Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ON SEMICONDUCTOR CORP | d8k.htm |

| EX-99.1 - PRESS RELEASE - ON SEMICONDUCTOR CORP | dex991.htm |

| EX-99.2 - CONFERENCE CALL SCRIPT FOR JULY 15, 2010 - ON SEMICONDUCTOR CORP | dex992.htm |

1

The Power of

ON Semiconductor

Investor Presentation

July 2010

SANYO

Semiconductor

Co., Ltd.

Exhibit 99.3 |

2

Forward Looking Statements

This presentation contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These forward-looking

statements include, but are not limited to, statements related to the

proposed transaction between ON Semiconductor and SANYO Electric and

expected benefits of such transaction. These forward-looking statements

are based on information available to ON Semiconductor as of the date of

this presentation. Forward-looking statements involve a number of risks and

uncertainties that could cause actual results to differ materially from those

anticipated by these forward-looking statements. Such risks and

uncertainties include a variety of factors, some of which are beyond ON

Semiconductor’s or control. Information concerning additional factors

that could cause results to differ materially from those projected in the

forward-looking statements is contained in ON Semiconductor’s Annual

Report on Form 10-K, as filed with the Securities and Exchange Commission (the

“SEC”) on February 25, 2010, Quarterly Reports on Form 10-Q,

Current Reports on Form 8-K and other of ON Semiconductor’s SEC

filings. Please refer to the end of these presentation materials for

additional important information regarding forward-looking statements

included in these presentation materials. |

3

A Winning Combination

More Than 100 Years of Semiconductor Expertise

•

World class, high volume, cost effective

products

•

Leader in:

–

Automotive, Computing, Consumer and

Communications end markets

–

Power management

–

Manufacturing excellence

Annualized Revenue:

~$2.3Bn

Annualized Gross Profit:

$973MM

Annualized Operating Income:

$453MM

•

Extensive analog IC product portfolio

–

Including energy efficient components

•

Strong position in Consumer and Automotive end

markets

•

Longstanding customer relationships with

Japanese and Asian electronics leaders

•

Business essentially breakeven today before

manufacturing integration

SANYO Semiconductor

Co., Ltd.

+

A New Global Leader

Emerges

•

Approximately $3.5 billion in Pro Forma revenue,

based on annualized most recent quarter sales

•

Manufacturing, operating expense, and capital

expenditure cost savings

•

Comprehensive product portfolio / end-market

coverage

•

Cross-selling opportunities

•

Expanded addressable market

Annualized Revenue:

~$1.2Bn

Annualized Gross Profit:

$348MM

Annualized Operating Income:

$16MM

Note: Annualized financials based on Second Fiscal Quarter 2010 estimates. ON Semiconductor

estimates based on mid-point of guidance given for Second Fiscal Quarter 2010, and confirmed in

press release dated 7/15/2010. SANYO Semiconductor estimates based on company guidance. See page 4 of

this presentation. |

4

Pro Forma Financials

Revenue

$573

$2,290

$1,216

$3,506

Gross Margin

42.5%

42.5%

28.6%

37.7%

Op. Income

$113

$453

$16

$469

Op. Inc. Margins

19.8%

19.8%

1.3%

13.4%

Employees

13,200

9,409

22,609

High Cost

~3,700

~4,900

~8,600

Low Cost

~9,500

~4,509

~14,009

($MM)

•

Significant Pro Forma revenue scale, with over $3.5 billion in combined annualized

revenue •

SANYO Semiconductor gross margin expansion to be achieved through operational cost

savings •

SANYO Semiconductor operating expenses as a % of sales to be brought in-line

with ON Semiconductor over time

SANYO

(2)

ON

Semiconductor

(1)

Combined

(3)

Estimated June Quarter Annualized

Q2’10 Guidance

Notes:

(1) Annualized financials based on Second Fiscal Quarter 2010 estimates. ON Semiconductor estimates

based on mid-point of guidance given for Second Fiscal Quarter 2010, and confirmed in press release dated 7/15/2010.

(2) Annualized financials based on June 2010 Quarter estimates. SANYO Semiconductor estimates based on

company guidance. (3) Represents combined annualized estimated financials for June 2010 Quarter

for ON Semiconductor and SANYO Semiconductor. |

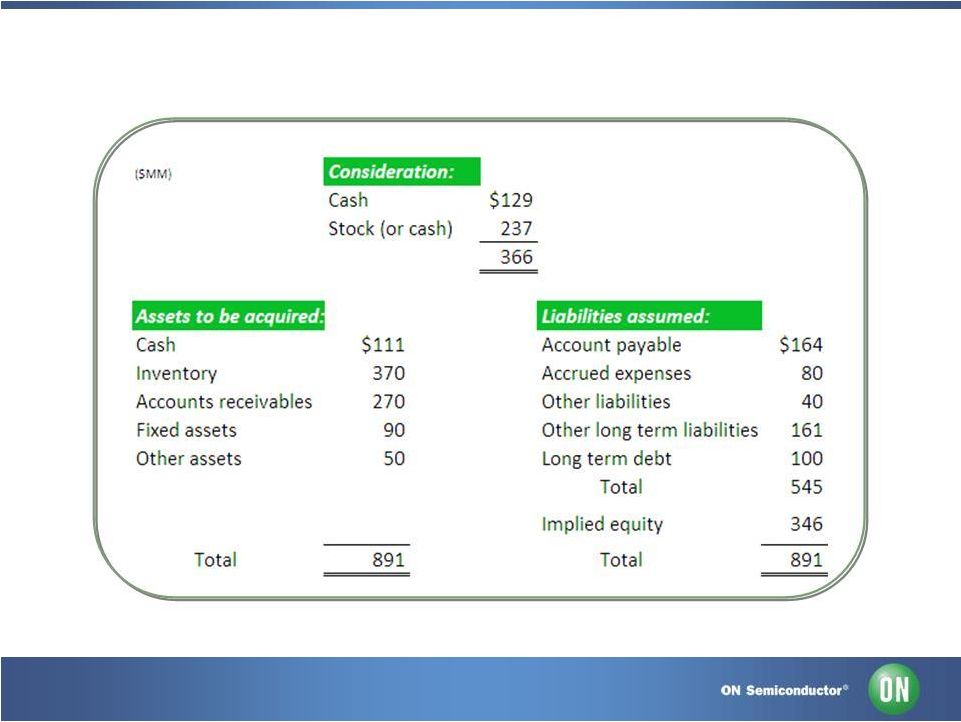

5

Est. Unaudited Net Assets to be Acquired at Close

Notes:

(1)

Represents

estimated

Balance

Sheet

as

of

closing.

As

part

of

purchase

accounting,

the

assets

and

liabilities

will

be

“fair

valued”

pursuant

to

an

appraisal.

Balance

sheet

information

based

on

SANYO

estimates

and

purchase

agreement. |

6

Total payment of ~$366MM (~¥33.0Bn) at closing

~$129MM (~¥11.6Bn) of cash; and up to ~$238MM (~¥21.4Bn) of ON

Semiconductor common stock, or cash

Assumption of ~$245MM (~¥22Bn) of net liabilities

Consideration

Brand & IP

SANYO Semiconductor name available for 3 years post closing

SANYO Semiconductor to have extensive IP portfolio >6,500 patents

Anticipated Close

and Conditions

By the end of calendar year 2010

Transaction is subject to various closing conditions and regulatory

approval

~35MM shares owned by SANYO Electric equates to approximately 7-8

percent ownership on a fully diluted basis, if stock used as consideration

ON Semiconductor has the option, at its discretion, to use cash in lieu of

all or a portion of the shares

Pro Forma

Ownership

Summary Transaction Terms |

7

•

Headquarters:

Phoenix, AZ

•

Founded:

Spun-off from Motorola 1999, IPO 2000

•

Employees:

13,200

•

Revenue:

~$2Bn

•

Market

Capitalization:

~$3Bn

•

Cash

&

Equivalents:

$561MM

(1)

•

Debt:

$935MM

(1)

ON Semiconductor Today

Low & Medium MOSFET

Analog Automotive

Auto Power

LDO & Vregs

Automotive

DC

DC Conversion

Analog Switches

AC-

DC Conversion

Low Voltage

Standard Logic

Power Switching

Signal & Interface

-

Medical

Integrated Sensor Products

Military & Aerospace

Industrial

Communications & High

Voltage

High Frequency

Foundry

Bipolar Power

Thyristor

Small Signal

Zener

Protection

Rectifier

Filters

Memory Products

(1) Source: Quarter ended 4/2/10.

Computing & Consumer

Products (23% of Revenue)

Digital & Mixed

Signal

(22% of Revenue)

Automotive & Power Group

(23% of Revenue)

Standard Products

(32% of Revenue)

-

Products Group

HQ: Phoenix,

AZ

U.S. mfg

facilities: AZ,

ID, and OR

European mfg facilities:

Belgium, Czech Republic,

and Slovakia

Asia / Pacific

mfg

facilities:

China,

Japan,

Malaysia,

and the

Philippines |

8

Power & Eco:

37%

Mobile:

12%

Auto:

13%

Other:

31%

Asian Manufacturers:

35%

Japanese Manufacturers:

61%

Hyper Device (Discrete):

24%

Hybrid IC:

9%

Custom LSI :

27%

Standard LSI:

40%

SANYO Semiconductor Today

By Region

By Application

Facility

Products

Wafer Size

Wafer Fabs - Japan

Gunma fab

HD/HIC/LSI

4" / 5" / 6"

Niigata fab

LSI

5" / 6"

Gifu fab

HD/LSI

5" / 6"

Back-End Process - Japan

Kitakata fab

LSI

Kasukawa fab

LSI

Hanyu fab

LSI

Back-End Process - Ex-Japan

Thailand fab (SSTH)

HD/HIC/LSI

Shekou fab (SSL)

HD

Tauchung fab (SET)

HD

HK fab (SSEHK)

HD

Philippines fab (SSMP)

HIC/LSI

Vietnam fab (SSV)

HIC

(1)

includes

revenue

from

Amorton

business.

Source: SANYO Semiconductor.

Manufacturing Locations

Revenue Segmentation (FYE March 2010)

(1)

•

Headquarters:

Gunma, Japan

•

Founded:

2006 (predecessor entities date to 1957)

•

Employees (as of Jan. 2010):

–

F/T: 8,206; 2,074 in wafer process manufacturing, and

3,955 in back-end process manufacturing

–

P/T: 1,203; 105 in wafer process manufacturing, and

899 in back-end process manufacturing

•

President:

Teruo

Tabata

•

Business

Overview:

Develops

and

manufactures

semiconductor products focused on power and eco areas;

proprietary analog and power management technologies;

leading customers worldwide

By Business Unit/Product

27%

Standard LSI

9%

Hyper Device

24%

Custom LSI

40%

Hybrid IC

(Discrete)

Asia

Asia (European &

3%

39%

22%

35%

American)

Other

Japan

Asia (Japanese)

1% |

9

Additional Product Opportunities

•

Acquisition Brings Extensive

Complementary Product Portfolio

•

Numerous Japanese Qualified

Packages

•

Deep Intellectual Property Portfolio,

including >6,500 Patents

•

Complementary Strength in

–

Microcontroller ICs

–

Motor driver ICs

Microcontroller ICs

Motor Driver ICs

Power Supply ICs

Data

Communication

ICs

Hybrid ICs

ASICs

Discrete Devices

Sensors

Video ICs

Audio ICs

Display Driver ICs |

10

Transaction Rationale

Complementary

Products, Customers

and End-markets

SANYO Semiconductor adds microcontrollers, motor controllers, inverters and other

products

ON Semiconductor is strong in N. America and Europe; SANYO strong in Japan and

Asia Significantly enhances ON Semiconductor’s position in the

Automotive and Consumer markets

Strengthens

Market Position in

Japan and Asia

Provides ON Semiconductor with significant market presence in Japan, the

world’s second largest semiconductor market; ON Semiconductor to be

the 3rd largest U.S. semiconductor

company

operating

in

Japan

(1)

Strengthens ON Semiconductor’s position in Korea, and other key Asian

markets Significant

Shareholder Value

Creation Opportunity

Acquiring approx. $1.2 billion revenue (based on 2Q’10 annualized) at ~0.5x

multiple -

Significantly below recent similar transactions

Acquisition expected to be accretive to earnings approximately twelve months post

close Increased Scale and

Cash Flow Generation

Potential

Pro forma annualized MRQ revenues of $3.5 billion

Pro forma combined post-manufacturing integration GMs to be in 40% range

Near term goal to deliver in excess of $30 million in pre-tax income on a

quarterly basis from SANYO Semiconductor in approximately six quarters

after closing the transaction Leverages Operational

Excellence to

Drive Cost Savings

(1) Source: Gartner, 2010.

Leverages ON Semiconductor’s successful track record of executing operational

restructurings; 7

acquisitions, 8 fab and 2 back-end facilities consolidations

ON Semiconductor to drive manufacturing

integration ON Semiconductor has owned and operated a factory in Japan since

1982

|

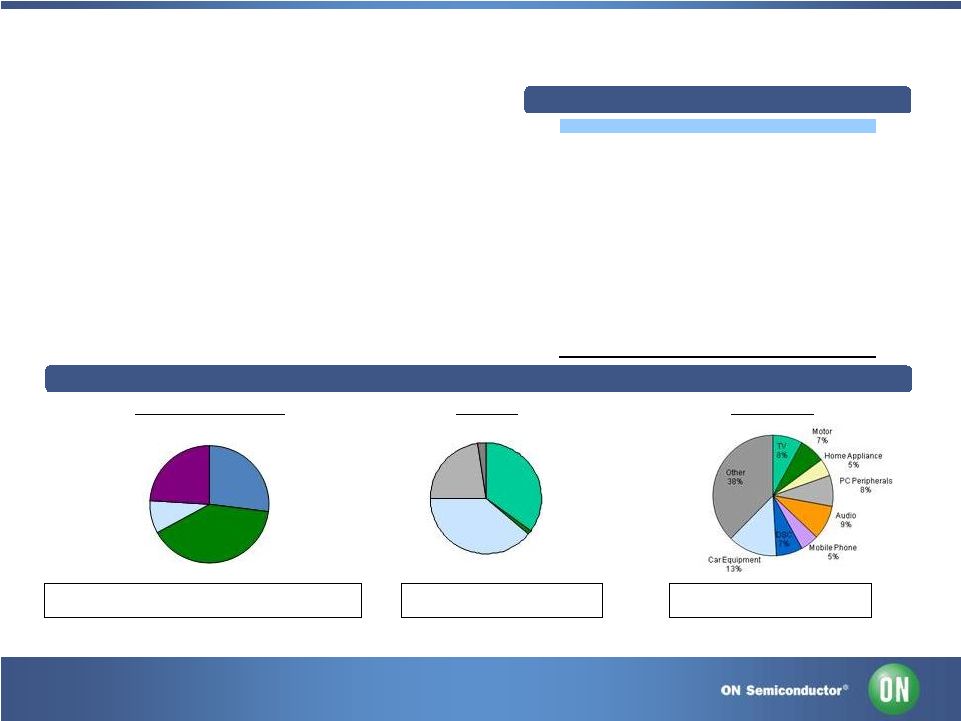

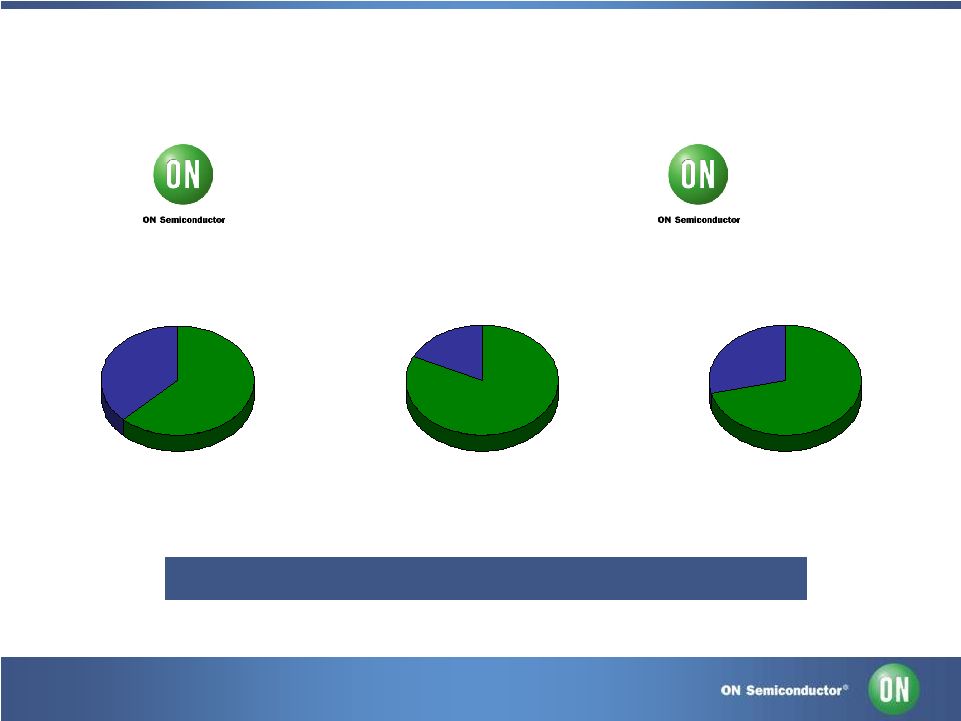

11

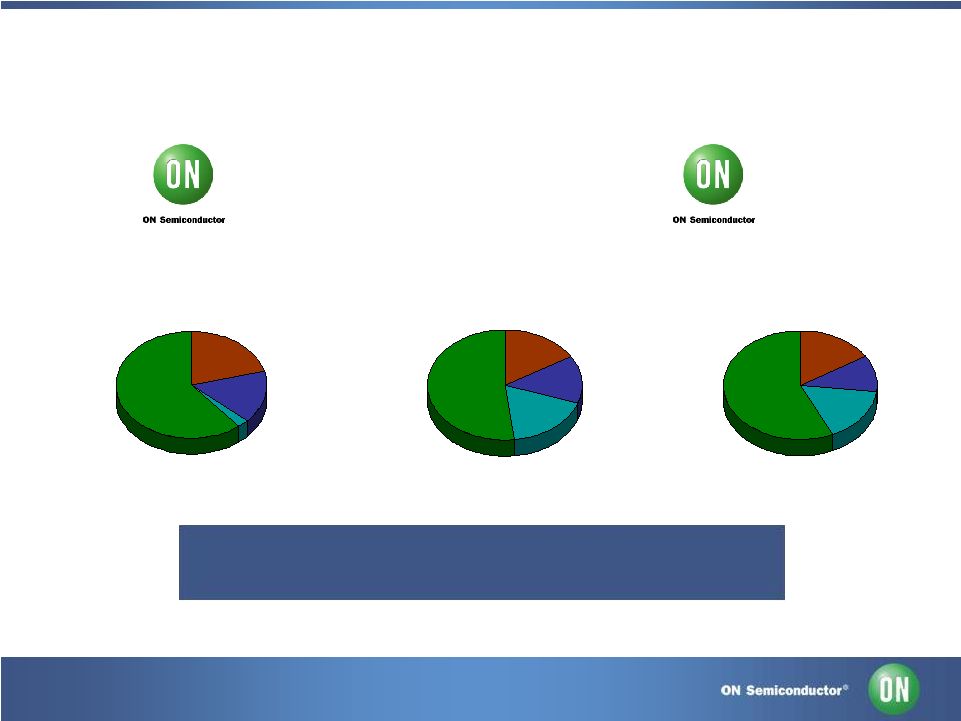

Note:

Revenue

breakdown

for

CY2009.

Charts

exclude

approximately

$20

million

manufacturing

services

revenue

for

ON

Semiconductor

in

CY2009.

Source: iSuppli.

A Diversified Product Platform

A Leader in Mixed Signal & Analog Technologies

Integrated

Circuits

71%

Discretes

29%

Integrated

Circuits

82%

Discretes

18%

SANYO

Semiconductor

Co., Ltd.

+

SANYO

Semiconductor

Co., Ltd.

Integrated

Circuits

62%

Discretes

38% |

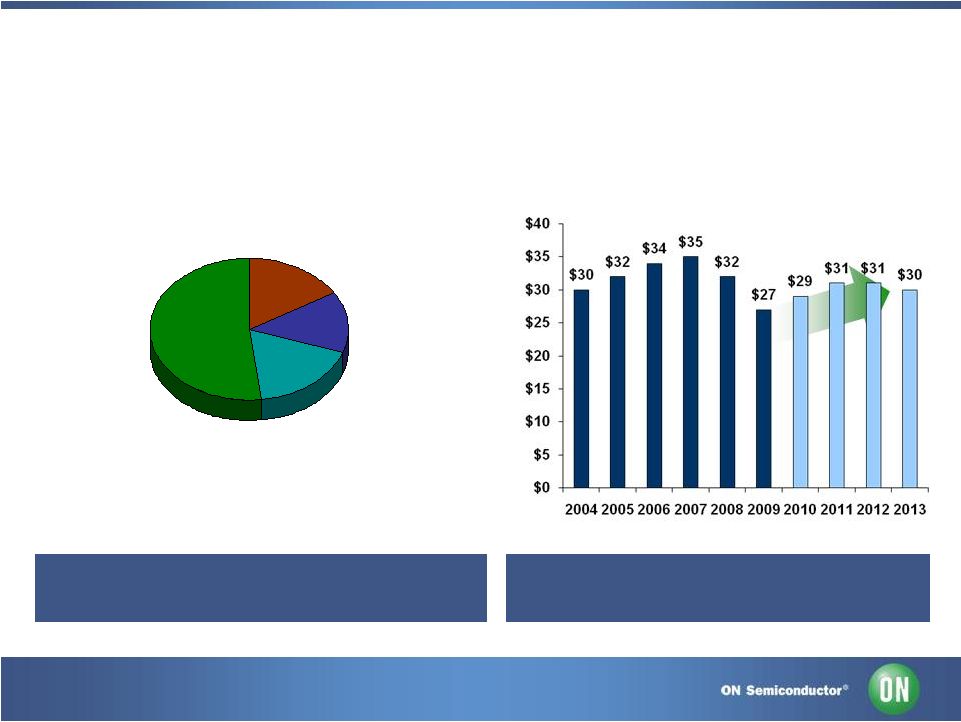

Japanese Semiconductor Market

Japan is the World’s Second Largest

Semiconductor Region

Japan Semiconductor Revenue

Source: Gartner Research, 2010.

Japan Semiconductor Market

Expected to Recover Over 2010-12

($Bn)

Global Semiconductor

Market, 2009

2009-12 CAGR: 5%

2009 Sales: $228Bn

Americas

16%

EMEA

14%

Japan

18%

Asia Pacific

52%

12 |

13

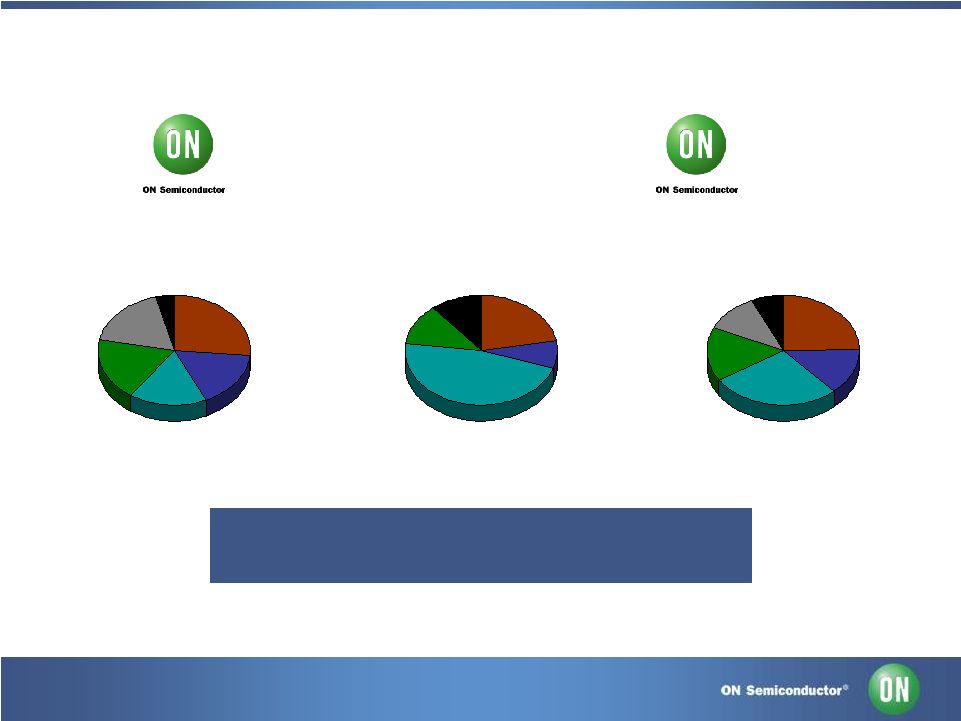

Diversified Geographic Footprint

Global Semiconductor

Market, 2009

Americas

16%

EMEA

14%

Japan

18%

Asia Pacific

52%

Americas

16%

EMEA

11%

Japan

16%

Asia-Pacific

57%

Americas

21%

EMEA

16%

Japan

3%

Asia-Pacific

61%

+

SANYO

Semiconductor

Co., Ltd.

Note:

Revenue

breakdown

for

CY2009.

Charts

exclude

approximately

$20

million

manufacturing

services

revenue

for

ON

Semiconductor

in

CY2009.

Source: iSuppli.

Pro

Forma

Geographic

Footprint

Mirrors

that of Semiconductor Industry |

14

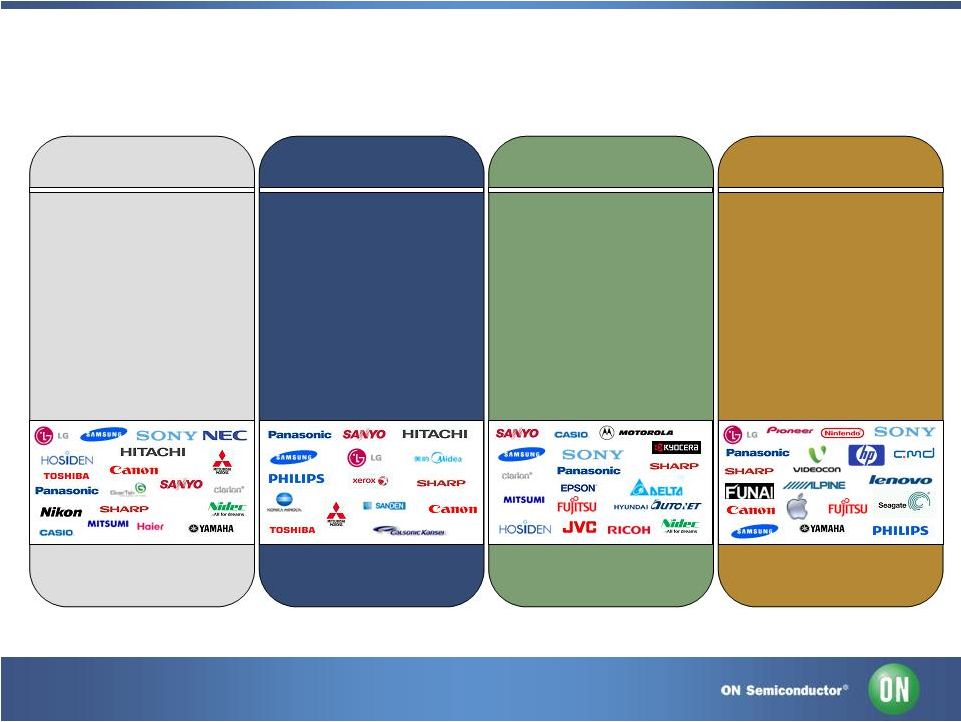

Balanced End Market Presence

Expanded Presence in Consumer

Strengthened Presence in Automotive

Note: LTM revenue breakdown as of 3/31/10. Charts exclude approximately $19 million

manufacturing services revenue for ON Semiconductor for the LTM period ended 3/31/10.

Sanyo

Semiconductor’s

“Consumer

Electronics”

segment

consists

of

“Video”,

“Audio”,

“Consumer

Electronics”,

and

“Amusement”

segments.

Sanyo

Semiconductor’s

“Computing”

segment

consists

of

“Computer

and

Peripherals”

segment.

ON

Semiconductor’s

“Other”

segment

represents

“Medical”

revenues.

Pro

Forma

“Other”

segment

consists

of

Sanyo

Semiconductor

“Other”

revenues

and

ON

Semiconductor’s

“Medical”

revenues.

Computing

25%

Comms

14%

Consumer

Electronics

27%

Auto

16%

Industrial

Electronics

11%

Other

7%

Computing

26%

Comms

17%

Consumer

Electronics

17%

Auto

18%

Ind.

18%

Other

4%

Computing

22%

Comms

8%

Consumer

Electronics

47%

Auto

12%

Other

11%

SANYO

Semiconductor

Co., Ltd.

+

SANYO

Semiconductor

Co., Ltd. |

ON

Semiconductor Market Segments Automotive and

Power Regulation

Computing & Consumer

Products

Digital & Mixed-Signal

Products Group

Standard Products

Low & Medium MOSFET

Analog Automotive

Auto Power

LDO & Vregs

Automotive

DC-DC Conversion

Analog Switches

AC-DC Conversion

Low Voltage

Standard Logic

Power Switching

Signal & Interface

Medical

Integrated Sensor Products

(“ISP”)

Military & Aerospace

Industrial Communications &

High Voltage

High Frequency

Foundry

Bipolar Power

Thyristor

Small Signal

Zener

Protection

Rectifier

Filters

Memory Products

$442MM

Revenue:

Note: LTM revenues as of 3/31/10.

$447MM

Revenue:

$425MM

Revenue:

$625MM

Revenue:

15 |

SANYO Semiconductor Business Units

Hyper Device Division

(Discrete)

HIC Division (Hybrid IC)

Standard LSI Division

Custom LSI Division

For power supply, general,

strobe; Transistor, IGBT

LED driver, MOSFET

Hybrid Products

Sustain driver HIC

Inverter HIC for white goods

Digital amp HIC for audio

Motor driver

Power supply IC

(TV/STB/mobile

System LSI for anti-shake, ESD-

EMI Protection IC

OE-IC for optical pickup

Touch sensor

Tuner device, High frequency IC

(AM/FM)

IC recorder SoC

(Gok-Low)

LSI for image quality adjustment

LSI for door phone

Small package EEPROM (2-

32k)

SPI NOR serial flash memory

Flash/display microcontroller

(8/16 bit)

Custom LSI for car equipment

$267MM

Revenue:

Note: LTM revenues as of 3/31/10. Converted at 90 JPY per USD.

Per SANYO Semiconductor management; excludes Other sales representing ~5% of total

revenue. $95MM

Revenue:

$448MM

Revenue:

$303MM

Revenue:

16 |

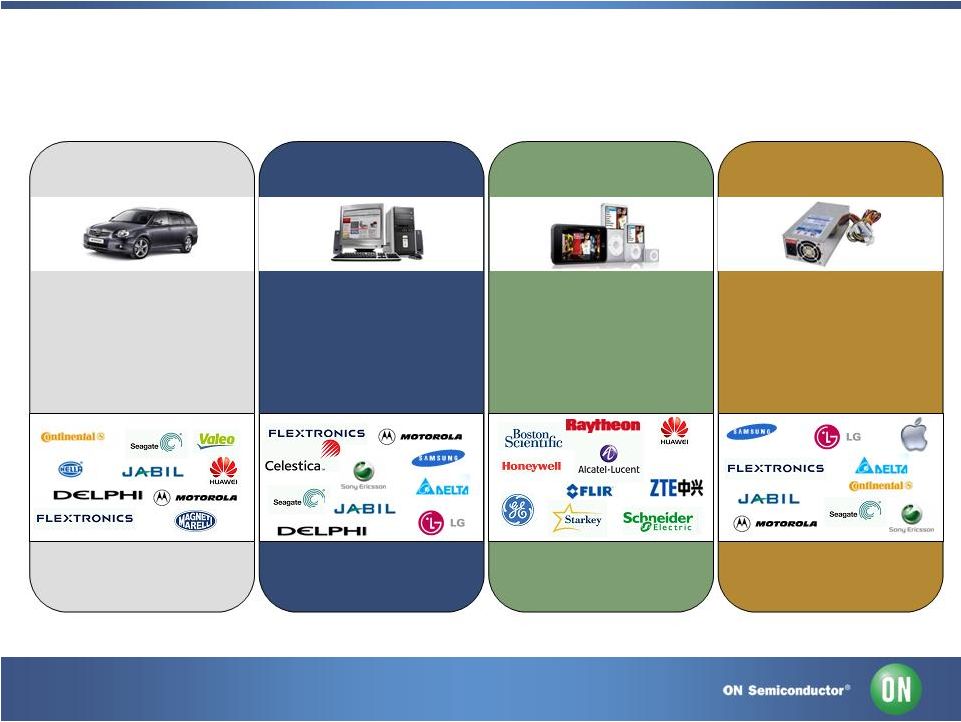

Broad and Deep Customer Relationships

SANYO Semiconductor

Co., Ltd.

17 |

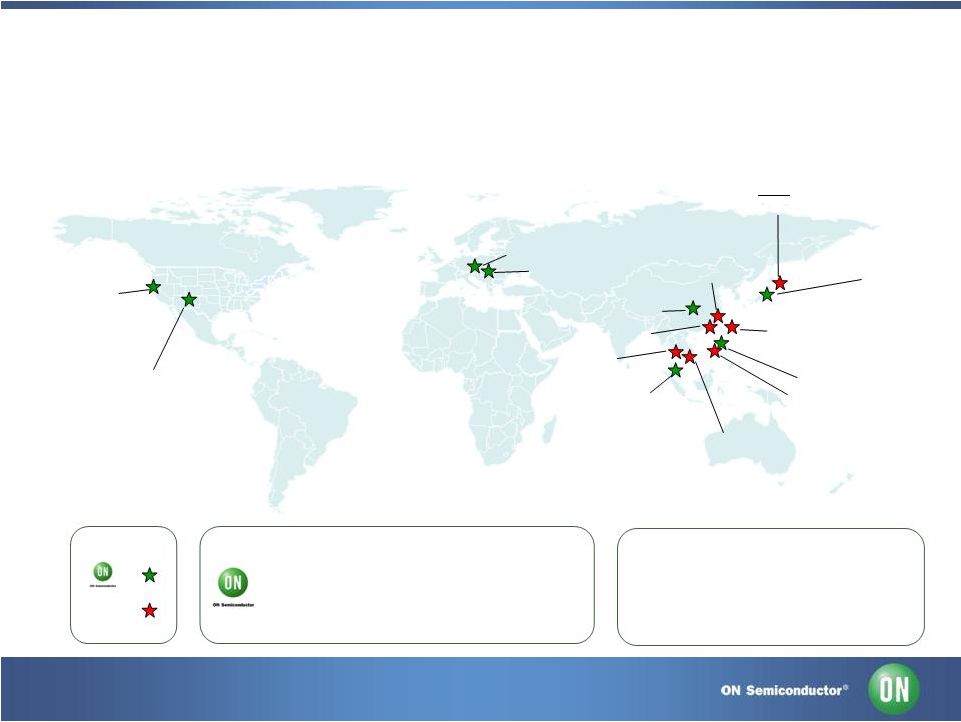

Leshan, China

Aizu, Japan

Gresham, OR

Phoenix, AZ

Roznov, Czech Republic

Piestany, Slovakia

Seremban, Malaysia

(Site 1 & 2)

Carmona, Philippines

Hong Kong, China

Global Manufacturing Infrastructure

Front-end Facilities:

•

Japan: Niigata, Gunma, Gifu

Back-end Facilities:

•

Japan: Hanyu, Kasukawa

•

China: Hong Kong, Taichung, Shekou

•

Philippines

•

Thailand

•

Vietnam

Philippines

Taichung, China

Shekou, China

Vietnam

Thailand

Japan:

Niigata, Gunma, Gifu, Hanyu, Kasukawa

Back-end Facilities:

•

Leshan, China

•

Seremban, Malaysia (Site-1)

•

Carmona, Philippines

Wafer Facilities:

•

Roznov, Czech Republic

Front-end Facilities:

•

Phoenix, Arizona

•

Gresham, Oregon

•

Aizu, Japan

•

Pietany, Slovakia

•

Seremban, Malaysia (Site-2)

•

Roznov, Czech Republic

SANYO

Semiconductor

Co., Ltd.

SANYO

Semiconductor

Co., Ltd.

Legend

18 |

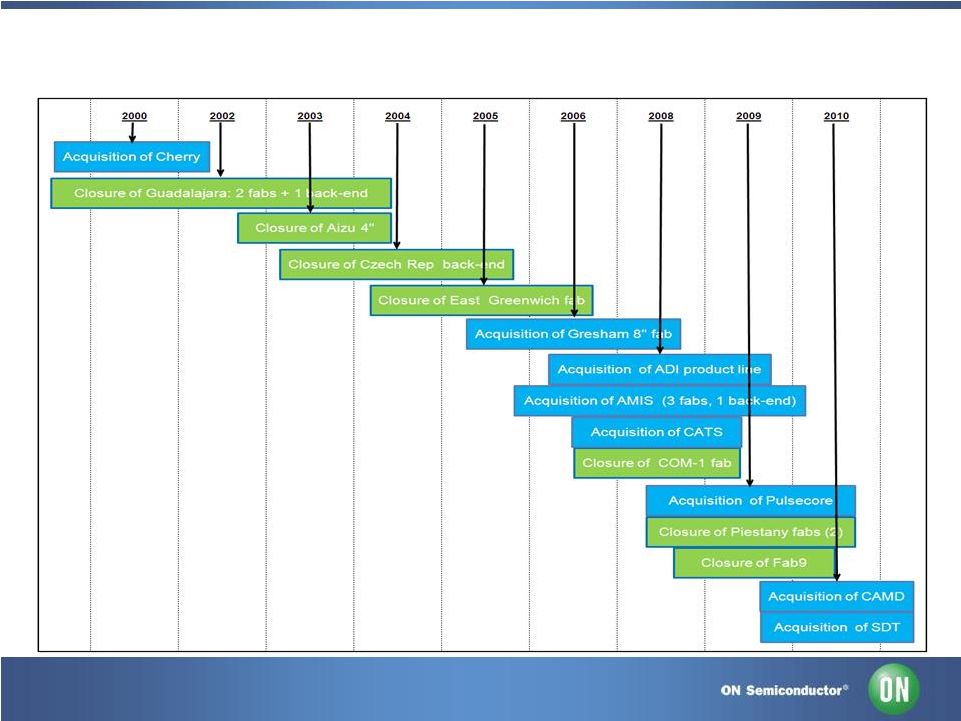

10-Year History of Manufacturing Consolidation

19 |

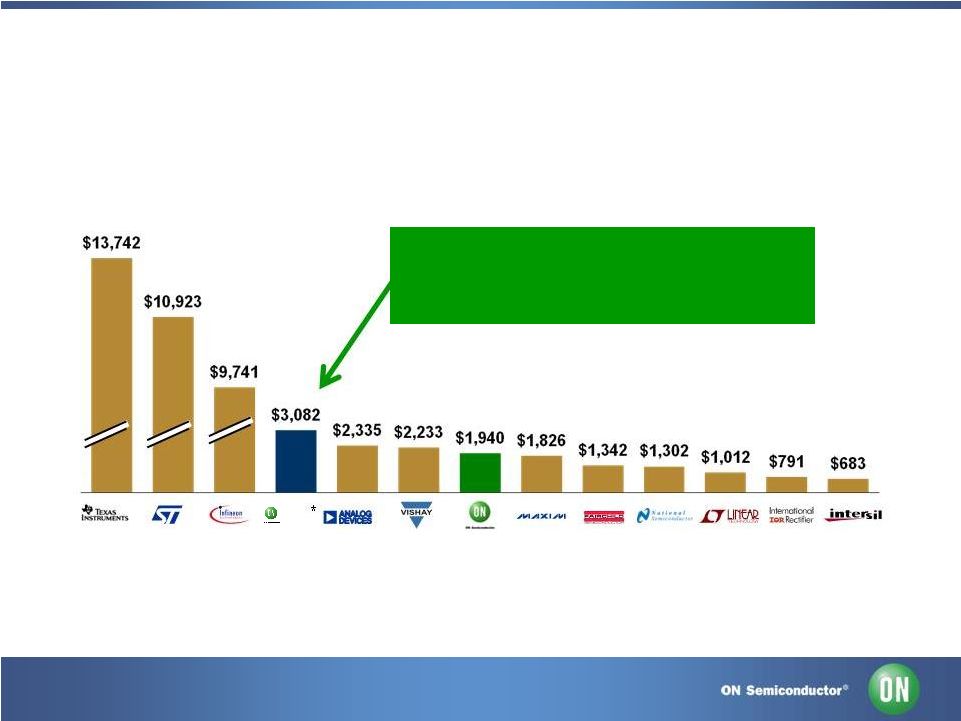

Significant Revenue Scale

Note:

*

Represents

combined

financials

as

reported

for

the

last

twelve

months

ending

March

2010

for

ON

Semiconductor

and

SANYO

Semiconductor.

($ in millions)

Combined Company Generates

Economies of Scale and

Improved Financial Performance

20

SANYO

/ |

21

Creating Shareholder Value

•

SANYO

Semiconductor

business

acquired

for

0.5x

AV

/

LTM

Revenue;

a

reasonable

price

relative

to

other

similar

businesses

–

Weighted Average Aggregate Value / LTM Revenue multiple paid in three recent

relevant semiconductor

acquisitions

was

5.0x

(1)

•

ON Semiconductor uniquely positioned to drive

manufacturing integration and

improved

financial

performance

at SANYO Semiconductor

–

Similar process technology roadmaps and assembly and test requirements

–

Extensive experience rationalizing manufacturing facilities

–

Experience operating manufacturing infrastructure worldwide, including in

Japan –

Gives SANYO Semiconductor access to ON Semiconductor’s leading edge Gresham

facility •

Post-restructuring, combined business to achieve similar financial profile to

ON Semiconductor

today

with

significantly

greater

scale,

diversity

and

growth

opportunities

–

$3.5Bn annualized revenues; significant manufacturing and operating expense saving

opportunity –

Enhanced position in Asia-Pacific; region experiencing above-average

economic growth Significant Long Term Stock Price Appreciation Potential

Note:

(1) Based on weighted average AV / LTM revenue multiple paid in Maxim/Teridian, Intersil/Techwell, and

Semtech/Sierra Monolithics transactions. |

22

A Winning Combination

SANYO

Semiconductor

Co., Ltd.

Complementary Products, Customers and End-markets

Strengthens Market Position in Japan and Asia

Leverages Operational Excellence to Drive Cost Savings

Increased Scale and Cash Flow Generation Potential

Significant Shareholder Value Creation Opportunity |

23

Forward Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements include, but are not

limited to, statements related to the proposed transaction between ON Semiconductor and SANYO

Electric, including the actual amount of consideration to be received by SANYO Electric in the

transaction; the closing and the anticipated timing of the closing and the effects of the proposed

transaction on ON Semiconductor. Forward-looking statements also include statements

regarding the potential benefits of the transaction, including the combined businesses’

projected and pro forma revenue, gross margin, cash flow and other financial results; expected cost savings, economies

of scale, cross selling opportunities and expansion of addressable market; the goal to deliver in

excess of $30 million in pre-tax income on a quarterly basis approximately six quarters

after closing; expected rates of post-manufacturing integration; the expectation that the

transaction will be accretive to ON Semiconductor approximately twelve months after the closing; the expected

recovery of the Japan semiconductor market and increases to the region’s capital spending; the

combined businesses’ integration plans and ON Semiconductor’s positioning to realize

greater scale, diversity and growth opportunities and significant long term stock price

appreciation potential. These forward-looking statements are based on information available to ON Semiconductor as of the

date of this presentation. Forward-looking statements involve a number of risks and

uncertainties that could cause actual results to differ materially from those anticipated by

these forward-looking statements. Such risks and uncertainties include a variety of factors,

some of which are beyond ON Semiconductor’s control. In particular, such risks and uncertainties

include difficulties encountered in integrating acquired businesses; the risk that the

transaction does not close when anticipated, or at all; pricing and demand for semiconductor

products; dependence on each company’s ability to successfully manufacture in increasing volumes on a cost-

effective basis and with acceptable quality for its current products; the adverse impact of increased

competition; changes in overall economic conditions and markets, including the current credit

markets; changes in demand for ON Semiconductor 's or SANYO Semiconductor's products; changes

in customers’ purchasing habits or procedures; technological and product development risks;

availability of raw materials; changes in manufacturing yields; control of costs and expenses;

significant litigation; risks associated with acquisitions and dispositions; risks associated

with leverage and restrictive covenants in debt agreements; risks associated with international

operations including foreign employment and labor matters associated with unions and collective bargaining

agreements; the threat or occurrence of international armed conflict and terrorist activities both in

the United States and internationally; and risks involving environmental or other governmental

regulation. Information concerning additional factors that could cause results to differ

materially from those projected in the forward-looking statements is contained in ON Semiconductor’s

Annual Report on Form 10-K as filed with the Securities and Exchange Commission (the

“SEC”) on February 25, 2010, Quarterly Reports on Form 10-Q, Current Reports on

Form 8-K and other of ON Semiconductor’s SEC filings. These forward-looking

statements should not be relied upon as representing ON Semiconductor’s views as of any

subsequent date and neither undertake any obligation to update forward-looking statements

to reflect events or circumstances after the date they were made.

|