Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Vantage Drilling CO | d8k.htm |

| EX-99.2 - PRESS RELEASE - Vantage Drilling CO | dex992.htm |

July 2010

Investor Update: Mandarin

Acquisition

Exhibit 99.1 |

Disclaimers

About this Presentation

This presentation does not constitute an offer to sell or the solicitation of an

offer to buy any securities. The information in this presentation is

current

only

as

of

the

date

on

its

cover.

For

any

time

after

the

cover

date

of

this

presentation,

the

information,

including

information

concerning

the

business, financial condition, results of operations and prospects of Vantage

Drilling Company (the “Company”), may have changed. The delivery of

this

presentation

shall

not,

under

any

circumstances,

create

any

implication

that

there

have

been

no

changes

in

the

Company’s

affairs

after

the

date

of this presentation.

The

Company

has

not

authorized

any

person

to

give

any

information

or

to

make

any

representations

about

the

Company

in

connection

with

this

presentation that is not contained in this presentation. If any information has

been or is given or any representations have been or are made to you outside

of this presentation, such information or representations should not be relied upon as having been authorized by the Company.

Industry and Market Data

The industry and market data contained in this presentation are based on and

derived from various public and, in some cases, non-public sources that

the Company believes to be reliable. However, certain industry and market data is subject to change and cannot always be verified with

complete certainty due to limits on the availability and reliability of raw data,

the voluntary nature of the data gathering process and other limitations and

uncertainties inherent in any statistical survey. Accordingly, you should be aware that the industry and market data contained in this

presentation, and estimates and beliefs based on such data, may not be reliable.

Although we believe such data and information to be accurate we have not

attempted to independently verify such information. Industry and market data involve risks and uncertainties and are subject to change

based on various factors.

Note

Regarding

Presentation

of

Non-GAAP

Financial

Measures

The

following

presentation

includes

certain

“non-GAAP

financial

measures”

as

defined

in

Regulation

G

under

the

Exchange

Act.

The

Appendix

at

the end of this presentation includes reconciliations of the non-GAAP financial

measures found in this presentation to the most directly comparable

financial measures calculated and presented in accordance with Generally Accepted

Accounting Principles in the United States. Our Form 8-K, dated July 7,

2010, provides further explanation and disclosure regarding our use of non-GAAP financial measures and should be read in

conjunction with these presentation slides. Our SEC filings, including that Form

8-K, can be found on the investor relations page of our website at

www.Vantagedrilling.com.

1 |

Disclaimers (Cont’d)

2

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”). All statements, other than statements of historical facts, included herein are “forward-looking

statements.” Forward-looking statements may be identified by words such as

“expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will” or

words of similar meaning and include, but are not limited to, statements about the expected

acquisition of the remaining interest in Mandarin Drilling Company and our future business,

financial condition and results of operations resulting from and following the proposed acquisition, including as set forth in the slide captioned

“Run-Rate Financial Potential of Vantage Owned Assets.” These statements are based

on the current expectations of our management and are inherently subject to uncertainties and

changes in circumstances. You are cautioned not to place undue reliance on these statements, the estimates, projections and other forward-

looking information in this presentation as they are based on current expectations and general

assumptions and are subject to various risks, uncertainties and other factors, including

factors relating to the fulfillment of certain closing conditions to the proposed transaction, effects of new rigs and new technology on the

market; effects on restrictions on offshore drilling, availability of capital and changes in global,

political, general economic, business, competitive and market conditions and those factors set

forth in our Form 10-K for the year ended December 31, 2009, and our Form 10-Q for the quarter ended March 31, 2010, and in

other documents we file with the SEC, many of which are beyond our control and which may cause actual

results to differ materially from the views, beliefs and estimates expressed herein. We

do not undertake any responsibility to revise or update any forward-looking statements contained herein.

All of the information set forth in the slide captioned “Run-Rate Financial Potential of

Vantage Owned Assets” is for illustrative purposes only and should not be relied upon as

(and is not) an indication of future performance. Our underlying assumptions may prove to be incorrect. Actual results will almost certainly differ,

and the variations between actual results and these assumptions may be material. We may achieve

materially lower dayrates, incur substantially more operating expenses and maintenance capital

expenditures and our asset utilization/efficiency could be materially lower. Due to the

variability of spot dayrates, we believe it is helpful to understand the effect on our run-rate financial potential that various jackup spot dayrates may

have. We do not, as a matter of course, make public projections as to future earnings or other

results. However, management has prepared the information set forth under

“Run-Rate Financial Potential of Vantage Owned Assets—Illustrative Range of Run-Rate Financial Potential” as an indicative analysis for the purpose

of illustrating the variability of our possible run-rate financial potential based on a range of

single jackup spot dayrates. The indicative analysis set forth in the slide captioned

“Run-Rate Financial Potential of Vantage Owned Assets” is not a financial forecast and does not comply

with the guidelines established by the American Institute of Certified Public Accountants with respect

to prospective financial information. However, we believe that our calculations were

prepared on a reasonable basis. THE ASSUMPTIONS AND ESTIMATES UNDERLYING THE INDICATIVE ANALYSIS ARE

INHERENTLY UNCERTAIN ALTHOUGH THEY ARE CONSIDERED REASONABLE BY OUR MANAGEMENT AS OF THE DATE

HEREOF. As the indicative analysis demonstrates, our possible results are subject to

great variability and are not predictable with any meaningful level of precision. Investors and potential

investors should recognize that actual performance could be materially worse than is illustrated in

the indicative analysis. Such adverse results could be driven by changes in the factors

and assumptions considered in the indicative analysis, and many of these factors and assumptions are beyond our control. |

Transaction Overview

3 |

Transaction Overview

Vantage Drilling Company (Ticker: VTG) ("Vantage" or the

"Company") is an international offshore drilling company operating

a fleet of high-specification drilling units Contracts

drilling

units,

related

equipment

and

work

crews

primarily

on

a

dayrate

basis

Additionally provides construction supervision services as well as management and

operations of drilling units owned by others

Total fleet of four jackups, two drillships, and two semisubmersibles

Five owned (four jackups, one drillship)

Three managed (one drillship, two semisubmersibles)

The

Company

currently

owns

a

45%

interest

in

Mandarin

Drilling

Company

(“Mandarin”),

which

owns the construction contract for a drillship, the Platinum Explorer, that

is to be delivered in November 2010

Vantage

has

an

agreement

to

purchase

the

remaining

55%

ownership

interest

in

Mandarin

from

F3 Capital

Vantage intends to finance the purchase of F3 Capital’s 55% ownership

interest in Mandarin and the remaining construction related payments on the

Platinum Explorer through a combination of notes, term loans, equity,

equity-linked securities and/or cash on hand, which may also include

refinancing some of its existing debt facilities 4

|

Transaction Overview

($Millions)

Preliminary Sources & Uses of Funds and Pro Forma Capitalization

(1)

Conversion feature on Note is subject to shareholder approval.

(2)

Adjustment to common equity in pro forma column reflects equity and/or cash.

5

As of

Pro Forma

3/31/10

3/31/10

Cash

30

$

30

$

Restricted / Escrowed Cash

38

706

Issuer Debt:

Existing Credit Facilities

152

$

-

$

Debt Financing: Term Loan

-

300

Debt Financing: Notes

-

500

Total Issuer Debt

152

$

800

$

P2021 Notes

131

131

Aquamarine Note

103

103

Total Debt

386

$

1,034

$

Convertible Note and/or Cash to F3 Capital

(1)

-

60

Common Equity

(2)

746

806

Total Capitalization

1,132

$

1,900

$

Sources of Funds

Uses of Funds

Debt Financing: Term Loan

300

$

Platinum Shipyard, Equipment and Oversight

650

$

Debt Financing: Notes

500

Retire Outstanding Debt

152

Convertible Note and/or Cash to F3 Capital

(1)

60

Payment to F3 Capital for Mandarin

70

Equity and/or Cash

60

Interest Reserve / Working Capital

18

Estimated Fees & Expenses

30

Total Sources of Funds

920

$

Total Uses of Funds

920

$

|

Transaction Overview

Owned Assets

($Millions)

Emerald Driller

Sapphire Driller

Aquamarine Driller

Topaz Driller

Platinum Explorer

Estimate of

Fair

Market

Value

(2)

$725 –

$775

$170 –

$190

$170 –

$190

$170 –

$190

$170 –

$190

$1,125

–

$1,215

FMV of Assets to be Included in Contemplated Financing

Ownership:

100%

(1)

100%

100%

100%

100%

(1)

Pro forma for the acquisition of remaining 55% of Mandarin.

(2)

Based on independent third party appraisals.

(3)

Management’s approximate estimated fair market value of capital spares, which

include extra riser equipment, thrusters and major BOP components.

Capital

Spares

(3)

:

$60

6 |

Transaction Overview

Run-Rate Financial Potential of Vantage Owned Assets

($Millions, except per day figures)

Illustrative Range of Run-Rate Financial Potential (10)

7

Illustrative

Calculation

(1)

Single Jackup:

Spot Dayrate

(2)

140,000

$

Utilization / Efficiency (3)

90.0%

Annual Revenue

46.0

$

Operating Expenses per Day (4)

58,000

$

Annual Operating Expenses

21.2

Annual Jackup EBITDA

24.8

$

Annual Maintenance Capital Expenditures (5)

0.8

Annual Jackup EBITDA less Maint. Capex

24.1

$

Drillship:

Annual Contracted Dayrate

(6)

585,000

$

Utilization / Efficiency (7)

97.0%

Annual Revenue

207.1

$

Operating Expenses per Day (8)

156,000

$

Annual Operating Expenses

56.9

Annual Drillship EBITDA

150.2

$

Annual Maintenance Capital Expenditures (5)

3.7

Annual Drillship EBITDA less Maint. Capex

146.5

$

Assets in Contemplated Financing (2 Jackups, 1 Drillship) (9):

EBITDA

199.8

$

EBITDA less Maint. Capex

194.7

All Company Assets (4 Jackups, 1 Drillship) (9):

EBITDA

249.5

$

EBITDA less Maint. Capex

242.8

(1)

All annual calculations assume a 365-day year.

(2)

Management's estimate of current market potential based on the

approximate average dayrate for ultra-premium jackups in Q2 2010. Management believes this is a reasonable estimate of current market

potential because the fixtures on which the average is based represent

the most recently published leading edge dayrates for fixtures of comparable jackups.

(3)

Management's assumption of industry standard productive times on

high-specification jackups. Vantage’s fleet achieved approximately 97% productive time for Q1 2010 and approximately 99% productive

time in Vantage’s first 17 months of operation.

(4)

Vantage’s approximate average operating expense per day on its

jackup fleet for Q1 2010. Operating expenses include an assumed allocation for a portion of Vantage’s Singapore operations base.

(5)

Single jackup figure reflects management’s budgeted estimate for

2010. Drillship figure reflects management’s budgeted estimate for first year of the drillship’s operations based on $10,000 per day, which

management believes is a reasonable assumption for a newbuild drillship.

(6)

Actual contracted dayrate, excluding portion of dayrate attributable to

mobilization fee. (7)

Utilization assumption based on newbuild vessel fully under contract,

less assumed 3% reduction in utilization / efficiency. Management believes this is a reasonable assumption for a newbuild vessel in its first

full year of operations.

(8)

Assumed operating expenses per day based on management’s internally

generated projections for 2011. Operating expenses include an assumed allocation for a portion of Vantage’s Singapore operations base.

(9)

EBITDA and EBITDA less Maint. Capex figures exclude income from

management fees related to construction management contracts and unallocated corporate SG&A (estimated at $17-$20 million per year

based on management’s internally generated projections for 2011).

(10)

For purposes of this chart, the company used the methodology set forth

in the Illustrative Calculation. The only calculation parameter that varies from the Illustrative Calculation is the single jackup spot dayrate.

Range of dayrates in this chart reflects approximate historical range

for similar assets over the last two years. |

8

?

Premium high-specification drilling units, including four jackup rigs, two

drillships and two semisubmersibles

?

Vantage’s rigs are capable of drilling to deeper depths and possess enhanced

operational efficiency and technical capabilities, resulting in higher

utilization, dayrates and margins ?

Management estimates fair market value of $360 million for two jackups and $810

million for the Platinum Explorer

?

Successful track

record

of

managing,

constructing,

marketing

and

operating

offshore

drilling

units

?

In-house team of engineers and construction personnel overseeing complex

construction projects ?

All jackups delivered on budget and on time

?

Jackup fleet has experienced approx. 99% of productive time for Vantage’s

first 17 months in operation Level of efficiency is exceptional for

newly-constructed jackup rigs upon commencement of contract ?

Significant cash flow visibility

?

Owned fleet contract backlog of approximately $1.3 billion and managed fleet

contract backlog of approximately $2.5 billion as of March 31, 2010

Owned fleet counterparties include Pearl Energy, VAALCO Energy, Foxtrot

International, ENI, Nido Petroleum,

Phu

Quy

(1)

and

ONGC

Managed deepwater rigs counterparties include PEMEX and Petrobras

Company Highlights

Premium Fleet and

Strong Collateral

Coverage

Premium Fleet and

Strong Collateral

Coverage

Proven Operational

Track

Record

Proven Operational

Track

Record

Significant

Contract Coverage

with

High Quality

Counterparties

Significant

Contract Coverage

with

High Quality

Counterparties

(1)

PVEP Phu Quy Petroleum Operating Co. Ltd. is a joint venture interest

between PetroVietnam Exploration Production Corp. and Total E&P Vietnam. |

Company Highlights (Cont’d)

Three construction management arrangements for one ultra-deepwater drillship

(DragonQuest) and two 6th generation semisubmersibles

Approximately $5.0 million of annual cash flow per contract during the

construction phase Management of drillship and semisubmersible operations

once in service Approximately $13.0 to $15.0 million per year per contract

for the duration of each contract Management team with extensive experience;

average of 28 years in the drilling industry Includes international and

domestic public company experience with industry-leading peers involving

numerous acquisitions and debt and equity financings

Experienced operating personnel already hired and crew member training ongoing for

Platinum Explorer

9

Construction

Supervision and

Management

Arrangements

Experienced

Management and

Operational Team |

Company Overview

10 |

Company Overview

11

Founded in September 2006 and completed its IPO in May

2007

Trades under ticker VTG with a current total

enterprise value of approximately $694 million

Current trading value reflects significant discount to asset value

Contracts offshore drilling units, related equipment and work crews on a dayrate

basis

Provides offshore rig construction supervision and

operations management services

Owns four newbuild

ultra-premium

high-specification jackups and pro forma

100% interest in the newbuild

drillship, the Platinum Explorer

Four jackups have been delivered on time and within budget

Provides construction and operating management

services

Three ultra-deepwater rigs: one drillship and two semisubmersibles

Approximately $5.0 million of annual cash flow per contract during the

construction phase Approximately $13.0 – $15.0 million of annual cash flow per rig

during the operating phase

Structured as a combination of a fixed daily fee and a variable fee based on dayrate and annual cash

flow |

Premium Newbuild

Fleet

Owned Fleet:

Four newbuild

ultra-premium high-specification Baker Marine Pacific Class 375

jackups Platinum

Explorer

–

ultra-deepwater

12,000

ft.

drillship

(equipped

for

first

contract

at

10,000

ft.)

•

The drillship is currently being constructed by Daewoo Shipbuilding & Marine

Engineering Co. Ltd. (“DSME”) Managed Fleet:

One ultra-deepwater 12,000 ft. drillship (under construction at DSME

Shipyard) Two

Moss

Maritime

CS50

MkII

6th

generation

10,000

ft.

semisubmersibles

(under

construction

at

Jurong

Shipyard)

Fleet Construction Cost ~ $4.5 Billion

Drillships

–

One Owned, One Managed

Semisubmersibles

–

Two

Managed

Jackups

–

Four Owned

12 |

Worldwide Operations

Vantage Offices

Owned Rigs

Managed Rigs

Contract: PEMEX

Semi I

Mexico GOM

Contract: Petrobras

DragonQuest

U.S. GOM

Contract: ONGC

Platinum Explorer

India

Houston

Singapore

Dubai

Contract: Pearl

Emerald Driller

Thailand

Contract: Foxtrot

Sapphire Driller

Ivory Coast

Contract: VAALCO

Sapphire Driller

Gabon

Contract: Nido

Aquamarine Driller

Philippines

Contract: Phu

Quy

(1)

Topaz Driller

Vietnam

Country of Operation

13

(1) PVEP Phu Quy Petroleum Operating Co. Ltd. is a

joint venture interest between PetroVietnam Exploration Production Corp. and Total E&P Vietnam.

|

Ultra-Premium Newbuild

Jackups

4 ultra-premium newbuild

jackups

100% owned by the Company

Total investment for each jackup

of approximately $230 million

Baker Marine Pacific Class 375 design

Drilling depth of 30,000 feet

Operate in up to 375 feet of water

All jackups

constructed at industry-leading PPL Shipyard in Singapore under

turnkey construction contracts

Emerald

Driller:

Delivered

and

operating

in

Southeast

Asia

Sapphire

Driller:

Delivered

and

operating

in

West

Africa

Aquamarine

Driller:

Delivered

and

operating

in

Southeast

Asia

Topaz

Driller:

Delivered

and

operating

in

Southeast

Asia

14 |

Advantages of Ultra-Premium Jackups

The Baker Marine Pacific Class jackup

is capable of drilling in up to 375 feet of water and has a maximum

drilling depth of 30,000 feet

Dimensions

236’

x 224’

x 28’

208’

x 178’

x 23’

Water Depth (Max/Min)

375’

300’

Drilling Depth -

Ft

30,000

25,000

Cantilever Reach

75’

45’

Leg Length

506’

418’

Spudcan Diameter

55.5’

48’

Variable Deck Load (Operating)

7,497 kips

4,000 kips

Accommodations (Persons)

120

66

•

Faster drilling times

•

Faster moving times

•

Increased volumes of consumable liquids

and drilling fluids

•

Reduced boat runs and non-productive

time

•

Improved pipe handling and offline

capability

•

Fast preloading time for all tanks

•

75’

x 30’

cantilever reach substantially

greater than the industry average

•

Pipe decks allow increased storage capacity

•

Premium drilling package:

•

3 x 2200HP mud pumps

•

Integrated diverter system

•

18 ¾

BOP handling system and 4 rams

•

High-capacity,

high

efficiency

–

5

x

CAT

3516 B Diesel engines

Baker Marine Pacific Class 375

Standard 300’

Comparison of Vantage Ultra-Premium Jackup to Standard Jackup

Increased Operational Efficiency and Improved Technical Capability

15 |

Ultra-Premium Jackup

Fleet

Emerald Driller

Sapphire Driller

Aquamarine Driller

Topaz Driller

Shipyard Delivery

December 2008

July 2009

September 2009

December 2009

Contract Details

Counterparty

Pearl Energy

VAALCO Energy; Foxtrot

International

Nido

Petroleum Limited

Phu

Quy

(2)

Commencement

Q1 2009

Q1 2010; Q3 2010

Q2 2010

Q1 2010

Length

2 years

5 months; 8 months

2 years

(1)

7 months

Average Drilling

Revenue per Day

$171,000

$115,500; $120,000

$120,000

$107,200

Gross Contract

Value

$126.5 million

$17.2 million; $28.4 million

$86.4 million

(1)

$22.5 million

(1)

The

contract

is

for

drilling

two

wells

plus

extended

well

tests.

Estimated

drilling

time

is

one

month

per

well

and

extended

well

tests

could

range

from

a

few

months

to

up

to

one

year

per

well.

The

first

extended

well

tests

period

has

been

contracted

through

April

2011.

(2)

PVEP

Phu

Quy

Petroleum

Operating

Co.

Ltd.

is

a

joint

venture

interest

between

PetroVietnam

Exploration

Production

Corp.

and

Total

E&P

Vietnam.

16 |

Ultra-Deepwater Drillships

•

Ultra-deepwater drillships

Platinum Explorer

(100% pro forma ownership):

delivery Nov-10

DragonQuest

(managed):

delivery

Q3

2011

•

DSME proprietary hull design

Drilling depth of 40,000 feet

Designed to operate in up to 12,000 feet of water

Equipped to operate in up to 10,000 feet of water

•

Construction ongoing at DSME shipyard

Construction oversight ongoing at shipyard

•

Platinum

Explorer

contracted

for

5

years

to

ONGC

•

DragonQuest

contracted

for

8

years

to

Petrobras

17 |

Platinum Explorer

General Specifications

Shipyard Delivery

November 2010

Design

DSME Ultra Deepwater Drillship

Dimensions

781’ x 137’ x 62‘

Water Depth

12,000 ft design / 10,000 ft equipped

Max. Drilling Depth

40,000 ft

Max. Wave Height

Normal Drilling: 15 ft, Max Operating: 24 ft

Drilling Equipment

Derrick

AKMH Pyramid Dynamic Derrick, 46 ft x 52 ft base x 210 ft

clear working height

Capacity

2 Million lbs Static Hook Load

Capacities

Diesel Fuel Oil

21,385 bbls

Heavy Fuel Oil

19,498 bbls

Drillwater

15,096 bbls

Fresh Water

8,176 bbls

Liquid Mud

20,127 bbls

Bulk Storage

31,783 ft³

Other

Accommodations

180 Persons

Shipyard: DSME, Okpo, Koje

Island, Korea

Total shipyard construction price: $630 million

Estimated additional $110 million of non-shipyard capital

expenditures to equip and commission the drillship for service

(includes approximately $60 million of major capital spare

components)

Vantage to become responsible for all construction costs following

acquisition of remaining 55% of Mandarin

18 |

Platinum

Explorer

Construction

Status

Platinum

Explorer

as

of

May

2010

Overall Construction Progress (May 2010)

Source: DSME.

19 |

Semisubmersibles

•

Two 6th generation semisubmersibles

•

Moss Maritime CS50 MkII

Drilling depth of 40,000 feet

Operate in up to 10,000 feet of water

•

Construction

ongoing

at

Jurong

Shipyard

Pte

Ltd,

Singapore

Semi

I

Delivery

Q4

2010

(PEMEX

/

five

years)

Semi

II

Delivery

Q3

2011

(Currently

marketing)

•

Construction

Management

Contracts:

Approximately

$5.0

million

of

annual

cash

flow per contract during the construction phase

•

Operating Management Contracts:

Approximately

$13.0

–

$15.0

million

of

annual

cash

flow

per

rig

Structured as a combination of a fixed daily fee and a variable fee based on

dayrate

and annual cash flow

20

:

: |

Fleet Status –

Average Drilling Revenue /

Day

(1)

2 years at $171,000

6 months at $132,500

(2)

5 years at $590,500

5 years at $503,000

21

Ownership

2010

2011

2012

Rig

%

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Jackups

Emerald Driller

100%

2 yrs. at $171K

Sapphire Driller

100%

5 mos. at $115.5K

8 mos. at $120K

Aquamarine Driller

100%

5 mos. at $154.2K

2 yrs. at $120K

(2)

Repriced

to Market Rate

Topaz Driller

100%

7 mos. at $107.2K

Drillships

Platinum Explorer

100%

(3)

5 yrs. at $590.5K

DragonQuest

Managed

8 yrs. at $551.3K

(4)

Semisubmersibles

Semi I

Managed

5 yrs. at $503K

Semi II

Managed

Construction

Commissioning/

Working

Operating

Option

Extended

Management

Mobilization

(Owned Rigs)

(Management

Contract

Well Test

Contract

Contract)

Option

(1)

Average drilling revenue per day is based on the total estimated revenue divided by the minimum number

of days committed in a contract. Unless otherwise noted, the total revenue includes any

mobilization and demobilization fees and other contractual revenues associated with the drilling

services. (2)

The contract is for drilling two wells plus extended well tests. Estimated drilling time is one month

per well and extended well tests could range from a few months to up to one year per well. The first

extended well tests period has been contracted through April 2011.

(3)

Pro forma for the acquisition of remaining 55% of Mandarin.

(4)

The drilling revenue per day includes the achievement of the 12.5% bonus opportunity, but excludes

mobilization revenues and revenue escalations included in the contract. |

Contract Overview and Customer Credit

Profile

Vessel Name

Owned/

Managed

Contract Party

Contract Party

Credit Rating

(S&P/Moody’s)

Contract

Length

Average Drilling

Revenue Per

Day

(1)

Contract Value

(Gross)

Construction

Management

Fee

Operating

Management

Fee

Emerald

Driller

Owned

AA / Aa3

2 Years

$171,000

$126.5 million

N/A

N/A

Sapphire

Driller

Owned

N/A

A-

/ BBB+

(2)

1) 5 months

2) 8 months

1) $115,500

2) $120,000

1) $17.2 million

2) $28.4 million

N/A

N/A

Aquamarine

Driller

Owned

N/A

2 years

(3)

$120,000

$86.4 million

(3)

N/A

N/A

Topaz Driller

Owned

Phu

Quy

(4)

N/A

7 months

$107,200

$22.5 million

N/A

N/A

Platinum

Explorer

Owned

N/A / A2

5 years

$590,500

$1.1 billion

N/A

N/A

DragonQuest

Managed

BBB-

/ A3

8 years

$551,300

$1.6 billion

$5.0 million

annually

$13.0-15.0

million

annually

Semi I

Managed

BBB / Baa1

5 years

$503,000

$0.9 billion

$5.0 million

annually

$13.0-15.0

million

annually

Semi II

Managed

$5.0 million

annually

N/A

22

(1)

Average drilling revenue per day is based on the total estimated revenue divided by the minimum number

of days committed in a contract. Unless otherwise noted, the total revenue includes

any mobilization and demobilization fees and other contractual revenues associated with the drilling services.

(2)

Foxtrot International is owned by Bouygues Group, which has an A- rating from S&P and

BBB+ rating per Fitch. (3)

The contract is for drilling two wells plus extended well tests. Estimated drilling time is one month

per well and extended well tests could range from a few months to up to one year per well. The

first extended well tests period has been contracted through April 2011. (4)

PVEP Phu Quy Petroleum Operating Co. Ltd. is a joint venture interest between PetroVietnam Exploration

Production Corp. and Total E&P Vietnam. |

Oil

and Natural Gas Corporation Founded

in

1956

and

based

in

Dehradun,

India,

ONGC

engages

in

the

exploration,

production, refining, marketing, and transportation of oil and natural gas in

India and internationally

Contributes over 80% of India’s oil and gas production

Market capitalization: $60 billion as of June 30, 2010

Rating: A2 (Moody’s)

Rig fleet: 31 jackups, 6 deepwater

Indian government owns a 74% stake in ONGC

2009-2010

E&P

spend

in

India

is

expected

to

reach

$8.6

billion,

and

expected

to

grow

18% for 2010-2011

(1)

(1)

Source: Offshore®.

23 |

Business Strategy

•

Customer demand for new high-specification units supported by:

Need for rigs well-suited for drilling through deep and complex formations and

drilling horizontally Enhanced efficiency providing faster drilling and

moving times Improved safety features and lower downtime for

maintenance •

Technological developments have made deepwater exploration more feasible and

cost-effective in recent years •

Water-depth capability and equipping of Vantage's ultra-deepwater drilling

units is attractive for customers Expect to provide significant advantages

in obtaining long-term deepwater drilling contracts in the future

•

International markets in the oil and gas industry exhibit less cyclicality than

the U.S. Gulf of Mexico market •

Internationally diverse platform reduces exposure to a single market

•

Through continued growth of presence in Asia and West Africa, intend to capitalize

on existing infrastructure to better serve customers and increase contract

backlog •

Focused on expanding relationships with national oil companies, major oil

companies, large independents and super-regionals

•

Expect to lead to longer-term contracts to build backlog

•

Strong

existing

relationships

have

contributed

to

large

existing

backlog

•

Growth through acquisitions of assets and other offshore drilling companies

•

Current construction management contracts provide potential acquisition

targets 24

Capitalize on Customer

Demand for High-Specification

Units

Focus on International Markets

Expand Deepwater Exposure

Expand Key Industry

Relationships

Pursue Acquisition

Opportunities |

Industry Overview

25 |

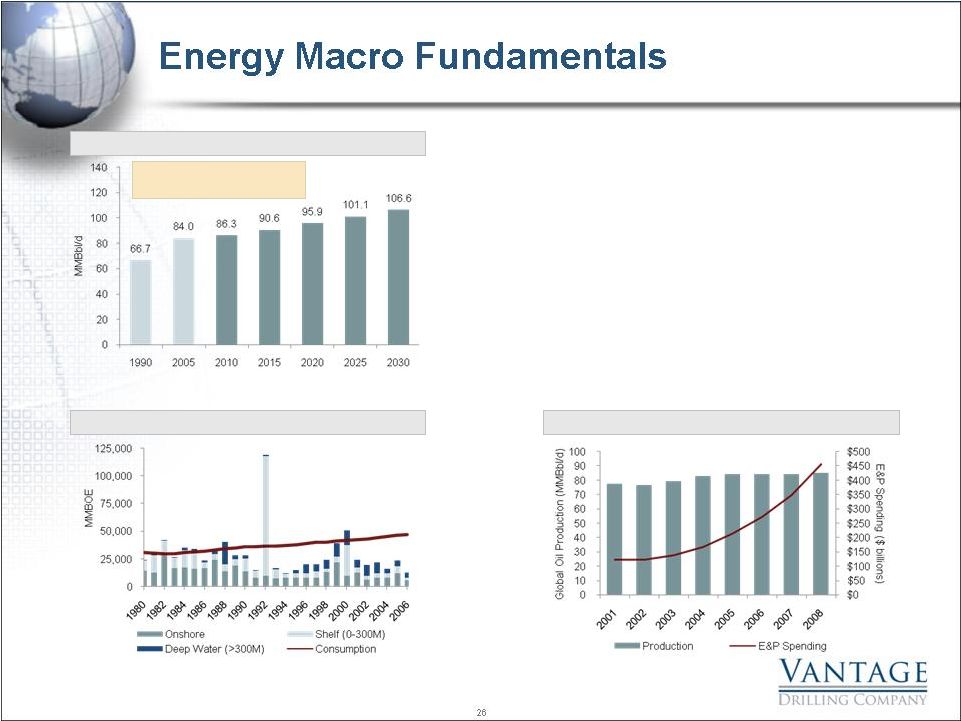

Gross Reserve Additions & Consumption

Global

Oil

Production

vs.

E&P

Spending

•

Despite the recent global economic slowdown, the rapid

development of some of the world’s most populous countries

will continue to drive long-term increase in global energy

demand

–

The EIA estimates long-term global demand for oil and

natural gas to grow at a CAGR of 0.9% and 1.6%,

respectively

•

While E&P spending has increased substantially, global oil

production has remained relatively constant over the past

decade

–

Since 1990, annual oil and gas reserve additions have fallen

short of global consumption in all but 2 years

•

Thus, significant capital expenditures will be required in the

future to replenish declining reserves

Demand is forecasted to

grow by 1.1% per year (2010

to 2030)

Worldwide Oil Demand

26

Source:

Barclays

Capital

E&P

Spending

Survey;

EIA;

ODS-PetroData. |

Premium Asset Advantage

•

Premium

jackups

(350’

+

IC

rigs)

and ultra-deepwater

floater have

historically maintained

significantly higher utilization

levels, particularly during

downturns in the energy industry

–

Operators demand newer, higher

specification rigs due to superior

operating performance, resulting in

lower maintenance downtimes,

improved safety and higher efficiency

•

A higher utilization level in the

international drilling market

continues to reflect a more

stable rig supply and demand

environment than the Gulf of

Mexico

•

Operators are willing to pay a

substantial

dayrate

premium

for

high-specification rigs

Global Jackup

Utilization

International vs. GOM Jackup

Utilization

Source: Riglogix; ODS-PetroData.

Historical

Floater

Dayrates

($Thousands)

Historical Floater Utilization

27 |

Premium Asset Advantage

International Jack-Up

Availability (Next 90 Days)

International Jack-Up Availability

(Next 90 Days) As % of Total Supply

Source: Riglogix.

After peaking at 35% of total supply in July 2009, the availability over the next

90 days for 350+ ft. IC jackups

located internationally has declined to approximately 25% currently

28 |

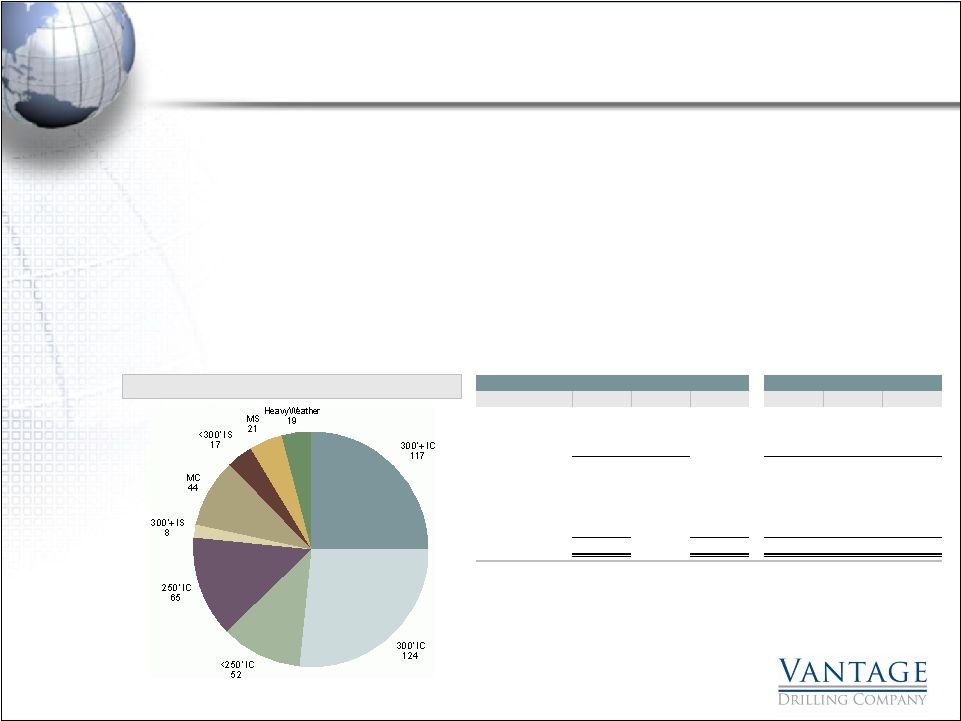

Profile of Global Jackup

Fleet

•

Capabilities

and

age

–

The

current

worldwide

fleet

is

comprised

mostly

of

older,

inefficient

rigs

–

27% of today’s jackups

are mat-supported and/or have less than 200ft of water depth capability

–

71% of today’s jackups

are 25 years or older

–

As of July 2010 a total of 127 rigs were either ready stacked, cold stacked, or in

an accommodation mode without contract –

How many will not return to service?

•

Setting

up

cyclical

recovery

–

Reduction

in

the

overall

fleet

should

result

in

pricing

power

and

high

utilization levels early on during the recovery

•

Age

is

a

factor

–

Demand

is

increasing

for

high-specification

jackups.

Many

customers

are

implementing age restrictions and new high-specification characteristics

Source: Riglogix.

Global Jackup

Fleet Distribution

29

Age

of

Jackup

Fleet

Water Depth (feet)

Age

Rigs

%

%

300+

200-299

<200

25 years or older

333

71%

64%

146

132

55

5 to 24 years

54

12%

10%

49

2

3

0 to 4 years

80

17%

15%

74

4

2

467

100%

269

138

60

2010 Deliveries

20

4%

14

4

2

2011 Deliveries

16

3%

16

0

0

2012 Deliveries

17

3%

16

1

0

520

100%

315

143

62 |

Profile of Global Ultra-Deepwater Fleet

•

The ultra-deepwater rig market maintains the most favorable long-term

outlook driven by recent discoveries in Brazil, West Africa, and the U.S.

Gulf of Mexico •

Ultra-deepwater rigs are capable of working in any water depth where operators

are currently likely to drill •

Can compete for any available work, while lower water depth drilling rigs have a

more limited market •

Projections

indicate

a

shortage

of

rigs

designed

for

the

4,000

–

6,000’

water

depth

range

which

will

likely

be filled by ultra-deepwater units

Floater Rig Supply By Type (# of Rigs)

Ultra-Deepwater Floaters By Operator

(1)

Source: Riglogix.

(1)

Ultra-Deepwater

(>7,500

ft)

drillships

and

semisubmersibles

currently

in

operation.

(2)

Other

operators

with

1

rig

each

include:

Det

Norske

Oljeselskap,

Murphy,

Taylor,

Woodside,

PEMEX,

Tullow,

ExxonMobil,

Husky,

Repsol,

Cairn

Energy

and

ONGC

for

a

total

of

11

rigs.

(3)

Other operators with 2 rigs each include: BHP Billiton, Noble Energy, Marathon,

Nexen, ENI and Devon Energy for a total of 12 rigs. 30

Midwater

111

Deepwater

55

Ultra-

Deepwater

76

Petrobras

16

Total

8

BP

7

Chevron

6

Anadarko

6

Statoil

4

Shell

Reliance

3

Others

(2 Rigs)

12

Others

(1 Rig)

11

3 |

Premium Jackup Fixtures

Source: Riglogix.

Highlight signifies PPL built, Baker Marine Pacific Class 375 design rigs.

Fixture Date

Manager

Rig Name

Rig Water

Depth (ft)

Operator

Region

Dayrate

Prior Dayrate

Contract Description

(At Delivery)

Start Date

Vessel Age

(Yrs)

Delivery

Date

17-Jun-10

Atwood

Atwood Beacon

400

Murphy

S America

115,000

$

115,000

$

10

months

4 wells

Sep-10

7.1

May-03

14-Jun-10

Atwood

Atwood Beacon

400

Edison

W Africa

115,000

110,000

2

months

1 well

Jul-10

7.1

May-03

9-Jun-10

PV Drilling

PV Drilling II

375

Hong Long POC

SE Asia

135,000

135,000

2

months

1 well

Aug-10

0.8

Sep-09

1-Jun-10

COSL

COSLBoss

400

Kangean Energy

SE Asia

158,000

198,000

8

months

5 wells + 2 options

Oct-10

2.4

Feb-08

25-May-10

Scorpion Offshore

Offshore Vigilant

350

Repsol YPF

S America

158,333

110,500

8

months

2 wells + 2x1 well options

Jul-10

1.8

Sep-08

25-May-10

Rowan

Rowan Gorilla V

400

Total

NW Europe

180,000

150,000

12

months

2 wells

May-11

11.6

Nov-98

24-May-10

Maersk Contractors

Maersk Convincer

375

Hoang Long JOC

SE Asia

137,000

175,000

3

months

1 well

Jun-10

1.8

Sep-08

17-May-10

Diamond Offshore

Ocean Scepter

350

OGX Petroleo

S America

130,000

100,000

12

months

1 year + 1-year option

Dec-10

2.1

May-08

16-Apr-10

Ensco

ENSCO 105

375

BG

Med/Black Sea

150,000

200,000

4

months

4 months

Oct-10

7.7

Oct-02

5-Apr-10

Aban Offshore

Deep Driller 1

375

GSPC

Indian Ocean

112,000

194,000

12

months

1 year + 2x6 month options

May-11

4.1

May-06

25-Mar-10

Scorpion Offshore

Offshore Resolute

350

Hoan Vu

SE Asia

135,000

146,250

2

months

1 well + 1 option

Jun-10

2.2

Apr-08

11-Mar-10

Egyptian Drilling

Sneferu

375

Maersk Oil

Middle East

80,000

NA

12

months

1 year + option(s)

Jun-10

0.5

Dec-09

1-Mar-10

Rowan

Gilbert Rowe

350

Maersk Oil

Middle East

75,000

75,000

12

months

1 year + 1 year option

May-11

28.7

Nov-81

1-Mar-10

Rowan

Rowan Paris

350

Maersk Oil

Middle East

75,000

75,000

12

months

1 year + 1 year option

Mar-11

29.7

Oct-80

17-Feb-10

Rowan

Rowan Gorilla VII

400

Apache

NW Europe

180,000

332,000

18

months

18 months + 2x6-month options

Mar-11

8.5

Jan-02

15-Feb-10

Transocean

GSF Constellation II

400

Pharaonic Petroleum

Med/Black Sea

109,000

109,000

12

months

4 wells + 3x1 well options

Apr-12

6.2

Apr-04

8-Feb-10

Seadrill

West Callisto

400

Premier

SE Asia

95,600

NA

9

months

8 wells + 5x1 well options

Mar-11

0.0

Jul-10

5-Feb-10

Diamond Offshore

Ocean Shield

350

Petronas Carigali

SE Asia

135,000

265,000

2

months

1 well

Apr-11

2.2

Apr-08

2-Feb-10

Seadrill

West Triton

375

Anadarko

SE Asia

139,500

116,000

2

months

1 well

Apr-10

2.5

Jan-08

2-Feb-10

Seadrill

West Triton

375

Twinza Oil

Indian Ocean

116,000

175,000

3

months

2 wells

Aug-10

2.5

Jan-08

1-Feb-10

Rowan

Rowan Gorilla V

400

Total

NW Europe

150,000

180,000

9

months

1 well

Jun-10

11.6

Nov-98

29-Jan-10

Scorpion Offshore

Offshore Mischief

350

Anadarko

S America

117,500

NA

7

months

3 wells + 3x1-well options

Feb-11

0.2

Apr-10

5-Jan-10

Vantage Drilling

Topaz Driller

375

PQPOC

SE Asia

119,000

115,000

7

months

3 wells + 1-well option

May-12

0.5

Dec-09

5-Jan-10

Diamond Offshore

Ocean Shield

350

Apache

Aus/NZ

100,000

265,000

12

months

1 year + 1-year option

Jan-11

2.2

Apr-08

4-Jan-10

PV Drilling

PV Drilling II

375

Lamson

SE Asia

125,000

NA

2

months

1 well

Jun-10

0.8

Sep-09

4-Jan-10

Vantage Drilling

Aquamarine Driller

375

Nido Petroleum

SE Asia

120,000

115,000

2

months

60 days + 10 mo. option + 12 mo. option

Oct-10

0.8

Sep-09

25-Nov-09

Ensco

ENSCO 101

400

Maersk Oil

NW Europe

170,000

279,000

4

months

2 wells + 1-well option

Apr-10

10.4

Feb-00

16-Nov-09

Ensco

ENSCO 100

350

GDF SUEZ

NW Europe

112,500

207,500

6

months

6 months + 6 months unpriced option

Nov-11

23.4

Feb-87

6-Nov-09

PV Drilling

PV Drilling II

375

KNOC

SE Asia

134,000

150,000

3

months

2 wells

Oct-10

0.8

Sep-09

23-Oct-09

Scorpion Offshore

Offshore Vigilant

350

EOG

C America

110,500

207,990

5

months

95-135 days

Jul-10

1.8

Sep-08

20-Oct-09

Vantage Drilling

Aquamarine Driller

375

Eni

Indian Ocean

115,000

NA

3

months

1 well

May-10

0.8

Sep-09

9-Oct-09

Noble

Noble Al White

360

Total

NW Europe

112,000

208,000

18

months

18 months + 1x6 month option

May-10

27.6

Dec-82

6-Oct-09

Seadrill

West Prospero

400

Red Sea Petroleum

Middle East

180,000

130,000

6

months

2 wells

Dec-09

3.0

Jun-07

1-Oct-09

ENSCO

ENSCO 106

400

Newfield

SE Asia

90,000

265,000

12

months

1 year + 1 year option

Oct-09

5.5

Jan-05

30-Sep-09

Atwood

Atwood Beacon

400

Hess

W Africa

110,000

113,000

9

months

6 wells + 6 x 1 well options

Oct-09

7.1

May-03

22-Sep-09

Rowan

Rowan Gorilla V

400

Total

NW Europe

180,000

180,000

12

months

1 year

Sep-09

11.6

Nov-98

2-Sep-09

Vantage Drilling

Sapphire Driller

375

Vaalco

W Africa

105,000

NA

5

months

4 wells + 2 x 1-well options

Dec-09

1.1

Jun-09

1-Sep-09

Transocean

GSF Constellation I

400

BP

C America

110,000

110,000

4

months

4 months

Sep-09

7.0

Jul-03

11-Aug-09

Transocean

GSF Adriatic IX

350

Afren Energy

W Africa

97,000

188,000

8

months

250 days + 425-day option

Sep-09

29.0

Jul-81

29-May-09

Vantage Drilling

Sapphire Driller

375

Foxtrot

W Africa

132,000

156,000

6

months

6 months + 6 months options

Jan-11

1.1

Jun-09

29-May-09

Vantage Drilling

Sapphire Driller

375

Foxtrot

W Africa

156,000

NA

3

months

Fixed portion of dayrate $5 mil effective

dayrate range $130k if option exercised

Aug-09

1.1

Jun-09

22-May-09

Scorpion Offshore

Offshore Resolute

350

Thang Long JOC

SE Asia

146,250

189,000

6

months

6 months

Aug-09

2.2

Apr-08

15-Apr-09

ENSCO

ENSCO 102

400

ConocoPhillips

NW Europe

198,000

150,000

14

months

14 months + rolling options

Sep-09

8.0

Jul-02

Median

120,000

$

153,000

$

7

months

Mean

128,376

$

166,368

$

7

months

Duration

31 |

Financial Overview

32 |

Financial Overview

(1)

Adjusted

for

share-based

compensation

expense.

See

“Reconciliation

from

Net

Income

(Loss)

to

Adjusted

EBITDA”

in

the

Appendix

to

this

presentation

for

detail.

Historical Financial Information

($Millions)

Fiscal Quarter Ended,

3/31/2009

6/30/2009

9/30/2009

12/31/2009

3/31/2010

Owned Rigs at Period End

1

1

2

3

4

Revenue

14.3

$

22.2

$

36.4

$

38.6

$

58.3

$

% Quarterly Growth

NA

55.2%

64.2%

5.8%

51.1%

EBITDA

5.3

$

8.3

$

13.0

$

3.4

$

23.1

$

% Margin

37.1%

37.3%

35.6%

8.9%

39.7%

Adjusted EBITDA

(1)

6.4

$

9.5

$

14.2

$

4.8

$

24.7

$

% Margin

45.1%

43.0%

39.0%

12.5%

42.3%

33 |

Financial Overview

Preliminary Pro Forma Capitalization

($Millions)

(1)

Adjustment to common equity in pro forma column reflects cash and/or equity.

34

As of

Pro Forma

3/31/10

3/31/10

Cash

30

$

30

$

Restricted / Escrowed Cash

38

706

Issuer Debt:

Existing Credit Facilities

152

$

-

$

Debt Financing: Term Loan

-

300

Debt Financing: Notes

-

500

Total Issuer Debt

152

$

800

$

P2021 Notes

131

131

Aquamarine Note

103

103

Total Debt

386

$

1,034

$

Convertible Note Issued to F3 Capital

-

60

Common Equity

(1)

746

806

Total Capitalization

1,132

$

1,900

$ |

Financial Overview

Run-Rate Financial Potential of Vantage Owned Assets

($Millions, except per day figures)

Illustrative Range of Run-Rate Financial Potential (10)

35

Illustrative

Calculation (1)

Single Jackup:

Spot Dayrate

(2)

140,000

$

Utilization / Efficiency (3)

90.0%

Annual Revenue

46.0

$

Operating Expenses per Day (4)

58,000

$

Annual Operating Expenses

21.2

Annual Jackup EBITDA

24.8

$

Annual Maintenance Capital Expenditures (5)

0.8

Annual Jackup EBITDA less Maint. Capex

24.1

$

Drillship:

Annual Contracted Dayrate

(6)

585,000

$

Utilization / Efficiency (7)

97.0%

Annual Revenue

207.1

$

Operating Expenses per Day (8)

156,000

$

Annual Operating Expenses

56.9

Annual Drillship EBITDA

150.2

$

Annual Maintenance Capital Expenditures (5)

3.7

Annual Drillship EBITDA less Maint. Capex

146.5

$

Assets in Contemplated Financing (2 Jackups, 1 Drillship) (9):

EBITDA

199.8

$

EBITDA less Maint. Capex

194.7

All Company Assets (4 Jackups, 1 Drillship) (9):

EBITDA

249.5

$

EBITDA less Maint. Capex

242.8

(1)

All annual calculations assume a 365-day year.

(2)

Management's estimate of current market potential based on the

approximate average dayrate for ultra-premium jackups in Q2 2010. Management believes this is a reasonable estimate of current market

potential because the fixtures on which the average is based represent

the most recently published leading edge dayrates for fixtures of comparable jackups.

(3)

Management's assumption of industry standard productive times on

high-specification jackups. Vantage’s fleet achieved approximately 97% productive time for Q1 2010 and approximately 99% productive

time in Vantage’s first 17 months of operation.

(4)

Vantage’s approximate average operating expense per day on its

jackup fleet for Q1 2010. Operating expenses include an assumed allocation for a portion of Vantage’s Singapore operations base.

(5)

Single jackup figure reflects management’s budgeted estimate for

2010. Drillship figure reflects management’s budgeted estimate for first year of the drillship’s operations based on $10,000 per day, which

management believes is a reasonable assumption for a newbuild drillship.

(6)

Actual contracted dayrate, excluding portion of dayrate attributable to

mobilization fee. (7)

Utilization assumption based on newbuild vessel fully under contract,

less assumed 3% reduction in utilization / efficiency. Management believes this is a reasonable assumption for a newbuild vessel in its first

full year of operations.

(8)

Assumed operating expenses per day based on management’s internally

generated projections for 2011. Operating expenses include an assumed allocation for a portion of Vantage’s Singapore operations base.

(9)

EBITDA and EBITDA less Maint. Capex figures exclude income from

management fees related to construction management contracts and unallocated corporate SG&A (estimated at $17-$20 million per year

based on management’s internally generated projections for 2011).

(10)

For purposes of this chart, the company used the methodology set forth

in the Illustrative Calculation. The only calculation parameter that varies from the Illustrative Calculation is the single jackup spot dayrate.

Range of dayrates in this chart reflects approximate historical range

for similar assets over the last two years. |

Appendix

Reconciliation of Net Income (Loss) to Adjusted EBITDA

($Millions)

Fiscal Quarter Ended,

3/31/2009

6/30/2009

9/30/2009

12/31/2009

3/31/2010

Net Income (Loss)

2.4

$

4.0

$

6.8

$

(4.3)

$

6.0

$

Interest Expense, Net

0.7

1.3

1.9

4.0

7.4

Income Tax Provision (Benefit)

0.6

0.9

1.1

(0.6)

2.3

Depreciation

1.7

2.1

3.2

4.3

7.5

EBITDA

5.3

$

8.3

$

13.0

$

3.4

$

23.1

$

Share-Based Compensation Expense

1.1

1.2

1.2

1.4

1.5

Adjusted EBITDA

6.4

$

9.5

$

14.2

$

4.8

$

24.7

$

36 |