Attached files

Exhibit 99.1

KAHIBAH LIMITED

CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009AND 2008, AND MARCH 31, 2010

KAHIBAH LIMITED

CONTENTS

|

PAGE

|

1

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

PAGES

|

2-3

|

CONSOLIDATED BALANCE SHEETS AS OF DECEMBER 31, 2009 AND 2008 AND MARCH 31, 2010 (UNAUDITED)

|

|

PAGES

|

4-5

|

CONSOLIDATED STATEMENTS OF INCOME FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008, AND FOR THE THREE MONTHS ENDED MARCH 31, 2010 AND 2009 (UNAUDITED)

|

|

PAGE

|

6

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008, AND FOR THE THREE MONTHS ENDED MARCH 31, 2010 AND 2009 (UNAUDITED)

|

|

PAGE

|

7

|

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008

|

|

PAGES

|

8-9

|

CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008, AND FOR THE THREE MONTHS ENDED MARCH 31, 2010 AND 2009 (UNAUDITED)

|

|

PAGES

|

10-35

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2009 AND 2008, AND MARCH 31, 2010 (UNAUDITED)

|

Report of Independent Registered Public Accounting Firm

To the Board of Directors and

Shareholders of Kahibah Limited:

We have audited the accompanying consolidated balance sheets of Kahibah Limited and subsidiaries (the “Company”) as of December 31, 2009 and 2008, and the related consolidated statements of income, comprehensive income, changes in shareholders’ equity and cash flows for each of the two years in the period ended December 31, 2009. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Kahibah Limited and subsidiaries as of December 31, 2009 and 2008 and the results of their operations and their cash flows for each of the two years in the period ended December 31, 2009 in conformity with accounting principles generally accepted in the United States of America.

/s/ Windes & McClaughry Accountancy Corporation

Irvine, California, United States

June 30, 2010

1

KAHIBAH LIMITED AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

|

March 31,

|

December 31,

|

December 31,

|

||||||||||

|

ASSETS

|

2010

|

2009

|

2008

|

|||||||||

|

(Unaudited)

|

||||||||||||

|

CURRENT ASSETS

|

||||||||||||

|

Cash and cash equivalents

|

$ | 4,307,052 | $ | 5,099,860 | $ | 3,584,959 | ||||||

|

Inventory

|

117,068 | 105,538 | 179,842 | |||||||||

|

Due from related parties

|

2,474,595 | 3,014,906 | 2,591,674 | |||||||||

|

Prepayments and other current assets

|

299,989 | 260,309 | 288,976 | |||||||||

|

Total Current Assets

|

7,198,704 | 8,480,613 | 6,645,451 | |||||||||

|

LONG-TERM ASSETS

|

||||||||||||

|

Property and equipment, net

|

28,647,753 | 28,779,123 | 29,338,450 | |||||||||

|

Land use rights, net

|

5,268,483 | 5,296,661 | 5,429,480 | |||||||||

|

Total Long-Term Assets

|

33,916,236 | 34,075,784 | 34,767,930 | |||||||||

|

TOTAL ASSETS

|

$ | 41,114,940 | $ | 42,556,397 | $ | 41,413,381 | ||||||

See accompanying notes to the consolidated financial statements.

2

KAHIBAH LIMITED AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (CONTINUED)

|

March 31,

|

December 31,

|

December 31,

|

||||||||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

2010

|

2009

|

2008

|

|||||||||

|

CURRENT LIABILITIES

|

(Unaudited)

|

|||||||||||

|

Accounts payable

|

$ | 132,657 | $ | 205,024 | $ | 303,228 | ||||||

|

Other payables

|

246,003 | 209,747 | 1,032,246 | |||||||||

|

Short-term bank loans

|

- | - | 1,021,273 | |||||||||

|

Refundable deposits

|

1,893,869 | 2,162,729 | 4,010,015 | |||||||||

|

Prepaid tuition

|

12,654,185 | 15,820,999 | 17,176,754 | |||||||||

|

Home purchase down payment

|

505,021 | 504,216 | 526,372 | |||||||||

|

Accrued expenses and other current liabilities

|

534,361 | 733,540 | 905,217 | |||||||||

|

Due to related parties

|

35,112 | 1,189,429 | 1,961,639 | |||||||||

|

Total Current Liabilities

|

16,001,208 | 20,825,684 | 26,936,744 | |||||||||

|

TOTAL LIABILITIES

|

16,001,208 | 20,825,684 | 26,936,744 | |||||||||

|

SHAREHOLDERS’ EQUITY

|

||||||||||||

|

Common stock, $1 par value; 50,000 shares authorized, issued and outstanding at March 31, 2010, and December 31, 2009 and 2008, respectively

|

50,000 | 50,000 | 50,000 | |||||||||

|

Additional paid-in capital

|

2,734,079 | 2,734,079 | 5,242,442 | |||||||||

|

Retained earnings

|

21,722,554 | 18,378,984 | 8,305,391 | |||||||||

|

Accumulated other comprehensive income

|

607,099 | 567,650 | 878,804 | |||||||||

|

TOTAL SHAREHOLDERS’ EQUITY

|

25,113,732 | 21,730,713 | 14,476,637 | |||||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

|

$ | 41,114,940 | $ | 42,556,397 | $ | 41,413,381 | ||||||

See accompanying notes to the consolidated financial statements.

3

KAHIBAH LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

|

For The Years Ended December 31,

|

||||||||

|

2009

|

2008

|

|||||||

|

REVENUES

|

||||||||

|

Tuition fee

|

$ | 14,975,999 | $ | 12,193,716 | ||||

|

Room and board and other services

|

6,187,872 | 4,910,833 | ||||||

|

TOTAL REVENUES

|

21,163,871 | 17,104,549 | ||||||

|

COST OF REVENUES

|

||||||||

|

Tuition cost

|

(4,819,163 | ) | (4,097,306 | ) | ||||

|

Room and board and other service cost

|

(4,654,233 | ) | (4,024,981 | ) | ||||

|

TOTAL COST OF REVENUES

|

(9,473,396 | ) | (8,122,287 | ) | ||||

|

GROSS PROFIT

|

11,690,475 | 8,982,262 | ||||||

|

OPERATING EXPENSES

|

||||||||

|

General and administrative

|

(1,484,893 | ) | (1,547,044 | ) | ||||

|

TOTAL OPERATING EXPENSES

|

(1,484,893 | ) | (1,547,044 | ) | ||||

|

INCOME FROM OPERATION

|

10,205,582 | 7,435,218 | ||||||

|

OTHER INCOME (EXPENSE)

|

||||||||

|

Interest income

|

26,668 | 37,576 | ||||||

|

Interest expense

|

(77,594 | ) | (227,012 | ) | ||||

|

Foreign exchange loss

|

(66,371 | ) | - | |||||

|

Miscellaneous expense

|

(14,692 | ) | (40,243 | ) | ||||

|

INCOME BEFORE INCOME TAXES

|

10,073,593 | 7,205,539 | ||||||

|

INCOME TAXES

|

- | - | ||||||

|

NET INCOME

|

$ | 10,073,593 | $ | 7,205,539 | ||||

|

Earnings per share

|

$ | 201.47 | $ | 144.11 | ||||

|

Basic and diluted earnings per share

|

$ | 201.47 | $ | 144.11 | ||||

|

Basic and diluted weighted average shares outstanding

|

50,000 | 50,000 | ||||||

See accompanying notes to the consolidated financial statements.

4

KAHIBAH LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

|

For The Three Months Ended March 31,

|

For The Three Months Ended March 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

REVENUES

|

||||||||

|

Tuition fee

|

$ | 4,237,391 | $ | 3,522,910 | ||||

|

Room and board and other services

|

1,699,339 | 1,402,323 | ||||||

|

TOTAL REVENUES

|

5,936,730 | 4,925,233 | ||||||

|

COST OF REVENUES

|

||||||||

|

Tuition cost

|

(989,413 | ) | (995,941 | ) | ||||

|

Room and board and other service cost

|

(1,203,334 | ) | (1,265,525 | ) | ||||

|

TOTAL COST OF REVENUES

|

(2,192,747 | ) | (2,261,466 | ) | ||||

|

GROSS PROFIT

|

3,743,983 | 2,663,767 | ||||||

|

OPERATING EXPENSES

|

||||||||

|

General and administrative

|

(449,451 | ) | (359,826 | ) | ||||

|

TOTAL OPERATING EXPENSES

|

(449,451 | ) | (359,826 | ) | ||||

|

INCOME FROM OPERATION

|

3,294,532 | 2,303,941 | ||||||

|

OTHER INCOME (EXPENSE)

|

||||||||

|

Interest income

|

5,109 | 10,499 | ||||||

|

Interest expense

|

- | (16,337 | ) | |||||

|

Foreign exchange loss

|

(4,004 | ) | - | |||||

|

Miscellaneous income

|

47,933 | 12,493 | ||||||

|

INCOME BEFORE INCOME TAXES

|

3,343,570 | 2,310,596 | ||||||

|

INCOME TAXES

|

- | - | ||||||

|

NET INCOME

|

$ | 3,343,570 | $ | 2,310,596 | ||||

|

Earnings per share

|

$ | 66.87 | $ | 46.21 | ||||

|

Basic and diluted earnings per share

|

$ | 66.87 | $ | 46.21 | ||||

|

Basic and diluted weighted average shares outstanding

|

50,000 | 50,000 | ||||||

See accompanying notes to the consolidated financial statements.

5

KAHIBAH LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

|

For The Years Ended

December 31,

|

For The Three Months

Ended March 31,

|

|||||||||||||||

|

(Unaudited)

|

||||||||||||||||

|

2009

|

2008

|

2010

|

2009

|

|||||||||||||

|

Net income

|

$ | 10,073,593 | $ | 7,205,539 | $ | 3,343,570 | $ | 2,310,596 | ||||||||

|

Foreign currency translation, net of tax

|

(311,154 | ) | 683,749 | 39,449 | 34,239 | |||||||||||

|

Total comprehensive income

|

$ | 9,762,439 | $ | 7,889,288 | $ | 3,383,019 | $ | 2,344,835 | ||||||||

See accompanying notes to the consolidated financial statements.

6

KAHIBAH LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008

|

Common Stock of Shares

|

Common stock

|

Additional Paid-in Capital

|

Retained Earnings

|

Accumulated Other Comprehensive (Loss) Income

|

Total

|

|||||||||||||||||||

|

BALANCE AT JANUARY 1, 2008

|

50,000 | $ | 50,000 | $ | 5,242,442 | $ | 1,099,852 | $ | 195,055 | $ | 6,587,349 | |||||||||||||

|

Foreign currency translation gain

|

- | 683,749 | 683,749 | |||||||||||||||||||||

|

Net income

|

- | - | 7,205,539 | - | 7,205,539 | |||||||||||||||||||

|

BALANCE AT DECEMBER 31, 2008

|

50,000 | 50,000 | 5,242,442 | 8,305,391 | 878,804 | 14,476,637 | ||||||||||||||||||

|

Foreign currency translation loss

|

(311,154 | ) | (311,154 | ) | ||||||||||||||||||||

|

Return of capital (Note 17)

|

- | (2,508,363 | ) | - | - | (2,508,363 | ) | |||||||||||||||||

|

Net income

|

- | - | 10,073,593 | - | 10,073,593 | |||||||||||||||||||

|

BALANCE AT DECEMBER 31, 2009

|

50,000 | $ | 50,000 | $ | 2,734,079 | $ | 18,378,984 | $ | 567,650 | $ | 21,730,713 | |||||||||||||

See accompanying notes to the consolidated financial statements.

7

KAHIBAH LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

For The Three Months Ended March 31,

|

For The Years Ended

December 31,

|

|||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

|||||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

(Unaudited)

|

(Unaudited)

|

||||||||||||||

|

Net income

|

$ | 3,343,570 | $ | 2,310,596 | $ | 10,073,593 | $ | 7,205,539 | ||||||||

|

Depreciation and amortization of property and equipment

|

268,318 | 274,626 | 1,082,153 | 1,106,779 | ||||||||||||

|

Amortization of land use rights

|

36,584 | 36,527 | 146,129 | 141,211 | ||||||||||||

|

Loss on disposal of property and equipment

|

1,759 | 5,226 | 5,723 | 66,888 | ||||||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||||||

|

(Increase) Decrease In:

|

||||||||||||||||

|

Accounts receivable

|

- | - | - | 36,915 | ||||||||||||

|

Inventory

|

(11,530 | ) | (585,033 | ) | 74,304 | (111,366 | ) | |||||||||

|

Prepayments and other current assets

|

(39,680 | ) | 14,953 | 28,667 | 63,095 | |||||||||||

|

Due from related parties

|

- | - | - | (10,466 | ) | |||||||||||

|

Increase (Decrease) In:

|

||||||||||||||||

|

Accounts payable

|

(72,367 | ) | (34,612 | ) | (98,204 | ) | (307,648 | ) | ||||||||

|

Other payables

|

36,256 | 9,973 | (822,499 | ) | (1,092,629 | ) | ||||||||||

|

Refundable deposits

|

(268,860 | ) | (120,804 | ) | (1,847,286 | ) | (3,755,889 | ) | ||||||||

|

Prepaid tuition

|

(3,166,814 | ) | (2,367,464 | ) | (1,355,755 | ) | 846,348 | |||||||||

|

Home purchase down payment

|

805 | (20,513 | ) | (22,157 | ) | 25,095 | ||||||||||

|

Accrued expenses and other current liabilities

|

(199,179 | ) | (331,909 | ) | (171,678 | ) | (107,229 | ) | ||||||||

|

Net cash (used in) provided by operating activities

|

$ | (71,138 | ) | $ | (808,434 | ) | $ | 7,092,990 | $ | 4,106,643 | ||||||

See accompanying notes to the consolidated financial statements.

8

KAHIBAH LIMITED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED)

|

For The Three Months Ended March 31,

|

For The Years Ended

December 31,

|

|||||||||||||||

|

2010

|

2009

|

2009

|

2008

|

|||||||||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

(Unaudited)

|

(Unaudited)

|

||||||||||||||

|

Purchases of property and equipment

|

$ | (93,006 | ) | $ | (22,748 | ) | $ | (466,188 | ) | $ | (161,207 | ) | ||||

|

Proceeds from disposal of property and equipment

|

- | 4,055 | 9,759 | 1,553 | ||||||||||||

|

Advances to/due from related parties

|

- | (403,616 | ) | (3,111,382 | ) | - | ||||||||||

|

Collection of amounts due from related parties

|

540,312 | - | 135,504 | 1,875,561 | ||||||||||||

|

Net cash provided by (used in) investing activities

|

$ | 447,306 | $ | (422,309 | ) | $ | (3,432,307 | ) | $ | 1,715,907 | ||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||||||||

|

Proceeds from short-term loans

|

$ | - | $ | - | $ | - | $ | 988,122 | ||||||||

|

Repayments of short-term loans

|

- | - | (1,022,540 | ) | (3,319,409 | ) | ||||||||||

|

Proceeds from related parties

|

- | - | 1,175,892 | - | ||||||||||||

|

Repayments to related parties

|

(1,154,318 | ) | (60,835 | ) | (1,896,650 | ) | 594,417 | |||||||||

|

Net cash (used in) provided by financing activities

|

$ | (1,154,318 | ) | $ | (60,835 | ) | $ | (1,743,298 | ) | $ | (1736,870 | ) | ||||

|

(DECREASE) INCREASE IN CASH AND CASH

|

||||||||||||||||

|

EQUIVALENTS

|

$ | (778,150 | ) | $ | (1,291,578 | ) | $ | 1,917,385 | $ | 4,085,680 | ||||||

|

Effect of exchange rate changes on cash

|

(14,658 | ) | (39,351 | ) | (402,484 | ) | (1,355,122 | ) | ||||||||

|

Cash and cash equivalents at beginning of year

|

5,099,860 | 3,584,959 | 3,584,959 | 854,401 | ||||||||||||

|

CASH AND CASH EQUIVALENTS AT END OF YEAR

|

$ | 4,307,052 | $ | 2,254,030 | $ | 5,099,860 | $ | 3,584,959 | ||||||||

|

SUPPLEMENTARY CASH FLOW INFORMATION

|

||||||||||||||||

|

Income taxes paid

|

$ | - | $ | - | - | $ | - | |||||||||

|

Interest paid

|

$ | - | $ | 16,337 | 77,594 | $ | 227,012 | |||||||||

See accompanying notes to the consolidated financial statements.

9

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

The accompanying consolidated financial statements include the financial statements of Kahibah Limited and its subsidiaries. Kahibah Limited and its subsidiaries are collectively referred to as the “Company.” The Company provides high quality bilingual educational services including full-curriculum primary and secondary schools in the People’s Republic of China (“PRC”) through its wholly owned subsidiaries. As of March 31, 2010 and December 31, 2009 and 2008, there were 50,000 shares of the Company’s $1 par value common stock issued and outstanding. The common stock of the Company was held 90% by Mr. Ren Zhiqing and 10% by Mr. Pan Mingxiao.

Kahibah Limited (“KL”) was incorporated under the laws of the British Virgin Islands (“BVI”) on December 6, 2005. On June 25, 2009, Mr. Ren Zhiqing and Mr. Pan Mingxiao entered into a Purchase Agreement to acquire KL for $10,285. Since June 25, 2009, KL was 90% and 10% owned by Mr. Ren Zhiqing and Mr. Pan Mingxiao, respectively. For several months prior to the Recapitalization (described below), Kahibah Limited was a “shell company,” as defined by Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”), and its primary business operations involved seeking the acquisition of assets, property, or businesses that would be beneficial to it and its shareholders.

On August 14, 2009, KL established a new company, Taiyuan Taiji Industry Development Co., Ltd. (“Taiyuan Taiji”.) Taiyuan Taiji is a company incorporated in the PRC. and KL is the sole shareholder of Taiyuan Taiji under the laws of the PRC. Taiyuan Taiji was organized pursuant to the laws of the PRC, for the purpose of acquiring Shanxi Taiji Industrial Development Co., Ltd. (“Shanxi Taiji”), a company formed on July 25, 1997 pursuant to the laws of the PRC.

On November 25, 2009, Taiyuan Taiji acquired Shanxi Taiji. This transaction was treated as a Recapitalization and Reverse Merger of Shanxi Taiji for financial reporting purposes. The effect of this Recapitalization was rolled back to the inception of Shanxi Taiji for financial reporting purposes. As a result, the historical financial statements of Shanxi Taiji become the historical financial statements of KL. Net equity of KL as of June 25, 2009 was less than 1% threshold, and thus the recapitalization effect was not presented on the consolidated statements of changes in shareholders’ equity for the years ended December 31, 2009.

Prior to November 25, 2009, Mr. Ren Zhiqing owned 90% of Shanxi Taiji, with the remaining balance being held by Mr. Pan Mingxiao. On November 25, 2009, the Company entered into a Share Exchange Agreement with Ms. Ren Bainv, a relative of Mr. Ren Zhiqing, which agreed to sell 5% ownership of Shaxi Taiji to Ms. Ren Bainv for $146,224. Since the Company has not yet received the capital contribution from Ms. Ren Bainv, the Company did not present non-controlling interest on its financial statements as of March 31, 2010 and December 31, 2009.

10

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTES 1 - ORGANIZATION AND PRINCIPAL ACTIVITIES (CONTINUED)

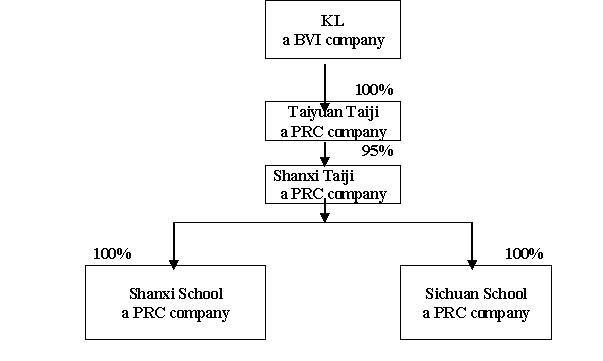

Below is a chart depicting the Company’s organizational structure:

Details of the Company’s wholly-owned subsidiaries as of March 31, 2010 are as follows:

|

Name

|

Place and Date of

Incorporation

|

Relationship

|

Principal Activities

|

|||

|

Taiyuan Taiji Industry Development Co., Ltd. (“Taiyuan Taiji”)

|

Shanxi, PRC

August 14, 2009

|

Wholly-owned subsidiary of KL

|

Investment holding company

|

|||

|

Shanxi Taiji Industrial Development Co., Ltd. (“Shanxi Taiji”)

|

Shanxi, PRC

July 25, 1997

|

95% control of Taiyuan Taiji

|

Investment holding company

|

|||

|

Shanxi Modern Bilingual School

("Shanxi School ")

|

Shanxi, PRC

April 1, 2005

|

Wholly-owned subsidiary of Shanxi Taiji

|

Bilingual education programs including full-curriculum primary and secondary education

|

|||

|

Sichuan Guang’an Shiyan Secondary School (“Sichuan School”)

|

Sichuan, PRC

August 26, 2002

|

Wholly-owned subsidiary of Shanxi Taiji

|

Pre-school, primary, secondary and vocational education

|

11

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES (CONTINUED)

This summary of significant accounting policies of the Company is presented to assist in understanding the Company’s consolidated financial statements. The consolidated financial statements and notes are representations of the Company’s management, which is responsible for their integrity and objectivity. These accounting policies conform to generally accepted accounting principles and have been consistently applied in the preparation of the consolidated financial statements.

The interim unaudited condensed financial statements as of March 31, 2010 have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information on the same basis as the annual financial statements and in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the Company's financial position, results of operations and cash flows for the periods shown. The results of operations for such periods are not necessarily indicative of the results expected for a full year or for any future period. They do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. Therefore, these condensed financial statements should be read in conjunction with the Company's audited consolidated financial statements and notes thereto for the year ended December 31, 2009 included here within.

NOTE 2 – BASIS OF PRESENTATION

The consolidated financial statements of the Company have been prepared in accordance with the accounting principles generally accepted in the United States of America (“US GAAP”.)

On July 1, 2009, The Company adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 105-10 (formerly Statement of Financial Accounting Standards (“SFAS”) No. 168, The FASB Accounting Standards Codification and Hierarchy of Generally Accepted Accounting Principles, a replacement of FASB Statement No. 162. ASC 105-10 establishes the FASB ASC as the source of authoritative accounting principles recognized by the FASB to be applied in preparation of financial statements in conformity with generally accepted accounting principles in the United States of America (“U.S. GAAP”.) The adoption of this standard had no impact on the Company’s consolidated financial statements.

The Company operates in two segments in accordance with accounting guidance FASB ASC Topic 280, Segment Reporting. Our Chief Executive Officer has been identified as the chief operating decision maker as defined by FASB ASC Topic 280.

NOTE 3 – PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of Kahibah Limited and the following wholly-owned subsidiaries:

(i) Shanxi Taiji Industrial Development Co., Ltd. (“Shanxi Taiji”);

(ii) Taiyuan Taiji Industry Development Co., Ltd. (“Taiyuan Taiji”);

(iii) Shanxi Modern Bilingual School (“Shanxi School”);

(iv)) Sichuan Guang’an Shiyan Secondary School (“Sichuan School”.)

All inter-company accounts and transactions have been eliminated in consolidation.

12

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 3 - PRINCIPLES OF CONSOLIDATION (CONTINUED)

Effective January 1, 2009, the Consolidation Topic, ASC 810-10-45-16, revised the accounting treatment for non-controlling minority interests of partially-owned subsidiaries. Non-controlling minority interests represent the portion of earnings that is not within the parent Company’s control. These amounts are now required to be reported as equity instead of as a liability on the balance sheet. Additionally, this statement requires net income from non-controlling minority interests to be shown separately on the consolidated statements of operations. There were no significant non-controlling minority interests for the years ended December 31, 2009 and 2008 and for the three months ended March 31, 2010 and 2009.

NOTE 4 – USE OF ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting periods. Measurement, estimates and assumptions are used for, but not limited to, the selection of the useful lives of property and equipment, impairment of long-lived assets, fair values and revenue recognition. Management makes these estimates using the best information available at the time the estimates are made; however actual results when ultimately realized could differ from those estimates. The current economic environment has increased the degree of uncertainty inherent in these estimates and assumption.

NOTE 5 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

(a)

|

Economic and Political Risks

|

The Company’s operations are conducted in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC economy.

The Company’s operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

|

(b)

|

Fair Value of Financial Instruments

|

The Company applies the provisions of accounting guidance, FASB ASC Topic 825 that requires all entities to disclose the fair value of financial instruments, both assets and liabilities recognized and not recognized on the balance sheet, for which it is practicable to estimate fair value, and defines fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties. As of March 31, 2010, and December 31, 2009 and 2008, the fair value of cash and cash equivalents, other receivables, accounts payable, short term bank loans, and other payables approximated carrying value due to the short maturity of the instruments, quoted market prices or interest rates which fluctuate with market rates except for related

13

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 5 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

(b)

|

Fair Value of Financial Instruments (continued)

|

party debt or receivables for which it is not practicable to estimate fair value.

Fair Value Measurements

Effective April 1, 2009, the FASB ASC Topic 825, Financial Instruments, requires disclosures about fair value of financial instruments in quarterly reports as well as in annual reports.

The FASB ASC Topic 820, Fair Value Measurements and Disclosures, clarifies the definition of fair value for financial reporting, establishes a framework for measuring fair value and requires additional disclosures about the use of fair value measurements.

Various inputs are considered when determining the fair value of the Company’s financial instruments. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. These inputs are summarized in the three broad levels listed below.

|

·

|

Level 1 – observable market inputs that are unadjusted quoted prices for identical assets or liabilities in active markets.

|

|

·

|

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.).

|

|

·

|

Level 3 – significant unobservable inputs (including the Company’s own assumptions in determining the fair value of financial instruments).

|

The Company’s adoption of FASB ASC Topic 825 did not have a material impact on the Company’s consolidated financial statements.

The carrying value of financial assets and liabilities recorded at fair value is measured on a recurring or nonrecurring basis. Financial assets and liabilities measured on a non-recurring basis are those that are adjusted to fair value when a significant event occurs. The Company had no financial assets or liabilities carried and measured on a nonrecurring basis during the reporting periods. Financial assets and liabilities measured on a recurring basis are those that are adjusted to fair value each time a financial statement is prepared. The Company had no financial assets and/or liabilities carried at fair value on a recurring basis at March 31, 2010 and December 31, 2009.

The availability of inputs observable in the market varies from instrument to instrument and depends on a variety of factors including the type of instrument, whether the instrument is actively traded, and other characteristics particular to the transaction. For many financial instruments, pricing inputs are readily observable in the market, the valuation methodology used is widely accepted by market participants, and the valuation does not require significant management discretion. For other financial instruments, pricing inputs are less observable in the market and may require management judgment.

14

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 5-SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

(c)

|

Cash and Cash Equivalents

|

For purposes of the consolidated statements of cash flows, the Company considers all highly liquid debt instruments purchased with a maturity of three months or less to be cash equivalents. There are no restriction to cash at March 31, 2010, and December 31, 2009 and 2008. A substantial amount of the Company’s cash is held in bank accounts in the PRC and is not protected by the Federal Deposit Insurance Corporation (“FDIC”) insurance or any other similar insurance. Given the current economic environment and the financial conditions of the banking industry there is a risk that deposits may not be readily available. Cash held in the PRC amounted to $4,307,052, $5,099,860 and $3,584,959 at March 31, 2010, and December 31, 2009 and 2008, respectively. The Company has had no loss on excess cash in domestic or foreign banks in past years.

|

(d)

|

Inventory

|

Inventory is stated at the lower of cost or net realizable value. The cost of teaching materials and low consumable tools materials is determined using the cost method.

|

(e)

|

Property and Equipment, Net

|

Property and equipment are carried at cost. The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is included in the consolidated statement of income. The cost of maintenance and repairs is charged to expense as incurred, whereas significant additions and betterments that increase the useful lives of the assets are capitalized. Depreciation is provided over their estimated useful lives, using the straight-line method. The Estimated useful lives are as follows:

|

Buildings

|

40 years

|

|||||||

|

Furniture and education equipment

|

3-10 years

|

|

||||||

|

Transportation equipment

|

10 years

|

|

||||||

|

Kitchen equipment

|

10 years

|

|||||||

|

Computer equipment and software

|

5 years

|

|

|

(f)

|

Land Use Rights, Net

|

According to the laws of the PRC, land in the PRC is owned by the government and cannot be sold to an individual or a company. However, the government grants the user a “land use right” to use the land. The land use right granted to the Company is being amortized using the straight-line method over the lease term of forty years.

|

(g)

|

Impairment of Long-Lived Assets

|

The Company’s long-lived assets and other assets (consisting of property and equipment and purchased land use rights) are reviewed for impairment in accordance with the guidance of the FASB ASC Topic 360-10, Property, Plant, and Equipment, and FASB ASC Topic 205, Presentation of Financial Statements. The Company tests for impairment losses on long-lived assets used in operations whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. Recoverability of an asset to be held and used is measured by a comparison

15

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 5 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

(g)

|

Impairment of Long-Lived Assets (continued)

|

of the carrying amount of an asset to the future undiscounted cash flows expected to be generated by the asset. If such asset is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds its fair value. Impairment evaluations involve management’s estimates on asset useful lives and future cash flows. Actual useful lives and cash flows could be different from those estimated by management which could have a material effect on our reporting results and financial positions. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary. Through March 31, 2010, the Company had not experienced impairment losses on its long-lived assets. However, there can be no assurances that demand for the Company’s services will continue, which could result in an impairment of long-lived assets in the future.

|

(h)

|

Income taxes

|

On March 16, 2007, the PRC National People’s Congress passed the PRC Enterprise Income Tax Law (“New EIT Law”) which became effective on January 1, 2008. Pursuant to the New EIT Law, a unified enterprise income tax rate of 25% and unified tax deduction standards will be applied consistently to both domestic-invested enterprises and foreign-invested enterprises.

Shanxi Taiji and Taiyuan Taiji are taxed pursuant to the New EIT Law with a unified enterprise income tax rate of 25%. Shanxi Taiji and Taiyuan Taiyuan Taiji did not pay any income taxes during the years ended December 31, 2009 and 2008 and for the three months ended March 31, 2010 due to net losses experienced in the past reporting periods. The two entities may apply the past periods’ net operating losses to futures years’ profits in order to reduce tax liability. Since Shanxi Taiji and Taiyuan Taiji have minimal business operations, the two entities are unlikely to have profits in future periods. As a result, all deferred tax assets and liabilities are diminimus, and management would have a 100% valuation allowance for all deferred tax assets.

The subsidiaries of Shanxi Taiji, which were registered as private schools (the “school-subsidiaries”), are not subject to income taxes determined in accordance with the Law for Promoting Private Education (2003) and school-subsidiaries registered as private schools not requiring reasonable returns (similar to a not-for-profit entity) are treated as public schools and are generally not subject to enterprise income taxes. Therefore, the school-subsidiaries are tax exempt.

Kahibah Limited is exempt from income tax on all sources of income pursuant to the tax law in the British Virgin Islands. However, pursuant and subsequent to the reverse merger (in Note 22), the parent company in U.S. may pay tax in future years.

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect of deferred tax assets of a change in tax rates is recognized in income in the period that includes the enactment date. Deferred income tax expense represents the change during the period in the deferred tax assets. The components of the deferred tax assets are individually classified as current based on their characteristics. Deferred tax assets and

16

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 5 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(h) Income taxes (continued)

liabilities are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

A provision has not been made at March 31, 2010 and 2009, and December 31, 2009 and 2008 for U.S. or additional foreign withholding taxes of undistributed earnings of foreign subsidiaries because it is the present intention of management to reinvest the undistributed earnings indefinitely in foreign operations. Generally, such earnings become subject to U.S. tax upon the remittance of dividends and under certain other circumstances. It is not practicable to estimate the amount of deferred tax liability on such undistributed earnings.

The Company recognizes that virtually all tax positions in the PRC are not free of some degree of uncertainty due to tax law and policy changes by the government. However, the Company cannot reasonably quantify political risk factors and thus must depend on guidance issued by current government officials.

Based on all known facts and circumstances and current tax law, the Company believes that the total amount of unrecognized tax benefits as of March 31, 2010 and 2009, and December 31, 2009 and 2008, is not material to its results of operations, financial condition or cash flows. The Company also believes that the total amount of unrecognized tax benefits as of March 31, 2010 and 2009, and December 31, 2009 and 2008, if recognized, would not have a material effect on its effective tax rate. The Company further believes that there are no tax positions for which it is reasonably possible, based on the current PRC tax law and policy, that the unrecognized tax benefits will significantly increase or decrease over the next twelve months producing, individually or in the aggregate, a material effect on the Company’s results of operations, financial condition or cash flows as of March 31, 2010 and 2009, and December 31, 2009 and 2008.

(i) Revenue Recognition and Prepaid Tuition

Revenues consist primarily of tuition and fees derived from providing meals and housing for students living on campus. Revenues from tuition are recognized pro-rata (on a straight-line basis) over the relevant period attended by the student of the applicable grade or program. If a student withdraws from a course or program within three months after the school year starts, the paid but unearned portion of the student’s tuition is 67% refunded. If a student withdraws after the first three months in a school year, no tuition will be refunded. In past years, there were minimal students who withdrew from a course or program before the end of a school year. As a result, the Company has recorded prepaid tuition as a current liability in the consolidated balance sheet due to if a student withdrew from school, the Company may have to return a portion of the prepaid tuition.

The School normally receives tuition and fees from students at their initial admission or before the start of the school year in September. Some students will benefit from discount of fees if they prepay tuition for two to three years of school term. Prepaid tuition is the portion of payments received but not earned and is reflected as a current liability in the accompanying consolidated balance sheets as such amounts are expected to be earned within the next year.

Based on the fees at time of admission, the School allocates the cash received from students to the appropriate categories as follows:

17

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 5 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(i) Revenue Recognition and Prepaid Tuition (continued)

|

Grade

|

Tuition

|

Cafeteria

|

Room

|

Others

|

Total

|

|||||||||||||||

|

Kindergarten

|

$ | 1,463 | $ | 658 | $ | 73 | $ | 146 | $ | 2,340 | ||||||||||

|

Lower primary school

|

1,901 | 804 | 146 | 219 | 3,070 | |||||||||||||||

|

Higher primary school

|

1,901 | 951 | 146 | 219 | 3,217 | |||||||||||||||

|

Junior middle school

|

2,165 | 936 | 190 | 219 | 3,510 | |||||||||||||||

|

Senior middle school

|

2,457 | 980 | 219 | 293 | 3,949 | |||||||||||||||

Prepaid tuition expected to be recognized into revenue for the next five years and thereafter is as follows:

|

2010

|

$ | 13,661,543 | ||

|

2011

|

1,742,260 | |||

|

2012

|

415,180 | |||

|

2013

|

2,016 | |||

|

Total

|

$ | 15,820,999 |

Room and Board and Other Revenues

Room and board revenues represent student room income and cafeteria income. Revenues are recognized as sales occur or rental services are rendered. During the years ended December 31, 2009 and 2008 and for the three months ended March 31, 2010 and 2009, the School recognized room and board income of $5,385,996, $4,826,454, $1,514,203, and 1,250,704 respectively.

Other revenues represent rental income earned from renting out apartments to faculty members and other miscellaneous revenues. Other revenues represent less than 5% of total revenues. Rental income are recognized upon the rental services are rendered. During the years ended December 31, 2009 and 2008 and for the three months ended March 31, 2010 and 2009, the School recognized rental income of $24,503, $22,710, $8,289 and $6,878, respectively.

The following table shows the breakdown of revenues by segment during the years ended December 31, 2009 and 2008 and for the three months ended March 31, 2010 and 2009:

|

The Years Ended December 31,

|

The Three Months Ended March 31,

|

|||||||||||||||||||||||||||||||

|

2009

|

2008

|

2010

|

2009

|

|||||||||||||||||||||||||||||

|

Revenue

|

%

|

Revenue

|

%

|

Revenue

|

%

|

Revenue

|

%

|

|||||||||||||||||||||||||

|

Tuition fee

|

$ | 14,975,999 | 70.76 | $ | 12,193,716 | 71.29 | $ | 4,237,391 | 71.38 | $ | 3,522,910 | 71.53 | ||||||||||||||||||||

|

Room and board and other fee

|

6,187,872 | 29.24 | 4,910,833 | 28.71 | 1,699,339 | 28.62 | 1,402,323 | 28.47 | ||||||||||||||||||||||||

|

Total

|

$ | 21,163,871 | 100.00 | $ | 17,104,549 | 100.00 | $ | 5,936,730 | 100.00 | $ | 4,925,233 | 100.00 | ||||||||||||||||||||

18

NOTE 5 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

(j)

|

Foreign Currency Translation

|

The Company’s principal country of operations is The People’s Republic of China. The financial position and results of operations of the Company are determined using the local currency (“Renminbi or RMB”) as the functional currency. The results of operations denominated in foreign currency are translated at the average rate of exchange during the reporting period.

Assets and liabilities denominated in foreign currencies at the balance sheet date are translated at the exchange rates prevailing at the balance sheet date. The results of operations are translated from Renminbi to US Dollar at the weighted average rate of exchange during the reporting period. The registered equity capital denominated in the functional currency is translated at the historical rate of exchange at the time of capital contribution. All translation adjustments resulting from the translation of the financial statements into the reporting currency (“US Dollars”) are dealt with as a component of accumulated other comprehensive income.

Translation adjustments net of tax totaled $39,449, $34,239, ($311,154), and $683,749 for the three months ended March 31, 2010 and 2009, and for the years ended December 31, 2009 and 2008, respectively.

As of March 31, 2010, and December 31, 2009 and 2008, the exchange rate was RMB6.8360, RMB6.8457and RMB6.8542, respectively. The average exchange rate for the three months ended March 31, 2010 and 2009 was RMB6.8317 and RMB6.8467, for the years ended December 31, 2009 and 2008 was RMB6.8547 and RMB7.0841, respectively.

|

(k)

|

Comprehensive Income

|

The Company reports comprehensive income in accordance with FASB ASC Topic 220 Comprehensive Income, which established standards for reporting and displaying comprehensive income and its components in a financial statement that is displayed with the same prominence as other financial statements.

Total comprehensive income is defined as all changes in stockholders' equity during a period, other than those resulting from investments by and distributions to stockholders (i.e., issuance of equity securities and dividends). Generally, for the Company, total comprehensive income equals net income plus or minus adjustments for currency translation. Total comprehensive income represents the activity for a period net of related tax and was an income of $9,762,439, an income of $7,889,288, an income of $3,383,019, and income of $2,344,835 for the period ended December 31, 2009 and 2008, and March 31, 2010 and 2009, respectively.

While total comprehensive income is the activity in a period and is largely driven by net earnings in that period, accumulated other comprehensive income or loss (“AOCI”) represents the cumulative balance of other comprehensive income as of the balance sheet date. For the Company, AOCI is primarily the cumulative balance related to the currency adjustments and increased overall equity by $567,650, $878,804 and $607,099 as of December 31, 2009, and 2008 and March 31, 2010, respectively.

19

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 5 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

(l)

|

Concentrations, Risks, and Uncertainties

|

All of the Company’s operations are located in the PRC. There can be no assurance that the Company will be able to successfully continue to provide the services offered and failure to do so would have a material adverse effect on the Company’s financial position, results of operations and cash flows. Also, the success of the Company’s operations is subject to numerous contingencies, some of which are beyond management’s control. These contingencies include general economic conditions, teacher salaries, competition, governmental and political conditions, and changes in regulations. Because the Company is dependent on trade in the PRC, the Company is subject to various additional political, economic and other uncertainties. Among other risks, the Company’s operations will be subject to risk of restrictions on transfer of funds, domestic and international customs, changing taxation policies, foreign exchange restrictions, and political and governmental regulations.

In accordance with Rule 504/4.08(e) (3) of Regulation S-X, the following are condensed parent company only financial statements for the three months ended March 31, 2010 and for the year ended December 31, 2009.

KAHIBAH LIMITED

CONDENSED PARENT COMPANY ONLY BALANCE SHEETS

AS OF DECEMBER 31, 2009 and MARCH 31, 2010

|

March 31,

|

December 31,

|

|||||||

|

ASSETS

|

2010

|

2009

|

||||||

|

(Unaudited)

|

||||||||

|

CURRENT ASSETS

|

||||||||

|

Cash and cash equivalents

|

$ | 9,949 | $ | 9,933 | ||||

|

Due from related parties

|

57,260 | 57,169 | ||||||

|

Total Current Assets

|

67,209 | 67,102 | ||||||

|

LONG-TERM ASSETS

|

||||||||

|

Investment in Taiyuan Taiji, reported on equity method

|

5,000,850 | 4,992,878 | ||||||

|

Total Long-Term Assets

|

5,000,850 | 4,992,878 | ||||||

|

TOTAL ASSETS

|

$ | 5,068,059 | $ | 5,059,980 | ||||

|

LIABILITIES AND SHAREHOLDERS’ DEFICIT

|

||||||||

|

Due to related parties

|

5,087,616 | 5,077,165 | ||||||

|

Total Current Liabilities

|

5,087,616 | 5,077,165 | ||||||

|

SHAREHOLDERS’ DEFICIT

|

||||||||

|

Common stock, $1 par value; 50,000 shares authorized, none issued and outstanding at March 31, 2010 and December 31, 2009, respectively

|

50,000 | 50,000 | ||||||

|

Accumulated deficit

|

(76,602 | ) | (74,262 | ) | ||||

|

Accumulated other comprehensive income

|

7,045 | 7,077 | ||||||

|

TOTAL SHAREHOLDERS’ DEFICIT

|

(19,557 | ) | (17,185 | ) | ||||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ DEFICIT

|

$ | 5,068,059 | $ | 5,059,980 | ||||

20

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 5 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(l) Concentrations, Risks, and Uncertainties (Continued)

KAHIBAH LIMITED

CONDENSED PARENT COMPANY ONLY INCOME STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2010

AND THE YEAR ENDED DECEMBER 31, 2009

|

For The Three Months Ended March 31,

|

For The Year Ended December 31,

|

|||||||

|

2010

(Unaudited)

|

2009

|

|||||||

|

NET REVENUES

|

$ | - | $ | - | ||||

|

COST OF REVENUES

|

- | - | ||||||

|

GROSS PROFIT

|

- | - | ||||||

|

OPERATING EXPENSES

|

||||||||

|

General and administrative

|

(2,341 | ) | (7,946 | ) | ||||

|

Total operating expenses

|

(2,341 | ) | (7,946 | ) | ||||

|

LOSS FROM OPERATION

|

(2,341 | ) | (7,946 | ) | ||||

|

OTHER INCOME (EXPENSE)

|

||||||||

|

Interest income

|

1 | 55 | ||||||

|

Interest expense

|

- | - | ||||||

|

Foreign exchange loss

|

- | (66,371 | ) | |||||

|

LOSS BEFORE INCOME TAXES

|

(2,340 | ) | (74,262 | ) | ||||

|

INCOME TAXES

|

- | - | ||||||

|

NET LOSS

|

$ | (2,340 | ) | $ | (74,262 | ) | ||

Notes to Condensed Parent Company Only Financial Statements

Note A- These condensed parent company only financial statements should be read in connection with consolidated financial statements and notes thereto.

The operations of the Company are located in the PRC. Accordingly, the Company’s business, financial condition, and results of operations may be influenced by the political, economic, and legal environments in the PRC, as well as by the general state of the PRC economy.

Payments of dividends may be subject to some restrictions due to the fact that the operating activities are conducted in subsidiaries residing in the PRC.

Note B - KL’s financial statements were originally denominated in RMB. The foreign exchange loss was due to KL spent $5,000,000 for investment in Taiyuan Taiji on August 14, 2009.

21

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 5 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

|

(m)

|

Basic and Diluted Earnings per share

|

Basic earnings per common stock are computed by dividing net earnings applicable to common stockholders by the weighted-average number of common stock outstanding during the period. Diluted earnings per common stock are determined using the weighted-average number of common stock outstanding during the period, adjusted for the dilutive effect of common stock equivalents, using the treasury stock method,

consisting of shares that might be issued upon exercise of common stock warrants. In periods where losses are reported, the weighted-average number of common stock outstanding excludes common stock equivalents, because their inclusion would be anti-dilutive.

Basic earnings per share are based on the weighted-average number of shares of common stock outstanding. Diluted earnings per share are based on the weighted-average number of shares of common stock outstanding adjusted for the effects of common stock that may be issued as a result of the following types of potentially dilutive instruments:

· Warrants,

· Employee stock potions, and

· Other equity awards, which include long-term incentive awards.

The FASB ASC Topic 260, Earnings per Share, requires the Company to include additional shares in the computation of earning per share, assuming dilution. The additional shares included in diluted earning per share represent the number of shares that would be issued if all of the Company’s outstanding dilutive instruments were converted into common stock.

Diluted earnings per share are based on the assumption that all dilutive options were converted or exercised. Dilution is computed by applying the treasury stock method. Under this method, options are assumed to be exercised at the time of issuance, and as if funds obtained thereby were used to purchase common stock at the average market price during the period.

Basic and diluted earnings per share are the same as there was no dilutive effect of the warrants and stock options for the three months ended March 31, 2010, and for the years ended December 31, 2009 and 2008.

|

(n)

|

Employee benefit costs

|

According to the PRC regulations on pensions, a company contributes to a defined contribution retirement plan organized by the municipal government in the province in which the Company’s subsidiaries are registered and all qualified employees are eligible to participate in the plan. Contributions to the plan are calculated at 20% of the employees’ salaries above a fixed threshold amount in which employees contribute 8% and the Company’s subsidiaries contribute the remaining 12%. The PRC government is responsible for the benefit liability to retired employees. The Company has no other material obligation for the payment of retirement beyond the annual contribution.

22

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 5 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(o) Recent Accounting Pronouncements

In October 2009, the FASB issued Accounting Standards Update, 2009-13, Revenue Recognition (Topic 605): Multiple Deliverable Revenue Arrangements – A Consensus of the FASB Emerging Issues Task Force. This update provides application guidance on whether multiple deliverables exist, how the deliverables should be separated and how the consideration should be allocated to one or more units of accounting. This update establishes a selling price hierarchy for determining the selling price of a deliverable. The selling price used for each deliverable will be based on vendor-specific objective evidence, if available, third-party evidence if vendor-specific objective evidence is not available, or estimated selling price if neither vendor-specific or third-party evidence is available. The Company will be required to apply this guidance prospectively for revenue arrangements entered into or materially modified after June 15, 2010; however, earlier application is permitted. The Company has not determined the impact that this update may have on its financial statements.

In June 2009, the FASB issued guidance which amends certain ASC concepts related to consolidation of variable interest entities. Among other accounting and disclosure requirements, this guidance replaces the quantitative-based risks and rewards calculation for determining which enterprise has a controlling financial interest in a variable interest entity with an approach focused on identifying which enterprise has the power to direct the activities of a variable interest entity and the obligation to absorb losses of the entity or the right to receive benefits from the entity. The Company adopted this guidance on January 1, 2010. The adoption did not have a material impact on the company’s financial statements.

The FASB issued Accounting Standards Update (ASU) No. 2010-11, Derivatives and Hedging (Topic 815): Scope Exception Related to Embedded Credit Derivatives. The FASB believes this ASU clarifies the type of embedded credit derivative that is exempt from embedded derivative bifurcation requirements. Specifically, only one form of embedded credit derivative qualifies for the exemption - one that is related only to the subordination of one financial instrument to another. As a result, entities that have contracts containing an embedded credit derivative feature in a form other than such subordination may need to separately account for the embedded credit derivative feature.

The amendments in the ASU are effective for each reporting entity at the beginning of its first fiscal quarter beginning after June 15, 2010. Early adoption is permitted at the beginning of each entity’s first fiscal quarter beginning after March 5, 2010. The Company has not determined the impact that this guidance may have on its financial statements.

The FASB has issued the following two updates to the Codification:

ASU No. 2010-04, Accounting for Various Topics: Technical Corrections to SEC Paragraphs; and

ASU No. 2010-05, Compensation - Stock Compensation (Topic 718): Escrowed Share Arrangements and the Presumption of Compensation.

23

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 5 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

(o) Recent Accounting Pronouncements (Continued)

ASU 2010-04 and ASU 2010-05 contain revisions to various “S” Sections in the Codification. These Sections reflect certain rules, regulations, interpretive releases of the SEC, which represent authoritative guidance for SEC registrants. The “S” Sections also include content from certain SEC Staff Accounting Bulletins as well as SEC Staff Announcements and SEC Observer Comments made at EITF meetings.

The technical corrections in ASU 2010-04 primarily reflect revisions to “S” Sections of various Codification Topics related to SEC Staff Announcements, to reflect the appropriate Codification references.

ASU 2010-05 updates paragraph 718-10-S99-2 of Codification Topic 718, Compensation - Stock Compensation, to reflect an SEC Staff Announcement on the SEC staff’s views on overcoming the presumption that escrowed share arrangements represent compensation for certain shareholders. This SEC Announcement codifies the SEC staff view documented in EITF Topic D-110, Escrowed Share Arrangements and the Presumption of Compensation. The Company has not determined the impact that this guidance may have on its financial statements.

The FASB has issued ASU No. 2010-02, Consolidation (Topic 810) – Accounting and Reporting for Decreases in Ownership of a Subsidiary - a Scope Clarification. This ASU clarifies that the scope of the decrease in ownership provisions of Subtopic 810-10 and related guidance applies to:

|

·

|

A subsidiary or group of assets that is a business or nonprofit activity;

|

|

·

|

A subsidiary that is a business or nonprofit activity that is transferred to an equity method investee of joint venture; and

|

|

·

|

An exchange of a group of assets that constitutes a business or nonprofit activity for a non-controlling interest in an entity (including an equity method investee or joint venture.)

|

24

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 6 – INVENTORY

Inventories consisted of the following:

|

March 31,

2010

(Unaudited)

|

December 31,

2009

|

December 31,

2008

|

||||||||||

|

Course materials

|

$ | 97,567 | $ | 88,822 | $ | 155,580 | ||||||

|

Low consumable tools

|

19,501 | 16,716 | 24,262 | |||||||||

|

Total inventory

|

$ | 117,068 | $ | 105,538 | $ | 179,842 | ||||||

A valuation allowance was not considered necessary because inventory was stated at the lower of cost or net realizable value at December 31, 2009 and 2008, and March 31, 2010. Net realizable value is based on estimated selling prices less any further costs expected to be incurred for completion and disposal. No amount was written off during the three months ended March 31, 2010 and 2009, and for the years ended December 31, 2009 and 2008.

NOTE 7 – PREPAYMENT AND OTHER CURRENT ASSETS

Prepayment and other current assets consisted of the following:

|

March 31,

2010

|

December 31,

2009

|

December 31,

2008

|

||||||||||

|

(Unaudited)

|

||||||||||||

|

Advances to suppliers

|

$ | 20,509 | $ | 20,475 | $ | 20,425 | ||||||

|

Other receivable

|

274,206 | 237,200 | 252,104 | |||||||||

|

Others

|

5,274 | 2,634 | 16,447 | |||||||||

|

Total

|

$ | 299,989 | $ | 260,309 | $ | 288,976 | ||||||

Other receivable primarily included staff advances travel and the related expenses to be charged to expenses other miscellaneous prepayments.

NOTE 8 – DUE FROM/TO RELATED PARTIES

|

(I)

|

Due From Related Parties

|

|

March 31,

2010

|

December 31,

2009

|

December 31,

2008

|

||||||||||||||

|

(Unaudited)

|

||||||||||||||||

|

Pan Mingxiao

|

b | - | $ | 558,736 | - | |||||||||||

|

Beijing Taiji Investment Co., Ltd.

|

c | $ | 2,474,595 | 2,456,170 | $ | 2,591,674 | ||||||||||

|

Total due from related parties

|

$ | 2,474,595 | $ | 3,014,906 | $ | 2,591,674 | ||||||||||

25

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 8 - DUE FROM/TO RELATED PARTIES (CONTINUED)

|

(II)

|

Due To Related Parties

|

|

March 31,

2010

|

December 31,

2009

|

December31,

2008

|

||||||||||||||

|

(Unaudited)

|

||||||||||||||||

|

Ren Zhiqing

|

a | $ | 19,562 | $ | 1,189,429 | $ | 63,908 | |||||||||

|

Pan Mingxiao

|

b | 15,550 | - | 1,081 | ||||||||||||

|

Pan Li’e

|

d | - | - | 1,896,650 | ||||||||||||

|

Total due to related parties

|

$ | 35,112 | $ | 1,189,429 | $ | 1,961,639 | ||||||||||

|

(a)

|

Ren Zhiqing is a director of the Company and ultimate controlling shareholder of the Company. Amount due from Ren Zhiqing represented a loan from Shanxi School, which were unsecured, interest-free and collectible on demand.

|

|

(b)

|

Pan Mingxiao is a shareholder of the Company and the chairman of Sichuan School, a subsidiary of the Company. Amount due from Pan Mingxiao represented a loan from Sichuan School, which were unsecured, interest-free and collectible on demand. Amount due to Pan Mingxiao represented a loan to Sichun School, which are unsecured, interest-free and have no fixed repayment term.

|

|

(c)

|

Beijing Taiji Investment Co., Ltd., (“Beijing Taiji”) is a company wholly owned by Ren Zhiqing. Amount due from represents loan from Kahibah Limited to Beijing Taiji, which were unsecured, interest-free and collectible on demand.

|

|

(d)

|

Pan Li’e is a relative of Pan Mingxiao, also see (b). The balance represents money loan to Shanxi School, which is interest-free, unsecured and have no fixed repayment term.

|

NOTE 9 – LAND USE RIGHTS, NET

Land use rights, net consisted of the following:

|

March 31,

2010

|

December 31,

2009

|

December 31,

2008

|

||||||||||

|

(Unaudited)

|

||||||||||||

|

Cost of land use rights

|

$ | 5,885,153 | $ | 5,875,770 | $ | 5,861,205 | ||||||

|

Less: Accumulated amortization

|

(616,670 | ) | (579,109 | ) | (431,725 | ) | ||||||

|

Land use rights, net

|

$ | 5,268,483 | $ | 5,296,661 | $ | 5,429,480 | ||||||

26

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 9 – LAND USE RIGHTS, NET (CONTINUED)

Amortization expense for the years ended December 31, 2009 and 2008, and March 31, 2010 and 2009 were $146,129, 141, 211, $36,584, and $36,527, respectively.

Amortization expense for the next five years and thereafter is as follows:

|

2010

|

$ | 146,129 | ||

|

2011

|

146,129 | |||

|

2012

|

146,129 | |||

|

2013

|

146,129 | |||

|

2014

|

146,129 | |||

|

Thereafter

|

4,566,016 | |||

|

Total

|

$ | 5,296,661 |

NOTE 10 – PROPERTY AND EQUIPMENT, NET

Property and equipment, net consisted of the following:

|

March 31,

2010

|

December 31,

2009

|

December 31,

2008

|

||||||||||

|

(Unaudited)

|

||||||||||||

|

At cost:

|

||||||||||||

|

Buildings

|

$ | 30,847,308 | $ | 30,798,131 | $ | 30,657,557 | ||||||

|

Transportation equipment

|

919,814 | 830,885 | 729,570 | |||||||||

|

Furniture & education equipment

|

3,377,514 | 3,388,716 | 3,141,311 | |||||||||

|

Kitchen equipment

|

474,108 | 473,352 | 452,572 | |||||||||

|

Computer and software

|

221,605 | 218,357 | 214,266 | |||||||||

|

Total cost

|

35,840,349 | 35,709,441 | 35,195,276 | |||||||||

|

Less : Accumulated depreciation

|

(7,192,596 | ) | (6,930,318 | ) | (5,856,826 | ) | ||||||

|

Property and equipment, net

|

$ | 28,647,753 | $ | 28,779,123 | $ | 29,338,450 | ||||||

For the years ended December 31, 2009, and 2008 and for the three months ended March 31, 2010 and 2009, depreciation and amortization expenses were $1,082,153, $1,106,779, $268,318, and $274,626, respectively.

NOTE 11 – OTHER PAYABLE

Other payables included traveling and the related expenses incurred by employee on behalf of the company. These amounts are unsecured, non-interest bearing and generally are short term in nature.

NOTE 12 – HOME PURCHASE DOWN PAYMENT

According to the School’s Employee Welfare Policy, the School may sign a home purchase agreement with teachers which would allow teachers to purchase home property at a discounted market rate. Pursuant to the home purchase agreement between the School and teachers, teachers were given the right to purchase a home property upon their 8th year of service. There were two payment options:

27

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 12 - HOME PURCHASE DOWN PAYMENT (CONTINUED)

(1) one-time full payment of the home purchase price based on the signed agreement; or (2) RMB 20,000 down payment with remaining balance to be paid in 8 equal annual installments until their 8th year of service. Those teachers who selected option (2) would be charged an interest of 7% if they do not make payment on time during the 8 year period. If teachers resign or leave the school for any reasons, they will be entitled to a refund based on the terms of the home purchase agreement. There were minimal refunds during the years ended December 31, 2009 and 2008, and for the three months ended March 31, 2010 and 2009. For accounting purposes, cash received from teachers through payment options (1) and (2) and late interest payments are recorded as deposit at the time the School receives. The School recognizes profit when the sale is consummated.

The School records the home purchase transactions in accordance to the deposit method pursuant to FASB ASC Topic 360-20, Real Estate Sales. Under the deposit method, the seller does not recognize any profit, does not record notes receivable, and continues to report in its financial statements the property which has been assumed by the buyer. Cash received from the buyer, including the initial investment and subsequent collections of principal and interest, is reported as a deposit. Interest collected that is subject to refund and is included in the deposit account before a sale is consummated is accounted for as part of buyer’s initial investment at the time the sale is consummated. There were no apartments sold during the years ended December 31, 2009 and 2008 and for the three months ended March 31, 2010 and 2009, and such the School recognized no income from selling apartments. As of March 31, 2010, December 31, 2009 and 2008, home deposits were $505, 021, $504,216 and $526,372, respectively.

Since 2006, the School decided not to continue with the home purchase benefit and will not enter into any new home purchase agreements. Any teachers living in the School’s apartments without any signed home purchase agreement are required to pay monthly rent and monthly rent is directly deducted from teacher’s payroll. Such payroll deductions are recorded as rental income for the period it pays. During the years ended December 31, 2009 and 2008, and for the three months ended March 31, 2010 and 2009, the School recognized rental income of $24,503, $22,710, $8,289, and $6,878, respectively.

NOTE 13 – ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued expenses and other current liabilities consisted of the following:

|

March 31,

2010

|

December 31,

2009

|

December 31,

2008

|

||||||||||

|

(Unaudited)

|

||||||||||||

|

Accrued payroll

|

$ | 404,325 | $ | 458,134 | $ | 487,313 | ||||||

|

Individual taxes withholding

|

4,419 | 4,827 | 3,366 | |||||||||

|

Welfare payable

|

- | - | 251,134 | |||||||||

|

Others

|

125,617 | 270,579 | 163,404 | |||||||||

|

Total

|

$ | 534,361 | $ | 733,540 | $ | 905,217 | ||||||

The PRC labor regulations require the Company to accrue for welfare based on certain percentages (14%) of the employees’ salaries and charged to general and administrative expenses. The accrual of welfare for employee benefits related to work clothes, employee on-job training and festival bonus.

28

KAHIBAH LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2009, 2008, AND MARCH 31, 2010(UNAUDITED)

NOTE 13 – ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES (CONTINUED)

Others primarily included transportation expenses, utility fees, property management fees, and other miscellaneous expenses payable.

NOTE 14 – REFUNDABLE DEPOSITS