Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Iridium Communications Inc. | d8k.htm |

Iridium

Communications Inc. RBC 2010 Technology, Media &

Communications Conference

Matt Desch, CEO

June 10, 2010

Exhibit 99.1 |

Disclaimer

Safe Harbor Statement

This

presentation

contains

statements

about

future

events

and

expectations

known

as

“forward-looking

statements”

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended

(the

“Securities

Act”),

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended

(the

“Exchange

Act”).

We

have

based

these

statements

on

our

current

expectations

and

the information currently available to us.

Forward-looking

statements

in

this

presentation

include

statements

regarding

the

expected

duration

of

the

existing

constellation;

expected

growth

in

revenue,

subscribers,

Operational

EBITDA

and

Operational

EBITDA

margins;

the

transition

to

the

Iridium

NEXT

constellation;

features

of

the

Iridium

NEXT

system;

expected

Iridium

NEXT

project

costs

and

deployment

schedule;

the

availability,

adequacy

and

terms

of

the

Iridium

NEXT

financing;

and

hosted

payload

opportunities.

Other

forward-looking

statements

can

be

identified

by

the

words

"anticipates,"

"may,"

"can,"

"believes,"

"expects,"

"projects,"

"intends,"

"likely,"

"will,"

"to

be"

and

other

expressions

that

are

predictions

of

or

indicate

future

events,

trends

or

prospects.

These

forward-looking

statements

involve

known

and

unknown

risks,

uncertainties

and

other

factors

that

may

cause

the

actual

results,

performance

or

achievements

of

Iridium

to

differ

materially

from

any

future

results,

performance

or

achievements

expressed

or

implied

by

such

forward-looking

statements.

These

risks

and

uncertainties

include,

but

are

not

limited

to,

uncertainties

regarding

expected

Operational

EBITDA

and

Operational

EBITDA

margins,

growth

in

subscribers

and

revenue,

overall

Iridium

NEXT

costs,

including

Euro

currency

exchange

risks,

the

company’s

ability

to

finalize

the

Iridium

NEXT

financing,

potential

delays

in

the

Iridium

NEXT

deployment,

levels

of

demand

for

mobile

satellite

services

(MSS),

and

the

company’s

ability

to

maintain

the

health,

capacity

and

content

of

its

satellite

constellation,

as

well

as

general

industry

and

economic

conditions,

and

competitive,

legal,

governmental

and

technological

factors.

Other

factors

that

could

cause

actual

results

to

differ

materially

from

those

indicated

by

the

forward-looking

statements

include

those

factors

listed

under

the

caption

"Risk

Factors"

in

the

company's

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2009,

filed

with

the

Securities

and

Exchange

Commission

on

March

16,

2010.

There

is

no

assurance

that

Iridium's

expectations

will

be

realized.

If

one

or

more

of

these

risks

or

uncertainties

materialize,

or

if

Iridium's

underlying

assumptions

prove

incorrect,

actual

results

may vary materially from those expected, estimated or projected.

Readers

are

cautioned

not

to

place

undue

reliance

on

these

forward-looking

statements,

which

speak

only

as

of

the

date

hereof.

We

undertake

no

obligation

to

release

publicly

any

revisions

to

any

forward-looking

statements

after

the

date

they

are

made, whether as a result of new information, future events or otherwise.

2

2 |

Basis of

Presentation 3

3

•

Reporting Entity

For comparison purposes, we have presented the operating results of Iridium Holdings

LLC and Iridium Communications Inc. on a combined basis for the year ended

December 31, 2009 along with the Iridium Holdings LLC operating results for 2008. The combined 2009 presentation is a simple

mathematical addition of the pre-acquisition results of operations of Iridium

Holdings LLC for the period from January 1, 2009 to September 29, 2009 and the

post-acquisition results of operations of Iridium Communications Inc. for the three months ended December 31, 2009. Please note that this

presentation is different from the “combined” presentation that we include in

the ‘Management’s Discussion and Analysis’ section of our Form 8-K

filed on May 10, 2010, which combined the pre-acquisition results of operations of

Iridium Holdings LLC for the period from January 1, 2009 to September 29, 2009

with the full year 2009 results of operations of Iridium Communications Inc., both pre- and post-acquisition. Iridium

Communications Inc. had no material operating activities from the date of formation of

GHL Acquisition Corp. until the acquisition. There are no other adjustments made

in the combined presentation. This presentation is intended to facilitate the evaluation and understanding of the financial

performance of the Iridium business on a year-to-year basis. Management

believes this presentation is useful in providing the users of our financial

information with an understanding of our results of operations because there were no

material changes to the operations or customer relationships of Iridium as a

result of the acquisition of Iridium Holdings LLC by GHL Acquisition Corp. •

Non-GAAP Measures

In addition to disclosing financial results that are determined in accordance with U.S.

GAAP, we disclose Operational EBITDA, which is a non-GAAP financial measure,

as a supplemental measure to help investors evaluate our fundamental operational performance. Operational EBITDA represents

earnings before interest, income taxes, depreciation and amortization, Iridium NEXT

revenue and expenses (for periods prior to the commencement of operations of

Iridium NEXT), stock-based compensation expenses, transaction expenses associated with the acquisition, the impact of purchase

accounting adjustments, and changes in the fair value of warrants. We also present

Operational EBITDA expressed as a percentage of total revenues, or Operational

EBITDA margin. Operational EBITDA does not represent, and should not be considered, an alternative to GAAP measurements such as

net income, and our calculations thereof may not be comparable to similarly entitled

measures reported by other companies. A reconciliation of Operational EBITDA to

net (loss) income, its comparable GAAP financial measure, is in the attached table. By eliminating interest, income taxes,

depreciation and amortization, Iridium NEXT revenue and expenses (for periods prior to

the deployment of Iridium NEXT only), stock-based compensation expenses,

transaction expenses associated with the acquisition, the impact of purchase accounting adjustments and changes in fair

value of the warrants, we believe the result is a useful measure across time in

evaluating our fundamental core operating performance. Management also uses

Operational EBITDA to manage our business, including in preparing its annual operating budget, financial projections and compensation

plans. We believe that Operational EBITDA is also useful to investors because similar

measures are frequently used by securities analysts, investors and other

interested parties in their evaluation of companies in similar industries. As indicated, Operational EBITDA does not include interest expense

on borrowed money or the payment of income taxes or depreciation expense on our capital

assets, which are necessary elements of our operations. It also excludes

expenses in connection with the development, deployment and financing of Iridium NEXT. Since Operational EBITDA does not account

for these and other expenses, its utility as a measure of our operating performance has

material limitations. Due to these limitations, our management does not view

Operational EBITDA in isolation and also uses other measurements, such as net income, revenues and operating profit, to

measure operating performance. |

Our

Company •

Satellite voice and data solutions for

enterprise & government

•

The only provider offering 100% worldwide coverage

•

#2 industry player by revenue

•

66 satellite Low Earth Orbit (LEO) constellation plus

in-orbit spares for service through Iridium NEXT

•

~359,000 billable subscribers at March 31, 2010

•

Anchor U.S. DoD

customer –

23% of revenue for

Q1 2010

(1)

4

•

Complements terrestrial communications solutions

•

Less than 10% of the earth’s surface is served by terrestrial wireless and

wireline •

Key Markets: maritime, aviation, handheld, government, machine-to-

machine (M2M)

•

Low and high speed data services growing rapidly

1)

Includes direct and indirect DoD revenues and revenues from certain other

governmental entities through the DoD gateway.

|

What

Investors Need to Know •

We have unique

service

capabilities

–

unlikely

to

be

replicated –

in

a market projected

to

double

by

2016

•

Our subscribers, service revenue and Operational EBITDA are all

growing rapidly (and did so through the recession)

•

We are a very attractive business with Operational EBITDA margin

over 40% and significant operating leverage which will cause our

margin to expand as we grow

•

We have a French government guarantee on a financing which will

enable us to fully fund our next-generation constellation which is

expected to last through 2030

•

We are currently valued at 3.3x our estimate for 2010 EBITDA as

strong number 2 player (vs. 10.5x for the market share leader)

5

1)

Source: Northern Sky Research and other sources

(1) |

Unique

Position in the MSS Market - Service Capabilities Not Easily Duplicated

6 |

Mobile

Satellite Services (MSS) Market •

MSS market generated ~ $1.2B in

2009 revenue

(1)

•

MSS Industry CAGR of 12% expected

2010 –

2015

(2)

•

Iridium & Inmarsat

are the two

largest providers

•

Thuraya

only offers regional APAC

& EMEA coverage

•

Globalstar

satellites unable to

provide reliable two-way

communication

•

Others (ORBCOMM, SkyTerra, ICO,

Terrestar) serve only specific

segments

(1)

This

estimate

includes

2008

Thuraya

revenues,

as

public

financials

are

not

available

for

2009.

(source:

TMF

Associates)

(2)

Northern Sky Research, 2009

(3)

Based on 2009 revenue

(4)

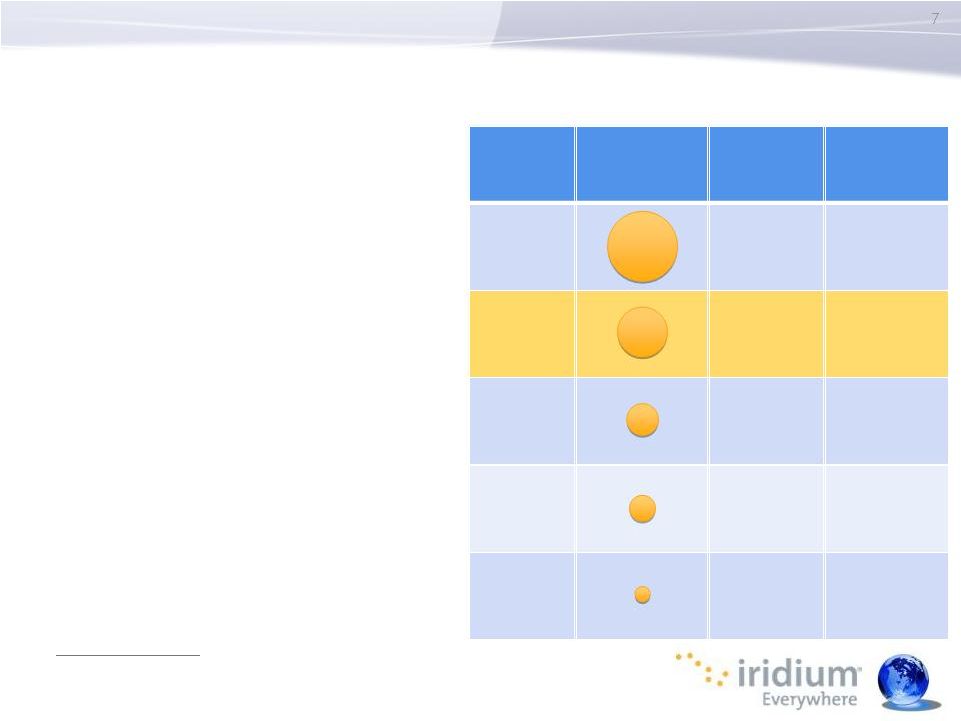

Inmarsat

Core (excludes Stratos)

MSS

Provider

Relative

Size

(1)(3)

2009

Revenue

2006-2009

Revenue

CAGR

Inmarsat

$695 MM

(4)

12%

Iridium

$319 MM

15%

Thuraya

$127 MM

(1)

N/A

Globalstar

$64 MM

-22%

Orbcomm

$28 MM

4%

7 |

Iridium

Markets & Illustrative Applications 8 |

U.S.

Government – The Anchor Customer

•

The U.S. government relies on Iridium for

global communications

•

Significant DoD

investment in proprietary

gateway & equipment

•

DoD

has been our anchor customer since 2001

•

Serves all DoD

branches (Army, Navy, Air Force,

Marines, Special Operations) & many other

government/international users

•

DoD

views our services as being

mission-critical

•

Five year

(1)

contract signed in Q1 08

•

Fixed fee per user (voice)

•

Tiered pricing (data)

•

Opportunities to expand relationship

(Netted, iGPS

& M2M)

•

Other militaries & governments also use our

services (e.g., UK) -

included in commercial

revenues

9

DoD

Revenue

(2)

2004

24%

2009

Total Revenue

$122 million

Total Revenue

$319 million

1)

As is customary for government contracts, Iridium’s DoD contract is structured as

a five year contract with one base year and four one-year options to

extend. Iridium’s contract with the DoD is currently in the second year of

optional extension, making this the third year of the overall DoD contract. Two

one-year option periods remain. 2)

Includes direct and indirect DoD revenues and revenues from certain other

governmental entities through the DoD gateway. |

M2M

(SBD) Data Transmission Voice Call

OpenPort

Session

Iridium Is Used –

Everywhere

10

One week plot of SBD Session, Voice Call, & OpenPort

Session Origination Points week of 5/23/10-5/29/10

(Commercial Traffic Only) |

Expanding

Distribution Network •

Wholesale distribution model

minimizes costs and risks

•

Growing web of hundreds of

total distribution partners

•

Partners provide “outsourced

R&D”

to develop specialty

products for individual

customer segments

•

>200 individual applications

targeting key verticals

11 |

New Core

Products Accelerating our Growth

2001

2001

0

Partners

0

Partners

02

03

04

05

06

07

08

Iridium

OpenPort

High

Functionality

Handset

Low Cost

Handset

Original

Motorola

Voice

Handset

Iridium

9505A

M2M

9601

Voice

& Data

Modem

iGPS

M2M

Chipset

12

M2M

9602

Iridium

9522B

Iridium

9555

U.S. DOD

Tactical Radio

(Netted)

Pre-NEXT

Devices

Iridium

Aero

OpenPort

2010

2010

09

>

200

Partners

>

200

Partners |

Licensing

in New Markets New Geographic Opportunities

•

Today we have distribution presence in over 100 countries

•

Potential distribution presence in certain countries offering large growth

opportunity: •

Russia,

China,

India,

South

Africa

–

Population

of

2.7B

(1)

•

Currently pursuing entering these and other countries

(1)

July 2009 estimate according to CIA World Factbook.

13 |

Growing

Rapidly, Even Through Recession

14 |

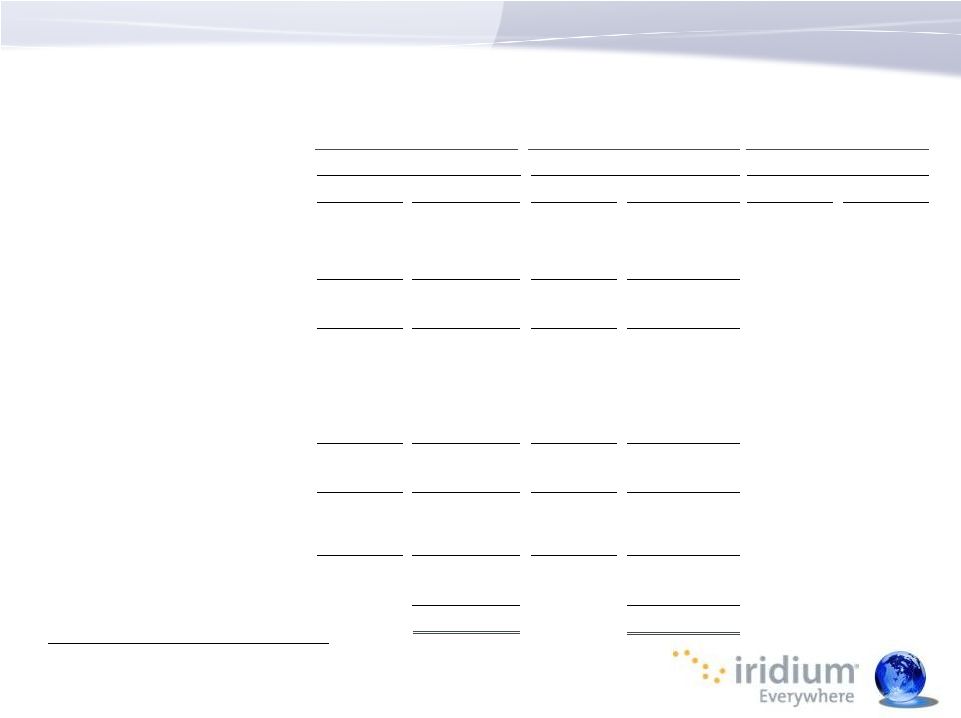

Continued

Growth Expected 2009

1Q’10

2010

Guidance

Subscribers

(1)

342K

Up 11.2%

359K

Up 14.3%

376K –

393K

Up 10 –

15%

Commercial

Service Revenue

$160.2 M

Up 20.3%

$40.9 M

Up 11.0%

Up 10 –

12%

Government

Service Revenue

(2)

$53.7 M

Up 2.4%

$13.7 M

Up 3.1%

Up 3 –

5%

Equipment

Revenues

$83.5 M

Down 30.4%

$21.8 M

Up 6.5%

Single Digit

Growth

Operational

EBITDA

(3)

$133.9 M

Up 20.5%

$33.6 M

Up 19.6%

$145 –

155 M

Up 8 –

16%

15

~375K already as of 6/10/10!

1)

Billable subscribers at the end of the respective periods, which exclude suspended

subscribers who elected to suspend their accounts and were no generating any

fees. 2)

Voice and M2M service revenue for the U.S. government

3)

Net Income in 2009 and 1Q10 were $48.5M and ($1.3M) respectively, which includes $17.0M

and $18.4M of expenses related to purchase price accounting adjustments, net of

tax, respectively. Operational EBITDA is defined on page 3. See

pages 33 and 36 for a reconciliation of Operational EBITDA to Net Income. |

Subscriber

and Service Revenue Key to Earnings Growth

•

Growing billable subscriber

base drives recurring service

revenue

•

Enterprise and government

end-users

•

Service revenue is predictable

and growing

($M's)

(000's)

Robust

Billable

Subscriber

Growth

1)

Billable subscribers exclude suspended subscribers who elected to suspend their

accounts and were not generating any fees at such time.

$235

$201

$159

$129

Q1 03

Q1 10

16

(1)

Service Revenue

16

$55

$60 |

•

Largely fixed cost business model

•

Expanding

Operational

EBITDA

margin

(1)

Substantial Operating Leverage

(1)

Operational EBITDA is defined on slide 3. Operational EBITDA margin is defined

as Operational EBITDA divided by total revenue.

Operational EBITDA

Operational EBITDA Margin

17

1Q10

Margin

41%

-

up

340bps

from

previous

1Q |

Government Backing for Low-Cost,

Flexible Financing

18 |

Iridium

Has a Strong Balance Sheet •

Net

Cash

of

$146M

at

end

of

1Q10

(1)

•

Strong

cash

producing

operations

-

2010

Operational

EBITDA

guidance provided of $145 –

155M

•

$262M of potential warrant proceeds from $7.00 and $11.50

warrants

19

(1) Includes Cash & Restricted Cash, less indebtedness at March 31, 2010

|

June

2 nd

Announcement

•

Iridium announced a comprehensive plan for Iridium NEXT

constellation and financing

•

Iridium

signed

an

agreement

with

Thales

Alenia

Space

(TAS)

for

next-

generation constellation after a comprehensive competitive process

•

$2.1B

(1)

contract for 81 satellites (66 operational, 6 in-orbit spares, 9

ground spares)

•

TAS beginning work immediately under an Authorization to Proceed

•

First launch scheduled during Q1 2015

•

Total

NEXT

cost

now

expected

to

be

$2.9B

to

be

spent

through

2017

(1)

•

Coface, France’s export credit agency (ECA), committed to

guarantee 95% of $1.8B facility

20

1) Computed at a Euro to USD exchange rate of 1.23 which will be converted to fixed

rate after financing close. |

•

Coface, France’s export credit agency, has issued a ‘Promise of

Guarantee’ which commits to cover 95% of $1.8B facility

•

Iridium expects an attractive fixed rate consistent with other ECA

financings

(1)

and a flexible, long term (15 years)

•

Facility only drawn down through 2017 as capital required; payoff over

the subsequent 7 years

•

With Iridium’s growth and delayed drawdown –

credit statistics very

manageable

•

Syndication underway now –

expect to be completed this summer

•

Coface

guarantee is not conditioned on Iridium raising additional debt

or

equity

Iridium NEXT Financing

21

(1) Globalstar’s

maximum potential rate is in the 6.5% range.

Combined with expected cash flows, Coface-backed credit

facility fully funds Iridium NEXT! |

Iridium

NEXT Prime Selection •

TAS offers the best comprehensive solution for

Iridium in terms of design, functionality, price,

schedule and financing

•

Initial launch scheduled during Q1 2015

•

Current fleet expected to provide service

through transition to Iridium NEXT

•

Fully compatible with current constellation and

customer devices to simplify network transition

and customer continuity

22

•

Iridium NEXT features:

•

Doubles current Iridium subscriber capacity for long-term growth

•

Supports

higher

data

speeds

–

enabling

the

most

competitive

price

points

in

the

industry

•

Capable

of

supporting

future

product

enhancements

•

Designed

to

host

secondary

payloads

–

in

discussion

with

numerous

potential

candidates

•

Will maintain Iridium’s unique architecture and its advantages

-

software upgradability |

Hosted

Payload Opportunity •

Significant interest from government and industry in sharing Iridium NEXT

global networked communications infrastructure

•

New cash flow stream potential for Iridium

•

Pre-launch

(2012

–

2014)

and

after

launch

(data

delivery

2015

and

beyond)

•

Potential customers appreciate the unique opportunity Iridium NEXT presents:

•

Unprecedented

spatial

and

temporal

coverage

with

66

payloads

•

Real-time

data

acquisition

from

on-board

sensors

•

Cost-effective

–

fraction of the cost of dedicated satellites

•

Thales Alenia

Space has “designed in”

hosted payload

flexibility

•

Active opportunities underway with various

governmental agencies

23

23 |

Putting

Cost of Iridium NEXT in Perspective •

$2.9B constellation (current estimated total cost)

(1)

•

Assumes constellation provides commercially acceptable service

through 2030

(2)

•

Large cash flow potential over constellation life justifies the

investment:

24

1)

Computed at a Euro to USD exchange rate of 1.23.

2)

Design life is expected to be 10 years. Historically, actual constellation life

has significantly exceeded design life. 3)

Cumulative Operational EBITDA based on midpoint of 2010 Operational EBITDA guidance

previously provided by management ($150M) and assuming Operational EBITDA grows

at 10% and 15% per year, respectively. For periods after the deployment of

Iridium NEXT, Operational EBITDA will not exclude revenues and expenses associated with Iridium NEXT.

See page 3 -

Basis of Presentation.

4)

The Operational EBITDA CAGRs

are for illustrative purposes only and are not intended to be and should not be relied

upon as management guidance or projections. |

Valued

at Large Discount to Peers 25 |

Iridium

Trading at 3.3x 2010E Operational EBITDA 26

Current Iridium Trading Valuation

Note: Balance sheet data as of 3/31/10.

1)

Includes shares outstanding plus the value of the outstanding warrants using the

treasury stock method. 2)

Cash and restricted cash, less indebtedness at March 31, 2010.

3)

Represents midpoint of management guidance.

4)

Source: Bloomberg as of 6/4/10; based on 2010 estimated EBITDA.

(2)

(1)

(4)

($ in millions, except per-share data)

Share Price as of 6/4/2010

$8.74

x Shares Outstanding

73.0

Market Capitalization

$638

Less: Net Cash

($146)

Enterprise Value

$492

Divided by: 2010E Operational EBITDA

(3)

$150

Ent. Value / 2010E Operational EBITDA

3.3x

Comparison to Inmarsat

Approx. 10.5x

(Primary Competitor)

26 |

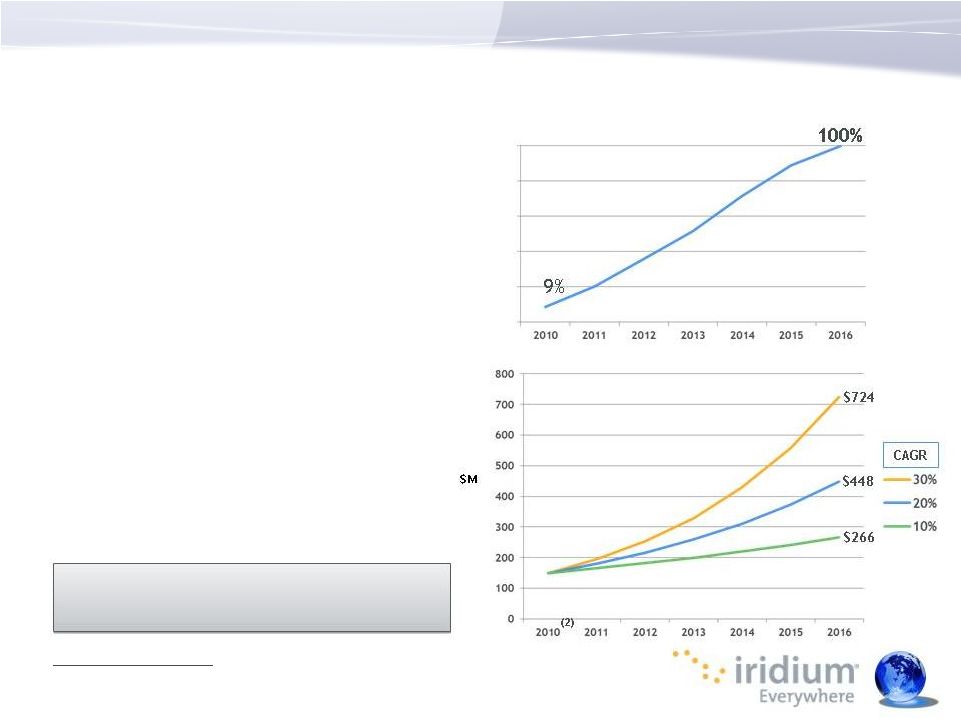

Iridium

NEXT Financing and Equity Value 27

27

Expected Iridium NEXT Cumulative Capex

Spend

•

$1.8B Coface-backed facility will be

drawn down over time in line with

capital expenditures…

•

While Operational EBITDA grows

(1)

Potential Operational EBITDA Growth

(1)

Significant Equity Value In All

Years As We Build NEXT

(1)

Operational EBITDA growth for illustrative purposes only and are not intended to be

and should not be relied upon as management guidance or projections

(2)

Midpoint of 2010 Guidance = $150M |

The

Iridium Success Story •

Company today has a record of performance -

nearly no net debt and

strong and growing Operational EBITDA…

•

Memories gradually fading from predecessor bankruptcy twelve years ago

•

Extensive scrutiny through recent corporate and financial transactions

validate Iridium’s business model

•

“Conventional wisdom”

in industry about operating risks repeatedly overcome

by Iridium’s track record and robust network design

•

$1.8 B French government guarantee to cover full financing needs

with

low-cost, flexible debt

•

Can focus now on growing operating margins and generating long term

earnings and value

28 |

Iridium

NEXT Constellation Industry Leadership

Fully Financed

Summary

Strong Base of Customers

Positive & Growing EBITDA

Leverage on Assets and

Expanding Margins

Distribution Model

Numerous Opportunities

for Growth in Fast

Increasing Revenue

Growing Market

29 |

Appendix |

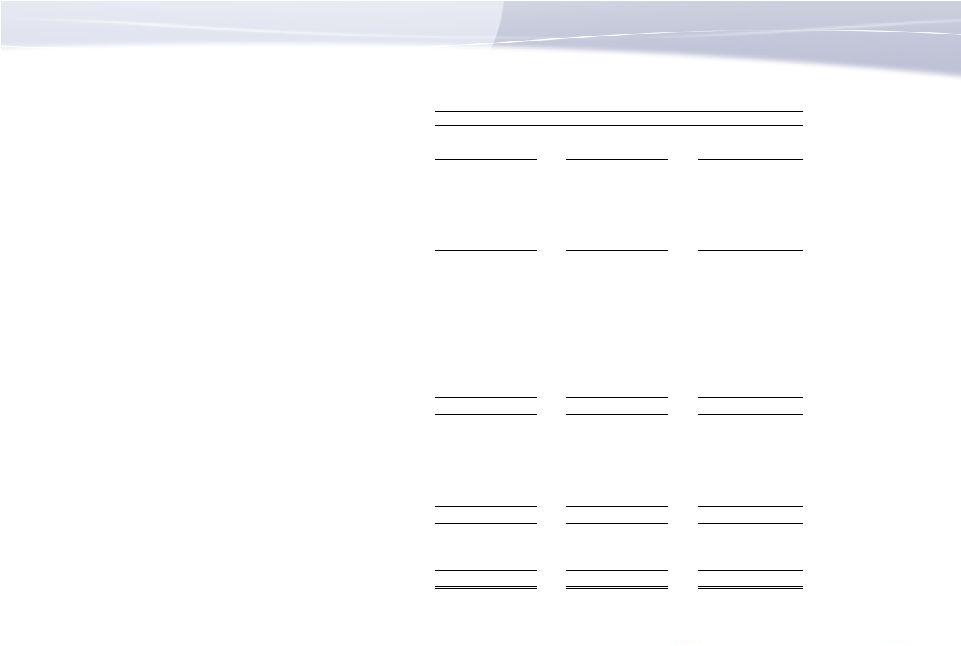

(1)

Subscribers as of the end of the period

(2)

Primarily Commercial M2M data subscribers who elected to suspend their accounts and as

a result were not generating fees at such time

Iridium Communications Inc. and Iridium Holdings LLC

Q1 2010 Summary Highlights

31

31

Iridium Holdings LLC

(In thousands)

2009

Revenue

Subscribers

(1)

Commercial

Voice and M2M data service

Voice

$ 32,838

219

M2M data

3,782

64

Total voice and M2M data service

36,620

283

Other

198

-

Total commercial

36,818

283

Government

Voice and M2M data service

Voice

13,218

29

M2M data

130

2

Total voice and M2M data service

13,348

31

Engineering and support

5,120

-

Total government

18,468

31

Equipment

20,503

-

Total revenue and billable subscribers

$ 75,789

314

Suspended

subscribers

(2)

14

Total subscribers

328

NM= Not Meaningful

Iridium Communications Inc.

2010

% Change

Revenue

Subscribers

(1)

Revenue

Subscribers

$ 36,607

248

11.5%

13.2%

4,050

76

7.1%

18.8%

40,657

324

11.0%

14.5%

229

-

15.7%

NM

40,886

324

11.0%

14.5%

13,494

30

2.1%

3.4%

263

5

102.3%

150.0%

13,757

35

3.1%

12.9%

5,256

-

2.7%

NM

19,013

35

3.0%

12.9%

21,843

-

6.5%

NM

$ 81,742

359

7.9%

14.3%

31

390

18.9%

For

the

Three

Months

Ended

March

31,

For

the

Three

Months

Ended

March

31, |

Iridium

Communications Inc. and Iridium Holdings LLC Q1 2010 Consolidated Statements of

Operations (In thousands)

32

32

Iridium Holdings LLC

Iridium Communications Inc.

For the Three Months Ended March 31,

2009

2010

Purchase Accounting

Adjustments

(1)

Revenue:

Services:

Government

$

18,468

$

19,013

$

-

Commercial

36,818

40,886

(1,056)

Subscriber equipment

20,503

21,843

-

Total revenue

75,789

81,742

(1,056)

Operating expenses:

Cost of subscriber equipment sales

11,316

23,145

10,873

Cost of services (exclusive of depreciation and amortization)

19,697

20,361

(1,020)

Research and development

12,094

4,265

-

Depreciation and amortization

3,675

22,511

19,053

Selling, general and administrative

13,939

15,930

-

Transaction costs

643

-

-

Total operating expenses

61,364

86,212

28,906

Operating profit (loss)

14,425

(4,470)

(29,962)

Other (expense) income:

Interest income (expense), net of capitalized interest

(4,639)

106

-

Other income (expense), net

(68)

117

Total other (expense) income

(4,707)

223

-

Earnings (loss) before provision (benefit) for taxes

9,718

(4,247)

(29,962)

Income tax (benefit) provision

-

(2,930)

(11,558)

Net income (loss)

$ 9,718

$

(1,317) $

(18,404) Operational EBITDA

$ 28,117

$ 33,619

$

- (1)

When comparing Iridium Communications Inc.'s results of operations to that of Iridium

Holdings LLC, the impact of the purchase accounting on the carrying value of

inventory, property and equipment, intangible assets and accruals, increased by

approximately $19.8 million, $348.2 million, $95.5 million and $29.0 million,

respectively compared to Iridium Holdings LLC’s balance sheet as of September 29,

2009. Similarly, Iridium Holdings LLC's deferred revenue decreased by $7.4

million. As a result of the purchase accounting adjustments related to the acquisition,

our cost of subscriber equipment sales increased in the first quarter of 2010 as

compared to those costs and expenses of Iridium Holdings LLC in prior periods and the

decrease in the carrying value of deferred revenue will also result in a

decrease in revenue throughout 2010. In addition, the increase in accruals will result

in a reduction in cost of services (exclusive of depreciation and amortization)

during 2010 and future periods. The increase in property and equipment and intangible

assets will result in an increase to depreciation and amortization expense

during 2010 and future periods. |

Iridium

Communications Inc. and Iridium Holdings LLC Q1 2010 Operational EBITDA

Non-GAAP reconciliation (In thousands)

33

33

Iridium Holdings LLC

Iridium Communications

Inc.

Three Months Ended

March 31, 2009

Three Months Ended

March 31, 2010

Net income (loss)

$

9,718

$

(1,317) Interest expense

4,622

12

Interest income

17

(118)

Income taxes

-

(2,930)

Depreciation and amortization

3,675

22,511

Iridium NEXT expenses, net

8,849

3,370

Share-based compensation

593

1,182

Transaction expenses

643

-

Purchase accounting adjustments

-

10,909

Operational EBITDA

$ 28,117

$

33,619 |

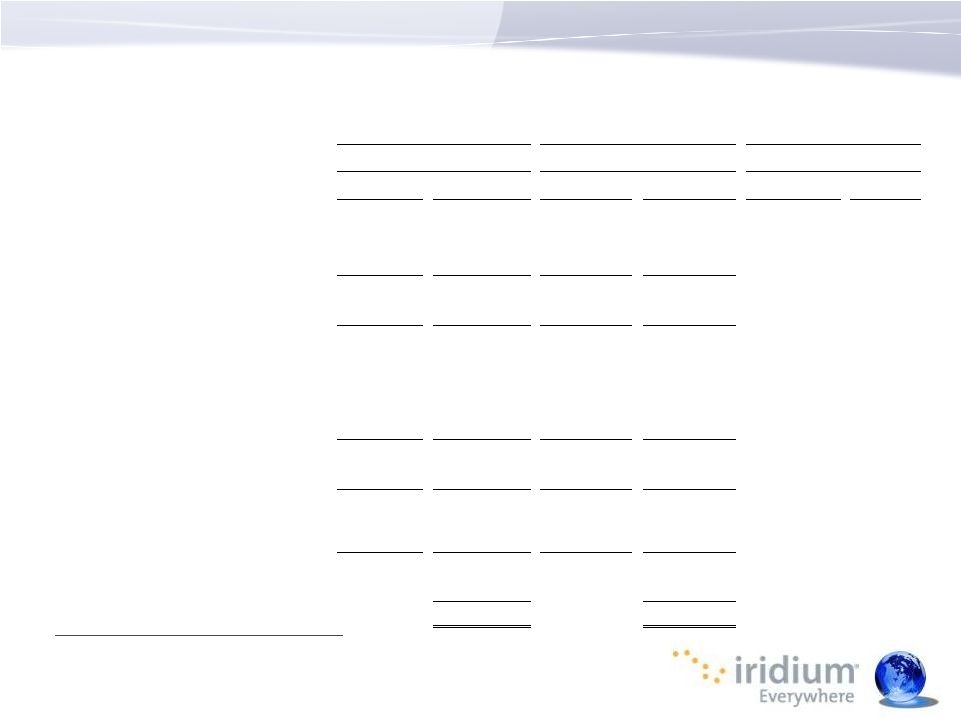

Iridium

Communications Inc. and Iridium Holdings LLC 2009 Summary Highlights

34

34

Iridium Holdings LLC

Iridium Communications Inc.

(In thousands)

For the Year Ended December 31,

2008

For the Year Ended December 31,

2009

% Change

Revenue

Subscribers

(1)

Revenue

Subscribers

(1)

Revenue

Subscribers

Commercial

Voice and M2M data service

Voice

$ 121,183

218

$ 143,133

238

18.1%

9.2%

M2M data

11,288

59

16,462

70

45.8%

18.6%

Total voice and M2M data service

132,471

277

159,595

308

20.5%

11.2%

Other

776

-

648

-

-16.5%

NM

Total commercial

133,247

277

160,243

308

20.3%

11.2%

Government

Voice and M2M data service

Voice

52,172

29

52,956

30

1.5%

3.4%

M2M data

277

2

770

4

178.0%

100.0%

Total voice and M2M data service

52,449

31

53,726

34

2.4%

9.7%

Engineering and support

15,310

-

21,472

-

40.2%

NM

Total government

67,759

31

75,198

34

11.0%

9.7%

Equipment

119,938

-

83,499

-

-30.4%

NM

Total revenue and billable subscribers

$

320,944

308

$

318,940

342

-0.6%

11.0%

Suspended subscribers

(2)

12

27

Total subscribers

320

369

15.3%

NM

= Not Meaningful

(1)

Subscribers as of the end of the period

(2)

Primarily Commercial M2M data subscribers who elected to suspend their accounts and as

a result were not generating fees at such time

|

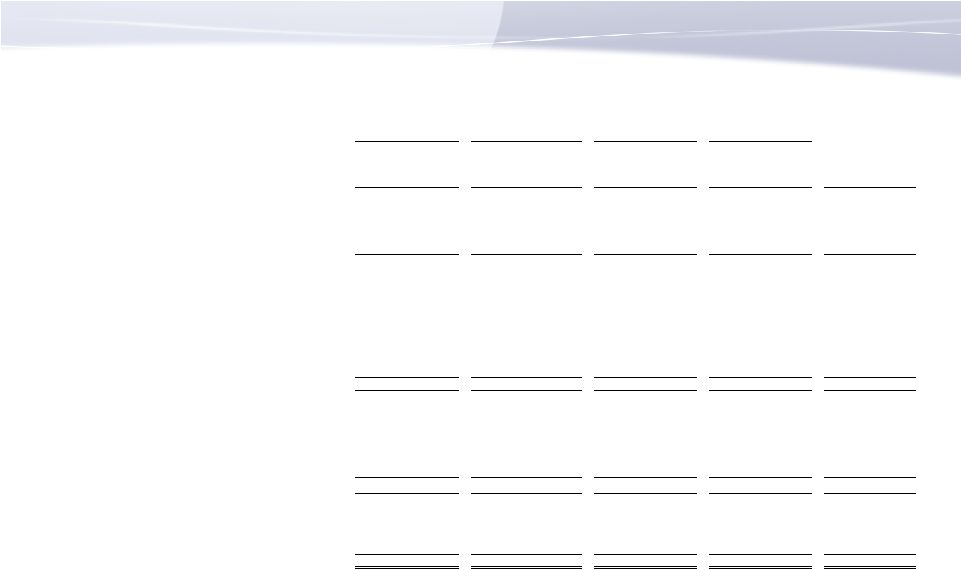

Iridium

Communications Inc. and Iridium Holdings LLC 2009

Consolidated Statements of Operations

(In thousands)

35

Iridium Holdings LLC

Iridium Communications

Inc.

Iridium Holdings LLC

Combined Year

For the Year Ended

December 31, 2008

For the Three Months

Ended December 31,

2009

For the Period January

1, 2009 to September

29, 2009

For the Year Ended

December 31, 2009

Impact of Purchase

Accounting

Adjustments on

2009 results

Revenue:

Services:

Government

$ 67,759

$

19,159

$ 56,039

$ 75,198

$

-

Commercial

133,247

39,537

120,706

160,243

(1,675)

Subscriber equipment

119,938

17,293

66,206

83,499

-

Total revenue

320,944

75,989

242,951

318,940

(1,675)

Operating

expenses:

Cost of subscriber equipment sales

67,570

18,657

33,265

51,922

8,899

Cost of services (exclusive of depreciation and amortization)

69,882

18,965

58,978

77,943

(1,020)

Research and development

32,774

5,974

17,432

23,406

-

Depreciation and amortization

12,535

22,376

10,850

33,226

18,621

Selling, general and administrative

55,105

16,307

44,505

60,812

-

Transaction costs

7,959

-

12,478

12,478

-

Total operating

expenses

245,825

82,279

177,508

259,787

26,500

Operating

profit

75,119

(6,290)

65,443

59,153

(28,175)

Other (expense) income:

Interest expense, net of capitalized interest

(21,094)

(47)

(12,829)

(12,876)

(78)

Interest income and other income (expense), net

(146)

324

670

994

-

Total other income (expense)

(21,240)

277

(12,159)

(11,882)

(78)

Earnings before provision (benefit) for taxes

53,879

(6,013)

53,284

47,271

(28,253)

Income tax provision (benefit)

-

(1,038)

-

(1,038)

(10,899)

Net income

$ 53,879

$

(4,975)

$ 53,284

$ 48,309

$

(17,354) Operational EBITDA

$ 111,103

$

30,211 $ 103,718

$ 133,929

$

-

35

(1)

See page 3 for definition of combined year.

(2)

When comparing Iridium Communications Inc.'s results of operations to that of Iridium

Holdings LLC, the impact of the purchase accounting on the carrying value of

inventory, property and equipment, intangible assets and accruals, increased by

approximately $19.8 million, $348.2 million, $95.5 million and $29.0 million, respectively

compared to Iridium Holdings LLC’s balance sheet as of September 29, 2009.

Similarly, Iridium Holdings LLC's deferred revenue decreased by $7.4 million. As a result of the

purchase accounting adjustments related to the acquisition, our cost of subscriber

equipment sales will increase in the first quarter of 2010 as compared to those costs and

expenses of Iridium Holdings LLC in prior periods and the decrease in the carrying

value of deferred revenue will also result in a decrease in revenue throughout 2010. In

addition, the increase in accruals will result in a reduction in cost of services

(exclusive of depreciation and amortization) during 2010 and future periods. The increase in

property and equipment and intangible assets will result in an increase to depreciation

and amortization expense during 2010 and future periods. (1)

(2) |

Iridium

Communications Inc. and Iridium Holdings LLC 2009 Operational EBITDA Non-GAAP

reconciliation (In thousands)

36

Iridium Holdings LLC

Iridium

Communications Inc.

Iridium Holdings LLC

Combined Year

(1)

For the Year Ended

December 31, 2008

Three Months Ended

December 31, 2009

For the Period January

1, 2009 to September

29, 2009

For the Year Ended

December 31, 2009

Net income

$ 53,879

$

(4,975)

$ 53,284

$ 48,309

Interest expense

21,094

47

12,829

12,876

Interest income

(1,345)

(298)

(287)

(585)

Income taxes

-

(1,038)

-

(1,038)

Depreciation and amortization

12,535

22,376

10,850

33,226

Iridium Next expenses, net

14,113

4,109

9,159

13,268

Stock-based compensation

2,868

436

5,405

5,841

Transaction expenses

7,959

-

12,478

12,478

Purchase accounting adjustments

-

9,554

-

9,554

Operational EBITDA

$ 111,103

$

30,211

$ 103,718

$ 133,929

(1)

See page 3 for definition of combined year.

36 |