Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - FIRST TRUST ENERGY INCOME & GROWTH FUND | fen_8k.txt |

EIP

Energy Income & Growth Fund (FEN)

June 30, 2009

2

FEN Background

Launched in June, 2004 during weak market for income securities.

Energy Income Partners (EIP) takes over as sub-advisor on Sept 14, 2007.

EIP immediately restructures portfolio by reducing cyclical exposure, selling

private equity positions, improving credit quality of portfolio companies and

increasing income generation.

Deleveraging in Fall of 2008 causes all MLP closed end funds

except FEN to

cut their distributions as FEN has a more conservative payout ratio.

In 2008 and 2009 FEN retires its Auction Rate Notes and replaces them with a

lending facility from BNP.

On April 12, 2010, FEN increased its dividend making it the first MLP fund to

do so since the credit crisis.

3

Asset Class Yield1 Dividend Growth2

(Last 10 Years)

Energy MLPs 7.0% 6.9%

Utilities 4.6% 4.0%

REITs 3.9% -2.6%

S&P 500 1.8% 3.2%

1Yield is as of 03/31/10.

210-year growth is per share annual growth in cash distributions or dividends from 03/31/00

to 03/31/10. MLPs are represented by the Alerian

MLP Index. Utilities are the components of the UTY Index. REITs are the Equity REIT component of the National Assn of REITs. It is not

possible to invest directly in an index. Past performance is no guarantee

of future results.

Source: Bloomberg, FactSet, NAREIT, Alerian Capital Management

Note: EIP gross yield will tend to be about 70-80 basis points lower than Alerian MLP Index

MLPs vs. other Asset Classes

4

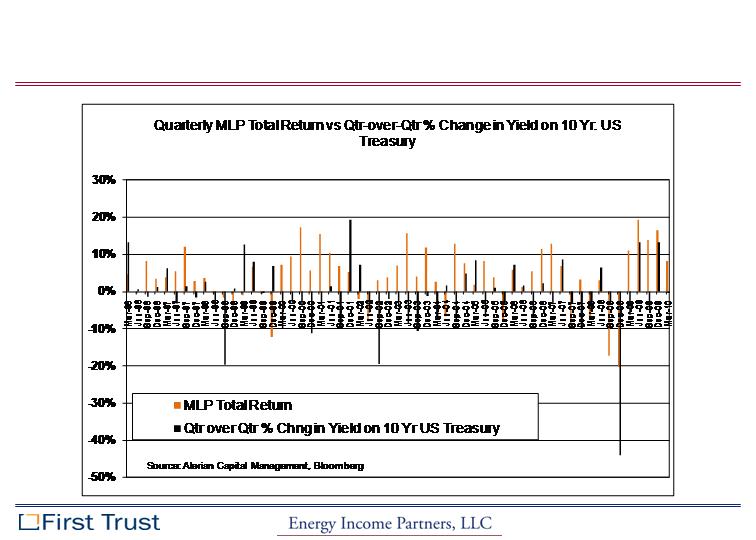

Interest Rates and MLP Performance

5

Disclosures

This closed-end fund invests in a portfolio consisting primarily of securities issued by MLPs. Investment in

the Fund involves risks of fluctuations in energy prices, decreases

in the supply of or demand for energy

commodities, increased government regulation, national disasters and various other risks. The use of

leverage for investment purposes increases both investment opportunity and investment risk. The risks

of

investing in the Fund are spelled out in the prospectus, shareholder report and other regulatory filings.

Certain statements made during today’s call may not be historical facts and are referred to as “forward-

looking statements” under the U.S. federal securities

laws. Forward-looking statements are not historical

facts but instead represent only the sub-advisor’s beliefs regarding future events, many of which, by their

nature, are inherently uncertain and outside the sub-advisor’s control. Actual

future results or occurrences

may differ significantly from those expressed or implied in any forward-looking statements due to numerous

factors. Generally, the words “believe,” “expect,” “intend,” “estimate,”

“anticipate,” “project,” “will”

and similar expressions identify forward-looking statements, which generally are not historical in nature.

You should not place undue reliance on forward-looking statements, which

speak only as of the date they are

made. FTA, the sub-advisor and the fund undertake no responsibility to update publicly or revise any

forward-looking statements.