Attached files

| file | filename |

|---|---|

| 8-K - EQUITY ONE INC 8-K 6-8-2010 - EQUITY ONE, INC. | form8k.htm |

NAREIT REITWeek Presentation

June 2010

Equity One

®

LOCATION

LOCATION

LOCATION

Forward Looking Statements

1

Certain matters discussed by Equity One in this presentation constitute forward-looking

statements within the meaning of the federal securities laws. Although Equity One believes

that the expectations reflected in such forward-looking statements are based upon

reasonable assumptions, it can give no assurance that these expectations will be achieved.

Factors that could cause actual results to differ materially from current expectations include

changes in macroeconomic conditions and the demand for retail space in the states in which

Equity One owns properties; the continuing financial success of Equity One’s current and

prospective tenants; continuing supply constraints in its geographic markets; the availability

of properties for acquisition; the success of its efforts to lease up vacant space; the effects of

natural and other disasters; the ability of Equity One to successfully integrate the operations

and systems of acquired companies and properties; and other risks, which are described in

Equity One’s filings with the Securities and Exchange Commission.

statements within the meaning of the federal securities laws. Although Equity One believes

that the expectations reflected in such forward-looking statements are based upon

reasonable assumptions, it can give no assurance that these expectations will be achieved.

Factors that could cause actual results to differ materially from current expectations include

changes in macroeconomic conditions and the demand for retail space in the states in which

Equity One owns properties; the continuing financial success of Equity One’s current and

prospective tenants; continuing supply constraints in its geographic markets; the availability

of properties for acquisition; the success of its efforts to lease up vacant space; the effects of

natural and other disasters; the ability of Equity One to successfully integrate the operations

and systems of acquired companies and properties; and other risks, which are described in

Equity One’s filings with the Securities and Exchange Commission.

This presentation also contains non-GAAP financial measures, including Funds from

Operations, or FFO. Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP measures can be found in Equity One’s quarterly supplemental

information package which is available on its website at www.equityone.net.

Operations, or FFO. Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP measures can be found in Equity One’s quarterly supplemental

information package which is available on its website at www.equityone.net.

LOCATION

LOCATION

LOCATION

Table of Contents

2

I. Corporate Overview

II. Management Team

III. Strategic Plan - Past and Present

IV. Asset Management

A. Portfolio Characteristics

B. Operational Excellence

C. Pillars of Asset Management

D. Capital & Counties

E. Case Studies

F. Redevelopment Pipeline

V. Balance Sheet Management

VI. Appendix

LOCATION

LOCATION

LOCATION

Corporate Mission

3

Our mission is to be the leading owner, operator,

developer and asset manager of neighborhood and

community shopping centers in the most supply

constrained markets of the United States.

Nearly 60% of our portfolio value is derived from South Florida, California,

and the Washington DC to Boston corridor. (1)

(1) Portfolio values represent fair values as of 3/31/10 plus Veranda Shoppes and Capital & Counties. Does not include development, redevelopment, land held for development

(except Westbury land), GRI and DRA properties. Percentage of gross value are pro-forma giving effect to consolidation of Capital & Counties.

(except Westbury land), GRI and DRA properties. Percentage of gross value are pro-forma giving effect to consolidation of Capital & Counties.

LOCATION

LOCATION

LOCATION

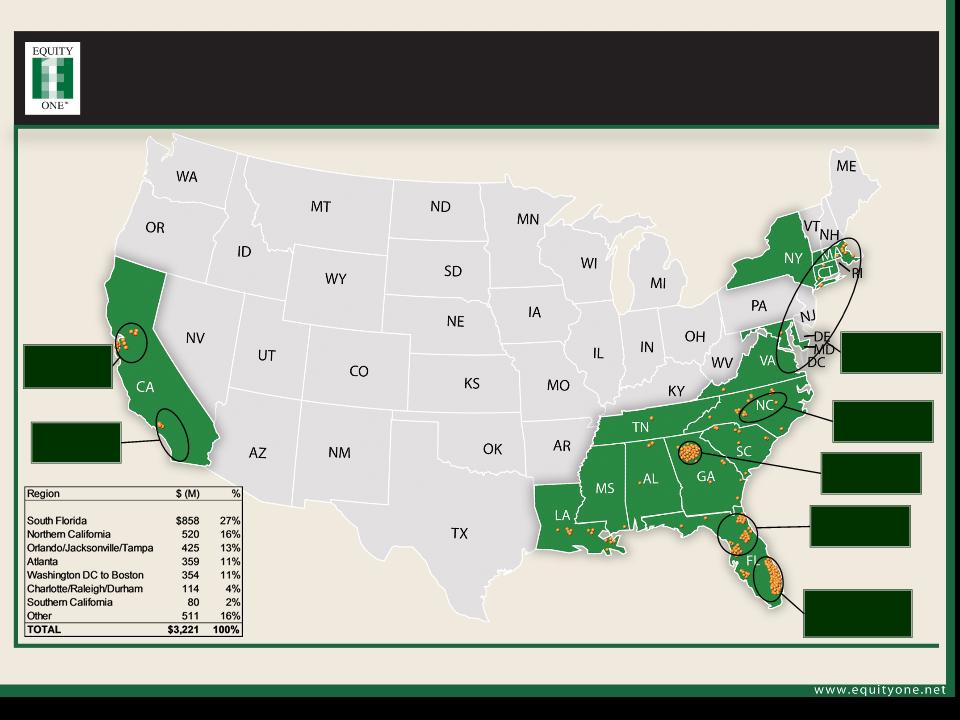

7 Targeted Markets

4

(1) Gross values (GV) represent fair values as of 3/31/10 plus Veranda Shoppes and Capital & Counties. Does not include development, redevelopment, land held for

development (except Westbury land), GRI and DRA properties. Percentage of gross value are pro-forma giving effect to consolidation of Capital & Counties.

development (except Westbury land), GRI and DRA properties. Percentage of gross value are pro-forma giving effect to consolidation of Capital & Counties.

C&C: $520M

% of GV: 16%

C&C: $80M

% of GV: 2%

Existing: $858M

% of GV: 27%

Existing: $425M

% of GV: 13%

Existing: $359M

% of GV: 11%

Existing: $114M

% of GV: 4%

Existing: $354M

% of GV: 11%

LOCATION

LOCATION

LOCATION

Corporate Overview

5

• Equity One specializes in the acquisition, asset management, development and

redevelopment of quality retail properties located across the United States.

redevelopment of quality retail properties located across the United States.

• We own 185 properties in 13 states. (1)

• Our largest markets are: South Florida (35%), North Florida (20%), Atlanta (14%),

and the Northeast (13%). (2)

and the Northeast (13%). (2)

• We recently announced the $600M acquisition of Capital & Counties, one of the

largest owners of retail real estate in the San Francisco Bay Area.

largest owners of retail real estate in the San Francisco Bay Area.

• Total equity capitalization / total enterprise value as of March 31, 2010: $1.7 billion /

$2.8 billion.

$2.8 billion.

• Investment grade credit ratings (Baa3/BBB-) from both Moody’s and S&P.

• Management and board have substantial ownership stake and experience:

– Beneficial ownership: 56.0%. (3)

– Management team has over 80 years of collective experience.

(1) As of 3/31/10 plus Veranda Shoppes acquired in April 2010.

(2) Ranked by percentage of total estimated fair value as of March 31, 2010 and includes Veranda Shoppes. Does not include JV properties.

(3) Beneficial ownership of current executive officers and directors as of 3/15/10 in accordance with rules of the SEC and including options exercisable within 60 days. Beneficial ownership: Chaim Katzman 49.9% and Nathan Hetz 5.0%.

LOCATION

LOCATION

LOCATION

Equity One is led by a dedicated and

disciplined management team

disciplined management team

6

Jeffrey Olson

CEO / Director

Thomas Caputo

President

President

Mark Langer

CFO and CAO

CFO and CAO

Arthur Gallagher

EVP, General

Counsel

EVP, General

Counsel

• Mr. Olson is responsible for all aspects of our business operations and growth strategy.

• Prior to joining Equity One in 2006, Mr. Olson served as President of the Eastern and Western shopping center regions

of Kimco Realty Corporation, the largest shopping center REIT in the US.

of Kimco Realty Corporation, the largest shopping center REIT in the US.

• Mr. Olson has over 20 years of industry experience serving in a variety of operations, acquisitions, finance and

accounting functions at UBS, CIBC, Salomon Brothers, The Mills Corporation, and The Reznick Group (accounting, tax,

and advisory services).

accounting functions at UBS, CIBC, Salomon Brothers, The Mills Corporation, and The Reznick Group (accounting, tax,

and advisory services).

• Mr. Caputo is responsible for leasing, acquisitions, dispositions, property management, and our investment

management program.

management program.

• Prior to joining Equity One in 2008, Mr. Caputo was an Executive Vice President at Kimco where he headed the

acquisition group and portfolio management program.

acquisition group and portfolio management program.

• Previously, he was a principal with RREEF, a pension fund advisor, overseeing nationwide retail acquisitions and

dispositions and was a member of its investment committee.

dispositions and was a member of its investment committee.

• Mr. Langer is responsible for all finance and accounting functions and joined Equity One in 2008.

• Prior to joining Equity One, he had been with Johnson Capital Management, an investment advisor, since 2000 where

he served as the Chief Operating Officer overseeing all infrastructure and administrative functions.

he served as the Chief Operating Officer overseeing all infrastructure and administrative functions.

• Previously, he was an audit partner at KPMG LLP where he was also responsible for recruiting, employee training and

practice development programs.

practice development programs.

• Mr. Gallagher is responsible for the Company’s legal, transactional and regulatory affairs, including corporate

governance, real estate acquisitions and dispositions, corporate and capital transactions, SEC compliance and litigation

issues.

governance, real estate acquisitions and dispositions, corporate and capital transactions, SEC compliance and litigation

issues.

• Previously, he was with the law firms of Simpson Thacher & Bartlett, New York City, and Greenberg Traurig, P.A.,

Miami.

Miami.

Lauren Holden

VP - Portfolio

Management

Management

• Ms. Holden is responsible for portfolio management functions including Equity One’s acquisition and disposition efforts.

In addition, Ms. Holden is in charge of the leasing and property management of Equity One’s Northeast portfolio.

In addition, Ms. Holden is in charge of the leasing and property management of Equity One’s Northeast portfolio.

• Prior to joining Equity One in 2008, Ms. Holden was a Senior Portfolio Manager at Kimco Realty Corporation.

• Previously, she was part of the investment banking group at Banc of America Securities.

LOCATION

LOCATION

LOCATION

Equity One is led by a dedicated and

disciplined management team

disciplined management team

7

Leasing

Laura Lynch

Kevin Buth

Bob Mitzel

Development/Construction

Mike Berfield

Bob Malagon

Ken Choquette

Property Management

Ken Miller

Joe Lopez

Legal Leasing

Brent Levison

Asset Management

Lauren Holden

Sara Lev

Andrea Drasites

Accounting/Finance

Angie Valdes

Keith Lavery

Adrienne Kelley

Acquisitions

Daniel Lovitz

Brad Kritzer

IT

Ivan De Moya

LOCATION

LOCATION

LOCATION

2006 Strategic Plan

8

Upgrade Portfolio

Quality

Quality

Decrease

Development

Exposure

Development

Exposure

Strengthen

Balance Sheet

Balance Sheet

Improve Access

to Capital

• Sold over $700M of lower tier assets prior to market downturn.

• Exited Texas and reduced exposure to other non-core markets.

• Purchased over $350M of A quality assets in South Florida (Airpark Plaza, Coral Reef,

Sunset I & II, Concord, Gateway Plaza at Aventura, Veranda Shoppes), Atlanta

(Buckhead Station), Long Island (Westbury + land), and Connecticut (Copps Hill Plaza).

Sunset I & II, Concord, Gateway Plaza at Aventura, Veranda Shoppes), Atlanta

(Buckhead Station), Long Island (Westbury + land), and Connecticut (Copps Hill Plaza).

• Identified additional target markets in the Northeast and on the West Coast.

• Completed existing project starts and limited development starts.

• Reduced overhead related to development team.

• Reduced capital commitments by limiting approved development projects.

• Reduced debt to undepreciated assets from 47.8% (12/31/06) to 44.4% (3/31/10).

• Completed three equity offerings totaling $280M (Q3 2008, Q2 2009 and Q1 2010).

• Raised $590M in long-term debt (6.2% average rate) to extend maturities.

Initiative

Status

• Formed over $275M in joint venture partnerships with CalPERS and DRA Advisors.

• In October 2008, recast $227M line of credit (expires October 2012 (1)) at L+140bps.

• In February 2010, expanded LOC commitments bringing total capacity to $272M.

(1) Includes 1-year extension option.

LOCATION

LOCATION

LOCATION

Positive Market Response

9

(1) Source: Bloomberg, 26 May 2010.

|

Total Returns Since August 6, 2006 (1)

|

||||

|

|

|

|

|

|

|

Acadia

|

|

|

|

-11.5%

|

|

Cedar

|

|

|

|

-48.7%

|

|

Developers Diversified

|

|

|

|

-74.4%

|

|

Federal Realty

|

|

|

|

9.5%

|

|

Kimco

|

|

|

|

-57.9%

|

|

Ramco-Gershenson

|

|

|

|

-54.5%

|

|

Regency

|

|

|

|

-33.3%

|

|

Saul Centers

|

|

|

|

2.9%

|

|

Weingarten

|

|

|

|

-36.1%

|

|

Average

|

|

|

|

-33.8%

|

|

|

|

|

|

|

|

Equity One

|

|

|

|

-9.4%

|

|

EQY Outperformance

|

|

|

|

2,434 bps

|

LOCATION

LOCATION

LOCATION

2010 Strategic Plan

10

Operational

Excellence

Excellence

Creative

Development

Development

• Focus on fundamentals - continue to improve all aspects of leasing process

• Maximize the value of existing assets through aggressive leasing efforts and effective

property management / cost containment

property management / cost containment

• Adopt consistent standards and vendor review procedures at all centers

• Maintain quality balance sheet / financial discipline

• Keep targeted leverage ratio of 40-45%

• Net Debt to EBITDA goal of 6.5

• Extend debt maturity profile

• Maintain access to multiple sources of capital

• Upgrade portfolio quality through accretive acquisitions

• Focus on supply constrained markets in targeted areas

• Reduce concentration in the Southeast

Initiative

Strategy

Balance Sheet

Management

Management

Strategic

Acquisitions

Acquisitions

• Build a pipeline of urban infill development and redevelopment properties that

represents 10% of total asset value

represents 10% of total asset value

• Increase ownership concentration in targeted markets through accretive development

projects

projects

LOCATION

LOCATION

LOCATION

Recent Transactions

11

• Announced the acquisition of Capital & Counties for $600M at a 7% pro forma cap rate.

• Acquired Westbury Plaza in Long Island for $103.7M at an 8% cap rate and the adjacent

22 acre land parcel for $24.5M.

22 acre land parcel for $24.5M.

• Acquired majority control of DIM Vastgoed in 1Q09 in a stock-for-stock transaction.

Increased stake to 95.5% during 2010 via tender offer and additional purchases.

Increased stake to 95.5% during 2010 via tender offer and additional purchases.

• Acquired Copps Hill Plaza (Ridgefield, Connecticut) for $33.4M, Veranda Shoppes

(Plantation, Florida) for $11.7M, and Gateway Plaza at Aventura (Aventura, FL) for

$8.0M.

(Plantation, Florida) for $11.7M, and Gateway Plaza at Aventura (Aventura, FL) for

$8.0M.

• Purchased the Chevron fuel station adjacent to EQY’s Banco Popular (North Miami

Beach, FL) for $2.0M, the outparcel adjacent to EQY’s Coral Reef Shopping Center

(Palmetto Bay, FL) for $1.0M, and the outparcel adjacent to EQY’s Ryanwood Square

(Vero Beach, FL) for $325K.

Beach, FL) for $2.0M, the outparcel adjacent to EQY’s Coral Reef Shopping Center

(Palmetto Bay, FL) for $1.0M, and the outparcel adjacent to EQY’s Ryanwood Square

(Vero Beach, FL) for $325K.

• In February 2010, we completed a $98.9 million equity offering in a bought transaction

and a concurrent private placement at a net price of $18.31/share.

and a concurrent private placement at a net price of $18.31/share.

LOCATION

LOCATION

LOCATION

(1) Excludes EQY developments/redevelopments, non-retail properties, land held, EQY joint ventures and DIM Vastgoed properties. NOI is Cash NOI and includes management fee expense.

(2) Demographics as of March 31, 2010. Includes Veranda Shoppes and Capital & Counties. Exclude EQY development/redevelopments, non-retail properties, land held, and joint venture properties.

(3) Source: SNL.

(4) Occupancy for EQY core portfolio and DIM.

Our portfolio is focused on necessity-based

consumer spending

consumer spending

12

• We are an owner and operator of grocer-anchored neighborhood shopping centers. As of

March 31, 2010, 75% of our NOI was derived from core properties that have a grocery

store or drug store.(1)

March 31, 2010, 75% of our NOI was derived from core properties that have a grocery

store or drug store.(1)

• Our properties are primarily found in in-fill markets and well-located mature trade areas

with healthy demographics (2):

with healthy demographics (2):

– 3-Mile average population density: 90,794

– 3-Mile average household income: $80,117 ($54,719 national average (3))

• Portfolio positioned to generate stable cash flows in a challenged operating environment:

– Three of our top five tenants are grocers.

– Percentage rent accounts for less than 1% of our rental income.

– Occupancy as of March 31, 2010 was 90.3%.(4)

– No more than 13% of lease rollover in any year for each of the next five years.

LOCATION

LOCATION

LOCATION

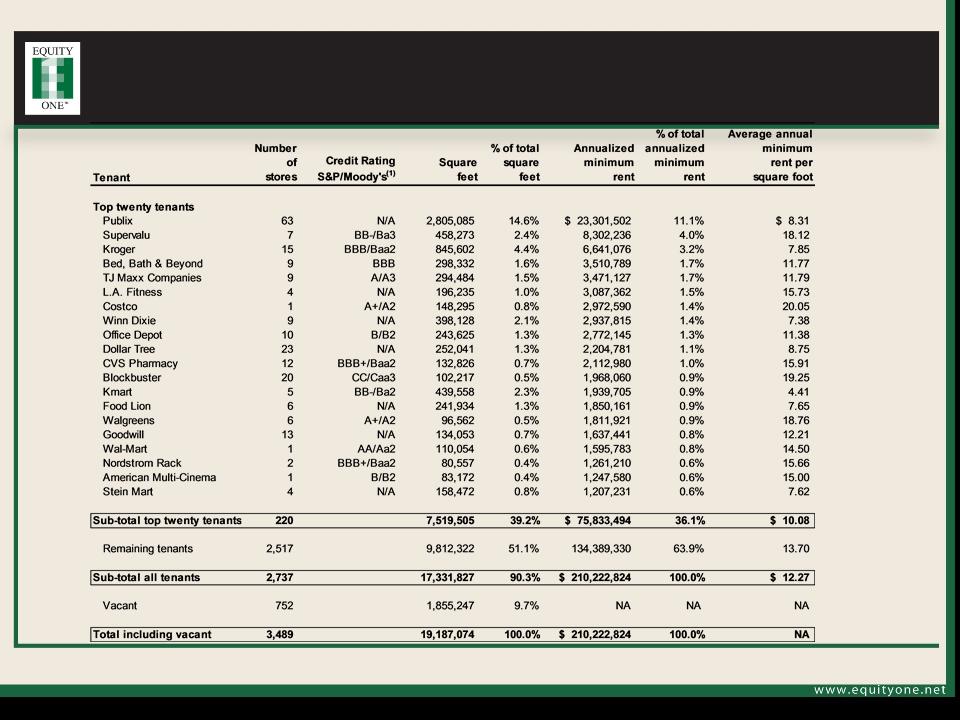

Tenant Concentration

as of March 31, 2010

as of March 31, 2010

13

Note: Figures as of March 31, 2010. Excludes EQY developments, non-retail properties, EQY joint ventures and DIM Vastgoed properties.

(1) Ratings as of March 31, 2010. Source: CreditRiskMonitor.

LOCATION

LOCATION

LOCATION

Operational Excellence

14

• We are committed to maximizing the value of our existing centers through aggressive

leasing efforts, attentive property management, and property enhancements.

leasing efforts, attentive property management, and property enhancements.

• Our leasing efforts involve staying very close to the market with weekly executive team

calls and frequent canvassing combined with incentives utilized to drive results.

calls and frequent canvassing combined with incentives utilized to drive results.

• Our tenant relations team carefully monitors credit risk and regularly performs portfolio

reviews with all major retailers to assess opportunities and strengthen relationships.

reviews with all major retailers to assess opportunities and strengthen relationships.

• We are allocating increased internal resources toward collection efforts.

• We have rebid our largest property management contracts in an effort to reduce

expenses.

expenses.

• We are committed to continue investing in our properties when many other landlords

are not in a position to do so.

are not in a position to do so.

LOCATION

LOCATION

LOCATION

Intensive Asset Management

Expand Space &

Term of Anchor

Tenant(s)

Term of Anchor

Tenant(s)

New Anchor

Or Major

Tenant

Tenant

Acquire

Adjacent

Site/Space

Adjacent

Site/Space

Renovate All/

Part of Center

Expand

Center

Center

Expense

Control

Control

15

LOCATION

LOCATION

LOCATION

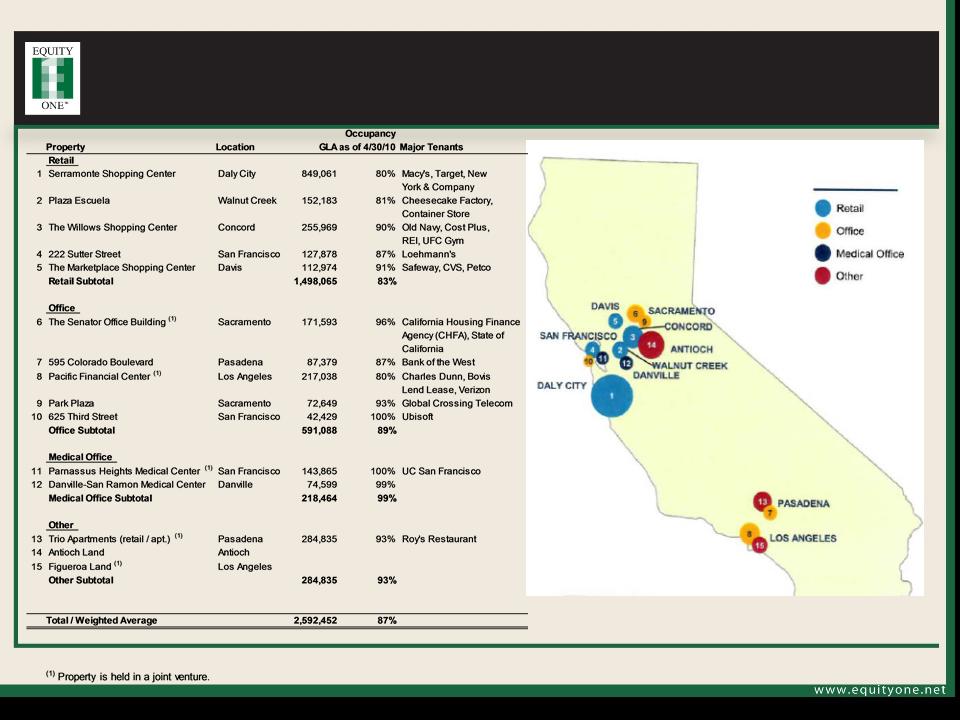

Capital & Counties - Executive Summary

16

• We have entered into an agreement to acquire Capital and Counties USA Inc. (C&C USA) through a joint venture

with its parent company, Capital Shopping Centres Group PLC.

with its parent company, Capital Shopping Centres Group PLC.

• All-stock transaction valued at approximately $600M (proforma cap rate is 7%)

• Capital Shopping Centres will receive 4.1M shares of EQY common stock and 10.9M joint venture units. (1)

• EQY will assume approximately $330M of mortgage debt, including its proportionate share of debt held by its

joint ventures, with a weighted average interest rate of 5.7%.

joint ventures, with a weighted average interest rate of 5.7%.

• “A” quality portfolio - 15 properties in California totaling 2.6M square feet

• 70% of the transaction value consists of retail assets

• Retail portfolio is concentrated in the San Francisco Bay Area and includes: Serramonte Shopping Center in

Daly City, Plaza Escuela in Walnut Creek, The Willows Shopping Center in Concord, 222 Sutter Street in San

Francisco, and The Marketplace Shopping Center in Davis.

Daly City, Plaza Escuela in Walnut Creek, The Willows Shopping Center in Concord, 222 Sutter Street in San

Francisco, and The Marketplace Shopping Center in Davis.

• The retail portfolio was 83% leased as of April 30, 2010. When including several major leases recently

executed or currently under letter of intent, the retail portfolio occupancy rate increases to 93%.

executed or currently under letter of intent, the retail portfolio occupancy rate increases to 93%.

• The average population density within a 3-mile ring of the retail properties is 180,848 people and the average

household income is $87,688.

household income is $87,688.

• We intend to dispose of a majority of the non-core assets.

• Expected to close late in the third quarter of 2010.

• Expected to be modestly accretive to funds from operations in the first year prior to transaction expenses and non-

cash purchase accounting adjustments.

cash purchase accounting adjustments.

(1) Capital Shopping Centres may redeem its units in the joint venture for Equity One common stock on a one-for-one basis or cash, at Equity One’s option.

LOCATION

LOCATION

LOCATION

Capital & Counties

17

LOCATION

LOCATION

LOCATION

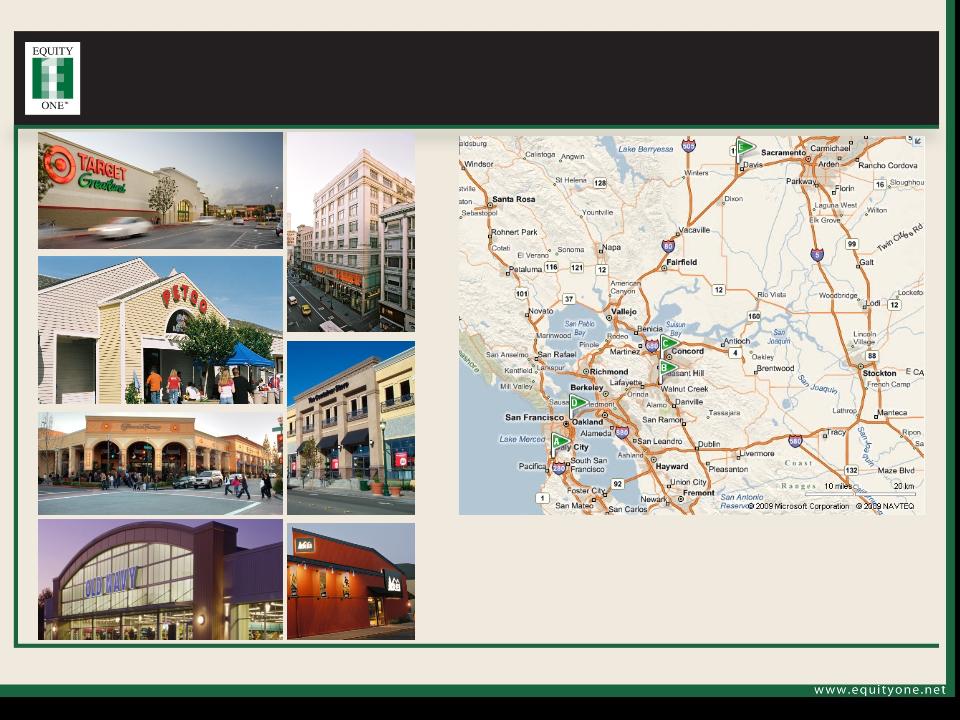

Equity One Becomes One of the Largest

Retail Property Owners in Bay Area

Retail Property Owners in Bay Area

18

A. Serramonte Shopping Center

B. Plaza Escuela

C. The Willows Shopping Center

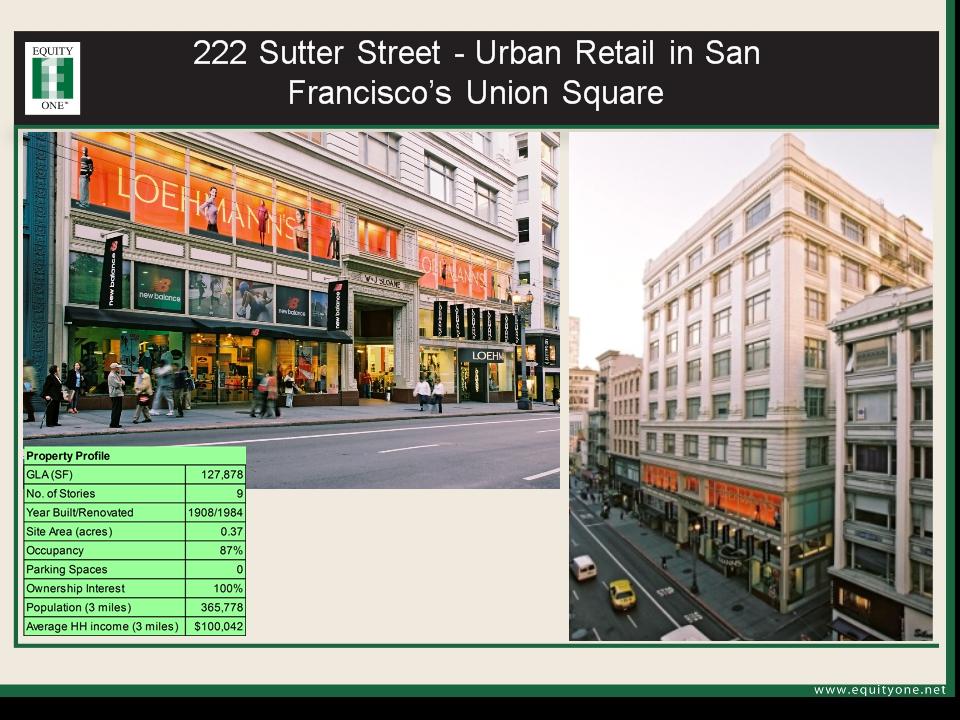

D. 222 Sutter Street

E. The Marketplace Shopping Center

Serramonte Shopping Center

222 Sutter Street

The Marketplace Shopping Center

Plaza Escuela

The Willows Shopping Center

LOCATION

LOCATION

LOCATION

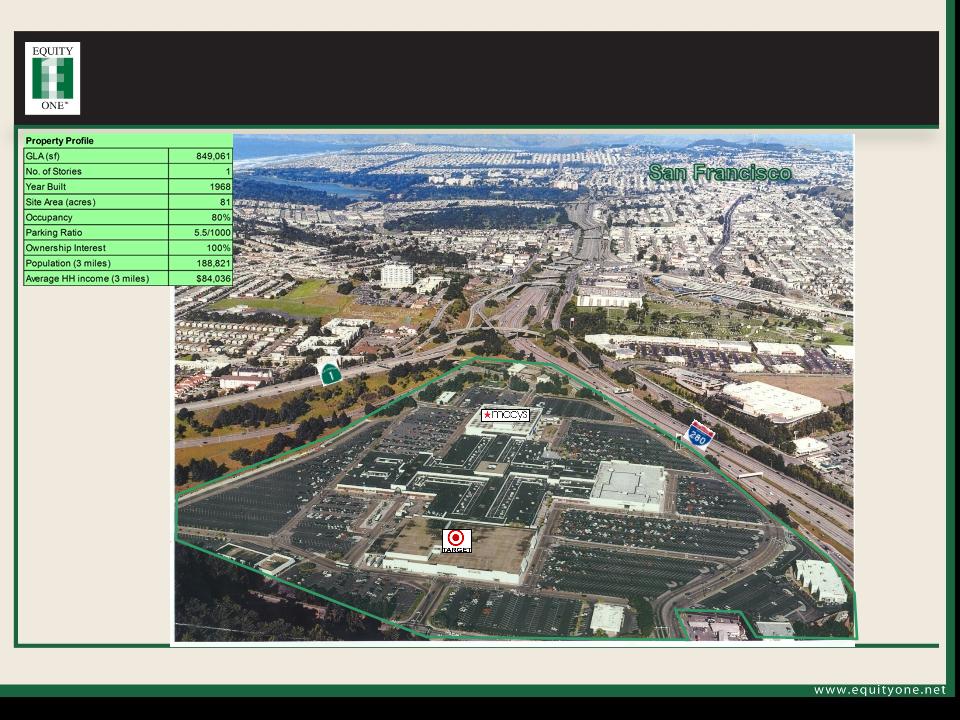

Serramonte Shopping Center - Ideally

Positioned for Further Development

Positioned for Further Development

19

LOCATION

LOCATION

LOCATION

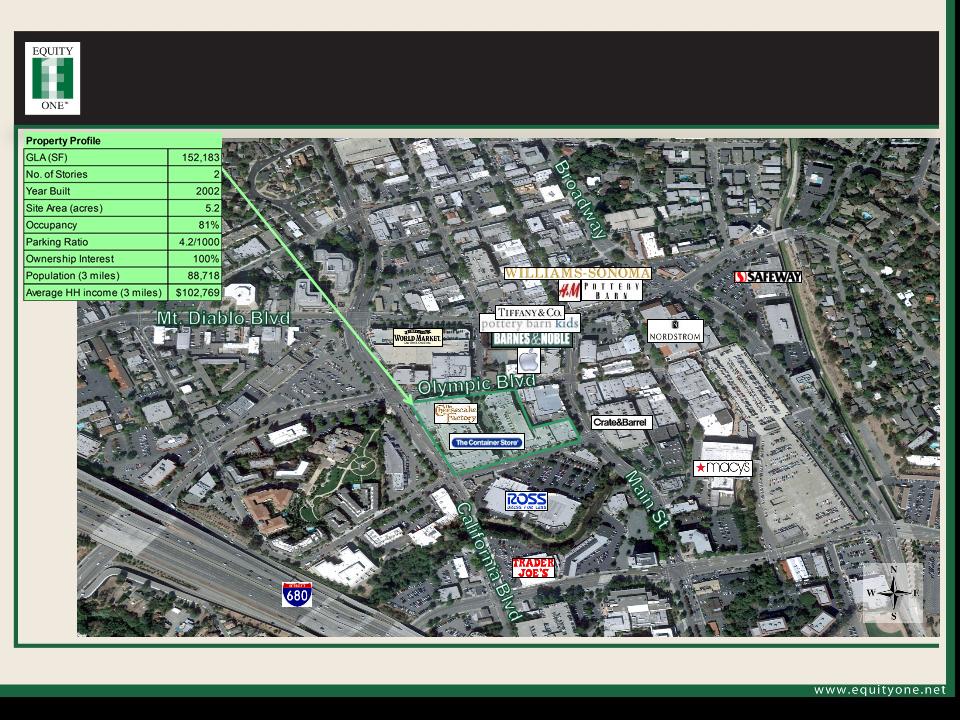

Plaza Escuela - Centrally Located in a

Prime, High-End Retail Market

Prime, High-End Retail Market

20

LOCATION

LOCATION

LOCATION

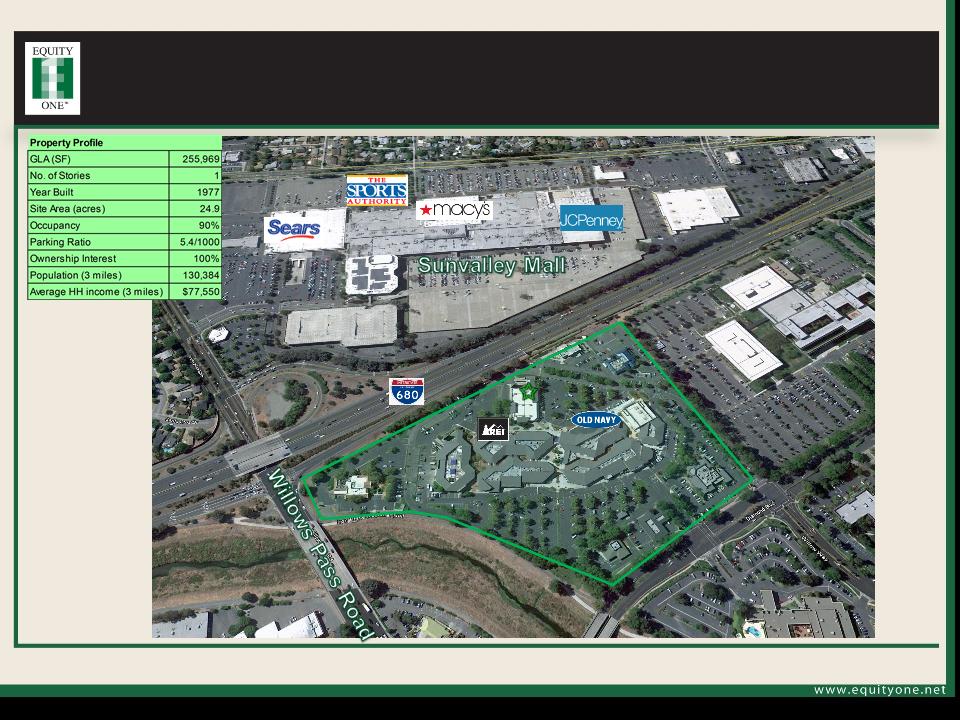

The Willows Shopping Center - Concord, CA

21

LOCATION

LOCATION

LOCATION

22

LOCATION

LOCATION

LOCATION

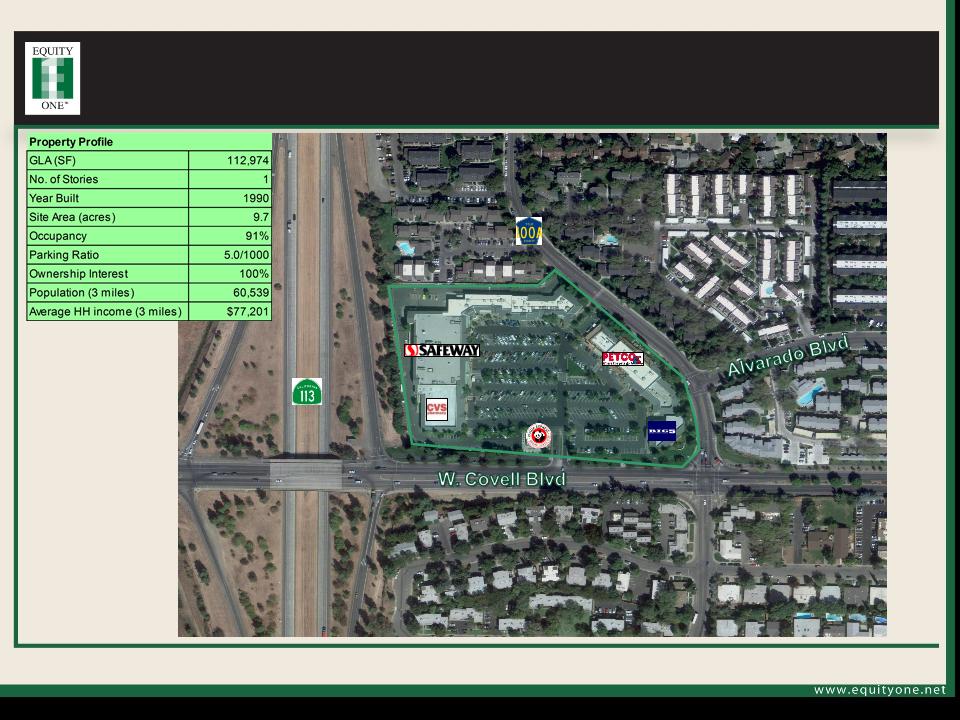

Davis Marketplace - Defensive Asset in High

Barrier to Entry Market

Barrier to Entry Market

23

LOCATION

LOCATION

LOCATION

Non-Core Assets

24

Parnassus Heights Medical Center

Danville-San Ramon Medical Center

The Senator Office Building

Park Plaza

625 Third Street

Trio Apartments / 595 Colorado Boulevard

Pacific Financial

Center

Center

LOCATION

LOCATION

LOCATION

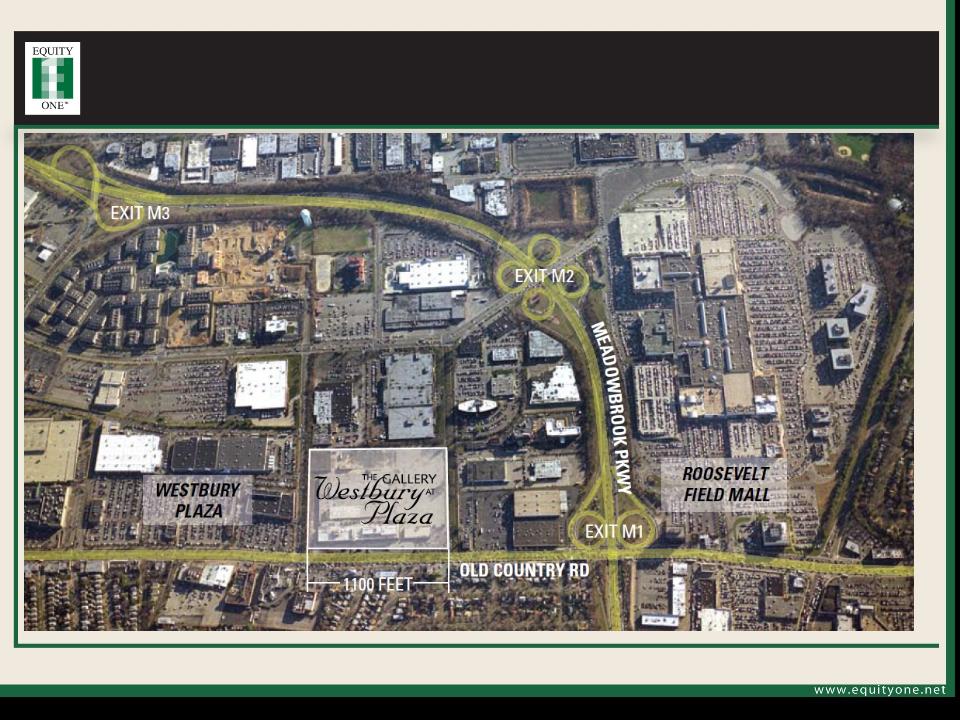

Case Study #1

Westbury Overview

Westbury Overview

25

Location: Westbury, NY

Closed: October 29, 2009

Cost: $103.7M

Cap rate: 8%

Size: 398,602 square feet

Anchors: Costco, Wal-Mart and

Sports Authority

Sports Authority

(1) Source: Applied Geographic Solutions / TIGER Geography 07/08.

Westbury Plaza

Development Parcel

Demographics (1): 3-mile 5-mile

Population: 152,426 418,640

Household income: $101,853 $114,235

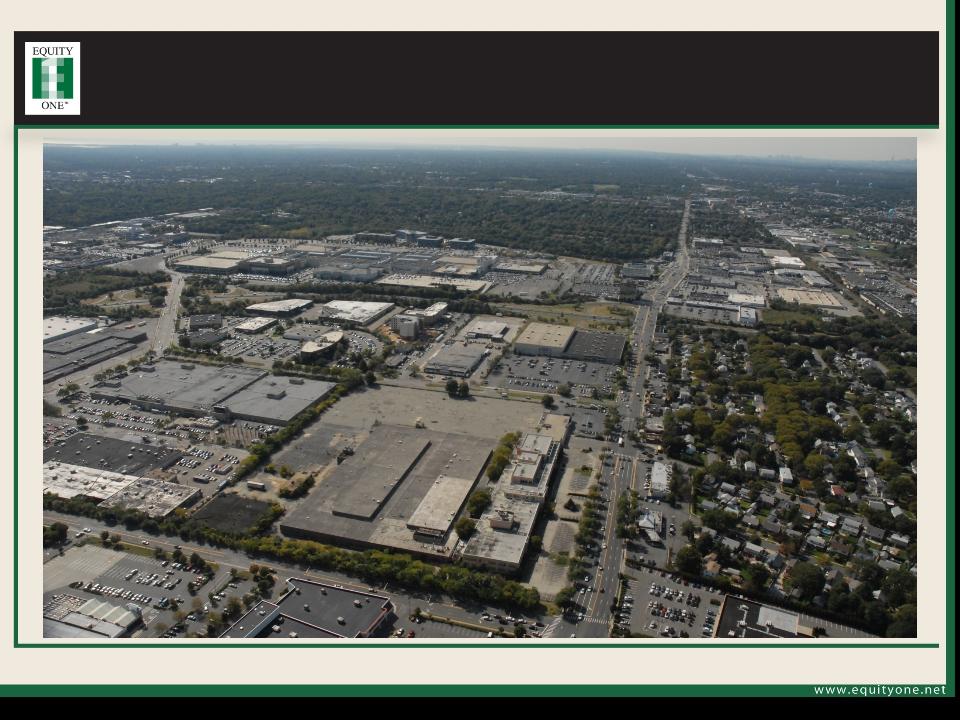

Location: Westbury, NY

Closed: November 16, 2009

Cost: $24.5M

Size: 22 acres

Current zoning: Allows for retail

development as-of-right

development as-of-right

Site Summary: Former Avis site sits

adjacent to Westbury

Plaza, less than one mile

from Roosevelt Field, and

benefits from over 1,000

feet of frontage along Old

Country Road.

adjacent to Westbury

Plaza, less than one mile

from Roosevelt Field, and

benefits from over 1,000

feet of frontage along Old

Country Road.

LOCATION

LOCATION

LOCATION

Case Study #1

Westbury Aerial

Westbury Aerial

26

LOCATION

LOCATION

LOCATION

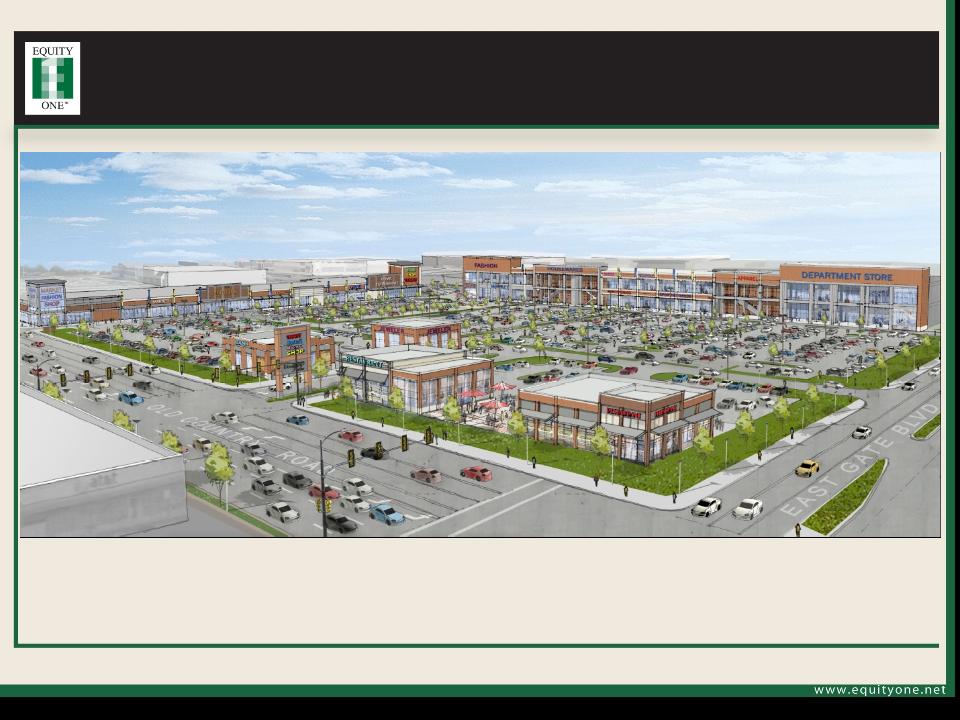

Case Study #1

Westbury Preliminary Rendering

Westbury Preliminary Rendering

27

LOCATION

LOCATION

LOCATION

Case Study #1

Westbury Preliminary Site Plan

Westbury Preliminary Site Plan

28

LOCATION

LOCATION

LOCATION

Case Study #1

Westbury Land

Westbury Land

29

LOCATION

LOCATION

LOCATION

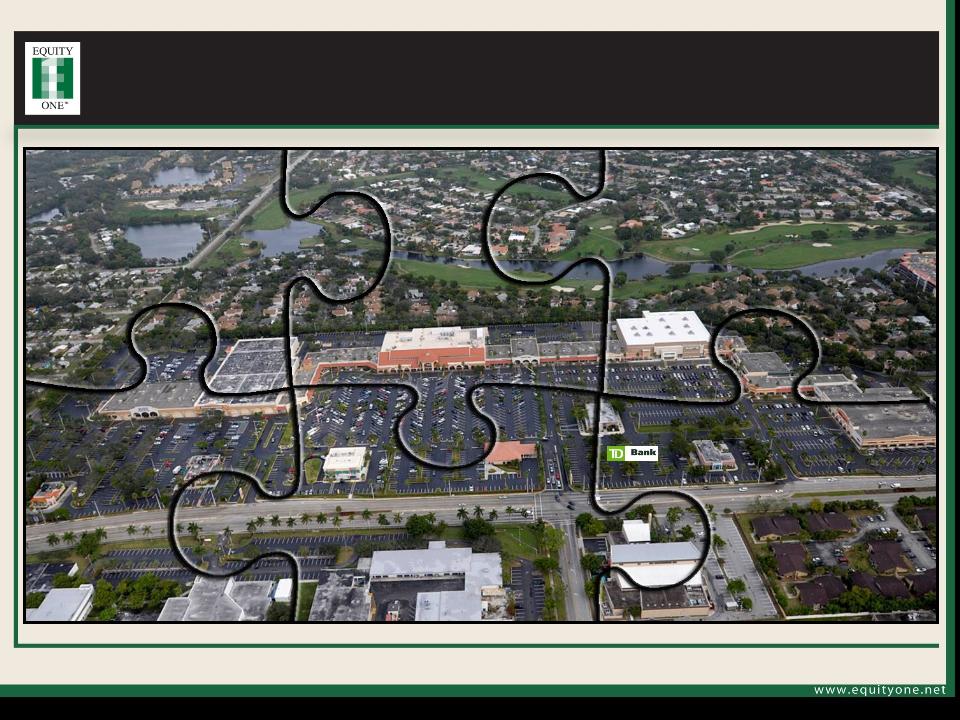

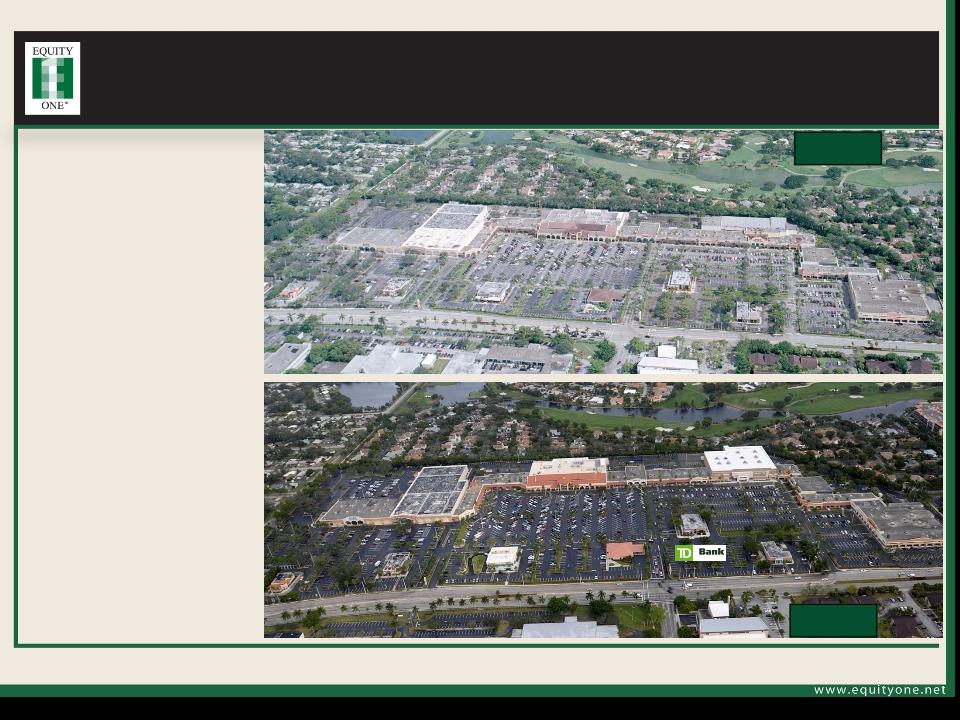

Case Study #2

Sheridan Plaza, Hollywood, FL

Sheridan Plaza, Hollywood, FL

30

After

Before

Project Summary:

Replaced an old,

underperforming AMC

Theater and five

adjacent tenants

totaling 11,663 sf with a

new 102,666 sf two-

story Kohl’s. Relocated

inline Starbucks and

Eastern Financial to

vacant outparcel.

Created new outparcel

ground leased to TD

Bank. Replaced

Conine’s with Azteca

Mexican Restaurant.

underperforming AMC

Theater and five

adjacent tenants

totaling 11,663 sf with a

new 102,666 sf two-

story Kohl’s. Relocated

inline Starbucks and

Eastern Financial to

vacant outparcel.

Created new outparcel

ground leased to TD

Bank. Replaced

Conine’s with Azteca

Mexican Restaurant.

LOCATION

LOCATION

LOCATION

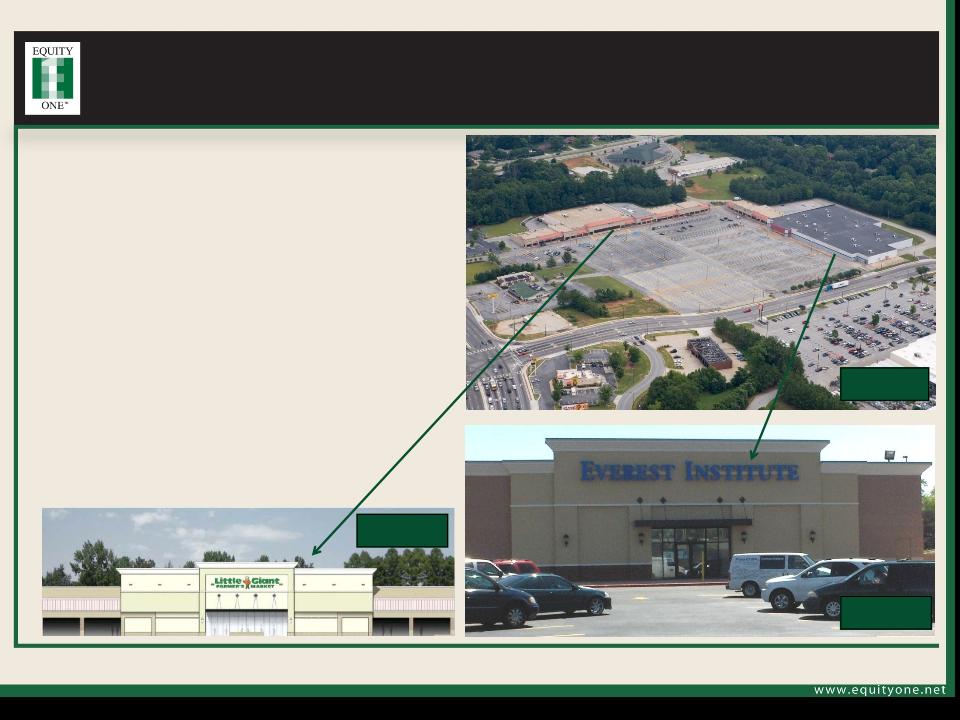

Case Study #3

Wesley Chapel Crossing, Decatur, GA

Wesley Chapel Crossing, Decatur, GA

31

After

Before

Project Summary:

Leased 50,000 sf to Corinthian College

(they operate as Everest Institute) for

the former Wal-Mart box. Executed new

lease with Little Giant, a local grocery

store operator, for the former Ingles

space (32,000 sf). Tenant is expected

to open in April 2010. Since Corinthian

College has opened, demand for space

has increased significantly and we have

interest from several national tenants for

the remaining 30,000 sf of the former

Wal-Mart space.

(they operate as Everest Institute) for

the former Wal-Mart box. Executed new

lease with Little Giant, a local grocery

store operator, for the former Ingles

space (32,000 sf). Tenant is expected

to open in April 2010. Since Corinthian

College has opened, demand for space

has increased significantly and we have

interest from several national tenants for

the remaining 30,000 sf of the former

Wal-Mart space.

After

LOCATION

LOCATION

LOCATION

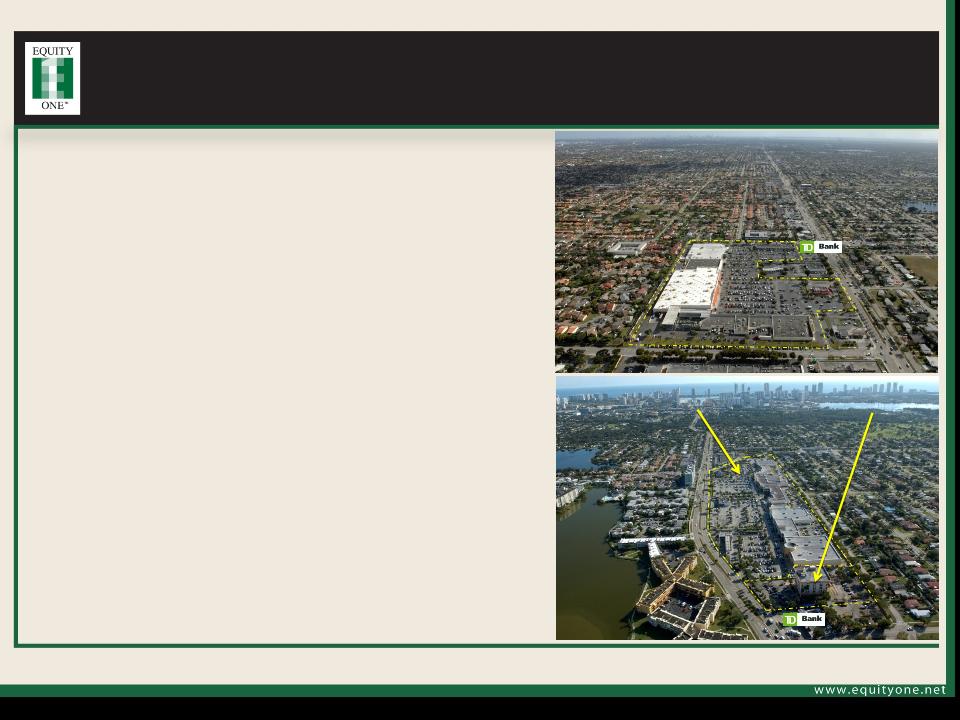

Case Study #4

Outparcel Acquisitions/Additions

Outparcel Acquisitions/Additions

32

Concord Shopping Plaza

Shops at Skylake / Banco Popular

Project Summary:

Maximize GLA by acquiring adjacent outparcels

and upgrading tenant mix.

and upgrading tenant mix.

Concord Shopping Plaza: Acquired the

adjacent parcel and replaced a vacant former

gas station with a new TD Bank.

adjacent parcel and replaced a vacant former

gas station with a new TD Bank.

Shops at Skylake / Banco Popular: Acquired

the adjacent parcel and replaced a Chevron gas

station with a new TD Bank.

the adjacent parcel and replaced a Chevron gas

station with a new TD Bank.

LOCATION

LOCATION

LOCATION

Redevelopment Pipeline

33

Our goal is to build a development and redevelopment pipeline that

represents approximately 10% of our total asset value by 2012.

Active Redevelopments

• Westbury - Currently in the predevelopment

stages and have already identified over a dozen

retailers interested in entering this market or

relocating an existing store to our site.

stages and have already identified over a dozen

retailers interested in entering this market or

relocating an existing store to our site.

• South Beach Regional - Executed lease with

Staples for old Hooters space

Staples for old Hooters space

• Pavilion - Executed lease with LA Fitness for

Publix space

Publix space

• Banco Popular - Purchased adjacent parcel.

Replaced Chevron gas station with a new TD

Bank

Replaced Chevron gas station with a new TD

Bank

• Concord Shopping Plaza - Purchased adjacent

parcel. Replaced vacant gas station with a new

TD Bank

parcel. Replaced vacant gas station with a new

TD Bank

Under Evaluation:

• Boca Village

• Coral Reef

• Dolphin Village

• El Novillo

• Hammocks

• Middlebeach

• North Village Center

• Piedmont Peachtree Crossing

• Pointe Royale

• Shops at Skylake

• Star’s at Cambridge

• Star’s at Quincy

• Summerlin

• Young Circle

LOCATION

LOCATION

LOCATION

We maintain a healthy balance sheet with modest

leverage, ample liquidity, and investment-grade metrics

leverage, ample liquidity, and investment-grade metrics

34

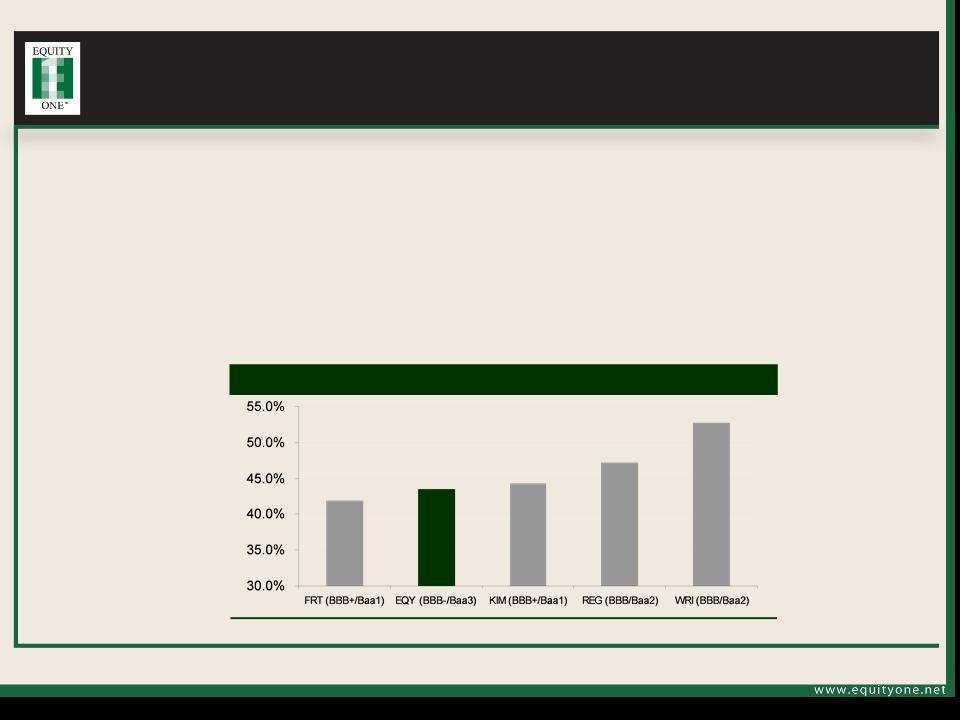

• Key leverage ratios:

– Net debt to total market cap as of March 31, 2010: 41.1%.

– Net Debt to Gross Real Estate & Securities as of March 31, 2010: 45.4%.

– Net Debt to EBITDA of 6.7X as of March 31, 2010.

– EBITDA to interest expense coverage of 2.2X as of March 31, 2010.

– Weighted average term to maturity for our total debt of 5.4 years as of March 31, 2010.

Q1 2010 Leverage (Total Debt + Preferred / Gross Assets)

Source: Company filings.

LOCATION

LOCATION

LOCATION

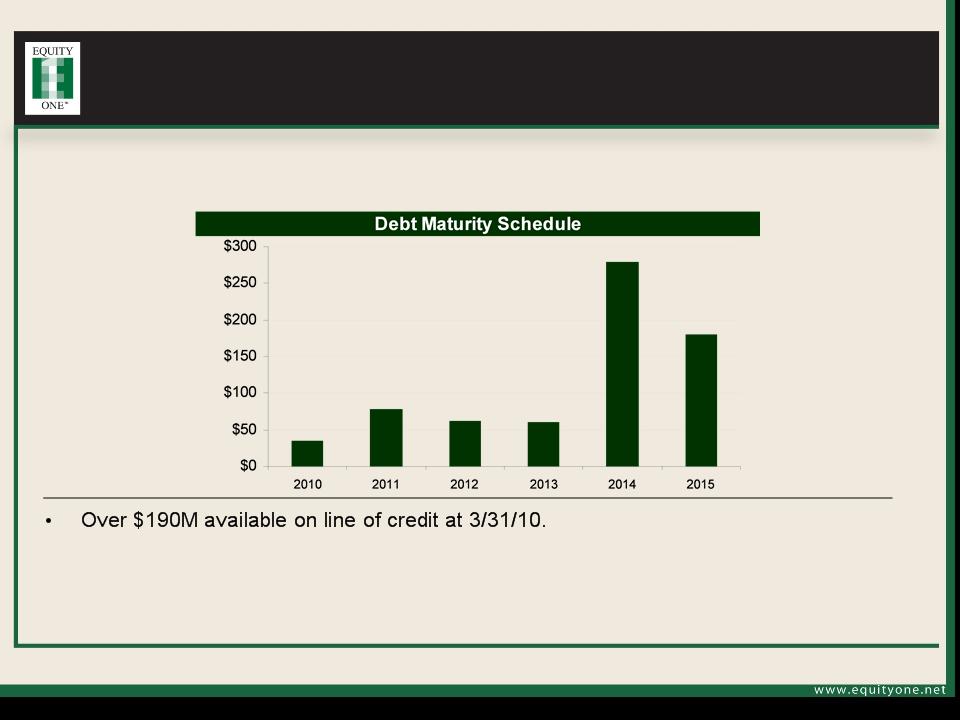

• We maintain a manageable debt maturity schedule with limited maturities through 2015.

Current Liquidity Position

35

Note: Debt Maturity Schedule and weighted average interest rates as of 03/31/10. Includes scheduled principal amortization. Credit facilities are shown as due on the initial maturity

dates, though certain extension options may be available.

dates, though certain extension options may be available.

In Millions

• Growing unencumbered asset base through maturing low LTV secured debt.

• Strong lending relationships with both traditional banks and life insurance companies.

• Demonstrated access to the public markets.

In Millions

7.9%

7.3%

5.3%

6.3%

6.2%

7.0%

LOCATION

LOCATION

LOCATION

Investment Thesis

36

Well-located, high quality, and productive grocery-anchored

shopping centers with an intensive focus on asset management

shopping centers with an intensive focus on asset management

A management team who has proven to be

effective allocators of capital

Investment strategy focused on identified core markets leading to

an upgrade in portfolio quality and further geographic diversity

an upgrade in portfolio quality and further geographic diversity

We are a premier operator positioned for growth

A healthy financial structure including a strong balance sheet,

modest leverage and ample liquidity

modest leverage and ample liquidity