Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kraton Corp | d8k.htm |

May 18, 2010

Kraton

Performance Polymers, Inc.

Houlihan

Lokey

5th Annual Global Industrials Conference

Exhibit 99.1 |

| Disclaimers

Forward-Looking Statements

This presentation may include “forward-looking statements”

that reflect our plans, beliefs,

expectations and current views with respect to, among other things, future events and

financial performance. Forward-looking statements are often characterized by the use of

words such as “believes,”

“estimates,”

“expects,”

“projects,”

“may,”

“intends,”

“plans”

or

“anticipates,”

or by discussions of strategy, plans or intentions. All forward-looking

statements in this presentation are made based on management's current expectations and

estimates, which involve risks, uncertainties and other factors that could cause actual

results to differ materially from those expressed in forward-looking statements. Readers are

cautioned not to place undue reliance on forward-looking statements. We assume no

obligation to update such information. Further information concerning issues that could

materially affect financial performance related to forward looking statements can be found in

our periodic filings with the Securities and Exchange Commission.

GAAP Disclaimer

This presentation includes the use of both GAAP (generally accepted accounting principles)

and non-GAAP financial measures. The non-GAAP financial measures are EBITDA and

Adjusted EBITDA. The most directly comparable GAAP financial measure is net

income/loss. A reconciliation of the non-GAAP financial measures used in this presentation

to

the

most

directly

comparable

GAAP

measure

is

included

herein.

We

consider

EBITDA

and Adjusted EBITDA important supplemental measures of our performance and believe

they are frequently used by investors and other interested parties in the evaluation of

companies in our industry. EBITDA and Adjusted EBITDA have limitations as analytical

tools and should not be considered in isolation or as a substitute for analysis of our results

under GAAP in the United States.

2 |

Investment

Highlights Leadership

Clear leader in the fast growing, attractive SBC market

Scale

Approximately twice the size of our largest competitor in each of our end-use

markets

High

Barriers to

Entry

Patented technology, custom designed product, process excellence, global reach

and customer relationships create strong competitive position

Kraton, therefore, commands price premiums in the market

Innovation

Most-productive innovator of new SBC products, often engineered to meet a specific

customer need

Earnings

Growth

Driven by cost initiatives, economic recovery, return to normal customer inventory

levels and new product introductions

Meaningful operating leverage

Experience

Strong leadership team demonstrating continuous improvement in productivity,

innovation and margin improvement even in a difficult macroeconomic environment

3 |

Experienced Management

Team Name

Title

Previous Experience

Years

Industry

Experience

Dan Smith

Chairman of the

Board

Lyondell

40

Kevin Fogarty

President & CEO

Koch (Invista)

18

Steve Tremblay

Chief Financial

Officer

Vertis

9

David Bradley

Chief Operating

Officer

General Electric (Lexan)

17

Lothar Freund

Research &

Technical Services

Hoechst AG (Invista)

20

4 |

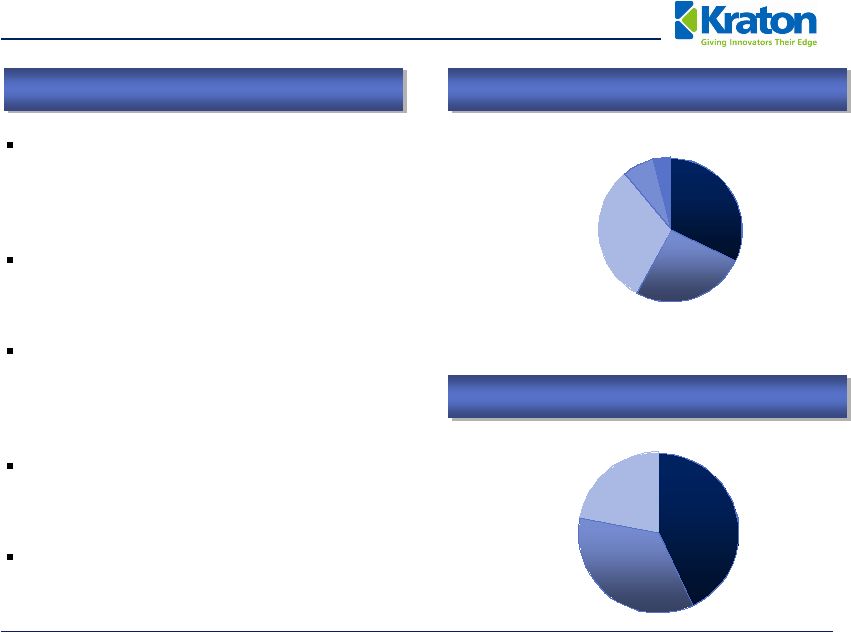

43%

35%

22%

32%

27%

31%

7%

3%

Kraton

Overview

We design and manufacture customized

SBC neat resin and compound solutions

to meet our leading customers’

specific

innovation needs

We currently offer approximately 800

products to more than 700 customers, in

over 60 countries

We are organized around four distinct

markets, or end-uses, providing industrial,

consumer and geographical diversification

second to none

We employ approximately 800 people in

15 locations in all major regions of the

world

LTM March 2010 operating revenue of

$1.1 billion and LTM March 2010 Adjusted

EBITDA

(2)

of $144 million

(1)

Sales revenue excludes by-products sales

(2)

Adjusted EBITDA is GAAP EBITDA excluding sponsor fees, restructuring and related charges, non-cash

expenses, and the gain on extinguishment of debt.

A reconciliation of net income or loss to EBITDA and Adjusted EBITDA is presented in the Appendix.

LTM

March

2010

Sales

Revenue

(1)

by

End-Use

LTM

March

2010

Sales

Revenue

(1)

by

Geography

North and

South

America

Europe,

Middle

East &

Africa

Asia Pacific

Paving and

Roofing

Adhesives,

Sealants and

Coatings

Footwear and

Other

Emerging

Businesses

Advanced

Materials

We are the world’s leading innovator of

Styrenic

Block Copolymers (SBCs)

5 |

Before Kraton

After Kraton

Kraton

Makes Products Better

Product Issue

Stretch in legs only (Spandex)

Not a fitted garment

High leakage rate

Overall improvement in stretch

(where it’s needed)

Better fit

Low leakage rate

Kraton

market share: 47%

2001

–

2007

CAGR:

11.4%

Elastic

Films

for

Disposable

Diapers

Kraton

as % of Diaper

cost: <2%

Phthalate plasticizers are used to

make PVC soft. However, plasticizers

can leach from finished products and

create health concerns

Limited recyclability

Vinyl Chloride polymers are unsafe

when burned or incinerated improperly

Fully recyclable

Kraton

imparts softness, toughness and clarity

Plasticizers & chlorine free

Product Issue

Kraton

as

an

alternative

for

soft

PVC

Kraton

as % of finished

product cost: <5%

6 |

Source:

Management estimates (1)

Based on LTM March 2010 sales of $1, 056 million (excludes by-product sales which are reported as

other revenues) (2)

Industry growth frm 2001-2008; however, IR Latex growth is Kraton growth from 2007-2009

(3)

Management’s estimates vs. next largest competitor based on 2008 sales

Clear Leader in Attractive Markets

Market position

LTM 2010

Revenue

(1)

#1

64%

Adhesives, Sealants,

and Coatings

Advanced Materials

#1

75%

Paving and Roofing

#1

74%

Emerging Businesses

#1

100%

32%

31%

27%

7%

2.6x

2.2x

1.9x

6.1x

#1 Market Position and Approximately Twice the Size of Our Closest Competitors

Top 4 market

share

Kraton

market

share relative to

#2 competitor

(3)

Growth

(2)

5.2%

8.0%

7.1%

28.8%

7 |

Unparalleled Global

Manufacturing and Service Capability

Houston, Texas

Global Headquarters &

Innovation Center

Not applicable

Belpre, Ohio

Manufacturing

189 kt

Wesseling,

Germany

Manufacturing

95 kt

Berre, France

Manufacturing

87 kt

Paulinia, Brazil

Manufacturing &

Innovation Center

28 kt

Kashima, Japan

Manufacturing Joint

Venture

20 kt

Amsterdam, The

Netherlands

Innovation Center

Not applicable

Mont St. Guibert,

Belgium

Technical Service

Office

Not applicable

Shanghai, China

Customer Service &

Technical Center

Not applicable

Tskuba, Japan

Innovation Center

Not applicable

High quality customer base

Majority of top customers have 15+ year

relationship

Blue chip customer base in the consumer

products, packaging, medical supplies,

construction and textile industries

Several key customer relationships are sole

source

Well diversified customer base

Location

Kraton

Capacity

Capability

8 |

Sustainable Competitive

Advantages Over 40 years of process know-how and expertise

Performance-critical

products

and

manufacturing

complexity

Technical

Barriers

Globally

recognized

brand

–

KRATON

®

Industry-leading R&D infrastructure

Global low-cost manufacturing footprint

Regulatory hurdles to new manufacturing sites

Stable raw material base with multiple sources of

supply and contract / relationships

Infrastructure

Barriers

Superior and

Innovative Products

+

High Customer

Switching Costs

+

Long-Term

Customers

Relationships

=

Leading

Market Position

Products

designed

cooperatively

to

meet

specific

customer needs / applications

Preferred supplier based on manufacturing

consistency and process know-how

Ongoing technical service offering

100% of products offered on demand

High

Value

Added

9 |

$15

$22

$23

$35

$61

$65

2005

2006

2007

2008

2009

Q1 2010

LTM

6%

11%

13%

14%

12%

13%

20%

2005

2006

2007

2008

2009

Q1 2010 LTM

2011 Goal

Key Attributes

Innovation-led Top Line Growth

Tremendous growth

Rapidly capture share from $2.2 billion natural

rubber latex industry

Margins well in excess of rest of business

Kraton

maintains 86% market share

Challenging process technology to replicate

for competitors and new entrants

IPO proceeds will help fund IR Latex

capacity expansion

20% of revenue from innovation

20% contribution margin premium

US $ in millions

Case Study: IR Latex and IR Revenue

Growth

Vitality Index

10

Vitality index in line with expectations

Strong recovery of automotive and overmolding applications as well as

ASC innovation volumes Encouraging momentum in PVC-free alternative for medical and wire

and cable applications |

Strong Diversified

Innovation Pipeline to Drive Growth Slush Molding

Protective Films

PVC Replacement

Wire & Cable

PVC Replacement

Medical Applications

11

HiMA |

Kraton

has Significant Growth & Profitability Opportunities

Project

Description

Estimated

Cost

Expected

Timing

Latex

Expansion

Capture additional market

demand

Up to $30 million

2011 -

2012

Asia Plan /

HSBC

Expansion

High-margin HSBC

capacity expansion

utilizing new technology

TBD

2012 +

Isoprene

Rubber and

Isoprene Latex

Debottleneck

Capital advantaged latex

expansion at Paulinia

and

IR capacity replacement

$37 million

2010 -

2011

We Typically Seek Higher Growth Opportunities with Relatively Rapid Steady-State

Payback

12 |

$17

$21

$17

$12

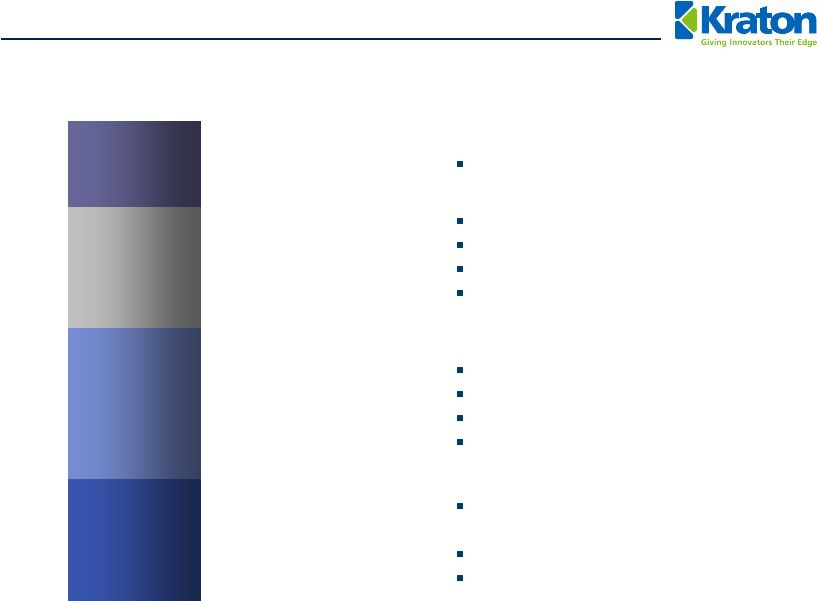

Culture of Continuous Cost Improvement

$67

2007

Belpre work process improvement

project

Offsite warehouse

Global office closures

2009

Berre fixed cost reduction

ERP project

Paulinia work process improvement project

Global staff reduction, discretionary

spending reduction

2010

Pernis IR shutdown

2008

Pernis SIS shutdown

RTS and SG&A staff reductions

Freight forward contract

Belpre energy reduction initiatives

Annualized run-rate of cost savings

US $ in millions

13 |

Earnings Growth

Update on 2010 Business Priorities

Innovation-led Top-line

Growth

Capital Investment

Approved $27 million isoprene rubber conversion at Belpre

Committed to a $10 million isoprene rubber latex debottleneck at

Paulinia

Phase II system and control upgrades at Belpre on target

Initiated project scoping for new HSBC capacity

Solid year-over-year and sequential volume and revenue growth

Benefited

from

“one-time”

sales

volume

and

FIFO

adjustment

Announced several rounds of price increases in response to rising raw

material and energy costs

Adjusted EBITDA up more than $50 million compared to Q109

Critical Capabilities

Filled a majority of open positions in Q1

Recruiting underway for all remaining critical needs, including investor

relations, market development, and engineering capabilities

14

Vitality index improving towards goal

Strong recovery in some key markets such as automotive, consumer

goods and paving & roofing

Encouraging momentum in PVC-free alternative for medical and wire

and cable applications |

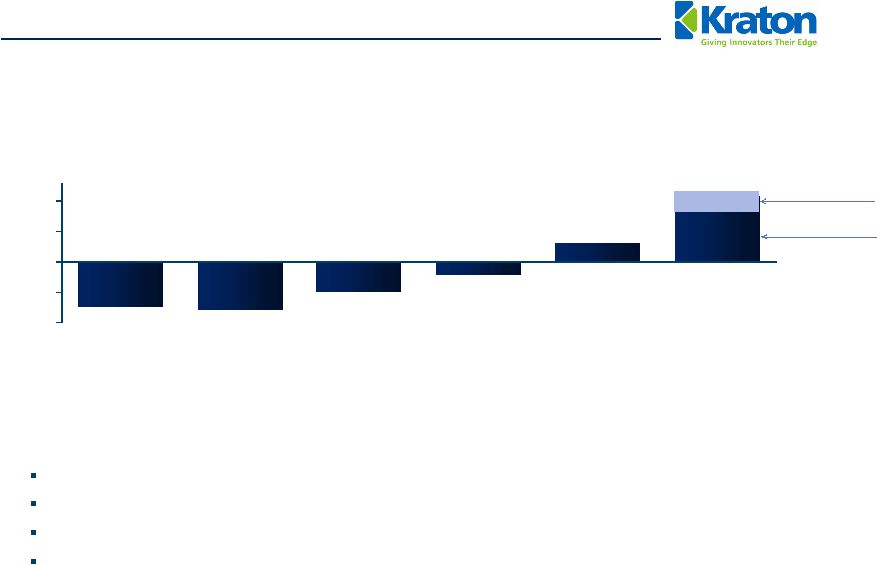

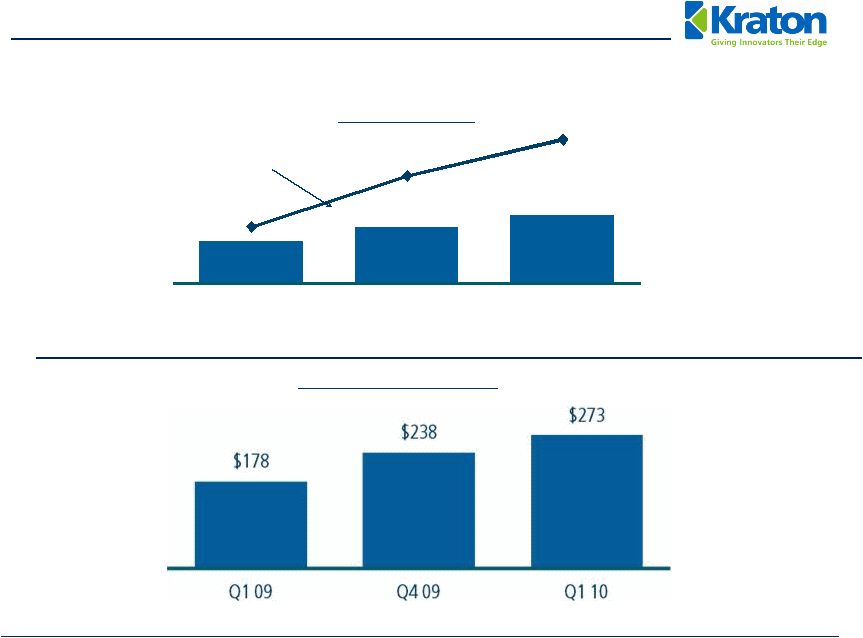

Volume Trends

Year-on-Year Change In Sales Volume:

Late Q3 2009, volume began to return to pre-economic crisis level

Q4 2009 and Q1 2010 represented a reversal in trends with both quarters posting volume growth

Q1 2010 up 20% v. Q4 2009; historically Q1 is flat to down versus prior year’s Q4

Sales volume

grew

from

47

kt

in

Q1

2009

to

73

kt

Q1

2010,

and

excluding

an

estimated

6

kt

(representing approximately $18 million of revenue) of sales that the company believes are

restocking

and

other

“one-time”

sales,

volume

is

up

20

kt

or

approximately

43%

versus

Q1

2009

15

(36.3)%

(38.7)%

(24.2)%

(9.7)%

16.0 %

54.6 %

-50.0%

-25.0%

0.0%

25.0%

50.0%

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

12.1%

42.5%

“One-time”

Core Growth

Growth |

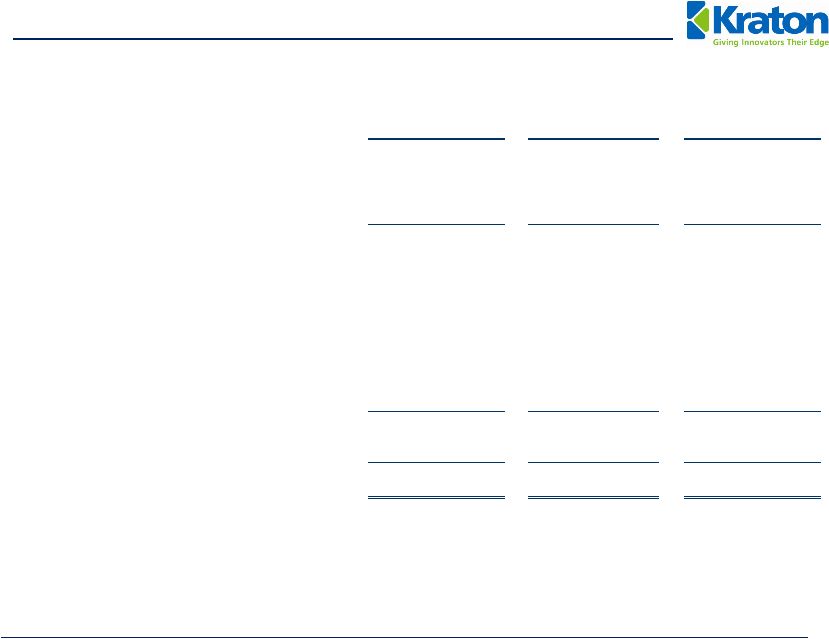

Selected Financial

Trends (1)

Excludes by-product revenue

47

61

73

61%

116%

155%

Q1 09

Q4 09

Q1 10

Volume (kt)

% of prior year

16

Sales Revenue

(1)

(US $ in Millions) |

Selected Financial

Trends (1)

Adjusted EBITDA is GAAP EBITDA excluding sponsor fees, restructuring and related charges,

non-cash expenses, and the gain on extinguishment of debt

17

$(10)

$35

$43

Q1 09

Q4 09

Q1 10

Diluted Earnings per Share

$(0.85)

$(0.07)

$0.64

Q1 09

Q4 09

Q1 10

Adjusted EBITDA

(1)

(US $ in Millions) |

$(50)

$(35)

$(73)

Quarterly Net Cash Used in

Operating Activities

Cash Flow

Q1 2010 reflects an increase in

working capital associated with an

increase in sales, higher inventory

(including effect of higher raw

material costs).

Cash conversion cycle (days)

favorable versus Q1 2009.

Working capital of 32% of LTM

revenue currently expected to return

to more normal 23% to 25% by year-

end.

US $ in millions

18

170

161

Q1 09

Q1 10

Q1 2010

Q1 2008

Q1 2009 |

Q1 2010

Capitalization US $ in millions

19

Amount

Cum. Debt /

Adjusted EBITDA

(1)

Cash and cash equivalents

$

12

Term loan

$

221

1.53x

Senior and Senior Discount Notes

163

1.14x

Total debt

384

2.67x

Stockholders’

equity

377

Total capitalization

$

761

Net debt

$

372

2.58x

(1)

Adjusted EBITDA is GAAP EBITDA excluding sponsor fees, restructuring and related charges,

non-cash expenses, and the gain on extinguishment of debt |

Appendix

|

Q1 2010 Financial

Overview (1)

Adjusted EBITDA is GAAP EBITDA excluding sponsor fees, restructuring and related charges, non-cash

expenses, and the gain on extinguishment of debt

US $ in Thousands except per share

data

21

Three months Ended

Three months Ended

Three months Ended

3/31/2010

12/31/2009

3/31/2009

Sales Volume (kt)

73

61

47

Total Operating Revenues

272,732

$

250,708

$

184,957

$

Cost of Goods Sold

203,605

189,840

176,023

Gross Profit

69,127

60,868

8,934

Operating expenses

Research and Development

5,984

6,098

4,969

Selling, General and Administrative

22,062

22,919

18,250

Depreciation and Amortization of Identifiable Intangibles

11,046

25,168

12,564

Gain on Extinguishment of Debt

-

-

19,491

Equity in Earnings of Unconsolidated Joint Venture

74

98

74

Interest Expense, net

6,064

9,179

8,908

Income (Loss) Before Income Taxes

24,045

(2,398)

(16,192)

Income Tax Expense

4,250

(882)

269

Net Income (Loss)

19,795

$

(1,516)

$

(16,461)

$

Earnings (Loss)

per

Common

Share

-

Diluted

0.64

$

(0.07)

$

(0.85)

$

Adjusted EBITDA

(1)

42,622

$

35,043

$

(9,717)

$

|

Q1 2010 Reconciliation of

Net Income/(Loss) to EBITDA and Adjusted EBITDA

(1) The EBITDA measure is used by management to evaluate operating performance. Management believes

that EBITDA is useful to investors because it is frequently used by investors and other

interested parties in the evaluation of companies in our industry. EBITDA is not a recognized

term under GAAP and does not purport to be an alternative to net income (loss) as an indicator of operating

performance or to cash flows from operating activities as a measure of liquidity. Since not all

companies use identical calculations, this presentation of EBITDA may not be comparable to

other similarly titled measures of other companies. Additionally, EBITDA is not intended to be a measure of

free cash flow for management's discretionary use, as it does not consider certain cash requirements

such as interest payments, tax payments and debt service requirements.

(2) Adjusted EBITDA is EBITDA excluding

sponsor fees, restructuring and related charges, non-cash expenses, and the gain on

extinguishment of debt.

22

US $ in Thousands

Three months Ended

Three months Ended

Three months Ended

3/31/2010

12/31/2009

3/31/2009

Net Income (Loss)

19,795

$

(1,516)

$

(16,461)

$

Add(deduct):

Interest expense, net

6,064

9,179

8,908

Income tax expense

4,250

(882)

269

Depreciation and amortization expenses

11,046

25,168

12,564

EBITDA

(1)

41,155

$

31,949

$

5,280

$

EBITDA

(1)

41,155

$

31,949

$

5,280

$

Add(deduct):

Sponsor fees and expenses

-

500

500

Restructuring and related charges

135

2,144

694

Other non-cash expenses

1,332

450

3,301

Gain on extinguishment of debt

-

-

(19,491)

Adjusted EBITDA

(2)

42,622

$

35,043

$

(9,716)

$

Restructuring and related detail:

Cost of goods sold

-

$

105

$

78

$

Selling, general and administrative

135

2,039

616

Total restructuring and related charges

135

$

2,144

$

694

$

|

May 18, 2010

Kraton

Performance Polymers, Inc.

Houlihan

Lokey

5th Annual Global Industrials Conference |