Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ORTHOVITA INC | d8k.htm |

2010

Corporate Presentation

: VITA

Exhibit 99.1 |

2

Safe Harbor Statement

This presentation contains forward-looking statements by Orthovita regarding our

current expectations of future events that involve risks and uncertainties,

including without limitation, our VITOSS

™

, VITAGEL

™

, VITASURE

™

and CORTOSS

™

products and other aspects of our business.

Such statements are based on our current expectations and are subject to a number of

substantial risks and uncertainties that could cause actual results or

timeliness to differ materially from those addressed in the forward-looking

statements. Factors that may cause such a difference include, but are not

limited to, our dependence on the commercial success of our approved products, the need

to maintain regulatory approvals to sell our products, our ability to manage commercial

scale manufacturing capability and capacity, our success in expanding our

commercial product portfolio and distribution

channel,

competition

and

other

risk

factors

listed

from

time

to

time

in

reports

filed

by

Orthovita

with

the

Securities

and

Exchange

Commission,

including

but

not

limited

to

risks

described

in

our

most

recently

filed

Form

10-K

under

the

caption

“Risk

Factors.”

Further

information

about

these

and

other

relevant

risks

and

uncertainties

may

be

found

in

Orthovita’s

filings

with

the

Commission, all of which are available from the Commission as well as from Orthovita

upon request. Orthovita undertakes no obligation to publicly update any

forward-looking statements. |

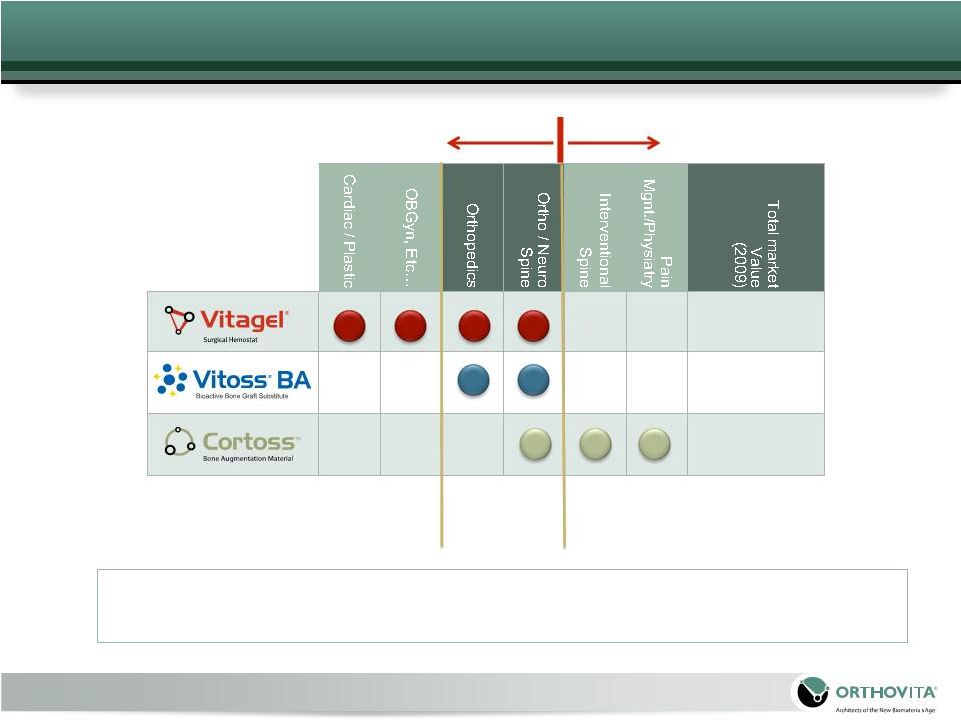

Positioned to be a

leading provider of novel, well researched Orthobiologics and Biosurgery

technologies for patients, surgeons and hospitals.

|

Biosurgery

Hemostats

Fixation

Fusion

Orthobiologics

4

Products and technologies

related to the management

of inter-operative bleeding

and soft tissue healing

Products and

technologies related

to the fusion, fixation

and regeneration of

the human skeleton |

5

|

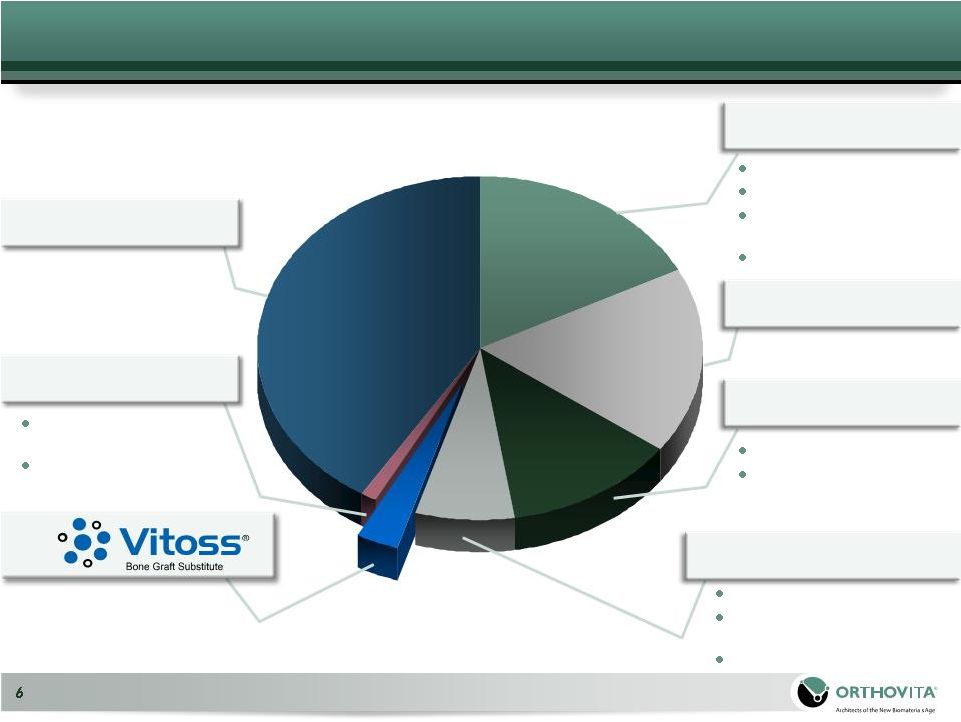

US

Bone

Grafting

Market

2008

–

1,450,900

procedures

Autograft

DBX

–

Synthes

Grafton

–

Osteotech

Allomatrix

–

Wright Medical

Etc…

Allograft Chips

Stem Cells

DBMs

InFuse

–

Medtronic

Op-1

–

Stryker Spine

Trinity Evolution

–

Orthofix

Osteocel

–

Nuvasive

Mastergraft

–

Medtronic

Healos

–

J&J Depuy

Spine

Etc…

*Millennium Research Group: US Markets for Orthopedic Biomaterials

2009

BMPs

Other Synthetics

®

®

®

®

®

®

®

®

® |

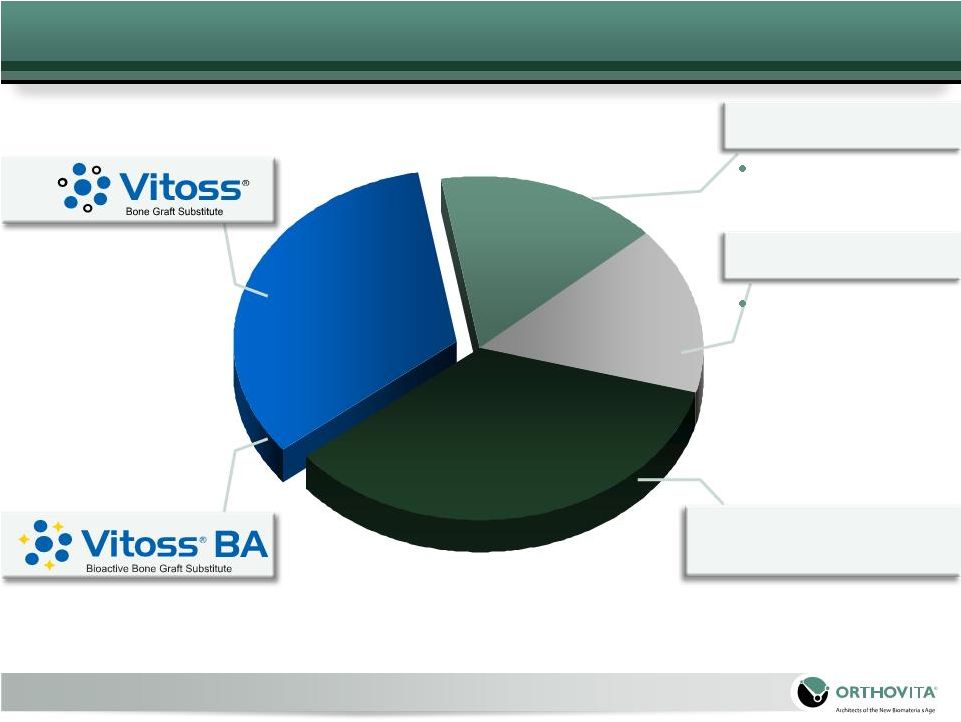

7

JJ

Depuy

Spine

Healos

Medtronic Spine

*Millennium Research Group: US Markets for Orthopedic Biomaterials

2009 Mastergraft

All Other

Synthetic BGSs

33%

16%

16%

35%

US Synthetic Bone Graft Substitute Market 2008 –

~$150mm |

8

Eliminates risks associated with autograft, allograft and BMPs

Broadest product range in category

*

When used as directed with BMA

Vitoss Bone Graft Substitute – Value

Proposition

Provides all three key components for bone regeneration

*

:

Scaffold – Cells - Signals

Vitoss Bioactive speeds bone regeneration vs standard

Vitoss

Equivalent efficacy to autograft, the gold standard

* |

9

The most pre-clinical and clinical research of any product in its class

Vitoss Comparative Effectiveness |

10

Vitoss Franchise Market Leadership

Early

Market

Entry

–

January

2002

Over 300,000 implantations

Most extensive bibliography in

its class

Covers majority of non-

structural bone grafting

indications

20 studies in spine with 745

patients

Extend Reach into BMP Market

Demonstrated effectiveness

with lower procedural cost

Vitoss BA enhances

conversion rationale

Leader in technology innovation |

11 |

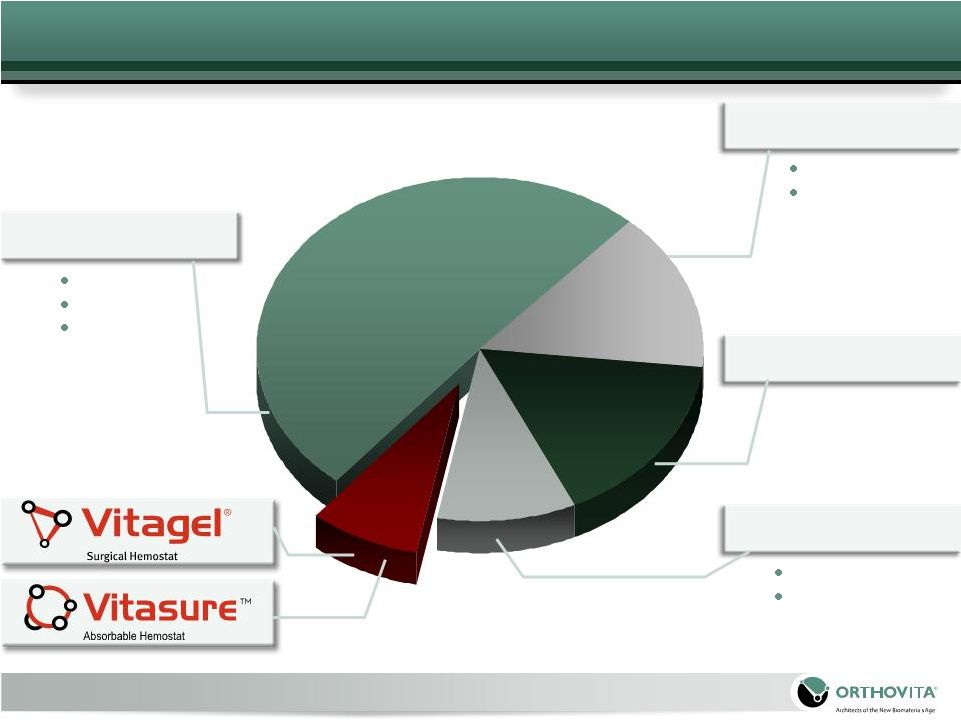

Floseal

®

Tisseel

®

Coseal

®

Surgiflo™

Evicel™

Bioglue

®

Hemostase™

Orthovita

Hemostat

Market

2008

–

$460

Million

Baxter

Cryolife

Ethicon

Platelet Gels

12

*2008, Millennium Research Group

“US Market for Surgical Hemostats, Internal Tissue Sealants and Adhesion Barriers, 2008"; Cryolife 2008 Year End Earnings;

*2008, Millennium Research Group

“US Market for Surgical Hemostats, Internal Tissue Sealants and Adhesion Barriers, 2008"; Cryolife 2008 Year End Earnings; |

13

Safety:

Plant based technology eliminates many of the safety issues

associated with thrombin based competitors (FloSeal, Baxter)

Ease-of-Use:

Always ready, easy-to-use, and inexpensive

Controls Bleeding, Facilitates Healing:

Only

hemostat

with

the

combination

of

microfibrillar

collagen,

thrombin and the patient’s own plasma; supports hemostasis

and fibroblast attachment

Knee

Arthroplasty

Research:

Less drainage, reduced transfusion

Animal Research:

Less adhesions, faster healing

Vitagel Surgical Hemostat

Vitasure

Absorbable Hemostat

Hemostasis Franchise – Value Proposition

|

14

Strategic

Role

of

Biosurgery

2010

Synergistic and complementary

soft-tissue product offering

to ORTHOBIOLOGICS product

platform

Opportunistic surgical sale

Supports account penetration in

new and developing geographies

Wide and diverse call pattern

allows business development in

major ORTHOBIOLOGICS

accounts |

15 |

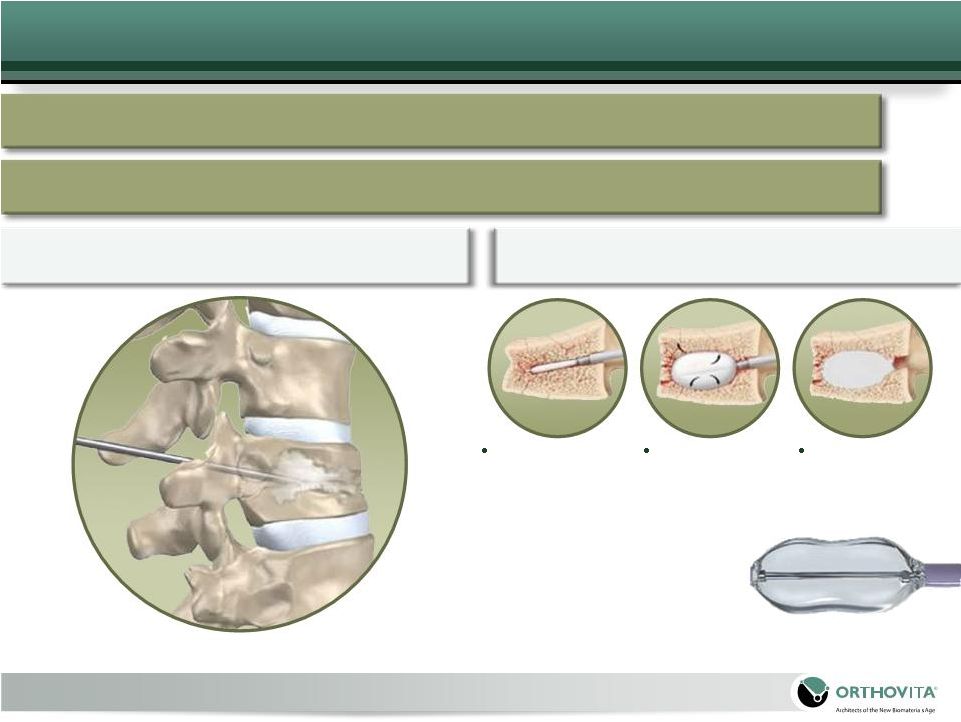

16

Treatment Options

Surgical Intervention

Vertebroplasty (VP)

Kyphoplasty (KP)

Catheter inserted

percutaneously

through pedicle

into body of

vertebra

using AP and

lateral fluroscopic

images

to guide placement

Balloon inflated

to provide some

restoration of

vertebral body

height

PMMA injected

to help maintain

correction

Conservative Care – Analgesics, Bed Rest,

Bracing |

17

•

An injectable, bioactive composite

that mimics the mechanical

properties of human cortical bone

•

First FDA-cleared alternative to

polymethylmethacrylate

(PMMA)

cement for use in vertebral

augmentation procedure

•

Indicated for the fixation of

pathological fractures of the

vertebral body using vertebral

augmentation

•

Painful vertebral compression

fractures can result from

osteoporosis, benign lesions

(hemangioma), and malignant

lesions (metastatic cancers,

myeloma).

•

Patent protected to 2022

Cortoss Bone Augmentation Material – VCF

System

|

18

Therapeutic Flow and Fill

Material flow promotes an non-

intrusive diffuse, symmetric fill

pattern

Physiological load transfer

through treated vertebra(e)

Safety

No MMA monomer release

Lower injection volumes

Unparalleled Control

Material preparation is an on-

demand process that takes

seconds to complete

Easy

‘start

&

stop’

capability

as

needed to control leaks

Cortoss Bone Augmentation Material – Value

Propositions

|

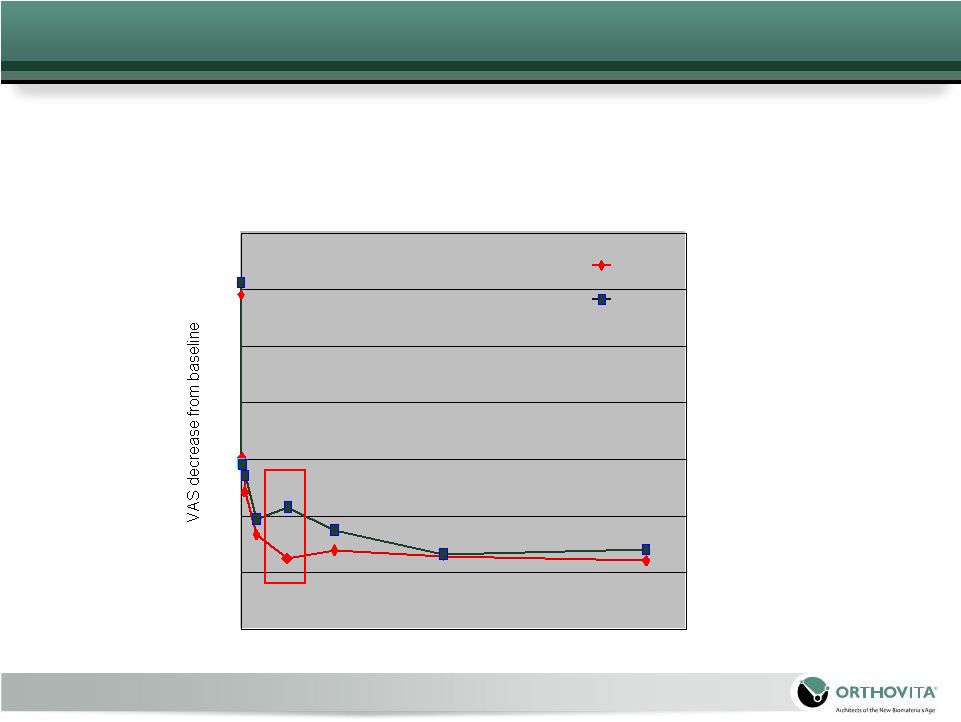

19

0

10

20

30

40

50

60

70

0

100

200

300

400

500

600

700

800Time

point (days) Cortoss

PMMA

FDA IDE Clinical Trial – Pain Results

At 3-months: Cortoss patients had a statistically significant

reduction in pain versus PMMA patients

|

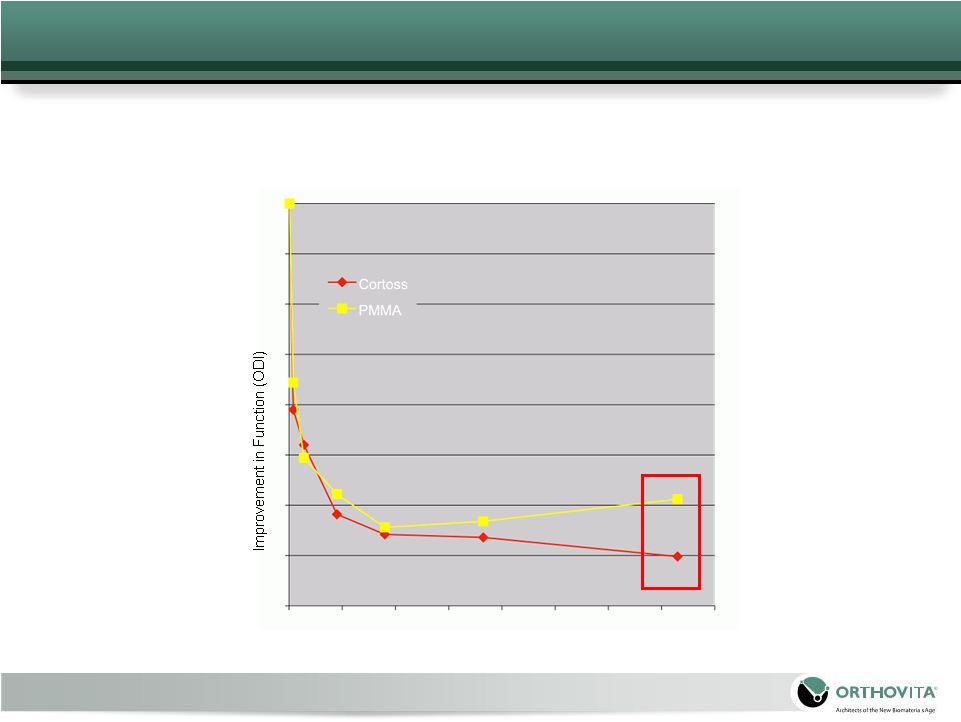

20

At

24-months:

A

statistically

significant,

greater

proportion of

Cortoss

patients

maintained

or

improved

function

(97%

vs

88%)

compared to the PMMA patients

FDA IDE Clinical Trial – Function Results

Time (Days) |

21

The CORTOSS population experienced measurable clinical and

cost benefits over the PMMA cohort in the following outcomes:

43.4%

fewer

adjacent

fractures

in

‘first-fracture’

Cortoss

patients

Fracture related re-hospitalizations:

2.9%

Cortoss

vs.

11.4%

PMMA

(4x)

Subsequent PVPs

or KPs:

7.4%

Cortoss

vs.

22.7%

PMMA

(3x)

The

Cortoss

patients

required

an

average

of

30% less material

to achieve desired fill

FDA IDE Clinical Trial – Additional Benefits

|

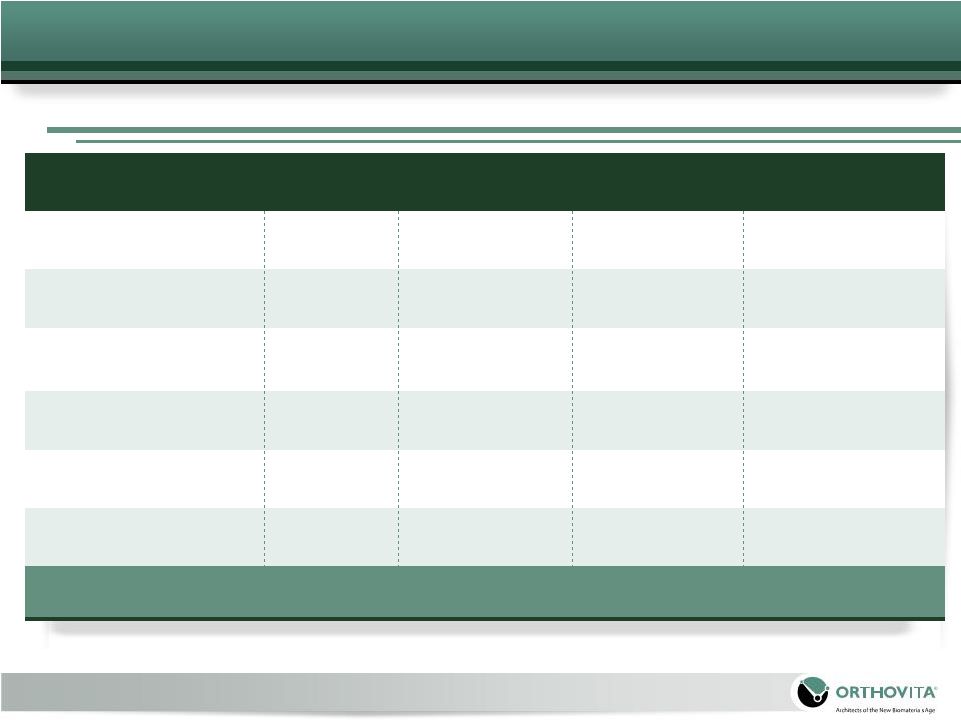

22

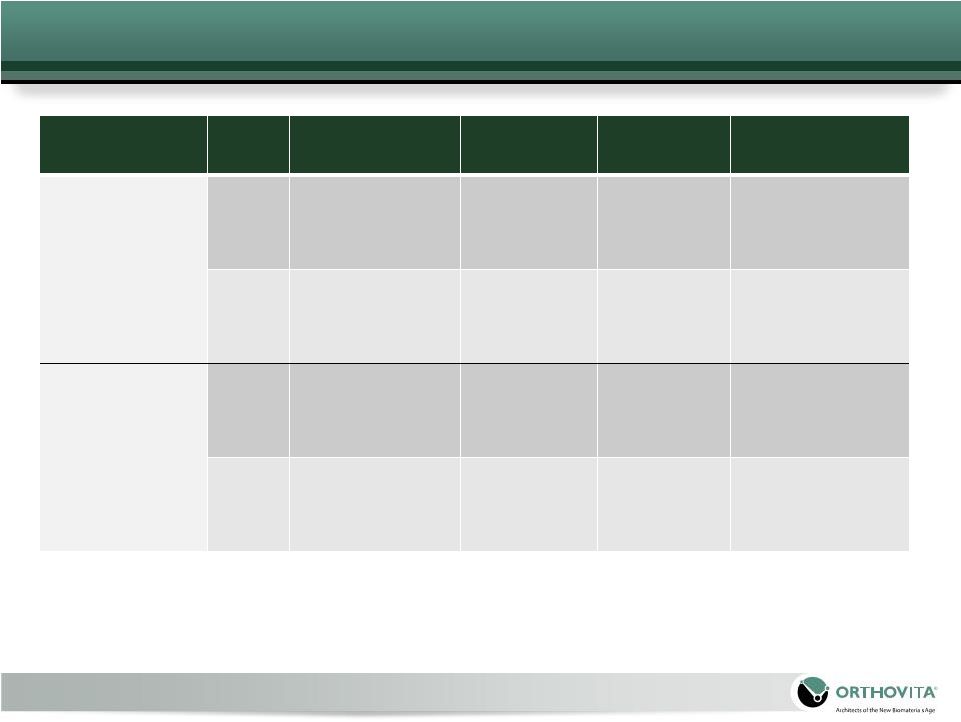

Medicare 2010 Facility Reimbursement

Procedure

Levels

Treated

In-patient

Out-patient

ASC

Physician

Vertebroplasty

1

$7,028 –

16,219

1

$2,141

$1,275

$489 -

518

3

2

2

$7,028 –

16,219

$3,211

$1,913

$718 -

747

Kyphoplasty

1

$7,028 –

16,219

$5,979

$3,551

$546 -

568

2

$7,028 –

16,219

$8,964

$5,327

$803 -

825

1

Reimbursement range dependent on patient co-morbidities

2

Additional levels are reimbursed at 50% of the first level

3

Variance is related to the levels treated. Thoracic is reimbursed at a higher rate

than lumbar Note:

These

are

national

averages,

specific

geographies

may

differ |

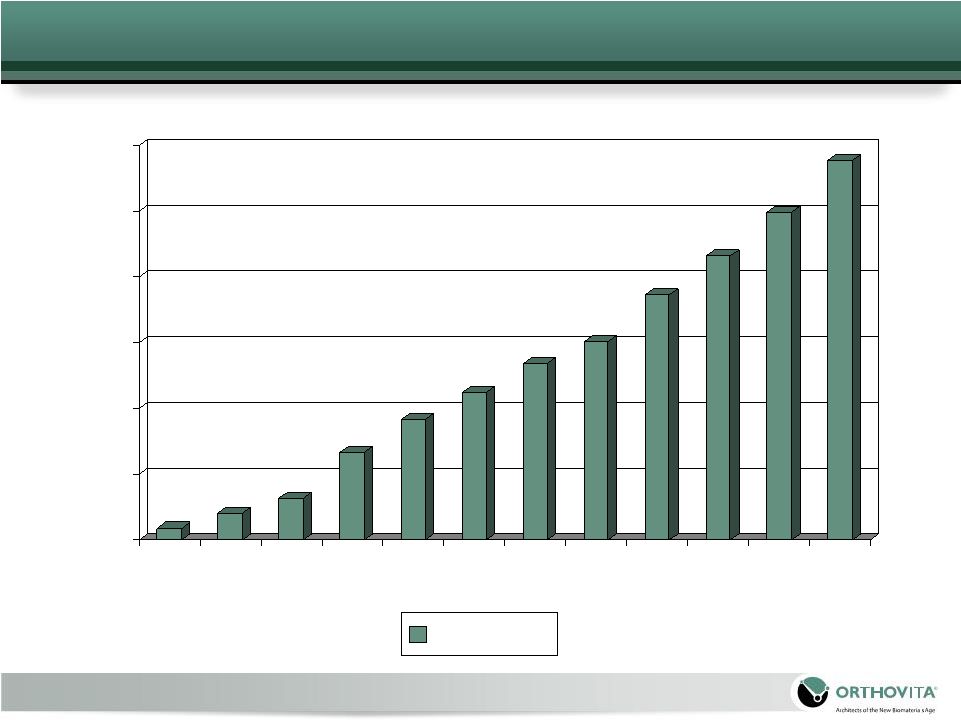

23

Cortoss Account Growth

0

50

100

150

200

250

300

July

Sep

Nov

Jan

Mar

May

Accounts |

External Challenges 2010

Recent controversies surrounding vertebroplasty have led to

a reduction in procedures, a movement from inpatient to

outpatient treatment, greater scrutiny by insurance providers

and, subsequently, a very challenging environment for

CORTOSS. |

Cortoss

Challenges 2010 Publication of NEJM articles

Temporary(?) reduction in referrals

Market size smaller than projected

Payment of fines for inappropriate overnight stays

Accelerated shift from hospital to outpatient procedures

Distraction sales force focus from Vitoss/Vitagel business

Passing of Health Care Reform Bill

Increased scrutiny of new technology by hosp. admins.

Increased lag-time from introduction to sale

Delayed sales ramp with CORTOSS

External events that affected VCF market: |

Impact

to Sales Force The environment is increasingly requiring our reps maintain

a perpetual, physical presence within the hospitals to:

-

Gain product access

-

Develop key relationships

-

Secure case continuity

-

Defend current business

The sales process is increasingly more time and labor

intensive to generate the same revenue. |

27

$460MM

$1.2BN

$500MM

~ $1.75B Market

Orthopedics/Spine

Our

unique

portfolio

of

biomaterials

provides

for

sizeable

value

creation

in

the

current

spine

and orthopedic markets. We are adjusting our distribution and call patterns to

address the new challenges and optimize in-

and outpatient procedural access.

Inpatients

Outpatients / ASC

Orthovita

and

the

target

audience

–

Integrating

Cortoss |

28

Recent

Events:

Noridian

LCD

Review

Noridian

is a CMS contractor that administers Medicare

reimbursement for 8 western states

On May 11 , Noridian

announced it was considering the non-

coverage of reimbursement for vertebroplasty and kyphoplasty

Prompted by two small studies published in New England Journal

of Medicine that questioned effectiveness of vertebroplasty

Concerned that these procedures have been used inappropriately

Without first trying conservative care

Treatment of more levels than necessary

“Disturbing

incidence of complications” Noridian

has established a comment period from May 11 to

September 6 , 2010

Political ramifications of eliminating Medicare coverage to

elderly osteoporotic patients in severe pain

Outcome may be better definition/tracking of appropriate use

Facet

injections

a

recent

example;

Noridian

mandated

creation

of

a

registry

`

th

th

th |

29

Industry

Develop advocacy by major industry groups (MDMA/ADVAMED)

Work collectively with key players to develop a concerted industry

response

Physicians and surgeons

Offer

to

coordinate

efforts

with

medical

societies

and

KOLs

to

respond to Noridian

Develop patient testimonials to submit to Noridian

Patients

Direct mailing to National Osteoporosis Foundation advocacy team

Awareness mailing to patients in affected geography

Government

Assess how and where to involve local representatives for

advocacy and response

Orthovita Response to Noridian LCD

Review |

30

Financial Overview |

31

Strong Growth, Improving Margins

1

2007

Net

loss

includes

a

$16.6mm

charge

for

the

repurchase

of

a

royalty

obligation

Dollars in Millions

2007

2008

2009

Q1 2010

Sales

$58.0

$76.9

$92.9

$24.1

Gross Margin

65%

66%

68%

69%

SG&A Expense

$44.6

$53.5

$57.2

$15.8

R&D Expense

$6.4

$6.7

$6.8

$1.3

Operating Loss

$(13.7)

$(9.2)

$(1.1)

$(0.4)

Net Loss

$(29.9)

$(10.8)

$(3.9)

$(1.2)

Cash and

Investments

$19.5

1 |

4

Point

Plan

–

Manage

to

the

Environment

Expense reductions implemented in Q2 2010

Develop specialized distribution channels

Hospital Inpatient Market – Spine/Neurosurgeon

Outpatient Market – Interventional Radiologist

Continue to develop product pipeline to leverage each

specialty

Manage reimbursement issues in VCF

|

33

Going Forward -

Core Strategies and Tactics

Maximize

Growth in

Existing Products

Pipeline

Development Goals

Potential to Fill Gaps

via Licenses &

Acquisitions

Tight focus on

profitable sales growth

–

manage to

environment

Maximize cross-sell of

all products to each

hospital customer

Develop IR/INR

specialty sales focus

Expand Cortoss label

to other indications

2011

–

Cortoss cavity

creation device

2011

–

Next

Generation of Vitoss

2011

–

Vitagel

Cellpaker

update in

conjunction with bone

marrow concentration

device

Bioactive Structural

Spine Implants

–

Regulatory clarity

Utilize collagen facility

capacity for new

product development

Acquire portfolio of

cavity creation devices

to meet all clinical

needs

Build-out Biosurgery

portfolio

Maximize proprietary

Bioactive implant

market opportunity |

THANK

YOU |