserves” under SEC definitions.

Statements of oil and gas reserves are estimates based on assumptions and may be imprecise. Investors are urged

to consider closely the disclosure regarding reserves in our 2009 Form 10-K.

Changing the way you succeed.

Presentation Outline

3

• Executive Summary

Summary of Q2 2010 Results (pg. 4)

2010 Outlook (pg. 8)

• Operational Highlights by Segment

Contracting Services (pg. 11)

Oil & Gas (pg. 17)

• Key Balance Sheet Metrics (pg. 20)

• Non-GAAP Reconciliations (pg. 22)

• Questions & Answers

Q4000 flaring oil and gas at BP Macondo spill site

Changing the way you succeed.

Executive Summary

4

($ in millions, except per share data)

(A) Results of Cal Dive, our former Shelf Contracting business, were consolidated through June 10, 2009, at which time our ownership interest dropped below 50%; thereafter, our remaining

interest was accounted for under the equity method of accounting until September 23, 2009, when we reduced our holdings with the sale of a substantial portion of our remaining interest in

Cal Dive. Revenues from our Shelf Contracting business totaled $197.7 million and $404.7 million in the three and six months ended June 30, 2009.

interest was accounted for under the equity method of accounting until September 23, 2009, when we reduced our holdings with the sale of a substantial portion of our remaining interest in

Cal Dive. Revenues from our Shelf Contracting business totaled $197.7 million and $404.7 million in the three and six months ended June 30, 2009.

(B) Included revenues of $73.5 million of previously disputed accrued royalties in first quarter 2009.

(C) After $53.4 million of non-cash charges related to convertible preferred stock in first quarter 2009.

(D) See non-GAAP reconciliations on slides 22-23.

(E) EBITDAX excludes Cal Dive contribution in all periods presented.

(B)

(C)

(A)

Changing the way you succeed.

Executive Summary

5

Second quarter results included the following matters:

• Non-cash impairment charges of $159.9 million ($1.00 per diluted share, after taxes) primarily

associated with a reduction in carrying values of 15 Gulf of Mexico (“GOM”) shelf oil and gas

properties due to a revision in mid-year proved reserve estimates resulting from the

reassessment of field economics.

associated with a reduction in carrying values of 15 Gulf of Mexico (“GOM”) shelf oil and gas

properties due to a revision in mid-year proved reserve estimates resulting from the

reassessment of field economics.

• In addition, we recorded incremental depletion expense of $18.8 million as a result of a reduction

in mid-year proved reserves for our deepwater Bushwood field.

in mid-year proved reserves for our deepwater Bushwood field.

Changing the way you succeed.

Executive Summary

6

• Contracting Services

o High utilization of Well Ops vessels; Well Enhancer and Seawell in the North Sea and Q4000 in

the Gulf of Mexico

the Gulf of Mexico

o Helix Producer I placed into service and contracted to BP

o Caesar placed into service and commenced GOM pipeline installation

• Oil and Gas

o Mid-year GOM reserve report finalized, with proved reserves of approximately 400 Bcfe

o Estimated PV-10 value of approximately $1.3 billion

o Downward revision of approximately 140 Bcfe from year end

o Proved developed- 43%

o Proved undeveloped- 57%

o Oil- 40%, Gas- 60%

o Second quarter average production rate of approximately 131 Mmcfe/d

o July average production rate of approximately 110 Mmcfe/d through the 27th

o Phoenix production to start upon return of Helix Producer I from BP spill containment operations

Changing the way you succeed.

Executive Summary

7

• Oil and gas production totaled 11.9 Bcfe for Q2 2010 versus 11.3 Bcfe in Q1 2010

o Avg realized price for oil of $72.59 / bbl ($71.82 / bbl in Q1 2010), inclusive of hedges

o Avg realized price for gas of $6.10 / Mcf ($5.75 / Mcf in Q1 2010), inclusive of hedges

• Balance sheet remains strong (see slide 20)

o Net debt balance of $1.09 billion at June 30, 2010

o Liquidity* of $647 million at June 30, 2010

*Liquidity as we define it is equal to cash and cash equivalents ($270 million), plus available capacity under our revolving credit facility ($377 million).

Oil and Gas (continued)

Changing the way you succeed.

2010 Outlook

8

• Contracting Services activity in Q3 2010 expected to stay consistent with Q2

o Q4 activity forecasted to decline due to seasonal and other factors

o Well intervention activity particularly robust

• Oil and gas revised downward

o Deferred start-up of Phoenix production due to HPI / BP operations

o Higher DD&A rates due to Bushwood reserve revisions; DD&A rates comparable to

Q2, 2010

Q2, 2010

• Capital expenditures of approximately $190 million expected for 2010

o $80 million relates to completion of major vessel projects

o Oil and Gas capital expenditures of approximately $70 million, excluding P&A of

approximately $60 million

approximately $60 million

Changing the way you succeed.

2010 Outlook

9

|

Broad Metrics

|

2010 Higher End

|

2010 Lower End

|

2009

|

|

Production Range

|

45 Bcfe

|

40 Bcfe

|

44 Bcfe

|

|

EBITDA

|

$450 million

|

$400 million

|

$490 million

|

|

CAPEX

|

$190 million

|

$190 million

|

$328 million

|

|

Commodity Price

Deck |

2010 Higher End

|

2010 Lower End

|

2009

|

|

|

Hedged

|

Oil

|

$75.43/ bbl

|

$75.51 / bbl

|

$67.11 / bbl

|

|

Gas

|

$5.82 / mcf

|

$5.94 / mcf

|

$7.75 / mcf

|

|

Changing the way you succeed.

10

Operations Highlights

Changing the way you succeed.

11

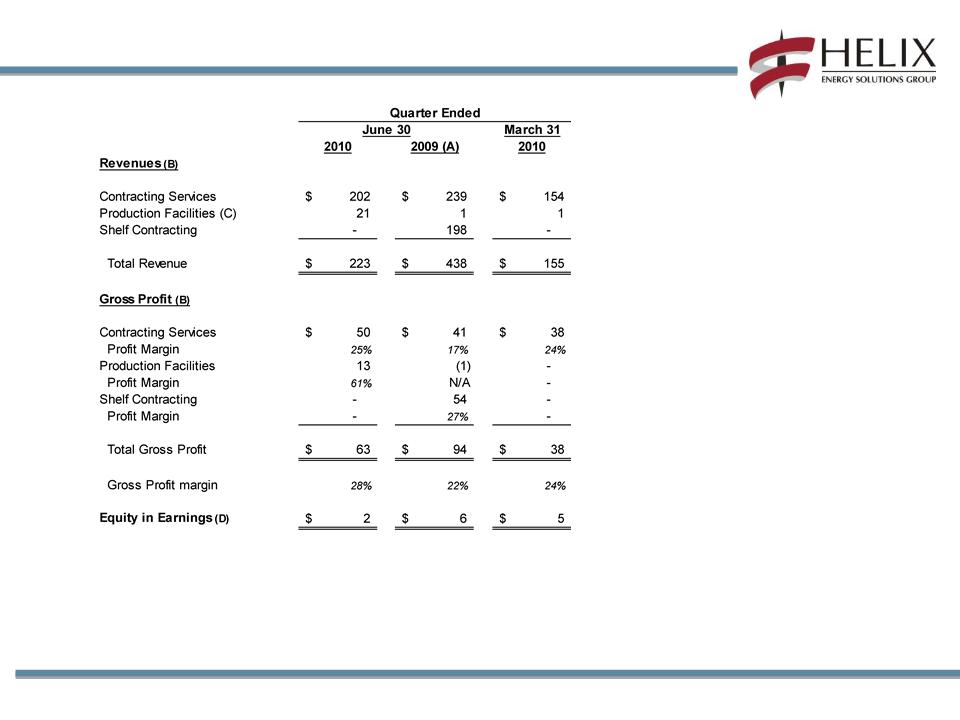

($ in millions, except percentages)

(A) Results of Cal Dive, our former

Shelf Contracting business, were

consolidated through June 10,

2009, at which time our ownership

interest dropped below 50%;

thereafter, our remaining interest

was accounted for under the equity

method of accounting until

September 23, 2009, when we

reduced our holdings with the sale

of a substantial portion of our

remaining interest in Cal Dive.

Shelf Contracting business, were

consolidated through June 10,

2009, at which time our ownership

interest dropped below 50%;

thereafter, our remaining interest

was accounted for under the equity

method of accounting until

September 23, 2009, when we

reduced our holdings with the sale

of a substantial portion of our

remaining interest in Cal Dive.

(B) See non-GAAP reconciliation on

slides 22-23. Amounts are prior to

intercompany eliminations.

slides 22-23. Amounts are prior to

intercompany eliminations.

(C) Includes both charter fee to Phoenix

field and BP.

field and BP.

(D) Amounts primarily represent equity

in earnings of Marco Polo and

Independence Hub investments, net

of our share of losses ($4.3 million

and $1.4 million in the second

quarter and first quarter of 2010,

respectively) associated with the

startup of the CloughHelix JV in

Australia.

in earnings of Marco Polo and

Independence Hub investments, net

of our share of losses ($4.3 million

and $1.4 million in the second

quarter and first quarter of 2010,

respectively) associated with the

startup of the CloughHelix JV in

Australia.

Contracting Services

Changing the way you succeed.

Contracting Services Q2 2010 Utilization

Intrepid

Express

Caesar (placed in service end of May)

Express

Caesar (placed in service end of May)

Olympic Canyon

Olympic Triton

Island Pioneer

Seawell

Well Enhancer

Q4000

Well Enhancer

Q4000

40 ROVs

2 ROV Drill Units

5 Trenchers

Deep Cygnus

Normand Fortress

Normand Fortress

12

Changing the way you succeed.

13

Macondo Containment (MC252)

Helix Containment Vessels

Changing the way you succeed.

14

Q4000 as command vessel for top kill operations

Q4000 burning oil & gas

New buoy for HPI under construction

HPI in MC252 processing Macondo production

Helix vessels at work in MC252

Helix is well positioned to support GOM Producers

Changing the way you succeed.

15

Contracting Services - Subsea Construction

Subsea Construction

• Caesar commenced installation

of 46 mile / 20 inch pipeline in

GOM

of 46 mile / 20 inch pipeline in

GOM

• Express and Intrepid enjoyed

high utilization in the quarter

high utilization in the quarter

• Expect third quarter utilization

for subsea construction fleet to

be >90%

for subsea construction fleet to

be >90%

ROV - Robotics

• Enjoyed high utilization for five chartered ROV support

vessels. Seacor Canyon has been returned to owners

vessels. Seacor Canyon has been returned to owners

• Island Pioneer and Deep Cygnus with Canyon trenchers

T750 and I-Trencher active in North Sea and offshore

Norway

T750 and I-Trencher active in North Sea and offshore

Norway

• Olympic Triton worked for Technip on the Jubilee project

offshore Ghana

offshore Ghana

• All ROV support vessels operated outside of the GOM in Q2

Canyon ROV working on Jubilee project offshore Ghana

Changing the way you succeed.

16

Contracting Services - Well Ops

North America

• Q4000 worked for Newfield on deepwater well

intervention job in April and on BP Macondo

containment, top kill and burn-off in May and June

intervention job in April and on BP Macondo

containment, top kill and burn-off in May and June

• Healthy backlog for remainder of 2010

North Sea

• Seawell and Well Enhancer enjoyed 99% utilization in

the quarter with strong performance on well intervention

projects in the North Sea

the quarter with strong performance on well intervention

projects in the North Sea

• Progressing Statoil Cat B FEED study for new well

intervention semi-submersible for offshore Norway

intervention semi-submersible for offshore Norway

• Healthy backlog for remainder of 2010

Asia Pacific

• Executed contract with China National Offshore Oil

Company (CNOOC) for Lufeng well intervention project

in South China Sea using the Normand Clough

Company (CNOOC) for Lufeng well intervention project

in South China Sea using the Normand Clough

• Work commenced in Q3, 2010

Well Ops APAC Subsea Intervention Lubricator being

tested for Well Ops Lufeng project

tested for Well Ops Lufeng project

Changing the way you succeed.

17

(A) Reflects hurricane insurance

proceeds less related costs. In

Q2 2009 proceeds totaled $97.7

million, offset by $7.4 million of

hurricane-related repair costs

and $51.5 million of additional

hurricane-related impairment

charges, including an estimated

$43.8 million increase to our

asset retirement obligations for

hurricane-affected properties.

proceeds less related costs. In

Q2 2009 proceeds totaled $97.7

million, offset by $7.4 million of

hurricane-related repair costs

and $51.5 million of additional

hurricane-related impairment

charges, including an estimated

$43.8 million increase to our

asset retirement obligations for

hurricane-affected properties.

(B) Second quarter 2010

impairments primarily associated

with the reduction in carrying

values of 15 GOM properties due

to a revision in mid-year

reserves. Second quarter 2009

impairments related to reduction

in carrying values of certain oil

and gas properties due to

reserve revisions. First quarter

2010 impairments related to

deterioration in certain field

economics due to lower natural

gas prices in the period.

impairments primarily associated

with the reduction in carrying

values of 15 GOM properties due

to a revision in mid-year

reserves. Second quarter 2009

impairments related to reduction

in carrying values of certain oil

and gas properties due to

reserve revisions. First quarter

2010 impairments related to

deterioration in certain field

economics due to lower natural

gas prices in the period.

(C) Including effect of settled hedges

and mark-to-market derivative

contracts.

and mark-to-market derivative

contracts.

Oil & Gas

Changing the way you succeed.

Oil & Gas

18

(A) Included accretion expense and an incremental $18.8 million in the quarter ended June 30, 2010 for our Bushwood field.

(B) Excluded hurricane-related repairs of $1.6, $(90.3) and $2.1 million, net of insurance recoveries, for the quarters ended June 30, 2010, June 30, 2009 and

March 31, 2010, respectively.

March 31, 2010, respectively.

(C) Excluded exploration expenses of $1.2, $1.5 and $0.2 million, and abandonment costs of $0.4, $0.8 and $0.8 million for the quarters ended June 30, 2010,

June 30, 2009 and March 31, 2010, respectively.

June 30, 2009 and March 31, 2010, respectively.

Operating Costs ($ in millions, except per Mcfe data)

Changing the way you succeed.

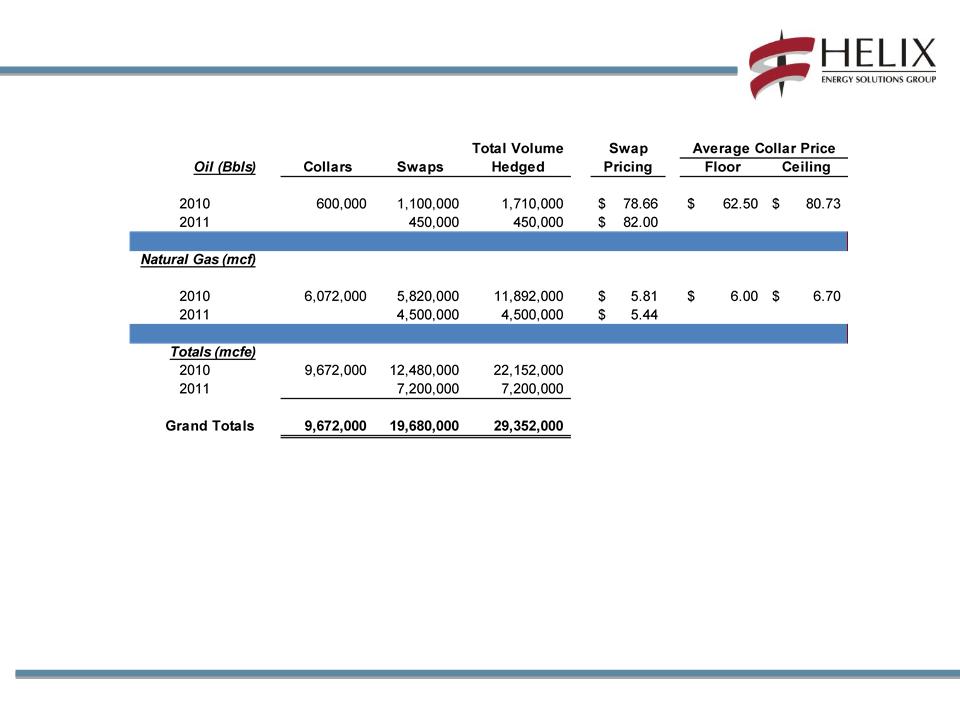

Summary of July 2010 - Dec 2011 Hedging Positions

19

Changing the way you succeed.

Key Balance Sheet Metrics

20

Debt (A)

Liquidity (B) of $647 million at 6/30/10

(A) Includes impact of unamortized debt discount under our Convertible Senior Notes.

(B) Liquidity as we define it is equal to cash and cash equivalents ($270 million), plus

available capacity under our revolving credit facility ($377 million).

available capacity under our revolving credit facility ($377 million).

Changing the way you succeed.

21

Non-GAAP

Reconciliations

Reconciliations

Changing the way you succeed.

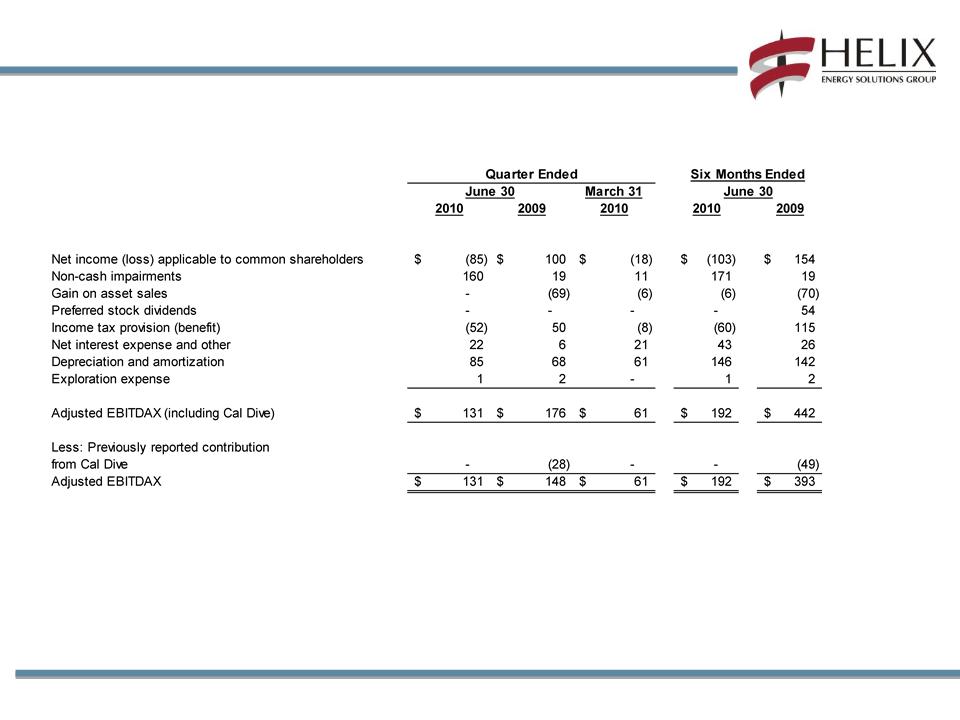

Non GAAP Reconciliations

22

Adjusted EBITDAX ($ in millions)

We calculate adjusted EBITDAX as earnings before net interest expense, taxes, depreciation and amortization,

and exploration expense. Further, we do not include earnings from our former interest in Cal Dive in any periods presented in our adjusted

EBITDAX calculation. These non-GAAP measures are useful to investors and other internal and external users of our financial statements in

evaluating our operating performance because they are widely used by investors in our industry to measure a company's operating

EBITDAX calculation. These non-GAAP measures are useful to investors and other internal and external users of our financial statements in

evaluating our operating performance because they are widely used by investors in our industry to measure a company's operating

performance without regard to items which can vary substantially from company to company and help investors meaningfully compare our results

from period to period. Adjusted EBITDAX should not be considered in isolation or as a substitute for, but instead is supplemental to, income from

operations, net income or other income data prepared in accordance with GAAP. Non-GAAP financial measures should be viewed in addition to,

and not as an alternative to our reported results prepared in accordance with GAAP. Users of this financial information should consider the types

of events and transactions which are excluded.

from period to period. Adjusted EBITDAX should not be considered in isolation or as a substitute for, but instead is supplemental to, income from

operations, net income or other income data prepared in accordance with GAAP. Non-GAAP financial measures should be viewed in addition to,

and not as an alternative to our reported results prepared in accordance with GAAP. Users of this financial information should consider the types

of events and transactions which are excluded.

Changing the way you succeed.

Revenue and Gross Profit As Reported ($ in millions)

23

Non GAAP Reconciliations

Changing the way you succeed.