Attached files

As filed with the Securities and Exchange Commission on July 2, 2010 2010 Registration No. ( )

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

SECURED RESOURCES CORP.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

1040

|

27-2504188

|

|

(State or other Jurisdiction of Incorporation or Organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

|

804 - 9th Avenue SW, Suite 1502, Calgary, Alberta T2P 0G9 | (403) 244-0571

|

|

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

|

|

Paracorp Incorporated | 318 N. Carson St., #208, Carson City, Nevada 89701 | (888) 972-7273

|

|

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

|

|

Copies of Communications to:

Peter J. Gennuso, Esq.

Gersten Savage LLP

600 Lexington Avenue, 9th Floor, New York, NY 10022

Facsimile: (212) 980-5192

|

|

As soon as practicable after the effective date of this Registration Statement.

|

|

Approximate date of commencement of proposed sale to the public

|

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities To Be Registered

|

Amount To Be Registered

|

Proposed Maximum Offering Price Per Share

|

Proposed Maximum Aggregate Offering Price (1)

|

Amount of Registration Fee

|

|

Common Stock, par value $0.0001

|

40,000,000

|

$0.002

|

$80,000

|

$5.70

|

|

(1)

|

There is no current market for the securities and the price at which the Shares are being offered has been arbitrarily determined by the Company and used for the purpose of computing the amount of the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended.

|

This Registration Statement shall also cover any additional shares of our common stock which may become issuable by reason of any stock dividend, stock split, recapitalization or other similar adjustments.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission and these securities may not be sold until that registration statement becomes effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

Subject to Completion, Dated: July 2, 2010

|

Secured Resources Corp.

Up to 40,000,000 Shares of Common Stock at $0.002 per share

This Prospectus relates to the offer and sale of up to 40,000,000 shares of common stock, $0.0001 par value (“Common Shares”) by Secured Resources Corp, a Nevada company (“we”, “us”, “our”, “Company” or similar terms). There are no securities being sold by existing security holders as part of this Prospectus.

This Offering will be conducted on a best efforts basis for up to ninety (90) days following the date of this Prospectus at a fixed price of $0.002 per Common Share. Our Board of Directors, may, at its discretion, elect to extend the Offering for up to an additional ninety (90) days if all the shares have not been sold. We are not using an underwriter for this Offering; we intend to offer the Common Shares through our officers and directors, with no commissions payable.

Should the Company be successful in selling the 40,000,000 shares, it will receive $80,000 in proceeds. There can be no assurance that we will sell all or any of the shares being offered. If we are unable to sell all of the shares, our ability to implement the business plan as identified in this Prospectus will be materially and adversely affected, as is further identified under the Use of Proceeds section commencing on page 11.

There is no requirement to sell any specific number or dollar amount of securities, but we will use our best efforts to sell the securities offered. We will not return any funds raised from investors in the event that we do not sell all of the securities being offered or if the funds raised are insufficient for the purposes set forth herein. There is no arrangement to place the proceeds from this Offering in an escrow, trust or similar account, as Nevada law does not require that funds raised pursuant to the sale of securities be placed into an escrow account. Any funds raised from this Offering will be immediately available to us for our use.

Our common stock is presently not listed on any national securities exchange or the Nasdaq Stock Market. Following the effective date of this registration statement on Form S-1, in which this Prospectus is included, we intend to have an application filed on our behalf by a market maker for approval of our common stock for quotation on the Over-the-Counter Bulletin Board (“OTC-BB”) quotation system. No assurance can be made, however that we will be able to locate a market maker to submit such application or that such application will be approved.

The Company is considered to be in unsound financial condition. Persons should not invest unless they can afford to lose their entire investment. Before purchasing any of the Common Shares covered by this Prospectus, carefully read and consider the risk factors included in the section entitled Risk Factors beginning on Page 4. These securities involve a high degree of risk, and prospective purchasers should be prepared to sustain the loss of their entire investment. There is currently no public trading market for the securities.

Neither the United States Securities and Exchange Commission (“SEC”), nor any state securities commission, has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2010

TABLE OF CONTENTS

|

Prospectus Summary

|

1

|

|

Risk Factors

|

4

|

|

Risks Relating to our Business

|

4

|

|

Risks Relating to Business in the Mineral Exploration and Development Sector

|

7

|

|

Risks Relating to our Common Shares and the Trading Market

|

9

|

|

Forward Looking Statements

|

11

|

|

Use of Proceeds

|

11

|

|

Determination of Offering Price

|

12

|

|

Dilution

|

12

|

|

Selling Security Holders

|

14

|

|

Plan of Distribution

|

14

|

|

Description of Securities to be Registered

|

15

|

|

Interests of Named Experts and Counsel

|

16

|

|

Information with Respect to the Registrant

|

16

|

|

Description of Business

|

16

|

|

Description of Property

|

19

|

|

Legal Proceedings

|

26

|

|

Market Price of and Dividends on the Registrant’s Common Equity and Related

Stockholder Matters

|

26

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

28

|

|

Directors, Executive Officers, Promoters and Control Persons

|

30

|

|

Executive Compensation, Corporate Governance

|

31

|

|

Security Ownership of Certain Beneficial Owners and Management

|

31

|

|

Transactions with Related Persons, Promoters and Certain Control Persons

|

32

|

|

Director Independence

|

32

|

|

Material Changes

|

33

|

|

Incorporation of Certain Information by Reference

|

33

|

|

Disclosure of Commission Position on Indemnification for Securities Act Liabilities

|

33

|

|

Financial Statements

|

33

|

i

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by the more detailed information and the financial statements and notes thereto appearing elsewhere in this Prospectus. Prospective investors should consider carefully the information discussed under Risk Factors and Use of Proceeds sections, commencing on Page 4 and Page 11, respectively. An investment in our securities presents substantial risks, and you could lose all or substantially all of your investment.

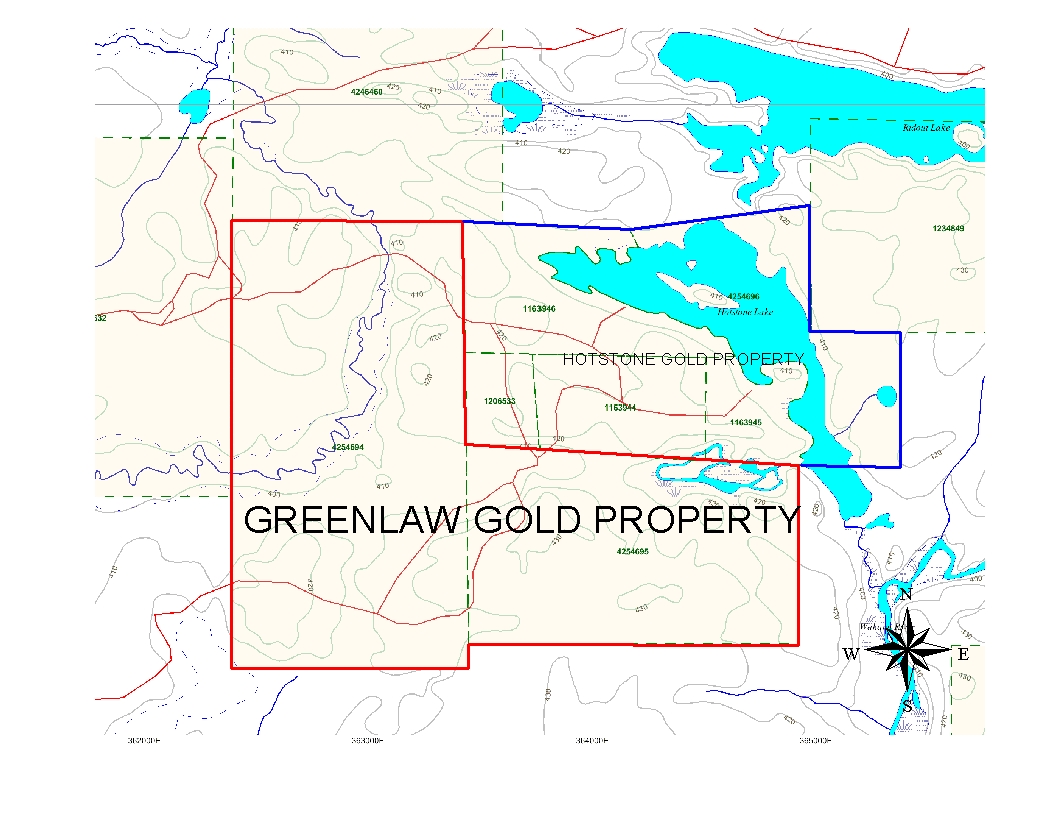

Secured Resources Inc. is a natural resource exploration stage company, holding a 100% interest in 2 un-patented claim blocks 4254694 and 4254695, totaling 24 claim units (approximately 400 hectares), located in the west-central portion of Greenlaw Township, in the Porcupine Mining District, in northeastern Ontario, known as the Greenlaw Gold Property (“Greenlaw Claims”). A legal description of the lands under the Greenlaw Gold Property can be found under the Description of Property section starting on Page 19 of this Prospectus. The Greenlaw Gold Property is located directly adjacent to the Hotstone Gold Property, approximately 50 kilometers south-east of the town of Chapleau, Ontario.

Subject to raising sufficient funds through this Offering, we intend to conduct mineral exploration on its Greenlaw Claims in order to assess whether there exists commercially exploitable mineral deposits. Our Exploration Program, which is to consist of chain surveying, soil sampling and sample analysis, is oriented toward identifying areas of mineralized bedrock containing commercially viable deposits of gold and other metallic minerals. We have not, nor to our knowledge has any predecessor, identified any commercially exploitable reserves of these minerals on the Greenlaw Claims. We are an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on the Greenlaw Claims.

Currently, we are uncertain of the number of mineral exploration phases we will conduct before concluding whether there are commercially viable minerals present on the Greenlaw Claims. Further phases beyond our planned initial Exploration Program will be dependent upon a number of factors including a consulting geologist’s recommendations based upon ongoing Exploration Program results, and our available funds.

To date, we have raised $1,250 through the sale of 12,500,000 shares of our common stock, which shares are restricted and are not being registered as part of this Offering. We have also received two loans totaling $45,000 from our two investors. From these proceeds of $46,250, $1,250 was used for the costs of incorporation, $20,000 for the total costs of preparing the Offering excluding audit, and $25,000 as payment in full to a consultant hired to seek out a suitable mining property. Subsequent to these payments, there was no cash on hand.

Through this Offering, we are seeking to raise $80,000 dollars from the sale of 40,000,000 shares of common stock at $0.002 per share. This is the maximum amount, and there is no minimum amount. We have no intention to return any stock sales proceeds to investors if the maximum amount is not raised. No commissions are to be paid in association with the selling of our stock under this Offering.

We will use our best efforts to raise the entire $80,000 under this Offering in order to proceed with our business plan. However, should we not be successful in doing so, we will be required to adjust our business plan according to the amounts raised, which may have a material and adverse effect on our operations. Most particularly, should we only be able to raise 25% or 50% of the amount being sought, we will not be in a position to undertake our planned Exploration Program, and will be required to raise additional funds in a short period of time. If we are unable to do so, our entire business would fail.

Should we be successful in raising the entire amount, then we intend to expend $33,000 on our planned Exploration Program, $3,000 for accounting costs, and have the remaining $44,000 on hand for working capital for the forthcoming year. Dependent upon the outcome of the Exploration Program, we will either determine to proceed with additional exploration on the Greenlaw Claims, or else seek out other suitable properties. In either instance, we would be required to raise additional capital, and we have not yet identified any sources for such capital.

1

We have elected to make this public offering of securities to raise the funds that are necessary to commence the Exploration Program on our Greenlaw Claims. Our decision to finance our expanded operations through this Offering is based on a presumption that we will be more successful by offering securities under an effective registration statement than through a private offering of equity or through debt financing. There can be no assurance that we will sell all or any of the shares being offered, and if we are unable to sell all of the shares, our ability to implement the plan of operations as identified in this Prospectus may be materially and adversely affected as further identified under the Use of Proceeds section commencing on Page 11.

Following is a brief summary of this Offering:

|

Securities being offered:

|

40,000,000 shares of common stock, par value $0.0001

|

|

Offering price per share:

|

$0.002

|

|

Offering period:

|

The shares are being offered for a period not to exceed 90 days from the effectiveness of this Prospectus, unless extended by our Board of Directors for an additional 90 days.

|

|

Net proceeds to us:

|

$80,000, based on the maximum 40,000,000 shares being sold. There is no assurance that we will be successful in selling this entire amount. Furthermore, there is no minimum amount of shares that may be sold under this Offering, and we have no intention to return any stock sales proceeds to investors should we sell lesser amounts than the maximum, even if the amounts raised are not sufficient to undertake our plan as identified in this Prospectus. For further information on the Use of Proceeds, please refer to that section commencing on Page 11.

|

|

Use of proceeds:

|

If we are successful in raising the entire $80,000, we plan to expend $33,000 to fund an Exploration Program on our mineral claims, and $3,000 on accounting costs. The remaining $44,000 will be available as general working capital, which shall include office and administration expenses, transfer agent fees, blue sky fees, ongoing legal and accounting costs, costs associated with the maintenance of a public company, and additional costs associated with the exploration of our mineral claims.

If we are unsuccessful in raising the maximum amounts under this Offering our ability to implement the business plan as identified in this Prospectus may be materially and adversely affected. Refer to Use of Proceeds section commencing on Page 11 for additional information.

|

|

Number of shares outstanding before the Offering:

|

12,500,000

|

|

Number of shares outstanding after the Offering if all the shares are sold:

|

52,500,000

|

2

Reporting Currency. Although our financial statements are reported in U.S. Dollars and are prepared according to U.S. GAAP, certain of our business operations may be conducted in Canadian dollars. We provide the following summary regarding historical exchange rates between these currencies. For such purposes, the exchange rate means the noon buying rate for a United States dollar from the Bank of Canada (the "Noon Buying Rate"). These translations should not be construed as representations that the Canadian dollar amounts actually represent such U.S. dollar amounts or that Canadian dollars could be converted into U.S. dollars at the rate indicated or at any other rate. As we were recently incorporated in the State of Nevada on April 12, 2010, the following is a table of the monthly average Noon Buying Rates for the two months of April 2010 through May 2010.

|

April 2010

|

May 2010

|

|

|

Average for period

|

$0.9950

|

$0.9629

|

On June 23, 2010, the Noon Buying Rate in effect for a Canadian dollar exchanged for a United States dollar was Cdn $0.9584.

Our principal executive offices are located at 804 – 9th Avenue SW, Suite 1502, Calgary, Alberta T2P 0G9. Our telephone number is (403) 244-0571.

3

RISK FACTORS

An investment in our securities should be considered highly speculative due to various factors, including the nature of our business and the present stage of our development. An investment in our securities should only be undertaken by persons who have sufficient financial resources to afford the total loss of their investment. In addition to the usual risks associated with investment in a business, you should carefully consider the following known material risk factors and all other information contained in this Prospectus before deciding to invest in our Common Shares. If any of the following risks occur, our business, financial condition and results of operations could be materially and adversely affected. Additional risks and uncertainties we do not presently know or that we currently deem immaterial may also impair our business, financial condition or operating results.

Risks Relating to our Business

Our independent auditors’ report states that there is a substantial doubt that we will be able to continue as a going concern.

Our independent auditors, De Joya Griffith & Company, LLC, state in their audit report dated June 29, 2010, and included with this prospectus, that since we are an exploration stage company, have no established source of revenue and are dependent on our ability to raise capital from stockholders or other sources to sustain operations, there is a substantial doubt that we will be able to continue as a going concern.

We have limited operating history and have earned no revenues to date, therefore face a high risk of business failure.

We have limited operating history and no revenues. We expect to incur losses in the foreseeable future due to significant costs associated with our business development, including costs associated with our planned operations. There can be no assurance that we will be able to successfully implement our business plan, or that our operations will ever generate sufficient revenues to fund our continuing operations or that we will ever generate positive cash flow from our operations. Further, we can give no assurance that we will attain or thereafter sustain profitability in any future period. Since our resources are very limited and will remain limited even if we are successful in raising all of the funds under this Offering, and we may not generate any revenues in the near future, unless we can raise additional equity or debt financing or generate revenues, we may have to cease operations.

We have no operational track record that would provide a basis for assessing our ability to conduct successful mineral exploration activities. We may not be successful in carrying out our business objectives.

We were incorporated on April 12, 2010 and to date, have been involved primarily in organizational activities, obtaining financing and seeking out and acquiring an interest in the claims. Accordingly we have no track record of successful exploration activities, strategic decision making by management, significant fund-raising ability, and other factors that would allow an investor to assess the likelihood that we will be successful as a junior resource exploration company. Junior exploration companies often fail to achieve or maintain successful operations, even in favorable market conditions. There is a substantial risk that we will not be successful in our exploration activities, or if initially successful, in thereafter generating any operating revenues or in achieving profitable operations.

We may be unable to achieve favorable rates of return on our claims.

The mining exploration and development industry is highly competitive. Many companies and individuals are engaged in the business of acquiring interests in and developing mining properties and the industry is not dominated by any single competitor or a small number of competitors. Should we wish to acquire additional properties in the future, we will be competing with numerous industry participants for the acquisition of land and rights to prospects. We will also be competing for the equipment and labor required to explore and develop our existing and possible future prospects. Many, if not most, of these competitors have financial, technical and other resources substantially in excess of those available to us. These competitive disadvantages, which could serve to limit our future prospects and substantially increase our cost of operations, could adversely affect our ability to operate with favorable rates of return.

4

We have not fulfilled our obligation relating to the acquisition of our 100% interest in our Property.

In order to fulfill our obligations under the agreement in which we acquired our 100% interest in the Greenlaw Claims, we must pay the amount of $10,000 to the vendor by June 15, 2012. If we fail to do so, we will lose our interest in the claims. Furthermore, while not explicitly contemplated in the agreement, in order to keep the claims active with the government of Ontario, an amount of approximately US$9,000 needs to be expended on approved Exploration Programs on the claims prior to February 22, 2012. Without such expenditures, the claims will lapse and therefore our interest in them would have no value. If we fail to raise sufficient funds under this Offering or in the future, we could lose our interest and you could lose a portion or all of your invested funds.

Because there is no minimum share sale requirement, it is possible that we will fail to adequately fund our initial operations even if we raise some funds from this Offering.

This Offering is not subject to any minimum share sale requirement. Consequently, the early investor is not assured of any other, later shares being sold. You may be the only purchaser. If we fail to sell the entire Offering or just a portion of the Offering, we may never be able to adequately fund operations and your investment could be lost. As a specific example, if we were to be successful in only selling 25% of our shares, resulting in gross and net proceeds of $20,000, our planned allocation of these proceeds is $3,000 towards accounting costs, and $17,000 for working capital. In such a circumstance, we would not be able to undertake any exploration activities which are fundamental to our business development, until and if we were able to raise additional capital. A similar situation exists if we were only able to raise 50% of the amounts being sought. Please refer to the Use of Proceeds section commencing on Page 11 for additional information on and risks associated with different levels of success in our funding efforts.

Failure to secure additional financing will affect our ability to survive.

We will require additional financing in addition to the funds we hope to raise from the sale of shares offered under this Prospectus in order to have the potential for profitable operations in the future. Such financing may not be forthcoming, and potential sources have not yet been identified. Even if additional financing is available, it may not be available on terms we find favorable. Failure to secure required additional financing will have a very serious effect on our ability to survive.

Our sole officer and director has no experience in the mining exploration and development industry, which may limit the success of our business.

Mr. David Adelman, our sole Officer and Director, does not have any experience in the mining industry. Although we believe that Mr. Adelman possesses business experience and acumen, he lacks specific experience in starting or operating a mining exploration company. In order to be successful in this industry, a great deal of specialized knowledge is required. As Mr. Adelman presently lacks this knowledge, we will be reliant upon outside consultants in the short and medium term. Over time, should we be successful in developing our business plan, we will also be required to hire additional employees with specific industry expertise, or to find a suitable partner with the requisite expertise. There is substantial competition for such consulting and in-house expertise, and we may have difficulty obtaining and retaining such individuals, particularly if we are operating on a constrained budget. These factors will together potentially limit our chances of future success.

Inability of our sole officer and director to devote sufficient time to our operations may limit our success.

Presently, our sole officer and director allocates only a portion of his time, which is currently approximately 1/2 to 1 day per week, to the operation of our business. Should our business develop faster than anticipated, he may not be able to devote sufficient time to our operations to ensure that we continue as a going concern. Even if this lack of sufficient time of our management is not fatal to our existence, it may result in our limited growth and success.

5

We may be unable to effectively manage our planned growth, which could have a material adverse effect on our business.

Our success will depend upon the expansion of our business. Expansion will place a significant strain on our financial, management and other resources, and will require us, among other things, to change, expand and improve our operating, managerial and financial systems and controls and improve coordination between our various corporate functions. We presently have no full-time employees or management personnel.

Our inability to effectively manage our growth, including the failure of any new personnel we hire to achieve anticipated performance levels, would have a material adverse effect on our business, financial condition and results of operations.

Our two stockholders, who collectively own 100% of our issued and outstanding stock, may continue to have a significant voice in management after the Offering, which could result in decisions adverse to our general stockholders.

Should the offering under this Prospectus not be fully subscribed, our two principal stockholders may collectively beneficially own or have the right to vote a majority of our outstanding Common Shares. For example, if we were to sell less than 12,500,000 shares, they would collectively own more than 50% of the issued and outstanding stock. As a result, these stockholders, acting together, would have the ability to control substantially all matters submitted to our stockholders for approval including:

- election of our board of directors;

- removal of any of our directors;

- amendment of our Articles of Incorporation or By-laws; and

- adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

We may not have access to all of the equipment and personnel we need to begin exploration which could cause us to delay or suspend operations.

Competition and unforeseen limitations on sources of equipment and expert personnel required to manage and undertake our planned Exploration Program could result in delays in undertaking any such program, or increase the costs associated with the program. We have not yet attempted to locate or negotiate with any personnel or suppliers of equipment; we plan to do so after this offering is complete and sufficient funds have been raised. If we cannot find the personnel or equipment we require, we will have to suspend our exploration plans until we are able to do so.

Because access to the Greenlaw Claims may be restricted by inclement weather, we may be delayed in our exploration efforts.

Access to the Greenlaw Claims is often restricted through the winter months. The property is located approximately 50 km south-east of the town of Chapleau, in central Ontario. The location is relatively remote and rugged, and experiences cold winters with often significant snow accumulations.

6

Because certain legislation, including the Sarbanes-Oxley Act of 2002, increases the cost of compliance with federal securities regulations as well as the risks of liability to officers and directors, we may find it more difficult for us to retain or attract officers and directors.

The Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding corporate accountability in connection with recent accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies, and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The Sarbanes-Oxley Act generally applies to all companies that file or are required to file periodic reports with the SEC, under the Securities Exchange Act of 1934. Upon becoming a public company, we will be required to comply with the Sarbanes-Oxley Act and it is costly to remain in compliance with the federal securities regulations. Additionally, we may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles. Significant costs incurred as a result of becoming a public company could divert the use of finances from our operations resulting in our inability to achieve profitability.

Risks Relating to Business in the Mineral Exploration and Development Sector

Because of the unique difficulties and uncertainties inherent in the mineral exploration business, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The search for valuable minerals also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time, we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position. In addition, there is no assurance that the expenditures to be made by us in the exploration of the mineral claims will result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

Because of factors beyond our control, which could affect the marketability of any substances found, we may have difficulty selling any substances we discover.

Even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. These factors could inhibit our ability to sell minerals in the event that commercial amounts of minerals are found.

7

Because we will be subject to compliance with government regulation, which may change, the anticipated costs of our Exploration Program may increase.

There are several governmental regulations that materially restrict mineral exploration or exploitation. We will be subject to the Mining Act of Ontario as we carry out our Exploration Program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. Currently, we have not experienced any difficulty with compliance of any laws or regulations, which affect our business. While our planned Exploration Program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business, prevent us from carrying out our Exploration Program, and make compliance with new regulations unduly burdensome.

The Company is subject to compliance with Environmental Regulations which may result in unanticipated future costs or liabilities.

Our operations may be subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain exploration and mining industry operations, such as seepage from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards, and enforcement, fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

If Native land claims affect the title to our mineral claims, our ability to prospect the mineral claims may be lost.

We are unaware of any outstanding native land claims on the Greenlaw Claims. Notwithstanding, it is possible that a native land claim could be made in the future. The federal and provincial government policy at this time is to consult with all potentially affected native bands and other stakeholders in the area of any potential commercial production. In the event that we encounter a situation where a native person or group claims an interest in the Greenlaw Claims, we may be unable to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish any interest that we may have in these claims. The Supreme Court of Canada recently ruled that both the federal and provincial governments in Canada are now obliged to negotiate these matters in good faith with native groups and at no cost to us. Notwithstanding, the costs and/or losses could be greater than our financial capacity and our business would fail.

Because the Province of Ontario owns the land covered by the Greenlaw Claims, our ability to conduct an exploratory program is subject to the consent of the Province of Ontario, which could be withheld.

The land covered by the Greenlaw Claims is owned by the Province of Ontario. The availability to conduct an exploratory program on the Greenlaw Claims is subject to the consent of the Province of Ontario, which could be withheld, thereby preventing us from undertaking our business plan.

Furthermore, in order to keep the Greenlaw Claims in good standing, the Province of Ontario requires that before the expiry dates of the mineral claims that exploration work on the mineral claims valued at an amount stipulated by the government be completed together with the payment of a filing fee or payment to the Province of Ontario in lieu of completing exploration work. In the event that these conditions are not satisfied prior to the expiry dates of the mineral claims, we will lose our interest in the mineral claims and the mineral claims then become available again to any party that wishes to stake an interest in these claims. In the event that we are ejected from the land or our mineral claims expire, we will lose all interest that we have in the claims. We are required to expend approximate US$9,000 before February 22, 2012, in order to keep our claims in good standing.

8

Risks Relating to our Common Shares and the Trading Market

We may, in the future, issue additional Common Shares which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 75,000,000 Common Shares with par value of $0.0001. The future issuance of our authorized Common Shares may result in substantial dilution in the percentage of our Common Shares held by our then existing stockholders. We may value any Common Shares issued in the future on an arbitrary basis. The issuance of Common Shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the Common Shares held by our investors, and might have an adverse effect on any trading market for our Common Shares.

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We are engaged in the business of exploring and, if warranted and feasible, developing natural resource properties. Our Lease is in the exploration stage only, requires additional expenditure to be secured, and is without known reserves of natural resources. Accordingly, we have not generated any revenues nor have we realized a profit from our operations to date, and there is little likelihood that we will generate any revenues or realize any profits in the short to medium term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of natural resources, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

There is no current trading market for our securities and if a trading market does not develop, purchasers of our securities may have difficulty selling their shares.

There is currently no established public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. We intend to apply for admission to quotation of our securities on the OTC Bulletin Board. If for any reason our Common Shares are not quoted on the OTC Bulletin Board or a public trading market does not otherwise develop, purchasers of the Common Shares may have difficulty selling their shares should they desire to do so. No market makers have committed to becoming market makers for our Common Shares and it may be that none will do so.

Our Common Shares are not currently marketable. Should we be successful in having our common stock quoted on the Over the Counter Bulletin Board (“OTC-BB”) you will be subject to the “Penny Stock” Rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock. These rules may affect your ability to resell your shares.

Our stock currently is not traded on any stock exchange or quoted on any stock quotation system. We intend to file an application for quotation on the OTC-BB upon completing this Offering. There can be no assurance we will be successful in our application, however, should we receive approval for quotation on the OTC-BB the SEC has adopted regulations that generally define a "penny stock" to be any equity security other than a security excluded from such definition by Rule 3a51-1 under the Securities Exchange Act of 1934, as amended. For the purposes relevant to our Company, it is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions.

9

It is anticipated that our Common Shares will be regarded as a “penny stock”, since our shares are not listed on a national stock exchange or quoted on the NASDAQ Market within the United States, to the extent the market price for our shares is less than $5.00 per share. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by the SEC, to provide the customer with additional information including current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer's account, and to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. To the extent these requirements may be applicable they will reduce the level of trading activity in the secondary market for the Common Shares and may severely and adversely affect the ability of broker-dealers to sell the Common Shares.

United States securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this Prospectus.

Secondary trading in Common Shares sold in this Offering will not be possible in any state in the U.S. unless and until the Common Shares are qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying the Common Shares for secondary trading, or identifying an available exemption for secondary trading in our Common Shares in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the Common Shares in any particular state, the Common Shares could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our Common Shares, the market for the Common Shares could be adversely affected.

We have not and do not intend to pay any cash dividends on our Common Shares, and consequently our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We have not, and do not, anticipate paying any cash dividends on our Common Shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

If our shares are quoted on the over-the-counter bulletin board, we will be required to remain current in our filings with the SEC and our securities will not be eligible for quotation if we are not current in our filings with the SEC.

In the event that our shares are quoted on the over-the-counter bulletin board, we will be required to remain current in our filings with the SEC in order for shares of our common stock to be eligible for quotation on the over-the-counter bulletin board. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 or 60 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the over-the-counter bulletin board, investors in our common stock may find it difficult to sell their shares.

10

FORWARD LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as: anticipate, believe, plan, expect, future, intend and similar expressions, to identify such forward-looking statements. You should not place too much reliance on these forward-looking statements. Actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced as described in the “RISK FACTORS” section and elsewhere in this prospectus. Factors which may cause the actual results or the actual plan of operations to vary include, among other things, decisions of the board of directors not to pursue a specific course of action based on its re-assessment of the facts or new facts, or changes in general economic conditions and those other factors set out in this prospectus. Except as required by law, we undertake no obligation to update any of the forward-looking statements in this Prospectus after the date hereof.

USE OF PROCEEDS

We intend to raise $80,000 dollars from the sale of 40,000,000 shares of common stock at $0.002 per share. This Offering has a maximum amount of $80,000 dollars and no minimum. We have no intention to return any stock sales proceeds to investors if the maximum amount is not raised. No commissions are to be paid in association with the selling of our stock under this Offering

We will use our best efforts to raise the entire $80,000 under this Offering in order to proceed with our business plan. However, should we not be successful in doing so, we will be required to adjust our business plan according to the amounts raised, which may have a material and adverse effect on our operations. The following table outlines our planned use of proceeds based on different percentages of shares sold and the corresponding proceeds raised.

|

Allocation of Proceeds based on %’age of Offering sold / Net Proceeds Raised

|

||||

|

Use of Proceeds

|

25%

($20,000)

|

50%

($40,000)

|

75%

($60,000)

|

100%

($80,000)

|

|

Accounting Costs

|

$3,000

|

$3,000

|

$3,000

|

$3,000

|

|

Initial Exploration Program

|

-

|

-

|

$33,000

|

$33,000

|

|

Working capital

|

$17,000

|

$37,000

|

$24,000

|

$44,000

|

In the event we are only able to sell 25% of the shares under this Offering, we will not have sufficient funds to commence the Exploration Program, which is integral to our business plan, as it will provide us with additional information with respect to the potential viability of the Greenlaw Claims. We would certainly need to obtain additional loans or investments totaling an estimated $60,000 immediately, as we would only have $17,000 of working capital available. Even with undertaking only minimal activities, the costs of maintaining a public company together with costs that we would expect to incur in raising such additional funds, would result in no progress on our business plan being made until such time as additional funds could be raised. We anticipate it would be difficult to raise such funds in this scenario, given the lack of success in our initial fund-raising efforts and that no exploration activities would have been undertaken.

Should we only be able to sell 50% of the shares under this Offering, we envision that we would be facing similar challenges to those faced in the 25% scenario, except that we would have a limited amount of time to raise the additional funds for our business plan, which we estimate to be at least $40,000. If it were to take more than 2 to 3 months to raise the capital shortfall, we expect the $40,000 requirement to increase, as we would be starting to spend funds that are required for exploration activities and working capital associated with the Exploration Program.

In both the above scenarios, we would expect to raise these funds through shareholder loans or the additional sales of common stock. There can be no assurance that we will be successful in raising these funds to allow us to execute our business plan. This situation would lead to all invested monies having been utilized without ever having undertaken the planned Exploration Program.

11

If we are only able to sell 75% of the shares under the Offering, we expect to proceed with the Exploration Program as contemplated. In such a scenario, we would have sufficient capital to sustain our operations and maintenance throughout our first year. However, operations would be maintained at a minimum and we would not have sufficient working capital to expand our Exploration Programs or to hire outside consultants for any work other than our Exploration Program.

Should we be successful in raising the entire $80,000 we are seeking from this Offering, we will have sufficient funds for our operations for the twelve (12) month period following the completion of this Offering. Our plan is to utilize $3,000 towards the expected costs of accounting, with $33,000 available for our planned Exploration Program, and $44,000 available for general working capital. The working capital would be used to pay office and administration expenses, ongoing legal, accounting fees and professional fees, transfer agent fees, and other minor operational costs. We will also be required to make a one-time non refundable payment of $10,000 within 2 years of signing the agreement to acquire our claims, which is by June 15, 2012. We will not use proceeds from this Offering to make that payment, but rather will use funds raised in the future to do so. If we cannot raise those funds to make this payment, our agreement will become voided

As at the date of this Offering, we have raised a total of $46,250 dollars, $1,250 was received from two investors by way of the sale of 12,500,000 shares of common stock. These shares sold are restricted and are not being registered in this Offering. We also received two loans totaling $45,000 from our two investors. From these total proceeds of $46,250, $1,250 was used for the costs of incorporation, $20,000 for the total costs of preparing the Offering, and $25,000 as payment in full to a consultant hired to seek out a suitable mining property. Subsequent to these payments, there was no cash on hand.

Whether or not we are successful in selling all the shares under this Offering, we will be required to raise additional funds in the future. The identified $33,000 Exploration Program will only serve to assist in identifying if further additional exploration work is warranted. If such additional work is determined not to be necessary, then our sole asset, the Greenlaw Claim, will quite possibly have no value, and we would need to identify and acquire alternative assets, which activities would also require additional financing. If the Exploration Program does suggest additional exploration and development work is warranted, then substantial additional expenditures will be required.

DETERMINATION OF OFFERING PRICE

There is no established market for our stock. The offering price for shares sold pursuant to this Offering is set at $0.002 per common share. To date, we have sold a total of 12,500,000 common shares for $0.0001 per share, for total proceeds of $1,250. All of the shares of outstanding common stock are restricted.

The price of the shares we are offering was arbitrarily determined in order for us to raise up to a total of $80,000 in this Offering. The offering price bears no relationship whatsoever to our assets, earnings, book value or other criteria of value. Among the factors considered were:

|

-

|

our cash requirements;- the proceeds to be raised by the offering;

|

|

-

|

our lack of operating history; and

|

|

-

|

the amount of capital to be contributed by purchasers in this Offering in proportion to the amount of stock to be retained by our existing shareholders.

|

There are no warrants, rights or convertible securities associated with this Offering.

DILUTION

“Net tangible book value” is the amount that results from subtracting the total liabilities and intangible assets from the total assets of an entity. Dilution occurs because we determined the offering price based on factors other than those used in computing book value of our stock. Dilution exists because the book value of shares held by existing stockholders is lower than the offering price offered to new investors.

12

We are offering shares of our common stock for $0.002 per share through this Offering. Since our inception on April 12, 2010 through to April 30, 2010, two unrelated third parties have purchased a total of 12,500,000 shares of our common stock, representing 100% of our issued and outstanding stock, for an aggregate of $1,250. There have been no additional sales of our stock subsequent to April 30, 2010.

As at April 30, 2010, our net tangible book value was ($0.0020) per common share. If we are successful in selling all of the offered shares at the public offering price, our pro forma net tangible book value will be $31,877 or approximately $0.0006 per share, which would represent an immediate increase of $0.0026 in net tangible book value per share. Based upon the offering price of $0.002 per share, and assuming all the 40,000,000 shares are sold, new investors would incur immediate dilution of $0.0014 per share, representing approximately 43% per share dilution.

Following is a table detailing dilution to investors if 25%, 50%, 75%, or 100% per cent of the offering is sold.

| 25 | % | 50 | % | 75 | % | 100 | % | |||||||||

|

Net Tangible Book Value Per Share Prior to Stock Sale

|

-0.0020 | -0.0020 | -0.0020 | -0.0020 | ||||||||||||

|

Net Tangible Book Value Per Share After Stock Sale

|

-0.0012 | -0.0002 | 0.0003 | 0.0006 | ||||||||||||

|

Increase (Decrease) in Net Book Value Per Share Due to Stock Sale

|

0.0008 | 0.0018 | 0.0023 | 0.0026 | ||||||||||||

|

Immediate Dilution (subscription price of $0.002 less net tangible book value per share)

|

0.0032 | 0.0022 | 0.0017 | 0.0014 |

Assuming all the shares are sold, the following table illustrates the pro forma per share dilution:

|

Price to the Public (1)

|

$ | 0.002 | ||

|

Net tangible book value per Share before Offering (2)

|

$ | -0.0020 | ||

|

Net tangible book value per Share after Offering (3), (4)

|

$ | 0.0006 | ||

|

Increase Attributable to purchase of Stock by New Investors (5)

|

$ | 0.0026 | ||

|

Immediate Dilution to New Investors (6)

|

$ | 0.0014 | ||

|

Percent Immediate Dilution to New Investors (7)

|

43 | % |

|

(1)

|

Offering price per equivalent common share.

|

|

(2)

|

The net tangible book value per share before the offering is determined by dividing the number of shares of common stock outstanding into our net tangible book value.

|

|

(3)

|

The net tangible book value after the offering is determined by adding the net tangible book value before the offering to the estimated proceeds to us from the current offering less an estimated $3,000 for the costs of accounting and $20,000 for the expensing of deferred financing costs.

|

|

(4)

|

The net tangible book value per share after the offering is determined by dividing the number of shares that will be outstanding after the offering into the net tangible book value after the offering as determined in Note 3.

|

|

(5)

|

The increase attributable to purchase of stock by new investors is derived by taking the net tangible book value per share after the offering and subtracting from it the net tangible book value per share before the offering.

|

|

(6)

|

The dilution to new investors is determined by subtracting the net tangible book value per share after the offering from the public offering price, giving a dilution value.

|

|

(7)

|

The percent of immediate dilution to new investors is determined by dividing the dilution to new investors by the price to the public.

|

Following is a comparison of the differences of your investment in our shares with the share investment of our existing stockholders, officers and directors.

The existing stockholders have purchased a total of 12,500,000 shares for an aggregate amount of $1,250, or an average cost of $0.0001 per share. Your investment in our shares will cost you $0.002 per share. In the event that this Offering is fully subscribed, the net tangible book value of the stock held by the existing stockholders will increase by $0.0026 per share, while your investment will decrease by $0.0014 per share. If this Offering is fully subscribed, the total capital contributed by new investors will be $80,000. The percentage of capital contribution will then be 1.5% for the existing stockholders and 98.5% for the new investors. The existing stockholders will then hold, as a percentage, 23.8% of our issued and outstanding shares, while the new investors will hold, as a percentage, 76.2%.

13

SELLING SECURITY HOLDERS

Our current stockholders are not selling any of the shares being offered in this Prospectus.

PLAN OF DISTRIBUTION

Underwriters and Underwriting Obligation, New Underwriters

Upon effectiveness of the registration statement, of which this Prospectus is a part, we will conduct the sale of shares we are offering on a self-underwritten, best-efforts basis. There will be no underwriters used, no dealer's commissions, no finder's fees, and no passive market making.

Other Distributions

Our officer and director, Mr. David Adelman will sell securities on our behalf in this Offering. Our officer and director intends to personally contact his friends, family members and business acquaintances in attempting to sell the shares offered hereunder. We will not be conducting a mass-mailing in connection with this Offering, nor will we use the Internet to conduct this Offering. We will not employ the services of an agent or intermediary to introduce us to prospective subscribers to the Offering.

Mr. David Adelman is not subject to a statutory disqualification as such term is defined in Section 3(a)(39) of the Securities Exchange Act of 1934. He will rely on Rule 3a4-1 to sell our securities without registering as a broker-dealer. He is serving as an officer and director and primarily performs substantial duties for or on our behalf otherwise than in connection with transactions in securities and will continue to do so at the end of the Offering, and have not been a broker or dealer, or an associated person of a broker or dealer, within the preceding 12 months, and have not nor will not participate in the sale of securities for any issuer more than once every 12 months. Mr. Adelman will not receive commissions or other remuneration in connection with his participation in this Offering based either directly or indirectly on transactions in securities.

We plan to offer our shares to the public at a price of $0.002 per share, with no minimum amount to be sold. Our sole officer and director may purchase shares under this Offering. We will keep the Offering open until we sell all of the shares registered, or for 90 days from the date of this prospectus, whichever occurs first. Our Board of Directors, may, at its discretion, elect to extend the Offering for up to an additional ninety (90) days if all the shares have not been sold. There can be no assurance that we will sell all or any of the shares offered. We have no arrangement or guarantee that we will sell any shares. All subscription checks will be made payable to us or as we may otherwise direct. Upon our acceptance of an investor’s signed subscription agreement and bank clearance of the funds from each investor’s subscription check, each investor will become a stockholder of the Company and receive a share certificate for the number of shares subscribed for.

Offerings on Exchange

Our securities are not going to be offered on an exchange or in connection with the writing of exchange-traded call options.

Underwriter’s Compensation

We are not using underwriters in connection with this Offering, and thus, there is no compensation, discounts or commissions to be paid to underwriters.

Underwriter's Representative on Board of Directors

We are not using underwriters in connection with this Offering, and thus, no underwriter has the right to designate or nominate a member or members of our Board of Directors.

Indemnification of Underwriters

Not Applicable.

14

Dealers’ Compensation

There are no discounts or commissions to be allowed or paid to any dealers, including cash, securities, contracts or other considerations to be received by any dealer in connection with the sale of the securities.

Finders

None.

Discretionary Accounts

None.

Passive Market Making

No underwriters or any selling group members intend to engage in passive market making transactions as permitted by Rule 103 of Regulation M.

Stabilization and Other Transactions

Not applicable.

DESCRIPTION OF SECURITIES TO BE REGISTERED

Capital Stock

Our Articles of Incorporation authorize the issuance of 75,000,000 shares of common stock with $0.0001 par value. We are not authorized to issue any series or shares of preferred stock. Each record holder of common stock is entitled to one (1) vote for each share held in all matters properly submitted to the stockholders for their vote. Cumulative voting for the election of directors is not permitted by our By-Laws.

Holders of outstanding shares of common stock are entitled to such dividends as may be declared from time to time by the Board of Directors out of legally available funds; and, in the event of liquidation, dissolution or winding up of our affairs, holders are entitled to receive, ratably, our net assets available to stockholders after distribution is made to the preferred stockholders, if any, who are given preferred rights upon liquidation. Holders of outstanding shares of common stock have no preemptive, conversion or redemptive rights. To the extent that additional shares of our common stock are issued, the relative interest of then existing stockholders may be diluted.

Debt Securities

None.

Warrants and Rights

None.

Other Securities

None.

Market Information for Securities Other Than Common Equity

Not applicable.

15

American Depositary Receipts

Not applicable.

INTERESTS OF NAMED EXPERTS AND COUNSEL

We have not hired or retained any experts or counsel on a contingent basis, who would receive a direct or indirect interest in the Company, or who is, or was, a promoter, underwriter, voting trustee, director, officer or employee of the Company.

De Joya Griffith & Company, LLC, of Henderson, NV, has audited our financial statements included in this Prospectus and Registration Statement to the extent and for the periods set forth in their audit report. De Joya Griffith & Company, LLC has presented their report with respect to our audited financial statements, and the report is included in reliance upon their authority as experts in accounting and auditing.

Gersten Savage LLP has issued an opinion on the validity of the shares being offered by this Prospectus, which opinion has been filed as an Exhibit to this Prospectus with Gersten Savage LLP’s consent.

INFORMATION WITH RESPECT TO THE REGISTRANT

Description of Business

General Information

We were incorporated on April 12, 2010, in the State of Nevada. We have never declared bankruptcy, have never been in receivership, and have never been involved in any legal action or proceedings. Since incorporation, we have not made any significant purchase or sale of assets, save for the acquisition of two unpatented mining claims as identified below. Neither we, nor our officer, director, promoters or affiliates, has had preliminary contact or discussions with, nor do we have any present plans, proposals, arrangements or understandings with any representatives of the owners of any business or company regarding the possibility of an acquisition or merger. We are not a blank check registrant as that term is defined in Rule 419(a)(2) of Regulation C of the Securities Act of 1933, as we have a specific business plan or purpose.

Business of the Company

We are a natural resource exploration company and anticipate exploring, and if warranted and feasible, developing natural resource assets. The Company’s first natural resource asset is a 100% undivided interest in a property acquired on June 15, 2010 in the Greenlaw Township, Ontario, Canada, as is further described below under Description of Property commencing on Page 19. Exploration of these claims is required before a determination as to its viability can be made. We do not have any current plans to acquire interests in additional mineral properties, though we may evaluate the possibility of such acquisitions in the future.

Our plan of operations for the current fiscal year is to carry out initial exploration work on the Property to in order to ascertain whether it possesses commercially exploitable quantities of gold and other precious metals. We will not be able to determine whether or not the Greenlaw Claims may contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on the work indicates economic viability.

The initial exploration work is expected to cost approximately US$33,000 (the “Exploration Program”). We have allocated this amount from the funds to be raised under this Offering to complete the Exploration Program, based on our raising at least 75% of the total proceeds of $80,000, as further detailed under Use of Proceeds section commencing on Page 11. The primary aspects of the Exploration Program are as described below in the Description of Property section commencing on Page 19.

16

Mineral property exploration is typically conducted in phases. Each subsequent phase of exploration work is recommended by a geologist based on the results from the most recent phase of exploration. Upon completion of our Phase 1 Exploration Program, we will make a decision as to whether or not we proceed to a subsequent phase based upon our analysis of the results of that program. Our management and board will make this decision based upon the recommendations of the independent geologist who oversees the program and records the results. We have not yet retained an independent geologist.

Even if we are ultimately successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit.

Based on being able to raise any additional funds required beyond those raised under this Offering and if we are successful in reaching the stage where our Greenlaw Claims, or some other properties in which we might be able to acquire working interests in are producing, our principal products are intended to be gold bearing ore and any related saleable by-products from the extraction and refining process.

Competitive Business Conditions

While we don’t yet have any mineral products for sale, the mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves. Furthermore, should we choose in the future to seek out and acquire additional mineral resource assets, we would potentially be at a distinct disadvantage when competing against companies with assets and experiences that are significantly greater than ours. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital.

Sources and Availability of Raw Materials

As we have not yet initiated our Exploration Program, and any subsequent possible mining / refining activities, we are not yet in competition with other companies for the human and equipment resources that are required to undertake such activities. Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. We have only recently acquired our mineral claims and our operations are not well-established. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of the Greenlaw Claims. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and entered into production of the mineral claim if a commercial viable deposit is found to exist.

Patents, Trademark, Licenses, Franchises, Concessions, Royalty Agreements or Labor Contracts

We are party to a 2% Net Smelter Returns royalty, payable to the vendor in our Acquisition Agreement. This royalty commences upon there being commercial production on the Greenlaw Claims, and continues for the duration of any such commercial production.

We do not own, either legally or beneficially, any patent or trademark, nor are we party to any agreements with the exception of our Acquisition Agreement.

17

Need For Government Approval of Principal Products or Services

There are no inherent factors or circumstances associated with this industry that would give cause for any patent, trademark or license infringements or violations. We have not entered into any franchise agreements or other contracts that have given, or could give rise to obligations or concessions. At present, we do not hold any intellectual property nor do we anticipate that we will have any need for any intellectual property.

Need For Government Approval of Principal Products or Services

We are not required to apply for or have any government approval for our products or services.

Effect of Existing or Probable Governmental Regulations on the Business

The future operations of the Company, including exploration and development activities and the commencement and continuation of commercial production, require licenses, permits or other approvals from various federal, provincial and local governmental authorities and such operations are or will be governed by laws and regulations relating to prospecting, development, mining, production, exports, taxes, labour standards, occupational health and safety, waste disposal, toxic substances, land use, water use, environmental protection, land claims of indigenous people and other matters. Most particularly, we will operate under the Ontario Ministry of Northern Development Mines and Forestry, Mines and Minerals Division, which will govern the primary aspects of our exploration and possible future development work. We believe that the Greenlaw Property is presently in substantial compliance with all material laws and regulations which currently apply to its activities. There can be no assurance, however, that we will obtain on reasonable terms or at all the permits and approvals, and the renewals thereof, which it may require for the conduct of its future operations or that compliance with applicable laws, regulations, permits and approvals will not have an adverse effect on plans to explore and develop the Greenlaw Claims. Possible future environmental and mineral tax legislation, regulations and actions could cause additional expense, capital expenditures, and restrictions and delay our planned exploration and operations, the extent of which cannot be predicted.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions there under, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Costs and Effects of Compliance with Environmental Laws

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of Canadian federal, provincial, state and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry. Although we intend to substantially comply with all applicable laws and regulations, when we begin our operations and exploration activities because these rules and regulations frequently are amended or interpreted, we cannot predict the future cost or impact of complying with these laws.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulations could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the costs of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

18

Our operations and properties are subject to extensive Canadian federal, state, provincial and local laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to safety and health. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences, (ii) restrict the types, quantities and concentration of various substances that can be released in the environment in connection with exploration activities, (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas, (iv) require remedial measures to mitigate pollution from former operations and (v) impose substantial liabilities for pollution resulting from our proposed operations.