Attached files

Table of Contents

As filed with the Securities and Exchange Commission on June 9, 2010

File No. 333-161382

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-effective Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

PHL VARIABLE INSURANCE COMPANY

(Exact name of registrant as specified in its charter)

| Connecticut | 6311 | 06-1045829 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

One American Row

Hartford, CT 06102

(800) 447-4312

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John H. Beers, Esq.

PHL Variable Insurance Company

One American Row

Hartford, CT 06102-5056

(860) 403-5050

(Name, address, including zip code, and telephone number, including area code, of agent for service)

As soon as practicable after the registration statement becomes effective.

(Approximate date of commencement of proposed sale to public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Calculation of Registration Fee

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum per unit |

Proposed maximum offering price |

Amount of registration fee | ||||

| Certificates of interest in contingent group deferred annuity contracts |

* | * | $5,000,000.00 | $279.00** | ||||

| * | The maximum aggregate offering price is estimated solely for the purpose of determining the registration fee. The amount to be registered and the proposed maximum offering price per unit are not applicable in that these contracts are not issued in predetermined amounts or units. |

| ** | Registration fee paid concurrently with the filing of the Registration Statement on August 17, 2009. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), SHALL DETERMINE.

Table of Contents

Phoenix Guaranteed Income Edge®

An Insurance Guarantee Issued by

PHL Variable Insurance Company

and available to clients of Investors Capital Advisory Services

The Phoenix Guaranteed Income Edge® (“Income Edge”) described in this prospectus is an insurance certificate offered to investment advisory clients of Investors Capital Advisory Services (“Investors Capital”) whose investments are managed under the Investor Protector Program, an advisory program offered by Investors Capital. Subject to certain conditions, the Income Edge guarantees predictable lifetime income payments regardless of the actual performance or value of the client’s assets managed under the Investor Protector Program.

This prospectus provides important information that a prospective purchaser of an Income Edge should know before purchasing. Please retain this prospectus for future reference.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The Income Edge is issued by PHL Variable Insurance Company (“PHL Variable”). It is not a bank deposit guaranteed by any bank or by the Federal Deposit Insurance Corporation or any other government agency. A purchase of the Income Edge is subject to certain risks. Please see the “Risk Factors” section on page 10.

The Income Edge is novel and innovative. The Internal Revenue Service has issued a ruling to PHL Variable Insurance Company indicating that the Income Edge certificate will be treated as an annuity contract under the Internal Revenue Code. In addition, the Internal Revenue Service has also issued rulings concerning the tax treatment to an individual investor relative to the certificate and the investor’s assets covered by the certificate. These rulings provide, in substance, that the certificate will be treated as an annuity contract and that the income tax treatment of the assets is unaffected by the existence of Income Edge. Accordingly, for tax reporting purposes, PHL Variable will treat any payments it makes under the terms of the Income Edge as amounts paid to certificate holders as an annuity. You should consult a tax advisor before purchasing your Income Edge. See “Taxation of the Income Edge” at page 41 for a discussion of the tax consequences of the Income Edge.

PHL Variable will offer the Income Edge through its affiliate, Phoenix Equity Planning Corporation (“PEPCO”), which is the principal underwriter. The Income Edge is offered only to investment advisory clients of Investors Capital. Prospective purchasers may apply to purchase an Income Edge only through Investors Capital Corporation, the registered broker-dealer firm of which Investors Capital is a part. Investors Capital Corporation has entered into a selling agreement with PEPCO in order to offer the Income Edge to investment advisory clients of Investors Capital.

|

PHL Variable Insurance Company | |

| One American Row PO Box 5056 Hartford, CT 06102-5056 | ||

|

Tel. 800/866-0753 |

| Prospectus dated June 14, 2010 |

1

Table of Contents

| Heading | Page | |||

|

| ||||

| 4 | ||||

| 4 | ||||

| 1. | 5 | |||

| 2. | 7 | |||

| 3. | How is the Income Edge Fee Percentage for my Certificate Determined? |

8 | ||

| 4. | Additional Fees Related to your Investor Protector Program and the Funds Held in your Account |

9 | ||

| 9 | ||||

| 10 | ||||

| 15 | ||||

| 1. | 16 | |||

| 16 | ||||

| What If You Want to Purchase an Income Edge For Your Individual Retirement Account (IRA)? |

16 | |||

| 2. | 17 | |||

| 3. | 17 | |||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 20 | ||||

| 22 | ||||

| How Will Investors Capital Manage Your Investments in the Account if You Purchase an Income Edge? |

22 | |||

| What Happens if Your Account is Managed in a Manner Unacceptable to Us? |

22 | |||

| 23 | ||||

| 23 | ||||

| Why Will Your Income Edge Terminate if Your Account is Not Managed Within the Permitted Ranges? |

24 | |||

| 4. | 24 | |||

| 5. | 26 | |||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| The Importance of Considering When to Start Making Withdrawals |

30 | |||

| 6. | 30 | |||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 7. | 31 | |||

| 31 | ||||

| 36 | ||||

| 8. | 37 | |||

| 37 | ||||

| What if You Die Before Your Account Investments Are Reduced to $0? |

38 | |||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

2

Table of Contents

| Heading | Page | |||

|

| ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| The Phoenix Companies, Inc.—Legal Proceedings about Company Subsidiaries |

45 | |||

| 45 | ||||

| 46 | ||||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 50 | ||||

| 53 | ||||

| 53 | ||||

| 53 | ||||

3

Table of Contents

Phoenix Guaranteed Income Edge

Certain terms used in this prospectus have specific and important meanings. We have capitalized these terms, and explained what each term means when it is first used in this prospectus. To help you locate the explanation of a defined term in case you need to refer back to that explanation as you read through this prospectus, there is a list in the back of this prospectus of all of the defined terms and the page on which the meaning of each term is first explained.

“We” or “us” means PHL Variable. “You” or “your” means the owner (or, if applicable, the joint spousal owners) of an Income Edge certificate described in this prospectus.

A group annuity contract will be issued to Investors Capital Holdings, Ltd., a Delaware holding company which is the parent of Investors Capital Corporation, and, in Massachusetts, subject to state approval, a group annuity contract will be issued to Investors Capital Corporation for certificates issued in Massachusetts. Phoenix Guaranteed Income Edge certificates are issued under such group contract(s) to investment advisory clients of Investors Capital who participate in the Investor Protector Program.

It is important for you to understand how the Income Edge works and your rights and obligations under the Income Edge. We have tried to anticipate some of the questions you may have when reading the prospectus. You will find these questions and corresponding explanations throughout the prospectus.

The following is a summary of the Income Edge. You should read the entire prospectus.

The Income Edge is an insurance certificate (“insurance certificate” is another term for “insurance policy”). The Income Edge is designed to provide income protection to investment advisory clients of Investors Capital whose assets are managed under the Investor Protector Program and who intend to use those assets as the basis for a withdrawal program to provide income payments for retirement or other long-term purposes. Subject to the conditions of the certificate, the Income Edge can provide you with guaranteed lifetime income payments regardless of how long you live or how your Account assets perform.

Through the Investor Protector Program, Investors Capital currently offers four asset allocation strategies. Investments from various asset categories, such as stocks, bonds, and cash, comprise model portfolios corresponding to the directives of the asset allocation strategies. For example, an asset allocation strategy could require a model portfolio to contain 40% equity investments and 60% fixed income investments to achieve particular objectives regarding factors including risk versus return and current income versus investment growth. There are currently four model portfolios corresponding to the four asset allocation strategies available through the Investor Protector Program and eligible for the Income Edge (we refer to these models in this prospectus as the “Model Portfolios”). You are required to purchase an Income Edge certificate at the time you elect the Investor Protector Program and we issue certificates on any day when the New York Stock Exchange is open for regular trading, a “Business Day”, and we are also open for business.

The amount you initially invest in the Investor Protector Program, as well as any subsequent investments you are permitted to make, will be invested in accordance with the asset allocation strategy corresponding to the Model Portfolio you choose. (Each investment you make under the Investor Protector Program must be in cash and is called a “Contribution.” If you make Contributions after your initial Contribution, these are referred to in this prospectus as “Additional Contributions.”) Your Contributions will be invested in shares of mutual funds, including exchange traded funds or “ETFs” (see “About the Model Portfolios” later in this prospectus for a description of ETFs). Your fund shares together with any cash or cash equivalent investments (collectively, these are referred to in this prospectus as the “assets”) will be held in a brokerage account for the Investor Protector Program at a financial institution. This brokerage account is referred to in this prospectus as your “Account.” The value of the assets in your Account that are invested in accordance with a Model Portfolio is referred to as your “Account Value” in this prospectus.

Investors Capital offers the Investor Protector Program through affiliated and unaffiliated registered investment advisor representatives (“Financial Advisors”). The Financial Advisors assist clients in analyzing whether the Account is appropriate in light of a client’s financial situation and in determining which asset allocation strategy is appropriate for the client. You may purchase the certificate only through a Financial Advisor or, if your Financial Advisor is not permitted to provide you with advice regarding the Income Edge under state laws and regulations relating to insurance agents, through a representative of Investors Capital’s affiliated insurance agency.

Subject to the conditions of the certificate, the Income Edge ensures predictable lifetime income payments by providing continuing income payments if your Account Value is reduced to $0 by withdrawals (if such withdrawals are limited in accordance with the terms of the Income Edge certificate) and/or poor investment performance while you (or, if you have purchased the Income Edge to provide income payments for the lives of you and your spouse, the “Spousal Income Guarantee,” you or your spouse) are living. The conditions to which the Income Edge is subject include the requirement to invest Account assets in accordance with the

4

Table of Contents

investment limitations for the Model Portfolio you selected. Additionally, withdrawals from the Account must be limited in accordance with the terms of the Income Edge certificate. The sale, transfer or exchange of assets out of your Account to provide an amount of cash you request or that is requested on your behalf, or to pay the Investor Protector Program Fee and the Financial Advisor Fee (these two fees are defined in the paragraph immediately below) to the extent that these fees, separately or together, exceed 2.00% of your Account Value in any calendar year, are “Withdrawals” for the purposes of the Income Edge.

There is an annual fee of up to 3.00% of your “Retirement Income Base” (defined below) for the Income Edge. The Income Edge fee is in addition to the fee that you pay to have your assets managed under the Investor Protector Program (the “Investor Protector Program Fee”) and the fee that you pay to your individual Financial Advisor (the “Financial Advisor Fee”). The Investor Protector Program Fee and the Financial Advisor Fee, separately or together, could exceed 2.00% of your Account Value in a calendar year. Withdrawals from the Account to pay these fees in excess of 2.00% of Account Value in any calendar year would be considered a Withdrawal for the purposes of the Income Edge. Additionally, the fund shares in the Account will be subject to any applicable fees and expenses, and the Account may be charged for miscellaneous Account activities (e.g. wire transfers) and/or special services (e.g. IRA maintenance). These fund and Account activities or special services charges are not considered “Withdrawals” for the purposes of the certificate. The Income Edge fee is payable while your Account Value is greater than $0, including on and after the Retirement Income Date. The Investor Protector Program Fee, the Financial Advisor Fee, the fees and expenses for the funds in your Account and miscellaneous Account fees are payable while you participate in the Investor Protector Program, subject to the terms of the client agreement you entered into with Investors Capital. There is a $100,000 minimum investment required to participate in the Investor Protector Program.

1. How Does the Income Edge Work?

The Income Edge provides continuing lifetime income payments if your Account Value is reduced to $0 by Withdrawals (within the limits of the certificate) and/or poor investment performance while you (or, if you have purchased the Spousal Income Guarantee, you or your spouse) are living.

| v | It is important to note that the Income Edge has no cash value. Rather, you own the assets in your Account. The assets in your Account are shares of registered mutual funds, including ETFs, which are valued in accordance with applicable law each Business Day. |

| v | The Income Edge certificate is an insurance policy we offer that is separate and distinct from the Investor Protector Program offered by Investors Capital. Accordingly, you and your Financial Advisor must complete two different sets of paperwork for the Income Edge and the Investor Protector Program, including completing and signing an application form for the Income Edge (the “Application”) and reviewing and signing certain disclosure documents related to the Income Edge. (In some states, you are not required to complete an application form for the Income Edge; instead, we use an “enrollment form” to obtain the information we need to determine whether to issue you an Income Edge certificate. When we refer to the “Application” in this prospectus, we intend for that term to mean either an application form in those states that require an application or an enrollment form in states in which an application is not required.) |

After we receive your Application, we review it to ensure it contains all necessary information and then evaluate the information to decide whether to issue you an Income Edge. This process is referred to in this prospectus as the “Application Process.” If after the Application Process we issue an Income Edge to you, the Business Day we issue your certificate is the “Certificate Effective Date.” We issue certificates on every Business Day, except when we are closed on a particular Business Day.

On the Certificate Effective Date we establish a “Retirement Income Base” for you that is then used to determine the amount of benefits, if any, you will receive under your Income Edge. The amount of your initial Retirement Income Base is your Account Value on the Certificate Effective Date. Typically, you and your Financial Advisor fill out the necessary paperwork and submit the Application for the Income Edge to us at the same time the separate application is submitted to Investors Capital to participate in the Investor Protector Program. If Investors Capital reviews and approves your application to participate in the Investor Protector Program and invests your initial Contribution that establishes your initial Account Value before we complete the Application Process for your Income Edge certificate, your initial Account Value may be different than the amount of your initial Retirement Income Base due to intervening changes in the Account Value because of market performance and/or Additional Contributions to, or Withdrawals from, your Account.

Your Income Edge certificate could be issued after your initial Account Value is calculated due to the following reasons:

| • | information in your Application for the Income Edge is incomplete and the Application Process is delayed while we attempt to obtain the missing information, |

| • | the amount of your Account Value exceeds $5 million and therefore we require additional time to approve your Application for an Income Edge certificate, or |

| • | you previously had an Income Edge related to your Account that you chose to terminate, and you then applied for and we issued a new Income Edge related to your Account. You must wait at least 90 days from the date you terminated an Income Edge to apply for a new Income Edge. |

5

Table of Contents

| v | The amount of your Retirement Income Base may change over time based on the amount and timing of Withdrawals; it may also change depending on whether you make Additional Contributions to your Account (there may be significant limitations on whether Additional Contributions will increase your Retirement Income Base), or do not decline an Annual Optional Increase (this feature, which is more fully described below, is provided by the Income Edge on each anniversary of the Certificate Effective Date, referred to in this prospectus as the “Certificate Anniversary Date,” and, in certain circumstances will increase the Retirement Income Base to equal the current Account Value). The effect of each of these factors on the Retirement Income Base is further described in later sections of this prospectus, including “Withdrawals from Your Account,” “Increases from Additional Contributions to Your Account” and “Increases as a Result of the Annual Optional Increase,” respectively. |

| v | There are certain restrictions regarding the amount and timing of Withdrawals. Withdrawals may also have tax consequences. |

| v | As described below, in addition to reducing your Account Value, certain Withdrawals may reduce the amount of benefits, if any, you will receive under your Income Edge or cause it to terminate. These withdrawals are called “Excess Withdrawals.” The following withdrawals are considered “Excess Withdrawals:” |

| • | Any Withdrawal before the “Retirement Income Date,” which is the later of the Certificate Effective Date or your 65th birthday (or, if you own your certificate jointly with your spouse, the younger spouse’s 65th birthday); |

| • | Any Withdrawal to the extent that it alone, or in combination with Withdrawals taken previously in a calendar year, exceeds an amount we call the “Retirement Income Amount” during any calendar year on or after the Retirement Income Date. Your Retirement Income Amount is 5% of your Retirement Income Base. If your certificate was issued as a traditional Individual Retirement Account or “IRA” and the required minimum distribution is a greater amount, withdrawing the required minimum distribution amount from your Account will not be considered an Excess Withdrawal. (See “Taxation of the Income Edge” for information about the required minimum distribution.) |

| v | Excess Withdrawals may reduce the amount of benefits, if any, you will receive under your Income Edge for the following reason: |

| • | Excess Withdrawals reduce the Retirement Income Base in the same proportion as the Account Value is reduced by the Withdrawal. As a result, when the Account Value is less than the Retirement Income Base at the time of an Excess Withdrawal, the dollar amount by which the Retirement Income Base is reduced will be greater than the dollar amount by which the Account Value is reduced. Excess Withdrawals that reduce your Account Value to $0 will cause your Income Edge to terminate. |

| v | Withdrawals that are not Excess Withdrawals and accordingly do not decrease the Retirement Income Base when taken may limit the increase to your Retirement Income Base that would otherwise result from Additional Contributions to your Account. Prior to the Retirement Income Date, you cannot take any Withdrawals without reducing the Retirement Income Base. As a result, Additional Contributions you make to your Account prior to the Retirement Income Date will increase the Retirement Income Base dollar for dollar. On or after the Retirement Income Date, Withdrawals that do not reduce the Retirement Income Base when taken will reduce or eliminate increases to the Retirement Income Base from a subsequent Additional Contribution, and could reduce or eliminate the effect of more than one subsequent Additional Contribution. (See “Increases in Your Retirement Income Base” later in this prospectus.) |

| v | To obtain the maximum potential benefit from your Income Edge under your specific circumstances, you should consider whether to wait until the Retirement Income Date to begin taking Withdrawals and thereafter limit your annual Withdrawals to your Retirement Income Amount, or required minimum distribution, if greater, during any calendar year. We will send you a notice each year showing your Retirement Income Amount and, if applicable, your required minimum distribution for that calendar year. For purposes of calculating the Retirement Income Amount in the annual notices, we assume that the amount of the Investor Protector Program Fee and the Financial Advisor Fee in total does not exceed 2.00% of your current Account Value, in which case the deduction of such fees from your Account Value would not be considered a Withdrawal. If the assets withdrawn from your Account to pay the Investor Protector Program Fee and your Financial Advisor Fee, separately or together, exceed 2.00% of the Account Value in a calendar year, the amount in excess of 2.00% of Account Value in a calendar year is a Withdrawal and, depending on your circumstances, all or a portion of such fee(s) could be an Excess Withdrawal that would immediately reduce your Retirement Income Base and will reduce the Retirement Income Amount in subsequent years, assuming the Retirement Income Base does not increase prior to the time the Retirement Income Amount is recalculated. |

| v | Withdrawals from an Account that is an IRA may be subject to Federal tax consequences. You should consult a tax advisor before taking any Withdrawal from your IRA. |

| v | In the event that your Account Value is reduced to $0 by Withdrawals on or after the Retirement Income Date (within the limits of the certificate) and/or poor investment performance, before or after the Retirement Income Date, PHL Variable will provide you with lifetime income payments in the amount of 5% of the Retirement Income Base each calendar year, until you (or, if you have purchased the Spousal Income Guarantee, you and your spouse) die. |

6

Table of Contents

| v | Lifetime income payments under your Income Edge are “contingent” because they are triggered only if Withdrawals (within the limits of the certificate) and/or poor investment performance, reduce your Account Value to $0 within your lifetime (or, if you have purchased the Spousal Income Guarantee, you and your spouse’s lifetimes). If this contingency does not occur, you will never receive any payments from us and your Income Edge will have no value. |

Example:

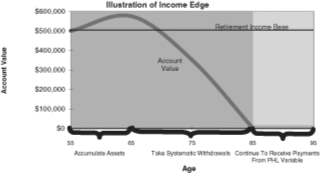

A hypothetical illustration of how the Income Edge works is provided below. Detailed examples using specific assumptions about fees and patterns of Withdrawals and/or Additional Contributions are provided throughout this prospectus.

This illustration makes the following assumptions:

| • | Your Account is not an IRA. You are 55 years old. You will be the sole owner of the Account. Your Income Edge is issued on the same Business Day that your initial Account Value was calculated so that your Retirement Income Base equals your Account Value on the Certificate Effective Date. On the Certificate Effective Date your Account Value is $500,000, so your Retirement Income Base will equal $500,000. You do not make Additional Contributions to your Account after the Certificate Effective Date. |

| • | You wait ten years until you reach your Retirement Income Date to make any requests for Withdrawals from the Account. There are no other Withdrawals (as that term is defined for purposes of the Income Edge) from the Account during this ten-year period. Your Account Value appreciates over this ten-year period, but because you do not make any Additional Contributions to your Account and you reject the Annual Optional Increase that would otherwise occur on any Certificate Anniversary Date, your Retirement Income Base remains at $500,000. You begin taking annual Withdrawals from your Account in the amount of $25,000, which is your Retirement Income Amount under the Income Edge. (In any calendar year on or after the Retirement Income Date, your Retirement Income Amount is equal to 5% of your Retirement Income Base and represents the maximum amount that may be withdrawn in that calendar year without reducing your Retirement Income Base.) You continue to take annual Withdrawals from your Account of $25,000 a year until you are 85 years old, by which time you have completely liquidated your Account due to the combined impact of the annual Withdrawal of the Retirement Income Amount, fees for the Income Edge, the Investor Protector Program and your Financial Advisor, fees associated with assets held in your Account and Account activities for which Investors Capital charges separately (e.g. wire transfers) and a prolonged market downturn. (These fees will also reduce your investment gains in your Account during times of positive investment performance.) Although your Account Value has been reduced to $0, your annual income payments of $25,000 continue because we begin paying you lifetime income payments equal to your Retirement Income Amount of 5% of the Retirement Income Base. These payments continue until your death which, for purposes of this illustration, is assumed to be at age 95. |

The sample illustration above uses age 55 as the age at purchase. You should note that a younger Income Edge purchaser (i.e., one who is under the age of 65) will pay more in Income Edge fees over the lifetime of the certificate for the same potential benefits received by an older Income Edge purchaser.

2. What Does the Income Edge Cost?

When you purchase your Income Edge you are required to pay the annual Income Edge fee that is payable, quarterly in advance, to us on the first day of each calendar quarter. The deduction of your Income Edge fee from your Account Value is not considered a Withdrawal for purposes of the Income Edge. When you purchase a certificate, the Income Edge fee is charged to your Account on the Certificate Effective Date, prorated based on the number of days remaining in the calendar quarter. Investors Capital will deduct the Income Edge fee from your Account on a pro-rata basis from the Account investments. The Investor Protector Program Fee and the Financial Advisor Fee for the quarter in which you begin participating in the Investor Protector Program and your Account is established are assessed quarterly in advance, are also prorated based on the number of days remaining in the calendar quarter and, unless you have elected to pay these fees with a different source of funds, are deducted on a pro-rata basis from Account assets (see “Additional Fees Related to your Investor Protector Program and the Funds Held in your Account” below). There are two versions of the Income Edge: the Individual Income Guarantee and the Spousal Income Guarantee. If you and your spouse jointly purchase an

7

Table of Contents

Income Edge, you will be charged the fee for the Spousal Income Guarantee, which is generally higher than the fee for the Individual Income Guarantee. The Income Edge fee is payable for so long as your certificate is in effect and your Account Value is greater than $0, including on and after the Retirement Income Date.

3. How is the Income Edge Fee Percentage for my Certificate Determined?

Generally, the Income Edge fee (which is calculated on the Certificate Effective Date and then on the first day of each calendar quarter as a percentage of the Retirement Income Base on the date of calculation) depends on the asset allocation strategy and the corresponding Model Portfolio you have chosen for your Account and which version of the Income Edge, individual or spousal, you have. Your Account can be invested in accordance with only one Model Portfolio at any one time.

The guaranteed maximum Income Edge fee percentage for each Model Portfolio, on an annual basis, is shown below:

| Investor Protector Program Model Portfolios | Individual Income Guarantee Fee Percentage as a Percentage of Retirement Income Base |

Spousal Income Guarantee Fee Percentage as a Percentage of Retirement Income Base |

||||

| Conservative |

3.00 | % | 3.00 | % | ||

| Conservative/Balanced |

3.00 | % | 3.00 | % | ||

| Balanced |

3.00 | % | 3.00 | % | ||

| Growth |

3.00 | % | 3.00 | % |

You should assume that the guaranteed maximum fee percentage will be charged unless we are offering a lower fee percentage at the time you elect the certificate. You will receive information about any lower fee percentages available when you begin the Application Process for your certificate. The applicable Income Edge fee percentage may change during your Application Process; that is, the amount of the Income Edge fee percentage may increase during the period between when you begin the Application Process by completing and submitting an Application and the Business Day on which we approve your Application and issue the certificate (i.e., the Certificate Effective Date). You will not have any special opportunity to reject a certificate due to any change in the Income Edge fee percentage. Accordingly, you should review the schedule page of your certificate to see the Income Edge fee percentage that will apply at issue. This fee percentage will be shown on the schedule page and will not exceed the maximum fee of 3.00%. If you are dissatisfied with the Income Edge fee percentage applicable to your certificate at any time, you may cancel the certificate by notifying us in writing. Income Edge fees are paid quarterly in advance and we will not refund any fee already taken in accordance with that schedule should you decide to cancel the certificate. If you cancel an Income Edge certificate, you cannot apply for a new Income Edge certificate for 90 days following cancellation of the earlier certificate.

PHL Variable could decide to change the current Income Edge fee percentage for a Model Portfolio at its discretion, including for reasons relating to the amount of risk it undertakes providing the guarantee under the Income Edge such as if it accepts certain changes in the Model Portfolios proposed by Investors Capital. Any change in the current Income Edge fee percentage would apply to certificates issued after the date of the change and, as described below, certain transactions may change the Income Edge fee percentage that applies to your certificate at certain points in time. The Income Edge fee percentage will never exceed the maximum fee of 3.00%. You can obtain information about the Income Edge fee percentages that may be in effect at any time by contacting your Financial Advisor, or Investors Capital at 1-866-377-4559, or by contacting PHL Variable at the number shown on the front of this prospectus.

Your Income Edge fee percentage will be reset if you make an Additional Contribution, do not decline the Annual Optional Increase, or transfer your Account Value to be invested in accordance with a different Model Portfolio. Any new Income Edge fee percentage following one of those transactions will be based, fully or in part, on the Income Edge fee percentage currently in effect for the Model Portfolio in accordance with which your Account assets are invested immediately following the transaction. The new Income Edge fee percentage will apply on the first day of the following calendar quarter unless another Additional Contribution or transfer were to occur, or the Annual Optional Increase was applied to your certificate during the quarter, in which case the Income Edge fee percentage will be reset again.

| • | In the case of an Additional Contribution, the reset Income Edge fee percentage will be a weighted average of the Income Edge fee percentage that applied to your certificate prior to the Additional Contribution and the Income Edge fee percentage in effect for the Model Portfolio in accordance with which your Account assets are invested at the time of the Additional Contribution. The weighted average fee percentage is the average of the fee percentage that applied to your Retirement Income Base prior to the Additional Contribution and the fee percentage that applies to the amount of any increase in the Retirement Income Base from the Additional Contribution weighted by the dollar amount of the Retirement Income Base before the Additional Contribution and the dollar amount of the increase in the Retirement Income Base (if any). |

8

Table of Contents

| • | Following an Annual Optional Increase that you do not decline and that results in an increase in the Retirement Income Base, the reset Income Edge fee percentage will be a weighted average of the Income Edge fee percentage that applied to your certificate prior to the Annual Optional Increase and the Income Edge fee percentage in effect for the Model Portfolio in accordance with which your Account assets are invested at the time of the Annual Optional Increase. The weighted average fee percentage is the average of the fee percentage that applied to your Retirement Income Base prior to the Annual Optional Increase and the fee percentage that applies to the amount of any increase in the Retirement Income Base from the Annual Optional Increase weighted by the dollar amount of the Retirement Income Base before the Annual Optional Increase and the dollar amount of the increase in the Retirement Income Base following the Annual Optional Increase. |

| • | In the case of a transfer, the reset Income Edge fee percentage will be the Income Edge fee percentage in effect for the Model Portfolio in accordance with which your Account assets are invested following the transfer. |

For a complete description of the annual Income Edge fee including the effect of transfers, Additional Contributions, and the Annual Optional Increase on the fee percentage you will be charged, see “Annual Income Edge Fee” later in this prospectus.

4. Additional Fees Related to your Investor Protector Program and the Funds Held in your Account

In addition to the Income Edge fees that are deducted while your Account Value is greater than $0, including on and after the Retirement Income Date, the Investor Protector Program Fee, the Financial Advisor Fee, and certain fees associated with the underlying mutual funds and ETFs held in your Account will be deducted from your Account Value for so long as you are participating in the Investor Protector Program and your Account has a value greater than $0, unless you designate another method of payment. The Investor Protector Program Fee is the fee you agree to pay Investors Capital for managing your Account. This fee covers management of the applicable Model Portfolio and trading/custodial costs. The Investor Protector Program Fee would also be charged for your Account in the absence of the Income Edge certificate. The Financial Advisor Fee is the fee charged by your Financial Advisor for providing you with general investment advice and would also be deducted from your Account Value in the absence of the Income Edge.

Amounts deducted from your Account Value that do not exceed 2.00% of your Account Value each calendar year to pay the Investor Protector Program Fee and/or Financial Advisor Fee will not reduce your Retirement Income Base. If the Investor Protector Program Fee and your Financial Advisor Fee, separately or together, exceed 2.00% of your Account Value in any calendar year, the deduction of these fees from your Account Value in excess of 2.00% in any calendar year will be considered a Withdrawal. Withdrawals can reduce your Retirement Income Base. See “Risk Factors” and “Withdrawals From Your Account” later in this prospectus.

For example, assume your Account Value is $500,000 and, in a particular calendar year, fees in the amount of 2.50% of your Account Value are deducted from your Account Value for your Financial Advisor Fee and Investor Protector Program Fee.

Fees paid from Account Value: 2.50% x $500,000 = $12,500

Fees paid from Account Value that are not treated as a Withdrawal: 2.00% x $500,000 = $10,000

Fees paid from Account Value that are treated as a Withdrawal: $12,500 - $10,000 = $2,500 in excess fees

In this example, 0.50% of fees (2.50% - 2.00%) or $2,500 will be treated as a Withdrawal from your Account that may reduce the Retirement Income Base.

Should you choose to pay these fees from a source other than the Account Value, payment of the fees would not cause a Withdrawal regardless of the fee amount.

Additionally, the mutual funds and/or ETFs that comprise the Model Portfolios have management fees and operating expenses. You do not pay these fees and expenses directly. Instead they are reflected in each fund’s net asset value and in the price at which shares are purchased for your Account. Funds may also have other fees and charges deducted from the amount invested upon purchase or from the proceeds from the sale of fund shares upon redemption, or periodic fees deducted from the value of fund shares. These fees and charges are not considered Withdrawals for purposes of your Income Edge. Your Account may also be subject to other fees for miscellaneous Account activities (e.g. wire transfers) of special services (e.g. IRA maintenance). These fees are not considered “Withdrawals” for the purposes of the Income Edge.

Incorporation of Certain Documents by Reference

The Securities and Exchange Commission (“SEC”) allows us to “incorporate by reference” information that we file with the SEC into this prospectus, which means that incorporated documents are considered part of this prospectus. We can disclose important information to you by referring you to those documents. This prospectus incorporates by reference our Annual Report on Form 10-K for the year ended December 31, 2009, our Quarterly Report on Form 10-Q for the period ended March 31, 2010 (File Number 333-20277), and the definitive proxy statement filed by the Phoenix Companies, Inc. pursuant to Regulation 14A on March 23, 2010 (File Number 001-16517). These documents contain information about our financial results and other matters for the applicable periods.

9

Table of Contents

You may request a copy of any documents incorporated by reference in this prospectus and any accompanying prospectus supplement (including any exhibits that are specifically incorporated by reference in them), at no cost, by writing to PHL Variable at: Investor Relations, One American Row, P.O. Box 5056, Hartford, CT 06102-5056, or telephoning PHL Variable at 860-403-7100. You may also access the incorporated documents at the following web pages: https://www.phoenixwm.phl.com/public/products/regulatory/index.jsp and the “Investor Relations” page of The Phoenix Companies, Inc. website at www.phoenixwm.com.

PHL Variable electronically files its Annual Report on Form 10-K, as well its Quarterly Reports on Form 10-Q, with the SEC. The Phoenix Companies, Inc. electronically files its proxy statement with the SEC. The SEC maintains a website that contains reports, information statements, and other information regarding issuers that file electronically with the SEC; the address of the website is http://www.sec.gov. The public may also read and copy any material we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

1. Investment Limitations

| v | The assets in your Account must be invested in accordance with the investment limitations for one of the four Model Portfolios to be covered by the Income Edge. Your Income Edge will terminate if the assets in your Account do not comply with these investment limitations. |

Each Model Portfolio is subject to limits on permitted allocations to equities and fixed income securities for the particular asset allocation strategy as well as on the permitted types of asset or sub-asset classes (such as Mid Cap US Equity) and the minimum and maximum percentage of total portfolio value permitted to be invested in each permitted asset or sub-asset class. We call these limits “Permitted Ranges.” The Permitted Ranges for the four Model Portfolios currently available with the certificate are shown in the later section of this prospectus called “The Current Permitted Ranges for the Model Portfolios.” Additionally, Investors Capital has proposed and PHL Variable has agreed that certain specific mutual funds and ETFs can be used in the Model Portfolios. These specific mutual funds and ETFs, and cash, when held in accordance with the Permitted Ranges, are the “Permitted Funds.” These Permitted Ranges, and the requirement to use only Permitted Funds, apply to all assets in the Model Portfolios unless Investors Capital proposes a change to the Permitted Ranges or the Permitted Funds and that change is accepted by PHL Variable. See “Investors Capital and the Account” later in this prospectus for information about the Permitted Ranges and the types of Permitted Funds. The assets in your Account could fail to satisfy these investment limitations for a variety of reasons, including reasons you, Investors Capital, or PHL Variable do not control. These reasons include:

| • | Investors Capital investing the assets in your Account, including any Additional Contribution you make, outside the Permitted Ranges and/or Permitted Funds, and failing to bring the Account assets in line with the Permitted Ranges and/or the Permitted Funds within ten Business Days after we provide notice thereof to Investors Capital (this period is called the “Cure Period” in this prospectus; please note that the “Termination” section of your certificate states that violations of investment limitations must be cured within five Business Days, but under our administrative procedures we ordinarily permit ten Business Days and we may extend this period, in our discretion, in the event of extraordinary circumstances where Investors Capital is not able to rebalance the Account within ten Business Days), and |

| • | changes in the value of Account assets that cause an Account to fail to satisfy the Permitted Ranges for the chosen Model Portfolio and Investors Capital’s failure to bring the investments in line with the Permitted Ranges within the Cure Period. Changes in the value of Account assets can occur when the value of the fund shares held in your Account increases or decreases due to market movement, when additional fund shares or cash are credited to your Account as dividends, or when fund shares are liquidated to pay fees, or to satisfy Withdrawals you request. |

Regardless of the reason, if at any time 100% of your Account assets are not invested in accordance with the Permitted Ranges, using only Permitted Funds, for your chosen Model Portfolio, your Income Edge will be at risk of terminating unless Investors Capital brings the assets in line with the investment limitations for the Model Portfolio within the Cure Period. Following the end of the Cure Period, we will notify an Income Edge certificate holder whose Account is no longer in compliance with the Permitted Ranges using only Permitted Funds of this circumstance and options by mailing a notification to the certificate holder’s address on our records at least 30 days prior to terminating the certificate. (In the event that the non-compliance is due to Investors Capital discontinuing the Model Portfolios, we will provide this notice as early as reasonably practicable prior to the termination, however such notice may be provided less than 30 days prior to termination.) See “What Happens if Your Account is Managed in a Manner Unacceptable to Us?” for a description of the options.

| v | You and/or your Financial Advisor may decide to reduce or eliminate assets in your Account that could terminate or reduce the benefit of your Income Edge. This may happen because, when reviewing the assets in your Account, your Financial Advisor, consistent with his or her fiduciary duty to you, would be required to consider changes in market conditions, such as a significant increase in the volatility of equity securities making a Model Portfolio with heavier allocation to equities inappropriate for an |

10

Table of Contents

| investor with a lower risk tolerance, and changes in your financial condition, such as an immediate need for cash, and may decide that these changes require adjustment or liquidation of the assets in your Account. You should carefully consider before purchasing an Income Edge certificate that: |

| • | if you withdraw your total Account Value prior to the Retirement Income Date, your Income Edge will terminate. |

| • | if, on or after the Retirement Income Date, you withdraw your total Account Value, your Income Edge will terminate unless your Retirement Income Amount (or, if your certificate was issued as a traditional IRA, your required minimum distribution, if greater) is greater than your Account Value. |

| • | if you make Withdrawals from your Account in any amount prior to your Retirement Income Date, or, in an amount that exceeds the Retirement Income Amount (or, if your certificate was issued as a traditional IRA, your required minimum distribution, if greater) in any calendar year on or after your Retirement Income Date, you will reduce your Retirement Income Base and the potential benefit of the Income Edge in the future. |

See “Withdrawals From Your Account” later in this prospectus.

| v | Investors Capital may discontinue offering the Model Portfolios, in which case there may not be a portfolio eligible for coverage under the Income Edge. Should this occur, Income Edge certificates related to the affected Model Portfolios would ultimately terminate. Affected certificate holders could choose to move their Account assets to a different investment advisor providing model portfolios for which the Income Edge is available, if any, and purchase a new Income Edge, could purchase a different lifetime income product from PHL Variable or a different issuer, or, prior to termination of the Income Edge, could elect the Lifetime Payment Option. We would notify any affected certificate holders of the pending termination as early as reasonably practicable. See “What Happens if Your Additional Contributions or Withdrawals, or Other Actions Cause the Investments in Your Account to Fall Outside the Permitted Ranges?” |

| v | The asset allocation strategies underlying the Model Portfolios eligible for Income Edge are designed to provide steady returns that limit both upside and downside potential thereby minimizing the risk to PHL Variable that your Account Value will be reduced to $0 before you (or, if you have purchased the Spousal Income Guarantee, you and your spouse) die, and that PHL Variable would therefore be obligated to begin making lifetime income payments to you (subject to the conditions described in this prospectus). Accordingly, a significant risk against which the Income Edge protects, i.e., that your Account Value will be reduced to $0 by Withdrawals (within the limits of the certificate) and/or poor investment performance and that you (or, if you have purchased the Spousal Income Guarantee, you and/or your spouse) live beyond the age when your Account Value is reduced to $0, may be minimal. |

| v | Because the asset allocation strategies and the limits on the amount of Withdrawals you may make annually without reducing your Retirement Income Base lessen the risk that your Account Value will be reduced to $0 while you are still alive, there is a low probability that we will be required to make any payments to you under your Income Edge. |

| v | The Investor Protector Program restricts transfers of Account Value to other Model Portfolios to once every 90 days. As a result, if you become dissatisfied with a Model Portfolio and wish to reallocate your Account assets in accordance with a different Model Portfolio, you may have to wait to do so. Additionally, you may only invest in one Model Portfolio at any one time. |

2. Lifetime Income Payments

| v | The Income Edge is designed to protect you from outliving the assets in your Account. If you terminate the Income Edge, or if you (or if you have elected the Spousal Income Guarantee, you and your spouse) die before your Account Value is reduced to $0 by Withdrawals (within the limits of the certificate) and/or poor investment performance, neither you nor your estate will receive any payments from us under your Income Edge, nor will your Income Edge provide for any cash value build-up for income payments. |

| v | If your Account Value is reduced to $0 by Withdrawals (within the limits of the certificate) and/or poor investment performance while you, or if you have purchased the Spousal Income Guarantee, you and/or your spouse are living, and you therefore receive lifetime income payments from us under your Income Edge, there is a risk that the total amount of the lifetime income payments you receive will be less than the total Income Edge fees you have paid. Since you must also pay fees for the assets in your Account to be covered by the Income Edge, namely the Investor Protector Program Fee, the Financial Advisor Fee, and any fees charged directly by the funds or ETFs used in the Model Portfolio you have elected, the risk that such fees could exceed the total amount of lifetime income payments we could be obligated to pay under the terms of the certificate is increased. |

3. Tax Consequences

| v | The Income Edge is novel and innovative. The Internal Revenue Service has issued a ruling to PHL Variable Insurance Company indicating that the Income Edge certificate will be treated as an annuity contract under the Internal Revenue Code. In addition, the Internal Revenue Service has also issued rulings concerning the tax treatment to an individual investor relative to the certificate and to Account assets. These rulings provide, in substance, that the certificate will be treated as an annuity contract and that the |

11

Table of Contents

| income tax treatment of the Account is unaffected by the existence of Income Edge. Accordingly, we will treat any Income Edge payments made to you after your Account Value has been reduced to $0 as ordinary income to you to the extent provided under the income tax rules for annuities. See “Taxation of the Income Edge” later in this prospectus. |

4. Financial Strength of PHL Variable Insurance Company

| v | The Income Edge is not a separate account product. This means that the assets at PHL Variable Insurance Company supporting the Income Edge are not held in a segregated account for the exclusive benefit of Income Edge certificate owners and are not insulated from the claims of PHL Variable’s third party creditors. Your lifetime income payments (if any) will be paid from our general account and, therefore, are subject to our claims paying ability. Many financial services companies, including insurance companies, continue to face challenges in this unprecedented market environment, and we are not immune to those challenges. We know it is important for you to understand how this market environment may impact our ability to meet the guarantee provided by the certificate. |

Under Connecticut law, life insurance companies, including PHL Variable, are required to hold a specified amount of reserves in order to meet the contractual obligations of their general account to contract owners. State insurance regulators also require life insurance companies to maintain a minimum amount of capital, which acts as a cushion in the event that the insurer suffers a financial impairment, based on the inherent risks in the insurer’s operations. These risks include those associated with losses that an insurer could incur as the result of its own investment of its general account assets, which could include bonds, mortgages, general real estate investments, and stocks. If your Account Value is reduced to $0 such that lifetime income payments would be due under the terms of the certificate and, at that time, PHL Variable’s general account was not able to make the lifetime income payments provided by the certificate, you would be treated as a general creditor of PHL Variable and may not obtain the benefit from the certificate. No fees paid for the certificate would be refunded.

We prepare financial statements in accordance with Generally Accepted Accounting Principles (“GAAP”) and as required by state insurance law. To better understand our financial condition, you should read our reports to the SEC on Forms 10-K and 10-Q, which include financial statements. Our Annual Report on Form 10-K for the year ended December 31, 2009 includes information about the effects of current market challenges on our business, including the effects of downgrades in our financial strength ratings. Investors should look to the financial strength of a company as one measure of its claims-paying ability. The financial strength of PHL Variable Insurance Company is currently rated by four nationally recognized statistical rating organizations (“NRSRO”). These NRSROs are A.M. Best, S&P, Moody’s and Fitch (we do not provide nonpublic information to Fitch). The NRSRO ratings are not specific to the Income Edge certificate and your lifetime income payments, if any, and may change over time. Useful information about PHL Variable’s financial strength, including our current financial strength ratings and information on our general account portfolio of investments can be found on our website (www.Phoenixwm.com). Additionally, you may obtain information on our financial condition and our financial strength ratings by reviewing our reports to the SEC on Forms 10-K, 10-Q and 8-K, as well as the definitive proxy statement filed with the SEC by the Phoenix Companies, Inc., including those reports which are incorporated by reference into this prospectus. See “Incorporation of Certain Documents by Reference” previously in this prospectus for information about how to obtain those documents for free. PHL Variable’s financial strength ratings do not apply to the Account or to any investments held in the Account.

5. Increases in Your Retirement Income Base

| v | Your Retirement Income Base does not automatically increase when the assets (e.g. fund shares) in your Account appreciate in value. Your Retirement Income Base may or may not increase if you make Additional Contributions to your Account (depending on whether you have made any Withdrawals from your Account that did not immediately reduce your Retirement Income Base) or you do not decline the Annual Optional Increase on a Certificate Anniversary Date (and potentially thereafter pay higher Income Edge fees). Therefore, there is a risk that your Retirement Income Base will not increase while you own your Income Edge. Additionally, there is a risk that inflation could outpace any increase in your Retirement Income Base and, as a result, any lifetime income payment you may receive in the future, based on the value of that Retirement Income Base, would have less purchasing power than the same dollar amount would have today. See “Increases in Your Retirement Income Base” later in this prospectus. |

6. Withdrawals

| v | If you make any Withdrawals from your Account before your Retirement Income Date, or you make Withdrawals on or after your Retirement Income Date and such Withdrawals alone, or in combination with other Withdrawals in the same calendar year, exceed your Retirement Income Amount (or, if your certificate was issued as a traditional IRA, the required minimum distribution, if greater), the amount of lifetime income payments that you could receive under your Income Edge, if any, may be reduced. We consider these Withdrawals “Excess Withdrawals”. Accordingly, Withdrawals must be carefully managed to avoid decreasing the amount of your Retirement Income Base and Retirement Income Amount or causing a termination of your Income Edge that may not be in your best interest. However, due to the long-term nature of the Income Edge, there is a risk that you may need funds prior to your Retirement Income Date, or in an amount in excess of your Retirement Income Amount (or, if your certificate was issued as a traditional IRA, the required minimum distribution, if greater), on or after your Retirement Income Date, and that if you |

12

Table of Contents

| do not have sources of income other than your Account available, you may need to make Withdrawals from your Account that will reduce the amount of any lifetime income payments you may receive under your Income Edge. You should carefully monitor your Retirement Income Base at all times as well as the amount of any Withdrawals. You may call Investors Capital at 1-866-377-4559 for information about your Retirement Income Base and Retirement Income Amount. |

| v | As noted above, you may have certain needs for Withdrawals from your Account. Additionally, you may choose to take Withdrawals from your Account if you become dissatisfied with the asset allocation strategies and/or Model Portfolios available, or you may choose to take Withdrawals for other reasons. Regardless of the reason, if these Withdrawals are Excess Withdrawals, the amount of lifetime income payments that you could receive under your Income Edge, if any, may be reduced. See “Withdrawals From Your Account” later in this prospectus. In addition, such Withdrawals may have tax consequences. See “Taxation of the Income Edge” later in this prospectus for a discussion of the tax consequences of the Income Edge. |

| v | You may take Withdrawals from your Account at any time and in any amount. As with any investment account, you must liquidate investments to provide for Withdrawals and Withdrawals may have tax consequences. As described below, certain Withdrawals can negatively affect your Income Edge or cause it to terminate. We call these Withdrawals “Excess Withdrawals.” The following Withdrawals are considered “Excess Withdrawals:” |

| • | Any Withdrawal before the “Retirement Income Date,” which is the later of the Certificate Effective Date or your 65th birthday (or, if you own your certificate jointly with your spouse, the younger spouse’s 65th birthday); |

| • | Any Withdrawal to the extent that it alone, or in combination with Withdrawals taken previously in a calendar year, exceeds the Retirement Income Amount during any calendar year on or after the Retirement Income Date. Your Retirement Income Amount is 5% of your Retirement Income Base. If your certificate was issued as a traditional IRA and the required minimum distribution is a greater amount, withdrawing the required minimum distribution amount from your Account will not be considered an Excess Withdrawal. |

For example, assume your certificate was issued as a traditional IRA and you are currently over 70 1/2 years old so your IRA has a required minimum distribution. In a given calendar year, assume your Retirement Income Amount is $25,000 and your required minimum distribution attributable to your Account Value is $35,000. You make a Withdrawal of $30,000. Even though the Withdrawal exceeds the Retirement Income Amount, it is less than the required minimum distribution so it does not affect your Retirement Income Base. See “Taxation of the Income Edge” for information about the required minimum distribution.

| v | Excess Withdrawals negatively affect your certificate in the following ways: |

| • | Excess Withdrawals reduce the Retirement Income Base. Excess Withdrawals reduce the Retirement Income Base in the same proportion as the Account Value is reduced by the Withdrawal. As a result, when the Account Value is less than the Retirement Income Base at the time an Excess Withdrawal is taken, the Retirement Income Base will be reduced by more than the dollar amount of the Withdrawal. |

| • | Excess Withdrawals that reduce your Account Value to $0 will cause your Income Edge to terminate. Stated differently, if any Withdrawal prior to the Retirement Income Date reduces your Account Value to $0, your Retirement Income Base reduces to $0 and your Income Edge will terminate. If a Withdrawal on or after the Retirement Income Date that alone, or in combination with other Withdrawals in that calendar year, exceeds the Retirement Income Amount (or for certificates issued as traditional IRAs, the required minimum distribution, if greater) and reduces your Account Value to $0, your Retirement Income Base will be reduced to $0 and your Income Edge will terminate. |

| v | Withdrawals from your Account can also limit the increase to your Retirement Income Base that would otherwise result from Additional Contributions to your Account. Additional Contributions prior to the Retirement Income Date will increase the Retirement Income Base dollar for dollar. Withdrawals taken on or after the Retirement Income Date that do not immediately reduce the Retirement Income Base may reduce any increase to the Retirement Income Base from an Additional Contribution and may affect more than one Additional Contribution. See “Increases in Your Retirement Income Base” later in this prospectus. |

| v | Unless you direct Investors Capital to use another source of payment, deductions are made from your Account Value to pay the Income Edge fee, the Investor Protector Program Fee, the Financial Advisor Fee and other fees associated with your Account and the funds held in your Account. Except as described below, deductions from your Account Value to pay these fees are not “Withdrawals” for purposes of the Income Edge. Deductions from your Account Value to pay the amount of the Investor Protector Program Fee and/or Financial Advisor Fee that separately or together exceed 2.00% of Account Value in any calendar year are Withdrawals for purposes of the Income Edge. See “Summary, Additional Fees Related to Your Investor Protector Program and the Funds Held in your Account” earlier in this prospectus for an example. The Investor Protector Program Fee is the fee charged for the Account and would be charged even in the absence of the Income Edge certificate. For more information on the Investor Protector Program fee, please see the Part II to the Investors Capital Form |

13

Table of Contents

| ADV. The Part II may be obtained by writing to Investors Capital at 230 Broadway, Lynnfield, MA 01940 or by calling 1-866-377-4559. The Financial Advisor Fee is the asset-based fee paid to your Financial Advisor for providing you general investment advice and would be charged even in the absence of the Income Edge certificate. Deductions from Account Value for the portion of these fees that exceeds 2.00% of Account Value in any calendar year before the Retirement Income Date are Excess Withdrawals. Deductions from Account Value for the portion of these fees that exceeds 2.00% of Account Value in any calendar year on or after the Retirement Income Date will be Excess Withdrawals if the cumulative amount of Withdrawals, including these deductions, in a calendar year exceeds the Retirement Income Amount in that calendar year. Any Excess Withdrawals reduce the Retirement Income Base. |

| v | You should note that there is no provision under the Income Edge to cure any decrease in the amount of your Retirement Income Base and Retirement Income Amount due to Withdrawals. |

| v | Your certificate does not require us to warn you or provide you with notice regarding potentially adverse consequences that may be associated with any Withdrawals or other factors affecting your Account Value. You should consider your ability to monitor factors affecting your Account Value, such as deductions to pay the Investor Protector Program Fee and the Financial Advisor Fee and Withdrawals you schedule or request before you purchase the Income Edge, and should carefully monitor that activity after you purchase the certificate. We will notify you in writing of changes to your Retirement Income Base and/or Retirement Income Amount and the date of any such changes. |

| v | On or after the Retirement Income Date, the longer you wait to start making Withdrawals from your Account, the less likely it is that you will benefit from your Income Edge because of decreasing life expectancy. Conversely, the longer you wait to begin making Withdrawals, the more opportunities you will have to take advantage of any appreciation of your Account Value by not declining an Annual Optional Increase and locking in a higher Retirement Income Base (not declining an Annual Optional Increase may increase your Retirement Income Base and result in a higher Income Edge fee). You should, of course, carefully consider when to begin making Withdrawals, but there is a risk that you will not begin making Withdrawals at the most financially beneficial time for you. |

| v | If, on or after the Retirement Income Date, you make Withdrawals in an aggregate amount less than the entire Retirement Income Amount in any calendar year, you ARE NOT permitted to increase the Retirement Income Amount in the next calendar year by the amount not withdrawn in the prior calendar year. |

7. Timing Issues

| v | As noted above, when you first purchase your Income Edge, the Retirement Income Base is set to your Account Value on the Certificate Effective Date. The determination of your Retirement Income Base may be delayed if your Application is incomplete, or your Account Value is greater than $5,000,000, in which case our administrative rules require additional review prior to acceptance. There is a risk that the value of your initial contribution into your Account will decrease before the Certificate Effective Date and therefore your Retirement Income Base will be less than the dollar amount of your initial contribution to the Account due to the differences in the timing of the Account opening and Application Process. See “How Does the Income Edge Work?” previously in this prospectus. |

| v | Additional Contributions made to your Account after the Certificate Effective Date must either be allowed to remain as cash within the Permitted Ranges for the Model Portfolio you have elected, or be invested in accordance with the Permitted Ranges for Model Portfolio you have elected by the end of the Cure Period. |

| v | If you purchase an Income Edge and your Account Value decreases to $0 solely due to poor market performance prior to the Retirement Income Date, we are not required to begin making lifetime payments (if any) to you until one month after your Retirement Income Date. If you (or, if you have purchased the Spousal Income Guarantee, both you and your surviving spouse) die before the Retirement Income Date, your Income Edge will terminate and you will receive no lifetime income payments from us and your Income Edge will terminate without any value. |

| v | If you purchase the Spousal Income Guarantee, the Retirement Income Date is the later of the Certificate Effective Date and the younger spouse’s 65th birthday. As a result, if the younger spouse is less than age 65 on the Certificate Effective Date, the Retirement Income Amount does not become available for withdrawal without reducing the Retirement Income Base until that younger spouse reaches age 65. |

8. Income Edge Fee and other Account Fees

| v |

There is a risk that the Income Edge fee percentage that will be applied to any increases in your Retirement Income Base resulting from Additional Contributions to your Account and/or the Annual Optional Increase will be a higher percentage than your current Income Edge fee percentage. There is a risk that the Income Edge fee for your certificate could increase if you choose to transfer your Account assets so they are invested in accordance with a different Model Portfolio than you previously elected and/or you do not decline an Annual Optional Increase or make an Additional Contribution that results in an increase |

14

Table of Contents

| to your Retirement Income Base. The Income Edge fee for your certificate could increase if we increase the Income Edge fee percentage for a Model Portfolio or if Investors Capital proposes a change in the Permitted Ranges and/or Permitted Funds for a Model Portfolio that PHL Variable accepts but that also causes PHL Variable to increase the Income Edge fee percentage for the affected Model Portfolio. In either case, any increased fee percentage would only apply to your certificate if you have elected the affected Model Portfolio for your Account and make an Additional Contribution to your Account or do not decline an Annual Optional Increase, or if you transfer your Account assets so they are invested in accordance with the affected Model Portfolio. You should carefully consider the possibility of an increased Income Edge fee before you purchase an Income Edge. The Income Edge fee percentage will not exceed 3.00% of the Retirement Income Base annually. See “How is the Income Edge Fee Percentage for my Certificate Determined” previously in this prospectus and “Annual Income Edge Fee” later in this prospectus. |

| v | Additionally, other fees apply to your Account and there is a risk that the deduction of these fees from your Account could negatively impact the potential benefit of the Income Edge. If the Investor Protector Program Fee and the Financial Advisor Fee, separately or together, exceed 2.00% of Account Value in a calendar year, deductions from Account Value for the portion of these fees that exceeds this amount will be considered Withdrawals for the purposes of the Income Edge. It is possible these fees, which are separate from the Income Edge fee, could exceed 2.00%. See “Additional Fees Related to your Investor Protector Program and the Funds Held in your Account” earlier in this prospectus, and “Withdrawals From Your Account” later in this prospectus. |

9. Divorce

| v | Two spouses legally married under federal law may purchase the Spousal Income Guarantee version of the Income Edge to provide predictable lifetime income payments for the lives of both spouses by providing continuing income payments if the investments in the spouses’ jointly-owned Account are reduced to $0 by withdrawals (within the limits of the certificate) and/or poor investment performance before both spouses die. There is a risk that if two spouses purchase a Spousal Income Guarantee version of the Income Edge and subsequently determine to obtain a divorce, such divorce could result in a loss of part or all of the income protection provided to each spouse by the Income Edge prior to the divorce. See “Divorce of Joint Spousal Owners of an Income Edge” later in this prospectus. |

10. Regulatory Protections

| v | The Income Edge certificates are the subject of a registration statement filed with the SEC in accordance with the Securities Act of 1933 (the “Securities Act”) and the offering of the Income Edge certificates must be conducted in accordance with the requirements of the Securities Act. We are also subject to applicable periodic reporting and other requirements imposed by the Securities Exchange Act of 1934. |

| v | We are not an investment adviser and do not provide investment advice to you in connection with your Income Edge. Therefore, we are not governed by the Investment Advisers Act of 1940 (the “Advisers Act”), and the protections provided by the Advisers Act are not applicable with respect to our sale of the Income Edge to you. Investors Capital is an investment adviser registered with the SEC and subject to the Advisers Act. Your Financial Advisor may also be subject to the Advisers Act if he or she is in the business of providing investment advice for a fee. |

11. Using Your Account as Collateral for a Loan

| v | The assets in your Account are owned by you, not by us. We have no control over any of the assets in your Account and you may sell such assets at any time in your complete and sole discretion and without any permission from us. The assets in your Account are not subject to our creditors, although they can be directly attached by your creditors. In addition, you may pledge the assets in your Account as collateral for a loan. In the case of such a pledge, if the assets in your Account decrease in value, your creditor may be able to liquidate assets in your Account to pay the loan. Any such liquidation may constitute a Withdrawal from your Account and reduce your Retirement Income Base. Using the assets in your Account as collateral for a loan, therefore, may reduce the future benefit of your Income Edge or cause your Income Edge to terminate. |

The Income Edge is offered to advisory clients of Investors Capital whose Account assets are managed under the Investor Protector Program. The Income Edge is designed for Investors Capital clients who intend to use the assets in their Account as the basis for a withdrawal program to provide income payments for retirement or other long-term purposes.

Subject to certain conditions, the Income Edge ensures predictable lifetime income payments regardless of the actual performance or value of your Account, by providing continuing income payments if your Account Value is reduced to $0 by Withdrawals (within the limits of the certificate) and/or poor investment performance. There are limitations on the amount and timing of Withdrawals, which are discussed below. There is an annual fee for the Income Edge which, unless you direct Investors Capital to deduct this from a different account, is deducted from your Account quarterly in advance.

15

Table of Contents