Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2010

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from [ ] to [ ]

Commission file number 000-53685

INTELIMAX MEDIA INC.

(Exact name of registrant as specified in its charter)

|

British Columbia

|

N/A

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

2320 – 555 West Hastings Street, Vancouver, British Columbia

|

V6B 4N4

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Registrant's telephone number, including area code:

|

604.742.1111

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange On Which Registered

|

|

|

N/A

|

N/A

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock with $0.00001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes o No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. Yes x No o

Indicate by check mark whether the registrant ha submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of Common Stock held by non-affiliates of the Registrant on was $0 based on $0, the average of the bid and ask prices on the OTC Bulletin Board, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

26,147,567 as of July 9, 2010

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| 2 | |

| 12 | |

| 17 | |

| 17 | |

| 17 | |

| 17 | |

| 18 | |

| 19 | |

| 19 | |

| 23 | |

| 24 | |

| 25 | |

| 25 | |

| 26 | |

| 27 | |

| 31 | |

| 32 | |

| 33 | |

| 34 | |

| 35 |

1

PART I

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in Canadian Dollars (CAD$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars, references to CAD $ refer to Canadian dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this current report and unless otherwise indicated, the terms "we", "us", "our" and "our company" mean Intelimax Media Inc., unless otherwise stated.

General Overview

We are the resulting entity of the merger of Cicero Resources Corp. and Intelimax Media Inc., Cicero Resources Corp. was incorporated on October 19, 2007 under the laws of the State of Nevada. Intelimax Media Inc. was incorporated on April 17, 2006 under the laws of the Province of British Columbia. On May 28, 2009 the two companies merged and we are the resulting entity existing under the laws of British Columbia. We are an Internet media and advertising company that specializes in the development and management of industry-specific websites and portals focusing on new media, online games, search, publishing, and media sales. We are a development stage company that has generated only nominal revenues and has had limited operations to date.

Our principal executive office is located at 2320 – 555 West Hastings Street, Vancouver, British Columbia, Canada, V6B 4N4. Our telephone number is 604.742.1111.

Development of Business

In 2009, management’s efforts to identify a target business for merger or acquisition resulted in a merger agreement with Intelimax. On May 28, 2009 the merger closed and we adopted the business of Intelimax. We are now an Internet media and advertising company that develops and manages industry-specific websites and portals focusing on new media, online games, search publishing and media sales. Our major current and planned products and services are as follows:

|

●

|

Pay-Per-Click Search Engine: This is Internet search software developed by us which can be customized for use in websites catering to a variety of interests. It combines searching and advertising by providing users with industry specific Internet content in response to search queries and at the same time generating revenues by supplying content from advertisers who have agreed to be a part of the potential search results. When a user searches for a specific term in this search utility, a large number of associated results are displayed and revenue is generated when the user selects one of our advertisers’ websites. We employ this software in both Gamboozle.com and Climateseek.com and only minor development is required to create a licensable version and allow it to be used on third party websites. However, there can be no certainty that we will be able to complete this development as we lack the required capital. Even if we are able to complete the anticipated developments, there can be no assurance that this will lead to increased revenue as we face significant competition for users and subscribers in Gamboozle.com’s and Climateseek.com’s respective markets.

|

|

●

|

Gamboozle.com: This website provides users with the ability to search for various products or services in the online gaming industry, offers multiplayer casino games, fantasy sports applications as well as arcade gaming and social interaction for visitors to the website. We anticipate expanding on our current subscriber and visitor base through various marketing initiatives and creating revenue through advertising placed on Gamboozle.com by third party service providers and our ‘Pay-Per-Click’ Internet search software. Gamboozle.com is currently online and fully functional. Minor improvements are required to allow for paid subscriptions and development of enhanced social interaction tools. There can be no certainty that we will be able to integrate these improvements as we lack the required capital. Additionally, even if we are able to improve Gamboozle.com as anticipated, there can be no assurance that this will lead to increased revenue as we face significant competition for users and subscribers in Gamboozle.com’s market.

|

2

|

●

|

ClimateSeek.com: We anticipate that this website will provide services similar to Gamboozle.com, but with a focus on global warming, climate change, renewable energy and the global carbon markets. We anticipate including various applications and content with which we hope to attract users and visitors interested in environmental issues. If we attract sufficient users we will be able to create revenue through advertising placed by third party service providers and our ‘Pay-Per-Click’ Internet search software. Additionally, we anticipate that in the future ClimateSeek.com will be used for the online purchase and sale of carbon credits. This website has been released online in pre-production, or ‘beta’ format. We expect to complete the design of the website and to fully the integrate carbon calculator and social interaction tools by November 2009. There can be no certainty that we will be able to develop Climateseek.com past its current ‘beta’ stage as we do not currently have the capital required to do so. Even if we do complete the design of Climateseek.com as anticipated, this may not result in the generation of revenues as we face significant competition in this market.

|

|

●

|

Gaming Platform: We have developed and acquired software which allows users to play multi-player poker, blackjack, roulette as well as slot machines online. Currently, our online gaming software has been integrated into our Gamboozle.com website as well as our pages on Facebook, MySpace and Bebo, which are social networking websites and is provided free of charge. One our gaming platform is developed to the point where we are able to provide premium content, we intend to offer it to users on a subscription basis which, if sufficient interest is developed, will produce revenues through subscription payments as well as advertising placed in the games. Though the gaming platform is fully operational, we anticipate developing additional games, creating a licensable version and revising it for use on third party websites. We are currently unable to undertake such improvements as we lack the required capital. Additionally, even if we do improve our Gaming Platform as anticipated, there can be no assurance that these improvements will result in additional revenue as we face significant competition in this market.

|

|

●

|

Fantasy Sports: The term fantasy sports describes multi-player games in which users act as fantasy owners and build a team that competes against other fantasy teams based on the statistics generated by individual players or teams of a professional sport. We have developed software which allows users to create teams from the rosters of actual sports players and then use their teams to compete against other users in various categories such as points scored, yards gained or home runs registered, depending on the specific sport. We hope to attract a subscriber base which will provide us with the users we need to generate revenues through third party advertising. Our fantasy sports software has been integrated into our Gamboozle.com website on free and paid subscription bases. This software is currently functional, but we anticipate enhancing the content during the next 12 months to include basketball as one of the fantasy sports in which a league may be created and to create additional subscription models for increased flexibility for our paid subscribers. However, we are currently unable to undertake such improvements as we lack the required capital. Additionally, even if we do improve our Fantasy Sports software as anticipated, there can be no assurance that these improvements will result in additional revenue as we face significant competition in this market.

|

Our Products

Pay-Per-Click Search Engine

Both Gamboozle.com and ClimateSeek.com use our Internet search software which allows users to find websites that relate to the specific search terms which are entered and allows us to present paying advertisers within the results of such search, therefore ensuring revenue production when a user selects one of the paying advertiser’s websites.

For most advertisers, the preferred method of paying for having their advertisements listed on third party websites is based on how many people visit their website due to a specific advertisement. This is achieved by keeping track of which website the user was directed from when they visited the advertiser’s website. When a user clicks on an online advertisement to navigate to the advertiser’s website, this is called a ‘click through’. The Pay-Per-Click software will allow advertisers to see the effectiveness of their ads based on the click through rate and they will only pay when users click through to their site. We have developed our Pay-Per-Click software with the purpose of having advertisers pay based on the true performance of their advertisements and users delivered from our websites.

Two other critical aspects of the Pay-Per-Click software are:

|

1)

|

Real Time Keyword Bidding – advertisers can bid on having their website placed in our search result listings based on certain keywords entered by a user of the Pay-Per-Click search software. The advertiser with the highest bid for the specific word entered by the user will be displayed as the top listing within the search results presented to the user. Our management believes that the bid price model assures that prices reflect demand in the market for different keywords and facilitate changing demand as new products and services are developed.

|

|

2)

|

Front Loaded Payment – advertisers can deposit an initial payment with us which will be used to pay for their click through advertising as a form of retainer. As their listings are followed by users who find them through our Pay-Per-Click search software, the cost per click is removed from their account until their account has a balance of zero. The advertisers can “reload” their account at any time. This will provide a very predictable cost for the advertiser and ensure that we are able to collect payment for our services.

|

We employ this software in both Gamboozle.com and Climateseek.com and only minor development is required to create a licensable version and allow it to be used on third party websites. We anticipate completing this development within the next 12 months if we are successful in generating or attracting sufficient capital to fund our operations and retain our employees. However, there can be no certainty that we will be able to attract sufficient capital. Even if we are able to complete the anticipated developments, there can be no assurance that this will lead to increased revenue as we face significant competition for users and subscribers in Gamboozle.com’s and Climateseek.com’s respective markets.

3

Gamboozle.com

Gamboozle.com is a website which allows users to play various online games of skill, luck or strategy and offers a specialized Internet searching option which provides users with results for various websites which match the user’s search criteria. It combines our Pay-Per-Click Search Engine, our Gaming Platform and our Fantasy Sports software. Our management believes that as the number of users and visitors to Gamboozle.com grows, we will be able to begin providing strategically placed search results from paying advertisers.

Gamboozle.com offers online games through our Gaming Platform and free prizes which our management hopes will encourage frequent visits and extended stays on the website. By developing a consistent and large user base we hope to be able to charge various third parties for displaying their advertisements on Gamboozle.com. Additionally, we plan on offering a subscription option for our various gaming applications which would generate revenues through automatic monthly dues. Gamboozle.com is not an online gambling, betting or lottery website and does not accept funds related to actual gambling.

The following is a sample of the products and services provided by Gamboozle.com which our management hopes will attract a sizeable user base:

|

●

|

Gamboozle Bucks - the core of Gamboozle is the Gamboozle Bucks. This is the artificial currency the users will use to enter raffles and interact with each other. Users can earn Gamboozle Bucks by playing different games and/or interacting with the content on the website.

|

|

●

|

Raffles and Prizes - Gamboozle has a free raffle system. Players purchase raffle tickets with their Gamboozle Bucks and enter a raffle to win free prizes.

|

|

●

|

Free Fantasy Sports - Gamboozle offers quick and simple fantasy sports leagues that can be played daily, weekly, monthly and for the whole season.

|

|

●

|

Casual Games - Gamboozle offers online strategy, wordplay and action games that offer instant prizes such as Gamboozle Bucks and free spins on the Gamboozle virtual slot machine.

|

|

●

|

Multi Player Poker - poker is the ultimate multi-player social game. Gamboozle offers an online based poker game which does not involve gambling with real money.

|

|

●

|

Social Networking - social networking is the ability for users to communicate directly with each other, either through live chat or a messaging system on a website. This creates a feeling of community on a particular website and encourages return visits by users.

|

Our management believes that the practice of using online video games to advertise a product will be successful for promoting online gaming and casino websites as these two entertainment mediums are closely related and share similar target demographics. Due to the highly competitive nature of the industry, our management believes that advertisers are willing to pay a premium for a targeted audience and users who are interested in online gaming will be more likely to select advertisements of online gambling and gaming websites. Since the launch of Gamboozle.com we have experienced consistent growth in our user database. Our current user database has over 90,000 users and over 2,000 people visit Gamboozle.com per day. We have already generated nominal revenues through the placement of advertising throughout the website.

Gamboozle.com is currently online and fully functional. Minor improvements are required to allow for paid subscriptions and development of enhanced social interaction tools. We anticipate that these improvements will take approximately 3 months to implement if we have sufficient capital to retain our employees and fund our operations. There can be no certainty that we will be able to attract sufficient capital to implement the planned improvements. Additionally, even if we are able to improve Gamboozle.com as anticipated, there can be no assurance that this will lead to increased revenue as we face significant competition for users and subscribers in Gamboozle.com’s market.

4

ClimateSeek.com

|

ClimateSeek.com is a website through which we expect to provide comprehensive content and applications focused on global warming, climate change, renewable energy and the global carbon markets. Though the website is currently in development and has minimal content, we anticipate that some of its main characteristics will be:

|

|

|

●

|

Our Pay-Per-Click Internet search tool which will be optimized to provide relevant search results from paying advertisers.

|

|

●

|

A social networking component which will allow users to discuss environmental issues in real time as well as through posting of messages. As with Gamboozle.com, it is our belief that social networking of this type will promote more frequent and longer visits to our website.

|

|

●

|

A carbon calculator which will calculate the amount of carbon a user produces given their particular lifestyle, residence, car, etc.

|

|

●

|

Environmentally themed online video games and contests.

|

|

●

|

Consistently updated news, blogs, articles relating to global warming, climate change, renewable energy and the global carbon markets.

|

|

●

|

Listings of environmentally focused products and applications which can help reduce a user’s negative impact on their environment. This may be a supplemental revenue source if sufficient users purchase products from retailers featured on ClimateSeek.com

|

Our management believes that by providing informative content and services we will be able to position ClimateSeek.com as a popular destination for Internet users interested in environmental issues. In addition, our management anticipates opportunities in the newly formed market for carbon credits, either as a reseller of carbon credits on ClimateSeek.com, or as a project proponent or an investor in projects generating carbon credits for sale in various carbon credit markets. We anticipate finalizing the development of Climateseek.com in November of 2009. However, there can be no certainty that we will be able to develop Climateseek.com past its current ‘beta’ stage by November of 2009 or at all as we do not currently have the capital required to do so. Even if we do complete the design of Climateseek.com as anticipated, this may not result in the generation of revenues as we face significant competition in this market.

Carbon Credits

The concept of carbon credit trading was developed as a result of the Kyoto Protocol and various other local legislative and corporate initiatives which aimed to control the production of green house gases (GHG) by countries and companies. Countries or companies whose output of GHG is below a fixed target are entitled to collect and sell surplus credits to countries and companies who are not meeting their reduction limits. Companies or government projects which cannot fulfill the reduction target can buy the surplus credits from other companies or governments in order to offset their emissions.

The Voluntary Market

The voluntary market refers to companies, government agencies, non-governmental agencies (NGOs) and individuals that purchase carbon credits for purposes other than meeting regulatory targets such as the ones set out by the Kyoto Protocol. A buyer can voluntarily purchase credits from various carbon credit projects. The action is defined as voluntary so long as the credits will not be used to meet a regulatory target. Retailers can sell voluntary emission reduction credits for voluntary or regulatory purposes. However, the vast majority of retailers only sell these voluntary credits to the voluntary market.

Over the past several years there has been a steadily increasing demand for voluntary carbon credits or offsets. In 2007 the voluntary market saw a total of US $332 million worth of carbon credit transactions, up from US $100 million the year before, according to the annual Ecosystem Market Place report. However, while growing rapidly, the retail market for voluntary carbon credits is still relatively small and fragmented compared to the Kyoto regulated market. There are an estimated 60 providers worldwide, most of them based in Europe, North America, and Australia.

5

Retailers or sellers tend to target a wide variety of market segments, including individuals, businesses, government departments, cities, townships and international events. Some are for-profit and others are non-profit. Their websites will generally have a carbon calculator, where users can calculate emissions from various activities such as flying or driving automobiles. Offsets for air travel seem to be the most popular marketing tool and individuals will usually receive confirmation in the form of a certificate in return for their purchase.

The Chicago Climate Exchange (CCX) is currently the largest exchange where voluntary carbon credits are sold and purchased. All CCX projects must first undergo a standardized registration, verification and crediting procedure approved by the CCX Offsets Committee before CCX credits are issued. Once issued, credits must be verified by an approved third-party CCX verifier and registered in the CCX registry. CCX credits can only be issued after the emission offset has actually occurred.

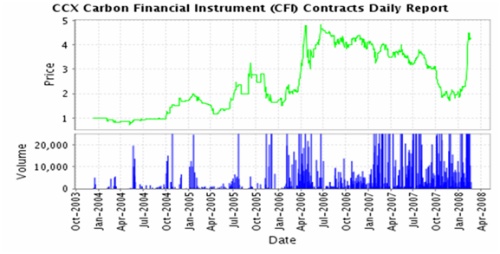

As can be seen in the table of historical results below, the CCX does have a significant amount of activity even though most of the trading taking place is based on voluntary purchases:

Prices and Volume reported in Metric Tons of CO2

6

We expect the market for voluntarily purchased carbon credits to increase as our society becomes more environmentally conscious and we will develop various applications and trading markets within the Climateseek.com website to facilitate the trading of carbon credits between individuals and businesses as consumers or vendors.

Carbon credits in the voluntary market range in price from as little as US $0.50 per credit, to as high as US $45.00 on some websites. This mainly depends on the type of project, verification or standard, and amount of credits being sold. At the retail level and in small quantities, carbon credits can be sold at much higher prices. However consumers are paying closer attention to the credibility of each company, type and sustainability of projects, and are becoming savvy to prices of offsets. We anticipate that with proper additions of content, by November of 2009 ClimateSeek.com can become a comprehensive resource for users looking to educate themselves and purchase carbon credits to offset their personal or business GHG emissions.

There can be no certainty that we will be able to develop Climateseek.com as anticipated. Please review the various risk factors which may affect our ability to complete the development of Climateseek.com, as well as our other websites and software products, in the “Risk Factors” section on Page 10 of this Registration Statement. In particular, we do not currently have sufficient capital to undertake the planned development of Climateseek.com and will be relying on equity and debt financing in order to complete development of Climateseek.com. There can be no assurance that such financing will be secured by us. Additionally, as Climateseek.com is not fully developed, it is possible that one of our competitors who is more established and better funded will develop similar content and features thereby eliminating what we believe to be our competitive advantage.

Gaming Software

We have developed software which enables users to play various casino type games such as blackjack, roulette and slot machines on our websites. We have acquired rights to software for online multi-player poker from Fireswirl Technologies Inc., a publicly traded company on the Canadian TSX Venture Exchange for a period of 36 months. The current agreement, entered into on August 22, 2008 requires us to provide a license fee equal to 10% of revenues derived from this software during the first 18 months and 20% for the next 18 months. The total amounts are not to exceed CAD $750,000 during the first 18 months and CAD $1,100,000 during the last 18 months. There are also provisions on the agreement for the outright purchase of this software and we are negotiating such a purchase at this time.

We have been working with, and developing, this software for our particular uses and have imbedded it into our Gamboozle.com website. Our gaming software allows users to play these various games against other users in real time. In particular, our poker software has been designed to host over 200 at the same time who are engaged in poker games amongst each other on our website.

Currently, we have integrated the poker software in our Gamboozle.com website. If we are successful in developing a sizeable database of users for our gaming software we will be able to expand our application offerings with premium content and increased prizes. In turn, we will be able to introduce a subscription system which will generate revenues from monthly subscription payments. Additionally, if our gaming software gains users and proves its popularity, it may be possible to license it to various other websites which are looking to attract visitors with additional applications.

A large number of users are necessary to create sufficient visits to our websites to be able to earn revenues from advertising and provide users with other users to play with or against. It is important for our business plan to generate a large number of users who visit our websites and use our application, but there can be no certainty that we will be able to attract sufficient users to make our business profitable. This is especially true for our poker software. As our multi-player poker software relies on multiple players in each virtual poker ‘room’ it is essential that we have sufficient users using our gaming software at the same time to induce other users to visit our website and prolong their stay.

Though the gaming platform is fully operational, we anticipate developing additional games, creating a licensable version and revising it for use on third party websites during the next 12 months if we have sufficient capital to undertake these developments. However, there can be no certainty that we will be able to attract sufficient capital to implement the anticipated improvement. and even if we do, there can be no assurance that these improvements will result in additional revenue as we face significant competition in this market.

7

Fantasy Sports

We have recently developed software for our users to play fantasy sports on our gaming website, Gamboozle.com. Fantasy sports describes multi-player games in which users act as fantasy owners and build a team that competes against other fantasy teams based on the statistics generated by individual players or teams of a professional sport. Probably the most common variant converts statistical performance of various players into points that are compiled and totaled according to a roster selected by a manager that makes up a fantasy team. These point systems are typically simple enough to be manually calculated by the user appointed as manager of the league. More complex variants use computer modeling of actual games based on statistical input generated by professional sports. In fantasy sports users have the ability to trade, dismiss, and sign players, like a real sports owner.

The industry surrounding fantasy sports experienced a drastic increase in popularity with the invention and popularization of the Internet. The Internet made stat collection as well as news and information more readily available. This made the experience and enjoyment of fantasy sports much more immediate and engrossing. It's estimated by the Fantasy Sports Trade Association that 29.9 million people age 12 and above in the U.S. and Canada played fantasy sports in 2007 and one can find fantasy sports on all of the major sports websites such as ESPN.com, Sportsline.com and more.

As opposed to all of our competitors, our fantasy sports software system allows users to play in a weekly game as opposed to being committed to the game for an entire season. Though seasonal subscriptions will be available, our current subscription model requires users to pay an entrance fee every week with the chance of winning a prize every week as well. This creates a small initial investment for the user and potentially, a consistent revenue stream for us.

Currently, the our fantasy sports software offers leagues in the National Football League, National Hockey League, Major League Baseball, and in mixed martial arts fighting. We have integrated our fantasy sports software into our Gamboozle.com website and we have adapted an application called Mixed Martial Arts Challenge, based heavily on our fantasy sports software, for use by Facebook members. Our management hopes that we will be able to license our fantasy sports software to heavily visited websites looking to enhance their offerings for a monthly fee or share of subscriptions.

Our fantasy sports software has been integrated into our Gamboozle.com website on free and paid subscription bases. This software is currently functional, but we anticipate enhancing the content during the next 12 months to include basketball as one of the fantasy sports in which a league may be created and create additional subscription models for increased flexibility for our paid subscribers if we have the necessary capital to fund this development. However, there can be no assurance that we will be able to attract the necessary capital and even if we do improve our Fantasy Sports software as anticipated, there can be no assurance that these improvements will result in additional revenue as we face significant competition in this market.

Distribution Methods

Attracting users and advertisers to our websites will be based on the following:

|

●

|

Software Licensing – we intend to increase the number of people using our software systems by licensing them to other website owners. We will share in the revenue generated through websites with which already have existing members and traffic.

|

|

●

|

Viral marketing/forums/blogs – we intend to capitalize on the recent popularization of online social communities by creating positive word of mouth within those communities and the Internet as a whole. We hope that imbedding our online gaming and fantasy sports software free of charge into websites such as Facebook or MySpace will create positive impressions on the users and drive visitors to our site.

|

|

●

|

Online advertising - we intend to take advantage online advertising of ClimateSeek.com and Gamboozle.com through various websites with high numbers of visitors. Our management believes that the most effective forms of advertising appear to be highly targeted text and visual advertisements on websites focused on similar interests to that of Gamboozle.com and ClimateSeek.com users.

|

|

●

|

Trade shows/Event Marketing – there are a number of trade shows that are geared towards the climate awareness and carbon trading industries as well as online gaming. We intend to market our websites and software by attending these various events and displaying our products and services.

|

|

●

|

Search Engine Optimization – our websites are developed with consideration to how they will interact with large Internet search utilities such as Google or Yahoo. By optimizing our websites in such a way that these ubiquitous search engines can identify our websites and their content more easily and therefore list us near the top of their result listings, we hope to attract more visitors.

|

|

●

|

Publicity – we anticipate employing website specific promotions for Gamboozle.com and ClimateSeek.com to attract visitors to our websites. These promotions may involve reaching out to communities and schools for educational programs on emission reduction via ClimateSeek.com or free raffles on Gamboozle.com

|

|

●

|

Print media – numerous industry publications exist for the climate as well as the Internet gaming industries and we anticipate purchasing advertising or arranging sponsorship in order to increase the awareness of our websites, products, and services.

|

|

●

|

Email campaigns/Newsletters – we are implementing email driven advertising campaigns for the purpose of attracting potential advertisers and as a marketing tool geared towards our membership database.

|

8

Competition

Gamboozle.com

We face competition from various websites currently in operation which provide products and services similar to those of Gamboozle.com ranging from micro home-business based businesses to multi-million dollar international enterprises. Some of our major competitors are Armorgames.com, pogo.com, miniclip.com, crazymonkeygames.com and newgrounds.com, as well as Gambling911.com, Casino.com, Pokerpages.com and Gambling.com which primarily offer casino type games.

Many of these competitors have longer operating histories, greater brand recognition, a higher number of subscribers and visitors to their websites, and better financial resources than we do. In order for us to successfully compete in the online gaming industry, we will need to attract more visitors to Gamboozle.com through advertising and attractive content. However, there can be no assurance that we will be able to attract sufficient visitors even if we fully develop Gamboozle.com and introduce all of our anticipated content to effectively compete in this marketplace.

Gambling.com, in particular is very similar to our website in that it uses a pay-per-click listings search, advertising imbedded in visible areas of the website and offers a tool that enables the user to find desired websites via the use of keyword searches. Our Gamboozle.com website is structured similarly, but with more focus on our free games section and possesses the following competitive advantages:

|

●

|

We offer a members’ area for users to interact with each other and create a community. We hope that our development of an online community of users around Gamboozle.com and its offerings will promote positive word of mouth marketing, loyalty amongst our user base and repeated visits.

|

|

●

|

Gamboozle.com offers a free online slot machine with cash and prizes. Users earn free Gamboozle Bucks on the website that they can use to spin the slot machine and win prizes. Our slot machine jackpot carries an average grand prize of over $1,000. Furthermore, this jackpot may be syndicated through affiliated websites as well as advertisements to attract more visitors to Gamboozle.com.

|

|

●

|

We have developed software which will allow other website owners to use our Pay-Per-Click search software in the form of an unobtrusive bar the top of their websites. This will provide added functionality to third party websites while potentially creating revenues for us.

|

|

●

|

We have incorporated a comprehensive blogging, or real time message posting system, system into Gamboozle.com. As a result, Gamboozle.com should be regularly updated with new content from users which will increase the frequency with which it is identified by various search programs on the Internet and our position in any search result listings generated by those programs.

|

ClimateSeek.com

We will face competition in from a number of websites ranging from micro home-business based businesses to multi-million dollar international enterprises. Websites such as TreeHugger.com, ENN.com and Terrapass.com provide various services pertaining to environmental news, information and the sale of carbon credits. These three websites have longer operating histories, greater brand recognition, a higher number of visitors and better financial resources than we do. In order for us to successfully compete in this marketplace, we will need to attract more visitors to Climateseek.com through advertising and attractive content. However, there can be no assurance that we will be able to attract sufficient visitors, and efficiently compete in this marketplace, even if we fully develop Climateseek.com and introduce all of our anticipated content.

We hope to distinguish ClimateSeek.com from these established websites by providing a more comprehensive experience for the user. We plan to do this by:

|

●

|

Offering not only the ability to offset a user’s GHG emissions by providing a carbon credit market, but also educate and inform on how the carbon credits were produced, the impact of GHG gasses on the global environment and the state of global climate issues in general. Our competitors offer the ability to purchase carbon offsets (CarbonFund.org) or provide news and information (TreeHugger.com), but our management is not aware of any website which combines the two into a comprehensive online destination for environmental awareness and the purchase of carbon credits.

|

|

●

|

Creating a community around ClimateSeek.com and its users. Out management hopes this will create a sense of loyalty amongst the visitors to our website and result in extended and more frequent visits to check for not only updates regarding environmental issues, but also other members of the website.

|

Additionally, a growing number of institutions and purchasers such as EcoSecurities, Natsource, CO2e, Shell, Merrill Lynch, Barclay’s Capital, World Bank and the European Bank for Reconstruction and Development are getting involved in conducting and facilitating carbon credit trading. An increasing number of exchanges including the European Climate Exchange, which deals mostly with carbon trading mandated under the Kyoto Protocol rules, and the Chicago Climate Exchange which is focused on North American carbon trading and generally sees participants join on a voluntary basis, have also gotten involved in the trading of carbon credits. Though these institutions and exchanges are far better established and have greater financial resources than us, they focus on institutional and corporate clients whereas Climateseek.com will cater mostly to the trading of carbon credits by individuals.

9

Fantasy Sports

Fantasy sports platforms such as ours are available on all of the major sports related news sites such as ESPN.com, CBS Sportsline and TSN.ca as well as less established websites focused on the fantasy sports marketplace. Many of these competitors have a much larger subscriber base, substantially greater financial resources and can gain access to subscribers and visitors through advertising and awareness over many different forms of media, including television networks owned by them. We hope to be able to effectively compete against the established websites in this marketplace by providing a fantasy sports platform with the following advantages:

|

●

|

None of our major competitors license their software. They appear to be focusing on their specific product exclusively on their specific website. Our management believes that this gives us an opportunity to start offering our product to many small and medium sized websites which are looking to add fantasy sports content to their applications.

|

|

●

|

Most of our competitors use a full season model. This means that users pay once per season to play. A season is generally defined by the annual season of the sport on which the ‘fantasy team’ is based. While this has proven to be an effective model, our management believes that providing for more flexible subscription lengths will promote increased usage. In a typical fantasy season, many participants no longer have a chance to win before the season is over, but they still want to play. Our system allows users to begin a new fantasy sports game every week, with a new round starting every Monday or Tuesday.

|

Subscription Poker

Once our multi-player online poker software has been fully developed, we anticipate providing premium content and services on a subscription basis. Currently, there is one major subscription poker network, Pureplay.com, as well as some smaller websites such as spadeclub.com and clubwpt.com. These appear to be to be our major competitors in the subscription poker space.

These three websites have longer operating histories, greater brand recognition, a higher number of visitors and better financial resources than we do. In order for us to successfully compete in this marketplace, we will need to provide unique content and appropriately market our software.

We believe that our systems will have the following advantages:

|

●

|

None of the other systems appear to have a licensing model. By making our software available on many websites we can take immediate market share without spending significant funds on marketing.

|

|

●

|

Our price point will be lower. All of the listed competitors charge a monthly membership fee of $19.95.

|

Our competitors may develop similar software to ours and use the same methods as we do and generally be able to respond more quickly to new or emerging technologies and changes in legislation and regulations relating to the industry. Additionally, our competitors may devote greater resources to the development, promotion and sale of their software or services than we do. Increased competition could also result in loss of key personnel, reduced margins or loss of market share, any of which could harm our business.

Intellectual Property

We own the copyright of our logos and all of the contents of our websites, www.Gamboozle.com and www.ClimateSeek.com. We have also developed proprietary software that consists of our gaming platform (poker and casino), fantasy sports and our Pay-Per-Click search software.

Research and Development

We have not spent any amounts on which has been classified as research and development activities in our financial statements since our inception.

10

Government Regulation and Costs of Compliance

Online Gaming

We do not require any government approvals to carry out our business plan as disclosed above. If, at some point in the future, our management chooses to use our gaming software for legal online gambling, the state of gambling laws in the US will have an impact on our business. Currently, the legislation regarding online gambling is in flux and not uniform. The following are some recent developments in US law regarding online gambling:

|

●

|

On May 6, 2009, Congressman Barney Frank (D-MA) unveiled a bill designed to allow U.S.-based companies to obtain licenses and operate federally regulated online gambling sites. The bill, titled the Internet Gambling Regulation, Consumer Protection, and Enforcement Act of 2009 (H.R. 2267), would also allow such sites to accept bets from U.S. customers. The bill has not yet been signed into law.

|

|

●

|

On June 7, 2007, Representative Robert Wexler (D-FL) introduced HR 2610, the Skill Game Protection Act, which would legalize Internet poker, bridge, chess, and other games of skill. Also on June 7, 2007 Representative Jim McDermott introduced H.R. 2607, the Internet Gambling Regulation and Tax Enforcement Act. IGRTEA would legislate Internet gambling tax collection requirements. The bill has not yet been signed into law.

|

|

●

|

In September 2006 both the US House of Representatives and the US Senate passed legislation (as an amendment to the unrelated SAFE Port Act) that would make transactions from banks or similar institutions to online gambling sites illegal. The passed bill only addressed banking issues. The Act was signed into law on October 13, 2006 by President George W. Bush. In response to SAFE Port Act, a number of online gambling operators including PartyGaming, Bwin, Cassava Enterprises, and Sportingbet announced that real-money gambling operations would be suspended for U.S. customers.

|

Environment

We anticipate that government regulation in the field of environmental protection and carbon dioxide production will impact the profitability and marketability of our www.ClimateSeek.com products and services. Though currently, increased regulation is expected, there is no certainty that such regulation will be implemented in a timely fashion and no certainty of the impact it will have on our business.

We are not aware of any material violations of environmental permits, licenses or approvals issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our intended business. At this time, we do not anticipate any material capital expenditures to comply with environmental or various regulations and requirements.

While our intended projects or business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us through increased operating costs and potential decreased demand for our technologies or products or services, which could have a material adverse effect on our results of operations.

Online Services

We are subject to a number of foreign and domestic laws and regulations that affect companies conducting business on the internet. In addition, laws and regulations relating to user privacy, freedom of expression, content, advertising, information security and intellectual property rights are being debated and considered for adoption by many countries throughout the world. We face risks from some of the proposed legislation that could be passed in the future.

In the US, laws relating to the liability of providers of online services for activities of their users and other third parties are currently being tested by a number of claims, which include actions for libel, slander, invasion of privacy and other tort claims, unlawful activity, copyright and trademark infringement and other theories based on the nature and content of the materials searched, the ads posted or the content generated by users. Certain foreign jurisdictions are also testing the liability of providers of online services for activities of their users and other third parties. Any court ruling that imposes liability on providers of online services for activities of their users and other third parties could harm our business.

A range of other laws and new interpretations of existing laws could have an impact on our business. For example, the Digital Millennium Copyright Act has provisions that limit, but do not necessarily eliminate, our liability for listing, linking or hosting third-party content that includes materials that infringe copyrights. The Child Online Protection Act and the Children’s Online Privacy Protection Act restrict the distribution of materials considered harmful to children and impose additional restrictions on the ability of online services to collect information from children under 13. In the area of data protection, many states have passed laws requiring notification to users when there is a security breach for personal data, such as California’s Information Practices Act. The costs of compliance with these laws may increase in the future as a result of changes in interpretation. Furthermore, any failure on our part to comply with these laws may subject us to significant liabilities.

Similarly, the application of existing laws prohibiting, regulating or requiring licenses for certain businesses of our advertisers, including, for example, online gambling, distribution of pharmaceuticals, adult content, financial services, alcohol or firearms, can be unclear. Application of these laws in an unanticipated manner could expose us to substantial liability and restrict our ability to deliver services to our users.

We also face risks due to government failure to preserve the internet’s basic neutrality as to the services and sites that users can access through their broadband service providers. Such a failure to enforce network neutrality could limit the internet’s pace of innovation and the ability of large competitors, small businesses and entrepreneurs to develop and deliver new products, features and services, which could harm our business.

We are also subject to federal, state and foreign laws regarding privacy and protection of user data. We post on our web site our privacy policies and practices concerning the use and disclosure of user data. Any failure by us to comply with

11

Employees

We currently have 4 employees engaged in administrative tasks and software development, all of whom are employed on a full time basis. We also anticipate engaging various consultants to provide legal, accounting, marketing and software development services.

Our business operations are subject to a number of risks and uncertainties, including, but not limited to those set forth below:

Risks Related to Our Business

We do not have sufficient capital resources to meet our cash requirements for the next 12 months and there can be no certainty that we will be able to secure the financing required to meet those requirements. If we do not have sufficient capital to fund our operations, you may lose your investment.

As of March 31, 2010 we had CAD $1,444 in our bank account. For the year ended March 31, 2010 our monthly cash requirement was approximately CAD $35,325. As of March 31, 2010 we did not have sufficient capital resources to fund our operations for one month. We intend to meet our ongoing cash requirements of CAD $1,047,000 for the next 12 months through a combination of equity and debt financing. However, there can be no assurance that we will be able to secure such financing. If financing is available, it may involve issuing securities which could be dilutive to holders of our shares. In the event we do not raise additional capital from conventional sources, such as our existing investors or commercial banks, it is likely that our growth will be restricted and we may be forced to scale back or curtail implementing our business plan and our business may fail. If we do not have sufficient capital to fund our operations, you may lose your investment.

Because our auditors have issued a going concern opinion, there is substantial uncertainty we will continue operations in which case you could lose your investment.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an ongoing business for the next 12 months. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue in business. As such we may have to cease operations and you could lose your investment.

Intelimax was incorporated on April 17, 2006, generated CAD $10,972 in revenue as of March 31, 2010, and have losses that we expect to continue into the future. There is no assurance our future operations will result in profitable revenues. If we cannot generate sufficient revenues to operate profitably, we will cease operations and you will lose your investment. Intelimax’s accumulated deficit from April 17, 2006 (inception) through March 31, 2010 was CAD $2,273,581.

Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

|

●

|

completion of this offering;

|

|

●

|

our ability to develop and continually update our websites, internet search utilities and gaming software;

|

|

●

|

our ability to procure and maintain on commercially reasonable terms relationships with third parties to integrate and maintain our search utilities and game software;

|

|

●

|

our ability to identify and pursue mediums through which we will be able to market our products;

|

|

●

|

our ability to attract customers to our products;

|

|

●

|

our ability to generate revenues through advertisements on our websites; and

|

|

●

|

our ability to manage growth by managing administrative overhead.

|

Based upon current plans, we expect to incur operating losses in future periods because we will be incurring expenses and not generating significant revenues. We cannot guarantee that we will be successful in generating significant revenues in the future. Failure to generate revenues which are greater than our expenses will cause you to lose your investment.

12

If we cannot prevent other companies from infringing on our technologies, we may not achieve profitability and you may lose your investment.

Our success is heavily dependent upon proprietary technology. To protect our proprietary technology, we rely principally upon copyright and trade secret protection. All proprietary information that can be copyrighted is marked as such. There can be no assurance that the steps taken by us in this regard will be adequate to prevent misappropriation or independent third-party development of our technology. Further, the laws of certain countries in which we anticipate licensing our technologies and products do not protect software and intellectual property rights to the same extent as the laws of the United States. We generally do not include in our software any mechanism to prevent or inhibit unauthorized use, but we generally require the execution of an agreement that restricts unauthorized copying and use of our products. If unauthorized copying or misuse of our products were to occur, our business and results of operations could be materially adversely affected.

While the disclosure and use of our proprietary technology, know-how and trade secrets are generally controlled under agreements with the parties involved, there can be no assurance that all confidentiality agreements will be honored, that others will not independently develop similar or superior technology, that disputes will not arise concerning the ownership of intellectual property, or that dissemination of our proprietary technology, know-how and trade secrets will not occur. Further, if an infringement claim is brought against us, litigation would be costly and time consuming, but may be necessary to protect our proprietary rights and to defend ourselves. We could incur substantial costs and diversion of management resources in the defense of any claims relating to the proprietary rights of others or in asserting claims against others. If we cannot prevent other companies from infringing on our technologies, we may not achieve profitability and you may lose your investment.

If we are subject to intellectual property rights claims which may be costly to defend, could require the payment of damages and could limit our ability to use certain technologies in the future we may not generate sufficient revenues or achieve profitability.

Companies in the Internet, technology and media industries own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. We may be subject to intellectual property rights claims in the future and our technologies may not be able to withstand any third-party claims or rights against their use. Any intellectual property claims, with or without merit, could be time consuming, expensive to litigate or settle and could divert management resources and attention. An adverse determination also could prevent us from offering our products and services to others and may require that we procure substitute products or services for these members.

With respect to any intellectual property rights claim, we may have to pay damages or stop using technology found to be in violation of a third party’s rights. We may have to seek a license for the technology, which may not be available on reasonable terms and may significantly increase our operating expenses. The technology also may not be available for license to us at all. As a result, we may also be required to develop alternative non-infringing technology, which could require significant effort and expense. If we cannot license or develop technology for the infringing aspects of our business, we may be forced to limit our product and service offerings and may be unable to compete effectively. Any of these results could harm our brand and prevent us from generating sufficient revenue or achieving profitability.

Changing consumer preferences will require periodic product introduction. If we are unable to continually meet consumer preferences we may not generate significant revenues.

As a result of changing consumer preferences, many Internet search utilities and websites are successfully marketed for a limited period of time. Even if our products become popular, there can be no assurance that any of our searching or gaming products will continue to be popular for a period of time. Our success will be dependent upon our ability to develop new and improved product lines. Our failure to introduce new features and product lines and to achieve and sustain market acceptance could result in us being unable to continually meet consumer preferences and generating significant revenues.

We face intense competition and if we are unable to successfully compete with our competitors we will not be able to achieve profitability.

The Internet search and Internet gaming industries are highly competitive. Many of our competitors have longer operating histories, greater brand recognition, broader product lines and greater financial resources and advertising budgets than we do. Many of our competitors offer similar products or alternatives to our products. There can be no assurance that we will procure an on-line market that will be available to support the sites we will offer or allow us to seek expansion. There can be no assurance that we will be able to compete effectively in this marketplace.

Further, our competitors may be able to develop technologies more effectively, have significantly more game content than us, may be able to license their technologies on more favorable terms, and may be able to adopt more aggressive pricing or licensing policies than us. They may have longer operating histories, greater brand name recognition, larger customer bases and significantly greater financial, technical and marketing resources. In the event that we are unable to successfully compete with our competitors we will not be able to achieve profitability.

13

If we do not attract customers to our website on cost-effective terms, we will not make a profit, which ultimately will result in a cessation of operations.

Our success depends on our ability to attract retail customers to our website on cost-effective terms. Our strategy to attract customers to our website, which has not been formalized or implemented, includes viral marketing, the practice of generating "buzz" among Internet users in our products through the developing and maintaining weblogs or "blogs", online journals that are updated frequently and available to the public, postings on online communities such as Facebook, MySpace, Yahoo!(R) Groups and amateur websites such as YouTube.com, and other methods of getting Internet users to refer others to our website by e-mail or word of mouth; search engine optimization, marketing our website via search engines by purchasing sponsored placement in search results; and entering into affiliate marketing relationships with website providers to increase our access to Internet consumers. We expect to rely on word of mouth marketing as the primary source of traffic to our website, with search engine optimization and affiliate marketing as secondary sources. Our marketing strategy may not be enough to attract sufficient traffic to our website. We do not currently employ any personnel specifically assigned to the marketing of our products. If we do not attract customers to our website on cost-effective terms, we will not make a profit, which ultimately will result in a cessation of operations.

Our success depends on the continuing efforts of our senior management team and employees and the loss of the services of such key personnel could result in a disruption of operations which could result in reduced revenues.

Our future success depends heavily upon the continuing services of the members of our senior management team, in particular our President, Michael Young, and our Chief Executive Officer, Charles Green. If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, we may not be able to replace them easily or at all, and our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. Competition for senior management and key personnel is intense, the pool of qualified candidates is very limited, and we may not be able to retain the services of our senior executives or key personnel, or attract and retain high-quality senior executives or key personnel in the future. We do not currently maintain key man insurance on our senior managers. The loss of the services of our senior management team and employees could result in a disruption of operations which could result in reduced revenues.

We rely on highly skilled personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively, generate sufficient revenues and achieve profitability.

Our performance and future success depends on the talents and efforts of highly skilled individuals. We will need to continue to identify, hire, develop, motivate and retain highly skilled personnel for all areas of our organization. Competition in the software industry for qualified employees is intense. Our continued ability to compete effectively depends on our ability to attract new employees and to retain and motivate our existing employees.

As competition in our industry intensifies, it may be more difficult for us to hire, motivate and retain highly skilled personnel. If we do not succeed in attracting additional highly skilled personnel or retaining or motivating our existing personnel, we may be unable to grow effectively generate sufficient revenues and achieve profitability.

All of our assets and our directors and officers are outside the United States, with the result that it may be difficult for investors to enforce within the United States any judgments obtained against us or our directors and officers.

All of our assets are located outside the United States and we do not currently maintain a permanent place of business within the United States. In addition, a majority of our officers and directors are nationals and/or residents of a country other than the United States, and all or a substantial portion of her assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against us or our directors and officers, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. Consequently, you may be effectively prevented from pursuing remedies under United States federal and state securities laws against us or our directors and officers.

If we are unable to adapt or expand our existing technology infrastructure to accommodate greater traffic or additional customer requirements, we may lose customers which will prevent us from achieving profitability.

Our website regularly serves a large number of users and customers and delivers a large number of daily video views. Our technology infrastructure is highly complex and may not provide satisfactory service in the future, especially as the number of customers using our gaming and searching services increases. We may be required to upgrade our technology infrastructure to keep up with the increasing traffic on our websites, such as increasing the capacity of our hardware servers and the sophistication of our software. If we fail to adapt our technology infrastructure to accommodate greater traffic or customer requirements, our users and customers may become dissatisfied with our services and switch to our competitors’ websites, which will prevent us from achieving profitability.

14

Risks Relating to the Internet Industry and Technology

Our business depends on the development and maintenance of the Internet infrastructure. Outages and delays could reduce the level of Internet usage generally as well as the level of usage of our services and reduce our revenues.

The success of our services will depend largely on the development and maintenance of the Internet infrastructure. This includes maintenance of a reliable network backbone with the necessary speed, data capacity, and security, as well as timely development of complementary products, for providing reliable Internet access and services. The Internet has experienced, and is likely to continue to experience, significant growth in the numbers of users and amount of traffic. The Internet infrastructure may be unable to support such demands. In addition, increasing numbers of users, increasing bandwidth requirements, or problems caused by “viruses,” “worms,” and similar programs may harm the performance of the Internet. The backbone computers of the Internet have been the targets of such programs. The Internet has experienced a variety of outages and other delays as a result of damage to portions of its infrastructure, and it could face outages and delays in the future. These outages and delays could reduce the level of Internet usage generally as well as the level of usage of our services and reduce our revenues.

Interruption or failure of our information technology and communications systems could impair our ability to effectively provide our products and services, which could damage our reputation and harm our operating results.

Our ability to provide our products and services depends on the continuing operation of our information technology and communications systems. Any damage to or failure of our systems could interrupt our service. Service interruptions could reduce our revenues and profits, and damage our brand if our system is perceived to be unreliable. Our systems are vulnerable to damage or interruption as a result of terrorist attacks, war, earthquakes, floods, fires, power loss, telecommunications failures, computer viruses, interruptions in access to our websites through the use of “denial of service” or similar attacks, hacking or other attempts to harm our systems, and similar events. Our servers, which are hosted at third-party internet data centers, are also vulnerable to break-ins, sabotage and vandalism. Some of our systems are not fully redundant, and our disaster recovery planning does not account for all possible scenarios. The occurrence of a natural disaster or a closure of an internet data center by a third-party provider without adequate notice could result in lengthy service interruptions. Interruption or failure of our information technology and communications systems could impair our ability to effectively provide our products and services, which could damage our reputation and harm our operating results.

If our software contains undetected errors, we could lose the confidence of users, resulting in loss of customers and a reduction of revenue.

Our online systems, including our websites, our enterprise video play software and other software applications and products, could contain undetected errors or “bugs” that could adversely affect their performance. We regularly update and enhance our website and our other online systems and introduce new versions of our software products and applications. The occurrence of errors in any of these may cause us to lose market share, damage our reputation and brand name, and reduce our revenues.

If we fail to detect click-through fraud, we could lose the confidence of our customers and our revenues could decline.

We are exposed to the risk of fraudulent clicks on ads posted by individuals seeking to increase the advertising fees paid to our web publishers when we commence internet advertising services. Although we have not historically generated revenues from advertising, we may do so in the future. We may have to refund revenue that our advertisers have paid to us and that was later attributed to click-through fraud. Click-through fraud occurs when an individual clicks on an ad displayed on a website for the sole intent of generating the revenue share payment to the publisher rather than to view the underlying content. From time to time it is possible that fraudulent clicks will occur and we would not allow our advertisers to be charged for such fraudulent clicks. This would negatively affect the profitability of our online advertising agency business, and this type of fraudulent act could hurt our brand. If fraudulent clicks are not detected, the affected advertisers may experience a reduced return on their investment in our performance-based advertising network, which could lead the advertisers to become dissatisfied with our online advertising agency business, and in turn lead to loss of advertisers and the related revenue. At the moment, we have no specific plans to focus on mitigating this risk through specific actions but we may need to subscribe to certain applicable software platforms that detect click-through fraud and possibly work with consultants to further mitigate this risk. If we fail to detect click-through fraud, we could lose the confidence of our customers and our revenues could decline.

If the security measures that we use to protect their personal information, such as credit card numbers, are ineffective, our customers may lose their confidence in our websites and stop visiting them. This may result in a reduction in revenues and increase our operating expenses, which would prevent us from achieving profitability.

Any breach in our website security could expose us to a risk of loss or litigation and possible liability. We anticipate that we will rely on encryption and authentication technology licensed from third parties to provide secure transmission of confidential information. As a result of advances in computer capabilities, new discoveries in the field of cryptography or other developments, a compromise or breach of our security precautions may occur. A compromise in our proposed security could severely harm our business. A party who is able to circumvent our proposed security measures could misappropriate proprietary information, including customer credit card information, or cause interruptions in the operation of our website. We may be required to spend significant funds and other resources to protect against the threat of security breaches or to alleviate problems caused by these breaches. However, protection may not be available at a reasonable price, or at all. Concerns regarding the security of e-commerce and the privacy of users may also inhibit the growth of the Internet as a means of conducting commercial transactions. This may result in a reduction in revenues and increase our operating expenses, which would prevent us from achieving profitability.

15

Risks Related to the Ownership of Our Stock

There is no active trading market for our common stock and if a market for our common stock does not develop, our investors will be unable to sell their shares.

There is currently no active trading market for our common stock and such a market may not develop or be sustained. Our common stock is currently listed on the OTC Bulletin Board, but since it has become eligible for quotation, there have not been any trades in our stock. Further, the OTC Bulletin Board is not a listing service or exchange, but is instead a dealer quotation service for subscribing members. If a public market for our common stock does not develop, then investors may not be able to resell the shares of our common stock that they have purchased and may lose all of their investment. If we establish a trading market for our common stock, the market price of our common stock may be significantly affected by factors such as actual or anticipated fluctuations in our operating results, general market conditions and other factors. In addition, the stock market has from time to time experience significant price and volume fluctuations that have particular affected the market prices of the shares of developmental stage companies, which may adversely affect the market price of our common stock in a material manner.

We will likely conduct further offerings of our equity securities in the future, in which case your proportionate interest may become diluted.

We completed an offering of 7,000,000 shares of our common stock at a price of $0.005 per share to investors on May 26, 2009. Since our inception, we have relied on such sales of our common stock to fund our operations. We will likely be required to conduct additional equity offerings in the future to finance our current business or to finance subsequent businesses that we decide to undertake. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, your percentage interest in us will be diluted.

Though our common stock has been quoted for trading on the OTC Bulletin Board since January 22, 2009, there have been no trades in our stock since that day. This could adversely affect your ability to sell your shares and the available price for the shares when sold. You may not be able to sell your shares at your purchase price or at any price at all.