Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INTERCONTINENTALEXCHANGE INC | t68469_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - INTERCONTINENTALEXCHANGE INC | ex99-1.htm |

Exhibit

99.2

|

IntercontinentalExchange

and Climate ExchangeGlobal Emissions MarketsTransaction OverviewJuly 8,

2010

www.theice.com

Exhibit

99.2

|

|

FORWARD-LOOKING

STATEMENTS

Safe

Harbor Statement under the Private Securities Litigation Reform Act of

1995

Certain

statements in this presentation may contain forward-looking information

regarding ICE, Climate Exchange and the combined company after the

completion of the transaction and are intended to be covered by the safe

harbor for “forward-looking statements” provided by the Private Securities

Litigation Reform Act of 1995. These statements include, but are not

limited to, the benefits of the transaction, including future strategic

and financial benefits, the plans, objectives, expectations and intentions

of ICE following the completion of the transaction, and other statements

that are not historical facts. Such statements are based upon the current

beliefs and expectations of ICEs management and are subject to significant

risks and uncertainties. Actual results may differ from those set forth in

the forward-looking statements.

For

a discussion of additional risks and uncertainties, which could cause

actual results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC) filings,

including, but not limited to, the risk factors in ICE's Annual Report on

Form 10-K for the year ended December 31, 2009, as filed with the SEC on

February 10, 2010.

You

should not place undue reliance on forward-looking statements, which speak

only as of the date of this announcement. Except for any obligations to

disclose material information under applicable laws, ICE undertakes no

obligation to release publicly any revisions to any forward-looking

statements to reflect events or circumstances after the date of this

presentation.

Important

Merger Information

The

transaction relates to the shares of an Isle of Man public limited company

and was made by means of scheme of arrangement under Isle of Man company

law (the Scheme) and under the UK City Code on Takeovers and Mergers (the

Code). The Scheme was

not

subject to the tender offer or proxy rules under the United States

Securities Exchange Act of 1934, as amended. Accordingly, the Scheme was

subject to the disclosure requirements, rules and practices applicable to

schemes of arrangements in the Isle of Man and under the Code, which

differ from the requirements of the United States tender offer and proxy

rules.

This

communication does not constitute an offer or invitation to purchase or

subscribe for any securities or the solicitation of any vote or approval

in any jurisdiction.

|

|

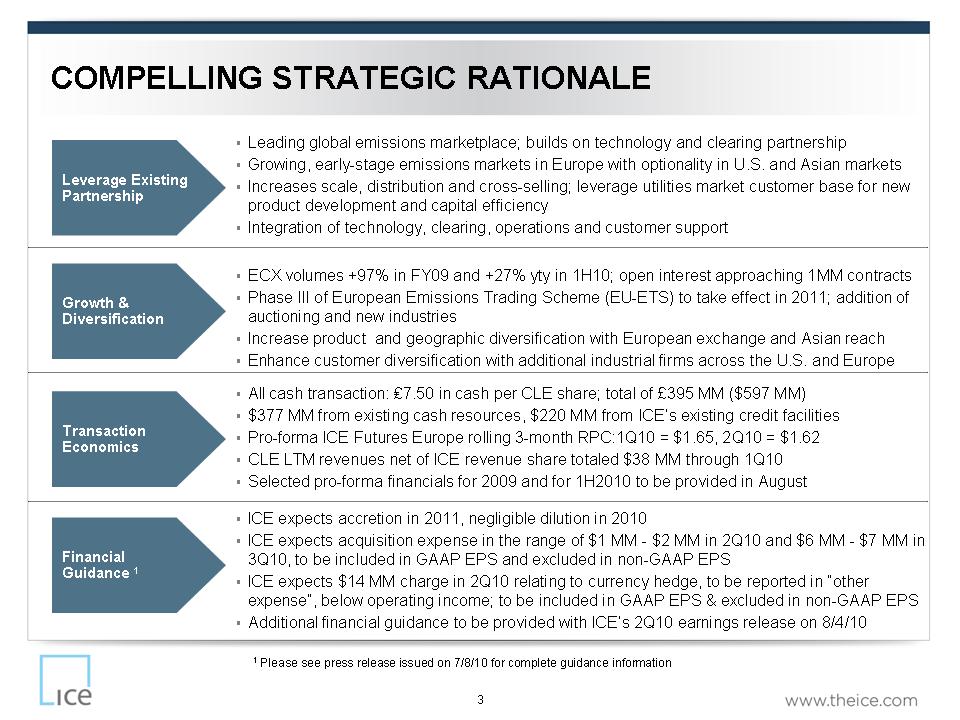

COMPELLING

STRATEGIC RATIONALE

.

Leading global emissions marketplace; builds on technology and clearing

partnership

.

Growing, early-stage emissions markets in Europe with optionality in U.S.

and Asian markets

.

Increases scale, distribution and cross-selling; leverage utilities market

customer base for new product development and capital

efficiency

.

Integration of technology, clearing, operations and customer

support

.

ECX volumes +97% in FY09 and +27% yty in 1H10; open interest approaching

1MM contracts

.

Phase III of European Emissions Trading Scheme (EU-ETS) to take effect in

2011; addition of auctioning and new industries

.

Increase product and geographic diversification with European exchange and

Asian reach

.

Enhance customer diversification with additional industrial firms across

the U.S. and Europe

Leverage

ExistingPartnership

Growth

&

Diversification

Transaction

Economics

FinancialGuidance

1

.

All cash transaction: £7.50 in cash per CLE share; total of £395 MM ($597

MM)

.

$377 MM from existing cash resources, $220MM from ICE’s existing credit

facilities

.

Pro-forma ICE Futures Europe rolling 3-month RPC:1Q10 = $1.65, 2Q10 =

$1.62

.

CLE LTM revenues net of ICE revenue share totaled $38 MM through

1Q10

.

Selected pro-forma financials for 2009 and for 1H2010 to be provided in

August

.

ICE expects accretion in 2011, negligible dilution in 2010

.

ICE expects acquisition expense in the range of $1 MM -$2 MM in 2Q10 and

$6 MM -$7 MM in 3Q10, to be included in GAAP EPS and excluded in non-GAAP

EPS

.

ICE expects $14 MM charge in 2Q10 relating to currency hedge, to be

reported in “other expense”, below operating income; to be included in

GAAP EPS & excluded in non-GAAP EPS

.

Additional financial guidance to be provided with ICE’s 2Q10 earnings

release on 8/4/10

1

Please see press release issued on 7/8/10 for complete guidance

information

|

|

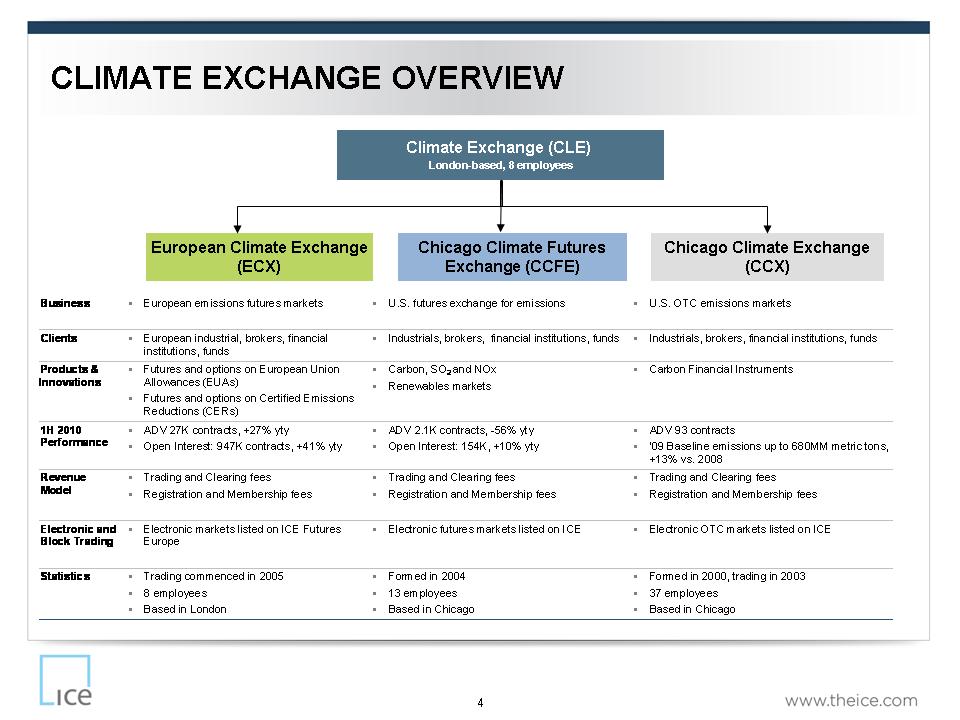

CLIMATE

EXCHANGE OVERVIEW

Climate

Exchange (CLE)

London-based,

8 employees

European

Climate Exchange

(ECX)

Chicago

Climate Exchange

(CCX)

Chicago

Climate Futures

Exchange

(CCFE)

Business

. European emissions futures markets

.

U.S. futures exchange for emissions

.

U.S. OTC emissions markets

Clients

. European industrial, brokers, financial institutions, funds

.

Industrials, brokers, financial institutions, funds . Industrials,

brokers, financial institutions, funds

Products

&

Innovations

.

Futures and options on European Union

Allowances

(EUAs)

.

Futures and options on Certified Emissions

Reductions

(CERs)

.

Carbon, SO2 and NOx

.

Renewables markets

.

Carbon Financial Instruments

1H

2010

Performance

.

ADV 27K contracts, +27% yty

.

Open Interest: 947K contracts, +41% yty

.

ADV 2.1K contracts, -56% yty

.

Open Interest: 154K, +10% yty

.

ADV 93 contracts

.

’09 Baseline emissions up to 680MM metric tons,

+13%

vs. 2008

Revenue

Model

.

Trading and Clearing fees

.

Registration and Membership fees

.

Trading and Clearing fees

.

Registration and Membership fees

.

Trading and Clearing fees

.

Registration and Membership fees

Electronic

and

Block

Trading

.

Electronic markets listed on ICE Futures Europe

.

Electronic futures markets listed on ICE . Electronic OTC markets listed

on ICE

Statistics

. Trading commenced in 2005

.

8 employees

.

Based in London

.

Formed in 2004

.

13 employees

.

Based in Chicago

.

Formed in 2000, trading in 2003

.

37 employees

.

Based in Chicago

|

|

0

250

500

750

1,000

1,250

1,500

1,750

2,000

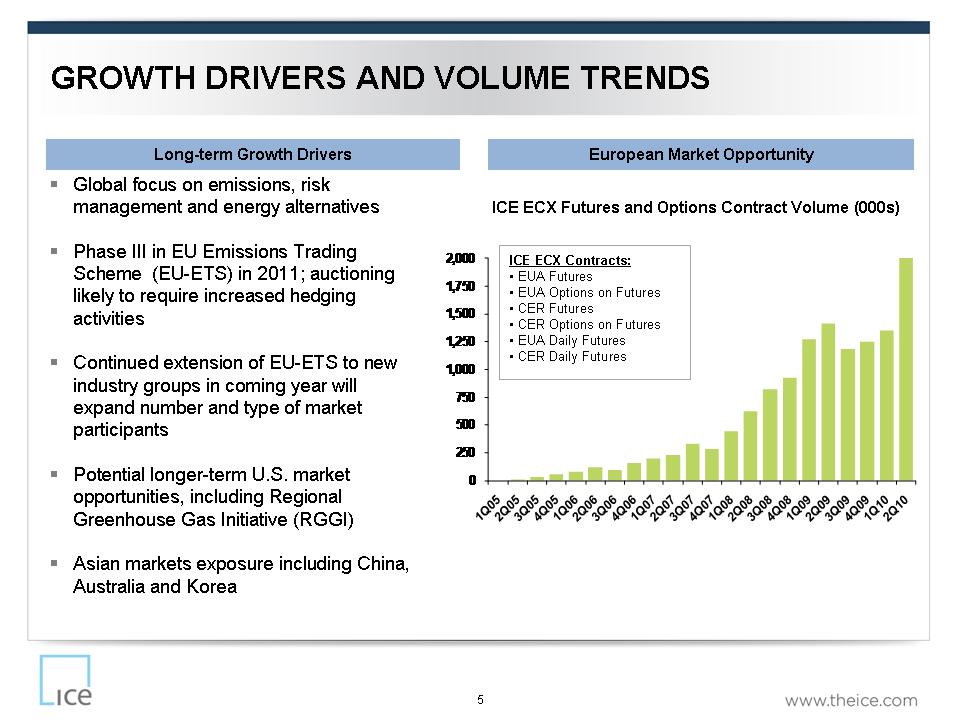

GROWTH

DRIVERS AND VOLUME TRENDS

5

European

Market Opportunity

Long-term

Growth Drivers

.Global

focus on emissions, risk management and energy alternatives

.Phase

III in EU Emissions Trading Scheme (EU-ETS) in 2011; auctioning likely to

require increased hedging activities

.Continued

extension of EU-ETS to new industry groups in coming year will expand

number and type of market participants

.Potential

longer-term U.S. market opportunities, including Regional Greenhouse Gas

Initiative (RGGI)

.Asian

markets exposure including China, Australia and Korea

ICE

ECX Futures and Options Contract Volume (000s)

ICE

ECX Contracts:

•EUA

Futures

•EUA

Options on Futures

•CER

Futures

•CER

Options on Futures

•EUA

Daily Futures

•CER

Daily Futures

|

|

Additional

Resources

.

ICE/CLE Transaction Information:

https://www.theice.com/climate_exchange_transaction.jhtml

.

CLE: http://www.climateexchangeplc.com/

.

ECX: http://www.ecx.eu/

.

CCX: http://www.chicagoclimatex.com/

.

CCFE: http://www.ccfe.com/

.

EU Emission Trading System:

http://ec.europa.eu/environment/climat/emission/index_en.htm

|