Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TIER REIT INC | a10-10797_1ex99d1.htm |

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - TIER REIT INC | a10-10797_18k.htm |

Exhibit 99.2

Behringer Harvard REIT I, Inc.

First Quarter 2010 Update and Estimated Share Valuation

Frequently Asked Questions

1) Why are you providing the estimated value per share now?

Pursuant to our estimated valuation policy, we are required to provide shareholders a per share estimated value of our common stock not based on our last public offering price by the end of June, which is 18 months after the end of our last public offering. In order for the new estimated valuation to be included on second quarter shareholder statements, the company’s advisor and board of directors opted to complete their valuation process now instead of waiting until the end of June.

2) Why is the estimated value per share so low? Is this a permanent share price? When do you anticipate updating the estimated value?

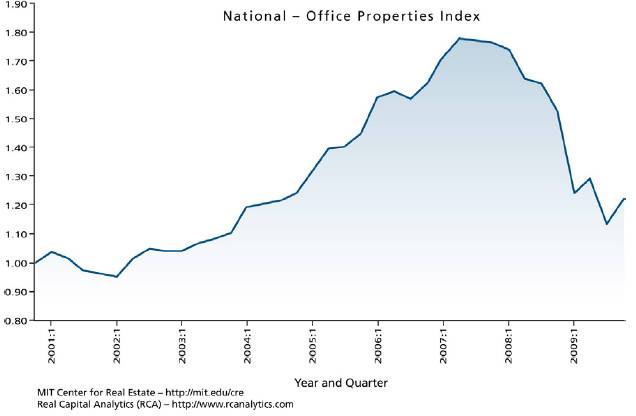

Today’s difficult economic environment for commercial real estate does not make this the optimal time to provide updated estimated per share values. For example, the MIT/Moody’s National-Office Commercial Property Price Index (CPPI) is down approximately 33% from its high in mid-2007.

MIT/Moody’s CPPI: National—Office Properties Index

The combined effects of depressed real estate values, increasing vacancy, reduced rental rates and leverage have created the perfect storm. In our view, our updated estimated per share value is not indicative of the eventual value the REIT expects to harvest under normalized economic conditions.

NOT FOR USE WITH PROSPECTIVE INVESTORS

Please also recall that this estimated valuation is at a particular snapshot in time — May 17, 2010. We expect to provide a new estimated share valuation at least every 18 months, and the estimated valuation will likely go up or down depending upon then-existing market and portfolio conditions.

3) What valuation methodology was utilized?

Our advisor estimated the current value of our real estate investments, debt obligations and other assets and liabilities primarily through the use of discounted cash flow analyses, which were initially prepared by our advisor’s asset management team and reviewed by both our advisor’s management and by an independent third party investment banking firm engaged by our advisor. Both our advisor and the third party investment banking firm employed a range of terminal capitalization rates, discount rates, growth rates and other variables consistent with the valuation of real estate assets based on their respective industry knowledge and experience. The third party investment banking firm arrived at its assumptions and valuation independent of our advisor. At the May 17, 2010 board meeting, our advisor made a recommendation that our board of directors adopt an estimated valuation of $4.25 per share, which was supported by the third party investment banking firm’s independent valuation.

4) What effect does the estimated value per share have on the distribution reinvestment plan?

In accordance with our Second Amended and Restated Distribution Reinvestment Plan, beginning with reinvestments made after May 17, 2010, distributions may be reinvested in shares of our common stock at the estimated per share value of $4.25 per share.

5) What effect does the estimated value per share have on the share redemption program?

In accordance with our Fourth Amended and Restated Share Redemption Program, as of May 17, 2010, the per share redemption price for exceptional redemptions, which are those redemptions made on circumstances of death, qualifying disability or confinement to long-term care, will be the estimated per share value of $4.25 per share.

6) What are the comparative occupancy rates of commercial office properties and unemployment rates?

The national average occupancy rate for commercial office properties was 82% in the first quarter of 2010, and our average was 86%. The U.S. unemployment rate was approximately 9.9% during that same time period. In contrast, during 2007 our average occupancy rate was 91% versus a national average of 87% with a 4.6% U.S. unemployment rate.

7) What are you doing to increase the value of the portfolio going forward?

We are making every effort to conserve cash whenever possible, including the following:

· reducing the distribution rate to 1%;

· adjusting the redemption budget to $1,062,500 per quarter for the remainder of 2010;

· benefitting from reduced asset management fees as a result of our advisor’s waiver of approximately $9.7 million since the beginning of 2009;

· purchasing the debt related to our assets at a discount and restructuring or refinancing maturing debt;

· evaluating the sale of select non-strategic assets;

· protesting real estate taxes at every property;

· re-bidding vendor contracts;

· structuring leases in such a way to conserve capital; and

· renegotiating service fees.

These actions are necessary in order to position us to increase occupancy at our properties and address debt maturities in 2011.

8) When can we expect a liquidity event to occur?

We contemplate providing our shareholders with a liquidity event by 2017 through a listing of our common stock on a national securities exchange, sale of our company or selling our assets and distributing the proceeds to our shareholders. Our independent directors may extend this date; however, depending upon then prevailing market conditions, we intend to consider beginning the process prior to 2013.

In making the decision to apply for listing of our shares, the board will try to determine whether listing our shares or liquidating our assets will result in greater value for our shareholders. The circumstances, if any, under which the directors will agree to list our shares cannot be determined at this time.

9) What is the distribution rate? Why did you lower the distribution rate?

At its meeting on May 17, 2010, the board voted to declare distributions at an annualized rate of 1% based on a $10 share price for May, June and July 2010. The distribution rate is reviewed and approved at least quarterly by the board.

Like other companies exposed to the illiquid capital markets, the effects of abnormally high unemployment and broad economic recession, the board determined it was critical to implement prudent capital preservation practices to protect shareholder value and position us to better navigate this economic cycle. Further, commercial office real estate is very capital intensive in nature, and this decision will help us retain needed capital for re-tenanting vacant space, making capital improvements to our properties and refinancing or restructuring our upcoming debt maturities.

The board has discretion to make all decisions regarding distributions and will continue to monitor the economy and cash position of the company with a focus on capital preservation and shareholder protection. In the current economic environment, our board may further reduce distributions or cease paying distributions. As is true for any company, distributions are not guaranteed to be made at any time and can vary from period to period based upon the results, plans and prospects of the company and the prevailing economic conditions.

10) Why did you change the redemptions program to limit it to requests for death, disability and long-term care and adjust the remaining 2010 annual budget?

The board took into account that on an annual basis a detailed budget for our expenditures is created, which is continually monitored. Budgeted expenditures for redemptions were based upon redemption rates throughout our operating history. Redemptions for the first quarter of 2009 alone exceeded the full year’s budgeted amount, and even after limiting redemptions to death, disability and long-term care after the first quarter, redemptions were almost double the budgeted amount for 2009. Continuing to fulfill redemptions of that magnitude could affect our ability to fulfill other funding obligations, including capital expenditures, tenant improvement costs and other expenditures budgeted to operate the company. Therefore, at its meeting on May 17, 2010, our board of directors elected to adjust

the 2010 funding limit for exceptional redemptions for each of the remaining two quarters of 2010 to $1,062,500 to reflect the adjustment in the estimated valuation.

11) Has the Company’s advisor continued to waive asset management fees?

The Company’s advisor waived $7.5 million of its asset management fees otherwise due for 2009 and approximately $2.2 million for the first quarter of this year. Other non-listed REITs have had their advisors defer fees, where those fees may later be recovered by their advisor, but the Company’s advisor has fully waived these fees. Instead of these asset management fees being paid to the Company’s advisor, we will retain this capital.

12) What are your debt maturities? How will you address them, particularly the 2011 maturities?

We have approximately $3 billion of debt. Of that debt, approximately two-thirds of it matures in 2015 or later; so, we have a very favorable debt maturity schedule. Between now and 2015, the only year that has significant maturities is 2011. In December of 2011, our line of credit reaches its final maturity date, after exercise of our one-year extension option. We believe that this facility will be readily refinanceable as it has a very conservative loan to value ratio today. The remaining loans could be more challenging, and we are working on various strategies to bring new equity to those properties that will enable us to pay the debt down if necessary at the maturity date. We believe that with a combination of cash on our balance sheet, new equity we may be able to raise at either the property level or at the corporate level, and a debt market that appears to be starting to recover, that we will be able to address these debt maturities as they come due nine to 20 months from now.

13) What properties have debt that needs to be restructured?

As disclosed in our 10-Q, we were in default or had events of default on four non-recourse property loans with a combined outstanding balance of approximately $114.1 million secured by 222 Bloomingdale Road, Executive Park, the Western Office portfolio, which consists of the 17655 Waterview, Gateway 12, Gateway 22, Gateway 23 and Southwest Center properties, and Minnesota Center. We are working with the lenders on these loans to restructure them. Further, we believe at least six other properties have property loans that will need to be modified during 2010 in order to support the underlying asset value.