Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 11, 2010 (June 9, 2010)

TRADEON, INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

000-53547 | 26-1548693 |

| (State or other jurisdiction of | (Commission File Number) | (IRS Employer Identification No.) |

| incorporation or organization) |

Jingsu Wujin Lijia Industrial Park

Lijia Town

Wujin

District, Changzhou City

Jiangsu Province 213176

People’s

Republic of China

(Address of principal executive offices)

(86)519-86230102

(Registrant's

telephone number, including area code)

30 Eliahu Miferrera St., Tel Aviv, Israel 69865

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements, which reflect our views with respect to future events and financial performance. These forward-looking statements are subject to certain uncertainties and other factors that could cause actual results to differ materially from such statements. These forward-looking statements are identified by, among other things, the words “anticipates”, “believes”, “estimates”, “expects”, “plans”, “projects”, “targets” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Important factors that may cause actual results to differ from those projected include the risk factors specified below.

USE OF DEFINED TERMS AND TREATMENT OF STOCK

Except as otherwise indicated by the context, references in this report to:

-

“TACN,” “the Company,” “we,” “us,” or “our,” refer to the combined business of TradeOn, Inc., and its wholly-owned subsidiaries, Best Green BVI, and Best Green Changzhou, and our controlled VIEs Best Cable and Best Appliances, but do not include the stockholders of TradeOn, Inc.;

-

“Best Appliances” refer to Jiangsu Best Electrical Appliances Co., Ltd, a PRC company;

-

“Best Cable” refer to Changzhou City Wujin Best Electronic Cables Co., Ltd., a PRC company;

-

“Best Green BVI” refer to Best Green Energy Industries Limited, a BVI company;

-

“Best Green Changzhou” refer to Best Green Energy (Changzhou) Co., Ltd., a PRC company;

-

“Best Green Investments” refer to Best Green Investments Limited, a BVI company;

-

“BVI” refer to the British Virgin Islands;

-

“China,” “Chinese” and “PRC,” refer to the People’s Republic of China;

-

“Exchange Act” refer to the Securities Exchange Act of 1934, as amended;

-

“RMB” refer to Renminbi, the legal currency of China;

-

“Securities Act” refer to the Securities Act of 1933, as amended;

-

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; and

-

“VIE” refer to our variable interest entities, which are affiliated companies that we control through contractual arrangements and include Best Appliances and Best Cable.

1

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On June 9, 2010, we entered into a share exchange agreement, or the Share Exchange Agreement, with Best Green BVI, and Best Green Investments, the sole shareholder of Best Green BVI. Pursuant to the Share Exchange Agreement, on June 9, 2010, Best Green Investments transferred all of the shares of the capital stock of Best Green BVI in exchange for 20,734,531 newly issued shares of our common stock, which, after giving effect to the Cancellation Agreement disclosed below, constituted 88.1% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the transactions contemplated by the Share Exchange Agreement.

As a condition precedent to the consummation of the Share Exchange Agreement, on June 9, 2010 we entered into a cancellation agreement, or the Cancellation Agreement, with Mr. Haifeng Lu, whereby Mr. Lu agreed to the cancellation of 4,000,000 shares of our common stock owned by him.

The foregoing description of the terms of the Share Exchange Agreement and the Cancellation Agreement is qualified in its entirety by reference to the provisions of the document filed as Exhibits 2.1 and 4.1 to this report, which is incorporated by reference herein.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On June 9, 2010, we completed an acquisition of Best Green BVI pursuant to the Share Exchange Agreement. The acquisition was accounted for as a recapitalization effected by a share exchange. Best Green BVI is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, on June 9, 2010, we acquired Best Green BVI in a reverse acquisition transaction. Item 2.01(f) of Form 8-K states that if the registrant was a shell company like we were immediately before the reverse acquisition transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10.

Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the acquisition of Best Green BVI, except that information relating to periods prior to the date of the reverse acquisition only relate to Best Green BVI unless otherwise specifically indicated.

CORPORATE STRUCTURE AND HISTORY

Our Corporate Structure

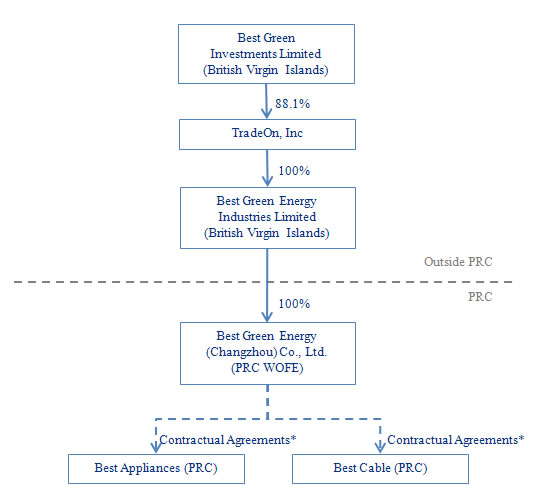

We are a Nevada holding company for several direct and indirect subsidiaries in the BVI and China. We own all of the issued and outstanding capital stock of Best Green BVI, a BVI corporation. Best Green BVI is a holding company that owns 100% of the outstanding capital stock of Best Green Changzhou, a PRC company.

2

Our principal manufacturing operations and sales and marketing activities in China are conducted through our VIEs. We control the VIEs through a series of contractual arrangements. These contracts include an Exclusive Technical Services and Business Consulting Agreement, or the Consulting Agreement, a Business Operation Agreement, an Equity Interest Pledge, and a Proxy Agreement. These agreements are among our indirect, wholly-owned subsidiary, Best Green Changzhou, and each of our VIEs. These contractual arrangements are described below.

-

Consulting Agreement. Under the Consulting Agreement, Best Green Changzhou provides exclusive technical, business and management consulting services to the VIEs in exchange for service fees equal to 100% of the VIE’s total annual net profits.

-

Business Operation Agreement. The Business Operation Agreement imposes restrictions on the operations of the VIEs. Under the Business Operation Agreement the VIEs are prohibited from engaging in any transaction which may materially affect its assets, obligations, rights or business operation without prior consent from us. The VIEs are also required to accept policies and suggestions provided by us from time to time with respect to employment or dismissal of employees, corporate management and financial management systems. The VIEs are also required to appoint the directors and members of senior management that we designate.

-

Equity Interest Pledge Agreement. The shareholders of the VIEs, Mr. Jianliang Shi and Ms. Xueqin Wang, or the VIE Shareholders, have pledged their entire equity interest in the VIEs to Best Green Changzhou pursuant to the Equity Interest Pledge Agreement. The equity interests are pledged as collateral security for the obligations of the VIEs under the Consulting Agreement and the Business Operation Agreement.

-

Proxy Agreement. The proxy agreement among Best Green Changzhou and the VIE Shareholders requires the VIE Shareholders to vote all of the equity interests in the VIEs at any shareholders meeting or other time when shareholders of the VIEs vote in accordance with our instructions.

As a result of these contractual agreements, Best Cable and Best Appliances became our variable interest entities. A variable interest represents a contractual or ownership interest in another entity that causes the holder to absorb the changes in fair value of the other entity’s net assets. Potential variable interests include: holding economic interests, voting rights, or obligations to an entity; issuing guarantees on behalf of an entity; transferring assets to an entity; managing the assets of an entity; leasing assets from an entity; and providing financing to an entity. In such cases consolidation of the VIE is required by the enterprise that controls the economic risks and rewards of the entity, regardless of ownership.

The following chart reflects our organizational structure as of the date of this report.

3

*Contractual agreements consisting of an exclusive technical and consulting service agreement, an equity interest pledge agreement, business operation agreement and proxy agreement.

Our Corporate History

Background and History of TradeOn, Inc.

We were a development stage company that was incorporated under the laws of the state of Nevada on December 7, 2007. We were planning to develop and commercialize a mobile price comparison service for use by the general public. Our service would have enabled consumers while out shopping in a store to compare or look up prices of a certain product by sending a text message from their cell phone to our TradeOnSMS system. Our planned system would have accepted text messages from mobile phones containing the name or part number of a certain product. Once the text message was received, TradeOnSMS would search the Internet for the best price and retailer and send back a text message to the mobile phone with the results. Our business never materialized and we became inactive until we acquired Best Green BVI on June 9, 2010.

4

Background and History of Best Green BVI and VIE

Best Green BVI was incorporated in the British Virgin Islands on March 31, 2010. Best Green BVI is a holding company that has no operations or assets other than its ownership of all of the capital stock of Best Green Changzhou. Best Green Changzhou was incorporated in the PRC on May 6, 2010. Best Cable was incorporated in the PRC on May 25, 1993 and Best Appliances was incorporated in the PRC on August 21, 2001. All of our manufacturing operations are conducted through Best Appliances and Best Cable through contractual arrangements.

Acquisition of Best Green BVI

On June 9, 2010, we entered into a share exchange agreement, or the Share Exchange Agreement, with Best Green BVI, and Best Green Investments, the sole shareholder of Best Green BVI. Pursuant to the Share Exchange Agreement, on June 9, 2010, Best Green Investments transferred all of the shares of the capital stock of Best Green BVI in exchange for 20,734,531 newly issued shares of our common stock, which, after giving effect to the Cancellation Agreement disclosed below, constituted 88.1% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the transactions contemplated by the Share Exchange Agreement.

As a condition precedent to the consummation of the Share Exchange Agreement, on June 9, 2010 we entered into a cancellation agreement, or the Cancellation Agreement, with Mr. Haifeng Lu, whereby Mr. Lu agreed to the cancellation of 4,000,000 shares of our common stock owned by him.

On April 24, 2010, Marsel Gilyazov, the sole director and owner of Best Green Investments entered into an option agreement with our Chairman and CEO Mr. Jianliang Shi and his wife Xueqin Wang, pursuant to which they were granted options to purchase 51% and 49% equity interest of Best Green Investments. They may exercise these options sixty (60) days after the date on which a disclosure statement on Form 8-K is filed in respect of the share exchange transaction (the “Share Exchange”), and ending on the fifth annual anniversary of that date.

Upon the closing of the reverse acquisition, Mr. Amit Sachs and Mr. Haifeng Lu, our directors and officers, submitted resignation letters pursuant to which they resigned from all offices that they held effective immediately and from their position as our directors that will become effective on the tenth day following the mailing by us of an information statement, or the Information Statement, to our stockholders that complies with the requirements of Section 14f-1 of the Exchange Act, which will be mailed out on or about June 30, 2010. Jianliang Shi was appointed as our Chairman of the Board of Directors and Chief Executive Officer and Zhengxing Shangguan was appointed as our director effective upon the closing of the reverse acquisition. In addition, our executive officers were replaced by the Best Green BVI’s executive officers upon the closing of the reverse acquisition as indicated in more detail below.

5

For accounting purposes, the share exchange transaction was treated as a reverse acquisition with Best Green BVI as the acquirer and TradeOn, Inc. as the acquired party. When we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Best Green BVI on a consolidated basis unless the context suggests otherwise.

We plan to amend our certificate of incorporation to change our name from “TradeOn, Inc.” to “China Green Energy Industries, Inc.” to reflect the current business of our company, which changed as a result of our acquisition of Best Green BVI.

Corporate Information

Our principal executive offices are located at Jingsu Wujing Lijia Industrial Park, Lijia Town, Wujin District, Changzhou City, Jiangsu Province 213176, People’s Republic of China. And our telephone number at that address is (86)519-86230103. Our principal website is located at http://www.chinagei.com. The information on our website is not part of this report.

BUSINESS

Overview

We manufacture and distribute clean technology-based consumer products. We also manufacture and distribute network and HDMI cable. Our products consist of light electric vehicles, or LEVs, and cryogen-free refrigerators. We manufacture several different varieties of LEVs and cryogen-free refrigerators. We sell some of our products under our own brand name of “BEST” and the balance of our products as an original equipment manufacturer, or OEM, for other companies, who are our customers.

Light Electric Vehicle

We entered the LEV business in 2008. We produce LEVs in China and sell them in the European market through sales agents and as an OEM. Currently, we have an annual production capacity of 20,000 LEVs and are the OEM LEV manufacturer for QWIC of the Netherlands.

Cryogen-free Refrigerator

We are the OEM of cryogen-free refrigerators for large multinational corporations such as Ford, Pepsi, Coca-Cola, Carlsberg and Disney. Currently, we possess an annual production capacity of 115,000 cryogen-free refrigerators.

Network cable and HDMI cable

The cable business is where we originally started our business and this division still provides us with relatively stable cash flow. Through years of operation in this segment, we have many important multinational customers including Wal-Mart, Home Depot and Carrefour. Currently, we possess an annual capacity of 25 million sets of network cables and high-definition multimedia interface, or HDMI cables.

Our Industry

6

We manufacture and distribute clean technology-based consumer products. We also manufacture and distribute network and HDMI cable. Our products consist of light electric vehicles, or LEVs, and cryogen-free refrigerators. We manufacture several different varieties of LEVs and cryogen-free refrigerators. We sell some of our products under our own brand name of “BEST” and the balance of our products as an original equipment manufacturer, or OEM, for other companies, who are our customers.

Light Electric Vehicle

Compared to motorbikes, LEVs enjoy the following advantages: less fossil fuel consumption, cheaper in price, more convenient to park inside cities, and less air and noise pollution. We believe many consumers are increasingly willing to consider purchasing LEVs due to environmental, economic, and convenience reasons. As a result, we believe the market for LEVs is poised for significant growth as consumers continue to shift their preferences strongly toward more energy efficient and lower emission vehicles.

According to the China Electronic Components Association after the 2009 Cleantech Forum in Copenhagen, the global demand for LEVs is predicted to grow 7 to 10% annually. As Europe and the United States have started to provide government aid for LEV purchases, we believe that sales of LEVs in Europe, especially in the Netherlands and United Kingdom, and the United States will increase.

Electric Vehicle Incentives in the United States

A number of states and municipalities in the United States, as well as certain private enterprises, have adopted incentive programs such as tax exemptions, tax credits, and other special privileges to encourage the use of alternative fuel vehicles. For example, New Jersey and Washington exempt the purchase of electric vehicles from state sales tax. Other states, including Colorado, Oregon, Georgia and Oklahoma, provide for substantial state tax credits for the purchase of electric vehicles. In California, several utilities offer reduced electricity rates for the purpose of recharging electric vehicles. As of December 1, 2009, the Sacramento Municipal Utility District, for example, offered an off-peak discount of approximately 50% off of the regular residential electricity rate for electricity used to charge electric vehicles. Similar programs exist with Southern California Edison and other utility companies. Municipalities in California also offer parking incentives for electric vehicles which include free or reduced fee parking in major metropolitan areas.

Electric Vehicle Incentives in Europe

We believe Europe has a regulatory environment that is generally very conducive to the development, production and sale of small, alternative energy vehicles. Through emission legislation, tax incentives and direct subsidies, the European Union is taking a progressive stance in reducing carbon emissions and increasing demand for electric vehicles.

In addition to a favorable regulatory environment, European countries have announced attractive combinations of subsidies and tax incentives. For example, the United Kingdom has announced a plan for up to £5,000 in support of electric vehicles and France has proposed €5,000 in direct subsidies for electric vehicle purchases through 2012. Additionally, a number of European countries are shifting their registration tax regime to a carbon dioxide-based system which typically reduces or eliminates annual registration taxes for electric vehicles due to their zero emissions profile. Certain European countries such as Norway have also adopted significant tax incentives for individuals to purchase electric vehicles.

7

China’s LEV Market

The Chinese market for LEVs is huge and has been growing rapidly. According to the China Electronic Components Association, 21.5 million LEVs were sold in China in 2008, representing growth of 26.5% over 2007. And in 2009, 24.5 million LEVs were sold in China. The following chart shows the historical and expected growth of LEV sales in China:

Source: China Electronic Components Association

Small Home Appliance

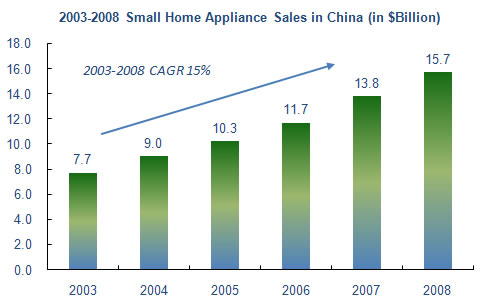

We currently produce and sell cryogen-free refrigerators, which are classified as small home appliances. Current international and domestic market highlights for small home appliances are described below:

| 1. |

Global sales of small home appliances grew from $77.94 billion in 2007 to $85.91 billion in 2008, of which China accounted for approximately 17%, or $13.3 billion, in 2007 and 18%, or $15.7 billion, in 2008. (Source: CCID Consulting, 2007, 2008 and 2008. 2009 Annual Report of China’s Small Electrical Appliance Industry) | |

| 2. |

China is the leading manufacturer of small home appliances producing 1.44 billion units in 2007 and 1.63 billion units in 2008, of which exports accounted for 74.3%; (Source: CCID Consulting, 2008, 2009 Annual Report of China’s Small Electrical Appliance Industry) |

In the US, the top five firms control over 90% of the market while in Europe the top five firms have approximately 60% market share. Top European market participants include Electrolux, Bosch, Black & Decker, Phillips, and Miele; (Source: Assembly Magazine, “Appliance Assembly: Environmental Restrictions Dictate European Designs” by Austin Weber, May 1, 2005)

8

According to CCDI Consulting, compound aggregate growth rate, or CAGR of small home appliance sales in China was 15% during 2003 to 2008. The following chart shows the growth of small home appliance sales in China:

Source: CCID Consulting, 2008-2009 Annual Report of Chinese Small Home Appliance Industry

Cable and Wire

General Cable and Wire Market

China’s cable and wire industry has surpassed the United States to become the largest cable and wire producer in the world. According to the Shanghai Cable & Wire Research Institute, the sale of cable and wire in China was $59 billion in 2006. (Source: Zhongli Sci-Tech Group IPO Prospectus, August 13, 2009.) In China, the cable & wire industry is expected to grow at a level comparable to that of the national economy, which is projected to be 7% to 8%. (Source: http://www.chinawirecable.com)

U.S. demand for insulated wire and cable is expected to grow 4.3% annually to $21.5 billion in 2010 (Source: US industry forecasts to 2010 & 2015 Insulated Wire & Cable), a rebound from the declines early in the decade, according to Zuosi Research. An improved capital investment climate, as well as rising motor vehicle production levels and strong growth in nonresidential construction expenditures, will provide opportunities for wire and cable suppliers. Product innovations will also help to boost demand, although pricing competition in the industry will remain intense.

9

HDMI Cable Market

According to a newly released market research report from Information Gatekeepers Inc. (IGI), on Active Optical Cables (AOC), the HDMI-based Active Optical Cable market will grow from $140 million in 2009 to over $1.7 billion by 2011, representing a CAGR of astoundingly 250%. During this period, early OEM providers will enjoy excellent average selling prices (ASPs) compared with the cost of building these cables. The AOC Market Report 2009 forecasts that the materials costs for HDMI-based active cables will also decline, allowing the cable providers to realize excellent product margins even as they grow their sales volumes.

IGI expects to see an early entrance of 20 Gigabit/s HDMI 2.0 in 2010, with higher average selling prices driving their revenue picture. Pressure from competing bus interfaces such as Display Port and Light Speed are anticipated to accelerate this high-speed transition late in 2010. The larger HDTV installed base and production of HDMI V1.4 devices will continue to drive demand for lower-speed 10 Gigabit/s HDMI models for quite some time. In 2014, even the relatively modest 32% share for 10 Gigabit/s HDMI AOC is expected to produce around $370 million in revenue.

Our Competitive Strengths

We believe that the following competitive strengths will sustain our rapid growth and enable us to continue to compete effectively:

-

We provide high quality products with international safety certifications. We have obtained ISO9001 and ISO14001 certifications for our production processes, and we also have obtained various other safety certifications, such as UL, TÜV and ETL for our products. See “Quality Control” below for a more detailed explanation of our quality control measures. These certifications enable us to sell to our international clients. As a result, our customers are more willing to pay a relatively higher price for our products.

-

We have customers that are multinational companies. Many of our customers are large multinational corporations. We are the OEM LEV manufacturer for QWIC of Netherlands and the OEM cryogen-free refrigerator manufacturer for Ford, Pepsi, Coca- Cola, Carlsberg and Disney. We also provide network cables and HDMI cables to Wal- Mart, Home Depot and Carrefour. These large multinational corporations provide us with stable orders while also providing customer confidence in our products to help grow our potential client base.

Our Growth Strategy

By leveraging our sales network and manufacturing capacity, we are taking the initiative to grow into a business group of new energy and environmentally friendly consumer goods businesses through the following strategies:

- Continue exploring the expanding global LEV market. We expect the rapidly growing LEV market to increase our revenue steadily in the coming years. Currently, we manufacture LEVs in China to leverage the low manufacturing cost and sell LEVs in the European market. European countries provide several incentives to help stimulate the use of LEVs. We expect these regulations to help the European LEV market grow rapidly, and we hope that our market position will help us take advantage of this opportunity. We expect growth in LEV sales as additional LEV incentives are implemented by European governments.

10

- Continue to increase sales of environmentally friendly consumer goods.

As people become more aware of the increasing need for environmental protection,

many consumers will choose to purchase cryogen-free refrigerators instead

of traditional refrigerators with cryogen. We provide environmentally friendly

non-cryogenic refrigerators. They contain zero cryogen and do not cause any

pollution during the manufacturing process or during use. We will continue

to work to increase sales of cryogen-free refrigerators and other related

environmentally friendly home appliances, including our thermostatic wine

cabinets and thermostatic cosmetics cases.

- Continue to strengthen our relationships and alliances with big multinational companies. Currently, we are the OEM LEV manufacturer for QWIC of Netherlands. We are also the non-cryogen refrigerator OEM manufacturer for Ford, Pepsi, Coca-Cola, Carlsberg and Disney. We intend to continue strengthening our relationships and alliances with existing and potential multinational corporate customers and leverage their financial resources and brand awareness with our relative low production cost to achieve faster and more sustained growth in the future.

Our Products

Light Electric Vehicle (LEV)

According to shape and speed, LEVs can be classified into the following categories:

-

Electric Scooters (10 - 15 mph)

-

Electric Bicycles (12 - 20 mph)

-

Electric Motorcycles (20 - 45 mph)

Our major LEV products are electric bicycles and electric motorcycles. These LEVs use a lithium battery or lead-acid battery for propulsion and their mileage per charge ranges from 40 miles to 60 miles. In small towns throughout China given the typical distance from ones home to one’s place of work or location of follow on transit (i.e., bus or train), one charge could enable a user to drive for the whole week or even longer. Our LEV can be charged using any home AC electric supply, which enables users to re-charge LEVs almost anywhere with convenience.

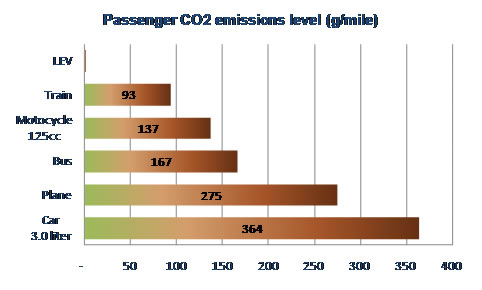

From an environmental perspective, use of LEVs eliminates emissions of carbon-dioxide (CO2) that would otherwise occur if a gas propelled motor vehicle were used. According to the UK Department for Environment, Food and Rural Affairs, each passenger riding an LEV can reduce CO2 emissions by 137g/mile when compared with a 125cc motorcycle and 364g/mile when compared with a 3.0 liter engine car. The following chart shows passenger CO2 emissions level by different forms of transportation:

11

Source: UK Department for Environment, Food and Rural Affairs, RAC Motoring Services

Currently we manufacture LEVs in China and sell them to the European market. We are also the OEM LEV manufacturer for QWIC of Netherlands. Below are depictions of two of our LEV products that we manufacture for QWIC.

Cryogen-free Refrigerator

Most refrigerators use cryogen. The most common type of cryogen used in refrigerators is Chlorofluorocarbon, or CFC, also commonly known by the DuPont trade name Freon. Use of CFCs has become heavily regulated because of the destructive effects on the ozone layer. Given the increasing environmental awareness and increase in environmental regulations, the market for cryogen-free refrigerators is growing.

12

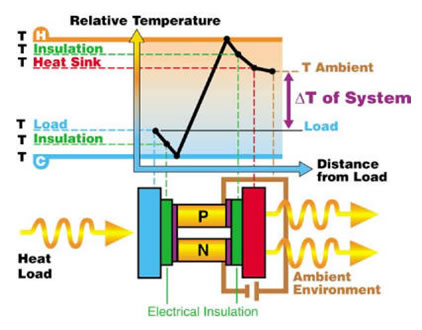

Our cryogen-free refrigerator cooling system is based on thermoelectric effect. The thermoelectric effect, also known as the Peltier effect, is the direct conversion of temperature differences to electric voltage and vice versa. A thermoelectric device creates a voltage when there is a different temperature on each side. Conversely when a voltage is applied to it, it creates a temperature difference. The following chart shows how thermoelectric effect works:

Our refrigerator works without cryogen and is based on thermoelectric effect. Compared with traditional refrigerators, it possesses the following advantages: zero cryogen pollution to the environment, less electricity consumption, compact in size, lower cost and price, and lower operating noise. Currently, we are the OEM manufacturer for Ford, Pepsi, Coca-Cola, Carlsberg and Disney branded mini size refrigerators. The following pictures depict our cryogen-free refrigerators:

13

By diversifying our cryogen-free refrigeration technology, we have extended our refrigerator product line to portable refrigerators, thermostatic wine cabinets, thermostatic cosmetics cases. We believe many consumers are increasingly willing to consider buying these products for environmental reasons and also because they are convenient to use.

Network cable and HDMI cable

Our major wire and cable products are network cables and HDMI cables.

14

Network Cable

Our network cables mainly include Category 5, or Cat-5, and Category 6, or Cat-6, cables. Category 5 cable is a twisted pair high signal integrity cable type. Cat-5 has been superseded by the Cat-5e specification structured cabling for computer networks such as Ethernet, and is also used to carry many other signals such as basic voice services, token ring, and ATM (at up to 155 Mbit/s, over short distances). Cat-6 cable is a cable standard for Gigabit Ethernet and other network protocols that are backward compatible with the Category 5/5e and Category 3 cable standards. Compared with Cat-5 and Cat-5e, Cat-6 features more stringent specifications for crosstalk and system noise.

HDMI Cable

High-Definition Multimedia Interface, or HDMI, is a compact audio/video interface for transmitting uncompressed digital data. It represents a digital alternative to consumer analog standards, such as radio frequency coaxial cable, composite video, S-Video, SCART, component video, D-Terminal, or VGA. HDMI connects digital audio/video sources—such as set-top boxes, DVD players, HD DVD players, Blue-ray Disc players, PCs, video game consoles such as the PlayStation 3 and Xbox 360, and AV receivers to compatible digital audio devices, computer monitors, and digital televisions. HDMI supports, on a single cable, any TV or PC video format, including standard, enhanced, and high-definition video; up to 8 channels of digital audio; and a Consumer Electronics Control, or CEC connection. The CEC allows HDMI devices to control each other when necessary and allows the user to operate multiple devices with one remote control handset. Because HDMI is electrically compatible with the signals used by Digital Visual Interface, or DVI, no signal conversion is necessary, nor is there a loss of video quality when a DVI-to-HDMI adapter is used. As an uncompressed connection, HDMI is independent of the various digital television standards used by individual devices, such as ATSC and DVB, as these are encapsulations of compressed MPEG video streams.

HDMI products started shipping in 2003. Over 850 consumer electronics and PC companies have adopted the HDMI specification. In Europe, either DVI-HDCP or HDMI is included in the HD ready in-store labeling specification for TV sets for HDTV, formulated by EICTA with SES Astra in 2005. HDMI began to appear on consumer HDTV camcorders and digital still cameras in 2006. Shipments of HDMI were expected to exceed that of DVI in 2008, driven primarily by the consumer electronics market.

We are certified by HDMI Licensing, LLC as member of HDMI and produce HDMI cables under a 1.3a and 1.3b standard. HDMI 1.3 was released in 2006 and increased the single-link bandwidth to 340 MHz (10.2 Gigabit/s). It optionally supports Deep Color, with 30-bit, 36-bit, and 48-bit xvYCC, sRGB, or YCbCr, compared to 24-bit sRGB or YCbCr in previous HDMI versions. It also optionally supports output of Dolby True-HD and DTS-HD Master Audio streams for external decoding by AV receivers.

Manufacturing

Manufacturing Facilities

15

Our corporate headquarters and all of our manufacturing facilities are located in Changzhou, China. We have a total of 49,900 square meters of land use rights. On such land we have an aggregate of approximately 46,800 square meters of manufacturing buildings and office space. We believe that our existing and planned facilities are adequate for our requirements for the foreseeable future.

Manufacturing Processes

Light Electric Vehicle (LEV)

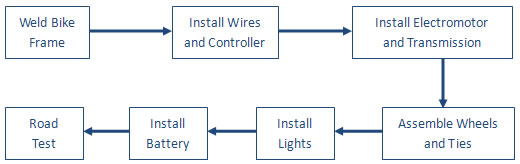

LEV parts, including electromotors, batteries, wheels, and ties are purchased from third party suppliers. We weld the bike frame together and assemble other parts to finalize the LEVs. Currently, we possess an annual production capacity of 20,000 LEVs.

The diagram below illustrates our LEV manufacturing process:

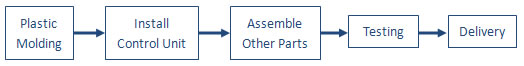

Cryogen-free Refrigerator

We purchase the semiconductor refrigeration component for our refrigerators from third party suppliers. We manufacture the body and case of the refrigerators through plastic injection molding. Our annual production capacity for refrigerators is 400,000 units.

The diagram below illustrates our refrigerator manufacturing process.

Network Cable and HDMI Cable

We produce network cables and HDMI cables in our manufacturing base in Changzhou, China. Currently, we possess annual capacity of 25 million sets of network cables and HDMI cables.

The diagram below illustrates our manufacturing process of a network cable and HDMI cable:

16

Raw Materials

Most of our raw materials are purchased from suppliers in China. Before we utilize raw materials in our manufacturing process, the raw materials must undergo an inspection process. The nature of the process depends on the type of raw materials. The type of raw materials and component parts that we require vary depending upon the product. The prices of the raw materials that we utilize to produce our products are determined based upon prevailing market conditions, supply and demand.

Light Electric Vehicle (LEV)

The major raw materials for LEV are steel, electromotors, batteries, wheels and tires. We purchase them from local suppliers in China.

Cryogen-free Refrigerator

The major raw materials that we utilize for the production of our cryogen-free refrigerators are polyvinyl chloride, or PVC, semiconductor refrigeration components, and air cooling fins. We purchase PVC from two suppliers in Zhejiang Province and Jiangsu Province. Air cooling fins are supplied by two suppliers in Jiangsu Province.

Network cable and HDMI cable

Raw materials for network cable and HDMI cable are copper and PVC. We purchase copper from one supplier in Jiangsu Province and PVC from two suppliers in Zhejiang Province and Jiangsu Province.

Quality Assurance and Quality Control

We closely monitor and test the quality of our products. We have established inspection points at key production stages to identify product defects during the production process, and our finished products are inspected and tested according to standardized procedures. We provide regular training and specific guidelines to our operators to ensure that our internal production processes meet quality standards. We have passed quality standards of ISO9001 and ISO14001 certifications since 2007. We have also obtained the following certifications, which enable us to export overseas countries.

|

UL Safety Certification for all

A/V cables since 2006 UL Safety Certification for net cables Cat5e, Cat6 since 2008 |

| |

HDMI member for 28#1.3a, 1.3b |

17

|

ISO9001 since 2007 ISO14001 standard since 2007 |

|

ETL Safety Certification for net cables Cat5e, Cat6 since 2009 |

| TÜV Safety Certification and GS Mark for cryogen-free refrigerators since 2006 | |

| Wal-Mart certified provider since 2009 | |

|

Carrefour certified provider since 2009 |

|

Home Depot certified provider since 2009 |

*All marks are trademarks or registered trademarks of their respective owners. The display of trademarks herein does not imply that a license of any kind has been granted.

Sales and Marketing

We use different distribution channels and deploy different sales and marketing strategies for our different products.

Light Electric Vehicle (LEV)

We sell LEVs to customers in European countries through our overseas agents and through OEM arrangements. We intend to continue to form strategic alliances with those agents and OEM customers in Europe. In addition, our sales team is developing new customers in Australia, the United States of America and the rest of Asia. We believe we can grow our LEV sales in those geographic areas with the establishment of an agent network. We are in the process of building this agent network in such areas.

Cryogen-free Refrigerator

We sell cryogen-free refrigerators through our overseas agents. We are also an OEM cryogen-free refrigerator manufacturer for Ford, Pepsi, Coca-cola, Carlsberg and Disney. We intend to continue to form strategic alliances additional multinational companies and leverage our production capacity and relatively high brand awareness.

Network cable and HDMI cable

Our network cable and HDMI cable products are sold to many multinational retailers including Wal-Mart, Carrefour and Home Depot. We are certified providers to those retailers. We intend to continue selling network cable and HDMI cable to those multinational retailers.

18

Competition

Light Electric Vehicle (LEV)

Competition in the LEV industry is heavy and still evolving. We believe the impact of new regulatory requirements for occupant safety, technological advances, and shifting customer needs are causing the industry to evolve in favor of LEVs. We believe the primary competitive factors in LEV markets are:

-

technological innovation;

-

product quality and safety;

-

service options;

-

product performance;

-

design and styling;

-

product price; and

-

manufacturing efficiency.

We believe that our LEVs compete in both the traditional market segment with motorbikes as well as the market segment of LEVs. Hence, our major competitors in LEV sales are traditional motorbikes manufacturers as well as innovational LEV manufacturers, including Loncin Holdings, Lifan Motorcycles, Jianshe Group, Luyuan E-vehicle, and Xinri Group.

Many of our current and potential competitors have significantly greater financial, technical, manufacturing, marketing and other resources than we do and may be able to devote greater resources to the design, development, manufacturing, distribution, promotion, sale and support of their products. Our competitors may be in a stronger position to respond quickly to new technologies and may be able to design, develop, market and sell their products more effectively. We believe our overseas customer relationships, as well as overseas OEM strategic alliances, are the basis on which we can compete in the overseas LEV market in spite of the challenges posed by our competitors.

Cryogen-free Refrigerator

As a cryogen-free refrigerator is a unique product, we believe it is a less competitive niche market at the current stage. Our major competitors are Mobicool and Laurina Electronics.

The manufacturing base of Mobicool is in Shenzhen, China. It manufactures and sells non-cryogen portable refrigerators and components in China and export to Europe market. Its products are purchased as original equipment by luxury car manufactures, including BMW, Volvo and Mercedes. Laurina Electronics is based in Shenzhen, China. It manufactures and sells refrigerators and other small home appliances in China and also exports them to the rest of the Asian market. We believe the primary competitive factors in this niche market are:

- product quality and performance; and

19

- relationships with OEM clients.

With our OEM relationships with Ford, Pepsi, Coca-cola, Carlsberg and Disney, we intend to continue to leverage our advantage of product quality, performance, and OEM experience in specific territory markets.

Network cable and HDMI cable

The wire and cable industry is highly competitive. Our competitors include a large number of independent suppliers. Certain competitors have substantially greater manufacturing, sales, research and financial resources than us. We believe the primary competitive factors in wire and cable markets are:

-

product quality and performance;

-

reliability of supply;

-

customer service; and

-

product price.

Certified by global retailers like Wal-Mart, Carrefour and Home Depot, we believe our products still possess a competitive advantage over other competitors. Our major competitors are those companies originally from Taiwan and Hong Kong, who established manufacturing bases in mainland China, as well as other Chinese local competitors, such as Jesmay Electronics and Ningbo Yizhou Electronics.

Intellectual Property

We rely on a combination of trademark, copyright and trade secret protection laws in China and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our intellectual property and our brand. We have applied for two patents for solar power water heaters as we intend to penetrate the solar heat power industry as a part of our green energy business strategy and supplementing our current LEV business. We also have confidentiality and non-competition policies in place as part of our company employment guidelines which is given to employees, and we enter into nondisclosure agreements with third parties. However, we cannot assure you that we will be able to protect or enforce our intellectual property rights.

We

own the trademark of “BEST”![]() , which is actively used for our products. We also own two other trademarks,

which are not used anymore or not frequently used for our products at the current

time.

, which is actively used for our products. We also own two other trademarks,

which are not used anymore or not frequently used for our products at the current

time.

Environmental Matters

Our manufacturing facilities are subject to various pollution control regulations with respect to noise and air pollution and the disposal of waste and hazardous materials. We also are subject to periodic inspections by local environmental protection authorities. Our controlled VIEs have received certifications from the relevant PRC government agencies indicating that their business operations are in material compliance with the relevant PRC environmental laws and regulations. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

20

Regulation

Because our controlled VIEs are located in the PRC, we are regulated by the national and local laws of the PRC.

We are subject to the environmental regulations described in the preceding section entitled “Our Business – Environmental Matters.”

There is no private ownership of land in China. Upon payment of a land grant fee, land use rights can be obtained from the government for a period unto 50 years in the case of industrial land and are typically renewable. We have received the necessary land use rights certificate for our land lots.

We are also subject to China’s foreign currency regulations. The PRC government has controlled Renminbi reserves primarily through direct regulation of the conversion of Renminbi into other foreign currencies. Although foreign currencies, which are required for “current account” transactions, can be bought freely at authorized PRC banks, the proper procedural requirements prescribed by PRC law must be met. At the same time, PRC companies are also required to sell their foreign exchange earnings to authorized PRC banks, and the purchase of foreign currencies for capital account transactions still requires prior approval of the PRC government.

Under current PRC laws and regulations, Foreign Invested Entities, or FIEs, may pay dividends only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, FIEs in China are required to set aside at least 10.0% of their after-tax profit based on PRC accounting standards each year to their general reserves until the cumulative amount of such reserves reaches 50.0% of their registered capital. These reserves are not distributable as cash dividends. The board of directors of an FIE has the discretion to allocate a portion of the FIEs’ after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

We do not face any significant government regulation in connection with the production of our products. We do not require any special government permits to produce our products other than those permits that are required of all corporations in China.

Our Employees

We had 525 employees as of March 31, 2010. The following table sets forth the number of our employees in each of our areas of operations and as a percentage of our total workforce as of March 31, 2010:

21

| As of March 31, 2010 | ||

| Employees | Percentage | |

| Manufacturing, Procurement and Logistics | 464 | 88% |

| Quality Control | 14 | 3% |

| Research and Development | 9 | 2% |

| Sales and Marketing | 13 | 2% |

| Administration and Management | 20 | 4% |

| Finance | 5 | 1% |

| Total | 525 | 100% |

As required by applicable PRC law, we have entered into employment contracts with most of our officers, managers and employees. We are working towards entering employment contracts with those employees who do not currently have employment contracts with us. We believe that we maintain a satisfactory working relationship with our employees, and we have not experienced any significant disputes or any difficulty in recruiting staff for our operations.

Our employees in China participate in a state pension scheme organized by PRC municipal and provincial governments. We are currently required to contribute to the scheme at the rate of 21% of the average monthly salary.

In addition, we are required by PRC law to cover employees in China with various types of social insurance, and we believe that we are in material compliance with the relevant PRC laws.

Insurance

We maintain property insurance for our premises located at Changzhou, China where our main production facilities are located. The aggregate maximum amount covered by our insurance policy is up to RMB 30, 622,000 (approximately $4,480,831). We also maintain property insurance for our automobiles. We do not maintain business interruption, product liability insurance or key-man life insurance. We believe our insurance coverage is customary and standard of companies of comparable size in comparable industries in China. However, we cannot ensure that our existing insurance policies are sufficient to insulate us from all loses and liabilities that we may incur.

Litigation

Changkuan Du, an employee of Best Cable, had personal injure on December 7, 2009. On January 26, 2010, Changkuan Du and Best Cable entered into a mediation agreement attested by Labor Security Service Bureau of Lijia Town Wujin District Changzhou City. Pursuant to the mediation agreement, Best Cable paid RMB 60,000 (approximately $8,780) to Changkuan Du as settlement, and Changkuan Du agreed to give up claims against Best Cable.

22

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

We are vulnerable to shortages in raw materials or fluctuations in raw material prices.

The major raw materials for the LEVs that we produce are steel, electromotor, batteries, wheels and tires. The major raw materials for cryogen-free refrigerators that we produce are polyvinyl chloride (PVC), semiconductor refrigeration components, and air cooling fins. Raw materials for our network cable and HDMI cable business consist of cooper and PVC. In order to ensure timely delivery of quality products to our customers at competitive prices, we must obtain sufficient quantities of good quality raw materials at acceptable prices in a timely manner. There is no assurance that we will be able to obtain sufficient quantities of raw materials from our suppliers which are of an acceptable quality and acceptable price in a timely manner.

Furthermore, as steel and copper are commodities, we are vulnerable to the risk of rising steel and copper prices, which is determined by demand and supply conditions in the global and the PRC market. Should there be any significant increases in the price of steel and copper, and if we are unable to pass on such increases in costs to our customers or find alternative suppliers who are able to supply us steel and copper at reasonable prices, our business and profitability would be adversely affected.

Our rapid expansion could significantly strain our resources, management and operational infrastructure which could impair our ability to meet increased demand for our products and hurt our business results.

To accommodate our anticipated growth, we will need to expend capital resources and dedicate personnel to implement and upgrade our accounting, operational and internal management systems and enhance our record keeping and contract tracking system. Such measures will require us to dedicate additional financial resources and personnel to optimize our operational infrastructure and to recruit more personnel to train and manage our growing employee base. If we cannot successfully implement these measures efficiently and cost-effectively, we will be unable to satisfy the demand for our products, which will impair our revenue growth and hurt our overall financial performance.

23

Our business is capital intensive and our growth strategy may require additional capital which may not be available on favorable terms or at all.

We believe that our current cash, cash flow from operations and the proceeds from this offering will be sufficient to meet our present and reasonably anticipated cash needs. We may, however, require additional cash resources due to changed business conditions, implementation of our strategy to expand our manufacturing capacity or other investments or acquisitions we may decide to pursue. If our own financial resources are insufficient to satisfy our capital requirements, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could limit our ability to expand our business operations and could harm our overall business prospects.

Any interruption in our production processes could impair our financial performance and negatively affect our brand.

We manufacture or assemble our products at our facilities in Changzhou, China. Our manufacturing operations are complicated and integrated, involving the coordination of raw material and component sourcing from third parties, internal production processes and external distribution processes. While these operations are modified on a regular basis in an effort to improve manufacturing and distribution efficiency and flexibility, we may experience difficulties in coordinating the various aspects of our manufacturing processes, thereby causing downtime and delays. We have also been steadily increasing our production capacity and have limited experience operating at these higher production volume levels. In addition, we may encounter interruption in our manufacturing processes due to a catastrophic loss or events beyond our control, such as fires, explosions, labor disturbances or violent weather conditions. Any interruptions in our production or capabilities at our facilities could result in our inability to produce our products, which would reduce our sales revenue and earnings for the affected period. If there is a stoppage in production at any of our facilities, even if only temporary, or delays in delivery times to our customers, our business and reputation could be severely affected. Any significant delays in deliveries to our customers could lead to increased returns or cancellations and cause us to lose future sales. We currently do not have business interruption insurance to offset these potential losses, delays and risks so a material interruption of our business operations could severely damage our business.

We may be exposed to infringement or misappropriation claims by third parties, which, if determined adversely against us, could disrupt our business and subject us to significant liability to third parties.

Our success largely depends on our ability to use and develop our technology, know-how and product designs without infringing upon the intellectual property rights of third parties. We may be subject to litigation involving claims of patent infringement or violation of other intellectual property rights of third parties. The holders of patents and other intellectual property rights potentially relevant to our product offerings may be unknown to us or may otherwise make it difficult for us to acquire a license on commercially acceptable terms.

Best

Cable has registered the trademark for “BEST”![]() . There may also be technologies licensed to and relied on by us that are subject

to infringement or other corresponding allegations or claims by others which

could damage our ability to rely on such technologies. In addition, although

we endeavor to ensure that companies that work with us possess appropriate intellectual

property rights or licenses, we cannot fully avoid the risks of intellectual property rights infringement created by suppliers

of components used in our products or by companies with which we work in

cooperative research and development activities.

. There may also be technologies licensed to and relied on by us that are subject

to infringement or other corresponding allegations or claims by others which

could damage our ability to rely on such technologies. In addition, although

we endeavor to ensure that companies that work with us possess appropriate intellectual

property rights or licenses, we cannot fully avoid the risks of intellectual property rights infringement created by suppliers

of components used in our products or by companies with which we work in

cooperative research and development activities.

24

Our current or potential competitors, many of which have substantial resources and have made substantial investments in competing technologies, may have obtained or may obtain patents that will prevent, limit or interfere with our ability to make, use or sell our products in China or other countries. The defense of intellectual property claims, including patent infringement suits, and related legal and administrative proceedings can be both costly and time consuming, and may significantly divert the efforts and resources of our technical and management personnel. Furthermore, an adverse determination in any such litigation or proceeding to which we may become a party could cause us to:

-

pay damage awards;

-

seek licenses from third parties;

-

pay additional ongoing royalties, which could decrease our profit margins;

-

redesign our products; or

-

be restricted by injunctions.

These factors could effectively prevent us from pursuing some or all of our business and result in our customers or potential customers deferring, canceling or limiting their purchase or use of our products, which could have a material adverse effect on our financial condition and results of operations.

If our customers that use our products successfully assert product liability claims against us due to defects in our products, our operating results may suffer and our reputation may be harmed.

Our products are primarily for commercial and residential use. Significant property damage or personal injuries can result from such uses. If our products are not properly designed, built or installed or if people are injured because of our products, we could be subject to claims for damages based on theories of product liability and other legal theories. The costs and resources to defend such claims could be substantial and, if such claims are successful, we could be responsible for paying some or all of the damages. Negative publicity from such claims may also damage our reputation, regardless of whether such claims are successful. Any of these consequences resulting from defects in our products would hurt our operating results and stockholder value.

25

Certain of our existing stockholders have substantial influence over our company, and their interests may not be aligned with the interests of our other stockholders.

Mr. Jianliang Shi, our Chairman, Chief Executive Officer and President will become the beneficial owner of approximately 88.1% of our common stock after he exercises his rights under the Option Agreement. As a result, he has significant influence over our business, including decisions regarding mergers, consolidations and the sale of all or substantially all of our assets, election of directors and other significant corporate actions. This concentration of ownership may also have the effect of discouraging, delaying or preventing a future change of control, which could deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of our company and might reduce the price of our shares.

Problems with product quality or product performance could result in a decrease in customers and revenue, unexpected expenses and loss of market share.

Our operating results depend, in part, on our ability to deliver quality products on a timely and cost-effective basis. As our products become more advanced, it may become more difficult to maintain our quality standards. If we experience deterioration in the performance or quality of any of our products, it could result in delays in shipments, cancellations of orders or customer returns and complaints, loss of goodwill and harm to our brand and reputation. Furthermore, our products are used together with components and in motor vehicles that have been developed and maintained by third parties, and when a problem occurs, it may be difficult to identify the source of the problem. In addition, some automobile parts and components may not be fully compatible with our products and may not meet our or our customers’ quality, safety, security or other standards. The use by customers of our products with incompatible or otherwise substandard components is largely outside of our control and could result in malfunctions or defects in our products and result in harm to our brand. These problems may lead to a decrease in customers and revenue, harm to our brand, unexpected expenses, loss of market share, the incurrence of significant warranty and repair costs, diversion of the attention of our engineering personnel from our product development efforts, customer relation problems or loss of customers, any one of which could materially adversely affect our business.

We have limited insurance coverage and do not carry any business interruption insurance, third-party liability insurance for our manufacturing facilities or insurance that covers the risk of loss of our products in shipment.

Operation of our facilities involves many risks, including equipment failures, natural disasters, industrial accidents, power outages, labor disturbances and other business interruptions. Furthermore, if any of our products are faulty, then we may become subject to product liability claims or we may have to engage in a product recall. We do not carry any business interruption insurance, product recall or third-party liability insurance for our manufacturing facilities or with respect to our products to cover claims pertaining to personal injury or property or environmental damage arising from defaults with our products, product recalls, accidents on our property or damage relating to our operations. Our existing insurance coverage may not be sufficient to cover all risks associated with our business. As a result, we may be required to pay for financial and other losses, damages and liabilities, including those caused by natural disasters and other events beyond our control, out of our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

26

We are dependent on our major customers.

Sales to our two largest customers, Belkin Electrical (Changzhou) Company Limited and Changzhou Xiu Yun Refrigeration Equipment Company Limited, accounted in aggregate of approximately 37 % and 3% of our revenue for 2009 and 2008, respectively.

Our ability to retain these major customers is therefore important to our continued success. There is however no assurance that these customers will continue to purchase our products at the current levels in the future. There is also no assurance that we will be able to decrease our dependence on these major customers over time. If these major customers cease or reduce significantly their purchase of our products and we are unable to obtain substitute orders of comparable size from other existing or new customers, there will be a material adverse impact on our financial performance and position.

We depend heavily on key personnel, and the loss of key employees and senior management could harm our business.

Our future business and results of operations depend in significant part upon the continued contributions of our key technical and senior management personnel, including our Chairman and Chief Executive Officer, Jianliang Shi and Chief Financial Officer, Jianfeng Xu. They also depend in significant part upon our ability to attract and retain additional qualified management, technical, marketing and sales and support personnel for our operations. If we lose a key employee, if a key employee fails to perform in his or her current position or if we are not able to attract and retain skilled employees as needed, our business could suffer. Turnover in our senior management could significantly deplete institutional knowledge held by our existing senior management team and impair our operations.

In addition, if any of these key personnel joins a competitor or forms a competing company, we may lose some of our customers. We have not entered into confidentiality and non-competition agreements with all of these key personnel. Even with respect to those key personnel with whom we have entered into confidentiality or non-competition agreements, it is not clear, in light of uncertainties associated with the PRC legal system, what the court decisions will be and the extent to which these court decisions could be enforced in China, where all of these key personnel reside and hold some of their assets.

Inability to maintain our competitiveness would adversely affect our financial performance.

We operate in a competitive environment and face competition from existing competitors and new market entrants. Some of these existing competitors are able to manufacture products which are similar to ours and we compete with each other on key attributes which include scale and capacity of our production facilities, pricing, brand name, timely delivery and customer service.

27

Competition in the products we manufacture could increase, or our competitors may be able to price their products more attractively, or may develop or acquire technology that is comparable to our intellectual property.

There is no assurance that we will be able to compete successfully in the future. Any failure by us to remain competitive would adversely affect our financial performance.

We may be unable to effectively manage our expansion.

We have identified several growth plans. These expansion plans may strain our financial resources. They may also overstretch our management personnel and require us to restructure our management structure.

If we are unable to successfully manage our expansion, we may encounter operational and financial difficulties which would in turn adversely affect our business and financial results.

We may require additional funding for our growth plans, and such funding may result in a dilution of your investment.

We attempted to estimate our funding requirements in order to implement our growth plans.

If the costs of implementing such plans should exceed these estimates significantly or if we come across opportunities to grow through expansion plans which cannot be predicted at this time, and our funds generated from our operations prove insufficient for such purposes, we may need to raise additional funds to meet these funding requirements.

These additional funds may be raised by issuing equity or debt securities or by borrowing from banks or other resources. We cannot ensure that we will be able to obtain any additional financing on terms that are acceptable to us, or at all. If we fail to obtain additional financing on terms that are acceptable to us, we will not be able to implement such plans fully. Such financing even if obtained, may be accompanied by conditions that limit our ability to pay dividends or require us to seek lenders’ consent for payment of dividends, or restrict our freedom to operate our business by requiring lender’s consent for certain corporate actions.

Further, if we raise additional funds by way of a rights offering or through the issuance of new shares, any shareholders who are unable or unwilling to participate in such an additional round of fund raising may suffer dilution in their investment.

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors.

28

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K. In addition, the independent registered public accounting firm auditing a company's financial statements must also attest to and report on the operating effectiveness of the company’s internal controls. We were not subject to these requirements for the fiscal year ended December 31, 2009; accordingly, we have not evaluated our internal control systems in order to allow our management to report on, and our independent auditors to attest to, our internal controls as required by these requirements of SOX 404. Under current law, we will be subject to these requirements beginning with our annual report for the fiscal year ending December 31, 2010. We can provide no assurance that we will comply with all of the requirements imposed thereby. There can be no assurance that we will receive a positive attestation from our independent auditors. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements.

Our holding company structure may limit the payment of dividends.

We have no direct business operations, other than our contractual control over our VIEs. While we have no current intention of paying dividends, should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our controlled VIEs and other holdings and investments. In addition, our controlled VIEs, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions as discussed below. If future dividends are paid in RMB, fluctuations in the exchange rate for the conversion of RMB into U.S. dollars may reduce the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars.

Chinese regulations currently permit the payment of dividends only out of accumulated profits as determined in accordance with Chinese accounting standards and regulations. Our controlled VIEs in China are also required to set aside a portion of their after tax profits according to Chinese accounting standards and regulations to fund certain reserve funds. Currently, our controlled VIEs in China are the only sources of revenues or investment holdings for the payment of dividends. If they do not accumulate sufficient profits under Chinese accounting standards and regulations to first fund certain reserve funds as required by Chinese accounting standards, we will be unable to pay any dividends.

29

RISKS RELATING TO OUR COMMERCIAL RELATIONSHIP WITH BEST CABLE AND BEST APPLIANCES

Our contractual arrangements with Best Cable and Best Appliances and their shareholders may not be as effective in providing control over them as direct ownership.

We rely on contractual arrangements with several affiliated PRC entities and their shareholders to operate our businesses. For a description of these contractual arrangements, see “Corporate structure”. In the opinion of our PRC legal counsel, Grandall Legal Group, these contractual arrangements are valid, binding and enforceable, and will not result in any violation of PRC laws or regulations currently in effect. These contractual arrangements may not be as effective in providing us with control over these entities as direct ownership. If we had direct ownership of these entities, we would be able to exercise our rights as a shareholder to effect changes in the boards of directors of these entities, which in turn could effect changes, subject to any applicable fiduciary obligations, at the management level. However, if any of these entities or any of their subsidiaries or their shareholders fails to perform its or his respective obligations under these contractual arrangements, we may not be able to enforce the relevant agreements if the agreements are ruled in violation of the PRC laws as mentioned above, even if the contracts are otherwise legal and valid. We may have to incur substantial costs and resources to enforce them, and seek legal remedies under PRC law, including specific performance or injunctive relief, and claiming damages, which may not be effective. Accordingly, it may be difficult for us to change our corporate structure or to bring claims against any of these entities if they do not perform their obligations under their contracts with us.

All of our revenues are generated through our VIE, and we rely on payments made by our VIE to Best Green Changzhou, our subsidiary, pursuant to contractual arrangements to transfer any such revenues to Best Green Changzhou. Any restriction on such payments and any increase in the amount of PRC taxes applicable to such payments may materially and adversely affect our business and our ability to pay dividends to our shareholders.

We conduct substantially all of our operations through Best Cable and Best Appliances, our VIE, which generates all of our revenues. As Best Cable and Best Appliances are not owned by our subsidiary, it is not able to make dividend payments to our subsidiary. Instead, Best Green Changzhou, our subsidiary in China, entered into a number of contracts with Best Cable and Bes Appliances, including Business Operation Agreement, Equity Interest Pledge Agreement, Exclusive Technical and Consulting Service Agreement and Proxy Agreement, pursuant to which Best Cable and Best Appliances pay Best Green Changzhou for certain services that Best Green Changzhou provides to Best Cable and Best Appliances. However, depending on the nature of services provided, certain of these payments are subject to PRC taxes at different rates, including business taxes and VATs, which effectively reduce the amount that Best Green Changzhou receives from Best Cable and Best Appliances. We cannot assure you that the PRC government will not impose restrictions on such payments or change the tax rates applicable to such payments. Any such restrictions on such payment or increases in the applicable tax rates may materially and adversely affect our ability to receive payments from Best Cable and Best Appliances or the amount of such payments, and may in turn materially and adversely affect our business, our net income and our ability to pay dividends to our shareholders.

Jianliang Shi’s association with Best Cable and Best Appliances could pose a conflict of interest which may result in Best Cable and Best Appliances decisions that are adverse to our business.

Jianliang Shi and Xueqin Wang, who hold an option to acquire a controlling interest in Best Green Investment are also controlling shareholders of our VIEs. Conflicts of interests between their dual roles as owners of both Best Cable and Best Appliances and our company may arise. We cannot assure you that when conflicts of interest arise, any or all of these individuals will act in the best interests of our company or that any conflict of interest will be resolved in our favor. In addition, these individuals may breach or cause Best Cable and Best Appliances to breach or refuse to renew the existing contractual arrangements, which will have a material adverse effect on our ability to effectively control Best Cable and Best Appliances and receive economic benefits from it. If we cannot resolve any conflicts of interest or disputes between us and the beneficial owners of Best Cable and Best Appliances, we would have to rely on legal proceedings, the outcome of which is uncertain and which could be disruptive to our business.

30

If Best Cable and Best Appliances or the Shareholders violate our contractual arrangements with it, our business could be disrupted and we may have to resort to litigation to enforce our rights which may be time consuming and expensive.