Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PEPCO HOLDINGS LLC | d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - PEPCO HOLDINGS LLC | dex991.htm |

Exhibit 2.1

EXECUTION COPY

PURCHASE AGREEMENT

BY AND AMONG

PEPCO HOLDINGS, INC.,

CONECTIV, LLC,

CONECTIV ENERGY HOLDING COMPANY, LLC

AND

NEW DEVELOPMENT HOLDINGS, LLC

Dated as of April 20, 2010

TABLE OF CONTENTS

| ARTICLE I |

DEFINITIONS |

1 | ||

| 1.01 |

Definitions |

1 | ||

| ARTICLE II |

SALE AND PURCHASE OF MEMBERSHIP INTERESTS; CLOSING |

24 | ||

| 2.01 |

Sale and Purchase of Membership Interests |

24 | ||

| 2.02 |

Closing Payment |

24 | ||

| 2.03 |

Closing |

25 | ||

| 2.04 |

Post-Closing Payment |

27 | ||

| 2.05 |

Tax Treatment of Payments |

28 | ||

| 2.06 |

Withholding Rights |

28 | ||

| ARTICLE III |

REPRESENTATIONS AND WARRANTIES OF PARENT, HOLDINGS AND THE COMPANY |

29 | ||

| 3.01 |

Organization and Qualification |

29 | ||

| 3.02 |

Authority to Execute and Perform Agreement |

29 | ||

| 3.03 |

Capitalization and Title to Membership Interests |

31 | ||

| 3.04 |

Subsidiaries |

31 | ||

| 3.05 |

Financial Statements |

32 | ||

| 3.06 |

Absence of Undisclosed Liabilities |

33 | ||

| 3.07 |

No Material Changes |

33 | ||

| 3.08 |

Tax Matters |

33 | ||

| 3.09 |

Compliance with Laws |

35 | ||

| 3.10 |

No Breach |

35 | ||

| 3.11 |

Consents and Approvals |

35 | ||

| 3.12 |

Actions and Proceedings |

36 | ||

| 3.13 |

Material Contracts |

36 | ||

| 3.14 |

Real Property |

38 | ||

| 3.15 |

Intellectual Property |

40 | ||

| 3.16 |

Benefit Matters |

41 | ||

| 3.17 |

Labor Matters |

42 | ||

| 3.18 |

Insurance |

43 | ||

| 3.19 |

Permits |

43 | ||

| 3.20 |

Environmental Matters |

44 | ||

| 3.21 |

Brokerage |

45 | ||

| 3.22 |

Sufficiency of Assets |

46 | ||

| 3.23 |

Personal Property |

46 | ||

| 3.24 |

Emission Allowances |

46 | ||

| 3.25 |

Delta Project |

46 | ||

| 3.26 |

Development Projects |

46 | ||

| 3.27 |

Credit Support |

46 | ||

| 3.28 |

Regulatory Matters |

47 | ||

| 3.29 |

PJM Capacity Awards |

47 | ||

| ARTICLE IV |

REPRESENTATIONS AND WARRANTIES OF PURCHASER | 47 | ||

| 4.01 |

Organization and Qualification |

47 | ||

| 4.02 |

Authority to Execute and Perform Agreement |

48 | ||

| 4.03 |

Compliance with Laws |

48 | ||

| 4.04 |

No Breach |

48 | ||

| 4.05 |

Consents and Approvals |

48 | ||

| 4.06 |

Actions and Proceedings |

49 | ||

| 4.07 |

Securities Law Matters |

49 | ||

| 4.08 |

Experience; Investigation |

49 | ||

| 4.09 |

Financing |

50 | ||

| 4.10 |

Brokerage |

50 | ||

| 4.11 |

Entity Classification for Tax Purposes |

50 | ||

| 4.12 |

Disclaimer Regarding Projections |

50 | ||

| ARTICLE V |

CONDUCT OF BUSINESS PENDING THE CLOSING |

50 | ||

| 5.01 |

Conduct of Business Pending the Closing |

50 | ||

| 5.02 |

Casualty Event; Condemnation |

55 | ||

| ARTICLE VI |

ADDITIONAL AGREEMENTS |

58 | ||

| 6.01 |

Regulatory Filings |

58 | ||

| 6.02 |

Standard of Efforts |

58 | ||

| 6.03 |

Notification of Certain Matters |

60 | ||

| 6.04 |

Access to Information; Confidentiality |

60 | ||

| 6.05 |

Public Statements |

62 | ||

| 6.06 |

No Solicitation |

63 | ||

| 6.07 |

Release of Parent Letters of Credit and Parent Guarantees |

63 | ||

| 6.08 |

Compliance with ISRA |

65 | ||

| 6.09 |

Reorganization |

68 | ||

| 6.10 |

Affiliate Obligations |

69 | ||

| 6.11 |

Termination or Assignment of Service Contracts |

69 | ||

| 6.12 |

Transition Services |

69 | ||

| 6.13 |

Insurance |

69 | ||

| 6.14 |

No Other Representations or Warranties |

70 | ||

| 6.15 |

Financing Related Cooperation |

70 | ||

| 6.16 |

Title |

70 | ||

| 6.17 |

Non-Solicitation of Employees |

71 | ||

| 6.18 |

Indebtedness |

71 | ||

| 6.19 |

Confidentiality |

71 | ||

| 6.20 |

Company Audited Financial Statements |

72 | ||

| 6.21 |

Coal Inventory and Ash Disposal |

72 | ||

| 6.22 |

Use of Trade Names |

73 | ||

| 6.23 |

Negotiation of Electricity Purchase Option |

73 | ||

| 6.24 |

Emission Allowances Filings |

73 | ||

| 6.25 |

Peak Season Maintenance and Capacity Testing |

73 | ||

| 6.26 |

Post-Closing Settlement Charges |

74 | ||

| 6.27 |

Ash Landfill |

75 | ||

-ii-

| 6.28 |

Identification and Agreement Regarding Shared Facilities and Equipment |

75 | ||

| 6.29 |

Delta Independent Engineer |

76 | ||

| ARTICLE VII | CONDITIONS |

76 | ||

| 7.01 |

Conditions to Each Party’s Obligation |

76 | ||

| 7.02 |

Conditions to Obligations of Purchaser |

76 | ||

| 7.03 |

Conditions to Obligations of Parent, Holdings and the Company |

78 | ||

| ARTICLE VIII | TAX MATTERS |

79 | ||

| 8.01 |

Tax Return Filings |

79 | ||

| 8.02 |

Tax Indemnification |

80 | ||

| 8.03 |

Cooperation |

82 | ||

| 8.04 |

Cash Grant, Refunds and Credits |

82 | ||

| 8.05 |

Tax Sharing Agreements |

83 | ||

| 8.06 |

Transfer Taxes |

83 | ||

| 8.07 |

Procedures Relating to Indemnification of Tax Claims |

83 | ||

| 8.08 |

Exclusive Remedy and Survival |

84 | ||

| 8.09 |

Tax Covenants |

84 | ||

| 8.10 |

Section 338(h)(10) Election |

85 | ||

| 8.11 |

Real Property Tax Legal Proceedings |

85 | ||

| ARTICLE IX | EMPLOYEE MATTERS |

86 | ||

| 9.01 |

Employee Matters |

86 | ||

| 9.02 |

COBRA |

92 | ||

| 9.03 |

WARN Act |

92 | ||

| 9.04 |

Employee Liabilities |

92 | ||

| 9.05 |

No Transfer of Benefit Plans |

93 | ||

| 9.06 |

No Additional Rights |

93 | ||

| ARTICLE X | SURVIVAL AND INDEMNIFICATION |

93 | ||

| 10.01 |

Survival |

93 | ||

| 10.02 |

Exclusivity |

94 | ||

| 10.03 |

Indemnification |

94 | ||

| 10.04 |

Method of Asserting Claims |

100 | ||

| 10.05 |

Manner of Payment |

102 | ||

| ARTICLE XI | TERMINATION |

102 | ||

| 11.01 |

Termination |

102 | ||

| 11.02 |

Effect of Termination |

104 | ||

| 11.03 |

Termination Damages |

104 | ||

| ARTICLE XII | MISCELLANEOUS |

107 | ||

| 12.01 |

Notices |

107 | ||

| 12.02 |

Expenses |

108 | ||

| 12.03 |

Interpretations |

108 | ||

| 12.04 |

Governing Law; Jurisdiction |

109 | ||

-iii-

| 12.05 |

Specific Performance and Other Remedies |

109 | ||

| 12.06 |

Entire Agreement |

110 | ||

| 12.07 |

Disclosure Letter |

110 | ||

| 12.08 |

Amendments |

110 | ||

| 12.09 |

Waiver |

110 | ||

| 12.10 |

Binding Effect; No Third Party Beneficiaries |

110 | ||

| 12.11 |

Assignability |

111 | ||

| 12.12 |

Severability |

111 | ||

| 12.13 |

Counterparts; Facsimile Transmission of Signatures |

111 | ||

| SCHEDULES |

||||

| Schedule I |

Generating Plants |

|||

| Schedule II |

“Knowledge Persons” |

|||

| Schedule III |

Working Capital Policies and Procedures |

|||

| Schedule IV |

Per Diem Adjustment |

|||

| Schedule V |

PJM Capacity Deficiency Charge Calculation |

|||

| Schedule VI |

Post-Closing Settlement Charges |

|||

| EXHIBITS | ||||

| Exhibit A |

Ash Landfill |

|||

| Exhibit B |

Form of Amended and Restated Cumberland Lease |

|||

| Exhibit C |

Form of Amended and Restated Generating Plant Easements |

|||

| Exhibit D |

Form of Amended Pipeline Agreement |

|||

| Exhibit E |

Form of Amended Pipeline Operation and Maintenance Agreement |

|||

| Exhibit F |

Form of Owner’s Affidavit |

|||

| Exhibit G |

Form of Potomac Option Agreement |

|||

| Exhibit H |

Form of Transition Services Agreement |

|||

| Exhibit I-1 |

Form of Release from Lien of ACE Mortgage |

|||

| Exhibit I-2 |

Form of Release from Lien of DPL Mortgage |

|||

| Exhibit J-1 |

Form of ACE Tax Exempt Bond Agreement |

|||

| Exhibit J-2 |

Form of DPL Tax Exempt Bond Agreement |

|||

-iv-

PURCHASE AGREEMENT

THIS PURCHASE AGREEMENT (this “Agreement”), dated as of April 20, 2010, by and among Pepco Holdings, Inc., a Delaware corporation (“Parent”), Conectiv, LLC, a Delaware limited liability company (“Holdings”), Conectiv Energy Holding Company, LLC, a Delaware limited liability company (the “Company”) and New Development Holdings, LLC, a Delaware limited liability company (“Purchaser”).

RECITALS

WHEREAS, Parent owns 100% of the membership interests of Holdings;

WHEREAS, Holdings owns 100% of the membership interests of the Company (the “Membership Interests”);

WHEREAS, Parent desires that Purchaser acquire, and Purchaser wishes to acquire, all of the Membership Interests from Holdings, upon the terms and subject to the conditions set forth in this Agreement; and

WHEREAS, prior to the consummation of the transactions contemplated by this Agreement, Parent, Holdings and the Company shall consummate the Reorganization (as defined below).

NOW, THEREFORE, in consideration of the premises and the mutual representations, warranties, covenants, and promises set forth in this Agreement, and intending hereby to be legally bound, subject to the terms and conditions set forth in this Agreement, Parent, Holdings, the Company and Purchaser hereby agree as follows:

ARTICLE I

DEFINITIONS

1.01 Definitions . Capitalized words and phrases used and not otherwise defined in this Agreement shall have the following meanings:

Accounting Firm: means Deloitte LLP or, if unavailable, a nationally-recognized public accounting firm that is independent with respect to Parent, Holdings, the Company and Purchaser (within the meaning of Rule 2-01 under Securities and Exchange Commission Regulation S-X) to be agreed upon by Holdings and Purchaser in writing.

ACE: means Atlantic City Electric Company.

ACE Mortgage: means the Mortgage and Deed of Trust, dated January 15, 1937, of ACE to The Bank of New York Mellon, as successor trustee, as amended and supplemented.

ACE Tax Exempt Bond Agreement: means the agreement between ACE and Conectiv Atlantic Generation L.L.C., substantially in the form attached hereto as Exhibit J-1.

Adjusted Restoration Cost: shall have the meaning set forth in Section 5.02(a).

Affiliate: means any Person that directly or indirectly, through one or more intermediaries, controls or is controlled by or is under common control with the Person specified. For purposes of this definition, control of a Person means the power, direct or indirect, to direct or cause the direction of the management and policies of such Person, whether by Contract or otherwise.

Agreement: shall have the meaning set forth in the introductory paragraph.

Amended and Restated Generating Plant Easements: mean the agreements evidencing the Generating Plant Easements, each to be substantially in the form attached hereto as Exhibit C.

Amended and Restated Hay Road and Edge Moor Easement: means an amended and restated easement between the relevant Company and DPL to be negotiated in good faith after the date hereof, and consistent (to the extent applicable) with the Amended and Restated Generating Plant Easements, including, without limitation, to the extent necessary, an easement for access purposes to the Ash Landfill (or, as to the Ash Landfill, a separate easement between the relevant Company and any other Affiliate of Parent designated by Parent).

Arbitration Submission: shall have the meaning set forth in Section 2.04(c).

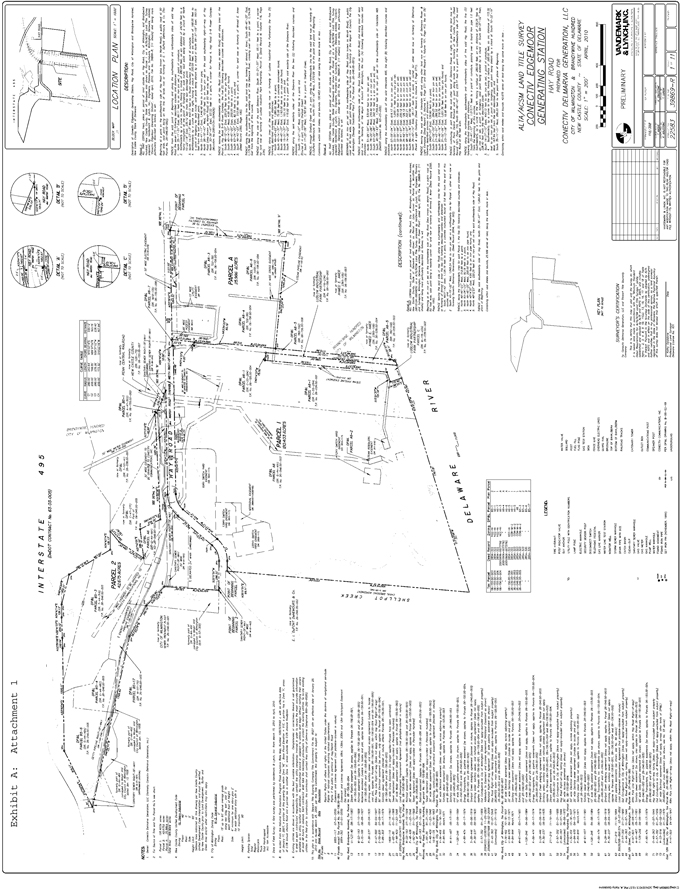

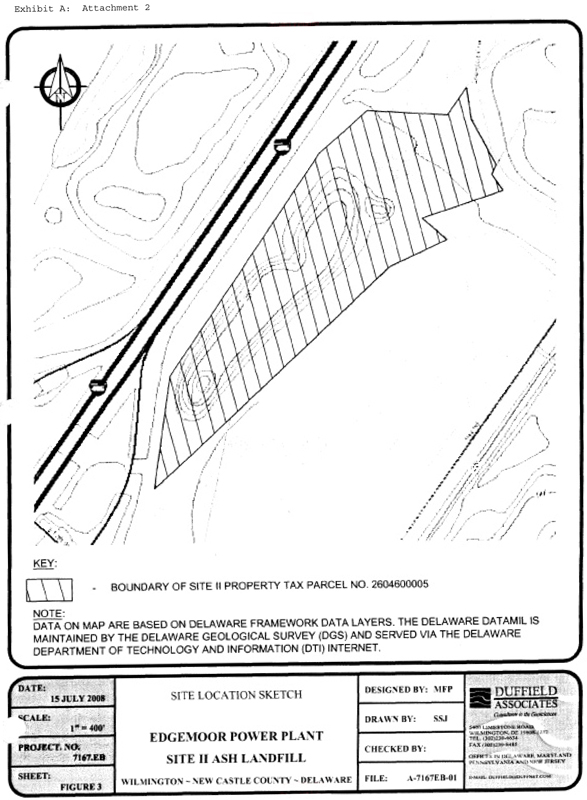

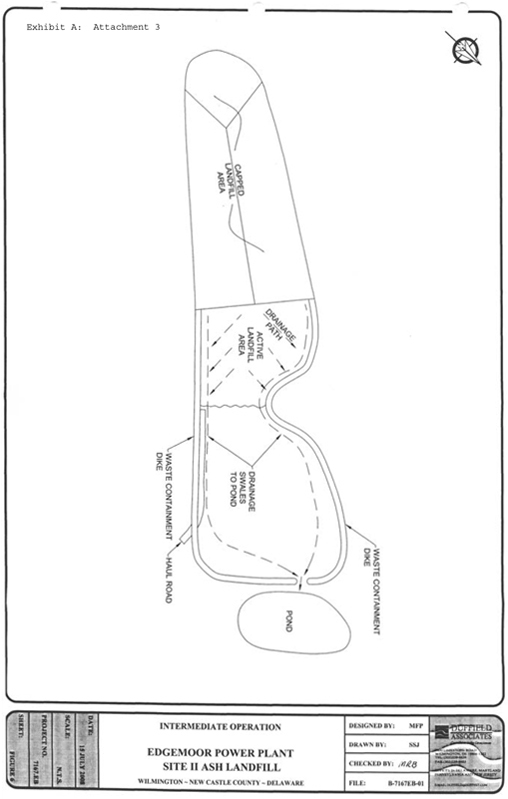

Ash Landfill: means the ash landfill (Site II) at the Edge Moor Generating Plant more particularly described on Exhibit A attached hereto.

Assumed Post-Closing Non-Union Pension Benefit: means the value of the Service Cost Accrual of the pension benefits that the applicable Post-Closing Non-Union Employee would have accrued under the Parent Retirement Plan (based on the expense which Parent would have been required to report on its income statement prepared in accordance with GAAP) for the two (2) year period immediately following the Closing Date had such employee continued as an employee of Parent or a Subsidiary thereof. The Service Cost Accrual will be calculated by Purchaser’s actuary for the two (2) year period as of the Closing Date using the assumptions set forth in Section 1.1(d) of the Disclosure Letter, and Parent’s actuary shall confirm the reasonableness of such calculations in the aggregate.

Assumed Post-Closing Non-Union Retiree Welfare Benefits: means the value of the Service Cost Accrual that Parent would have recorded on its income statement in accordance with GAAP for the Service Cost Accrual of retiree welfare benefits for Post-Closing Non-Union Employees for the two (2) year period immediately following the Closing Date had such employee continued as an employee of Parent or a Subsidiary thereof. The Service Cost Accrual will be calculated by Purchaser’s actuary for the two (2) year period as of the Closing Date using the assumptions set forth in Section 1.1(e) of the Disclosure Letter, and Parent’s actuary shall confirm the reasonableness of such calculations in the aggregate.

Balance Sheet: shall have the meaning set forth in Section 3.05(a).

Balance Sheet Date: shall have the meaning set forth in Section 3.05(a).

-2-

Bankruptcy and Equity Exception: shall have the meaning set forth in Section 3.02(e).

Benefit Plan: shall have the meaning set forth in Section 3.16(a).

Books and Records: means all files, documents, instruments, papers, books, reports, records, tapes, microfilms, photographs, letters, budgets, ledgers, journals, title policies, supplier lists, regulatory filings, operating data and plans, technical documentation (design specifications, functional requirements, operating instructions, logic manuals, flow charts, etc), user documentation (installation guides, user manuals, training materials, release notes, working papers, etc.), and other similar materials, in all such cases which are primarily related to the business and the assets and the operations of the Companies, in whatever form (including electronic), and regardless of whether maintained by the Company or an Affiliate, but excluding materials relating to the transactions contemplated by this Agreement; provided, however, that “Books and Records” shall only include personnel records to the extent permissible by Law.

Bulk Sale Act: shall have the meaning set forth in Section 8.02(a)(vi).

Business Day: means any day other than Saturday, Sunday or any day on which commercial banks in New York are authorized or required to close.

Business IT: shall mean the computers, computer software, firmware, middleware, servers, workstations, routers, hubs, switches, data communications lines, data, and all other information technology equipment and computer systems currently used in the businesses of the Companies.

Calpine Guarantee: means the Guarantee, dated as of the date of this Agreement, made by Calpine Corporation, a Delaware corporation and the indirect parent of Purchaser, for the benefit of Parent.

Cap: shall have the meaning set forth in Section 10.03(c)(i).

Capacity Resource Deficiency Charge: means the Capacity Resource Deficiency Charge calculated in accordance with Section A of Schedule V.

Cash Collateral: means, collectively, all cash posted as collateral by the Companies, including such cash collateral held in NYMEX brokerage accounts or posted with wholesale counterparties, local distribution companies or independent system operators. The amount of Cash Collateral as of the date hereof, along with the counterparties, and contract or instrument under which it is posted, is set forth in Section 1.1(c) of the Disclosure Letter.

Cash Grant: means a grant provided for in Section 1603 of the American Recovery and Reinvestment Act of 2009.

Casualty Event: shall have the meaning set forth in Section 5.02(a).

CES: means Conectiv Energy Supply, Inc., a Delaware corporation.

-3-

Citi: shall have the meaning set forth in Section 4.09.

Claim Notice: means written notification pursuant to Section 10.04(a) of a Third Party Claim as to which indemnity under Section 10.03(a) or 10.03(b) is sought by an Indemnified Party, enclosing a copy of all papers served, if any, and specifying the nature of and basis for such Third Party Claim and for the Indemnified Party’s claim against the Indemnifying Party under Section 10.03(a) or 10.03(b), together with the amount or, if not then reasonably ascertainable, the estimated amount, determined in good faith, of such Third Party Claim.

Closing: shall have the meaning set forth in Section 2.03(a).

Closing Condition Satisfaction Date: shall have the meaning set forth in Section 2.03(a).

Closing Date: shall have the meaning set forth in Section 2.03(a).

Closing Date Capital Expenditures: means (i) the aggregate amount of all funds actually expended by the Companies during the period beginning on January 1, 2010 and ending at 11:59 P.M., New York time, on the Business Day immediately prior to the Closing Date, (A) in respect of Scheduled Capital Expenditures which are shown on Section 1.1(b) of the Disclosure Letter as budgeted for the period beginning on July 1, 2010, (B) for additions, improvements or replacements not exceeding $500,000 in the aggregate, relating to the business or operations of the Companies that constitute necessary repairs due to breakdown or casualty made in response to a business emergency or other unforeseen operational matters occurring after the date hereof, or (C) for any capital expenditure that is approved by Purchaser in writing, (ii) reduced by the aggregate amount of Scheduled Capital Expenditures which are shown on Section 1.1(b) of the Disclosure Letter as budgeted for the period prior to June 30, 2010 and not spent by the Closing, and (iii) without duplication of any adjustment in clause (ii) of this definition, reduced by the aggregate amount of any additional costs and capital expenditures that are not identified in the Delta Construction Budget and that are certified by the Delta Independent Engineer as required to be expended by any of the Companies following the Closing to achieve COD and otherwise accomplish the work with respect to the Delta Project contemplated by the Delta Construction Budget in accordance with Good Construction Practices and the requirements of the Constellation PPA, net of any reductions in costs and capital expenditures identified in the Delta Construction Budget that the Delta Independent Engineer certifies will not be required to be expended by any of the Companies following the Closing to accomplish the work with respect to the Delta Project contemplated by the Delta Construction Budget; provided, however, that any such cost or capital expenditure reductions are consistent with Good Construction Practices and are not attributable to (A) any decrease in quality or scope of the construction of the Delta Project, including, without limitation, with respect to construction services, equipment and parts, or (B) any change in quantity or scope of the construction of the Delta Project from that reflected in the Delta Construction Budget on the date hereof.

Closing Date Fuel Inventory: means the amount equal to the fair market value of Fuel Inventory as of 11:59 P.M. on the Business Day immediately prior to the Closing Date, calculated in accordance with the policies and procedures set forth on Schedule III (which, for purposes of clarity, shall take into account the quantity, grade and quality of such fuel).

-4-

Closing Date Inventory Cost: means the book value of the Inventory determined in accordance with GAAP (that is, the lower of cost or market value) as of 11:59 P.M. on the Business Day immediately prior to the Closing Date and which, for the avoidance of doubt, shall not include the cost of any obsolete inventory or part.

Closing Date Working Capital: means the (i) amount of “cash and cash equivalents” (including Cash Collateral, but excluding any posted letters of credit), (ii) “accounts receivable” (including accounts receivable from Affiliates of Parent to the extent that any one or more of the Companies will receive the benefits thereof after the Closing and excluding margin deposits) and (iii) “prepayments” and “pre-paid” expenses made by the Companies at or prior to the Closing Date (to the extent that any one or more of the Companies will receive the benefits thereof after the Closing), in each case included in “current assets” of the Companies minus the amount of “current liabilities” of the Companies, each calculated in accordance with GAAP and also consistent with the procedures and definitions set forth on Schedule III, as of 11:59 P.M. on the Business Day immediately prior to the Closing Date. For the avoidance of doubt, “Closing Date Working Capital” shall exclude Fuel Inventory, Emission Allowances, REC Inventory and Inventory.

Closing Deliverables: shall have the meaning set forth in Section 2.03(b).

Closing Extension Date: means the later of (i) the date that is three (3) Business Days after the date that is 45 days following the date Purchaser receives the Company Audited Financial Statements and the Unqualified Opinion in accordance with Section 6.20 and (ii) the first date as of which the Closing would have been required to occur had Purchaser not elected to defer the Closing pursuant to Section 2.03(a).

Closing Payment: shall have the meaning set forth in Section 2.02.

COBRA: means the Consolidated Omnibus Budget Reconciliation Act.

COD: means the date (or, if the Delta Independent Engineer certifies to a range of dates, the midpoint) that the Delta Project is reasonably expected (i) to be designated as a capacity resource by PJM, in an amount that is equal to at least 518 megawatts and (ii) to be capable of generating electrical output equal to at least 518 megawatts, including allowance for sufficient time to run the Facility Test (as defined in the Constellation PPA).

Code: means the United States Internal Revenue Code of 1986, as amended, and the regulations promulgated and the rulings issued thereunder.

Collective Bargaining Agreement: means any collective bargaining agreement with any labor union representing employees of any of the Companies.

Columbia Gas Contract: means the Transportation Agreement, No. 75630, dated May 12, 2003, by and between Columbia Gas Transmission, LLC and CES.

-5-

Companies: means the Company and the Subsidiaries, other than the Excluded Subsidiaries.

Company: shall have the meaning set forth in the introductory paragraph.

Company Audited Financial Statements: means the audited consolidated balance sheets of the Company and its Subsidiaries as of December 31, 2009 and 2008 and the audited consolidated statements of income, cash flows and shareholder’s equity for each of the three years in the period ended December 31, 2009 and the associated notes to such consolidated financial statements, prepared in accordance with GAAP and audited in accordance with generally accepted auditing standards in the United States of America.

Company Non-Union Employee: means any employee employed by the Companies, other than a Union Employee.

Company Pro Forma Balance Sheet: means the consolidated balance sheet of the Company and its consolidated Subsidiaries as of February 28, 2010, as adjusted to give effect to the Reorganization and the Push Down Accounting Adjustments.

Company Transaction Costs: means the fees and expenses of any advisor or other third party paid or payable by the Companies in connection with the transactions contemplated by this Agreement, including any fees and expenses of Credit Suisse, Morgan Stanley, any amounts payable by the Companies to any Affiliate, officer, director or employee in the nature of a “change in control”, closing or signing bonus or similar payment as a result of this Agreement or the transactions contemplated hereby and any fees and expenses incurred in connection with obtaining any third party consents or approvals that are required to be obtained as a condition to the Closing.

Company Unaudited Financial Statements: shall have the meaning set forth in Section 3.05(a).

Compliance with ISRA: means the receipt by Parent or Purchaser of (i) a letter or letters from the NJDEP, in accordance with Subchapter 5 of the ISRA regulations, approving, as applicable, a de minimis quantity exemption, an area of concern review application, a regulated underground storage tank waiver application, a minimal environmental concern application, a negative declaration or a remediation-in-progress waiver (as each such term is defined under ISRA), (ii) a No Further Action Letter issued by the NJDEP, or a Response Action Outcome issued by an LSRP, or (iii) other written determination by the NJDEP or an LSRP that the requirements of ISRA are being or have been satisfied with respect to the New Jersey ISRA Property.

Condemnation Value: shall have the meaning set forth in Section 5.02(d).

Confidentiality Agreement: means the Confidentiality Agreement, dated as of November 10, 2009, between Parent and Purchaser.

-6-

Constellation PPA: means the Tolling Agreement, dated December 13, 2007, between Conectiv Mid-Merit, LLC and Constellation Energy Commodities Group, Inc., and all security documents related thereto.

Consumed Pre-Closing Emission Allowances: shall have the meaning set forth in Section 3.24.

Contract: means any agreement, license, sublicense, easement, sales order, purchase order, commitment, lease, evidence of Indebtedness, guarantee, mortgage, indenture, security agreement or other contract, instrument, understanding or arrangement that is binding on any Person or any of its property under applicable Laws.

Credit Rating: means, with respect to any Person, the rating then assigned to such Person’s unsecured, senior long-term debt obligations not supported by third party credit enhancements, or if such Person does not have such a rating, then the rating then assigned to such Person as an issuer, by S&P and/or Moody’s, as applicable, and any successors thereto.

Credit Suisse: means Credit Suisse Securities (USA) LLC.

Cumberland Lease: means the Lease Agreement, dated July 1, 2000, between ACE and Conectiv Atlantic Generation, LLC.

December 2011 Settlement Calculation Notice: shall have the meaning set forth in Section 6.26(b).

Deductible: shall have the meaning set forth in Section 10.03(c)(ii).

Deepwater Easement: means one or more easement agreements between the relevant Company and ACE or any other Affiliates of Parent designated by Parent to be negotiated in good faith after the date hereof, and consistent (to the extent applicable) with the Amended and Restated Generating Plant Easements, including, without limitation, an easement for access purposes to the ash disposal parcel.

Delta Construction Budget: shall have the meaning set forth in Section 3.25.

Delta Independent Engineer: means The Shaw Group Inc. (Boston, Massachusetts office) or, if unavailable, a nationally-recognized engineering firm selected by mutual agreement of Parent and Purchaser within ten (10) Business Days following the date of this Agreement, which shall be retained by Purchaser no later than 20 Business Days following the date of this Agreement, with the cost shared equally by Purchaser and Parent.

Delta Pipeline Matter: means the matter identified as such in Section 3.13 of the Disclosure Letter.

Delta Project: means the approximately 565 megawatt dual fuel combined cycle generation plant under construction in Peach Bottom Township, Pennsylvania.

-7-

Designated Entities: means Conectiv Atlantic Generation, LLC, Conectiv Delmarva Generation, LLC, Conectiv Bethlehem, LLC, Conectiv Mid Merit, LLC and Conectiv Vineland Solar, LLC.

Designated Generating Plants: means the Generating Plants listed in Section 1.1(f) of the Disclosure Letter, including the Real Property associated with such Generating Plants.

Deutsche Bank: shall have the meaning set forth in Section 4.09.

Development Projects: means the following development projects at various stages of planning as to which no construction has commenced: (i) Cumberland 3, a planned dual fuel combustion turbine generation plant of approximately 100 megawatts to be located in Cumberland, New Jersey; (ii) Delta 2, a planned dual fuel combined cycle generation plant of approximately 565 megawatts to be located in Peach Bottom Township, Pennsylvania; (iii) Powell, a planned dual fuel combustion turbine generation plant of approximately 200 megawatts to be located in Prince Georges County, Maryland; and (iv) Talbert, a planned dual fuel combustion turbine generation plant of approximately 200 megawatts to be located in Prince Georges County, Maryland.

Disclosure Letter: means the disclosure letter delivered by Parent, Holdings and the Company to Purchaser simultaneously with the execution of this Agreement.

Dispute Period: means the period ending 30 days following receipt by an Indemnifying Party of either a Claim Notice or an Indemnity Notice.

Dollars or $: means dollars in lawful currency of the United States of America.

DPL: means Delmarva Power & Light Company.

DPL Mortgage: means the Mortgage and Deed of Trust, dated October 1, 1943, of DPL to The Bank of New York Mellon, as successor trustee, as amended and supplemented.

DPL Tax Exempt Bond Agreement: means the agreement between DPL and Conectiv Delmarva Generation L.L.C., substantially in the form attached hereto as Exhibit J-2.

Easement Real Property: shall have the meaning set forth in Section 3.14(a).

Emission Allowances: means all allowance allocations to emit specified units of pollutants or Hazardous Substances under any Environmental Laws, including (i) any air pollution control and emission reduction program designed to mitigate interstate or intra-state transport of air pollutants or reduce or control the emission of any air pollutants, including without limitation, SO2, NOx, carbon dioxide, or other greenhouse gases, (ii) any program designed to mitigate impairment of surface waters, watersheds, or groundwater, or (iii) any pollution reduction program with a similar purpose. Emission Allowances include all allowances as described above, regardless of whether the Governmental or Regulatory Authority establishing such Emission Allowances designates them as credits, benefits, offsets, allowances or by any other name.

-8-

Environmental Claim: means any complaint, summons, citation, directive, order, litigation, notice of violation, proceeding or judgment from any Governmental or Regulatory Authority or Person alleging violations of or Liability under any Environmental Laws.

Environmental Condition: means the presence or Release to the environment, including air, surface and subsurface water, groundwater, soil and sediments, whether at the Real Property or otherwise, of Hazardous Substances, including any migration of Hazardous Substances through air, surface and subsurface water, groundwater, soil and sediments, at, to or from the Real Property, or at, to or from any Off-Site Location, regardless of when such presence or Release occurred or is discovered.

Environmental Laws: means all federal, state and local laws, regulations, rules, ordinances, codes, principles of common law, decrees, judgments, directives, or judicial or administrative orders relating to pollution or protection of the environment, natural resources or human health and safety, including laws relating to the Release or threatened Release of Hazardous Substances (including to air, surface water, groundwater, land, surface and subsurface strata) or otherwise relating to the manufacture, processing, distribution, presence, use, treatment, storage, disposal, arrangement for disposal, Release, transport, handling, removal or remediation of Hazardous Substances, laws relating to record keeping, notification, disclosure and reporting requirements respecting Hazardous Substances, and laws relating to the management, use, restoration or compensation for use of or damage to natural resources.

Environmental Permits: means all licenses, permits, consents, approvals and governmental authorizations under Environmental Laws.

ERISA: means the Employee Retirement Income Security Act of 1974, as amended.

ERISA Affiliate: shall have the meaning set forth in Section 3.16(b).

Estimated Capital Expenditures: means Parent’s good faith estimate of the aggregate amount of Closing Date Capital Expenditures.

Estimated Fuel Inventory: means the aggregate amount of the Fuel Inventory resulting from the Inventory Audit.

Estimated Inventory Cost: means the aggregate amount of the Inventory resulting from the Inventory Audit.

Estimated Working Capital: means Parent’s good faith estimate of the aggregate amount of the Closing Date Working Capital.

Excluded Assets: means the Excluded Contracts, the Excluded Subsidiaries, REC Inventory, the Ash Landfill and Madison.

Excluded Contracts: means each of the Contracts to which one of the Companies is a party, but to which one of the Companies will not be a party after giving effect to the Reorganization.

-9-

Excluded Subsidiaries: means each of CES (but not its Subsidiaries), ACE REIT, Inc. (but not its Subsidiaries), Conectiv Pennsylvania Generation, LLC, Delaware Operating Services Company, Conectiv Northeast, LLC and Energy Systems Northeast, LLC.

Federal Power Act: means the Federal Power Act of 1935, as amended.

FERC: means the Federal Energy Regulatory Commission, or any successor agency.

FERC Approval: means the approval by FERC under Section 203 of the Federal Power Act.

Financing Commitments: shall have the meaning set forth in Section 4.09.

Former Property: means any real property or facility owned, leased or operated by any of the Companies or a predecessor thereof prior to the Closing Date, that is not owned, leased or operated by any of the Companies on or after the Closing Date.

Fuel Inventory: means the fuel oil inventory related to the operation of the Generating Plants and located at or in transit to such Generating Plants, which shall not include coal, natural gas or the chemicals used in the burning of coal.

GAAP: means United States generally accepted accounting principles, as in effect from time to time.

General Information Notice: shall have the meaning set forth in Section 6.08(a).

Generating Plant: means the Generating Plants listed on Schedule I.

Generating Plant Easement: means, with respect to Generating Plants that on Schedule I are designated as located on an easement granted by an Affiliate of Parent, the real property easement upon which such Generating Plant is located.

Good Construction Practices: means (i) those practices, methods, equipment, specifications and standards of safety and performance, as the same may change from time to time, as are commonly used by the firms performing engineering and/or construction services on facilities of the type and size of the Delta Project, which in the exercise of reasonable judgment and in light of the facts known at the time the decision was made, are considered good, safe and prudent practice in connection with the construction, installation and use of electrical and other equipment, facilities and improvements, with commensurate standards of safety, performance, dependability, efficiency and economy; and (ii) in compliance with all applicable Laws.

Good Industry Practices: means any of the practices, methods and acts generally engaged in or approved by a significant portion of the electric power generation industry during the relevant time period that, in the exercise of reasonable judgment in light of the applicable manufacturer’s recommendations and the facts known or that reasonably should have been known at the time the decision was made, would reasonably have been expected to accomplish the desired result at a reasonable cost consistent with good business practices, reliability, safety and expedition.

-10-

Governmental or Regulatory Authority: means any government, quasi-governmental authority, court, tribunal, arbitrator, authority, regulatory body, agency, commission, official or other instrumentality and any supranational organization of sovereign states exercising such function for such sovereign states of the United States or any foreign country or any domestic or foreign state, county, city or other political subdivision exercising executive, legislative or judicial authority and including any governmental, quasi-governmental or non-governmental body administering, regulating or having general oversight over gas, electricity, power or other markets, including FERC, NERC, any independent system operator, or any regional transmission organization, including PJM.

Hazardous Substances: means (i) any petrochemical or petroleum products, oil, radioactive materials, radon gas, asbestos in any form that is or could become friable, urea formaldehyde foam insulation and transformers or other equipment that contain dielectric fluid which may contain levels of polychlorinated biphenyls; (ii) for purposes of this Agreement, oil ash and coal ash; (iii) any chemicals, materials or substances defined as or included in the definition of “hazardous substances,” “hazardous wastes,” “hazardous materials,” “restricted hazardous materials,” “extremely hazardous substances,” “toxic substances,” “contaminants” or “pollutants” or words of similar meaning and regulatory effect; or (iv) any other chemical, material or substance, which is prohibited, limited, subject to regulation, investigation, control or remediation, or that could give rise to Liability, under any Environmental Law.

Holdings: shall have the meaning set forth in the introductory paragraph.

HSR Act: means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

Improvements: means all buildings, structures, fixtures and improvements, including all building systems, sewer, storm and waste water systems and other water distribution systems located on or included in the Real Property, including those under construction.

Indebtedness: of any Person means: (i) any and all Liabilities of any Person (A) for borrowed money (including the current portion thereof), (B) under or related to any reimbursement obligation relating to a letter of credit, bankers’ acceptance or note purchase facility, (C) evidenced by a bond, note, debenture or similar instrument (including a purchase money obligation), (D) for the payment of money relating to a lease or instrument that is required to be classified as a capitalized/finance lease obligation in accordance with GAAP, (E) for all or any part of the deferred purchase price of property or services (other than trade payables), and (F) under or related to any agreement that is an interest rate swap agreement, basis swap, forward rate agreement, commodity swap, commodity option, equity or equity index swap or option, bond option, interest rate option, forward foreign exchange agreement, rate cap, collar or floor agreement, currency swap agreement, cross-currency rate swap agreement, currency option or other similar agreement (including any option to enter into any of the foregoing), and (ii) any and all Liabilities of others described in the preceding clause (i) that such Person has

-11-

guaranteed or that is recourse to such Person or any of its assets or that is otherwise its legal liability or that is secured in whole or in part by the assets of such Person. For purposes of this Agreement, Indebtedness shall include any and all accrued interest, success fees, prepayment premiums, make-whole premiums or penalties, and fees or expenses (including, without limitation, attorneys’ fees) associated with any Indebtedness.

Indemnified Party: means any Person claiming indemnification under any provision of Article VIII or X.

Indemnifying Party: means any Person against whom a claim for indemnification is being asserted under any provision of Article VIII or X.

Indemnity Notice: means written notification pursuant to Section 10.04 of a claim for indemnity under Article X by an Indemnified Party, specifying the nature of and basis for such claim, together with the amount or, if not then reasonably ascertainable, the estimated amount, determined in good faith, of such claim.

Institutional Controls: shall have the meaning set forth in Section 6.08(g).

Intellectual Property: means all: (i) registered and unregistered copyrightable works of authorship and copyrights, including software programs (whether in source code, object code or human readable form) and related documentation and registrations and applications for any of the foregoing; (ii) inventions and discoveries, whether or not patentable, patents, patent applications and industrial designs, including any registrations, invention disclosures, revisions, provisionals, divisionals, continuations, continuations-in-part, renewals, reissues, extensions and reexaminations for any of the foregoing, as applicable; (iii) registered and unregistered trademarks, service marks, trade names, logos, designs, symbols, trade dress business names, Internet domain names and other similar designations of source or origin, together with the goodwill of the business symbolized by any of the foregoing and registrations and applications relating to any of the foregoing; and (iv) trade secrets and other confidential ideas, know-how, concepts, methods, processes, formulae, data, customer lists, mailing lists, business plans or other proprietary information that gives a competitive advantage.

Interconnect Lateral Agreement: means the Interconnect and Delivery Lateral Reimbursement and Operating Agreement, dated April 28, 2009, between Transcontinental Gas Pipe Line Company, LLC and Conectiv Mid-Merit, LLC.

Inventory: means materials, spare parts, consumable supplies and chemical inventories (other than chemicals used in the burning of coal) relating to the operation of the Generating Plants; provided, however, that “Inventory” shall not include (i) Fuel Inventory, (ii) REC Inventory, (iii) subject to Section 6.21, coal, (iv) Emission Allowances or (v) materials, spare parts, consumable supplies and chemical inventories that are obsolete or otherwise not useful to the operation of the Generating Plants in the manner in which they are being operated immediately prior to the Closing.

Inventory Audit: shall have the meaning set forth in Section 2.02.

Inventory Target: shall have the meaning set forth in Section 2.02(e).

-12-

IRS: means the United States Internal Revenue Service.

ISRA: means the Industrial Site Recovery Act, N.J.S.A. 13:1K-6 et seq., and the regulations promulgated thereunder, N.J.A.C. 7:26B-1.1 et seq., as amended by the SRRA.

ISRA Compliance Costs: means all fees, costs and expenses incurred to achieve Compliance with ISRA, including attorneys’, consultants’ and engineering fees and disbursements, NJDEP filing fees and oversight charges, costs associated with any remedial action permits, costs (including any surcharges) associated with securing and maintaining any remediation funding source, laboratory and analytical costs and expenses, equipment charges, costs associated with any NJDEP audits pursuant to SRRA, and industrial or hazardous waste disposal costs, including those costs incurred after the Closing pursuant to Section 6.08.

Law or Laws: means all laws, statutes, rules, regulations, ordinances, codes, Orders, authorizations, judicial decisions, governmental agreements and other pronouncements having the effect of law of the United States, any foreign country or any domestic or foreign state, county, city or other political subdivision or of any Governmental or Regulatory Authority.

Lease: shall have the meaning set forth in Section 3.14(b).

Leased Real Property: shall have the meaning set forth in Section 3.14(a).

Legal Proceeding: means any civil, criminal, judicial, administrative or arbitral actions, suits, audits, hearings, litigation, proceedings (public or private), claims, investigations or governmental proceedings.

Liabilities: of any Person means any and all debts, liabilities, commitments and obligations, whether accrued or fixed, known or unknown, absolute or contingent, matured or unmatured, determined or determinable.

LIBOR: means the London Interbank Offered Rate, as quoted in The Wall Street Journal.

Lien: means any mortgage, pledge, assessment, security interest, lease, lien, equity, adverse claim, levy, charge, obligation or other encumbrance, of every kind and character.

Loss: means any and all Liabilities, damages, claims, fines, penalties, deficiencies, losses and expenses (including court costs, reasonable fees of attorneys, accountants and other experts or other reasonable expenses of litigation or other proceedings or any claim, default or assessment).

Lost Profits: shall have the meaning set forth in Section 5.02(a).

LSRP: means a Licensed Site Remediation Professional as defined at N.J.S.A. 58:10C-2.

-13-

Madison: means the retired plant more commonly known as the Madison Street Combustion Turbine Generating Station located in Wilmington, Delaware.

March 2011 Settlement Calculation Notice: shall have the meaning set forth in Section 6.26(a).

Marks: shall have the meaning set forth in Section 6.22.

Master Leases: means (i) that certain Master Lease Agreement, dated April 22, 2009, by and between Banc of America Leasing & Capital, L.L.C. and PHI Service Company et al. and (ii) that certain Master Lease Agreement, dated February 1, 2003, by and between BLC Corporation and PHI Service Company.

Material Adverse Effect: means a materially adverse effect on the business, assets, Liabilities, condition (financial or otherwise) or results of operations of (a) the Companies considered as a single enterprise, (b) any Specified Generating Plant or (c) the Other Generating Plants; provided, however, that in no event shall any of the following, alone or in combination, be deemed to constitute, nor shall any of the following be taken into account in determining whether there has occurred, a Material Adverse Effect: (i) effects resulting from changes in the national, regional or local wholesale or retail markets for electric power; (ii) effects resulting from changes in the national, regional or local wholesale or retail markets for natural gas; (iii) effects resulting from changes in the national, regional or local markets for commodities or supplies, including electric power, natural gas or other fuel and water, as applicable, used in connection with the business and operations of the Companies; (iv) effects resulting from changes in the national, regional or local electric generating, transmission or distribution industry; (v) effects resulting from changes in the national, regional or local electric transmission or distribution systems or operations thereof; (vi) effects resulting from any change in PJM market design and pricing; (vii) effects resulting from changes in applicable Law or any interpretations of applicable Law by any Governmental or Regulatory Authority, including any interpretations relating to the wholesale market serviced by the Companies; (viii) effects resulting from weather conditions or climate change; (ix) effects resulting from factors generally affecting the economy, financial markets or capital markets; or (x) effects of any war, act of terrorism, civil unrest or similar event; provided further, however, that:

(A) in the case of items (i) – (x), such adverse items shall only be excluded to the extent any such effects do not have a disproportionate impact on respectively (1) the Companies considered as a single enterprise, (2) the affected Specified Generating Plant or (3) the affected Other Generating Plants, in each case as compared to other Persons or plants engaged in the fossil fuel power generation business who is a participant in the PJM power pool;

(B) a Casualty Event or Condemnation Event addressed by Section 5.02 shall not be deemed to constitute, nor shall any such Casualty Event or Condemnation Event be taken into account in determining whether there has occurred, a Material Adverse Effect; except that a Casualty Event or Condemnation Event affecting a Specified Generating Plant may be taken into account in determining whether a Material Adverse Effect has occurred with the Companies considered as a single enterprise, but not otherwise; and

-14-

(C) in no event shall (1) any additional costs or capital expenditures relative to the Delta Construction Budget as determined by the Delta Independent Engineer taken into account in determining Closing Date Capital Expenditures or (2) any delay in achieving COD for which Purchaser is entitled to a Purchase Price adjustment under Section 2.02(i), be taken into account in determining whether a Material Adverse Effect has occurred with respect to the Delta Project.

Material Contract: shall have the meaning set forth in Section 3.13.

Membership Interests: shall have the meaning set forth in the Recitals.

Moody’s: means Moody’s Investor Services, Inc.

Morgan Stanley: means Morgan Stanley & Co. Incorporated.

NERC: means the North American Electric Reliability Corporation, any regional reliability entity and any successor agency.

New Jersey ISRA Property: means the Industrial Establishments, as defined at N.J.A.C. 7:26B-1.4, located in New Jersey on which the following Generating Plants are situated: Carll’s Corner, Cedar, Deepwater, Mickleton, Middle, Missouri Avenue, Cumberland, Sherman Avenue and Conectiv Vineland Solar.

NJDEP: means the New Jersey Department of Environmental Protection, its divisions, bureaus and subdivisions.

No Further Action Letter: shall have the meaning set forth at N.J.S.A. 13:1K-8.

Non-Union Employee: means a Company Non-Union Employee or a Service Company Employee.

Notice of Disagreement: shall have the meaning set forth in Section 2.04(b).

NOx: means nitrogen oxide.

Off-Site Location: means any real property other than the Real Property.

Order: means any writ, judgment, decree, injunction, award, settlement or stipulation, decision, determination, ruling, subpoena or verdict or similar order entered, issued, made or rendered by any Governmental or Regulatory Authority (in each such case whether preliminary or final).

Other Generating Plants: means any combination of Generating Plants (other than the Specified Generating Plants) that in the aggregate have a capacity equal to at least 50% of the aggregate capacity of the Generating Plants (other than the Specified Generating Plants).

Outside Date: shall have the meaning set forth in Section 11.01(b).

Owned Intellectual Property: means Intellectual Property owned by the Company or any Subsidiary.

-15-

Owned Real Property: shall have the meaning set forth in Section 3.14(a).

Parent: shall have the meaning set forth in the introductory paragraph.

Parent Employer Party: means any of Parent, the Company, a Subsidiary or any of their respective Affiliates.

Parent Guarantees: means, after giving effect to the Reorganization, collectively, those indemnities, performance bonds, surety bonds, performance guaranties, other guaranty obligations, keepwells, net worth maintenance agreements, reimbursement obligations, letters of comfort and other similar arrangements to which Parent or any of its Affiliates (other than the Companies) is a party or by which any of them are bound in favor of, or for the benefit of, the business and operations of any of the Companies (other than the Parent Letters of Credit). The outstanding Parent Guarantees (including the maximum aggregate amount of each such Parent Guarantee and the Contract under which each such Parent Guarantee is posted), after giving effect to the Reorganization, are listed in Section 6.07(b) of the Disclosure Letter (as it may be amended from time to time in accordance with Section 6.07(d)).

Parent Letters of Credit: means, after giving effect to the Reorganization, collectively, those letters of credit issued to secure an obligation of any of the Companies under which Parent or any of its Affiliates (other than the Companies) is the party responsible for the reimbursement of any draws by the beneficiary. The outstanding Parent Letters of Credit (including the amount of each such Parent Letter of Credit and the Contract under which each such Parent Letter of Credit is posted), after giving effect to the Reorganization, are listed in Section 6.07(a) of the Disclosure Letter (as it may be amended from time to time in accordance with Section 6.07(d)).

Parent Retiree Welfare Plan: means The Pepco Holdings, Inc. Welfare Plan for Retirees, as in effect immediately prior to the Closing.

Parent Retirement Plan: means The Pepco Holdings, Inc. Retirement Plan, as in effect immediately prior to the Closing.

Parent Savings Plan: means The Pepco Holdings, Inc. Retirement Savings Plan, as in effect immediately prior to the Closing.

Parent’s ISRA Compliance Cost Audit: shall have the meaning set forth in Section 6.08(e)(v).

Payment for Purchased Capacity for Planning Year 2010/11: means the Payment for Purchased Capacity for Planning Year 2010/11 calculated in accordance with Section B of Schedule V.

Peak Season Maintenance: means planned outages and maintenance outages during the Peak Season (as defined by PJM).

-16-

Permit: means all licenses, permits, consents, approvals, franchises, variances, waivers, exemptions, orders and authorizations required by Law or by any Governmental or Regulatory Authorities (other than Environmental Permits).

Permitted Disclosure Updates: shall have the meaning set forth in Section 6.03(b).

Permitted Liens: means (i) any Lien for Taxes that is either (A) not yet due and payable or (B) being contested in good faith by appropriate proceedings; (ii) purchase money Liens arising in the ordinary course of business consistent with past practices not exceeding $100,000 in the aggregate; (iii) imperfections or irregularities of title, easements, covenants, rights of way and other restrictions of record and other Liens, in each case, (A) not, materially, individually or in the aggregate, detracting from the value of, or impairing the use of, the Real Property of any Generating Plant by the Companies, and (B) not rendering the Real Property unmarketable or uninsurable by a nationally recognized title insurance company; (iv) the terms and conditions of the Leases and the Generating Plant Easements, the Material Contracts, the Permits listed in Section 3.19 of the Disclosure Letter or the Environmental Permits listed in Section 3.20 of the Disclosure Letter; (v) pledges and deposits made in the ordinary course of business in compliance with workers’ compensation, unemployment insurance and other social security Laws; (vi) any statutory mechanics’, workmen’s, repairmen’s or other like Lien, imposed by applicable Law and recorded in the applicable land records and not exceeding $1,000,000 in the aggregate that is either (A) not yet due and payable or (B) being contested in good faith by appropriate proceedings; (vii) Liens identified in Section 1.1(a) of the Disclosure Letter; (viii) with respect to Real Property, any and all Laws relating to zoning, building and the use, occupancy, subdivision or improvement of the Real Property; (ix) any Lien identified in the most recent version (as of the date of this Agreement) of the title report or survey listed in Section 3.14(a) of the Disclosure Letter, except such Liens identified in any such title report or survey and listed in Section 6.16(a)(i) of the Disclosure Letter; and (x) any other Liens which are deemed Permitted Liens under Section 6.16 hereof; provided, however, that Permitted Liens shall in no event include Liens securing any Indebtedness (except as permitted under clause (ii) of this definition), including without limitation under any bond indenture or mortgage, made by Parent or any of its Affiliates or any third party grantor of any easement in favor of one of the Companies.

Person: means any natural person, corporation, general partnership, limited partnership, limited liability company, proprietorship, other business organization, trust, union, association or Governmental or Regulatory Authority.

Personal Property: shall have the meaning set forth in Section 3.23.

Pipeline Agreement: means the Claymont to Hay Road Pipeline Owners’ Agreement between Conectiv Delmarva Generation, Inc. and DPL, dated July 1, 2000.

Pipeline O&M Agreement: means the Claymont to Hay Road Pipeline Operation and Maintenance Agreement between Conectiv Delmarva Generation, Inc. and DPL, dated as of July 1, 2000, as amended by Amendment No. 1 to the Claymont to Hay Road Pipeline Operation and Maintenance Agreement between Conectiv Delmarva Generation, Inc. and DPL, dated August 24, 2000.

-17-

PJM: means PJM Interconnection, L.L.C. and any successor agency.

Post-Closing Non-Union Employee: means a Company Non-Union Employee whose employment by any of the Companies, or an Affiliate of Purchaser, continues following the Closing (including any Service Company Employee whose employment is transferred to one of the Companies at or prior to the Closing in accordance with Section 9.01(a)(iii)).

Post-Closing Payment Amount: means if the Purchase Price finally determined, either through agreement of the parties or pursuant to Section 2.04(c), is greater than the Closing Payment, the amount of such excess, and if the Purchase Price is less than the Closing Payment, the amount of such shortfall.

Post-Closing Tax Period: means all taxable periods (or portions thereof) beginning on or after the Closing Date.

Post-Signing Lien: means any Lien (including, without limitation, a Seller’s Lien) other than a Permitted Lien that is identified by Purchaser to Parent after the date of this Agreement, and that is added by Purchaser’s Title Insurance Company as an update to any title commitment or is shown on any updated survey listed in Section 3.14(a) of the Disclosure Letter dated after the date of this Agreement (regardless of when such new matter was actually recorded or filed), provided that such Lien is identified by Purchaser as objectionable by written notice to Parent within five (5) Business Days following Purchaser’s receipt of the updated title commitment or updated survey; provided, however, that any such new Lien to which Purchaser does not object in writing to Parent within such five (5) Business Day period shall thereafter constitute a Permitted Lien and not a Post-Signing Lien.

Potomac Option Agreement: shall have the meaning set forth in Section 5.01(f)(iv).

Powell Option Agreement: means that certain Option Agreement dated as of January 2, 2008, between David Powell and Kathryn Powell, as sellers and CES, as purchaser, as amended by that certain Amendment No. 1 to Option Agreement, dated as of December 31, 2009.

Pre-Closing Tax Filing Period: means all taxable periods (or portions thereof) ending on or before the Closing Date.

Pre-Closing Tax Period: means all taxable periods (or portions thereof) ending before the Closing Date.

Property Taxes: shall have the meaning set forth in Section 8.02(c).

Proposed Post-Closing Payment Notice: shall have the meaning set forth in Section 2.04(a).

-18-

PUHCA 2005: means the Public Utility Holding Company Act of 2005, as amended.

Purchase Price: means (i) One billion, six hundred fifty million dollars ($1,650,000,000), (ii) plus the Closing Date Capital Expenditures; (iii) (A) plus, if the Closing Date Working Capital is greater than $0, the amount of such excess on a dollar-for-dollar basis, or (B) minus, if the Closing Date Working Capital is less than $0, the amount of such shortfall on a dollar-for-dollar basis; (iv) plus the Closing Date Fuel Inventory; (v) (A) plus, if the Closing Date Inventory Cost is greater than Inventory Target, the amount of such excess on a dollar-for-dollar basis, or (B) minus, if the Closing Date Inventory Cost is less than the Inventory Target, the amount of such shortfall on a dollar-for-dollar basis; (vi) minus the amount, if any, determined in accordance with Section 2.02(f); (vii) minus the amount, if any, determined in accordance with Section 2.02(g); (viii) plus the amount, if any, determined in accordance with Section 2.02(h); and (ix) minus the amount, if any, determined in accordance with Section 2.02(i).

Purchase Price Allocation: shall have the meaning set forth in Section 8.09(b).

Purchaser: shall have the meaning set forth in the introductory paragraph.

Purchaser Indemnified Parties: shall have the meaning set forth in Section 10.03(a).

Purchaser Indemnitees: shall have the meaning set forth in Section 8.02(a).

Purchaser Letter of Credit: means an irrevocable, standby letter of credit issued by a major U.S. commercial bank or the U.S. branch office of a foreign bank, which, in either case, has a Credit Rating of at least (i) “A-” by S&P and “A3” by Moody’s, if such entity is rated by both S&P and Moody’s or (ii) “A-” by S&P or “A3” by Moody’s, if such entity is rated by either S&P or Moody’s, but not both, and which letter of credit is in a form and substance reasonably acceptable to Parent.

Purchaser’s ISRA Status Report: shall have the meaning set forth in Section 6.08(e)(v).

Purchaser’s Savings Plan: shall have the meaning set forth in Section 9.01(b)(iv).

Purchaser’s Title Insurance Company: means Stewart Title Company (or another national title company reasonably acceptable to Purchaser).

Purchaser’s Union Pension Plans: shall have the meaning set forth in Section 9.01(c)(ii).

Push Down Accounting Adjustments: means the push down of certain purchase accounting adjustments related to the acquisition of the Company by Parent in 2002.

PWC: means PricewaterhouseCoopers.

-19-

Real Property: shall have the meaning set forth in Section 3.14(a).

Real Property Tax Legal Proceeding: shall have the meaning set forth in Section 8.11.

REC Inventory: means the renewable energy credits attributable to the Generating Plants prior to the Closing.

Recaptured Section 1603 Payments: means the amount of Section 1603 Payments that must be repaid to the United States Department of the Treasury as a result of property being disposed of to a person who is not eligible to receive Section 1603 Payments and/or ceasing to qualify as a “specified energy property” (as that term is used in Section 1603 of the American Recovery and Reinvestment Tax Act of 2009).

Regulatory Action: means the commencement of, or inclusion in, any action, suit or proceeding by a state utility regulatory authority having jurisdiction, challenging or seeking determination (i) of the ability of Purchaser, Parent, Holdings, the Company or any of their respective Affiliates to complete the transactions contemplated by this Agreement or the validity or enforceability of the Transaction Documents, without the receipt of prior approval of such regulatory body or (ii) with respect to the current ownership or operation of the Designated Generating Plants, including with respect to the owner’s use of or access thereto. Regulatory Action shall include, without limitation, the issuance of any injunction or restraining order by such regulatory authority or court of competent jurisdiction that prevents any Transaction Document Affiliate from delivering at the Closing any Transaction Document to which it will be a party or performing its obligations thereunder.

Release: means release, spill, leak, discharge, dispose of, pump, pour, emit, empty, inject, leach, dump or allow to escape into or through the environment.

Released Environmental Claims: shall have the meaning set forth in Section 10.03(g).

Remediation: means an action of any kind to address an Environmental Condition or Release of Hazardous Substances, including any or all of the following activities: (i) monitoring, investigation, assessment, treatment, cleanup, containment, removal, mitigation, response or restoration work; (ii) obtaining any permits, licenses and other governmental authorizations, consents and approvals necessary to conduct any such activity; (iii) preparing and implementing any plans or studies for any such activity; (iv) obtaining a written notice from a Governmental or Regulatory Authority with jurisdiction over the Company or any Subsidiary under Environmental Laws that no material additional work is required by such Governmental or Regulatory Authority; (v) the use, implementation, application, installation, operation or maintenance of removal actions, remedial technologies applied to the surface or subsurface soils or sediments, excavation and treatment or disposal of soils or sediments, systems for long-term treatment of surface water or ground water, engineering controls or institutional controls; and (vi) any other activities reasonably determined by a party to be necessary or appropriate or required under Environmental Laws to address an Environmental Condition or a Release of Hazardous Substances.

-20-

Remediation Cap: shall have the meaning set forth in Section 10.03(a)(vii)(A).

Remediation Certification: shall have the meaning set forth in Section 6.08(a).

Reorganization: shall have the meaning set forth in Section 6.09.

Representatives: means any officer, director, principal, agent, stockholder, source of financing (including pursuant to the Financing Commitments), investment banker, employee, counsel, consultant, independent auditor or other representative of a Person and each of the respective officers, directors, principals, agents, stockholders, employees, counsel or other representatives of any of the foregoing.

Required Approvals: means (i) the filings required under the HSR Act, (ii) the FERC Approval and (iii) the additional approvals and notices set forth in Section 6.01 of the Disclosure Letter.

Response Action Outcome: shall have the meaning set forth at N.J.S.A. 58:10C-2.

Restoration Cost: shall have the meaning set forth in Section 5.02(a).

RGGI CO2 Allowances: means The Regional Greenhouse Gas Initiative (RGGI) CO2 allowances.

S&P: means Standard & Poor’s Financial Services LLC.

Scheduled Capital Expenditures: means those capital expenditures identified in Section 1.1(b) of the Disclosure Letter.

Section 1603 Payments: means payments under Section 1603 of the American Recovery and Reinvestment Tax Act of 2009 by the United States Department of the Treasury to certain eligible persons who place in service specified energy property.

Securities Act: means the Securities Act of 1933, as amended.

Seller Indemnified Parties: shall have the meaning set forth in Section 10.03(b).

Seller Retained Environmental Liabilities: shall have the meaning set forth in Section 10.03(a)(vii).

Seller’s Lien: means any Lien other than a Permitted Lien that is placed on the Real Property or Personal Property after the date of this Agreement by Parent or any of its Affiliates in violation of Section 5.01(b)(i).

Service Company Employee: means an individual employed by a Parent Employer Party, other than the Companies, who is employed primarily in connection with the business and operations of the Companies.

Service Contracts: shall have the meaning set forth in Section 6.11.

-21-

Service Cost Accrual: shall have the meaning designated to such term under Financial Accounting Standards No. 87 and No. 106.

Shared Facilities or Services: shall have the meaning set forth in Section 6.28.

Shared Property: shall have the meaning set forth in Section 6.28.

Shared Services Agreement: shall have the meaning set forth in Section 6.28.

Shipper-Must-Have-Title Requirement: means the capacity release policy adopted by FERC, which provides that all shippers shall have title to the gas at the time the gas is delivered to the transporter and while it is being transported by the transporter.

SO2 : means sulfur dioxide.

Specified Covenants: shall have the meaning set forth in Section 12.05(a).

Specified Generating Plants: means each of the following Generating Plants: Bethlehem, Hay Road, the Delta Project and Edge Moor.

Specified Representations: shall have the meaning set forth in Section 10.03(c)(i).

Spectra Service Agreement: means the Service Agreement Rate Schedule FT-1, Contract No. 830164 (originally No. 800378), dated October 18, 1994, by and between Spectra (as successor to Texas Eastern Transmission Corporation) and CES.

SRRA: means the Site Remediation Reform Act, N.J.S.A. 58:10C-1 et seq., and the regulations promulgated thereunder, including, but not limited to, the Administrative Requirements for the Remediation of Contaminated Sites, N.J.A.C. 7:26C-1 et seq.

Straddle Period: shall have the meaning set forth in Section 8.02(c).

Subsidiary or Subsidiaries: means any corporation, limited liability company, partnership, joint venture or any other entity of which the Company (either alone or through or together with any other Subsidiary) owns, directly or indirectly, securities or other interests entitling the Company (either alone or through or together with any other Subsidiary) to elect or appoint at least 50% of the members of the board of directors or other similar governing body of such corporation or other legal entity or otherwise conferring on the Company (either alone or through or together with any other Subsidiary) the power to direct the business and policies of such corporation or other legal entity.

Supplemental Disclosures: shall have the meaning set forth in Section 6.03(b).

Survival Period: shall have the meaning set forth in Section 10.01.

-22-

Tax or Taxes: means (i) all Federal, state, county, local, municipal, foreign and other taxes, assessments, duties or similar charges of any kind whatsoever, including all corporate franchise, income, sales, use, ad valorem, receipts, value added, profits, license, withholding, payroll, employment, excise, premium, property, customs, net worth, capital gains, transfer, stamp, documentary, social security, environmental, alternative minimum, occupation, recapture and other taxes and including all interest, penalties and additions imposed with respect to such amounts and (ii) any liability for such amounts as a result of (A) being a transferee or successor or member of a combined, consolidated, unitary or affiliated group or (B) an obligation under a tax sharing, tax allocation or similar agreement.

Tax Claim: shall have the meaning set forth in Section 8.07(a).

Tax Returns: means all returns, declarations of estimated tax payments, reports, estimates, information returns and statements, including any claims for refunds or any related or supporting information with respect to any of the foregoing, filed or to be filed with any Taxing Authority in connection with the determination, assessment, collection or administration of any Taxes.

Taxing Authority: means the IRS and any other domestic, foreign, federal, national, state, county or municipal or other local government, any subdivision, agency, commission or authority thereof, or any quasi-governmental body exercising tax regulatory authority.

Third Party Claim: shall have the meaning set forth in Section 10.04(a).

To the knowledge of Parent, Holdings and the Company: means (i) the actual knowledge of the individuals listed on Schedule II after due inquiry and (ii) all knowledge that would reasonably have been expected to be obtained by such Persons based upon such Person’s position or office.

Transaction Document Affiliate: means an Affiliate of Parent (other than Holdings or any of the Companies) that is a party to one or more of the Transaction Documents.

Transaction Documents: means (i) the Transition Services Agreement, (ii) the amended and restated Cumberland Lease to be substantially in the form attached hereto as Exhibit B, (iii) the Amended and Restated Generating Plant Easements, (iv) the amended Pipeline Agreement to be substantially in the form attached hereto as Exhibit D, (v) the amended Pipeline O&M Agreement to be substantially in the form attached hereto as Exhibit E, (vi) the Potomac Option Agreement to be substantially in the form attached hereto as Exhibit G, (vii) the ACE Tax Exempt Bond Agreement and the DPL Tax Exempt Bond Agreement to be substantially in the form attached hereto as Exhibits J-1 and J-2, respectively, (viii) the Deepwater Easement, (ix) the Amended and Restated Hay Road and Edge Moor Easement, and (x) the Shared Services Agreement.

Transfer Taxes: shall have the meaning set forth in Section 8.06.

Transition Services Agreement: shall have the meaning set forth in Section 2.03(b)(v).

-23-

Union Employee: means any employee of any of the Companies, at the date of Closing, who is covered by a Collective Bargaining Agreement.

Unpermitted Lien: means (i) a Lien on the Real Property or Personal Property identified in Section 6.16(a)(i) of the Disclosure Letter or (ii) a Post-Signing Lien.

Unqualified Opinion: means the unqualified report prepared by PricewaterhouseCoopers with respect to the Company Audited Financial Statements indicating that such statements present fairly, in all material respects, the financial position of the Company and its Subsidiaries and the results of their operations and their cash flows as of and for the periods presented therein in conformity with GAAP.

Unreleased Parent Guarantees: shall have the meaning set forth in Section 6.07(b).

Unreleased Parent Letters of Credit: shall have the meaning set forth in Section 6.07(a).

WARN Act: Worker Adjustment and Retraining Notification Act of 1989.

ARTICLE II

SALE AND PURCHASE OF MEMBERSHIP INTERESTS; CLOSING

2.01 Sale and Purchase of Membership Interests. Subject to the terms and conditions of this Agreement, at the Closing, Holdings shall sell, assign, transfer, convey and deliver to Purchaser, and Purchaser shall purchase, acquire and accept from Holdings, all of the right, title and interest of Holdings in and to the Membership Interests free and clear of all Liens.

2.02 Closing Payment. In consideration for the sale and transfer of the Membership Interests to Purchaser by Holdings, Purchaser shall pay to Holdings at the Closing an aggregate amount in cash (the “Closing Payment”) equal to:

(a) One billion, six hundred fifty million dollars ($1,650,000,000);

(b) plus the Estimated Capital Expenditures;

(c)(i) plus, if the Estimated Working Capital is greater than $0, the amount of such excess on a dollar-for-dollar basis, or (ii) minus, if the Estimated Working Capital is less than $0, the amount of such shortfall on a dollar-for-dollar basis;

(d) plus the Estimated Fuel Inventory;

(e)(i) plus, if the Estimated Inventory Cost is greater than $18,890,000 (the “Inventory Target”), the amount of such excess on a dollar-for-dollar basis, or (ii) minus, if the Estimated Inventory Cost is less than the Inventory Target, the amount of such shortfall on a dollar-for-dollar basis;

-24-

(f) minus, for each day commencing on July 1, 2010 through and including the Closing Extension Date, the per diem amount set forth on Schedule IV; provided, however, that no such reduction shall be made to the extent the Closing is delayed beyond July 1, 2010, due to the action or inaction of Purchaser that results in the failure of Purchaser to satisfy the conditions to Closing that are within Purchaser’s reasonable control (for the purposes of the foregoing, Purchaser’s election to defer the Closing Date under Section 2.03(a) shall not be considered “action or inaction” under this Section 2.02(f));

(g) minus the amount, if any, of the sum of (i) Capacity Resource Deficiency Charge and (ii) Payment for Purchased Capacity for Planning Year 2010/11;

(h) plus, if Purchaser notifies Parent in writing no later than May 15, 2010 that Purchaser desires to acquire title to any equipment or assets used by any of the Companies that is located at or used at any of the Generating Plants or computers, printers or scanners used by any personnel to be hired by Purchaser or one of its Affiliates at the Closing and leased by Parent or one of its Affiliates pursuant to a Master Lease, an amount equal to fifty percent (50%) of the amount required to purchase such equipment or assets under the terms of the applicable Master Lease; and