Attached files

| file | filename |

|---|---|

| EX-32.1 - SECTION 906 CERTIFICATION - PENGRAM CORP | exhibit32-1.htm |

| EX-31.1 - SECTION 302 CERTIFICATION - PENGRAM CORP | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K /A

(Amendment No.

1)

(Mark One)

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended November 30, 2009

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____to _____

COMMISSION FILE NUMBER 000-52626

PENGRAM CORPORATION

(Exact

name of registrant as specified in its charter)

| NEVADA | 68-0643436 |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

| 1200 Dupont Street, Suite 2J | |

| Bellingham, WA | 98225 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code (360) 255-3436

Securities registered pursuant to Section 12(b) of the Act: NONE.

Securities registered under Section 12(g) of the Act: Common Stock, $0.001 Par Value Per Share.

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined by Rule 405 of the Securities Act.

[ ]

Yes [x] No

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act.

[ ]

Yes [x] No

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

[x] Yes [

] No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (s. 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

[ ] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (s229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [x] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). [ ] Yes [x] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $7,679,086, based on a price of $0.32, being the average bid and ask price of our common stock as of May 29, 2009, our most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 15, 2010, the Registrant had 54,247,144 shares of common stock outstanding.

EXPLANATORY NOTE

Pangram Corporation is filing this Amendment No. 1 to its Annual Report on Form 10-K for the year ended November 30, 2009, as originally filed with the Securities and Exchange Commission (“SEC”) on March 16, 2010 (the “Original Form 10-K”), in response to the SEC’s comment letter dated June 10, 2010.

This Amendment No. 1 amends the mineral property disclosure under Item 1 of Part I of the Original Form 10-K.

Item 15 of Part III of this Amendment No. 1 has been amended to contain the currently dated certifications from our principal executive officer and principal financial officer, as required by Section 302 and 906 of Sarbanes-Oxley Act of 2002 and Rule 12b-15 under the Securities Exchange Act of 1934, as amended.

Except as described above, Amendment No. 1 does not modify, amend or update the disclosure made in the Original Form 10-K.

The filing of this Amendment No. 1 shall not be deemed an admission that the Original Form 10-K when made included any untrue statements of material fact or omitted to state a material fact necessary to make a statement not misleading.

2

PART I

ITEM 1. BUSINESS.

GENERAL

We were incorporated on April 28, 2006 under the laws of the State of Nevada. On April 13, 2009 we amended our Articles of Incorporation by increasing our issued and authorized common stock on a three-for-one basis. Accordingly, our authorized capital of common stock increased from 100,000,000 shares, par value of $0.001 per share, to 300,000,000 shares, par value of $0.001 per share.

Our business plan is to assemble a portfolio of mineral properties with gold potential and to engage in the exploration and development of these properties. We currently own a 100% interest in our lead mineral project called the “Clisbako Property”. We also have options to acquire: (i) a 100% interest in the “Golden Snow Project," the “Fish Project” and the “CPG Project;" and (ii) an 85% interest in the “Manado Gold Property.” Our mineral properties are described in detail below.

We anticipate that we will be focusing our resources on the exploration of the Clisbako Property, the Golden Snow Project and the exercising of our option of the Manado Gold Property due to their potential and current state of development.

We allowed our interest in the Texada Gold Property and June Claims to lapse in order to focus our resources on the Clisbako Property, the Golden Snow Project and the Manado Gold Property. See “Non-Material Mineral Properties” below. We are actively reviewing other gold potential mineral properties for future acquisition.

RECENT CORPORATE DEVELOPMENTS

Since the filing of our Quarterly Report on Form 10-Q for the quarter ended August 31, 2009, we experienced the following corporate developments:

| 1. |

On January 19, 2010, we entered into the Manado Agreement. See “Manado Gold Property” below. |

| 2. |

On January 21, 2010, we entered into a second extension agreement (the "Second Extension Agreement") with Bako Resources Inc. See “Clisbako Property” below. |

| 3. |

On January 21, 2010, we announced that our directors have approved proceeding with an exploration program including the drilling of the main targets on the Clisbako Property. |

| 4. |

On February 5, 2010, we entered into the June Agreement. See “June Claims” below. |

| 5. |

On March 15, 2010, we entered into a third extension agreement dated for reference February 15, 2009 with Bako Resources Inc. See “Clisbako Property” below. |

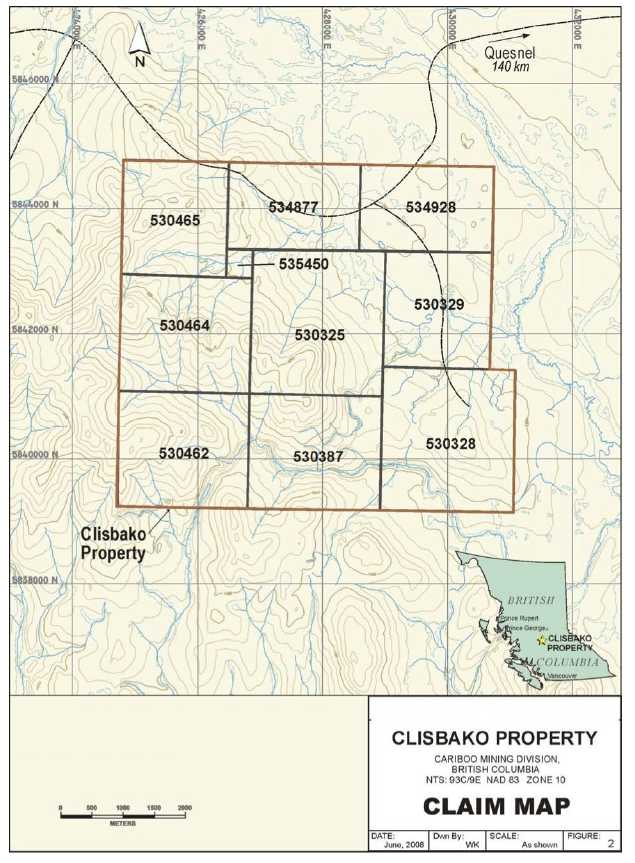

CLISBAKO PROPERTY

Our main mineral property is the “Clisbako Property,” which we own a 100% interest. The Clisbako Property covers an area of approximately 3,388 hectares and is located in the Interior Plateau Region of north central British Columbia. It is composed of ten contiguous mineral claims, situated within the Cariboo Mining Division. The claims are situated approximately 80 miles west of Quesnel, British Columbia

3

Description of Property

Our acquisition of the Clisbako Property was completed under the terms of a purchase agreement dated December 16, 2008 with Bako Resources Inc. (“Bako”). Under the terms of the purchase agreement, we issued to Bako 2,000,000 pre-split (6,000,000 post-split) shares and a promissory note in the amount of $56,600 (CDN $70,000 translated to US$65,913 as at November 30, 2009) payable on June 30, 2009. On July 23, 2009, we entered into an extension agreement with Bako to extend the due date of the promissory to December 31, 2009. In consideration of the extension, we issued 60,000 shares of our common stock to Bako. On January 21, 2010, we entered into a second extension agreement with Bako, whereby Bako agreed to extend the due date of a non-interest bearing promissory note in the amount of CDN $70,000 payable to Bako from December 31, 2009 to February 15, 2010. In consideration of the extension, we issued to Bako 10,000 shares of our common stock. On March 15, 2010, we entered into a third extension agreement dated for reference February 15, 2009, with Bako, whereby Bako agreed to extend the due date of a non-interest bearing promissory note in the amount of CDN $65,000 payable to Bako from December 31, 2009 to June 30, 2010. In consideration of the extension, we agreed to pay CDN $5,000 of the promissory note and issue to Bako 20,000 shares of our common stock

The Clisbako Property covers approximately 3,388 hectares. The mineral claims making up the Clisbako Property are recorded with the Ministry of Energy, Mines and Petroleum Resources (the “Ministry of Mines”) as follows:

| Tenure Number | Area in Hectares | Expiry Date |

| 530325 | 489.55 | October 29, 2010 |

| 530328 | 489.74 | October 29, 2010 |

| 530329 | 313.10 | October 29, 2010 |

| 530387 | 391.81 | October 29, 2010 |

| 530462 | 391.81 | October 29, 2010 |

| 530464 | 391.66 | October 29, 2010 |

| 530465 | 313.21 | October 29, 2010 |

| 534877 | 293.62 | October 29, 2010 |

| 534928 | 293.62 | October 29, 2010 |

| 535450 | 19.58 | October 29, 2010 |

The Province of British Columbia owns the land covered by the Clisbako Property. To our knowledge, there are no aboriginal land claims that might affect our title to the Clisbako Property or the Province’s title of the property.

In order to maintain the Clisbako Property in good standing, we must complete minimum exploration work on the Clisbako Property and file confirmation of the completion of the work with the Ministry of Mines. In lieu of completing this work, we may pay a fee equal to the minimum exploration work that must be performed with the Ministry of Mines. The completion of mineral exploration work or payment in lieu of exploration work in any year will extend the existence of our mineral claims for one additional year. The minimum exploration work that must be performed and/or the fee for keeping our claims current is equal to $8.00 CDN (approximately $7.57 US) per hectare. As our mineral claims are in good standing until October 29, 2010, we will be required to complete minimum exploration work or pay a minimum fee of CDN$27,104 (approximately US$25,632) on or before October 29, 2010 and each year thereafter in order to keep the Clisbako Property current. If we fail to complete the minimum required amount of exploration work or fail to make a payment in lieu of this exploration work, our mineral claims will lapse and we will lose all interest in our mineral claims.

Location, Access, Climate and Physiography

The Clisbako Property is located in the Interior Plateau Region of north central British Columbia. It is composed of ten contiguous mineral claims, situated within the Cariboo Mining Division. The claims are situated approximately 80 miles west of Quesnel, British Columbia.

4

Figure 1

Location of Clisbako Property

5

Access to the property is by paved highway west from Quesnel to Nazko, then 30 miles southwest by gravel Forest Service Roads (“FSR”). The 4200 FSR crosses the northern portion of the Clisbako Property and branch roads and logging tracks provide access to much of the rest of the property.

The climate of the area is characteristically dry. Average annual temperature is approximately 2° C, with average summer highs in July and August of 14° C and January winter lows averaging -13° C. Average annual precipitation is approximately 440 millimeters, with an estimated 40% falling as snow. The majority of rainfall occurs between June and August.

The claims cover a wide variety of terrain, from swampy meadows to forested upland slopes. Elevations range from 1,250 meters along the Clisbako River to over 1,500 meters to the west. A significant portion of the property has been logged by clearcut methods. Forest cover is typical of the region, consisting of lodgepole pine, with local stands of black spruce, fir and birch along drainages. Timber harvesting has occurred with numerous cut blocks scattered throughout the claim area. Swampy meadow lands in the eastern and northeastern portions of the property that form the headwaters of the Clisbako River system are saturated for much of the year but dry out in late summer. These areas are sparsely treed.

Property History

Historical work to date on the Clisbako Property has outlined eight main zones, as currently identified, of epithermal mineralization and alteration referred to as the North, Central, South, West Lake, Obvious, West Lake Boulder, Gore and Bari zones. Historical records indicate that soil geochemical surveys and geophysical surveys have been conducted over several grids on the property, and a total of 34 diamond drill holes have been completed. The bulk of the work has been concentrated within a 2 kilometer by 4 kilometer north trending corridor in the centre of the project area. Prior to 1989, there is no recorded work on the Clisbako Property.

Eighty Eight Resources Ltd.: 1989 – 1991 - In 1989, a regional reconnaissance exploration program was conducted within the Nechako Basin by Eighty Eight Resources Ltd. Epithermal quartz float collected on the property returned weakly to moderately anomalous gold, silver and arsenic values. Subsequent work traced these samples to their source and led to the discovery of several extensive areas of epithermal silicification and argillic alteration in 1990.

A property consisting of 15 contiguous claims (Clisbako 1-15) covering 7,500 hectares was staked by Eighty-Eight Resources Ltd. to cover these areas. Dawson Geological Consultants Ltd. were contracted to complete a compass and flag grid covering the 4 main mineralized zones (North, Boulder, Central and South Zones). Crews collected 1,320 soil samples from grids covering the mineralized areas, and a total of 253 rock samples were collected from areas of epithermal silicification as well as from mineralized float believed to be locally derived. Geological mapping was also completed.

Minnova Inc.: 1991- 1992 - The property was subsequently optioned to Minnova Inc., and five more claims (Clisbako 16-20) were added to the property in April, 1991, following a compilation of data and re-interpretation of the 1990 field work. Minnova then proceeded to fly an airborne magnetic and electro-magnetic survey over the entire property. Grid line spacing over the pre-existing grid was tightened to 100 meters line spacing and grid lines were extended 1 kilometer to the west. The entire gridded area was geologically mapped and sampled, the results of which delineated the Gore and Pond epithermal alteration zones. A total of 18 trenches were excavated covering 5 mineralized zones (North, South, Central, Discovery and Trail Zones), all of which were mapped in detail and sampled. Based on the results of these programs a 19 hole NQ drill program was completed totaling 3,024 meters. This included 11 holes in the North Zone, 7 holes in the South Zone and 1 diamond drill hole in the Central Zone. The program confirmed the presence of widespread anomalous gold concentrations but failed to delineate any zones of economic significance.

In June, 1992, a total of seventeen 2-post claims were added on the claim group, presumably to ensure that there were no internal fractions between the Clisbako 4 & 13, 7 & 14, 5 & 10 and 8 & 10 claims. Minnova conducted a gradient array IP geophysical survey over 17 partial grid lines covering those zones identified to date in the central portion of the property. An additional 7 trenches were completed in the West Lake, Gore, West Pit and Central Zones. An 11 hole, 1,358 meter NQ drill program was conducted to evaluate the results of the gradient array IP survey and extensions to zones identified in 1991. Although the drilling intersected extensive widths of strong epithermal alteration in each target area, no significant precious metal values were detected. Nonetheless, indicator elements such as mercury, arsenic and tin were strongly anomalous throughout, indicating that the system as a whole has a classic epithermal signature.

6

Phelps Dodge: 1994 – 1996 - After the expiration of Minnova’s option, Phelps Dodge examined the property and subsequently optioned it in the fall of 1994. Phelps Dodge, through Fox Geological Services Inc., carried out a 22 line kilometer soil geochemical sampling program in 1994. Thick glacial till cover in the project area effectively masks any bedrock leaching and the soil survey failed to define zones of epithermal alteration.

Fox Geological was retained again to conduct a combined rock and soil geochemistry program, IP geophysical survey, geological mapping and a diamond drilling program during the 1995 field season. The 1995 program focused on developing new targets in relatively under explored parts of the property and further evaluating known zones of mineralization with limited historical work.

Fox Geological Services completed 36 miles of gridding west of Camp Lake to the western claim boundary. Mapping and prospecting on the grid generated 339 rock samples of bedrock and float . This sample was collected from a cluster of weakly quartz veined feldspar phyric rhyolite float boulders within a discrete dispersion train in till. The bedrock source of these boulders has not been discovered.

Soil geochemical surveys totaling 22 line kilometers covered the western and central portions of the claim group along one kilometer spaced lines with detailed coverage in the Gore and Bari zones resulting in 677 soil samples. Anomalous gold results were usually isolated, one sample occurrences, but anomalous arsenic values outlined a prominent 2000 meter by 800 meter north trending zone which coincided with several new zones of quartz veining outlined by prospecting. Additional follow-up was recommended in the Bari 1 and 2 zones.

The IP survey consisted of a total of 17.8 line kilometers. Two different arrays were utilized: a reconnaissance style survey with electrodes spaced 75 meters apart along road lines and a detailed survey with 150 meter electrode spacing over two established grid lines. The wider separations failed to detect any anomalous readings that were not detected using shorter separations.

A total of 700.9 meters of NQ2 diamond drilling in 4 drill holes was conducted on the West Lake boulder train and the Obvious Zone. Drilling failed to encounter economic concentrations of gold with results similar to those obtained from the North and South Zones.

A short 4 day field program was completed in 1996 consisting of geological mapping and sampling in the Bari Zone area. A total of 24 rock samples were submitted for analysis with most samples containing anomalous values of gold and arsenic from boulder float.

Although a large gold bearing epithermal system had been outlined in the central claim area covering approximately 20 square kilometers, gold tenors are generally very low, rarely exceeding 0.5 ppm.

Goodall (Global Geological): 1996 – 2003 - The Bako 1 to 16 claims were subsequently staked by Geoff Goodall, P. Geo. in 1996 to cover previously identified zones of alteration and mineralization. A prospecting program was conducted on the Bako 1 to 5 mineral claims in the spring of 2002. These claims cover eight zones of hydrothermal alteration typified by pronounced bleaching of the host felsic volcanics and are characterized by intense argillic alteration accompanied by multi-stage intense quartz veining, weak to strong silicification, and/or hydrothermal brecciation. The work program consisted of prospecting traverses and rock geochemical sampling of areas adjacent to and within previously discovered zones of alteration. A total of fifty-two rock samples were collected. A strong correlation was shown to exist between anomalous gold values and anomalous silver values. Samples with anomalous concentrations of antimony also had anomalous levels of arsenic, and mercury was weakly anomalous.

Bard Ventures: 2003 - 2004 - The property was optioned to Bard Ventures in late 2003 and Global Geological Services established two geophysical grids over the Discovery and Brooks Zones totaling 24.5 line kilometers. Previous mapping and sampling programs within these areas uncovered concentrations of quartz rich boulder float.

7

Regional Geology

The Clisbako property is located in the northern part of the Chilcotin Plateau. Specifically, it is situated in the south central part of the Anahim Volcanic Belt along an east-west trend defined by three peralkaline shield volcano complexes (Rainbow Range, Ilgachuz Range, Itcha Range) that comprise the western part of the belt. The oldest rocks exposed in the Chilcotin Plateau area are Pennsylvanian to Permian age Cache Creek Group sedimentary rocks. These are overlain by upper Triassic to lower Jurassic Takla Group andesite-basalt flows, tuffs and breccias and associated clastic rocks. Predominant in the northern portion of the Chilcotin Plateau are andesite flows and breccias, and sedimentary rocks of the mid-Jurassic Hazelton Group. This sequence is unconformably overlain by the upper Cretaceous, Paleocene, Eocene and possibly Oligocene rocks of the Ootsa Lake Group. This latter Group is comprised of rhyolitic to dacitic tuffs, flows and breccias with minor amounts of andesite, basalt, conglomerate and tuffaceous shale.

A sequence of Eocene to Miocene andesite, dacite and rhyolite volcanics of the Endako Group and Pliocene to Pleistocene Chilcotin Group vesicular andesite and basalt flows, breccias and cinder cones conformably overlie the Ootsa Lake Group. Pleistocene to recent till, gravel and sand infill drainages basins and locally form eskers and moraines up to 100 meters thick. Phelps Dodge compiled a detailed regional geology synopsis of the area as part of the work they conducted.

The Clisbako Property is dominantly underlain by felsic volcanics and volcaniclastics of Eocene age that are referred to informally as the Clisbako Volcanics. The Clisbako Volcanics underlie a large, regionally circular area within which a wide variety of assemblages of the Clisbako Volcanics occur. This area appears to be a distinct basin of volcanic deposition and is referred to as the Clisbako Caldera Complex. The age of the complex is Early to Middle Eocene, based on Potassium-Argon age dates and palynology. Chemically similar volcanics, also of Eocene age, to the north in the Nechako River map area are referred to as the Ootsa Lake Group (for the felsic members) and the Endako Group (for the basic and intermediate members).

Volcanic, subvolcanic and volcaniclastic rocks within the Clisbako Caldera Complex range in composition from basalt to rhyolite and include a wide variety of textural types and facies assemblages. Dacites, rhyodacites and rhyolites are the most common compositional types, with andesites and basalts subordinate. Passive eruptive sequences of flows and domes are the most abundant volcanic assemblages with explosive pyroclastics more common towards its west central parts. Associated with both the passive and explosive assemblages is a highly variable assemblage of lahars, fanglomerates, coarse and fine-grained fluvial assemblages and locally, chemically deposited siliceous sinters that have been interpreted as parts of a moat facies. Chemical analysis of these volcanics shows them to be potassium-rich and may be classified as belonging to the high-potash calcalkaline magma series.

Passive eruptive sequences of flows and domes are the most abundant volcanic assemblages. Explosive pyroclastics occur throughout the Caldera Complex, but are most common towards its west-central parts. Intimate with both the passive and explosive volcanic assemblages is a highly variable assemblage of lahars and fanglomerates, coarse and fine-grained fluvial assemblages and locally, chemically deposited siliceous sinters that comprise volcaniclastic sediments that are here interpreted as parts of a "moat" facies. Rock units of the moat facies from recessive assemblages and are very poorly exposed. The distribution of these three facies assemblages within the caldera suggests the presence of a number of separate basins within the larger caldera structure.

In the north and northeastern parts of the complex, aphyric and biotite phyric rhyolite and rhyodacite flows and flow domes are common. In the north part of the area a lahar-moat facies containing boulder breccia, conglomerate, sandstones and lacustrine siltstone with opaline sinters is associated with mainly flow and flowdome units of andesite and dacite composition. The south eastern part of the caldera complex is underlain by platy fractured, generally aphyric to weakly augite phyric dacite and andesite, with local areas of basalt and minor suggestions of the presence of a lacustrine moat facies. The southwestern part of the caldera is underlain mainly by dacitic, andesite and subordinate biotite phyric flow units, with local areas to the north of biotitequartz phyric rhyolite flow and pyroclastics. Here, the lahar-lacustrine-siliceous sinter moat assemblage occupies a large area in the central part of this southwestern sector.

The central and northwestern parts of the Clisbako Caldera complex, underlying the Clisbako, Baez and Bako claim blocks, are underlain by a bimodal suite of volcanics. Here, the dominant facies is an assemblage of aphyric to weakly to moderately augite and feldspar phyric dacite flows with local intercalations of polylithic volcaniclastics, volcanogenic breccia and fluvial clastics. The subordinate volcanic assemblage in this central and western sector comprises varieties of variably quartz, biotite, hornblende, plagioclase and sanidine phyric felsic volcanics that includes explosive ash flow tuffs, subvolcanic intrusions and breccias. Moat facies assemblages, including siliceous sinters have been noted in this area proximal to the felsic volcanic assemblages to the immediate northeast of this west-central facies, and the presence of boulders in float train suggests its presence within the area.

8

Property Geology

The Clisbako Property area is one of very low relief that has been extensively glaciated. Glaciation advanced from the south-southwest, covering the area with a variable thickness of till. Outcrop is very limited within the project area and bedrock exposure is likely under 1%. The best exposures are found on rounded, hummocky ridge crests and are dominated by platy to massive dacites and rhyodacites. Outcrop is also exposed in incised outwash channels and in logging slashes. The more recessive and easily weathered rock assemblages such as the moat facies and clay-argillic alteration assemblages are poorly represented in natural exposures, although their distribution has been somewhat enhanced by logging slashes and road cuts.

Contacts were not observed between major units and very rarely seen between beds. All age relationships between stratigraphic elements are deductive. In addition, no zone of definitive faulting could be documented by the presence of natural and man-made exposures, with the exception of trenching in the North Zone. There, the zone is very strongly faulted, marked by clay gouge, kaolinized zones and shattered rock and serves to suggest that faulting is an important, if mostly hidden, structural element.

Dacitic flow units underlie much of the terrain in the central and western parts of the Clisbako claim area. Rhyolite assemblage fragmental units underlie the low lying slopes to the north and east. These rocks are in turn overlain by Miocene basalts along the Clisbako River valley. Most units strike northerly and dip gently east although dip reversals are common.

Exploration work to date has focused on an area roughly two kilometers by four kilometers in size. Rocks in this area consist of rhyolitic flows, tuffs and breccias interbedded with dacite and amydgaloidal andesite flows and associated pyroclastic rocks. These are tilted and block-faulted and fill a north-trending, shallow, graben and local depositional basins.

The stratigraphic and subvolcanic lithologies that underlie the Clisbako claims can be subdivided into three separate assemblages consisting of, in probable chronological order, a dacitic facies, a rhyolite facies and a basalt-andesite assemblage. These east-dipping strata are disrupted by north-trending faults near Mount Dent and at Camp Lake on the Clisbako claims. Fluvial and lacustrine (moat facies) volcaniclastic sediments form portions of all three assemblages. The most extensive and probably oldest volcanic facies is represented by a suite of dacitic flows that are typically aphanitic to sparsely porphyritic with fine-grained augite phenocrysts. Locally interbedded with the volcanics of the Dacite Assemblage are variable thicknesses of clastic rocks that range from sharpstone conglomerate-fanglomerate to laminated fluvial fine-grained sandstone composed of detritus derived directly from the dacite flows.

Rhyolites of the felsic facies assemblage lie in a north-south trending band through the central part of the claim block. This assemblage has been interpreted as one of the centers of felsic volcanism within the Clisbako Caldera Complex. Volcanic and subvolcanic members of this facies include ash flow tuffs, flows, breccias, dykes and domes (plugs) and are composed of variations of plagioclase, biotite, quartz, hornblende and sanidine phenocrysts. It is distinguished from the dacite assemblage by the presence of common hydrous minerals biotite and hornblende. Associated spatially and compositionally with rhyolites of the felsic assemblage are volcaniclastics of a moat facies, including ash tuffs, siltstone, sandstone, conglomerate and siliceous sinters.

Overlying the Clisbako Formation is a 30 to 50 meter thick basalt-andesite facies, the youngest unit. This is comprised of olivine basalt flows and locally abundant pyroclastic rocks and has been correlated with the Miocene Endako Group. It appears in the extreme northeast portion of the claim block.

North to north-northeast striking faults are the most prominent structures on the property. They dip moderately to steeply east and west (40° to 80°) and are responsible for extensive block faulting of the Clisbako Formation. Measured offsets range from a few meters to about 200 meters. Epithermal alteration is hosted by several of these faults.

9

Faulting has caused considerable rotation of the volcanic sequence, resulting in highly variable dips. For example, on the west part of the grid, units of the Dacite member dip steeply to vertically while at the North Zone bedding is nearly flat lying.

A shallow graben is defined by the north trending faults in the grid area. Epithermal style alteration at the North, Central, South, Gore and West Lake zones occur along these structures. The easternmost fault, the East Boundary Fault, hosts epithermal alteration intermittently over a length of 2 kilometers. The South, Trail and Central Zones occur along this structure.

Other structures include northwest and northeast trending linears which form conspicuous drainage patterns in the northeast claim area. They have no measurable offset and their significance is uncertain.

Several occurrences of epithermal-style alteration are known in the east part of the property. They are all similar in style.

The zones are characterized by wide haloes of pervasive argillic alteration occurring in the hanging wall of the graben faults. Extensive stockworks of quartz, pyrite (+ marcasite) veinlets occur throughout the argillic zones. Overall sulphide content averages about 0.5% .

Stockworks grade into areas of pervasive silicification close to the faults. These commonly contain irregular shaped bodies of hydrothermal breccia and banded veins.

Argillic alteration occurs up to 100 meters into the hanging wall of the source structures. In zones where several parallel structures occur close together, such as at the North Zone, the argillic zones coalesce. Silicification is more restricted, occurring as 1 to 25 meter wide zones along fault planes. Narrow subparallel silicified zones also occur in the footwall of the host structures.

Footwall alteration is less intense than the hanging wall alteration. Argillic alteration is typical, however at some locations weak propylitization consisting mostly of chlorite and calcite veinlets is developed.

Alteration is well developed in a variety of host rocks. At the North, West Lake and Central zones alteration occurs in rhyolites and crystal tuffs. At the South Zone, the strongest alteration is hosted by amygdaloidal andesite.

Mineralization

Mineralization at Clisbako consists of epithermal silica stockworks and breccias developed on north-striking faults. Previous operators have outlined eight zones of hydrothermal alteration on the property. These zones are associated with rocks of the felsic assemblage, grading outward into rocks of the dacite assemblage. The zones are referred to as the Bari, Brooks, Gore, Discovery, Obvious, West Lake, South and North zones. The alteration zones are typified by pronounced bleaching of the host felsic volcanics and are characterized by intense argillic alteration accompanied by multi-stage intense quartz veining, weak to strong silicification, and/or hydrothermal brecciation. Locally, early argillic alteration is almost completely overprinted and masked by later successive stages of silicification.

It has been suggested that the hydrothermal alteration and mineralization were developed along complex steeply dipping north to north-east trending fault structures which were formed during the development of the Clisbako Caldera. However, within the claim area the alteration zones appear to be controlled by a series of closely spaced subparallel small-scale faults, rather than a single major structure. The rocks between the individual small-scale faults are highly fractured, intensely hydrothermally altered and flooded with a pervasive stockwork of quartz veinlets.

The various mineralized zones and prospects, along with boulders in glacial dispersion trains, are composed of quartz veined volcanic rocks. Vein textures include massive fine to medium grained quartz, banded chalcedony, stockworks of comb-textured quartz and drusy vugs. Calcite occurs in very small amounts and as fracture coatings and as replacement of alkali feldspars in propylitically altered rock. Quartz veins are varied and have been described as; stockwork, druzy, massive, sugary, stringers, blue/black, chalcedonic, banded, comb quartz in open space fillings, crustiform, or brecciated. Some of the veins show quartz pseudomorphs after coarse bladed calcite, evidence of boiling.

10

The argillic zones contain an average of less than 0.5% sulfide mineralization, but in the silicified zones the sulfide content may reach 5% over narrow widths. Low sulphide concentrations are typical of an acid-sulphate epithermal system.

Pyrite is the dominant sulphide and typically is very fine grained. In this form it most commonly occurs as disseminations in dark gray to blue-black chalcedonic quartz, is disseminated in the matrices of siliceous hydrothermal breccias, or fills quartz lined cavities. Coarse-grained pyrite is locally associated with marcasite and arsenopyrite. Pyragerite has been identified south of Clisbako Lake, within the North Zone, and may be the main silver bearing mineral. Barite has been observed at several localities.

Alteration fringing the siliceous lodes and breccias is dominantly argillic, generally widespread and locally intense. It consists of illite and montmorillonite replacement of plagioclase feldspar phenocrysts and the ground mass, with minor sericitization of hornblende and biotite phenocrysts. Mineralized zones generally comprise an inner zone of silicious breccia and quartz stockworks lying on or within controlling fault structures and a wide distal zone of argillic alteration that may extend up to 150 meters or more out from the silica core zone. Propylitic alteration is pervasive and comprises fine disseminated and fracture controlled chlorite which imparts a pale green color to the rocks. It is accompanied by variable amounts of calcite along fractures and as replacement of alkali feldspar. Potassic alteration as measured by alkali feldspar staining of rocks is variable. In only one occurrence has potassium feldspar been observed within a vein. Gold grades are elevated close to the inner silicified zone while the argillic envelope is usually barren. The various zones explored are described in detail below.

The North zone lies in a down-faulted block of feldspar (+/- quartz) phyric rhyolite flows and tuffs and dacite flows and pyroclastic breccias south of Camp Lake. It is exposed in a gully in which trench excavations have exposed argillic-altered rocks over 300 meters. It has a well defined east boundary marked by a fault. The west boundary is poorly constrained and is probably continuous with the West Lake Zone.

Alteration associated with north-striking faults consists of extensive silicification, quartz and pyrite stockworks, banded epithermal veins and siliceous breccia. These zones contain elevated precious metal and pathfinder element values. Argillic alteration is most pronounced distal from the siliceous zones. Barren quartz stockworks are common in the argillic zone.

The Central zone is a stockwork lying along the same fault structure that hosts the South zone. Quartz-clay alteration is similar to that at the North zone, with extensive quartz stockworks and pervasive argillic alteration occurring in a flow-banded dacite. The zone is narrow and probably connects with the North Zone to the north.

Four trenches have been excavated on the Discovery zone across two narrow, hydrothermal breccias. The matrix consists of a bluish-grey clay gouge. The wallrock, which consists of flow banded dacite, is moderately silicified up to four meters away from the breccia. A second less altered breccia, consists of black, sulphidic quartz fragments in a moderate to strongly argillized dacite host. This interval was only weakly mineralized, however a sulphide-rich interval was enriched in arsenic.

The South Zone is typified by a large area of silicification and hydrothermal breccia. The main outcrop area, in a small creek at the south end of the property, consists of a zone of hydrothermal breccia, veins and stockworks over an outcrop area of 150 meters and has been traced by drilling for some 300 meters.

The zone shows evidence of multiple stages of silicification indicated by cross cutting relationships and clast types within hydrothermal breccia veins. The hanging wall is strongly bleached and variably silicified in which a strongly developed stockwork of pyritic veinlets are cut by irregular veins of dark grey, banded chalcedony. One such vein was traced continuously for 22 meters. It was from these veins that the best assays were obtained by Minnova.

Despite the intense alteration, silicification and breccia development, precious metal and pathfinder element concentrations are low. The highest gold concentrations occur in sulphide-rich hydrothermal breccias and zones of banded grey chalcedony. Minnova drilled ten holes in the South zone area in 1991 and 1992. Most holes returned low grade to barren zones of siliceous breccia.

11

Two zones were identified by IP surveys southwest of Camp Lake, the West Lake and West Pit Zones. The West Pit is a 200-metre long chargeability high centered on line 416N at 285+00E. It has been traced intermittently as far south as line 400N. Trenching in 1992 failed to reach bedrock. Subcrop and overburden contains abundant bright yellow clay along with fragments of silicified rock and vein quartz. The West Lake zone, immediately west of the North zone, consists of a coincident chargeability and resistivity high with a strike length of about 300 meters. Trenching on the West Lake zone exposed a quartz stockwork zone containing three-meter wide banded and bladed, pyritic, quartz-chalcedony veins.

Minnova drilled six holes in the West Lake-West Pit area in 1992 to follow-up trenching and induced polarization surveys.

The Obvious Zone is located along the 4200 Forest Service Road approximately 2 kilometers north of the North Zone at Camp Lake, and was discovered by prospecting the excavated ditches adjacent to the road. Float boulders of quartz veins and silicified feldspar phyric rhyolite tuffs are present within till and subcrop. The Obvious Zone was drill tested by hole 236-34.

The West Lake Boulder Train is located along a reclaimed logging access road along the west shore of Camp Lake. The boulder dispersion train comprises angular float blocks up to 50 cm in size in till along a tightly confined, north trending dispersion train over 600 meters in length. Float blocks include massive fine grained quartz, silica breccias and quartz stockworks. This zone was drill tested by 3 drill holes, 236-31, 236-32, and 236-33.

The Gore Zone is located approximately 1.5 kilometers southwest of the North Zone on the eastern slope of the ridge rising to the west of Camp Lake. The Zone comprises north trending massive silica breccias and quartz vein stockworks within dacite flows and rhyolite tuffs and is exposed over an area of 500 meters by 50 meters.

The Bari Zone comprises two separate silica breccia bodies and several float and subcrop occurrences centered about 2.5 kilometers due west of the North Zone. Local lithologies include propylitically altered dacite flows and a 50 meter thick pyroclastic breccia unit with variably silicified angular clasts. Two separate zones, the Bari 1 and Bari 2 zones are partially exposed through a thin cover of till and comprise north-trending zones of hydrothermal breccia up to five meters thick. Accessory minerals include arsenopyrite and barite and possible sulphosalts indicated by an unusual grass green colored weathering. Both zones are within a large arsenic soil anomaly which extends for 2 kilometers from L 406N to L 426N.

Detailed sampling in 1996 failed to enhance the prospect.

Prospecting and rock geochemical sampling on the Bari Zone in 2002 has confirmed the existence of epithermal style gold and silver mineralization within an argillically altered and quartz veined felsic volcanic assemblage. More than 80% of the 52 rock samples returned anomalous values for gold, silver, arsenic, tin, mercury, molybdenum or barium.

Current Exploration Activities

James Chapman, P. Geo. and P. Eng., and Willie Kushner, B.Sc. Geo., our consulting geologists, concluded that a strong potential for mineralization on the property lies within structurally controlled features at depth.

Our consulting geologists recommend a three-phase continuing exploration program be undertaken on the property to determine the prime localities of mineralization on which to focus concentrated exploration.

12

The three-phase program and its approximate estimated costs consist of the following:

| Phase |

Recommended Exploration Program |

Approximate

Estimated Cost |

Status |

| Phase I | Soil geochemical surveys, prospecting, mapping and geophysics in order to better define the Bari 1 and Bari 2 zones. | CDN $122,000 ($115,375) |

Plan to implement in Third Quarter 2010. |

| Phase II | Trenching and IP geological surveys. | CDN $152,000 ($143,746) |

To be determined based on the results of Phase I. |

| Phase III | Diamond drilling on selected targets. | CDN $523,000 ($494,601) |

To be determined based on the results of Phase I. |

| Total Estimated Cost | CDN $797,000

($753,723) |

Subject to obtaining sufficient financing, Phase I of our exploration program is intended to be commenced in the summer of 2010. If we are able to obtain financing, Phase I of our exploration program on the Clisbako Property will involve soil geochemical surveys, prospecting, mapping and geophysics in order to define the Bari 1 and Bari 2 zones.

Upon implementing our exploration program on the Clisbako Property, we plan to use industry standard quality assurance/quality control protocols and chain of custody procedures for collecting samples and obtaining related information.

MANADO GOLD PROPERTY

On January 19, 2010, we entered into an agreement with Agus Abidin dated for reference November 2, 2009 (the “Manado Agreement”) to acquire an option to earn up to an 85% interest in the Manado Gold Property. Under the terms of the Manado Agreement, we have agreed to pay $35,000 to the owners of the Manado Gold Property (the “Owners”) for the exclusive right for 90 days to formalize an agreement (the “Acquisition Agreement”) to earn up to an 85% undivided interest in the Manado Gold Property. After the 90 day period, we may elect to exercise our option to enter into the Acquisition Agreement and will have 30 days to finalize the terms of the formal Acquisition Agreement. On January 21, 2010, we entered into an extension agreement with Agus Abidin whereby the parties agreed to extend the due diligence period to March 31, 2010.

Under the terms of the proposed Acquisition Agreement, we will be able to earn an interest in the Manado Gold Property by making cash payments, issuing shares and completing work programs at various stages. We will be able to acquire:

| (a) |

an initial 10% interest in the Manado Gold Property by paying $90,000 and issuing 150,000 shares of our common stock to the Owners on execution of the Acquisition Agreement, and completing a mineral exploration program at a cost of not less than $250,000 prior to the first anniversary of the Acquisition Agreement; | |

| (b) |

an additional 15% interest in the Manado Gold Property by paying $100,000 and issuing 300,000 shares of our common stock to the Owners on the first anniversary of the Acquisition Agreement, and completing a mineral exploration program at a cost of not less than $500,000 prior to the second anniversary of the Acquisition Agreement; | |

| (c) |

an additional 26% interest in the Manado Gold Property by paying $200,000 and issuing 500,000 shares of our common stock to the Owner on the second anniversary of the Acquisition Agreement, and completing a mineral exploration program at a cost of not less than $1,000,000 prior to the third anniversary of the Acquisition Agreement; and | |

| (d) |

an additional 34% interest in the Manado Gold Property by completing a scoping study. |

13

If we acquire an 85% interest in the Manado Gold Property under the proposed Acquisition Agreement, we will be responsible for the costs of any feasibility studies and, if warranted, placing the Manado Gold Property into commercial production. In addition, we will have an option to acquire the remaining 15% interest in the Manado Gold Property by paying the Owners $5,000,000.

Additional terms of the proposed Acquisition Agreement include, among other things, that we will be responsible for all costs in maintaining the Manado Gold Property in good standing, and we will have the right to terminate the Acquisition Agreement on 60 days notice. If the proposed Acquisition Agreement is terminated, we will be entitled to retain the interest in the property we earned as of the termination date.

During the Due Diligence Period, the Owner of the Manado Gold Property is prohibited from negotiating with or entering into an agreement with any third party in connection with the disposition or any other encumbrance of it its interest in the Manado Gold Property.

There is no assurance that we will exercise our option to enter into the formal Acquisition Agreement, or that we will be able to earn any interest in the Manado Gold Property.

Description of the Property

The Manado Gold Property is comprised of four contiguous mining tenements called “Bagkit Limpoga Jaya”, “Hakian Wellem Rumansi”, “Ratak Mining”, and “Manembo Mineral” which cover an area of approximately 300 hectares.

Location, Access and Physiography

The Manado Gold Property is located 50 miles south of Manado in northern Sulawesi, Indonesia. It is accessible by 3 miles of partly paved all-weather road from Ratatotok, a village along the coastal national highway, which in turn is accessible by 60 miles of paved road from Manado. The city of Manado is a major commercial center served by local and international flights as well as ocean-going vessels.

14

Figure 2

Location of Manado Gold Property

15

Property History

In 1981, PT Newmont Minahasa Raya, an Indonesian subsidiary of Newmont Gold Company of Denver, commenced the exploration of their contract of work (“COW”) concession. The exploration program led to the discovery of several small gold deposits. The largest of the deposits known as the Mesel together with other smaller satellite deposits was placed into production in 1996. Due to deteriorating relations with the local people and government, Newmont was forced to cease mining operations in 2002 but continued milling ore stockpile up to 2004. PT Newmont produced a total 2 million grams of gold mainly from the Mesel open pit.

Newmont also identified three zones that my contain gold mineralization, which are called Limpoga, Pasolo and Nona Hoa. These zones were defined by the drilling of some 273 boreholes. Although detailed engineering and economic studies were completed, no mining in any one of the three zones was actually carried out. After the departure of Newmont, all three zones were subsequently included in tenements acquired by local companies in Manado.

Newmont drilled a total of 6,457 meters at the Limpoga zone between 1989 to 1999. In particular, 92 closely-spaced (40 meters) diamond drill holes were drilled between 1989 to 1993. In late 1998, Newmont completed an additional 1,695 meters of closed spaced (20 meters) diamond drill holes. In 1999, Newmont also drilled 19 Reverse Circular (“RC”) holes for a total of 1,064 meters at the Limpoga zone. This large amount of high density drilling provided the data points for detailed engineering, which included geotechnical, bulk density, permeability and metallurgical tests. The historical drilling of Newmont indicated 196,000 tons of mineralized material at an estimated grade of 7.99 g/t at the Limpoga zone.

Regional Geology

Recent exploration has highlighted North Sulawesi as a significant gold province located within a series of spatially overlapping Tertiary volcanic arcs. In the western ensialic portion, rhyodacitic volcanics overlie quartzo-feldspathic metamorphic basement. In contrast, the central and eastern ensimatic areas comprise marine basaltic basement overlain by andesitic volcanic, the centres of which have migrated progressively eastwards from the Early Miocene until the present day.

Property Geology

Located on the Manado Gold Property is a massive karsted basal limestone unit overlain by a volcanogenic sediment which is a reworked tuff. This sediment is commonly calcareous at is base and shows slump and bedding textures. The bedding dips from 15-60o to the north. Intruding this sequence is the Limpgoa andesite. The andesite is porphyritic and invariably altered to an assemblage of chlorite+ carbonate. Porphyroblasts of hornblende and feldspar occur in a fine grained matrix. Petrographic studies indicate this rock to be a tonalite. A sequence of andesite tuffs, flowing overlying the reworked tuff to the east is most likely volcanic equivalents of the Limpoga andesite. Unconformably overlying all the previous units is a series of volcaniclastic rocks. This unit comprises of volcanic conglomerate, breccia and, in places flows. The rocks are mostly of andesitic composition with minor porphyritic hornblende dacite.

Eluvial deposits of quartz and clay sit on the karsted limestone surface. There deposits are interpreted to be erosional remnants of silicificied cavefill sediments mostly in the footwall of the LP fault zone.

The east northeast – west southwest trending Limpoga Lambak fault is the main structural feature of the Limpogo zone. This fault dips 60° to the north and exploits the unconformity separating volcanistic rock to the north from the andesite, limestone and reworked tuff to the south. The LP fault is a splay off the Limpoga-Lambak fault. This fault dips from 45-60° to the north and is the main control of gold mineralization. The fault is manifested as a fault breccia. Clasts of subangular to angular silicified, argillised tuff and limestone.

Elsewhere in the immediate area, low sulphidation gold veins occur such as those in the Nona Hoa and Pasolo zones. Both styles of mineralization are hosted in Miocene carbonate rocks occurring in a northeasterly graben. Visible gold is characteristic of the three zones.

16

Mineralization

The rock types that host gold are quartz boulder and clay sediments which comprise 30% of the Limpoga deposit, brecciated fault zone material, limestone and reworked tuff. The formations at Mesel are hosted in silicified, decalcified and dolomitized carbonates developed at intersecting east-west and north-west faults.

The mineralized areas of the Mesel and Libongan zones are hosted in Miocene volcaniclastics and sediments occurring either as disseminations or as veins. The extensively occurring limestone, which may contain anomalous gold mineralization, presents an excellent potential for the development of a large bulk mineable gold deposit.

In this region, the following gold mineralization categories are recognized: gold copper porphyries; gold and metal breccias; and high and low sulphidation ephithermal systems.

Current Exploration Activities

We plan to conduct due diligence as soon as practicable pursuant to the Manado Agreement. Our due diligence period does not expire until March 31, 2010. Upon satisfactory due diligence and subject to entering into a formal option agreement, we plan to commence an initial exploration program of approximately $250,000 in order to confirm results of the previous exploration work on the mineralized zones.

GOLDEN SNOW PROJECT, FISH PROJECT AND CPG PROJECT

One May 29, 2009 we acquired an option for a 100% undivided interest (the “Nevada Option Agreement”) in certain mineral properties known as the Golden Snow Project in Eureka County, Nevada, the Fish Project in Esmeralda County, Nevada and the CPG Project in Mineral County, Nevada (collectively, the “Eureka Optioned Properties”). Our acquisition of the option was completed pursuant to the terms and conditions of an assignment agreement (the “Assignment Agreement”) dated May 29, 2009 with Portal Resources Ltd. (“PRL”) and Portal Resources US Inc.’s (the “Assignor”). Under the terms of the Assignment Agreement, the Assignor assigned all of its rights and interest in the an option agreement (the “Option Agreement”) dated August 28, 2008 among the Assignor, Claremont Nevada Mines LLC (“Claremont”), Scoonover Exploration LLC (“Scoonover”) and JR Exploration LLC (“JR”). In consideration of the assignment, we issued 150,000 shares of common stock to PRL.

In order to maintain and exercise the Nevada Option Agreement, we will be required to:

| (a) |

pay to Claremont: | |

| (i) |

$10,000 on August 28, 2009 (which amount has been paid); | |

| (ii) |

$15,000 on August 28, 2010; | |

| (iii) |

$20,000 on August 28, 2011; | |

| (iv) |

$25,000 on August 28, 2012; and | |

| (v) |

$30,000 on August 28, 2013 and each subsequent year of the term of the Nevada Option Agreement (the term is for ten years and may be renewed for an additional ten years); | |

| (b) |

pay the annual claim maintenance fees for the Optioned Properties during the term of the Nevada Option Agreement. The Eureka Optioned Properties are in good standing until September 1, 2010; and | |

| (c) |

pay $1,000 to Claremont in conjunction with the delivery to Claremont of a copy of a mine plan of operations in respect of the Eureka Optioned Properties, or a final feasibility study in respect of the Optioned Properties. | |

Upon our exercising of the Nevada Option Agreement, Claremont, Scoonover and JR will collectively reserve a 3% net smelter royalty on the Eureka Optioned Properties. We may purchase up to 2% of the royalty for $500,000 per 1% of the royalty.

Of the Golden Snow Project, the Fish Project and the CPG Project we have decided to focus our resources on the exploration of the Golden Snow Project due to its potential and current state of development.

17

Figure 3

Location of Nevada Properties

Golden Snow Project

Description of Property

The Golden Snow Project consists of 114 unpatented mining claims covering approximately 3.5 square miles eight miles southwest of Eureka, Nevada. The titles to the property will expire on September 1, 2010 if we do not renew our claim.

Location, Access, and Physiography

The Golden Snow Project is contiguous to the southern end of Staccato Gold’s Lookout Mountain property, which has identified several mineralized areas.

18

Figure 4

Location of Golden Snow Project

19

Property History

Exploration in the Eureka District commenced in the 1860s. The Company does not have any records of exploration work conducted on the Golden Snow Project prior to 2006.

In 2006, Minterra Resources acquired the Golden Snow Project. After its acquisition, Minterra Resources commenced a gravity survey and a 95 line kilometer ground magnetic survey across the Golden Snow Project. The gravity data identified two up-thrown (horst) blocks and the magnetic data indicate a prominent circular high that is approximately 2,782 feet in diameter and has a similar signature to Eocene age intrusive and extrusive rocks throughout the Eureka District.

In 2007, Minterra Resources completed a 932 sample soil geochemistry program designed to further refine and evaluate the prominent horst-bounding faults. Analysis of the data produced numerous large, coherent, multipoint clusters of anomalous gold, arsenic, antimony, mercury, lead, zinc and barite.

Geology

Many of the sediment-hosted gold deposits in Nevada appear to have developed at or near platform margin/basin margin sites where mineralization is found to be disseminated along the “low-stands” or karsted zone separated different stratigraphic units. The Golden Snow Project is positioned along this major platform margin that extends northwards to Cortez Hills, Pipeline and beyond. Future study of the location of these platform margins may result in the discovery of additional world-class gold deposits in Nevada.

Gold mineralization has come up along the host margin where Devonian age rocks are in contract with the Cambrian age rocks. The mineralization is not only found within the feeder fault, but it is also disseminated out along these “low-stand zones” which are commonly the break between different rock formations. Another example of the same host margin mineralization can be seen in a cross section of the mineralization at Lone Tree. Mineralization has also been discovered along the Wayne Zone Fault, which forms the western edge of the horst, and spreads out along favorable host rocks. Both styles of mineralization appear to potentially exist at the Golden Snow Project.

The geology of the Golden Snow Project has been interpreted to consist of Devonian age rocks striking north/south and trending southward under pediment cover. It has also been interpreted that the Cambrian section is possibly in fault contact with the Devonian section. Both rock types are favorable host rocks for Carlin-style mineralization throughout Nevada, especially in the Eureka Area.

The following sets out the geological units exposed on the Golden Snow Project:

Bay State Dolomite – The Bay State Dolomite is a massive dark grey to black to purplish dolomite which is reported to be 600-850 feet thick in the Eureka Area. The lower portion of this unit is made up of irregular bedded light-grey, dolomite sandstone. The upper portion is in gradational contact with the overlying Devils Gate Limestone.

Sentinel Mountain Dolomite – The Sentinel Mountain Dolomite gradationally overlies Oxyoke Canyon. It is composed of alternating, thick-bedded, coarse-grained, light-gray dolomite and motted, finely laminated, chocolate brown dolomites with a strong petroliferous odor when broken. It ranges in thickness from 410 feet to 600 feet.

Oxyoke Canyon – The Oxyoke is predominantly light gray to brown weathering, fine to medium-grained, quartz sandstone with a dolomatic matrix. It ranges in thickness of less than 20 feet up to 400 feet thick throughout the Eureka Area.

Sadler Ranch – The Sadler Ranch locally has been divided up into an upper and lower dolomite and a middle crinoidal dolomite. The lower dolomite is a medium to thick-bedded, very finely grained, light gray to yellowish-gray dolomite. The middle crinoidal dolomite is a light to medium-gray, poorly bedded, laminated to cross-laminated, crinoidal packstone with thin lenses of mudstone and packstone. The upper dolomite is a medium to thick-bedded, very fine-grained, light-gray laminated dolomite. The thickness of this unit varies from 90 feet to 450 feet.

20

McColley Canyon/Bartine Member – The McColley Canyon is dominantly a medium to thick bedded gray limestone with interbedded light brown-gray fossiliferous and organic-rich dolomite. The Bartine is composed of thin to medium-bedded, medium-gray, fine grained limestone and yellowish argillaceous limestone with abundant brachiopods. Some people combine these units whereas others map them as separate units. These rocks vary from 330 feet to 650 feet thick.

Beacon Peak Dolomite – This unit is a massive, light gray to brown, finely laminated dolomite, with local thin beds of finely laminated dolomite and thin lenses of well rounded, quartz-rich sandstones with a dolomitic matrix. The average thickness is 328 feet.

Mineralization

Two major target zones exist on the Golden Snow Project. These primary targets would be eastern and western boundary of the horst block. Both the eastern and western edge extends for over 15,000 feet as shown by gravity geophysics. Only drill hole ELP-8 drilled close enough to the eastern edge of the gravity high to test for possible mineralization. The remaining holes were either far to east and out into the abyss, or too far west of the eastern horst fault and on top of the gravity high.

A magnetic survey run over the eastern portion of the claim block shows a magnetic high and has been interpreted to be an intrusive as opposed to volcanics. This area is also a potential favorable target area for gold and base-metal mineralization.

Numerous anomalous zones with large, coherent clusters of anomalous gold, arsenic, antimony, mercury, lead and barite have been identified on the Golden Snow Project. The majority of the anomalies appear to be located in the northeastern and eastern and eastern portion of the claim block because of surface or near surface bedrock. These values are probably related to mineralization associated with the buried intrusive. Anomalous arsenic, antimony and mercury are present in the area of the Ratto Fault. Since these minerals are usually formed distal to gold in Carlin-style systems the geochemistry may indicate gold mineralization at depth.

Current Exploration Activities

Subject to obtaining sufficient financing, in the summer of 2010, we plan to retain a consulting geologist to conduct a review of the Golden Snow Project in order to recommend an exploration program. Once our consulting geologist has provided us with their findings, we will determine whether to proceed with an exploration program on these properties.

Fish Project

Description of Property

The Fish Project consists of 58 unpatented lode mining claims and is 492 hectares or 1.9 square miles.

Location, Access, and Physiography

The Fish Project is located on the northeaster flank of Lone Mountain in the Lone Mountain District, Esmeralda County, Nevada about 12 airline miles west of the historic mining town of Tonopah, Nevada.

21

Figure 5

Location of Fish Project

Road access is 14 miles west of Tonopah via U.S. Highway 95 to old Millers Mill Site and then 4.5 miles south along gravel and dirt roads. A network of unimproved dirt roads of the property offers access for four-wheel drive vehicles.

The Fish Project is located within the Basin and Range province of Nevada, characterized by rugged ranges and self-contained drainage basis floored by dry playa lakes. The property is located on the east and northeast facing slopes of Lone Mountain. Elevations range from 5700 feet in the relatively low relief area in the eastern part of the claim block to 6546 feet along a ridge in the western part of the claims. The eastern half of the claims have moderately steep to rolling slopes while the western half of the property have steep slopes cut by occasional cliffs. The summit of Lone Mountain is about 3 miles southwest of the property at an elevation of 9108 feet.

Property History

The Lone Mountain area was first prospected in the 1860s by Mexican miners but mining property did not begin until about 1900. Most of the mining and exploration activity in the Lone Mountain District during 1902 to 1918 period was directed towards the Alpine Mine and associated prospects on the western side of the range.

22

In the early 1980s, Atlas minerals previously conducted drilling on quartz veining in the northern portion of the property. However, their drilling program did not detect any significant mineralization.

Geology

The Fish Project lies within the Walker Lane structural belt of western Nevada, an area with multiple episodes of structural deformation and igneous activity. The dominant fault direction is a right lateral strike slip, sub parallel to and likely related to crustal scale motion along the San Andreas Fault system to the west. The topographic disruption is essentially a regional scale drag faulting system between two regional tectonic blocks.

Mineralization

Mineralization on the Fish Project is enigmatic due to a lack of information about the historic workings. However, field observations, mapped geology and geochemical samples suggest a carbonate replacement or quartz vein base metal – silver system. Historical reports of mineralization indicate anomalous values of zinc, lead, copper and silver.

Current Exploration Activities

The Fish Project currently represents an early stage exploration property. Due to the potential of the Golden Snow Project, we have deprioritized the implementation of an exploration program on this property.

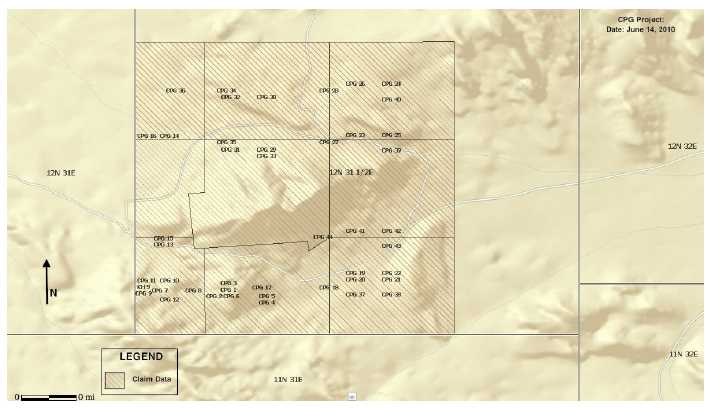

CPG Project

Description of Property

The CPG Project consists of 44 unpatented mining claims covering approximately 1.3 square miles within Mineral County, Nevada.

Location, Access, and Physiography

The CPG Project is located approximately 29 miles east of Schurz, Nevada in Mineral County, Nevada at the north end of Bovard Mining District.

23

Figure 6

Location of CPG Project

The CPG Project can be accessed from Hawthorne, Nevada via a 29 mile country gravel road and then turning west on an unimproved dirt road for about 4 miles. The CPG Project can also be reached from Fallon, Nevada by traveling east on U.S. Highway 50 for about 35 miles, then south on State Route 839 about 19 miles to the end of the pavement and then south along the gravel county road 11 miles to turn to the dirt access road. The nearest commercial airport is at Reno, approximately 110 miles from the CPG Project.

The climate is characterized by winters with temperatures between 0 and 40 degrees Fahrenheit and summer temperatures between 35 and 85 degrees Fahrenheit.

The CPG Project lies on the eastern flank of the Gabbs Valley Range, part of the Great Basin physiographic province is situated in a region of moderate to steep relief in northwestern Nevada. The Gabbs Valley Range is the central part of the S-shaped mountain block that includes the Gillis Range and the Pilot Mountains. The range is about 35 miles long, the summit occurring at 8360 feet with maximum relief of more than 3000 feet. Elevations on the property range from 4500 feet in the east to 5452 feet at the peak of Copper Mountain. North south trending mountain ranges and intermontane basins characterize the area.

Property History

The Company is unaware of any exploration work conducted on the CPG Project.

Geology

The CPG Project is centered on a plug of Jurassic granite intruding limestone of the Triassic Luning Formation. These rocks then formed an apparent topographic high that was buried under Miocene tuff.

The contact between the Luning Formation limestone and the Jurassic granite body shows a highly compressed metasomatic alteration pattern associated with mineralized porphyries. On the surface, the alteration patter extends only a few feet into the limestone. At depth, the historic reports suggest the zone is somewhat wider. Mineralization at the surface is found near the contact zone with the intrusive and along nearby fault zones. In both cases, the broken zones have been intruded by later bimodal felsic and mafic-appearing dikes.

24

To the west of Copper Mountain, the Miocene volcanic rocks can be seen overlying the Luning Formation and Jurassic granite. The contact is marked by a red stained zone that is likely the pre-eruptice paleosurface or may be a detachment fault.

Mineralization

A Jurassic age quartz monazite has intruded limestones and caused skarnification and deposition of principally copper mineralization. The skarn mineralization is pod-like and occurs adjacent to hornblende quartz feldspar porphyry dikes trending approximately east-west.

Curr ently Exploration Activities

The CPG Project is an early stage exploration property. Due to the potential of the Golden Snow Project, we have deprioritized the implementation of an exploration program on this property.

NON-MATERIAL MINERAL PROPERTIES

June Claims

On February 5, 2010, we entered into an option agreement to acquire the June Mineral Claims (the "June Claims") in the Alberni Mining Division of the Province of British Columbia.

Under the terms of the option agreement, we can acquire a 100% undivided interest in the property, subject to a royalty of 2% of net smelter returns, by paying $43,000 and issuing 300,000 common shares in stages over a three year period as follows:

| (a) |

paying the Optionor US $3,000 on execution of the June Option Agreement, which payment has been made; | |

| (b) |

paying the Optionor US $10,000 on or before May 6, 2010; | |

| (c) |

paying the Optionor US $10,000 and issuing 100,000 shares of the Optionee’s common stock on or before February 5, 2011; | |

| (d) |

paying the Optionor US $10,000 and issuing 100,000 shares of the Optionee’s common stock on or before the February 5, 2012; and | |

| (e) |

paying the Optionor US $10,000 and issuing 100,000 shares of the Optionee’s common stock on or before February 5, 2013. |

On May 6, 2010, we determined that we would not proceed with our interest in the June Claims. Accordingly, we did not make the option payment of US $10,000, which caused our interest in the June Claims to lapse.

Texada Gold Property

In June 2009, we staked a property called the “Texada Gold Property." The property was comprised of five mineral claims and was located on Texada Island, British Columbia. On June 10, 2010, we decided to allow our interest in the Texada Gold Property to lapse.

25

COMPLIANCE WITH GOVERNMENT REGULATION

British Columbia Regulations

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the Province of British Columbia. The main agency that governs the exploration of minerals in the Province of British Columbia, Canada, is the Ministry of Mines. The Ministry of Mines manages the development of British Columbia’s mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the Ministry of Mines regulates and inspects the exploration and mineral production industries in British Columbia to protect workers, the public and the environment.

The material legislation applicable to us is the Mineral Tenure Act, administered by the Mineral Titles Branch of the Ministry of Mines, and the Mines Act, as well as the Health, Safety and Reclamation Code and the Mineral Exploration Code. The Mineral Tenure Act and its regulations govern the procedures involved in the location, recording and maintenance of mineral titles in British Columbia. The Mineral Tenure Act also governs the issuance of leases which are long term entitlements to minerals.

All mineral exploration activities carried out on a mineral claim or mining lease in British Columbia must be in compliance with the Mines Act. The Mines Act applies to all mines during exploration, development, construction, production, closure, reclamation and abandonment. It outlines the powers of the Chief Inspector of Mines, to inspect mines, the procedures for obtaining permits to commence work in, on or about a mine and other procedures to be observed at a mine. Additionally, the provisions of the Health, Safety and Reclamation Code for mines in British Columbia contain standards for employment, occupational health and safety, accident investigation, work place conditions, protective equipment, training programs, and site supervision. Also, the Mineral Exploration Code contains standards for exploration activities including construction and maintenance, site preparation, drilling, trenching and work in and about a water body.

Additional approvals and authorizations may be required from other government agencies, depending upon the nature and scope of the proposed exploration program. If the exploration activities require the falling of timber, then either a free use permit or a license to cut must be issued by the Ministry of Forests. Items such as waste approvals may be required from the Ministry of Environment, Lands and Parks if the proposed exploration activities are significantly large enough to warrant them. Waste approvals refer to the disposal of rock materials removed from the earth which must be reclaimed. An environmental impact statement may be required.

In order to maintain our mineral claims in good standing, we must complete exploration work on the mineral claims and file confirmation of the completion of work on the mineral claims with the applicable mining recording office of the Ministry of Mines. In the Province of British Columbia, the recorded holder of a mineral claim is required to perform a minimum amount of exploration work on a claim or make payment in the equivalent sum in lieu of work. The fee is CDN $4.00 (approximately US$3.78) in the first three years and CDN$8.00 (approximately US$7.67) in subsequent years. There is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. The completion of mineral exploration work or payment in lieu of exploration work in any year will extend the existence of our mineral claims for one additional year. If we fail to complete the minimum required amount of exploration work or fail to make a payment in lieu of this exploration work, then our mineral claims will lapse, and we will lose all interest that we have in our mineral claims.

Nevada Regulations

Exploration and development activities are all subject to stringent national, state and local regulations. All permits for exploration and testing must be obtained through the local Bureau of Land Management (“BLM”) offices of the Department of Interior in the State of Nevada. The granting of permits requires detailed applications and filing of a bond to cover the reclamation of areas of exploration. From time to time, an archaeological clearance may need to be obtained prior to proceeding with any exploration programs.We plan to secure all necessary permits for any future exploration.

We have to apply for and receive permits from the BLM to conduct drilling activities on BLM administered lands. Mining operations are regulated by the Mine and Safety Health Administration (“MSHA”). MSHA inspectors periodically visit projects to monitor health and safety for the workers, and to inspect equipment and installations for code requirements. Workers must have completed MSHA safety training and must take refresher courses annually when working on a project. A safety officer for the project should also on site.

26

Other regulatory requirements monitor the following:

| (i) |

Explosives and explosives handling. | |

| (ii) |

Use and occupancy of site structures associated with mining. | |

| (iii) |

Hazardous materials and waste disposal. | |

| (iv) |

State Historic site preservation. | |

| (v) |

Archaeological and paleontological finds associated with mining. |

We believe that we are in compliance with all laws and plan to continue to comply with the laws in the future. We believe that compliance with the laws will not adversely affect its business operations. There is however no assurance that any change in government regulation in the future will not adversely affect our business operations.