Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported): July 9, 2010 (July 2, 2010)

CHINA UNITECH GROUP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 000-52832 | 98-0500738 |

| (State or other jurisdiction of | (Commission File Number) | (IRS Employer Identification No.) |

| incorporation or organization) |

1-D-1010, Yuanjing Park, Long Xiang Road,

Long Gang

District, Shenzhen

Guangdong Province

P. R. China 518117

(Address of principal executive offices)

+86 755-2894-3820

(Registrant's

telephone number, including area code)

No. 1 Xinxin Garden, No. 51 Fangjicun Xudong Road, Wuchang, Wuhan, Hubei, China 430062

(Former name or former address, if

changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

[ ] Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, in this report:

-

“BVI” refers to the British Virgin Islands;

-

“China,” “Chinese” and “PRC,” refer to the People’s Republic of China, excluding Hong Kong, Macao and Taiwan;

-

“China Unitech,” “the Company,” “we,” “us,” or “our,” refer to the combined business of China Unitech Group, Inc., and its wholly-owned subsidiaries, Classic Bond and Zhonghefangda, and our controlled VIE Junlong, but do not include the stockholders of China Unitech Group, Inc.;

-

“Classic Bond” refers to Classic Bond Development Limited, a BVI company;

-

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

-

“Junlong” refers to Shenzhen Junlong Culture Communications Co., Ltd., a PRC company and our variable interest entity, or VIE;

-

“RMB” refer to Renminbi, the legal currency of China;

-

“SEC” refer to the Securities and Exchange Commission;

-

“Securities Act” refer to the Securities Act of 1933, as amended;

-

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States;

-

“VIE” refer to Junlong, our variable interest entity, which is an affiliated company that we control through contractual arrangements; and

-

“Zhonghefangda” refer to “Shenzhen Zhonghefangda Internet Technology Co., Limited, a PRC company and a wholly-owned subsidiary of Classic Bond.

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On July 2, 2010, we entered into a share exchange agreement, or the Share Exchange Agreement, with Classic Bond and the shareholders of Classic Bond. Pursuant to the Share Exchange Agreement, on July 2, 2010, we acquired 100% of the issued and outstanding capital stock of Classic Bond in exchange for 19,000,000 newly issued shares of our common stock, par value $0.00001 per share, which constituted 94% of our issued and outstanding common stock on a fully-diluted basis as of and immediately after the consummation of the transactions contemplated by the Share Exchange Agreement.

As a condition precedent to the consummation of the Share Exchange Agreement, on July 2, 2010 we entered into a cancellation agreement, or the Cancellation Agreement, with certain shareholders, whereby such shareholders agreed to the cancellation of 5,173,600 shares of our common stock owned by them.

The foregoing description of the terms of the Share Exchange Agreement and the Cancellation Agreement is qualified in its entirety by reference to the provisions of the document filed as Exhibits 2.1 and 4.1 to this report, which is incorporated by reference herein.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On July 2, 2010, we completed an acquisition of Classic Bond pursuant to the Share Exchange Agreement. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein Classic Bond is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, on July 2, 2010, we acquired Classic Bond in a reverse acquisition transaction. Item 2.01(f) of Form 8-K states that if the registrant was a shell company as we were immediately before the reverse acquisition transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities under the Exchange Act on Form 10.

Accordingly, we are providing below the information that would be included in a Form 10 registration statement. Please note that the information provided below relates to the combined enterprises after the acquisition of Classic Bond, except that information relating to periods prior to the date of the reverse acquisition only relate to Classic Bond and its subsidiaries unless otherwise specifically indicated.

1

CORPORATE STRUCTURE AND HISTORY

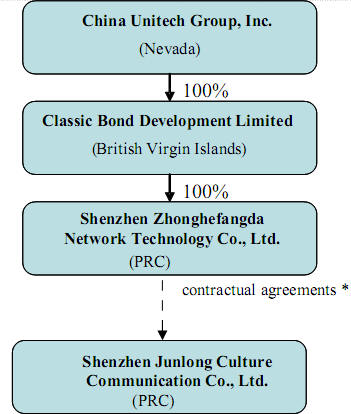

Our Corporate Structure

We are a Nevada holding company for our direct and indirect subsidiaries in the BVI and China. We own all of the issued and outstanding capital stock of Classic Bond, a BVI corporation. Classic Bond is a holding company that owns 100% of the outstanding capital stock of Zhonghefangda, a PRC company.

Current PRC laws and regulations impose substantial restrictions on foreign ownership of the internet café business in China. Therefore, our principal operations and sales and marketing activities in China are conducted through Junlong, our VIE, which holds the licenses and approvals for conducting the internet café business in China. Junlong was incorporated in the PRC in December 2003. It obtained its license to operate internet cafés in 2005. We control the VIE through a series of contractual arrangements. These contracts include a Management and Consulting Services Agreement, an Option Agreement, an Equity Pledge Agreement, and a Voting Rights Proxy Agreement. The Management and Consulting Services Agreement, dated June 11, 2010, is between our indirect, wholly-owned subsidiary, Zhonghefangda, and our VIE. The rest of the agreements, also dated June 11, 2010, are among Zhonghefangda, our VIE and its shareholders. These contracts are summarized below. Please also refer to the full text of the contracts, which are filed as exhibits to this report.

-

Management and Consulting Services Agreement. Under the Management and Consulting Services Agreement between Junlong and Zhonghefangda, Zhonghefangda provides management and consulting services to the VIE in exchange for service fees up to 100% of the VIE’s Aggregate Net Profits (as defined in the agreement). In consideration for its right to receive the VIE’s aggregate net profits, Zhonghefangda will reimburse to the VIE the full amount of Net Losses (as defined in the Agreement) incurred by the VIE. During the term of the agreement, the VIE may not contract with any other party to provide services that are the same or similar to the services to be provided by Zhonghefangda pursuant to the agreement. The term of this agreement is 20 years, renewable for succeeding periods of the same duration until terminated pursuant to terms of the agreement.

-

Option Agreement. Under the Option Agreement, the shareholders of the VIE, Mr. Dishan Guo, Mr. Jinzhou Zeng and Ms. Xiaofen Wang, or the VIE Shareholders, who collectively own 100% of the equity interest in the VIE, granted Zhonghefangda an exclusive, irrevocable option to purchase all or part of their equity interests in the VIE, exercisable at any time and from time to time, to the extent permitted under PRC law. The purchase price of the equity interest will be equal to the original paid-in registered capital of the transferor, adjusted proportionally if less than all of the equity interest owned by the transferor is purchased.

-

Equity Pledge Agreement. The VIE Shareholders have pledged their entire equity interest in the VIE to Zhonghefangda pursuant to the Equity Pledge Agreement. The equity interests are pledged as collateral to secure the obligations of the VIE under the Management and Consulting Services Agreement and the VIE Shareholders’ obligations under the Option Agreement and the Proxy Agreement.

-

Voting Rights Proxy Agreement. Pursuant to the Voting Rights Proxy Agreement, each of the VIE Shareholders has irrevocably granted and entrusted Zhonghefangda with all of the voting rights as a shareholder of the VIE for the maximum period of time permitted by law. Each VIE Shareholder has also covenanted not to transfer his or her equity interest in the VIE to any party other than Zhonghefangda or a designee of Zhonghefangda.

2

We believe that the terms of these agreements are no less favorable than the terms that we could obtain from disinterested third parties. According to our PRC counsel, China Commercial Law Firm, our conduct of business through these agreements complies with existing PRC laws, rules and regulations.

As a result of these contractual arrangements, Junlong became our controlled VIE. A variable interest represents a contractual or ownership interest in another entity that causes the holder to absorb the changes in fair value of the other entity’s net assets. Potential variable interests include: holding economic interests, voting rights, or obligations to an entity; issuing guarantees on behalf of an entity; transferring assets to an entity; managing the assets of an entity; leasing assets from an entity; and providing financing to an entity. In such cases consolidation of the VIE is required by the enterprise that controls the economic risks and rewards of the entity, regardless of ownership. We have consolidated Junlong’s historical financial results in our financial statements as a variable interest entity pursuant to U.S. GAAP.

The following chart reflects our organizational structure as of the date of this report.

*Contractual agreements consisting of a management and consulting service agreement, an equity pledge agreement, option agreement and proxy agreement.

3

Our Corporate History and Background

We were incorporated in the State of Nevada on March 14, 2006. From our office in China, we planned to operate in the online travel business using the website www.chinabizhotel.com. The website was planned to offer viewers the ability to book hotel rooms in China and earn us booking fees from the respective hotels. However, we did not engage in any operations and were dormant from our inception until our reverse acquisition of Classic Bond on July 2, 2010.

Acquisition of Classic Bond

On July 2, 2010, we completed a reverse acquisition transaction through a share exchange with Classic Bond and its shareholders, whereby we acquired 100% of the issued and outstanding capital stock of Classic Bond, in exchange for 19,000,000 shares of our common stock, which shares constituted 94% of our issued and outstanding shares on a fully-diluted basis, as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Classic Bond became our wholly-owned subsidiary and the former shareholders of Classic Bond, became our controlling shareholders. The share exchange transaction with Classic Bond was treated as a reverse acquisition, with Classic Bond as the acquirer and China Unitech Group, Inc. as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Classic Bond and its consolidated subsidiaries.

Upon the closing of the reverse acquisition, Xuezheng Yuan, our sole director and officer, submitted a resignation letter pursuant to which he resigned, with immediate effect, from all offices that he held and from his position as our sole director that will become effective on the tenth day following the mailing by us of an information statement, or the Information Statement, to our stockholders that complies with the requirements of Section 14f-1 of the Exchange Act, which will be mailed out on or about July 12, 2010. Also upon the closing of the reverse acquisition, our board of directors increased its size from one to five members and appointed Dishan Guo, Zhenquan Guo, Lei Li, Wenbin An and Lizong Wang to fill the vacancies created by the resignation of Xuezheng Yuan and such increase. Mr. Dishan Guo's appointment became effective upon closing of the reverse acquisition, while the remaining appointments will become effective on the tenth day following our mailing of the Information Statement to our stockholders. In addition, our executive officers were replaced by the Classic Bond executive officers upon the closing of the reverse acquisition as indicated in more detail below.

As a result of our acquisition of Classic Bond, we now own all of the issued and outstanding capital stock of Classic Bond. Classic Bond was incorporated in the British Virgin Islands on November 2, 2009 to serve as an investment holding company. Junlong was incorporated in the PRC in December 2003. It obtained its first licenses from the Ministry of Culture to operate an internet café chain in 2005 and opened its first internet café in April 2006.

We plan to amend our certificate of incorporation to change our name from “China Unitech Group, Inc.” to “China Internet Café Holdings Group, Inc.” to reflect the current business of our company, which changed as a result of our acquisition of Classic Bond.

DESCRIPTION OF BUSINESS

Overview

We operate a chain of 28 internet cafés that we own in Shenzhen, Guangdong, China. We provide top quality internet café facilities and we believe we are the largest internet café chain in Shenzhen. We provide internet access at reasonable prices to students and migrant workers. Although we sell snacks, drinks, and game access cards, over 99% of our revenue comes from selling access time to our computers. We sell internet café memberships to our customers. Members purchase prepaid IC cards (a pocket-sized card with embedded integrated circuits that can be used for identification, authentication, data storage and application processing), which include stored value that will be deducted based on time usage of computer at the internet café. The cards are only sold at our cafés. We deduct the amount that reflects the access time used by a customer when the customer’s IC card is inserted into the IC card slot on the computer.

4

The internet cafés are generally open 24 hours, 7 days a week.

As of March 31, 2010, we had 312 employees.

Our Industry

Background on Internet Cafés in China

Internet cafés have been booming in China in the recent years. According to the "Survey of China Internet Café Industry" by the Ministry of Culture in 2005, China had 110,000 internet cafés, with more than 1,000,000 employees and contributing RMB 18,500,000,000 to China's GDP. According to an article entitled “China Surpasses U.S. in Number of Internet Users” written by David Barboza in the New York Times July 26, 2008 issue, the number of internet users in the China reached about 253 million in June 2008, thereby, putting China ahead of the United States as the world’s biggest internet market. Within the Chinese internet market, internet cafés have been a fast growing segment.

The internet café market in China, like most places worldwide, originally started out as simply a location to access the internet. However, China’s cafés have changed into full service entertainment centers where people can relax outside work and home. These cafés provide services that are vastly different from the internet cafés initially established in China. They provide decent facilities at a reasonable fee, with specific configuration for online games and audio visual entertainment. They are a source of cost effective entertainment for low-income earners who cannot afford computers, game consoles or an internet connection, such as migrant workers and students. In internet cafés, customers have access to popular online games and can either socialize or entertain themselves. Players gather together in internet cafés for games such as World of Warcraft (WOW), and Call to Arms played either with their friends in the café or with users across the globe.

After tightened regulations on the operations of internet cafés, there are currently around 81,000 internet cafés in China. (Source: “Internet cafe ban call draws Chinese hacker wrath”. AFP 3 Mar 2010. http://www.google.com/hostednews/afp/article/ALeqM5gJus4tWVAaeWI8IoS-n238PYpFjw) The largest chain has over 1,000 locations. There are currently 10 chains which have licenses to operate nationally.

Computer Gaming Industry in China

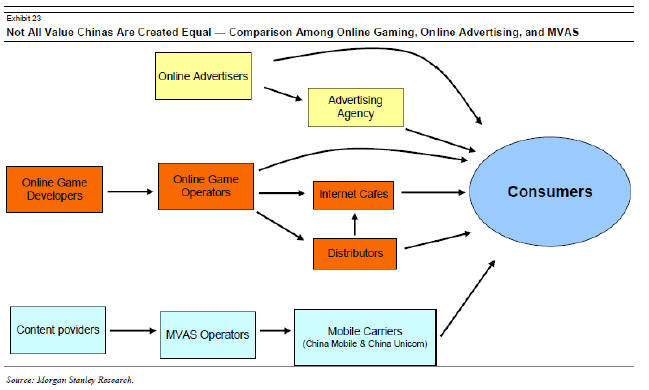

According to Pearl Research, a business intelligence and consulting firm, China’s online game market rose 63% in 2008 to $2.8 billion. Given the relatively low rate of computer ownership in China as compared to Western countries, internet cafés have become the primary distribution point for games in China. A substantial number of game players access online games through internet cafés and these players are crucial for survival of internet cafés. The chart below shows the robust revenue growth of online game companies from 2003 to 2009.

5

The following diagram prepared by Morgan Stanley depicts the interdependent relations between online game developers and internet cafés. (Source: Ji, Richard and Meeker, Mary. "Creating Consumer Value in Digital China" Morgan Stanley Equity Research Global. September 12, 2005.)

Given the pivotal position of internet cafés, many online game companies have been making great efforts to support internet cafés to expand their customer base.

Partnerships between Internet Cafés and Other Online Information Providers

Besides games, internet cafés are able to develop partnerships with other online information providers. These companies provide games as well as other information services. As can seen by the chart below, these providers have significant revenues and profits.

6

Table 1 Major Internet Internet Company Revenues

|

|

|

% of Revenue |

| ||

|

Company |

2009 Q1 Revenue Million US$ |

Mobile Value-Added Service (MVAS) |

Gaming / Internet Value-Added Service (IVAS) |

Advertising |

Operating Margin |

|

Sohu |

$84.4 |

10% |

49% |

41% |

40% |

|

Baidu |

$81.9 |

– |

– |

100% |

27% |

|

Sina |

$71.3 |

33% |

– |

67% |

19% |

|

Shanda |

$111 |

– |

97% |

3% |

40% |

|

NetEase |

$93 |

– |

86% |

14% |

63% |

|

Tencent |

$204.1 |

20% |

70% |

10% |

51% |

|

|

|

|

|

|

|

|

Total |

$646 |

11% |

58% |

31% |

40% |

(Source: I2I Group. “Social Media Opportunities.” October 2009. Online PowerPoint. http://www.i2i-m.com/downloads/Handbook%20of%20Social%20Media%20in%20China%202.ppt.)

Our Competitive Strengths

We believe that the following strengths enable us to compete effectively in and to capitalize on growth in the internet café market in China:

-

Company-owned Cafés. Unlike most of our competitors who franchise their internet cafés, all of our cafés are direct outlets. This model makes it easier to carry out management decisions at each of our cafés. It also allows us to maximize operating profit and create a consistent name brand.

-

Good Scale of Operation. We have registered capital of RMB 10 million (approximately $1.47 million) with 28 cafés. The scale of operations allows us to control cost and standardize store management.

-

Proprietary Software. We developed the software “SAFLASH” that provides fast and stable internet connections. Its automatic flow control prevents users from being disconnected when there is a disruption of internet traffic. Stability is a key requirement for online gamers. Our R&D team is working constantly to improve the software.

-

Government and Industry Relations. We have developed excellent working relationship with the government that has assisted us to better comply with internet café related laws and regulations and to understand regulatory trends in our industry. Our CEO Dishan Guo is the executive president of Shenzhen Longgang District Internet Industry Association. This association is an associated department of the Ministry of Culture and sets the internet café industry standards. As a result of his involvement, Mr. Guo gains valuable insight into new standards and may also have the opportunity to influence industry standards.

7

Our Growth Strategy

We are committed to enhancing our sales, profitability and cash flows through the following strategies:

-

We will seek to grow by business expansion. We plan to expand in the southwest and mid-east regions of China through acquisitions of local small chains, in order to meet the requirements of applying for a national chain license. The national chain license requires 30 internet cafes in 3 provinces. We plan to accomplish acquisitions of internet cafes in Guizhou in the third quarter, and Sichuan in quarter 4 in order to help us satisfy the requirements of obtaining a national chain license. We also want to fully develop our wholly-owned branches through effective integration of resources. Most of our current competitors that offer franchising simply provide a franchise license to entrepreneurs to get started in exchange for a yearly fee. Junlong, on the other hand, is deeply involved in the operational management of its company-owned cafes. After we obtain a national chain license, we will focus on developing high-end internet cafes in the more developed cities to create new concepts of internet café operation. We expect to spread to the less developed cities in three years in order to gain competitive market shares. We plan to put 20% of our resources to the less developed cities for market integration after we are granted a national license, which will effectively lay the foundation for us in those cities.

We will seek to grow by improving our company structure. To optimize our resources and operations, we plan to improve our company structure so that 20% of our internet cafés will be large stores each with 300 or more computers mainly focusing on movies, high-end games and entertainment; 50% of cafés will be medium stores with 150 to 300 computers and a few movie suites focusing on high-end games; 10% of cafés will be small stores in the developed cities to spread our reputation with 100 to 150 computers. In order to penetrate the less developed cities, we want to open 20% of our stores in those cities. Our mission is to set up internet cafés all over China to become a real national chain and the industry leader.

We will seek to grow by location selection. Internet café is a retail business. Internet cafes are located in highly populated areas so as to attract customers. Junlong’s internet cafes are located at busy and well attended areas such as industrial zones and business quarters. We have conducted market research in Sichuan, Guizhou, Yunan provinces and Chonqing municipalities in March. As a result of this market research, we have identified the university areas in Sichuan and Chongqing, the residential areas and business quarters in Yunan and Guizhou as prime areas for the establishment of internet cafes. Our future expansion in the south-western region will built on the basis of these locations.

8

Use of Prepaid IC Cards

Internet café members purchase prepaid IC cards which include stored value that will be deducted based on time usage of computer at the internet café. The cards are only sold at our cafés. We deduct from the stored value amount to reflect customer usage when the customers’ IC cards are inserted into the IC card slot on the computer. Revenues derived from the prepaid IC cards at the internet café are recognized when services are provided. Below is our IC card sample.

Outstanding customer balances on the IC cards are included in deferred revenue on the balance sheets. The Company does not charge any service fees that cause a decrease in customer balances.

The basic membership comes with the IC card and costs RMB 10 (approximately $1.47) on top of the initial credits deposited. Members receive a discount (e.g. RMB 50 (approximately $7.35) deposit gets RMB 60 (approximately $8.82) credit in the IC card). There is no expiration date for IC cards, but money deposited into the IC cards is not refundable.

Revenues from computer usage for the fiscal years ended December 31, 2009 and 2008 were $14,038,931 and $10,107,823, respectively.

Software on the Computers

We have on average 250 computers in each location and a total of 6,339 computers for the 28 cafés. We install more than 100 online games on each of our computers. We also provide movies, music and online chatting software. We use Microsoft Word compatible software called “WPS” which is a freeware provided by Kingsoft, a Chinese software company, so that we do not pay for the much higher priced Microsoft Office license

Third Party Gaming Cards, Snacks and Drinks

We also sell third party on-line gaming cards, snacks and drinks. The commission for the sale of gaming cards is generally 20% of the value of the cards. Concessions (snacks and drinks) are also sold to customers. Revenue from concession sales amounted to less than 1% of our total revenue in fiscal years 2008 and 2009.

9

New products or services

We are considering opening more “luxury” cafes in the future to meet the needs of high income groups. This strategy is only in the planning stage. Further, although this is potentially a very interesting marketing and branding tool, we do not expect these locations to significantly increase our overall revenues.

Franchising

We own all of our cafes. However, beginning in 2012 we expect to utilize a modified franchise model in addition to owning our own cafes. We expect that our franchisees will pay the start up costs for a new internet café. After the initial investment, we will select the location and provide intensive training and staff to run the café. Once the café becomes operational, our employees will run the café and provide management support. We expect the franchisee to be more akin to an investor than an owner/operator. We will pay the franchisee a percentage of the café’s profit for providing the funds necessary to open the café and operate it.

Our Customers

Our customers are individuals who come into the location to surf the internet and/or play online games with their friends locally and remotely with individuals around the world.

Internet café users are mainly young males with low incomes, mainly migrant workers. At our cafés migrant workers are provided a convenient channel at low cost to communicate with their families and friends. For example, VOIP (Voice over IP) service at the café is much cheaper than any other telecommunications method. Low income earners can arrange a time to chat online with their friends and families in their home cities.

We estimate that at our internet café approximately 50% of computer time is spent on gaming, 30% for other entertainment (e.g. online chatting, online movies, or online music); and 20% for other purpose (e.g work).

In the last few years there has been a decrease in the number of internet café users as a result of increased availability of internet connections at home. However, we believe that we will be able to maintain organic growth by providing quality services to our core customers. Even if someone has internet access in their home or dormitory, these locations do not provide the atmosphere and services provided by internet cafés at a reasonable cost. For example, if a computer is set up in the limited space of a dormitory, an additional internet connection would need to be purchased. A computer suitable for online gaming costs RMB 5,000 (approximately $735.29) or more. The monthly rent for an ADSL connection costs an additional RMB 100 (approximately $14.71) and even this may not be good enough for some online games such as WOW. In these types of games, there is a very important play mode called RAID, where, for example, 40 people are needed on a team to kill some monster in the dungeon. This requires all players to have very stable internet connections. A typical low-end computer and ADSL connection would suffer significant lags and cause performance issues. Internet cafés, on the other hand, can provide high speed computers and internet connections at much lower cost to the players.

Our future plans are to open internet cafés around university areas in the south-western provinces. Students spend more time in internet cafés because their time is very flexible. We believe that major users of internet cafés in the future will be young game players.

10

Competition

There are approximately 168,000 Internet cafés in China in 2009. (Source: http://www.ai-media.cn/chinastats.htm (accessed March 23, 2010) The market is extremely fragmented. One of the largest national chains which has around 1,000 locations only has less than 2% of the national market. The following describes some of the local, regional and national competitors.

Local Competitors in Shenzhen

-

Shenzhen Weiwo internet café Chain Company. Weiwo was founded in 1997. Currently, Weiwo has 14 cafés. The company mainly operates a franchise model, with only 3 company owned cafés. The cafés are mainly located in Futian district, Shenzhen City. The company concentrates on mid-range market. Each café is relatively small with 100 to150 computers (for a total of around 1,600 computers). Its franchised stores are charged a franchising fee per month of approximately RMB 5,000 (approximately $735.29). Weiwo is the smallest internet café chain company in Shenzhen.

-

Shenzhen Bian Internet Co. Ltd. Although the company entered into the internet café industry in 2003, its current structure was founded on February 22, 2007 and obtained its regional internet café chain license in 2007. The company operates mostly as a franchise model with 26 registered café, only 3 of which are directly owned by the company. Each café has 80-150 computers. It also has a few large cafés with more than 200 computers. The estimated total number of computers owned by the company is 4,000. There is a significant turnover in franchise ownership with around one third of the franchise cafés transferring their licenses to other internet café owners.

-

Quansu Internet Café Chain Company. Quansu was founded in 1998 as a subsidiary investment project of the Shenzhen Commercial Bank Investment Co. Ltd. The company owns 36 cafés, 8 of which are directly owned and 28 of which are franchises. Each café has 80-150 computers. The total number of computers is approximately 6,000. The cafés are located in Baoan District, Futian District and Luohu District. In May 2009, Quansu switched its major business towards its internet cable connection business and public telephone business.

National Competitors

Currently there are ten national internet café chains:

-

Zhongqing Network Home Co., Ltd.

-

Beijing Cultural Development Co., Ltd.

-

China Digital Library Co., Ltd.

-

Yalian Telecommunication Network Co., Ltd.

-

China Heritage Information Center

-

Capital Networks Limited

-

Great Wall Broadband Network Service Co., Ltd.

-

China United Telecommunications Co., Ltd. (China Unicom)

-

CLP Chinese Tong Communication Co., Ltd.

-

Reid Investment Holding Company

11

The 10 national chains generally have strong financial support. However, to our knowledge these chains have not been successful in expanding their operations.

Competitors in Potential Markets

As we plan to expand our operations in other major cities, we identify the following competitors in the potential new markets where we expect to operate in the future:

-

Kunming – Yunnan Jin-Zhao Yuan Culture Communication Network Co., Ltd. The company was founded on May 1, 2003 by the Yunnan Provincial Department of Culture. It obtained its business license and registration to operate a chain of Internet cafés from the Industrial and Commercial Bureau of Yunnan Province on April 31, 2004. It has a registered capital of RMB 10 million. The company has opened approximately 15 cafés with an average of 200 computers in each café and a total of nearly 3,000 computers.

-

Chengdu – Chengdu Shang Dynasty Networks Co., Ltd. The company was founded in 2002 with a registered capital of RMB 12 million. It would be most accurately described as a multifunctional entertainment facility with coffee bars and multi-function rooms. Its facilities have full range of digital entertainment including hardware and software products, and professional e-sport training. The company has four wholly owned cafés, and has more than 20,000 registered members.

Intellectual Property

Trademark

Junlong owns the trademark Junlong, as specified in the Registration Certificate No. 4723040 issued by the Trademark Office under the State Administration of Industry and Commerce of the PRC. The registration is valid from January 28, 2009 to January 27, 2019.

Domain Name

We own and currently utilize the domain name, www.cnculture.com.cn. We have recently also acquired the domain name www.chinainternetcafe.com, which we believe better reflects our business. We will transition from our old domain name to our new one during the third quarter of 2010.

Software

The main piece of intellectual property for Junlong is the SAFLASH software. This software, developed on a Microsoft Windows platform, increases internet connection stability. Its automatic flow control prevents users from being disconnected when there is a disruption in internet traffic. The stability is a key requirement for online gamers.

Although there are no patents or copyrights for this software, it is only used internally on our computer systems and is not available for download. We also entered into a confidentiality agreement with the IT manager Zhenfan Li whose team developed this software. Our competitive advantage lies in continually updating SAFLASH to assure internet connection stability.

12

Regulation

Because our controlled VIE is located in the PRC, we are regulated by the national and local laws of the PRC.

In 2001, the Chinese government imposed a minimum capital requirement of RMB 10 million (approximately $1.47 million) for regional café chains and RMB 50 million (approximately $7.35 million) for national café chains. On September 29, 2002, Ministry of Information Industry, Ministry of Public Security, Ministry of Culture and State Administration for Commerce and Industry issued “Regulations on the Administration of Business Sites of Internet Access Services.” The regulations require a license to operate internet cafés which may not be assigned or leased to any third parties. The regulations also have detailed provisions regarding internet cafés’ business operations and security control.

We have been in compliance of these regulations. In August 2004, we increased our registered capital to RMB 10 million (approximately $1.46 million). In 2005, Junlong obtained internet café licenses of operating internet café chain in Shenzhen from the local counterpart of Ministry of Culture.

The Ministry of Cultural of China is in charge of regulating national internet café chains. To obtain a license to operate a national internet café chain, an applicant must, among other things, (i) a minimum registered capital of RMB 50 million, (ii) own or control at least 30 internet cafés, which shall cover at least three provinces or municipalities under direct administration of the State Council, and (iii) have been in full compliance with administrative regulations with respect to internet cafés for at least one year before submitting the application. Other requirements include having appropriate computer and ancillary facilities, necessary and qualified personnel and sound internal policy. Application for a national internet café chain shall be first made to the provincial counterpart of the Ministry of Cultural. After preliminary approval, the provincial authority will submit the application to the Ministry of Culture for final approval. In rendering its approval, the authorities consider such factors as the then existing number of the internet café chains.

We are subject to China's foreign currency regulations. The PRC government has controlled Renminbi reserves primarily through direct regulation of the conversion of Renminbi into other foreign currencies. Although foreign currencies, which are required for “current account” transactions, can be bought at authorized PRC banks, the proper procedural requirements prescribed by PRC law must be met. At the same time, PRC companies are also required to sell their foreign exchange earnings to authorized PRC banks, and the purchase of foreign currencies for capital account transactions still requires prior approval of the PRC government.

Under current PRC laws and regulations, Foreign Invested Entities, or FIEs, may pay dividends only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, FIEs in China are required to set aside at least 10.0% of their after-tax profit based on PRC accounting standards each year to their general reserves until the cumulative amount of such reserves reaches 50.0% of their registered capital. These reserves are not distributable as cash dividends. The board of directors of an FIE has the discretion to allocate a portion of the FIEs’ after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

Our Employees

As of March 31, 2010, we employed a total of 312 full-time employees. The following table sets forth the number of employees by function:

| Function | Number of |

| Employees | |

| Senior Management | 35 |

| Accounting | 5 |

| Staff employees | 272 |

| Total | 312 |

13

As required by applicable PRC law, we have entered into employment contracts with most of our officers, managers and employees. We are working towards entering employment contracts with those employees who do not currently have employment contracts with us. We believe that we maintain a satisfactory working relationship with our employees, and we have not experienced any significant disputes or any difficulty in recruiting staff for our operations.

Litigation

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. We are currently not a party to any legal proceeding and are not aware of any legal claims that we believe will have a material adverse affect on our business, financial condition or operating results.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Our limited operating history makes evaluating our business and prospects difficult.

Our VIE Junlong was established in December 2003 and obtained the license to operate internet cafés in Shenzhen in 2005. Our limited operating history may not provide a meaningful basis for you to evaluate our business and prospects. Our business strategy has not been proven over time and we cannot be certain that we will be able to successfully expand our business.

You should also consider additional risks and uncertainties that may be experienced by early stage companies operating in a rapidly developing and evolving industry.

We are dependent on our management team and the loss of any key member of that team could have a material adverse effect on our operations and financial condition.

We attribute our success to the leadership and contributions of our managing team comprising executive directors and key executives, in particular, to our Chief Executive Officer, Dishan Guo and our Chief Technology Officer Zhenfan Li.

Our continued success is therefore dependent to a large extent on our ability to retain the services of these key management personnel. The loss of their services without timely and qualified replacement, will adversely affect our operations and hence, our revenue and profits. The loss of the services of Dishan Guo and Zhenfan Li in particular, will have an adverse impact on our performance.

14

We have not obtained social insurance benefits for all of our employees and could incur administrative fines and penalties that could materially affect our financial condition and reputation.

We have obtained social benefits coverage for employees who work at the headquarters of Junlong. For other employees, because of the high mobility of their work, they usually work on a probationary basis and will not enter into a long employment relationship with us. We are subject to administrative fines and penalties as a result of our failure to obtain social insurance for these employees. The amount of these fines and penalties, in the aggregate, may adversely affect our financial condition and our public image.

Tightened regulations on internet cafés may adversely affect our operations and revenues.

The Chinese government has been tough on internet café regulations. In 2003, the Chinese government imposed a minimum capital requirement of RMB 10 million (approximately $1.47 million) for regional café chains and RMB 50 million (approximately $7.32 million) for national café chains. On September 29, 2002, the State Council issued “Regulations on the Administration of Business Sites of Internet Access Services.” The regulations require a license to operate internet cafés which may not be assigned or leased to any third parties. The regulations also have detailed provisions regarding internet cafés’ business operations and security control. These regulations reduced the number of internet cafés.

If the Chinese government decided to impose more stringent regulations on internet cafés and their operations, our business may be adversely affected and our revenues may decrease as a result.

There may be reduced use of internet cafés with the increase in computer ownership and internet connections at home and any such reduction would negatively affect our financial performance.

With the rapid economic development and growing disposable income, computer ownership and internet connections at home will gradually increase. Although internet cafés provide easy access to the latest games, movies and music, fast and stable internet connections and a sense of community, there is no guarantee that individuals will continue to use internet cafés when they can have internet access at home.

Negative media coverage of internet cafés may reduce the number of customers that visit our internet cafes and result in lower revenues.

In the last few years there have been several negative stories in the media about internet cafes. A fatal fire in Beijing's Lanjisu Internet café in June 2002 raised nationwide concern about the country’s burgeoning internet café business. In 2006, a report from the China National Children's Center, a government think-tank, said that 13 percent of China's 18 million internet users under 18 were internet addicts. Responding to the problems associated with internet cafés, China imposed more stringent laws and regulations on internet cafés. In 2007, fearful of soaring internet addiction and juvenile crime, China banned the opening of new internet cafes for a year. Such negative media coverage may result in stricter government regulations and reduced number of customers.

We may be unable to adequately safeguard our intellectual property or we may face claims that may be costly to resolve or that limit our ability to use such intellectual property in the future.

Our business is reliant on our intellectual property. Our software SAFLASH is the result of our research and development efforts, which we believe to be proprietary and unique. However, we are unable to assure you that third parties will not assert infringement claims against us in respect of our intellectual property or that such claims will not be successful. It may be difficult for us to establish or protect our intellectual property against such third parties and we could incur substantial costs and diversion of management resources in defending any claims relating to proprietary rights. If any party succeeds in asserting a claim against us relating to the disputed intellectual property, we may need to obtain licenses to continue to use the same. We cannot assure you that we will be able to obtain these licenses on commercially reasonable terms, if at all. The failure to obtain the necessary licenses or other rights could cause our business results to suffer.

15

Further, we rely upon a combination of trade secrets, non-disclosure and other contractual agreements with our employees as well as limitation of access to and distribution of our intellectual property in our efforts to protect intellectual property. However, our efforts in this regard may be inadequate to deter misappropriation of our proprietary information or we may be unable to detect unauthorized use and take appropriate steps to enforce our rights. Policing unauthorized use of our intellectual property is difficult and there can be no assurance that the steps taken by us will prevent misappropriation of our intellectual property.

Where litigation is necessary to safeguard our intellectual property, or to determine the validity and scope of the proprietary rights of others, this could result in substantial costs and diversion of our resources and could have a material adverse effect on our business, financial condition, operating results or future prospects.

We may not have sufficient insurance coverage and an interruption of our business or loss of a significant amount of property could have a material adverse effect on our financial condition and operations.

We currently do not maintain any insurance policies against loss of key personnel and business interruption as well as product liability claims. If such events were to occur, our business, financial performance and financial position may be materially and adversely affected.

Inability to maintain our competitiveness would adversely affect our financial performance.

We operate in a competitive environment and face competition from existing competitors and new market entrants. Some of these existing competitors, especially the national chains of internet cafés have more resources than us and may provide better services to customers.

There is no assurance that we will be able to compete successfully in the future. Any failure by us to remain competitive would adversely affect our financial performance.

16

We may be adversely affected by a significant or prolonged economic downturn in the level of consumer spending in the industries and markets served by our customers.

We rely on the spending of our customers in our cafés for our revenues, which may in turn depend on the customers’ level of disposable income, perceived future earning capabilities and willingness to spend. Any significant or prolonged decline of the PRC economy or economy of such markets served by our customers will affect consumers’ disposable income and consumer spending in these markets, and lead to a decrease in demand for consumer products.

To the extent that such decrease in demand for consumer products translates into a decline in the demand for internet café services, our performance will be adversely affected.

Revocation or failure to renew the license for operating internet café chain will adversely affect our business.

We hold a license for operating a regional internet café chain in Shenzhen and each of our internet cafés obtains a license for the internet access services. These licenses are currently valid and are renewable at the end of its term by application to the relevant authorities.

If any license is revoked or suspended or we are unable to renew the licenses for any reason, our business operations and correspondingly, our financial performance, would be adversely affected.

We may be unable to effectively manage our expansion.

We have identified several growth plans. These expansion plans may strain our financial resources. They may also overstretch our management personnel and require us to restructure our management structure.

If we are unable to successfully manage our expansion, we may encounter operational and financial difficulties which would in turn adversely affect our business and financial results.

We may require additional funding for our growth plans, and such funding may result in a dilution of your investment.

We attempted to estimate our funding requirements in order to implement our growth plans.

If the costs of implementing such plans should exceed these estimates significantly or if we come across opportunities to grow through expansion plans which cannot be predicted at this time, and our funds generated from our operations prove insufficient for such purposes, we may need to raise additional funds to meet these funding requirements.

These additional funds may be raised by issuing equity or debt securities or by borrowing from banks or other resources. We cannot assure you that we will be able to obtain any additional financing on terms that are acceptable to us, or at all. If we fail to obtain additional financing on terms that are acceptable to us, we will not be able to implement such plans fully. Such financing even if obtained, may be accompanied by conditions that limit our ability to pay dividends or require us to seek lenders’ consent for payment of dividends, or restrict our freedom to operate our business by requiring lender’s consent for certain corporate actions.

17

Further, if we raise additional funds by way of a rights offering or through the issuance of new shares, any shareholders who are unable or unwilling to participate in such an additional round of fund raising may suffer dilution in their investment.

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K. In addition, the independent registered public accounting firm auditing a company's financial statements must also attest to and report on the operating effectiveness of the company’s internal controls. We were not subject to these requirements for the fiscal year ended December 31, 2009; accordingly, we have not evaluated our internal control systems in order to allow our management to report on, and our independent auditors to attest to, our internal controls as required by these requirements of SOX 404. Under current law, we will be subject to these requirements beginning with our annual report for the fiscal year ending December 31, 2010. We can provide no assurance that we will comply with all of the requirements imposed thereby. There can be no assurance that we will receive a positive attestation from our independent auditors. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements.

Our holding company structure may limit the payment of dividends.

We have no direct business operations, other than our ownership of our subsidiaries and contractual relationship with Junlong. While we have no current intention of paying dividends, should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries and other holdings and investments. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions as discussed below. If future dividends are paid in RMB, fluctuations in the exchange rate for the conversion of RMB into U.S. dollars may reduce the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars. Further, dividends paid to non-PRC stockholders may be subject to a 10% withholding, as further discussed under “Risk Factors – Under the EIT Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC shareholders.”

Chinese regulations currently permit the payment of dividends only out of accumulated profits as determined in accordance with Chinese accounting standards and regulations. Our subsidiaries in China are also required to set aside a portion of their after tax profits according to Chinese accounting standards and regulations to fund certain reserve funds. Currently, our subsidiaries in China are the only sources of revenues or investment holdings for the payment of dividends. If they do not accumulate sufficient profits under Chinese accounting standards and regulations to first fund certain reserve funds as required by Chinese accounting standards, we will be unable to pay any dividends.

18

RISKS RELATING TO OUR COMMERCIAL RELATIONSHIP WITH JUNLONG

Our contractual arrangements with Junlong and its shareholders may not be as effective in providing control over them as direct ownership.

We rely on contractual arrangements with our VIE and its shareholders to operate our business. For a description of these contractual arrangements, see “Corporate structure”. In the opinion of our PRC legal counsel, China Commercial Law Firm, these contractual arrangements are valid, binding and enforceable, and will not result in any violation of PRC laws or regulations currently in effect. These contractual arrangements may not be as effective in providing us with control over these entities as direct ownership. If we had direct ownership of these entities, we would be able to exercise our rights as a shareholder to effect changes in the boards of directors of these entities, which in turn could effect changes, subject to any applicable fiduciary obligations, at the management level. However, if Junlong or any of its shareholders fails to perform its or his respective obligations under these contractual arrangements, we may not be able to enforce the relevant agreements. If the agreements are ruled in violation of the PRC laws, even if the contracts are otherwise legal and valid, we may not be able to enforce our rights under these contracts. We may have to incur substantial costs and resources to enforce them, and seek legal remedies under PRC law, including specific performance or injunctive relief, and claiming damages, which may not be effective. Accordingly, it may be difficult for us to change our corporate structure or to bring claims against any of these entities if they do not perform their obligations under their contracts with us.

All of our revenues are generated through our VIE, and we rely on payments made by our VIE to Zhonghefangda, our subsidiary, pursuant to contractual arrangements to transfer any such revenues to Zhonghefangda. Any restriction on such payments and any increase in the amount of PRC taxes applicable to such payments may materially and adversely affect our business and our ability to pay dividends to our shareholders.

We conduct substantially all of our operations through Junlong, our VIE, which generates all of our revenues. As Junlong is not owned by our subsidiary, it is not able to make dividend payments to our subsidiary. Instead, Zhonghefangda, our subsidiary in China, entered into a number of contracts with Junlong, including Management and Consulting Services Agreement, Equity Pledge Agreement, Option Agreement and Voting Rights Proxy Agreement, pursuant to which Junlong pays Zhonghefangda for certain services that Zhonghefangda provides to Junlong. However, depending on the nature of services provided, certain of these payments are subject to PRC taxes at different rates, including business taxes and VATs, which effectively reduce the amount that Zhonghefangda receives from Junlong. We cannot assure you that the PRC government will not impose restrictions on such payments or change the tax rates applicable to such payments. Any such restrictions on such payment or increases in the applicable tax rates may materially and adversely affect our ability to receive payments from Junlong or the amount of such payments, and may in turn materially and adversely affect our business, our net income and our ability to pay dividends to our shareholders.

Dishan Guo’s association with Junlong could pose a conflict of interest which may result in Junlong decisions that are adverse to our business.

Dishan Guo, Jinzhou Zeng and Xiaofen Wang, who hold controlling interest in Classic Bond are also controlling shareholders of our VIE. Conflicts of interests between their dual roles as owners of both Junlong and our company may arise. We cannot assure you that when conflicts of interest arise, any or all of these individuals will act in the best interests of our company or that any conflict of interest will be resolved in our favor. In addition, these individuals may breach or cause Junlong to breach or refuse to renew the existing contractual arrangements, which will have a material adverse effect on our ability to effectively control Junlong and receive economic benefits from it. If we cannot resolve any conflicts of interest or disputes between us and the beneficial owners of Junlong, we would have to rely on legal proceedings, the outcome of which is uncertain and which could be disruptive to our business.

19

If Junlong or the VIE Shareholders violate our contractual arrangements with it, our business could be disrupted and we may have to resort to litigation to enforce our rights which may be time consuming and expensive.

Our operations are currently dependent upon our commercial relationship with Junlong. If Junlong or their shareholders are unwilling or unable to perform their obligations under our commercial arrangements with them, including payment of revenues under the Management and Consulting Service Agreement, we will not be able to conduct our operations in the manner currently planned.

If the PRC government determines that the agreements establishing the structure for operating our China business do not comply with applicable PRC laws, rules and regulations, we could be subject to severe penalties including being prohibited from continuing our operations in the PRC.

On August 9, 2006, six PRC regulatory agencies, including the CSRC, promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006 (the “2006 M&A Rules”). This new regulation, among other things, governs the approval process by which a PRC company may participate in an acquisition of assets or equity interests. In the opinion of our PRC counsel, China Commercial Law Firm, this approval process was not required in our case because we have not acquired either the equity or assets of a company located in the PRC, and that the VIE agreements do not constitute such an acquisition. If the PRC government were to take a contrary view, we might be subject to fines or other enforcement action, and might be forced to amend or terminate our contractual arrangements with Junlong, which could have an adverse effect on our business.

The 2006 M&A Rules also contain provisions requiring offshore special purpose vehicles, or SPVs, formed for the purpose of acquiring PRC domestic companies and controlled by PRC individuals, to obtain the approval of the CSRC prior to listing their securities on an overseas stock exchange. In the opinion of our PRC counsel, China Commercial Law Firm, CSRC’s approval was not required for our offering of securities since we are not an SPV as defined in the Rules, nor have we acquired a PRC domestic company. However, there remains some uncertainty as to how this regulation will be interpreted or implemented. If the CSRC or another PRC regulatory agency subsequently determines that its approval was required, we may face sanctions by the CSRC or another PRC regulatory agency or other actions which could have an adverse effect on our business.

Uncertainties in the PRC legal system may impede our ability to enforce the commercial agreements that we have entered into with Junlong or any arbitral award thereunder and any inability to enforce these agreements could materially and adversely affect our business and operation.

While disputes under the Consulting Agreement with Junlong is subject to binding arbitration before the China International Economic and Trade Arbitration Commission, or CIETAC, in accordance with CIETAC Arbitration Rules, the agreements are governed by PRC law and an arbitration award may be challenged in accordance with PRC law. For example, a claim that the enforcement of an award in our favor will be detrimental to the public interest, or that an issue does not fall within the scope of the arbitration would require us to engage in administrative and judicial proceedings to defend an award. China’s legal system is a civil law system based on written statutes and unlike common law systems, it is a system in which decided legal cases have little value as precedent. As a result, China’s administrative and judicial authorities have significant discretion in interpreting and implementing statutory and contractual terms, and it may be more difficult to evaluate the outcome of administrative and judicial proceedings and the level of legal protection available than in more developed legal systems. These uncertainties may impede our ability to enforce the terms of the Consulting Agreement and the other contracts that we may enter into with Junlong. Any inability to enforce the Consulting Agreement or an award thereunder could materially and adversely affect our business and operation.

20

Our arrangements with Junlong and the VIE Shareholders may be subject to a transfer pricing adjustment by the PRC tax authorities which could have an adverse effect on our income and expenses.

We could face material and adverse tax consequences if the PRC tax authorities determine that our contracts with Junlong and the VIE Shareholders were not entered into based on arm’s length negotiations. Although our contractual arrangements are similar to other companies conducting similar operations in China, if the PRC tax authorities determine that these contracts were not entered into on an arm’s length basis, they may adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. Such an adjustment may require that we pay additional PRC taxes plus applicable penalties and interest, if any.

RISKS RELATED TO DOING BUSINESS IN CHINA

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption law, and any determination that we violated such laws could hurt our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We are also subject to Chinese anti-corrpution laws, which strictly prohibits bribery. We have operations, agreements with third parties and make sales in China, which may experience corruption. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants, sales agents or distributors of our Company, even though these parties are not always subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption law may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the United States government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

Changes in China’s political or economic situation could harm us and our operating results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have this effect are:

21

-

Level of government involvement in the economy;

-

Control of foreign exchange;

-

Methods of allocating resources;

-

Balance of payments position;

-

International trade restrictions; and

-

International conflict.

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. For example, state-owned enterprises still constitute a large portion of the Chinese economy and weak corporate governance and a lack of flexible currency exchange policy still prevail in China. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy was similar to those of the OECD member countries.

Our business is largely subject to the uncertain legal environment in China and your legal protection could be limited.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which precedents set in earlier legal cases are not generally used. The overall effect of legislation enacted over the past 20 years has been to enhance the legal protections afforded to foreign invested enterprises in China. However, these laws, regulations and legal requirements are relatively recent and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold licenses and permits such as requisite business licenses. In addition, all of our executive officers and our directors are residents of China and not of the U.S., and substantially all the assets of these persons are located outside the U.S. As a result, it could be difficult for investors to effect service of process in the U.S., or to enforce a judgment obtained in the U.S. against our Chinese operations and our controlled VIE.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

China only recently has permitted provincial and local economic autonomy and private economic activities. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

22

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as -2.2% . These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively.

The majority of our revenues will be settled in Renminbi and U.S. dollars, and any future restrictions on currency exchanges may limit our ability to use revenue generated in Renminbi to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the Renminbi for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. In addition, conversion of Renminbi for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the Renminbi.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC controlled VIEs, limit our PRC controlled VIEs’ ability to distribute profits to us or otherwise materially adversely affect us.

23

In October 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75, which required PRC residents to register with the competent local SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Internal implementing guidelines issued by SAFE, which became public in June 2007 (known as Notice 106), expanded the reach of Circular 75 by (i) purporting to cover the establishment or acquisition of control by PRC residents of offshore entities which merely acquire “control” over domestic companies or assets, even in the absence of legal ownership; (ii) adding requirements relating to the source of the PRC resident’s funds used to establish or acquire the offshore entity; (iii) covering the use of existing offshore entities for offshore financings; (iv) purporting to cover situations in which an offshore SPV establishes a new subsidiary in China or acquires an unrelated company or unrelated assets in China; and (v) making the domestic affiliate of the SPV responsible for the accuracy of certain documents which must be filed in connection with any such registration, notably, the business plan which describes the overseas financing and the use of proceeds. Amendments to registrations made under Circular 75 are required in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations, and Notice 106 makes the offshore SPV jointly responsible for these filings. In the case of an SPV which was established, and which acquired a related domestic company or assets, before the implementation date of Circular 75, a retroactive SAFE registration was required to have been completed before March 31, 2006; this date was subsequently extended indefinitely by Notice 106, which also required that the Registrant establish that all foreign exchange transactions undertaken by the SPV and its affiliates were in compliance with applicable laws and regulations. Failure to comply with the requirements of Circular 75, as applied by SAFE in accordance with Notice 106, may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV’s affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV, or from engaging in other transfers of funds into or out of China.