Attached files

| file | filename |

|---|---|

| EX-31.1 - China Architectural Engineering, Inc. | v187099_ex31-1.htm |

| EX-32.1 - China Architectural Engineering, Inc. | v187099_ex32-1.htm |

| EX-23.1 - China Architectural Engineering, Inc. | v187099_ex23-1.htm |

| EX-31.2 - China Architectural Engineering, Inc. | v187099_ex31-2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K/A

Amendment

No. 4

x ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2009

OR

o TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

FOR

THE TRANSITION PERIOD FROM _______ TO ___________

COMMISSION

FILE NO. 001-33709

CHINA

ARCHITECTURAL ENGINEERING, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Delaware

|

51-05021250

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

|

105

Baishi Road, Jiuzhou West Avenue, Zhuhai

People’s

Republic of China

|

519070

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

REGISTRANT’S

TELEPHONE NUMBER, INCLUDING AREA CODE: 0086-756-8538908

SECURITIES

REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

Title of Each Class

|

Name of Each Exchange on Which

Registered

|

|

|

Common

Stock, $0.001 par value

|

|

NASDAQ

Global Select Market

|

SECURITIES

REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form

10-K.

o

Indicate

by check mark whether the registrant is a large accelerated filer, accelerated

filer, non-accelerated filer, or a smaller reporting company. See the

definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large

accelerated filer o

|

Accelerated

filer o

|

Non-accelerated

filer x

|

Smaller

reporting company o

|

|

(Do

not check if a smaller

|

|||

|

reporting

company)

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act). Yes o No x

The

aggregate market value of the registrant's issued and outstanding shares of

common stock held by non-affiliates of the registrant as of June 30, 2009 (based

on the price at which the registrant’s common stock was last sold on such date)

was approximately $43.2 million.

There

were 55,156,874 shares outstanding of the registrant’s common stock, par value

$0.001 per share, as of March 28, 2010. The registrant’s common

stock is listed on the Nasdaq Global Select Market under the ticker symbol

“CAEI”.

DOCUMENTS

INCORPORATED BY REFERENCE: None.

EXPLANATORY

NOTE

This

Amendment No. 4 on Form 10-K/A (this “Amendment No. 4”) is

being filed in order to (i) revise the date of the auditor report from April 30,

2010 to May 14, 2010 and (ii) to correct that date of the restatements to May

14, 2010. The Form 10-K was originally filed on March 4, 2010 (the

“Original Filing”) and it was amended by Amendment Nos. 1, 2, and 3 on the Form

10-K/A filed with the Securities and Exchange Commission (the “SEC”) on April

30, May 14, and May 27, 2010 (the “Amendments”). Other than as

indicated above, there have not been other changes to the annual report, as

previously amended, but the entire filing is restated in this Amendment No. 4

for ease of reference.

As a

result of this Amendment No. 4, the certifications pursuant to Section 302 and

Section 906 of the Sarbanes-Oxley Act of 2002 have been revised, re-executed and

re-filed as of the date of this Amendment No. 4. Except as specifically

indicated in any amendments to the Original Filing, this Amendment No. 4

continues to describe conditions as of the date of the Original Filing, and the

disclosures contained herein have not been updated to reflect events, results or

developments that have occurred after the Original Filing, unless indicated in

the Amendments, or to modify or update those disclosures affected by subsequent

events unless otherwise indicated in this annual report. Among other

things, forward-looking statements made in the Original Filing have not been

revised to reflect events, results or developments that have occurred or facts

that have become known to us after the date of the Original Filing, and such

forward-looking statements should be read in their historical context. This

Amendment No. 4 should be read in conjunction with the Company’s filings made

with the SEC subsequent to the Original Filing, including any amendments to

those filings.

CHINA

ARCHITECTURAL ENGINEERING, INC.

TABLE

OF CONTENTS TO ANNUAL REPORT ON FORM 10-K/A

For

the Fiscal Year Ended December 31, 2009

|

ITEM

|

Page

|

|||

|

PART I

|

1

|

|||

|

Item

1.

|

Business

|

1

|

||

|

Item 1A.

|

Risk

Factors

|

9

|

||

|

Item 1B.

|

Unresolved

Staff Comments

|

27

|

||

|

Item

2.

|

Properties

|

27

|

||

|

Item

3.

|

Legal

Proceedings

|

28

|

||

|

Item

4.

|

(Removed

and Reserved)

|

29

|

||

|

|

||||

|

PART II

|

30

|

|||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

30

|

||

|

Item

6.

|

Selected

Financial Data

|

32

|

||

|

Item

7.

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operations

|

33

|

||

|

Item

7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

45

|

||

|

Item

8.

|

Financial

Statements and Supplementary Data

|

46

|

||

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

46

|

||

|

Item

9A.

|

Controls

and Procedures

|

46

|

||

|

Item

9B.

|

Other

Information

|

49

|

||

|

PART III

|

50

|

|||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

50

|

||

|

Item

11.

|

Executive

Compensation

|

53

|

||

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

62

|

||

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

63

|

||

|

Item

14.

|

Principal

Accounting Fees and Services

|

64

|

||

|

|

||||

|

PART IV

|

|

|||

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

|

||

|

|

||||

|

Signatures

|

65

|

i

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The

information contained in this report, including in the documents incorporated by

reference into this report, includes some statements that are not purely

historical and that are “forward-looking statements.” Such forward-looking

statements include, but are not limited to, statements regarding our and their

management’s expectations, hopes, beliefs, intentions or strategies regarding

the future, including our financial condition and results of operations. In

addition, any statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any underlying

assumptions, are forward-looking statements. The words “anticipates,”

“believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,”

“might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,”

“should,” “will,” “would” and similar expressions, or the negatives of such

terms, may identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking.

The

forward-looking statements contained in this report are based on current

expectations and beliefs concerning future developments and the potential

effects on the parties and the transaction. There can be no assurance that

future developments actually affecting us will be those anticipated. These

forward-looking statements involve a number of risks, uncertainties (some of

which are beyond the parties’ control) or other assumptions that may cause

actual results or performance to be materially different from those expressed or

implied by these forward-looking statements, including the

following:

|

|

·

|

Our dependence on government

contracts and government sponsored

contracts;

|

|

|

·

|

Fluctuation and unpredictability

of costs related to our products and

services;

|

|

|

·

|

Changes in the laws of the PRC

that affect our operations;

|

|

|

·

|

Our failure to meet or timely

meet contractual performance standards and

schedules;

|

|

|

·

|

Adverse capital and credit market

conditions;

|

|

|

·

|

Any occurrence of epidemic

diseases and other cross-region infectious

diseases;

|

|

|

·

|

Reduction or reversal of our

recorded revenue or profits due to “percentage of completion” method of

accounting;

|

|

|

·

|

Increasing provisions for bad

debt related to our accounts

receivable;

|

|

|

·

|

Our dependence on the steel and

aluminum markets;

|

|

|

·

|

Exposure to product liability and

defect claims;

|

|

|

·

|

Our ability to obtain all

necessary government certifications and/or licenses to conduct our

business;

|

|

|

·

|

Expenses and costs related to our

issuance of our bonds and bond

warrants;

|

|

|

·

|

Our intended acquisition of an

ownership interest in Shanghai ConnGame Network Co.

Ltd.;

|

|

|

·

|

The cost of complying with

current and future governmental regulations and the impact of any changes

in the regulations on our operations;

and

|

|

|

·

|

The other factors referenced in

this report, including, without limitation, under the sections entitled

“Risk Factors”, “Management’s Discussion and Analysis of Financial

Condition and Results of Operations”, and

“Business”.

|

These

risks and uncertainties, along with others, are also described below under the

heading “Risk Factors.” Should one or more of these risks or uncertainties

materialize, or should any of the parties’ assumptions prove incorrect, actual

results may vary in material respects from those projected in these

forward-looking statements. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information, future

events or otherwise, except as may be required under applicable securities

laws.

ii

PART

I

ITEM

1. BUSINESS

Overview

We have

traditionally specialized in high-end curtain wall systems (including glass,

stone and metal curtain walls), roofing systems, steel construction systems,

eco-energy saving building conservation systems and related products, for public

works and commercial real estate projects. We provide timely, high

quality, reliable, fully integrated and cost-effective service solutions to our

clients using specialized technical expertise in the design, engineering,

fabrication, installation and construction of structural exterior cladding

systems. We compete on the strength of our reputation, relationships with

government and commercial clients, and our ability to give expression to the

vision of leading architects. By focusing on innovation while outsourcing

commoditized manufacturing work, we believe we are able to add artistic and

technological value to projects at cost-effective price points.

Proposed

Acquisition of 60% Equity Interest in ConnGame

In

December 2009, we and First Jet entered into a letter of intent for the

Acquisition (“Letter of Intent”) that set forth the principal terms under which

we would issue up to 25,000,000 shares of our common stock to First Jet to

acquire 60% of the equity interest of Shanghai ConnGame Network Co. Ltd., a

company formed under the laws of the People’s Republic of China (“ConnGame”),

which is a developer and publisher of MMORPG (Massively Multiplayer Online Role

Playing Game). In January 2010, our board of directors and stockholders approved

our acquisition of a 60% equity interest in ConnGame.

We

believe that our proposed acquisition of ConnGame will expand our core

capabilities and facilitate our planned transformation into a high-end

architectural design consultant and service provider, as we intend to leverage

ConnGame’s design engines and virtual applications to broaden our service

capabilities and scope of architectural collaborations. We intend to utilize

ConnGame's technology and online platform to provide technical consulting and

advisory services to architects, real estate developers and governments. We

believe our acquisition of ConnGame will enable us to strengthen our core

architectural engineering and design abilities. We believe that our planned

focus on design and construction will reduce our exposure to unpredictable

operational risks that relate to construction projects, in addition to providing

us with the tools to strengthen our ability to complete projects within budget

limitations. We also believe that the acquisition of ConnGame and its

technologies will enable us to better evaluate estimated profitable of

construction projects before we enter into contracts. We believe that our

technology profile will be strengthened, particularly with ConnGame’s virtual

and online and graphic technologies, and that the technology and capabilities

will permit us to render more animated, detailed, and interactive designs that

could assist us in attaining highly desirable projects from our bidding

competitors.

We

believe that our acquisition would also enable us to enter China's large online

game market, with ConnGame’s two to-be-released MMORPG games. We believe that

the online game industry and its related business model will be a growing market

in China.

If and

when the acquisition of the 60% interest of ConnGame is completed, we will seek

to divide our business services into the following:

|

|

·

|

Construction

and fabrication—We

intend conduct our construction and fabrication services within

China.

|

|

|

·

|

Construction

consulting and design services—We believe that we will be able

to utilize the technical skills and expertise of ConnGame to provide

unique consulting services for the design and fabrication projects

globally, with such services to include real-time and interactive

capabilities.

|

|

|

·

|

Online

Games—ConnGame has

targeted to launch its first game in mid-2010 and its second game in late

2010, subject to final

testing.

|

|

|

·

|

Network

Gaming and Home Decoration—We intend to develop a platform

to provide services on home decoration through an interactive style,

develop online games to provide to architects, other professionals, and

individual consumers the ability to design and interact with other

users.

|

Completion

of the proposed acquisition is subject to negotiation and execution of a

definitive equity transfer agreement, regulatory approvals, and other customary

closing conditions. Therefore, there can be no guarantee that the acquisition

will be consummated.

For

additional information regarding our planned operations after the proposed

acquisition, please see “Item

7—Management’s Discussion and Analysis of Financial Condition and Results of

Operations—Proposed Acquisition of 60% Equity Interest in

ConnGame.”

1

International

and Domestic (China) Construction Market

Historically,

the relative growth of the Chinese economy had assisted in the growth of China’s

construction industry, especially in the commercial and public works sectors. As

architectural designs for these buildings have become more complex, challenging

and modern in scope, there has been an increased need for technology driven

companies providing high-end specialty curtain wall systems. In addition,

governmental agencies and international regulators are becoming more

environmentally conscious in the enactment of regulations governing new

construction. Awareness of fuel costs and environmental concerns have resulted

in regulation designed to ensure that new commercial and public works buildings

have a low environmental impact. Technologies such as solar lighting, advanced

shading systems and circulating sea water systems are constantly improving the

ability of structures to interact with the environment by taking advantage of

natural conditions, thus meeting the dual goals of reducing energy costs and

lessening environmental impact.

In 2009,

as China’s economy has also been negatively impacted by the global economic

crisis, investments in the construction sector have been significantly reduced

and, as a consequence, China’s construction industry has become a challenging

environment in which to operate. The government of the People's Republic of

China adopted an economic stimulus package designed to limit the amount of

damage that the global financial crisis could do to China’s economy, the third

largest economy in the world. The PRC government indicated that the stimulus

funds were to be invested in key areas such as housing, rural infrastructure,

transportation, health and education, environment, industry, disaster

rebuilding, income-building, tax cuts, and finance. We expect that we may be

able to benefit from the stimulus plans over the next few years. Preliminary

government spending plans indicate that there may be an opportunity for the use

of our products, especially on the infrastructure related projects such as large

scale railway stations and airport terminals, and public facilities, such as

libraries, museums, exhibition halls, stadiums, planetariums and science

centers.

The

recent trends in the global economy have had a significant adverse impact on the

commercial construction industry as a whole. As a result, the competitive

environment in which we operate has become more competitive, increasing the

number of re-bid construction projects and amount of time between bidding and

award of a project, reducing selling prices, and causing competitors to modify

the scope and type of projects on which they bid. In 2008 we increased the

number of international construction projects, but in 2009 the spread of the

global recession and reduction in the nature and scope of international

construction projects has led us to primarily focus our attention on domestic

projects in China. Dubai, Doha, Kuwait and other middle east region have been

suffered a great impact markedly under the global financial crisis. Our projects

suffered a certain degree of impact as well. However, we conducted our Dubai and

Doha Projects construction under the original schedule, and executed the design

for Kuwait project. After the completion of “soft-open” of Dubai Metro Rail

Project in September 2009, the contractor called bonds and refused to sign and

pay for the project payments, which have resulted in a cash flow difficulties

for our company. We dispute the contractor’s rights to call the bonds and

seeking remedies for its actions. In addition, after a thorough review and

analysis of the feasibility and profitability of the Singapore Project, we

determined that it was in the best interests of our company to withdraw from the

project.

We do not

believe that the international economy will experience a swift recovery in the

near future and therefore its negative impact on construction industry still

exists and will exist in the near future. As a result, we suspended the orders

of the construction of international projects, and shifted the focus of our

business to design and professional consulting services. We have taken steps to

continue our development and research of new technologies and to maintain our

company’s position in the industry. To develop projects and generate revenue, we

have sought to join new projects in the position of design and project

consultant and the role of material supplier.

Although

we believe that a global market opportunity still exists for our services and

products despite the difficult environment, we believe that it would be more

advantageous to our business to take advantage of our low design and production

cost in China. We believe that the Chinese market has faired much better than

most of the international markets. With the strength of our reputation and

history of notable projects in China, we are focusing our resources and efforts

in our domestic market. We believe that we have long-standing relationships with

leading Chinese and international architects, having completed high profile

projects in China, including the National Grand Theater in Beijing, the Shanghai

South Railway Station, the Shenzhen International Airport, the National Palace

Museum in Beijing, the Wuhan Qintai Grand Theatre and Wuhan International Horse

Racing Course. During the year 2009, we commenced certain landmark projects in

China, which consisted of the Changsha Train Station, Changsha Museum, Guangzhou

Science Town, and projects in Jinan and Inner Mongolia. These projects are

expected to be completed in 2010. We plan to continue to meet the needs of

government and private sector customers in the larger cities.

Products

and Services

We

specialize in high-end curtain wall systems (including glass, stone and metal

curtain walls), roofing systems, steel construction systems, eco-energy saving

building conservation systems and related products, for public works and

commercial real estate projects. We provide timely, high quality, reliable,

fully integrated and cost-effective service solutions to our clients using

specialized technical expertise in the design, engineering, fabrication,

installation and construction of structural exterior cladding systems. We design

and develop systems to offer custom-designed solutions for developers of

commercial and public works projects with special architectural features. In

terms of project management, we conduct overall project planning and control

over key areas of activities such as design and engineering, procurement,

production scheduling, quality control and site installation.

2

Concept

and Project Management

Initially,

we work with the architect to develop, clarify and enhance the overall creative

vision for the project. In the design of a curtain wall system, architects are

freely able to choose different structure systems to meet the requirements of

various architectural models. All contracts awarded are assigned a project

number, which was designed to track each component and man-hour associated with

the project through the entire construction process. All project drawings,

specifications and completion schedules on a project are reviewed by our senior

management team, and all projects are assigned to one or more project managers,

who assume primary responsibility for all aspects of the project. Reporting to

the project manager are construction supervisors, safety and administration

staff, quality control staff and project engineering staff. Each of these

project team members coordinates with internal functional departments and

outside suppliers as appropriate. Often a project manager assigned to a given

project will have significant experience in similar projects. A project manager

generally will be responsible for a number of projects in various stages of

completion at any given time, depending on the scope, complexity, and geographic

location of such projects. Each project is divided into critical sequences that

follow the anticipated curtain wall construction path. Each sequence follows a

timeline, the status of which is continually monitored. Project managers

coordinate and manage design changes or other changes in scheduled completion

deadlines in an effort to minimize overall project delays.

We hope

that the proposed acquisition of ConnGame will enable us to leverage ConnGame’s

design engines and virtual applications to broaden our service capabilities and

scope of architectural collaborations. We intend to utilize ConnGame's

technology and online platform to provide technical consulting and advisory

services to architects, real estate developers and governments.

Design

Specific

technical parameters of the concept are established as new design elements are

created and combined with existing technologies. During the design phase, our

engineers and technicians review preliminary and completed designs and make

recommendations regarding types of connections, possible savings on fabrication

techniques, and methods of installation. Operating state-of-the art

computer-aided design (CAD) stations, these individuals provide customized

design solutions in the form of structural calculations, drawings, fabrication

and installation details, together with technical advice and consultancy on

specifications, feasibility studies and material procurement. At the

implementation stage of the project, detailed fabrications/shop-drawings are

produced, discussed and agreed with the project architect/manager. These form

the blueprint for project execution and scheduling. Every order is scheduled for

production through CAD and computer-aided manufacturing (CAM) systems with

progress tracked at each stage of the project process. Quality control and

assurance programs are a combination of our specifications with quality

inspectors working at all production stages.

Engineering

We

maintain significant in-house structural engineering and detailing capabilities

that enable us to implement and coordinate with our shop and field personnel

original project specifications and changes to building and structural designs

sought by our clients. These resources help influence critical determinations as

to the most cost-effective systems, designs, connections, and installation

procedures for a particular project. Our engineers work on-site with suppliers

to machine our patented curtain wall elements and to procure the appropriate raw

materials. Our detailers prepare detail shop drawings of the dimensions,

positions, locations, and connections, and the fabrication and installation

sequences, of each component utilized in a project, and continually update these

drawings to accommodate design and other changes. Our automated detailing

systems produce updated detail drawings electronically, which can be delivered

to our domestic and foreign field locations. Detailers coordinate directly with

customers and our suppliers and installation teams to determine and plan the

order of fabrication and installation of a project and associated personnel and

equipment requirements.

Fabrication

Although

we are responsible for hiring suppliers and manufacturers, we subcontract the

manufacture of parts made from glass, metal and other materials used in our

exterior cladding systems. Once parts have been manufactured by subcontracted

factories, we will occasionally process them further. This processing usually

entails procedures such as adding metal frames to or drilling holes in glass

panes, or cutting and bending steel rods into customized shapes. All of our

products are fabricated in accordance with applicable industry and specific

customer standards and specifications.

Installation

We have

38 full-time project managers/supervisors and approximately 500 part-time

on-site workers who are engaged on our projects. Our installation teams consist

of highly trained, skilled and experienced field operatives with established

lines of communication between the work site, the technical design department

and the factory, ensuring that clients are provided with optimum and

cost-effective practical solutions. Site installation is managed through our

trained project management staff, and each project has a dedicated project team.

On site there are a number of our supervisors who are each responsible for a

different section of the curtain wall project. The installation process

typically consists of pre-assembly of metal and glass component parts at the

project site, the lifting of components by crane to the appropriate location at

the site and the final assembly of major components. The installation team

coordinates its site delivery program with the main contract schedule to meet

completion deadlines.

Customer

Service

Our

quality control and assurance department is comprised of trained technicians who

are responsible for the quality assurance, including quality control of

in-process fabrication and site installation by a detailed inspection as well as

continued maintenance after project completion. We have adopted important safety

policies that are administered and enforced by our senior management and provide

training on safety procedures and techniques to our shop and field

personnel.

3

Product

Attributes

Our

exterior cladding systems products are highly engineered specialty wall systems

consisting primarily of a series of glass panels set in metal frames, stone

panels, or metal panels, as well as roofing systems and related products. A

curtain wall is fixed to the commercial building by mechanical connection,

either in a primarily inoperable mode or adjustable with special settings with

spring or press systems. Glass panels are connected to the metal support system

by metal clamps and fixing bolts. The support system of fixing bolts could be a

steel, aluminum and or glass structure, with glass flank or spidery tension rod

or cable.

We offer

a variety of support systems:

|

|

·

|

Glass Fin

Support System. The

facial glass mixing with the glass fin provides facade with maximum

transparence, which eliminates the differential expansion among glass

metal structures.

|

|

|

·

|

Metal

Structure Support System. This system utilizes both steel

post and steel truss of aluminum post in a metal structure. One of our

most popular support systems, its flexibility can fully meet the criteria

of demanding modern architecture. At the same time, the combination of

transparent glass and steady metal structure completely realizes a harmony

between beauty and force, elegance and

strength.

|

|

|

·

|

Spidery

Tension Rod/Cable Support System. This system utilizes a stainless

steel tension rod connector for connecting the tension rod or the tension

cable to the steel structure in order to form a stable spidery structure

for glass curtain wall supporting. A response to the challenge of modern

architecture, architects are able to create a smooth and transparent

facade.

|

We use a

variety of clamping devices to integrate the glass frame to the support system.

Metal “spider” clamps are cast from stainless or high-strength carbonic steel in

and provide the features of high strength, simple installment and easy

maintenance. Our metal clamps integrate the facial glass with the structure,

enhancing the hardness of an entity. Transferable cabling structure makes the

curtain wall stretch higher, meeting designers’ requirements for the larger size

of vertical space. The combination of steel and glass embodies the feature of

stability, lightness and transparency, expressing the majesty and originality of

a building.

Our

fixing bolts are made of stainless steel and are used for holding the glass

glazing. These specifically designed bolts transfer the wind loads, deflection

stress and the weight of glass itself to the metal support system, which helps

reduce the strain on the glass and ensure structural integrity. These bolts are

offered in both countersink and flat head. Countersink head fixing bolts they

provide a smooth surface when fit flush in the outward surfaces of the glass.

They are typically utilized in single and double glazed glass structures. The

cylindrical head of our flat head fixing bolts protrude from the surface of

glass, which provides more strength against wind force and shear force and can

use to fix laminated and insolated glass.

We offer

a variety of glass panels allowing a diverse selection of styles to meet the

architectural demands of our clients:

|

|

·

|

Insulating

Glass. Increases a

window’s thermal performance and sound insulation; constructed with two or

more pieces of glass separated by a desiccant-filled spacer and sealed

with an organic sealant. The desiccant absorbs the insulating glass unit’s

internal moisture.

|

|

|

·

|

Laminated

Glass. Consists of

two or more pieces of glass fused with a vinyl or urethane interlayer and

is used primarily for skylight, security and hurricane-resistant

application.

|

|

|

·

|

Energy-

Efficient Coated Glass. Provides solar control, both

minimizing heat gain and controlling thermal transfer, by adding coatings

to glass. In addition, coatings add color and varying levels of

reflectively.

|

|

|

·

|

Spandrel

Glass. The use of

full coverage paint on insulated glass or polyester opacifier film backing

on high performance coated glass for the non-vision areas of the

building.

|

Projects

General

Our work

is performed under cost-plus-fee contracts and fixed-price contracts. The length

of our contracts varies but typically has duration of one to two

years.

4

Approximately

95% of our sales are from fixed price contracts. Our remaining sales are from

cost-plus-fee contracts. Under fixed-price contracts, we receive a fixed price.

Approximately 70% of contracts are modified after they begin, usually to

accommodate requests from clients to increase project size and scope. In cases

where fixed-price contracts are modified, the fixed price is renegotiated and

adjusted upwards accordingly. A disadvantage of fixed-price contracts is that we

realize a profit only if we control our costs and prevent cost over-runs on the

contracts, which can oftentimes be out of our control, such as cost of

materials. An advantage of these contracts is that we can adjust the material

and technology that we use in the project, as long as we satisfy the

requirements of our customer, and there is a potential to benefit from lower

costs of materials.

Under

cost-plus-fee contracts, which may be subject to contract ceiling amounts, we

are reimbursed for allowable costs and fees, which may be fixed or

performance-based. If our costs exceed the contract ceiling or are not allowable

under the provisions of the contract or any applicable regulations, we may not

be reimbursed for all our costs. An advantage of cost-plus-fee contracts is that

the cost of materials generally has no effect on our profit, since we are

reimbursed for costs. A disadvantage is that the profit resulting from any cost

savings on the materials goes to the contractor and not us.

During

2009, we completed approximately 37 projects. Our three largest projects are

Dubai Metro Red Line, Guangdong Science City Headquarter Phase I, and Doha High

Rise Office Tower, which accounted for approximately 43.2 %, 9.2 % and 7.0% of

our sales, respectively, for the year ended December 31, 2009. For the year

ended December 31, 2009, approximately 24% of our sales came from new

construction projects starting in 2009 and for the year ended December 31, 2008,

approximately 58% of our sales came from new construction projects starting in

2008.

Nine

Dragon Project

In May

2009, we entered into a Framework Agreement to undertake several large scale

constructions of projects at the Zhejiang Nine Dragon Holiday Resort in China.

Pursuant to the terms of the Framework Agreement, the projects are to include

the construction of a marine park, playland, movie city and hotel. In July 2009,

we entered into a Letter of Intent of Land Transfer with the affiliates of

Shanghai Nine Dragon, and we agreed to sell 17 million shares of our common

stock to affiliates of Nine Dragon, with the related proceeds being used as the

working capital for the construction of Nine Dragon Project. However, the

affiliates attempted to renegotiate the use of proceeds to instead be used for

the purchase the apartments of Nine Dragon. Such request was rejected by our

board of directors and majority of the stockholders, and as a result, the

transaction was not completed. We actively maintain communication with Shanghai

Nine Dragon, endeavoring to obtain the design and construction work contracts of

the project.

Sales

and Marketing

Sales

Sales

managers lead our sales and marketing efforts through our domestic headquarters

in Zhuhai, China, and our main regional sales offices in Beijing, Shanghai,

Guangzhou, Shenzhen, and Wuhan. We deal with overseas operational issues through

our subsidiaries in Hong Kong and USA, and establish local project departments

only when the project possesses substantial feasibility. We employ full-time

project estimators and chief estimators. Our sales representatives attempt to

maintain relationships with governments, developers, general contractors,

architects, engineers, and other potential sources of business to determine

potential new projects under consideration. Our sales efforts are further

supported by our executive officers and engineering personnel, who have

substantial experience in the design, engineering, fabrication, and installation

of high-end specialty curtain walls.

We

primarily compete for new project opportunities through our relationships and

interaction with our active and prospective customer base, which we believe

provides us with valuable current market information and sales opportunities. In

addition, we are often contacted by governmental agencies in connection with

public construction projects, and by large private-sector project owners and

general contractors and engineering firms in connection with new building

projects both in China and other countries, often at the recommendation of

architects and engineers we have worked with in the past.

Upon

selection of projects to bid or price, our estimating division reviews and

prepares projected costs of shop, field, detail drawing preparation, raw

materials, and other costs. On bid projects, a formal bid is prepared detailing

the specific services and materials we plans to provide, payment terms and

project completion timelines. Upon acceptance, our bid proposal is finalized in

a definitive contract. We experience an average accounts settlement period

ranging from three months to as high as one year from the time we provide

services to the time we receive payment from our customers. In contrast, we

typically need to place certain deposit with our suppliers on a portion of the

purchase price in advance and for some suppliers we must maintain a deposit for

future orders. We are typically paid by the contractor the entire amount due to

us for our services and products once the entire project is completed, which

could be significantly after we complete the curtain wall portion of the

project. China’s policy requires the contractor to pay 85% of our total contract

value to us before the project is completed, and the remainder may be paid when

the contractor completes the entire project. In addition, current national

policy in China dictates that for government projects sub-contractors will be

paid directly from the government budget offices, not through general

contractors and/or developers. Because our payment cycle is considerably shorter

than our receivable cycle, we may experience working capital shortages. We have

used bank loans, cash provided by operations and other financings to fund our

operations.

5

Marketing

Management

believes that we have developed a reputation for innovative technology and

quality in the specialty high-end curtain wall industry. Marketing efforts are

geared towards advancing us as a brand of choice for building the world’s most

modern and challenging projects. Our marketing plan has historically focused on

print advertising, participation in tradeshows, exhibitions, lecture and

technology briefings to architects and property owners. To better showcase our

diverse products to potential customers, we regularly exhibit at leading trade

shows and exhibitions. Our dynamic, state-of-the-art trade show exhibits are

developed internally to showcase our latest product offerings.

Production

Supplier

Selection

We

procure high quality glass panes, metal support beams, and other curtain wall

components from a number of regional and international suppliers, depending on

the requirements of the contract. Once the suppliers are chosen, our engineers

work with them to configure their production processes to manufacture anything

from a standard glass pane to a patented fixing bolt or connector. All

manufacturing is monitored and approved by our quality control and engineering

departments.

Component

Processing and Delivery

Once the

curtain wall components are produced, they are either shipped directly to the

site or sent to one of our facilities for further processing. Such processing

typically involves drilling holes in glass panes, affixing metal frame pieces to

glass panes, and cutting steel rods and bending them into customized shapes. The

project manager and project engineer jointly approve all factory

purchases.

Quality

Control

Our

manufacturing production facilities are designed and maintained with a view

towards conforming to good practice standards. To comply with the strict

requirements of our customer base, we have implemented a quality assurance plan

setting forth our quality assurance procedures. Our quality control department

is responsible for maintaining quality standards throughout the production

process. Quality control executes the following functions:

|

|

·

|

setting internal controls and

regulations for semi-finished and finished

products;

|

|

|

·

|

implementing sampling systems and

sample files;

|

|

|

·

|

maintaining quality of equipment

and instruments;

|

|

|

·

|

auditing production records to

ensure delivery of quality

products;

|

|

|

·

|

articulating the responsibilities

of quality control staff;

and

|

|

|

·

|

on-site evaluation of supplier

quality control systems.

|

We have

received the following certifications in recognition of our production and

quality assurance program:

|

|

·

|

ISO 9001 - International Quality

System Certification, valid from April 9, 2008 to April 8,

2011;

|

|

|

·

|

ISO 14001 - International

Environmental System Certification, valid from April 9, 2008 to April 8,

2011; and

|

|

|

·

|

ISO 18001 - International Safety

System Certification, valid from April 16, 2008 to April 15,

2011.

|

Research

and Development

Companies

such as us are under pressure from customers to respond more quickly with new

designs and product innovations to support rapidly changing consumer tastes and

regulatory requirements. We believe that the engineering and technical expertise

of our management and key personnel, together with our emphasis on continuing

research and development in support of our high-end curtain wall technologies,

allows us to efficiently and timely identify and bring new, innovative products

to market for our customers using the latest technologies, materials and

processes. We believe that continued research and development activities are

critical to maintaining our offering of technologically-advanced products to

serve a broader array of our customers.

For

example, in an effort to add value and create new markets, we are working to

develop high performance systems that reduce the need for air conditioning in

the summer and heat in the winter. Our products under development are designed

to both reduce the direct light and heat coming into the building and, through

the use of photovoltaic cells, to harness the energy collected from the sun and

further reduce external energy costs by generating power for use in other areas

of the building. Other features are designed to add a level of programmed

intelligence, automatically adjusting louvers/blinds and other façade controls

to achieve predetermined levels for user comfort. These efforts are made to meet

the demand for self-sustaining buildings and clean, renewable power in response

to climbing energy prices and declining energy reserves.

6

Our

research and development strategy relies primarily on internal innovation and

development, supplemented with collaboration with academic and research

institutions. For example, in 2001, we were appointed by the Chinese Ministry of

Construction to lead the committee tasked with establishing national standards

for the fixing bolt glass curtain wall technology industry. Luo Ken Yi, our

Chief Executive Officer was the Editor-in-Chief for the new standard code. Also,

in recognition of our contributions to the curtain wall industry, Luo Ken Yi and

two other of our engineers were appointed to senior posts at the Architectural

Glass and Metal Structure Institute of Qinghua University in Beijing, one of the

most prestigious research institutions in China, which we helped to create in

1999. We were able to incorporate many of the academic research results by the

Institute into our projects, including the National Grand Theater in Beijing and

the Hangzhou Grand Theater, both completed in 2007.

As of

December 31, 2009, we employed 108 designers and engineers. We currently

own 79 patents, of which 51 are approved, and 28 pending approval. Of the 51

approved, 48 are in China and 3 are in other countries.

We

expended $2,926, $711,318 and $111,129 on research and development activities

for each of the years ended December 31, 2009, 2008 and 2007, respectively.

These amounts exclude design and construction of customized molds used to

manufacture the pieces used for a particular project, as well as sample and

testing costs.

Backlog

As of

December 31, 2009, our total backlog of orders considered to be firm was

approximately $39 million, compared with $176 and $106 million at December 31,

2008 and 2007, respectively. Of our 2009 amounts, 92 % of the backlog, or $36

million, is expected to generate revenues in fiscal 2010, compared to 66% of our

2008 backlog ($117 million) realized in fiscal 2009; 80% of our 2007 backlog

($85 million) realized in fiscal 2008 and 100% of our 2006 backlog ($10 million)

realized in fiscal 2007. The decrease in backlog is primarily due to the absence

of new international projects taken by the company. Our backlog as at December

31, 2009 consisted entirely of projects within our home market of

China.

We define

backlog as the total anticipated revenue from projects already begun and

upcoming projects for which contracts have been signed or awarded and pending

signing. We view backlog as an important statistic in evaluating the level

of sales activity and short-term sales trends in our business. However, as

backlog is only one indicator, and is not an effective indicator of the ultimate

profitability of our sales, we do not believe that backlog should be used as the

sole indicator of our future earnings. There can be no assurance that the

backlog at any point in time will translate into net revenue in any subsequent

period.

Competition

The

markets that we serve are highly competitive, price and lead-time sensitive and

are impacted by changes in the commercial construction industry, including

unforeseen delays in project timing and workflow. In addition, competition in

the markets of the building industry is intense. It is based primarily

on:

|

|

·

|

quality;

|

|

|

·

|

service;

|

|

|

·

|

delivery;

|

|

|

·

|

ability to provide added value in

the design and engineering of

buildings;

|

|

|

·

|

price;

|

|

|

·

|

speed of construction in

buildings and components;

and

|

|

|

·

|

personal relationships with

customers.

|

We

compete with several large integrated glass manufacturers, numerous specialty,

architectural glass and window fabricators, and major contractors and

subcontractors. We also compete with a number of other manufacturers of

engineered building systems ranging from small local firms to large national

firms. Many of our competitors have greater financial or other resources than we

do. In addition, we and other manufacturers of engineered high-end curtain walls

compete with alternative methods of building construction. If these alternative

building methods compete successfully against us, such competition could

adversely affect us.

7

Government

Regulation

Construction

industry

China’s

construction industry is heavily regulated by the national government. On

November 1, 1997, the National Government of the PRC published the Construction

Law of the PRC, Presidential Order No. 91, which is the basic construction law

of China. This law outlines the basic requirements and rules for all

construction activity in China. Underneath the National Government, the Ministry

of Construction also writes laws. On March 14, 2001, the Ministry of

Construction published Rule No. 87, which puts forth licensing requirements for

all construction companies operating in China. The Ministry of Construction also

writes specific standards for all different types of construction. The three

standards from the Ministry of Construction which are most relevant to our

business are: (i) the Curtain Wall Engineering and Design Licensing Standard,

and (ii) the Light-Duty Steel Building Structure Engineering and Design

Licensing Standard, and (iii) the Automated Building Control System Standard.

These standards stipulate the basic requirements for construction companies in

China in such areas as registered capital, tangible assets, liability insurance,

employee regulations and engineering certifications. The standards also have

graded levels of qualification. We have first class certification for the

Curtain Wall Standard and Second Class Certification for the Light Steel

Structure Standard. In addition, provincial and municipal governments may also

enact regulations through their own construction bureaus.

Business

license

Any

company that conducts business in the PRC must have a business license that

covers a particular type of work. Our business license covers our present

business, which is to design, fabricate and install curtain wall systems

(including glass, stone and metal curtain walls), roofing systems, steel

construction systems, eco-energy saving building conservation systems and

provision of related products, for public works and commercial real estate

projects. Prior to expanding our business beyond that of our business

license, we are required to apply and receive approval from the PRC

government.

Employment

laws

We are

required to contribute a portion of our employees’ total salaries to the Chinese

government’s social insurance funds, including medical insurance, unemployment

insurance and job injuries insurance, and a housing assistance fund, in

accordance with relevant regulations. We are required to contribute to

government social security, medical insurance, unemployment insurance,

disability insurance and so on for our employees based in Hong Kong, Australia

and the United States. Changes in Chinese labor laws that became effective

January 1, 2008 that results in an increase of labor costs and impose

restrictions on our relationship with our employees. There can be no assurance

that the labor laws will not change further or that their interpretation and

implementation will vary, which may have a negative effect upon our business and

results of operations.

Patent

protection in China

The PRC’s

intellectual property protection regime is consistent with those of other modern

industrialized countries. The PRC has domestic laws for the protection of rights

in copyrights, patents, trademarks and trade secrets.

The PRC

is also a signatory to most of the world’s major intellectual property

conventions, including:

|

|

·

|

Convention establishing the World

Intellectual Property Organization (WIPO Convention) (June 4,

1980);

|

|

|

·

|

Paris Convention for the

Protection of Industrial Property (March 19,

1985);

|

|

|

·

|

Patent Cooperation Treaty

(January 1, 1994); and

|

|

|

·

|

The Agreement on Trade-Related

Aspects of Intellectual Property Rights (TRIPs) (November 11,

2001).

|

Patents

in the PRC are governed by the China Patent Law and its Implementing

Regulations, each of which went into effect in 1985. Amended versions of the

China Patent Law and its Implementing Regulations came into effect in 2001 and

2003, respectively.

The PRC

is signatory to the Paris Convention for the Protection of Industrial Property,

in accordance with which any person who has duly filed an application for a

patent in one signatory country shall enjoy, for the purposes of filing in the

other countries, a right of priority during the period fixed in the

convention.

The

Patent Law covers three kinds of patents—patents for inventions, utility models

and designs. The Chinese patent system adopts the principle of first to file;

therefore, where more than one person files a patent application for the same

invention, a patent can only be granted to the person who first filed the

application. Consistent with international practice, the PRC only allows the

patenting of inventions or utility models that possess the characteristics of

novelty, inventiveness and practical applicability. For a design to be

patentable, it cannot be identical with or similar to any design which, before

the date of filing, has been publicly disclosed in publications in the country

or abroad or has been publicly used in the country, and should not be in

conflict with any prior right of another.

8

PRC law

provides that anyone wishing to exploit the patent of another must conclude a

written licensing contract with the patent holder and pay the patent holder a

fee. One broad exception to this rule, however, is that, where a party possesses

the means to exploit a patent but cannot obtain a license from the patent holder

on reasonable terms and in reasonable period of time, the PRC State Intellectual

Property Office, or SIPO, is authorized to grant a compulsory license. A

compulsory license can also be granted where a national emergency or any

extraordinary state of affairs occurs or where the public interest so requires.

SIPO, however, has not granted any compulsory license to date. The patent holder

may appeal such decision within three months from receiving notification by

filing a suit in a people’s court.

PRC law

defines patent infringement as the exploitation of a patent without the

authorization of the patent holder. Patent holders who believe their patent is

being infringed may file a civil suit or file a complaint with a PRC local

Intellectual Property Administrative Authority, which may order the infringer to

stop the infringing acts. Preliminary injunction may be issued by the People’s

Court upon the patentee’s or the interested parties’ request before instituting

any legal proceedings or during the proceedings. Damages in the case of patent

infringement is calculated as either the loss suffered by the patent holder

arising from the infringement or the benefit gained by the infringer from the

infringement. If it is difficult to ascertain damages in this manner, damages

may be reasonably determined in an amount ranging from one to more times of the

license fee under a contractual license. The infringing party may be also fined

by Administration of Patent Management in an amount of up to three times the

unlawful income earned by such infringing party.

Foreign

currency exchange

Under the

PRC foreign currency exchange regulations applicable to us, the Renminbi is

convertible for current account items, including the distribution of dividends,

interest payments, trade and service-related foreign exchange transactions.

Conversion of Renminbi for capital account items, such as direct investment,

loan, security investment and repatriation of investment, however, is still

subject to the approval of the PRC State Administration of Foreign Exchange, or

SAFE. Foreign-invested enterprises may only buy, sell and/or remit foreign

currencies at those banks authorized to conduct foreign exchange business after

providing valid commercial documents and, in the case of capital account item

transactions, obtaining approval from the SAFE. Capital investments by

foreign-invested enterprises outside of China are also subject to limitations,

which include approvals by the Ministry of Commerce, the SAFE and the State

Reform and Development Commission. We currently do not hedge our exposure

to fluctuations in currency exchange rates.

Dividend

distributions

Under

applicable PRC regulations, foreign-invested enterprises in China may pay

dividends only out of their accumulated profits, if any, determined in

accordance with PRC accounting standards and regulations. In addition, a

foreign-invested enterprise in China are required to set aside at least 10.0% of

their after-tax profit based on PRC accounting standards each year to its

general reserves until the accumulative amount of such reserves reach 50.0% of

its registered capital. These reserves are not distributable as cash dividends.

The board of directors of a foreign-invested enterprise has the discretion to

allocate a portion of its after-tax profits to staff welfare and bonus funds,

which may not be distributed to equity owners except in the event of

liquidation

Employees

As of

December 31, 2009, we had 298 full-time employees. We now have a small

number of employees in Doha (Qatar), Dubai (the United Arab Emirates), the

United States and Australia. Approximately 36% of our employees are

designers and engineers, 10% are project managers/supervisors and the remaining

employees are supply chain and administrative staff. We believe that our

relationship with our employees is good.

Available

Information

The

Company maintains a website at www.caebuilding.com. This corporate website

provides free access to the Company’s Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q, Current Reports on Form 8-K and, if applicable, amendments

to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as

reasonably practicable after electronic filing such material with, or furnishing

it to, the Securities and Exchange Commission.

ITEM

1A. RISK FACTORS

Any

investment in our securities involves a high degree of risk. Investors should

carefully consider the risks described below and all of the information

contained in this report before deciding whether to purchase our securities. Our

business, financial condition or results of operations could be materially

adversely affected by these risks if any of them actually occur. The trading

price of our common stock could decline due to any of these risks, and an

investor may lose all or part of his investment. Some of these factors have

affected our financial condition and operating results in the past or are

currently affecting our company. This report also contains forward-looking

statements that involve risks and uncertainties. Our actual results could differ

materially from those anticipated in these forward-looking statements as a

result of certain factors, including the risks we face as described below and

elsewhere in this report. With respect to this discussion, the terms, “we,”

“us,” or “our” refer to China Architectural Engineering, Inc., and all of our

subsidiaries.

9

RISKS

RELATED TO OUR OPERATIONS

If

we are unable to accurately estimate and control our contract costs and

timelines, then we may incur losses on our contracts, which may result in

decreases in our operating margins and in a significant reduction or elimination

of our profits.

If we do

not control our contract costs, we may be unable to maintain positive operating

margins or experience operating losses. Approximately 95% of our sales are from

fixed-price contracts. The remaining 5% of our sales are from cost-plus-fee

contracts. Under fixed-price contracts, we receive a fixed price. Consequently,

we realize a profit on fixed-price contracts only if we control our costs and

prevent cost over-runs on the contracts. Approximately 70% of contracts are

modified after they begin, usually to accommodate requests from clients to

increase project size and scope. In cases where fixed-price contracts are

modified, the fixed price is renegotiated and adjusted upwards accordingly.

Under cost-plus-fee contracts, which may be subject to contract ceiling amounts,

we are reimbursed for allowable costs and fees, which may be fixed or

performance-based. If our costs exceed the contract ceiling or are not allowable

under the provisions of the contract or any applicable regulations, we may not

be reimbursed for all our costs. Under each type of contract, if we are unable

to estimate and control costs and/or project timelines, we may incur losses on

our contracts, which may result in decreases in our operating margins and in a

significant reduction or elimination of our profits.

Due

to global recession, its negative effect on the construction industry, and other

reasons, we do not intend to engage in any international projects in 2010, which

accounted for a majority of our revenues in 2009. We have shifted our

focus to projects located in mainland China and our contract revenues and net

income will be materially reduced if we are not able to secure sufficient

projects in China.

For

fiscal 2009, 2008 and 2007, revenue from sales of our products and services

internationally (for our purposes, outside of China) represented approximately

57%, 44.6% and 4.9%, respectively, of our total revenue. As a result of

our recent restructure and reorganization to turn back to local instead of

oversea market due to the recent change in international economic environments,

our Shenzhen office was down sized and moved out from the leasehold multi-floor

office building to a smaller leased place at minimal operations in September

2009. The set up of the Shenzhen office was originally for the support of the

overseas operations which we have decided to discontinue. As a result, the

current improvement works to the leasehold multi-floor office building were

stopped and was written off in the third quarter of 2009, a loss of $1.9

million. In addition, a substantial percentage of our revenue has been

derived from international projects in the past few years, and with the loss of

such sources of revenue going forward, our results of operations will suffer if

we are unable to secure a sufficient amount of projects in mainland China to

offset the void in revenue that we have received from international projects in

the past, which could negatively affect our stock price.

We

depend on a small number of customers for the vast majority of our sales. A

reduction in business from any of these customers could cause a significant

decline in our sales and profitability.

The vast

majority of our sales are generated from a small number of customers. For the

year ended December 31, 2009, we had three customers that each accounted for at

least 7.0% of the revenues that we generated, with one customer accounting for

43.2% of our revenue. These three customers accounted for a total of

approximately 59.4% of our revenue for that period. We expect that we will

continue to depend upon a small number of customers for a significant majority

of our sales for the foreseeable future. A reduction in business from any

of these customers could cause a significant decline in our sales and

profitability.

A

substantial portion of our assets has been comprised of construction contract

receivables representing amounts owed by a small number of customers. If any of

these customers fails to timely pay us amounts owed, we could suffer a

significant decline in cash flow and liquidity which, in turn, could cause us to

be unable to pay our liabilities and purchase an adequate amount of inventory to

sustain or expand our sales volume.

Our

construction contract receivables represented approximately 65.7% and 68.8% of

our total current assets as of December 31, 2009 and 2008, respectively. As of

December 31, 2009, our largest customer represented over 43.9% of the total

amount of our construction contract receivables. As a result of the substantial

amount and concentration of our construction contract receivables, if any of our

major customers fails to timely pay us amounts owed, we could suffer a

significant decline in cash flow and liquidity which could adversely affect our

ability to borrow funds to pay our liabilities and to purchase inventory to

sustain or expand our current sales volume.

The

growth of aging receivables and a deterioration in the collectability of these

accounts could adversely affect our results of operations.

We

provide for bad debts principally based upon the aging of accounts receivable,

in addition to collectability of specific customer accounts, our history of bad

debts, and the general condition of the industry. We recorded a general

provision for doubtful accounts amounting to approximately $5.2 million in 2008

and $1.4 million in 2009, which management believes is commensurate to cover the

associated credit risk in the portfolio of our construction contract related

receivables. As of December 31, 2009 our provision for doubtful accounts

was $6.6 million, which was 6.9% of our construction contract related

receivables of $95.8 million. We believed it was appropriate to increase the

reserve for doubtful accounts primarily due to an increase in the aging of our

accounts receivable, the growth of the outstanding balance of receivables as of

December 31, 2009, and the general decline in the domestic and global

economy. Due to the difficulty in assessing future trends, we could be

required to further increase our provisions for doubtful accounts. As our

accounts receivable age and become uncollectible our cash flow and results of

operations are negatively impacted.

10

Our

use of the “percentage-of-completion” method of accounting could result in

reduction or reversal of previously recorded revenues and profits.

A

substantial portion of our revenues and profits are measured and recognized

using the “percentage-of-completion” method of accounting, which is discussed

further in Note 2, “Summary of Significant Accounting Policies” to our

“Financial Statements.” Our use of this method results in recognition of

revenues and profits ratably over the life of a contract, based generally on the

proportion of costs incurred to date to total costs expected to be incurred for

the entire project. The effect of revisions to revenues and estimated costs is

recorded when the amounts are known or can be reasonably estimated. There

are uncertainties inherent in the estimating process, and estimate revisions may

occur. Such revisions could occur in any period and their effects could be

material. As is customary in the construction industry, we intend to

conduct interim reviews on a rolling basis, and it may be determined during

these reviews that actual costs on a project or projects vary materially from

estimates, including reductions or reversals of previously recorded revenues and

profits. Our results of operations for current and past periods may be

negatively affected by revisions to estimates and reductions or reversals of

previously recorded revenues and profits, which could harm the value of our

securities.

Our

dispute with the master contractor on the Dubai Metro Rail Project may result in

costly and time-consuming litigation that could require significant time and

attention of management and a reversal of recognized revenue in accordance with

the “percentage of completion” method of accounting, either of which may have a

material adverse effect on our financial position and results of

operations.

Techwell,

our wholly owned subsidiary, was removed by the master contractor of the Dubai

Metro Rail Project, which was the primary focus of Techwell, and such master

contractor also called for and received payment of $2.1 million in performance

bonds and $7.3 million in advance payment bonds that were issued on Techwell's

behalf for the project. The calling of the advance payment bonds was based on

the master contractor's belief that it had paid in excess of the construction

work performed. We and certain of our subsidiaries are guarantor of the

bonds that were paid by the banks, and we are liable under the guarantee

agreements for such amounts paid by the banks. Although we do not believe

that the master contractor had a proper basis for calling the bonds, there can

be no assurance can be given that the dispute will be resolved in our

favor. With less than 5% of its contract remaining to be completed, we had

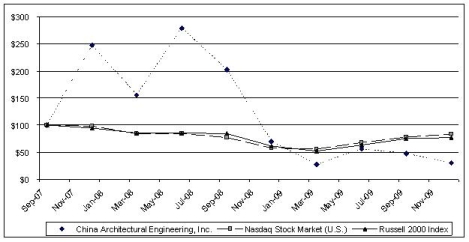

generated approximately $105.4 million in total revenue since construction began