Attached files

| file | filename |

|---|---|

| 8-K - OGE ENERGY CORP. 8-K - OGE ENERGY CORP. | oge8k070110.htm |

Exhibit 99.01

BEFORE THE

CORPORATION COMMISSION OF OKLAHOMA

IN THE MATTER OF THE APPLICATION OF )

OKLAHOMA GAS AND ELECTRIC COMPANY )

FOR AN ORDER GRANTING PRE-APPROVAL )

TO CONSTRUCT THE CROSSROADS WIND ) CAUSE NO. PUD 201000037

FARM, AND AUTHORIZING A RECOVERY )

RIDER )

JOINT STIPULATION AND SETTLEMENT AGREEMENT

June 28, 2010

I. Introduction

The undersigned parties believe it is in the public interest to effectuate a settlement of the issues in Cause No. PUD 201000037.

Therefore, now the undersigned parties to the above entitled cause present the following Joint Stipulation and Settlement Agreement (“Joint Stipulation”) for the Oklahoma Corporation Commission’s (“Commission”) review and approval as a compromise and settlement of all issues in this proceeding between the parties to this Joint Stipulation (“Stipulating Parties”). The Stipulating Parties represent to the Commission that the Joint Stipulation represents a fair, just, and reasonable settlement of these issues, that the terms and conditions of the Joint Stipulation are in the public interest, and the Stipulating Parties urge the Commission to issue an Order in this Cause adopting this Joint Stipulation.

The Stipulating Parties agree that the Commission has jurisdiction with respect to the issues presented in this proceeding by virtue of Article IX, §18 et seq. of the Oklahoma Constitution, 17 O.S. §152 and 17 O.S. §286(C).

It is hereby stipulated and agreed by and between the Stipulating Parties as follows:

II. Stipulated Facts

A. On April 8, 2010, Oklahoma Gas and Electric Company (“OG&E” or the “Company”) filed an application requesting that the Commission issue an order (i) determining that the costs to OG&E for the construction of the new Crossroads Wind Farm (“Crossroads”) and related facilities are prudent, and that the Crossroads facility will be used and useful when placed in service; (ii) authorizing OG&E to implement a recovery rider to be effective until Crossroads is placed in rate base by order of the Commission; and (iii) approving a waiver from the Commission’s competitive bidding rules (“Application”).

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 2 of 8

B. Crossroads is an 86-turbine, 197.8 MW wind-powered electric generation facility located in Dewey County, Oklahoma. The Crossroads facility is expected to come on-line during the second half of 2011. Crossroads will interconnect to OG&E’s new 345 kV Woodward to Oklahoma City transmission line (“Windspeed”). The Crossroads facilities will utilize Siemens Energy SWT-2.3-101 wind turbine generators each with a nameplate rating of 2.3 MW. Each turbine will have a 101-meter rotor diameter and will be supported by an 80-meter tower (262 feet). A separate interconnection request has been made with the Southwest Power Pool (“SPP”) for an incremental 29.7 MW. With these additional 29.7 MW, the Crossroads facility would be 227.5 MW.

III. Settlement Agreement

A. The Stipulating Parties request that the Commission issue an order granting pre-approval of Crossroads and finding that Crossroads is a prudent investment. The Stipulating Parties also request that the Commission issue an order finding that Crossroads, when constructed, placed in service and interconnected to Windspeed, will be used and useful to OG&E’s customers, subject to material compliance with expected operations. The Stipulating Parties agree that the operational performance of Crossroads shall be reviewed pursuant to OAC 165:35-39 and OAC 165:35-35.

B. The Stipulating Parties also request that the Commission authorize the recovery of costs associated with Crossroads through a recovery rider (“Crossroads Rider,” which is attached hereto as Stipulation Exhibit BJS-1, and which includes illustrations of the revenue requirement calculations) that will become effective upon the issuance of the final order approving this Joint Stipulation and the submission to and approval of the Crossroads Rider tariff by the Director of the Public Utility Division. The Crossroads Rider will be effective until new rates are implemented after OG&E’s 2013 general rate case. In that 2013 general rate proceeding, the net depreciated balance of Crossroads’ plant costs will be included in rate base. The Stipulating Parties further agree that the rate of return utilized for the Crossroads Rider will initially be calculated using the capital structure, return on equity, interest costs and tax effect as approved in Order No. 516261 in Cause No. PUD 200500151. This rate of return will be adjusted to reflect the rate of return approved by the Commission in OG&E’s 2011 rate case; and the new rate of return will be applied on the effective date of the rates approved in the 2011 rate case.

C. The Stipulating Parties request that the Commission grant OG&E’s request for a waiver from the Commission’s competitive bidding requirements. This waiver is based on: (i) OG&E’s representations that the Crossroads project will deliver significantly greater benefit to customers than other top bidders in its most recent RFP and other wind resource opportunities available to OG&E at this time, and that the opportunity to realize these benefits may be lost if action is not taken at this time; and (ii) the agreements described in this Joint Stipulation.

D. Except as otherwise provided in Paragraph O, the Stipulating Parties agree that OG&E’s projected capital cost for the Crossroads project is $389 million, based in part on a Danish Krone/U.S. Dollar exchange rate of 6.00 and the projected capital cost is subject to an

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 3 of 8

adjustment at the closing of OG&E’s Turbine Supply Agreement with Siemens. The Stipulating Parties further agree that OG&E’s capital costs for which it is entitled recovery (“Capped Investment Amount”) shall not exceed the lesser of: 1) an amount equal to: (i) $389 million as adjusted for the Krone/Dollar exchange rate at 9:00 am central time on the date a Commission Order is issued in this cause according to the Yahoo Finance website; plus (ii) a variance which does not exceed three (3) percent of the amount calculated pursuant to (i); or 2) the Maximum Stipulated Cost as described in Paragraph E.

E. The Stipulating Parties further agree that the Capped Investment Amount described in Paragraph D represents an investment that is fair, just and reasonable and in the public interest and is deemed prudent and will be included in the revenue requirement in OG&E’s planned 2013 general rate case. To the extent OG&E’s total investment in Crossroads exceeds the Capped Investment Amount, OG&E shall be entitled to offer evidence and seek to establish that the excess above the Capped Investment Amount was prudently incurred and should be included in OG&E’s rate base. Any construction costs incurred by OG&E in excess of the Capped Investment Amount shall not include interim carrying costs on the Plant in Service and will not be eligible for cost recovery until OG&E’s next general rate case. The Stipulating Parties further agree that neither this Joint Stipulation nor any of the provisions hereof shall become effective in the event the Capped Investment Amount is more than $416.2 million (“Maximum Stipulated Cost”) on the date of a final Commission order approving this Joint Stipulation.

F. The Stipulating Parties agree that OG&E shall pass through to Oklahoma retail customers 100 percent of the Oklahoma jurisdictional Renewable Energy Credits (“RECs”) proceeds (after deduction of third-party transaction costs if applicable) generated by Crossroads RECs during the term of and through the Crossroads Rider. The REC proceeds will be allocated to jurisdictions and customer classes using an energy allocator.

G. The Stipulating Parties agree that OG&E shall file an application with the Commission within sixty (60) days of a final Commission order in this proceeding requesting amendments to the current Minimum Filing Requirements (OAC 165:35-39) for the purpose of providing additional information regarding electric utility wind generation facilities and wind energy purchase power agreements. This additional information shall include, but not be limited to, the amount of production tax credits utilized in the reporting year. The Stipulating Parties agree to collaborate in developing the requested amendments. OG&E agrees to provide the additional information simultaneously with the filing of its Minimum Filing Requirements until such time as the proposed amendments are adopted or rejected by the Commission.

H. The Stipulating Parties agree that OG&E’s Oklahoma retail customers shall be credited with one hundred (100) percent of the Oklahoma jurisdictional share of the actual Crossroads production tax credits (“PTCs”) created during the term of, and as specified in, the Crossroads Rider. Likewise, at the end of the Crossroads Rider and for the remaining life of the Crossroads project PTCs, OG&E will continue to credit its Oklahoma retail customers with one hundred (100) percent of the Oklahoma jurisdictional share of the actual test year benefits of the

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 4 of 8

PTCs (as adjusted for known and measurable changes) in the determination of the revenue requirement in each general rate proceeding.

I. The Stipulating Parties further agree that OG&E will pass through to Oklahoma retail customers the Oklahoma jurisdictional share of all net damage payments received from the wind developer or the turbine manufacturer. The Stipulating Parties further understand that, under the terms of the contracts with these entities, this damage payment amount will not exceed $85 million. The Stipulating Parties further agree that, in light of the benefits to customers associated with higher achieved Crossroads output and the early completion of the Crossroads project, OG&E will pass through to Oklahoma customers the Oklahoma jurisdictional share of all bonuses paid to the wind developer or the turbine manufacturer pursuant to contract. The Stipulating Parties further understand that, under the terms of the contracts with these entities, this bonus amount will not exceed $3.2 million.

J. The Stipulating Parties agree that, to the extent that Crossroads makes additional amounts of OG&E’s coal or natural gas-fired generation capacity or energy available for sale in the SPP’s Energy Imbalance Service (“EIS”) market, all revenues associated with these increased EIS market sales will continue to be credited to OG&E’s retail customers.

K. Except as otherwise provided in Paragraph O, the Stipulating Parties further agree that, if the three-year rolling average of Crossroads megawatt-hours of production (including a credit for energy not produced due to curtailments or other events caused by system emergencies, force majeure events, or transmission system issues) falls below 712,844 MWhs, OG&E shall file testimony demonstrating the prudent operation of Crossroads when it files its Minimum Filing Requirements pursuant to OAC 165:35-39.

L. The Stipulating Parties agree that Crossroads’ O&M expense will be capped at the amounts contained in Stipulation Exhibit BJS-2 until rates are implemented after the next general rate case.

M. The Stipulating Parties agree that on or before May 1, 2011, OG&E will submit an interim, updated Integrated Resource Plan (“IRP”) as contemplated by Subsection 37 of Chapter 35 of the Commission’s Rules, provided that:

1) The updated IRP analysis will specifically address the need and timing for additional wind resources in OG&E’s system, including but not limited to various amounts of wind and timing of additional wind including assessments of the benefits based on consideration of the operation of the SPP day-ahead market, transmission limitations/requirements for expanded wind resource development, the added costs for fossil fuel-fired power plants when those fossil fuel plants are used to accommodate variable wind generation, current expectation of the impacts of regional haze rules on OG&E’s coal generation, and a range of scenarios for natural gas prices and climate legislation and other factors which may impact the amounts and timing of wind resource additions over the next ten (10) years.

2) No less than sixty (60) days prior to the filing of the updated integrated resource

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 5 of 8

plan, the Stipulating Parties further agree that OG&E will hold a collaborative technical conference for all stakeholders in order to allow all stakeholders the opportunity to provide input regarding utility objectives, assumptions, and planning scenarios to be contained in the updated IRP analysis.

The Stipulating Parties agree that OG&E shall pay for and be able to recover costs associated with third party consultants needed by the Attorney General and/or the Commission Staff to participate in the stakeholder technical conference. This Paragraph M is not an admission by the Stipulating Parties that OG&E has a need for additional wind resources nor is it intended to relieve OG&E of its burden of proof to demonstrate that any agreements it enters into to acquire wind energy assets or to purchase wind energy are reasonable or prudent.

N. The Stipulating Parties agree that, except as otherwise provided herein, OG&E will not seek Commission preapproval for the construction or acquisition of any new wind generation asset or for a long term wind purchase power agreement until it finalizes and submits a new IRP described in Paragraph M; provided that this restriction does not apply to preapproval of the Crossroads expansion identified in Paragraph O or the procurement of the Company’s next incremental amount of wind energy (at least 100 MW and no more than 150 MW), which shall be awarded through a competitive procurement process. If OG&E conducts such a competitive procurement process before completion of the IRP specified in Paragraph M, OG&E will include in its preapproval application the analysis specified in Paragraph M.1 above. The Stipulating Parties further agree that, for the purposes of such wind energy competitive procurement process, the Independent Evaluator selected to participate in the process shall be either: a) a Commission staff member or a third party agreed to by OG&E, the Attorney General and Public Utility Division staff; or b) if OG&E, the Attorney General and the Commission Staff cannot agree to an Independent Evaluator pursuant to (a), a Commission Staff member or third party appointed by the Commission after notice and hearing. This Paragraph N is not an admission by the Stipulating Parties that OG&E has a need for additional wind resources nor is it intended to relieve OG&E of its burden of proof to demonstrate that any agreements it enters into to acquire wind energy assets or to purchase wind energy are reasonable or prudent.

O. The Stipulating Parties recognize that OG&E has the opportunity to expand Crossroads by an additional 29.7 MW (twelve (12) additional turbines including nine (9) 2.3 MW wind turbines and three (3) 3 MW turbines). The Stipulating Parties agree that, subject to the conditions set forth in this Paragraph O, this incremental quantity of wind generation capacity would be beneficial to OG&E customers. Therefore, the Stipulating Parties agree that if the pending SPP interconnection study concludes on or before September 1, 2010, that these additional turbines can be interconnected at incremental costs below $4.7 million as confirmed by the Attorney General and the Commission Staff, OG&E’s decision to proceed with the construction of these additional twelve (12) turbines shall be prudent, the turbines will be used and useful when placed in service, and the costs and associated recovery for these additional turbines shall be included in the Crossroads Rider. In such a case, the Capped Investment Amount shall not exceed the lesser of: 1) an amount equal to: (i) $448.8 million as adjusted for the Krone/Dollar exchange rate at 9:00 am central time on the date a Commission Order is issued in this cause according to the Yahoo Finance website; plus (ii) a variance which does not exceed three (3) percent of the amount calculated pursuant to (i); or 2) the Alternative Maximum

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 6 of 8

Stipulated Cost as described below. The Stipulating Parties further agree that neither this Joint Stipulation nor any of the provisions hereof shall become effective in the event the Capped Investment Amount is more than $480.2 million (“Alternative Maximum Stipulated Cost”) on the date of a final Commission order approving this Joint Stipulation. If OG&E constructs these additional turbines, the three-year rolling average of Crossroads’ megawatt-hours of production (for purposes of Paragraph K above) will be 819,879 MWhs.

IV. General Reservations.

The Stipulating Parties represent and agree that, except as specifically provided:

A. Negotiated Settlement. This Joint Stipulation represents a negotiated settlement for the purpose of compromising and resolving the issues presented in this Cause.

B. Authority to Execute. Each of the undersigned counsel of record affirmatively represents to the Commission that he or she has fully advised his or her respective clients(s) that the execution of this Joint Stipulation constitutes a resolution of issues which were raised in this proceeding; that no promise, inducement or agreement not herein expressed has been made to any Stipulating Party; that this Joint Stipulation constitutes the entire agreement between and among the Stipulating Parties; and each of the undersigned counsel of record affirmatively represents that he or she has full authority to execute this Joint Stipulation on behalf of his or her client(s).

C. Balance/Compromise of Positions. The Stipulating Parties stipulate and agree that the agreements contained in this Joint Stipulation have resulted from negotiations among the Stipulating Parties. The Stipulating Parties hereto specifically state and recognize that this Joint Stipulation represents a balancing of positions of each of the Stipulating Parties in consideration for the agreements and commitments made by the other Stipulating Parties in connection therewith. Therefore, in the event that the Commission does not approve and adopt all of the terms of this Joint Stipulation, this Joint Stipulation shall be void and of no force and effect, and no Stipulating Party shall be bound by the agreements or provisions contained herein. The Stipulating Parties agree that neither this Joint Stipulation nor any of the provisions hereof shall become effective unless and until the Commission shall have entered an Order approving all of the terms and provisions as agreed to by the parties to this Joint Stipulation.

D. Admissions and Waivers. The Stipulating Parties agree and represent that the provisions of this Joint Stipulation are intended to relate only to the specific matters referred to herein, and by agreeing to this settlement, no Stipulating Party waives any claim or right which it may otherwise have with respect to any matters not expressly provided for herein. In addition, none of the signatories hereto shall be deemed to have approved or acquiesced in any ratemaking principle, valuation method, cost of service determination, depreciation principle or cost allocation method underlying or allegedly underlying any of the information submitted by the parties to this Cause and except as specifically provided in this Joint Stipulation, nothing contained herein shall constitute an admission by any Stipulating Party that any allegation or contention in this proceeding is true or valid or shall constitute a determination by the

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 7 of 8

Commission as to the merits of any allegations or contentions made in this proceeding.

E. No Precedential Value. The Stipulating Parties agree that the provisions of this Joint Stipulation are the result of negotiations based upon the unique circumstances currently represented by the Applicant and that the processing of this Cause sets no precedent for any future causes that the Applicant or others may file with this Commission. The Stipulating Parties further agree and represent that neither this Joint Stipulation nor any Commission order approving the same shall constitute or be cited as precedent or deemed an admission by any Stipulating Party in any other proceeding except as necessary to enforce its terms before the Commission or any court of competent jurisdiction. The Commission’s decision, if it enters an order approving this Joint Stipulation, will be binding as to the matters decided regarding the issues described in this Joint Stipulation, but the decision will not be binding with respect to similar issues that might arise in other proceedings. A Stipulating Party’s support of this Joint Stipulation may differ from its position or testimony in other causes. To the extent there is a difference, the Stipulating Parties are not waiving their positions in other causes. Because this is a stipulated agreement, the Stipulating Parties are under no obligation to take the same position as set out in this Joint Stipulation in other dockets.

F. Discovery. As between and among the Stipulating Parties, any pending requests for information or discovery and any motions that may be pending before the Commission are hereby withdrawn.

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 8 of 8

WHEREFORE, the Stipulating Parties hereby submit this Joint Stipulation and Settlement Agreement to the Commission as their negotiated settlement of this proceeding with respect to all issues raised within the Application filed herein by Oklahoma Gas & Electric Company or by Stipulating Parties to this Cause, and respectfully request the Commission to issue an Order approving the recommendations of this Joint Stipulation and Settlement Agreement.

|

OKLAHOMA GAS & ELECTRIC COMPANY

|

|

Dated: 6/28/2010

|

By: /s/ William J. Bullard

|

|

William J. Bullard

|

|

|

Kimber L. Shoop

|

|

OKLAHOMA OFFICE OF THE ATTORNEY GENERAL

|

|

Dated: 6/28/2010

|

By: /s/ William L. Humes

|

|

William L. Humes

|

|

OKLAHOMA INDUSTRIAL ENERGY CONSUMERS

|

|

Dated: 6/28/2010

|

By: /s/ J. Fred Gist

|

|

J. Fred Gist

|

|

OG&E SHAREHOLDERS ASSOCIATION

|

|

Dated: 6/28/2010

|

By: /s/ Ronald E. Stakem

|

|

Ronald E. Stakem

|

|

PUBLIC UTILITY DIVISION

|

|

|

OKLAHOMA CORPORATION COMMISSION

|

|

Dated: 6/28/2010

|

By: /s/ Brandy L. Wreath

|

|

Brandy L. Wreath

|

|

|

Deputy Director

|

|

CHERMAC ENERGY CORPORATION

|

|

Dated: 6/28/2010

|

By: /s/ Richard Goodwin

|

|

Richard Goodwin

|

Stipulation Exhibit BJS-1

Page 1 of 2

| OKLAHOMA GAS AND ELECTRIC COMPANY | Original Sheet No. 55.00 |

| P. O. Box 321 | Replacing Original Sheet No. N/A |

| Oklahoma City, Oklahoma 73101 | Date Issued XXXXXX xx, 20xx |

|

STANDARD PRICING SCHEDLUE:CR

|

STATE OF OKLAHOMA

|

|

CROSSROADS RIDER

|

EFFECTIVE IN: All territory served.

PURPOSE: Recover the Oklahoma jurisdictional portion of the annual revenue requirement associated with the Crossroads Wind Energy Project.

APPLICABILITY: Rider is applicable to all Oklahoma retail rate classes and customers except those specifically exempted by special contract.

TERM: This rider shall terminate upon the implementation of new rates from the Company’s general rate review immediately after all Crossroads wind turbines are declared operational.

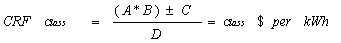

CROSSROADS RIDER FACTOR (CRF) CALCULATIONS: The following formula calculates the charges, on a per kilowatt-hour (kWh) basis, for each of the major rate classes and the combined minor rate classes. The revenue requirement reflected in the Crossroads Rider Factor shall include all operational turbines and shall be adjusted as each turbine is placed into operation.

|

||

Where:

Major Rate Classes = Residential, General Service, Power and Light, and Large Power and Light

Combined Minor Rate Classes (Other) = Municipal Lighting + Municipal Pumping + Outdoor Security Lighting + Public Schools (demand and non-demand) + Oil and Gas Producers

A = Oklahoma Jurisdiction Crossroads Rider Revenue Requirement

B = Production Demand Allocation Factor for each class identified above

C = Annual Class True-Up

D= Base kWh for each Class identified above

And:

|

|

A) Oklahoma Jurisdiction Crossroads Rider Revenue Requirement: The revenue requirement shall be based upon the most recently approved return on rate base (ROR), income tax expense, O&M expense, insurance expense, asset retirement obligation, depreciation, property tax, project damage payments, project bonuses, and reduced for production tax credits. The revenue requirement will also be reduced by the proceeds from REC sales as described in C) Annual Class True-Up.

|

Rates Authorized by the Oklahoma Corporation Commission: Public Utilities Division Stamp

(Effective) (Order No.) (Cause/Docket No.)

XXXXXX xx, 20xx xxxxxx PUD201000xxxx

Stipulation Exhibit BJS-1

Page 2 of 2

| OKLAHOMA GAS AND ELECTRIC COMPANY | Original Sheet No. 55.01 |

| P. O. Box 321 | Replacing Original Sheet No. N/A |

| Oklahoma City, Oklahoma 73101 | Date Issued XXXXXX xx, 20xx |

|

STANDARD PRICING SCHEDLUE:CR

|

STATE OF OKLAHOMA

|

|

CROSSROADS RIDER

|

|

|

B) Production Demand Allocation Factor: The most recently approved production demand allocation factor (1CP Average & Excess).

|

|

Class

|

Allocator

Percentage*

|

||

|

Residential

|

46.8208

|

||

|

General Service

|

8.7280

|

||

|

Power and Light

|

27.2523

|

||

|

Large Power and Light

|

14.6669

|

||

|

Other

|

2.5320

|

||

|

*Adjusted to exclude jurisdictions not at issue

|

|||

|

|

C) Annual Class True-Up: The over or under amount which will be the difference between the revenues collected through the rider from a previous period and the Oklahoma Actual Revenue Requirements of the corresponding period. All true-up amounts for any previous period will be added to or subtracted from the expected Oklahoma Retail jurisdictional amount by Class or “Other” for the next calendar year collection. In addition, 100 percent of the Oklahoma jurisdictional share of the proceeds (after deduction of third party transaction costs if applicable) from the sale of Crossroads RECs generated during the term of this rider shall be credited to Class based on an energy allocator.

|

|

|

D) Base kWh: The applicable projected Oklahoma jurisdictional kWh as determined by the Company computed using the most current twelve (12) billing month kWh (November thru October, weather adjusted) and submitted to the Commission in November of each year.

|

FINAL REVIEW: The Company shall provide the OCC Staff a final report reflecting actual collected revenues through the term of this rider as compared to what should have been collected based on the actual costs over the same period. The final over/under recovery will be refunded or collected through the Rider for Fuel Cost Adjustment.

Rates Authorized by the Oklahoma Corporation Commission: Public Utilities Division Stamp

(Effective) (Order No.) (Cause/Docket No.)

XXXXXX xx, 20xx xxxxxx PUD201000xxxx

|

Attachment 1 to Stipulation Exhibit BJS-1

|

|||

|

Illustration of Estimated Revenue Requirement for Crossroads Wind Farm

|

|||

|

Performed 6/24/2010

|

|||

|

46.38% CF; Expected CO2 and Gas; 197.8 MW

|

|||

|

2012

|

2013

|

|||||

|

REVENUE REQUIREMENTS

|

||||||

|

Rate Base

|

||||||

|

Utility Plant

|

$389,000,000

|

$389,000,000

|

||||

|

Asset Retirement Obligation (ARO) Asset

|

$5,704,308

|

$5,704,308

|

||||

|

ARO Accumulated Amortization

|

-$52,289

|

-$166,376

|

||||

|

ARO Liability

|

-$5,857,930

|

-$6,202,962

|

||||

|

Accumulated Provision for Depreciation

|

-$7,137,694

|

-$22,710,844

|

||||

|

State PTC Tax Asset

|

$0

|

$0

|

||||

|

Accumulated Deferred Income Taxes

|

-$10,561,781

|

-$41,654,729

|

||||

|

Total Rate Base

|

$371,094,613

|

$323,969,397

|

||||

|

Return with Taxes

|

$45,793,075

|

$39,977,824

|

||||

|

Expenses

|

||||||

|

O&M Expenses

|

$6,770,903

|

$6,886,803

|

||||

|

ARO Accretion

|

$335,984

|

$355,773

|

||||

|

ARO Amortization

|

$114,086

|

$114,086

|

||||

|

Depreciation

|

$15,573,150

|

$15,573,150

|

||||

|

Insurance

|

$125,779

|

$128,924

|

||||

|

Property Taxes

|

$3,893,288

|

$3,893,288

|

||||

|

Total Expenses

|

$26,813,190

|

$26,952,024

|

||||

|

Revenue Requirement

|

||||||

|

Total Company Revenue Requirement

|

$72,606,265

|

$66,929,847

|

||||

|

Production Tax Credits - Federal & state

|

-$34,072,778

|

-$35,370,789

|

||||

|

Net Total Company Revenue Requirement

|

$38,533,487

|

$31,559,059

|

||||

|

PRODUCTION COST SAVINGS

|

||||||

|

OGE Fuel Cost

|

$28,521,154

|

$31,219,578

|

||||

|

COGEN Cost

|

$1,950,437

|

$3,690,109

|

||||

|

Purchase Power

|

$2,600

|

$26,200

|

||||

|

Total Fuel Cost

|

$30,474,191

|

$34,935,887

|

||||

|

Variable O&M

|

$1,799,311

|

$1,443,556

|

||||

|

CO2 Costs

|

$3,552,709

|

$4,903,696

|

||||

|

Total Variable Production Costs

|

$35,826,210

|

$41,283,139

|

||||

|

CREDITS

|

||||||

|

Renewable Energy Certificates (REC)

|

$967,009

|

$964,367

|

||||

|

Total Company NET BENEFIT/(COST)

|

($1,740,267)

|

$10,688,448

|

||||

|

Attachment 2 to Stipulation Exhibit BJS-1

|

|||

|

Illustration of Estimated Revenue Requirement for Crossroads Wind Farm

|

|||

|

Performed 6/24/2010

|

|||

|

46.38% CF; Expected CO2 and Gas; 227.5 MW

|

|||

|

2012

|

2013

|

|||||

|

REVENUE REQUIREMENTS

|

||||||

|

Rate Base

|

||||||

|

Utility Plant

|

$448,800,000

|

$448,800,000

|

||||

|

Asset Retirement Obligation (ARO) Asset

|

$6,560,716

|

$6,560,716

|

||||

|

ARO Accumulated Amortization

|

-$60,140

|

-$191,354

|

||||

|

ARO Liability

|

-$6,737,402

|

-$7,134,235

|

||||

|

Accumulated Provision for Depreciation

|

-$8,227,489

|

-$26,178,374

|

||||

|

State PTC Tax Asset

|

$0

|

$0

|

||||

|

Accumulated Deferred Income Taxes

|

-$12,093,024

|

-$47,715,451

|

||||

|

Total Rate Base

|

$428,242,660

|

$374,141,301

|

||||

|

Return with Taxes

|

$52,845,144

|

$46,169,037

|

||||

|

Expenses

|

||||||

|

O&M Expenses

|

$7,568,537

|

$7,698,176

|

||||

|

ARO Accretion

|

$386,426

|

$409,187

|

||||

|

ARO Amortization

|

$131,214

|

$131,214

|

||||

|

Depreciation

|

$17,950,885

|

$17,950,885

|

||||

|

Insurance

|

$144,984

|

$148,608

|

||||

|

Property Taxes

|

$4,487,721

|

$4,487,721

|

||||

|

Total Expenses

|

$30,669,768

|

$30,825,792

|

||||

|

Revenue Requirement

|

||||||

|

Total Company Revenue Requirement

|

$83,514,912

|

$76,994,828

|

||||

|

Production Tax Credits - Federal & state

|

-$39,188,863

|

-$40,681,772

|

||||

|

Net Total Company Revenue Requirement

|

$44,326,049

|

$36,313,057

|

||||

|

PRODUCTION COST SAVINGS

|

||||||

|

OGE Fuel Cost

|

$31,886,930

|

$33,688,231

|

||||

|

COGEN Cost

|

$2,648,642

|

$6,410,593

|

||||

|

Purchase Power

|

-$10,200

|

$12,000

|

||||

|

Total Fuel Cost

|

$34,525,372

|

$40,110,825

|

||||

|

Variable O&M

|

$1,609,812

|

$1,557,994

|

||||

|

CO2 Costs

|

$5,814,626

|

$6,435,406

|

||||

|

Total Variable Production Costs

|

$41,949,809

|

$48,104,224

|

||||

|

CREDITS

|

||||||

|

Renewable Energy Certificates (REC)

|

$1,112,207

|

$1,109,168

|

||||

|

Total Company NET BENEFIT/(COST)

|

($1,264,033)

|

$12,900,336

|

||||

|

Stipulation Exhibit BJS-2

|

||||

|

2012

|

2013

|

|||

|

O&M Expenses* (based on 197.8 MW)

|

$6,770,903

|

$6,886,803

|

||

|

O&M Expenses* (based on 227.5 MW)

|

$7,568,537

|

$7,698,176

|

||

* Does not include depreciation, property tax, insurance, ARO accretion, ARO amortization or contractual damage/bonus payments.