Attached files

| file | filename |

|---|---|

| EX-5 - EX-5 - Eagle Life Insurance Co | a2199090zex-5.htm |

| EX-4.(V) - EX 4(V) - Eagle Life Insurance Co | a2199090zex-4_v.htm |

| EX-4.II - EX-4II - Eagle Life Insurance Co | a2199090zex-4_ii.htm |

| EX-23.I - EX-23I - Eagle Life Insurance Co | a2199090zex-23_i.htm |

| EX-23.III - EX-23.III - Eagle Life Insurance Co | a2199090zex-23_iii.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

TABLE OF CONTENTS 3

TABLE OF CONTENTS 4

Table of Contents

As filed with the Securities and Exchange Commission on June 18, 2010

Registration No. 333-160345

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Pre-Effective Amendment No. 2 to

Form S-1

Registration Statement under the Securities Act of 1933

Eagle Life Insurance Company

(Exact name of Registrant as specified in its charter)

| Iowa (State or other jurisdiction of incorporation or organization) |

6311 (Primary Standard Industrial Classification Code Number) |

26-3218907 (I.R.S. Employer Identification No.) |

| Agent for Service: Debra J. Richardson Eagle Life Insurance Company 6000 Westown Parkway West Des Moines, Iowa 50266 Phone: 1-866-526-0995 (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service) |

Copy to: Stephen E. Roth, Esq. Thomas E. Bisset, Esq. Sutherland Asbill & Brennan LLP 1275 Pennsylvania Avenue, N.W. Washington, DC 20004-2415 (202) 383-0100 |

|

Eagle Life Insurance Company 6000 Westown Parkway West Des Moines, Iowa 50266 Phone: 1-866-526-0995 (Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices) |

||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Calculation of Registration Fee

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per unit |

Proposed maximum aggregate offering price |

Amount of registration fee |

||||

|---|---|---|---|---|---|---|---|---|

| Flexible Premium Deferred Indexed Annuity Contract | * | * | $500,000,000* | $27,900† | ||||

- *

- The

maximum aggregate offering price is estimated solely for the purposes of determining the registration fee. The amount to be registered and the proposed

maximum offering price per unit are not applicable since these securities are not issued in predetermined amounts or units.

- †

- The registration fee of $27,900 was previously paid in connection with the filing of the Registrant's initial Registration Statement on June 30, 2009.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Prospectus Dated June 28, 2010

FALCON GOLD

FLEXIBLE PREMIUM DEFERRED INDEXED ANNUITY CONTRACT

ISSUED BY

EAGLE LIFE INSURANCE COMPANY

6000 Westown Parkway

West Des Moines, Iowa 50266

Offered Through: American Equity Capital, Inc.

| The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

This prospectus describes the Falcon Gold Annuity Contract ("Contract"), an individual flexible premium deferred indexed annuity contract issued by Eagle Life Insurance Company ("Eagle Life," the "Company", "we", "us", or "our"). The Contract is designed for individuals and certain retirement plans that qualify for special federal income tax treatment, as well as those that do not qualify for such treatment. The Contract offers you the ability to allocate your monies among three interest rate calculation methods or interest crediting options, accumulate interest earnings under the Contract on a tax-deferred basis and receive annuity payments. Purchasing the Contract in connection with a retirement plan that qualifies for special federal income tax treatment, however, does not provide any additional tax advantage beyond that already available through the retirement plan. The Contract is not an investment in the stock market or in any securities index.

The Contract offers the following interest rate calculation methods or interest crediting options:

- •

- 1-Year Fixed Value Option

- •

- 1-Year Annual Point to Point Value Option

- •

- 1-Year Monthly Point to Point Value Option

There are risks associated with the Contract. These risks include liquidity risks, risk that an Index Credit may not be credited to your Accumulated Value at the end of a Contract Year, risks that we may eliminate or substitute an interest rate calculation method, company solvency risks, and interest rate risks. Also, Surrender Charges and Market Value Adjustments ("MVA") may apply for a number of years, so the Contract should only be purchased for the long-term. Under some circumstances, you may receive less than the amount of Premiums you have paid into the Contract. The MVA may be either positive or negative, which means the MVA may increase or decrease the amount you receive as a withdrawal or upon surrender. Withdrawals and surrenders may be subject to income tax and may be subject to a 10% IRS penalty tax if taken before age 591/2. Accordingly, you should carefully consider your income and liquidity needs before purchasing the Contract. Additional information about these and other risks appears in the "Risk Factors" section on page and "Federal Income Taxes" on page .

We do not guarantee that the Contract will have the same or similar Indexed Value Options for the period you own the Contract. Although it is highly unlikely, it is possible that we may terminate or substitute an Indexed Value Option. If you do not wish to allocate your Contract Value to one or more of the remaining options available under the Contract, you may surrender your Contract, but if you do so during the Surrender Charge Period you will be assessed a Surrender Charge, and you may be subject to an MVA, which may result in you receiving less than the Premiums you have paid into the Contract. Although it is highly unlikely, it is also possible that we may eliminate all of the Indexed Value Options leaving only the Fixed Value Option available under the Contract. If that happens and you do not want to allocate all of your Contract Value to the Fixed Value Option, you may surrender your Contract, but if you do so during the Surrender Charge Period you will be assessed a Surrender Charge, and you may be subject to an MVA, which may result in you receiving less than the Premiums you have paid into the Contract.

American Equity Capital, Inc. ("American Equity Capital") is the principal underwriter for the Contract. American Equity Capital is not required to sell any specific number or dollar amount of securities but will use its best efforts to sell the securities offered. There are no arrangements to place funds in an escrow, trust, or similar account. This is a continuous offering.

This prospectus provides important information you should know before investing. Please keep the prospectus for future reference.

Neither the Securities and Exchange Commission ("SEC") nor any state securities commission has approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

An investment in this Contract is not a bank deposit and is not insured or guaranteed by any bank or by the Federal Deposit Insurance Corporation or any other government agency.

i

ii

The Contract may not be available in all states. This prospectus does not constitute an offer to sell any Contract and it is not soliciting an offer to buy any Contract in any state in which the offer or sale is not permitted. We do not authorize anyone to provide any information or representations regarding the offering described in this prospectus other than the information and representations contained in this prospectus.

iii

Accumulated Value: The amount under the Contract in the Fixed Value Option or an Indexed Value Option as adjusted for any withdrawals.

Annuitant: The person named in the application whose life is used to determine the amount and duration of any income payments involving life contingencies. The Contract Owner and the Annuitant must be the same person, unless the Contract Owner is a non-natural person.

Beneficiary: The person(s) or entity(ies) to whom the Death Benefit Proceeds will be paid in the event of the death of the Contract Owner or the Annuitant (if the Contract Owner is a non-natural person). The Contract Owner designates the initial Beneficiary on the Application.

Cap Rate: For the Indexed Value Options, a maximum rate or limit for a specified period that is used to determine the amount of any Index Credit.

Cash Surrender Value: The amount payable by us upon surrender of the Contract. It is equal to the greater of: (i) the Contract Value minus any Surrender Charge and plus or minus any MVA; or (ii) the Minimum Guaranteed Surrender Value.

Company, us, we, our, Eagle Life: Eagle Life Insurance Company.

Contract: The Contract, including any endorsements, riders or signed amendments, and the attached application.

Contract Date, Contract Month, Contract Year and Contract Anniversary: Coverage under the Contract begins on the Contract Date shown on your Contract Specifications Page. We measure Contract Months, Contract Years and Contract Anniversaries from the Contract Date.

Contract Owner, Owner: The person or entity who owns the Contract. The Contract Owner is the person or entity named in the application, unless subsequently changed, filed with and accepted by the Company, entitled to exercise all rights and privileges provided under the Contract.

Contract Value: The sum of your Accumulated Values in the Fixed Value Option and each Indexed Value Option.

Current Fixed Value Interest Rate: The interest rate we credit to your Accumulated Value in the Fixed Value Option, except for the portion of your initial Premium payment allocated to the Fixed Value Option only for the first Contract Year. The Current Fixed Value Interest Rate is declared from time to time and is never less than the Fixed Value Minimum Guaranteed Interest Rate. We may change the Current Fixed Value Interest Rate at any time in our sole discretion.

Death Benefit Proceeds: The amount we pay the Beneficiary on the death of the Contract Owner or the Annuitant (if the Contract Owner is a non-natural person). The Death Benefit Proceeds equal the greater of the Contract Value or the Minimum Guaranteed Surrender Value determined as of the date of the death.

Excess Withdrawals: Where the Lifetime Income Benefit Rider has been selected and scheduled payments under the Rider have commenced, Excess Withdrawals include any withdrawals you take in addition to those scheduled payments under the Rider.

Fixed Value Minimum Guaranteed Interest Rate: The minimum annual rate of interest we will credit under the Fixed Value Option. The Fixed Value Minimum Guaranteed Interest Rate is equal to 1%.

1

Fixed Value Option: An interest crediting methodology under which we credit a fixed rate of interest.

Home Office: 6000 Westown Parkway, West Des Moines, Iowa 50266. Phone 1-866-526-0995.

Index or S&P 500 Index: Standard & Poor's 500 Composite Stock Price Index.

Index Credit: The amount of interest we may credit for a Contract Year to your Accumulated Value allocated to an Indexed Value Option. The amount of an Index Credit is determined by reference to the performance of the S&P 500 Index over the Contract Year, subject to the applicable interest rate calculation methodology, including a Cap Rate.

Index Price: For any day, the closing price for the S&P 500 Index on that day. We use the Index Price to calculate Index Credits under the Indexed Value Options.

Index Publication Date: Any day on which a price for the S&P 500 Index is published.

Indexed Value Option: An interest crediting methodology under which we may credit an Index Credit to your Accumulated Value allocated to an Indexed Value Option. We make available two Indexed Value Options under the Contract, the 1-Year Annual Point to Point Value Option and the 1-Year Monthly Point to Point Value Option.

Initial Fixed Value Interest Rate: The interest rate we credit to the portion of your initial Premium allocated to the Fixed Value Option only for the first Contract Year. The Initial Fixed Value Interest Rate is set forth in the specifications page of your Contract and is never less than the Fixed Value Minimum Guaranteed Interest Rate.

IRC: Internal Revenue Code of 1986, as amended.

Issue Age: The age of the Contract Owner or Annuitant on the last birthday before the Contract Date.

Maturity Date: The date the Contract matures and the Maturity Proceeds become payable. The Maturity Date is the first Contract Anniversary immediately following the Annuitant's 114th birthday.

Maturity Proceeds: The amount we pay if the Contract is in force on the Maturity Date. The Maturity Proceeds equal the greater of the Contract Value or the Minimum Guaranteed Surrender Value on the Maturity Date.

Minimum Guaranteed Surrender Value: The minimum amount that we will pay you on the date that you surrender the Contract. The Minimum Guaranteed Surrender Value equals 87.5% of all Premiums paid (less any withdrawals you may have taken prior to surrender) accumulated at the Minimum Guaranteed Interest Rate.

Minimum Guaranteed Interest Rate: The minimum rate of interest that will be credited to the Minimum Guaranteed Surrender Value.

MVA: An adjustment that will be made to the Proceeds you receive if you surrender the Contract or take a withdrawal in excess of the Penalty-Free Withdrawal amount during the Surrender Charge Period. The MVA reflects in part the difference between the effective yield of the BofA Merrill Lynch 3-5 Year US Corporate Index or the BofA Merrill Lynch 5-7 Year US Corporate Index, depending upon the Surrender Charge Schedule you choose, at the time of the surrender or withdrawal and the effective yield of the applicable index on the Contract Date. The MVA may be either positive or negative.

MVA Factor: A factor we use in calculating the amount of any MVA.

2

Premium: A payment you make under the Contract. Each Premium must be forwarded either to the Company's Home Office or to your registered representative. The initial Premium must be received by us on or before the Contract Date.

Proceeds. The amount paid to the payee(s) under the Contract upon withdrawal, surrender, death or maturity. Proceeds paid upon withdrawal or surrender during the Surrender Charge Period will reflect any applicable Surrender Charge and MVA.

Settlement Option: The annuity payout options available under the Contract.

Supplementary Contract: A contract we issue in exchange for this Contract when you or your Beneficiary choose a Settlement Option.

Surrender Charge: A charge that we may assess if you surrender the Contract or take a withdrawal during the Surrender Charge Period.

Surrender Charge Period: The number of Contract Years during which we may assess a Surrender Charge on certain withdrawals and surrender. You may choose to have either a three, five or seven year Surrender Charge Period apply to your Contract.

Surrender Proceeds: The amount we will pay you if you surrender your Contract. The Surrender Proceeds are equal to the Cash Surrender Value of your Contract.

Withdrawal Amount: The amount we deduct from the Contract to pay a request for withdrawal.

Withdrawal Proceeds. The amount we pay you if you request a withdrawal from the Contract. During the Surrender Charge Period, the Withdrawal Proceeds will reflect any applicable Surrender Charge and MVAs.

3

The following summarizes key features of the Contract. This summary does not include all of the information you should consider before purchasing a Contract. You should carefully read the entire prospectus, which contains more detailed information concerning the Contract and the Company, before making an investment decision.

Your Contract is a deferred annuity contract. There are two phases to your Contract, an accumulation phase and a payout phase. Your Contract can help you save for retirement because it allows you to accumulate tax-deferred savings during the accumulation phase and provides insurance against outliving your accumulated savings in the payout phase. Earnings on your Premiums accumulate on a tax-deferred basis and remain tax-deferred until you withdraw them, surrender or receive annuity payments.

You may purchase the Contract for a minimum initial Premium of $10,000. You may make additional Premium payments subject to certain restrictions; see the "Additional Premiums" section on page for more information on restrictions governing additional Premium payments. We require a minimum Contract Value of $2,000 to keep the Contract in force, except when you have started receiving payments under the Lifetime Income Benefit Rider. For more information on the Rider, see the "Lifetime Income Benefit Rider" section on page .

Interest is credited in two ways under your Contract. Under the Fixed Value Option, we credit interest based on a fixed rate of interest we declare in advance. Under the Indexed Value Options, we credit interest by reference to the performance of the S&P 500 Index, in accordance with the interest rate calculation methodology you have chosen and subject to a Cap Rate. You determine how to allocate your Premium and Contract Value among the interest crediting options. You generally will not pay taxes on your earnings until you withdraw them. When you purchase the Contract, you are not buying shares in a securities index or an individual security.

Please call your registered representative or the Company at 1-866-526-0955 if you have questions about how your Contract works.

WHAT ARE MY CONTRACT'S FEES AND CHARGES?

The Surrender Charge, MVA and an optional rider charge (if you elect the Lifetime Income Benefit Rider) are the only fees and charges we assess under the Contract.

You may choose to have either a three, five or seven year Surrender Charge Schedule apply to your Contract. We will not issue the Contract unless you choose a Surrender Charge Schedule. During the Surrender Charge Period, if you surrender your Contract, fully or partially, or make a withdrawal larger than the Penalty-Free Withdrawal amount, you will be assessed a Surrender Charge and may be assessed an MVA. We will waive all or a portion of the Surrender Charge where your request for surrender or withdrawal meets the conditions of the Confinement Care Rider or Terminal Illness Rider. For information on the Confinement Care Rider or Terminal Illness Rider, see the "Surrender Charge" section on page . We only apply Surrender Charges and an MVA to withdrawals or surrenders made during the Surrender Charge Period.

For withdrawals during the Surrender Charge Period, the Surrender Charge equals the Withdrawal Amount (in excess of the Penalty-Free Withdrawal amount) multiplied by the applicable Surrender Charge Percentage as set forth under the Surrender Charge Schedule you selected. For surrenders during the Surrender Charge Period, the Surrender Charge equals your Contract Value plus any

4

Penalty-Free Withdrawal amounts taken in the 12 months prior to surrender of the Contract, multiplied by the applicable Surrender Charge Percentage. Below are the available Surrender Charge Schedules:

| |

Contract Year | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8+ | |||||||||||||||||

3-Year Surrender Charge Schedule: Surrender Charge Percentage |

8 | % | 7 | % | 6 | % | 0 | % | 0 | % | 0 | % | 0 | % | 0 | % | |||||||||

5-Year Surrender Charge Schedule: Surrender Charge Percentage |

8 | % | 7 | % | 6 | % | 5 | % | 4 | % | 0 | % | 0 | % | 0 | % | |||||||||

7-Year Surrender Charge Schedule: Surrender Charge Percentage |

8 | % | 7 | % | 6 | % | 5 | % | 4 | % | 3 | % | 2 | % | 0 | % | |||||||||

See the "Surrender Charge" section on page for more information on the Surrender Charge Period and Surrender Charges.

During the Surrender Charge Period, if you surrender your Contract or take a withdrawal in excess of the Penalty-Free Withdrawal amount, we will apply an MVA to the amount surrendered or withdrawn. The MVA is an adjustment that reflects in part the difference between the effective yield of the BofA Merrill Lynch 3-5 Year US Corporate Index or the BofA Merrill Lynch 5-7 Year US Corporate Index, depending upon the Surrender Charge Schedule you choose, at the time of the surrender or withdrawal and the effective yield of the applicable index on the Contract Date. The MVA may be either positive or negative, which means the MVA may increase or decrease the amount you receive as a surrender or withdrawal. See the "Market Value Adjustment" section on page for more information on the calculation of the MVA.

If you elect the Lifetime Income Benefit Rider, we assess an annual charge that equals the rider fee rate multiplied by your Contract Value on each Contract Anniversary. The rider fee rate is disclosed on the first page of the Rider and will never be higher than the maximum rider fee rate of 1%. See the "Lifetime Income Benefit Rider" section on page for more information on the Lifetime Income Benefit Rider.

WHAT ARE MY CONTRACT'S BENEFITS?

Your Contract offers you several benefits.

Principal and Interest Guarantees. Your Contract provides you with a Minimum Guaranteed Surrender Value which, on the date of Surrender of the Contract, equals 87.5% of all Premiums paid (less any withdrawals you may have taken prior to surrender) accumulated at the Minimum Guaranteed Interest Rate. In addition, your Contract guarantees that interest credited to the Fixed Value Option will never be less than 1% annually. These guaranteed interest rates are calculated as effective annual rates, compounded daily.

Upside Potential with Limited Downside Risk. Your Contract provides you the opportunity to earn interest that may be higher than the interest you could otherwise earn under a traditional annuity contract that credits a fixed rate of interest. The Contract does this through the Index Value Options which credit interest by reference to the performance of the S&P 500 Index. In addition, your Contract offers some protections against negative Index returns by providing that Index Credits will never be less than zero, and therefore negative Index returns will never reduce your Accumulated Value. In some circumstances, your Contract may credit interest that is lower than the interest that would be credited under a traditional annuity contract that credits a fixed rate of interest. Please see "WHAT ARE MY CONTRACT'S RISKS?" section on page .

5

Protection on Growth. Your Contract has an annual reset design for crediting interest under the Index Value Options. The annual reset design compares the change in the Index from the beginning of the Contract Year to the end of the Contract Year. The starting Index Price for any Contract Year (other than the initial Contract Year) is the Index Price as of the ending date of the previous Contract Year. This means if the Index Price at the end of a Contract Year is lower than it was at the beginning, even though amounts allocated to the Index Value Options will not be credited with interest for that Contract Year, the Accumulated Value remains the same and the beginning Index Price for the next Contract Year will be reset to the lower Index Price. The annual reset design provides incremental protection on growth by locking in the previous Contract Year's anniversary value. Locking in the positive index returns and ignoring negative index returns preserves your Contract's principal, including prior Index Credits.

Protection from Outliving your Income. Your Contract provides you with the opportunity to receive annuity payments anytime after the first Contract Year. Annuitizing your Contract converts your Cash Surrender Value into a stream of income which can be based on your life expectancy. Depending upon the type of annuity payout option you choose, annuitization of your Contract can provide you with an income stream that you cannot outlive.

Tax Deferral. Your Contract provides for tax-deferred growth. This may allow your money to grow faster because you earn interest on dollars that otherwise may have been paid in taxes. Your Premium payments earn interest, the interest compounds within the Contract and the money you may have otherwise paid in taxes earns interest. Interest earned under the Contract, whether as interest credited under the 1-Year Fixed Value Option or under one of the Indexed Value Options, generally is not taxed until it is withdrawn. You may purchase the Contract in certain tax qualified retirement plans (a "Qualified Contract"). However, note that tax qualified retirement plans provide their own tax deferral benefit; the purchase of this Contract does not provide additional tax deferral benefits beyond those provided in the tax qualified plan retirement plan. Please see the "Federal Income Taxes" section on page .

Annual Penalty-Free Withdrawals. During the Surrender Charge Period, you may take one (1) Penalty-Free Withdrawal from your Contract each Contract Year after the first Contract Year in an amount of up to 10% of your Contract Value without incurring a Surrender Charge or an MVA ("Penalty-Free Withdrawal amount"). However, taxes and tax penalties may apply to Penalty-Free Withdrawals and withdrawals may be restricted under certain Qualified Contracts.

Death Benefit Proceeds. The Company will pay out the Death Benefit Proceeds to your Beneficiary upon the death of the Contract Owner, or the Annuitant, in the case of a non-natural Contract Owner. The Death Benefit Proceeds payable under the Contract will equal the greater of the Contract Value or the Minimum Guaranteed Surrender Value. The Contract may allow you to avoid probate. By naming a Beneficiary, you may minimize the delays, expense and publicity often associated with probate. Your Beneficiary will receive Death Benefit Proceeds in either a lump sum or a series of income payments. There may be tax and other legal implications associated with naming particular Beneficiaries and selecting the form of payment. Please consult with your own legal or tax advisor regarding how to best structure payment of the Death Benefit Proceeds in your own individual situation. Death Benefit Proceeds are not subject to a Surrender Charge or an MVA.

Lifetime Income Benefit Rider. For an extra charge, we offer the Lifetime Income Benefit Rider. The Lifetime Income Benefit Rider guarantees that you can receive certain scheduled payments for your life, even if your Contract Value is reduced to zero, provided certain conditions are met. Scheduled payments under the Lifetime Income Benefit Rider are not subject to a Surrender Charge or an MVA unless you also make a withdrawal and together the withdrawal and scheduled payments under the Lifetime Income Benefit Rider exceed the Penalty-Free Withdrawal amount. Scheduled payments under the Lifetime Income Benefit Rider are not annuity payments and do not receive the

6

same favorable tax treatment as annuity payments. For more information on the Rider, see the "Lifetime Income Benefit Rider" section on page .

Your Contract also has various risks associated with it. It is important for you to understand the following risk factors before purchasing the Contract in order to determine whether the Contract is suited to your needs and goals.

Liquidity Risk. Your Contract is designed to be a long-term savings plan that you may use to help save for retirement. Your Contract is not designed to be a short-term investment. There is a risk that you may encounter a personal financial situation in which you need to surrender or withdraw all or a part of your Contract during the Surrender Charge Period. Withdrawals and surrenders in excess of the Penalty-Free Withdrawal amount taken before the end of the Surrender Charge Period are subject to a Surrender Charge and an MVA. The application of Surrender Charges and MVAs may result in a loss of a portion of your principal and/or earnings. Also, withdrawals may be subject to income taxes, and before age 591/2 may be subject to a 10% federal tax penalty. Accordingly, you could incur charges and pay income taxes should you take withdrawals, withdrawals after scheduled payments under the Lifetime Income Benefit Rider commence, or surrender your Contract during the Surrender Charge Period.

In certain circumstances, we may defer payment of your Surrender Proceeds for up to six months after we receive your request for surrender.

Indexed Interest Crediting Risk. We guarantee that if the Index declines, it will not reduce your Accumulated Value in an Indexed Value Option. However, if the Index declines or does not change, you bear the risk that no Index Credits will be added to your Accumulated Value in an Indexed Value Option at the end of a Contract Year. You also bear the risk that sustained declines in the Index may result in Index Credits not being credited to your Accumulated Value for a prolonged period. In addition, withdrawals from an Indexed Value Option prior to the end of a Contract Year will not receive an Index Credit for that year.

Historical Performance. The historical performance of the Index should not be taken as an indication of its future performance. While the trading prices of the underlying stocks comprising the Index will determine the level of the Index, it is impossible to predict whether the level of the Index will fall or rise. Trading prices of the underlying stocks comprising the Index will be influenced by the complex and interrelated economic, financial, regulatory, geographic, judicial, political and other factors that can affect the capital markets generally. Such trading prices also will be affected by the equity trading markets on which the underlying common stocks are traded, and by various circumstances that can influence the levels of the underlying common stocks in a specific market segment or the level of a particular underlying stock.

Other Interest Rate Risks. It is within our sole discretion to set the Cap Rate for the Indexed Value Options as well as the Initial Fixed Value Interest Rate and Current Fixed Value Interest Rate for the Fixed Value Option. The Cap Rate places an upper limit on the amount of interest an Indexed Value Option can earn in a Contract Year. Thus, if the Index increases, an Indexed Value Option may be credited with interest up to the Cap Rate which may be less than the increase in the Index. We will send you a notice at least 15 days before each Contract Anniversary disclosing the Cap Rate we expect to guarantee for the following Contract Year. In the highly unlikely event that volatile financial markets prevent us from being able to guarantee the Cap Rate for the next Contract Year in such notice, we will notify you of the new Cap Rate as soon as possible prior to the Contract Anniversary. We guarantee that the Cap Rate will not be less than the guaranteed minimum Cap Rate specified in your Contract.

7

The Initial Fixed Value Interest Rate is guaranteed for the first Contract Year. We guarantee that the Current Fixed Value Interest Rate will never be less than the Fixed Value Minimum Guaranteed Interest Rate specified in your Contract. However, we have the right to change the Current Fixed Value Interest Rate at any time in our sole discretion. Therefore, you bear the risk that any Current Fixed Value Interest Rate we establish in the future may be lower than the Current Fixed Value Interest Rate we currently credit and may not exceed the Fixed Value Minimum Guaranteed Interest Rate.

MVA Risk. If you surrender your Contract or take a withdrawal in excess of the Penalty-Free Withdrawal amount during the Surrender Charge Period, we will apply an MVA to the amount surrendered or withdrawn. There is a risk that the effective yield of the index used in the calculation of the MVA will increase from the Contract Date and, as a result, the MVA may decrease the Surrender Proceeds or Withdrawal Proceeds you receive. See the "Market Value Adjustment" section on page .

Maturity Date Risk. The terms of the Contract do not require you to surrender or settle the Contract before the Maturity Date (age 114). You are permitted, however, to surrender and elect a Settlement Option at any time. If the Contract is not settled until the Annuitant has reached an advanced age, however, there is a risk that the Contract might not be treated as an annuity for federal income tax purposes. In that event, the income and gains under the Contract would be currently includible in your income. You should consult a tax adviser.

Cost of Managing Index Credit Obligation. We manage our obligation to credit Index Credits under each Indexed Value Option, in part, by purchasing call options on the Index and by prospectively adjusting the Cap Rate on Contract Anniversaries to reflect changes in the cost of purchasing such call options (which cost varies based on market conditions). In certain cases, the cost of the call options may require us to reduce the Cap Rate for an Indexed Value Option for future Contract Years and thereby reduce the amount of the Index Credit you may otherwise receive or possibly discontinue an Indexed Value Option altogether. However the Cap Rate will never be reduced below the guaranteed minimum Cap Rate specified in your Contract.

Risk That We May Eliminate or Substitute an Index or Index Value Option. There is no guarantee that the Index described in this prospectus or the Indexed Value Options will be available during the entire time you own your Contract. If (i) the Index is discontinued, (ii) we are unable to utilize the Index, or (iii) the calculation of the Index is changed substantially, we may substitute a suitable equity index for the Index. If we do so, the performance of the new index may differ from the Index. This, in turn, may affect the amount of any future Index Credits you earn. With respect to our elimination or substitution of an Index, it is important to note the following:

- •

- A "substantial change" to the calculation of the Index may mean, but would not be limited to, a significant change in the

identity of the issuers that comprise the Index or the concentration of the Index in an industry segment or sector.

- •

- The suitability of a replacement index would depend on a number of factors, including, but not limited to, the

comparability of the replacement index and the replaced index with respect to the number of issuers that comprise the index and whether the index concentrates on any particular industry segment or

sector.

- •

- Examples of when we would be unable to utilize an index include, but would not be limited to, situations where we were

unable to obtain a license for the use of the index or if the publisher of the index went out of business.

- •

- Any elimination or substitution of the Index will not affect the guarantees under the Contract.

Although we believe it is highly unlikely, it is possible that we may eliminate all of the Indexed Value Options, leaving only the Fixed Value Option available under the Contract. In that event, your

8

Accumulated Value in the Indexed Value Options would be transferred to the Fixed Value Option. For more information, please see the "Contract Value: Indexed Value Options" section on page . IF WE TERMINATE OR SUBSTITUTE AN INDEXED VALUE OPTION AND YOU DO NOT WISH TO ALLOCATE YOUR CONTRACT VALUE TO ONE OR MORE OF THE REMAINING OPTIONS AVAILABLE UNDER THE CONTRACT, YOU MAY SURRENDER YOUR CONTRACT, BUT YOU MAY BE SUBJECT TO A SURRENDER CHARGE AND AN MVA, WHICH MAY RESULT IN A LOSS OF PREMIUM AND CREDITED INTEREST.

Lifetime Income Benefit Rider Risks. There are certain risks associated with the Lifetime Income Benefit Rider. For example, Excess Withdrawals may significantly reduce the value of the Rider and even cause the Rider to terminate. Excess Withdrawals taken during the Surrender Charge Period may also be subject to Surrender Charges and MVAs.

Creditor and Solvency Risk. Our general account assets support the guarantees under the Contract and are subject to the claims of our creditors. As such, the guarantees under the Contract are subject to our financial strength and claims-paying ability, and therefore, to the risk that we may default on those guarantees. You need to consider our financial strength and claims-paying ability in meeting the guarantees under the Contract. You may obtain information on our financial condition by reviewing our financial statements included in this prospectus. Information concerning our business and operations is also set forth in the "Information Regarding Eagle Life Insurance Company" section on page .

No Ownership Rights. Purchasing a Contract is not equivalent to investing in the underlying stocks comprising the S&P 500 Index. You will have no ownership interest or rights in the underlying stocks comprising the Index, such as voting rights, dividend payments, or other distributions. Also, we are not affiliated with the sponsor of the Index or the underlying stocks comprising the S&P 500 Index. Consequently, the Index and the issuers of the underlying stocks comprising the Index have no involvement with the Contract.

Possible Tax Law Changes. There is always the possibility that the tax treatment of the Contract could change by legislation or otherwise. We have the right to modify the Contract in response to legislative changes that could otherwise diminish the favorable tax treatment that Contract Owners currently receive. You should consult a tax adviser with respect to legislative developments and their effect on the Contract.

Your Contract Value is calculated by adding together the Accumulated Values in the Fixed Value Option and the Indexed Value Options. It will be reduced by the amount of any withdrawals you make, but cannot decrease due to any negative performance of the Index. Your Contract Value will be increased by the amount of any Premium payments you make and any interest credited under the Contract.

Generally, your Accumulated Value in an Option at any time will equal:

- •

- Any Premium allocated to the Option,

- •

- Minus any Withdrawal Amounts taken from that Option,

- •

- Plus any interest credited (or Index Credits earned*),

- •

- Adjusted for any transfers into or out of the Option.

- *

- Note that a Cap Rate, or upper limit on annual interest credited, applies to each of the Indexed Value Options but does not apply to the Fixed Value Option. The Cap Rate for each Indexed Value Option is specified in your Contract. At least 15 days prior to each Contract Anniversary, we will send you a notice that identifies the Cap Rate for each Indexed Value

9

Option that we expect to guarantee for the next Contract Year as well as the Current Fixed Value Interest Rate. You can also call your registered representative or the Company at 1-866-526-0995 for information regarding the Cap Rate. In the highly unlikely event that volatile financial markets prevent the Company from being able to guarantee the Cap Rate for the next Contract Year in such notice, the Company will notify Contract Owners of the Cap Rate as soon as possible prior to the Contract Anniversary.

HOW ARE MY PREMIUMS ALLOCATED?

You may allocate all or any portion of your initial Premium to the Fixed Value Option or either of the two Indexed Value Options. To select an Indexed Value Option at Contract issuance, you must allocate at least 10% of the initial Premium to that Option. We will accept additional Premiums between Contract Anniversaries. Additional Premiums received between Contract Anniversaries are held in the Fixed Value Option and will earn the Current Fixed Value Interest Rate until the next Contract Anniversary. If we receive your additional Premium on a Contract Anniversary, you may allocate all or any portion of your additional Premium directly to the Fixed Value Option or either of the two Indexed Value Options. There are no minimum allocation requirements for additional Premiums.

MAY I TRANSFER MONEY BETWEEN OPTIONS?

On each Contract Anniversary, you may choose to transfer your Accumulated Value between Options, subject to a $1,000 minimum to maintain an Indexed Value Option. If a transfer or withdrawal reduces your Accumulated Value in an Indexed Value Option below $1,000, we will automatically transfer the remaining Accumulated Value to the Fixed Value Option on the next Contract Anniversary. There is no minimum required Accumulated Value to maintain the Fixed Value Option. Transfers between Options are not subject to Surrender Charges or an MVA.

WHAT ARE MY CONTRACT'S PAY OUT PROVISIONS?

We will pay you Proceeds from the Contract when you take a withdrawal, you surrender your Contract, the Contract Owner or the Annuitant (if the Contract Owner is a non-natural person) dies, or when the Contract matures. We will pay all Death Benefit Proceeds or Maturity Proceeds under an automatic settlement option, unless you or your Beneficiary, as applicable, chooses to apply the Death Benefit or Maturity Proceeds to provide payments under another Settlement Option or in a lump sum. See "Contract Proceeds and Payout Provisions: Settlement Options" on page . A Surrender Charge and an MVA may apply to a surrender or withdrawal taken during the Surrender Charge Period. In addition, a surrender or withdrawal may be subject to income tax and, if you are younger than age 591/2 at the time of the withdrawal or surrender, a 10% penalty tax may apply. Withdrawals may be restricted under certain Qualified Contracts. You may choose to annuitize your Contract anytime after the first Contract Year.

You may request a withdrawal under the Contract at any time. When you request a withdrawal, we deduct the amount of the withdrawal first from your Accumulated Value under the Fixed Value Option, then proportionally from your Accumulated Value under the Indexed Value Options. During the Surrender Charge Period, you may make one Penalty-Free Withdrawal in each Contract Year beginning after the first Contract Year. A Penalty-Free Withdrawal allows you to withdraw up to 10% of the Contract Value each Contract Year (determined at the time of withdrawal) without a Surrender Charge or an MVA applied to those amounts. Any withdrawals taken after the end of the Surrender Charge Period will not be subject to a Surrender Charge or an MVA.

10

If a withdrawal reduces your Accumulated Value in an Indexed Value Option below $1,000, we will transfer the remaining Accumulated Value to the Fixed Value Option on the next Contract Anniversary. If a withdrawal reduces your Contract Value below $2,000, the Contract will terminate and we will pay you the Surrender Proceeds, except when scheduled payments under the Lifetime Income Benefit are being made.

You may be eligible to withdraw amounts in addition to the 10% Penalty-Free Withdrawal amount described above during the Surrender Charge Period without a Surrender Charge or MVA applied to those amounts if you qualify for a waiver under either the Confinement Care Rider or Terminal Illness Rider. See the "CONTRACT PROCEEDS AND PAYOUT PROVISIONS: Withdrawal" section on page for more information on the Confinement Care and Terminal Illness waivers.

When you request a withdrawal, you can specify either the gross or net amount of the withdrawal. The net amount (Withdrawal Proceeds) is the actual amount you would receive, which would be net of any Surrender Charge or MVA. The gross amount (Withdrawal Amount) equals the net amount plus any Surrender Charge and MVA. The gross amount (Withdrawal Amount) is the amount that would be deducted from your Contract Value to honor the withdrawal request.

Depending upon whether a Penalty-Free Withdrawal, a Surrender Charge or an MVA applies, the Withdrawal Proceeds you receive could be greater or less than the Withdrawal Amount deducted from your Contract Value.

If you surrender your Contract, we will pay you the Surrender Proceeds in a lump sum or under a Settlement Option. The Surrender Proceeds are equal to the Cash Surrender Value of your Contract, which is the greater of: (i) the Contract Value minus any Surrender Charges and plus or minus any MVA; or (ii) the Minimum Guaranteed Surrender Value as of the date of surrender. We consider any amount previously taken as a Penalty-Free Withdrawal within 12 months of the surrender of the Contract during the Surrender Charge Period part of the surrender for purposes of applying a Surrender Charge or MVA. If the state in which you live requires us to pay premium taxes, we will calculate your Surrender Proceeds as if we had deducted the premium taxes from your Premium payments when we received them.

On the date that we receive due proof of death of the Contract Owner or Annuitant (if the Contract Owner is a non-natural person), we will pay the Death Benefit Proceeds to the Beneficiary. The Death Benefit Proceeds will be payable in a lump sum or under a Settlement Option. The Death Benefit Proceeds equal the greater of the Contract Value or the Minimum Guaranteed Surrender Value determined as of the date of death. If death occurs before the Maturity Date, we will pay the Death Benefit Proceeds to the designated Beneficiary. We do not apply a Surrender Charge or MVA to amounts payable as Death Benefit Proceeds. However, if the state in which you live requires us to pay premium taxes, we will calculate your Death Benefit Proceeds as if we had deducted the premium taxes from your Premium payments when we received them.

If the Contract is in force on the Maturity Date, we will pay Maturity Proceeds that equal the greater of the Contract Value or the Minimum Guaranteed Surrender Value on the Maturity Date.

11

Should you decide to receive income payments on or after the Maturity Date or surrender, you will have several annuity payout options from which to choose. Annuity payout options are a benefit of deferred annuities, but annuitization is not a requirement of the Contract. The following Settlement Options are available: Automatic, Income for a Specified Period, Life Income, Income of a Specified Amount, and Joint and Survivor Income. Each Settlement Option provides for income payments for a minimum of 5 years. We may also make other Settlement Options available.

DO I HAVE A RIGHT TO EXAMINE AND RETURN THE CONTRACT?

You may cancel your Contract and return it to us or to your registered representative within a certain number of days of its receipt and receive a refund of the Premium you paid less any withdrawals you made. Generally, you must return your Contract within 15 days of receipt, but some states may permit a longer period.

This Contract terminates on the earliest of:

- •

- The date you fail to maintain the $2,000 minimum Contract Value we require (unless the Lifetime Income Benefit Rider is in

effect and LIB payments have begun);

- •

- The date you choose to exercise the annuitization option;

- •

- The date you surrender your Contract;

- •

- The date the Owner/Annuitant dies; or

- •

- The Maturity Date.

12

The Falcon Gold Annuity Contract is an individual flexible premium deferred indexed annuity contract issued by Eagle Life. This Contract is designed for individuals and certain retirement plans that qualify for special federal income tax treatment, as well as those that do not qualify for such treatment. During the accumulation phase, your Contract can help you save for retirement because it can allow your Contract Value to earn interest on a tax-deferred basis and you can later elect to receive retirement income for life or a period of years. During the pay-out phase of your Contract, you can elect to receive annuity payments by applying the Cash Surrender Value to one of the Settlement Options offered in your Contract.

Interest is credited in two ways under your Contract. Under the Fixed Value Option, we credit interest based on a stated rate of interest we declare in advance. Under the Indexed Value Options, we credit interest by reference to the performance of the S&P 500 Index, in accordance with the interest rate calculation methodology you have chosen and subject to a Cap Rate. You determine how to allocate your Premium among the interest crediting options. You generally will not pay taxes on your earnings until you withdraw them.

The Falcon Gold Annuity Contract offers three different Surrender Charge Schedules, each having a distinct Surrender Charge Period. The rates of interest we declare for the Fixed Value Option and the Cap Rate for each Indexed Value Option may vary depending upon the Surrender Charge Schedule you select. Generally, Surrender Charge Schedules with longer Surrender Charge Periods will have higher Initial Fixed Value Interest Rates, Current Fixed Value Interest Rates and Cap Rates. Conversely, in general Surrender Charge Schedules with shorter Surrender Charge Periods will have lower Initial Fixed Value Interest Rates, Current Fixed Value Interest Rates and Cap Rates. For further information on the Surrender Charge Schedules, see the "Surrender Charge—Credited Interest Rates and Cap Rates" section on page ." The Contract is not an investment in the stock market or in the S&P 500.

We describe your rights under the Contract below and in your Contract. Contracts issued in your state may provide different features and benefits than those described in this prospectus. Those differences may include the length of the period you have to examine the Contract and return it to us for a refund, the amount of the Surrender Charge, the Maturity Date, or the availability of certain Settlement Options. We will identify any such state variations in your Contract. Your registered representative can provide you with more information about any state variations that apply to your Contract. The Contract does not participate in the surplus or profits of the Company and the Company does not pay any dividends on it.

To purchase a Contract, you must complete an application and pay an initial Premium of at least $10,000. The initial Premium must be received by us on or before the Contract Date. Both the Contract Owner and the Annuitant, in the case of a non-natural Contract Owner, must be under the age of 80 to be eligible to purchase a Contract. After we receive a completed application, and any other necessary information, we will begin the process of issuing the Contract. There may be delays in our processing of your application because of delays in receipt of your application from your registered representative or because of delays in determining whether the Contract is suitable for you. Any such delays may affect the date we issue your Contract. Your application is subject to our approval. We reserve the right to refuse to issue a Contract at any time in our sole discretion. We may discontinue offering the Contract at any time.

13

We impose a maximum limit on the amount of Premiums that may be paid under the Contract of $1,000,000. We may allow a Contract Owner to make Premium payments under the Contract in an amount that exceeds the maximum limit for cumulative Premium payments in our sole discretion.

| Note: | You may use the Contract with certain tax qualified retirement plans. The Contract includes attributes such as tax deferral on accumulated earnings. Tax qualified retirement plans provide their own tax deferral benefit; the purchase of this Contract does not provide additional tax deferral benefits beyond those provided in the qualified plan. Accordingly, if you are purchasing this Contract through a tax qualified retirement plan, you should consider purchasing the Contract for its other features such as the underlying guarantees, the Death Benefit and other non-tax related benefits. Please consult a tax adviser for information specific to your circumstances to determine whether the Contract is an appropriate investment for you. |

If mandated by applicable law, including Federal laws designed to counter terrorism and prevent money laundering, we may be required to reject your Premium. We may also be required to provide additional information about you or your Contract to government regulators. In addition, we may be required to block a Contract Owner's account and thereby refuse to honor any request for transfer, withdrawal, surrender, annuity payments, and Death Benefit Proceeds, until instructions are received from the appropriate government regulator.

You have the right to examine your Contract, determine that you are satisfied and that it meets your needs. You may return the Contract to the Company or your registered representative within 15 days of your receipt of the Contract without incurring any Surrender Charges. Some states may permit a longer period to examine and return the Contract. If you return the Contract within the specified timeframe, the Company will cancel your Contract and refund any Premium, less withdrawals, if any, within 10 days of the earlier of the Company's or your registered representative's receipt of the returned Contract.

You may make additional Premium payments at any time, as long as each additional Premium payment is at least $1,000, and not greater than the maximum limit on cumulative Premium payments we allow. We may return any portion of a Premium payment that would cause the Contract to exceed any Company, federal or state limitations on Premium payments received during any taxable year.

We cannot process your requests for transactions relating to the Contract until we have received them in good order at our Home Office. "Good order" means the actual receipt of the transaction request in writing, along with all information and supporting legal documentation necessary to effect the transaction. This information and documentation generally includes your completed application, the Contract number, the transaction amount (in dollars), selected allocation among the Options, your signature, as reflected on the Contract, if necessary, and any other information or supporting documentation that we may require. "Good order" also generally includes receipt of a sufficient Premium payment by us to effect the transaction. We may, in our sole discretion, determine whether any particular transaction request is in good order, and we reserve the right to change or waive any good order requirements at any time.

14

TAX-FREE "SECTION 1035" EXCHANGES

You can generally exchange one annuity contract for another in a "tax-free exchange" under Section 1035 of the IRC. Before making an exchange, you should compare both contracts carefully. Remember that if you exchange another contract for the Contract described in this prospectus, you might have to pay a surrender charge or any applicable market value adjustment on the existing contract. If the exchange does not qualify for Section 1035 tax treatment, you may have to pay federal income tax, including a possible penalty tax, on your old contract. There may be a new Surrender Charge Period for the Contract and other charges may be higher (or lower) and the benefits may be different. There may be delays in our processing of the exchange. You should not exchange another contract for this one unless you determine, after knowing all the facts, that the exchange is in your best interest. The person selling you this Contract will generally earn a commission from us.

Once purchased, the Contract belongs to you, the Contract Owner. You have all rights granted by the Contract. Contract Owner means the owner named in the application or any successor or assignee if ownership has been assigned. During the Annuitant's lifetime all rights may be exercised by the Owner subject to the rights of (a) any assignee of record with the Company, and (b) any irrevocably named Beneficiary. The Owner and the Annuitant must be the same person unless the Owner is a non-natural person.

Subject to the "Death Benefit Proceeds" section of the prospectus, all rights of the Owner terminate on the death of the Owner/Annuitant. If the Owner is not a natural person, the death of any Annuitant shall be treated as the death of an Owner of the Contract. If you have any questions concerning the criteria you should use when choosing an Owner/Annuitant, consult your registered representative.

You have the right to name a Beneficiary when you apply for the Contract and to add a new Beneficiary at any time while you own the Contract. While the Contract is in force, you may change the Beneficiary by a signed written notice sent to our Home Office, unless the Beneficiary is an irrevocable Beneficiary. The change will take effect on the date we receive the notice. Any change is subject to payment or other action we took before receiving notice. See "Naming a Beneficiary" on page .

All rights of a Beneficiary, including an irrevocable Beneficiary, will end if the Beneficiary dies before the Owner/Annuitant. If the Beneficiary dies while the Contract is in force, you may add a new Beneficiary by a signed written notice sent to our Home Office.

You must notify us of any assignment of your Contract by a signed written notice sent to our Home Office. All assignments of the Contract are subject to our approval and will only be effective if approved by us. We reserve the right to refuse any assignment at any time in our sole discretion. Qualified Contracts may not be assigned or transferred except as permitted by the IRC and/or the Employee Retirement Income Security Act of 1974 ("ERISA"). An assignment will take effect on the date we approve the assignment. We have no liability for our actions or omissions related to a requested assignment done in good faith. Consult your tax adviser about the tax consequences of an assignment. Also, you should consult an attorney before you assign your Contract. Please note that a change of Owner does not change automatically the Beneficiary, however, the new Owner may change the Beneficiary. See "Right to Name a Beneficiary" on page .

15

You must instruct us as to how the initial Premium is to be allocated among the Fixed and Indexed Value Options. The allocation of the initial Premium to an Indexed Value Option must be at least 10% of the Initial Premium amount subject to the requirement that a minimum of $1,000 remain in an Indexed Value Option to maintain the Option.

All additional Premium payments received between Contract Anniversaries are deposited into the Fixed Value Option and will earn the Current Fixed Value Interest Rate. On the next Contract Anniversary, you may transfer all or a portion of your Accumulated Value in the Fixed Value Option to an Indexed Value Option. If we receive an additional Premium on a Contract Anniversary, you may allocate all or any portion of your additional Premium directly to the Fixed Value Option or either of the two Indexed Value Options.

We permit transfers of Accumulated Value between and among the Options on each Contract Anniversary. If you make a transfer on a Contract Anniversary or a withdrawal from an Indexed Value Option that reduces your Accumulated Value in the Indexed Value Option below the $1,000 minimum balance we require to maintain an Indexed Value Option, we will automatically transfer your remaining Accumulated Value from that Indexed Value Option to the Fixed Value Option on the next Contract Anniversary.

Based on current tax laws, transfers between Options are not taxable. Transfers are also not subject to Surrender Charges or MVAs. If you do not elect to make a transfer, your Accumulated Value will remain in the same Option(s) for the next Contract Year.

For a transfer of Accumulated Value among Options to take effect as of a Contract Anniversary, you must submit a written request satisfactory to us that we receive at our Home Office on or before the Contract Anniversary. You must designate the Options from which the transfer will be made and the amount of the transfer either expressed as a total dollar amount or a percentage of your Contract Value.

We offer three different Surrender Charge Schedules under the Contract. The Surrender Charge Schedules vary by length of Surrender Charge Period. We currently offer Surrender Charge Schedules with Surrender Charge Periods of three, five and seven years. The rates of interest we declare for the Fixed Value Option and the Cap Rate for each Indexed Value Option may vary depending upon the Surrender Charge Schedule you select. For further information on the Surrender Charge Schedules, see the "Surrender Charge—Credited Interest Rates and Cap Rates" section on page ."

Your Contract Value is the sum of your Accumulated Value in the Fixed Value Option and each Indexed Value Option. Your Contract Value will increase by the amount of any Premium payments and any interest credited, including any Index Credits earned. It will be reduced by the amount of any withdrawals, but cannot decrease due to any negative performance of the Index.

On the Contract Date, your Accumulated Value in the Fixed Value Option equals the amount of the initial Premium allocated to that Option. On each subsequent Contract Anniversary, your Accumulated Value in the Fixed Value Option equals:

- •

- Your Accumulated Value in the Fixed Value Option on the last Contract Anniversary (for the first Contract Anniversary, your Accumulated Value on the Contract Date); plus

16

- •

- Any Premium payments since the last Contract Anniversary (for the first Contract Year, the Contract Date); minus

- •

- Any Withdrawal Amounts from the Fixed Value Option since the last Contract Anniversary (for the first Contract Year, the

Contract Date); plus

- •

- Any interest credited to the Fixed Value Option since the last Contract Anniversary (for the first Contract Year, the

Contract Date); and adjusted for

- •

- Any transfers into or out of the Fixed Value Option on the current Contract Anniversary.

The transfer of Accumulated Value from an Indexed Value Option to the Fixed Value Option on a Contract Anniversary will not change your Contract Value. In that case, your Accumulated Value in the Indexed Value Option will decrease and your Accumulated Value in the Fixed Value Option will increase by the same amount. Transfers are not subject to Surrender Charges or MVAs.

Between Contract Anniversaries, your Accumulated Value in the Fixed Value Option equals:

- •

- Your Accumulated Value in the Fixed Value Option on the last Contract Anniversary (for the first Contract Anniversary,

your Accumulated Value on the Contract Date); plus

- •

- Any Premium payments since the last Contract Anniversary (for the first Contract Year, the Contract Date); minus

- •

- Any Withdrawal Amounts from the Fixed Value Option since the last Contract Anniversary (for the first Contract Year, the

Contract Date); plus

- •

- Any interest credited to the Fixed Value Option since the last Anniversary (for the first Contract Year, the Contract Date).

For the first Contract Year, the portion of your initial Premium allocated to the Fixed Value Option will earn the Initial Fixed Value Interest Rate. Other than your initial Premium credited with the Initial Fixed Value Interest Rate for the first Contract Year, your Accumulated Value in the Fixed Value Option, including any additional Premiums we receive in the first and later Contract Years, will earn the Current Fixed Value Interest Rate, which we will declare from time to time and guarantee will never be less than the Fixed Value Minimum Guaranteed Interest Rate. The Fixed Value Minimum Guaranteed Interest Rate is guaranteed for the life of the Contract. We may change the Current Fixed Value Interest Rate at any time in our sole discretion. We credit interest on your Accumulated Value in the Fixed Value Option on a daily basis.

We consider various factors in setting the Initial Fixed Value Interest Rate and the Current Fixed Value Interest Rate, including investment returns available at the time that we issue the Contract, sales commissions, administrative expenses, regulatory and tax requirements, general economic trends, and competitive factors. In addition, the Initial Fixed Value Interest Rate and the Current Fixed Value Interest Rate may vary depending on your Contract's Surrender Charge Schedule. Additional information about the effect of the different Surrender Charge Schedules on the Initial Fixed Value Interest Rate and the Current Fixed Value Interest Rate appears in the "Surrender Charge—Credited Interest Rates and Cap Rates" section on page .

The specification page of the Contract identifies the Initial Fixed Value Interest Rate we credit to the portion of your initial Premium payment allocated to the Fixed Value Option for the first Contract Year. At least 15 days prior to each Contract Anniversary, we will send you a notice that identifies the Current Fixed Value Interest Rate we expect to credit at the beginning of the next Contract Year. You can also call your registered representative or the Company at 1-866-526-0995 for information regarding the Initial Fixed Value Interest Rate and the Current Fixed Value Interest Rate.

17

On the Contract Date, your Accumulated Value in an Indexed Value Option equals the amount of the initial Premium allocated to that Option. On each subsequent Contract Anniversary, your Accumulated Value in an Indexed Value Option equals:

- •

- Your Accumulated Value in the Indexed Value Option on the last Contract Anniversary (for the first Contract Anniversary,

your Accumulated Value on the Contract Date); minus

- •

- Any Withdrawal Amounts from the Indexed Value Option since the last Contract Anniversary (for the first Contract Year, the

Contract Date); plus

- •

- Any Index Credit earned for the Option on the current Contract Anniversary; and adjusted for

- •

- Any transfers into or out of the Option on the current Contract Anniversary.

Between Contract Anniversaries, your Accumulated Value in an Indexed Value Option equals:

- •

- Your Accumulated Value in the Indexed Value Option on the last Contract Anniversary (during the first Contract Year, your

Accumulated Value on the Contract Date); minus

- •

- Any Withdrawal Amounts from the Indexed Value Option since the last Contract Anniversary (for the first Contract Year, the Contract Date).

We will credit interest to your Accumulated Value in an Indexed Value Option on a Contract Anniversary based on the percentage change in the Index during the Contract Year just completed, subject to the applicable interest rate calculation methodology, including a Cap Rate.

The Contract offers two Indexed Value Options: the Annual Point to Point Value Option and the Monthly Point to Point Value Option. Both Indexed Value Options are currently linked to the S&P 500 Index. Past performance of the Index is no guarantee of future performance of your Accumulated Value under the Indexed Value Options of the Contract.

Index Credit. Your Accumulated Value allocated to an Indexed Value Option will earn interest, an Index Credit, based on the particular Option chosen (either the Annual Point to Point Value Option or the Monthly Point to Point Value Option), the performance of the Index and the Cap Rate. The earned Index Credit, if any, will be added to your Accumulated Value under the chosen Indexed Value Option on the Contract Anniversary. We will apply Index Credits before we process transfers of Accumulated Value on a Contract Anniversary. Since your Contract is not an investment in the stock market or in the Index, the Index Credits will not mirror the exact performance of any stock market or index. While Index Credits may equal zero, they will never be less than zero, and therefore will never reduce your Accumulated Value.

Cap Rate. The Cap Rate is the maximum rate or limit that we use in determining the amount of an Index Credit. We set the initial Cap Rate at the time we issue the Contract but this rate may change annually on each Contract Anniversary for the following Contract Year. The Cap Rate may vary depending on which Indexed Value Option your Premiums are allocated to and your Contract's Surrender Charge Schedule. The guaranteed minimum Cap Rate on the Annual Point to Point Value Option is 4%. The guaranteed minimum monthly Cap Rate on the Monthly Point to Point Value Option is 1%. For each Indexed Value Option, the Cap Rate will not be less than the applicable guaranteed minimum Cap Rate. The Company in its sole discretion will make the determination whether to declare a Cap Rate above the guaranteed minimum Cap Rate. The Cap Rate applies only to the Indexed Value Options (and not to the Fixed Value Option). The initial Cap Rate is specified in your Contract. It is important to note that we only guarantee the current Cap Rate for one Contract Year. At least 15 days prior to each Contract Anniversary, we will send you a notice that identifies the Cap

18

Rate for each Indexed Value Option we expect to guarantee for the next Contract Year. You can also call your registered representative or the Company at 1-866-526-0995 for information regarding Cap Rates.

We consider various factors in determining the Cap Rate, including investment returns available at the time that we issue the Contract, sales commissions, administrative expenses, regulatory and tax requirements, general economic trends, and competitive factors. In addition, the Cap Rate may vary depending on your Contract's Surrender Charge Schedule. Additional information about the effect of a particular Surrender Charge Schedule on the Cap Rate appears in the "Surrender Charge—Credited Interest Rates and Cap Rates" section on page .

We determine the Cap Rate at our sole discretion. We can neither predict nor guarantee what those rates will be in the future.

| Note: | If all or any part of your Accumulated Value under an Indexed Value Option is annuitized, utilized in the settlement of the Death Benefit, or distributed in the form of Withdrawal Proceeds or Surrender Proceeds on any date other than a Contract Anniversary, that portion of your Accumulated Value will not participate in any Index Credits for the Contract Year in which the funds were annuitized, utilized in the settlement of the Death Benefit, or distributed. |

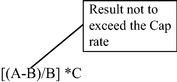

The Index Credit for the Annual Point to Point Value Option is calculated as follows:

- A

- = The

Index Price on the current Contract Anniversary

- B

- = The

Index Price on the last Contract Anniversary (for the first Contract Anniversary, the Index Price on the Contract Date)

- C

- = Your Accumulated Value under the Annual Point to Point Indexed Value Option on the last Contract Anniversary (for the first Contract Anniversary, your Accumulated Value on the Contract Date), minus any Withdrawal Amount(s) since the last Contract Anniversary for the Option

For examples of how Index Credits are calculated for the Annual Point to Point Value Option, please see the "Index Credit and MVA Examples: Calculation of the Annual Point to Point Value Option Index Credit" section on page 31.

The Monthly Point to Point Value Option uses a crediting method that is based on the monthly changes in the Index, subject to a monthly Cap Rate. The Index Credit, if any, is credited annually on the Contract Anniversary but is based on the sum of the 12 monthly percentage changes in the Index Price—which monthly percentage changes could be positive or negative. On each Contract Anniversary these monthly percentage changes, each of which cannot exceed the monthly Cap Rate, are added together to determine the Index Credit for that Contract Year. Negative monthly returns have no downside limit. However, any annual Index Credit will never be less than zero, and therefore will never reduce your Accumulated Value.

19

The Index Credit for the Monthly Point to Point Value Option is calculated as follows:

- A)

- The

MPT Sum (described below); multiplied by

- B)

- Your Accumulated Value under the Monthly Point to Point Value Option on the last Contract Anniversary (for the first Contract Anniversary, your Accumulated Value on the Contract Date), minus any Withdrawal Amount(s) since the last Contract Anniversary

The MPT Sum is determined by adding the MPT Ratios for each Contract Month during the Contract Year. Each monthly MPT Ratio is calculated as follows:

- A)

- The

Index Price on the Index Date;* minus

- B)

- The

Index Price on the immediately preceding Index Date (for the first Contract Month, the Index Price on the Contract Date); divided by

- C)

- The

Index Price on the immediately preceding Index Date (for the first Contract Month, the Index Price on the Contract Date); adjusted

- D)

- To

not exceed the monthly Cap Rate.

- *

- Index Date. Index Date, as used in calculating the Monthly Point to Point Value, is the Contract Date and the same day of each month thereafter. If the same day does not exist in a month (such as the 31st) or is not an Index Publication Date, then the Index Date is the immediately preceding day that is an Index Publication Date. For example, if the Contract Date is January 31, 2011, the next Index Date is February 28, 2011 (if it is an Index Publication Date), and the last day of each following month (if it is an Index Publication Date).

For examples of how Index Credits are calculated for the Monthly Point to Point Value Option, see the "Index Credit and MVA Examples: Calculation of the Monthly Point to Point Value Option Index Credit" section on page 33.

Termination or Substitution of an Index or Indexed Value Option. There is no guarantee that any of the Indexed Value Options will be available during the entire time you own your Contract. If: (i) the Index is discontinued, (ii) we are unable to utilize the Index, or (iii) the calculation of the Index is changed substantially, we may substitute a suitable equity index for the Index. If we do so, the performance of the new index may differ from the Index and could result in a lower Index Credit earned. This, in turn, may affect the Index Credits you earn. If we determine to substitute the Index during a Contract Year, we will delay the effective date of the substitution until the next Contract Anniversary.

If the Index is discontinued during a Contract Year, we may transfer your Accumulated Value in the Indexed Value Options to the Fixed Value Option and credit the Accumulated Value transferred with the Current Fixed Value Interest Rate for the remainder of the Contract Year. We will treat the portion of the Contract Year in which your Accumulated Value remained in the Indexed Value Option as a full Contract Year for the purpose of crediting any Index Credits.

Please note that we may terminate or substitute any or all of the Indexed Value Options at any time in our sole discretion by sending you written notice to your last known address stating the effective date on which the Indexed Value Option(s) will terminate or be substituted. We will send you the notice at least 60 days before the effective date of an Indexed Value Option's termination or substitution. On and after the effective date of the Indexed Value Option's termination or substitution, your Accumulated Value in that Indexed Value Option will be automatically transferred to the Fixed Value Option and will be credited with the Current Fixed Value Interest Rate for the remainder of the Contract Year. We will treat the portion of the Contract Year in which your Accumulated Value remained in the Indexed Value Option as a full Contract Year for the purpose of crediting any Index

20

Credits. IF WE TERMINATE OR SUBSTITUTE AN INDEXED VALUE OPTION AND YOU DO NOT WISH TO ALLOCATE YOUR CONTRACT VALUE TO ONE OR MORE OF THE REMAINING OPTIONS AVAILABLE UNDER THE CONTRACT, YOU MAY SURRENDER YOUR CONTRACT, BUT YOU MAY BE SUBJECT TO A SURRENDER CHARGE AND AN MVA, WHICH MAY RESULT IN A LOSS OF PREMIUM AND CREDITED INTEREST.

If we substitute an Indexed Value Option for a new Indexed Value Option, the new Indexed Value Option may be based on a different equity index and may use a different interest rate calculation methodology. The interest credited under the new Indexed Value Option may differ from the replaced Indexed Value Option and could result in a lower Index Credit earned.