Attached files

| file | filename |

|---|---|

| EX-23.1 - Secure America Acquisition CORP | v187261_ex23-1.htm |

| EX-21.1 - Secure America Acquisition CORP | v187261_ex21-1.htm |

| EX-10.32 - Secure America Acquisition CORP | v187261_ex10-32.htm |

As filed with the Securities and

Exchange Commission on June 4, 2010

Registration

No.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER THE

SECURITIES ACT OF 1933

ULTIMATE

ESCAPES, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

7011

|

26-0188408

|

||

|

(State

or other jurisdiction of

incorporation

or organization)

|

Primary

Standard Industrial

Classification

Code Number

|

(IRS

Employer

Identification

Number)

|

3501

W. Vine Street, Suite 225

Kissimmee,

Florida 34741

(407)

483-1900

(Address,

Including Zip Code and Telephone Number,

Including

Area Code, of Registrant’s Principal Executive Offices)

James

M. Tousignant

President

and Chief Executive Officer

Ultimate

Escapes, Inc.

3501

W. Vine Street, Suite 225

Kissimmee,

Florida 34741

(407)

483-1900

Copies

to:

Alan

I. Annex, Esq.

Jason

Simon, Esq.

Greenberg

Traurig, LLP

MetLife

Building

200

Park Avenue

New

York, NY 10166

(212)

801-9200

(Name,

Address, Including Zip Code and Telephone Number,

Including

Area Code, of Agent for Service)

Approximate date of commencement of

proposed sale to the public: As soon as practicable after the effective

date of this Registration Statement.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. x

If this

form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering.

If this

form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

If this

form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

|

Non-accelerated

filer o (Do

not check if a smaller reporting company)

|

Smaller

reporting company x

|

CALCULATION

OF REGISTRATION FEE

|

Amount to be

Registered

(1)

|

Proposed

Maximum

Offering

Price Per

Share

(2)

|

Proposed

Maximum

Aggregate

Offering

Price

|

Amount of

Registration

Fee

|

|||||||||||||

|

Title of Each

Class of Securities to be Registered

|

||||||||||||||||

|

Warrants,

each to purchase one share of common stock

|

2,075,000 | $ | - | $ | - | $ | - |

(3)

|

||||||||

|

Common

stock, par value $0.0001 per share, issuable upon exercise of

warrants

|

2,075,000 |

(4)

|

$ |

1.20

|

|

2,490,000

|

|

$ |

177.54

|

|

||||||

|

Common

stock, par value $0.0001 per share

|

587,368 | $ |

1.20

|

|

$ |

704,841.60

|

|

$ |

50.26

|

|

||||||

|

Common

stock, par value $0.0001 per share, issuable upon exercise of

warrants

|

10,000,000 |

(5)

|

$ |

1.20

|

|

$ |

12,000,000

|

|

$ |

855.60

|

|

|||||

|

Common

stock, par value $0.0001 per share, issuable upon conversion of ownership

units of Ultimate Escape Holdings, LLC

|

7,556,675 | $ |

1.20

|

|

$ |

9,068,010

|

|

$ |

646.55

|

|

||||||

|

(1)

|

Pursuant to Rule 416 under the

Securities Act of 1933, this Registration Statement also covers any

additional securities that may be offered or issued in connection with any

stock split, stock dividend or similar

transaction.

|

|

|

|

|

(2)

|

Estimated solely for the purpose

of calculating the registration fee pursuant to Rule 457(f)(1) and (3) and

Rule 457(c) under the Securities Act of 1933, based on the average of the

high and low sale prices of the Registrant’s common stock on June

2, 2010, as reported

by the Over-the-Counter bulletin

board.

|

|

(3)

|

Pursuant to Rule

457(g) of the Securities Act, no separate registration fee is required

with respect to the

warrants.

|

|

(4)

|

Issuable upon exercise of the

warrants being registered

hereunder.

|

|

(5)

|

Issuable upon exercise of

outstanding publicly traded

warrants.

|

The Registrant hereby amends this

Registration Statement on such date or dates as may be necessary to delay its

effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act, as amended, or

until this Registration Statement shall become effective on such date as the

Commission, acting pursuant to such Section 8(a), may

determine.

|

The

information in this prospectus is not complete and may be changed. We may

not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an

offer to sell these securities and is not soliciting an offer to buy these

securities in any jurisdiction where the offer or sale is not

permitted.

|

PROSPECTUS

SUBJECT

TO COMPLETION, DATED JUNE 4, 2010

Ultimate

Escapes, Inc.

20,219,043

Shares of Common Stock

2,075,000

Warrants

This

prospectus relates to the issuance by us of 19,631,675 shares of our common

stock, par value $0.0001 per share, of which:

|

|

·

|

10,000,000

shares are issuable upon the exercise of outstanding warrants originally

issued in our initial public offering pursuant to a prospectus dated October 23,

2007;

|

|

|

·

|

2,075,000

shares are issuable upon the exercise of outstanding warrants issued in a

private placement to our founder;

and

|

|

|

·

|

7,556,675

shares of common stock are issuable upon conversion of ownership units of

one of our subsidiaries, Ultimate Escapes Holdings,

LLC.

|

This

prospectus also relates to the resale by selling stockholders of up to (i)

2,075,000 warrants issued in a private placement to our founder and (ii) 587,368

shares of common stock issued to the selling stockholders in private

transactions.

Each warrant entitles the holder to

purchase one share of our common stock. In order to obtain the

shares, the holders of the warrants must pay an exercise price of $8.80 per

share. To the extent that the holders exercise, for cash, all of the

warrants registered for resale under this prospectus, we would receive up to

$18,260,000 in the aggregate from such exercise. We intend to use

such proceeds, if any, for working capital and other general corporate

purposes.

The

selling stockholders may dispose of their shares of common stock or warrants in

a number of different ways and at varying prices. See “Plan of

Distribution.”

Our

common stock and warrants are quoted on the Over-the-Counter bulletin board

(“OTC bulletin board”) maintained by the Financial Industry Regulatory Authority

under the symbol “ULEI” and “ULEIW”, respectively. The closing bid

prices for our common stock and warrants on June 2, 2010 were $1.20 per share

and $0.01 per warrant, respectively, as reported on the OTC bulletin

board.

We may

amend or supplement this prospectus from time to time by filing amendments or

supplements as required. You should read this entire prospectus and any

amendments or supplements carefully before you make your investment

decision.

Investing in our securities involves

risks. You should consider the risks that we have described in “Risk

Factors” beginning on page 6 of this prospectus before buying our

securities.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or

disapproved of these securities or passed upon the adequacy or accuracy of this

prospectus. Any representation to the contrary is a criminal

offense.

The date

of this prospectus is , 2010.

TABLE

OF CONTENTS

|

Page

|

|

|

Prospectus

Summary

|

1

|

|

Risk

Factors

|

6

|

|

Cautionary

Note Regarding Forward-Looking Statements

|

21

|

|

Use

of Proceeds

|

21

|

|

Price

Range of Securities and Dividends

|

21

|

|

Selected

Financial Data

|

23

|

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

24

|

|

Business

|

37

|

|

Management

|

51

|

|

Certain

Relationships and Related Party Transactions

|

61

|

|

Principal

and Selling Stockholders

|

67

|

|

Plan

of Distribution

|

74

|

|

Description

of Securities

|

75

|

|

Legal

Matters

|

80

|

|

Disclosure

of Commission Position on Indemnification for Securities Act

Liabilities

|

80

|

|

Where

You Can Find More Information

|

81

|

|

Index

to Consolidated Financial Statements

|

82

|

You should rely only on the

information contained in this prospectus. Neither the selling stockholders nor

we have authorized any other person to provide you with different information.

If anyone provides you with different or inconsistent information, you should

not rely on it. Neither the selling stockholders nor we are making an offer to

sell these securities in any jurisdiction where the offer or sale is not

permitted. You should assume that the information appearing in this prospectus

is accurate as of the date on the front cover of this prospectus only. Our

business, financial condition, results of operations and prospects may have

changed since that date.

PROSPECTUS

SUMMARY

This

summary highlights basic information about us and this offering. This summary

does not contain all of the information you should consider before investing in

our common stock and warrants. You should read this entire prospectus carefully

before making an investment decision. When we use the words “Company,” “we,”

“us” or “our company” in this prospectus, we are referring to Ultimate Escapes,

Inc., a Delaware corporation, and our subsidiaries, unless it is clear from the

context or expressly stated that these references are only to Ultimate Escapes,

Inc. Unless otherwise indicated, all information contained in this prospectus

assumes that no outstanding stock options or warrants will be exercised. This

prospectus contains forward-looking statements, which involve risks and

uncertainties. Our actual results could differ materially from those anticipated

in these forward-looking statements as a result of certain factors, including

those set forth under “Risk Factors” and elsewhere in this

prospectus.

Our

Company

We

operate a family of luxury destination club offerings, including Elite Club TM

, Signature Club TM

and Premiere Club TM

, with over 1,200 affluent club members, as well as an experienced management

team and increasing market share. We provide club members and their families

with flexible access to a growing portfolio of multi-million dollar club

residences, exclusive member services and resort amenities. We believe that we

offer our club members access to more club destinations than any other luxury

destination club in the world, with over 140 luxury club residences in 45 global

destinations available today in the mainland United States and Hawaii, Mexico,

Central America, the Caribbean and Europe. Elite Club properties have a

target home value of approximately $3 million, Signature Club properties

have a target home value of approximately $2 million and Premiere Club properties have

a target home value of approximately $1 million. As of December 31, 2009, we had

433 Elite Club members,

545 Signature Club

members and 236 Premiere

Club members.

Our

strategy is to combine the privacy and intimacy of multi-million dollar

residences in a wide variety of global resort destinations with “white glove”

member concierge services and club amenities. We offer a unique and compelling

value proposition that is a cost effective vacation alternative for a large,

affluent target market. For the consumer market, a club membership offers a more

flexible, efficient and cost effective vacation alternative as compared with the

high costs, inefficiencies and hassles of second home ownership in this cost

range, the expense, uncertainties and time-consuming effort to rent luxury

villas in the United States and international markets or the high costs and

typical small rooms of luxury hotels. For the corporate market, our corporate

membership option targets the growing multi-billion dollar corporate reward and

incentive market, and offers corporations an affordable, flexible corporate

reward and incentive program for top performing employees, senior executives,

board members, key advisors, existing customers and new prospects.

Our

Industry

Although

there are significant differences between destination club offerings and

timeshare offerings, we believe that the continued growth of luxury destination

clubs will parallel the dramatic growth of timeshare sales over the last 20

years. The increasing wealth of “baby boomers,” coupled with the desirability of

shared-use vacation alternatives, bodes well for continued destination club

growth over many years, particularly given the low 1% market penetration of

qualified buyers of luxury share-use vacation offerings, according to Ragatz

Associates, an international consulting and market research firm in the resort

real estate industry. If luxury destination clubs are able to achieve the same

market penetration in their target market over the next 10 – 20 years as

timeshare operators have achieved over the last 20 years, the luxury destination

club industry could potentially grow from approximately 5,000 club members today

to over 300,000 club members in 10 – 20 years (assuming a 5% market penetration

of Spectrem Group’s estimated 6.7 million “millionaires” in the United States

with assets of at least $1 million and 840,000 “pentamillionaires” in the United

States with assets of at least $5 million), in addition to the large potential

corporate membership market.

1

Our

management believes that the emerging luxury destination club market is still in

its infancy and has many years of continued growth potential when the global

economy improves, as major resort and hospitality brands like the Ritz Carlton

Destination Club and other luxury brands and new market entrants continue to

enter the luxury marketplace. Our management believes that barriers to entry in

the luxury destination club market are increasing and further consolidation is

likely, forcing smaller destination club players to focus on niche markets, sell

to or merge with larger clubs or go out of business. Established hospitality and

resort brands will likely enter the growing luxury destination club market in

greater numbers, as most recently demonstrated by the 2009 launch of the Ritz

Carlton Destination Club. In addition, new destination clubs will continue to

form in Europe and Asia, as well as existing clubs expanding their presence

internationally to address greater affluence and future high growth markets in

Europe and Asia.

Our

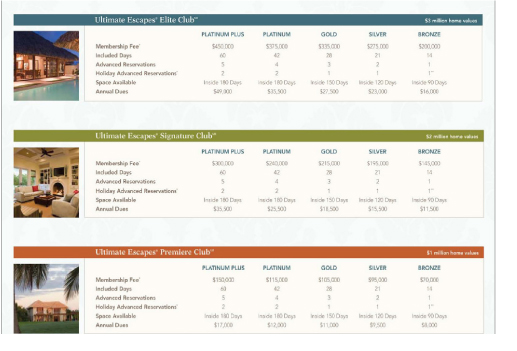

Products and Services

We offer

a variety of club membership plans that provide club members between 14 and 60

days of use annually at a unique collection of club destinations and affiliate

destinations located around the world. Our destination properties are located in

or near resort markets with global tourist and business appeal that offer club

members a world class vacation experience. By combining the best elements of

multi-million dollar single family residences with world class amenities and

concierge service, management believes it has created the best and most

cost-effective option for luxury second-home ownership available in the market

today. Other services provided by us include:

|

|

·

|

The

Ultimate

Collection — provides club members with access to over 140 luxury

four- and five-star hotels in many of the world’s most desirable cities

and resorts throughout the United States, Europe, Asia, the Middle East,

Central America and South America, Africa and

Australia.

|

|

|

·

|

The

Ultimate Rewards

Program — rewards club members who recommend a friend, family

member or business colleague for club membership that subsequently joins

us. Club members can redeem reward points for extra club days, annual

dues, private yacht and jet charters, private chef services, trips to

special events and much more.

|

|

|

·

|

We

have invested millions of dollars in developing a proprietary web-based

technology platform and we are planning to begin using “smart home”

technology in the future to improve our ability to manage club properties,

reduce energy and water consumption and provide club members with a safer

and more comfortable experience and home

environment.

|

Our

Growth Strategy

Our

management expects to achieve strong EBITDA and revenue growth over the next

several years.

Key

elements of our future growth strategy include:

|

|

·

|

Expand

organic sales;

|

|

|

·

|

Pursue

additional acquisitions;

|

|

|

·

|

Continue

global expansion;

|

|

|

·

|

Introduce

new club offerings;

|

|

|

·

|

Pursue

marketing partnerships and joint ventures with real estate developers and

hospitality REITs; and

|

|

|

·

|

Introduce

“private label” offerings with resort and hospitality

brands.

|

2

Corporate

Information

We were

incorporated in Delaware on May 14, 2007 under the name “Fortress America

Acquisition Corporation II” (subsequently changed to Secure America Acquisition

Corporation) as a blank check company for the purpose of acquiring one or more

domestic or international businesses. On October 29, 2009, we consummated a

business combination with Ultimate Escapes Holdings, LLC (“Ultimate Escapes

Holdings”) pursuant to a Contribution Agreement, as amended (the “Contribution

Agreement”), whereby we acquired ownership units in Ultimate Escapes Holdings

and Ultimate Escapes Holdings became a subsidiary of us. In this prospectus, we

refer to our acquisition of Ultimate Escapes Holdings pursuant to the

Contribution Agreement as the “reverse merger,” and we refer to the limited

liability company membership units in Ultimate Escapes Holdings as “ownership

units.” Effective upon the consummation of the reverse merger, we changed our

name to Ultimate Escapes, Inc. Prior to the consummation of the reverse merger,

on September 15, 2009, Ultimate Escapes Holdings acquired all of the assets and

business of its former parent company Ultimate Resort Holdings, LLC (“Ultimate

Resort Holdings”) and also acquired a majority of the assets and business of

Private Escapes Destination Clubs (“Private Escapes”).

Our

principal executive offices are located at 3501 West Vine Street, Suite 225,

Kissimmee, Florida 34641, and our telephone number is (407) 483-1900. Our

website is www.ultimateescapes.com. The

information contained in our website is not a part of this

prospectus.

Public

Stockholders’ Warrants

Each

warrant issued in our initial public offering entitles the registered holder to

purchase one share of our common stock at a price of $8.80 per share. As of

April 30, 2010, 10,000,000 of these public warrants were issued and outstanding.

The warrants, none of which have been exercised as of April 30, 2010, will

expire on October 29, 2013 at 5:00 p.m., New York City time.

We may

call the warrants for redemption at any time beginning one year after the

completion of the reverse merger:

|

|

•

|

in

whole and not in part;

|

|

|

•

|

at

a price of $0.01 per warrant at any time after the warrants become

exercisable;

|

|

|

•

|

upon

not less than 30 days’ prior written notice of redemption to each warrant

holder; and

|

|

|

•

|

if,

and only if, after the expiration of one year after the reverse merger,

the reported last sale price of the common stock equals or exceeds $15.05

per share for any 20 trading days within a 30-trading day period ending on

the third business day prior to the notice of redemption to

warrantholders.

|

The

warrants may be exercised upon surrender of the warrant certificate on or prior

to the expiration date at the offices of the warrant agent, with the exercise

form on the reverse side of the warrant certificate completed and executed as

indicated, accompanied by full payment of the exercise price, by certified check

payable to us, for the number of warrants being exercised. The warrant holders

do not have the rights or privileges of holders of common stock or any voting

rights until they exercise their warrants and receive shares of common stock.

After the issuance of shares of common stock upon exercise of the warrants, each

holder will be entitled to one vote for each share held of record on all matters

to be voted on by stockholders.

Sponsor

Warrants

Secure

America Acquisition Holdings, LLC, our principal initial stockholder, purchased,

in a private placement that occurred immediately prior to our initial public

offering, warrants to purchase up to 2,075,000 shares of our common stock (the

“sponsor warrants”), exercisable at a per-share price of $8.80. The sponsor

warrants are identical to the public stockholder warrants, except that (i) the

sponsor warrants are not subject to redemption so long as the sponsor warrants

are held by Secure America Acquisition Holdings, LLC or its members as of the

date of the issuance of the sponsor warrants, (ii) the sponsor warrants may be

exercised on a cashless basis whereas the public stockholder warrants cannot be

exercised on a cashless basis, and (iii) upon an exercise of the sponsor

warrants, the holders of the sponsor warrants will receive unregistered shares

of our common stock.

The

sponsor warrants, unlike the public stockholder warrants, may be exercised on a

cashless basis. Exercises on a cashless basis enable the holder to convert the

value in the warrant (the fair market value of the common stock minus the

exercise price of the warrant) into shares of common stock.

3

THE

OFFERING

|

Shares Offered by the

Company

|

19,631,675

shares of common stock, par value $0.0001 per share, of

which:

|

|

|

·

10,000,000 shares are issuable upon the exercise of outstanding

warrants originally issued in our initial public

offering;

|

||

|

·

2,075,000 shares are issuable upon the exercise of outstanding

warrants issued in a private placement to our founder;

and

|

||

|

·

7,556,675 shares of our common stock are issuable upon conversion

of ownership units of one of our subsidiaries, Ultimate Escapes Holdings

(“Conversion

Shares”).

|

||

|

Shares and/or Warrants Offered

by Selling Stockholders

|

(i) 2,075,000

warrants issued in a private placement to our founder; and (ii) 587,368

shares of common stock issued to the selling stockholders in private

transactions

|

|

|

Warrant Exercise

Price

|

$8.80

per share

|

|

|

Common Stock Outstanding as of

April 30, 2010

|

2,759,094

shares

|

|

|

Common Stock to be Outstanding

Assuming Exercise of All of the Warrants and Issuance of Conversion

Shares

|

22,390,769 shares

|

|

|

Use of

Proceeds

|

We

will receive up to an aggregate of $18,260,000 from the exercise of the

warrants, if they are exercised in full. We expect that any net proceeds

from the exercise of the warrants will be used for general corporate

purposes and to fund working capital.

|

|

|

The

selling stockholders will receive all of the proceeds from the sale of any

shares of common stock and/or warrants sold by them pursuant to this

prospectus. We will not receive any proceeds from these

sales.

|

||

|

OTC Bulletin Board

Symbols:

|

||

|

Common

Stock

|

ULEI

|

|

|

Warrants

|

ULEIW

|

4

Summary

Consolidated Financial Data

Because

the business combination with Ultimate Escapes Holdings was considered a reverse

acquisition and recapitalization for accounting purposes, the historical

financial statements of Ultimate Escapes Holdings became our historical

financial statements. On September 15, 2009, Ultimate Resort Holdings

contributed all of its assets and liabilities to its wholly-owned subsidiary,

Ultimate Escapes Holdings. On September 15, 2009, Private Escapes contributed a

majority of its assets, liabilities, properties and other rights to Ultimate

Escapes Holdings in exchange for an 8% ownership interest in Ultimate Escapes

Holdings. Accordingly, the operating results of Private Escapes are

included in our consolidated financial statements from September 16,

2009.

The

following table summarizes our consolidated financial data. Our summary

consolidated financial data is derived from our audited consolidated financial

statements as of December 31, 2009 and for the years ended December 31, 2009 and

2008, which are included elsewhere in this prospectus. The information provided

below is only a summary and should be read in conjunction with our consolidated

financial statements and related notes and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” contained elsewhere in this

prospectus.

|

As of and for the Three Months

Ended March 31,

|

As of and for the Years

Ended December 31,

|

|||||||||||||||

|

|

2010

|

2009

|

2009

|

2008

|

||||||||||||

|

|

(unaudited)

|

(unaudited)

|

|

|

||||||||||||

|

|

(In thousands)

|

|||||||||||||||

|

Statement

of Operations Data:

|

|

|

|

|

||||||||||||

|

Revenues

|

$ | 7,315 | $ | 8,628 | $ | 37,011 | $ | 22,541 | ||||||||

|

Operating

income (loss)

|

(3,714 | ) | 1,048 | (3,411 | ) | (13,763 | ) | |||||||||

|

Net

loss

|

(6,472 | ) | (1,224 | ) | (12,965 | ) | (23,222 | ) | ||||||||

|

Balance

Sheet Data:

|

||||||||||||||||

|

Total

assets

|

$ | 198,688 | N/A | $ | 207,616 | $ | 131,498 | |||||||||

|

Working

capital

|

(34,372 | ) | N/A | (32,711 | ) | (8,917 | ) | |||||||||

|

Owners’

equity

|

(29,091 | ) | N/A | (22,986 | ) | (36,927 | ) | |||||||||

5

RISK

FACTORS

Our

business, industry and common stock are subject to numerous risks and

uncertainties. The discussion below sets forth all of such risks and

uncertainties that are material and presently known to us. Any of the following

risks, if realized, could materially and adversely affect our revenues,

operating results, profitability, financial condition, prospects for future

growth and overall business, as well as the value of our common stock and

warrants.

Risks

Related to Our Company

We

have a history of losses, and may never achieve or sustain

profitability.

We

incurred substantial losses, and we may continue to incur substantial losses in

the future. We incurred net losses of $6.5 million, $13.0 million and $23.2

million during the three months ended March 31, 2010, the year ended December

31, 2009 and the year ended December 31, 2008, respectively. We have also

experienced a decrease in new club membership sales and existing club member

upgrades during 2009 and the

first four months of 2010. These circumstances raise substantial

doubt about our ability to continue to fund operating losses and provide

necessary operating liquidity. Even if we do achieve profitability, we may be

unable to sustain or increase our profitability in the future.

We

have received a report from our independent registered public accounting firm

expressing doubt regarding our ability to continue as a going

concern.

Our

independent registered public accounting firm noted in their report accompanying

our consolidated balance sheets of December 31, 2009 and 2008 and the related

consolidated statements of operations, changes in owners’ equity (deficit) and

cash flows for the years ended December 31, 2009 and 2008 that our recurring

losses from operations and ongoing requirements for additional capital

investment raise substantial doubt about our ability to continue as a going

concern. Management plans to maintain our viability as a going concern

by:

|

|

§

|

if

necessary, selling selected club

properties;

|

|

|

§

|

closely

maintaining and reducing operating expenses;

and

|

|

|

§

|

seeking

to raise additional working

capital.

|

We cannot assure you that our plans

will be successful. This doubt about our ability to continue as a going concern

could adversely affect our ability to obtain additional financing at favorable

terms, if at all, as such an opinion may cause investors to have reservations

about our long-term prospects, and may adversely affect our relationship with

customers and others. If we cannot successfully continue as a going concern, our

stockholders may lose their entire investment in us.

Our

business is capital intensive and the lack of available financing to fund the

acquisition of additional destination club properties and our operations could

adversely affect our ability to maintain and grow our club membership base which

could adversely affect our business, financial condition and results of

operations.

In order

for our destination clubs to remain attractive and competitive, we have to spend

a significant amount of money to keep the properties well maintained, modernized

and refurbished and to add new luxury properties periodically to our portfolio

of destination club properties as we add new club members. This creates an

ongoing need for cash and, to the extent we cannot fund expenditures from cash

generated by operations, funds must be borrowed or otherwise obtained. We could

finance future expenditures from any of the following sources:

|

|

•

|

cash

flow from operations;

|

|

|

•

|

non-recourse,

sale-leaseback or other

financing;

|

6

|

|

•

|

bank

borrowings;

|

|

|

•

|

annual

dues increases or club member

assessments;

|

|

|

•

|

public

and private offerings of debt or

equity;

|

|

|

•

|

sale

of existing real estate; or

|

|

|

•

|

some

combination of the above.

|

We might

not be able to obtain financing for future expenditures on favorable terms or at

all, which could inhibit our ability to continue to grow. Events during 2008 and

2009, including the failures and near failures of numerous financial services

companies and the decrease in liquidity and available equity and debt capital

have negatively impacted the capital markets for real estate investments.

Accordingly, our financial results have been and may continue to be impacted by

the cost and availability of funds needed to grow our business.

We

have a substantial amount of indebtedness, which could adversely affect our

financial position.

We have a

substantial amount of indebtedness. As of March 31, 2010, we had total debt of

approximately $120 million, consisting of $96 million of borrowings under our

senior secured credit facility and $24 million of additional debt obligations

secured by destination club properties. Our senior secured credit facility is an

amended and restated revolving credit facility with CapitalSource, secured by

our real estate assets, which will mature on April 30, 2011, subject to

extension by us for up to two one-year periods. The maximum principal amount

available to us under the credit facility is currently approximately $95

million, subject to a maximum borrowing base amount, calculated as a percentage

of the appraisal value of all owned property encumbered by a mortgage in favor

of CapitalSource. In addition, the revolving credit facility has minimum loan

amortization amounts that require cumulative amortization of $10,300 by June 30,

2010 and $17,800 by December 31, 2010, with the remaining balance due on April

30, 2011 if we do not elect an extension. If we elect a first

one-year extension, then cumulative amortization must be $22,800 by June 30,

2011 and $25,300 by December 31, 2011, with the remaining balance due on April

30, 2012 if we do not exercise a second extension. If we exercise the

second one-year extension, then cumulative amortization must be $27,800 by June

30, 2012 and $30,300 by December 31, 2012, with the remaining balance due by

April 30, 2013. The revolving credit facility includes financial and

operational covenants that limit our ability to incur additional indebtedness

and pay dividends as well as purchase or dispose of significant assets.

Covenants in the revolving credit facility include obligations to maintain a

cash coverage amount of one month’s debt service as of June 30, 2010 through

September 29, 2010, two months debt service from September 30, 2010 through

December 30, 2010, and three months debt service after December 31, 2010, to

maintain a leverage ratio between debt and consolidated net worth of no more

than 3.5 to 1, to comply with specified ratios of number of club properties to

club members, to have a net loss of no more than $10 million in fiscal

2009 and $5 million in fiscal 2010, and to have net income in each year

thereafter (as adjusted in each year for the non-refundable portion of new

member initiation fees not yet recognized in income and, in 2009, for non-cash

stock-based compensation), and to maintain a consolidated debt ratio of no more

than 80%. Although we believe that we are in compliance with all of the

covenants in the revolving credit facility, we have previously violated certain

covenants contained in our prior revolving credit facility with CapitalSource,

which covenant violations were waived by the lender, we cannot provide any

assurance that in the future, if we were to need a waiver of a breach of a

covenant, that such a waiver would be granted. In addition, we have

approximately $24 million in additional indebtedness secured by real estate

assets with various first and second mortgage lenders. In the event we default

on our secured debt obligations, the lenders could enforce their rights under

the loan agreements, which would impair our ability to conduct our business and

have a material adverse effect on our business, financial condition and results

of operations. If we are unable to make payments on one or more mortgages on the

properties or otherwise default on our debt obligations, the lenders could

foreclose on such properties, which would have a material adverse effect on our

business, financial condition and results of operations. We may also incur

significant additional indebtedness in the future. Our substantial indebtedness

may:

|

|

•

|

make

it difficult for us to satisfy our financial obligations, including making

scheduled principal and interest payments on our

indebtedness;

|

7

|

|

•

|

limit

our ability to borrow additional funds for working capital, capital

expenditures, acquisitions or other general business

purposes;

|

|

|

•

|

limit

our ability to use our cash flow or obtain additional financing for future

working capital, capital expenditures, acquisitions or other general

business purposes;

|

|

|

•

|

require

us to use a substantial portion of our cash flow from operations to make

debt service payments;

|

|

|

•

|

limit

our flexibility to plan for, or react to, changes in our business and

industry;

|

|

|

•

|

place

us at a competitive disadvantage compared to less leveraged competitors;

and

|

|

|

•

|

increase

our vulnerability to the impact of adverse economic and industry

conditions.

|

We

may not be able to generate sufficient cash to service our debt

obligations.

Our

ability to make payments on and to refinance our indebtedness will depend on our

financial and operating performance, which is subject to prevailing economic and

competitive conditions and to certain financial, business and other factors

beyond our control. We may be unable to maintain a level of cash flows from

operating activities sufficient to permit us to pay the principal, premium, if

any, and interest on our indebtedness.

If our

cash flows and capital resources are insufficient to fund our debt service

obligations, we may be forced to reduce or delay investments and capital

expenditures, or to sell assets, seek additional capital or restructure or

refinance our indebtedness. These alternative measures may not be successful and

may not permit us to meet our scheduled debt service obligations. In the absence

of such operating results and resources, we could face substantial liquidity

problems and might be required to dispose of material assets or operations to

meet our debt service and other obligations. Our senior secured credit agreement

restricts our ability to dispose of assets, and requires the use of proceeds

from any disposition of assets to repay our indebtedness. We may not be able to

consummate those dispositions or to obtain the proceeds that we could realize

from them and these proceeds may not be adequate to meet any debt service

obligations then due.

The

luxury vacation industry is highly competitive and we are subject to risks

relating to competition that may adversely affect our performance.

We

operate principally in the luxury vacation industry and compete against numerous

global, regional and boutique destination clubs; as well as other shared usage

or interval ownership resort and vacation property companies, real estate

developers and sponsors; vacation home owners, brokers and managers; resort

sponsors and managers; and, more broadly, luxury resorts and other

transient/leisure accommodations; as well as alternative leisure and recreation

categories, such as golf clubs or other club membership organizations. We have

encountered and expect to encounter in the future intense competition from our

rivals in the destination club industry and from other companies offering

competitive products and services. Many of our competitors have greater consumer

recognition or resources and/or more established and familiar products than us.

The factors that we believe are important to customers include:

|

|

•

|

number

and variety of club destinations available to club

members;

|

|

|

•

|

quality

of member services and concierge

services;

|

|

|

•

|

quality

of destination club properties;

|

|

|

•

|

pricing

of club membership plans;

|

|

|

•

|

type

and quality of resort amenities

offered;

|

8

|

|

•

|

reputation

of club;

|

|

|

•

|

destination

club properties in proximity to major population

centers;

|

|

|

•

|

availability

and cost of air and ground transportation to destination club properties;

and

|

|

|

•

|

ease

of travel to resorts (including direct flights by major

airlines).

|

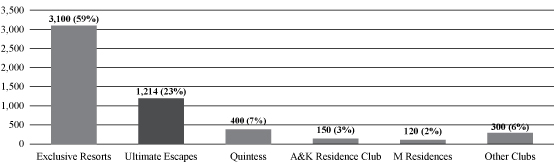

We have

many competitors for our club members, including other major resort destinations

worldwide. We also directly compete with other destination clubs, such as

Exclusive Resorts, which is the largest company in the destination club

marketplace, as measured by number of club members. Our destination club members

can choose from any of these alternatives.

We

compete with numerous other resorts that may have greater financial resources

than we do and that may be able to adapt more quickly to changes in customer

requirements or devote greater resources to promotion of their offerings than we

can. We believe that developing and maintaining a competitive advantage will

require continued investment in our technology platform, brand, existing

destination club properties and the acquisition of additional luxury properties

to our portfolio of destination club properties. There can be no assurance that

we will have sufficient resources to make the necessary investments to do so, or

that we will be able to compete successfully in this market or against such

competitors.

We

are subject to the operating risks common to the luxury vacation industry which

could adversely affect our business, financial condition and results of

operations.

Our

business is subject to numerous operating risks common to the luxury vacation

industry. Some of these risks include:

|

|

•

|

impact

of war and terrorist activity (including threatened terrorist activity)

and heightened travel security measures instituted in response

thereto;

|

|

|

•

|

travelers’

fears of exposure to contagious

diseases;

|

|

|

•

|

decreases

in the demand for transient rooms and related lodging services, including

a reduction in personal and business travel as a result of general

economic conditions;

|

|

|

•

|

cyclical

over-building in the vacation ownership

industry;

|

|

|

•

|

restrictive

changes in zoning and similar land use laws and regulations or in health,

safety and environmental laws, rules and regulations and other

governmental and regulatory action;

|

|

|

•

|

changes

in travel patterns;

|

|

|

•

|

the

costs and administrative burdens associated with compliance with

applicable laws and regulations, including, among others, franchising,

timeshare, privacy, licensing, labor and employment, and regulations under

the Office of Foreign Assets Control and the Foreign Corrupt Practices

Act;

|

|

|

•

|

the

availability and cost of capital to allow us to fund acquisitions of

additional destination club properties, renovations and

investments;

|

|

|

•

|

disruptions

in relationships with third parties, including marketing alliances and

affiliations with luxury resort property

owners;

|

|

|

•

|

foreign

exchange fluctuations; and

|

9

|

|

•

|

the

financial condition of the airline industry and the impact on air

travel.

|

The

matters described above could result in a decrease in the number, or lack of

growth, in our destination club members and could have a material adverse effect

on the luxury vacation industry, which in turn could have a material adverse

effect on our business, financial condition and results of

operations.

The

current slowdown in the travel industry and the global economy generally will

continue to impact our financial results and growth.

The

present economic slowdown and the uncertainty over its breadth, depth and

duration has had a negative impact on the luxury vacation

industry. The current downturn in the economy has reduced, and may in

the future reduce the demand for our destination club memberships and may

increase club member resignations and redemptions. Accordingly, our financial

results have been impacted by the economic slowdown and both our future

financial results and growth could be further harmed if the recession continues

for a significant period or becomes worse.

We

are subject to the risks that generally relate to real estate investments, which

may have a material adverse effect on our business, financial condition and

results of operations.

We are

subject to the risks that generally relate to investments in real property

because we own most of our destination club properties. The investment returns

available from equity investments in real estate depend in large part on the

amount of income earned and capital appreciation generated by the related

properties, and the expenses incurred. In addition, a variety of other factors

affect income from properties and real estate values, including governmental

regulations, insurance, zoning, tax and eminent domain laws, interest rate

levels and the availability of financing. When interest rates increase, the cost

of acquiring, developing, expanding or renovating real property increases and

real property values may decrease as the number of potential buyers decreases.

Similarly, as financing becomes less available, it becomes more difficult both

to acquire and to sell real property. In addition, our loan facility restricts

our ability to sell our assets, including our real estate holdings. Finally,

under eminent domain laws, governments can take real property. Sometimes this

taking is for less compensation than the owner believes the property is worth.

Any of these factors could have a material adverse impact on our results of

operations or financial condition. In addition, equity real estate investments

are difficult to sell quickly and we may not be able to adjust our portfolio of

owned properties quickly in response to economic or other conditions. If our

properties do not generate revenue sufficient to meet operating expenses,

including debt service and capital expenditures, our income and financial

condition will be adversely affected. The real estate investment industry is

susceptible to trends in the national and/or regional economies and there can be

no assurance that we can operate our destination club properties and then later

sell any or all of them at a profit.

The

need for ongoing property renovations could adversely affect our business,

financial condition and results of operations.

Our

properties require routine maintenance as well as periodic renovations and

capital improvements. Ongoing renovations at a particular property may

negatively impact the desirability of the property as a vacation destination. A

significant decrease in the supply of available vacation rental accommodations

and the need for vacation rental services during renovation periods, coupled

with the inability to attract vacationers to properties undergoing renovations,

could have a material adverse effect on our business, financial condition and

results of operations.

10

Environmental

liabilities, including claims with respect to mold or hazardous or toxic

substances, could have a negative impact on our reputation and cause us to incur

additional expense to remedy any such liability or claim.

Under

various federal, state, local and foreign environmental laws, ordinances and

regulations, a current or previous property owner of real property may be liable

for the costs of removal or remediation of hazardous or toxic substances,

including mold, on, under or in such property. These laws could impose liability

without regard to whether we knew of, or were responsible for, the presence of

hazardous or toxic substances. The presence of hazardous or toxic substances, or

the failure to properly clean up such substances when present, could jeopardize

our ability to develop, use, sell or rent the real property or to borrow using

the real property as collateral. If we arrange for the disposal or treatment of

hazardous or toxic wastes, we could be liable for the costs of removing or

cleaning up wastes at the disposal or treatment facility, even if we never owned

or operated that facility. Other laws, ordinances and regulations could require

us to manage, abate or remove lead or asbestos containing materials. Similarly,

the operation and closure of storage tanks are often regulated by federal,

state, local and foreign laws. Certain laws, ordinances and regulations,

particularly those governing the management or preservation of wetlands, coastal

zones and threatened or endangered species, could limit our ability to develop,

use, sell or rent our real property.

We cannot

provide any assurances that environmental issues will not exist with respect to

any destination club property we own or acquire. Even if environmental

inspections are made, environmental issues may later be determined to exist

because the inspections were not complete or accurate or environmental releases

migrate to the properties from adjacent property. In addition to liability for

environmental issues which can substantially adversely impact our business and

financial condition, the marketability of the destination club properties for

sale or refinancing can be adversely affected because of the concerns of a third

party who may buy or lend money on the properties over the possible

environmental liability and/or environmental clean-up costs. In addition, our

reputation may be damaged by any alleged claim or incurrence of environmental

liabilities, which could reduce demand for our destination club memberships and

have a material adverse effect on our business.

We

own properties that are located internationally and thus are subject to special

political and monetary risks not generally applicable to our domestic

properties.

We

operate properties located abroad which, as of December 31, 2009, included 44

properties in 12 international locations. We intend to expand our portfolio of

international destination club properties. Properties abroad generally are

subject to various political, geopolitical, and other risks that are not present

or are different in the United States. These risks include the risk of war,

terrorism, civil unrest, expropriation and nationalization and regulation, as

well as the impact in cases in which there are inconsistencies between U.S. law

and the laws of an international jurisdiction. In addition, sales in

international jurisdictions typically are made in local currencies, which

subject us to risks associated with currency fluctuations. Currency devaluations

and unfavorable changes in international monetary and tax policies could have a

material adverse effect on our profitability and financing plans, as could other

changes in the international regulatory climate and international economic

conditions, in the event that we increase our operation of properties

abroad.

We

have a limited operating history, which may make it difficult to predict our

future performance.

We have

been operating only since 2004 and therefore do not have an established

operating history. In addition, the acquisition of certain assets and

liabilities of Private Escapes was consummated on September 15, 2009, and as a

result we now have a much larger base of club members, club properties and

employees to manage and operate. Consequently, any predictions you make about

our future success or viability may not be as accurate as they could be if we

had a longer operating history.

We

may experience financial and operational risks in connection with acquisitions.

In addition, businesses acquired by us may incur significant losses from

operations or experience impairment of carrying value.

We

completed our acquisition of certain assets and liabilities of Private Escapes

on September 15, 2009, and intend to selectively pursue other acquisitions.

However, we may be unable to identify attractive acquisition candidates or

complete transactions on favorable terms. In addition, in the case of acquired

assets or businesses, we may need to:

|

|

•

|

successfully

integrate the operations, as well as the accounting, financial and

disclosure controls, management information, technology, human resources

and other administrative systems, of acquired businesses with existing

operations and systems;

|

|

|

•

|

maintain

third party relationships previously established by acquired

companies;

|

11

|

|

•

|

retain

senior management and other key personnel at acquired businesses;

and

|

|

|

•

|

successfully

manage acquisition-related strain on our and/or the acquired businesses’

management, operations and financial

resources.

|

We may

not be successful in addressing these challenges or any others encountered in

connection with historical and future acquisitions. In addition, the anticipated

benefits of one or more acquisitions may not be realized and future acquisitions

could result in potentially dilutive issuances of equity securities and/or the

assumption of contingent liabilities. Also, the value of goodwill and other

intangible assets acquired could be impacted by one or more unfavorable events

or trends, which could result in impairment charges. The occurrence of any of

these events could adversely affect our business, financial condition and

results of operations.

We

may not be able to achieve our growth objectives.

We may

not be able to achieve our objectives for maintaining our existing club members,

increasing our number of new club members through organic growth, acquisitions

and acquiring additional luxury properties to add to our portfolio of

destination club properties. Our ability to complete acquisitions of additional

properties depends on a variety of factors, including our ability to obtain

financing on acceptable terms and requisite lender and government approvals.

Even if we are able to complete acquisitions of additional luxury properties, we

may not be able to grow our club membership base or effectively integrate such

acquisitions.

Extensive

laws and government regulations could affect the way we conduct our business

plan.

Our

business exists in a regulatory environment that is changing and evolving and

where certain regulatory matters are currently uncertain. Such matters include,

but are not limited to, the question of whether our destination club memberships

constitute timeshare/vacation ownership plans or timeshare use plans, as well as

whether such club memberships being offered may constitute the offering of

unregistered securities under the US federal and/or state securities laws. We

believe that our club membership sales do not constitute timeshare/vacation

ownership plans or timeshare use plans, nor do they constitute offers of

securities under any federal or state laws or regulations. If, however, the club

membership sales were determined to constitute timeshare/vacation ownership

plans or timeshare use plans, or be deemed to be securities under any state or

federal law, we would be required to comply with applicable state timeshare

regulations or state and federal securities laws, including those laws

pertaining to registration or qualification of securities, licensing of

salespeople and other matters. If we cannot comply with the applicable timeshare

regulations or state and federal securities requirements, in that event, and/or

the determination may create liabilities or contingencies, including rescission

rights relating to the club memberships we previously sold, as well as fines and

penalties that could adversely affect our business, financial condition and

results of operations.

If

we are unable to obtain the necessary permits and approvals in connection with

our acquisition of destination club properties, it may have a material adverse

effect on our business.

We intend

to continue to acquire additional destination club properties for our portfolio.

To successfully acquire and operate the properties as intended, we and/or our

subsidiaries must apply for and receive any necessary federal, state and/or

local and foreign permits and licenses as may be applicable to the properties.

We expect to receive such necessary permits and approvals; however, there can be

no assurance that such permits and approvals will be obtained. Failure to

receive the necessary permits and approvals could prohibit or substantially and

adversely impact our operations.

Increased

insurance risk, perceived risk of travel and adverse changes in economic

conditions as a result of recent events could significantly reduce our cash

flow, revenues and earnings.

We

believe that insurance and surety companies are re-examining many aspects of

their business, and may take actions including increasing premiums, requiring

higher self-insured retentions and deductibles, requiring additional collateral

on surety bonds, reducing limits, restricting coverages, imposing exclusions,

such as mold damage, sabotage and terrorism, and refusing to underwrite certain

risks and classes of business. Any increased premiums, mandated exclusions,

change in limits, coverages, terms and conditions or reductions in the amounts

of bonding capacity available may adversely affect our ability to obtain

appropriate insurance coverages at reasonable costs, which could significantly

reduce our business cash flow, revenues and earnings.

12

The

illiquidity of real estate investments could significantly limit our ability to

respond to adverse changes in the performance of our properties and

significantly reduce our cash flow, revenues and earnings.

Because

real estate investments are relatively illiquid, our ability to promptly sell

one or more of our properties in response to changing economic, financial and

investment conditions is limited. We cannot predict whether we will be able to

sell any property for the price or on the terms set by us, or whether any price

or other terms offered by a prospective purchaser would be acceptable to us. We

also cannot predict the length of time needed to find a willing purchaser and to

close the sale of a property.

We may be

required to expend funds to correct defects or to make improvements before a

property can be sold. We may not have funds available to correct those defects

or to make those improvements and as a result our ability to sell the property

would be limited. In acquiring a property, we may agree to lock-out provisions

that materially restrict us from selling that property for a period of time or

impose other restrictions on us. These factors and any others that would impede

our ability to respond to adverse changes in the performance of our properties

could significantly reduce our cash flow, revenues and earnings.

We

are subject to litigation in the ordinary course of business which could be

costly and time consuming.

We are,

from time to time, subject to various legal proceedings and claims, either

asserted or unasserted. Any such claims, whether with or without merit, could be

time-consuming and expensive to defend and could divert management’s attention

and resources. Although our management believes that we have adequate insurance

coverage and accrues loss contingencies for all known matters that are probable

and can be reasonably estimated, we cannot assure that the outcome of all

current or future litigation will not be costly and time consuming and otherwise

divert management’s attention away from operating the business.

Fluctuations

in real estate values may require us to write down the book value of real estate

assets.

Under

United States generally accepted accounting principles, we are required to

assess the impairment of our long-lived assets whenever events or changes in

circumstances indicate that the carrying value may not be recoverable. Factors

management considers that could trigger an impairment review include significant

underperformance relative to minimum future operating results, significant

change in the manner of use of the assets, significant technological or industry

changes, or changes in the strategy for our overall business. When we determine

that the carrying value of certain long-lived assets is impaired, an impairment

loss equal to the excess of the carrying value of the asset, or asset group,

over its estimated fair value is recognized. These impairment charges would be

recorded as operating losses. Any material write-downs of assets could have a

material adverse effect on our financial condition and earnings.

We

will incur increased costs as a result of being a public company.

As a

public company, we incur significant legal, accounting and other expenses that

we did not incur as a private company. The U.S. Sarbanes-Oxley Act of 2002 and

related rules of the SEC and stock exchanges regulate corporate governance

practices of public companies. We expect that compliance with these public

company requirements will increase costs and make some activities more

time-consuming. For example, we have created new board committees and adopted

new internal controls and disclosure controls and procedures. In addition, we

incur additional expenses associated with our SEC reporting requirements. A

number of those requirements require us to carry out activities we have not done

previously. For example, under Section 404 of the Sarbanes-Oxley Act, our

management will need to assess and report on our internal control over financial

reporting and our independent accountants may need to issue an opinion on that

assessment and the effectiveness of those controls. Furthermore, if we identify

any issues in complying with those requirements (for example, if we or our

independent accountants identified a material weakness or significant deficiency

in our internal control over financial reporting), we could incur additional

costs rectifying those issues, and the existence of those issues could adversely

affect us, our reputation or investor perceptions of us.

13

We also

expect that it will be difficult and expensive to obtain and maintain director

and officer liability insurance, and we may be required to accept reduced policy

limits and coverage or incur substantially higher costs to obtain the same or

similar coverage. As a result, it may be more difficult for us to attract and

retain qualified persons to serve on our board of directors or as executive

officers. Advocacy efforts by stockholders and third parties may also prompt

even more changes in governance and reporting requirements. We cannot predict or

estimate the amount of additional costs we may incur or the timing of such

costs.

We

depend on key personnel for the future success of our business and the loss of

one or more of our key personnel could have an adverse effect on our ability to

manage our business and implement our growth strategies, or could be negatively

perceived in the capital markets.

Our

future success and ability to manage future growth depends, in large part, upon

the efforts and continued service of our senior management team, which has

substantial experience in the resort and hospitality industry. Our President and

Chief Executive Officer, James Tousignant, our Chairman, Richard Keith, and our

Chief Financial Officer, Philip Callaghan, have been actively involved in the

acquisition, ownership and operation of resort properties and are actively

engaged in our management. Messrs. Tousignant, Keith and Callaghan substantially

determine our strategic direction, especially with regard to operational,

financing, acquisition and disposition activity. The departure of any of them

could negatively impact our ability to grow and manage our

operations.

Although

we are party to employment agreements with some of our key personnel, these

employment agreements do not require them to remain our employees and,

therefore, they could terminate their employment with us at any time without

penalty. We do not currently maintain key man life insurance on any of our

executives, and such insurance, if obtained in the future, may not be sufficient

to cover the costs of recruiting and hiring a replacement or the loss of an

executive’s services.

It could

be difficult for us to find replacements for such key personnel, as competition

for such personnel is intense. The loss of services of one or more members of

senior management could have an adverse effect on our ability to manage our

business and implement our growth strategies. Further, such a loss could be

negatively perceived in the capital markets, which could reduce the market value

of our securities.

Damage

to our destination club properties and other operational risks may disrupt our

business and adversely impact our financial results.

Depending

on the location of our destination club properties, a particular property may

bear an increased risk for damage by inclement weather, construction defects,

environmental matters, acts of terrorism, or other forces or acts, whether

intentional or unintentional. In addition, we rely heavily on our information

systems and other data processing systems. Any such damage to properties or

disruption in information systems could cause us to suffer financial loss, a

disruption of our businesses, regulatory intervention or reputational

damage.

Furthermore,

we depend on our headquarters in Kissimmee, Florida, where most of our

information systems and personnel are located, for the continued operation of

our business. A natural disaster or other catastrophic event or disruption in

the infrastructure that supports our businesses, including a disruption

involving electronic communications or other services used by us or third

parties with whom we conduct business, or directly affecting our headquarters,

could have a material adverse impact on our ability to continue to operate our

business without interruption. The impact of any disaster or disruption on our

business will likely be exacerbated by the fact that we do not have any disaster

recovery program in place to mitigate the harm or minimize the lost data that

may result from such a disaster or disruption. In addition, insurance and other

safeguards might only partially reimburse us for our losses, if at

all.

14

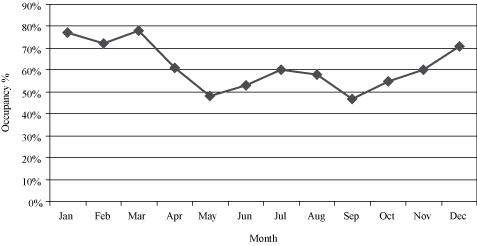

We

are vulnerable to the risk of unfavorable weather conditions and continued

inclement weather could reduce our revenues and earnings.

Our

ability to attract visitors to our resorts is influenced by weather conditions.

Unfavorable weather conditions can adversely affect visits and our revenues and

profits. Adverse weather conditions may discourage visitors from participating

in outdoor activities at our resorts. There is no way for us to predict future

weather patterns or the impact that weather patterns may have on results of

operations or visitation. Extreme weather conditions such as hurricanes or

prolonged periods of adverse weather conditions, or the occurrence of such

conditions during peak visitation periods, could have a material adverse effect

on our financial condition and results of operations by reducing revenues and

earnings.

Our

property development and management operations are conducted in many areas that

are subject to natural disasters and severe weather, such as hurricanes and

floods. We also may be affected by unforeseen engineering, environmental, or

geological problems. These conditions could delay or increase the cost of

construction projects, damage or reduce the availability of materials, and

negatively impact the demand for resorts in affected areas. If insurance

does not fully cover business interruptions or losses resulting from these

events, our earnings, liquidity and capital resources could be adversely

affected.

Our

success depends, in part, on the integrity of our systems and infrastructure.

System interruptions may have an adverse impact on our business, financial

condition and results of operations.

Our

success depends, in part, on our ability to maintain the integrity of our

systems and infrastructure, including websites, information and related systems

and call centers. System interruptions may adversely affect our ability to

operate websites, process and fulfill club member reservations and other

transactions, respond to customer inquiries and generally maintain

cost-efficient operations. We may experience occasional system interruptions

that make some or all systems or data unavailable or prevent us from efficiently

providing services. We also rely on third-party computer systems, broadband and

other communications systems and service providers in connection with the

provision of services generally, as well as to facilitate, process and fulfill

transactions. Any interruptions, outages or delays in these systems, or

deterioration in the performance of these systems and infrastructure, could

impair our ability to provide services. Fire, flood, power loss,

telecommunications failure, hurricanes, tornadoes, earthquakes, acts of war or

terrorism, acts of God and similar events or disruptions may damage or interrupt

computer, broadband or other communications systems and infrastructure at any

time. Any of these events could cause system interruption, delays and loss of

critical data, and could prevent us from providing services. Although we have

backup systems for certain aspects of our operations, these systems are not

fully redundant and disaster recovery planning is not sufficient for all

eventualities. In addition, we may not have adequate insurance coverage to

compensate for losses from a major interruption. If any of these adverse events

were to occur, it could adversely affect our business, financial condition and

results of operations.

In

addition, any penetration of network security or other misappropriation or

misuse of personal consumer information could cause interruptions in our

operations and subject us to increased costs, litigation and other liabilities.

Claims could also be made against us for other misuse of personal information,