Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CAMBRIDGE HEART INC | d8k.htm |

Investor

Presentation June 7, 2010

Exhibit 99.1 |

Forward Looking

Statements 2

Statements in this presentation that are not purely historical are forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995 including, but not

limited to, statements about existing and potential partnerships and distribution

arrangements that Cambridge Heart, Inc. (the “Company”) is, or may become party to,

statements about the Company’s expected launch of the MTWA Module by Cardiac Sciences

Corporation, future operating results, the Company’s belief that the Company’s existing

cash resources are sufficient to fund operations through March 31, 2011, the Company’s

expectations and estimates regarding MTWA Module metrics (i.e., MTWA Module and sensor sales

prices, gross margins and sensor utilization), and product development plans. These

forward-looking statements are based on current expectations and assumptions that are

subject to risks and uncertainties. Actual results could differ materially from the

results expressed or implied in these forward-looking statements. Material deviations

from our current operating plan, including a delay in launching the MTWA Module, lower than

expected sales of the MTWA Module, lower than expected sales of the Heartwave II System, lower than

expected sales prices or gross margins for the MTWA Module and lower than expected sensor utilization by

purchasers of the MTWA Module, may cause or contribute to such differences. Other factors

that may cause or contributed to such differences include failure to achieve broad market

acceptance of the Company’s MTWA technology, failure of our sales and marketing

organization or partners to market our products effectively, inability to hire and retain

qualified clinical applications specialists in the Company's target markets, failure to

obtain or maintain adequate levels of first-party reimbursement for use of the Company's MTWA

test, customer delays in making final buying decisions, decreased demand for the Company's

products, failure to obtain funding necessary to develop or enhance our technology, adverse results in

future clinical studies of our technology, failure to obtain or maintain patent protection for

our technology and overall economic and market conditions. Many of these factors are

more fully discussed, as are other factors, in Part I, Item 1A. “Risk Factors” of

the Company’s Annual Report on Form 10 K for the fiscal year ended December 31, 2009,

which is on file with the SEC and available at www.EDGAR.com. In addition, any

forward-looking statements represent our estimates only as of today and should not be relied upon as

representing our estimates as of any subsequent date. While the Company may elect to update

forward- looking statements at some point in the future, the Company specifically disclaims

any obligation to do so except as may be legally necessary, even if the Company’s estimates

should change. |

Corporate

Mandates Impact the number of deaths from sudden

cardiac arrest (SCA) from today’s 300,000 –

400,000 annual incidents

Make MTWA testing a standard annual

diagnostic assessment of ~12 million high-risk

cardiac patients

Leverage MTWA core technology into new,

broader-based diagnostic cardiac applications

3 |

The

Opportunity New business model, major risks eliminated, attractive

valuation

Key components for success in place

–

Large addressable market of ~ 12 million high risk cardiac patients

–

FDA Clearance

–

CMS and private reimbursement in place

–

Significant IP and clinical validation

–

New marketing partnership set to commence

Recurring revenue stream builds shareholder value

–

Razor/razor-blade model

–

High-margin disposables

4 |

Overview &

Milestones 1980’s: Early research at MIT

1990: CHI was founded

1994: Landmark publication in NEJM

1996: Initial public offering (CAMH)

1996: First 510(k) & CH2000 launch

1999: Regulatory study completed & received FDA labeling claims

2000: HearTwave

I launch

2005: HearTwave

II launch

2006:

NCD

by

CMS,

Class

II-a

Guideline,

Coverage

by

many

private

payers

2007 –

2008: Co-marketing agreement with SJM

2009:

Agreement

with

Cardiac

Science

Corporation

to

develop

and

market

an Alternans module for integration into existing stress platform

2010: MTWA OEM Module 510(k)

5 |

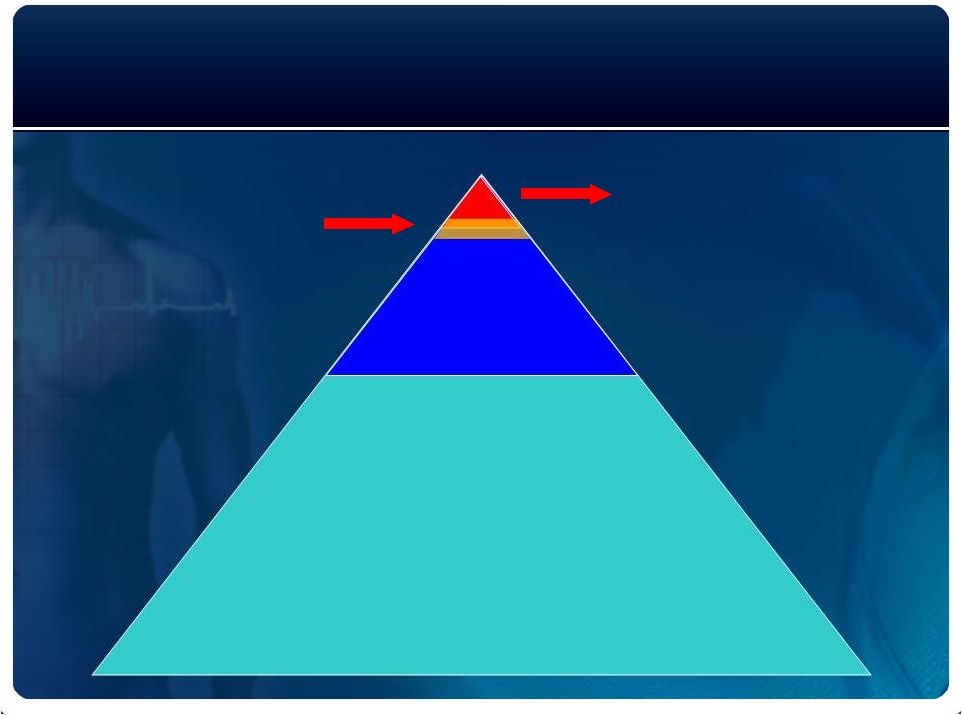

High SCA Risk

Population: Large US Market Opportunity

5 million

Heart Failure

1-2 million

other

8 million

Post MI

~ 12 million

high-risk

individuals

Circulation 2/10/2006 Heart Disease and Stroke Statistics

300,000 –

400,000 deaths per year

6 |

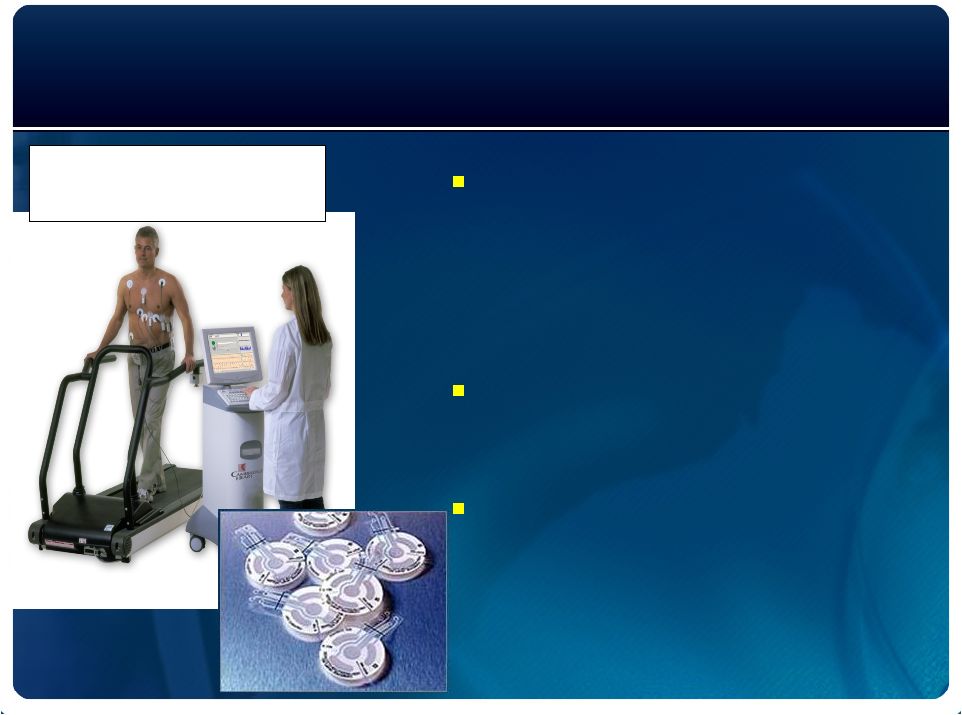

Microvolt

T-Wave Alternans (MTWA) More effective at

identifying at-risk SCA

patients than invasive

electrophysiology (EP) test

Extraordinary negative

predictive value (NPV)

Ensure delivery of

appropriate therapy

HearTwave®

II

7 |

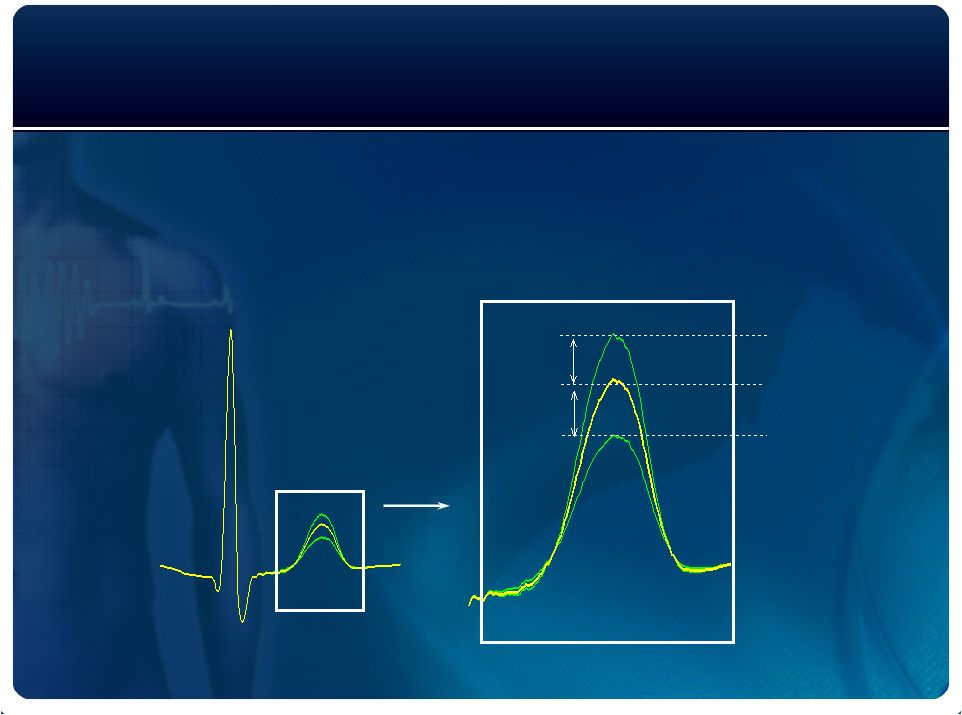

The

Technology MTWA

Analytic Spectral Method

13 patents protect all components of the technology

Even Beats

Odd Beats

Mean

V

alt

V

alt

Q

R

S

T

8 |

Clinical

Validation 200+ publications in peer-reviewed journals

Large prospective clinical trials

–

ALPHA Study -

Boston Scientific

–

ABCD Study –

St. Jude Medical

–

MASTER Study --

Medtronic

–

Ikeda Study

–

Meta

Analysis

–

Hahnloser

(March

2009

HRS

Supplement)

Applicable patient populations

–

Primary

prevention

(ejection

fraction

35%)

–

Post MI

–

Congestive heart failure

–

Syncope

–

Dilated cardiomyopathy

9 |

Class IIa

Guideline

American College of Cardiology/American Heart Assoc./European Society of

Cardiology 2006 Guideline for Management of Patients With Ventricular

Arrhythmias and the Prevention of Sudden Cardiac Death (Developed in

collaboration with the HRS and EHRA)

–

Class IIa

It

is

reasonable

to

use

T-Wave

Alternans

for

improving

the

diagnosis

and

risk

stratification

of

patients with ventricular arrhythmias or who are

at risk for developing life-threatening ventricular

arrhythmias. (Level of Evidence: A)

10 |

CMS National

Coverage “CMS (Medicare) has determined that there is

sufficient evidence to conclude that Microvolt T-

wave Alternans (MTWA) diagnostic testing is

reasonable and necessary

for the evaluation of

patients at risk of sudden cardiac death, only

when the spectral analytic method*

is

used, and CMS is issuing the following national

coverage determination (NCD) for this

indication.”

93025 (3/21/2006)

* Cambridge Heart US Patent # 6,735,466 granted May 2004

11 |

Medicare

Reimbursement National Average: $196

–

Reimbursement is limited if MTWA is performed at

the same time as standard stress, stress echo or

nuclear stress testing

–

Negatively impacts physician’s ability to integrate

MTWA testing for high-risk cardiac

patients

CHI has requested that CMS remove the current

limitations

–

A positive outcome would provide full reimbursement

for both stress and MTWA tests during the same

patient visit

12 |

Private

Coverage Private payers followed CMS:

–

Aetna, Cigna, Humana

–

HCSC, BC/BS of NY, Horizon (NJ), Care First, MI, IA, SD,

MN, KS, Wellmark, Premera, BCBS of AZ

–

Harvard Pilgirim

–

Regionals: GHI, Tufts, Med. Mutual of Ohio, Health Net

Coverage typically for ICD indicated population

Other private payers in progress

13 |

Initial Market

Positioning 14

Historical clinical positioning and marketing

linked MTWA testing to ICD therapy

That positioning limited the market opportunity

and perception of MTWA testing

–

300,000 to 1 million primary prevention patients

–

Focus on EP community and testing of border line patients

–

Entanglement in clinical disagreements on ICD therapy

Additional Challenges

–

Relatively expensive, stand-alone MTWA equipment platform

–

Single product offering and inability to offer a complete

“solution”;

–

Practice integration issues

–

Lack of distribution

–

Economic environment for medical capital equipment |

New Strategic

Direction Position MTWA as a tool to

“assess” and “manage

” an individual’s risk of SCA in the high risk

population

Make MTWA more accessible to the high risk

population

–

Develop multiple product embodiments and industry partnerships

–

Create an attractive physician ROI

–

Simplify practice integration

Re-organize resources on the primary corporate

value driver (i.e. sensor utilization)

15 |

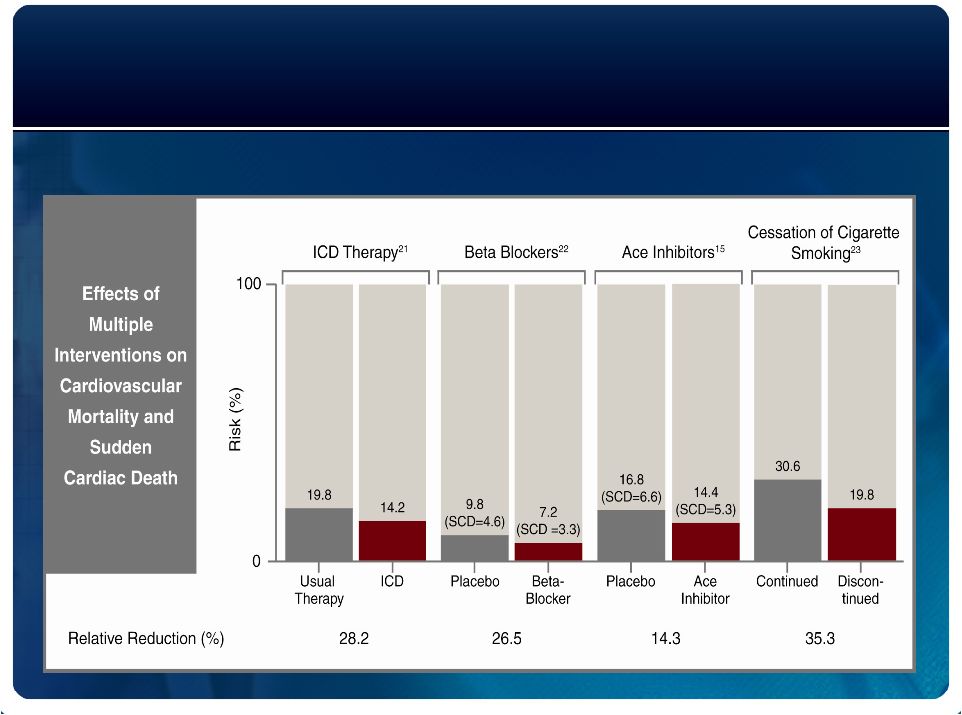

SCA Risk

Management in Preserved EF Population

Non-device interventions for reducing SCA risk

Adapted from Myerburg, NEJM 2009; 360(9):938. |

300,000 –

1,000,000 primary

prevention population

Reluctant / borderline

Patients

New Strategic Direction

~ 12 million

post MI, HF

and other high

risk patients

~ 40,000,000

Cardiac stress tests per year |

OEM Alternans

Module Taps into existing market for stress systems

–

Approximately 4,000 units sold per year (1)

with

an estimated

installed base of 35,000. 40 million tests performed per year.

–

Key players: CSC (39%), GE (30%), Welch Allyn (6%) Schiller

(5%), Mortara

& Philips (4% combined)

(1)

Materially improves physician ROI

–

Reduces technology acquisition costs

–

Maximizes reimbursement

Significantly simplifies practice integration

–

Simplified training

–

Simplified EMR connectivity

(1) Source: Frost & Sullivan, 2009 Report. US market data only.

18 |

First

Partnership Signed Cardiac Science: US stress market leader

–

5 year, non-exclusive, worldwide

–

Partner will market and sell modules and sensors (CHI to drive

utilization)

•

Module end-user pricing in-line with other stress upgrades/options ($5-$8k).

•

End-user sensor pricing in-line with current CHI of $64 to $84 per sensor.

–

Partner will sell directly to the end-user and retain a portion of the

revenue.

Module will be offered as an upgrade to:

–

Partner’s existing installed base of stress systems

–

Partner’s new system sales

Product Launch –

Q3 2010

–

Module development (CHI & CSC) –

Completed in February 2010

–

Regulatory requirements –

510(k) received in April 2010

–

Marketing & sales training –

On-going

19 |

2010 Strategic

Initiatives MTWA Module –

Other Stress Platforms

–

CHI’s

current development work is portable to other manufacturer’s cardiac

stress platforms

MTWA Module –

Other embodiments

–

Ambulatory Holter

platform

–

Event recording services

–

Pacemaker programmer

Heartwave II System

–

Independent/corporate distribution networks

•

Geography not covered by CHI’s

existing direct sales force.

20 |

2010 Strategic

Initiatives Ischemia Application

–

Data suggest MTWA can identify ischemia missed by current tests

–

Pilot study to begin in July 2010

•

PI identified

•

Protocol completed

•

IRB approval in progress

MTWA and Pharmacological Agents

–

Drug development phase

–

Resuscitation of failed drugs

–

Individualized medicine

21 |

The Market

Opportunity Disposable sensor gross margin in excess of 70%

COGS reductions opportunity based on volume

10% Penetration of ~12 million high risk patients:

$60 Million in annual recurring revenue from the sale of

proprietary sensors

25% Penetration of ~12 million high risk patients:

$150 Million in annual recurring revenue from the sale of

proprietary sensors

22 |

MTWA Module

Metrics Upfront Module Revenue

–

$1,000 -

$5,000 (platform/channel dependant)

–

70% -

90% gross margin

Recurring Sensor Revenue

–

$35 -

$70 per MTWA test (platform/channel dependant)

–

+70% gross margin

Possible Range of Sensor Utilization/System

–

70 to 140 sensors/system/year

23 |

Cash Flow

Summary Current Quarterly Revenue -

$800,000 +

20%

–

U.S. HearTwave

Systems

–

U.S. Sensor revenue

–

All other (includes service and ROW sales)

Quarterly Cash Expenditures -

$1,900,000

–

Largely fixed cash expenditures except commissions and minimal COGS

Quarterly Cash Burn -

$1,100,000 plus CAPEX

Cash at March 31, 2010 –

$2.2 million

–

Coupled with proceeds of $2 mm from exercise of Series D Warrants, the

Company believes is sufficient to fund operations through Q1 2011

24 |

Capital

Structure Series C-1 Convertible Preferred (SJM Mar 2007)

–

$12.5 million junior liquidation preference

–

Converts into 4.2 million common shares at $2.99

Series D Convertible Preferred (Dec 2009)

–

Purchased by directors and existing individual and institutional

shareholders

–

$1.8 million senior liquidation preference

–

Converts into 22.6 million common shares at $0.082

–

Short-term warrants to purchase 11 million common shares at

$0.107 (expires 12/31/10); and long-term warrants to purchase 7

million common shares at $0.142 (exercised as of 6/4/10)

Capital Structure (on as converted and exercised basis)

–

111 million common shares issued and outstanding

–

9 million employee/director options (7 mm at $0.16 exercise price)

25 |

The

Opportunity New business model, major risks eliminated, low valuation

Key components for success in place

–

Large addressable market of ~ 12 million high risk cardiac patients

–

FDA Clearance

–

CMS and private reimbursement in place

–

Significant IP and clinical validation

–

New marketing partnership set to commence

Recurring revenue stream builds shareholder value

–

Razor/razor-blade model

–

High-margin disposables

26 |

Investor

Presentation June 7, 2010 |