Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PERDOCEO EDUCATION Corp | d8k.htm |

Career Education Corporation

UBS Global Technology and Services Conference

June 8, 2010

Copyright Career Education Corporation 2010

Exhibit 99.1 |

Mike Graham

Executive Vice President and Chief Financial Officer

Copyright Career Education Corporation 2010 |

During

this

presentation,

we

will

make

forward-looking

statements

subject

to

known

and

unknown

risks

and

uncertainties

that

could

cause

actual

performance

to

differ

materially

from

that

expressed

or

implied

by

the

statements.

These

statements

are

based

on

information

currently

available

to

us.

Some

factors

that

could

cause

actual

results

and

performance

to

differ

are:

•Our

ability

to

comply

with

the

extensive

regulatory

requirements

and

accreditation

requirements

for

school

operations

•Changes

and

uncertainties

in

student

lending

markets

and

federal

and

state

student

financial

aid

programs

•Financial

and

operating

results,

including

new

student

starts

•Our

ability

to

manage

and

grow

our

business

in

current

and

changing

economic,

political,

regulatory

and

competitive

environments

•Litigation,

claims

and

administrative

proceedings

involving

the

company

•Other

risks

described

from

time

to

time

in

our

press

releases

and

our

filings

with

the

Securities

and

Exchange

Commission

We

undertake

no

obligation

to

publicly

release

any

revisions

to

forward-looking

statements

to

reflect

events

or

expectations

after

the

date

of

this

presentation.

We

provide

a

detailed

discussion

of

risk

factors

in

our

SEC

filings

and

encourage

you

to

review

the

filings.

Safe Harbor |

The

Company

has

included

some

non-GAAP

financial

measures

in

this

presentation

to

discuss

the

Company's

financial

results

and

outlook.

As

a

general

matter,

the

Company

uses

these

non-GAAP

measures

in

addition

to

and

in

conjunction

with

results

presented

in

accordance

with

GAAP.

Among

other

things,

the

Company

may

use

such

non-GAAP

financial

measures

in

addition

to

and

in

conjunction

with

corresponding

GAAP

measures,

to

help

analyze

the

performance

of

its

core

business,

in

connection

with

the

preparation

of

annual

budgets,

and

in

measuring

performance

for

some

forms

of

compensation.

In

addition,

the

Company

believes

that

non-GAAP

financial

measures

are

used

by

analysts

and

others

in

the

investment

community

to

analyze

the

Company's

historical

results

and

in

providing

estimates

of

future

performance

and

that

failure

to

report

these

non-GAAP

measures

could

result

in

confusion

among

analysts

and

others

and

a

misplaced

perception

that

the

Company's

results

have

underperformed

or

exceeded

expectations.

These

non-GAAP

financial

measures

reflect

an

additional

way

of

viewing

aspects

of

the

Company's

operations

that,

when

viewed

with

the

GAAP

results

and

the

reconciliations

to

corresponding

GAAP

financial

measures,

provide

a

more

complete

understanding

of

the

Company's

results

of

operations

and

the

factors

and

trends

affecting

the

Company's

business.

However,

these

non-GAAP

measures

should

be

considered

as

a

supplement

to,

and

not

as

a

substitute

for,

or

superior

to,

the

corresponding

measures

calculated

in

accordance

with

GAAP.

Non-GAAP Financial Measures |

Career Education Overview

Purpose:

To

change

lives

through

education.

Purpose:

To

change

lives

through

education.

Bachelors

28%

Masters

4%

Certificate

24%

Associates

44%

21 to 30

43%

Under 21

16%

Over 30

41%

Students by Degree Type

Students by Age

*Demographics as of December 31, 2009

*Student Population and Graduates as of March 31, 2010

Over 116,000 Students

Over 467,000 Graduates |

Population

66,700

28,200

12,200

9,500

% Online

70%

<1%

<1%

# of Campuses

26

38

18

13

Accreditation

Regional

National

National

Program

Emphasis

Business, IT

Health, Design,

Protective

Health

Culinary

Business,

Design

Bachelors

Masters

Certificate

Associates

Career Education:

Diversified Institutions

University

TM

TM

International

Career-focused

*Demographics as of December 31, 2009

* Student Population as of March 31, 2010 |

2009: A Watershed Year

2007-2008

2009

Recognize > Redefine > Reach

Strengthen

foundation

Accelerate

growth

2005

2006

2007

2008

2009

Revenue

+11%

“Watershed”:

“…an

important

point

or

transition

between

two

phases,

conditions,

etc.” |

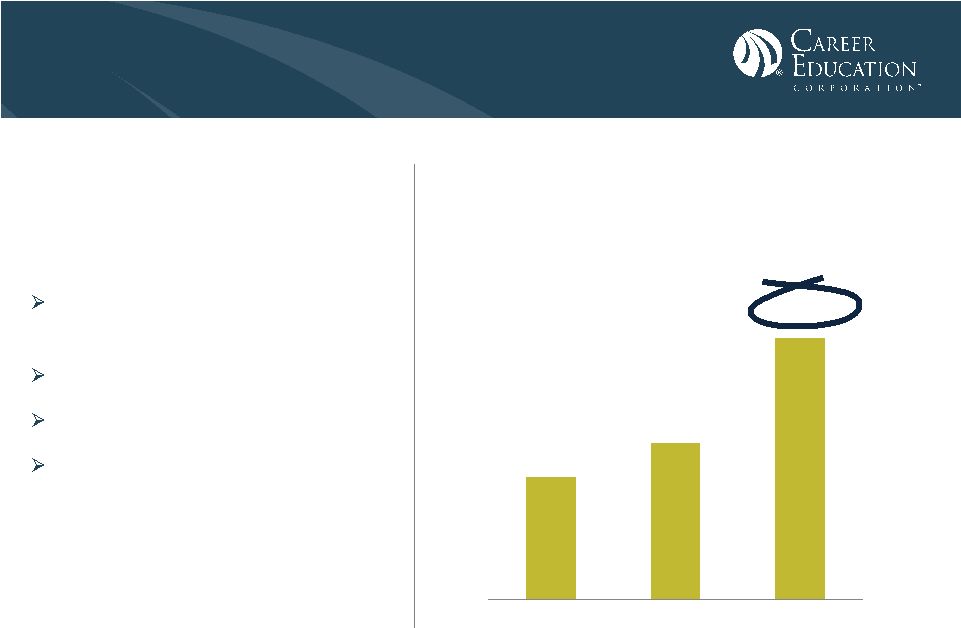

Results…

2007

2008 2009

Operating Income

+75%

In Millions

Student Population

2007

2008 2009

+19% |

Continued

Momentum

in

First

Quarter 2010

•

Revenue increased 22%

•

Operating income increased 72%

•

Earnings per share increased 154%

…results position us well for the balance of the year

Achieved Record Student Population Levels

Achieved Record Student Population Levels

117,000

+24% |

Career Education:

Path Forward

2007-2008

2009

2010+

Recognize > Redefine > Reach

Next Level

•Focus

•Growth

Strengthen

foundation

Accelerate

growth |

Largest Future

Opportunities

Well Positioned in Key Segments

University

•

Significant online

presence

•

Presence in high-

demand programs

Career-

focused

•

Strong position in

largest growth

programs

•

Premier brands in

niche markets

International

TM

TM |

Enablers for Growth

•

Quality

•

Programs

•

Technology

•

Geographic Expansion |

University

42%

Graduation

Rate

/1

73%

Placement

Rate

/2

Career-

focused

57%

Graduation

Rate

/1

81%

Placement

Rate

/2

Enablers for Growth:

Continued Focus on Quality Outcomes

A Simplified View of Complicated Metrics

/1:

Based

on

internal

data

available

of

students

who

graduated

within

150%

of

the

program

length.

University

cohort

is

for

students

starting

calendar

year

2003

and Career-

focused

cohort

is

for

students

starting

calendar

year

2006.

Certain

students

are

excluded

from

cohort

such

as

those

who

died

or

were

disabled

or

those

serving

in

the

armed

forces,

a

foreign

aid

service

or

on

church

missions.

/2:

Based

on

internal

data

available

of

students

graduating

between

7/1/2008

and

6/30/2009

who

have

obtained

employment

within

their

field

or

a

related

field

by

12/31/2009.

Certain

graduates

are

excluded

from

cohort

such

as

those

who

are

continuing

their

education

and

those

that

have

waived

employment

assistance

due

to

death,

disability

or

incarceration,

those

serving

in

the

armed

forces,

those

of

non-immigrant

status

and

those

voluntarily

not

seeking

employment

utilizing

skills

directly or

indirectly

taught

in

their

field

of

study.

TM

TM |

•

CEC institutions expect to

significantly increase 2010

new program introductions

Transplant existing programs

within institutions

Augment current program areas

Enter new program areas

Expand into higher degrees

•

Developed 3-year Pipelines

70

89

150

2008

2009

2010 Est

Number of New Programs

New Programs:

Accelerate Development |

Technology:

Innovative Learning Options

University

•

Flexible learning model to suit

learner’s preference

TM

Health

•

Simpro online simulators for

cognitive skills training |

•

Measured expansion into new

markets

6 to 8 new campuses per year

•

Externship-driven

•

Disciplined real estate

approach

•

Program extensions into higher

degrees leveraging regional

accreditation

Geographic Expansion:

Health Education

2008

2009

2010 Est.

26

34

40 -

42

Number of Health Campuses |

2010

Student Population Growth

15%+

Revenue Growth

15%+

Operating Income Growth

40%+

Annual

Growth

Short-term Milestones -

2010

2010+

Next Level

•Focus

•Growth

•Value

|

8-10%

Low 20’s%

Annual

Revenue

Growth

2010 Target Operating Margin

Short-term Milestones -

2010

International

TM

TM |

2011 -

2014

Student Population Growth

8-10%

Revenue Growth

8-10%

Operating Income Growth

15-20%

Annual

Growth

Long-term Milestones

2010+

Next Level

•Focus

•Growth

•Value

|

8-10%

Low 20’s%

Annual

Revenue

Growth

2014 Target Operating Margin

Long-term Milestones

International

TM

TM |

Continue

to

Generate

Strong

Cash Flow

2007 -

2009 |

Share Repurchase

•

Remain committed to returning

excess cash to shareholders

•

$306 million total authorization as of

April 30, 2010

High ROI Strategic Investments

$85 million in 2010

•

Health Education Start-Ups

•

Chicago-area

Real

Estate

consolidation

•

Culinary Real Estate optimization

Strong Balance Sheet

•

Maintain appropriate ED ratios

•

Disciplined approach to student

payment plans

M&A

•

Disciplined approach

•

Potential for accretive tuck-in

acquisitions across University,

Career Focused and International

•

New Locations

•

New Programs Areas

Uses of Cash |

CEC Strategic Summary

$3 Billion in

2014

Revenue

1Million

Graduates

Outstanding

Share Price

Growth

$3 Billion in

2014

Revenue

1Million

Graduates

Outstanding

Share Price

Growth

Growth

Growth

Strong Market

Trends

Enhance

Program

Development

Investment in

Leading IT

Platform

Utilize Scale &

Resources

Accelerate

M & A and

Geographic

Expansion

+

Focus

Focus

Continue Culture

of Quality and

Compliance

Intentional

Portfolio

Choices

Improved

Marketing

Effectiveness

Leverage Shared

Services

Improve Human

Capital

Management

=

Value

Value

For:

For:

Students

Students

Employees

Employees

Shareholders

Shareholders |

Thank You!

Thank You!

Copyright Career Education Corporation 2010 |