Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ABRAXAS PETROLEUM CORP | fbr8k62410.htm |

Small-Cap E&P Conference

June 24, 2010

Exhibit 99.1

2

Forward-Looking Statements

The information presented herein may contain predictions, estimates and

other forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Although the Company believes that its expectations are based on

reasonable assumptions, it can give no assurance that its goals will be

achieved.

other forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Although the Company believes that its expectations are based on

reasonable assumptions, it can give no assurance that its goals will be

achieved.

Important factors that could cause actual results to differ materially from

those included in the forward-looking statements include the timing and

extent of changes in commodity prices for oil and gas, the need to develop

and replace reserves, environmental risks, competition, government

regulation and the ability of the Company to meet its stated business

goals.

those included in the forward-looking statements include the timing and

extent of changes in commodity prices for oil and gas, the need to develop

and replace reserves, environmental risks, competition, government

regulation and the ability of the Company to meet its stated business

goals.

3

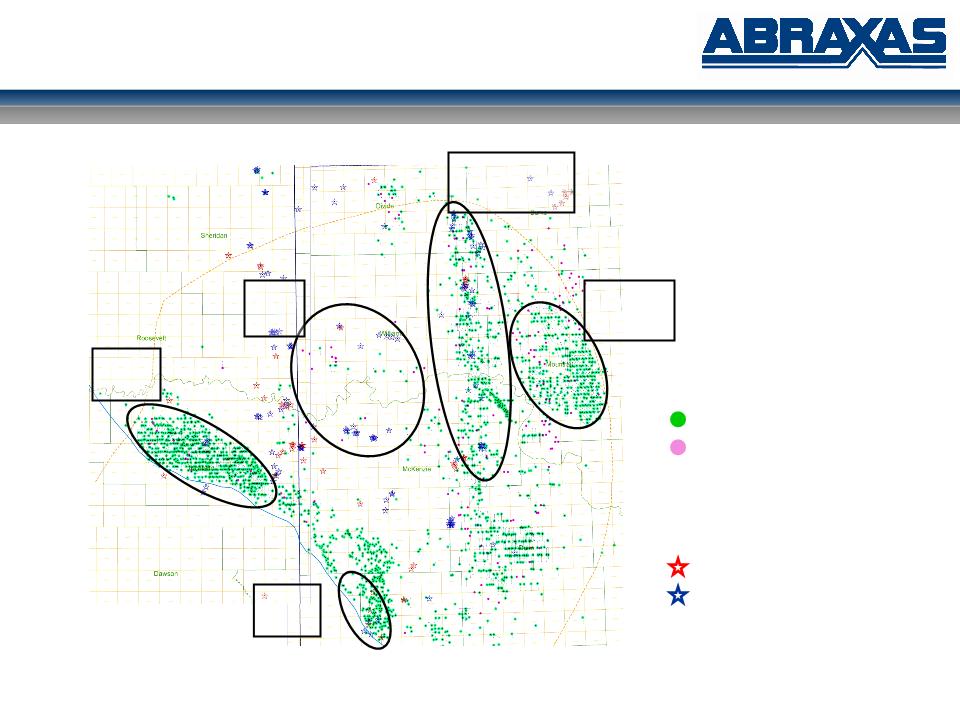

LEGEND:

Bakken producers

Bakken permits (Q1 2010)

EXISTING ABRAXAS WELLS

(VARIOUS FORMATIONS):

Abraxas operated wells

Abraxas non-operated wells

Bakken Sleeper (Industry)

Montana North Dakota

EOG, WLL:

Parshall &

Sanish

CTL, MRO, DNR:

Nesson

Anticline

XOM:

Elm

Coulee

WLL:

Lewis &

Clark

BEXP:

Rough

Rider

4

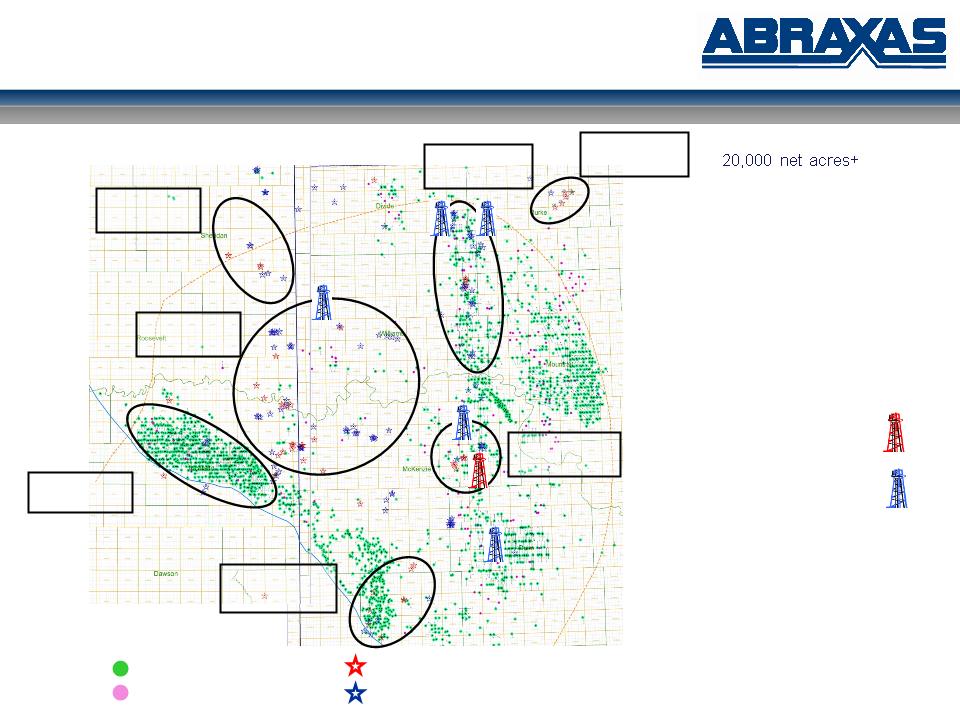

Bakken producers Abraxas operated wells

Bakken permits (Q1 2010) Abraxas non-operated wells

Bakken Sleeper (AXAS)

17% average WI

(WI range of 2 - 50%)

= ~100 gross (1280 acre) units

Numerous opportunities

(operated and non-operated)

NO LEASE EXPIRATIONS - acreage

principally held by production

principally held by production

July 2010 -

first operated well

first operated well

NON-OP: 8 WELLS

1 - ORRI BPO: on production

2 - 10% WI: on production

3 - 2% WI: on production

4 - 2% WI: flowing back

5 - 4% WI: spud - summer 2010

6 - 4% WI: spud - summer 2010

7 - 4% WI: spud - summer 2010

8 - 4% WI: spud - summer 2010

Montana North Dakota

Nesson

2,600 net acres

Elm Coulee

440 net acres

Elkhorn Ranch

2,000 net acres

Harding

5,800 net acres

North Fork

3,200 net acres

Carter

3,200 net acres

Sheridan

3,000 net acres

3

4

2

1

5-8

5

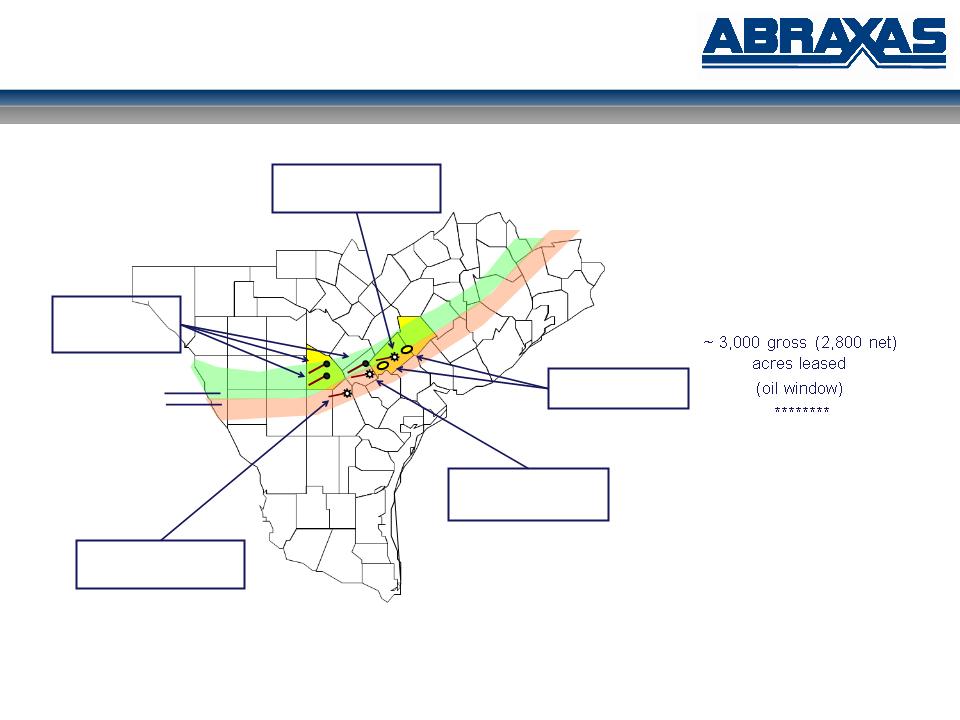

Eagle Ford Shale

AXAS:

~ 3,200 gross (2,900 net)

acres HBP

acres HBP

(gas/condensate window)

~1,800 gross/net acres

leased

(gas window)

********

Leasing geologically /

geophysically controlled

geophysically controlled

******

No expensive trend acreage

South Texas

gas window

oil window

PXD:

Eagle Ford Discovery

Enduring:

Eagle Ford Discovery

AXAS:

HBP acreage

PXD:

Eagle Ford Discovery

EOG:

Eagle Ford Oil

Discoveries

gas/condensate

window

6

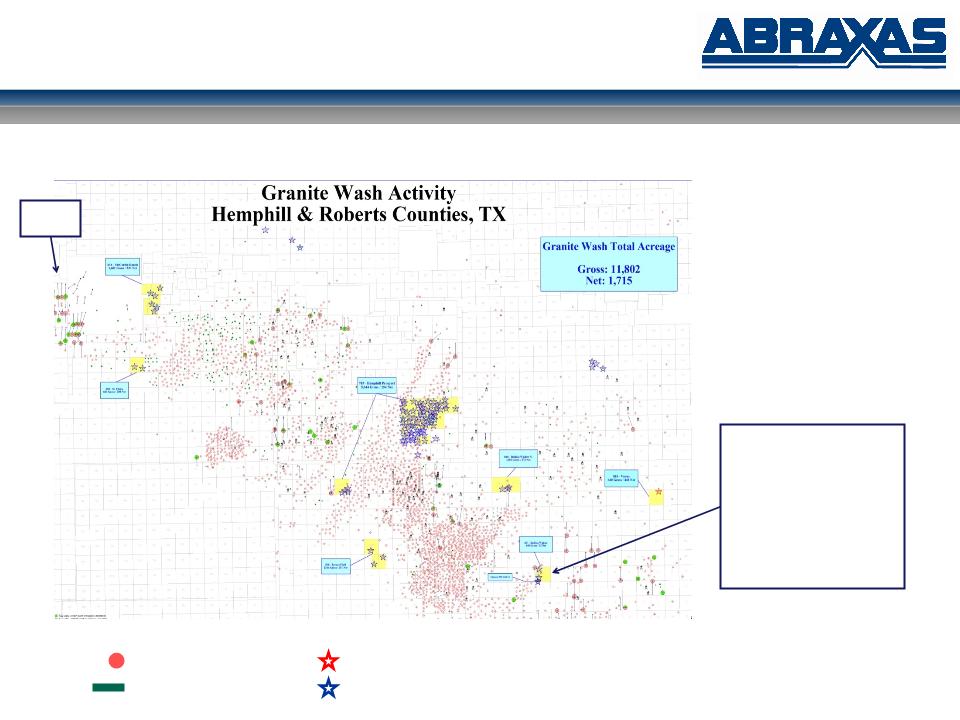

Granite Wash

AXAS:

Acreage - HBP

11,802 gross

1,715 net

8% Non-Op WI

XEC Huff 16-5H

Hemphill Co., TX

Texas Panhandle

XEC:

Huff 16-5H

1st 60 day average:

15.8 MMcfpd, 350 Bopd

(17.9 MMcfepd)

1st 60 day CUM:

947 MMcf, 21 MBO

(1.07 Bcfe)

CHK

Granite Wash producers Abraxas operated wells

GW horizontal lateral Abraxas non-operated wells

7

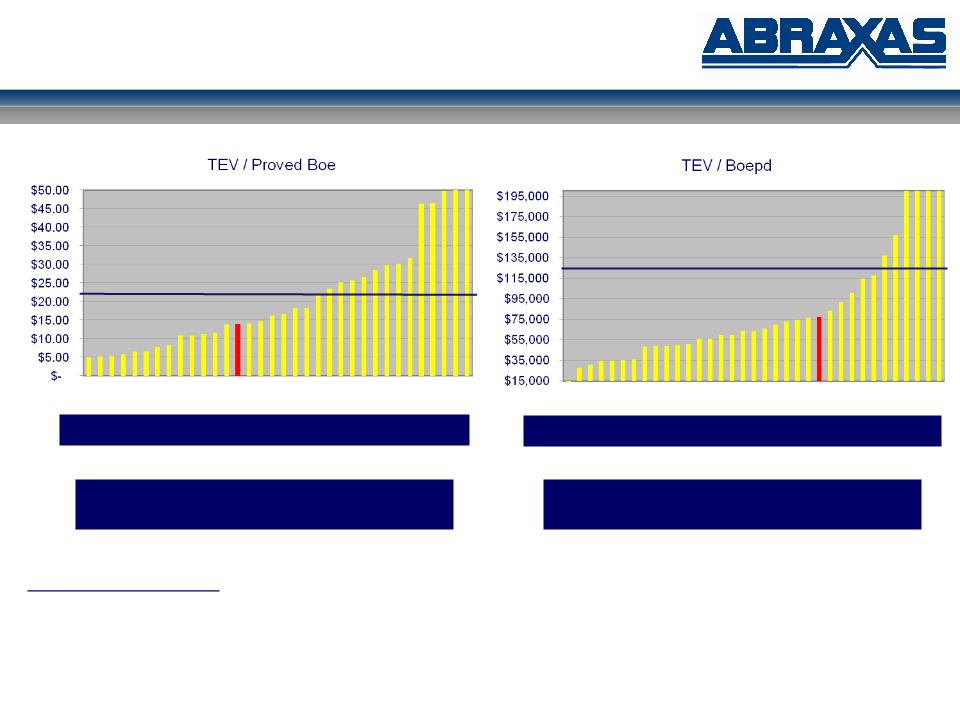

Peer Group Analysis

Source: Company filings with the SEC and market capitalization on May 14, 2010

E&P analysis includes market capitalization < $1B (AEZ, AREX, ATPG, AXAS, CFW, CPE, CRZO, CWEI, DBLE, DNE, DPTR, END, EPM, FXEN, GDP, GEOI, GMET, GMXR, GPOR,

GPR, GST, GSX, KOG, MCF, MHR, NGAS, NOG, PETD, PHX, PINN, PQ, RAME, REXX, SGY, VQ, WRES)

GPR, GST, GSX, KOG, MCF, MHR, NGAS, NOG, PETD, PHX, PINN, PQ, RAME, REXX, SGY, VQ, WRES)

35% undervalued compared to E&P in analysis

Mean equates to an AXAS share price of:

$5.14

Mean equates to an AXAS share price of:

$5.71

40% undervalued compared to E&P in analysis

8

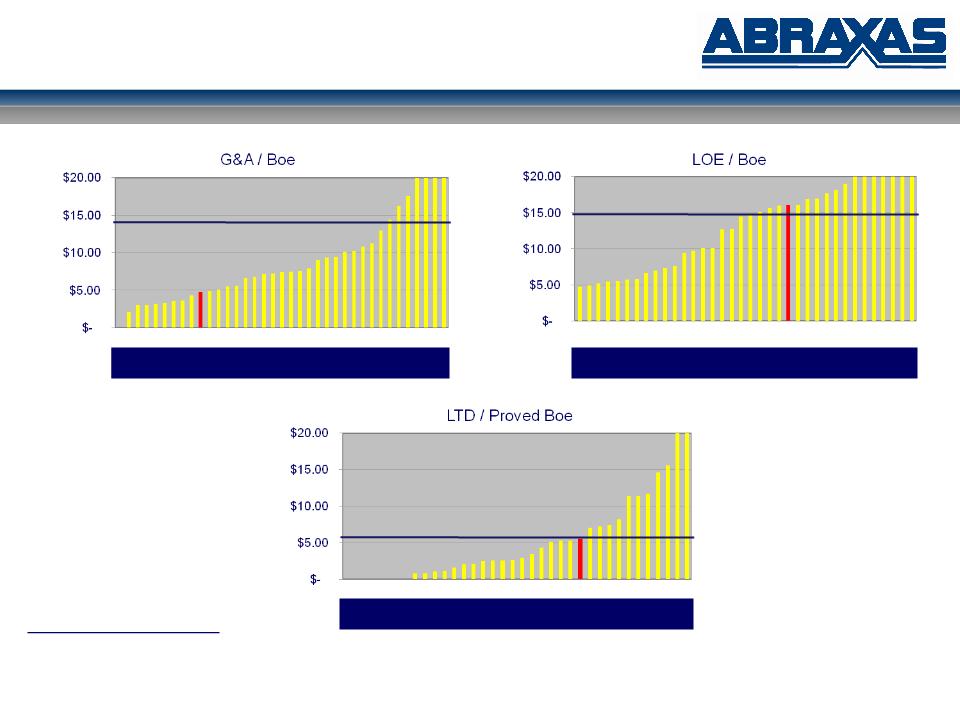

Peer Group Analysis

Source: Company filings with the SEC

E&P analysis includes market capitalization < $1B (AEZ, AREX, ATPG, AXAS, CFW, CPE, CRZO, CWEI, DBLE, DNE, DPTR, END, EPM, FXEN, GDP, GEOI, GMET, GMXR, GPOR,

GPR, GST, GSX, KOG, MCF, MHR, NGAS, NOG, PETD, PHX, PINN, PQ, RAME, REXX, SGY, VQ, WRES)

GPR, GST, GSX, KOG, MCF, MHR, NGAS, NOG, PETD, PHX, PINN, PQ, RAME, REXX, SGY, VQ, WRES)

67% under average of E&P in analysis

8% over average of E&P in analysis

In-line with average of E&P in analysis

9

AXAS Highlights

§ NASDAQ: AXAS

§ Fully diluted shares outstanding: ~76 million

§ ~50% institutional

§ ~10% insider

§ Current average trading volume: ~500,000 shares per day

§ Market capitalization: ~$230 million

§ Total long-term debt: ~$138 million

§ Re-paid term loan portion (March-10)

§ High quality assets

§ Unparalleled upside opportunities

§ 85% of PDP hedged through 2012 and 70% in 2013

§ $74.96 per barrel and $6.38 per Mmbtu

§ 2010 Guidance:

§ Production: 1.7 - 2.0 MMBoe

§ EBITDA: $38 - 45 Million

§ CapEx: $30 Million

10

Operational Highlights

Ø Predictable, long-lived production

§ R/P ratio of 15.3 years

§ Conventional and unconventional reservoirs

Ø 1,828 gross (405 net) producing wells: average working interest 22%

§ ~690 gross (250 net) wells/units comprise top 90% by PV

Ø Substantial inventory: 152 proved undeveloped locations

§ Numerous additional identified locations

Ø 307,625 gross (160,542 net) acres

§ No material lease expiry issues or drilling commitments

Ø Operational control - over 80% of PV10

§ Over 30 years of operational history

§ Efficient, low-cost operator

§ Long history of drilling success

Net proved reserves and R/P ratio as of December 31, 2009

Well count and acreage as of December 31, 2009

11

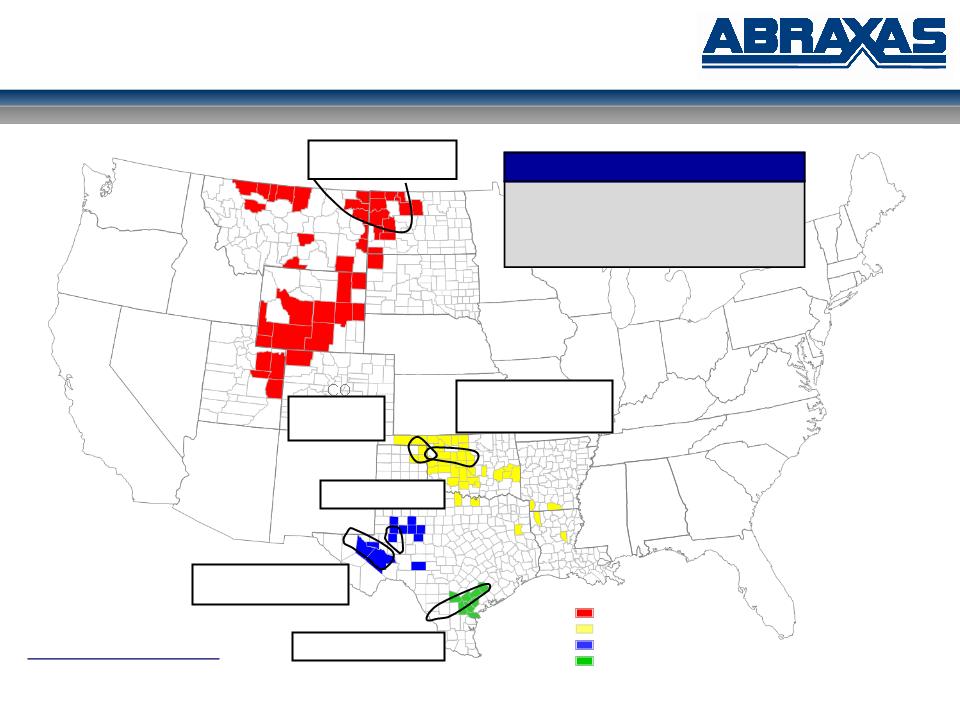

High Quality Assets

ND

SD

MT

WY

UT

TX

OK

AR

LA

Proved Reserves (MMBoe): 24.9

- Proved Developed: 56%

- Gas/Oil %: 65/35%

- Operated: 82%

Abraxas Petroleum Corporation

Net proved reserves as of December 31, 2009

Bakken / Three Forks

Play

Central Anadarko

Cana - Woodford

Shale Play

Barnett / Woodford

Shale Play

Wolfberry Trend

Rocky Mountain

Mid-Continent

Permian Basin

Gulf Coast

Eagle Ford Shale Play

Granite Wash

Play

12

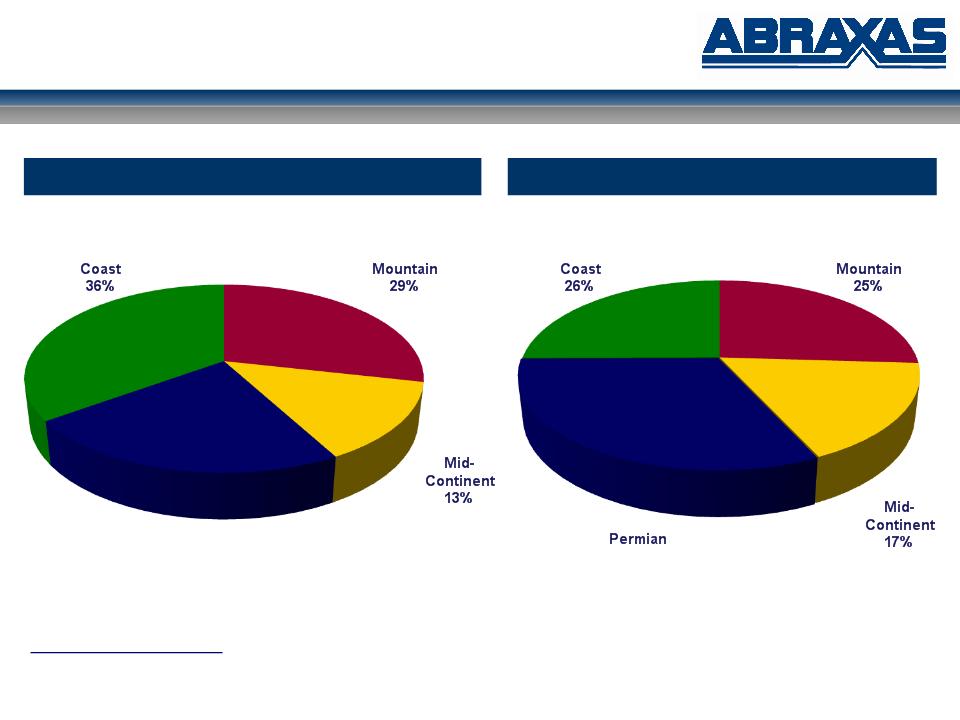

Reserve / Production Summary

Proved Reserves - 24.9 MMBoe

Production - 4,028 Boepd

Net proved reserves as of December 31, 2009

Daily net production for the quarter ended March 31, 2010

Rocky

Permian

Basin

22%

Gulf

Rocky

Basin

32%

Gulf

13

Near-Term Drilling Catalysts

|

AXAS OPERATED:

|

OUTSIDE OPERATED:

|

|

Bakken/Three Forks, North Dakota

• 2+ horizontal oil wells

• Permitting

• AXAS ~40% WI

West Texas

• 5 vertical oil wells

• 1 horizontal oil well

|

Bakken/Three Forks, North Dakota

• Continental operated

• Flowing back (TF)

• AXAS 2% WI

• Oasis operated

• On production (Bakken)

• AXAS 2% WI

|

|

• Permitting

• AXAS 100%

|

• Continental operated

• Summer 2010

|

|

Eagle Ford, South Texas

• First horizontal well

• End of summer (2010)

• Oil window

• AXAS 100%

|

• ECO-Pad ™

• 4 wells (2-Bakken, 2-TF)

• AXAS 4% WI

|

|

Canada

• 2 horizontal oil wells

• Summer 2010

• CANAXAS 100%

|

|

14

Business Plan

§ Allocate portion of 2010 CapEx to Bakken

§ Investigate Bakken acceleration

§ Increase Eagle Ford position

§ Principally in oil leg

§ Non-core asset sales: >$40 MM - principally non-op

§ Pay down debt

§ Accelerate CapEx: 1/2 of sales above $10 MM

§ Target 50/50 oil/gas production mix by end of 2010

§ Target greater than 90% operated by end of 2010

§ NOL preservation

§ Increase investor interest

§ Increase analyst coverage

§ 3 new equity analyst since year-end ‘09

15

NASDAQ: AXAS

16

Appendix

17

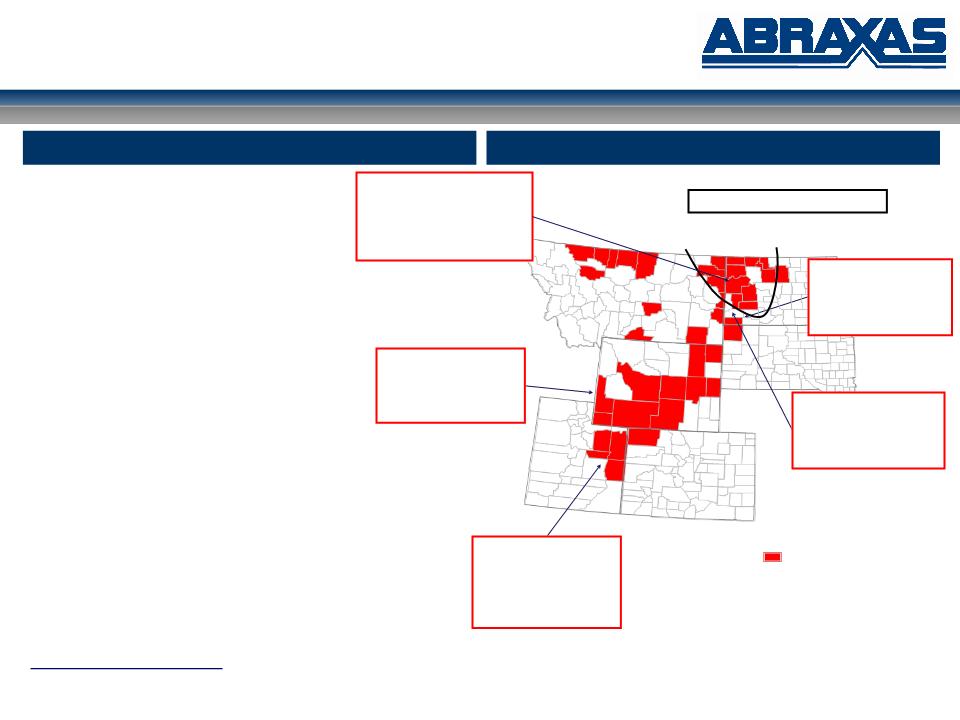

Rocky Mountain

Ø 7.2 MMBoe of proved reserves

Ø 63% proved developed

Ø 82% crude oil

Ø 1,045 Boepd of production

Ø 19.0 R/P ratio

Ø 900 gross (110 net) producing wells

Ø 66 PUD locations

Ø 90,362 net acres

Ø Primary producing basins include:

§ Williston Basin (MT and ND)

§ Powder River & Green River Basins (WY)

§ Unita Basin (UT)

Ø Bakken / Three Forks - HBP

Rocky Mountain

ND

SD

MT

WY

CO

UT

Medicine Pole Hills Unit

Bowman Co., ND

3 PUD

Red River B: 9,350’

Operator: Continental

Natural Buttes Field

(Chapita Wells Unit)

Uintah Co., UT

27 PUD

Wasatch: 7,000’

Operator: EOG Resources

Cow Hollow Field

Lincoln Co., WY

8 PUD

Frontier: 11,000’

Operator: Kerr-McGee

Bakken Play / Three Forks / Sanish

Area of Operations

Overview

Roosevelt Field

Billings Co., ND

3 PUD

Nisku: 10,000’

Operator: Abraxas/Summit

North Fork / Nesson Fields

McKenzie / Williams Co., ND

21 PUD

Bakken: 10,000’

Operator: Abraxas

Net proved reserves, well count and acreage as of December 31, 2009

Daily net production for the quarter ended March 31, 2010

18

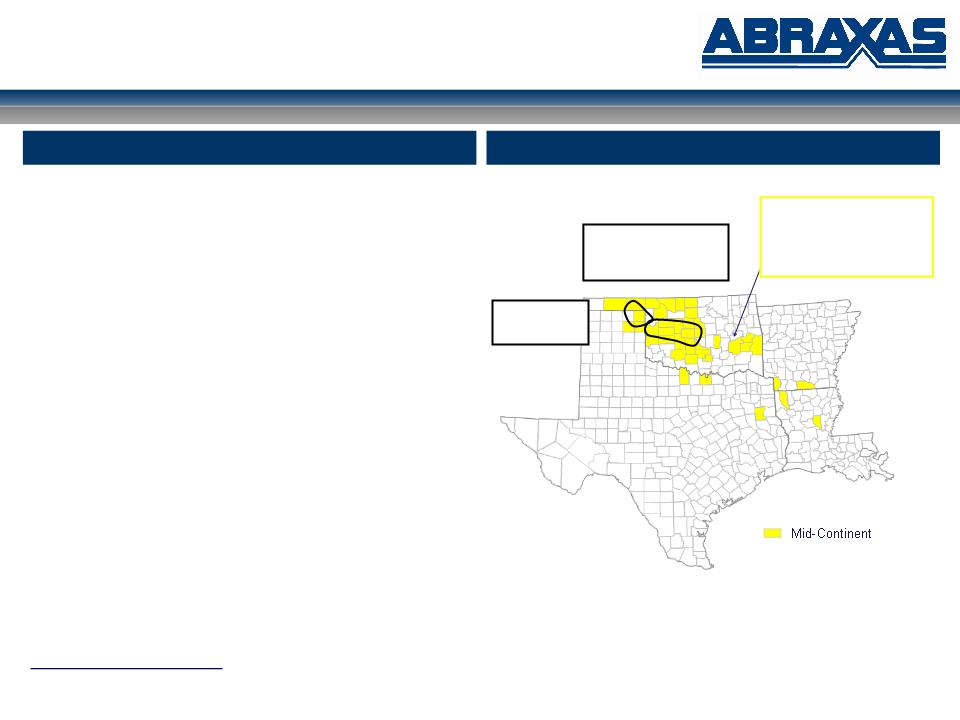

Mid-Continent

Ø 3.1 MMBoe of proved reserves

Ø 72% proved developed

Ø 84% natural gas

Ø 692 Boepd of production

Ø 12.3 R/P ratio

Ø 617 gross (89 net) producing wells

Ø 56 PUD locations

Ø 22,703 net acres

Ø Primary producing basins include:

§ Anadarko Basin (Western OK)

§ Arkoma Basin (Eastern OK)

§ ARK-LA-TEX

Ø Cana Shale (Cimarex, Devon, Chesapeake) - HBP

Ø Granite Wash (Forest, Newfield, Cimarex) - HBP

TX

OK

AR

LA

Central Anadarko

Cana - Woodford

Shale Play

Pittsburg County CBM

Pittsburg Co., OK

53 PUD

Hartshorne Coal: 3,000’

Operator: Chesapeake / AXAS

Area of Operations

Overview

Net proved reserves, well count and acreage as of December 31, 2009

Daily net production for the quarter ended March 31, 2010

Granite Wash

Play

19

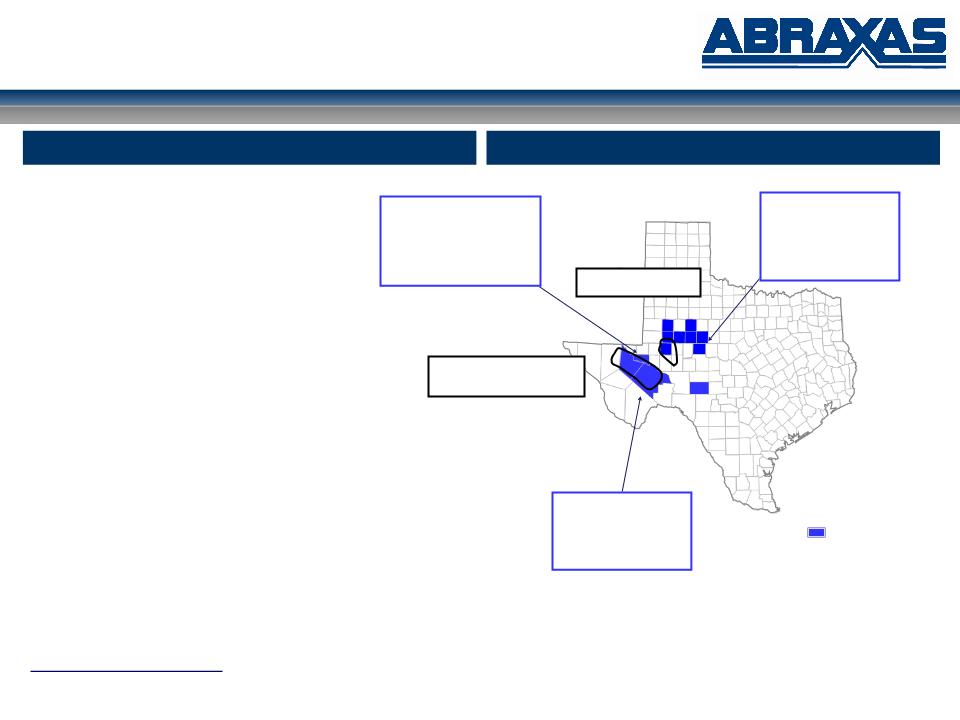

Permian Basin

Permian Basin

Ø 5.6 MMBoe of proved reserves

Ø 66% proved developed

Ø 70% natural gas

Ø 1,281 Boepd of production

Ø 11.9 R/P ratio

Ø 237 gross (158 net) producing wells

Ø 13 PUD locations

Ø 36,064 net acres

Ø Primary producing sub-basins:

§ Delaware Basin

§ Eastern Shelf

Ø Barnett / Woodford Shale - fee minerals

TX

Oates SW

Pecos Co., TX

1 PUD

Devonian: 14,000’

Operator: Abraxas

Operator: Abraxas

ROC Complex

Ward Co., TX

2 PUD

Devonian: 13,000’

Montoya: 14,000’

Operator: Abraxas

Area of Operations

Overview

Beulah Coleman

Midland Co., TX

8 PUD

Wolfberry: 9,000’

Devonian: 11,500’

Operator: Abraxas

Barnett / Woodford

Shale Play

Wolfberry Trend

Net proved reserves, well count and acreage as of December 31, 2009

Daily net production for the quarter ended March 31, 2010

20

Gulf Coast

Gulf Coast

Ø 9.0 MMBoe of proved reserves

Ø 38% proved developed

Ø 91% natural gas

Ø 1,010 Boepd of production

Ø 24.5 R/P ratio

Ø 74 gross (48 net) producing wells

Ø 17 PUD locations

Ø 11,414 net acres

Ø Primary producing sub-basin:

§ Onshore Gulf Coast

Ø Eagle Ford Shale - HBP

§ Currently leasing additional acreage

TX

Portilla Field

San Patricio Co., TX

3 PUD (2 PDNP)

Frio: 7,000’

Vicksburg: 9,000’

Vicksburg: 9,000’

Operator: Abraxas

Edwards Trend

DeWitt / Lavaca Co., TX

11 PUD (3 PDNP)

Edwards: 13,500’

Operator: Abraxas

Area of Operations

Overview

Eagle Ford

Shale Play

Net proved reserves, well count and acreage as of December 31, 2009

Daily net production for the quarter ended March 31, 2010

21

NASDAQ: AXAS