Attached files

Exhibit 10.52

AMENDED AND RESTATED

MASTER AGREEMENT FOR DEBT AND EQUITY

RESTRUCTURE OF CITY NATIONAL PLAZA

THIS MASTER AGREEMENT FOR DEBT AND EQUITY RESTRUCTURE OF CITY NATIONAL PLAZA (this “Agreement”) is made effective as of February 19, 2010 (the “Effective Date”), by and among the CALIFORNIA STATE TEACHERS’ RETIREMENT SYSTEM, a public entity (“CalSTRS”), CNP INVESTOR, LLC, a Delaware limited liability company (“CNP Investor”), THOMAS PROPERTIES GROUP, L.P., a Maryland limited partnership (“TPG”), TPG/CalSTRS, LLC, a Delaware limited liability company (“TPG/CalSTRS”), TPGA, LLC, a Delaware limited liability company (“TPGA”), TPG PLAZA INVESTMENTS, LLC, a Delaware limited liability company (“TPG Plaza Investments”), 505 FLOWER ASSOCIATES, LLC, a Delaware limited liability company (“Guarantor”), 515/555 FLOWER JUNIOR MEZZANINE ASSOCIATES, LLC, a Delaware limited liability company (“Junior Mezzanine Borrower”), 515/555 FLOWER MEZZANINE ASSOCIATES, LLC, a Delaware limited liability company (“Senior Mezzanine Borrower”), and 515/555 FLOWER ASSOCIATES, LLC, a Delaware limited liability company (“Mortgage Borrower”). The capitalized terms used in this Agreement, including without limitation any schedules, appendices and exhibits to this Agreement, and not otherwise defined shall have the meanings given to such terms in Exhibit “A”.

The Parties entered into that certain Master Agreement for Debt and Equity Restructure of City National Plaza on February 19, 2010 (the “Original Master Agreement”). The Parties now desire to change certain of the terms and conditions thereof and hereby amend and restate and supersede the Original Master Agreement in its entirety as set forth below. Effective as of the Effective Date, the Original Master Agreement shall be null and void and of no force and effect.

RECITALS

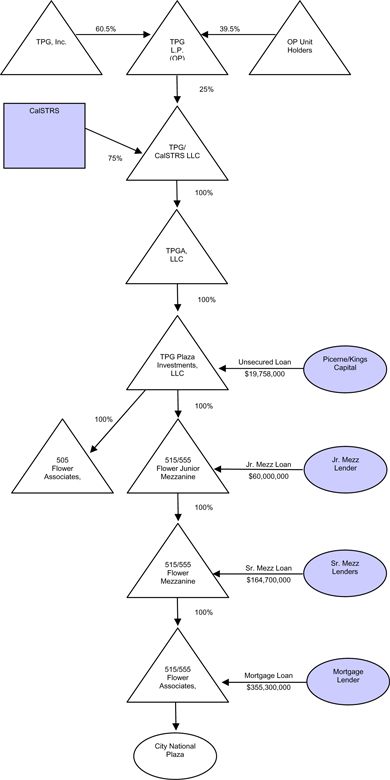

A. TPG/CalSTRS owns indirectly through a series of wholly owned subsidiaries (the “Title Holding Subsidiaries”) that certain office complex commonly known as City National Plaza, located at 505 – 555 South Flower Street, Los Angeles, California (the “Project”). TPG and CalSTRS are the sole members of TPG/CalSTRS. The current ownership structure for the Project is shown on Exhibit “B” attached hereto.

B. TPGA is a Title Holding Subsidiary directly and wholly owned by TPG/CalSTRS.

C. TPG Plaza Investments is a Title Holding Subsidiary directly and wholly owned by TPGA.

D. In connection with a prior restructure of the ownership of TPG Plaza Investments, TPG Plaza Investments entered into a financing arrangement with certain of its prior members referred to herein as the Picerne/Kings Capital Loan.

E. For purposes of financing the Project, additional Title Holding Subsidiaries directly and indirectly wholly owned by TPG Plaza Investments obtained the loans identified on Exhibit “C” attached hereto (the “Mezzanine Loans”), which are currently held by the various holders of the Mezzanine Loans (the “Mezzanine Lenders”). Guarantor guaranteed certain obligations of the borrowers under the Mezzanine Loans pursuant to various guarantees (the “Loan Guaranties”).

F. Also for purposes of financing the Project, another Title Holding Subsidiary obtained that certain mortgage loan in the principal amount of Three Hundred Fifty Five Million Three Hundred Thousand Dollars ($355,300,000) (the “Mortgage Loan”).

G. TPG, for itself and on behalf of TPG/CalSTRS and the Title Holding Subsidiaries, after considering the financial status of the Project and the Mezzanine Loans as well as alternative sources of financing, has specifically requested that CalSTRS acquire the Mezzanine Loans and thereafter retire the Mezzanine Loans in

exchange for an increased equity interest in TPG/CalSTRS relating solely to the Project (the “CNP Additional Interest”).

H. In connection with the request to acquire the Mezzanine Loans, CalSTRS has formed CNP Investor for the purposes of holding the Mezzanine Loans while they remain outstanding. Pursuant to the CNP Investor LLC Agreement, CalSTRS is the sole member of CNP Investor, and TPG is the non-member manager thereof with such authority and responsibility as set forth therein.

I. Upon the Effective Date, CNP Investor entered into a loan purchase agreement with each of the Mezzanine Lenders (the “Loan Purchase Agreements”), pursuant to which CNP Investor agreed to purchase each Mezzanine Loan from the applicable Mezzanine Lender. Following the acquisition of the Mezzanine Loans, in anticipation of and immediately prior to the “Conversion” (as defined below), CNP Investor will distribute the Mezzanine Loans to its sole member, CalSTRS, which will retire the Mezzanine Loans and convert the Mezzanine Loans into the CNP Additional Interest, all subject to and in accordance with the terms hereof.

J. Upon the Effective Date, TPG and CalSTRS entered into that certain Sixth Amendment to Second Amended and Restated Operating Agreement of TPG/CalSTRS, LLC, which is being amended and restated concurrently herewith, in connection with the matters described in this Agreement (the “Sixth Amendment”). TPG and CalSTRS have also entered into that certain Seventh Amendment to Second Amended and Restated Operating Agreement of TPG/CalSTRS, LLC dated as of May 6, 2010.

K. To effectuate the Conversion, TPG and CalSTRS intend to enter into that certain Eighth Amendment to Second Amended and Restated Operating Agreement of TPG/CalSTRS, LLC, in the form attached hereto as Exhibit “D” (the “Eighth Amendment”).

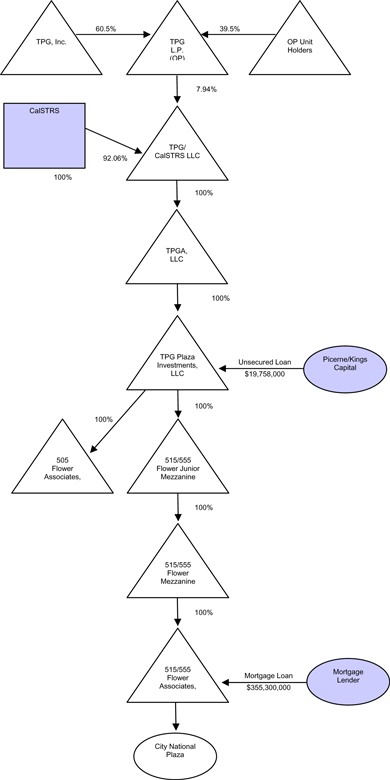

L. If the acquisition of the Mezzanine Loans and the Conversion were to be consummated as described above, then the ownership structure for the Project would be as set forth on Exhibit “E” attached hereto.

M. The Parties now desire to set forth herein the terms and conditions pursuant to which CNP Investor will acquire the Mezzanine Loans, following which CalSTRS, as the assignee of the Mezzanine Loans, will convert the Mezzanine Loans into the CNP Additional Interest.

AGREEMENT

NOW THEREFORE, in consideration of the mutual promises, covenants and representations hereinafter contained, and subject to the conditions hereinafter set forth, the parties hereto fully incorporate the Recitals above herein and hereby agree as follows:

ARTICLE I.

PURCHASE OF MEZZANINE LOANS

1.1 Loan Purchase Agreements. CNP Investor, as described above, has entered into the Loan Purchase Agreements with respect to the Mezzanine Loans. TPG shall use commercially reasonable efforts to facilitate the consummation of the Loan Purchase Agreements, including without limitation, by consulting and coordinating with the Mezzanine Lenders and assisting with the satisfaction of conditions to closing thereunder. Notwithstanding the foregoing, CNP shall have the right and authority to make all decisions and take all actions under the Loan Purchase Agreements in its sole and absolute discretion.

1.2 Rights of CNP Investor as Lender. Anything herein to the contrary notwithstanding, during the period prior to the Conversion, while CNP Investor is the holder of the Mezzanine Loans, Article VII shall apply, and CNP Investor (and CalSTRS as the owner of CNP Investor) shall have all rights and remedies available under the Mezzanine Loan Documents or otherwise, as more specifically set forth in Article VII.

1.3 Mortgage Lender Notification and Consent. Following the acquisition of all of the Mezzanine Loans in accordance with the Loan Purchase Agreements, CalSTRS, CNP Investor and TPG shall cooperate in

notifying Mortgage Lender that (i) CNP Investor has acquired the Mezzanine Loans using purchase funds consisting of new cash equity funds of CalSTRS which were not derived directly or indirectly from the Project, and (ii) CNP Investor has waived and relinquished, for the benefit of Mortgage Lender, certain rights of the Mezzanine Lenders under the Intercreditor Agreement. Further, each of CalSTRS, CNP Investor and TPG shall use commercially reasonable efforts to obtain from Mortgage Lender its written (A) acknowledgment of the foregoing, (B) consent to the retirement of the Mezzanine Loans, without any prepayment of the Mortgage Loan or other material condition to such consent, and (C) acknowledgment that upon the retirement of the Mezzanine Loans, the Intercreditor Agreement will be terminated as provided therein (collectively, the “Mortgage Lender Consent”).

1.4 Effect of Closing under Loan Purchase Agreements. The Parties intend that all closings under the Loan Purchase Agreements shall occur concurrently. Notwithstanding the execution and entry into this Agreement by all Parties on the date hereof, the performance by the Parties of their respective obligations set forth in Articles II, III and V of this Agreement shall commence to apply only upon the acquisition of the Mezzanine Loans by CNP Investor, if and when such acquisition occurs. Unless and until CNP Investor acquires the Mezzanine Loans, no Party shall have any obligations to any other Party arising under Articles II, III and V of this Agreement.

1.5 No Distributions. Unless agreed by all the members of TPG/CalSTRS in writing, no distributions shall be made by TPG Plaza Investments from the date hereof until the Mezzanine Loan Acquisition Date.

ARTICLE II.

CONVERSION OF LOANS TO EQUITY

2.1 Agreement to Convert. Following the acquisition of the Mezzanine Loans by CNP Investor, once all of the conditions to the Conversion provided for herein have been satisfied or waived and as further provided in Section 2.2, CNP Investor shall distribute the Mezzanine Loans to its sole member, CalSTRS, which shall thereafter immediately acquire the CNP Additional Interest in exchange for CalSTRS entering into the Loan Termination Agreements with each of the Mezzanine Borrowers to terminate all outstanding obligations under the Mezzanine Loans, all in accordance with the terms and conditions set forth below, thereby converting the Mezzanine Loans into the CNP Additional Interest (the “Conversion”). CalSTRS shall convert all, and not less than all, of the Mezzanine Loans acquired from the Mezzanine Lenders.

2.2 Timing of Closing of the Conversion. The Conversion shall be scheduled to occur on the date (the “Scheduled Conversion Date”) that is the earlier of (i) five (5) days following receipt by CalSTRS, CNP Investor and TPG of the Mortgage Lender Consent, (ii) the maturity date of the Mezzanine Loans, or (iii) the date that the Mortgage Loan has been fully repaid.

ARTICLE III.

CLOSING OF CONVERSION

3.1 Conversion Closing. Provided that upon the Scheduled Conversion Date (a) all of the conditions to Conversion Closing set forth in this Agreement have been satisfied or waived by the Party in whose favor the condition runs and (b) this Agreement has not been terminated by any Party in accordance with the provisions set forth herein, the transactions contemplated hereby shall be consummated (the “Conversion Closing”), with the date that Conversion Closing actually occurs being the “Conversion Date”.

3.2 CalSTRS’ Closing Deliveries. Upon the Conversion Closing, CalSTRS shall deliver, or cause to be delivered, to TPG:

3.2.1 Two originals of the Omnibus Assignment (Senior Mezzanine) and the Omnibus Assignment (Junior Mezzanine) in the forms attached hereto as Exhibit “F”, (collectively, the “Loan Assignments”), duly executed by CNP Investor, as assignor, and CalSTRS, as assignee;

3.2.2 The original of the note for each Mezzanine Loan marked cancelled by CalSTRS and two originals of the Loan Termination Agreement (Senior Mezzanine) in the form attached hereto as Exhibit “G”, and

two originals of the Loan Termination Agreement (Junior Mezzanine) in the form attached hereto as Exhibit “H” (collectively, the “Loan Termination Agreements”), duly executed by CalSTRS;

3.2.3 Two originals of the Eighth Amendment, duly executed by CalSTRS; and

3.2.4 Such other documents and certificates as may be reasonably required by TPG to consummate the Conversion.

3.3 TPG’s Closing Deliveries. Upon the Conversion Closing, TPG shall deliver, or cause to be delivered, to CalSTRS:

3.3.1 Two originals of each of the Loan Termination Agreements, duly executed by Junior Mezzanine Borrower and Senior Mezzanine Borrower, as applicable;

3.3.2 Two originals of the Eighth Amendment, duly executed by TPG; and

3.3.3 Such other documents and certificates as may be reasonably required by CalSTRS to consummate the Conversion.

3.4 Cash Reconciliation. It had been the intention of the Parties to implement the Conversion concurrently with the Mezzanine Loan Acquisition Date. However, the Parties recognize that the conditions set forth in Sections 5.1.1 and 5.2.1 will necessitate a delay in the Conversion beyond the Mezzanine Loan Acquisition Date. The Parties desire that, to the maximum extent possible, the economic effect of a Conversion concurrent with the acquisition of the Mezzanine Loans be replicated notwithstanding such delay. Therefore, upon the Conversion Closing, TPG shall certify in writing as to the financial information necessary to perform the reconciliation, and the Parties shall in good faith reconcile the differences between the economic results of the Conversion occurring on the Conversion Date as compared to a hypothetical closing on the Mezzanine Loan Acquisition Date. The Parties shall then calculate an amount of cash that shall be paid by CalSTRS to the Original Interest Holders with respect to the Original Interests, or by the Original Interest Holders to CalSTRS with respect to the CNP Additional Interest, as applicable based on the net debits and credits for the reconciliation, such that the Conversion on the Conversion Date will result in the same economic effect as if the Conversion had occurred on the Mezzanine Loan Acquisition Date. This reconciliation shall include, without limitation, the following adjustments:

3.4.1 The Original Interest Holders shall be credited, and CalSTRS shall be debited, with an amount equal to the Original Interest Percentage multiplied by the total debt service payments received by CNP Investor during the Reconciliation Period.

3.4.2 CalSTRS shall be credited, and the Original Interest Holders shall be debited, with an amount equal to the CNP Additional Interest Percentage multiplied by the total distributions relating to the City National Plaza Project, if any, by TPG/CalSTRS to the Original Interest Holders during the Reconciliation Period.

3.4.3 The Original Interest Holders shall be credited, and CalSTRS shall be debited, with an amount equal to the CNP Additional Interest Percentage multiplied by the total capital contributions relating to the City National Plaza Project, if any, made by the Original Interest Holders to TPG/CalSTRS during the Reconciliation Period.

Each individual credit to the Original Interest Holders shall be allocated between TPG and CalSTRS as if it were a distribution pursuant to Section 6.02, as amended from time to time, of the TPG/CalSTRS LLC Agreement.

ARTICLE IV.

REPRESENTATIONS AND WARRANTIES

4.1 Representations and Warranties of TPG. TPG hereby makes the following representations and warranties to CalSTRS and CNP Investor as of the date hereof, the Mezzanine Loan Acquisition Date and the Conversion Date as if such representations and warranties were made on and as of that date:

4.1.1 Each of the TPG Parties has the power and authority to enter into and to carry out the terms and provisions of this Agreement and the Conversion Documents, as applicable to each of them.

4.1.2 This Agreement constitutes, and the Conversion Documents when executed will constitute, the legal, valid and binding agreement of each of the TPG Parties, as applicable to each of them, enforceable in accordance with their respective terms, except to the extent that enforcement may be affected by laws relating to bankruptcy, reorganization, insolvency and creditors’ rights and by the availability of injunctive relief, specific performance and other equitable remedies.

4.1.3 The execution and delivery of this Agreement and all of the Conversion Documents, the consummation of the transactions and the performance of the obligations contemplated hereby and thereby by each of the TPG Parties, as applicable, will not conflict with, or result in a violation of or default under, any provision of any governing instrument applicable to any of the TPG Parties, or any agreement or instrument to which any of the TPG Parties is a party or by which it or any of its properties is bound, assuming that any required consents of the lenders are obtained in connection with the acquisition and Conversion of the Mezzanine Loans, or any permit, franchise, judgment, decree, statute, law, rule or regulation applicable to any of the TPG Parties or any of the properties of the TPG Parties.

4.1.4 To TPG’s actual current knowledge, the outstanding principal balance of each of the Mezzanine Loans, the Mortgage Loan and the Picerne/Kings Capital Loan as of February 14, 2010 is as set forth on Exhibit “I” hereto.

4.1.5 To TPG’s actual current knowledge, the balance of the Mortgage Lender Reserve Accounts as of February 14, 2010 is as set forth in Exhibit “I” hereto.

4.1.6 To TPG’s actual current knowledge, the Net Operating Cash as of February 14, 2010 is as set forth in Exhibit “I” hereto.

4.1.7 To TPG’s actual current knowledge, the aggregate accrued and unpaid interest with respect to each of the Mezzanine Loans, the Mortgage Loan and the Picerne/Kings Capital Loan as of February 14, 2010 is set forth on Exhibit “I” attached hereto.

4.1.8 To TPG’s actual current knowledge, there are no material liabilities of TPG Plaza Investments or its subsidiaries other than as shown on Exhibit “I” attached hereto and other than any liabilities accounted for in the Net Operating Cash.

4.1.9 To TPG’s actual current knowledge, there exists no Event of Default nor any event or default which, but for the passage of time and/or the giving of notice, would constitute an Event of Default with respect to any of the Mezzanine Loans, the Mortgage Loan or the Picerne/Kings Capital Loan, excluding any default that may be alleged arising from the proposed acquisition or Conversion of the Mezzanine Loans.

4.1.10 TPG, for itself and on behalf of the other TPG Parties acknowledges that CalSTRS is a unit of the California State and Consumer Services Agency established pursuant to Title I, Division 1, Parts 13 and 14 of the California Education Code, Sections 22000, et seq., as amended (the “Education Code”). As a result, TPG, for itself and on behalf of the TPG Parties, acknowledges that CalSTRS is prohibited from engaging in certain transactions with or for the benefit of an “employer”, “employing agency”, “member”, “beneficiary” or “participant” (as those terms are defined or used in the Education Code). In addition, TPG, for itself and on behalf of the TPG Parties, acknowledges that CalSTRS may be subject to certain restrictions and requirements under the Internal Revenue Code, 26 U.S.C. Section 1 et seq. (the “Code”). Accordingly, TPG represents and warrants to CalSTRS that (1) none of the TPG Parties is an employer, employing agency, member, beneficiary or participant; (2) none of the TPG Parties has made any contribution or contributions to CalSTRS; (3) neither an employer, employing agency, member, beneficiary nor participant, nor any person who has made any contribution to CalSTRS, nor any combination thereof, is related to any of the TPG Parties by any relationship described in Section 267(b) of the Code; (4) neither CalSTRS, David L Bonuccelli & Associates, their affiliates, related entities, agents, officers, directors or employees, nor any CalSTRS board member, employee or internal investment contractor (collectively,

“CalSTRS Affiliates”) has received or will receive, directly or indirectly, any payment, consideration or other benefit from, nor does any CalSTRS Affiliate have any agreement or arrangement with, any of the TPG Parties or any person or entity affiliated with any of them, relating to the transactions contemplated by this Agreement except as expressly set forth in this Agreement; and (5) except for publicly traded shares of stock or other publicly traded ownership interests, no CalSTRS Affiliate has any direct or indirect ownership interest in TPG or any person or entity affiliated with TPG.

4.1.11 To TPG’s actual current knowledge, (1) none of the Mezzanine Lenders is an employer, employing agency, member, beneficiary or participant; (2) none of the Mezzanine Lenders has made any contribution or contributions to CNP Investor or CalSTRS; (3) neither an employer, employing agency, member, beneficiary nor participant, nor any person who has made any contribution to CalSTRS or CNP Investor, nor any combination thereof, is related to any Mezzanine Lender by any relationship described in Section 267(b) of the Code; (4) neither CalSTRS, Thomas Properties Group, Inc., TPG/CalSTRS, Guarantor, the Title Holding Subsidiaries, CNP Investor, their affiliates, related entities, agents, officers, directors or employees, nor any CalSTRS board member, employee or internal investment contractor (collectively “CalSTRS Loan Purchase Related Parties”) has received or will receive, directly or indirectly, any payment, consideration or other benefit from, nor does any CalSTRS Loan Purchase Related Party have any agreement or arrangement with, any Mezzanine Lender or any person or entity affiliated with a Mezzanine Lender, relating to the Mezzanine Loan purchase transactions except as expressly set forth in this Agreement; and (5) except for publicly traded shares of stock or other publicly traded ownership interests, no CalSTRS Loan Purchase Related Party has any direct or indirect ownership interest in any Mezzanine Lender or any person or entity affiliated with any Mezzanine Lender.

With respect to the representations and warranties set forth in Sections 4.1.5 through 4.1.8, TPG shall execute and deliver to CalSTRS a separate certificate setting forth the amounts applicable as of the date when such representations and warranties are remade as of the Mezzanine Loan Acquisition Date and the Conversion Date.

4.2 Representations and Warranties of CalSTRS. CalSTRS hereby makes the following representations and warranties to TPG as of the date hereof, the Mezzanine Loan Acquisition Date and the Conversion Date as if such representations and warranties were made on and as of that date:

4.2.1 Each of CalSTRS and CNP Investor has the power and authority to enter into and to carry out the terms and provisions of this Agreement and the Conversion Documents, as applicable to each of them.

4.2.2 This Agreement constitutes, and the Conversion Documents when executed will constitute, the legal, valid and binding agreement of CalSTRS and CNP Investor, as applicable to each of them, enforceable in accordance with its terms, except to the extent that enforcement may be affected by laws relating to bankruptcy, reorganization, insolvency and creditors’ rights and by the availability of injunctive relief, specific performance and other equitable remedies.

4.2.3 The execution and delivery of this Agreement and all of the Conversion Documents, the consummation of the transactions and performance of the obligations contemplated hereby and thereby by CalSTRS and CNP Investor, as applicable, will not conflict with, or result in a violation of or default under, any provision of any governing instrument applicable to CalSTRS or CNP Investor, or any agreement or instrument to which CalSTRS or CNP Investor is a party or by which it or any of its properties is bound, or any permit, franchise, judgment, decree, statute, law, rule or regulation applicable to CalSTRS or CNP Investor or any of the properties of CalSTRS or CNP Investor.

4.3 Survival of Representations and Warranties. This Article IV shall survive the consummation of any of the transactions contemplated hereby and the termination hereof, whether or not the transactions contemplated hereby are consummated.

ARTICLE V.

CONDITIONS PRECEDENT.

5.1 Conditions Precedent to Conversion Obligations of CNP Investor and CalSTRS. In addition to the other terms and conditions set forth in this Agreement, the obligation of CNP Investor and CalSTRS to consummate the Conversion is subject to, and is expressly conditioned on the satisfaction of, each of the following conditions, which are for the sole and exclusive benefit of CalSTRS and CNP Investor; provided, however, in the event any such condition has not been satisfied, CNP Investor or CalSTRS may either waive the same and proceed to the Conversion Closing, terminate this Agreement in which case no Party shall have any ongoing obligations to any other Party arising under this Agreement except as otherwise provided herein, or exercise its rights under Article VI:

5.1.1 The Mortgage Lender Consent shall have been obtained, the maturity date of the Mezzanine Loans shall have passed, the Mortgage Loan shall have been fully repaid or the Mortgage Borrower shall have arranged for the Mortgage Loan to be repaid immediately following the Conversion.

5.1.2 TPG and the other TPG Parties shall have performed and complied with all agreements, covenants and obligations required by this Agreement to be so performed or complied with by TPG and the other TPG Parties.

5.1.3 All representations and warranties made by TPG in this Agreement shall be accurate in all material respects.

5.1.4 The Conversion shall not be prohibited by or conflict with any applicable law, rule, regulation, stay, order or judgment binding on CNP Investor or CalSTRS and issued by any court of competent jurisdiction in the United States or by any regulatory authority (“Applicable Laws”).

5.1.5 No action, suit, or other proceeding relating to the transactions contemplated hereby (collectively, “Proceedings”) shall have been instituted or threatened by a third party before or by any court or regulatory authority.

5.2 Conditions Precedent to Conversion Obligations of TPG. In addition to the other terms and conditions set forth in this Agreement, the obligation of TPG and the other TPG Parties to consummate the Conversion is subject to, and is expressly conditioned on the satisfaction of, each of the following conditions; provided, however, in the event any such condition has not been satisfied, TPG may either waive the same and proceed to the Conversion Closing, terminate this Agreement, in which case no Party shall have any ongoing obligations to any other Party arising under this Agreement except as otherwise provided herein, or exercise its rights under Article VI:

5.2.1 The Mortgage Lender Consent shall have been obtained, the maturity date of the Mezzanine Loans shall have passed, the Mortgage Loan shall have been fully repaid, or the Mortgage Borrower shall have arranged for the Mortgage Loan to be repaid immediately following the Conversion.

5.2.2 CalSTRS and CNP Investor shall have performed and complied with all agreements, covenants and obligations required by this Agreement to be so performed or complied with by CalSTRS and CNP Investor.

5.2.3 All representations and warranties made by CalSTRS in this Agreement shall be accurate in all material respects.

5.2.4 The Conversion shall not be prohibited by or conflict with any Applicable Laws binding on the TPG Parties.

5.2.5 No Proceedings shall have been instituted or threatened by a third party before or by any court or Regulatory Authority.

ARTICLE VI.

TERMINATION/

EVENTS OF DEFAULT.

6.1 Termination. Each Party shall use its commercially reasonable efforts to cause the satisfaction of all conditions to the consummation of this Agreement that are in the control of such Party and to cooperate as reasonably necessary in the satisfaction of all other conditions to the consummation of this Agreement. This Agreement may be terminated on or before the Conversion Closing as follows:

6.1.1 Upon the mutual written agreement of the Parties;

6.1.2 In accordance with Section 1.4 above;

6.1.3 By the Party benefited by a closing condition if that closing condition fails to occur within the time period provided therefor, or if no specified time period, by the Scheduled Conversion Date;

6.1.4 By CalSTRS or CNP Investor, upon an Event of Default by any of the TPG Parties as the Defaulting Party; or

6.1.5 By TPG, upon an Event of Default by either CalSTRS or CNP Investor as the Defaulting Party.

6.2 Event of Default. Each of the following shall constitute an “Event of Default” by the “Defaulting Party” (as defined below):

6.2.1 A breach by any of the parties of a material representation, warranty or obligation contained in this Agreement, if such breach is not cured within ten (10) calendar days after the date the other Party has provided written notice of such breach to the Defaulting Party;

6.2.2 The rendering, by a court with appropriate jurisdiction, of a decree or order (1) adjudging such Party or any of its Primary Affiliates bankrupt or insolvent; or (2) approving as properly filed a petition seeking reorganization, readjustment, arrangement, composition, or similar relief for such Party or any of its Primary Affiliates under the federal bankruptcy Laws or any other similar applicable Law or practice, and if such decree or order shall have continued undischarged and unstayed for a period of sixty (60) days.

6.2.3 The rendering, by a court with appropriate jurisdiction, of a decree or order (1) for the appointment of a receiver, a liquidator, or a trustee or assignee in bankruptcy or insolvency of such Party or any of its Primary Affiliates, or for the winding up and liquidation of such Party’s or any of its Primary Affiliate’s affairs, provided that such decree or order shall have remained in force undischarged and unstayed for a period of sixty (60) days; or (2) for the sequestration or attachment of any property of such Party or any of its Primary Affiliates without its return to the possession of such Party or its release from such sequestration or attachment within sixty (60) days thereafter.

6.2.4 Such Party or any of its Primary Affiliates (1) institutes proceedings to be adjudicated a voluntary bankrupt or an insolvent; (2) consents to the filing of a bankruptcy proceeding against such Party or Primary Affiliate; (3) files a petition or answer or consent seeking reorganization, readjustment, arrangement, composition, or similar relief for such Party or Affiliate under the federal bankruptcy Laws or any other similar applicable Law or practice; (4) consents to the filing of any such petition, or to the appointment of a receiver, a liquidator, or a trustee or assignee in bankruptcy or insolvency for such Party or Primary Affiliate or a substantial part of such Party’s or Primary Affiliate’s property; (5) makes an assignment for the benefit of such Party’s or Primary Affiliate’s creditors; (6) is unable to or admits in writing such Party’s or Primary Affiliate’s inability to pay such Party’s or Primary Affiliate’s debts generally as they become due; or (7) takes any action in furtherance of any of the aforesaid purposes.

6.3 Defaulting Party. For the purposes of implementing the provisions contained in this Agreement, the “Defaulting Party” shall be (i) in the case of an Event of Default referenced in Section 6.2.1 , the Party whose action or inaction, or whose Primary Affiliate’s action or inaction, caused or resulted in the breach; and (ii) in the case of an Event of Default referenced in Section 6.2.2, 6.2.3 or 6.2.4, the Party who, or whose Primary Affiliate, is the subject of such court decree or order, has instituted such proceedings or filed such petitions, or is insolvent, etc. The “Non-Defaulting Party” is the Party that is not the Defaulting Party.

6.4 Remedies. No Party shall be limited to the termination right granted by virtue of Sections 6.1.3, 6.1.4 or 6.1.5, and such Party may elect any remedy existing at law or in equity, including, without limitation, the following:

6.4.1 Proceeding to the Conversion Closing, despite the non-fulfillment of any condition or breach or any representation or warranty hereunder;

6.4.2 With respect to an Event of Default by TPG, termination of this Agreement by CalSTRS and the transactions contemplated hereby prior to the Conversion Closing and proceeding to exercise any or all remedies available to such Party under this Agreement at law or in equity;

6.4.3 With respect to an Event of Default by TPG that would prevent the Conversion from occurring, including, without limitation, failure of TPG to deliver the Conversion Documents described in Section 3.3 above, at any time following the Mezzanine Loan Acquisition Date, at the election of CNP Investor in its sole and absolute discretion, deem such Event of Default to constitute an “Event of Default” under all of the Mezzanine Loans and CNP Investor may exercise all rights and remedies with respect to such “Event of Default” under the Mezzanine Loans; or

6.4.4 With respect to an Event of Default by CNP Investor or CalSTRS prior to the Conversion Closing, termination of this Agreement by TPG and proceeding to exercise any or all remedies available to TPG Parties under this Agreement at law or in equity.

6.5 Survival of Remedies. Anything to the contrary notwithstanding, remedies against a Defaulting Party shall survive the termination of this Agreement indefinitely.

ARTICLE VII.

INDEPENDENCE OF RIGHTS

AS LENDER AND MEMBER.

7.1 Acknowledgments. TPG for itself and on behalf of the TPG Parties recognizes and acknowledges the following:

7.1.1 CNP Investor has agreed, and CalSTRS, as the sole member of CNP Investor, has agreed to cause CNP Investor, to acquire the Mezzanine Loans if CNP Investor, in its capacity as the holder of the Mezzanine Loans, and CalSTRS as its owner, are treated as, and are entitled to all of the rights and remedies of, a third-party lender not in any way related to the TPG Parties. Were CNP Investor, in its capacity as the Lender, or CalSTRS as the owner of the Lender, to not be treated as, or entitled to all of the rights and remedies of, a third party lender not in any way related to the TPG Parties, CNP Investor would not have agreed to enter, and CalSTRS would not have agreed to cause CNP Investor to enter, into the Loan Purchase Agreements to purchase the Mezzanine Loans.

7.1.2 TPG and the other TPG Parties are agreeing to the provisions of this Article VII to induce CNP Investor to acquire, and CalSTRS to cause CNP Investor to acquire, the Mezzanine Loans. TPG and the other TPG Parties acknowledge that CalSTRS and CNP Investor will be relying upon the provisions of this Article VII in acquiring the Mezzanine Loans and that, but for this Article VII and the other provisions set forth in this Agreement, CNP Investor would not acquire, and CalSTRS would not cause CNP Investor to acquire, the Mezzanine Loans. The TPG Parties will be benefited by CNP Investor acquiring the Mezzanine Loans and by the Conversion and that such benefit constitutes actual and adequate consideration for this Agreement.

7.1.3 Any provision of this Article VII referencing CNP Investor as Lender shall extend, whether or not explicitly set forth, to CalSTRS as the owner of CNP Investor.

7.1.4 The admission of TPG or any of its Affiliates as members of CNP Investor shall in no way affect any of the acknowledgments, agreements or waivers made by any of the TPG Parties pursuant to this Article VII.

7.2 Acquisition of Mortgage Loan. It is the parties’ intention to refinance the Mortgage Loan on or prior to the maturity date of the Mortgage Loan. Notwithstanding the foregoing and without in any way limiting the provisions of Section 7.1, TPG and the other TPG Parties agree that CalSTRS, CNP Investor and their Affiliates shall be free to acquire the Mortgage Loan as if it were a third party not in any way related to the TPG Parties, at par, at a discount or on any terms, upon the maturity of the Mortgage Loan (whether scheduled or accelerated). In the event of any acquisition of the Mortgage Loan by CalSTRS, CNP Investor or any of their Affiliates, the provisions of this Article VII shall apply equally to the Mortgage Loan, with CalSTRS, CNP Investor or such Affiliate as the “CalSTRS Lender” and CalSTRS, CNP Investor or such Affiliate as a “CalSTRS Member” of a TPG Related Party for purposes of this Article VII. Notwithstanding the foregoing, the Parties hereto agree that CalSTRS, CNP Investor or any applicable Affiliate will convert the Mortgage Loan into an equity interest in the Project commensurate on a dollar-for-dollar basis with the then-outstanding principal, interest and other payments due under the Mortgage Loan in a manner similar to, and on substantially the same terms as, the Conversion contemplated herein.

7.3 Exercise of Management Control with Respect to Mezzanine Loans. Anything contained in the TPG/CalSTRS LLC Agreement to the contrary notwithstanding, TPG and CalSTRS agree that the following shall apply with respect to the borrower’s or guarantor’s interest in the Mezzanine Loans, but only during the period that CNP Investor is the holder of the Mezzanine Loans:

7.3.1 TPG shall be designated to act on behalf of TPG/CalSTRS in connection with all matters related to the Mezzanine Loans. Decisions of TPG/CalSTRS relating to the Mezzanine Loans shall not require any approval of CalSTRS or its representatives.

7.3.2 The Representatives of CalSTRS to the Management Committee of TPG/CalSTRS shall not be entitled to take any action or exercise any right or remedy on behalf of TPG/CalSTRS related to the actions of Senior Mezzanine Borrower or Junior Mezzanine Borrower under the Mezzanine Loans, including but not limited to participating in any decisions or actions of TPG/CalSTRS with respect to the Mezzanine Loans or participating in any Management Committee discussions or decisions that relate to the Mezzanine Loans.

7.3.3 TPG acting alone shall have the right and authority, on behalf of the TPG Parties, to (i) negotiate and agree to the terms and provisions of any supplements, modifications or amendments to the Mezzanine Loan Documents; (ii) exercise any rights or remedies, make any elections, give any notices and take any actions authorized or required of any of the TPG Parties under the Mezzanine Loan Documents; (iii) institute and settle legal proceedings and/or take any other action necessary or appropriate to enforce the rights, exercise the remedies and protect the interests of the TPG Parties under the Mezzanine Loan Documents; and (iv) make any and all decisions and take any and all actions on behalf of the TPG/CalSTRS in connection with the Mezzanine Loan.

Nothing in this Section 7.3 shall affect the rights of CNP Investor and CalSTRS as Lender.

7.4 TPG Party Agreements. TPG, for itself and on behalf of the TPG Parties and their Constituents, agrees that:

7.4.1 Any CalSTRS Lender’s relationship to any of the TPG Parties and their Constituents as Lender is and shall be treated as entirely separate and independent from any CalSTRS Member’s relationship to the TPG Parties and their Constituents as a member in a TPG Related Party.

7.4.2 Any permission, approval, consent, authorization or other such communication by a CalSTRS Lender in its capacity as Lender shall not be or be deemed to be a permission, approval, consent,

authorization or other such communication by, or to in any way bind, a CalSTRS Member in its capacity as a member in a TPG Related Party. Any permission, approval, consent, authorization or other such communication by a CalSTRS Member in its capacity as a member in a TPG Related Party, shall not be or be deemed to be a permission, approval, consent, authorization or other such communication by, or to in any way bind, the CalSTRS Lender in its capacity as Lender.

7.4.3 In its capacity as Lender, a CalSTRS Lender (i) shall be entitled to take any action or exercise any right or remedy, or refrain from taking any action or exercising any right or remedy, permitted hereunder or under any of the Mezzanine Loan Documents, other applicable loan documents, or applicable Laws as if the CalSTRS Lender were an independent third party with no relationship to the TPG Parties or their Constituents other than the Mezzanine Loans or such other applicable loans, and (ii) shall not be subject to, and the TPG Parties’ and their Constituents’ obligations to a CalSTRS Lender in its capacity as Lender shall not be limited, excused by or subject to, any defenses, offsets, counterclaims or other remedies of any nature which the TPG Parties or their Constituents might have against a CalSTRS Member in its capacity as a member in a TPG Related Party.

7.4.4 In its capacity as a member in a TPG Related Party, a CalSTRS Member (i) shall be entitled to take any action or exercise any right or remedy, or refrain from taking any action or exercising any right or remedy, permitted hereunder or under the applicable operating agreement of the TPG Related Party, or applicable Laws as if the CalSTRS Lender were not the Lender, and (ii) shall not be subject to, and the TPG Parties’ and their Constituents’ obligations to the CalSTRS Member in its capacity as a member in a TPG Related Party shall not be limited, excused by or subject to, any defenses, offsets, counterclaims or other remedies of any nature which any of the TPG Parties or their Constituents might have against the CalSTRS Lender in its capacity as Lender.

7.4.5 Each of the TPG Parties and each of their respective Constituents unconditionally and irrevocably waives any right or power to withhold, delay or otherwise limit in any way the performance of any of the duties, obligations and liabilities of such TPG Party and its Constituents (i) to any CalSTRS Lender in its capacity as Lender, notwithstanding any defenses, offsets, counterclaims or other remedies of any nature which any of the TPG Parties or their Constituents might have against the CalSTRS Member in its capacity as a member in a TPG Related Party; and (ii) to a CalSTRS Member in its capacity as a member in a TPG Related Party, notwithstanding any defenses, offsets, counterclaims or other remedies of any nature which any TPG Party or its Constituents might have against a CalSTRS Lender in its capacity as the Lender.

7.4.6 None of the rights, remedies, benefits or protections in favor of, and none of the duties, obligations or liabilities of any of the TPG Parties or their Constituents to, (i) a CalSTRS Lender in its capacity as the Lender shall be diminished, impaired or affected in any way by virtue of a CalSTRS Member being a member in a TPG Related Party; or (ii) a CalSTRS Member in its capacity as a member in a TPG Related Party shall be diminished, impaired or affected in any way by virtue of a CalSTRS Lender being the Lender.

7.4.7 Any duties, liabilities or obligations (including without limitation fiduciary duties, liabilities or obligations) owed by a CalSTRS Member, in its capacity as a member in a TPG Related Party, to any TPG Party or its Constituents shall not extend or apply in any way to the separate and independent relationship of any CalSTRS Lender to the TPG Parties and their Constituents in its capacity as the Lender, and any duties, liabilities or obligations (including without limitation fiduciary duties, liabilities or obligations) owed by a CalSTRS Lender in its capacity as Lender, to any of the TPG Parties or their Constituents shall not extend or apply in any way to the separate and independent relationship to any of the TPG Parties and their Constituents of any CalSTRS Member in its capacity as a member in a TPG Related Party. Any such duties, liabilities or obligations (including without limitation fiduciary duties, liabilities or obligations), to the extent they would so extend or apply, are hereby knowingly and intentionally waived and released.

7.4.8 No CalSTRS Member, in its capacity as a member in a TPG Related Party, has, nor shall be deemed to have, any duties, liabilities or obligations (including without limitation fiduciary duties, liabilities or obligations) to any of the TPG Parties or their Constituents to the extent that any such duty, liability or obligation (including without limitation fiduciary duties, liabilities or obligations) shall be based on or derived from a CalSTRS Lender being the Lender. No CalSTRS Lender, in its capacity as Lender, has, nor shall be deemed to have, any duties, liabilities or obligations (including without limitation fiduciary duties, liabilities or obligations) to any of the TPG Parties or their Constituents to the extent that any such duty, liability or obligation (including without

limitation fiduciary duties, liabilities or obligations) shall be based or derives from any CalSTRS Member being a member in a TPG Related Party.

7.4.9 Neither the provisions of this Article VII nor anything contained herein shall create, result in or be an admission or evidence of, or be deemed to create, result in or be an admission or evidence of, any duty, obligation or liability (including without limitation fiduciary duties, obligations or liabilities) on the part of any CalSTRS Member, in its capacity as a member in a TPG Related Party, or any CalSTRS Lender, in its capacity as Lender, that does not or would not exist in the absence of this Article VII.

7.5 Release and Waiver. In connection with this Agreement, each of the TPG Parties acknowledges and agrees on its own behalf, and on behalf of its Constituents, that the TPG Parties and their respective Constituents have waived and released certain rights, defenses and remedies that might otherwise have been available to the TPG Parties or their Constituents. The releases, waivers and other provisions of this Article VII shall be effective with respect to all matters, past and present, known and unknown, suspected and unsuspected, notwithstanding that factual matters now unknown or unknowable may have given or may hereafter give rise to losses, damages, liabilities, costs and expenses which are presently unknown, unanticipated and unsuspected. The waivers, releases and other provisions of this Article VII, including without limitation the following waiver of the provisions of California Civil Code Section 1542, have been expressly bargained for, negotiated and agreed upon in light of the foregoing. In furtherance of this intention, TPG, TPG Plaza Investments, each of the TPG Parties, on behalf of themselves and their Constituents, hereby expressly waive any and all rights and benefits conferred upon it or them by the provisions of California Civil Code Section 1542, which provides as follows:

“A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM MUST HAVE MATERIALLY AFFECTED HIS SETTLEMENT WITH THE DEBTOR.”

7.6 Certain Additional Representations and Warranties of TPG. TPG represents, warrants and acknowledges as follows:

7.6.1 The TPG Parties and their Constituents are sophisticated and knowledgeable business Persons and have read and understand the agreements, releases, waivers and other provisions set forth in this Agreement.

7.6.2 In negotiating this Agreement, the TPG Parties and their Constituents have been represented by and consulted with competent legal counsel, accountants and other consultants of their choosing experienced in the matters addressed in this Agreement.

7.6.3 Such legal counsel, accountants and consultants have explained to the TPG Parties and their Constituents, and the TPG Parties and their Constituents have asked such questions and received such answers as the TPG Parties and their Constituents have deemed necessary concerning, the agreements, releases, waivers and other provisions set forth in this Agreement, and the TPG Parties and their Constituents understand the specific and general rights, defenses and remedies being waived and released.

7.7 Certain Additional Representations and Warranties of CalSTRS. CalSTRS represents, warrants and acknowledges as follows:

7.7.1 CalSTRS, CNP Investor and their Constituents are sophisticated and knowledgeable business Persons and have read and understand the agreements, releases, waivers and other provisions set forth in this Agreement.

7.7.2 In negotiating this Agreement, CalSTRS, CNP Investor and their Constituents have been represented by and consulted with competent legal counsel, accountants and other consultants of their choosing experienced in the matters addressed in this Agreement.

7.7.3 Such legal counsel, accountants and consultants have explained to CalSTRS, CNP Investor and their Constituents, and CalSTRS, CNP Investor and their Constituents have asked such questions and received such answers as CalSTRS, CNP Investor and their Constituents have deemed necessary concerning, the agreements, releases, waivers and other provisions set forth in this Agreement, and CalSTRS, CNP Investor and their Constituents understand the specific and general rights, defenses and remedies being waived and released.

7.8 Survival. This Article VII shall survive the consummation of any of the transactions contemplated hereby and the termination hereof, whether or not the transactions contemplated hereby are consummated.

ARTICLE VIII.

MISCELLANEOUS.

8.1 Notices. Any notice or other communication required or permitted to be given by a Party hereunder shall be in writing, and shall be deemed to have been given by such Party to the other Party or Parties (a) on the date of personal delivery, (b) on the same business day of any facsimile or electronic transmission to a Party, or (c) three (3) business days after being placed in the United States mail, as applicable, registered or certified, postage prepaid, at its mailing or delivery address, facsimile number or e-mail address set forth below, or at such other address as any Party may subsequently advise:

| If to CalSTRS: | California State Teachers’ Retirement System 100 Waterfront Place, 15th Floor West Sacramento, California 95605-2807 | |

| Attention: Lamont King, Esq. Phone: (916) 414-1717 Fax: (916) 414-1723 | ||

| and Attention: Michael J. Thompson Phone: (916) 414-7978 | ||

| Fax: (916) 414-7984 | ||

| With a copy to: | ||

| Cox, Castle & Nicholson LLP 2049 Century Park East, Suite 2800 Los Angeles, California 90067 | ||

| Attention: John H. Kuhl, Esq. Phone: (310) 284-2267 Fax: (310) 277-7889 | ||

| If to TPG: | Thomas Properties Group, Inc. 515 South Flower Street, Sixth Floor Los Angeles, CA 90071 | |

| Attention: John R. Sischo Phone: (213) 830-2265 Fax: (213) 633-4760 | ||

| With a copy to: | ||

| Thomas Properties Group, Inc. 515 South Flower Street, Sixth Floor Los Angeles, CA 90071 | ||

| Attention: Paul S. Rutter Phone: (213) 233-9753 Fax: (213) 633-4760 | ||

8.2 Notification. From the date hereof and until the Conversion Closing, each Party shall promptly notify the other if (a) it receives notice or any Proceeding in connection with the transactions contemplated hereby, (b) any fact or circumstance makes any representation or warranty of such Party set forth herein untrue or inaccurate as of the Conversion Date, the Acquisition Date or the date hereof, or (c) there is a breach of or default under any covenant of such Party set forth in this Agreement or the occurrence of any event that may make the satisfaction of any of the conditions set forth in this Agreement impossible or highly unlikely.

8.3 Entire Agreement. This Agreement, together with the exhibits hereto and the other documents being executed concurrently herewith constitute the entire agreement between the parties hereto pertaining to the subject matter hereof and supersede all prior agreements, understandings, negotiations, and discussions, whether oral or written. Without limiting the foregoing, the parties agree that that certain Agreement Regarding TPG Plaza Investments Percentage Interests and Capital Contributions is hereby rendered null and void in its entirety as of the Effective Date.

8.4 Severability. If any part of this Agreement is determined to be void, invalid or unenforceable, such void, invalid, or unenforceable portion shall be deemed to be separate and severable from the other portions of this Agreement, and the other portions shall be given full force and effect, as though the void, invalid or unenforceable portions or provisions were never a part of this Agreement.

8.5 Amendment and Modification. No supplement, modification, waiver or termination of this Agreement shall be binding unless executed in writing by the Party to be bound.

8.6 Headings. Article, section, subsection, paragraph or clause headings are not to be considered part of this Agreement and are included solely for convenience and reference and shall not be held to define, construe, govern or limit the meaning of any term or provision of this Agreement. References in this Agreement to articles, sections, subsections, paragraphs or clauses, or any similar reference, shall be reference to an article, section, subsection, paragraph or clause of this Agreement unless otherwise stated or the context otherwise requires.

8.7 Assignment; Successors. No Party hereto may assign its rights hereunder without the prior written consent of the Parties. Subject to the foregoing, the terms, provisions and obligations of this Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective heirs, representatives, successors and assigns. Notwithstanding anything that may be construed to the contrary herein, each provision of this Agreement constitutes a binding obligation on the parties from and after the date hereof, notwithstanding that such provision may apply only upon satisfaction of certain conditions or commence at a particular time.

8.8 Governing Law; Jurisdiction; Litigation. This Agreement has been prepared, executed and delivered in, and shall be interpreted under, the internal laws of the State of California, without giving effect to its conflict of law provisions. Each of the parties hereto irrevocably and unconditionally waives any objection to the laying of venue of any action, suit or proceeding arising out of this Agreement or the transactions contemplated hereby in (a) the courts of the State of California, Los Angeles County, or (b) the United States District Court for the Central District of California, and hereby further irrevocably and unconditionally waives and agrees not to plead or claim in any such court that any such action, suit or proceeding brought in any such court has been brought in an inconvenient forum. In the event of litigation arising hereunder, the prevailing party shall be entitled to recover from the non-prevailing party its reasonable attorneys’ fees and expenses incurred in connection with such litigation at all levels, including before the filing of suit.

8.9 Interpretation. This Agreement is to be deemed to have been prepared jointly by the parties hereto, and if any inconsistency or ambiguity exists herein, it shall not be interpreted against any Party but according to the application of rules of the interpretation of contracts, if such an uncertainty or ambiguity exists. Each Party has had the availability of legal counsel during the joint preparation of this Agreement.

8.10 Third Parties. Nothing in this Agreement, expressed or implied, is intended to confer upon any person other than the parties hereto any rights or remedies under or by reason of this Agreement.

8.11 Expenses. Each Party shall bear its own expenses incurred by it in connection with the negotiation, execution and delivery of this Agreement and the agreements contemplated by it, including without limitation, the fees and expenses of each Party’s legal counsel, accountants and other advisors.

8.12 Attorneys’ Fees. In the event any Party incurs legal fees or other costs to enforce any of the terms of this Agreement, to resolve any dispute with respect to its provisions, or to obtain damages for breach thereof, whether by prosecution or defense, the unsuccessful party to such action shall pay the prevailing party’s reasonable expenses, including, without limitation, reasonable attorneys’ fees and costs, incurred in such action. In addition to the foregoing award of costs and fees, the prevailing party shall also be entitled to recover its attorneys’ fees incurred in any post judgment proceedings to collect or enforce any judgment.

8.13 Waiver of Rights. Failure to insist on compliance with any of the terms, covenants, or conditions hereof shall not be deemed a waiver of such terms, covenants, or conditions, nor shall any waiver or relinquishment of any right or power hereunder at any one time or more times be deemed a waiver or relinquishment of such rights or powers at any other time or times.

8.14 Further Assurances. Each Party hereto will, from time to time after the execution of this Agreement, execute and deliver such instruments, documents and assurances and take such further acts as the other Parties may reasonably request to carry out the purpose and intent of this Agreement without undue delay. Any Party who fails to comply with this Section 8.14 shall reimburse the other Parties for any direct expenses, including attorneys’ fees and court costs that, as a result of this failure, become reasonably necessary for carrying out this Agreement.

8.15 Interpretation. In the interpretation of this Agreement, the singular may be read as the plural, and vice versa, the neuter gender as the masculine or feminine, and vice versa, and the future tense as the past or present, and vice versa, all interchangeably as the context may require in order to fully effectuate the intent of the parties and the transactions contemplated herein. Syntax shall yield to the substance of the terms and provisions hereof.

8.16 Counterparts. This Agreement may be executed in counterparts, each one of which so executed shall be deemed an original, and all of which shall together constitute one and the same agreement.

8.17 Execution of Documents and Funding by CalSTRS. TPG understands that for administrative reasons CalSTRS requires (a) up to three (3) business days to sign any document after such document has been submitted to CalSTRS for signature and an additional two (2) business days to deliver such document; and (b) up to five (5) business days after all documents have been signed by all parties and all other conditions to the Conversion Closing have been satisfied to cause funds to be transferred, if applicable. All closing documents to be executed by CalSTRS shall be agreed to and prepared in final execution form and received by CalSTRS to allow for compliance with the foregoing schedule. In the event any of the foregoing conditions are not complied with in accordance with the foregoing schedule, the Scheduled Conversion Date shall be automatically extended by the number of days necessary to allow CalSTRS the time periods set forth above for the execution and delivery of documents and the transfer of funds.

8.18 CalSTRS Counsel.

8.18.1 The parties acknowledge and agree that Cox, Castle & Nicholson LLP (“CalSTRS Counsel”) has represented and will represent only CalSTRS and CNP Investor in connection with this Agreement, the acquisition and ownership of the Mezzanine Loans by CNP Investor, the Conversion and the Conversion

Documents (the “CalSTRS Matters”). As part of the CalSTRS Matters, CalSTRS Counsel will represent CalSTRS in its capacity as the owner of CNP Investor in connection with the acquisition of the Mezzanine Loans and the enforcement of the Lender’s rights and remedies under the Mezzanine Loan Documents, including without limitation, if necessary, the appointment of a receiver and foreclosure. CalSTRS Counsel does not and will not represent any of the TPG Parties or any of their Constituents in connection with the CalSTRS Matters. Further, no attorney/client, trust, confidential or other special relationship exists or will exist between CalSTRS Counsel, on one hand, and the TPG Parties or any of their Constituents, on the other hand, in connection with the CalSTRS Matters, and CalSTRS Counsel shall have no duties to the TPG Parties or any of their Constituents in connection with the CalSTRS Matters.

8.18.2 The parties further acknowledge and agree that one or more of the TPG Parties may have in the past, and may in the future, engage CalSTRS Counsel for advice or representation on matters not related to the CalSTRS Matters including, without limitation, matters related to the ownership, operation and financing of the Project with unrelated parties (the “Venture Matters”). CalSTRS Counsel’s sole client in the Venture Matters will be the applicable TPG Party. Each of the TPG Parties, on its own behalf and on behalf of its Constituents consents to CalSTRS Counsel’s representation of any of the TPG Parties and acknowledges and agrees that, in the Venture Matters, CalSTRS Counsel is not representing any party other than the applicable TPG Party. Thus, no lawyer-client, trust, confidential or other special relationship will exist between CalSTRS Counsel and any such party other than the applicable TPG Party in connection with the Venture Matters. Nothing in this Section 8.18 shall prohibit CalSTRS Counsel from representing TPG/CalSTRS and the Title Holding Subsidiaries with respect to the ownership and operation of the Project and, with the sole exception of the Mezzanine Loans during the period when CNP Investor owns the Mezzanine Loans, its financing.

8.18.3 CalSTRS and the TPG Parties, each on its own behalf and on behalf of its Constituents, agree that CalSTRS Counsel may concurrently represent CalSTRS in its capacity as the holder of the Mezzanine Loans in connection with the CalSTRS Matters and TPG/CalSTRS in connection with Venture Matters. CalSTRS and the TPG Parties, each on its own behalf and on behalf of its Constituents, waives and releases any conflicts arising out of that concurrent representation.

8.18.4 Further, the parties intend that CalSTRS Counsel shall remain free to represent CalSTRS or its affiliates on any issue or matter, including any dispute that is or may be adverse to the interests of the TPG Parties. Therefore, each of the TPG Parties, on its own behalf and on behalf of its Constituents, agrees that if a future dispute were to arise between CalSTRS, on the one hand, and any one or more of the TPG Parties, on the other hand, CalSTRS Counsel may represent CalSTRS in such dispute, whether or not related to the Venture Matters. CalSTRS Counsel is also authorized to share with CalSTRS any and all information related to the Venture Matters. Further, CalSTRS Counsel may withdraw from representation of any TPG Party for any reason and may continue to represent CalSTRS on any matter, including any matter that is adverse to a TPG Party, even if it is related to the matter with respect to which CalSTRS Counsel has withdrawn from representing a TPG Party.

8.18.5 Each of the TPG Parties, on its own behalf and on behalf of its Constituents, waives and releases any conflicts arising out of CalSTRS Counsel’s representation of any TPG Party in connection with Venture Matters. The TPG Parties, each on its own behalf and on behalf of its Constituents, covenants and agrees, that in no event may any of the TPG Parties any of their Constituents seek to disqualify CalSTRS Counsel from any matter on the grounds of CalSTRS Counsel’s representation of a TPG Party in connection with Venture Matters. By way of example, in the event any dispute or controversy arises between TPG/CalSTRS, on the one hand, and CalSTRS, on the other hand, then CalSTRS Counsel may represent CalSTRS in any such dispute or controversy.

8.18.6 This Section 8.18 shall survive the consummation of the transactions contemplated hereby or the termination hereof, whether or not any of the transactions have been consummated.

[Signatures appear on the following pages.]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

| CALSTRS: | ||||||||

| CALIFORNIA STATE TEACHERS’ RETIREMENT SYSTEM, a public entity | ||||||||

| By: | /s/ Christopher J. Ailman | |||||||

| Christopher J. Ailman, Chief Investment Officer | ||||||||

| TPG: | ||||||||

| THOMAS PROPERTIES GROUP, L.P., a Maryland limited partnership | ||||||||

| By: | THOMAS PROPERTIES GROUP, INC. | |||||||

| a Delaware corporation Its General Partner | ||||||||

| By: | /s/ John R. Sischo | |||||||

| John R. Sischo, Co-Chief Operating Officer | ||||||||

| CNP INVESTOR: | ||||||||

| CNP INVESTOR, LLC, | ||||||||

| a Delaware limited liability company | ||||||||

| By: | California State Teachers’ Retirement System, a public entity, its sole member | |||||||

| By: | /s/ Christopher J. Ailman | |||||||

| Christopher J. Ailman, Chief Investment Officer | ||||||||

| TPG/CALSTRS: | ||||||||

| TPG/CalSTRS, LLC, | ||||||||

| a Delaware limited liability company | ||||||||

| By: | Thomas Properties Group, L.P., | |||||||

| a Maryland limited partnership its Manager | ||||||||

| By: | Thomas Properties Group, Inc., | |||||||

| a Delaware corporation, | ||||||||

| General Partner | ||||||||

| By: | /s/ John R. Sischo | |||||||

| John R. Sischo, Co-Chief Operating Officer | ||||||||

| TPGA: | ||||||

| TPGA, LLC, a Delaware limited liability company | ||||||

| By: | /s/ John R. Sischo | |||||

| John R. Sischo, Vice President | ||||||

| TPG PLAZA INVESTMENTS: | ||||||

| TPG PLAZA INVESTMENTS, LLC, a Delaware limited liability company | ||||||

| By: | /s/ John R. Sischo | |||||

| John R. Sischo, Vice President | ||||||

| JUNIOR MEZZANINE BORROWER: | ||||||

| 515/555 FLOWER JUNIOR MEZZANINE ASSOCIATES, LLC, a Delaware limited liability company | ||||||

| By: | /s/ John R. Sischo | |||||

| John R. Sischo, Vice President | ||||||

| SENIOR MEZZANINE BORROWER: | ||||||

| 515/555 FLOWER MEZZANINE ASSOCIATES, LLC, a Delaware limited liability company | ||||||

| By: | /s/ John R. Sischo | |||||

| John R. Sischo, Vice President | ||||||

| MORTGAGE BORROWER: | ||||||

| 515/555 FLOWER ASSOCIATES, LLC, a Delaware limited liability company | ||||||

| By: | /s/ John R. Sischo | |||||

| John R. Sischo, Vice President | ||||||

| GUARANTOR: | ||||||

| 505 FLOWER ASSOCIATES, LLC, a Delaware limited liability company | ||||||

| By: | /s/ John R. Sischo | |||||

| John R. Sischo, Vice President | ||||||

EXHIBIT “A”

DEFINITIONS

“Affiliate” means, with reference to a specified Person:

(a) a Person that, directly or indirectly, through one or more intermediaries, has control of, is controlled by or is under common control with, the specified Person;

(b) any Person that is an officer, director, controlling shareholder, general partner, managing member or trustee of, or serves in a similar capacity with respect to, the specified Person, or for which the specified Person is an officer, director, controlling shareholder, general partner, managing member or trustee, or serves in a similar capacity; or

(c) with respect to TPG, any Key Individual.

“Agreement” shall have the meaning ascribed thereto in the first paragraph of this Agreement.

“Applicable Laws” shall have the meaning ascribed thereto in Section 5.1.4 above.

“CalSTRS” shall have the meaning ascribed thereto in the first paragraph of this Agreement.

“CalSTRS Affiliates” shall have the meaning ascribed thereto in Section 4.1.8 above.

“CalSTRS Counsel” shall have the meaning ascribed thereto in Section 8.18.1 above.

“CalSTRS Lender” means, collectively, (i) CalSTRS or any of its Affiliates that is a Lender and (ii) CalSTRS or any of its Affiliates that is a direct or indirect owner of such Person described in clause (i) of this definition. CalSTRS Lender shall include, without limitation, CalSTRS and CNP Investor but only during such period, if any, that CNP Investor owns the Mezzanine Loans and prior to the Conversion Date or at such other time as CalSTRS, CNP Investor or any of their Affiliates is a Lender.

“CalSTRS Loan Purchase Related Parties” shall have the meaning ascribed thereto in Section 4.1.9 above.

“CalSTRS Matters” shall have the meaning ascribed thereto in Section 8.18.1 above.

“CalSTRS Member” means, collectively, (i) CalSTRS or any of its Affiliates that is a member or partner in a company or partnership and (ii) CalSTRS or any of its Affiliates that is a direct or indirect owner of such member or partner described in clause (i) of this definition. CalSTRS Member shall include, without limitation, CalSTRS as a member of TPG/CalSTRS and CalSTRS as a member of CNP Investor.

“CNP Additional Interest” shall have the meaning ascribed thereto in Recital G above.

“CNP Additional Interest Percentage” means 68.25%, which is the percentage corresponding to the CNP Additional Interest of CalSTRS in TPG/CalSTRS solely with respect to the Project, after the Conversion.

“CNP Investor” shall have the meaning ascribed thereto in the first paragraph of this Agreement.

“CNP Investor LLC Agreement” shall mean that certain Limited Liability Company Agreement of CNP Investor, LLC dated concurrently herewith, as amended from time to time.

“CNP Original Interest Percentage” means 31.75%, which is the percentage corresponding to the Interest of the Original Interest Holders in TPG/CalSTRS solely with respect to the Project, after the Conversion.

“Code” shall have the meaning ascribed thereto in Section 4.1.10 above.

“Constituent” means, with respect to any Person, such Person’s board members, officers, directors, shareholders, partners, members, retirants, beneficiaries, trustees, agents, employees, internal investment contractors, representatives, Affiliates and, with respect to TPG, the Key Individuals.

“Conversion” shall have the meaning ascribed thereto in Section 2.1 above.

“Conversion Closing” shall have the meaning ascribed thereto in Section 3.1 above.

“Conversion Date” shall have the meaning ascribed thereto in Section 3.1 above.

“Conversion Documents” means all of the documents required to be delivered in accordance with Sections 3.2 and 3.3 hereof.

“Defaulting Party” shall have the meaning ascribed thereto in Section 6.3 above.

“Education Code” shall have the meaning ascribed thereto in Section 4.1.8 above.

“Eighth Amendment” shall have the meaning ascribed thereto in Recital K above.

“Event of Default” shall have the meaning ascribed thereto in Section 6.2 above.

“Guarantor” shall have the meaning ascribed thereto in the first paragraph of this Agreement.

“Intercreditor Agreement” means that certain Intercreditor Agreement, dated as of November 14, 2006 relating to the Mezzanine Loans with respect to the Project.

“Junior Mezzanine Borrower” shall have the meaning ascribed thereto in the first paragraph of this Agreement.

“Key Individuals” means James A. Thomas and John R. Sischo (or any replacement for any of them approved pursuant to the preceding definition), collectively; the term “Key Individual” means any one (1) of the Key Individuals.

“Lender”, as used herein, shall mean (i) the holder of the Mezzanine Loans or (ii) the holder of any other loan to any of the TPG Related Parties, including, without limitation, the Mortgage Loan, or (iii) the direct and indirect owners of any such holders.

“Loan Guaranties” shall have the meaning ascribed thereto in Recital E hereof.

“Loan Purchase Agreements” shall have the meaning ascribed thereto in Recital I hereof.

“Loan Termination Agreements” shall have the meaning ascribed thereto in Section 3.2.2 hereof.

“Mezzanine Debt Amount” means, as of the Mezzanine Loan Acquisition Date, the outstanding principal amount of the Mezzanine Loans plus all accrued but unpaid interest thereon and any other amounts payable under the Mezzanine Loans.

“Mezzanine Lenders” shall have the meaning ascribed thereto in Recital E hereof.

“Mezzanine Loan Acquisition Date” means the date upon which CNP Investor acquires the Mezzanine Loans pursuant to the Loan Purchase Agreements.

“Mezzanine Loan Documents” shall mean the loan documents evidencing and securing the various Mezzanine Loans.

“Mezzanine Loans” shall have the meaning ascribed thereto in Recital E hereof.

“Mortgage Borrower” shall have the meaning ascribed thereto in the first paragraph of this Agreement.

“Mortgage Debt Amount” means, as of the Mezzanine Loan Acquisition Date, the outstanding principal amount of the Mortgage Loan plus all accrued but unpaid interest thereon and any other amounts payable under the Mortgage Loan.

“Mortgage Lender” shall mean the holder of the Mortgage Loan.

“Mortgage Lender Consent” shall have the meaning ascribed thereto in Section 1.3 above.

“Mortgage Lender Reserve Accounts” means the net reserves held by the Mortgage Lender on behalf of or for the benefit of the Mortgage Borrower.

“Mortgage Loan” shall have the meaning ascribed thereto in Recital F hereof.

“Net Operating Cash” means cash on hand of Mortgage Borrower, Junior Mezzanine Borrower, Senior Mezzanine Borrower and TPG Plaza Investments, less payables of such Persons, other than the Mortgage Debt Amount, Picerne/Kings Capital Debt Amount, Junior Mezzanine Debt Amount and Senior Mezzanine Debt Amount, as of February 14, 2010, on a cash accounting basis.

“Non-Defaulting Party” shall have the meaning ascribed thereto in Section 6.3 hereof.

“Original Interest Holders” shall mean TPG and CalSTRS, which were Members of TPG/CalSTRS prior to the Conversion and continue as well following the Conversion.

“Original Interests” shall mean the Interests of the Original Interest Holders solely with respect to the Project prior to the Conversion.

“Parties” means the signatories to this Agreement, each of which is a “Party”.

“Person” means and includes an individual, a corporation, a partnership, a limited liability company, a joint venture, a trust, an unincorporated organization and a government or any department or agency thereof, or any entity similar to any of the foregoing.

“Picerne/Kings Capital Debt Amount” means, as of the Mezzanine Loan Acquisition Date, the outstanding principal amount of the Picerne/Kings Capital Loan plus all accrued but unpaid interest thereon and any other amounts payable under the Picerne/Kings Capital Loan.

“Picerne/Kings Capital Loan” means that certain loan to TPG Plaza Investments by Kenneth A. Picerne, as Trustee of the Kenneth A. Picerne Trust dated June 4, 1999 and Kings Capital Portfolio No. 9 LLC in the original principal amount of Nineteen Million Seven Hundred Fifty Eight Thousand Dollars as evidenced by that certain Non-Negotiable Promissory Note dated as of May 26, 2009.

“Primary Affiliates” means, as to any of TPG Parties, James A. Thomas and Thomas Properties Group, Inc., a Delaware corporation.

“Proceedings” shall have the meaning ascribed thereto in Section 5.1.5 above.

“Project” shall have the meaning ascribed thereto in Recital A hereof.

“Reconciliation Period” means the period commencing on the Loan Acquisition Date and terminating on the Conversion Date.

“Representative” shall have the meaning ascribed thereto in the TPG/CalSTRS LLC Agreement.

“Scheduled Conversion Date” shall have the meaning ascribed thereto in Section 2.2 above.

“Senior Mezzanine Borrower” shall have the meaning ascribed thereto in the first paragraph of this Agreement.

“Sixth Amendment” shall have the meaning ascribed thereto in Recital J.

“Title Holding Subsidiary” shall have the meaning ascribed thereto in Recital A hereof as well as the meaning ascribed thereto in the TPG/CalSTRS LLC Agreement. With respect to the Project, the Title Holding Subsidiaries of TPG/CalSTRS shall include, without limitation, TPGA, TPG Plaza Investments, Junior Mezzanine Borrower, Senior Mezzanine Borrower, Mortgage Borrower and Guarantor.

“TPG” shall have the meaning ascribed thereto in the first paragraph of this Agreement.

“TPGA” shall have the meaning ascribed thereto in the first paragraph of this Agreement.

“TPG/CalSTRS” shall have the meaning ascribed thereto in the first paragraph of this Agreement.

“TPG/CalSTRS LLC Agreement” means that certain Second Amended and Restated Limited Liability Company Agreement dated as of October 13, 2004, by and between CalSTRS and TPG, as amended by the following amendments and any further amendments entered into from time to time: First Amendment to Second Amended and Restated Operating Agreement of TPG/CalSTRS, LLC, dated as of June 8, 2006; Second Amendment to Second Amended and Restated Operating Agreement of TPG/CalSTRS, LLC, dated as of May 25, 2007; Third Amendment to Second Amended and Restated Operating Agreement of TPG/CalSTRS, LLC, dated as of February 1, 2008; Fourth Amendment to Second Amended and Restated Operating Agreement of TPG/CalSTRS, LLC, dated as of November 5, 2008; Fifth Amendment to Second Amended and Restated Operating Agreement of TPG/CalSTRS, LLC, dated as of October 30, 2009; and the Sixth Amendment; as amended from time to time.

“TPG Parties” means TPG, TPG/CalSTRS and the Title Holding Subsidiaries. With respect to any provision herein requiring any of the TPG Parties to take or refrain from any action, TPG shall be obligated, subject only to any required authorizations by CalSTRS under the TPG/CalSTRS LLC Agreement or the CNP Investor LLC Agreement, as applicable, to take or refrain from such action.

“TPG Plaza Investments” shall have the meaning ascribed thereto in the first paragraph of this Agreement.

“TPG Related Party” means any TPG Party or any other Person in which both TPG and CalSTRS have an ownership interest.

“Venture Matters” shall have the meaning ascribed thereto in Section 8.18.2 above.

EXHIBIT “B”

CURRENT OWNERSHIP STRUCTURE

EXHIBIT “C”

MEZZANINE LOANS

| 1. | Participation A-1 ($19,641,161) in Replacement Promissory Note A (Senior Mezzanine) dated October 27, 2006. |

| 2. | Participation A-2A ($24,122,389) in Replacement Promissory Note A (Senior Mezzanine) dated October 27, 2006. |

| 3. | Participation A-2B ($24,122,389) in Replacement Promissory Note A (Senior Mezzanine) dated October 27, 2006. |