Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - General Motors Co | d8k.htm |

| EX-99.1 - NEW RELEASE DATED, MAY 17, 2010 AND FINANCIAL STATEMENTS - General Motors Co | dex991.htm |

General Motors Company

Q1 2010 Results

May 17, 2010

Exhibit 99.2

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

***************

************* |

Forward Looking Statements

In this press release and in related comments by our management,

our use

of the words “expect,”

“anticipate,”

“possible,”

“potential,”

“target,”

“believe,”

“commit,”

“intend,”

“continue,”

“may,”

“would,”

“could,”

“should,”

“project,”

“projected,”

“positioned”

or similar expressions is intended to identify forward-

looking statements that represent our current judgment about possible future

events. We believe these judgments are reasonable, but these statements

are not guarantees of any events or financial results, and our actual

results may differ materially due to a variety of important factors. Among

other items, such factors might include: our ability to realize

production efficiencies and to achieve reductions in costs as a result of

our restructuring initiatives and labor modifications; our ability to

maintain quality control over our vehicles and avoid material vehicle

recalls; our ability to maintain adequate liquidity and financing sources

and an appropriate level of debt, including as required to fund our

planning significant investment in new technology; our ability to realize

successful vehicle applications of new technology; and our ability to

comply with the continuing requirements related to U.S. and other

government support.

GM's most recent annual report on Form 10-K and quarterly report on Form

10-Q provides information about these and other factors, which we may

revise or supplement in future reports to the SEC.

1 |

Jul

10 – Sep 30

2009

Q4

2009

Q1

2010

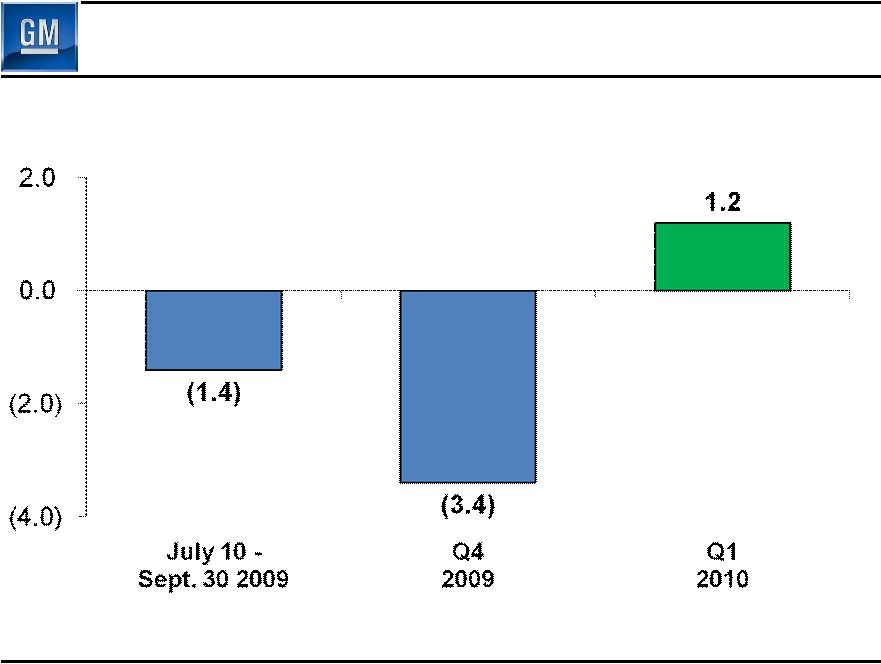

GAAP

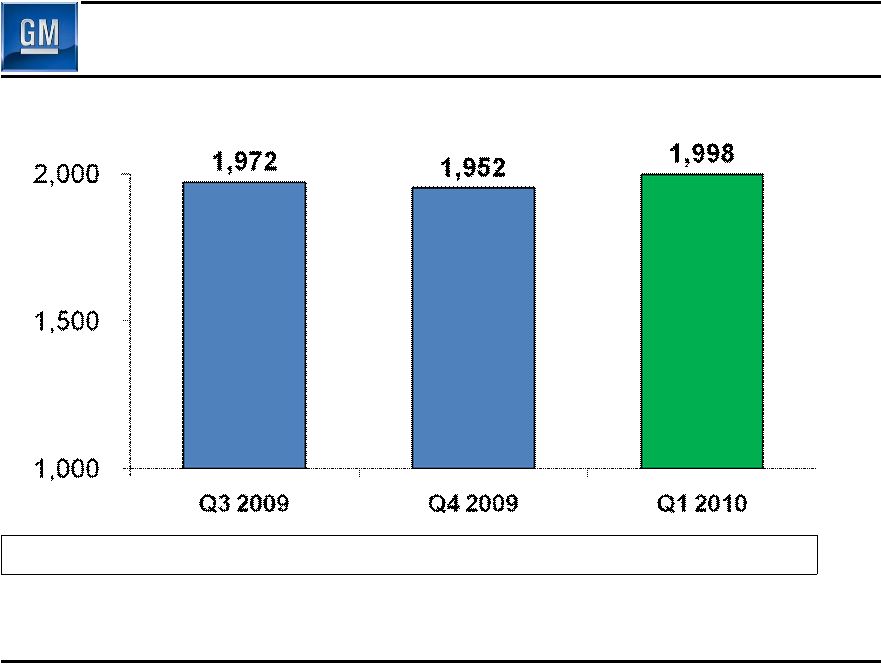

Net Revenue ($B)

25.1

32.3

31.5

Operating Income ($B)

(1.0)

(3.9)

1.2

Net Income Attr. Common

Stockholders ($B)

(0.9)

(3.5)

0.9

EPS –

Diluted ($/Share)

(2.20)

(8.53)

1.66

Non-

GAAP

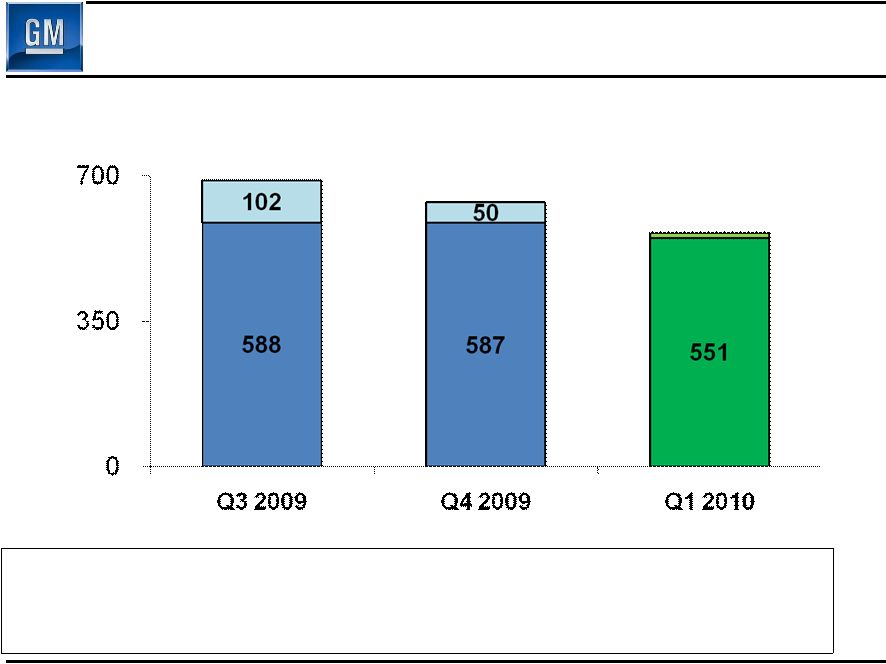

EBIT -

Adj. ($B)

(0.6)

(1.0)

1.7

Free Cash Flow ($B)

2.0

(2.9)

1.0

Summary of Q1 2010 Results

2 |

Q1

Operating Income Walk to EBIT- Adj.

3

($ B)

Q1

2010

Operating Income

1.2

Equity Income

0.4

Non-Controlling Interests

(0.1)

Non-Operating Income

0.3

Earnings Before Interest & Taxes (EBIT)

1.8

Less Adjustments

0.1

EBIT-

Adj.

1.7 |

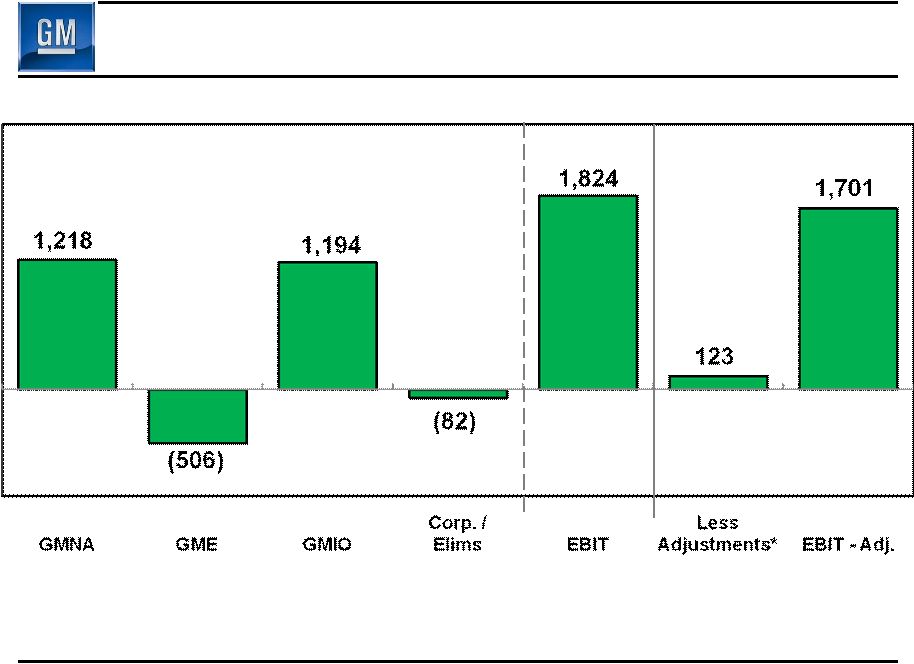

Q1

2010 EBIT & EBIT - Adj.

4

($M)

* Included in Earnings Before Interest and Taxes (EBIT)

Gain on

Saab Sale |

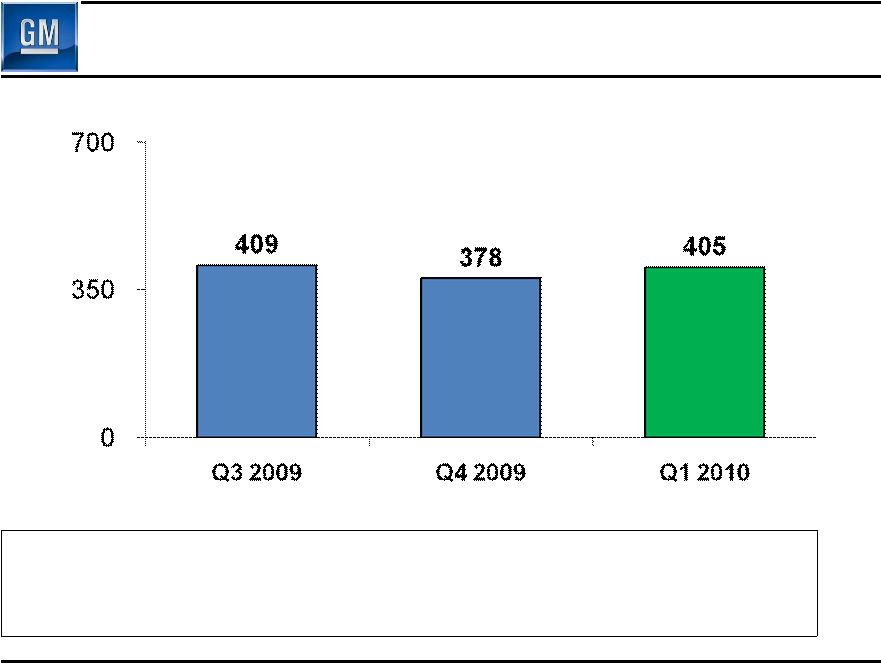

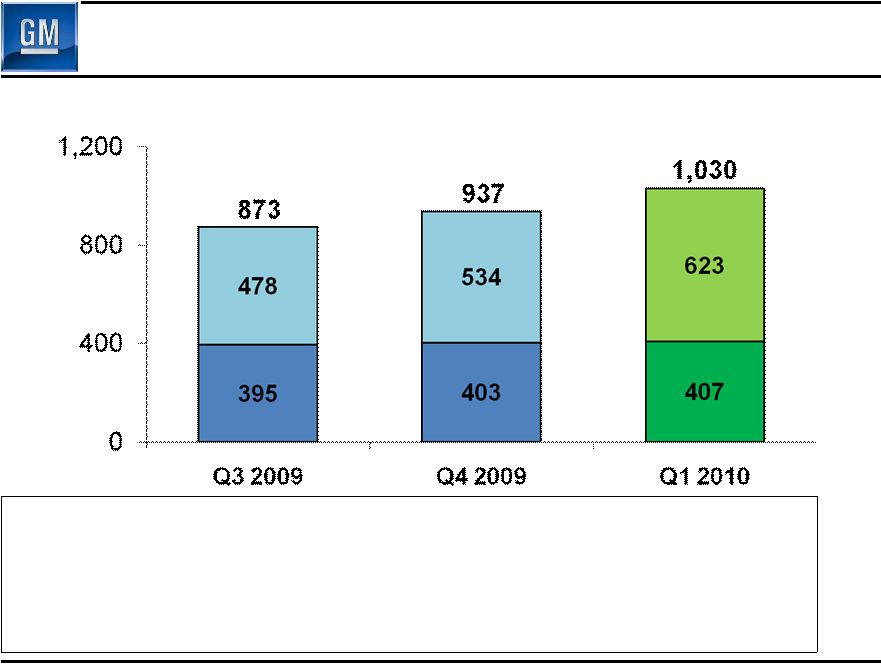

Q1

2010 Global Deliveries 5

(000’s)

Global Share

11.8%

11.5%

11.2%

GM deliveries & market share includes vehicles sold around the world under GM

and JV brands and through GM branded distribution network

|

Q1

2010 GMNA Deliveries 6

(000’s)

GMNA Share

18.7%

19.3%

17.8%

U.S. Share

19.4%

20.2%

18.4%

U.S. 4 Brand Share

16.7%

18.6%

18.1%

Discontinued

Brands

Chevy, Buick,

GMC, Cadillac

690

637

563 |

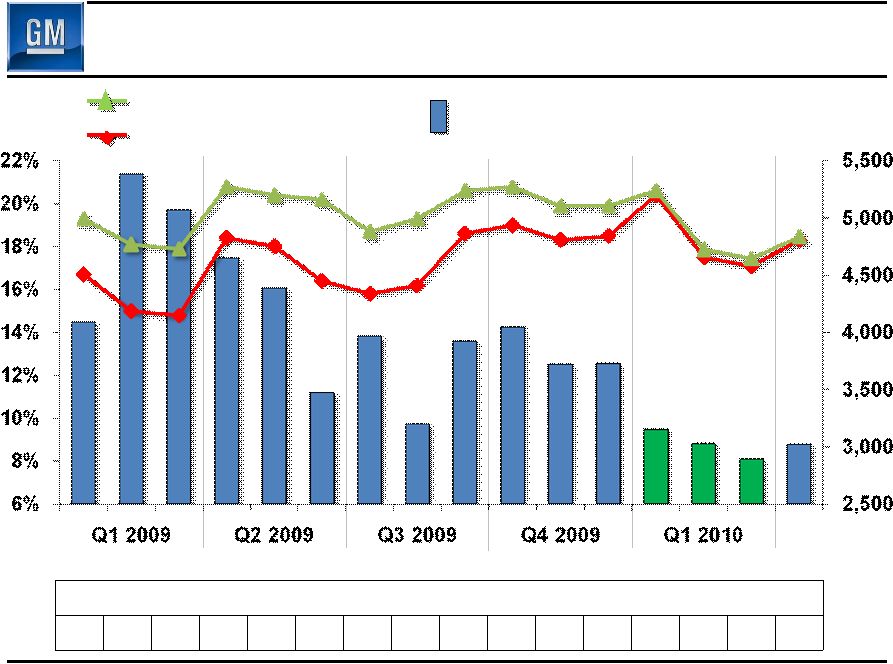

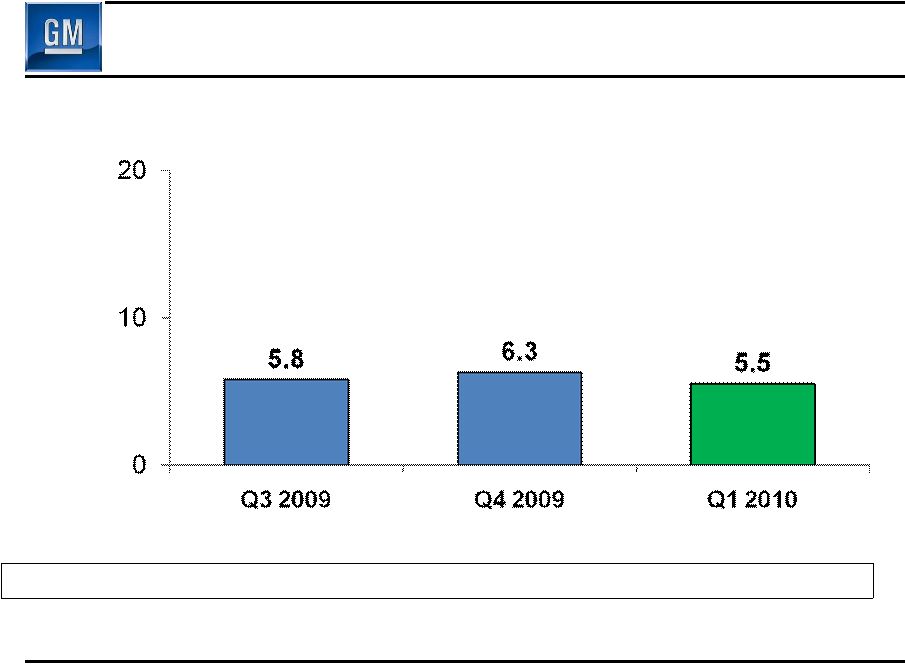

Key

GMNA Performance Indicators 7

GM Average U.S. Retail Incentive (4 Brand) % of Industry Average

127

152

143

137

137

121

143

135

149

154

141

132

119

106

98

108

Share

$/Unit

U.S. 4 Brand Share

U.S. Total Share

Apr

2010

Avg. GM U.S. Retail

Incentive –

4 Brands

Note: Incentive Information Based on J.D. Power and Associates Power

Information Network data |

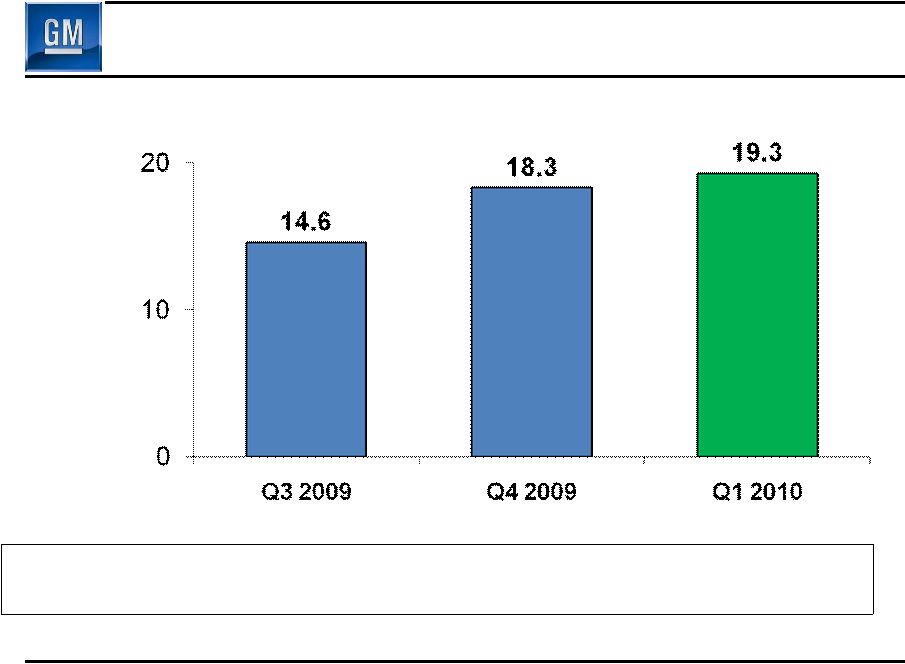

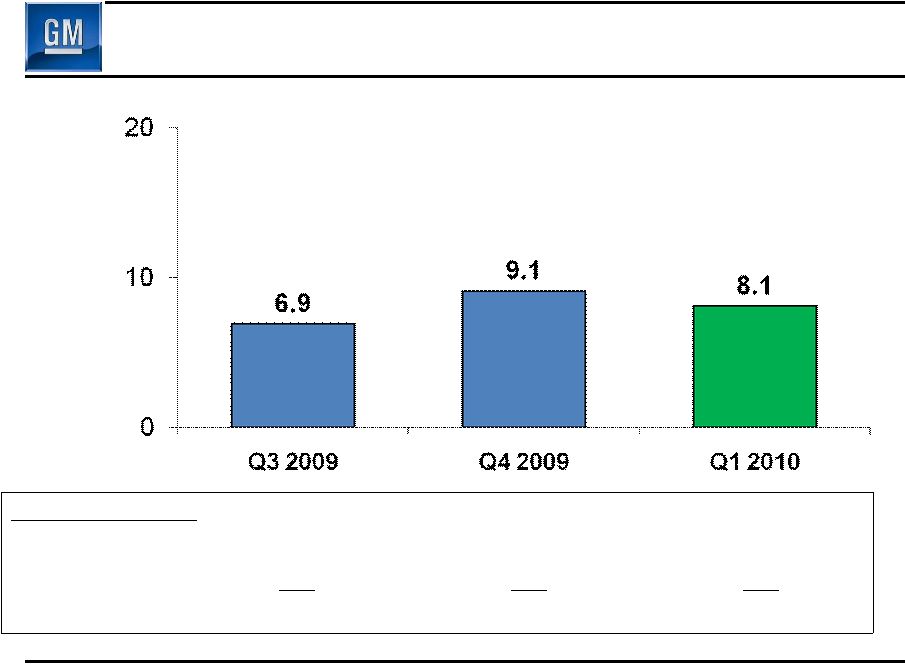

Q1

2010 GMNA Net Revenue 8

($B)

GMNA Production (000’s)

531

616

668

U.S. Dealer Inv (000’s)

424

385

428

Q3 2009 represents combined net revenue for GM and Old GM

|

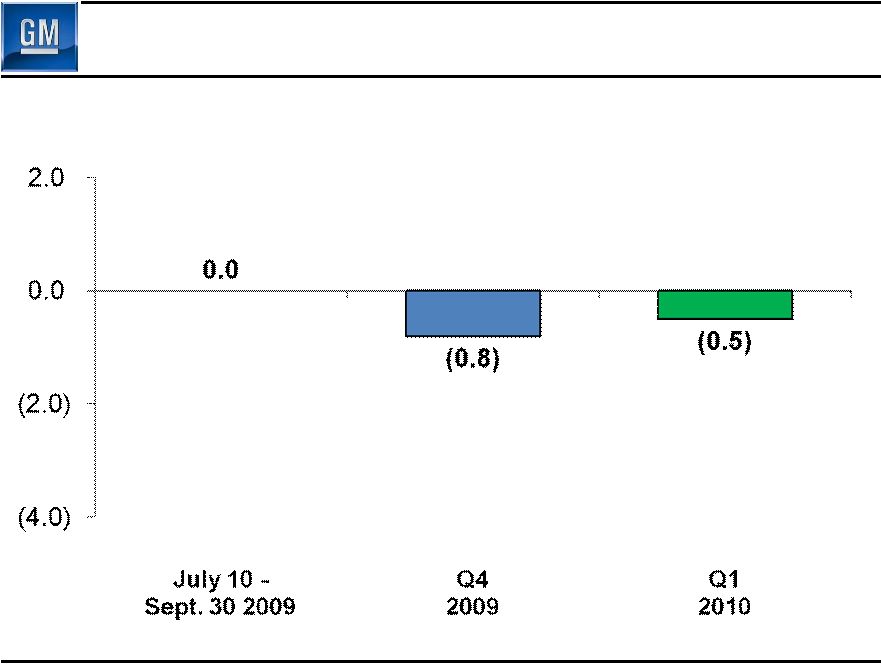

Q1

2010 GMNA Earnings Before Interest & Taxes 9

($B) |

Q1

2010 GME Deliveries 10

(000’s)

GME Share

8.9%

8.2%

8.5%

Germany Share

9.4%

8.8%

8.2%

U.K. Share

12.0%

11.2%

11.8% |

Q1

2010 GME Net Revenue 11

Total Production (000’s)

277

266

357

($B)

Q3 2009 represents combined net revenue for GM and Old GM

|

Q1

2010 GME Earnings Before Interest & Taxes 12

($B) |

Q1

2010 GMIO Deliveries 13

(000’s)

GMIO Share

10.3%

10.3%

10.3%

China Share

13.4%

13.3%

13.5%

Brazil Share

19.8%

18.7%

19.9%

India Share

3.1%

3.7%

4.2%

China

GMIO Excl.

China |

Q1

2010 GMIO Net Revenue 14

Production (000’s)

Fully Consolidated

414

456

455

Joint Venture

491

584

605

Total

905

1,040

1,060

($B)

Q3 2009 represents combined net revenue for GM and Old GM

|

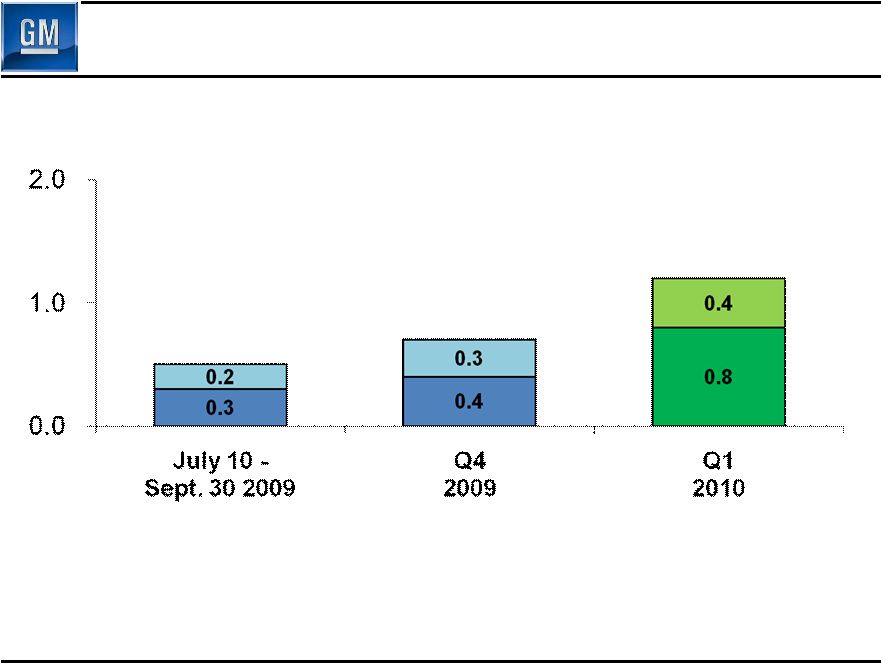

Q1

2010 GMIO Earnings Before Interest & Taxes 15

($B)

0.5

0.7

1.2

Equity

Income

Inc. Before

Int/Tax/Equity |

Cash

Flow 16

($B)

July 10 –

Sept 30

2009

Q4

2009

Q1

2010

Net Income /(Loss)

(0.6)

(3.2)

1.2

Depreciation / Amortization

2.0

2.2

1.8

Working Capital

6.4

(2.1)

(0.7)

Pension / OPEB & Other

(4.9)

1.2

(0.6)

Net cash provided/(used)

operating activities

2.9

(1.9)

1.7

Capital Expenditures

(0.9)

(1.0)

(0.7)

Free Cash Flow

2.0

(2.9)

1.0 |

Depreciation / Amortization & Cap Ex

17

($M)

July 10 –

Sept 30

2009

Q4

2009

Q1

2010

GMNA

1,348

1,384

1,174

GME

401

551

384

GMIO

170

277

194

Corp / Other

66

44

51

Total Depreciation &

Amortization

1,985

2,256

1,803

Capital Expenditures

881

1,033

755 |

Key

Balance Sheet Items ($B)

December 31

2009

March 31

2010

Cash & marketable securities*

36.2

35.7

Key Obligations:

Debt

15.8

14.2

Preferred Stock

7.0

7.0

Underfunded Pensions

27.5

26.9

Underfunded OPEB

9.6

9.4

18

* Includes UST & Canadian HC Trust Restricted Cash

|

Summary

•

Profitable, and positive cash flow

•

U.S. y-o-y 4-brand share up & average retail incentive

down, GMNA breakeven substantially lowered

•

Well positioned to grow profitably in GMIO

•

More work to do in GME

•

Making progress on designing, building and selling the

world's best vehicles

19 |

General Motors Company

Select Supplemental Financial Information

*****************************

*****************************

*****************************

*****************************

*****************************

******

******

******

******

******

******

******

******

******

******

******

******

******

******

******

******

******

******

******

******

******

******

* |

Operating Income Walk to EBIT-

Adj

S1

($ Billions)

Jul 10 –

Sep 30

2009

Q4

2009

Q1

2010

Operating Income

(1.0)

(3.9)

1.2

Equity Income

0.2

0.3

0.4

Non-Controlling Interests

(0.3)

(0.2)

(0.1)

Non-Operating Income/(Expense)

0.4

(0.2)

0.3

Earnings Before Interest & Taxes

(0.7)

(4.0)

1.8

Less Adjustments

(0.1)

(3.0)

0.1

EBIT-

Adj.

(0.6)

(1.0)

1.7 |

Detail of Adjustments

S2

($M)

July 10 –

Sept 30

2009

Q4

2009

Q1

2010

Earnings Before Interest

& Taxes (EBIT)

(741)

(4,046)

1,824

Less Adjustments

-

Gain on Saab Sale

-

-

123

-

VEBA Settlement

-

(2,571)

-

-

GMAC Investment Impairment

-

(270)

-

-

Delphi Related

(110)

(150)

-

-

CAMI Debt Ext.

-

(101)

-

Total Adjustments

(110)

(3,092)

123

EBIT –

Adj.

(631)

(954)

1,701 |

Restructuring Excluded From Adjustments

S3

($M)

July 10 –

Sept 30

2009

Q4

2009

Q1

2010

GMNA –

Dealer Related

(187)

(88)

(18)

GMNA –

Non-Dealer Related

134

(208)

97

Total GMNA

(53)

(296)

79

Total GME

(9)

(28)

(273)

Total GMIO

(27)

(56)

-

Total

(89)

(380)

(194) |

GMIO

Joint Ventures S4

Shanghai -

GM

SAIC -

GM

Wuling

FAW -

GM

GM -

Daewoo

GM

Ownership

49%

34%

50%

70%

Deliveries

100%

100%

100%

100%

Market

Share

100%

100%

100%

100%

Revenue

0%

0%

0%

100%

Earnings

49%

Equity Income

34%

Equity Income

50%

Equity Income

70%

After adj. for Non-

Controlling Interest |