Attached files

| file | filename |

|---|---|

| EX-5.1 - Advaxis, Inc. | v191063_ex5-1.htm |

| EX-23.2 - Advaxis, Inc. | v191063_ex23-2.htm |

| EX-23.1 - Advaxis, Inc. | v191063_ex23-1.htm |

File

No. 333-•

As

filed with the Securities and Exchange Commission on July 23, 2010

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ADVAXIS,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

2836

|

02-0563870

|

||

|

(State

or other jurisdiction

of

incorporation or organization)

|

(Primary

Standard Industrial

Classification

Code Number)

|

(I.R.S.

Employer

Identification

No.)

|

Technology

Centre of New Jersey

675

US Highway One

North

Brunswick, New Jersey 08902

(732)

545-1590

(Address,

including zip code, and telephone number, including area code, of registrant’s

principal executive office)

Mr.

Thomas A. Moore

Chief

Executive Officer

Technology

Centre of New Jersey

675

US Highway One

North

Brunswick, New Jersey 08902

(732)

545-1590

(Name,

address, including zip code, and telephone number, including area code, of agent

for service)

Copies

to:

Robert

H. Cohen, Esq.

Greenberg

Traurig, LLP

The

MetLife Building

200

Park Avenue

New

York, New York 10166

Phone:

(212) 801-9200

Fax:

(212) 801-6400

Approximate date of commencement of

proposed sale to the public. From time to time after

this Registration Statement becomes effective, as determined by the selling

stockholders named in the prospectus contained herein.

If any of

the Securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, as

amended, check the following box: x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act Registration Statement number of the earlier effective

Registration Statement for the same offering: ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, please check the following box and list the Securities Act

Registration Statement number of the earlier effective Registration Statement

for the same offering: ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act Registration

Statement number of the earlier effective Registration Statement for the same

offering: ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

|

Non-accelerated

filer ¨ (Do

not check if smaller reporting company)

|

Smaller

reporting company x

|

CALCULATION

OF REGISTRATION FEE

|

Title of each

class of securities

to be registered

|

Amount

to be

registered(1)

|

Proposed

maximum

offering price

per share

|

Proposed

maximum

aggregate

offering price

|

Amount of

registration fee

|

|||||||||||

|

Common

Stock, par value $0.001 per share

|

3,500,000

shares

|

(2) | $ | 0.175 | (3) | $ | 612,500 | $ | 43.68 | (3) | |||||

|

Common

Stock, par value $0.001 per share

|

2,818,000

shares

|

(4) | $ | 0.18 | (5) | $ | 507,240 | $ | 36.17 | (5) | |||||

|

Common

Stock, par value $0.001 per share

|

40,500,000

shares

|

(6) | $ | 0.25 | (5) | $ | 10,125,500 | $ | 721.95 | (5) | |||||

|

Total

|

46,818,000

shares

|

— | — | $ | 801.80 | ||||||||||

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933, as amended, this

Registration Statement shall be deemed to cover the additional securities

(i) to be offered or issued in connection with any provision of any

securities purported to be registered hereby to be offered pursuant to

terms which provide for a change in the amount of securities being offered

or issued to prevent dilution resulting from stock splits, stock dividends

or similar transactions and (ii) of the same class as the securities

covered by this Registration Statement issued or issuable prior to

completion of the distribution of the securities covered by this

Registration Statement as a result of a split of, or a stock dividend on,

the registered securities.

|

|

|

(2)

|

Represents

shares of the registrant’s issued and outstanding common stock being

registered for resale.

|

|

|

(3)

|

Estimated

solely for purposes of calculating the registration fee pursuant to Rule

457(c) of the Securities Act of 1933, as amended, based on the average of

the high and low prices of the common stock of the registrant as reported

on the OTC Bulletin Board on July 19,

2010.

|

|

|

(4)

|

Represents

shares of the registrant’s common stock issuable upon exercise of a

warrant at an exercise price of $0.18 per

share.

|

|

|

(5)

|

Calculated

pursuant to rule 457(g).

|

|

|

(6)

|

Represents

shares of the registrant’s common stock issuable upon exercise of a

warrant at an exercise price of $0.25 per

share.

|

The

registrant hereby amends this Registration Statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this Registration Statement

shall thereafter become effective in accordance with section 8(a) of the

Securities Act of 1933 or until the Registration Statement shall become

effective on such date as the commission, acting pursuant to section 8(a) may

determine.

The

information in this prospectus is not complete and may be

changed. The selling stockholders may not sell these securities until

the registration statement filed with the Securities and Exchange Commission is

effective. This prospectus is not an offer to sell these securities,

and it is not soliciting offers to buy these securities, in any state where the

offer or sale of these securities is not permitted.

PROSPECTUS,

SUBJECT TO COMPLETION, DATED JULY 23, 2010

ADVAXIS,

INC.

46,818,000

Shares

Common

Stock

This

prospectus relates to the resale of up to (i) 3,500,000 shares of our common

stock issued to Numoda Capital Innovations, LLC, which we refer to as Numoda

Capital, as payment for certain services rendered by one of its affiliates to

us, (ii) 2,818,000 shares of our common stock underlying a warrant issued to an

affiliate of Optimus Capital Partners, LLC, which we refer to as Optimus, in

connection with a tranche closing of our Series A preferred equity financing and

(iii) 40,500,000 shares of our common stock underlying a warrant issued to an

affiliate of Optimus in our Series B preferred equity financing. The

shares covered by this prospectus may be sold by the selling stockholders from

time to time in the over-the-counter market or other national securities

exchange or automated interdealer quotation system on which our common stock is

then listed or quoted, through negotiated transactions at negotiated prices or

otherwise at market prices prevailing at the time of sale.

Pursuant

to registration rights granted by us to the selling stockholders, we are

obligated to register the shares held by Numoda Capital and the shares to be

acquired upon exercise of the warrants held by the affiliate of

Optimus. The distribution of the shares by the selling stockholders

is not subject to any underwriting agreement. We will receive none of

the proceeds from the sale of shares by the selling stockholders. The

selling stockholders identified in this prospectus will receive the proceeds

from the sale of the shares. However, we may receive the proceeds

from the exercise of the warrants held by the affiliate of Optimus in certain

circumstances. We will bear all expenses of registration incurred in

connection with this offering, but all selling and other expenses incurred by

the selling stockholders will be borne by them.

Our

common stock is quoted on the Over-The-Counter Bulletin Board, or OTC Bulletin

Board, under the symbol ADXS.OB. On July 19, 2010, the last reported

sale price per share for our common stock as reported by the OTC Bulletin Board

was $0.18.

Investing

in our common stock involves a high degree of risk. We urge you to

carefully consider the ‘‘Risk Factors’’ beginning on page 6.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or

accuracy of the prospectus. Any representation to the contrary is a

criminal offense.

The date

of this prospectus is ____________, 2010.

TABLE

OF CONTENTS

|

ABOUT

THIS PROSPECTUS

|

ii

|

|||

|

PROSPECTUS

SUMMARY

|

1 | |||

|

THE

OFFERING

|

5 | |||

|

RISK

FACTORS

|

6 | |||

|

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

19 | |||

|

USE

OF PROCEEDS

|

21 | |||

|

MARKET

PRICE OF AND DIVIDENDS ON OUR COMMON STOCK

|

||||

|

AND

RELATED STOCKHOLDER MATTERS

|

21 | |||

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF

|

||||

|

FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

|

22 | |||

|

DESCRIPTION

OF BUSINESS

|

36 | |||

|

MANAGEMENT

|

56 | |||

|

EXECUTIVE

COMPENSATION

|

60 | |||

|

STOCK

OWNERSHIP

|

68 | |||

|

SELLING

STOCKHOLDERS

|

70 | |||

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

71 | |||

|

DESCRIPTION

OF OUR CAPITAL STOCK

|

71 | |||

|

SHARES

ELIGIBLE FOR FUTURE SALE

|

76 | |||

|

PLAN

OF DISTRIBUTION

|

77 | |||

|

LEGAL

MATTERS

|

79 | |||

|

EXPERTS

|

79 | |||

|

INTERESTS

OF NAMED EXPERTS AND COUNSEL

|

79 | |||

|

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

|

79 | |||

|

INDEX

TO FINANCIAL STATEMENTS

|

F-1 | |||

ABOUT

THIS PROSPECTUS

You

should only rely on the information contained in this prospectus. We

have not authorized anyone to give any information or make any representation

about this offering that differs from, or adds to, the information in this

prospectus or in its documents that are publicly filed with the

SEC. Therefore, if anyone does give you different or additional

information, you should not rely on it. The delivery of this

prospectus does not mean that there have not been any changes in our condition

since the date of this prospectus. If you are in a jurisdiction where

it is unlawful to offer the securities offered by this prospectus, or if you are

a person to whom it is unlawful to direct such activities, then the offer

presented by this prospectus does not extend to you. This prospectus

speaks only as of its date except where it indicates that another date

applies.

Market

data and certain industry forecasts used in this prospectus were obtained from

market research, publicly available information and industry publications. We

believe that these sources are generally reliable, but the accuracy and

completeness of such information is not guaranteed. We have not independently

verified this information, and we do not make any representation as to the

accuracy of such information.

In this

prospectus, the terms “we”, “us”, “our” and “our company” refer to Advaxis,

Inc., a Delaware corporation, resulting from the reincorporation of our company

from Colorado to Delaware described elsewhere in this prospectus (unless the

context references such entity prior to the June 20, 2006 reincorporation from

Colorado to Delaware, in which case it refers to the Colorado

entity).

The name

Advaxis is our trademark. Other trademarks and product names appearing in this

prospectus are the property of their respective owners.

ii

PROSPECTUS

SUMMARY

This

summary highlights some important information from this prospectus, and it may

not contain all of the information that is important to you. You

should read the following summary together with the more detailed information

regarding us and our common stock being sold in this offering, including “Risk

Factors” and our financial statements and related notes, included elsewhere in

this prospectus.

Our

Company

We are a

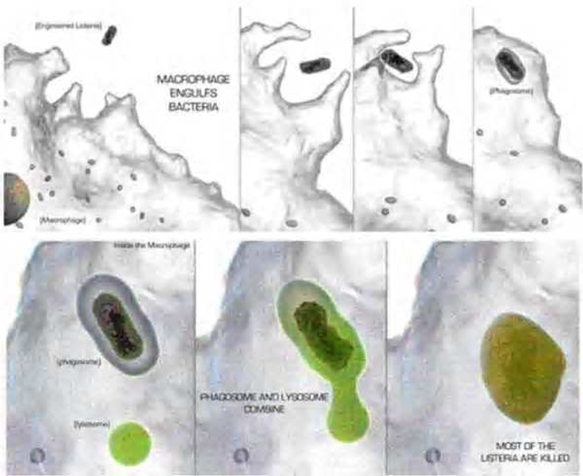

development stage biotechnology company with the intent to develop safe and

effective cancer vaccines that utilize multiple mechanisms of immunity. We are

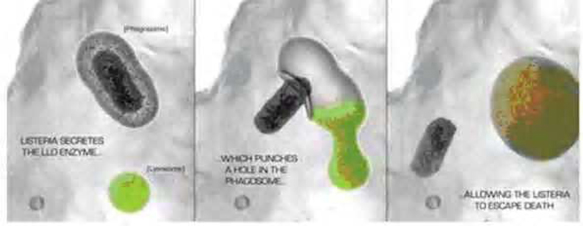

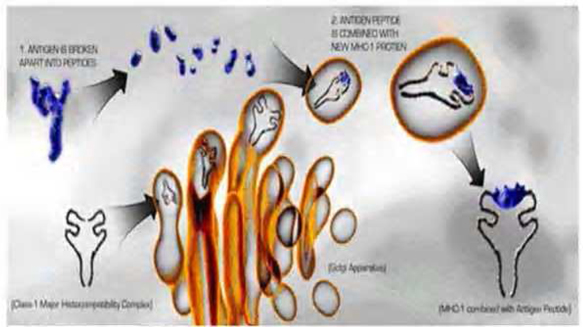

developing a live Listeria vaccine technology

under license from Penn, which secretes a protein sequence containing a

tumor-specific antigen. We believe this vaccine technology is capable of

stimulating the body’s immune system to process and recognize the antigen as if

it were foreign, generating an immune response able to attack the cancer. We

believe this to be a broadly enabling platform technology that can be applied to

the treatment of many types of cancers, infectious diseases and auto-immune

disorders.

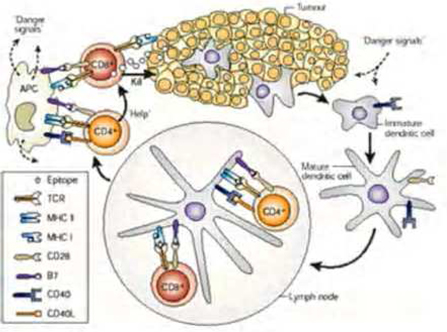

The

discoveries that underlie this innovative technology are based upon the work of

Yvonne Paterson, Ph.D., Professor of Microbiology at Penn. This

technology involves the creation of genetically engineered Listeria that stimulate the

innate immune system and induce an antigen-specific immune response involving

both arms of the adaptive immune system. In addition, this technology

supports, among other things, the immune response by altering tumors to make

them more susceptible to immune attack, stimulating the development of specific

blood cells that underlie a strong therapeutic immune response.

We have

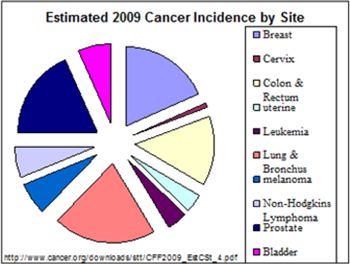

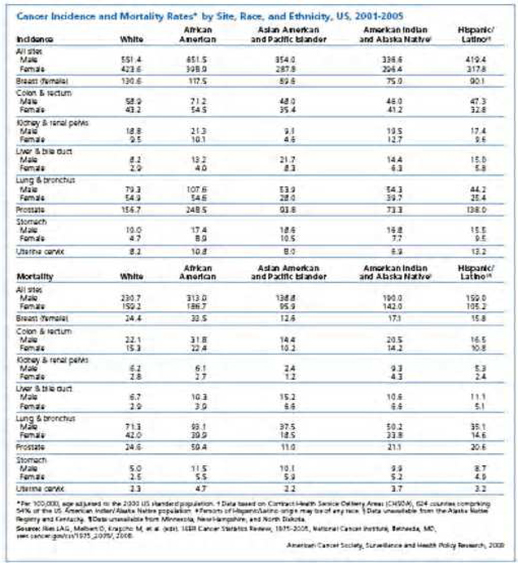

focused our initial development efforts upon therapeutic cancer vaccines

targeting cervical cancer, its predecessor condition, cervical intraepithelial

neoplasia, which we refer to as CIN, head and neck cancer, breast cancer,

prostate cancer, and other cancers. Our lead products in development are as

follows:

|

Product

|

Indication

|

Stage

|

||

|

ADXS11-001

|

Cervical

Cancer

|

Phase I Company

sponsored & completed in 2007.

|

||

|

Cervical

Intraepithelial Neoplasia

|

Phase II Company

sponsored study; commenced in March 2010 (with patient dosing commencing

in June 2010).

|

|||

|

Cervical

Cancer

|

Phase II Company

sponsored study anticipated to commence in July-August 2010 in India. 110

Patients with advanced cervical cancer.

|

|||

|

Cervical

Cancer

|

Phase II The Gynecologic

Oncology Group of the National Cancer Institute has agreed to conduct a

study which we expect will commence in late 2010.

|

|||

|

Head

& Neck Cancer

|

Phase I The Cancer

Research UK (CRUK) is funding a study of up to 45 patients at 3 UK

facilities that we expect will commence in October

2010.

|

|||

|

ADXS31-142

|

Prostate

Cancer

|

Phase I Company

sponsored (timing to be determined).

|

||

|

ADXS31-164

|

Breast

Cancer

|

Phase I Company

sponsored (timing to be

determined).

|

We have

sustained losses from operations in each fiscal year since our inception, and we

expect these losses to continue for the indefinite future, due to the

substantial investment in research and development. As of October 31,

2009 and April 30, 2010, we had an accumulated deficit of $16,603,800 and

$29,795,519, respectively, and shareholders’ deficiency of $15,733,328 and

$21,962,320, respectively.

1

To date,

we have outsourced many functions of drug development including manufacturing

and clinical trials management. Accordingly, the expenses of these

outsourced services account for a significant amount of our accumulated

loss. We cannot predict when, if ever, any of our product candidates

will become commercially viable or approved by the United States Food and Drug

Administration, which we refer to as the FDA. We expect to spend

substantial additional sums on the continued administration and research and

development of proprietary products and technologies, including conducting

clinical trials for our product candidates, with no certainty that our products

will receive FDA approval, become commercially viable or profitable as a result

of these expenditures.

We intend

to continue to devote a substantial portion of our resources to the continued

pre-clinical development and optimization of our technology so as to develop it

to its full potential and to find appropriate new drug

candidates. Specifically, we intend to conduct research relating to

developing our Listeria

technology using new tumor antigens, and to develop new strains of Listeria, which may lead to

additional cancer and infectious disease products, to improve the Listeria platform by

developing new Listeria

strains that are more suitable as live vaccine vectors, and to continue to

develop the use of the Listeria virulence factor LLO

as a component of a fusion protein based vaccine. These activities

may require significant financial resources, as well as areas of expertise

beyond those readily available. In order to provide additional resources and

capital, we may enter into research, collaborative or commercial partnerships,

joint ventures, or other arrangements with competitive or complementary

companies, including major international pharmaceutical companies or

universities.

Recent

Developments

Series

B Preferred Equity Financing

On July

19, 2010, we entered into a Preferred Stock Purchase Agreement with Optimus,

which we refer to as the Series B purchase agreement, pursuant to which Optimus

agreed to purchase, upon the terms and subject to the conditions set forth

therein and described below, up to $7.5 million of our newly authorized,

non-convertible, redeemable Series B preferred stock, which we refer to as our

Series B preferred stock, at a price of $10,000 per share. The conditions

necessary to effect the commitment closing under the Series B purchase

agreement, which we refer to as the Commitment Closing, were also satisfied on

July 19, 2010.

Under the

terms of the Series B purchase agreement, and after the SEC has declared

effective the registration statement of which this prospectus is a part, we may

from time to time until July 19, 2013, present Optimus with a notice to purchase

a specified amount of Series B preferred stock. Subject to

satisfaction of certain closing conditions, Optimus is obligated to purchase

such shares of Series B preferred stock on the 10th trading day after the date

of the notice. We will determine, in our sole discretion, the timing and amount

of Series B preferred stock to be purchased by Optimus, and may sell such shares

in multiple tranches. Optimus will not be obligated to purchase the Series B

preferred stock upon our notice (i) in the event the average closing sale price

of our common stock during the nine trading days following delivery of our

notice falls below 75% of the closing sale price of our common stock on the

trading day prior to the date such notice is delivered to Optimus, or (ii) to

the extent such purchase would result in Optimus and its affiliates beneficially

owning more than 9.99% of our outstanding common stock.

Holders

of Series B preferred stock will be entitled to receive dividends, which will

accrue in shares of Series B preferred stock on an annual basis at a rate equal

to 10% per annum from the issuance date. Accrued dividends will be payable upon

redemption of the Series B preferred stock or upon the liquidation, dissolution

or winding up of our company. The Series B preferred stock ranks, with respect

to dividend rights and rights upon liquidation:

|

|

·

|

senior

to our common stock and any other class or series of preferred stock

(other than Series A preferred stock or any class or series of preferred

stock that we intend to cause to be listed for trading or quoted on

Nasdaq, NYSE Amex or the New York Stock

Exchange);

|

|

|

·

|

pari passu with any

outstanding shares of our Series A preferred stock (none of which are

issued and outstanding as of the date hereof);

and

|

|

|

·

|

junior

to all of our existing and future indebtedness and any class or series of

preferred stock that we intend to cause to be listed for trading or quoted

on Nasdaq, NYSE Amex or the New York Stock

Exchange.

|

2

The

Series B preferred stock has a liquidation preference per share equal to the

original price per share thereof plus all accrued dividends thereon, and is

subject to repurchase following the consummation of certain fundamental

transactions by us. Upon or after the fourth anniversary of the

applicable issuance date, we have the right, at our option, to redeem all or a

portion of the shares of Series B preferred stock, at their liquidation

value. We also have the right, at our option, to redeem all or a

portion of the shares of Series B preferred stock, at a price per share equal

to: (i) 136% of their liquidation value if redeemed on or after the applicable

issuance date but prior to the first anniversary of the applicable issuance

date, (ii) 127% of their liquidation value if redeemed on or after the first

anniversary but prior to the second anniversary of the applicable issuance date,

(iii) 118% of their liquidation value if redeemed on or after the second

anniversary but prior to the third anniversary of the applicable issuance date,

and (iv) 109% of their liquidation value if redeemed on or after the third

anniversary but prior to the fourth anniversary of the applicable issuance

date.

The

Series B purchase agreement provides that we will pay to Optimus a

non-refundable fee of $195,000 on the earlier of (x) the closing date of the

first tranche (by offset from the gross proceeds from such tranche) or (y) the

six-month anniversary of the date of the Commitment Closing.

In

addition, on the date of the Commitment Closing, we issued to Optimus a

three-year warrant to purchase up to 40,500,000 shares of our common stock, at

an initial exercise price of $0.25 per share, subject to adjustment as described

below. The warrant will become exercisable on the earlier of (i) the date on

which a registration statement registering for resale the shares of our common

stock issuable upon exercise of the warrant becomes effective and (ii) the first

date on which such warrant shares are eligible for resale without limitation

under Rule 144 (assuming a cashless exercise of the warrant).

The

warrant consists of and is exercisable in tranches, with a separate tranche

being created upon each delivery of a tranche notice under the Series B purchase

agreement. On each tranche notice date, that portion of the warrant

equal to 135% of the tranche amount will vest and become exercisable, and such

vested portion may be exercised at any time during the exercise period on or

after such tranche notice date. On and after the first tranche notice

date and each subsequent tranche notice date, the exercise price of the warrant

will be adjusted to the closing sale price of a share of our common stock on the

applicable tranche notice date. The exercise price of the warrant may

be paid (at the option of Optimus) in cash or by Optimus’s issuance of a

four-year, full-recourse promissory note, bearing interest at 2% per annum, and

secured by a specified portfolio of assets. However, such promissory

note is not due or payable at any time that (a) we are in default of any

preferred stock purchase agreement for Series B preferred stock or any warrant

issued pursuant thereto, any loan agreement or other material agreement or (b)

there are any shares of the Series B preferred stock issued or

outstanding. The warrant also provides for cashless exercise in

certain circumstances. If Optimus fails to acquire and pay for the Series B

preferred stock upon delivery of our notice in accordance with the terms of the

Series B purchase agreement (assuming the timely and full satisfaction of all of

the conditions set forth therein) and the warrant has not previously been

exercised in full, we have the right to demand surrender of the warrant (or any

remaining portion thereof) without compensation, and the warrant will

automatically be cancelled.

Our right

to deliver a notice to Optimus and the obligation of Optimus to accept a notice

and to acquire and pay for the Series B preferred stock subject to such notice

at a tranche closing are subject to the satisfaction of certain conditions,

which include, among others:

|

|

·

|

our

common stock must be listed for trading or quoted on the OTC Bulletin

Board (or another eligible trading market), and we must be in compliance

with all requirements under the Securities Exchange Act of 1934, as

amended, in order to maintain such

listing;

|

|

|

·

|

either

(i) we have a current, valid and effective registration statement covering

the resale of all warrant shares or (ii) all warrant shares are eligible

for resale without limitation under Rule 144 (assuming cashless exercise

of the warrant);

|

|

|

·

|

there

must not be any material adverse effect with respect to our company since

the date of the Series B purchase agreement, other than losses incurred in

the ordinary course of business;

|

|

|

·

|

we

must not be in default under any material

agreement;

|

|

|

·

|

certain

lock-up agreements with our senior officers and directors and certain

beneficial owners of 10% or more of our outstanding common stock must be

effective;

|

3

|

|

·

|

there

must not be any legal restraint prohibiting the transactions contemplated

by the Series B purchase agreement;

and

|

|

|

·

|

the

aggregate of all shares of our common stock beneficially owned by Optimus

and its affiliates must not exceed 9.99% of our outstanding common

stock.

|

On the

date of the Commitment Closing, we issued 500 shares of Series B preferred stock

to Optimus, which we refer to as the Series B exchange shares, in exchange for

the 500 shares of Series A preferred stock that was held by Optimus on such date

so that all shares of our preferred stock held or subsequently purchased by

Optimus under the Series B purchase agreement would be redeemable upon

substantially identical terms. Any accrued and unpaid dividends on

the Series A preferred stock were deemed cancelled and such amount of accrued

and unpaid dividends were reflected as accrued and unpaid dividends of the

Series B preferred stock issued to Optimus. In addition, on the date

of the Commitment Closing, the security and collateral provisions of each of the

outstanding promissory notes that an affiliate of Optimus gave to us in lieu of

the payment of the exercise price of certain warrants previously issued by us to

such affiliate of Optimus was amended and restated and such affiliate of Optimus

entered into a Security Agreement with us in connection with such

amendments.

Our

History

We were

originally incorporated in the State of Colorado on June 5, 1987 under the name

Great Expectations, Inc. We were administratively dissolved on

January 1, 1997 and reinstated on June 18, 1998 under the name Great

Expectations and Associates, Inc. In 1999, we became a reporting

company under the Securities Exchange Act of 1934, as amended. We

were a publicly-traded “shell” company without any business until November 12,

2004 when we acquired Advaxis, Inc., a Delaware corporation, through a Share

Exchange and Reorganization Agreement, dated as of August 25, 2004, which we

refer to as the Share Exchange, by and among Advaxis, the stockholders of

Advaxis and us. As a result of the Share Exchange, Advaxis become our

wholly-owned subsidiary and our sole operating company. On December

23, 2004, we amended and restated our articles of incorporation and changed our

name to Advaxis, Inc. On June 6, 2006, our shareholders approved the

reincorporation of our company from Colorado to Delaware by merging the Colorado

entity into our wholly-owned Delaware subsidiary.

Principal

Executive Offices

Our

principal executive offices are located at Technology Centre of New Jersey, 675

US Highway One, North Brunswick, New Jersey 08902 and our telephone number is

(732) 545-1590. We maintain a website at www.advaxis.com which

contains descriptions of our technology, our drugs and the trial status of each

drug. The information on our website is not incorporated into this

prospectus.

4

THE

OFFERING

|

Shares

of common stock offered by us

|

None

|

|

|

Shares

of common stock which may be sold by the selling

stockholders

|

A

total of 46,818,000 shares of our common stock (1)

consisting of:

|

|

|

|

·

3,500,000 shares of our common stock issued to Numoda Capital as

payment for certain services rendered by one of its affiliates to

us;

|

|

|

|

||

|

·

2,818,000 shares of our common stock underlying a warrant issued to

an affiliate of Optimus in connection with a tranche closing of our Series

A preferred equity financing; and

|

||

|

·

40,500,000 shares of our common stock underlying a warrant issued

to an affiliate of Optimus in our Series B preferred equity

financing.

|

||

|

Use

of proceeds

|

We

will not receive any proceeds from the resale of the shares of common

stock offered by the selling stockholders as all of such proceeds will be

paid to the selling stockholders. Furthermore, we will not

receive cash proceeds from the exercise of the warrants held by the

affiliate of Optimus to the extent they are exercised by a promissory

note, as permitted by the terms of such warrants.

|

|

|

Risk

factors

|

The

purchase of our common stock involves a high degree of

risk. You should carefully review and consider the “Risk

Factors” section of this prospectus for a discussion of factors to

consider before deciding to invest in shares of our common

stock.

|

|

|

OTC

Bulletin Board market symbol

|

ADXS.OB

|

(1) These

shares represent approximately 15.1% of our currently outstanding shares of

common stock (based on 309,559,255 shares of common stock outstanding as of July

1, 2010 on a fully diluted basis (assuming the warrant to purchase 40,500,000

shares of our common stock was issued and outstanding on the date

thereof)).

5

RISK

FACTORS

An

investment in our common stock is highly speculative, involves a high degree of

risk and should be made only by investors who can afford a complete loss of

their investment. You should carefully consider, together with the

other matters referred to in this prospectus, the following risk factors before

you decide whether to buy our common stock.

Risks

Related to our Business

We

are a development stage company.

We are an

early stage development stage company with a history of losses and can provide

no assurance as to future operating results. As a result of losses

which will continue throughout our development stage, we may exhaust our

financial resources and be unable to complete the development of our

production. Our deficit will continue to grow during our drug

development period.

We have

sustained losses from operations in each fiscal year since our inception, and we

expect losses to continue for the indefinite future, due to the substantial

investment in research and development. As of October 31, 2009 and

April 30, 2010, we had an accumulated deficit of $16,603,800 and $29,795,519,

respectively, and shareholders’ deficiency of $15,733,328 and $21,962,320,

respectively. We expect to spend substantial additional sums on the

continued administration and research and development of proprietary products

and technologies with no certainty that our products will become commercially

viable or profitable as a result of these expenditures.

As

a result of our current lack of financial liquidity and negative stockholders

equity, our auditors have expressed substantial concern about our ability to

continue as a “going concern” .

Our

limited capital resources and operations to date have been funded primarily with

the proceeds from public and private equity and debt financings, NOL and

Research tax credits and income earned on investments and grants. Based on our

currently available cash, we do not have adequate cash on hand to cover our

anticipated expenses for the next 12 months. If we fail to raise a significant

amount of capital, we may need to significantly curtail operations, cease

operations or seek federal bankruptcy protection in the near future. These

conditions have caused our auditors to raise substantial doubt about our ability

to continue as a going concern. Consequently, the audit report

prepared by our independent public accounting firm relating to our financial

statements for the year ended October 31, 2009 included a going concern

explanatory paragraph.

There

can be no assurance that we will receive funding from Optimus in connection with

the Series B preferred equity financing.

We have

entered into the Series B purchase agreement, pursuant to which Optimus has

agreed to purchase up to $7.5 million of our Series B preferred stock from time

to time, subject to our ability to effect and maintain an effective registration

statement for the shares underlying the warrant issued to an affiliate of

Optimus to purchase up to 40,500,000 shares of common stock, issued in

connection with the transaction. Additionally, the Series B purchase

agreement provides that in order to require Optimus to purchase our Series B

preferred stock at any time: (i) we must be in compliance with our SEC reporting

obligations, (ii) our common stock must be quoted on the OTC Bulletin Board or

another eligible trading market, (iii) a material adverse effect relating to,

among other things, our results of operations, assets, business or financial

condition must not have occurred since July 19, 2010, other than losses incurred

in the ordinary course of business, (iv) we must not be in default under any

material agreement, (v) Optimus and its affiliates must not own more than 9.99%

of our outstanding common stock, and (vi) we must comply with certain other

requirements set forth in the Series B purchase agreement. If we fail

to comply with any of these requirements, Optimus will not be obligated to

purchase our Series B preferred stock and we will not receive any funding from

Optimus. Moreover, if we exercise our option to require Optimus to purchase our

Series B preferred stock, and our common stock has a closing price of less than

$0.17 per share on the trading day immediately preceding our delivery of the

exercise notice, we will trigger at closing certain anti-dilution protection

provisions in certain outstanding warrants that would result in an adjustment to

the number and price of certain outstanding warrants.

6

If

the average closing sale price of our common stock on each tranche notice date

is less than $0.25 per share, we may not be able to require Optimus to purchase

the entire $7.5 million of Series B preferred stock issuable under the Series B

purchase agreement.

In

connection with our Series B preferred equity financing, we issued to an

affiliate of Optimus a three-year warrant to purchase up to 40,500,000 shares of

our common stock, at an initial exercise price of $0.25 per

share. The warrant provides that on each tranche notice date under

the Series B purchase agreement, (i) that portion of the warrant equal to 135%

of the tranche amount will vest and become exercisable (and such vested portion

may be exercised at any time during the exercise period on or after such tranche

notice date) and (ii) the exercise price will be adjusted to the closing sale

price of a share of our common stock on such tranche notice date. We

are not permitted to deliver a tranche notice under the Series B purchase

agreement if the number of registered shares underlying the warrant is

insufficient to cover the portion of the warrant that will vest and become

exercisable in connection with such tranche notice. If the average

closing sale price on each tranche notice date is less than $0.25 per share, we

will not have a sufficient number of registered shares available under this

prospectus to require Optimus to purchase the entire $7.5 million without

issuing an additional warrant, and effecting an additional registration

statement relating to the shares of our common stock issuable upon exercise of

such additional warrant. In such an event, we cannot assure you that

we will be able to timely effect and maintain a registration statement so as to

permit us to require Optimus to purchase the entire $7.5 million of Series B

preferred stock under the Series B purchase agreement.

Our

business will require substantial additional investment that we have not yet

secured, and our failure to raise capital and/or pursue partnering opportunities

will materially adversely affect our business, financial condition and results

of operations.

We expect

to continue to spend substantial amounts on research and development, including

conducting clinical trials for our product candidates. However, we will not have

sufficient resources to develop fully any new products or technologies unless we

are able to raise substantial additional financing on acceptable terms, secure

funds from new partners or consummate a preferred equity financing under the

Series B purchase agreement. We cannot be assured that financing will be

available at all. Our failure to raise a significant amount of

capital in the near future, will materially adversely affect our business,

financial condition and results of operations, and we may need to significantly

curtail operations, cease operations or seek federal bankruptcy protection in

the near future. Any additional investments or resources required

would be approached, to the extent appropriate in the circumstances, in an

incremental fashion to attempt to cause minimal disruption or

dilution. Any additional capital raised through the sale of equity or

convertible debt securities will result in dilution to our existing

stockholders. No assurances can be given, however, that we will be

able to achieve these goals or that we will be able to continue as a going

concern.

We

have significant indebtedness which may restrict our business and operations,

adversely affect our cash flow and restrict our future access to sufficient

funding to finance desired growth.

As of

April 30, 2010, our total outstanding indebtedness was approximately $4.3

million, which included the face value of our outstanding bridge notes in the

amount of approximately $3.4 million and the note outstanding to our chief

executive officer in the amount of approximately $0.9 million. The total

face value of the notes outstanding as of April 30, 2010 is due on or before

November 30, 2010. We dedicate a substantial portion of our cash to

pay interest and principal on our debt. If we are not able to service our debt,

we would need to refinance all or part of that debt, sell assets, borrow more

money or sell securities, which we may not be able to do on commercially

reasonable terms, or at all. In addition, our failure to timely repay

(or extend) amounts due and owing under our outstanding senior and junior bridge

notes, may trigger the anti-dilution protection provisions in substantially all

of our warrants (other than the warrants issued to the affiliate of Optimus), in

which case holders of our common stock will experience significant additional

dilution. As of July 1, 2010, approximately 80 million warrants would

be subject to these anti-dilution protection provisions.

As of

April 30, 2010, $150,000 of this indebtedness is secured by substantially all of

our assets. The terms of our notes include customary events of

default and covenants that restrict our ability to incur additional

indebtedness. These restrictions and covenants may prevent us from engaging in

transactions that might otherwise be considered beneficial to us. A breach of

the provisions of our indebtedness could result in an event of default under our

outstanding notes. If an event of default occurs under our notes

(after any applicable notice and cure periods), the holders would be entitled to

accelerate the repayment of amounts outstanding, plus accrued and unpaid

interest. In the event of a default under our senior

indebtedness, the holders could also foreclose against the assets securing such

obligations. In the event of a foreclosure on all or substantially

all of our assets, we may not be able to continue to operate as a going

concern.

7

Our

limited operating history does not afford investors a sufficient history on

which to base an investment decision.

We

commenced our Listeria

System vaccine development business in February 2002 and have existed as a

development stage company since such time. Prior thereto we conducted

no business. Accordingly, we have a limited operating

history. Investors must consider the risks and difficulties we have

encountered in the rapidly evolving vaccine and therapeutic biopharmaceutical

industry. Such risks include the following:

|

|

·

|

competition

from companies that have substantially greater assets and financial

resources than we have;

|

|

|

·

|

need

for acceptance of products;

|

|

|

·

|

ability

to anticipate and adapt to a competitive market and rapid technological

developments;

|

|

|

·

|

amount

and timing of operating costs and capital expenditures relating to

expansion of our business, operations and

infrastructure;

|

|

|

·

|

need

to rely on multiple levels of complex financing agreements with outside

funding due to the length of the product development cycles and

governmental approved protocols associated with the pharmaceutical

industry; and

|

|

|

·

|

dependence

upon key personnel including key independent consultants and

advisors.

|

We cannot

be certain that our strategy will be successful or that we will successfully

address these risks. In the event that we do not successfully address

these risks, our business, prospects, financial condition and results of

operations could be materially and adversely affected. We may be

required to reduce our staff, discontinue certain research or development

programs of our future products and cease to operate.

We

can provide no assurance of the successful and timely development of new

products.

Our

products are at various stages of research and development. Further

development and extensive testing will be required to determine their technical

feasibility and commercial viability. Our success will depend on our

ability to achieve scientific and technological advances and to translate such

advances into reliable, commercially competitive products on a timely

basis. Immunotherapy and vaccine products that we may develop are not

likely to be commercially available until five to ten or more

years. The proposed development schedules for our products may be

affected by a variety of factors, including technological difficulties,

proprietary technology of others, and changes in governmental regulation, many

of which will not be within our control. Any delay in the

development, introduction or marketing of our products could result either in

such products being marketed at a time when their cost and performance

characteristics would not be competitive in the marketplace or in the shortening

of their commercial lives. In light of the long-term nature of our

projects, the unproven technology involved and the other factors described

elsewhere in “Risk Factors,” there can be no assurance that we will be able to

successfully complete the development or marketing of any new

products.

Our

research and development expenses are subject to uncertainty.

Factors

affecting our research and development expenses include, but are not limited

to:

|

|

·

|

competition

from companies that have substantially greater assets and financial

resources than we have;

|

|

|

·

|

need

for acceptance of products;

|

|

|

·

|

ability

to anticipate and adapt to a competitive market and rapid technological

developments;

|

|

|

·

|

amount

and timing of operating costs and capital expenditures relating to

expansion of our business, operations and

infrastructure;

|

|

|

·

|

need

to rely on multiple levels of outside funding due to the length of the

product development cycles and governmental approved protocols associated

with the pharmaceutical industry;

and

|

8

|

|

·

|

dependence

upon key personnel including key independent consultants and

advisors.

|

We

are subject to numerous risks inherent in conducting clinical

trials.

We

outsource the management of our clinical trials to third

parties. Agreements with clinical investigators and medical

institutions for clinical testing and with other third parties for data

management services, place substantial responsibilities on these parties which,

if unmet, could result in delays in, or termination of, our clinical

trials. For example, if any of our clinical trial sites fail to

comply with FDA-approved good clinical practices, we may be unable to use the

data gathered at those sites. If these clinical investigators,

medical institutions or other third parties do not carry out their contractual

duties or obligations or fail to meet expected deadlines, or if the quality or

accuracy of the clinical data they obtain is compromised due to their failure to

adhere to our clinical protocols or for other reasons, our clinical trials may

be extended, delayed or terminated, and we may be unable to obtain regulatory

approval for or successfully commercialize our agent ADXS11-001. We are not

certain that we will successfully recruit enough patients to complete our

clinical trials. Delays in recruitment and such agreements would

delay the initiation of the Phase II trials of ADXS11-001.

We or our

regulators may suspend or terminate our clinical trials for a number of

reasons. We may voluntarily suspend or terminate our clinical trials

if at any time we believe they present an unacceptable risk to the patients

enrolled in our clinical trials. In addition, regulatory agencies may

order the temporary or permanent discontinuation of our clinical trials at any

time if they believe that the clinical trials are not being conducted in

accordance with applicable regulatory requirements or that they present an

unacceptable safety risk to the patients enrolled in our clinical

trials.

Our

clinical trial operations are subject to regulatory inspections at any

time. If regulatory inspectors conclude that we or our clinical trial

sites are not in compliance with applicable regulatory requirements for

conducting clinical trials, we may receive reports of observations or warning

letters detailing deficiencies, and we will be required to implement corrective

actions. If regulatory agencies deem our responses to be inadequate,

or are dissatisfied with the corrective actions we or our clinical trial sites

have implemented, our clinical trials may be temporarily or permanently

discontinued, we may be fined, we or our investigators may be precluded from

conducting any ongoing or any future clinical trials, the government may refuse

to approve our marketing applications or allow us to manufacture or market our

products, and we may be criminally prosecuted.

The

successful development of biopharmaceuticals is highly uncertain.

Successful

development of biopharmaceuticals is highly uncertain and is dependent on

numerous factors, many of which are beyond our control. Products that

appear promising in the early phases of development may fail to reach the market

for several reasons including:

|

|

·

|

Preclinical

study results that may show the product to be less effective than desired

(e.g., the study failed to meet its primary objectives) or to have harmful

or problematic side effects;

|

|

|

·

|

Failure

to receive the necessary regulatory approvals or a delay in receiving such

approvals. Among other things, such delays may be caused by

slow enrollment in clinical studies, length of time to achieve study

endpoints, additional time requirements for data analysis, or Biologics

License Application preparation, discussions with the FDA, an FDA request

for additional preclinical or clinical data, or unexpected safety or

manufacturing issues;

|

|

|

·

|

Manufacturing

costs, formulation issues, pricing or reimbursement issues, or other

factors that make the product uneconomical;

and

|

|

|

·

|

The

proprietary rights of others and their competing products and technologies

that may prevent the product from being

commercialized.

|

Success

in preclinical and early clinical studies does not ensure that large-scale

clinical studies will be successful. Clinical results are frequently

susceptible to varying interpretations that may delay, limit or prevent

regulatory approvals. The length of time necessary to complete clinical studies

and to submit an application for marketing approval for a final decision by a

regulatory authority varies significantly from one product to the next, and may

be difficult to predict.

9

We

must comply with significant government regulations.

The

research and development, manufacture and marketing of human therapeutic and

diagnostic products are subject to regulation, primarily by the FDA in the U.S.

and by comparable authorities in other countries. These national

agencies and other federal, state, local and foreign entities regulate, among

other things, research and development activities (including testing in animals

and in humans) and the testing, manufacturing, handling, labeling, storage,

record keeping, approval, advertising and promotion of the products that we are

developing. Noncompliance with applicable requirements can result in

various adverse consequences, including delay in approving or refusal to approve

product licenses or other applications, suspension or termination of clinical

investigations, revocation of approvals previously granted, fines, criminal

prosecution, recall or seizure of products, injunctions against shipping

products and total or partial suspension of production and/or refusal to allow a

company to enter into governmental supply contracts.

The

process of obtaining requisite FDA approval has historically been costly and

time-consuming. Current FDA requirements for a new human biological

product to be marketed in the U.S. include: (1) the successful conclusion of

preclinical laboratory and animal tests, if appropriate, to gain preliminary

information on the product’s safety; (2) filing with the FDA of an

Investigational New Drug Application, which we refer to as an IND, to conduct

human clinical trials for drugs or biologics; (3) the successful completion of

adequate and well-controlled human clinical investigations to establish the

safety and efficacy of the product for its recommended use; and (4) filing by a

company and acceptance and approval by the FDA of a Biologic License

Application, which we refer to as a BLA, for a biological product, to allow

commercial distribution of a biologic product. A delay in one or more

of the procedural steps outlined above could be harmful to us in terms of

getting our product candidates through clinical testing and to

market.

We

can provide no assurance that our products will obtain regulatory approval or

that the results of clinical studies will be favorable.

In

February 2006, we received permission from the appropriate governmental agencies

in Israel, Mexico and Serbia to conduct Phase I clinical testing of ADXS11-001,

our Listeria -based

cancer vaccine that targets cervical cancer in women in those

countries. The study was completed in the fiscal quarter ended

January 31, 2008. The next step was to manufacture and test our

product for future sale or distribution in the U.S. which required a filing of

an IND with the FDA for our Phase II CIN trial. The filing was based on

information from the Phase I trial and other pre-clinical information. On

January 6, 2009 we received permission to conduct our clinical trial under this

IND from the FDA. However, even though we are allowed to conduct this

trial, as with any experimental agent, we are always at risk to be placed on

clinical hold by the FDA at any time as our product may have effects on humans

are not fully understood or documented. There can be delays in

obtaining FDA or any other necessary regulatory approvals of any proposed

product and failure to receive such approvals would have an adverse effect on

the product’s potential commercial success and on our business, prospects,

financial condition and results of operations. In addition, it is

possible that a product may be found to be ineffective or unsafe due to

conditions or facts which arise after development has been completed and

regulatory approvals have been obtained. In this event, we may be

required to withdraw such product from the market. To the extent that

our success will depend on any regulatory approvals from governmental

authorities outside of the U.S. that perform roles similar to that of the FDA,

uncertainties similar to those stated above will also exist.

We

rely upon patents to protect our technology. We may be unable to

protect our intellectual property rights and we may be liable for infringing the

intellectual property rights of others.

Our

ability to compete effectively will depend on our ability to maintain the

proprietary nature of our technologies, including the Listeria System, and the

proprietary technology of others with which we have entered into licensing

agreements.

As of

June 15, 2010 we have 27 patents that have been issued and licenses for 45

patent applications that are pending. We have licensed most of these

patents and applications from Penn and we have obtained the rights to all future

patent applications originating in the laboratories of Dr. Yvonne Paterson and

Dr. Fred Frankel. Further, we rely on a combination of trade secrets

and nondisclosure, and other contractual agreements and technical measures to

protect our rights in the technology. We depend upon confidentiality

agreements with our officers, employees, consultants, and subcontractors to

maintain the proprietary nature of the technology. These measures may not afford

us sufficient or complete protection, and others may independently develop

technology similar to ours, otherwise avoid the confidentiality agreements, or

produce patents that would materially and adversely affect our business,

prospects, financial condition, and results of operations. Such

competitive events, technologies and patents may limit our ability to raise

funds, prevent other companies from collaborating with us, and in certain cases

prevent us from further developing our technology due to third party patent

blocking rights.

10

We are

aware of a private company, Anza Therapeutics, Inc (formerly Cerus Corporation),

which is no longer in existence, but had been developing Listeria

vaccines. We are also aware of Aduro Biotech, a company comprised in

part of former Cerus and Anza employees that has recently formed to investigate

Listeria

vaccines. We believe that through our exclusive license with Penn we

have earliest known and dominant patent position in the U.S. for the use of

recombinant Listeria

monocytogenes expressing proteins or tumor antigens as a vaccine for the

treatment of infectious diseases and tumors. We successfully defended

our intellectual property by contesting a challenge made by Anza to our patent

position in Europe on a claim not available in the U.S. The European

Patent Office, which we refer to as the EPO, Board of Appeals in Munich, Germany

has ruled in favor of The Trustees of Penn and its exclusive licensee Advaxis

and reversed a patent ruling that revoked a technology patent that had resulted

from an opposition filed by Anza. The ruling of the EPO Board of

Appeals is final and can not be appealed. The granted claims, the

subject matter of which was discovered by Dr. Yvonne Paterson, scientific

founder of Advaxis, are directed to the method of preparation and composition of

matter of recombinant bacteria expressing tumor antigens for treatment of

patients with cancer. Based on searches of publicly available

databases, we do not believe that Anza, Aduro or any other third party owns any

published Listeria

patents or has any issued patent claims that might materially and adversely

affect our ability to operate our business as currently contemplated in the

field of recombinant Listeria

monocytogenes. Additionally, our proprietary position that is the

issued patents and licenses for pending applications restricts anyone from using

plasmid based Listeria

constructs, or those that are bioengineered to deliver antigens fused to LLO,

ActA, or fragments of LLO or ActA.

We

are dependent upon our license agreement with Penn; if we fail to make payments

due and owing to Penn under our license agreement, our business will be

materially and adversely affected.

Pursuant

to the terms of our license agreement with Penn, as amended, we have acquired

exclusive licenses for an additional 27 patent applications related to our

proprietary Listeria

vaccine technology. However, as of April 30, 2010, we owed Penn

approximately $249,000 in patent expenses and $130,000 in sponsored research

agreement fees and we have agreed to satisfy these obligations in five monthly

payments of $65,000 beginning in May, 2010 plus a payment of approximately

$54,000 before September 30, 2010. We can provide no assurance that

we will be able to make all payments due and owing thereunder, that such

licenses will not be terminated or expire during critical periods, that we will

be able to obtain licenses for other rights which may be important to us, or, if

obtained, that such licenses will be obtained on commercially reasonable

terms.

If we are

unable to maintain and/or obtain licenses, we may have to develop alternatives

to avoid infringing on the patents of others, potentially causing increased

costs and delays in product development and introduction or precluding the

development, manufacture, or sale of planned products. Some of our licenses

provide for limited periods of exclusivity that require minimum license fees and

payments and/or may be extended only with the consent of the licensor. We can

provide no assurance that we will be able to meet these minimum license fees in

the future or that these third parties will grant extensions on any or all such

licenses. This same restriction may be contained in licenses obtained in the

future. Additionally, we can provide no assurance that the patents underlying

any licenses will be valid and enforceable. Furthermore, in 2001, an issue arose

regarding the inventorship of U.S. Patent 6,565,852 and U.S. Patent Application

No. 09/537,642. These patent rights are included in the patent rights licensed

by us from Penn. GlaxoSmithKline plc, Penn and we expect that the issue will be

resolved through a correction of inventorship to add certain GSK inventors,

where necessary and appropriate, an assignment of GSK’s possible rights under

these patent rights to Penn, and a sublicense from us to GSK of certain subject

matter, which is not central to our business plan. To date, this arrangement has

not been finalized and we cannot assure that this issue will ultimately be

resolved in the manner described above. To the extent any products developed by

us are based on licensed technology, royalty payments on the licenses will

reduce our gross profit from such product sales and may render the sales of such

products uneconomical.

We

have no manufacturing, sales, marketing or distribution capability and we must

rely upon third parties for such.

We do not

intend to create facilities to manufacture our products and therefore are

dependent upon third parties to do so. We currently have an agreement

with Cobra Manufacturing for production of our immunotherapies and vaccines for

research and development and testing purposes. Our reliance on third

parties for the manufacture of our products creates a dependency that could

severely disrupt our research and development, our clinical testing, and

ultimately our sales and marketing efforts if the source of such supply proves

to be unreliable or unavailable. If the contracted manufacturing

source is unreliable or unavailable, we may not be able to replace the

development of our product candidates, our clinical testing program may not be

able to go forward and our entire business plan could

fail.

11

If

we are unable to establish or manage strategic collaborations in the future, our

revenue and product development may be limited.

Our

strategy includes eventual substantial reliance upon strategic collaborations

for marketing and commercialization of ADXS11-001, and we may rely even more on

strategic collaborations for research, development, marketing and

commercialization of our other product candidates. To date, we have

not entered into any strategic collaborations with third parties capable of

providing these services although we have been heavily reliant upon third party

outsourcing for our clinical trials execution. In addition, we have

not yet marketed or sold any of our product candidates or entered into

successful collaborations for these services in order to ultimately

commercialize our product candidates. Establishing strategic

collaborations is difficult and time-consuming. Our discussion with

potential collaborators may not lead to the establishment of collaborations on

favorable terms, if at all. For example, potential collaborators may

reject collaborations based upon their assessment of our financial, regulatory

or intellectual property position. If we successfully establish new

collaborations, these relationships may never result in the successful

development or commercialization of our product candidates or the generation of

sales revenue. To the extent that we enter into co-promotion or other

collaborative arrangements, our product revenues are likely to be lower than if

we directly marketed and sold any products that we may develop.

Management

of our relationships with our collaborators will require:

|

|

·

|

significant

time and effort from our management

team;

|

|

|

·

|

coordination

of our research and development programs with the research and development

priorities of our collaborators;

and

|

|

|

·

|

effective

allocation of our resources to multiple

projects.

|

If we

continue to enter into research and development collaborations at the early

phases of product development, our success will in part depend on the

performance of our corporate collaborators. We will not directly

control the amount or timing of resources devoted by our corporate collaborators

to activities related to our product candidates. Our corporate

collaborators may not commit sufficient resources to our research and

development programs or the commercialization, marketing or distribution of our

product candidates. If any corporate collaborator fails to commit

sufficient resources, our preclinical or clinical development programs related

to this collaboration could be delayed or terminated. Also, our

collaborators may pursue existing or other development-stage products or

alternative technologies in preference to those being developed in collaboration

with us. Finally, if we fail to make required milestone or royalty

payments to our collaborators or to observe other obligations in our agreements

with them, our collaborators may have the right to terminate those

agreements.

We

may incur substantial liabilities from any product liability claims if our

insurance coverage for those claims is inadequate.

We face

an inherent risk of product liability exposure related to the testing of our

product candidates in human clinical trials, and will face an even greater risk

if the product candidates are sold commercially. An individual may

bring a liability claim against us if one of the product candidates causes, or

merely appears to have caused, an injury. If we cannot successfully

defend ourselves against the product liability claim, we will incur substantial

liabilities. Regardless of merit or eventual outcome, liability

claims may result in:

|

|

·

|

decreased

demand for our product candidates;

|

|

|

·

|

damage

to our reputation;

|

|

|

·

|

withdrawal

of clinical trial participants;

|

|

|

·

|

costs

of related litigation;

|

12

|

|

·

|

substantial

monetary awards to patients or other

claimants;

|

|

|

·

|

loss

of revenues;

|

|

|

·

|

the

inability to commercialize product candidates;

and

|

|

|

·

|

increased

difficulty in raising required additional funds in the private and public

capital markets.

|

We have

insurance coverage on our Phase II CIN and cervical cancer trials for each

clinical trial site. We do not have product liability insurance

because we do not have products on the market. We currently are in

the process of obtaining insurance coverage and to expand such coverage to

include the sale of commercial products if marketing approval is obtained for

any of our product candidates. However, insurance coverage is

increasingly expensive and we may not be able to maintain insurance coverage at

a reasonable cost and we may not be able to obtain insurance coverage that will

be adequate to satisfy any liability that may arise.

We

may incur significant costs complying with environmental laws and

regulations.

We and

our contracted third parties will use hazardous materials, including chemicals

and biological agents and compounds that could be dangerous to human health and

safety or the environment. As appropriate, we will store these

materials and wastes resulting from their use at our or our outsourced

laboratory facility pending their ultimate use or disposal. We will

contract with a third party to properly dispose of these materials and

wastes. We will be subject to a variety of federal, state and local

laws and regulations governing the use, generation, manufacture, storage,

handling and disposal of these materials and wastes. We may also

incur significant costs complying with environmental laws and regulations

adopted in the future.

If

we use biological and hazardous materials in a manner that causes injury, we may

be liable for damages.

Our

research and development and manufacturing activities will involve the use of

biological and hazardous materials. Although we believe our safety

procedures for handling and disposing of these materials will comply with

federal, state and local laws and regulations, we cannot entirely eliminate the

risk of accidental injury or contamination from the use, storage, handling or

disposal of these materials. We do not carry specific biological or

hazardous waste insurance coverage, workers compensation or property and

casualty and general liability insurance policies which include coverage for

damages and fines arising from biological or hazardous waste exposure or

contamination. Accordingly, in the event of contamination or injury,

we could be held liable for damages or penalized with fines in an amount

exceeding our resources, and our clinical trials or regulatory approvals could

be suspended or terminated.

We

need to attract and retain highly skilled personnel; we may be unable to

effectively manage growth with our limited resources.

As of

July 1, 2010, we had ten employees. We do not intend to

significantly expand our operations and staff unless we get adequate

financing. If funded then our new employees may include key

managerial, technical, financial, research and development and operations

personnel who will not have been fully integrated into our

operations. We will be required to expand our operational and

financial systems significantly and to expand, train and manage our work force

in order to manage the expansion of our operations. Our failure to

fully integrate any new employees into our operations could have a material

adverse effect on our business, prospects, financial condition and results of

operations.

We

operate under an agreement with AlphaStaff, a professional employment

organization that provides us with payroll and human resources

services. Our ability to attract and retain highly skilled personnel

is critical to our operations and expansion. We face competition for

these types of personnel from other technology companies and more established

organizations, many of which have significantly larger operations and greater

financial, technical, human and other resources than we have. We may

not be successful in attracting and retaining qualified personnel on a timely

basis, on competitive terms, or at all. If we are not successful in

attracting and retaining these personnel, our business, prospects, financial

condition and results of operations will be materially adversely

affected. In such circumstances we may be unable to conduct certain

research and development programs, unable to adequately manage our clinical

trials and other products, and unable to adequately address our

management needs. In addition, from time to time, we are unable to

make payroll due to our lack of cash.

13

We

depend upon our senior management and key consultants and their loss or

unavailability could put us at a competitive disadvantage.

We depend

upon the efforts and abilities of our senior executives, as well as the services

of several key consultants, including Yvonne Paterson, Ph.D. The loss

or unavailability of the services of any of these individuals for any

significant period of time could have a material adverse effect on our business,

prospects, financial condition and results of operations. We have not

obtained, do not own, nor are we the beneficiary of, key-person life

insurance.

Risks