Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: June 30, 2010

China Bilingual Technology & Education Group Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

333-162103

|

68-0678185

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

NO.2 LONGBAO STREET,XIAODIAN ZONE,

TAIYUAN CITY,SHANXI PROVINCE,CHINA

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

030031

(Zip Code)

01186-351-7963988

(Registrant's telephone number, including area code)

21 Pulawska St., Suite 23

Lublin, Poland 20-051

(Former Name or Former Address if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

1

Item 1.01 Entry into a Material Definitive Agreement

On June 30, 2010, the board of directors of Designer Export, Inc (“the Company”) approved a stock dividend whereby each stockholders of record in July 14, 2010 will receive 1.582,781 shares of common stock for each share of common stock which such stockholders own on the record date (“the Dividend”)

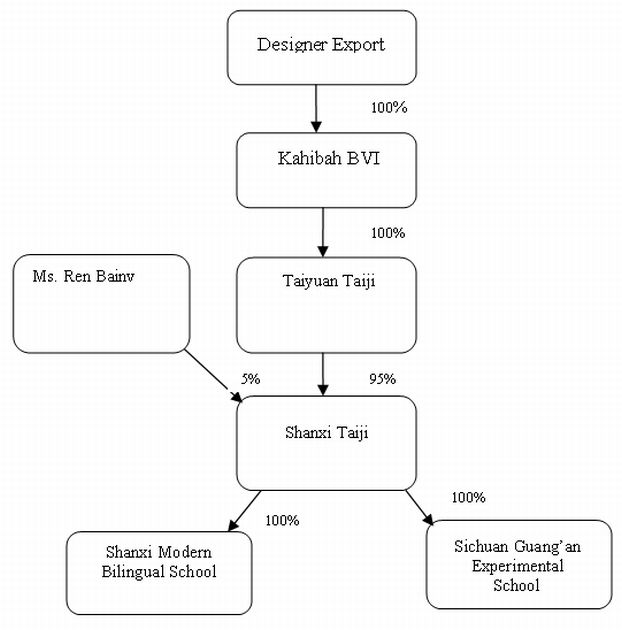

On June 30, 2010, the Company acquired all of the outstanding capital stock of Kahibah Limited, a British Virgin Islands limited liability company (“Kahibah”), through China Bilingual Education Inc. a Nevada corporation (the “Merger Sub”) wholly owned by the Company. Kahibah is a holding company whose only asset, held through Taiyuan Taiji Industry Development Co., Ltd (“Taiyuan Taiji”), a wholly-foreign owned enterprise (WOFE) under the laws of the People’s Republic of China (“PRC”), is 95% of the registered capital of Shanxi Taiji Industrial Development Co., Ltd. (“Shanxi Taiji”), an equity joint venture company organized under the laws of the People’s Republic of China. Ninety-five percent of the equity interests in Shanxi Taiji are owned by Taiyuan Taiji. On November 25, 2009, Kahibah entered into a share exchange agreement to sell the remaining 5% ownership to Ms. Ren Baiv. However, as of March 31, 2010, Ms. Ren Baiv has not yet paid the capital contribution. Shanxi Taiji owns all of the registered capital of Shanxi Modern Bilingual School, a private non-enteraprise entity incorporated under the laws of the PRC (“Shanxi Modern Bilingual School”) and Sichuan Guangan Experimental High School, a private non-enterprise entity incorporated under the laws of the PRC (“Sichuan Guangan Experimental High School”). Since its inception, Shanxi Taiji has striven to meet the market demands for educational needs through the establishment of the Shanxi Modern Bilingual School and the Sichuan Guangan Experimental High School. The following chart shows our structure (the “Ownership Structure”):

In the Opinion of Shanxi Huanghe Law Firm, our PRC legal counsel:

· Taiyuan Taiji is a limited liability company duly incorporated, validly existing and in good standing as a wholly-foreign owned enterprise under the laws of the PRC. All equity interests in Taiyuan Taiji are owned by Kahibah BVI. All equity interests in Taiyuan Taiji have been duly authorized, validly issued and are fully paid and, to Shanxi Huanghe’s knowledge, free and clear of all pledges, options, claims, restrictions under voting or transfer or any other encumbrances;

· Shanxi Taiji is a limited liability company, duly incorporated, validly existing and in good standing under the laws of the PRC. 95% of the equity interests in Shanxi Taiji are owned by Taiyun Taiji. On November 25, 2009, the company entered into a share exchange agreement to sell the remaining 5% ownership to Ms. Ren Baiv. However, as of March 31, 2010, Ms. Ren Baiv has not yet paid the capital contribution. All of the equity interests in Shanxi Taiji have been duly authorized, validly issued and are fully paid, and to Shanxi Huanghe’s knowledge, free and clear of all pledges, options, claims, restriction upon voting or transfer or any other encumbrances.

· Shanxi Modern Bilingual School and Sichuan Guang’an Experimental School are duly incorporated, validly existing and in good standing as private non-enterprise entities under the laws of the PRC. All of the registered capital of the Shanxi Modern Bilingual School and the Sichuan Guang’an Experimental School are owned by Shanxi Taiji and have been fully paid, and to Shanxi Huanghe’s knowledge are free and clear of all pledges, options, claims restrictions upon voting or transfer or any of encumbrances.

2

· The articles of association, business license and other constitutive or organization documents of each Taiyum Taiji, Shanxi Taiji, Shanxi Modern Bilingual School and Sichuan Guang’an Experimental School (collectively, the “PRC Subsidiaries”), comply with the requirements of applicable PRC laws and are in full force and effect.

· Each of the PRC Subsidiaries has adequate corporate and authority to own, lease, and operate its properties and assets and possess necessary certificates, approvals, licenses or permits issued by the PRC (whether national or regional, or any other organization empowered by the laws or administrative regulations to exercise administrative authority in the PRC). Such certificates, approvals licenses or permits are in full force and effect. None of the PRC Subsidiaries is in violation of any applicable PRC Laws in any material respects with respect to the conduct of their business.

· The Ownership Structure complies with the current PRC laws and regulations.

In connection with the acquisition, the following transactions took place:

● The Merger Sub issued 10 shares of the common stock of the Merger Sub which constituted no more than 10% ownership interest in the Merger Sub to the shareholders of Kahibah, in exchange for all the shares of the capital stock of Kahibah (the “Share Exchange” or “Merger”). The 10 shares of the common stock of the Merger Sub were converted into approximately 10,105,386 shares (or 26,100,000 shares on a Post-Dividend basis) of the common stock of the Company so that upon completion of the Merger, the shareholders of Kahibah own approximately 87% of the common stock of the Company.

● Urszula Dorota Paszko resigned as the Company’s President, Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer on June 30, 2010.

● Ren Zhiqing, Chief Executive Officer of Shanxi Taiji, was elected to serve on our Board of Directors as Chairman and as Chief Executive Officer of the Company.

● Pan Mingxiao, an officer and director of Shanxi Taiji, was elected to serve on our Board of Directors and as Executive Vice-President of the Company.

.● Zhao Hegui, an officer and director of Shanxi Taiji, was elected to serve on our Board of Directors and as Executive Vice-President of the Company.

● Immediately following the Merger, pursuant to an Agreement of Conveyance, Transfer and Assignment of Assets and Assumption of Liabilities (the “Conveyance Agreement”), we transferred all of our pre-Merger assets and liabilities to our wholly-owned subsidiary, Designer Export Holdings, Inc. (“SplitCo”) to certain of our shareholders. Thereafter, pursuant to a Stock Purchase Agreement (the “Stock Purchase Agreement”), we transferred all of the outstanding capital stock of SplitCo to certain of our stockholders in exchange for the cancellation of 3,000,000 shares of our common stock (the “Split Off Transaction”), with 1,510,000 shares of common stock held by persons who were stockholders of ours prior to the Merger remaining outstanding. These 1,510,000 (or 3,900,000 shares on a Post-Dividend basis) shares constitute our “public float” and are our only shares of registered common stock and accordingly are our only shares available for resale without further registration.

● As part of the Merger, the Company’s name will be changed from “Designer Export, Inc.” to “China Bilingual Technology Education Group Inc.” The Company is communicating with FINRA for the name change and trading symbol change on the OTC Bulletin Board.

As a result of these transactions, persons affiliated with Kahibah now own securities that in the aggregate represent approximately 87% of the equity in the Company.

References to a company’s “registered capital” are to the equity of such company, which under PRC law is measured not in terms of shares owned but in terms of the amount of capital that has been contributed to a company by a particular shareholder or all shareholders. The portion of a limited liability company’s total capital contributed by a particular shareholder represents that shareholder’s ownership of the company, and the total amount of capital contributed by all shareholders is the company’s total equity. Capital contributions are made to a company by deposits into a dedicated account in the company’s name, which the company may access in order to meet its financial needs. When a company’s accountant certifies to PRC authorities that a capital contribution has been made and the company has received the necessary government permission to increase its contributed capital, the capital contribution is registered with regulatory authorities and becomes a part of the company’s “registered capital.”

3

For accounting suppose, the share exchange translation was treated as a reverse acquisition, with Designer Exports, Inc. as the acquired party and Kahibah as the acquirer. In addiction, the historical financial statements of Kahibah will become the historical financial statement of the company.

Unless otherwise specified or required by context, references to “we,” “our” and “us” refer collectively to Designer Export, Kahibah BVI, Taiyuan Taiji, Shanxi Taiji, Shanxi Modern Bilingual School and Sichuan Guang’an Experimental School.

New Management

Upon the completion of the Merger, the new executive officers and directors of the Company will be:

|

Name

|

Age

|

Positions with the Company

|

||

|

Ren Zhiqing

|

53

|

Chairman and Chief Executive Officer

|

||

|

Pan Mingxiao

|

34

|

Executive Vice-President and Director

|

||

|

Zhao Hegui

|

47

|

Executive Vice-President and Director

|

All directors hold office until the next annual meeting of our shareholders and until their successors have been elected and qualify. Officers serve at the pleasure of the Board of Directors.

Ren Zhiqing is our Chairman of the Board, and Chief Executive Officer. He has been the Chief Executive Officer of Shanxi Taiji Industrial Development Co., Ltd. since its formation in 1997. Previously, he was the president of Shanxi Modern Trade and Economics Institute(1993 to 1997). Head of China Yinjing News Agent Shanxi Branch (1989 to 1993). Reporter of China Economic News Agency (1986 to 1989). Mr. Ren earned his Bachelors degree at Shanxi College of Traditional Chinese Medicine.

Pan Mingxiao is our Executive Vice President and Director. He has been an officer and director of Shanxi Taiji Industrial Development Co., Ltd since 2004. Previously, he was the Chief Financial Officer of Shanxi Modern Bilingual School. Mr. Pan earned his Bachelors degree from Peking University.

Zhao Hegui is our Executive Vice President and Director. He has been an officer and director of Shanxi Taiji Industrial Development Co., Ltd since 2009. Previously, he was the Head of Shanxi Modern Bilingual School (2004 to 2009) and Managing President of Shanxi Modern Bilingual School (2003 to 2004). Mr. Zhao earned his Bachelors in Shanxi Education Institute.

Audit Committee Financial Expert

Our board of directors currently acts as our audit committee. Because we only recently executed the merger agreement our Board of Directors is still in the process of finding an "audit committee financial expert" as defined in Regulation S-K and directors that are "independent" as that term is used in Section 10A of the Securities Exchange Act.

Audit Committee

We have not yet appointed an audit committee. At the present time, we believe that the members of Board of Directors are collectively capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. We do, however, recognize the importance of good corporate governance and intend to appoint an audit committee comprised entirely of independent directors, including at least one financial expert, in the near future.

Compensation Committee

We do not presently have a compensation committee. Our board of directors currently acts as our compensation committee.

Nominating Committee

We do not presently have a nominating committee. Our board of directors currently acts as our nominating committee. We are in search for qualified independent board members to staff this committee.

4

Form 10 Disclosure

Prior to closing of the Merger, the Company was a “shell company” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, as required by SEC rules, set forth below is the information that would be required if the Company were filing a general form for registration of securities on Form 10 under the Exchange Act.

Please note that the information provided below relates to the combined Company after the Share Exchange, unless otherwise specifically indicated.

INFORMATION REGARDING THE ACQUIRED COMPANIES

Shanxi Taiji Industrial Development Co., Ltd

Shanxi Taiji was incorporated as a limited liability company on July 25, 1997 under PRC law. It is currently 95% owned by Taiyuan Taiji and 5% owned by Ms. Ren Bainv who has not yet paid capital contribution as of March 31, 2010. Shanxi Taiji is an equity joint venture under the laws of the PRC. The Shanxi Modern Bilingual School and Sichuan Guangan Experimental High School hold the requisite local licenses to provide educational services in China.

Shanxi Modern Bilingual School

Shanxi Modern Bilingual School was founded in 1998 by Shanxi Taiji, approved by Taiyuan Bureau of Education. It is a set of kindergarten, elementary, middle and high school in one full-time boarding school. It has an elegant school environment, covering 133,000 square meters. The school has three academic buildings, an administration building, four apartment buildings, two cafeterias, six teacher residential building, a multi-functional arts gymnasium and three high standard epoxy polyurethane plastic 400-meters circular track field, and 3 standard basketball courts and children’s playground.

The school is equipped with:

· audio-visual language teaching facilities;

· a multimedia amphitheater;

· modern computer classrooms, which allow us to teach remotely;

· physics, chemistry, and biology laboratories;

· a library; and a

· reading, art and music rooms

Since its inception, the number of students enrolled in our school has increased over the years from 536 students in 1999, 1360 students in 2000, to more than 4100 students in 2004. At present, we have more than 6,000 students and 140 classes, and have become the largest private school in Shanxi Province.

We currently have 600 full-time teachers, 13 foreign teachers, with an average age of 35. 60.6% of the teachers are middle and senior teachers, and 80.4% of teachers are national, provincial, municipal and district subject leaders, the backbone of teachers, teaching experts.

Our school stresses bilingual education. The foreign language teaching and mother-tongue teaching are equally important. We strive to make the English language penetrate into the student's school and family life, so that students can become proficient in the English language.

Every year, nearly 5% of our students have achieved more than 600 scores in the College Entrance Examination. More than 200 students of our school received awards in the competitions of math, physics, chemistry, biology, music, arts, calligraphy, and computers. In two consecutive years, 2002 and 2003, Taiyuan Bureau of Education awarded our school for high school education and teaching quality "Special Award" and "Comprehensive Excellence Award", junior secondary education teaching quality "prize" and the "Excellence Award." In March 2004, our school was commended in Taiyuan City Bureau of Education, known as "health, sanitation, safety school." After 2004, our school was awarded by the Education Bureau in Taiyuan City, " Taiyuan Excellence high school ", "high school graduation exam prize", the school has been awarded the "Outstanding Private Middle School in Shanxi Province", " Green School in Shanxi Province "," National Children's computer examination training points "and" Model School in Information Technology in Shanxi Province, "" dissemination of popular science bases in Shanxi Province "," read the classic works of Chinese classical poems in national outstanding school, "" National 'Creative Writing' experimental school. "

5

Sichuan Guang’an Experimental High School

Sichuan Guang’an Experimental High School was established by Shanxi Taiji in 2002. It is a private high school which is high-profile, high standard, full-time school. The school environment is beautiful, tree-lined, with top hardware and a unique architectural style. The campus covers an area of 70,000 square meters. We have two teaching buildings, four teachers’ apartments, four students’ apartment buildings, two cafeterias, a complex building, a audio-visual technology building (also for library), and a large-scale indoor sports center. Campus greening projects cost $300 thousand, we planted trees, shrubs and banyan to improve the school’s life environment, . All school equipment meets provincial-level high school’s standards.

The school is equipped with:

· modern art rooms;

· science labs,

· multimedia network classroom

· a language lab;

· a high specification amphitheater;

· music, dance and , piano rooms;

· 400 meters circular track and field; and

· basketball courts, volleyball courts and badminton courts.

The number of existing staff is 300, including 160 full-time teachers. 80% of which are high school or intermediate teaching experts. We have 70 classes. Our school’s characteristics are: expert administration, an excellent teaching team, small class sizes; bilingual education; and a modern learning environment. Since our school was established our students have shown excellent academic performance. In 2003 college entrance examination 90.5% of our students achieved the enrollment mark, ranking the first in Guangan’s high school. Huaying Matriculation champion came from our school and the highest mark of Chinese, mathematics, English, integrated science all came from our school. In 2004, College of Liberal Arts Huaying champion still came from our school; in 2005, 8 of the top ten Huaying college entrance students were from our school. In 2009, the rate of college entrance of our school ranked number one in Huaying City.

Our students have won numerous awards at the national, provincial, municipal and other types of competitions. Our school won the Guang'an " 2004 College Entrance Examination growth Award", awarded by the National Education, "15" plan, "Key lessons Experimental School", Huaying "fire safety education demonstration School ", and as named" Huaying Private Education advanced unit "by City High School in 2006 first prize in the quality of education, Huaying enterprises advanced units within the public security, basic education curriculum reform Huaying advanced group; in 2007, the quality of high school education; the first prize of annual college entrance examination in 2007; Huaying working special contribution ; 2006-2007, advanced private education units; in 2008, first prize of the quality of high school education; in 2009, received the 2007-2008 school degree Huaying advanced unit in private education, Huaying second faculty Games men's high school basketball group first. Our school is the only school employing qualified foreign teachers, and it is the Huaying’s first large-scale private education school.

STRATEGY

The school will merger the same kind of school to have a large scale, and carry out the same management and the same teaching method. And we will enlarge the business style from the basic education to training services and globe exchange programme.

Competition

The Chinese education industry is highly competitive. Competition among educational institutions is primarily driven by location, courses, research capability and reputation. In all of the geographical areas in which we operate or expect to operate, there are other educational institutions, training centers and other education providers, which provide services comparable to those that we offer or expect to offer. Competition between Chinese educational institutions has intensified in recent years due to the increase in private educational institutions and extra-curricular training centers that allow students to choose the educational institutions and courses they would like to attend.

In general, educational institutions compete within the communities they serve based on the teaching quality and specialty of the teachers, enrollment rate, reputation, the physical condition of their facilities and teaching equipment. We strive to distinguish the educational institutions we operate based on the quality provided and our ability to attract and retain teachers with varied specialties. We strive to maintain and improve the level of enrollment and to provide quality facilities and teaching services.

We face competition from domestic and international education service providers that are seeking to acquire and operate educational institutions in China. We expect competition for attractive opportunities to intensify because of the continued privatization of the education industry in China and the difficulty in setting up new educational institutions in China, which requires approval from the local Bureau of Education or the Ministry of Education of China. Other competitors, such as high-end standalone private educational institutions and training centers that cater to high-income consumers and foreign expatriates, have emerged primarily as a result of the increasing affluence of the Chinese population. These standalone private educational institutions and training centers are managed by both foreign and domestic high school, college and university operators.

6

Government Approvals and Regulations

General Regulatory Environment

China’s education industry is regulated by various government agencies, mainly including the Ministry of Education. The Ministry of Education has branch offices across China to oversee the education industry at the provincial, municipal and county levels, which together with the Ministry of Education (“MOE”) we refer to as the Education Authorities. These Education Authorities, together with other relevant government agencies, such as the Ministry of Civil Affairs (“MCA”) and Ministry of Labor and Social Security have promulgated rules and regulations relating to the establishment, licensing and operation of educational institutions, the licensing, administration and management of educational staff and the taxation of educational services and incomes.

Operation of Private Schools

Level of Approval

Pursuant to the Law of the People’s Republic of China on Promotion of Private Education promulgated by the Standing Committee of the Ninth National People’s Congress State Council of the PRC which became effective on September 1, 2003, and the Implementation Rules to the Law of the People’s Republic of China on Promotion of Private Education issued by the State Council which became effective on April 1, 2004, each Private School must obtain a private funded school education permit from the relevant Education Authority in order to conduct business as an education service provider. Private schools providing certifications, pre-school education, education for self-study aid and other academic education shall be subject to approval by the Education Authorities. The Education Authorities under the local people’s governments at or above the county level shall be responsible for the work relating to private schools of academic education in their own administrative region. The administrative departments for labor and social security and the relevant departments under the local people’s governments at or above the county level shall respectively be responsible for the work relating to private schools of non-academic education which means occupational qualification training and occupational skill training within the scope of their duties. For degree education, (i) establishment of colleges is preliminarily examined by Education Authorities at the provincial level, and then is examined and approved by the government of the provincial level; (ii) establishment of universities for bachelor or higher degrees is preliminarily examined by Education Authorities of the provincial level, and then is examined and approved by MOE; (iii) establishment of senior high schools, vocational middle schools and technical secondary schools is preliminarily examined by Education Authorities of the county level, and then is examined and approved by educational authorities of the municipal level and shall be delivered to the government of the municipal level and educational authorities of the provincial level for reference; (iv) establishment of junior middle schools and primary schools is examined and approved by Education Authorities of the county level and shall be delivered to Education Authorities of the municipal level for reference. A duly approved private school will be granted a Permit for operating a Private School, and shall be registered with the MCA or its local counterparts as a privately run non-enterprise institution. Each of our schools has obtained the Permit for operating a Private School and has been registered with the relevant local counterpart of the MCA.

Expansion of Business

Pursuant to the Implementation Rules to the Law of the People’s Republic of China on Promotion of Private Education issued by the State Council in 2004, private schools and government-run schools shall share equal legal status, and the State safeguards the autonomy of the private schools. The State protects the lawful rights and interests of the sponsors, principals, teachers and staff members of private schools. Prospectors and advertisements of private schools shall be approved by relevant examination and approval authorities. And upon the approval of its prospectors and advertisements, the private school enjoys its independent right of recruiting students and enjoys the equal recruiting right as government-run schools of the same kind. The private schools may make plans on the scope, standard and method of recruiting students independently. Private schools shall abide by the relevant regulations with respect to recruiting college-level or above students. In addition, operation of a private school is highly regulated. For example, the types and amounts of fees charged by a private school providing certifications shall be approved by the governmental pricing authority and be publicly disclosed. So for a private school to expand its business, it has some discretionary power, but it must abide by a procedure under which, any increase in recruitment of students or increase in fees must be approved in advance by the relevant authorities.

Levels and Grades of schools

Subject to the Education Law of the People’s Republic of China issued by the eighth National People’s Congress in 1995, schools of the basic education system are divided into four levels including infant school education, primary education, secondary education and higher education. Accordingly, based on the four levels, there are the following kinds of schools: nursery school, primary school, junior middle school, senior high school, and university. Nursery school, primary school and junior middle school represent compulsory education. With respect to universities, there are several kinds of college degrees: bachelor degree, master degree and doctorate degree. And for different levels of private schools, there are different approval authorities. The State Council and all local people’s government at different levels shall supervise and manage the educational work according to the principle of management by different levels and division of labor with individual responsibility. Secondary and lower education shall be managed by the local people’s government under the leadership of the State Council. Higher education shall be managed by the State Council and the people’s government of the province, autonomous region or municipality directly under the central government. Besides the basic education system, the state adopts a vocational education system and an adult education system. The people’s government at different levels, relevant administrative departments, enterprises and institutions shall adopt measures to develop and ensure for citizens vocational school education or vocational training in various forms. Meanwhile, no organization or individual may establish or operate a school or any other institution of education for profit-making purposes. However, private schools may be operated for “reasonable returns,” as described in more detail below.

7

School Privatization

Although no definitive regulation has been promulgated with respect to the privatization of government-run schools, the Chinese government has announced a series of regulations and policies to encourage private schools and Sino-foreign-run schools. The Standing Committee of the Ninth National People’s Congress issued Law of the People’s Republic of China on Promotion of Private Schools to encourage social funds to invest in the education industry in 2002. To implement the above law, the State Council issued the Implementation Rules to the Law of the People’s Republic of China on Promotion of Private Schools in 2004. In order to encourage foreign funds to invest in the Chinese education industry and strengthen international exchange and cooperation in the field of education, the State Council also issued Regulations of the People’s Republic of China on Chinese-Foreign Schools in 2003. National Development and Reform Commission and Ministry of Commerce jointly modified Catalogue of Foreign Investment Industries in 2007, in which there are encouraged education industry, restricted education industry and prohibited education industry. The encouraged education industry is a higher-degree educational institution (only limited to joint venture or cooperative), the restricted education industry is a common senior high school education mechanism (only limited to joint venture or cooperative) and the prohibited education industry is a compulsory education and military, police, political and other kinds of education that are of a special nature in the PRC.

Special tax rules applicable to preferential tax treatment and non-preferential tax treatment for privately-run schools

Private schools are divided into three categories: private schools established with donated funds; private schools that require reasonable returns and private schools that do not require reasonable returns.

Law of the People’s Republic of China on Promotion of Private Schools prescribes principally that private schools enjoy the preferential tax treatment polices regulated by the state. And the Implementation Rules to the Law of the People’s Republic of China on Promotion of Private Schools prescribes further, that the private schools established by donation and the private schools whose investors do not ask for reasonable rewards of investment may enjoy the same preferential tax and other preferential treatments as the government-run schools. And for private schools whose investors ask for reasonable rewards of investment, its preferential tax treatment policies are jointly formulated by the Finance department, Tax department and other related administrative departments of the State Council. To date, however, no regulations have been promulgated by the relevant authorities in this regard.

Notwithstanding whether a school is state or privately-owned, the preferential local tax treatments include: business tax, urban maintenance and construction tax, extra charges for education, enterprise income tax, house property tax, deed tax, land-use tax of cities and towns, stamp tax, etc.

1. With respect to the business tax and enterprise income tax: (i) the proceeds from educational services provided by a degree educational school will be exempted from business tax; (ii) the proceeds from students working during school term will be exempted from business tax; (iii) the proceeds from technology development, technology transfer or relevant technological consultant or services provided by school will be exempted from business tax; (iv) the proceeds from caring services provided by a kindergarten or nursing school will be exempted from business tax; (v) the proceeds from further-study classes or training classes held by a government-run preliminary school, secondary school or higher school (not including subordinate enterprises) will be exempted from business tax; (vi) the proceeds from the operation of an enterprise owned wholly by a government-run vocational school will be exempted from business tax, and for the proceeds from the operation of an enterprise owned by a privately-run vocational school, the business tax is not exempted; (vii) donation to education careers from a taxpayer contributed through non-profit social entities or state organs will be exempted from income tax; (viii) the proceeds from an educational institution in accordance with regulations of non-profit income under Enterprise Income Tax Law will be exempted from income tax; and (ix) individual income tax derived from interest of savings deposit of education will be exempted.

2. With respect to the house property tax, land-use tax of cities and towns, stamp tax: (i) house or land of all kinds of schools, kindergartens or nursing schools invested by state or enterprises will be exempted from house property tax or land-use tax; and (ii) the writing papers signed by property owners to denote the property to schools will be exempted from stamp tax.

3. With respect to farm land occupation tax: the farm land approved for schools or nursing schools will be exempted from farm land occupation tax.

8

Restrictions on Foreign Ownership

China has been gradually relaxing the restrictions on domestic private investment in private schools since 1978. From 1978-1992, the development of private schools was in an early stage; from 1992-1997, the development of private schools was in a fast-development stage; and since 1997, the development of private schools have been in a regulatory development stage. The private school system has become an important and necessary part of the Chinese education system. In 2003, the State Council promulgated the Regulations of the People’s Republic of China on Operating Chinese-Foreign Schools, and MOE issued the Implementing Rules for the Regulations on Operating Chinese-foreign Schools, or the Implementing Rules, which encourage substantive cooperation between overseas educational organizations with relevant qualifications and experience in providing high-quality education and Chinese educational organizations to jointly operate various types of schools in the PRC, with such cooperation in the areas of higher education and occupational education being encouraged. Chinese-foreign cooperative schools are not permitted, however, to engage in compulsory education and military, police, political and other kinds of education that are of a special nature in the PRC.

The establishment of a Chinese-foreign joint venture educational institution in China requires approvals from different levels of government, which are difficult to obtain. An application for establishing a Chinese-foreign cooperatively-run school offering higher education for academic qualifications at or above the regular university education shall be subject to examination and approval of the MOE; an application for establishing a Chinese- foreign cooperatively-run school offering specialized higher education or higher education for non-academic qualifications shall be subject to examination and approval of the people’s government of the province, autonomous region or municipality directly under the Central Government where the proposed school is to be located. An application for establishing a Chinese-foreign cooperatively-run school offering secondary education for academic qualifications, programs of tutoring self-taught students for examinations, programs offering supplementary teaching of school courses and pre-school education shall be subject to examination and approval of the education administrative department of the people’s government of the province, autonomous region or municipality directly under the Central Government where the proposed school is to be located. An application for establishing a Chinese-foreign cooperatively-run school offering vocational technical training shall be subject to examination and approval of the labor administrative department of the people’s government of the province, autonomous region or municipality directly under the Central Government where the proposed school is to be located.

Consequently, we have set up an ownership structure through which we control the Shanxi Modern Bilingual School and Sichuan Guang’an Experimental School.

Licensing Requirements

Each educational institution in China is required to obtain a private funded school education permit (a “Education Permit”), from the relevant local Education Authority. To obtain an Education Permit, a private school must submit an application to its relevant Education Authority to demonstrate that it (i) has obtained a permit for setting up the educational institution from the relevant Educational Authority; (ii) is in compliance with certain basic operational standards for a legal person pursuant to Company Law; (iii) is in proper corporate form with proper name, organizational structure and premises; (iv) has adequate funds and meets certain minimum facility and personnel requirements promulgated by MOE; (v) has proper bylaws; and (vi) is capable of bearing civil liabilities independently. In addition, private schools are permitted to conduct only those business activities within the approved business scope established by the relevant Education Authority.

We have approvals from the Shanxi Education Commission (which has the authority to issue and regulate education permits) which constitute the requisite private funded school education permits for the establishment of private schools in price bureau of Shanxi, approvals for charging fees from local Pricing Regulator Authorities and all of the necessary permits, registrations, licenses and/or approvals required by the local government authority to operate.

Organizations and Activities of Private Schools

According to the Law of the People’s Republic of China on Promotion of Private schools, a private school shall set up an executive council, a board of directors or other forms of decision-making bodies of the school.

The executive council or the board of directors of the school shall be composed of the sponsors or their representatives, the principal, and the representatives of the teachers and staff members. More than one-third of the council members or directors shall, at least, have five years’ education or teaching experience each. The executive council or the board of directors of the school shall be composed of not less than five persons, with one of them serving as chairman of the council or board. The list of the names of the chairman and members of the council or the chairman of the board and directors shall be submitted to the examination and approval authority for the record.

The executive council or the board of directors of a school shall exercise the following functions and powers: (i) to appoint and dismiss the principal; (ii) to amend the articles of association of the school and formulate rules and regulations of the school; (iii) to make development plans and approve annual work plans; (iv) to raise funds for running the school, and examine and verify the budgets and final accounts; (v) to decide on the size and the wage standards of the teachers and staff members; (vi) to decide on the division, merging and termination of the school; and (vii) to decide on other important matters.

9

The chairman of the executive council or the board of directors or the principal of a private school shall serve as the legal representative of the school. A private school shall, in reference to the qualifications for the principal of a government-run school of the same grade and category, appoint its principal, and the age limit may appropriately be extended both ways, and the appointment shall be reported to the examination and approval authority for verification and approval.

The principal of a private school shall be in charge of education, teaching and administration of the school, and exercise the following functions and powers: (i) to carry out the decisions made by the executive council, board of directors or any other form of decision-making body; (ii) to put into execution the development plans, draw up the annual work plans and financial budgets, and formulate the rules and regulations of the school; (iii) to appoint and dismiss staff members of the school, and give rewards and impose punishments; (iv) to make arrangements for education, teaching and scientific research and ensure the quality of education and teaching; (v) to be responsible for the daily work of school administration; and (vi) other powers delegated by the executive council, the board of directors or any other form of decision-making body of the school.

A private school may, on the basis of relevant classifications, the length of schooling and academic performance and in accordance with the relevant regulations of the State, issue academic credentials, certificates for completing a course or qualification certificates of training to the students it enrolls. Students who receive training in vocational skills may be awarded vocational qualification certificates of the State when they are considered qualified by the vocational skills appraisal authority approved by the State. A private school shall, in accordance with law, ensure that the teachers and staff members participate in democratic management and supervision through the representative assembly of the teachers and staff members with the teachers as the main body, or through other forms. Teachers and staff members of a private school shall, in accordance with the Trade Union Law, have the right to form trade union organizations to protect their lawful rights and interests.

We believe that Shanxi Modern Bilingual School and Sichuan Guang’an Experimental School currently operate in compliance with the relevant regulations.

Ownership of Foreign Entities by PRC Residents

The PRC State Administration of Foreign Exchange, or SAFE, issued a public notice, or the SAFE Notice, in October 2005 regarding the use of special purpose vehicles, or SPVs, by PRC residents seeking offshore financing to fund investments in the PRC. The SAFE Notice requires PRC residents to register with and receive approvals from SAFE in connection with offshore investment activities. The SAFE Notice provides that each PRC resident who is an ultimate controller of the offshore company must complete the prescribed registration procedure with the relevant local branch of SAFE prior to establishing or assuming control of an offshore company for the purpose of transferring to that offshore company assets of or equity interest in a PRC enterprise.

The notice applies retroactively. As a result, PRC residents who have established or acquired control of these SPVs that have made onshore investments in China were required to complete the relevant overseas investment foreign exchange registration procedures by March 31, 2006. These PRC residents must also amend the registration with the relevant SAFE branch in the following circumstances: (i) the PRC residents have completed the injection of equity investment or assets of a domestic company into the SPV; (ii) the overseas funding of the SPV has been completed; or (iii) there is a material change in the capital of the SPV. If we are deemed an SPV under the SAFE Notice, we would be required to comply with the approval and registration requirements under the SAFE Notice. As of date of this Report, our shareholders have not registered their ownership interests in us with SAFE because our shareholders believe that the SAFE Notice is not applicable to them. In the event SAFE holds a different view from that of our shareholders, failure of our PRC shareholders to comply with these registration requirements may subject them to fines or legal sanctions or limit the ability of Shanxi Taiji to obtain or update its foreign exchange registration certificate with SAFE, which may in turn subject us to fines or legal sanctions, restrict our cross-border investment activities or limit Shanxi Taiji ability to distribute dividends to us.

Regulations on Foreign Currency Exchange

Under the Foreign Currency Administration Rules promulgated by the State Council in 1996 and last revised on August 5, 2008 and various other regulations issued by SAFE, and other relevant PRC government authorities, Renminbi is convertible into other currencies for the purpose of current account items, such as trade related receipts and payments, interest and dividend. The conversion of Renminbi into other currencies and remittance of the converted foreign currency outside China for the purpose of capital account items, such as direct equity investments, loans and repatriation of investment, requires the prior approval from SAFE or its local office. Payments for transactions that take place within China must be made in Renminbi. PRC companies may repatriate foreign currency payments received from abroad subject to SAFE’s requirements. Foreign-invested enterprises may retain foreign currency in accounts with designated foreign exchange banks. Domestic enterprises may convert all of their foreign currency current account proceeds into Renminbi. Capital investments by the Company into Taiyuan Taiji will be considered capital account items, which are subject to rigorous regulations and controls in China. Payments for international equipment will be considered current account items, which only need to satisfy certain documentary and procedural requirements of the foreign exchange regulations.

10

Regulations on Dividend Distribution

The principal regulations governing dividend distributions by wholly foreign owned enterprises and Sino-foreign equity joint ventures include:

|

•

|

The Wholly Foreign Owned Enterprise Law (1986), as amended;

|

|

•

|

The Wholly Foreign Owned Enterprise Law Implementing Rules (1990), as amended;

|

|

•

|

The Sino-foreign Equity Joint Venture Enterprise Law (1979), as amended; and

|

|

•

|

The Sino-foreign Equity Joint Venture Enterprise Law Implementing Rules (1983), as amended.

|

Under these regulations, wholly foreign owned enterprises and Sino-foreign equity joint ventures in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, before paying dividends to their shareholders, these foreign-invested enterprises are required to set aside at least 10% of their profits each year, if any, to fund certain reserve funds until the amount of the cumulative total reserve funds reaches 50% of the relevant company’s registered capital. Accordingly, our wholly-owned subsidiary, Taiyuan Taiji is allowed to distribute dividends to us only after having set aside the required amount of its profits into the reserve funds as required under applicable PRC laws and regulations.

11

Employees

We have 1500 employees, all of which are full-time consisting of: 50 individuals in the management and administration department, 850 teachers and 600 staff members in the support department. None of our employees are represented by a labor union. We intend to hire additional employees on an as-needed basis during the next 12 months.

Description of Property

All land in the PRC is owned by the government and cannot be sold to any individual or entity. Instead, the government grants or allocates landholders a "land use right," which we sometimes refer to informally as land ownership. There are four methods to acquire land use rights in the PRC: (1) grant of the right to use land; (2) assignment of the right to use land; (3) lease of the right to use land; and (4) allocated land use rights. In comparison with Western common law concepts, granted land use rights are similar to life estates and allocated land use rights are in some ways similar to leaseholds. Granted land use rights are provided by the government in exchange for a grant fee, and carry the rights to pledge, mortgage, lease, and transfer within the term of the grant. Land is granted for a fixed term, generally 70 years for residential use, 50 years for industrial use, and 40 years for commercial and other use. The term is renewable in theory. Unlike the typical case in Western nations, granted land must be used for the specific purpose for which it was granted. Allocated land use rights are generally provided by the government for an indefinite period (usually to state-owned entities) and cannot be pledged, mortgaged, leased, or transferred by the user. Allocated land can be reclaimed by the government at any time. Allocated land use rights may be converted into granted land use rights upon the payment of a grant fee to the government.

The Shanxi Taiji holds the certificate of ownership of property of the People’s Republic of China, which indicates:

|

Certificate No.

|

How held

|

Location

|

Purpose

|

Area (sq.m.)

|

Registration date

|

|||||

|

Bing government land registered number(2000)NO.00048

|

Leased

|

18 Longbao street, Taiyuan

|

For education

|

19,865.09

|

May-02

|

|||||

|

Bing government land registered number(2000)NO.00047

|

Leased

|

18 Longbao street Taiyuan

|

For education

|

28,501.63

|

May-02

|

|||||

|

Bing government land registered number(2006)NO.20196

|

Allotted

|

18 Longbao street, Taiyuan

|

For education

|

44,251.05

|

Sep-06

|

|||||

|

Bing government land registered number(2000)NO.20087

|

Allotted

|

40 double tower south road, Taiyuan

|

For dormitory

|

6,763.46

|

Feb-06

|

|||||

|

China registered number

(2002)NO.1437

|

Allotted

|

Shanhe duan, Guanghua steet, Huaying city,

|

For education

|

81,549.00

|

Jul.-02

|

|||||

|

China registered number

(2004)NO.1505

|

Allotted

|

Shanhe duan, Guanghua steet, Huaying city,

|

For education

& dormitory

|

7911.04

|

Nov.-04

|

Shanxi Modern Bilingual School has an elegant school environment, covering 133,000 square meters. The school has three academic buildings, an administration building, four apartment buildings, two cafeterias , six teacher residential buildings, a multi-functional arts gymnasium and three high standard epoxy polyurethane plastic 400-meters circular track fields, and 3 standard basketball courts and a children’s playground.

Sichuan Guang'an Experimental High School’s campus covers an area of 70,000 square meters. It has two teaching buildings, four teachers’ apartments, four students’ apartment buildings, two cafeteria, a complex building, a audio-visual technology building(also for library), and a large-scale Indoor Sports Centre. Campus greening projects cost $300 thousand, we planted trees, shrubs and banyan to improve the school’s life environment, We have built modern science labs, multimedia network classroom, multi-campus language lab and multimedia interactive distance learning network, a high specification amphitheater and art, music, dance, piano houses and other special classrooms, a high standard epoxy polyurethane plastic 400 meters circular track and field, standard basketball courts, volleyball courts and badminton courts.

12

Security Ownership of Certain Beneficial Owners and Management

Upon completion of the Merger, there were 30,000,000 shares (on a post-dividend basis) of the Company’s common stock issued and outstanding.

The following table sets forth information known to us with respect to the beneficial ownership of our common stock as of June 30, 2010 by the following:

|

·

|

Each shareholder who beneficially owns more than 5% of our common;

|

|

·

|

Each of our named executive officers;

|

|

·

|

Each of our directors; and

|

|

·

|

Executive officers and directors as a group.

|

Beneficial ownership is determined in accordance with the rules of the SEC, which deem a person to beneficially own any shares the person has or shares voting or dispositive power over and any additional shares obtainable within 60 days through the exercise of options, warrants or other purchase rights. Shares of our common stock subject to options, warrants or other rights to purchase that are currently exercisable or are exercisable within 60 days of June 30, 2010 (including shares subject to restrictions that lapse within 60 days of June 30, 2010) are deemed outstanding for purposes of computing the percentage ownership of the person holding such shares, options, warrants or other rights, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. Unless otherwise indicated, each person possesses sole voting and investment power with respect to the shares identified as beneficially owned.

|

Name and Address of Beneficial Owner(1)

|

Amount and Nature

of Beneficial

Ownership

|

Percentage

of Class

|

||||||

|

Ren Zhiqing, Chairman and Chief Executive Officer

|

20,400,000

|

(2) |

68.00

|

% | ||||

|

Pan Mingxiao, Executive Vice-President and Director

|

1,490,000

|

(2) |

4.96

|

% | ||||

|

Zhao Hegui, Executive Vice-President and Director

|

0

|

0

|

||||||

|

All such directors and executive officers as a group (3 persons)

|

21,890,000

|

(2) |

72.96

|

% | ||||

(1) All shares are owned of record and beneficially. Except as otherwise noted, each shareholder’s address is c/o China Bilingual Technology & Education Group Inc., No. 2 Longbao Street, Xiodian Zone, Taiyuan City, Shanxi Province, Chiona 030031.

(2) On a post-dividend basis

13

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our consolidated financial statements and the related notes included elsewhere in this document. The following discussion contains forward-looking statements. The words or phrases “would be,” “will allow,” “expect to”, “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” or similar expressions are intended to identify forward-looking statements. Such statements include, among others, those statements concerning our expected financial performance, our corporate strategy and operational plans. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties, including, among others: (a) those risks and uncertainties related to general economic conditions in China, including regulatory factors that may affect such economic conditions; (b) whether we are able to manage our planned growth efficiently and operate profitable operations, including whether our management will be able to identify, hire, train, retain, motivate and manage required personnel or that management will be able to successfully manage and exploit existing and potential market opportunities; (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations; and (d) whether we are able to successfully fulfill our primary requirements for cash which are explained below under “Liquidity and Capital Resources”. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim any obligation, to update any forward-looking statements to reflect occurrences, developments, unanticipated events or any other circumstances after the date of such statement unless required by law. For additional information regarding these risks and uncertainties, see “Risk Factors”. Our consolidated financial statements have been prepared in accordance with U.S. GAAP. In addition, our consolidated financial statements and the financial data included in this document reflect the Merger and have been prepared as if our current corporate structure had been in place throughout the relevant periods.

Overview

On June 30, 2010, Designer Export, Inc. (the “Company”) acquired all of the outstanding capital stock of Kahibah Limited, a British Virgin Islands limited liability company (“Kahibah”), through China Bilingual Education Acquisition Inc. a Nevada corporation (the “Merger Sub”) wholly owned by the Company. For accounting suppose, the share exchange translation was treated as a reverse acquisition, with Designer Exports, Inc. as the acquired party and Kahibah as the.acquirer. In addition. The historical financial statements of Kahibah will become the historical financial statement of the company.

The accompanying consolidated financial statements include the financial statements of Kahibah Limited and its subsidiaries. Kahibah Limited and its subsidiaries are collectively referred to as the “Company.” The Company provides high quality bilingual educational services including full-curriculum primary and secondary schools in the People’s Republic of China (“PRC”) through its wholly owned subsidiaries. As of March 31, 2010 and December 31, 2009 and 2008, there were 50,000 shares of the Company’s $1 par value common stock issued and outstanding. The common stock of the Company was held 90% by Mr. Ren Zhiqing and 10% by Mr. Pan Mingxiao.

Kahibah Limited (“KL”) was incorporated under the laws of the British Virgin Islands (“BVI”) on December 6, 2005. On June 25, 2009, Mr. Ren Zhiqing and Mr. Pan Mingxiao entered into a Purchase Agreement to acquire KL for $10,285. Since June 25, 2009, KL was 90% and 10% owned by Mr. Ren Zhiqing and Mr. Pan Mingxiao, respectively. For several months prior to the Recapitalization (described below), Kahibah Limited was a “shell company,” as defined by Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”), and its primary business operations involved seeking the acquisition of assets, property, or businesses that would be beneficial to it and its shareholders.

On August 24, 2009, KL established a new company, Taiyuan Taiji Industry Development Co., Ltd. (“Taiyuan Taiji”.) Taiyuan Taiji is a company incorporated in the PRC. and KL is the sole shareholder of Taiyuan Taiji under the laws of the PRC. Taiyuan Taiji was organized pursuant to the laws of the PRC, for the purpose of acquiring Shanxi Taiji Industrial Development Co., Ltd. (“Shanxi Taiji”), a company formed on July 25, 1997 pursuant to the laws of the PRC.

On November 25, 2009, Taiyuan Taiji acquired Shanxi Taiji. This transaction was treated as a Recapitalization and Reverse Merger of Shanxi Taiji for financial reporting purposes. The effect of this Recapitalization was rolled back to the inception of Shanxi Taiji for financial reporting purposes. As a result, the historical financial statements of Shanxi Taiji become the historical financial statements of KL. Net equity of KL as of June 25, 2009 was less than 1% threshold, and thus the recapitalization effect was not presented on the consolidated statements of changes in shareholders’ equity for the years ended December 31, 2009.

Prior to November 25, 2009, Mr. Ren Zhiqing owned 90% of Shanxi Taiji, with the remaining balance being held by Mr. Pan Mingxiao. On November 25, 2009, the Company entered into a Share Exchange Agreement with Ms. Ren Bainv, a relative of Mr. Ren Zhiqing, which agreed to sell 5% ownership of Shaxi Taiji to Ms. Ren Bainv for $146,224. Since the Company has not yet received the capital contribution from Ms. Ren Bainv, the Company did not present non-controlling interest on its financial statements as of March 31, 2010 and December 31, 2009.

14

We are a fast-growing education-oriented company in China, and we operate two private schools, consisting of kindergarten, elementary, middle school and high school. Our Shanxi Modern Bilingual School was established in 1998 and provides students with an innovative and top quality bilingual education. Our Sichuan Guang’an Experimental High School was established in 2002 as a high-profile, high-standards, full-time boarding school.

Results of Operations

Operation Results for the Three Months Ended March 31, 2010 and 2009

Revenues

During the three months ended March 31, 2010, we had revenues of $5,936,730 as compared to revenues of $4,925,233 during the three months ended March 31, 2009, an increase of $1,011,497, or 20.54%. The increase was a result of an increase in the number of students attending our schools.

Cost of Revenue

During the three months ended March 31, 2010, our cost of revenue was $2,192,747, as compared to cost of revenue of $2,261,466 during the three months ended March 31, 2009, a decrease of $68,719 or 3.04%. The decrease in cost of revenue was primarily the result of depreciation of equipments which had already been fully depreciated before March 31, 2010..

General and Administrative Expenses

General and administrative expenses, totaled $449,451 during the three months ended March 31, 2010 as compared to $ 359,826 for the three months ended March 31, 2009. The increase of $89,625 or 24.91% in general and administrative expense was mainly attributed to additional fees paid for going public.

Interest expense

Interest expense decreased from $ 16,337 during the three months ended March 31, 2009 to $0 for the three month ended March 31, 2010. The decreased interest expense resulted from the bank loan of Shanxi Taiji paid off on Oct 9th, 2009, so the interest for three month ended March 31, 2010 is nil.

Net Income attributable to the Company

As a result of the factors described above, we had net income attributable to the Company in the amount of $ 3,343,570 for the three months ended March 31, 2010, as compared with $ 2,310,596 during the three months ended March 31, 2009. The increase in net income was mainly attributed to the increase of the revenue.

Comprehensive Income

Our business operates primarily in Chinese Renminbi (“RMB”), but we report our results in U.S. Dollars. The conversion of our accounts from RMB to U.S. Dollars results in translation adjustments. As a result of a currency translation adjustment gain, our comprehensive income was $ 3,383,019 during the three months ended March 31, 2010, as compared with $ 2,344,835 during the three months ended March 31, 2009. The increase is due to the increase in revenue.

Liquidity and Capital Resources

Presently, our principal sources of liquidity come from tuition paid by students that attend our schools. As of March 31, 2010, we had negative working capital of $8,802,504, as compared to negative working capital of $12,345,071 as of December 31, 2009. Based on our current operating plan, we believe that our existing resources, including cash generated from operations as well as the bank loans, will be sufficient to meet our working capital requirement for our current operations. In order to fully implement our business plan and continue our growth, however, we will require additional capital either from our shareholders or from outside sources, although there is no assurance that we will be able to obtain additional capital if and when it is needed.

15

Operating Activities

Cash used in operating activities totaled ($71,138) for the three months ended March 31, 2010 as compared to ($808,434) used in operating activities for the three months ended March 31, 2009. The increase in cash provided by operations is due to two following reasons. The first reason is that the net income which eliminated the prepaid tuition fee increased $0.2 million based on the more students in 2010 than in 2009. The other reason is that the less purchasing inventory which resulted the cash increased $0.5 million for the three months ended March 31, 2010 than for the three months ended March 31, 2009.

Investing Activities

Cash provided by investing activities was $447,306 for the three months ended March 31, 2010 as compared cash used investing activities of ($422,309) for the three months ended March 31, 2009. The increase of cash provided by investing activities is mainly attributable to the related party returned Mr. Pan returned $540,000 during the three months ended March 31, 2010 compared to cash advanced to related parties of $403,000 in March 31, 2009.

Financing Activities

Cash used in financing activities total $1,154,318 for the three months ended March 31, 2010 as compared to $60,835 provided for the three months ended March 31, 2009. The increase in cash used by financing activities resulted primarily from repayments to related parties Mr. Ren $1.1million during the three months ended March 31, 2010.

Operation Results of the Fiscal Year Ended December 31, 2009 and 2008

Revenues

During the year ended December 31, 2009, we had revenues of $ 21,163,871, as compared with $17,104,549 during the year ended December 31, 2008, an increase of approximately $4,059,322, or 23.73% due to the increase in the number of students attending our schools and an increase in tuition.

Cost of Revenue

During the year ended December 31, 2009, our cost of revenue was $ 9,473,396, as compared to cost of revenue of $8,122,287 during the year ended December 31, 2008, an increase of $1,351,109, or 16.63%. The increase in cost of revenue was primarily the result of an increase in the number of students attending our schools.

General and Administrative Expenses

General and administrative expenses, totaled $1,484,893 during the year ended December 31, 2009 as compared to $1,547,044 for the year ended December 31, 2008. The decrease of $62,151, or 4.02% in general and administrative expense was mainly attributed to a decrease in depreciation expenses.

Interest expense

Interest expense decreased from $227,012 during the year ended December 31, 2008 to $ 77,594 for the year ended December 31, 2009. The decreased interest expense resulted from a decrease in our bank loans.

Net Income attributable to the Company

As a result of the factors described above, we had net income attributable to the Company in the amount of $10,073,593 for the year ended December 31, 2009, as compared with $7,205,539 during the year ended December 31, 2008. The increase in net income was mainly attributed to the increase of the revenue.

Comprehensive Income

Our business operates primarily in Chinese Renminbi (“RMB”), but we report our results in U.S. Dollars. The conversion of our accounts from RMB to U.S. Dollars results in translation adjustments. As a result of a currency translation adjustment gain, our comprehensive income was $9,762,439 during the year ended December 31, 2009, as compared with $7,889,288 during the year ended December 31, 2008. The increase is due to the increase of the revenue.

16

Off-Balance Sheet Arrangements

None

Critical Accounting Policies and Estimates

USE OF ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting periods. Measurement, estimates and assumptions are used for, but not limited to, the selection of the useful lives of property and equipment, impairment of long-lived assets, fair values and revenue recognition. Management makes these estimates using the best information available at the time the estimates are made; however actual results when ultimately realized could differ from those estimates. The current economic environment has increased the degree of uncertainty inherent in these estimates and assumption.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

(a)

|

Property and Equipment, Net

|

Property and equipment are carried at cost. The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts and any gain or loss is included in the consolidated statement of income. The cost of maintenance and repairs is charged to expense as incurred, whereas significant additions and betterments that increase the useful lives of the assets are capitalized. Depreciation is provided over their estimated useful lives, using the straight-line method. The Estimated useful lives are as follows:

|

Buildings

|

40 years

|

|

Furniture and education equipment

|

3-10 years

|

|

Transportation equipment

|

10 years

|

|

Kitchen equipment

|

10 years

|

|

Computer equipment and software

|

5 years

|

|

(b)

|

Land Use Rights, Net

|

According to the laws of the PRC, land in the PRC is owned by the government and cannot be sold to an individual or a company. However, the government grants the user a “land use right” to use the land. The land use right granted to the Company is being amortized using the straight-line method over the lease term of forty years.

|

(c)

|

Impairment of Long-Lived Assets

|

The Company’s long-lived assets and other assets (consisting of property and equipment and purchased land use rights) are reviewed for impairment in accordance with the guidance of the FASB ASC Topic 360-10, Property, Plant, and Equipment, and FASB ASC Topic 205, Presentation of Financial Statements. The Company tests for impairment losses on long-lived assets used in operations whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. Recoverability of an asset to be held and used is measured by a comparison of the carrying amount of an asset to the future undiscounted cash flows expected to be generated by the asset. If such asset is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds its fair value. Impairment evaluations involve management’s estimates on asset useful lives and future cash flows. Actual useful lives and cash flows could be different from those estimated by management which could have a material effect on our reporting results and financial positions. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary. Through March 31, 2010, the Company had not experienced impairment losses on its long-lived assets. However, there can be no assurances that demand for the Company’s services will continue, which could result in an impairment of long-lived assets in the future.

17

|

(d)

|

Income taxes

|

On March 16, 2007, the PRC National People’s Congress passed the PRC Enterprise Income Tax Law (“New EIT Law”) which became effective on January 1, 2008. Pursuant to the New EIT Law, a unified enterprise income tax rate of 25% and unified tax deduction standards will be applied consistently to both domestic-invested enterprises and foreign-invested enterprises.

Shanxi Taiji and Taiyuan Taiji are taxed pursuant to the New EIT Law with a unified enterprise income tax rate of 25%. Shanxi Taiji and Taiyuan Taiyuan Taiji did not pay any income taxes during the years ended December 31, 2009 and 2008 and for the three months ended March 31, 2010 due to these two entities experienced net losses in the past reporting periods. The two entities may apply the past periods’ net operating losses to futures years’ profits in order to reduce tax liability. Since Shanxi Taiji and Taiyuan Taiji have minimal business operations, the two entities are unlikely to have profits in future periods. As a result, all deferred tax assets and liabilities are diminimus, and management would have a 100% valuation allowance for all deferred tax assets.

The subsidiaries of Shanxi Taiji, which were registered as private schools (the “school-subsidiaries”), are not subject to income taxes determined in accordance with the Law for Promoting Private Education (2003) and school-subsidiaries registered as private schools not requiring reasonable returns (similar to a not-for-profit entity) are treated as public schools and are generally not subject to enterprise income taxes. Therefore, the school-subsidiaries are tax exempt.

Kahibah Limited is exempt from income tax on all sources of income pursuant to the tax law in the British Virgin Islands. However, pursuant and subsequent to the reverse merger (in Note 22), the parent company in U.S. may pay tax in future years.

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect of deferred tax assets of a change in tax rates is recognized in income in the period that includes the enactment date. Deferred income tax expense represents the change during the period in the deferred tax assets. The components of the deferred tax assets are individually classified as current based on their characteristics. Deferred tax assets and liabilities are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

A provision has not been made at March 31, 2010 and 2009, and December 31, 2009 and 2008 for U.S. or additional foreign withholding taxes of undistributed earnings of foreign subsidiaries because it is the present intention of management to reinvest the undistributed earnings indefinitely in foreign operations. Generally, such earnings become subject to U.S. tax upon the remittance of dividends and under certain other circumstances. It is not practicable to estimate the amount of deferred tax liability on such undistributed earnings.

The Company recognizes that virtually all tax positions in the PRC are not free of some degree of uncertainty due to tax law and policy changes by the government. However, the Company cannot reasonably quantify political risk factors and thus must depend on guidance issued by current government officials.

Based on all known facts and circumstances and current tax law, the Company believes that the total amount of unrecognized tax benefits as of March 31, 2010 and 2009, and December 31, 2009 and 2008, is not material to its results of operations, financial condition or cash flows. The Company also believes that the total amount of unrecognized tax benefits as of March 31, 2010 and 2009, and December 31, 2009 and 2008, if recognized, would not have a material effect on its effective tax rate. The Company further believes that there are no tax positions for which it is reasonably possible, based on the current PRC tax law and policy, that the unrecognized tax benefits will significantly increase or decrease over the next twelve months producing, individually or in the aggregate, a material effect on the Company’s results of operations, financial condition or cash flows as of March 31, 2010 and 2009, and December 31, 2009 and 2008.

18

|

(i)

|

Revenue Recognition and Prepaid Tuition

|