Attached files

Table of Contents

Index to Financial Statements

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 25, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 333-122531

THE MONEY TREE INC

(Exact name of registrant as specified in its charter)

| Georgia | 58-2171386 | |

| State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

114 South Broad Street

Bainbridge, Georgia 39817

(Address, including zip code, of principal executive offices)

Registrant’s telephone number, including area code (229) 246-6536

Securities registered pursuant to Section 12(b) of the act:

None

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 of 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K(§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any attachment to this Form 10-K. þ

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | þ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes þ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second quarter. Not Applicable

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the last practicable date.

| Class |

Outstanding at November 25, 2009 | |

| Class A, Voting | 2,686 Shares | |

| Class B, Non-Voting | 26,860 Shares |

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

Index to Financial Statements

ANNUAL REPORT ON FORM 10-K/A

FOR FISCAL YEAR ENDED SEPTEMBER 25, 2009

TABLE OF CONTENTS

| Item 1. | Business | 2 | ||

| Item 1A. | Risk Factors | 11 | ||

| Item 2. | Properties | 15 | ||

| Item 3. | Legal Proceedings | 15 | ||

| Item 4. | Submission of Matters to a Vote of Security Holders | 15 | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 16 | ||

| Item 6. | Selected Financial Data | 16 | ||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 | ||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 35 | ||

| Item 8. | Financial Statements and Supplementary Data | 36 | ||

| Item 9A. | Controls and Procedures | 74 | ||

| Item 10. | Directors and Executive Officers of the Registrant | 76 | ||

| Item 11. | Executive Compensation | 77 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 81 | ||

| Item 13. | Certain Relationships and Related Transactions | 82 | ||

| Item 14. | Principal Accounting Fees and Services | 82 | ||

| Item 15. | Exhibits, Financial Statement Schedules | 83 | ||

Table of Contents

Index to Financial Statements

PART I

EXPLANATORY NOTE

This amendment No. 1 to this Annual Report on Form 10-K/A (“Form 10-K/A”) is being filed in order to correct previously issued historical consolidated financial statements of The Money Tree Inc. (the “Company”) as of September 25, 2009 and 2008, and for each of the three years in the period ended September 25, 2009, initially filed with the Securities and Exchange Commission (the “SEC”) on December 23, 2009, for errors in previously reported amounts related to net finance receivables, shareholders’ deficit, provision for credit losses, provision for income taxes and net loss.

For the convenience of the reader, this Form 10-K/A includes all of the information contained in the original report on Form 10-K, and no attempt has been made in this Form 10-K/A to modify or update the disclosures presented in the original report on Form 10-K, except as required to reflect the effects of the restatement. The Form 10-K/A does not reflect events occurring after the filing of the Form 10-K or modify or update those disclosures, including the exhibits to the Form 10-K affected by subsequent events. Information not affected by the restatement is unchanged and reflects the disclosures made at the time of the original filing of the Form 10-K on December 23, 2009. Accordingly, this Form 10-K/A should be read in conjunction with our filings made with the Securities and Exchange Commission subsequent to the filing of the original Form 10-K, including any amendments to those filings. The following items have been amended as a result of the restatement:

| • | Part I – Item 1 – Business; |

| • | Part I – Item 1A – Risk Factors; |

| • | Part II – Item 6 – Selected Financial Data; |

| • | Part II – Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| • | Part II – Item 8 – Financial Statements and Supplemental Data; |

| • | Part IV – Item 15 – Exhibits and Financial Statement Schedules. |

We have not amended and do not intend to amend our previously filed Quarterly Reports on Form 10-Q for periods affected by the restatement. For this reason, the consolidated financial statements and related financial information for the affected periods contained in any other prior reports should no longer be relied upon. In addition, this Form 10-K/A includes current certifications from the Company’s CEO and CFO as Exhibits 31.1, 31.2, and 32.1.

On April 23, 2010, the Company decided to restate our audited consolidated financial results as of September 25, 2009 and 2008 and for the three years ended September 25, 2009, 2008 and 2007 (the “Restatement”). The Restatement reflects the following adjustments:

| 1. | Consumer bankruptcy portfolio amounts contained in the Company’s net finance receivables were overstated due to an insufficient reserve for loan losses. The result was an overstatement of net finance receivables due to this insufficiency for the periods noted above, an understatement of provision for credit losses for the years ended September 25, 2009 and 2007 and an overstatement of provision for credit losses for the year ended September 25, 2008. |

| 2. | As a result of the above adjustments, we have reassessed the realizability of our net deferred income tax assets and, as a result, increased our valuation allowance recorded against such net deferred income tax assets. |

The impact of the adjustments related to the Restatement for the years ended September 25, 2009, 2008 and 2007 is summarized below:

| Net Income (Loss) | Accumulated Deficit, September 25, 2006 |

|||||||||||||||

| Year ended September 25, | ||||||||||||||||

| 2009 | 2008 | 2007 | ||||||||||||||

| As Previously Reported |

$ | (11,951,193 | ) | $ | (11,966,366 | ) | $ | 375,637 | $ | (2,982,984 | ) | |||||

| Adjustment: |

||||||||||||||||

| (Increase)/Decrease in provision for credit losses |

(983,897 | ) | 769,329 | (2,957,287 | ) | (5,754,931 | ) | |||||||||

| (Increase)/Decrease in provision for income taxes |

— | 1,210,000 | (1,210,000 | ) | — | |||||||||||

| Total adjustments |

(983,897 | ) | 1,979,329 | (4,167,287 | ) | (5,754,931 | ) | |||||||||

| As Restated |

$ | (12,935,090 | ) | $ | (9,987,037 | ) | $ | (3,791,650 | ) | $ | (8,737,915 | ) | ||||

Additional information about the decision to restate these financial statements can be found in our Current Report on Form 8-K, filed with the SEC on April 29, 2010.

1

Table of Contents

Index to Financial Statements

| Item 1. | Business: |

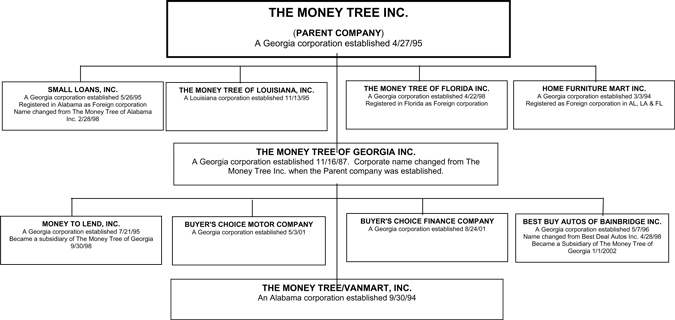

We originally incorporated in the State of Georgia in 1987 under the name The Money Tree Inc. Then, in 1995, pursuant to a corporate reorganization, we changed the name of the company to The Money Tree of Georgia Inc. and formed a new parent company called The Money Tree Inc. We have been engaged in the consumer finance business since our inception, primarily making, purchasing and servicing direct consumer loans, consumer sales finance contracts and motor vehicle installment sales contracts. Direct consumer loans are direct loans to customers for general use, which are collateralized by existing automobiles or consumer goods, or are unsecured. Consumer sales finance contracts consist of retail installment sales contracts for purchases of specific consumer goods by customers either from our branch locations or from a retail store and are collateralized by such consumer goods. Motor vehicle installment sales contracts are initiated by us or purchased from automobile dealers subject to our credit approval. Direct consumer loans and consumer sales finance contracts originate primarily in our branch office locations. As of September 25, 2009, direct consumer loans comprised 30.0%, motor vehicle installment sales contracts comprised 45.1%, and consumer sales finance contracts comprised 24.9% of the gross amount of our outstanding loans and contracts.

As of the date of this report, we operate 102 consumer finance branch offices in cities located throughout Georgia, Florida, Alabama and Louisiana and three used car lots in Georgia.

2

Table of Contents

Index to Financial Statements

We operate our business through the following wholly-owned subsidiaries: The Money Tree of Georgia Inc.; The Money Tree of Louisiana, Inc.; The Money Tree of Florida Inc.; Small Loans, Inc.; and Home Furniture Mart Inc. Below is a map showing our branch office locations:

3

Table of Contents

Index to Financial Statements

We fund our loan demand through a combination of cash collections from our loans, proceeds raised from the sale of debentures and demand notes and loans from various banks and other financial institutions.

Our direct consumer loans generally serve individuals with limited access to other sources of consumer credit such as banks, savings and loans, other consumer finance businesses and credit cards. Direct consumer loans are general loans made to people who need money typically for the following purposes:

| • | paying some unusual or unforeseen expense; |

| • | paying off an accumulation of small debts; or |

| • | purchasing furniture and appliances. |

To the extent they are secured at all, direct consumer loans are generally secured by personal property and/or motor vehicles already owned by our customers. Automobile sales finance loans are made primarily in the Bainbridge, Columbus and Dublin, Georgia locations (subsequent to September 25, 2009 the Columbus Georgia lot was closed). They are typically made in amounts from $3,000 to $30,000 on maturities of 24 to 54 months. Consumer sales finance contracts consist of retail installment sales contracts for purchases of specific consumer goods by customers either at our branch locations or at a retail store. The consumer goods purchased by the customer serve as collateral for these loans. We originate consumer sales finance contracts at our branch offices and sometimes purchase such contracts from retail dealers. These loans have maturities that typically range from three to 36 months and generally do not individually exceed $4,000 in principal amount. We generally charge the maximum interest rates allowed under applicable federal and state laws for our loans.

Prior to making a loan or purchasing a consumer sales finance contract or a motor vehicle installment sales contract, we undertake a credit investigation to determine the income, existing indebtedness, length and stability of employment, and other relevant information concerning the customer. When a loan is made, if it is secured at all, we are granted a security interest in personal property or automobiles of the borrower. In making direct consumer loans, we place emphasis upon the customer’s ability to repay rather than upon the potential resale value of the underlying collateral. In making motor vehicle installment sales and consumer sales finance contracts, however, we place increased emphasis upon the marketability and value of the underlying collateral.

Our business consists mainly of making loans to salaried people and wage earners who depend on their earnings to make their repayments. Our ability to operate on a profitable basis, therefore, depends to a large extent on the continued employment of these people and their ability to meet their obligations as they become due. In the event of a sustained recession or a continued downturn in the U.S. and local economies in which we operate with resulting unemployment and continued increases in the number of personal bankruptcies, our collection ratios and profitability would be detrimentally affected. See “Risk Factors – We could suffer increased credit losses if there is a continued downturn in the economy.”

4

Table of Contents

Index to Financial Statements

Below is a chart detailing the relationships of our subsidiaries and other related entities:

5

Table of Contents

Index to Financial Statements

Lending and Collection Operations

We seek to provide short-term loans to the segment of the population that has limited access to other sources of credit and is considered a higher credit risk. See “Risk Factors – Our typical customer base has ‘subprime’ credit ratings and higher than average credit risks which has resulted in increased loan defaults.” In evaluating the creditworthiness of potential customers, we primarily examine the individual’s discretionary income, length of current employment, duration of residence and prior credit experience. We make loans to individuals on the basis of the customer’s discretionary income and other factors and the loans are limited to amounts that we believe the customer can reasonably be expected to repay from that income. All of our new customers are required to complete standardized credit applications in person or by telephone at our local offices. We equip each of our local offices to perform immediate background, employment and credit checks. Generally, we perform loan approval at our headquarters; however, some branch managers have limited authority to approve loans up to certain amounts. When initiating a loan for a new customer, our employees verify the applicant’s employment and credit histories through telephone checks with employers or other employment references and a variety of credit services. We require substantially all new customers to submit a listing of personal property that will be pledged as collateral to secure the loan, but we do not rely on the value of such collateral in the loan approval process and generally do not perfect our security interest in that collateral. Accordingly, if the customer were to default in the repayment of the loan, we may not be able to recover the outstanding loan balance by resorting to the sale of collateral.

We believe that the development and continual reinforcement of personal relationships with customers improve our ability to monitor their creditworthiness, reduce credit risk and generate repeat loans. It is not unusual for us to have made a number of loans to the same customer over the course of several years, many of which were refinanced with a new loan after two or three payments. In determining whether to refinance existing loans, we typically require loans to be current in their payments, and repeat customers are generally required to complete a new credit application if they have not completed one within the prior two years.

In the fiscal year ended September 25, 2009, approximately 34.9% of the total number of loans we made resulted from refinancing of existing loans. Refinancings accounted for approximately 19.9% of the total volume of loans we made during that period. In the fiscal year ended September 25, 2008, approximately 34.4% of the total number of loans and 22.5% of the total volume of loans we made resulted from refinancing of existing loans. A refinancing represents a new loan transaction with an existing customer in which a portion of the new loan is used to repay the balance of an existing loan and the remaining portion is advanced to the customer. We actively market the opportunity to refinance existing loans prior to maturity due to the established credit of these customers. The refinancings result in increased amounts borrowed by the customer and additional fees and income realized by us.

We typically do not perfect our security interest in collateral securing our loans by filing Uniform Commercial Code financing statements. We usually charge a non-filing or non-recording insurance fee in connection with our direct consumer loans. These fees are equal in aggregate amount to the premiums paid by us to purchase non-filing insurance coverage from an unaffiliated insurance company. Under our non-filing insurance coverage, we are reimbursed for losses on direct consumer loans resulting from our policy of not perfecting our security interest in collateral pledged to secure the loans. Non-file insurance is not available for motor vehicle installment sales contracts and consumer sales finance contracts. We must rely on the collateral securing the loan for these two products, and any recovery on such collateral is very uncertain. See “Risk Factors – The collectibility of our finance receivables may be affected by general economic conditions and we may not be able to recover the full amount of delinquent accounts by resorting to sale of collateral or receipt of non-filing insurance proceeds.”

Competition

We compete with several national and regional finance companies, as well as a variety of local finance companies, in the communities in which we operate. We believe that we compete effectively in the marketplace primarily based on our emphasis on customer service and the variety of services we provide.

Customer Service Training. We believe intensive training for all employees is integral to the success of our customer service emphasis. Our branch structure includes three positions at each branch office: customer service representative; manager trainee; and branch manager. Customer service representatives meet customers, take payments and input loans. In addition, customer service representatives are responsible for soliciting additional business from existing customers who visit a branch by refinancing current loans. Manager trainees collect past due loans and solicit loans. Branch managers oversee branch operations and the loan making process. When an employee is hired, he or she is required to successfully complete a one- to two-week training course in our headquarters for the position. Branch managers attend both the customer service representative and collection

6

Table of Contents

Index to Financial Statements

training classes as well as a one-week manager training class (for a total of three weeks of training). Branch managers are also trained on location in their respective branches by one of our traveling trainers and by a regional manager. Designated employees in our headquarters also provide answers to questions by telephone that arise during the course of dealing with customers at the branch offices.

Additional Services to Customers. In addition to the loan services we provide, we offer certain services typically provided by banks or other institutions to consumers who do not have relationships with commercial banks or such other institutions. Please see the “Certain Relationships and Related Transactions” section for a discussion of conflicts and issues arising from various relationships between us, our executive officers and our affiliates. We believe that our ability to service our customers’ needs distinguishes us from most of our competitors that solely offer loan services. Listed below are a number of services offered by us in this capacity.

Direct Deposit. We (working in conjunction with our bank) are an approved “Authorized Payment Agent” for Social Security, Veterans Administration (VA), military and retirement benefits. We (working in conjunction with our bank) also accept direct deposit of employee payroll checks for our customers. This service allows customers to elect to receive their benefits or payroll checks at a local branch office.

Sale and Financing of Certain Consumer Goods. In each branch office location (or next door to the branch office in the State of Louisiana), we offer for sale certain furniture, appliances, electronics and other household items. See “Regulation and Supervision – State Laws.” We receive a mark-up for each of the products sold. In addition, we offer financing to eligible consumers desiring to finance the purchase of these consumer goods.

Motor Club Memberships. We offer motor club membership from Interstate Motor Club, Inc. to all customers possessing a valid driver’s license. Reimbursement benefits to members include: bail bond; emergency road service; wrecker service; emergency ambulance expense; lock and key service; emergency travel expense; and legal fees. We receive a commission on sales of motor club memberships. Interstate Motor Club, Inc. is owned by Bradley D. Bellville, our President and a director; Jefferey V. Martin, one of our directors; and two of Mr. Martin’s siblings. See “Certain Relationships and Related Transactions.”

Prepaid Telephone Service. We offer prepaid telephone service to all of our customers. We receive a commission for each customer who signs up for the service as well as a commission for each monthly payment collected. The telephone service is provided through Budget Phone, Inc., an unaffiliated entity.

Bank Draft. We offer bank draft services to all of our customers whereby amounts owed to us are automatically debited from the customer’s bank account and paid to us on a regular periodic basis. This results in ease of payment for the customer and, we believe, reduced collections costs and added predictability of cash flow.

Insurance and Other Benefits

We offer various credit and non-credit insurance products in connection with our loans. We sell insurance products as a licensed agent for a non-affiliated insurance company pursuant to certain underwriting guidelines set by the insurance company. During our fiscal year ended September 25, 2009, we earned $8.4 million in commissions from the sale of insurance products.

We offer credit life insurance, credit accident and sickness insurance and collateral protection insurance. Credit life insurance is elected by those customers who prefer to have their indebtedness covered in the event of death. Credit accident and sickness insurance is available to customers who are gainfully employed for a minimum of 30 hours per week, and provides coverage in the form of continued payments on the loan made by us in the event the customer is unable to work for a period of time. Collateral protection insurance is written to protect our security interest in certain collateral. Examples of covered collateral are automobiles, trucks, travel trailers and certain boats. When a claim is made, the insurance proceeds are payable to us and any excess is payable to the customer. This insurance pays for partial losses as well as total losses of the collateral.

7

Table of Contents

Index to Financial Statements

We also offer non-credit accidental death and dismemberment insurance to customers. This type of insurance may have a term shorter or longer than the term of the loan and coverage may exceed the principal amount of the loan. Proceeds of claims are payable to the customers and/or their beneficiaries. Customers are not required to purchase these insurance products from us in order to obtain any other product or service provided by us. See “Regulation and Supervision – State Laws.”

Provision for Credit Losses

Provision for credit losses (sometimes known as bad debt expense) is charged against income in amounts sufficient, in the opinion of senior management, to maintain an allowance for credit losses at a level considered adequate to cover the probable losses inherent in our finance receivable portfolio. Credit loss experience, contractual delinquency of finance receivables and management’s judgment are all factors used in assessing the overall adequacy of the allowance and the resulting provision for credit losses. Charge-offs are typically determined in one of three ways. First, an account that is at least 180 days past due with no payments made within the last 180 days may be charged off. Second, an account may be determined by senior management to be uncollectible under certain circumstances, as in the event of death of the customer who did not elect to purchase credit life insurance for his loan contract or in situations when repossession and sale of collateral occurs on consumer sales finance and motor vehicle installment sales contracts and the balance is not recoverable through legal process or other methods. Third, upon receipt of a notice of bankruptcy filing from the customer, the account is charged off within 30 days.

In addition to these general means of designating an account to be charged off, branch managers may encounter other situations when charge-off is appropriate. We require that a supervisor visit each branch to review all of their accounts that are potential charge-off accounts on a monthly basis. Then each supervisor meets with the operations manager for a final review. Prior to these visits, the branch manager is responsible for ensuring that all phases of the collection process have been followed. A comprehensive charge-off checklist has been developed to help the branch manager verify that all collection activities and procedures have been followed in order to have that account charged off. Senior management reviews the charge-off checklist to determine whether an account should be charged off or whether the branch manager should undertake further collection measures for the particular account.

Direct consumer loans are charged off net of proceeds from non-filing insurance. We purchase non-filing insurance on certain direct consumer loans in lieu of filing a Uniform Commercial Code financing statement. Premiums collected are remitted to the insurance company to cover possible losses from charge-offs as a result of not recording. Should we ever discontinue our practice of purchasing non-filing insurance, the proceeds from these claims would not be available to us to offset future credit losses and additional provisions for credit losses would be required.

For consumer sales finance and motor vehicle installment sales contracts, we are granted a security interest in the collateral for which the loan was made. In the event of default, the collateral on such contracts may be repossessed at 31 to 60 days’ delinquency (roughly two payments). After repossession, the collateral is sold (typically within 30 days) according to UCC-9 disposition of collateral rules and the proceeds of the sale are applied to the customer’s account. If the likelihood of collection on a judgment is favorable, a suit is filed for the deficiency balance remaining and, if granted, garnishment and/or execution follow for collection of the balance. If the collateral is not conducive to repossession because it is in unmarketable condition, judgment is sought without repossession and sale of collateral. If collection on a judgment is not favorable, the balance of the account is charged off.

As stated in the Explanatory Note to Part I, management has determined that our previous policy with respect to our consumer bankruptcy portfolio created an insufficient reserve for loan losses. Under the new policy, upon receipt of a notice of bankruptcy filing from the customer, the account is fully charged off within 30 days. If payments are received from the bankruptcy court or the bankruptcy is dismissed and the branch is able to recover all or a portion of the past due account, via cash collections or the sale of collateral, these amounts are now reported as recoveries of charge-offs.

For the fiscal years ended September 25, 2009, 2008 and 2007, our charge-offs, net of recoveries, were $10.6 million, $9.4 million and $5.1 million, respectively. We have experienced a significant increase in net charge-offs in 2008 and 2009 when compared to previous years. The declining economy, increase in cost of consumer goods, the rise in unemployment levels and bankruptcy filings have had a negative impact on our customer base. These factors have played a role in the significant increase of loan defaults occurring over the past three years. Although we continue to seek remedies through the legal process to attempt to collect past due amounts, sufficient evidence did not exist to defer the losses associated with these defaults.

8

Table of Contents

Index to Financial Statements

Allowance for Credit Losses

The allowance for credit losses (a deduction from finance receivables reported on our Consolidated Balance Sheet and sometimes known as a bad debt reserve) is determined by several factors. Historical loss experience coupled with the levels of and trends in delinquencies are the primary factors in the determination of the allowance for credit losses. Other factors such as borrowers’ ability to repay, effects of any changes in risk selection and lending policies and practices, and general economic conditions, to a lesser extent, are also considered. An evaluation is performed to compare the amount of accounts charged off, net of recoveries of such accounts, in relation to the average net outstanding finance receivables for the period being reviewed. Management has historically used this methodology to provide a benchmark for determining the allowance due to our loan portfolio in the direct consumer and consumer sales finance segments, consisting primarily of a large number of smaller balance homogeneous loans. A review is also performed of loans that comprise the automotive segment to determine if the allowance should be adjusted based on possible exposure related to collectibility of these loans. In accordance with the auto sales contract, we may repossess the collateralized vehicle after 30 days without payment to protect the vehicle’s integrity and to minimize our loss.

For the fiscal years ended September 25, 2009, 2008 and 2007, the charge-offs, net of recoveries, were $10.6 million, $9.4 million and $5.1 million, respectively. These amounts represent 16.7%, 12.8% and 6.9% of the respective year’s net average outstanding receivables. As discussed above, the poor economic conditions have played a role in the significant increase of loan defaults occurring over the past three years which has resulted in the subsequent increase in the relationship of net charge-offs to net outstanding finance receivables. Due to these circumstances, management revised its methodology in determining the adequacy of its allowance to rely much more heavily on current data.

Consequently, at September 25, 2009, we have established an allowance, expressed as a percentage of average net finance receivables, of 19.4% of direct consumer loans, 29.8% of consumer sales finance loans and 6.5% of loans in the automotive segment. The balance of the allowance for credit losses was $8.9 million and $8.8 million at September 25, 2009 and 2008, respectively.

Regulation and Supervision

Federal Laws

Our lending operations are subject to extensive federal regulation, including the Truth in Lending Act, the Equal Credit Opportunity Act and the Fair Credit Reporting Act. These laws generally require us to provide certain disclosures to prospective borrowers and protect against discriminatory lending practices and unfair credit practices.

The Truth in Lending Act requires us to make certain disclosures to our customers, including the terms of repayment, the total finance charge, the annual percentage rate charged and other information relating to the loan.

The Equal Credit Opportunity Act prohibits us from discriminating against loan applicants based on race, color, sex, age or marital status. Pursuant to Regulation B promulgated under the Equal Credit Opportunity Act, we are required to make certain disclosures regarding consumer rights and advise consumers whose credit applications are not approved of the reasons for the rejection.

The Fair Credit Reporting Act requires us to provide certain information to consumers whose credit applications are not approved on the basis of a report obtained from a consumer reporting agency. On December 4, 2003, President Bush signed into law the Fair and Accurate Credit Transaction Act. The FACT Act reauthorizes and amends the Fair Credit Reporting Act and permanently extends the state preemption provisions of the Fair Credit Reporting Act. The FACT Act also creates new provisions to strengthen consumer rights by addressing the problem of identity theft, as well as limit the disclosure of medical information for credit purposes.

The Federal Trade Commission (FTC) Credit Practices Rule prevents consumer lenders from using certain household goods as collateral on direct cash loans. We collateralize such loans with non-household goods such as automobiles, boats, mobile homes, and other exempt items.

9

Table of Contents

Index to Financial Statements

We are subject to the consumer privacy provisions of the Gramm-Leach-Bliley Act and, as such, are regulated by the FTC. The GLB Act restricts or prohibits our ability to offer non-affiliated third parties access to nonpublic personal information generated by our business. While we do not currently share any such nonpublic personal information with non-affiliated third parties, we may do so in the future. Required compliance with the GLB Act and these rules, or our failure to comply with them, may increase the overall cost to us in providing our products and services and may limit potential future revenue opportunities. In addition, the GLB Act allows states to enact consumer privacy laws that may be more burdensome or restrictive than the GLB Act, the rules promulgated thereunder and other existing federal laws. The GLB Act, the FTC’s rules, or the adoption of other consumer privacy laws or regulations could have a material adverse effect on our business, financial condition and operating results.

We are subject to the USA PATRIOT Act of 2001, including Section 352 of the Money Laundering Abatement Act, reasonably expected to detect and cause the reporting of suspicious transactions in connection with the sale of debentures and demand notes by us, direct deposits made by customers and the issuance of money orders to customers. In addition to other procedures, for investments or other cash receipts greater than $10,000, we obtain a copy of a valid driver’s license or picture identification and complete the required IRS Form 8300.

State Laws

General

State laws require that each office in which a small loan business is conducted be licensed by the state and that the business be conducted according to the applicable statutes and regulations. The granting of a license depends on the financial responsibility, character and fitness of the applicant, and, where applicable, the applicant must show finding of a need through convenience and advantage documentation. As a condition to obtaining such license, the applicant must consent to state regulation and examination and to the making of periodic reports to the appropriate governing agencies. Licenses are revocable for cause, and their continuance depends upon compliance with the law and regulations issued pursuant thereto. We have never had any of our small loan business licenses revoked.

We are also subject to state regulations governing insurance agents. State insurance regulations require that insurance agents be licensed and limit the premium amount charged for such insurance.

Georgia Laws

Direct consumer loans we make in Georgia are subject to the Georgia Industrial Loan Act. GILA governs loans of $3,000 or less and requires that lenders, like us, who are subject to GILA not loan funds for more than 36 months and 15 days. GILA provides for a maximum rate of interest and specifies permitted additional fees that can be charged for a loan, including loan fees, maintenance fees and late fees. Under GILA, a lender may also sell certain types of insurance. GILA permits us to charge and collect from our customers premiums actually paid for insurance obtained for the customer, provided that the insurance is reasonably related to the type and value of the property issued and the amount and term of the loan, and further provided that the insurance is obtained through an insurance company authorized to do business in Georgia and through a regular insurance agent licensed by the state insurance commissioner.

We also make a comparatively small number of direct consumer loans for amounts greater than $3,000 and for a longer period than 36 months and 15 days. These loans are not subject to GILA restrictions, but are made at an open, negotiated rate which, along with other terms of the loan, is subject only to the general Georgia usury laws.

In connection with the sale and financing of motor vehicles, we are generally subject to the Georgia Motor Vehicle Sales Financing Act. MVSFA requires, among other things, that certain content and notices be present in contracts and regulates the specific manner of execution and delivery of contracts. MVSFA also regulates related insurance purchased, the amount of certain finance charges, the treatment of prepayment and recovery of deficiencies in repossession cases.

Louisiana Laws

We are registered as a non-depository licensed lender in Louisiana. Direct consumer loans and sales finance loans we make in Louisiana are governed by the Louisiana Consumer Credit Law. The Louisiana Office of Financial Institutions regulates the Louisiana Consumer Credit Law. The Louisiana Consumer Credit Law generally

10

Table of Contents

Index to Financial Statements

regulates consumer loans made in Louisiana and provides for maximum rates of interest that may be charged based upon outstanding loan balance (the higher the loan balance the less the interest rate allowed to be charged). The Louisiana Consumer Credit Law specifies the permitted additional fees that may be charged in connection with a loan, including loan fees, maintenance fees and late fees. The Louisiana Consumer Credit Law allows us to request or require our customers to provide insurance in connection with consumer credit transactions. However, the maximum rates to be charged for such insurance are set by statute. The Louisiana Consumer Credit Law prevents us from displaying or selling merchandise at our branch office locations and requires that the space in which we make our consumer loans be separated from any location in which we display or sell merchandise by walls that may be broken only by a passageway in which the public does not have access.

Alabama Laws

Direct consumer loans and sales finance loans we make in Alabama are governed by the Alabama Consumer Credit Act and the regulations promulgated thereunder, also referred to as the Mini-Code. The Alabama State Banking Department, Bureau of Loans regulates the Mini-Code. The Mini-Code governs loans of $2,000 or less and provides for maximum finance charges depending on the loan balance and specifies permitted additional fees that may be charged for a loan, including loan fees, maintenance fees and late fees. Furthermore, the Mini-Code requires that we refund or credit certain unearned finance charges when a customer renews or extends a loan. The Mini-Code also requires that loans of less than $1,000 be repaid in substantially equal installments at periodic intervals over a period of not more than 36 months and 15 days for amounts financed of more than $300 and 24 months and 15 days for amounts financed of $300 or less. The Mini-Code permits us to charge and collect insurance premiums from our customers so long as the insurance is offered and written by a licensed insurance company authorized to do business in Alabama. However, the maximum rates to be charged for such insurance are set by statute. The Mini-Code also requires us to obtain the prior written approval of the State Banking Department prior to conducting any other business on the premises.

We also make a small number of consumer loans for amounts greater than $2,000 in Alabama. Such loans are not subject to the Mini-Code, but are made at an open, negotiated rate which, along with other terms of the loan, is subject only to the general Alabama usury laws.

Florida Laws

Direct consumer loans and sales finance loans we make in Florida are governed by the Florida Consumer Finance Act and are regulated by the Florida Department of Banking and Finance. The Florida Consumer Finance Act generally governs loans of less than $25,000 and provides for maximum rates of interest depending upon the loan balance and specifies permitted additional fees that may be charged for a loan, including loan fees, maintenance fees and late fees. The Florida Consumer Finance Act permits us to charge and collect insurance premiums from our customers so long as they are provided under a group or individual insurance policy which complies with the insurance laws of the State of Florida.

Employees

As of September 25, 2009, we had 370 full-time employees and five part-time employees. We do not have employment agreements with any of our employees.

| Item 1A. | Risk Factors: |

Our operations are subject to a number of risks. You should carefully read and consider these risks, together with all other information in this report. If any of the following risks actually occur, our business, financial condition or operating results and our ability to repay the debentures and demand notes could be materially adversely affected.

There is uncertainty as to our ability to continue as a going concern.

The opinion of our independent registered accounting firm for the fiscal year ended September 25, 2009, which is included in Item 8 of this report, contains a going concern qualification. This conclusion is based on our operating losses, a deficiency in net interest margin and our shareholders’ deficit. Those factors, as well as uncertainty in securing financing for continued operations, create an uncertainty regarding our ability to continue as a going concern.

11

Table of Contents

Index to Financial Statements

We suffered significant losses during fiscal years 2007, 2008 and 2009 and we anticipate such losses will likely continue in 2010.

Our net losses were approximately $3.8 million, $10.0 million and $12.9 million during fiscal years 2007, 2008 and 2009, respectively. We anticipate that such significant losses will likely continue in 2010.

We may be unable to meet our debenture and demand note redemption obligations which could force us to sell off our loan receivables and other operating assets or cease our operations.

We may issue demand notes, debentures, or similar debt instruments to investors in order to raise funds for our operations. As of September 25, 2009, we had a total of $73,602,821 of debentures and $3,146,707 of demand notes outstanding, which demand notes may be redeemed by our investors at any time. Of this amount, our subsidiary, The Money Tree of Georgia Inc., has issued $30,730,844 of debentures and $441,747 of demand notes. While the maturing debentures of our subsidiary are subject to substantially similar early redemption and automatic extension provisions as the debentures, we cannot predict with any accuracy the number of debenture holders who will elect to redeem such debentures at or prior to maturity. We intend to pay these and any other redemption obligations using our normal cash sources, such as collections on finance receivables and used car sales, as well as proceeds from the sale of the debentures and demand notes. We are substantially reliant upon the net offering proceeds we receive from the sale of the debentures and demand notes. However, during the fiscal year ended September 25, 2009, we redeemed $18.6 million in debentures, while only receiving $10.0 million from the sale of new debentures. Therefore, we have had to use funds from operations to fund these net redemptions. Our operations and other sources of funds may not provide sufficient available cash flow to meet our continued redemption obligations if the amount of redemptions continues at its current pace and we continue to suffer losses and use funds from operations to fund redemptions. If we are unable to repay or redeem the principal amount of debentures or demand notes when due, and we are unable to obtain additional financing or other sources of capital, we may be forced to sell off our loan receivables and other operating assets or we might be forced to cease our operations.

If we default in our debenture or demand note payment obligations, the indenture agreements relating to our debentures and demand notes provide that the trustee could accelerate all payments due under the debentures and demand notes, which would further negatively affect our financial position.

Our obligations with respect to the debentures and demand notes are governed by the terms of indenture agreements with U.S. Bank National Association, as trustee. Under the indentures, in addition to other possible events of default, if we fail to make a payment of principal or interest under any debenture or demand note and this failure is not cured within 30 days, we will be deemed in default. Upon such a default, the trustee or holders of 25% in principal of the outstanding debentures or demand notes could declare all principal and accrued interest immediately due and payable. Since our total assets do not cover these debt payment obligations, we would most likely be unable to make all payments under the debentures or demand notes when due, and we might be forced to cease our operations.

We suffered significant credit losses in 2009 due to continued weakening economic conditions, and there is no guarantee such credit losses will not continue during this downturn in the economy or that our operations and profitability will not continue to be negatively affected.

Because our business consists mainly of making loans to individuals who depend on their earnings to make their repayments, our ability to operate on a profitable basis depends to a large extent on the continued employment of those individuals and their ability to meet their financial obligations as they become due. In the current recession and continued downturn in the U.S. and local economies in which we operate, our customers have been affected by the resulting unemployment and increases in the number of personal bankruptcies. Therefore, we continue to experience increased credit losses and our collection ratios and profitability could continue to be materially and adversely affected. This recession has negatively affected our customers’ disposable income, confidence and spending patterns and preferences, which in turn are negatively impacting our sales of consumer goods and vehicles and our customers’ ability to repay their obligations to us. As a result, we continue to experience significant credit losses through loan charge-offs. For the fiscal year ended September 25, 2009, our charge-offs, net of recoveries, for our entire loan portfolio were $10.6 million, or 16.7% of average net finance receivables, and charge-offs for the direct consumer loans and consumer sales finance contract segments were 23.1% of the related average receivables. These high levels of charge-offs have had a negative impact on our operations and profitability. Should the current economic conditions continue or worsen, our operations and profitability will continue to be materially and adversely affected.

12

Table of Contents

Index to Financial Statements

Our significant shareholders’ deficit balance may limit our ability to obtain future financing, which could have a negative effect on our operations and our liquidity.

As of September 25, 2009, we had a shareholders’ deficit of $33,774,045, which means our total liabilities exceed our total assets. Bankruptcy law defines this as balance sheet insolvency. The existence of a significant shareholders’ deficit may limit our ability to obtain future debt or equity financing. If we are unable to obtain financing in the future, it will likely have a negative effect on our operations and our liquidity and our ability to continue as a going concern.

Our lack of a significant line of credit could affect our liquidity.

We have operated without a significant line of credit for the past several years. We have been seeking for several months to obtain a line of credit as an additional source of long-term financing. If we fail to obtain a line of credit, we will be more dependent on the proceeds from the debentures and demand notes for our continued liquidity. Since our sales of the debentures and demand notes have been significantly curtailed, our failure to obtain a line of credit would negatively affect our ability to meet our obligations.

The collectibility of our finance receivables has been severely and negatively affected by general economic conditions and we have not been able to recover the full amount of delinquent accounts by resorting to sale of collateral or receipt of non-filing insurance proceeds.

Our liquidity is dependent on, among other things, the collection of our finance receivables. We continually monitor the delinquency status of our finance receivables and promptly institute collection efforts on delinquent accounts. Collections of our consumer finance receivables have been severely and negatively affected by general economic conditions. Since we do not ordinarily perfect our security interest in collateral for loans, we have not been able to recover the full amount of outstanding receivables by resorting to the sale of collateral or receipt of non-filing insurance proceeds.

Our typical customer base has “subprime” credit ratings and higher than average credit risks which has resulted in increased loan defaults.

We typically lend money to individuals who have difficulty receiving loans from banks and other financial institutions because of credit problems or other adverse financial circumstances. Therefore, we have a higher risk of loan default among our customers than other lending companies. If we continue to suffer increased loan defaults, our operations will be materially adversely affected.

If we or our operations suffer from severe negative publicity, we could be faced with significantly greater payment or redemption obligations from holders of the demand notes than we have cash available for such payments or redemptions.

Because our demand notes are payable or redeemable at any time by holders, we cannot control the amount or timing of such payments or redemptions. If we or our operations suffer from severe negative publicity, we may receive significantly greater payment or redemption requests in a short time period than we have cash available to fund such payments or redemptions. In such event, we could be declared in default on the demand notes and other debt instruments.

Our internal controls over financial reporting may not be effective in preventing or detecting misstatements in our financial statements, and if we fail to detect material misstatements in our financial statements, our financial condition and operating results could be severely and negatively affected.

During our fiscal years ended September 25, 2009 and 2008, we concluded that our system of internal controls over financial reporting contained a material weakness and was not operating effectively. This resulted in errors in our previously issued financial statements. There can be no assurance that in the future our system of internal controls would detect misstatements in our financial statements. If we fail to detect material misstatements in our financial statements in the future, our financial condition and operating results could be severely and negatively affected.

13

Table of Contents

Index to Financial Statements

Hurricanes or other adverse weather events could negatively affect local economies or cause disruption to our branch office locations, which could have an adverse effect on our business or results of operations.

Our operations are conducted in the States of Georgia, Florida, Alabama and Louisiana, including areas susceptible to hurricanes or tropical storms. Such weather events can disrupt our operations, result in damage to our branch office locations and negatively affect the local economies in which we operate. We cannot predict whether or to what extent future hurricanes will affect our operations or the economies in our market areas, but such weather events could result in a decline in loan originations and an increase in the risk of delinquencies, foreclosures or loan losses. Our business or results of operations may be adversely affected by these and other negative effects of future hurricanes.

Additional competition may decrease our liquidity and profitability.

We compete for business with a number of large national companies and banks that have substantially greater resources, lower cost of funds, and a more established market presence than we have. If these companies increase their marketing efforts to include our market niche of borrowers, or if additional competitors enter our markets, we may be forced to reduce our interest rates and fees in order to maintain or expand our market share. Any reduction in our interest rates or fees could have an adverse impact on our liquidity and profitability.

An increase in market interest rates may result in a reduction in our liquidity and increased losses or delay in our return to profitability and impair our ability to pay interest and principal on our debentures and demand notes.

Interest rates are currently at or near historic lows. Sustained, significant increases in interest rates could unfavorably impact our liquidity and increase our losses or delay our return to profitability by reducing the interest rate spread between the rate of interest we receive on loans and interest rates we must pay under our demand notes and debentures and any bank debt we incur. Any reduction in our liquidity and increase in our losses or delay in our return to profitability would diminish our ability to pay principal and interest on the debentures and demand notes.

We are subject to many laws and governmental regulations, and any changes in these laws or regulations may materially adversely affect our financial condition and business operations.

Our operations are subject to regulation by federal authorities and state banking, finance, consumer protection and insurance authorities and are subject to various laws and judicial and administrative decisions imposing various requirements and restrictions on our operations which, among other things, require that we obtain and maintain certain licenses and qualifications, and limit the interest rates, fees and other charges we may impose in our consumer finance business. Although we believe we are in compliance in all material respects with applicable laws, rules and regulations, we cannot assure you that we are or that any change in such laws, or in the interpretations thereof, will not make our compliance with such laws more difficult or expensive or otherwise adversely affect our financial condition or business operations.

We are devoting resources to comply with various provisions of the Sarbanes-Oxley Act, including Section 404 relating to internal controls testing and auditor attestation, and this may reduce the resources we have available to focus on our core business.

For fiscal year ended September 25, 2009, we are subject to the requirements of Section 404(A) of the Sarbanes-Oxley Act, and in order to ensure compliance with the various provisions of the Sarbanes-Oxley Act, we have evaluated our internal controls over financial reporting to allow management to report on our internal controls systems. Among other things, we may not be able to conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. Any failure to comply with the various requirements of the Sarbanes-Oxley Act, may require significant management time and expenses, and divert attention or resources away from our core business.

Beginning with the fiscal year ending September 25, 2010, our independent registered public accounting firm will be required to attest to our internal controls systems and may not be able or willing to issue a favorable assessment of our internal controls over financial reporting.

We are controlled by the Martin family and do not have any independent board members overseeing our operations.

Our board of directors consists of Bradley D. Bellville, our President, and Jefferey V. Martin. We do not have any independent directors on our board. In addition, The Vance R. Martin Family Trust owns a majority of the outstanding shares of our voting capital stock. While W. Derek Martin, our former Chairman, is no longer an officer or actively involved in our operations, he serves as the sole trustee of the Trust. Therefore, the Martin family will be able to exercise significant control over our affairs, including the election of directors.

14

Table of Contents

Index to Financial Statements

| Item 2. | Properties: |

As of the date of this report, we lease all 102 of our branch office locations, the three used car lots and our corporate headquarters in Bainbridge, Georgia. Martin Family Group, LLLP owns and leases to us the real estate for thirteen of these branch office locations, one used car lot and our corporate headquarters. One of our shareholders is the president of Martin Investments, Inc. which is the managing general partner of Martin Family Group LLLP. In addition, Martin Sublease, L.L.C. leases from the owners, and subleases to us, 53 of these branch office locations and two used car lots.

| Item 3. | Legal Proceedings: |

As of the date of this report, neither we nor any of our officers or directors is a party to, and none of our property is presently the subject of, any pending or threatened legal proceeding or proceeding by a governmental authority that could have a material adverse effect on our business. We are a party to litigation and other contingent assets and liabilities arising in the normal course of business.

| Item 4. | Submission of Matters to a Vote of Security Holders: |

No matters were submitted to a vote of the security holders during the quarter ended September 25, 2009.

15

Table of Contents

Index to Financial Statements

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities: |

Not applicable.

| Item 6. | Selected Financial Data: |

The following selected consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes included elsewhere in this report. The selected consolidated balance sheet data, as of September 25, 2009 and 2008, and the selected consolidated statement of operations data, for the fiscal years ended September 25, 2009, 2008 and 2007, have been derived from our audited consolidated financial statements and related notes included in this report. The selected consolidated balance sheet data, as of September 25, 2007, 2006, and 2005, and the selected consolidated statement of operations data, for the fiscal year ended September 25, 2006 and 2005, have been derived from our audited financial statements that are not included in this report.

16

Table of Contents

Index to Financial Statements

| As of, and for, the Fiscal Year Ended September 25, | ||||||||||||||||||||

| 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||

| (Restated) | (Restated) | (Restated) | (Restated) | (Restated) | ||||||||||||||||

| Interest and fee income |

$ | 15,589 | $ | 19,280 | $ | 19,481 | $ | 20,048 | $ | 18,843 | ||||||||||

| Interest expense |

(7,611 | ) | (8,275 | ) | (8,026 | ) | (7,350 | ) | (6,355 | ) | ||||||||||

| Net interest and fee income before provision for credit losses |

7,978 | 11,005 | 11,455 | 12,698 | 12,488 | |||||||||||||||

| Provision for credit losses |

(10,614 | ) | (13,043 | ) | (7,940 | ) | (4,718 | ) | (4,116 | ) | ||||||||||

| Net revenue (loss) from interest and fees after provision for credit losses |

(2,636 | ) | (2,038 | ) | 3,515 | 7,980 | 8,372 | |||||||||||||

| Insurance commissions |

8,354 | 9,615 | 10,120 | 11,263 | 10,490 | |||||||||||||||

| Commissions from motor club memberships(1) |

1,602 | 1,844 | 1,947 | 1,957 | 1,475 | |||||||||||||||

| Delinquency fees |

1,561 | 1,720 | 1,776 | 1,565 | 1,676 | |||||||||||||||

| Income tax service income(2) |

— | — | 3 | 83 | 162 | |||||||||||||||

| Other income |

530 | 647 | 748 | 689 | 797 | |||||||||||||||

| Net revenues before retail sales |

9,411 | 11,788 | 18,109 | 23,537 | 22,972 | |||||||||||||||

| Retail sales |

16,019 | 17,164 | 19,002 | 17,972 | 15,061 | |||||||||||||||

| Cost of sales |

(10,366 | ) | (11,131 | ) | (12,170 | ) | (11,611 | ) | (9,358 | ) | ||||||||||

| Gross margin on retail sales |

5,653 | 6,033 | 6,832 | 6,361 | 5,703 | |||||||||||||||

| Net revenues |

15,064 | 17,821 | 24,941 | 29,898 | 28,675 | |||||||||||||||

| Operating expenses |

(28,426 | ) | (28,469 | ) | (27,604 | ) | (29,151 | ) | (29,205 | ) | ||||||||||

| Net operating income (loss) |

(13,362 | ) | (10,468 | ) | (2,663 | ) | 747 | (530 | ) | |||||||||||

| Other non-operating income |

— | — | — | 151 | — | |||||||||||||||

| Loss on sale of property and equipment |

(11 | ) | (21 | ) | (19 | ) | (75 | ) | (81 | ) | ||||||||||

| Income (loss) before income tax benefit (expense) |

(13,373 | ) | (10,669 | ) | (2,682 | ) | 823 | (611 | ) | |||||||||||

| Income tax benefit (expense) |

438 | 682 | (1,109 | ) | (274 | ) | (304 | ) | ||||||||||||

| Net income (loss) |

$ | (12,935 | ) | $ | (9,987 | ) | $ | (3,791 | ) | $ | 549 | $ | (915 | ) | ||||||

| Ratio of earnings to fixed charges(3) |

(4) | (4) | (4) | 1.10 | (4) | |||||||||||||||

| Cash and cash equivalents |

$ | 2,922 | $ | 12,541 | $ | 17,854 | $ | 12,920 | $ | 9,619 | ||||||||||

| Finance receivables(5) |

56,281 | 68,601 | 72,276 | 73,178 | 72,370 | |||||||||||||||

| Allowance for credit losses |

(8,925 | ) | (8,814 | ) | (5,150 | ) | (2,275 | ) | (2,484 | ) | ||||||||||

| Finance receivables, net |

47,356 | 59,787 | 67,126 | 70,903 | 69,886 | |||||||||||||||

| Other receivables |

717 | 957 | 861 | 1,013 | 1,099 | |||||||||||||||

| Inventory |

2,202 | 3,167 | 3,057 | 2,195 | 2,402 | |||||||||||||||

| Property and equipment, net |

4,227 | 4,906 | 4,220 | 4,581 | 4,850 | |||||||||||||||

| Total assets |

59,254 | 83,857 | 95,862 | 95,732 | 91,231 | |||||||||||||||

| Senior debt |

327 | 695 | 512 | 669 | 1,186 | |||||||||||||||

| Senior subordinated debt |

— | — | — | 600 | 1,000 | |||||||||||||||

| Subordinated debt, related parties |

— | — | — | 370 | 800 | |||||||||||||||

|

Debentures(6) |

73,603 | 82,209 | 81,861 | 77,910 | 68,905 | |||||||||||||||

| Demand notes(6) |

3,147 | 3,658 | 5,991 | 8,137 | 12,867 | |||||||||||||||

| Shareholders’ deficit |

$ | (33,774 | ) | $ | (20,839 | ) | $ | (10,852 | ) | $ | (7,060 | ) | $ | (6,609 | ) | |||||

| (1) | Received from Interstate Motor Club, Inc., an affiliated entity. |

| (2) | Received from Cash Check Inc. of Ga., an affiliated entity. |

| (3) | The ratio of earnings to fixed charges represents the number of times fixed charges are covered by earnings. For purposes of this ratio, “earnings” is determined by adding pre-tax income to “fixed charges,” which consists of interest on all indebtedness and an interest factor attributable to rent expense. |

| (4) | Calculation results in a deficiency in the ratio (i.e., less than one-to-one coverage). The deficiency in earnings to cover fixed charges was $13,372,623; $10,669,231; $2,682,314; and $611,423 for the years ended September 25, 2009, 2008, 2007, and 2005, respectively. |

| (5) | Net of unearned insurance commissions, unearned finance charges and unearned discounts. |

| (6) | Issued, in part, by our subsidiary, The Money Tree of Georgia Inc. See Note 7 to our consolidated audited financial statements for the year ended September 25, 2009. |

17

Table of Contents

Index to Financial Statements

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion includes the effects of the restatement of the audited consolidated financial statements discussed in the explanatory note on page one and should be read in conjunction with the information under “Selected Consolidated Financial Data” and our audited consolidated financial statements and related notes and other financial data included elsewhere in this report.

Overview

We make consumer finance loans and provide other financial products and services through our branch offices in Georgia, Alabama, Louisiana and Florida. We sell retail merchandise, principally furniture, appliances and electronics, at certain of our branch office locations and operate three used automobile dealerships in the State of Georgia. We also offer insurance products, prepaid phone services and automobile club memberships to our loan customers.

We fund our consumer loan demand through a combination of cash collections from our consumer loans, proceeds raised from the sale of debentures and demand notes and loans from various banks and other financial institutions. Our consumer loan business consists of making, purchasing and servicing direct consumer loans, consumer sales finance contracts and motor vehicle installment sales contracts. Direct consumer loans generally serve individuals with limited access to other sources of consumer credit, such as banks, savings and loans, other consumer finance businesses and credit cards. Direct consumer loans are general loans made typically to people who need money for some unusual or unforeseen expense, for the purpose of paying off an accumulation of small debts or for the purchase of furniture and appliances. Please see “Business” for a more detailed discussion of the various types of loans we make to our customers. The following table sets forth certain information about the components of our finance receivables:

| Description of Loans and Contracts |

| |||||||||||

| As of, or for, the Year Ended September 25, | ||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| (Restated) | (Restated) | (Restated) | ||||||||||

| Direct Consumer Loans: |

| |||||||||||

| Number of Loans Made to New Borrowers |

33,045 | 27,770 | 20,838 | |||||||||

| Number of Loans Made to Former Borrowers |

64,774 | 57,862 | 55,117 | |||||||||

| Number of Loans Made to Existing Borrowers |

50,504 | 85,329 | 110,364 | |||||||||

| Total Number of Loans Made |

148,323 | 170,961 | 186,319 | |||||||||

| Total Volume of Loans Made |

$ | 48,940,971 | $ | 66,766,194 | $ | 73,350,400 | ||||||

| Average Size of Loans Made |

$ | 330 | $ | 391 | $ | 394 | ||||||

| Number of Loans Outstanding |

47,619 | 63,424 | 74,204 | |||||||||

| Total of Loans Outstanding |

$ | 20,098,661 | $ | 33,068,727 | $ | 39,608,318 | ||||||

| Percent of Loans Outstanding |

30.0 | % | 40.8 | % | 45.9 | % | ||||||

| Average Balance on Outstanding Loans |

$ | 422 | $ | 521 | $ | 534 | ||||||

18

Table of Contents

Index to Financial Statements

| Description of Loans and Contracts |

| |||||||||||

| As of, or for, the Year Ended September 25, | ||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| (Restated) | (Restated) | (Restated) | ||||||||||

| Motor Vehicle Installment Sales Contracts: |

||||||||||||

| Total Number of Contracts Made |

775 | 763 | 977 | |||||||||

| Total Volume of Contracts Made |

$ | 14,097,733 | $ | 14,217,234 | $ | 17,965,678 | ||||||

| Average Size of Contracts Made |

$ | 18,191 | $ | 18,633 | $ | 18,389 | ||||||

| Number of Contracts Outstanding |

2,742 | 2,726 | 2,798 | |||||||||

| Total of Contracts Outstanding |

$ | 30,151,923 | $ | 30,707,329 | $ | 32,259,968 | ||||||

| Percent of Total Loans and Contracts |

45.1 | % | 37.8 | % | 37.4 | % | ||||||

| Average Balance on Outstanding Contracts |

$ | 10,996 | $ | 11,265 | $ | 11,530 | ||||||

| Consumer Sales Finance Contracts: |

||||||||||||

| Number of Contracts Made to New Customers |

2,241 | 865 | 137 | |||||||||

| Number of Loans Made to Former Customers |

68 | 3,161 | 2,684 | |||||||||

| Number of Loans Made to Existing Customers |

3,112 | 3,211 | 3,120 | |||||||||

| Total Contracts Made |

5,421 | 7,237 | 5,941 | |||||||||

| Total Volume of Contracts Made |

$ | 17,046,757 | $ | 18,883,178 | $ | 16,869,906 | ||||||

| Number of Contracts Outstanding |

7,242 | 7,792 | 7,044 | |||||||||

| Total of Contracts Outstanding |

$ | 16,663,172 | $ | 17,373,830 | $ | 14,420,494 | ||||||

| Percent of Total Loans and Contracts |

24.9 | % | 21.4 | % | 16.7 | % | ||||||

| Average Balance of Outstanding Contracts |

$ | 2,301 | $ | 2,230 | $ | 2,047 | ||||||

Below is a table showing our total gross outstanding finance receivables:

| September 25, 2009 |

September 25, 2008 |

September 25, 2007 | |||||||

| (Restated) | (Restated) | (Restated) | |||||||

| Total Loans and Contracts Outstanding (gross): |

|||||||||

| Direct Consumer Loans |

$ | 20,098,661 | $ | 33,068,727 | $ | 39,608,318 | |||

| Motor Vehicle Installment |

30,151,923 | 30,707,329 | 32,259,968 | ||||||

| Consumer Sales Finance |

16,663,172 | 17,373,830 | 14,420,494 | ||||||

| Total Gross Outstanding |

$ | 66,913,756 | $ | 81,149,886 | $ | 86,288,780 | |||

Below is a roll-forward of the balance of each category of our outstanding finance receivables. Loans originated reflect the gross amount of loans made or purchased during the period presented inclusive of pre-computed interest, fees and insurance premiums. Collections represent cash receipts in the form of repayments made on our loans as reflected in our Consolidated Statements of Cash Flows. Refinancings represent the amount of the pay off of loans refinanced. Charge-offs represent the gross amount of loans charged off as uncollectible. Rebates/other adjustments primarily represent reductions to gross loan amounts of precomputed interest and insurance premiums resulting from loans refinanced and other loans paid off before maturity. See “Summary of Significant Accounting Policies – Income Recognition” in Note 2 to our Consolidated Financial Statements for further discussion related to rebates of interest.

19

Table of Contents

Index to Financial Statements

| Fiscal Year Ended September 25, 2009 |

Fiscal Year Ended September 25, 2008 |

Fiscal Year Ended September 25, 2007 |

||||||||||

| (Restated) | (Restated) | (Restated) | ||||||||||

| Direct Consumer Loans: |

||||||||||||

| Balance – beginning |

$ | 33,068,727 | $ | 39,608,318 | $ | 45,671,669 | ||||||

| Loans originated |

48,940,971 | 66,766,194 | 73,350,400 | |||||||||

| Collections |

(40,671,119 | ) | (47,076,723 | ) | (52,252,511 | ) | ||||||

| Refinancings |

(10,912,645 | ) | (14,791,503 | ) | (18,154,981 | ) | ||||||

| Charge-offs, gross |

(8,589,238 | ) | (8,894,529 | ) | (5,579,005 | ) | ||||||

| Rebates/other adjustments |

(1,738,035 | ) | (2,543,030 | ) | (3,427,254 | ) | ||||||

| Balance – end |

$ | 20,098,661 | $ | 33,068,727 | $ | 39,608,318 | ||||||

| Consumer Sales Finance Contracts: |

||||||||||||

| Balance – beginning |

$ | 17,373,830 | $ | 14,420,494 | $ | 11,213,566 | ||||||

| Loans originated |

17,046,757 | 18,883,178 | 16,869,906 | |||||||||

| Collections |

(7,760,796 | ) | (7,267,346 | ) | (6,058,209 | ) | ||||||

| Refinancings |

(5,635,286 | ) | (5,460,970 | ) | (4,993,560 | ) | ||||||

| Charge-offs, gross |

(3,966,748 | ) | (2,521,245 | ) | (1,758,664 | ) | ||||||

| Rebates/other adjustments |

(394,585 | ) | (680,281 | ) | (852,545 | ) | ||||||

| Balance – end |

$ | 16,663,172 | $ | 17,373,830 | $ | 14,420,494 | ||||||

| Motor Vehicle Installment Sales Contracts: |

||||||||||||

| Balance – beginning |

$ | 30,707,329 | $ | 32,259,968 | $ | 31,280,840 | ||||||

| Loans originated |

14,097,733 | 14,217,234 | 17,965,678 | |||||||||

| Collections |

(11,502,246 | ) | (13,286,462 | ) | (14,469,121 | ) | ||||||

| Refinancings |

— | — | — | |||||||||

| Charge-offs, gross |

(1,768,170 | ) | (1,370,165 | ) | (1,185,753 | ) | ||||||

| Rebates/other adjustments |

(1,382,723 | ) | (1,113,246 | ) | (1,331,676 | ) | ||||||

| Balance – end |

$ | 30,151,923 | $ | 30,707,329 | $ | 32,259,968 | ||||||

| Total: |

||||||||||||

| Balance – beginning |

$ | 81,149,886 | $ | 86,288,780 | $ | 88,166,075 | ||||||

| Loans originated |

80,085,461 | 99,866,606 | 108,185,984 | |||||||||

| Collections |

(59,934,161 | ) | (67,630,531 | ) | (72,779,841 | ) | ||||||

| Refinancings |

(16,547,931 | ) | (20,252,473 | ) | (23,148,541 | ) | ||||||

| Charge-offs, gross |

(14,324,156 | ) | (12,785,939 | ) | (8,523,422 | ) | ||||||

| Rebates/other adjustments |

(3,515,343 | ) | (4,336,557 | ) | (5,611,475 | ) | ||||||

| Balance – end |

$ | 66,913,756 | $ | 81,149,886 | $ | 86,288,780 | ||||||

20

Table of Contents

Index to Financial Statements

Below is a reconciliation of the amounts of the finance receivables originated and repaid (collections) from the receivable roll-forward to the amounts shown in our Consolidated Statements of Cash Flows.

| Fiscal Year Ended September 25, 2009 |

Fiscal Year Ended September 25, 2008 |

Fiscal Year Ended September 25, 2007 |

||||||||||

| Finance Receivables Originated: |

||||||||||||

| Direct consumer loans |

$ | 48,940,971 | $ | 66,766,194 | $ | 73,350,400 | ||||||

| Consumer sales finance |

17,046,757 | 18,883,178 | 16,869,906 | |||||||||

| Motor vehicle installment sales |

14,097,733 | 14,217,234 | 17,965,678 | |||||||||

| Total gross loans originated |

80,085,461 | 99,866,606 | 108,185,984 | |||||||||

| Non-cash items included in gross finance receivables* |

(21,745,038 | ) | (26,531,233 | ) | (31,243,362 | ) | ||||||

| Finance receivables originated – cash flows** |

$ | 58,340,423 | $ | 73,335,373 | $ | 76,942,622 | ||||||

| Loans Repaid: |

||||||||||||

| Collections |

||||||||||||

| Direct consumer loans |

$ | 40,671,119 | $ | 47,076,723 | $ | 52,252,512 | ||||||

| Consumer sales finance |

7,760,796 | 7,267,346 | 6,058,208 | |||||||||

| Motor vehicle installment sales |

11,502,246 | 13,286,462 | 14,469,121 | |||||||||

| Finance receivables repaid – cash flows |

$ | 59,934,161 | $ | 67,630,531 | $ | 72,779,841 | ||||||

| * | Includes precomputed interest and fees (since these amounts are included in the gross amount of finance receivables originated but are not advanced in the form of cash to customers) and refinanced receivable balances (since there is no cash generated from the repayment of original receivables refinanced). |

| ** | Includes amounts advanced to customers in conjunction with refinancings, which were $4,738,460 for the fiscal year ended September 25, 2009; $10,078,648 for the fiscal year ended September 25, 2008; and $10,545,399 for the fiscal year ended September 25, 2007. |

Segments and Seasonality

We segment our business operations into the following two segments:

| • | consumer finance and sales; and |