Attached files

| file | filename |

|---|---|

| EX-10.6 - SUPPLEMENT TO DISTRIBUTION AGREEMENT - Dong Fang Minerals, Inc. | exhibit10-6.htm |

| EX-10.2 - SHARE CANCELLATION AGREEMENT - Dong Fang Minerals, Inc. | exhibit10-2.htm |

| EX-16.1 - LETTER TO THE SEC - Dong Fang Minerals, Inc. | exhibit16-1.htm |

| EX-10.1 - SHARE CANCELLATION AGREEMENT - Dong Fang Minerals, Inc. | exhibit10-1.htm |

| EX-10.5 - SUPPLEMENT TO DISTRIBUTION AGREEMENT - Dong Fang Minerals, Inc. | exhibit10-5.htm |

| EX-10.3 - RELEASE - Dong Fang Minerals, Inc. | exhibit10-3.htm |

| EX-10.4 - DISTRIBUTION AGREEMENT - Dong Fang Minerals, Inc. | exhibit10-4.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 15, 2010

HELI ELECTRONICS CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 000-53692 | N/A |

| (State or other jurisdiction of | (Commission File Number) | (I.R.S. Employer Identification |

| incorporation) | No.) |

No. 50 Fengxiang South Road, Jianggao Town, Baiyun District,

Guangzhou, P.R. China.

(Address of principal executive

offices)

(86) 020-36356228

(Registrant’s telephone

number, including area code)

Room A606, Dacheng International Centre,

78

Dongsihuanzhonglu

Chaoyang District, Bejing, P.R. China

(Registrant’s former name, address and telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

TABLE OF CONTENTS

1

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

| Item 3.01 | Unregistered Sales of Equity Securities. |

| Item 5.01 | Changes in Control of Registrant |

|

Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; |

As used in this Current Report on Form 8-K, unless otherwise stated, all references to the “Company”, “we,” “our” and “us” refer to Heli Electronics Corp.

Share Exchange

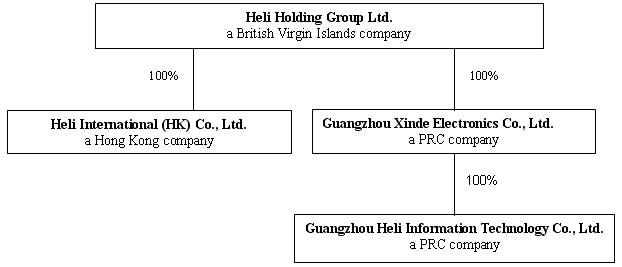

On June 14, 2010 we entered into a share exchange agreement (the “Share Exchange Agreement”) with Heli Holding Group Ltd., a company incorporated under the laws of the British Virgin Islands (”Heli Holding”) and all of the shareholders of Heli Holding (the “Heli Shareholders”). According to the terms of the Share Exchange Agreement, we agreed to acquire all of the share capital in Heli Holding from the Heli Shareholders in exchange for 144,280,000 shares of our common stock (the “Share Exchange”). Heli Holding owns 100% of the issued and outstanding share capital of Guangzhou Xinde Electronics Co., Ltd. (“Xinde”) and Heli International (HK) Company Limited (“Heli HK”). Xinde owns 100% of the issued and outstanding share capital of Guangzhou Heli Information Technology Co., Ltd. (“Heli IT”) and Heli HK does not currently have any operations.

On June 15, 2010 we closed the transactions contemplated by the Share Exchange Agreement and acquired Heli Holding as our wholly owned subsidiary. Going forward, we have abandoned our former business and will focus on the business operations of Heli IT, a wholly owned subsidiary of Heli Holding, incorporated under the laws of the People’s Republic of China (“China”). Heli IT is a logistics and distribution company currently specializing in sales and marketing of audio and visual (AV) products in mainland China for Haier Group, a world leader in electronics and electrical appliances. Our company’s long term goals are to leverage our brand awareness and experience in the field of distribution, sales and marketing to offer a full range of electronics and electrical products from a wide range of manufacturers.

On June 14, 2010, prior to the consummation of the Share Exchange and the issuances and cancellations contemplated therein, we had 720,720,000 shares of our common stock issued and outstanding following a 120 for 1 forward split. Upon the closing of the transactions contemplated by the Share Exchange Agreement we issued 144,280,000 shares of our common stock to the Heli Shareholders and cancelled an aggregate of 599,000,000 shares of common stock held by Lu Lu and Jian Hong Liu, our former director and officers. The 144,280,000 shares were issued in reliance upon an exemption from registration pursuant to Regulation S promulgated under the Securities Act of 1933, as amended (the “Securities Act”). As of the filing of this Current Report on Form 8-K there are 266,000,000 shares of our common stock issued and outstanding.

2

Organization

Set forth below is an organizational chart showing the entities that exist after the consummation of the Share Exchange.

Accounting Treatment

The Share Exchange is being accounted for as a “reverse merger,” since the Heli Shareholders now own a majority of the outstanding shares of our common stock immediately following the Share Exchange. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Share Exchange will be those of Heli Holding and will be recorded at the historical cost basis of Heli Holding, and the consolidated financial statements after completion of the Share Exchange will include the assets and liabilities our company and Heli Holding, historical operations of Heli Holding, and operations of the Heli Electronics Corp., from the closing date of the Share Exchange. As a result of the issuance of the shares of our common stock pursuant to the Share Exchange, a change in control of our company occurred on the date of consummation of the Share Exchange. We will continue to be a “smaller reporting company,” as defined under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), following the Share Exchange.

3

Description of Business

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. To the extent that any statements made in this report contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects”, “plans”, “will”, “may,”, “anticipates”, “believes”, “should”, “intends”, “estimates”, and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, our ability to raise additional capital to finance our activities; the effectiveness, profitability and marketability of our products; legal and regulatory risks associated with the share exchange; the future trading of our common stock; our ability to operate as a public company; our ability to protect our proprietary information; general economic and business conditions; the volatility of our operating results and financial condition; our ability to attract or retain qualified senior management personnel and research and development staff; and other risks detailed from time to time in our filings with the Securities and Exchange Commission (the “SEC”), or otherwise.

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We do not undertake any obligation to publicly update any forward-looking statements. As a result, investors should not place undue reliance on these forward-looking statements.

Overview

We were incorporated in the State of Nevada on November 7, 2007 as a mineral exploration company under the name Dong Fang Minerals, Inc. On March 29, 2010, we merged our wholly owned subsidiary corporation, Heli Electronics Corp. into Dong Fang Minerals, Inc., in order to change our name to Heli Electronics Corp. On April 5, 2010, we split our authorized and issued shares of common stock on the basis of 120 for 1. We maintain our statutory registered agent’s office at The Corporation Trust Company of Nevada, 1000 East William Street, Suite 204, Carson City, Nevada 89701 and our business offices are located at No. 50 Fengxiang South Road, Jianggao Town, Baiyun District, Guangzhou, P.R. China and our telephone number is (86) 020-36356228.

Previous Business

Before we experienced the change of control and closed the transactions contemplated by the Share Exchange Agreement with Heli Holding, we planned to explore mineral properties. We were not able to raise sufficient funds to continue this business and our management consequently began to focus on opportunities for business combinations with revenue-generating companies.

4

Current Business

Upon acquiring Heli Holding pursuant to the Share Exchange agreement, we adopted the business of Heli IT, Heli Holding’s wholly owned subsidiary. We are now a logistics and distribution company currently specializing in sales and marketing of audio and visual (AV) products in mainland China for Haier Group, a world leader in electronics and electrical appliances. Our long term goals are to leverage our brand awareness and experience in the field of distribution, sales and marketing to offer a full range of electronics and electrical products from a wide range of manufacturers.

On April 8, 2008 Heli IT entered into a distributor agreement with Suzhou Haier Information Technology Co., Ltd. for Haier Group produced multimedia speakers, mini-combination systems, as well as home theater systems. The term of the agreement is 10 years and it gives us the right to distribute the enumerated product lines within mainland China (not including Hong Kong, Macau and Taiwan) and market ourselves as authorized distributors of Haier products. We are obligated to ensure that we purchase at least $7.5 Million ($50 Million Chinese Yuan Renminbi) every year for the term of the agreement. This agreement has been renewed on an annual basis as per its terms. A full copy of this agreement is attached to this Current Report as Exhibit 10.4. On January 8, 2010 we amended the distribution agreement with Suzhou Haier to eliminate the monthly purchase requirements and transfer the responsibility for after sales service from Heli IT to Suzhou Haier. A full copy of this amendment is attached to this Current Report as Exhibit 10.5. Additionally, on May 28, 2010 we further amended this agreement to transfer all responsibility for delivered products to our company and to allow our company to unilaterally determine the price at which the products will be sold. A full copy of this amendment is attached to this Current Report as Exhibit 10.6.

Business Developments

Heli IT was established in March 2008. It became the official national marketing and promotion partner of Haier Group’s AV division in China in June 2008 and has been responsible for the general distribution of Haier mini speakers, multimedia stereo systems, home theatres, digital disc players, web players and other AV products since that time. Additionally, Heli IT is Haier’s official logistics and distribution partner for the mainland Chinese market.

- March 2008 – Heli IT established in Guangzhou.

- May 2008 - The National Working Conference was held at Haier’s headquarters in Qingdao, Shandong, in order to determine the market layout of Haier AV products in China.

- June 2008 – Heli IT authorized by Haier for marketing and promotion of Haier brand Audio and Visual products in mainland China.

- October 2008 - Branch offices in Northeastern, Northwestern, Central, Southwest and East China established.

- March 2009 - The Haier Distributor Conference held in Guangzhou to rearrange the product system and re-plan the marketing strategy.

- March 2010 - The Haier Distributor Conference held in Guangzhou to discuss establishment of Haier special image stores throughout the mainland China.

5

Principal Products

We market and distribute products from the Haier Audio/Visual line. These products include multimedia stereo systems, mini combination stereo systems and home theaters.

Multimedia Stereo Systems

Haier’s multimedia stereo systems are divided into several series, including the:

- ST Series – a line of desktop computer speakers ranging from 2 to 6 separate speakers;

- TP Series – premium home theatre systems;

- TQ Series – multi use, multi speaker systems in modern design; and

- HS Series – affordable multi-speaker systems for home theatre or computer use

| ST Series | TP Series |

|

|

| TQ Series | HS Series |

|

|

Mini Combinations

Haier’s mini combinations are intended for smaller home entertainment centers. They produce superior sounds as compared to the multimedia systems with deep bass and excellent mid to high range sounds. They all can be controlled by remote control for extra convenience to the customer and they can be customized to suit a customer’s specific needs. Many of them include karaoke ready systems, and have many types of inputs including mp3 players and other devices.

6

Home Theatres

Haier’s home theatres are intended for larger home entertainment centers. Many of them include Dolby Digital surround sound stand up speakers for premium sound quality and acoustics. They are extremely customizable to fit a customer’s exact needs and equipment. Everything is controllable by remote. These are our premium offerings intended for discerning buyers interested in the highest quality audio reproduction.

Markets, Customers and Distribution

With the current economic development, AV products are an important part of household consumption in China. According to the figures of the domestic audio-visual products industry market research in 2009 provided by Huicong AV Special Issue, the annual sales of stereo systems, DVD players, home theater and web players exceeded US $13 billion, an increase of 25.35% compared with the previous year. It accounts for over 90% of the amount spent in domestic household consumption (not taking into account basic necessities), and has become the leading type of domestic household good.

7

With the new policy of providing more home appliances into Chinese countryside areas implemented by China in 2008, audio-visual appliances are becoming more and more popular with residents in smaller towns and with wealthy farmers.

Our mainly carry out distribution and marketing through co-distributors, agents, and through cooperation with large Chinese domestic electrical appliance supermarkets, such as Gome, Huihai IT chains, and Suning. We have also established specialty stores and special display areas in electronics stores exclusively for our Haier products.

We current have 48 co-distributors or agents, 62 special Haier display areas within electronics stores and 31 specialty stores in southern China; 40 co-distributors or agents, 57 special Haier display areas in stores and 27 specialty stores in other areas. In addition to providing support for logistics and warehousing, we also employ 45 officers and 15 technical personnel to provide on-site business guidance and after-sales service according to regional distribution.

Currently, our major customers are the following outlets and co-distributors in their respective categories:

- Commercial Business Websites: Jingdong.com; Joyo.com. Both are leading shopping websites for purchasing electronics that cater to the Chinese market.

- Electronics Superstores: Gome; Suning. Both are leading electronics superstores within China.

- Other Reliable Channels: Jiangsu Zhifu; Shanghai Yuanchu. Both are local leading traditional distribution and marketing agents that Heli has partnerships with to deliver goods to certain localities

In addition, we emphasize Internet sales and TV shopping networks and have started preparing development of online specialty stores for our products. Cooperation with Jingdong Mall and Century Electrical Appliance Network has already begun. We have also reached cooperation agreements with large shopping channels such as Enjoying Shopping, Easy Shopping, Shanghai Youyou, Hunan Joy, Gungdong TianTian, Guizhou Jiayou, Hubei Meijia, Shenzhen Yihe, Sichuan Starry Sky, Liaoning Yijia, Henan Huanteng, and Shanghai Hejia, among others.

Competition

We face competition from various domestic Chinese audio video companies as well as distributors of international products ranging from small, private businesses to large, state-sponsored enterprises.

Many of our competitors have longer operating histories, better brand recognition and greater financial resources than we do. In order for us to successfully compete in our industry we will need to:

-

continue developing brand awareness for our company as well as the Haier line of products;

8

-

continue developing our relationships with distributors and agents; and

- increase our financial resources.

However, there can be no assurance that even if we do these things we will be able to compete effectively with the other companies in our industry.

We believe that we will be able to compete effectively in our industry because of:

- the current brand recognition of Haier audio video equipment in China;

- well diversified distribution network including TV shopping channels, internet portals and standard bricks and mortar outlets;

- high quality logistics systems; and

- a developed customer service and after sales support system.

However, as we are a newly-established company, we face the same problems as other new companies starting up in an industry, such as lack of available funds. Our competitors may be substantially larger and better funded than us, and have significantly longer histories of research, operation and development than us. In addition, they may develop similar technologies to ours and use the same methods as we do and generally be able to respond more quickly to new or emerging technologies and changes in legislation and regulations relating to the industry. Additionally, our competitors may devote greater resources to the development, promotion and sale of their products or services than we do. Increased competition could also result in loss of key personnel, reduced margins or loss of market share, any of which could harm our business.

Intellectual Property

We have not filed for any protection of our name or trademark. As a distribution company we do not directly own any of the intellectual property rights attached to any of the products we distribute.

Research and Development

We did not incur any research and development expenses from our inception to March 31, 2010.

Reports to Security Holders

We are subject to the reporting and other requirements of the Exchange Act and we intend to furnish our shareholders with annual reports containing financial statements audited by our independent auditors and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

9

Government Regulations

We are not aware of any government regulations which would have a significant impact on our operations.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Employees

As of June 15, 2010 we had 83 employees, with all of them being engaged on a full time basis.

Description of Property

We currently rent an office totaling approximately 20,000 square meters in area and we pay approximately $17,552 in rent on a monthly basis. The term of the lease is three years ending on December 31, 2011.

Financial Information

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following is a discussion of Heli Holding’s financial statements for the years ended December 31, 2009 and 2008 as well as the interim period ended March 31, 2010. The financials of Heli Holding will be our financials going forward due to the reverse take-over accounting treatment of the Share Exchange transaction. Pro-forma financial statements are not required to be filed as this transaction is treated as a recapitalization.

The following discussion should be read in conjunction with the financial statements of Heli Holding, including the notes thereto, appearing elsewhere in this report. The discussion of results, causes and trends should not be construed to imply any conclusion that these results or trends will necessarily continue into the future. All references to currency in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section are to U.S. dollars, unless otherwise noted.

10

Liquidity and Capital Resources

For the three months ended March 31, 2010

As of March 31, 2010 we had $316,839 in cash, $9,256,332 in net accounts receivable and $1,689,235 in inventories for a total of $11,262,406 in current assets. Our total assets as of March 31, 2010 were $11,280,591 and our total liabilities were $7,442,479. As of March 31, 2010 we had working capital of $3,819,927.

During the three months ended March 31, 2010 we received net cash of $44,465 from operating activities, compared to net cash of $711,730 from operating activities during the same period in 2009. The decrease in net cash received during the period ended March 31, 2010 was mostly due to an increase of $897,277 in changes of corporate taxes payable.

During the three months ended March 31, 2010 we spent net cash of $3,701 on investing activities compared to $2,066 during the same period in 2009. These expenditures were all for the acquisition of equipment.

During the three months ended March 31, 2010 and March 31, 2009 we did not receive any cash flows from financing activities.

During the three months ended March 31, 2010 we recorded a gain of $5,300 due to exchange rates and an overall cash increase of $46,064 compared to a gain of $255 and a total cash increase of $709,919 during the period ended March 31, 2009.

We have entered into a three-year agreement ending December 2011 for the lease of office premises. Our commitments for minimum lease payments under these non-cancelable operating leases for the remaining lease term are as follows:

| Year Ended | |||

| December 31, | |||

| 2010 | $ | 210,614 | |

| 2011 | $ | 210,614 | |

| Total | $ | 421,228 |

For the years ended December 31, 2009 and December 31, 2008

As of December 31, 2009 we had $270,775 in cash, current assets of $4,873,920, current liabilities of $2,588,490 and working capital of $2,285,430. As of December 31, 2008 we had $60,753 in cash, current assets of $846,459, current liabilities of $770,636 and working capital of $75,823. As of December 31, 2009 we had total assets of $4,889,258, compared to total assets of $852,558 as of December 31, 2008. Since we only began distributing Haier products in April of 2008, we experienced a significant increase in operations and sales during fiscal 2009 as we were able to fully implement our business plan and our products gained market acceptance.

During the year ended December 31, 2009 we received net cash of $227,179 from operating activities, compared to $5,625 net cash used on operating activities during the year ended December 31, 2008. The increase in receipts from operating activities during the year ended December 31, 2009 was primarily due to an increase in revenue generated by the sale of our audio video products.

11

During the year ended December 31, 2009 we spent net cash of $12,015 on investing activities, compared to $6,607 used on investing activities during the year ended December 31, 2008. All of these amounts were spent on purchases of equipment to aid our business operations.

During the year ended December 31, 2009 we did not spend any cash on financing activities, compared to net cash of $72,075 received from financing activities during the year ended December 31, 2008. The cash received during fiscal 2008 was provided in the form of capital contributions.

During the year ended December 31, 2009 we recognized a loss of $5,142 due to the effect of exchange rates on our cash, compared to a gain of $910 due to the same effect during the year ended December 31, 2008. Our net cash increased by $210,022 during the year ended December 31, 2009, compared to a net cash increase of $60,753 during the year ended December 31, 2008.

We anticipate that we will meet our ongoing cash requirements by retaining income as well as through equity or debt financing. We plan to cooperate with various individuals and institutions to acquire the financing required to distribute our products and anticipate this will continue until we accrue sufficient capital reserves to finance all of our productions independently.

We estimate that our expenses over the next 12 months (beginning June 2010) will be approximately $1,422,600 as described in the table below. These estimates may change significantly depending on the nature of our future business activities and our ability to raise capital from shareholders or other sources.

| Estimated | Estimated | |

| Description | Completion Date | Expenses |

| ($) | ||

| Legal and accounting fees | 12 months | 150,000 |

| Marketing and advertising | 12 months | 17,600 |

| Management and operating costs | 12 months | 650,000 |

| Salaries and consulting fees | 12 months | 420,000 |

| Fixed asset purchases | 12 months | 10,000 |

| General and administrative expenses | 12 months | 175,000 |

| Total | 1,422,600 |

We intend to meet our cash requirements for the next 12 months through a combination of retained earnings, debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any private placement or debt financings. However, there is no assurance that any such financing will be available or if available, on terms that will be acceptable to us. We may not raise sufficient funds, or have sufficient retained earnings, to fully carry out our business plan.

12

Debt Cancellation

On June 15, 2010, concurrently with the closing of the Share Exchange, Jiang Hong Liu, our former director and officer provided a release and debt cancellation to eliminate all debt owed to him by our company.

Share Cancellation

Also on June 15, 2010 and also concurrently with the closing of the Share Exchange, we entered into, and closed, agreements with our former sole director and officers, Lu Lu and Jiang Hong Liu to cancel 299,500,000 shares of our common stock held by each of them for an aggregate of 599,000,000 shares cancelled.

Results of Operations

Results of operations for the periods ended March 31, 2010 and 2009 are summarized below:

| Three Months Ended | Three Months Ended | |

| March 31, 2010 | March 31, 2009 | |

| ($) | ($) | |

| Revenue | 18,840,826 | 6,406,114 |

| Cost of Goods Sold | 16,473,516 | 5,628,029 |

| Expenses | 331,289 | 178,988 |

| Income Taxes | 510,246 | 152,027 |

| Net Income | 1,525,775 | 447,070 |

During the three months ended March 31, 2010, we earned revenues of $18,840,826, compared to $6,406,114 during the same period in 2008. These revenues were generated through sales of various audio video equipment distributed by us. Sales of our products increased during the period in 2010 due to increased market acceptance. The cost of the goods sold, accounted for at the price that we purchased the audio video equipment was $16,473,516 during the period in 2010 and $5,628,029 in 2009. There was no substantial change in the per unit costs during these two periods, but sales increased substantially during the three month period ended March 31, 2010 compared to March 31, 2009. This resulted in an increase in gross profit of $2,367,310 during the period ended in 2010 compared to $778,085 during the same period in 2009.

During the three months ended March 31, 2010 we incurred had net income of $1,525,775 after the payment of taxes, operating expenses and the cost of goods sold compared to net income of $447,070 during the same period in 2009.

Our total operating expenses for the three months ended March 31, 2010 were $331,289 and were comprised of $184,576 in selling expenses, $145,803 in general and administrative expenses and $910 in depreciation. Our total operating expenses during the same period in 2009 were $178,988 and were comprised of $70,515 in selling expenses, $108,116 in general and administrative expenses, and $357 in depreciation. The increase in expenses during the three months ended March 31, 2010 was due to an increase in operations and higher sales during that period.

13

Our general and administrative expenses consist of selling, wages, rent, taxes and miscellaneous office expenses.

Results of operations for the years ended December 31, 2009 and 2008 are summarized below:

| Year Ended | Year Ended | |

| December 31, 2009 | December 31, 2008 | |

| ($) | ($) | |

| Revenue | 29,831,658 | 815,992 |

| Cost of Goods Sold | 26,092,420 | 690,928 |

| Expenses | 770,542 | 116,201 |

| Income Taxes | 744,737 | - |

| Net Income | 2,223,959 | 8,863 |

Revenues

During the year ended December 31, 2009 we generated $29,831,658 in revenues, compared to revenues of $815,992 during the year ended December 31, 2008. Our cost of revenues increased from $690,928 during the year ended December 31, 2008 to $26,092,420 during the year ended December 31, 2009. The increase in revenues and cost of goods sold during the year ended December 31, 2009 was due to a substantial increase in sales of various audio visual equipment distributed by us. We saw a considerable demand for our products and increased our business operations to satisfy consumer demand.

Expenses

During the year ended December 31, 2009 our total expenses were $770,542 not including cost of revenues, compared to total expenses of $116,201 not including cost of revenues during the year ended December 31, 2008. Our expenses during fiscal 2009 were made up of $316,441 in selling expenses, $451,333 in general and administrative expenses and $2,768 in depreciation. Our expenses during fiscal 2008 were made up of $25,134 in selling expenses, $90,485 in general and administrative expenses and $582 in depreciation.

Net Income

For the year ended December 31, 2009 we generated net income of $2,223,959, compared to net income of $8,863 for the year ended December 31, 2008.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenues and operating results has not been significant.

14

Critical Accounting Policies

Our financial statements are affected by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete listing of these policies is included in Note 2 of the notes to our financial statements for the years ended December 31, 2009 and 2008. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting year. Because of the use of estimates inherent in the financial reporting process, actual results could differ from those estimates.

Revenue Recognition

We generate revenues from the sales of audio and video electronic products. Sales are recognized when the following four revenue criteria are met: persuasive evidence of an arrangement exists, delivery has occurred, the selling price is fixed or determinable, and collectability is reasonably assured. Sales are presented net of value added tax (VAT). No return allowance is made as products returns are insignificant based on historical experience.

Inventories

Inventories are valued at the lower of cost, as determined on by the first-in, first-out (FIFO) method, or market. Costs of inventories include purchase and related costs incurred in bringing the products to their present location and condition. Market value is determined by reference to selling prices after the balance sheet date or to management’s estimates based on prevailing market conditions. The management writes down the inventories to market value if it is below cost. The management also regularly evaluates the composition of its inventories to identify slow-moving and obsolete inventories to determine if valuation allowance is required.

Accounts Receivable

Trade receivable are recognized and carried at original invoiced amount less an allowance for uncollectible accounts, as needed.

The allowance for doubtful accounts on trade receivable reflects management’s best estimate of probable losses determined principally on the basis of historical experience. The allowance for doubtful account is determined primarily on the basis of management’s best estimate of probable losses, including specific allowances for known troubled accounts. All accounts or portions thereof deemed to be uncollectible or to require an excessive collection cost are written off to the allowance for losses. When facts subsequently become available to indicate that the amount provided as the allowance was incorrect, an adjustment which classified as a change in estimate is made. As of March 31, 2010 and December 31, 2009 and 2008, there was no allowance for doubtful accounts recorded.

15

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the ownership, as of June 15, 2010, of our common stock by each of our directors, by all of our executive officers and directors as a group and by each person known to us who is the beneficial owner of more than 5% of any class of our securities. As of June 15, 2010, there were 266,000,000 shares of our common stock issued and outstanding. All persons named have sole or shared voting and investment control with respect to the shares, except as otherwise noted. The number of shares described below includes shares which the beneficial owner described has the right to acquire within 60 days of the date of this Form 8-K.

| Title

of Class |

Name

and Address of Beneficial Owner |

Amount

and Nature of Beneficial Ownership |

Percent

of Class (1) |

| Common | Xin Qiu (2) | ||

| Stock | No. 50 Fengxiang South Road, Jianggao | 137,066,000 | 51.5% |

| Town, Baiyun District, | |||

| Guangzhou, P.R. China. | |||

| Common | Hong Liu | ||

| Stock | No. 50 Fengxiang South Road, Jianggao | 0 | 0 |

| Town, Baiyun District, | |||

| Guangzhou, P.R. China. | |||

| Common | Guozhong Ao | ||

| Stock | No. 50 Fengxiang South Road, Jianggao | 0 | 0 |

| Town, Baiyun District, | |||

| Guangzhou, P.R. China. | |||

| Common | Yaoyun Zheng | ||

| Stock | No. 50 Fengxiang South Road, Jianggao | 0 | 0 |

| Town, Baiyun District, | |||

| Guangzhou, P.R. China. | |||

| All Officers and Directors as a Group | 137,066,000 | 51.5% |

| (1) |

Based on 266,000,000 issued and outstanding shares of our common stock as of June 15, 2010. |

| (2) |

Xin Qiu is our President, Chief Executive Officer and director. |

| (3) |

Hong Liu is our , Chief Financial Officer, Principal Accounting Officer, Secretary and Treasurer |

| (4) |

Guozhong Ao is our Chief Operations Officer |

| (5) |

Yaoyun Zheng is our Executive Vice President of Sales and Marketing |

16

Changes in Control

As of June 15, 2010 we had no pension plans or compensatory plans or other arrangements which provide compensation in the event of termination of employment or a change in our control.

Directors and Executive Officers

Directors and Officers

Our Articles state that our authorized number of directors shall be not less than one and shall be set by resolution of our Board of Directors. Our Board of Directors has fixed the number of directors at three, and we currently have three directors.

Our current directors and officers are as follows:

| Name | Age | Position |

| Xin Qiu | 35 | President, Chief Executive Officer and Director. |

| Hong Liu | 29 | Chief Financial Officer, Principal Accounting Officer Secretary and Treasurer. |

| Guozhong Ao | 32 | Chief Operations Officer |

| Yaoyun Zheng | 42 | Executive Vice President of Sales and Marketing |

Our Director will serve in that capacity until our next annual shareholder meeting or until their successors are elected and qualified. Officers hold their positions at the will of our Board of Directors. There are no arrangements, agreements or understandings between non-management security holders and management under which non-management security holders may directly or indirectly participate in or influence the management of our affairs.

Xin Qiu, President, Chief Executive Officer and Director

Mr. Qiu currently serves as the President, CEO and Chairman of the Board of Guangzhou Heli Information Technology Co., Ltd. located in Guangzhou, Guangdong Province. He graduated from Nanchang University in Nanchang, Jiangxi Province, in July 1995, with a degree in Accounting. From June 2000 until March 2008, he worked for AVTE Electronics Co., Ltd. in Guangzhou, where he served as Vice President, and oversaw sales and marketing of the company. He established Guangzhou Heli Information Technology Co., Ltd in March 2008. His expertise lies in marketing household electronics, electrical appliances and computer peripherals.

Hong Liu, Chief Financial Officer, Principal Accounting Officer Secretary and Treasurer

Ms. Liu is currently the CFO and Secretary of Guangzhou Heli Information Technology Co., Ltd., in Guangzhou. She graduated from the Jilin University of Finance and Economics (Changchun, Jilin Province, China), with a degree in Finance in June 2007. From December 2006 until April 2007, she served as an Accountant Intern at Shenzhen Shiwei Chuang Electronics Technology Co., Ltd in Shenzhen, Guangdong Province. From May 2007 until November 2009, she served as Financial Manager at Shenzhen Puguang Trading Co., Ltd. (Joint Venture Company) in Shenzhen, overseeing the company’s finances. From December 2009 until the present, she has served as the Financial Manager and currently as CFO (as of June 2010) of Guangzhou Heli Information Technology Co., Ltd. Currently, her responsibilities include overseeing the finances of Guangzhou Heli Information Technology Co., Ltd. as well as cost analyzing, budgeting, and developing financial plans. She has also served as Corporate Secretary since June 2010.

17

Guozhong Ao, Chief Operations Officer

Mr. Ao is currently the Chief Operations Officer and a Director of Guangzhou Heli Information Technology Co., Ltd., in Guangzhou. He Graduated from The Hunan University of Science and Technology (Xiangtian, Hunan Province) in June 1999 with a degree in Mechatronics (Mechanics and Electronics Engineering). From August 2004 until January 2006, he served as Project Engineer in Shenzhen ALEPH Electronics Co., Ltd. in Shenzhen, Guangdong Province. He was responsible for designing and testing sensors and other security products. From February 2006 until December 2008, he served as R&D Department Manager at Shenhen Luckystar Holdings Co., Ltd. in Shenzhen. There he was responsible for overseeing R&D for plastics injections and mold making. From March 2008 until January 2010, he served as R&D Department Manager at Shenzhen Sowell Technology Co., Ltd. in Shenzhen, where he oversaw R&D of digital receivers. From March 2010 until the present, he has served as General Manager of Guangzhou Xinde Electronics in Guangzhou, China. He is now concurrently serving this in addition to his duties at Guangzhou Heli Information Technology Co., Ltd.

Yaoyun Zheng, Executive Vice President of Sales and Marketing

Mr. Zheng is currently the Marketing Director of Guangzhou Heli Information Technology Co., Ltd located in Guangzhou, Guangdong Province, China. In July 1991, he graduated from Zhaoqing University in Zhaoqing, Guangdong Province with a degree in Electronics and Electrical Equipment. He joined Guangzhou Haoyong Industrial Co., Ltd., an electronics company, in October 2001, in Guangzhou. He had assumed the role of Sales Director up until September 2005, when he was promoted to General Manager of its Northwest Branch, in Xi’an, Shaanxi Province. He was responsible of overseeing all day-to-day operations of the branch. He was later promoted to Assistant CEO of the entire company. He left Guangzhou Haoyong in June 2009. In July 2009, he became the Marketing Director at Guangzhou Heli Information Technology Co., Ltd., where he was responsible for designing and implementing the company’s marketing plans and strategies. He was recently appointed to Executive Vice President of Sales and Marketing in June 2010.

Other Directorships

During the last 5 years, none of our directors held any other directorships in any company with a class of securities registered pursuant to section 12 of the Exchange Act or subject to the requirements of section 15(d) of such Act or any company registered as an investment company under the Investment Company Act of 1940.

Board of Directors and Director Nominees

Since our Board of Directors does not include a majority of independent directors, the decisions of the Board regarding director nominees are made by persons who have an interest in the outcome of the determination. The Board will consider candidates for directors proposed by security holders, although no formal procedures for submitting candidates have been adopted. Unless otherwise determined, at any time not less than 90 days prior to the next annual Board meeting at which a slate of director nominees is adopted, the Board will accept written submissions from proposed nominees that include the name, address and telephone number of the proposed nominee; a brief statement of the nominee’s qualifications to serve as a director; and a statement as to why the security holder submitting the proposed nominee believes that the nomination would be in the best interests of our security holders. If the proposed nominee is not the same person as the security holder submitting the name of the nominee, a letter from the nominee agreeing to the submission of his or her name for consideration should be provided at the time of submission. The letter should be accompanied by a résumé supporting the nominee's qualifications to serve on the Board, as well as a list of references.

18

The Board identifies director nominees through a combination of referrals from different people, including management, existing Board members and security holders. Once a candidate has been identified, the Board reviews the individual's experience and background and may discuss the proposed nominee with the source of the recommendation. If the Board believes it to be appropriate, Board members may meet with the proposed nominee before making a final determination whether to include the proposed nominee as a member of the slate of director nominees submitted to security holders for election to the Board.

Some of the factors which the Board considers when evaluating proposed nominees include their knowledge of and experience in business matters, finance, capital markets and mergers and Share Exchanges. The Board may request additional information from each candidate prior to reaching a determination, and it is under no obligation to formally respond to all recommendations, although as a matter of practice, it will endeavor to do so.

Conflicts of Interest

Our directors are not obligated to commit their full time and attention to our business and, accordingly, they may encounter a conflict of interest in allocating their time between our operations and those of other businesses. In the course of their other business activities, they may become aware of investment and business opportunities which may be appropriate for presentation to us as well as other entities to which they owe a fiduciary duty. As a result, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. They may also in the future become affiliated with entities that are engaged in business activities similar to those we intend to conduct.

In general, officers and directors of a corporation are required to present business opportunities to the corporation if:

-

the corporation could financially undertake the opportunity;

-

the opportunity is within the corporation’s line of business; and

-

it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation.

We plan to adopt a code of ethics that obligates our directors, officers and employees to disclose potential conflicts of interest and prohibits those persons from engaging in such transactions without our consent.

19

Significant Employees

Other than as described above, we do not expect any other individuals to make a significant contribution to our business.

Legal Proceedings

None of our directors, executive officers, promoters or control persons has been involved in any of the following events during the past five years:

1. A petition under the Federal bankruptcy laws or any state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

2. Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

3. Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities:

i. Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

ii. Engaging in any type of business practice; or

iii. Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

4. Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (f)(3)(i) of this section, or to be associated with persons engaged in any such activity;

5. Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

6. Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

20

7. Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

i. Any Federal or State securities or commodities law or regulation; or

ii. Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or

iii. Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

8. Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Audit Committee and Charter

We have a separately-designated audit committee of the board. Audit committee functions are performed by our board of directors. None of our directors are deemed independent. All directors also hold positions as our officers. Our audit committee is responsible for: (1) selection and oversight of our independent accountant; (2) establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters; (3) establishing procedures for the confidential, anonymous submission by our employees of concerns regarding accounting and auditing matters; (4) engaging outside advisors; and, (5) funding for the outside auditory and any outside advisors engagement by the audit committee.

Audit Committee Financial Expert

None of our directors or officers have the qualifications or experience to be considered a financial expert. We believe the cost related to retaining a financial expert at this time is prohibitive. Further, because of our limited operations, we believe the services of a financial expert are not warranted.

Code of Ethics

We have adopted a corporate code of ethics. We believe our code of ethics is reasonably designed to deter wrongdoing and promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public reports; comply with applicable laws; ensure prompt internal reporting of code violations; and provide accountability for adherence to the code.

21

Disclosure Committee and Charter

We have a disclosure committee and disclosure committee charter. Our disclosure committee is comprised of all of our officers and directors. The purpose of the committee is to provide assistance to the Chief Executive Officer and the Chief Financial Officer in fulfilling their responsibilities regarding the identification and disclosure of material information about us and the accuracy, completeness and timeliness of our financial reports.

Family Relationships

There are no family relationships among our officers, directors, or persons nominated for such positions.

Executive Compensation

The following summary compensation table sets forth the total annual compensation paid or accrued by us to or for the account of our principal executive officer during the last completed fiscal year and each other executive officer whose total compensation exceeded $100,000 in either of the last two fiscal years:

Summary Compensation Table (1)

| Name and Principal Position |

Year |

Salary |

Total |

| Lu Lu (2) | 2010 | 0 | 0 |

| 2009 | |||

| 2008 | |||

| Jian Hong Liu (3) | 2010 | 0 | 0 |

| 2009 | |||

| 2008 |

| (1) |

We have omitted certain columns in the summary compensation table pursuant to Item 402(a)(5) of Regulation S-K as no compensation was awarded to, earned by, or paid to any of the executive officers or directors required to be reported in that table or column in any fiscal year covered by that table. |

| (2) |

Lu Lu served as our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Secretary, Treasurer and Director from November 2, 2009 to June 15, 2010. |

| (3) |

Jian Hong Liu served as our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Secretary, Treasurer and Director from our inception to November 2, 2009. |

Option Grants

As of the date of this report we had not granted any options or stock appreciation rights to our named executive officers or directors.

22

Management Agreements

We have not yet entered into any consulting or management agreements with any of our current executive officers or directors.

Compensation of Directors

Our directors did not receive any compensation for their services as directors from our inception to the date of this report. We have no formal plan for compensating our directors for their services in the future in their capacity as directors, although such directors are expected in the future to receive options to purchase shares of our common stock as awarded by our Board of Directors or by any compensation committee that may be established.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension, retirement or similar benefits to our directors or executive officers. We have no material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of the Board of Directors or a committee thereof.

Compensation Committee

We do not currently have a compensation committee of the Board of Directors or a committee performing similar functions. The Board of Directors as a whole participates in the consideration of executive officer and director compensation.

Certain Relationships and Related Transactions, and Director Independence

On June 15, 2010, pursuant to the closing of the Share Exchange, we issued 137,066,000 shares of our common stock to Xin Qiu, our President, Chief Executive Officer and Director.

Also on June 15, 2010 we also entered into and closed a share cancellation agreement with our former director and officer, Lu Lu, pursuant to which Lu Lu cancelled 299,500,000 shares of our common stock.

There have been no other transactions since the beginning of our last fiscal year or any currently proposed transactions in which we are, or plan to be, a participant and the amount involved exceeds $120,000 or one percent of the average of our total assets at year end for the last two completed fiscal years, and in which any related person had or will have a direct or indirect material interest.

Director Independence

Our securities are quoted on the OTC Bulletin Board which does not have any director independence requirements. Once we engage further directors and officers, we plan to develop a definition of independence and scrutinize our Board of Directors with regard to this definition.

23

Legal Proceedings

We are not aware of any material pending legal proceedings to which we are a party or of which our property is the subject. We also know of no proceedings to which any of our directors, officers or affiliates, or any registered or beneficial holders of more than 5% of any class of our securities, or any associate of any such director, officer, affiliate or security holder are an adverse party or have a material interest adverse to us.

Market Price of and Dividends on the Registrant’s Common

Equity and Related

Stockholder Matters

Market Information

Our common stock is not traded on any exchange. Our common stock is quoted on OTC Bulletin Board, under the trading symbol “HELI.OB”. We cannot assure you that there will be a market in the future for our common stock.

OTC Bulletin Board securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Bulletin Board securities transactions are conducted through a telephone and computer network connecting dealers. OTC Bulletin Board issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a national or regional stock exchange.

The following table reflects the high and low bid information for our common stock obtained from Stockwatch and reflects inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

The high and low bid prices of our common stock for the periods indicated below are as follows:

| OTC Bulletin Board |

||

| Quarter Ended(1) | High | Low |

| April 30, 2010 | $10.00 | $2.50 |

The first trade of our common stock on the OTC Bulletin Board occurred on March 30, 2010.

Holders

As of the date of this report there were 54 holders of record of our common stock.

Dividends

To date, we have not paid dividends on shares of our common stock and we do not expect to declare or pay dividends on shares of our common stock in the foreseeable future. The payment of any dividends will depend upon our future earnings, if any, our financial condition, and other factors deemed relevant by our Board of Directors.

24

Equity Compensation Plans

As of the date of this report we did not have any equity compensation plans.

Recent Sales of Unregistered Securities

During the last three years, we completed the following sales of unregistered securities:

-

In November 2007, we issued a total of 5,000,000 shares of our pre-split common stock to two former directors for total cash proceeds of $50. These shares were issued without a prospectus pursuant to Regulation S under the Securities Act.

-

On June 15, 2010, pursuant to the closing of the Share Exchange agreement, we issued 144,280,000 shares of our common stock to the Heli Shareholders. These shares were issued without a prospectus pursuant to Regulation S under the Securities Act.

Our reliance upon the exemption under Rule 903 of Regulation S of the Securities Act was based on the fact that the sales of the securities were completed in an "offshore transaction", as defined in Rule 902(h) of Regulation S. We did not engage in any directed selling efforts, as defined in Regulation S, in the United States in connection with the sale of the securities. Each investor was not a U.S. person, as defined in Regulation S, and was not acquiring the securities for the account or benefit of a U.S. person.

Since our inception we have made no purchases of our equity securities.

On May 20, 2008, the Securities and Exchange Commission declared our Form S-1 Registration Statement effective (File number 333-150192) permitting us to offer up to 240,000,000 shares of common stock at $0.000833 per share. There was no underwriter involved in our public offering. On September 30, 2008, we sold a total of 120,720,000 shares of common stock and received cash proceeds of $100,600.

Since then we have spent the proceeds as follows:

| Transfer Agent and Filing Fees | $ | 12,320 | |||||

| Professional Fees | $ | 43,992 | |||||

| Total Expenses | $ | 56,312 |

25

Description of Registrant’s Securities to be Registered

Our authorized capital stock consists of 12,000,000,000 shares of common stock, $0.00001 par value.

Common Stock

As of the date of this report we had 266,000,000 shares of our common stock issued and outstanding.

Holders of our common stock have no preemptive rights to purchase additional shares of common stock or other subscription rights. Our common stock carries no conversion rights and is not subject to redemption or to any sinking fund provisions. All shares of our common stock are entitled to share equally in dividends from sources legally available, when, as and if declared by our Board of Directors, and upon our liquidation or dissolution, whether voluntary or involuntary, to share equally in our assets available for distribution to our security holders.

Our Board of Directors is authorized to issue additional shares of our common stock not to exceed the amount authorized by our Articles of Incorporation, on such terms and conditions and for such consideration as our Board may deem appropriate without further security holder action.

Voting Rights

Each holder of our common stock is entitled to one vote per share on all matters on which such stockholders are entitled to vote. Since the shares of our common stock do not have cumulative voting rights, the holders of more than 50% of the shares voting for the election of directors can elect all the directors if they choose to do so and, in such event, the holders of the remaining shares will not be able to elect any person to our Board of Directors.

Dividend Policy

Holders of our common stock are entitled to dividends if declared by our Board of Directors out of funds legally available for the payment of dividends. From our inception to March 31, 2010 we did not declare any dividends.

We do not intend to issue any cash dividends in the future. We intend to retain earnings, if any, to finance the development and expansion of our business. However, it is possible that our management may decide to declare a stock dividend in the future. Our future dividend policy will be subject to the discretion of our Board of Directors and will be contingent upon future earnings, if any, our financial condition, our capital requirements, general business conditions and other factors.

Preferred Stock

We are authorized to issue up to 100,000,000 shares of $0.00001 par value preferred stock. We have no shares of preferred stock outstanding. Under our Articles of Incorporation, the Board of Directors has the power, without further action by the holders of the common stock, to determine the relative rights, preferences, privileges and restrictions of the preferred stock, and to issue the preferred stock in one or more series as determined by the Board of Directors. The designation of rights, preferences, privileges and restrictions could include preferences as to liquidation, redemption and conversion rights, voting rights, dividends or other preferences, any of which may be dilutive of the interest of the holders of the common stock.

26

Indemnification of Directors and Officers

The only statute, charter provision, bylaw, contract, or other arrangement under which any controlling person, director or officer of us is insured or indemnified in any manner against any liability which he may incur in his capacity as such, is as follows:

-

Article IX of our Bylaws, filed as Exhibit 3.4 to this Current Report; and

-

Chapter 78 of the Nevada Revised Statutes (the “NRS”).

Nevada Revised Statutes

Section 78.138 of the NRS provides for immunity of directors from monetary liability, except in certain enumerated circumstances, as follows:

“Except as otherwise provided in NRS 35.230, 90.660, 91.250, 452.200, 452.270, 668.045 and 694A.030, or unless the Articles of Incorporation or an amendment thereto, in each case filed on or after October 1, 2003, provide for greater individual liability, a director or officer is not individually liable to the corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his capacity as a director or officer unless it is proven that:

| (a) |

his act or failure to act constituted a breach of his fiduciary duties as a director or officer; and |

| (b) |

his breach of those duties involved intentional misconduct, fraud or a knowing violation of law.” |

Section 78.5702 of the NRS provides as follows:

| 1. |

A corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with the action, suit or proceeding if he: |

| (a) |

is not liable pursuant to NRS 78.138; or | |

| (b) |

acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. |

27

| 2. |

A corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by him in connection with the defense or settlement of the action or suit if he: |

| (a) |

is not liable pursuant to NRS 78.138; or | |

| (b) |

acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation. |

To the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in subsections 1 and 2, or in defense of any claim, issue or matter therein, the corporation shall indemnify him against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection with the defense.

Our Bylaws

Our bylaws provide that we will indemnify our directors and officers to the fullest extent not prohibited by Nevada law.

The general effect of the foregoing is to indemnify a control person, officer or director from liability, thereby making us responsible for any expenses or damages incurred by such control person, officer or director in any action brought against them based on their conduct in such capacity, provided they did not engage in fraud or criminal activity.

28

Financial Statements and Supplementary Data

Heli Holding Group Ltd.

Consolidated Financial Statements

(Expressed in US dollars)

29

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Heli Holding

Group, Ltd.

British Virgin Islands

We have audited the accompanying consolidated balance sheets of Heli Holding Group Ltd. and Subsidiaries (the “Company”) as of December 31, 2009 and 2008 and the related consolidated statements of operations and comprehensive income, changes in shareholders’ equity and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements of the Company referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2009 and 2008 and the results of its operations and its cash flows for the two years then ended in conformity with accounting principles generally accepted in the United States of America.

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston,

Texas

June 15, 2010

F-1

Heli Holding Group Ltd. and Subsidiaries

Consolidated Balance Sheets

| March 31, | December 31, | December 31, | |||||||

| 2010 | 2009 | 2008 | |||||||

| (Unaudited) | |||||||||

| Assets | |||||||||

| Current Assets | |||||||||

| Cash and cash equivalents | $ | 316,839 | $ | 270,775 | $ | 60,753 | |||

| Accounts receivable, net | 9,256,332 | 3,335,423 | 19,118 | ||||||

| VAT receivable | - | - | 95,140 | ||||||

| Inventories, net | 1,689,235 | 1,084,061 | 671,448 | ||||||

| Advance to suppliers | - | 183,661 | - | ||||||

| Total current assets | 11,262,406 | 4,873,920 | 846,459 | ||||||

| Property and equipment, net | 18,185 | 15,338 | 6,099 | ||||||

| Total Assets | $ | 11,280,591 | $ | 4,889,258 | $ | 852,558 | |||

| Liabilities and Shareholders' Equity | |||||||||

| Current Liabilities | |||||||||

| Accounts payable | $ | 7,387,961 | $ | 1,782,663 | $ | 640,263 | |||

| Customer deposits | - | - | 125,223 | ||||||

| Accrued liabilities | 54,518 | 62,868 | 5,150 | ||||||

| Income tax payable | - | 742,959 | - | ||||||

| Total current liabilities | 7,442,479 | 2,588,490 | 770,636 | ||||||

| Total Liabilities | 7,442,479 | 2,588,490 | 770,636 | ||||||

| Shareholders' Equity | |||||||||

| Common Stock $1

par value, 50,000 shares

authorized, issued and outstanding |

50,000 | 50,000 | 50,000 | ||||||

| Additional paid-in capital | 22,075 | 22,075 | 22,075 | ||||||

| Accumulated other comprehensive income (loss) | 7,440 | (4,129 | ) | 984 | |||||

| Statutory reserve fund | 223,421 | 223,421 | - | ||||||

| Retained earnings | 3,535,176 | 2,009,401 | 8,863 | ||||||

| Total shareholders' equity | 3,838,112 | 2,300,768 | 81,922 | ||||||

| Total Liabilities and Shareholders' Equity | $ | 11,280,591 | $ | 4,889,258 | $ | 852,558 |

The accompanying notes are an integral part of these consolidated financial statements

F-2

Heli Holding Group Ltd. and

Subsidiaries

Consolidated Statements of Operations and Comprehensive

Income

| Three Months ended | For the Year Ended | |||||||||||

| March 31, | December 31, | |||||||||||

| 2010 | 2009 | 2009 | 2008 | |||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| Revenue | $ | 18,840,826 | $ | 6,406,114 | $ | 29,831,658 | $ | 815,992 | ||||

| Cost of Goods Sold | (16,473,516 | ) | (5,628,029 | ) | (26,092,420 | ) | (690,928 | ) | ||||

| Gross Profit | 2,367,310 | 778,085 | 3,739,238 | 125,064 | ||||||||

| General and administrative | ||||||||||||

| Selling Expenses | 184,576 | 70,515 | 316,441 | 25,134 | ||||||||

| General and administrative | 145,803 | 108,116 | 451,333 | 90,485 | ||||||||

| Depreciation | 910 | 357 | 2,768 | 582 | ||||||||

| Total operating expenses | 331,289 | 178,988 | 770,542 | 116,201 | ||||||||

| Income before income taxes | 2,036,021 | 599,097 | 2,968,696 | 8,863 | ||||||||

| Income taxes | (510,246 | ) | (152,027 | ) | (744,737 | ) | - | |||||

| Net income | $ | 1,525,775 | $ | 447,070 | $ | 2,223,959 | $ | 8,863 | ||||

| Other Comprehensive Income | ||||||||||||

| Foreign currency translation adjustment | 11,569 | 342 | (5,113 | ) | 984 | |||||||

| Comprehensive Income | $ | 1,537,344 | $ | 447,412 | $ | 2,218,846 | $ | 9,847 | ||||

The accompanying notes are an integral part of these consolidated financial statements

F-3

Heli Holding Group Ltd. and

Subsidiaries

Consolidated Statements of Cash Flows

| Three Months ended | For the Year Ended | |||||||||||

| March 31, | December 31, | |||||||||||

| 2010 | 2009 | 2009 | 2008 | |||||||||

| (Unaudited) | (Unaudited) | |||||||||||

| Cash Flows From Operating Activities | ||||||||||||

| Net Income | $ | 1,525,775 | $ | 447,070 | $ | 2,223,959 | $ | 8,863 | ||||

| Adjustments to reconcile net income

to net cash provided by (used in) operating activities: |

||||||||||||

| Depreciation | 910 | 357 | 2,768 | 582 | ||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Accounts receivable, net | (5,910,623 | ) | (3,409,350 | ) | (3,316,258 | ) | (19,118 | ) | ||||

| VAT receivable | - | 95,538 | 95,375 | (95,140 | ) | |||||||

| Advance to suppliers | 184,227 | - | (183,661 | ) | - | |||||||

| Inventories, net | (601,831 | ) | (78,369 | ) | (410,956 | ) | (671,448 | ) | ||||

| Accounts payable and accrued liabilities | 5,591,257 | 3,630,204 | 1,198,525 | 645,413 | ||||||||

| Customer deposit | - | (125,747 | ) | (125,532 | ) | 125,223 | ||||||

| Corporate tax payable | (745,250 | ) | 152,027 | 742,959 | - | |||||||

| Net cash provided by (used in) operating activities | 44,465 | 711,730 | 227,179 | (5,625 | ) | |||||||

| Cash Flows From Investing Activities | ||||||||||||

| Purchase of equipment | (3,701 | ) | (2,066 | ) | (12,015 | ) | (6,607 | ) | ||||

| Net cash used in investing activities | (3,701 | ) | (2,066 | ) | (12,015 | ) | (6,607 | ) | ||||

| Cash Flows From Financing Activities | ||||||||||||

| Capital contribution | - | - | - | 72,075 | ||||||||

| Net cash provided by financing activities | - | - | - | 72,075 | ||||||||

| Effect of exchange rate changes on cash | 5,300 | 255 | (5,142 | ) | 910 | |||||||

| Net increase in cash and cash equivalents | 46,064 | 709,919 | 210,022 | 60,753 | ||||||||

| Cash and cash equivalents, beginning of period | 270,775 | 60,753 | 60,753 | - | ||||||||

| Cash and cash equivalents, end of period | $ | 316,839 | $ | 770,672 | $ | 270,775 | $ | 60,753 | ||||

| Supplemental disclosure information: | ||||||||||||

| Income taxes paid | $ | 1,253,325 | $ | - | $ | - | $ | - | ||||

| Interest paid | $ | - | $ | - | $ | - | $ | - | ||||

F-4

Heli Holding Group Ltd. and