Attached files

| file | filename |

|---|---|

| 8-K - CROWN HOLDINGS, INC. -- FORM 8-K - CROWN HOLDINGS INC | d8k.htm |

Exhibit 99.1

For purposes of this Exhibit 99.1, unless the context otherwise requires: (i) “Crown” refers to Crown Holdings, Inc. and its subsidiaries on a consolidated basis; (ii) “Crown Cork” refers to Crown Cork & Seal Company, Inc. and not its subsidiaries; (iii) “Crown Americas” refers to Crown Americas LLC and not its subsidiaries, and (iv) “Crown European Holdings” refers to Crown European Holdings SA and not its subsidiaries. References to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Crown’s consolidated financial statements refer to the corresponding sections of Crown’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2010 and Crown’s Annual Report on Form 10-K for the year ended December 31, 2009.

FORWARD-LOOKING STATEMENTS

Statements included herein, which are not historical facts (including any statements concerning plans and objectives of management for future operations or economic performance, or assumptions related thereto), are “forward-looking statements” within the meaning of the U.S. federal securities laws. Forward-looking statements can be identified by words, such as “believes,” “estimates,” “anticipates,” “expects” and other words of similar meaning in connection with a discussion of future operating or financial performance. These may include, among others, statements relating to:

| • | Crown’s senior notes offering and the use of proceeds therefrom described herein, and Crown’s ability to implement it on the terms described herein; |

| • | Crown’s plans or objectives for future operations, products or financial performance; |

| • | Crown’s indebtedness and other contractual obligations; |

| • | the impact of an economic downturn or growth in particular regions; |

| • | anticipated uses of cash; |

| • | cost reduction efforts and expected savings; |

| • | Crown’s policies with respect to executive compensation; and |

| • | the expected outcome of contingencies, including with respect to asbestos-related litigation and pension and postretirement liabilities. |

These forward-looking statements are made based upon Crown’s expectations and beliefs concerning future events impacting it and, therefore, involve a number of risks and uncertainties. Crown cautions that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements.

Important factors that could cause the actual results of operations or financial condition of Crown to differ include, but are not necessarily limited to:

| • | the ability of Crown to repay, refinance or restructure its short and long-term indebtedness on adequate terms and to comply with the terms of its agreements relating to debt; |

1

| • | Crown’s ability to generate significant cash to meet its obligations and invest in its business and to maintain appropriate debt levels; |

| • | restrictions on Crown’s use of available cash under its debt agreements; |

| • | changes or differences in U.S. or international economic or political conditions, such as inflation or fluctuations in interest or foreign exchange rates (and the effectiveness of any currency or interest rate hedges), tax rates and tax laws (including with respect to taxation of unrepatriated non-U.S. earnings or as a result of the depletion of net loss carry forwards); |

| • | the impact of health care reform in the United States; |

| • | the collectibility of receivables; |

| • | war or acts of terrorism that may disrupt Crown’s production or the supply or pricing of raw materials, including in Crown’s Middle East operations, impact the financial condition of customers or adversely affect Crown’s ability to refinance or restructure its remaining indebtedness; |

| • | changes in the availability and pricing of raw materials (including aluminum can sheet, steel tinplate, energy, water, inks and coatings) and Crown’s ability to pass raw material, energy and freight price increases and surcharges through to its customers or to otherwise manage these commodity pricing risks; |

| • | Crown’s ability to obtain and maintain adequate pricing for its products, including the impact on Crown’s revenue, margins and market share and the ongoing impact of price increases; |

| • | energy and natural resource costs; |

| • | the cost and other effects of legal and administrative cases and proceedings, settlements and investigations; |

| • | the outcome of asbestos-related litigation (including the number and size of future claims and the terms of settlements, and the impact of bankruptcy filings by other companies with asbestos-related liabilities, any of which could increase Crown Cork’s asbestos-related costs over time, the adequacy of reserves established for asbestos-related liabilities, Crown Cork’s ability to obtain resolution without payment of asbestos-related claims by persons alleging first exposure to asbestos after 1964, and the impact of state legislation dealing with asbestos liabilities and any litigation challenging that legislation and any future state or federal legislation dealing with asbestos liabilities); |

| • | Crown’s ability to realize deferred tax benefits; |

| • | changes in Crown’s critical or other accounting policies or the assumptions underlying those policies; |

| • | labor relations and workforce and social costs, including Crown’s pension and postretirement obligations and other employee or retiree costs; |

| • | investment performance of Crown’s pension plans; |

| • | costs and difficulties related to the acquisition of a business and integration of acquired businesses; |

| • | the impact of any potential dispositions, acquisitions or other strategic realignments, which may impact Crown’s operations, financial profile, investments or levels of indebtedness; |

| • | Crown’s ability to realize efficient capacity utilization and inventory levels and to innovate new designs and technologies for its products in a cost-effective manner; |

| • | competitive pressures, including new product developments, industry overcapacity, or changes in competitors’ pricing for products; |

2

| • | Crown’s ability to achieve high capacity utilization rates for its equipment; |

| • | Crown’s ability to maintain and develop competitive technologies for the design and manufacture of products and to withstand competitive and legal challenges to the proprietary nature of such technology; |

| • | Crown’s ability to generate sufficient production capacity; |

| • | loss of customers, including the loss of any significant customers; |

| • | changes in consumer preferences for different packaging products; |

| • | the financial condition of Crown’s vendors and customers; |

| • | weather conditions, including their effect on demand for beverages and on crop yields for fruits and vegetables stored in food containers; |

| • | changes in governmental regulations or enforcement practices, including with respect to environmental, health and safety matters and restrictions as to foreign investment or operation; |

| • | the impact of Crown’s initiative to generate additional cash, including the reduction of working capital levels and capital spending; |

| • | the ability of Crown to realize cost savings from its restructuring programs; |

| • | Crown’s ability to maintain adequate sources of capital and liquidity; |

| • | costs and payments to certain of Crown’s executive officers in connection with any termination of such executive officers or a change in control of Crown; |

| • | the impact of existing and future legislation regarding refundable mandatory deposit laws in Europe for non-refillable beverage containers and the implementation of an effective return system; and |

| • | changes in Crown’s strategic areas of focus. |

Crown does not intend to review or revise any particular forward-looking statement in light of future events.

3

Crown Holdings, Inc.

Crown is a worldwide leader in the design, manufacture and sale of packaging products for consumer goods. Crown’s primary products include steel and aluminum cans for food, beverage, household and other consumer products and metal vacuum closures and caps. These products are manufactured in Crown’s plants both within and outside the United States and are sold through Crown’s sales organization to the soft drink, food, citrus, brewing, household products, personal care and various other industries. At March 31, 2010, Crown operated 136 plants along with sales and service facilities throughout 41 countries and had approximately 21,000 employees.

For the fiscal year ended December 31, 2009 and the three months ended March 31, 2010, Crown had net sales of approximately $7,938 million and $1,777 million, respectively, and Adjusted EBITDA (a non-GAAP measure that is defined in “—Summary Historical and Adjusted Consolidated Condensed Financial Data”) of $1,006 million and $195 million, respectively. Approximately 72% of such net sales were derived from operations outside the United States, of which 73% of these non-U.S. revenues were derived from operations in the European Division, in the fiscal year ended December 31, 2009. Approximately 71% of such net sales were derived from operations outside of the United States in the three months ended March 31, 2010. For the twelve months ended March 31, 2010, Crown had net sales of approximately $8,031 million and Adjusted EBITDA of approximately $998 million.

The following chart demonstrates the breadth of Crown’s product portfolio and its geographic presence:

| North America |

Latin America |

Europe | Middle East/ Africa |

Asia- Pacific | ||||||

| Food cans |

* | * | * | * | * | |||||

| Beverage cans |

* | * | * | * | * | |||||

| Aerosol cans |

* | * | * | * | ||||||

| Specialty cans |

* | * | * | |||||||

| Closures and caps |

* | * | * | * | * | |||||

| Can-making equipment |

* |

4

Business Strengths

Crown’s principal strength lies in its ability to meet the changing needs of its global customer base with products and processes from a broad range of well-established packaging businesses. Crown believes that it is well-positioned within the packaging industry because of its:

| • | Global leadership positions. Crown is a leading producer of food, beverage and aerosol cans and of closures in North America, Europe and Asia. Crown maintains its leadership through an extensive geographic presence, with 136 plants located throughout the world as of March 31, 2010. Its large manufacturing base allows Crown to service its customers locally while achieving significant economies of scale. |

| • | Strong customer base. Crown provides packaging to many of the world’s leading consumer products companies. Major customers include Anheuser-Busch InBev, Cadbury plc, Coca-Cola, Cott Beverages, Heineken, Mars, Nestlé, Pepsi-Cola, Procter & Gamble (Gillette), SC Johnson and Unilever, among others. These consumer products companies represent generally stable businesses that provide consumer staples such as soft drinks, alcoholic beverages, foods and household products. In addition, Crown has long-standing relationships with many of its largest customers. |

| • | Broad and diversified product base. Crown produces a wide array of products differentiated by type, purpose, size, shape and benefit to customers. Crown is not dependent on any specific product market since no product in any one geographical region represents a substantial share of total revenues. |

| • | Business and industry fundamentals. Fundamental changes in its business, including price increases, cost reduction initiatives and working capital reductions, have improved Crown’s business outlook. |

| • | Technological leadership resulting in superior new product and process development. Crown believes that it possesses the technology, processes and research, development and engineering capabilities to allow it to provide innovative and value-added packaging solutions to its customers, as well as to design cost-efficient manufacturing systems and materials. |

| • | Financially disciplined management team. Crown’s current executive leadership is focused on improving profit and increasing free cash flow. |

| – | All levels of Crown’s management are committed to minimizing capital employed in their respective businesses. |

| – | Crown is prudent about its capital spending, attempting to pursue projects that provide an adequate return. In place of high capital spending, Crown attempts to maximize the usefulness of all assets currently employed. |

5

Business Strategy

Crown has several key business strategies:

| • | Grow in targeted markets. Crown plans to capitalize on its leading food, beverage and aerosol can positions by targeting geographic areas with strong growth potential. Crown believes that it is well-positioned to take advantage of the growth potential in Southern and Eastern Europe with numerous food and beverage can plants already established in those markets. In addition, as a leading packaging supplier to the Middle Eastern, Southeast Asian and Latin American markets, Crown will work to benefit from the anticipated growth in the consumption of consumer goods in these regions. Crown may also consider possible acquisitions to grow its business (within developed or developing markets). |

| • | Increase margins through ongoing cost reductions. Crown plans to continue to reduce manufacturing costs, enhance efficiencies and drive return on invested capital through investments in equipment and technology and through improvements in productivity and material usage and by maintaining a disciplined approach to managing supplier contacts. |

| • | Maximize cash flow generation. Crown has established performance-based incentives to increase its free cash flow and operating income. In recent years Crown has used free cash flow to reduce outstanding indebtedness and repurchase Crown common stock. |

| – | Crown uses the economic profit concept in connection with its executive compensation program, which requires each business unit to exceed prior year’s returns on the capital that it employs. |

| – | Crown will continue to attempt to focus its capital expenditures on projects that provide an adequate return. |

| • | Serve the changing needs of the world’s leading consumer products companies through technological innovation. Crown intends to capitalize on the demand of its customers for higher value-added packaging products. By continuing to improve the physical attributes of its products, such as strength of materials and graphics, Crown plans to further improve its existing customer relationships, as well as attract new customers. |

6

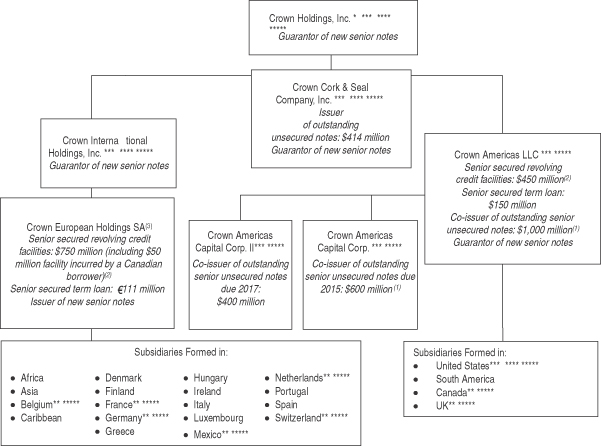

Organizational Structure

The following chart shows a summary of Crown’s current organizational structure, as well as the applicable obligors under the new senior notes, other outstanding notes and Crown’s senior secured credit facilities, as of the date hereof after giving effect to the offering. Crown may modify this corporate structure in the future.

| * | Guarantor of Crown Cork’s obligations under its outstanding unsecured notes. |

| ** | Guarantors of outstanding first priority senior secured notes and senior secured credit facilities to Crown European Holdings and its subsidiaries. |

7

| *** | Guarantors of outstanding first priority senior secured notes and senior secured credit facilities. |

| **** | Guarantors of Crown Americas LLC and Crown Americas Capital Corp.’s obligations under the outstanding senior unsecured notes and Crown Americas LLC and Crown Americas Capital Corp. II’s obligations under the outstanding senior unsecured notes. |

| ***** | Guarantors of Crown European Holdings’ obligations under the new senior notes. |

| (1) | The net proceeds from the offering of the new senior notes are intended to be used to retire all or a portion of Crown European Holdings’ outstanding €150 million first priority senior secured notes, to retire all of Crown’s outstanding $200 million senior unsecured notes due 2013, to pay fees and expenses associated with the offering of the new senior notes and to provide funds for general corporate purposes. See “Description of Certain Indebtedness.” |

| (2) | To the extent that lenders under Crown’s senior secured revolving credit facilities due 2011 did not participate as lenders under Crown’s senior secured revolving credit facilities due 2015, which were established on June 15, 2010, the senior secured revolving credit facilities due 2011 remain outstanding, subject to their maturity on May 15, 2011. Total availability under the senior secured revolving credit facilities due 2011 now consists of up to $165.0 million available to Crown Americas in U.S. dollars and up to approximately $63.6 million available, subject to certain sublimits, to Crown European Holdings and the subsidiary borrowers in euro and pound sterling. Prior to maturity of the senior secured revolving credit facilities due 2011, borrowings under the senior secured revolving credit facilities due 2011 and the senior secured revolving credit facilities due 2015 are limited to $1.2 billion in the aggregate. |

| (3) | Crown European Holdings SA is the issuer of €150 million of outstanding first priority senior secured notes. As described above, Crown presently anticipates that it will commence a tender offer for any and all first priority senior secured notes. There can be no assurance that Crown will commence the anticipated tender offer or that any first priority senior secured notes will be tendered or purchased in the anticipated tender offer. |

Crown is a Pennsylvania corporation. Crown’s principal executive offices are located at One Crown Way, Philadelphia, Pennsylvania 19154, and its telephone number is (215) 698-5100. Crown European Holdings (formerly known as CarnaudMetalbox SA) is a société anonyme organized under the laws of France. Crown European Holdings is an indirect, wholly-owned subsidiary of Crown.

8

Summary Historical and Adjusted Consolidated Condensed Financial Data

The following table sets forth summary historical and adjusted consolidated condensed financial data for Crown. The summary of operations data and other financial data for each of the years in the three-year period ended December 31, 2009 and the balance sheet data as of December 31, 2008 and 2009 have been derived from Crown’s audited consolidated financial statements and the notes thereto. The summary of operations data and other financial data for the three-month period ended March 31, 2010 and the three-month period ended March 31, 2009, and the balance sheet data as of March 31, 2009 and 2010 have been derived from Crown’s unaudited interim consolidated financial statements and which, in the opinion of management, include all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the result for the unaudited periods. The summary of operations data and other financial data for the twelve-month period ended March 31, 2010 have been derived from the summary of operations data for the year ended December 31, 2009 and the three-month periods ended March 31, 2009 and 2010. The December 31, 2007 balance sheet data has been derived from Crown’s audited consolidated financial statements. The adjusted financial data gives effect to the issuance of the new senior notes and the expected application of the net proceeds therefrom described herein and borrowings under Crown’s senior secured revolving credit facilities due 2015 on June 15, 2010 and the application of proceeds therefrom. You should read the following financial information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Crown’s audited consolidated financial statements, the related notes and the other financial information.

| (dollars in millions) | ||||||||||||||||||||||||

| Year

Ended December 31, |

Three Months Ended March 31, |

Twelve Months Ended March 31, |

||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2009 | 2010 | 2010 | |||||||||||||||||||

| Summary of Operations Data: |

||||||||||||||||||||||||

| Net sales |

$ | 7,727 | $ | 8,305 | $ | 7,938 | $ | 1,684 | $ | 1,777 | $ | 8,031 | ||||||||||||

| Cost of products sold, excluding depreciation and amortization |

6,468 | 6,885 | 6,551 | 1,392 | 1,483 | 6,642 | ||||||||||||||||||

| Depreciation and amortization |

229 | 216 | 194 | 47 | 44 | 191 | ||||||||||||||||||

| Gross profit |

1,030 | 1,204 | 1,193 | 245 | 250 | 1,198 | ||||||||||||||||||

| Selling and administrative expense |

385 | 396 | 381 | 89 | 79 | 371 | ||||||||||||||||||

| Provision for asbestos |

29 | 25 | 55 | — | — | 55 | ||||||||||||||||||

| Provision for restructuring |

20 | 21 | 43 | 1 | 22 | 64 | ||||||||||||||||||

| Provision for asset impairments and loss/gain on sale of assets |

100 | 6 | (6 | ) | — | (1 | ) | (7 | ) | |||||||||||||||

| Loss from early extinguishments of debt |

— | 2 | 26 | — | — | 26 | ||||||||||||||||||

| Interest expense |

318 | 302 | 247 | 61 | 47 | 233 | ||||||||||||||||||

| Interest income |

(14 | ) | (11 | ) | (6 | ) | (2 | ) | (1 | ) | (5 | ) | ||||||||||||

| Translation and exchange adjustments |

(9 | ) | 21 | (6 | ) | 4 | (2 | ) | (12 | ) | ||||||||||||||

| Income from continuing operations before income taxes and equity earnings |

201 | 442 | 459 | 92 | 106 | 473 | ||||||||||||||||||

| Provision for/(benefit from) income taxes |

(400 | ) | 112 | 7 | 24 | 39 | 22 | |||||||||||||||||

| Equity loss/(gain) in affiliates |

— | — | (2 | ) | (5 | ) | — | 3 | ||||||||||||||||

| Income from continuing operations |

601 | 330 | 450 | 63 | 67 | 454 | ||||||||||||||||||

| Net income |

601 | 330 | 450 | 63 | 67 | 454 | ||||||||||||||||||

| Net income attributable to noncontrolling interests |

(73 | ) | (104 | ) | (116 | ) | (23 | ) | (26 | ) | (119 | ) | ||||||||||||

| Net income attributable to Crown Holdings |

$ | 528 | $ | 226 | $ | 334 | $ | 40 | $ | 41 | $ | 335 | ||||||||||||

9

| (dollars in millions) | ||||||||||||||||||||||||

| Year Ended December 31, |

Three Months Ended March 31, |

Twelve Months Ended March 31, |

||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2009 | 2010 | 2010 | |||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| Net cash flows provided by/(used for): |

||||||||||||||||||||||||

| Operating activities |

$ | 509 | $ | 422 | $ | 756 | $ | (345 | ) | $ | (416 | ) | $ | 685 | ||||||||||

| Investing activities |

(94 | ) | (186 | ) | (200 | ) | (50 | ) | (21 | ) | (171 | ) | ||||||||||||

| Financing activities |

(396 | ) | (77 | ) | (701 | ) | 114 | 386 | (429 | ) | ||||||||||||||

| EBITDA(1) |

734 | 949 | 894 | 198 | 196 | 892 | ||||||||||||||||||

| Adjusted EBITDA(2) |

874 | 1,024 | 1,006 | 203 | 195 | 998 | ||||||||||||||||||

| Capital expenditures |

156 | 174 | 180 | 50 | 32 | 162 | ||||||||||||||||||

| Ratio of earnings to fixed charges(3) |

1.6 | x | 2.4 | x | 2.7 | x | 2.4 | x | 3.0 | x | 2.9 | x | ||||||||||||

| Adjusted Financial Data: |

||||||||||||||||||||||||

| Total secured debt(4) |

$ | 1,297 | ||||||||||||||||||||||

| Total debt(5) |

3,244 | |||||||||||||||||||||||

| Net interest expense(6) |

232 | |||||||||||||||||||||||

| Ratio of total secured debt to Adjusted EBITDA |

1.3 | x | ||||||||||||||||||||||

| Ratio of total debt to Adjusted EBITDA |

3.3 | x | ||||||||||||||||||||||

| Ratio of Adjusted EBITDA to net interest expense |

4.3 | x | ||||||||||||||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 457 | $ | 596 | $ | 459 | $ | 296 | $ | 399 | $ | 399 | ||||||||||||

| Working capital(7) |

151 | 385 | 317 | 626 | 686 | 686 | ||||||||||||||||||

| Total assets |

6,979 | 6,774 | 6,532 | 6,580 | 6,790 | 6,790 | ||||||||||||||||||

| Total debt |

3,437 | 3,337 | 2,798 | 3,398 | 3,174 | 3,174 | ||||||||||||||||||

| Crown Holdings shareholders’ equity/(deficit) |

15 | (317 | ) | (6 | ) | (274 | ) | 36 | 36 | |||||||||||||||

| (1) | EBITDA is a non-GAAP measurement that consists of income from continuing operations before income taxes and equity earnings plus the sum of interest expense (net of interest income) and depreciation and amortization. The reconciliation from income from continuing operations to EBITDA is as follows: |

| (dollars in millions) | ||||||||||||||||||||||||

| Year Ended December 31, |

Three Months Ended March 31, |

Twelve Months Ended March 31, |

||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2009 | 2010 | 2010 | |||||||||||||||||||

| Income from continuing operations |

$ | 601 | $ | 330 | $ | 450 | $ | 63 | $ | 67 | $ | 454 | ||||||||||||

| Add/(deduct): |

||||||||||||||||||||||||

| Equity loss/(gain) in affiliates |

— | — | 2 | 5 | — | (3 | ) | |||||||||||||||||

| Provision for /(benefit from) income taxes |

(400 | ) | 112 | 7 | 24 | 39 | 22 | |||||||||||||||||

| Interest income |

(14 | ) | (11 | ) | (6 | ) | (2 | ) | (1 | ) | (5 | ) | ||||||||||||

| Interest expense |

318 | 302 | 247 | 61 | 47 | 233 | ||||||||||||||||||

| Depreciation and amortization |

229 | 216 | 194 | 47 | 44 | 191 | ||||||||||||||||||

| EBITDA |

$ | 734 | $ | 949 | $ | 894 | $ | 198 | $ | 196 | $ | 892 | ||||||||||||

10

| (2) | Adjusted EBITDA is a non-GAAP measurement that consists of EBITDA plus the sum of provision for asbestos, provision for restructuring, legal settlement included in selling and administrative expense, provision for asset impairments and loss/gain on sale of assets, loss from early extinguishments of debt and translation and exchange adjustments. The reconciliation from EBITDA to Adjusted EBITDA is as follows: |

| (dollars in millions) | ||||||||||||||||||||||

| Year

Ended December 31, |

Three Months Ended March 31, |

Twelve Months Ended March 31, |

||||||||||||||||||||

| 2007 | 2008 | 2009 | 2009 | 2010 | 2010 | |||||||||||||||||

| EBITDA |

$ | 734 | $ | 949 | $ | 894 | $ | 198 | $ | 196 | $ | 892 | ||||||||||

| Add/(deduct): |

||||||||||||||||||||||

| Provision for asbestos* |

29 | 25 | 55 | — | — | 55 | ||||||||||||||||

| Provision for restructuring |

20 | 21 | 43 | 1 | 22 | 64 | ||||||||||||||||

| Legal settlement included in selling and administrative expense |

— | — | — | — | (20 | ) | (20 | ) | ||||||||||||||

| Provision for asset impairments and loss/gain on sale of assets |

100 | 6 | (6 | ) | — | (1 | ) | (7 | ) | |||||||||||||

| Loss from early extinguishments of debt |

— | 2 | 26 | — | — | 26 | ||||||||||||||||

| Translation and exchange adjustments |

(9 | ) | 21 | (6 | ) | 4 | (2 | ) | (12 | ) | ||||||||||||

| Adjusted EBITDA |

$ | 874 | $ | 1,024 | $ | 1,006 | $ | 203 | $ | 195 | $ | 998 | ||||||||||

| * | Crown made asbestos-related payments of $26 million, $25 million, $26 million, $3 million and $4 million during 2009, 2008 and 2007 and the three months ended March 31, 2009 and 2010, respectively. |

EBITDA and Adjusted EBITDA are provided for illustrative and informational purposes only and do not purport to represent, and should not be viewed as indicative of, Crown’s actual or future financial condition or results of operations. EBITDA and Adjusted EBITDA do not represent and should not be considered as alternatives to net income, operating income, net cash provided by operating activities or any other measure of operating performance or liquidity that is calculated in accordance with U.S. generally accepted accounting principles. EBITDA and Adjusted EBITDA information has been included in this exhibit because Crown believes that certain analysts, rating agencies and investors may use it as supplemental information to evaluate a company’s ability to service its indebtedness and overall operating performance over time. However, EBITDA and Adjusted EBITDA have material limitations as analytical tools and should not be considered in isolation, or as substitutes for analysis of Crown’s results as reported under U.S. generally accepted accounting principles. A limitation associated with EBITDA and Adjusted EBITDA is that they do not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenues in Crown’s business. Any measure that eliminates components of Crown’s capital structure and costs associated with carrying significant amounts of assets on its balance sheet has material limitations as a performance measure. Management evaluates the costs of such tangible and intangible assets through other financial measures such as capital expenditures. In addition, in evaluating EBITDA and Adjusted EBITDA, you should be aware that the adjustments may vary from period to period and in the future Crown will incur expenses such as those used in calculating these measures. Furthermore, EBITDA and Adjusted EBITDA, as calculated by Crown, may not be comparable to calculations of similarly titled measures by other companies. In light of the foregoing limitations, Crown does not rely solely on EBITDA and Adjusted EBITDA as performance measures and also considers its results as calculated in accordance with U.S. generally accepted accounting principles. For purposes of the covenants in the documents governing Crown’s indebtedness, EBITDA is defined differently.

| (3) | For purposes of computing the ratio of earnings to fixed charges, earnings consist of income before income taxes and equity earnings plus fixed charges (exclusive of interest capitalized during the period), amortization of interest previously capitalized and distributed income from less-than-50%-owned companies. Fixed charges include interest incurred, expensed and capitalized, amortization of debt issue costs and the portion of rental expense that is deemed representative of an interest factor. For purposes of the covenants in the documents governing Crown’s indebtedness, the ratio of earnings to fixed charges is defined differently. |

| (4) | Adjusted total secured debt consists of borrowings under Crown’s senior secured term loan facilities (reflecting repayment of $400 million of senior secured term loan facilities using borrowings under the senior secured revolving credit facilities due 2015 on June 15, 2010), borrowings under the senior secured revolving credit facilities ($1,073) (reflecting $400 million of borrowings on June 15, 2010 to repay the senior secured term loan facilities), receivables securitization and factoring facilities ($185) and capitalized leases and other secured debt |

11

| ($39). Adjusted total secured debt assumes the repurchase of all €150 million of outstanding first priority senior secured notes in the anticipated tender offer. There can be no assurance that Crown will commence the anticipated tender offer or that any first priority senior secured notes will be tendered or purchased in the anticipated tender offer. Adjusted total secured debt may increase to the extent first priority senior secured notes are not tendered and purchased in the anticipated tender offer. |

| (5) | Adjusted total debt may increase to the extent first priority senior secured notes are not tendered and purchased in the anticipated tender offer or Crown elects not to commence the tender offer. Proceeds of the offering of the new senior notes that are not used to repurchase first priority senior secured notes or senior unsecured notes due 2013 or to pay fees and expenses in connection with the offering of the new senior notes are expected to be used for general corporate purposes. |

| (6) | Adjusted net interest expense reflects use of the proceeds of the offering of the new senior notes to repay $203 million of outstanding first priority senior secured notes and to repurchase $200 million of outstanding senior secured notes due 2013 and the borrowing of $400 million under the senior secured revolving credit facilities due 2015 used to repay $400 million under the senior secured term loan facilities on June 15, 2010. Assuming that no first priority senior secured notes are tendered and purchased in the anticipated tender offer would increase adjusted net interest expense by $13 million. |

| (7) | Working capital consists of current assets less current liabilities. |

12

RISK FACTORS

Risks Related to Crown’s Business

The substantial indebtedness of Crown could prevent it from fulfilling its obligations under its indebtedness.

Crown is highly leveraged. As a result of Crown’s substantial indebtedness, a significant portion of Crown’s cash flow will be required to pay interest and principal on its outstanding indebtedness, and Crown may not generate sufficient cash flow from operations, or have future borrowings available under its senior secured credit facilities, to enable it to repay its indebtedness, or to fund other liquidity needs. As of March 31, 2010, giving adjusted effect to the offering of the new senior notes and the anticipated use of proceeds therefrom and borrowings under Crown’s senior secured revolving credit facilities due 2015 and the use of proceeds therefrom, Crown and its subsidiaries had approximately $3.2 billion of indebtedness, including $1.3 billion of secured indebtedness and $46 million of additional indebtedness of non-guarantor subsidiaries and the ability to borrow $379 million under Crown’s senior secured revolving credit facilities. Crown’s ratio of earnings to fixed charges was 2.7 times for the fiscal year ended December 31, 2009, and 3.0 times for the three months ended March 31, 2010. The net proceeds from the offering of the new senior notes are intended to be used to retire all or a portion of Crown European Holdings’ outstanding €150 million first priority senior secured notes, to retire all of Crown’s outstanding $200 million senior unsecured notes due 2013, to pay fees and expenses associated with the offering of the new senior notes and to provide funds for general corporate purposes, which may include repurchases of Crown common stock. Crown’s senior secured revolving credit facilities that mature on June 15, 2015 bear higher interest rates than those applicable to Crown’s senior secured revolving credit facilities that mature on May 15, 2011. Crown’s $253 million and €199 million senior secured term loan facilities mature on November 15, 2012. Crown’s $600 million of senior notes mature on November 15, 2015 and its $400 million of senior notes mature on May 15, 2017. In addition, at March 31, 2010 Crown had approximately $50 million and €77 million outstanding under Crown’s committed $200 million North American and €120 million European securitization facilities, which mature in March 2013 and November 2010, respectively. See “Description of Certain Indebtedness.”

The substantial indebtedness of Crown could:

| • | increase Crown’s vulnerability to general adverse economic and industry conditions, including rising interest rates; |

| • | restrict Crown from making strategic acquisitions or exploiting business opportunities; |

| • | limit Crown’s ability to make capital expenditures in order to grow Crown’s business or maintain manufacturing plans in good working order and repair; |

| • | limit, along with the financial and other restrictive covenants under Crown’s indebtedness, Crown’s ability to obtain additional financing, dispose of assets or pay cash dividends; |

| • | require Crown to dedicate a substantial portion of its cash flow from operations to service its indebtedness, thereby reducing the availability of its cash flow to fund future |

13

| working capital, capital expenditures, research and development expenditures and other general corporate requirements; |

| • | require Crown to sell assets used in its business; |

| • | limit Crown’s ability to refinance its existing indebtedness, particularly during periods of adverse credit market conditions when refinancing indebtedness may not be available under interest rates and other terms acceptable to Crown or at all; |

| • | increase Crown’s cost of borrowing; |

| • | limit Crown’s flexibility in planning for, or reacting to, changes in its business and the industry in which it operates; and |

| • | place Crown at a competitive disadvantage compared to its competitors that have less debt. |

If its financial condition, operating results and liquidity deteriorate, Crown’s creditors may restrict its ability to obtain future financing and its suppliers could require prepayment or cash on delivery rather than extend credit to it. If Crown’s creditors restrict advances, Crown’s ability to generate cash flows from operations sufficient to service its short and long-term debt obligations will be further diminished. In addition, Crown’s ability to make payments on and refinance its debt and to fund its operations will depend on Crown’s ability to generate cash in the future.

14

Some of Crown’s indebtedness is subject to floating interest rates, which would result in Crown’s interest expense increasing if interest rates rise.

As of March 31, 2010, approximately $1.3 billion of Crown’s $3.2 billion of total indebtedness (giving adjusted effect to the offering of the new senior notes and the application of the proceeds therefrom) and other outstanding obligations were subject to floating interest rates. Changes in

15

economic conditions could result in higher interest rates, thereby increasing Crown’s interest expense and reducing funds available for operations or other purposes. Crown’s annual interest expense was $247 million, $302 million and $318 million for 2009, 2008 and 2007, respectively. Based on the amount of variable rate debt outstanding at December 31, 2009, a 1% increase in variable interest rates would have increased its 2009 annual adjusted interest expense by $9 million. Accordingly, Crown may experience economic losses and a negative impact on earnings as a result of interest rate fluctuation. The actual effect of a 1% increase could be more than $9 million as Crown’s average borrowings on its variable rate debt may be higher during the year than the amount at December 31, 2009. In addition, the cost of Crown’s securitization facilities would also increase with an increase in floating interest rates. Although Crown may use interest rate protection agreements from time to time to reduce its exposure to interest rate fluctuations in some cases, it may not elect or have the ability to implement hedges or, if it does implement them, they may not achieve the desired effect. See “Capitalization,” “Description of Certain Indebtedness” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Market Risk.”

16

Crown is subject to the effects of fluctuations in foreign exchange rates, which may reduce its net sales and cash flow.

Crown is exposed to fluctuations in foreign currencies as a significant portion of its consolidated net sales, its costs, assets and liabilities, are denominated in currencies other than the U.S. dollar. For the fiscal years ended December 31, 2009, 2008 and 2007 and the three months ended March 31, 2010, Crown derived approximately 72%, 74%, 73% and 71%, respectively, of its consolidated net sales from sales in foreign currencies. In its consolidated financial statements, Crown translates local currency financial results into U.S. dollars based on average exchange rates prevailing during a reporting period. During times of a strengthening U.S. dollar, its reported international revenue and earnings will be reduced because the local currency will translate into fewer U.S. dollars. Conversely, a weakening U.S. dollar will effectively increase the dollar-equivalent of Crown’s expenses and liabilities denominated in foreign currencies. Crown’s translation and exchange adjustments reduced reported income before tax by $21 million in 2008, $2 million in 2006 and $94 million in 2005, and increased reported income before tax by $2 million in the three months ended March 31, 2010, $6 million in 2009 and $9 million in 2007. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Market Risk.” Although

17

Crown may use financial instruments such as foreign currency forwards from time to time to reduce its exposure to currency exchange rate fluctuations in some cases, it may not elect or have the ability to implement hedges or, if it does implement them, they may not achieve the desired effect. For the year-ended December 31, 2009, a .10 movement in the Euro (e.g., from 1 USD = 1.40 Euro to 1 USD = 1.30 Euro) would have impacted net income by $12 million.

Crown’s international operations, which generated approximately 72% of its consolidated net sales in 2009, are subject to various risks that may lead to decreases in its financial results.

Crown is an international company and the risks associated with operating in foreign countries may have a negative impact on Crown’s liquidity and net income. Crown’s international operations generated approximately 72%, 74%, 73% and 71% of its consolidated net sales in 2009, 2008, 2007, and the three months ended March 31, 2010, respectively. In addition, Crown’s business strategy includes continued expansion of international activities, including within developing markets and areas, such as Asia, Eastern Europe, the Middle East and South America, that may pose greater risk of political or economic instability. Approximately 26%, 26%, and 24% of Crown’s consolidated net sales in 2009, 2008 and 2007, respectively, were generated outside of the developed markets in Western Europe, the United States and Canada.

Crown’s international operations are subject to various risks associated with operating in foreign countries, including:

| • | restrictive trade policies; |

| • | inconsistent product regulation or policy changes by foreign agencies or governments; |

| • | duties, taxes or government royalties, including the imposition or increase of withholding and other taxes on remittances and other payments by non-U.S. subsidiaries; |

| • | customs, import/export and other trade compliance regulations; |

| • | foreign exchange rate risks; |

| • | difficulty in collecting international accounts receivable and potentially longer payment cycles; |

| • | increased costs in maintaining international manufacturing and marketing efforts; |

| • | non-tariff barriers and higher duty rates; |

| • | difficulties associated with expatriating cash generated or held abroad in a tax-efficient manner and changes in tax laws; |

| • | difficulties in enforcement of contractual obligations and intellectual property rights; |

| • | exchange controls; |

| • | national and regional labor strikes; |

| • | language and cultural barriers; |

| • | high social benefit costs for labor, including costs associated with restructurings; |

| • | civil unrest or political, social, legal and economic instability; |

| • | product boycotts, including with respect to the products of Crown’s multi-national customers; |

| • | customer, supplier, and investor concerns regarding operations in areas such as the Middle East; |

| • | taking of property by nationalization or expropriation without fair compensation; |

18

| • | imposition of limitations on conversions of foreign currencies into dollars or payment of dividends and other payments by non-U.S. subsidiaries; |

| • | hyperinflation and currency devaluation in certain foreign countries where such currency devaluation could affect the amount of cash generated by operations in those countries and thereby affect Crown’s ability to satisfy its obligations; and |

| • | war, civil disturbance, global or regional catastrophic events, natural disasters, widespread outbreaks of infectious diseases and acts of terrorism. |

There can be no guarantee that a deterioration of economic conditions in countries in which Crown operates would not have a material impact on Crown’s results of operations.

Crown’s profits will decline if the price of raw materials or energy rises and it cannot increase the price of its products, and Crown’s financial results could be adversely affected if Crown was not able to obtain sufficient quantities of raw materials.

Crown uses various raw materials, such as steel, aluminum, water, natural gas, electricity and other processed energy, in its manufacturing operations. Sufficient quantities of these raw materials may not be available in the future or may be available only at increased prices. Crown’s raw material supply contracts vary as to terms and duration, with steel contracts typically one year in duration with fixed prices and aluminum contracts typically multi-year in duration with fluctuating prices based on aluminum ingot costs. The availability of various raw materials and their prices depends on global and local supply and demand forces, governmental regulations (including tariffs), level of production, resource availability, transportation, and other factors. In particular, in recent years the consolidation of steel suppliers, shortage of raw materials affecting the production of steel and the increased global demand for steel, including in China and other developing countries, have contributed to an overall tighter supply for steel, resulting in increased steel prices and, in some cases, special surcharges and allocated cut backs of products by steel suppliers. In addition, future steel supply contracts may provide for prices that fluctuate or adjust rather than provide a fixed price during a one-year period.

The prices of certain raw materials used by Crown, such as steel, aluminum and processed energy, have historically been subject to volatility. In 2009, consumption of steel and aluminum represented approximately 30% and 33%, respectively, of Crown’s consolidated cost of products sold, excluding depreciation and amortization. For 2009, the weighted average market price for steel used in packaging increased approximately 26%, and the average price of aluminum ingot on the London Metal Exchange decreased approximately 30%. As a result of raw material price increases, in 2008 and 2009, Crown implemented price increases in most of its steel and aluminum product categories. As a result of continuing global supply and demand pressures, other commodity-related costs affecting its business may increase as well, including natural gas, electricity and freight-related costs.

While certain, but not all, of Crown’s contracts pass through raw material costs to customers, Crown may be unable to increase its prices to offset increases in raw material costs without suffering reductions in unit volume, revenue and operating income. In addition, any price increases may take effect after related cost increases, reducing operating income in the near term. Significant increases in raw material costs may increase Crown’s working capital requirements, which may increase Crown’s average outstanding indebtedness and interest expense and may exceed the amounts available under Crown’s senior secured credit facilities and other sources of liquidity. In addition, Crown hedges raw material costs on behalf of certain customers and may suffer losses if such customers are unable to satisfy their purchase obligations.

19

If Crown is unable to purchase steel, aluminum or other raw materials for a significant period of time, Crown’s operations would be disrupted and any such disruption may adversely affect Crown’s financial results. If customers believe that Crown’s competitors have greater access to raw materials, perceived certainty of supply at Crown’s competitors may put Crown at a competitive disadvantage regarding pricing and product volumes.

Pending and future asbestos litigation and payments to settle asbestos-related claims could reduce Crown’s cash flow and negatively impact its financial condition.

Crown Cork, a wholly-owned subsidiary of Crown, is one of many defendants in a substantial number of lawsuits filed throughout the United States by persons alleging bodily injury as a result of exposure to asbestos. In 1963, Crown Cork acquired a subsidiary that had two operating businesses, one of which is alleged to have manufactured asbestos-containing insulation products. Crown Cork believes that the business ceased manufacturing such products in 1963.

Crown recorded pre-tax charges of $55 million, $25 million, $29 million, $10 million and $10 million to increase its accrual for asbestos-related liabilities in 2009, 2008, 2007, 2006 and 2005, respectively. As of March 31, 2010, Crown Cork’s accrual for pending and future asbestos-related claims was $226 million. Crown Cork’s accrual includes estimates for probable costs for claims through the year 2019. Potential estimated additional claims costs of $38 million beyond 2019 have not been included in Crown’s liability, as Crown believes cost projections beyond ten years are inherently unreliable due to potential changes in the litigation environment and other factors whose impact cannot be known or reasonably estimated. Assumptions underlying the accrual include that claims for exposure to asbestos that occurred after the sale of the subsidiary’s insulation business in 1964 would not be entitled to settlement payouts and that the state statutes described under Note K to Crown’s audited consolidated financial statements, including Texas and Pennsylvania statutes, are expected to have a highly favorable impact on Crown Cork’s ability to settle or defend against asbestos-related claims in those states and other states where Pennsylvania law may apply.

Crown Cork had 50,000 asbestos-related claims outstanding at December 31, 2009. Of the 50,000 claims outstanding at December 31, 2009, approximately 15,000 claims relate to claimants alleging first exposure to asbestos after 1964 and 35,000 relate to claimants alleging first exposure to asbestos before or during 1964, of which approximately 12,000 were filed in Texas, 2,000 were filed in Pennsylvania, 6,000 were filed in other states that have enacted asbestos legislation and 15,000 were filed in other states. The outstanding claims at December 31, 2009 exclude 33,000 pending claims involving plaintiffs who allege that they are, or were, maritime workers subject to exposure to asbestos, but whose claims Crown believes will not have a material effect on Crown’s consolidated results of operations, financial position or cash flow. The outstanding claims at December 31, 2009 also exclude approximately 19,000 inactive claims. Due to the passage of time, Crown considers it unlikely that the plaintiffs in these cases will pursue further action. The exclusion of these inactive claims had no effect on the calculation of Crown’s accrual as the claims were filed in states where Crown’s liability is limited by statute.

20

Crown Cork made cash payments of $4 million, $26 million, $25 million, $26 million, $26 million and $29 million in the first three months of 2010 and in 2009, 2008, 2007, 2006 and 2005, respectively, for asbestos-related claims. These payments have reduced and any such future payments will reduce the cash flow available to Crown Cork for its business operations and debt payments.

Asbestos-related payments and defense costs may be significantly higher than those estimated by Crown Cork because the outcome of this type of litigation (and, therefore, Crown Cork’s reserve) is subject to a number of assumptions and uncertainties, such as the number or size of asbestos-related claims or settlements, the number of financially viable responsible parties, the extent to which the state statutes relating to asbestos liability are upheld and/or applied by the courts, Crown Cork’s ability to obtain resolution without payment of asbestos-related claims by persons alleging first exposure to asbestos after 1964, and the potential impact of any pending or future asbestos-related legislation. Accordingly, Crown Cork may be required to make payments for claims substantially in excess of its accrual, which could reduce Crown’s cash flow and impair its ability to satisfy its obligations. As a result of the uncertainties regarding its asbestos-related liabilities and its reduced cash flow, the ability of Crown to raise new money in the capital markets is more difficult and more costly, and Crown may not be able to access the capital markets in the future. Further information regarding Crown Cork’s asbestos-related liabilities is presented within “Management’s Discussion and Analysis of Financial Condition and Results of Operations” under the headings, “Provision for Asbestos” and “Liquidity and Capital Resources” and under Note K to Crown’s audited consolidated financial statements.

Crown has significant pension plan obligations worldwide and significant unfunded postretirement obligations, which could reduce its cash flow and negatively impact its results of operations and its financial condition.

Crown sponsors various pension plans worldwide, with the largest funded plans in the U.K., U.S. and Canada. In 2009, 2008, 2007, 2006 and 2005, Crown contributed $74 million, $71 million, $65 million, $90 million and $401 million, respectively, to its pension plans and currently anticipates its 2010 funding to be approximately $75 million (including $15 million contributed as of March 31, 2010, and $60 million expected to be contributed in the remainder of 2010). Pension expense in 2010 is expected to decrease to approximately $115 million from $130 million in 2009. A 0.25% change in the 2010 expected rate of return assumptions would change 2010 pension expense by approximately $9 million. A 0.25% change in the discount rates assumptions as of December 31, 2009 would change 2010 pension expense by approximately $5 million. Crown may be required to accelerate the timing of its contributions under its pension plans. The actual impact of any accelerated funding will depend upon the interest rates required for determining the plan liabilities and the investment performance of plan assets. An acceleration in the timing of pension plan contributions could decrease Crown’s cash available to pay its outstanding obligations and its net income.

Based on current assumptions, Crown has no minimum U.S. pension funding requirement in calendar year 2010 for its funded plan, but expects to make contributions of approximately $22 million, including $20 million to its funded plan and $2 million related to its supplemental executive retirement plan.

The difference between pension plan obligations and assets, or the funded status of the plans, significantly affects the net periodic benefit costs of Crown’s pension plans and the ongoing funding requirements of those plans. Among other factors, significant volatility in the equity markets and in the value of illiquid alternative investments, changes in discount rates, investment returns and the market value of plan assets can substantially increase Crown’s

21

future pension plan funding requirements. A significant increase in Crown’s funding requirements could have a negative impact on Crown’s results of operations and profitability. See Note V to Crown’s audited consolidated financial statements for further detail. Crown’s U.S. pension plan was underfunded on a termination basis by approximately $497 million as of December 31, 2009. While its U.S. pension plan continues in effect, Crown continues to incur additional pension obligations. Crown’s pension plan assets consist primarily of common stocks and fixed income securities and also include alternative investments such as interests in private equity or hedge funds. If the performance of investments in the plan does not meet Crown’s assumptions, the underfunding of the pension plan may increase, Crown may have to contribute additional funds to the pension plan, and its pension expense may increase. In addition, its retiree medical plans are unfunded.

Crown’s U.S. pension plan is subject to the Employee Retirement Income Security Act of 1974, or ERISA. Under ERISA, the Pension Benefit Guaranty Corporation, or PBGC, has the authority to terminate an underfunded plan under certain circumstances. In the event its U.S. pension plan is terminated for any reason while the plan is underfunded, Crown will incur a liability to the PBGC that may be equal to the entire amount of the underfunding. In addition, as of December 31, 2009, the unfunded accumulated postretirement benefit obligation, as calculated in accordance with U.S. generally accepted accounting principles, for retiree medical benefits was approximately $511 million, based on assumptions set forth under Note V to Crown’s audited consolidated financial statements.

Acquisitions or investments that Crown may pursue could be unsuccessful, consume significant resources and require the incurrence of additional indebtedness.

Crown may pursue acquisitions and investments that complement its existing business. These acquisitions and investments may involve significant cash expenditures, debt incurrence (including the incurrence of additional indebtedness under Crown’s senior secured revolving credit facilities or other secured or unsecured debt), operating losses and expenses that could have a material effect on Crown’s financial condition and operating results.

In particular, if Crown incurs additional debt, Crown’s liquidity and financial stability could be impaired as a result of using a significant portion of available cash or borrowing capacity to finance an acquisition. Moreover, Crown may face an increase in interest expense or financial leverage if additional debt is incurred to finance an acquisition, which may, among other things, adversely affect Crown’s various financial ratios and Crown’s compliance with the conditions of its existing indebtedness. In addition, such additional indebtedness may be incurred under Crown’s senior secured credit facilities or otherwise secured by liens on Crown’s assets, in which case the notes and the note guarantees would be effectively subordinated to the additional debt.

Acquisitions involve numerous other risks, including:

| • | diversion of management time and attention; |

| • | failures to identify material problems and liabilities of acquisition targets or to obtain sufficient indemnification rights to fully offset possible liabilities related to the acquired businesses; |

| • | difficulties integrating the operations, technologies and personnel of the acquired businesses; |

| • | inefficiencies and complexities that may arise due to unfamiliarity with new assets, businesses or markets; |

| • | disruptions to Crown’s ongoing business; |

22

| • | inaccurate estimates of fair value made in the accounting for acquisitions and amortization of acquired intangible assets which would reduce future reported earnings; |

| • | the inability to obtain required financing for the new acquisition or investment opportunities and Crown’s existing business; |

| • | potential loss of key employees, contractual relationships, suppliers or customers of the acquired businesses or of Crown; and |

| • | inability to obtain required regulatory approvals. |

To the extent Crown pursues an acquisition that causes it to incur unexpected costs or that fails to generate expected returns, Crown’s financial position, results of operations and cash flows may be adversely affected, and Crown’s ability to service its indebtedness, including the notes, may be negatively impacted.

Crown’s principal markets may be subject to overcapacity and intense competition, which could reduce Crown’s net sales and net income.

Food and beverage cans are standardized products, allowing for relatively little differentiation among competitors. This could lead to overcapacity and price competition among food and beverage can producers, if capacity growth outpaced the growth in demand for food and beverage cans and overall manufacturing capacity exceeded demand. These market conditions could reduce product prices and contribute to declining revenue and net income and increasing debt balances. As a result of industry overcapacity and price competition, Crown may not be able to increase prices sufficiently to offset higher costs or to generate sufficient cash flow. The North American food and beverage can market, in particular, is considered to be a mature market, characterized by slow growth and a sophisticated distribution system.

Competitive pricing pressures, overcapacity, the failure to develop new product designs and technologies for products, as well as other factors could cause Crown to lose existing business or opportunities to generate new business and could result in decreased cash flow and net income.

Crown is subject to competition from substitute products and decreases in demand for its products, which could result in lower profits and reduced cash flows.

Crown is subject to substantial competition from producers of alternative packaging made from glass, cardboard, flexible materials and plastic. Crown’s sales depend heavily on the volumes of sales by Crown’s customers in the food and beverage markets. Changes in preferences for products and packaging by consumers of prepackaged food and beverage cans can significantly influence Crown’s sales. Changes in packaging by Crown’s customers may require Crown to re-tool manufacturing operations, which could require material expenditures. In addition, a decrease in the costs of, or a further increase in consumer demand for, alternative packaging could result in lower profits and reduced cash flows for Crown. For example, increases in the price of aluminum and steel and decreases in the price of plastic resin, which is a petrochemical product and may fluctuate with prices in the oil and gas market, may increase substitution of plastic food and beverage containers for metal containers or increases in the price of steel may increase substitution of aluminum packaging for aerosol products. Moreover, due to its high percentage of fixed costs, Crown may be unable to maintain its gross margin at past levels if it is not able to achieve high capacity utilization rates for its production equipment. In periods of low world-wide demand for its products, Crown experiences relatively low capacity utilization rates in its operations, which can lead to reduced margins during that period and can have an adverse effect on Crown’s business.

23

The loss of a major customer and/or customer consolidation could reduce Crown’s net sales and profitability.

Many of Crown’s largest customers have acquired companies with similar or complementary product lines. This consolidation has increased the concentration of Crown’s business with its largest customers. In many cases, such consolidation has been accompanied by pressure from customers for lower prices, reflecting the increase in the total volume of product purchased or the elimination of a price differential between the acquiring customer and the company acquired. Increased pricing pressures from Crown’s customers may reduce Crown’s net sales and net income.

The majority of Crown’s sales are to companies that have leading market positions in the sale of packaged food, beverages and aerosol products to consumers. Although no one customer accounted for more than 10% of its net sales in 2009, 2008 or 2007, the loss of any of its major customers, a reduction in the purchasing levels of these customers or an adverse change in the terms of supply agreements with these customers could reduce Crown’s net sales and net income. A continued consolidation of Crown’s customers could exacerbate any such loss.

Crown’s business is seasonal and weather conditions could reduce Crown’s net sales.

Crown manufactures packaging primarily for the food and beverage can market. Its sales can be affected by weather conditions. Due principally to the seasonal nature of the soft drink, brewing, iced tea and other beverage industries, in which demand is stronger during the summer months, sales of Crown’s products have varied and are expected to vary by quarter. Shipments in the U.S. and Europe are typically greater in the second and third quarters of the year. Unseasonably cool weather can reduce consumer demand for certain beverages packaged in its containers. In addition, poor weather conditions that reduce crop yields of packaged foods can decrease customer demand for its food containers.

Crown is subject to costs and liabilities related to stringent environmental and health and safety standards.

Laws and regulations relating to environmental protection and health and safety may increase Crown’s costs of operating and reduce its profitability. Crown’s operations are subject to numerous U.S. federal and state and non-U.S. laws and regulations governing the protection of the environment, including those relating to treatment, storage and disposal of waste, the use of chemicals in Crown’s products and manufacturing process, discharges into water, emissions into the atmosphere, remediation of soil and groundwater contamination and protection of employee health and safety. Future regulations may impose stricter environmental requirements affecting Crown’s operations or may impose additional requirements regarding consumer health and safety, such as potential restrictions on the use of bisphenol-A, which is used in the lining of food and beverage cans. Although the U.S. FDA currently permits the use of bisphenol-A in food packaging materials and confirmed in a January 2010 update that studies employing standardized toxicity tests have supported the safety of current low levels of human exposure to bisphenol-A, the FDA in that January 2010 update noted that exposure to the chemical is of “some concern” for infants and children and more research was needed, and further suggested reasonable steps to reduce exposure to bisphenol-A. The U.S. EPA recently issued an action plan for bisphenol-A, which includes, among other things, consideration of whether to add bisphenol-A to the chemical concern list on the basis of potential environmental effects and use of the EPA’s Design for the Environment program to encourage reductions in bisphenol-A manufacturing and use. Moreover, certain U.S. Congressional bodies, states and municipalities, as well as certain foreign nations, have either proposed or already passed legislation banning the use of bisphenol-A in certain products or requiring warnings regarding bisphenol-A. Further, the U.S. or additional international, federal, state or other regulatory authorities

24

could prohibit the use of bisphenol-A in the future. In addition, recent public reports and allegations regarding the potential health hazards of bisphenol-A could contribute to a perceived safety risk about Crown’s products and adversely impact sales or otherwise disrupt Crown’s business. While Crown is exploring various alternatives to the use of bisphenol-A, there can be no assurance Crown will be successful in its efforts or that the alternative will not be more costly to Crown.

Also, for example, future restrictions in some jurisdictions on air emissions of volatile organic compounds and the use of certain paint and lacquering ingredients may require Crown to employ additional control equipment or process modifications. Crown’s operations and properties, both in the U.S. and abroad, must comply with these laws and regulations. In addition, a number of governmental authorities in the U.S. and abroad have introduced or are contemplating enacting legal requirements, including emissions limitations, cap and trade systems or mandated changes in energy consumption, in response to the potential impacts of climate change. Given the wide range of potential future climate change regulations in the jurisdictions in which Crown operates, the potential impact to Crown’s operations is uncertain. In addition, the potential impact of climate change on Crown’s operations is highly uncertain. The impact of climate change may vary by geographic location and other circumstances, including weather patterns and any impact to natural resources such as water.

A number of governmental authorities both in the U.S. and abroad also have enacted, or are considering, legal requirements relating to product stewardship, including mandating recycling, the use of recycled materials and/or limitations on certain kinds of packaging materials such as plastics. In addition, some companies with packaging needs have responded to such developments, and/or to perceived environmental concerns of consumers, by using containers made in whole or in part of recycled materials. Such developments may reduce the demand for some of Crown’s products, and/or increase its costs. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Environmental Matters.”

Crown has written down a significant amount of goodwill, and a further write down of goodwill would result in lower reported net income and a reduction of its net worth.

During 2007, Crown recorded a charge of $103 million to write down the value of goodwill in its European Closures reporting unit due to a decrease in projected operating results. Further impairment of Crown’s goodwill would require additional write down of goodwill, which would reduce Crown’s net income in the period of any such write down. At March 31, 2010, the carrying value of Crown’s goodwill was approximately $2 billion. Crown is required to evaluate goodwill reflected on its balance sheet at least annually, or when circumstances indicate a potential impairment. If it determines that the goodwill is impaired, Crown would be required to write off a portion or all of the goodwill.

If Crown fails to retain key management and personnel Crown may be unable to implement its business plan.

Members of Crown’s senior management have extensive industry experience, and it would be difficult to find new personnel with comparable experience. Because Crown’s business is highly specialized, we believe that it would also be difficult to replace Crown’s key technical personnel. Crown believes that its future success depends, in large part, on its experienced senior management team. Losing the services of key members of its management team could limit Crown’s ability to implement its business plan. In addition, under Crown’s unfunded Senior Executive Retirement Plan certain members of senior management are entitled to lump sum payments upon retirement or other termination of employment and a lump sum death benefit of five times the annual retirement benefit.

25

A significant portion of Crown’s workforce is unionized and labor disruptions could increase Crown’s costs and prevent Crown from supplying its customers.

A significant portion of Crown’s workforce is unionized and a prolonged work stoppage or strike at any facility with unionized employees could increase its costs and prevent Crown from supplying its customers. In addition, upon the expiration of existing collective bargaining agreements, Crown may not reach new agreements without union action and any such new agreements may not be on terms satisfactory to Crown. Moreover, additional groups of currently non-unionized employees may seek union representation in the future. If Crown is unable to negotiate acceptable collective bargaining agreements, it may become subject to union-initiated work stoppages, including strikes. Additionally, as was expected, the Employee Free Choice Act, which was passed in the U.S. House of Representatives in 2007, was reintroduced in the new Congress in 2009. If reintroduced and enacted in its most recent form, the Employee Free Choice Act could make it significantly easier for union organizing drives to be successful. The Employee Free Choice Act could also give third-party arbitrators the ability to impose terms, which may be harmful to Crown, of collective bargaining agreements upon Crown and a labor union if Crown and such union are unable to agree to the terms of an initial collective bargaining agreement and could increase the penalties Crown may incur if it engages in labor practices in violation of the National Labor Relations Act.

Failure by Crown’s joint venture partners to observe their obligations could adversely affect the business and operations of the joint ventures and, in turn, the business and operations of Crown.

A portion of Crown’s operations, including certain joint venture beverage can operations in Asia, the Middle East and South America, is conducted through certain joint ventures. Crown participates in these ventures with third parties. In the event that Crown’s joint venture partners do not observe their obligations, it is possible that the affected joint venture would not be able to operate in accordance with its business plans or that Crown would have to increase its level of commitment to the joint venture.

If Crown fails to maintain an effective system of internal control, Crown may not be able to accurately report financial results or prevent fraud.

Effective internal controls are necessary to provide reliable financial reports and to assist in the effective prevention of fraud. Any inability to provide reliable financial reports or prevent fraud could harm Crown’s business. Crown must annually evaluate its internal procedures to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires management and auditors to assess the effectiveness of internal controls. If Crown fails to remedy or maintain the adequacy of its internal controls, as such standards are modified, supplemented or amended from time to time, Crown could be subject to regulatory scrutiny, civil or criminal penalties or shareholder litigation.

In addition, failure to maintain adequate internal controls could result in financial statements that do not accurately reflect Crown’s financial condition. There can be no assurance that Crown will be able to complete the work necessary to fully comply with the requirements of the Sarbanes-Oxley Act or that Crown’s management and external auditors will continue to conclude that Crown’s internal controls are effective.

26

Crown is subject to litigation risks which could negatively impact its operations and net income.

Crown is subject to various lawsuits and claims with respect to matters such as governmental, environmental and employee benefits laws and regulations, securities, labor, and actions arising out of the normal course of business, in addition to asbestos-related litigation described under the risk factor titled “Pending and future asbestos litigation and payments to settle asbestos-related claims could reduce Crown’s cash flow and negatively impact its financial condition.” Crown is currently unable to determine the total expense or possible loss, if any, that may ultimately be incurred in the resolution of such legal proceedings. Regardless of the ultimate outcome of such legal proceedings, they could result in significant diversion of time by Crown’s management. The results of Crown’s pending legal proceedings, including any potential settlements, are uncertain and the outcome of these disputes may decrease its cash available for operations and investment, restrict its operations or otherwise negatively impact its business, operating results, financial condition and cash flow.

Crown is subject to antitrust investigations in Europe. In July of 2010, the Spanish National Antitrust Commission issued a Statement of Facts (Pliego de Concreción de Hechos) alleging that Crown European Holdings and one of its subsidiaries violated Spanish and European competition law by coordinating certain commercial terms and exchanging information with competitors in Spain. The Statement of Facts does not constitute a decision on the merits and is subject to a reply by Crown. If the Antitrust Commission finds that Crown’s subsidiaries violated competition law, the Antitrust Commission has the authority to levy fines. Also in July, a subsidiary of Crown became aware of an investigation by the Netherlands Competition Authority in relation to competition law matters. No allegations have been made at this stage by the Dutch authorities. Crown believes that the allegations in Spain are without merit and intends to defend its position vigorously. However, Crown is unable to predict the ultimate outcome of the foregoing or their impact on Crown.

The recent global credit and financial crisis could have adverse effects on Crown.

The recent global credit and financial crisis could have significant adverse effects on Crown’s operations, including as a result of any the following:

| • | downturns in the business or financial condition of any of Crown’s key customers or suppliers, potentially resulting in customers’ inability to pay Crown’s invoices as they become due or at all; |

| • | potential losses associated with hedging activity by Crown for the benefit of Crown’s customers, or cost impacts of changing suppliers; |

| • | a fall in the fair value of Crown’s pension assets, potentially requiring Crown to make significant additional contributions to its pension plans to meet prescribed funding levels; |

| • | the deterioration of any of the lending parties under Crown’s senior secured revolving credit facilities or the creditworthiness of the counterparties to Crown’s derivative transactions, which could result in such parties’ failure to satisfy their obligations under their arrangements with Crown; |

| • | noncompliance with the covenants under Crown’s indebtedness as a result of a weakening of Crown’s financial position or results of operations; and |