Attached files

Exhibit 10.1

Avago Performance Bonus (“APB”)

FY2010 Plan Document

| Document: Annual Performance Bonus |

Applicability: Regular exempt,non-exempt, non-commissioned, non-bargaining unit employees | |

| Approved: December 1, 2009 |

Effective Date: November 1, 2009 | |

| Re-Approve: |

Review date: Annual |

Purpose

The purpose and scope of the Avago Performance Bonus Plan Document is to define the process of the award annual incentive bonus and to ensure that the parameters are managed consistently across the Avago Technologies (the “Company”).

Introduction

The Company has established the Avago Performance Bonus (“Program”) for eligible Employees. The objectives of this discretionary Program are to:

| • | Share the success of the company |

| • | Reward employees for outstanding business results, |

| • | Foster teamwork, and |

| • | Retain employees |

Program Period

Incentive awards under the Program are based on Corporate performance and Business Division or Function performance measured against predetermined targets for each Program Period. The Program Period begins on the first day of each fiscal year and ends on the last day of the fiscal year.

Eligibility

At the beginning of each fiscal year Program Period, the Company will determine Program participation eligibility for all employment positions for such Program Period.

Prior to the beginning of the Program Period the criteria for participation in the Program will be set by the Company at its sole discretion.

Participation in the Program during a Program Period is not a guarantee of on-going employment nor does it create any right to participate in the Program during any subsequent Program Period.

Pg 1 of 9

Avago Technologies Confidential

Conditions of Eligibility: All regular full-time and regular part-time employees who are:

| • | Not on a Sales Incentive Program (SIP); |

| • | In active regular employment status before the first day of the fourth quarter of the fiscal year performance period. |

| • | In regular active employment status on the Avago Performance Bonus (APB) payout date |

Description

The performance results for the Program Period are based on a weighting system comprised of Corporate performance and Business Division/Function performance.

| Corporate Performance | Corporate performance for the Program Period will be based on the attainment of Company targets as defined for the specific fiscal year: Targets are set by the CEO and Compensation Committee of the Board of Directors. Attainment measurements and targets are maintained by Finance. | |

| Business Division or Function Performance | Business Division or Function performance for the Program Period will be based on the attainment of Business Division or Function goals. Goals are set by Business Division or Function VPs and approved by the CEO and Compensation Committee of the Board of Directors. Attainment measurements and targets are maintained by Finance. | |

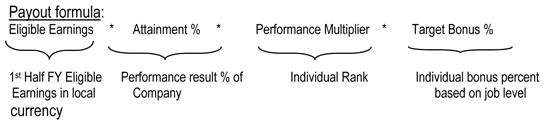

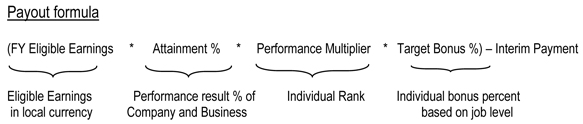

| Program Award Determination | The Program award payout (“Program Award”) for each participant will be determined as follows. | |

Definitions:

| 1. | Eligible Earnings: Represents base wages earned during the performance period and excludes overtime pay, shift differential, week-end differential, disability payments, or other allowances. |

Total eligible earnings for the Program Period will be adjusted for part-time status, unpaid LOA, hire date or re-hire date.

| 2. | Attainment %: Payout on performance achieved for each Business attainment goal between the threshold and the maximum will be linearly interpolated. |

| 3. | Performance Multiplier: Based on the performance rank of each participant with payout multipliers as follows: |

| • | Rank 1 | 1.5 times the on-target bonus | ||

| • | Rank 2 | 1.0 times the on-target bonus | ||

| • | Rank 3 | 0.5 times the on-target bonus |

Pg 2 of 9

Avago Technologies Confidential

| 4. | Target Bonus Percent: Percent of eligible earnings that will be paid if the Company and Business Division/Function attainment is 100% of goals. This percent is assigned to job levels as follows: |

| • ICA |

5 | % | |||||

| • ICB |

|||||||

| • Entry |

7 | % | |||||

| • Career |

9 | % | |||||

| • Expert |

12 | % | |||||

| • Master |

15 | % | |||||

| • Fellow |

20 | % | |||||

| • People Manager |

|||||||

| • Supervisor |

10 | % | |||||

| • Operating Manager |

12 | % | |||||

| • Integrating Manager |

17 | % | |||||

| • Senior Manager I & II |

30 | % | |||||

Target Bonus Percent is prorated based on eligibility and job level change during the performance period.

Any exceptions require approval from the VP of Human Resources and the CEO

Pg 3 of 9

Avago Technologies Confidential

Payout

There are two payouts in the FY2010 annual Program Period.

Interim Payment: The first payout is an interim payout made after the end of the first fiscal half which is calculated using the annual formula with the following additional criteria:

| • | Achievement of first half corporate metrics |

| • | Performance Rank in place from prior year |

| • | Capped at 100% for rank 1 and rank 2 employees |

| • | Capped at 50% for rank 3 employees |

| Metric |

Weight | Achievement % Threshold for Minimum Payout |

Payout at Minimum Attainment Threshold |

Payout at Target 100% |

Payout

at Maximum Attainment Maximum | |||||

| Revenue Growth |

25% | 39% | 50% | 100% | 100% | |||||

| Operating Profit |

25% | 81% | 50% | 100% | 100% | |||||

| Business Division or Function Results * |

N/A | Division/Function Specific |

Final Payment: The fiscal year end payout is made after the end of the fiscal year and is calculated using the annual formula based on:

| • | Actual achievement against full fiscal year Corporate and Division/Function metrics |

| • | Current year performance rank |

| • | Less the interim payment |

Pg 4 of 9

Avago Technologies Confidential

| Metric |

Weight | Achievement % Threshold for Minimum Payout |

Payout

at Minimum Attainment Threshold |

Payout at Target 100% |

Payout

at Maximum Attainment Maximum | |||||

| Revenue Growth |

25% | 53% | 50% | 100% | 150% | |||||

| Operating Profit |

25% | 81% | 50% | 100% | 150% | |||||

| Business Division or Function Results * |

50% | Division/Function Specific |

50% | 100% | 150% |

Policies and Practices

Various considerations may impact the administration and payout of the Program. Such considerations may include but are not limited to the following

| 1. | Program Administration: The Company will establish guidelines for the Program in line with corporate strategies and objectives. The Company has final authority as to any issues related to the interpretation and the administration of the Program, including the resolution of any unusual circumstances. |

| 2. | Management Discretion: The Company will set the Program performance targets. The Company may, at its sole discretion, at any time alter, amend, suspend or in any other way modify the Program to align with the changing needs of the Company without prior notification to any participant. |

| 3. | Payment Authorization: Employees will be eligible to participate in the APB program period on a prorata basis based upon hire date and dependent upon being actively employed before the first day of the fourth quarter of the current fiscal year and being actively employed and on Avago payroll through to the APB payout date. All awards must be approved by the CEO and Compensation Committee. The program award will be paid in full, as soon as administratively feasible, following the end of a Program Period. |

Pg 5 of 9

Avago Technologies Confidential

| 4. | Termination: Any employee may be excluded from Program participation, at any time, at the sole discretion of the Company. In order to receive a Program Award payment for the applicable Program Period, an employee must be (1) on the payroll, and (2) an eligible participant of the Program at the time of payout. The company will not seek repayment of a valid bonus payout if the employee terminates employment after payment for the previous performance period. |

| 5. | Pro-rated payments: Pro-rated payment will only be made in cases as set forth below: |

| • | Position changes from non-sales to sales (on SIP) or from sales (on SIP) to non- sales. |

| • | Reclassification from one job level to another (upward or downward). |

| • | Transfer between Business Divisions or Functions during the fiscal year of the performance period. |

| • | Termination for Disability: In the event a participant terminates employment with the Company for disability reasons, such employee will be considered eligible for completed plan periods in which the employee participated. |

| • | Termination upon Death: Upon the death of a participant, the award will be considered fully vested for all completed plan periods in which the employee participated. Payment will be made to legal beneficiaries, as designated by the employee and on file the Company. |

| 6. | Right of Employment and Payment: Management reserves the right, at its sole discretion, to restrict participation in the Program at any time. Participation under this Program does not affect the employment status of the participant and does not imply continued employment with Company. Either participant or Company may terminate the employment relationship at any time, for any reason, with or without cause. |

Payments made under the Program are not an element of the participant’s salary or base compensation (“Compensation”) and shall not be considered as part of such Compensation in the event of severance, redundancy, resignation or any other situation unless required by local law. The granting and receipt of payments under the Program is voluntary and at the Company’s sole discretion, and does not constitute a claim for further payments regardless of how many times such payments have previously been granted to the participant.

| 7. | Unfunded Status/Right of Assignment: No assets are reserved for this Program and no person has a right or interest in Company assets as a result of the existence of this Program. No right or interest in the Program may be assigned or transferred, or subject to any lien, directly, by operation of law or otherwise, including without limitation, bankruptcy, pledge, garnishment, attachment, levy or other creditor’s process. |

Pg 6 of 9

Avago Technologies Confidential

| 8. | Taxes: All awards payable under the Program are taxable as ordinary income in the year of payment and subject to applicable taxes and withholdings. Employees on a temporary relocation are paid and taxed from their home country. |

| 9. | Plan Amendment or Termination: The Company may amend or terminate this Program at any time. While the Company intends that any amendment or termination would be prospective, the Company reserves the right to act retroactively without prior written notice to the participants. |

| 10. | Final Decision: The Chief Executive Officer (“CEO”) will make the final determination as to the eligibility for participation in the Program and any other applicable terms. All decisions made by the CEO regarding this Program shall be final, and shall not be subject to review or appeal. |

This Program shall be governed by the laws of the State of California, without regard to choice-of-law provisions.

Pg 7 of 9

Avago Technologies Confidential

APPENDIX

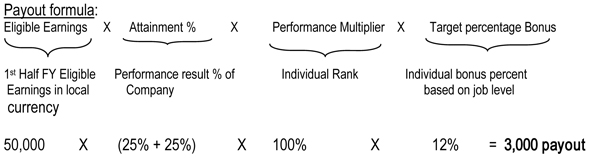

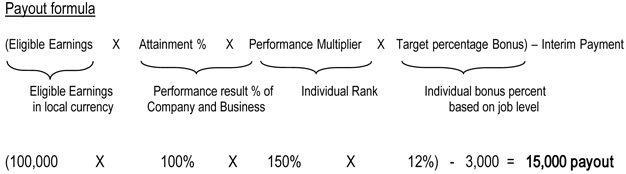

Payout Examples at Target:

The examples of the interim and the final payouts are based on the following assumptions.

| • | Employed full time during the entire fiscal year |

| • | Annual Eligible Earnings in local currency is 100,000 |

| • | Performance Rank is 1 |

| • | Bonus target is 12% |

| • | Corporate attainment for 1st half and fiscal year both at 100% |

| • | Division attainment at 100% |

Interim Payment: The first payout is an interim payout made after the end of the first fiscal half which is calculated using the annual formula with the following additional criteria:

| • | Achievement of first half corporate metrics (excludes Division metrics) |

| • | Performance Rank in place from prior year |

| • | Capped at 100% for rank 1 and rank 2 employees |

| • | Capped at 50% for rank 3 employees |

| Metric |

Weight | Achievement % Threshold for Minimum Payout |

Payout

at Minimum Attainment Threshold |

Payout at Target 100% |

Payout

at Maximum Attainment Maximum | |||||

| Revenue Growth |

25% | 39% | 50% | 100% | 100% | |||||

| Operating Profit |

25% | 81% | 50% | 100% | 100% | |||||

| Business Division or Function Results * |

N/A | Division/Function Specific |

Pg 8 of 9

Avago Technologies Confidential

Final Payment: The fiscal year end payout is made after the end of the fiscal year and is calculated using the annual formula based on:

| • | Actual achievement against full fiscal year Corporate and Division/Function metrics |

| • | Current year performance rank |

| • | Less the interim payment |

| Metric |

Weight | Achievement % Threshold for Minimum Payout |

Payout

at Minimum Attainment Threshold |

Payout at Target 100% |

Payout

at Maximum Attainment Maximum | |||||

| Revenue Growth |

25% | 53% | 50% | 100% | 150% | |||||

| Operating Profit |

25% | 81% | 50% | 100% | 150% | |||||

| Business Division or Function Results * |

50% | Division/Function Specific |

50% | 100% | 150% |

Pg 9 of 9

Avago Technologies Confidential