Attached files

| file | filename |

|---|---|

| EX-16.3 - LETTER - Enservco Corp | aspen163.htm |

| EX-10.9 - 2010 STOCK INCENTIVE PLAN - Enservco Corp | aspen109.htm |

| EX-21.1 - SUBSIDIARIES OF ASPEN - Enservco Corp | aspen211.htm |

| EX-99.1 - FINANCIAL STATEMENTS OF DILLCO - Enservco Corp | aspen991.htm |

| EX-16.2 - LETTER - Enservco Corp | aspen162.htm |

| EX-14.1 - CODE OF BUSINESS CONDUCT - Enservco Corp | aspen141.htm |

| EX-3.02 - AMENDED AND RESTATED BY-LAWS - Enservco Corp | aspen302.htm |

| EX-10.12 - INDEMNITY AGREEMENT - Enservco Corp | aspen1012.htm |

| EX-10.06 - EMPLOYMENT AGREEMENT (KASCH) - Enservco Corp | aspen1006.htm |

| EX-10.11 - LOAN AGREEMENT - Enservco Corp | aspenexh1011.htm |

| EX-10.10 - LOAN AGREEMENT - Enservco Corp | aspenexh1010.htm |

| EX-10.05 - EMPLOYMENT AGREEMENT (HERMAN) - Enservco Corp | aspen1005new.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 8-K

|

CURRENT REPORT

|

|

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report:

July 27, 2010

ASPEN EXPLORATION CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

0-9494

|

84-0811316

|

|

State of

|

Commission File

|

IRS Employer

|

|

Incorporation

|

Number

|

Identification No.

|

830 Tenderfoot Hill Road, Suite 310

Colorado Springs, CO 80906

Address of principal executive offices

719-867-9911

Telephone number, including

Area code

2050 S. Oneida St., Suite 208, Denver, CO 80224-2426

Former name or former address if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

1

Item 2.01 - Completion of Acquisition or Disposition of Assets.

I. GENERAL

On June 24, 2010, Aspen Exploration Corporation (“Aspen”) entered into an Agreement and Plan of Merger and Reorganization (the “Agreement”). The material terms of the Agreement were described in a Current Report on Form 8-K dated June 24, 2010 and filed with the Securities and Exchange Commission on June 24, 2010.

Pursuant to the Agreement, on July 27, 2010 (the “Effective Date of the Merger Transaction”) Dillco Fluid Service, Inc. (“Dillco”) merged with Aspen Newco Inc. (“Newco”) with Dillco being the surviving entity of that transaction (the “Merger Transaction”). Newco was a wholly owned subsidiary of Aspen and was formed solely to effect the transaction described in the Agreement. As a result of the Merger Transaction, Dillco became a wholly owned subsidiary of Aspen.

As further described in this Form 8-K, Dillco and its subsidiaries (collectively referred to in this Form 8-K as “DHW”) provide services to the domestic onshore oil and natural gas industry including hot oiling, acidizing, frac heating, freshwater and saltwater hauling, frac tank rental, well site construction and other general oil field services. DHW’s operations are currently primarily within oil and natural gas producing regions in Kansas, Oklahoma, Utah, Colorado, Pennsylvania, and West Virginia. DHW is currently considering opportunities to provide services in the Bakken Shale region in North Dakota and in the Eagle Ford Shale basin in southern Texas.

In the Merger Transaction each share of Dillco common stock that was issued and outstanding at the closing of the Merger Transaction was converted into the right to receive restricted shares of Aspen’s common stock. In total Aspen issued 14,519,244 shares of its restricted common stock to effect the Merger Transaction, which at the closing, and based on the closing sales price of Aspen’s common stock on the trading day before the announcement of the Merger Transaction ($0.36), represented approximately $5,227,000 in value for the Dillco shareholders.

Michael D. Herman, an officer and director of Dillco and owner of 90% of Dillco’s outstanding shares, owned 277,400 shares of Aspen common stock immediately before the completion of the Merger Transaction, and now directly and indirectly owns 13,344,320 shares after completion of the transaction. Mr. Herman’s ownership interest in Aspen before the Merger Transaction had no bearing on the Company’s decision to enter into the Agreement. Aspen conducted a significant amount of due diligence prior to entering into the Agreement and closing the Merger Transaction. Further, prior to closing the Merger Transaction, Aspen received an opinion from a third party financial advisor that the consideration paid by Aspen to effect the Merger Transaction is fair to Aspen’s stockholders from a financial point of view. Other than Mr. Herman’s ownership of Aspen common stock, there were no material relationships between Aspen or its affiliates and any of the parties to the Merger Agreement, other than the Merger Agreement.

Following the Effective Date of the Merger Transaction, Aspen filed a trade name affidavit with the Secretary of State of Colorado reflecting that it will do business as Enservco Corporation. In the coming weeks, the Company or one of its subsidiaries will file trade name affidavits in other states to protect the name Enservco in those states, and is considering whether to apply for a national trademark.

Aspen was a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) immediately before the completion of the Merger Transaction. However as a result of the Merger Transaction it is no longer a shell company. Accordingly, pursuant to the requirements of Item 2.01(a) (f) of Form 8-K, set forth below is the information that would be required if Aspen was filing a general form for registration of securities on Form 10 under the Exchange Act, reflecting Aspen’s common stock, which is the only class of its securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of the Merger Transaction.

2

II. INFORMATION REGARDING THE COMPANY AFTER GIVING EFFECT TO THE MERGER TRANSACTION

Forward Looking Statements

The information in this discussion contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements involve risks and uncertainties, including statements regarding the Company’s capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may”, “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” estimate,” “predict,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Actual events or results may differ materially. The Company disclaims any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements. The information constitutes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Overview

Dillco conducts certain of its business operations directly, but other portions of its operations and assets are (and historically were) operated and held in various subsidiary and related entities. To avoid confusion among the various entities described and referred to in this Form 8-K, and to distinguish between their operations and activities on a pre and post Merger Transaction basis, unless otherwise indicated the following entity names and/or abbreviations have the following meanings when used in this Form 8-K:

|

Entity Name/Abbreviation

|

Explanation/Reference

|

|

“Aspen”

|

Aspen Exploration Corporation and activities it engaged in prior to the Effective Date of the Transaction

|

|

“Company” or “Enservco”

|

Aspen Exploration Corporation on a consolidated or company-wide basis after including Dillco and Heat Waves as Aspen intends to operate under the name “Enservco.”

|

|

“Dillco”

|

Dillco Fluid Service, Inc. without regard to any of its current or former parent or subsidiary entities.

|

|

“DHW”

|

DHW means Dillco and its subsidiary entities as a whole without regard to Aspen.

|

|

“Heat Waves”

|

Heat Waves Hot Oil Service LLC, without regard to any related entities.

|

|

“ELLC”

|

Enservco LLC, the former holding company of Dillco, Heat Waves and other related entities, which as of July 26, 2010 merged with and into Dillco resulting in the cessation of ELLC’s separate existence.

|

|

“Real GC”

|

Real GC, LLC is a Colorado limited liability company that owns land in Garden City, Kansas. Real GC is a wholly owned subsidiary of Heat Waves.

|

|

“Trinidad Housing”

|

Trinidad Housing, LLC is a Colorado limited liability company that owns land and a building in Trinidad, Colorado that has been converted for use as rental housing for Heat Waves employees from out of town who were located at the Trinidad facility. Trinidad Housing is a wholly owned subsidiary of Dillco.

|

|

“HNR”

|

HNR LLC is a related entity formed as a Colorado limited liability company and owned by Mr. Herman and members of his family. Prior to December 31, 2009, HNR owned assets used by Dillco.

|

|

“HES”

|

HE Services LLC is a subsidiary of Heat Waves and is a Nevada limited liability company. HES owns construction equipment used by Heat Waves. Prior to March 1, 2010 HES was an affiliated company owned by Mr. Herman.

|

3

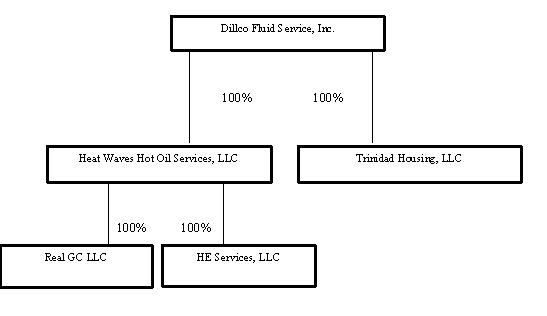

ELLC historically (and prior to the Merger Transaction) served as a holding company for Dillco and various related and affiliated companies. As further described below, on July 26, 2010 ELLC merged with and into Dillco with Dillco being the surviving entity in that transaction. As a result, Dillco was not only an operating company itself but the parent corporation of various entities including Heat Waves Hot Oil Service LLC (see organizational chart below).

A. Description of the Business

Aspen

Aspen was incorporated under the laws of the State of Delaware on February 28, 1980 for the primary purpose of acquiring, exploring and developing oil and natural gas and other mineral properties. Historically, and through its fiscal year ended June 30, 2009 Aspen’s emphasis had been participation in the oil and natural gas segment, acquiring interests in producing oil or natural gas properties and participating in drilling operations. Previously Aspen was engaged in a broad range of activities associated with the oil and natural gas business in an effort to develop oil and natural gas reserves primarily in the Sacramento Valley in California and also in the East Poplar Field in Montana. In the 1980’s and 1990’s, Aspen also participated in various hard-rock mineral ventures, primarily involving the exploration for gold in various parts of Alaska.

On June 30, 2009, Aspen disposed of all of its remaining oil and natural gas producing assets and as a result was no longer engaged in active business operations. Since June 30, 2009, Aspen primarily focused on identifying and executing upon a business opportunity. On June 24, 2010, Aspen entered into an Agreement and Plan of Merger and Reorganization (the “Agreement”) with Dillco. Going forward Aspen intends to focus its business operations primarily on those business operations conducted by DHW. Aspen also intends to operate its business under the name “Enservco Corporation” and may propose a name change to its stockholders at a future meeting of stockholders.

4

DHW

DHW provides oil field services to the domestic onshore oil and natural gas industry. These services include pressure testing, hot oiling, acidizing, frac heating, freshwater and saltwater hauling, frac tank rental, well site construction and other general oil field services. DHW currently operates in southern Kansas, northwestern Oklahoma, northeastern Utah, northern New Mexico, southern Wyoming, northwestern West Virginia, Colorado, and southwest Pennsylvania.

Historically, DHW has focused its growth strategy on strategic acquisitions of operating companies and then expanding operations through additional capital investment consisting of the acquisition and fabrication of property and equipment. DHW’s strategy also included expanding DHW’s geographical footprint as well as expanding the services it provides. These strategies are exemplified by the acquisitions of operating entities described below as well as: (1) in 2008 and 2009, DHW spent approximately $7.8 million and $2.0 million, respectively for the acquisition and fabrication of property and equipment and (2) to expand its footprint, in mid-2008 Heat Waves moved into northwestern Utah, and in early 2010 Heat Waves began providing services in the Marcellus Shale natural gas field in Pennsylvania and West Virginia. Heat Waves is currently exploring opportunities to provide services in North Dakota and Texas.

Going forward, the Company expects to continue to pursue its growth strategies by exploring additional acquisitions, considering expansion of the geographic areas in which it operates and the products and services it provides to customers, as well as further investments in its assets and equipment.

DHW Corporate History and Structure.

In March 2006, Michael D. Herman acquired a majority interest in Heat Waves. At that time Heat Waves had been in active business operations for approximately eight years, primarily focusing its operations in eastern Colorado and western Kansas, providing hot oiling, acidizing, frac heating and water hauling services. In 2008, Mr. Herman acquired the remaining membership interests in Heat Waves thereby becoming the 100% interest holder.

Mr. Herman formed ELLC in May 2007 to hold ownership interests in various oil and natural gas service companies, including Heat Waves. In December 2007, ELLC acquired all of the outstanding stock of Dillco which was an established service company located in Hugoton, Kansas. Dillco is a Kansas corporation that was formed in 1984. Dillco’s services consist primarily of water hauling, well site construction, and the rental of frac tanks.

In August 2009, Rick D. Kasch, the principal financial officer of the DHW entities, acquired from Mr. Herman a 10% membership interest in ELLC and a 5% membership interest in HES.

Reorganization of DHW. Starting in 2009, ELLC, DHW and other related entities engaged n various transactions that in an attempt to reorganize DHW as a whole with the aim to achieve better operational and administrative efficiencies. The various actions and transactions effected to accomplish this reorganization are described below.

5

In December 2009, HNR sold assets consisting of land (including disposal wells), buildings and equipment (frac tanks, trailers and dozers) to ELLC for approximately $1.1 million which was equal to historical carrying cost and approximated fair value based on an independent appraisal conducted in December 2009. These assets were, and currently are, used by Dillco in its business operations. ELLC paid no cash for this equipment, but set off the purchase price against certain debt that HNR owed to ELLC. ELLC then contributed the equipment to its 100% owned subsidiary, Dillco.

Also in December 2009, Heat Waves purchased Mr. Herman’s membership interest in Real GC, LLC for $174,382, the parties’ estimate of the fair value of Real GC and the real properties that it owns. Real GC owns land in Garden City, Kansas which Heat Waves uses for an acid dock and the storage of trucks and equipment.

In December 2009, ELLC contributed its ownership interests in Heat Waves and Trinidad Housing to Dillco, so that all material business operations and related assets were held directly by Dillco or its subsidiary entities.

In March 2010 Mr. Herman contributed his ownership in HES to ELLC which in turn contributed the ownership to Dillco, which in turn contributed the ownership to Heat Waves. HES’ assets consisted of construction equipment used by Heat Waves. No cash was paid for the ownership interest. The transaction was recorded on ELLC’s books as an owner’s contribution.

On July 26, 2010, immediately prior to completion of the Merger Transaction, Dillco merged with ELLC with Dillco being the surviving entity. Prior to that transaction, ELLC directly and indirectly owned all of the outstanding stock and/or membership interests of Dillco, Heat Waves and other entities that owned assets utilized by Dillco and Heat Waves in their business operations. As a result, at the time of the Merger Transaction, Dillco and its subsidiary entities were organized as set forth below:

6

Immediately prior to the completion of the Merger Transaction, and as a result of the reorganization described above, Dillco had two shareholders, Mr. Herman (90% of the outstanding Dillco stock) and Mr. Kasch (10%). Mr. Herman has been a Manager, Chairman, Chief Executive Officer, and control person of ELLC, Dillco, Heat Waves and the other Dillco subsidiaries since the time of their formation and/or acquisition. Mr. Kasch has served as the Chief Financial Officer and a Manager for these same entities since the time of their formation and/or acquisition.

The Company’s Business Structure. Dillco and its wholly owned subsidiary Heat Waves are the primary operating entities through which the Company will conduct its operations. The below table provides an overview of the Company’s subsidiaries as a result of the completion of the Merger Transaction.

|

Name

|

State of Formation

|

Ownership

|

Business

|

|

Dillco Fluid Service, Inc.

|

Kansas

|

100% by Enservco

|

Oil and natural gas field services, including water hauling and well site construction primarily in the Hugoton Basin in western Kansas and northeastern Oklahoma.

|

|

Aspen Gold Mining Co.

|

Colorado

|

100% by Enservco

|

No active business operations or assets.

|

|

Heat Waves Hot Oil Services LLC

|

Colorado

|

100% by Dillco

|

Oil and natural gas field services, including pressure testing, hot oiling, acidizing, and frac heating.

|

|

HE Services, LLC

|

Nevada

|

100% by Heat Waves

|

No active business operations. Owns construction equipment used by Heat Waves.

|

|

Real GC, LLC

|

Colorado

|

100% by Heat Waves

|

No active business operations. Owns real property in Garden City, Kansas.

|

|

Trinidad Housing, LLC

|

Colorado

|

100% by Dillco.

|

No currently active business operations. Owns real property in Trinidad, Colorado.

|

Overview of DHW’s Business:

DHW provides a wide range of services to a diverse group of independent and major oil and natural gas companies. These include well servicing (frac heating, hot oiling and acidizing), fluid services (fresh and salt water hauling) and well site construction services. These services play a fundamental role in establishing and maintaining a well throughout its productive life. DHW’s operations are currently concentrated in domestic, onshore oil and natural gas producing regions in southern Kansas, northwestern Oklahoma, northeastern Utah, northern New Mexico, southern Wyoming, northwestern West Virginia and all of Colorado and Pennsylvania. DHW is currently exploring opportunities, based on customer needs, to provide services in the Bakken Shale basin in North Dakota and the Eagle Ford Shale basin in south Texas.

7

Management believes that DHW is strategically positioned with its ability to provide its services to a large customer base in key oil and natural gas basins in the United States. Management is optimistic that as a result of the significant expenditures it has made in new equipment in combination with the benefits that may be realized from the Merger Transaction, that the Company will be able to further grow and develop DHW’s business operations.

Dillco. From its inception in 1974, Dillco has focused primarily on providing water hauling services, well site construction services and frac tank rental to energy companies working in western Kansas and northwest Oklahoma. Water hauling has been the primary source of Dillco’s revenue. Dillco currently owns and operates a fleet of water hauling trucks and related assets, including specialized tank trucks, frac tanks, water disposal wells, construction and other related equipment. These assets transport, store and dispose of both fresh and salt water, as well as provide well site construction and maintenance services.

Heat Waves. Heat Waves provides a range of well maintenance services to a diverse group of independent and major oil and natural gas companies. The primary services provided are intended to: (1) assist in the fracturing of formations for newly drilled producing oil and natural gas wells and (2) help maintain and enhance the production of existing wells throughout their productive life. These services consist of frac heating, hot oiling and acidizing. Heat Waves also provides water hauling and well site construction services. Heat Waves’ operations are in southern Kansas, northwestern Oklahoma, northeastern Utah, northern New Mexico, southern Wyoming, northwestern West Virginia, Colorado, and southwest Pennsylvania (Marcellus Shale). Heat Waves is currently exploring opportunities, based on customer needs, to provide services in the Bakken Shale basin in North Dakota and the Eagle Ford Shale basin in south Texas.

HES. HES owns construction and related equipment that Heat Waves uses in its well site construction and maintenance services. However, HES does not currently engage in any business activities itself. HES also owns a disposal well that Dillco uses for salt water disposal. HES acquired the well from Mr. Herman in March 2010 for $100,000, that is payable on or before September 15, 2010. Although this purchase price was not based on an appraisal, management of DHW believes that this transaction was fair to HES and its parent companies.

Real GC. Real GC owns land in Garden City, Kansas, which Heat Waves uses for the location of an acid dock facility, truck and inventory storage, and other related purposes.

Trinidad Housing. Trinidad Housing owns land and a building in Trinidad, Colorado that was previously used as a nursing home. The building has been converted for use as rental housing for Heat Waves employees from out of town that were located at the Trinidad facility. There currently are no such employees and the property is actively being marketed for sale.

Disposal Wells. Dillco and HES together own a total of five disposal wells and one temporarily abandoned oil well. The disposal wells are not currently commercially licensed and are used for disposing of salt water by Dillco and Heat Waves. HES plans to obtain a commercial license for one of its wells in the near future.

Products and Services

DHW provides a range of services to the owner and operators of oil and natural gas properties. Such services can generally be grouped into the three following categories:

(1) water hauling, frac tank rental and disposal services,

(2) well enhancement services, and

(3) construction services.

8

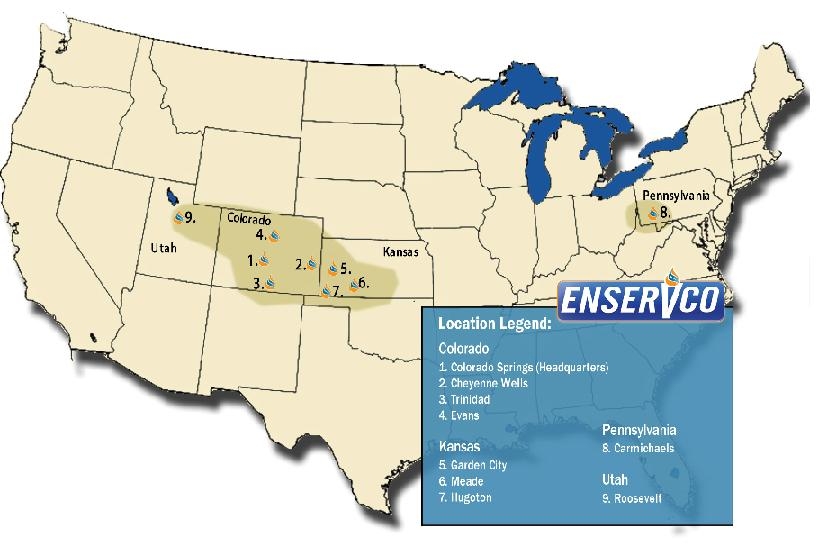

Dillco primarily provides water hauling, frac tank rental, and well site construction services whereas Heat Waves primarily provides well enhancement services, and construction services. The following map shows the primary areas in which Heat Waves and Dillco have active business operations.

The following is a further description of the services provided by DHW.

Water Hauling, Frac Tank Rental and Disposal Services.

Water Hauling - Water hauling accounts for approximately 40% of DHW’s combined revenues. Dillco currently owns and operates approximately 30 water hauling trucks equipped with pumps to move water from or into wells, tanks and other storage facilities in order to assist customers in managing their water-cost needs. Each truck has a hauling capacity of up to 130 barrels. The trucks are used to:

|

(1)

|

transport water to fill frac tanks on well locations,

|

|

(2)

|

transport contaminated water produced as a by-product of wells to disposal wells, including injection wells owned and operated by us,

|

|

(3)

|

transport drilling and completion fluids to and from well locations, and

|

|

(4)

|

following completion of fracturing operations, the trucks are used to transport the flow-back produced as a result of the fracturing process from the well site to disposal wells.

|

9

Most wells produce residual salt or fresh water in conjunction with the extraction of the oil or natural gas. Dillco’s trucks pick up water at the well site and transport it to a disposal well for injection or to other environmentally sound surface recycling facilities. This is regular maintenance work that is done on a periodic basis depending on the volume of water a well produces. Water-cost management is an ongoing need for oil and natural well gas operators throughout the life of a well. Dillco’s ability to outperform competitors in this segment is dependent on the significant economies relating to logistics - specifically, proximity between areas where water is produced or used and where strategic placement and/or access to both disposal wells and recycling facilities. Dillco, Heat Waves and HES own and/or operate five water disposal wells in Kansas and Oklahoma. It is management’s intent to expand the Company’s disposal well holdings and access to recycling facilities.

Typically Dillco and a customer enter into a contract for services after that customer has completed a competitive bidding process. Requirements for minor or incidental water hauling services are usually purchased on a “call out” basis and charged according to a published schedule of rates. Dillco competes for services both on a call out and contractual basis.

Workover, completion, and remedial activities also provide the opportunity for higher operating margins from tank rentals and water hauling services. Drilling and workover jobs typically require water for multiple purposes. Completion and workover procedures often also require large volumes of water for fracturing operations, a process of stimulating a well hydraulically to increase production. All fluids are required to be transported from the well site to an approved disposal facility.

Competitors in the water hauling business are mostly small, regionally focused companies. The level of water hauling activity is comprised of a relatively stable demand for services related to the maintenance of producing wells and a highly variable demand for services used in the drilling and completion of new wells. As a result, the level of domestic onshore drilling activity significantly affects the level of DHW’s activity in this service area.

Disposal Well Services – DHW derives revenues from five disposal wells it owns that have permits which allow for the injection of salt water and incidental non-hazardous oil and natural gas wastes. Our trucks frequently transport fluids to be disposed in these water disposal wells. DHW’s disposal wells have injection capacities of up to approximately 3,000 barrels per day. The disposal wells are located in southwestern Kansas and northwestern Oklahoma in areas in proximity to our customers’ producing wells. Most oil and natural gas wells produce varying amounts of water throughout their productive lives. In the states in which we operate, oil and natural gas wastes and water produced from oil and natural gas wells are required by law to be disposed of in authorized facilities, including permitted water disposal wells. These disposal wells are licensed by state authorities pursuant to guidelines and regulations imposed by the Environmental Protection Agency and the Safe Drinking Water Act and are completed in an environmentally sound manner in permeable formations below the fresh water table.

Frac Tank Rental. Dillco also generates revenues from the rental of frac tanks which can store up to 500 barrels of water and are used by oilfield operators to store fluids at the well site, including fresh water, salt water, and acid for frac jobs, flowback, temporary production and mud storage. DHW transports the tanks on its trucks to well locations that are usually within a 30 mile radius of its nearest yard but can range from just a couple of miles up to as many as 200 miles. Frac tanks are used during all phases of the life of a producing well. DHW generally rents frac tanks at daily rates and charges hourly rates for the transportation of the tanks to and from the well site.

10

Well Enhancement Services.

Well enhancement services consist of frac heating, acidizing, hot oiling services, and pressure testing. These services are provided primarily by Heat Waves which currently utilizes a fleet of approximately 100 custom designed trucks and other related equipment. Heat Waves’ operations are currently in southern Kansas, northwestern Oklahoma, northeastern Utah, northern New Mexico, southern Wyoming, northwestern West Virginia and Colorado and southwestern Pennsylvania (Marcellus Shale). Heat Waves is currently exploring opportunities, based on customer needs, to provide services in the Bakken Shale basin in North Dakota and the Eagle Ford Shale basin in south Texas. Well enhancement services accounted for approximately 45% of DHW’s total revenues for 2009 on a consolidated basis.

Frac Heating - Fracturing services are intended to enhance the production from oil and natural gas wells where the natural flow has been restricted by underground formations through the creation of conductive flowpaths to enable the hydrocarbons to reach the wellbore. The fracturing process consists of pumping a fluid slurry, which largely consists of fresh water and sand, into a cased well at sufficient pressure to fracture (i.e. create conductive flowpaths) the producing formation. Sand, bauxite or synthetic proppants are suspended in the fracturing fluid slurry and are pumped into the well under great pressure to fracture the formation. To ensure these solutions are properly mixed (gel frac) or that plain water (used in slick water fracs) can flow freely, the water frequently needs to be heated to a sufficient temperature as determined by the well owner/operator.

Heat Waves owns and operates frac heaters designed to heat large amounts of water stored in reservoirs or frac tanks. Heat Waves provides frac heating services to customers primarily in northeastern Utah, southern Wyoming, northwestern West Virginia and all of Colorado and Pennsylvania (Marcellus Shale). Heat Waves is also exploring opportunities in the Bakken Shale formation in northwestern North Dakota and the Eagle Ford Shale basin in southern Texas.

Acidizing - Acidizing is most often used for three functions:

| · |

increasing permeability throughout the formation,

|

| · |

cleaning up formation damage near the wellbore caused by drilling , and

|

| · |

for removing buildup of materials restricting the flow in the formation or through perforations in the well casing.

|

Heat Waves provides acidizing services by utilizing its fleet of mobile acid transport and pumping trucks. For most customers, Heat Waves supplies the acid solution and also pumps that solution into a given well. There are customers who provide their own solutions and hire Heat Waves to pump the solution.

11

Hot Oil Services – Hot oil services involve the circulation of a heated fluid, typically oil, to dissolve or dislodge paraffin or other hydrocarbon deposits from the tubing of a producing oil natural gas well. This is performed by circulating the hot oil down the casing and back up the tubing to remove the deposits from the well bore. Hot oiling is intended to melt the hydrocarbon deposits. Hot oil servicing also includes the heating of oil storage tanks. The heating of storage tanks is done:

(1) to eliminate water and other soluble waste in the tank for which the operator’s revenue is reduced at the refinery; and

(2) because heated oil flows more efficiently from the tanks to transports taking oil to the refineries in colder weather.

Pressure Testing – Pressure testing consist of pumping fluids into (1) new or existing wells or (2) other components of the well system such as flow lines to detect leaks, Hot oil trucks and pressure trucks are used to perform this service.

Construction Services.

Dillco and Heat Waves derive revenue from their fleet of power units which includes dozers, trenchers, motor graders, backhoes and other heavy equipment used in road and well-site construction. Contracts for well site construction services are normally awarded by our customers on the basis of competitive bidding and may range in scope from several days to several weeks in duration. Construction service revenues are directly impacted by the drilling activities of oil and natural gas companies.

Assets and Properties

As described above, DHW utilizes and owns a fleet of fluid trucks, frac tanks, construction equipment, disposal wells and other assets to provide its services and products. On a consolidated basis, approximately 55% of DHW’s total assets (excluding any real properly) are owned by Heat Waves and approximately 45% are owned by Dillco. As further described in the financial statements, substantially all of the equipment and personal property assets owned by Dillco and Heat Waves are subject to a security interest to secure loans made to Dillco and its subsidiary companies.

Historically, some of the equipment utilized by Dillco and Heat Waves was leased from related entities - HNR and HES. Previously HNR and HES were not subsidiary entities of Dillco, but were owned by Mr. Herman and his family. HNR was formed to acquire certain assets utilized primarily by Dillco, and HES was formed to acquire construction equipment leased to Heat Waves. As further described in Section H hereof, on December 31, 2009 Dillco acquired certain assets from HNR and then in March 2010 HES became a wholly owned subsidiary of Heat Waves.

Except as noted in the preceding paragraph, DHW acquired all of its owned property and leased its other properties from unaffiliated third parties. The following table sets forth real property owned and leased by the Company. Unless otherwise indicated, the properties are used in Heat Waves’ operations.

12

Owned Properties:

|

Location/Description

|

Approximate Size

|

|

Roosevelt, UT

· Shop

· Land - shop

|

5,000 sq. ft.

1.1 acres

|

|

Garden City, KS

· Shop*

· Land – shop*

· Land – acid dock, truck storage, etc.

|

11,700 sq. ft.

1 acre

10 acres

|

|

Trinidad, CO

· Shop*

· Land – shop*

· Employee rental housing – house

· Employee rental housing - land

|

9,200 sq. ft.

5 acres

5,734 sq. ft.

0.4 acre

|

|

Hugoton, KS (Dillco)

· Shop/Office/Storage

· Land – shop/office/storage

· Land - office

|

9,367 sq. ft.

3.3 acres

10 acres

|

|

Meade, KS (Dillco)

· Shop

· Land

|

7,000 sq. ft.

1.2 acres

|

* Property is collateral for debt incurred at time of purchase.

Leased Properties:

|

Location/Description

|

Approximate Size

|

Monthly Rental

|

Lease Expiration

|

|

Roosevelt, UT

· Shop

· Land

|

6,000 sq. ft.

10 acres

|

Prepaid for 60 months @ $2,500 per month

|

November 2014

|

|

Cheyenne Wells, CO

· Shop

· Land

|

3,000 sq.ft.

0.44 acre

|

$1,000

|

Month to month

|

|

Platteville, CO

· Shop

· Land

|

3,200 sq. ft.

1.5 acres

|

3,000

|

May 2011

|

|

Medicine Lodge

· Shop

· Land

|

4,000 sq. ft.

20 acres

|

1,000

|

Month to month

|

|

Carmichaels, PA

· Shop

· Land

|

5,000 sq. ft.

12.1 acres

|

$8,600

|

April 2012

|

|

Roosevelt, UT

· Employee housing

|

1,700 sq. ft.

|

$1,300

|

May 2011

|

|

Colorado Springs, CO

· Corporate offices

|

2,067 sq. ft.

|

$2,000

|

May 2011

|

|

Denver, CO

· Admin offices

|

1,108 sq. ft. plus 750 sq. ft. of basement storage

|

$1,261

|

June 2011 – terminable with 60 day notice

|

Note - All leases have renewal clauses

13

Competitive Business Conditions

The markets in which DHW operates are highly competitive. Competition is influenced by such factors as price, capacity, the quality and availability of equipment, availability of work crews, and reputation and experience of the service provider. DHW believes that an important competitive factor in establishing and maintaining long-term customer relationships is having an experienced, skilled, and well-trained work force. Although we believe customers consider all of these factors, price is often the primary factor in determining which service provider is awarded the work.

The demand for DHW’s services fluctuate primarily in relation to the price (or anticipated price) of oil and natural gas which, in turn, is largely driven by the worldwide supply of, and demand for, oil and natural gas. Generally, as supply of those commodities decreases and demand increases, service and maintenance requirements increase as oil and natural gas producers drill new wells and attempt to maximize the productivity of their existing wells to take advantage of the higher priced environment. However, in a lower oil and natural gas price environment, such as the one experienced during much of 2009, demand for service and maintenance decreases as oil and natural gas producers decrease their drilling activity and forego or reduce budgeted maintenance expenditures.

DHW’s competition primarily consists of small regional or local contractors. Dillco attempts to differentiate itself from its competition in large part through its superior equipment and the range and quality of services it has the capability to provide. DHW invests a significant amount of capital into purchasing, developing, and maintaining a fleet of trucks and other equipment that are critical to the services it provides. Further, DHW concentrates on providing services to a diverse group of large and small independent oil and natural gas companies. We believe we have been successful using this business model and believe it will enable us to continue to grow our business.

Dependence on One or a Few Major Customers

DHW serves numerous major and independent oil and natural gas companies that are active in its core areas of operations. Although DHW does not believe it is dependent on a single customer or a few customers, during fiscal 2009, DHW’s largest customer accounted for approximately 12% of total revenues (other customers are less than 7% of revenues). While DHW believes equipment could be redeployed in the current market environment if we lost any material customers, such loss could have an adverse effect on DHW’s business until the equipment is redeployed.

Seasonality

Portions of DHW’s operations are impacted by seasonal factors, particularly with regards to its frac water heating and hot oiling services. In regards to frac heating, because customers rely on Heat Waves to heat large amounts of water for use in fracturing formations, demand for this service is much greater in the colder months. Similarly, hot oiling services are in higher demand during the colder months when they are needed for maintenance of existing wells and to heat oil storage tanks.

14

Acidizing and well site maintenance (including roads) services are contra-seasonal to frac heating and hot oiling. New well site construction is done on request, but maintenance work is primarily during the non-winter months. Acidizing is also done primarily during non-winter months.

The hauling of water from producing wells is not as seasonal as the rest of the services as wells produce water year round regardless of weather conditions. Hauling of water for the drilling or fracturing of wells is not so much seasonal as it is dependent on when customers decide to drill or complete wells.

Raw Materials

DHW purchases a wide variety of raw materials, parts, and components that are made by other manufacturers and suppliers for our use. DHW is not dependent on any single source of supply for those parts, supplies or materials. However, there are a limited number of vendors for certain acids and chemicals. DHW utilizes a limited number of suppliers and service providers available to fabricate and/or construct the trucks and equipment used in its hot oiling, frac heating, and acid related services.

Patents, Trademarks, Licenses, Franchises, Concessions, Royalty Agreements or Labor Contracts

DHW enters into agreements with local property owners where its disposal wells are located whereby DHW generally agrees to pay those property owners a fixed amount per month plus a percentage of DHW’s revenues derived from utilizing those wells. The terms of these agreements are separately negotiated with the given property owner. In fiscal 2009, the total amount paid under these various agreements was less than $15,000 and given the amounts paid DHW does not believe these agreements are material to the Company or its business operations. Aspen may file for a national trademark for the name “Enservco,” but has not yet done so.

Government Regulation

DHW is subject to a variety of government regulations ranging from environmental to OSHA to the Department of Transportation. DHW does not believe that it is in material violation of any regulations that would have a significant negative impact on DHW’s operations.

Through the routine course of providing services, DHW handles and stores bulk quantities of hazardous materials. If leaks or spills of hazardous materials handled, transported or stored by us occur, DHW may be responsible under applicable environmental laws for costs of remediating any damage to the surface or sub-surface (including aquifers). DHW’s operations are subject to stringent federal, state and local laws regulating the discharge of materials into the environment or otherwise relating to health and safety or the protection of the environment. Numerous governmental agencies, such as the U.S. Environmental Protection Agency, commonly referred to as the “EPA,” issue regulations to implement and enforce these laws, which often require difficult and costly compliance measures. Failure to comply with these laws and regulations may result in the assessment of substantial administrative, civil and criminal penalties, as well as the issuance of injunctions limiting or prohibiting activities. In addition, some laws and regulations relating to protection of the environment may, in certain circumstances, impose strict liability for environmental contamination, rendering a person liable for environmental damages and cleanup costs without regard to negligence or fault on the part of that person. Strict adherence with these regulatory requirements increases our cost of doing business and consequently affects our profitability. DHW believes that it is in substantial compliance with current applicable environmental laws and regulations and that continued compliance with existing requirements will not have a material adverse impact on the Company’s operations. However, environmental laws and regulations have been subject to frequent changes over the years, and the imposition of more stringent requirements could have a materially adverse effect upon the Company’s capital expenditures, earnings or our competitive position.

15

In the United States, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), also known as “Superfund,” imposes liability without regard to fault or the legality of the original conduct, on certain classes of persons who contributed to the release of a “hazardous substance” into the environment. In the course of DHW’s operations, it does not typically generate materials that are considered “hazardous substances.” One exception, however, would be spills that occur prior to well treatment materials being circulated down hole. For example, if DHW spills acid on a roadway as a result of a vehicle accident in the course of providing well enhancement/stimulation services, or if a tank with acid leaks prior to down hole circulation, the spilled material may be considered a “hazardous substance.” In this respect, DHW is occasionally considered to “generate” materials that are regulated as hazardous substances and, as a result, may incur CERCLA liability for cleanup costs. Also, claims may be filed for personal injury and property damage allegedly caused by the release of hazardous substances or other pollutants.

Additionally, DHW operates facilities that are subject to requirements of the Clean Water Act, as amended, or “CWA,” the Safe Drinking Water Act, and analogous state laws that impose restrictions and controls on the discharge of pollutants into navigable waters. Spill prevention, control and counter-measure requirements under the CWA require implementation of measures to help prevent the contamination of navigable waters in the event of a hydrocarbon spill. Regulations in the states in which DHW owns and operates wells (Kansas and Oklahoma) require us to obtain a permit to operate each of our disposal wells. The applicable regulatory agency may suspend or modify one of our permits if DHW’s well operations are likely to result in pollution of freshwater, substantial violation of permit conditions or applicable rules, or if the well leaks into the environment.

Because DHW’s trucks must travel over public highways to get to customer’s wells, DHW is subject to the regulations of the Department of Transportation. These regulations are very comprehensive and cover a wide variety of subjects from the maintenance and operation of vehicles to driver qualifications to safety. Violations of these regulations can result in penalties ranging from monetary fines to a restriction on the use of the vehicles. Under new regulations effective July 1, 2010, the continued violation of regulations could result in a shutdown of all of the vehicles in either Dillco or Heat Waves. DHW does not believe it is in significant violation of Department of Transportation regulations at this time that would result in a shutdown of vehicles.

Employees

As of July 27, 2010 the Company employed approximately 75 full time employees. Of these employees, following the Merger Transaction, five will be employed by Enservco, approximately 30 by Dillco, and approximately 40 by Heat Waves.

Report to Security Holders

The Company (under the name “Aspen Exploration Corporation”) files reports with the Securities and Exchange Commission (“SEC”) as required by Section 13(a) of the Securities Exchange Act of 1934. The public may read and copy an materials filed by the Company with the SEC at the SEC’s public reference room at 450 Fifth Street, N.W., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

16

B. Risk Factors

The Company’s securities are highly speculative and involve a high degree of risk, including among other items the risk factors described below. The below risk factors are intended to generally describe certain risks that could materially affect the Company and its contemplated business activities as a result of the completion of the Merger Transaction.

You should carefully consider the risks described below and elsewhere herein in connection with any decision whether to acquire, hold or sell the Company’s securities. If any of the contingencies discussed in the following paragraphs or other materially adverse events actually occurs, the business, financial condition and results of operations could be materially and adversely affected. In such case, the trading price of our common stock could decline, and you could lose all or a significant part of your investment.

Operations Related Risks

Our business depends on domestic spending by the oil and natural gas industry, and this spending and our business has been, and may continue to be, adversely affected by industry and financial market conditions that are beyond our control.

We depend on our customers’ willingness to make operating and capital expenditures to explore, develop and produce oil and natural gas in the United States. Customers’ expectations for lower market prices for oil and natural gas, as well as the availability of capital for operating and capital expenditures, may cause them to curtail spending, thereby reducing demand for our services and equipment. As an example, DHW believes the weak global economy and decrease in demand for oil and natural gas during much of 2009 significantly contributed to its net loss of approximately $5.9 million in fiscal 2009.

Industry conditions are influenced by numerous factors over which the Company has no control, such as the supply of and demand for oil and natural gas, domestic and worldwide economic conditions, weather conditions, political instability in oil and natural gas producing countries, and merger and divestiture activity among oil and natural gas producers. The volatility of the oil and natural gas industry and the consequent impact on exploration and production activity could adversely impact the level of drilling and activity by some of the Company’s customers. This reduction may cause a decline in the demand for the Company’s services or adversely affect the price of its services. In addition, reduced discovery rates of new oil and natural gas reserves in the Company’s market areas also may have a negative long-term impact on its business, even in an environment of stronger oil and natural gas prices, to the extent existing production is not replaced and the number of producing wells for the Company’s to service declines.

17

Recent deterioration in the global economic environment has caused the oilfield services industry to experience volatility in terms of demand, and the rate at which demand may slow, or return to former levels, is uncertain. Recent adverse changes in capital markets and declines in prices for oil and natural gas have caused many oil and natural gas producers to announce reductions in capital budgets for future periods. Limitations on the availability of capital, or higher costs of capital, for financing expenditures may cause these and other oil and natural gas producers to make additional reductions to capital budgets in the future even if commodity prices increase from current levels. These cuts in spending will curtail drilling programs as well as discretionary spending on well services, which may result in a reduction in the demand for the Company’s services, the rates we can charge and our utilization. In addition, certain of the Company’s customers could become unable to pay their suppliers, including the Company. Any of these conditions or events could adversely affect the Company’s operating results.

We may not be successful in integrating the operations of Dillco and its privately-held subsidiary companies into the Company, a publicly held company with its securities registered under the Securities Exchange Act of 1934 and subject to the reporting requirements thereof.

Although principal management of DHW (Messrs. Herman and Kasch) have prior experience with public companies reporting under the Securities Exchange Act of 1934 (the “1934 Act”), we may face challenges in integrating the financial reporting and disclosure requirements of a broadly-based private company into the requirements of the 1934 Act, especially as those requirements were enhanced by the Sarbanes-Oxley Act of 2002 and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The 1934 Act and the rules and regulations thereunder impose extensive reporting obligations on all reporting companies, and further require internal control over financial reporting that is much more extensive than even prudently managed private companies and their lenders require. The difficulties associated with internal control over financial reporting and disclosure controls is increased as a result of the geographical diversity of Dillco’s and Heat Waves’ operations. While members of management are working diligently to meet these obligations, we cannot offer any assurance that management will be successful in such integration or that the report on internal control that the Company will have to include in its next quarterly reports may not identify material weaknesses in internal control over financial reporting or disclosure controls.

If oil and natural gas prices remain volatile, remain low or decline further it could have an adverse effect on the demand for our services.

The demand for many of the Company’s services is primarily determined by current and anticipated oil and natural gas prices and the related general production spending and level of drilling activity in the areas in which we have operations. Volatility or weakness in oil and natural gas prices (or the perception that oil and natural gas prices will decrease) affects the spending patterns of the Company’s customers and may result in the drilling of fewer new wells or lower production spending on existing wells. This, in turn, could result in lower demand for the Company’s services and may cause lower rates and lower utilization of the Company’s well service equipment. Continued low oil and natural gas prices, a further decline in oil and natural gas prices or a reduction in drilling activities could materially and adversely affect the demand for the Company’s services and its results of operations.

Prices for oil and natural gas historically have been extremely volatile and are expected to continue to be volatile. For example, although oil prices exceeded $140 per barrel and natural gas prices exceeded $13 per Mcf in 2008, prices fell to below $40 per barrel and $6 per Mcf by the end of 2008. Through June 2010 oil prices have remained volatile reaching highs of over $86 per barrel and lows of less than $68 per barrel. Similarly, natural gas prices have exceeded $5 per Mcf during 2010 but have also been below $4 per Mcf. The speed and severity of the decline in oil and natural gas prices recently experienced could materially affect the demand for the Company’s services and the rates that we are able to charge.

18

Demand for the majority of the Company’s services is substantially dependent on the levels of expenditures by the oil and natural gas industry. The Company’s customers’ capital expenditures may decline in 2010 and beyond if current global economic conditions continue or worsen. This could have a material adverse effect on the Company’s financial condition, results of operations and cash flows.

The current on-going global economic volatility and uncertainty has reduced worldwide demand for oil and natural gas and resulted in significantly lower crude oil and natural gas prices compared to their record highs in July 2008. It is difficult to predict how long the global economic volatility will continue, or to what extent this will continue to affect us. The significant decline in oil and natural gas prices reduced many of DHW’s customers’ activities and spending on DHW’s services and products in 2009; this reduction in customer activities and spending could continue through 2010 and beyond. Demand for the majority of the Company’s services depends substantially on the level of expenditures by the oil and natural gas industry for the exploration, development and production of oil and natural gas reserves. These expenditures are sensitive to the industry’s view of future economic growth and the resulting impact on demand for oil and natural gas. The worldwide deterioration in the financial and credit markets, which began in the second half of 2008, resulted in diminished demand for oil and natural gas and significantly lower oil and natural gas prices. This caused many of DHW’s customers to reduce or delay their oil and natural gas exploration and production spending in 2009, which consequently reduced the demand for DHW’s services, and exerted downward pressure on the prices of DHW’s services and products. If the economic downturn continues for a prolonged period or if there is little or no economic growth, it will likely result in further reductions of exploration and production expenditures by the Company’s customers, causing further declines in the demand for, and prices of, Company services and products. This could result in a material adverse effect on the Company’s financial condition, results of operations and cash flows.

The reduction in cash flows being experienced by the Company’s customers resulting from declines in commodity prices, together with the reduced availability of credit and increased costs of borrowing funds could have significant adverse effects on the financial condition of some of the Company’s customers. This could result in project modifications, delays or cancellations, general business disruptions, and delay in, or nonpayment of, amounts that are owed to the Company, which could have a material adverse effect on the Company’s results of operations and cash flows.

Environmental compliance costs and liabilities could reduce our earnings and cash available for operations.

The Company is subject to increasingly stringent laws and regulations relating to importation and use of hazardous materials and environmental protection, including laws and regulations governing air emissions, water discharges and waste management. We incur, and expect to continue to incur, capital and operating costs to comply with environmental laws and regulations. The technical requirements of these laws and regulations are becoming increasingly complex, stringent and expensive to implement. These laws may provide for “strict liability” for damages to natural resources or threats to public health and safety. Strict liability can render a party liable for damages without regard to negligence or fault on the part of the party. Some environmental laws provide for joint and several strict liability for remediation of spills and releases of hazardous substances.

19

The Company uses hazardous substances and wastes in its operations. Accordingly, we could become subject to potentially material liabilities relating to the investigation and cleanup of contaminated properties, and to claims alleging personal injury or property damage as the result of exposures to, or releases of, hazardous substances. In addition, stricter enforcement of existing laws and regulations, new laws and regulations, the discovery of previously unknown contamination or the imposition of new or increased requirements could require the Company to incur costs or become the basis of new or increased liabilities that could reduce its earnings and cash available for operations. The Company believes it is currently in substantial compliance with environmental laws and regulations.

Competition within the well services industry may adversely affect our ability to market our services.

The well services industry is highly competitive and fragmented and includes numerous small companies capable of competing effectively in our markets on a local basis, as well as several large companies that possess substantially greater financial and other resources than the Company does. The Company’s larger competitors’ greater resources could allow those competitors to compete more effectively than the Company can. The amount of equipment available may exceed demand, which could result in active price competition.

We depend on several significant customers, and a loss of one or more significant customers could adversely affect our results of operations.

The Company’s customers consist primarily of major and independent oil and natural gas companies. During 2009, DHW’s top five customers accounted for approximately 38% of its total revenues. The loss of any one of these customers or a sustained decrease in demand by any of such customers could result in a substantial loss of revenues and could have a material adverse effect on the Company’s results of operations.

Our operations are subject to inherent risks, some of which are beyond our control. These risks may be self-insured, or may not be fully covered under our insurance policies.

The Company’s operations are subject to hazards inherent in the oil and natural gas industry, such as, but not limited to, accidents, blowouts, explosions, fires and oil spills. These conditions can cause:

|

§

|

personal injury or loss of life,

|

|

§

|

damage to or destruction of property, equipment and the environment, and

|

|

§

|

suspension of operations.

|

The occurrence of a significant event or adverse claim in excess of the insurance coverage that we maintain or that is not covered by insurance could have a material adverse effect on the Company’s financial condition and results of operations. In addition, claims for loss of oil and natural gas production and damage to formations can occur in the well services industry. Litigation arising from a catastrophic occurrence at a location where our equipment and services are being used may result in our being named as a defendant in lawsuits asserting large claims.

The Company maintains insurance coverage that it believes to be customary in the industry against these hazards. However, the Company does not have insurance against all foreseeable risks, either because insurance is not available or because of the high premium costs. As such, not all of the Company’s property is insured. The occurrence of an event not fully insured against, or the failure of an insurer to meet its insurance obligations, could result in substantial losses. In addition, the Company may not be able to maintain adequate insurance in the future at rates it considers reasonable. Insurance may not be available to cover any or all of the risks to which we are subject, or, even if available, it may be inadequate, or insurance premiums or other costs could rise significantly in the future so as to make such insurance prohibitively expensive. It is likely that, in our insurance renewals, our premiums and deductibles will be higher, and certain insurance coverage either will be unavailable or considerably more expensive than it has been in the recent past. In addition, our insurance is subject to coverage limits, and some policies exclude coverage for damages resulting from environmental contamination.

20

We may not be successful in identifying, making and integrating our acquisitions.

A component of the Company’s growth strategy will likely be to make geographic-focused acquisitions that will strengthen its presence in selected regional markets. Pursuit of this strategy may be restricted by the deterioration of credit markets, which may significantly limit the availability of funds for such acquisitions. In addition to restricted funding availability, the success of this strategy will depend on the Company’s ability to identify suitable acquisition candidates and to negotiate acceptable financial and other terms. There is no assurance that the Company will be able to do so. The success of an acquisition depends on our ability to perform adequate due diligence before the acquisition and on our ability to integrate the acquisition after it is completed. While the Company intends to commit significant resources to ensure that it conducts comprehensive due diligence, there can be no assurance that all potential risks and liabilities will be identified in connection with an acquisition. Similarly, while the Company expects to commit substantial resources, including management time and effort, to integrating acquired businesses into ours, there is no assurance that we will be successful integrating these businesses. In particular, it is important that the Company be able to retain both key personnel of the acquired business and its customer base. A loss of either key personnel or customers could negatively impact the future operating results of the acquired business.

Compliance with climate change legislation or initiatives could negatively impact our business.

The U.S. Congress is considering legislation to mandate reductions of greenhouse gas emissions and certain states have already implemented, or are in the process of implementing, similar legislation. Additionally, the U.S. Supreme Court has held in its decisions that carbon dioxide can be regulated as an “air pollutant” under the Clean Air Act, which could result in future regulations even if the U.S. Congress does not adopt new legislation regarding emissions. At this time, it is not possible to predict how legislation or new federal or state government mandates regarding the emission of greenhouse gases could impact the Company’s business; however, any such future laws or regulations could require us or our customers to devote potentially material amounts of capital or other resources in order to comply with such regulations. These expenditures could have a material adverse impact on the Company’s financial condition, results of operations, or cash flows.

Our success depends on key members of our management, the loss of any of whom could disrupt our business operations.

The Company depends to a large extent on the services of some of its executive officers. The loss of the services of Michael D. Herman, Rick D. Kasch and/or Austin Peitz, or other key personnel could disrupt the Company’s operations. Although the Company has entered into employment agreements with Messrs. Herman, Kasch and Peitz, that contain, among other non-compete and confidentiality provisions, we may not be able to enforce the non-compete and/or confidentiality provisions in the employment agreements.

21

Debt Related Risks

Our indebtedness could restrict our operations, make us more vulnerable to adverse economic conditions, and are collateralized by substantially all of the Company’s assets.

We now have, and will continue to have, a significant amount of indebtedness. As of March 31, 2010, DHW owed approximately $12.4 million to banks and another $1.7 million of subordinated debt to Mr. Herman, (who as a result of the Merger Transaction became the largest individual Company stockholder).

The Company’s current and future indebtedness could have important consequences. For example, it could:

|

§

|

impair our ability to make investments and obtain additional financing for working capital, capital expenditures, acquisitions or other general corporate purposes,

|

|

§

|

limit our ability to use operating cash flow in other areas of our business because we must dedicate a substantial portion of these funds to make principal and interest payments on our indebtedness,

|

|

§

|

make us more vulnerable to a downturn in our business, our industry or the economy in general as a substantial portion of our operating cash flow will be required to make principal and interest payments on our indebtedness, making it more difficult to react to changes in our business and in industry and market conditions,

|

|

§

|

put us at a competitive disadvantage to competitors that have less debt, and

|

|

§

|

increase our vulnerability to interest rate increases to the extent that we incur variable rate indebtedness.

|

If the Company is unable to generate sufficient cash flow or are otherwise unable to obtain the funds required to make principal and interest payments on our indebtedness, or if we otherwise fail to comply with the various debt service covenants and/or reporting covenants in the business loan agreements or other instruments governing our current or any future indebtedness, we could be in default under the terms of our credit facilities or such other instruments. In the event of a default, the holders of our indebtedness could elect to declare all the funds borrowed under those instruments to be due and payable together with accrued and unpaid interest, the lenders under our credit facility could elect to terminate their commitments there under and we or one or more of our subsidiaries could be forced into bankruptcy or liquidation. Any of the foregoing consequences could restrict our ability to grow our business and cause the value of our common stock to decline.

We may be unable to meet the obligations of various financial covenants that are contained in the terms of our loan agreements with Great Western Bank.

Dillco’s agreements with Great Western Bank impose various obligations and financial covenants on Dillco. The outstanding amount under a line of credit with Great Western Bank is due in full in May 2011 unless it is renewed on a year-to-year basis. Additionally, the term loan with Great Western Bank requires that Dillco make a $1 million payment on or before June 2, 2011. Both of these loans with Great Western Bank have a variable interest rate, are guaranteed by all of Dillco’s subsidiaries (and Aspen has agreed to serve as guarantor), and are collateralized by substantially all of Dillco’s and Heat Waves’ equipment, inventory and accounts receivable. Further, the related agreements with Great Western Bank impose various financial covenants on the Company including maintaining a prescribed debt service ratio, minimum net worth, maximum leverage ratio, and limit the Company’s ability to incur additional debt obligations. If Dillco is unable to comply with its obligations and covenants under the loan agreements and it declares an event of default all of Dillco’s obligations to Great Western Bank could be immediately due.

22

Enservco is a guarantor of to the debt owed to Great Western Bank.

Upon closing of the Merger Transaction, Aspen is obligated to guarantee Dillco’s debt to Great Western Bank. As a result, any default by Dillco on its obligations to Great Western may directly impact the Company’s assets.

The agreements between Dillco and its primary lender contain cross default provisions with the debt of our principal shareholder, Michael D. Herman.

Michael D. Herman is our principal shareholder, a director, and our president and chief executive officer. Before the Effective Date of the Merger Transaction, Mr. Herman controlled Dillco and its affiliated entities, and had various personal and unrelated business loans with Great Western Bank. When DHW negotiated its loan agreements with Great Western Bank, the bank insisted that they contain cross default provisions, although neither Dillco nor Enservco is a guarantor of Mr. Herman’s personal indebtedness. As a result of these cross-default provisions, should Mr. Herman default on any of the other debt he has through the bank in his personal capacity, the bank could declare Dillco’s loans in default and call upon the Company’s guarantee with respect to Dillco’s loans (but not Mr. Herman’s separate obligations). Upon an event of default Dillco might not be able to immediately satisfy its obligations to Great Western Bank which would likely adversely impair the Company’s ability to conduct its business operations and pay its other obligations necessary to maintain its business operations.

The variable rate indebtedness with Great Western Bank subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Dillco’s borrowings through Great Western Bank bear interest at variable rates, exposing the Company to interest rate risk. Absent our ability to hedge our variable rates, if such rates increase, Dillco’s debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same and the Company’s net income and cash available for servicing Dillco’s indebtedness would decrease.

Risks Related to Our Common Stock

It is likely that any efforts we may make to raise capital or effect a business transaction will result in substantial additional dilution to our shareholders.

As part of its growth strategy the Company may desire to raise capital and or utilize its common stock to effect strategic business transactions. Either such action will likely require that Enservco issue equity (or debt) securities which would result in dilution to our existing stockholders. Although we will attempt to minimize the dilutive impact of any future capital-raising activities or business transactions, we cannot offer any assurance that we will be able to do so. If we are successful in raising additional working capital, we may have to issue additional shares of our common stock at prices that may be a discount from the then-current market price of our common stock.

23

The majority of our common stock is currently considered restricted stock and our common stock is not currently eligible to be resold pursuant to Rule 144.

A significant portion of our outstanding common stock is considered either “restricted shares” or “control shares” as defined in Rule 144 under the Securities Act. The restricted shares may only be sold if they are registered under the Securities Act or qualify for exemption from registration under the Securities Act. However, because Aspen was a shell company our restricted common stock is not currently eligible to be resold pursuant to Rule 144 until twelve months after the filing of this Form 8-K.

Because we have no plans to pay dividends on our common stock, investors must look solely to stock appreciation for a return on their investment in us.

We do not anticipate paying any cash dividends on our common stock in the foreseeable future. We currently intend to retain all future earnings to fund the development and growth of our business. Any payment of future dividends will be at the discretion of our board of directors and will depend on, among other things, our earnings, financial condition, capital requirements, level of indebtedness, statutory and contractual restrictions applying to the payment of dividends and other considerations that the board of directors deems relevant. The terms of Dillco’s existing senior credit facility restrict the payment of dividends without the prior written consent of the lenders. Investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize a return on their investment. Investors seeking cash dividends should not purchase our common stock.

Our common stock is subject to the penny stock rules which limits the market for our common stock.

Because our stock is quoted on the OTC Bulletin Board and since the market price of the common stock is less than $5.00 per share, the common stock is classified as a “penny stock.” SEC Rule 15g-9 under the Securities Exchange Act of 1934 imposes additional sales practice requirements on broker-dealers that recommend the purchase or sale of penny stocks to persons other than those who qualify as an “established customer” or an “accredited investor.” This includes the requirement that a broker-dealer must make a determination that investments in penny stocks are suitable for the customer and must make special disclosures to the customers concerning the risk of penny stocks. Many broker-dealers decline to participate in penny stock transactions because of the extra requirements imposed on penny stock transactions. Application of the penny stock rules to our common stock reduces the market liquidity of our shares, which in turn affects the ability of holders of our common stock to resell the shares they purchase, and they may not be able to resell at prices at or above the prices they paid.

General Corporate Risks

Risks of related party transactions.

There are a number of related party transactions that were extant at DHW and its subsidiaries prior to, or entered into as a result of, the Merger Transaction. These include:

|

·

|

Mr. Herman’s subordinated loan to Heat Waves. In November 2009, Mr. Herman advanced $500,000 to Heat Waves to pay down long-term debt. Interest (at 3% per annum) is due annually in arrears. Heat Waves’ obligations to Mr. Herman are subordinated to Dillco’s obligations to Great Western Bank and accordingly, payment of interest is deferred.

|

24

|

·

|