Attached files

| file | filename |

|---|---|

| 8-K - CENTRAL EUROPEAN MEDIA 8-K 6-30-2010 - CENTRAL EUROPEAN MEDIA ENTERPRISES LTD | form8k.htm |

Exhibit 99.1

2

Safe Harbour Statement

This presentation contains written or oral forward-looking statements, including those related to our capital needs, business strategies,

expectations and commitments. Statements that include the words “may”, “expect”, “intend”, “plan”, “target”, “prospect”, “forecast”,

“believe”, “project”, “anticipate”, “estimate”, “continue” and similar statements of a future or forward-looking nature identify forward-looking

statements. For these statements and all other forward-looking statements, we claim the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently subject to risks

and uncertainties, many of which cannot be predicted with accuracy or are otherwise beyond our control and some of which might not even

be anticipated. Future events and actual results affecting our strategic plan as well as our financial position, results of operations and cash

flows, could differ materially from those described in or contemplated by the forward-looking statements. Important factors that contribute

to such risks include, but are not limited to, the effect of the credit crisis and economic downturn in our markets; decreases in television

advertising spending and the rate of development of the advertising markets and the pace of any related recovery in the countries in which

we operate; the successful integration of Media Pro Entertainment and the bTV group in Bulgaria; our ability to make future investments in

television broadcast operations; our ability to develop and implement strategies regarding sales and multi-channel distribution; changes in

the political and regulatory environments where we operate and application of relevant laws and regulations; the timely renewal of

broadcasting licenses and our ability to obtain additional frequencies and licenses; and our ability to acquire necessary programming and

attract audiences.

expectations and commitments. Statements that include the words “may”, “expect”, “intend”, “plan”, “target”, “prospect”, “forecast”,

“believe”, “project”, “anticipate”, “estimate”, “continue” and similar statements of a future or forward-looking nature identify forward-looking

statements. For these statements and all other forward-looking statements, we claim the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently subject to risks

and uncertainties, many of which cannot be predicted with accuracy or are otherwise beyond our control and some of which might not even

be anticipated. Future events and actual results affecting our strategic plan as well as our financial position, results of operations and cash

flows, could differ materially from those described in or contemplated by the forward-looking statements. Important factors that contribute

to such risks include, but are not limited to, the effect of the credit crisis and economic downturn in our markets; decreases in television

advertising spending and the rate of development of the advertising markets and the pace of any related recovery in the countries in which

we operate; the successful integration of Media Pro Entertainment and the bTV group in Bulgaria; our ability to make future investments in

television broadcast operations; our ability to develop and implement strategies regarding sales and multi-channel distribution; changes in

the political and regulatory environments where we operate and application of relevant laws and regulations; the timely renewal of

broadcasting licenses and our ability to obtain additional frequencies and licenses; and our ability to acquire necessary programming and

attract audiences.

For a more detailed description of these uncertainties and other features, please see the “Risk Factors” section in our most recent

Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission. Forward-looking statements speak only as of the

date on when they were made and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a

result of new information, future developments of otherwise.

Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission. Forward-looking statements speak only as of the

date on when they were made and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a

result of new information, future developments of otherwise.

Headlines

3

Recoveries are starting in some markets but are slower and

more fragile than expected.

more fragile than expected.

We still expect overall growth in the second half of the year.

We are successfully integrating the newly acquired bTV in

Bulgaria into CME.

Bulgaria into CME.

Inventory is selling out; we are prepared to increase prices in

the fall.

the fall.

Depreciation of EUR against US$ is affecting our results.

Questions?

4

In Czech Republic and Slovenia GDP and

TV Ad market grew in Q2. Prices will

follow.

TV Ad market grew in Q2. Prices will

follow.

ING June 28: "With better debt and budget

deficit figures than most of the Eurozone,

and cheaper labour costs, emerging Europe

should clearly outperform the Eurozone in

2011. “ (Charles Robertson, Chief

Economist , ING)

deficit figures than most of the Eurozone,

and cheaper labour costs, emerging Europe

should clearly outperform the Eurozone in

2011. “ (Charles Robertson, Chief

Economist , ING)

5

CEE recovery is slow and mixed

Good news

Credit ratings of Greece, Spain and Portugal cut

Romania and Bulgaria announce austerity measures

to reduce public spending

to reduce public spending

Hungary announces potential default

US$ has strengthened against EUR by 10% since

our last earnings call

our last earnings call

Romania, Bulgaria and Croatia expected to remain

in recession in 2010

in recession in 2010

Retail and consumer confidence has not recovered

from its low point in 2009

from its low point in 2009

TV ad spending in our markets continued to decline

in Q2

in Q2

Bad news

Q1 macros: Q1 was the lowest point

6

Source: European Commission, Eurostat

Source: CME Internal Estimates (April 29th, 2010)

Source: Eurostat

Consumer Confidence Index

TV Ad Market

Annual Change Rate, %

Final consumption expenditure of households

Annual Change Rate, %

Consumer confidence fell

sharply last year. Signs of

improvement are varied.

sharply last year. Signs of

improvement are varied.

Real GDP Growth

Macroeconomic estimates

7

Real GDP

TV Ad Spend

0.4%

(5.4%)

Q2 2010

Source: CME estimates based on average economist consensus reports issued in April, May & June 2010 (ING, BNP, JPM, Bloomberg), TV ad spend - CME estimates

FY 2010

1%

(1%)

8

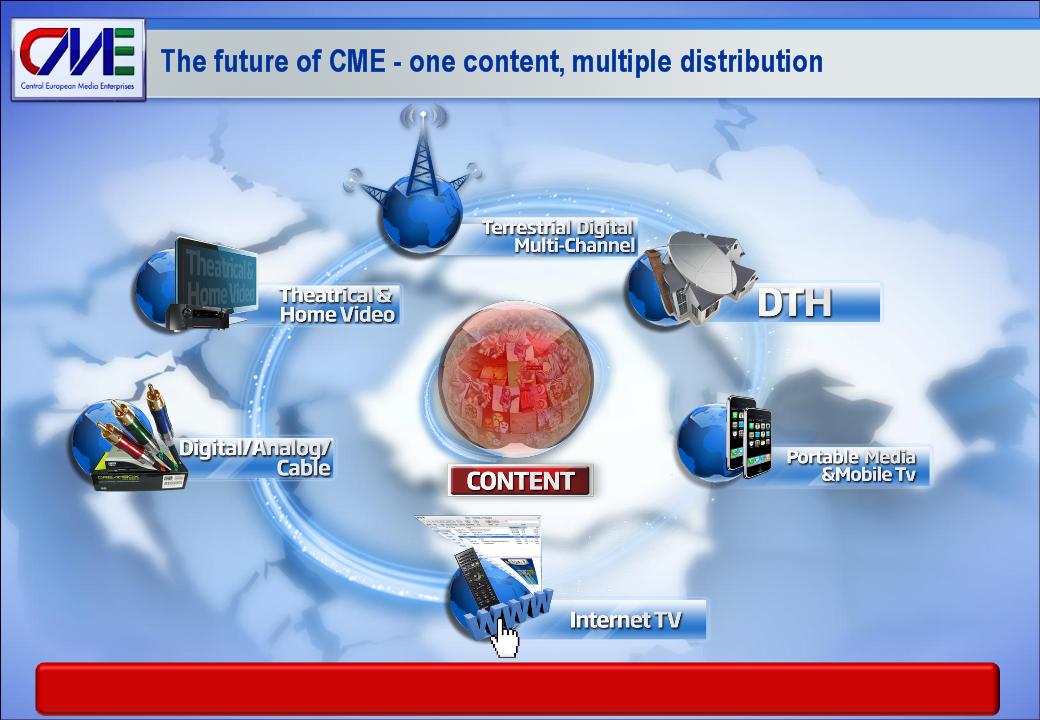

CME today: vertically integrated media and entertainment company

§ We are leaders in audience

in all our 6 markets

in all our 6 markets

New Media

§ We launched over 40 online

products and services with

2.0 million daily unique

users

products and services with

2.0 million daily unique

users

Content

§ We are integrating Mediapro

and became a leading

producer and distributor of

television fiction in the region

and became a leading

producer and distributor of

television fiction in the region

Broadcast

We are the winner of the region. Some

players left, some players are prepared to

leave ….

players left, some players are prepared to

leave ….

Our Goal by 2014 is to be one of the largest media companies in Europe

Our Goal by 2014 is to be one of the largest media companies in Europe

9

Key indicators of sustainable upturn: convergence

Source: Group M and CME estimates

Western Europe includes Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, The Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and UK

Ad intensity is advertising spend per capita as a percentage of GDP per capita.

Total Ad spend per capita 2009

10

CME markets

Western

European

markets

European

markets

$12,000

$39,000

9%

4%

2009 GDP per

capita

capita

2004 to 2009

GDP CAGR

GDP CAGR

$44

$248

0.37%

0.63%

2009 Total Ad

spend per

capita

spend per

capita

2009 Ad

intensity

intensity

US$ 14.46

US$ 14.61

Avg. Product

prices

prices

11

Key indicators of sustainable upturn: our audience leadership

Sources: ATO Mediaresearch, TNS-AGB INTL, PMT/TNS SK, TNS Bulgaria

Leadership charts for four of our markets: May 10 - May 16 2010

12

Key indicators of sustainable upturn: our market leadership

Audience Share

Market Share

Power Ratio

=

/

2.0x

1.7x

2.5x

1.8x

2009 All Day Audience Share and Market Share

#2

#1

#1

#1

2.1x

#1

Sources: Audience share data: Croatia, AGB Nielsen Media Research; Czech Republic, ATO Mediaresearch; Slovak Republic, PMT/TNS SK; Slovenia,

Peoplemeters AGB Media Services; Romania and Peoplemeters Taylor Nelson Sofres, CME estimates

Peoplemeters AGB Media Services; Romania and Peoplemeters Taylor Nelson Sofres, CME estimates

1 Unaudited pro forma data for the combined operations of bTV group and Pro.BG group. The bTV group was acquired in April 2010.

1.6x

#1

1

TV and Internet will be the winners from advertising spend growth

TV continues to have the broadest reach and capture the highest share of advertisers’ marketing budgets

13

Source: Zenith Optimedia

We have a history of outperforming our markets

Between 2006 - 2008 TV ad spend in our markets grew at an

average rate of 15% per year.

average rate of 15% per year.

In the same period our revenues* grew 35% per year on

average.

average.

Average EBITDA* margin 2006 - 2008: 41%

CME remains an attractive media investment

* Czech Republic, Romania, Slovak Republic, Slovenia and Croatia

Our vertically integrated operational model provides for diversified revenues and will be more resilient to the

future challenges in our industry.

future challenges in our industry.

We are building leadership in content and internet with low investments.

We are uniquely positioned to take advantage of recovery in CEE.