Attached files

| file | filename |

|---|---|

| EX-23 - PLATINUM ENERGY RESOURCES INC | v189379_ex23.htm |

| EX-31.2 - PLATINUM ENERGY RESOURCES INC | v189379_ex31-2.htm |

| EX-31.1 - PLATINUM ENERGY RESOURCES INC | v189379_ex31-1.htm |

| EX-32.1 - PLATINUM ENERGY RESOURCES INC | v189379_ex32-1.htm |

| EX-32.2 - PLATINUM ENERGY RESOURCES INC | v189379_ex32-2.htm |

| EX-99.1 - PLATINUM ENERGY RESOURCES INC | v189379_ex99-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

10-K

(Mark

One)

x ANNUAL REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE

ACT OF 1934

For

the fiscal year ended December 31, 2009

o TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE

ACT OF 1934

For

the transition period from ______ to ______.

Commission

file number: 000-51553

PLATINUM

ENERGY RESOURCES, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

14-1928384

|

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

11490

Westheimer Road, Suite 1000

|

|

|

Houston,

Texas

|

77077

|

|

(Address

of principal executive offices)

|

(zip

code)

|

|

Registrant’s

telephone number, including area code

|

(281)

649-4500

|

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act:

Units,

each consisting of one share of common stock, par value

$0.0001

per share, and one warrant

Common

Stock, par value $0.0001 per share

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act.

Yes

o

No

x

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or Section

15(d) of the Act. Yes o

No

x

Indicate

by check mark whether the registrant: (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

Yes x No o

Indicate by check mark whether the

registrant has submitted electronically and posted on its corporate Web site, if

any, every Interactive Data File required to be submitted and posted pursuant to

Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12

months (or for such shorter period that the registrant was required to submit

and post such files). Yes

o

No

o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this Chapter) is not contained herein, and

will not be contained, to the best of registrant's knowledge, in definitive

proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Act.

Large accelerated

filer o Accelerated filer o Non-accelerated filer (Do not check

if a smaller reporting company)

o Smaller

reporting company

x

Indicate by check mark whether the

registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act).

Yes o

No

x

As

of June 30, 2009, the aggregate market value of the registrant’s common stock

held by non-affiliates of the registrant was $6,418,580 based on the closing

price as reported on the OTC Bulletin Board.

Indicate

the number of shares outstanding of each of the issuer’s classes of common

stock, as of the latest practicable date.

|

Class

|

Outstanding at June 25,

2010

|

|

|

Common

Stock, $0.0001 par value per share

|

22,606,475 shares

|

|

Page

|

|||

|

PART

I

|

|||

|

Item

1.

|

Business.

|

4

|

|

|

Item

1A.

|

Risk

Factors.

|

8

|

|

|

Item

1B.

|

Unresolved

Staff Comments.

|

14

|

|

|

Item

2.

|

Properties.

|

14

|

|

|

Item

3.

|

Legal

Proceedings.

|

20

|

|

|

Item

4.

|

Reserved.

|

22

|

|

|

PART

II

|

|||

|

Item

5.

|

Market For Registrant’s Common

Equity, Related Stockholder Matters and Issuer Purchases of

Equity

Securities.

|

23

|

|

|

Item

6.

|

Selected

Financial Data.

|

||

|

Item

7.

|

Management’s Discussion and

Analysis of Financial Condition and Results of

Operations.

|

23

|

|

|

Item 7A.

|

Quantitative and Qualitative

Disclosures About Market Risk.

|

||

|

Item

8.

|

Financial Statements and

Supplementary Data.

|

36

|

|

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure.

|

36

|

|

|

Item 9A(T).

|

Controls and

Procedures.

|

36

|

|

|

Item 9B.

|

Other

Information.

|

||

|

PART

III

|

|||

|

Item

10.

|

Directors, Executive Officers

and Corporate Governance.

|

37

|

|

|

Item

11.

|

Executive

Compensation.

|

39

|

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

43

|

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence.

|

44

|

|

|

Item

14.

|

Principal Accounting Fees and

Services.

|

44

|

|

|

PART

IV

|

|||

|

Item

15.

|

Exhibits,

Financial Statement Schedules.

|

46

|

2

FORWARD-LOOKING

STATEMENTS

The

statements contained in this report, other than statements of historical fact,

constitute forward-looking statements. Such statement include, without

limitation, all statements as to the production of natural gas and oil, product

price, natural gas and oil reserves, drilling and completion results, capital

expenditures and other such matters. These statements relate to events and/or

future financial performance, and involve known and unknown risks, uncertainties

and other factors that may cause our results, level of activity, performance or

achievements or the industry in which we operate to be materially different from

any future results, levels of activity, performance or achievements expressed or

implied by the forward-looking statements. These risks and other

factors included those listed under “Risk Factors” and elsewhere in this

report.

In some

cases, you can identify forward-looking statements by terminology such as “may,”

“will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential,” “continue” or the negative of these terms

or other comparable terminology. These statements are only predictions. Actual

events or results may differ materially. In evaluating these statements, you

should specifically consider various factors, including the risks outlined under

“Risk Factors.” These factors may cause our actual results to differ materially

from any forward-looking statement. Factors that could affect our actual results

and could cause actual results to differ materially from those in

forward-looking statements include, but are not limited to the

following:

|

|

·

|

The

volatility of realized natural gas and oil prices;

|

|

|

·

|

The

potential for additional impairment due to future decreases in natural gas

and oil prices;

|

|

|

·

|

Uncertainties

about the estimated quantities of natural gas, and oil

reserves;

|

|

|

·

|

The

discovery, estimation, development and replacement of natural gas and oil

reserves;

|

|

|

·

|

Our

business and financial strategy;

|

|

|

·

|

Our

cash flow, liquidity and financial position;

|

|

|

·

|

Our

production volumes;

|

|

|

·

|

Our

operating expenses, general and administrative costs, and development

costs;

|

|

|

·

|

Our

future operating results;

|

|

|

·

|

Our

prospect development and property acquisitions;

|

|

|

·

|

The

marketing of natural gas and oil;

|

|

|

·

|

The

impact of weather and the occurrence of natural disaster such as floods

and hurricanes;

|

|

|

·

|

Government

regulation of the natural gas and oil industry;

|

|

|

·

|

Environmental

regulations;

|

|

|

·

|

The

effect of legislation, regulatory initiatives and litigation related to

climate change;

|

|

|

·

|

Developments

in oil-producing and natural gas producing countries;

and

|

|

|

·

|

Our

strategic plans, objectives, expectations and intentions for future

operations.

|

Although

we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance

or achievements. Moreover, neither we nor any other person assumes

responsibility for the accuracy and completeness of these forward-looking

statements. We do not intend to update any of the forward-looking

statements after the date of this report to confirm prior statements to actual

results.

3

PART

I

Item 1.

Business.

Platinum

Energy Resources, Inc. (which we refer to as “we,” “us,” “Platinum” or the

“Company”) is an independent oil and gas exploration and production ("E&P")

company. We have approximately 37,000 acres under lease in relatively long-lived

fields with well-established production histories. Our properties are

concentrated primarily in the Gulf Coast region in Texas, the Permian Basin in

Texas and New Mexico, and the Fort Worth Basin in Texas.

Our

principal business strategy is to provide long-term growth in stockholder value

by drilling, developing and exploiting our oil and gas properties. We believe

there exists opportunities to exploit mature fields that may have substantial

remaining reserves. As the major, large independent oil and gas companies

focus on more costly and risky international and offshore prospects, the smaller

independents, such as Platinum, have an opportunity to take advantage

of the significant reserves left behind.

Our

exploration and production activities commenced in October 2007 upon our

acquisition of significantly all of the assets and liabilities of Tandem Energy

Corporation (“TEC”) including 21,000 acres under lease in Texas and New

Mexico. Subsequent to the TEC acquisition we have completed a series

of low risk strategic acquisitions adding an additional 16,000 lease acres to

our portfolio, which we believe will complement our business plan.

In

addition we provide engineering and project management services to the oil and

gas industry and others, through our wholly owned subsidiary Maverick

Engineering Inc. (“Maverick”), which we acquired on April 29,

2008. Following the consummation of this acquisition, we moved our

corporate headquarters to Maverick’s Houston office.

Business

Strategy

Platinum’s

long term strategy is to provide growth in stockholder value by drilling,

developing and exploiting our oil and gas properties. The Company

maintains a large inventory of drilling and optimization projects to achieve

organic growth from its capital development program. In general, we

seek to be the operator of wells in which we have a working interest. As

operator, we design and manage the development of a well and supervise operation

and maintenance activities on a day-to-day basis. As of

December 31, 2009, we operated properties representing approximately 89

percent of our proved reserves. As the operator, we are able to better control

expenses, capital allocation, and the timing of exploitation and development

activities on our properties. The number, types and location of

wells drilled varies depending on the Company’s capital budget, the cost of each

well, anticipated production and the estimated recoverable reserves attributable

to each well.

Due to

the recent downturn in the global economy as well as the decrease in natural gas

prices, we significantly reduced our capital expenditures and drilling activity

in 2009. Our goal in 2010 will be to keep our exploration and

development capital expenditures within our cash flow from operations, while

maintaining our estimated proved reserve base and production, protecting against

lease expirations and non-consent penalties, and continuing to focus on cost

control.

4

Corporate

History

We

were incorporated in Delaware on April 25, 2005 as a blank check company for the

purpose of effecting a business combination with an unidentified operating

business in the global oil and natural gas industry. On October 28, 2005, we

consummated our IPO of 14,400,000 units with each unit consisting of one share

of our common stock, $0.0001 per share, and one warrant to purchase one share of

common stock at an exercise price of $6.00 per share. The units were sold at an

offering price of $8.00 per unit, generating gross proceeds of $115,200,000. In

October 2007, the Company acquired substantially all of the assets and assumed

all of the liabilities of TEC described below. Prior to the TEC

transaction, the Company had no operations other than conducting an initial

public offering and seeking a business combination. Effective on April 29, 2008,

Platinum acquired Maverick, an engineering services company.

Drilling,

Exploration and Production Activities

Platinum’s

exploration efforts are focused on discovering new reserves by drilling and

completing wells under our existing leases, as well as leases we may acquire in

the future. The investment associated with drilling a well and future

development of our leasehold acreage depends principally upon whether any

problems are encountered in drilling the wells, whether the wells, in the case

of gas wells, can be timely connected to existing infrastructure or will require

additional investment in infrastructure, and, if applicable, the amount of water

encountered in the wells.

Due to

the recent downturn in the global economy as well as the decrease in natural gas

prices, we reduced our capital expenditures and drilling activity in 2009. Our

goal in 2010 is to keep our exploration and development capital expenditures

within our cash flow from operations, while maintaining our estimated proved

reserve base and production, protecting against lease expirations and

non-consent penalties, and continuing to focus on cost control.

Title

to Properties

We

believe that the title to our leasehold properties is good and defensible in

accordance with standards generally acceptable in the oil and gas industry,

subject to exceptions that are not material as to detract substantially from the

use of the properties. Our leasehold properties are subject to royalty,

overriding royalty and other outstanding interests customary in the industry.

The properties may be subject to burdens such as liens incident to operating

agreements and taxes, development obligations under oil and gas leases, and

other encumbrances, easements and restrictions. We do not believe any of these

burdens will materially interfere with our use of these properties. For a

description of our oil and gas leasehold properties, see “Properties

- Current Oil and Gas Activities”.

As is

customary in the oil and gas industry, only a preliminary title examination is

conducted at the time properties believed to be suitable for drilling operations

are acquired. We rely upon oil and gas land men to conduct the title

examination. We intend to perform necessary curative work with respect to any

significant defects in title prior to proceeding with drilling

operations.

Competition

The oil

and natural gas business is highly competitive. We compete with private and

public companies in all facets of the oil and gas business, including suppliers

of energy and fuel to industrial, commercial and individual customers. Numerous

independent oil and gas companies, oil and gas syndicates and major oil and gas

companies actively seek out and bid for oil and gas prospects and properties as

well as for the services of third-party providers, such as drilling companies,

upon which we rely. Many of these companies not only explore for, produce and

market oil and gas, but also carry out refining operations and market the

resultant products on a worldwide basis. A substantial number of our competitors

have longer operating histories and substantially greater financial and

personnel resources than us.

Competitive

conditions may be substantially affected by various forms of energy legislation

and regulation considered from time to time by the government of the United

States and the states in which we have operations, as well as factors that we

cannot control, including international political conditions, overall levels of

supply and demand for oil and gas, and the markets for synthetic fuels and

alternative energy sources. Intense competition occurs with respect to

marketing, particularly of natural gas.

5

Regulatory

Matters

General. The availability of

a ready market for oil and gas production depends upon numerous factors beyond

our control. These factors include local, state, federal and international

regulation of oil and gas production and transportation, as well as regulations

governing environmental quality and pollution control, state limits on allowable

rates of production by a well or proration unit, the amount of oil and gas

available for sale, the availability of adequate pipeline and other

transportation and processing facilities, and the marketing of competitive

fuels. For example, in the case of gas wells, a productive well may be “shut-in”

because of an over-supply of gas or lack of an available pipeline in the areas

in which we may conduct operations. State and federal regulations are generally

intended to prevent waste of oil and gas, protect rights to produce oil and gas

between owners in a common reservoir, and control contamination of the

environment. Pipelines and gas plants are also subject to the jurisdiction of

various federal, state and local agencies that may affect the rates at which

they are able to process or transport gas from our properties.

Applicable

legislation is under constant review for amendment or expansion. These efforts

frequently result in an increase in the regulatory burden on companies in the

oil and gas industry and a consequent increase in the cost of doing business and

decrease in profitability. Numerous federal and state departments and agencies

issue rules and regulations imposing additional burdens on the oil and gas

industry that are often costly to comply with and carry substantial penalties

for non-compliance. Our production operations may be affected by changing tax

and other laws relating to the petroleum industry, constantly changing

administrative regulations and possible interruptions or termination by

government authorities.

Sales of Oil and Natural Gas.

Sales of any oil that we produce will be affected by the availability, terms and

costs of transportation. The rates, terms and conditions applicable to the

interstate transportation of oil by pipelines are regulated by the Federal

Energy Regulatory Commission (“FERC”) under the Interstate Commerce Act. FERC

has implemented a simplified and generally applicable ratemaking methodology for

interstate oil pipelines to fulfill the requirements of Title VIII of the Energy

Policy Act of 1992 comprised of an indexing system to establish ceilings on

interstate oil pipeline rates. FERC has announced several important

transportation-related policy statements and rule changes, including a statement

of policy and final rule issued February 25, 2000, concerning alternatives to

its traditional cost-of-serve rate-making methodology to establish the rates

interstate pipelines may charge for their services. The final rule revises

FERC’s pricing policy and current regulatory framework to improve the efficiency

of the market and further enhance competition in natural gas

markets.

Sales of

any natural gas that we produce will be affected by the availability, terms and

costs of transportation. The rates, terms and conditions applicable to the

interstate transportation of gas by pipelines are regulated by FERC under the

Natural Gas Acts, as well as under Section 311 of the Natural Gas Policy Act.

Since 1985, the FERC has implemented regulations intended to increase

competition within the gas industry by making gas transportation more accessible

to gas buyers and sellers on an open-access, non-discriminatory

basis.

Pipelines. Pipelines that we

use to gather and transport our oil and gas are subject to regulation by the

Department of Transportation (“DOT”) under the Hazardous Liquids Pipeline Safety

Act of 1979, as amended (“HLPSA”), relating to the design, installation,

testing, construction, operation, replacement and management of pipeline

facilities. The HLPSA requires pipeline operators to comply with regulations

issued pursuant to HLPSA designed to permit access to and allowing copying of

records and to make certain reports and provide information as required by the

Secretary of Transportation.

State Restrictions. State

regulatory authorities have established rules and regulations requiring permits

for drilling operations, drilling bonds and reports concerning operations. Many

states have statutes and regulations governing various environmental and

conservation matters, including the unitization or pooling of oil and gas

properties and establishment of maximum rates of production from oil and gas

wells, and restricting production to the market demand for oil and gas. Such

statutes and regulations may limit the rate at which oil and gas could otherwise

be produced from our properties.

6

Most

states impose a production or severance tax with respect to the production and

sale of crude oil, natural gas and natural gas liquids within their respective

jurisdictions. State production taxes are generally applied as a percentage of

production or sales. In addition, in the event we conduct operations on federal

or state oil and gas leases, such operations must comply with numerous

regulatory restrictions, including various nondiscrimination statutes, royalty

and related valuation requirements, and certain of such operations must be

conducted pursuant to certain on-site security regulations and other appropriate

permits issued by the Bureau of Land Management or the Minerals Management

Service or other appropriate federal or state agencies.

Other. Oil and gas rights may

be held by individuals and corporations, and, in certain circumstances, by

governments having jurisdiction over the area in which such rights are located.

As a general rule, parties holding such rights grant licenses or leases to third

parties, such as us, to facilitate the exploration and development of these

rights. The terms of the licenses and leases are generally established to

require timely development. Notwithstanding the ownership of oil and gas rights,

the government of the jurisdiction in which the rights are located generally

retains authority over the manner of development of those rights.

Environmental

Matters

General. Our activities are

subject to local, state and federal laws and regulations governing environmental

quality and pollution control in the United States. The exploration, drilling

and production from wells, natural gas facilities, including the operation and

construction of pipelines, plants and other facilities for transporting,

processing, treating or storing natural gas and other products, are subject to

stringent environmental regulation by state and federal authorities, including

the Environmental Protection Agency (“EPA”). Such regulation can increase our

cost of planning, designing, installing and operating such

facilities.

Significant

fines and penalties may be imposed for the failure to comply with environmental

laws and regulations. Some environmental laws provide for joint and several

strict liability for remediation of releases of hazardous substances, rendering

a person liable for environmental damage without regard to negligence or fault

on the part of such person. In addition, we may be subject to claims alleging

personal injury or property damage as a result of alleged exposure to hazardous

substances, such as oil and gas related products.

Waste Disposal. We may

generate wastes, including hazardous wastes, that are subject to the federal

Resource Conservation and Recovery Act (“RCRA”) and comparable state statutes.

The EPA has limited the disposal options for certain wastes that are designated

as hazardous under RCRA (“Hazardous Wastes”). Furthermore, it is possible that

certain wastes generated by our oil and gas operations that are currently exempt

from treatment as Hazardous Wastes may in the future be designated as Hazardous

Wastes, and therefore be subject to more rigorous and costly operating and

disposal requirements.

CERCLA. The federal

Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”),

also known as the “Superfund” law, generally imposes joint and several liability

for costs of investigation and remediation and for natural resource damages,

without regard to fault or the legality of the original conduct, on certain

classes of persons with respect to the release into the environment of

substances designated under CERCLA as hazardous substances (“Hazardous

Substances”). These classes of persons or so-called potentially responsible

parties include the current and certain past owners and operators of a facility

where there is or has been a release or threat of release of a Hazardous

Substance and persons who disposed of or arranged for the disposal of the

Hazardous Substances found at such a facility. CERCLA also authorizes the EPA

and, in some cases, third parties to take action in response to threats to the

public health or the environment and to seek to recover from the potentially

responsible parties the costs of such action. Although CERCLA generally exempts

petroleum from the definition of Hazardous Substances, we may have generated and

may generate wastes that fall within CERCLA’s definition of Hazardous

Substances.

7

Air Emissions. Our operations

may be subject to local, state and federal regulations for the control of

emissions of air pollution. Major sources of air pollutants are subject to more

stringent, federally imposed permitting requirements, including additional

permits. Producing wells may generate volatile organic compounds and nitrogen

oxides. If ozone problems are not resolved by the deadlines imposed by the

federal Clean Air Act, or on schedule to meet the standards, even more

restrictive requirements may be imposed, including financial penalties based

upon the quantity of ozone producing emissions. If we fail to comply strictly

with applicable air pollution regulations or permits, we may be subject to

monetary fines and be required to correct any identified deficiencies.

Alternatively, regulatory agencies could require us to forego construction,

modification or operation of certain air emission sources.

We

believe that we are in substantial compliance with current applicable

environmental laws and regulations and that, absent the occurrence of an

extraordinary event, compliance with existing local, state, federal and

international laws, rules and regulations governing the release of materials in

the environment or otherwise relating to the protection of the environment will

not have a material effect upon our business, financial condition or results of

operations. However, since environmental costs and liabilities are inherent in

our operations and in the operations of companies engaged in similar businesses

and since regulatory requirements frequently change and may become more

stringent, there can be no assurance that material costs and liabilities will

not be incurred in the future. Such costs may result in increased costs of

operations and acquisitions and decreased production.

Engineering

Activities

Maverick

provides engineering and construction services primarily for three types of

clients: (1) upstream oil and gas, domestic oil and gas producers and pipeline

companies; (2) industrial, petrochemical and refining plants; and (3)

infrastructure, private and public sectors, including state municipalities,

cities, and port authorities. Most of the Company’s work is performed under time

and material projects. In accordance with industry practice, substantially all

of our contracts are subject to cancellation or termination at the discretion of

the client. In a situation where a client terminates a contract, we would

ordinarily be entitled to receive payment for work performed up to the date of

termination and, in certain instances, we may be entitled to allowable

termination and cancellation costs.

Employees

At

December 31, 2009, we had 162 full-time employees, none of whom were

subject to a collective bargaining agreement.

Website

Address

The

Company maintains an internet website at www.platenergy.com. The

Company makes available, free of charge, on its website, its annual reports on

Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and

amendments to those reports, as soon as reasonably practicable after providing

such reports to the SEC. The information contained in or incorporated

into its website is not part of this report.

Item 1A. Risk Factors.

We

are subject to a high degree of risk. You should consider the risks described

below carefully and all of the information contained in this report. If any of

these risks, as well as other risks and uncertainties that are not currently

known to us or that we currently believe are not material, actually occur, our

business, financial condition and results of operations may suffer

significantly.

8

Since

Tandem Energy Holdings, Inc. was a publicly-traded shell corporation, our

acquisition of all of the assets and substantially all liabilities

of its operating subsidiary may subject us to successor

liability for the shell corporation’s known and unknown

liabilities.

On

October 26, 2007, we acquired substantially all of the assets and assumed

substantially all of the liabilities of Tandem Energy Corporation, a Colorado

corporation (“Old TEC”), a wholly owned subsidiary of Tandem Energy Holdings,

Inc. (“TEHI”). TEHI was originally incorporated in Nevada as Las

Vegas Major League Sports, Inc. (“LVMS”) on July 22, 1993 with the plan of

engaging in certain business activities associated with the Canadian Football

League. In April 1994, it completed an initial public offering and began trading

under the symbol LVTD. In 1996, LVMS filed for bankruptcy protection and ceased

being a reporting company and also ceased operations and was considered to be a

“shell” corporation. In 1998, LVMS changed its name to Pacific Medical Group,

Inc. (“Pacific Medical”) in connection with a share exchange transaction with a

privately-held company whose business plan was to engage in the manufacture and

sale of medical products. To our knowledge, that business was unsuccessful and,

again, the company ceased operations and was considered to be a “shell”

corporation. In February, 2005, Pacific Medical Group changed its name to Tandem

Energy Holdings, Inc. and changed its trading symbol to TDYH.PK. In June, 2005,

Old TEC became a wholly-owned subsidiary of TEHI.

The risks

and uncertainties that were involved in the acquisition of Old TEC include that

we may be deemed to be a successor to TEHI, Old TEC’s parent, and thus subject

to the existing liabilities, including undisclosed liabilities, of the prior

shell corporation arising out of its prior business operations, financial

activities and equity dealings. There is also a risk of litigation by

third parties or governmental investigations or proceedings. These risks and

uncertainties are generally greater when a corporation is used as a shell

vehicle more than once.

In

addition, TEHI was unable to locate corporate records and other material

agreements and documents relating to itself and its predecessors in name, LVTD

and Pacific Medical, for periods prior to mid-March 2005. As a

result, no assurance can be given that successor liability claims will

not be made that actions taken by TEHI or its predecessors in name were

without proper corporate authorization. Furthermore, no assurance can

be given that additional shares had not been issued by TEHI’s predecessors in

name and that therefore TEHI capitalization at the time of the acquisition was

accurate. TEHI has been informed of a claim of ownership of 2.7

million shares of TEHI common stock. These shares were not included

in the outstanding shares of TEHI at the time of the TEC acquisition and

are the subject of outstanding litigation against TEHI. Such claim

could result in a successor liability claim against us.

9

The

volatility of oil and natural gas prices due to factors beyond our control

greatly affects our profitability.

Our

revenues, operating results, profitability, future rate of growth and the

carrying value of our oil and natural gas properties depend primarily upon the

prevailing prices for oil and natural gas. Historically, oil and natural gas

prices have been volatile and are subject to fluctuations in response to changes

in supply and demand, market uncertainty and a variety of additional factors

that are beyond our control. Any significant decline in the price of oil and

natural gas or any other unfavorable market conditions could have a material

adverse effect on our operations, financial condition and level of expenditures

for the development of our oil and natural gas reserves, and may result in write

downs of our investments as a result of our use of the full cost accounting

method.

Prices

for natural gas and crude oil fluctuate widely. These fluctuations in oil and

natural gas prices may result from relatively minor changes in the supply of and

demand for oil and natural gas, market uncertainty and other factors that are

beyond our control, including:

|

|

·

|

Worldwide

and domestic supplies of oil and natural gas;

|

|

|

·

|

Weather

conditions;

|

|

|

·

|

The

level of consumer demand;

|

|

|

·

|

The

price and availability of alternative fuels;

|

|

|

·

|

The

availability of drilling rigs and completion equipment;

|

|

|

·

|

The

proximity to, and capacity of transportation

facilities;

|

|

|

·

|

The

price and level of foreign imports;

|

|

|

·

|

The

nature and extent of domestic and foreign governmental regulation and

taxation;

|

|

|

·

|

Worldwide

economic and political conditions;

|

|

|

·

|

The

effect of worldwide energy conservation measures;

|

|

|

·

|

Political

instability or armed conflicts in oil-producing regions;

and

|

|

|

·

|

The

overall economic environment.

|

These

factors and the volatility of the energy markets make it extremely difficult to

predict future oil and natural gas price movements with any certainty. Declines

in oil and natural gas prices would not only reduce revenue, but could reduce

the amount of oil and natural gas that we can produce economically and, as a

result, could have a material adverse effect on our financial condition, results

of operations and reserves.

Oil and natural gas prices

could decline to a point where it would be uneconomic for us to sell our oil and

gas at those prices, which could result in a decision to shut in production

until the prices increase.

Our oil

and natural gas properties will become uneconomic when oil and natural prices

decline to the point at which our revenues are insufficient to recover our

lifting costs. For example, in 2009, our average oil and gas lifting costs were

approximately $25.56 per Boe. A market price decline below our

lifting costs would result in our having to shut in certain production until

prices increase.

Hedging

activities may prevent us from benefiting from price increases and may expose us

to other risks.

Hedging

is a strategy that can help a company to mitigate the volatility of oil and gas

prices by limiting its losses if oil and gas prices decline; however, this

strategy may also limit the potential gains that a company could realize if oil

and gas prices increase. From time to time, we use derivative instruments

(primarily collars and price swaps) to hedge the impact of market fluctuations

on natural gas and crude oil prices and net income and cash flow. To the extent

that we engage in hedging activities, we may be prevented from realizing the

benefits of price increases above the levels of the hedges. Hedging activities

are subject to risks associated with differences in prices at different

locations, particularly where transportation constraints restrict a producer’s

ability to deliver oil and gas volumes to the delivery point to which the

hedging transaction is indexed. Additionally, hedging strategies are normally

more effective with companies with a certain volume of production, and our

current oil production levels may not be sufficient to be able to employ a

meaningful hedging strategy.

10

Our ability to

sell crude oil and natural gas production could be materially harmed by failure

to obtain adequate services such as transportation and

processing.

The sale

of crude oil and natural gas production depends on a number of factors beyond

our control, including the availability, proximity and capacity of pipelines,

natural gas gathering systems and processing facilities. Any significant change

in market factors affecting these infrastructure facilities or our failure to

obtain these services on acceptable terms could materially harm our business. We

deliver crude oil and natural gas through gathering systems and pipelines that

we do not own. These facilities may be temporarily unavailable due to market

conditions or mechanical reasons or may become unavailable in the

future.

Our

proved reserves will generally decline as reserves are produced and as such,

success will depend on acquiring or finding additional reserves.

Our

future success depends upon our ability to find, develop or acquire additional

oil and natural gas reserves that are economically recoverable. According to

reports of proved reserves prepared as of December 31, 2009 by Williamson

Petroleum Consultants Inc., independent petroleum consultants, and by our own

engineers, our proved reserves will decline at a significant rate as reserves

are produced and, except to the extent that we conduct successful exploration or

development activities or acquire properties containing proved reserves, or

both, such reserves will continue to decline. To increase reserves and

production, we must commence drilling, workover or acquisition activities. There

can be no assurance, however, that we will have sufficient resources to

undertake these actions, that our drilling and workover projects or other

replacement activities will result in significant additional reserves or that we

will have success drilling productive wells at low finding and development

costs. Furthermore, although our revenues may increase if prevailing oil and

natural gas prices increase significantly, our finding costs for additional

reserves may also increase.

Approximately

57% of our proved reserves are classified as proved

undeveloped.

Approximately

57% of our reserves are classified as proved undeveloped reserves. The future

development of these undeveloped reserves into proved developed reserves is

highly dependent upon our ability to fund estimated total capital development

cost of approximately $23.3 million, of which $4.0 million, $5.8 million and

$10.2 million are expected to be incurred in 2010, 2011 and 2012, respectively.

If such development costs are not incurred or are substantially reduced, our

proved undeveloped and total proved reserves could be substantially reduced. The

reduction in such reserves could have a materially negative impact on our

ability to produce profitable future operations. The successful conversion of

these proved undeveloped reserves into proved developed reserves is dependent

upon the following:

|

|

·

|

The

funding of the estimated proved undeveloped capital development costs is

highly dependent upon our ability to generate sufficient working capital

through operating cash flows, and our ability to borrow funds and/or raise

equity capital.

|

|

|

·

|

Our

ability to generate sufficient operating cash flows is highly dependent

upon successful and profitable future operations and cash flows which

could be negatively impacted by fluctuating oil and gas prices and

increased operating costs. No assurance can be given that we will have

successful and profitable future operations and positive future cash

flows.

|

|

|

·

|

Our

ability to borrow funds in the future is dependent upon the terms of

future loan agreements, borrowing base calculations and other lending and

operating conditions. No assurance can be given that we will be able to

secure future borrowings at competitive borrowing rates and conditions, if

at all.

|

|

|

·

|

Projections

for proved undeveloped reserves are largely based on their analogy to

similar producing properties and to volumetric calculations. Reserves

projections based on analogy are subject to change due to subsequent

changes in the analogous properties. Volumetric calculations are often

based upon limited log and/or core analysis data and incomplete reservoir

fluid and formation rock data. Since these limited data must frequently be

extrapolated over an assumed drainage area, subsequent production

performance trends or material balance calculations may cause the need for

significant revisions to the estimates of

reserves.

|

Estimates

of oil and natural gas depend on many assumptions that may vary substantially

from actual production.

There are

numerous uncertainties inherent in estimating quantities of proved reserves and

in projecting future rates of production and timing of expenditures, including

many factors beyond our control. The reserve information relating to proved

reserves set forth in this report represents only estimates based on reports of

proved reserves prepared as of December 31, 2009 by Williamson Petroleum

Consultants, independent petroleum engineers, and by our own engineers.

Williamson Petroleum Consultants was not engaged to evaluate and prepare reports

relating to the probable reserves on our properties and interests as these are

more uncertain than evaluations of proved reserves. Petroleum engineering is not

an exact science. Information relating to our proved oil and natural gas

reserves is based upon engineering estimates. Estimating quantities of proved

crude oil and natural gas reserves is a complex process. It requires

interpretations of available technical data and various assumptions, including

assumptions relating to economic factors. Any significant inaccuracies in these

interpretations or assumptions or changes of conditions could cause the

quantities of our reserves to be overstated.

11

To

prepare estimates of economically recoverable crude oil and natural gas reserves

and future net cash flows, engineers analyze many variable factors, such as

historical production from the area compared with production rates from other

producing areas. It is also necessary to analyze available geological,

geophysical, production and engineering data, and the extent, quality and

reliability of this data can vary. The process also involves economic

assumptions relating to commodity prices, production costs, severance and excise

taxes, capital expenditures and workover and remedial costs. For these reasons,

estimates of the economically recoverable quantities of oil and natural gas

attributable to any particular group of properties, classifications of such

reserves based on risk of recovery and estimates of the future net cash flows

expected there from prepared by different engineers or by the same engineers at

different times may vary substantially. Actual production, revenues and

expenditures with respect to our reserves will likely vary from estimates, and

such variations may be material.

Our

operations entail inherent casualty risks which may not be covered by adequate

insurance.

We must

continually acquire, explore and develop new oil and natural gas reserves to

replace those produced and sold. Our hydrocarbon reserves and revenues will

decline if we are not successful in our drilling, acquisition or exploration

activities. We hope to maintain our reserve base primarily through successful

exploration and production operations, but we may not be successful in this

regard. Casualty risks and other operating risks could cause reserves and

revenues to decline.

Although

many of our properties are located across Texas and southeast New Mexico and are

not confined to one geographic area, our Tomball field, the largest producer in

our current portfolio, and much of our Maverick business are located in the Gulf

Coast region of Texas, an area that may be subject to catastrophic weather and

natural disasters such as floods, earthquakes and hurricanes. If such disaster

were to occur, it could severely disrupt our operations in that area and results

of operations could be materially and adversely affected. Our

operations are subject to inherent casualty risks such as fires, blowouts,

cratering and explosions. Other risks include pollution, the uncontrollable

flows of oil, natural gas, brine or well fluids. These risks may result in

injury or loss of life, suspension of operations, environmental damage or

property and equipment damage, all of which would cause us to experience

substantial financial loss.

Our

drilling operations involve risks from high pressures and from mechanical

difficulties such as stuck pipes, collapsed casings and separated cables. In

accordance with customary industry practice, we maintain insurance against some,

but not all, of these risks. There can be no assurance that any insurance will

be adequate to cover any losses or liabilities. We cannot predict the continued

availability of insurance, or its availability at premium levels that justify

its purchase. In addition, we may be liable for environmental damages caused by

previous owners of properties that we purchased, which liabilities would not be

covered by our insurance. We are currently unaware of any material liability we

may have for environmental damages caused by previous owners of properties

purchased by us.

Many

of our wells produce at very low production rates while producing waste water

many times that rate.

Many of

our wells produce at production rates as low as one Boe per day and produce

waste water at many times the rate of production. Even a modest decrease in oil

and gas prices may render these wells uneconomic to produce, when compared to

wells which produce at higher rates. Consequently, these uneconomic wells could

cause a downward revision in our oil and gas reserves.

Our

operations also entail significant operating risks.

Our

drilling activities involve risks, such as drilling non-productive wells or dry

holes, which are beyond our control. The cost of drilling and operating wells

and of installing production facilities and pipelines is uncertain. Cost

overruns are common risks that often make a project uneconomical. The decision

to purchase and to exploit a property depends on the evaluations made by reserve

engineers, the results of which are often inconclusive or subject to multiple

interpretations. We may also decide to reduce or cease its drilling operations

due to title problems, weather conditions, noncompliance with governmental

requirements or shortages and delays in the delivery or availability of

equipment or fabrication yards.

12

Our

operations are subject to various governmental regulations that require

compliance that can be burdensome and expensive.

Our oil

and natural gas operations are subject to extensive federal, state and local

governmental regulations that may be changed from time to time in response to

economic and political conditions. Matters subject to regulation relate to the

general population’s health and safety and are associated with compliance and

permitting obligations including regulations related to discharge from drilling

operations, use, storage, handling, emission and disposal, drilling bonds,

reports concerning operations, the spacing of wells, unitization and pooling of

properties and taxation. From time to time, regulatory agencies have imposed

price controls and limitations on production by restricting the rate of flow of

oil and natural gas wells below actual production capacity to conserve supplies

of oil and natural gas. In addition, the production, handling, storage,

transportation and disposal of oil and natural gas, by-products thereof and

other substances and materials produced or used in connection with oil and

natural gas operations are subject to regulation under federal, state and local

laws and regulations primarily relating to protection of human health and the

environment. These laws and regulations have continually imposed increasingly

strict requirements for water and air pollution control and solid waste

management, and compliance with these laws may cause delays in the additional

drilling and development of our properties. Significant expenditures may be

required to comply with governmental laws and regulations applicable to us. We

believe the trend of more expansive and stricter environmental legislation and

regulations will continue. While, historically, we have not experienced any

material adverse effect from regulatory delays, there can be no assurance that

such delays will not occur for us in the future.

Price

declines have resulted in and may in the future result in write-downs of our

asset carrying values.

Commodity

prices have a significant impact on the present value of our proved

reserves. Recent declines in oil and gas prices have resulted in

material downward revisions in the estimated present value of our proved

reserves. Accounting rules require us to write down, as a non-cash

charge to earnings, the carrying value of our oil and gas properties for

impairments. We are required to perform impairment tests on our

assets periodically and whenever events or changes in circumstances warrant a

review of our assets. To the extent such tests indicate a reduction

of the estimated useful life or estimated future cash flows of our assets, the

carrying value may not be recoverable and therefore requires a

write-down. We recorded impairments of property and equipment

totaling $16.6 million in 2009 and we may incur impairment charges in the

future, which could have a material adverse effect on our results of operations

in the period incurred.

Our method of

accounting for investments in oil and natural gas properties may result in

impairment of asset value, which could affect our stockholder equity and net

profit or loss.

We follow

the full cost method of accounting for our crude oil and natural gas properties.

Under this method, all direct costs and certain directly related internal costs

associated with acquisition of properties and successful, as well as

unsuccessful, exploration and development activities are capitalized.

Depreciation, depletion and amortization of capitalized crude oil and natural

gas properties and estimated future development costs, excluding unproved

properties, are based on the unit-of-production method based on proved reserves.

Net capitalized costs of crude and natural gas properties, as adjusted for asset

retirement obligations, net of salvage value, are limited, by country, to the

lower of unamortized cost or the cost ceiling, defined as the sum of the present

value of estimated future net revenues from proved reserves based on unescalated

average prices for the preceding 12 months, discounted at 10%, plus the cost of

properties not being amortized, if any, plus the lower of cost or estimated fair

value of unproved properties included in the costs being amortized, if any, less

related income taxes. Excess costs are charged to proved property impairment

expense. No gain or loss is recognized upon sale or disposition of crude oil and

natural gas properties, except in unusual circumstances.

Properties

that we acquire may not produce as projected, and we may be unable to identify

liabilities associated with the properties or obtain protection from sellers

against them.

As part

of our business strategy, we continually seek acquisitions of oil and gas

properties. The successful acquisition of oil and natural gas properties

requires assessment of many factors, which are inherently inexact and may be

inaccurate, including the following:

|

|

·

|

future

oil and natural gas prices;

|

|

|

·

|

the

amount of recoverable reserves;

|

|

|

·

|

future

operating costs;

|

|

|

·

|

future

development costs;

|

|

|

·

|

failure

of titles to properties;

|

|

|

·

|

costs

and timing of plugging and abandoning wells;

and

|

|

|

·

|

potential

environmental and other

liabilities.

|

Our

assessment will not necessarily reveal all existing or potential problems, nor

will it permit us to become familiar enough with the properties to assess fully

their capabilities and deficiencies. With respect to properties on which there

is current production, we may not inspect every well location, every potential

well location, or pipeline in the course of our due diligence. Inspections may

not reveal structural and environmental problems such as pipeline corrosion or

groundwater contamination. We may not be able to obtain or recover on

contractual indemnities from the seller for liabilities that it created. We may

be required to assume the risk of the physical condition of the properties in

addition to the risk that the properties may not perform in accordance with our

expectations.

13

Oil

and gas drilling and producing operations can be hazardous and may expose us to

environmental liabilities.

Our oil

and gas operations will subject us to many risks, including well blowouts,

cratering and explosions, pipe failure, fires, formations with abnormal

pressures, uncontrollable flows of oil, natural gas, brine or well fluids, and

other environmental hazards and risks. If any of these risks occur, we could

sustain substantial losses as a result of:

|

|

·

|

injury

or loss of life;

|

|

|

·

|

severe

damage to or destruction of property, natural resources and

equipment;

|

|

|

·

|

pollution

or other environmental damage;

|

|

|

·

|

clean-up

responsibilities;

|

|

|

·

|

regulatory

investigations and penalties; and

|

|

|

·

|

Suspension

of operations.

|

Our

liability for environmental hazards could include those created either by the

previous owners of properties that we purchase or lease or by acquired companies

prior to the date we acquire them. We expect to maintain insurance against some,

but not all, of the risks described above. Our insurance may not be adequate to

cover casualty losses or liabilities. Also, we may not be able to obtain

insurance at premium levels that justify its purchase.

Terrorist

activities and military and other actions could adversely affect our

business.

Terrorist

attacks and the threat of terrorist attacks, whether domestic or foreign, as

well as the military or other actions taken in response to these acts, cause

instability in the global financial and energy markets. The United States

government has issued public warnings that indicate that energy assets might be

specific targets of terrorist organizations. These actions could adversely

affect us, in unpredictable ways, including the disruption of fuel supplies and

markets, increased volatility in crude oil and natural gas prices, or the

possibility that the infrastructure on which we rely could be a direct target or

an indirect casualty of an act of terror.

Maverick,

our wholly owned subsidiary, is dependent upon a small number of customers for a

large portion of its net revenues, and a decline in sales to its major customers

could harm Maverick's results of operations.

During

2009 and 2008, Maverick’s six largest customers, accounted for approximately 68%

and 71%, respectively, of net revenues attributable to the engineering division

excluding intercompany revenues. Maverick's customer concentration

could increase or decrease depending on future customer requirements, which will

depend in large part on business conditions in the market sectors in which

Maverick's customers participate. The loss of one or more major customers or a

decline in sales to Maverick’s major customers could significantly harm

Maverick's business and results of operations. If Maverick is not able to expand

its customer base, it will continue to depend upon a small number of customers

for a significant percentage of its sales. There can be no assurance that its

current customers will not reduce the amount of services for which Maverick is

retained or otherwise terminate their relationship with Maverick.

Risk

of Going Concern

The

Company has a going concern risk, since its inception the Company has incurred

cumulative losses of $111,276,255 through December 31, 2009. The Company’s line

of credit, with Bank of Texas, matured on June 1, 2010. Through June 30, 2010,

there have been no notices of foreclosures on the Company’s assets that secure

the debt, however the company does not currently have sufficient liquid assets

pay the balance of the Senior Credit Facility. See Note 2 to the financial

statements for a further discussion.

Item 1B. Unresolved Staff

Comments.

Not

applicable.

Item 2. Properties.

Platinum’s

principal executive offices are located at 11490 Westheimer Road, Suite 1000,

Houston, Texas 77077. We also maintain division offices in

Victoria, Corpus Christi and Yoakum, Texas.

Current

Oil and Gas Activities

We own

core producing and non-producing oil and natural gas properties in Texas and New

Mexico. The following is a summary of our major operating

areas.

14

Tomball Field. We own an

interest in, and are operator of, oil and natural gas properties in the Tomball

Field, which is located in Harris County, Texas, and is approximately 30 miles

northwest of Houston, Texas. The Tomball Field contains multiple productive

formations ranging in depth from 1,000 to 9,000 feet, including the Yegua,

Cockfield, and Wilcox. Current operations consist of 19 producing wells and 6

water disposal wells. At December 31, 2009, we held 7,000 acres and had an

inventory of 3 proved undeveloped locations in the Tomball Field. We own a 100%

working interest and net revenue interests ranging from 84.5% to 87.5%. TEC

began operating the Tomball field in 1996, but it has been producing

continuously since 1930. The current daily net production from the field is

approximately 251.6 Bbls of oil and 723.2 Mcf of gas per day. The field is also

producing approximately 16,000 Bbls of water per day.

Ira Field. We own an interest

in, and are operator of, an oil production unit in the Ira Field, which is

located in Scurry County, Texas, and is approximately 75 miles northeast of

Midland, Texas. The Ira Field production is from the San Andres formation at

approximately 1,800 feet. Current operations consist of 150 producing wells and

75 water injection wells. At December 31, 2009, we held 3,600 acres and had an

inventory of 76 proved undeveloped locations in the Ira Field. We own an 88%

working interest and 72% net revenue interest. TEC, through it predecessor in

interest, began operating the IRA Field in 2004, but the IRA Field has been

producing continuously since 1955. The current daily net production from the

field is approximately 105.3 Bbls of oil per day. The field is also producing

approximately 4,000 Bbls of water per day.

Ball Field. We own an

interest in, and are operator of, oil and natural gas properties in the Ball

Field, which is located in Palo Pinto County, Texas, and is approximately 75

miles west of Fort Worth, Texas. The Ball Field contains multiple productive

formations ranging in depth from 3,000 to 3,800 feet, including the Big Saline,

Duffer, and Barnett Shale. Current operations consist of 17 producing wells and

1 water disposal well. At December 31, 2009, we held 4,900 acres and had an

inventory of 17 proved undeveloped locations in the Ball Field. We own working

interests ranging from 50% to 100%, and net revenue interests ranging from 40.3%

to 87.5%. TEC began operating the Ball Field in 1993, but it has been producing

continuously since 1930. The current daily net production from the field is

approximately 416 Mcf of gas per day. The field is also producing approximately

495 Bbls of water per day. On December 28, 2007 we acquired an additional

50% working interest in the Barnett Shale acreage for approximately $920,000.

This acquisition increased our net acreage position by 2,300 net acres and gave

us a 100% working interest in the Barnett. We have completed a 3 D seismic

program and plan to begin a horizontal drilling program in the Barnett as soon

as the economic climate improves.

Ballard Field. We own an

interest in, and are operator of, an oil production unit in the Ballard Field,

which is located in Eddy County, New Mexico, and is approximately 150 miles

northwest of Midland, Texas. The Ballard Field contains multiple productive

formations ranging in depth from 2,000 to 3,000 feet, including the Yates,

Grayburg, and San Andres. Current operations consist of 46 producing wells and

26 water injection wells. During 2008 we drilled and completed 6 proved

undeveloped locations. All 6 wells are currently

producing. At December 31, 2009, we held approximately 3,000 net

acres. We own an 86% working interest and 78.7% net revenue interest. TEC,

through its predecessor in interest, began operating the Ballard Field in 2004,

but it has been producing continuously since 1965. The current daily net

production from the field is approximately 86.9 Bbls of oil and 44.6 Mcf of gas

per day. The field is also producing approximately 1,300 Bbls of water per

day.

USM Field. We own an interest

in, and are operator of, oil and natural gas properties in the USM Field, which

is located in Pecos County, Texas, and is approximately 120 miles southwest of

Midland, Texas. The USM Field production is from the Yates and Queen formations

at approximately 3,200 feet. Current operations consist of 54 producing wells

and 4 water disposal wells. During 2008 we drilled and completed 4 proved

undeveloped locations. All 4 wells are currently

producing. At December 31, 2009, we held approximately 3,000 net

acres in the field. We own working interests ranging from 90% to 100%, and net

revenue interests ranging from 79.3% to 89.6%. TEC, through its predecessor in

interest, began operating the USM Field in 2004, but it has been producing

continuously since 1985. The current daily net production from the field is

approximately 44.9 Bbls of oil and 106.4 Mcf of gas per day. The

field is also producing approximately 80 Bbls of water per day.

Choate Field. We own an

interest in, and are operator of, oil and natural gas properties in the Choate

Field, which is located in Hardin County, Texas, and is approximately 35 miles

northwest of Beaumont, Texas. The Choate Field production is from sand lenses

flanking a salt dome ranging in depth from 1,000 to 2,500 feet. Current

operations consist of 23 producing wells. During 2008, we drilled 11 proved

undeveloped locations, 9 of which were successful and are currently

producing. At December 31, 2009, we held 50 acres and had an

inventory of 6 proved undeveloped locations in the Choate Field. We own a 75%

working interest and 57% net revenue interest. TEC, through its predecessor in

interest, began operating the Choate Field in 2004, but it has been producing

continuously since 1960. The current daily net production from the field is

approximately 71.1 Bbls of oil per day. The field is also producing

approximately 200 Bbls of water per day.

Lothian Properties. In

December 2007 we purchased, for $6.2 million plus customary closing adjustments,

approximately 200 producing wells from Lothian Oil and Gas, Inc. The Lothian

assets acquired consist of oil and gas properties located in Chavez, Lea and

Eddy counties, New Mexico and are adjacent to or near our Ballard Field. The

current net production is approximately 80.7 Bbls of oil and 89.0 Mcf of gas per

day. The field is also producing approximately 23 Bbls of water per

day.

Other. We own numerous small

mineral, royalty and non-operated working interests in various oil and natural

gas properties located in Texas, New Mexico, Louisiana, Montana, and North

Dakota.

15

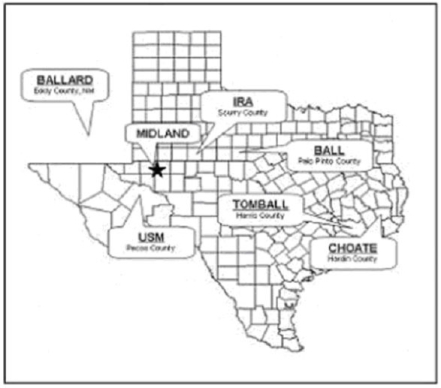

Below is

a map indicating the locations of the Company’s significant operated properties

in Texas and New Mexico.

Natural

Gas and Oil Data

In January 2009 the SEC issued Release

No. 33-8995, “Modernization of Oil and Gas Reporting” (Release 33-8995),

amending oil and gas reporting requirements under Rule 4-10 of

Regulation S-X and Industry Guide 2 in Regulation S-K and bringing

full-cost accounting rules into alignment with the revised disclosure

requirements. The new rules revised certain definitions and terms,

including the definition of proved reserves, which was revised to indicate that

entities must use the unweighted arithmetic average of the

first-day-of-the-month commodity price over the preceding 12-month period,

rather than the end-of-period price, when estimating whether reserve quantities

are economical to produce. Likewise, the 12-month average price is

used to calculate cost center ceilings for impairment and to compute

depreciation, depletion, and amortization. Another significant

provision of the new rules is a general requirement that, subject to limited

exceptions, proved undeveloped reserves may only be booked if they relate to

wells scheduled to be drilled within five years of booking.

In

January 2010 the Financial Accounting Standards Board (FASB) issued Accounting

Standards Update (ASU) No. 2010-03, “Oil and Gas Reserve

Estimation and Disclosures” (ASU 2010-03), which amends Accounting Standards

Codification (ASC) Topic 932, “Extractive Industries — Oil and Gas” to

align the guidance with the changes made by the SEC. The Company adopted Release

33-8995 and the amendments to ASC Topic 932 resulting from ASU 2010-03

(collectively, the Modernization Rules) effective December 31,

2009.

Estimated

Proved Reserves and Future Net Cash Flows

Proved

oil and gas reserves are the estimated quantities of natural gas, crude oil, and

condensate that geological and engineering data demonstrate with reasonable

certainty to be recoverable in future years from known reservoirs under existing

conditions, operating conditions, and government regulations. Reserve estimates

are considered proved if they are economically producible and are supported by

either actual production or conclusive formation tests. Estimated reserves that

can be produced economically through application of improved recovery techniques

are included in the “proved” classification when successful testing by a pilot

project or the operation of an active, improved recovery program using reliable

technology establishes the reasonable certainty for the engineering analysis on

which the project or program is based. Economically producible means a resource

which generates revenue that exceeds, or is reasonably expected to exceed, the

costs of the operation. Reasonable certainty means a high degree of confidence

that the quantities will be recovered. Reliable technology is a grouping of one

or more technologies (including computational methods) that has been

field-tested and has been demonstrated to provide reasonably certain results

with consistency and repeatability in the formation being evaluated or in an

analogous formation. Estimated proved developed oil and gas reserves can be

expected to be recovered through existing wells with existing equipment and

operating methods.

16

Proved

undeveloped (PUD) reserves include those reserves that are expected to be

recovered from new wells on undrilled acreage, or from existing wells where a

relatively major expenditure is required for recompletion. Undeveloped reserves

may be classified as proved reserves on undrilled acreage directly offsetting

development areas that are reasonably certain of production when drilled, or

where reliable technology provides reasonable certainty of economic

productivity. Undrilled locations may be classified as having undeveloped

reserves only if a development plan has been adopted indicating that they are

scheduled to be drilled within five years, unless specific circumstances justify

a longer time period.

Qualifications

of Technical Persons and Internal Controls over Reserves Estimation

Process

Our

proved reserve information as of December 31, 2009, included in this Annual

Report was estimated by our independent petroleum engineers, Williamson

Petroleum Consultants, Inc., in accordance with generally accepted petroleum

engineering and evaluation principles and definitions and guidelines established

by the SEC. The technical persons responsible

for preparing the reserve estimates presented herein meet the

requirements qualifications, independence, objectivity, and confidentiality set

forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas

Reserves Information promulgated by the Society of Petroleum

Engineers.

We

maintain an internal staff of petroleum engineers who work closely with our

independent petroleum engineers to ensure the integrity, accuracy and timeliness

furnished to Williamson Petroleum Consultants, Inc. in their reserves estimation

process. In the fourth quarter, our technical team met on a regular

basis with representatives of Williamson Petroleum Consultants, Inc. to review