Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - FIFTH THIRD BANCORP | d8k.htm |

Exhibit 99.1

Barclays Capital

Financial Services Conference

Kevin T. Kabat

Chairman, President & Chief Executive Officer

May 18, 2010

Please refer to earnings release dated April 22, 2010 and 10-Q dated

May 7, 2010 for further information, including full results reported on a U.S.

GAAP basis

Fifth Third Bank | All Rights Reserved |

2

Fifth Third Bank | All Rights Reserved

Fifth Third franchise

*

As of 5/13/10

$113 billion assets (#13)

$84 billion deposits (#13)

$11 billion market cap (#13)*

16 affiliates in 12 states

1,309 banking centers

2,364 ATMs

Leading market share in mature Midwest

market

Built strong presence in higher growth

Southeastern markets over past 5 years

Naples

Kentucky

Tennessee

Georgia

Florida

North

Carolina

West

Virginia

Pennsylvania

Ohio

Michigan

Illinois

Indiana

Missouri |

3

Fifth Third Bank | All Rights Reserved

Diversified franchise

2009

net

revenue

-

$2.8

billion*

Branch Banking (38% of net revenue)

Retail and business banking

$18.4B average loans; $44.6B average core deposits

3.8M customers; 1.4M online banking customers

Commercial Banking (35% of net revenue)

Corporate and middle market lending, treasury services,

international trade finance, commercial leasing and

syndicated finance

$41.4B average loans; $18.4B average core deposits

765 corporate client relationships and 13,500 middle market

client relationships

Consumer Lending (22% of net revenue)

Real estate-secured mortgages, home equity loans, credit

cards, student loans, and auto lending

$20.5B average loans

7,600 dealer indirect auto lending network

Investment Advisors (5% of net revenue)

Private Bank, Retail Brokerage, Asset Management, and

Institutional Services

$3.1B average loans; $4.9B average core deposits

$25B assets under management; $187B assets under care

*

Represents

tax-equivalent

net

revenue

(income

before

taxes,

excluding

provision

for

loan

and

lease

losses).

Excludes

$1.5B

general

corporate,

of

which

approximately

$221M represented 1H09 contribution of Fifth Third Processing Solutions (51%

interest subsequently sold) 38%

22%

35%

5%

Branch

Banking

$1.1B

Investment

Advisors

$139M

Commercial

Banking

$1.0B

Consumer Lending

$610M |

4

Fifth Third Bank | All Rights Reserved

1Q10 in review

•

Net loss of $10 million

versus 4Q09 net loss of

$98 million

•

Pre-provision net revenue

of $568 million, up $6

million from 4Q09

•

Net interest margin of

3.63%, up 8 bps

sequentially

•

Average core deposits up

$4.4B, or 6% sequentially

•

Extended $18 billion of new

and renewed credit

Strong operating trends

•

Nonperforming assets declined

3% and nonperforming loans

declined 7% sequentially

(lowest levels since 2Q09)

–

Total delinquencies

declined 15% sequentially

(lowest level since 3Q07)

•

Net charge-offs declined 18%

sequentially (lowest level since

1Q09)

•

Allowance to loan ratio of

4.91%, 139% of nonperforming

loans and leases and 1.6 times

annualized 1Q10 net charge-

offs

•

Realized credit losses have

been significantly below SCAP

scenarios

Significant improvements in credit

•

Tangible common equity

ratio of 6.4%

•

Tier 1 common ratio of

7.0%

•

Leverage ratio of 12.0%

(8.9% ex-TARP)

•

Tier 1 capital ratio of

13.4% (10.0% ex-TARP)

Robust capital levels |

5

Fifth Third Bank | All Rights Reserved

Peer performance summary

Source: SNL and company reports.

(1)

Regional bank peer average consists of BBT, CMA, HBAN, KEY, MTB,

MI, PNC, RF, STI, USB, WFC, and ZION, unless otherwise noted.

(2)

Midwest peer average consists of CMA, HBAN, KEY, MI, and USB, unless

otherwise noted. *

Operating fee growth, core pre-tax pre-provision earnings, and operating

efficiency ratio exclude the following items: securities gains/losses, gains/losses from debt

extinguishments, leveraged lease gains/losses, gains from asset sales, goodwill

impairment charges, and other non-recurring items. Average loans include only loans

held-for-investment. NPAs exclude loans held-for-sale and covered

assets. Continued relative outperformance on key value drivers

FITB

1Q10

Regional

bank peers

(1)

1Q10

Midwest

peers

(2)

1Q10

SEQ performance

vs. peers

Net interest margin /

(bps)

3.63% (+8)

3.60% (+13)

3.37% (+18)

Better

Operating fee growth*

-1%

-9%

-5%

Better

Core pre-tax pre-provision earnings* / loans

2.9%

2.7%

2.6%

Better

Operating efficiency ratio*

62%

64%

65%

Better

Average core deposits growth

6%

0%

0%

Better

Average loan growth*

1%

-1%

-2%

Better

NPA ratio* /

(bps)

4.02% (-20)

4.33% (+11)

3.47% (-7)

Better

Net charge-off ratio /

(bps)

3.01% (-61)

2.48% (-46)

2.86% (-90)

Area of focus |

6

Fifth Third Bank | All Rights Reserved

Pre-tax pre-provision earnings

4.6%

4.5%

4.2%

3.2%

2.9%

2.7%

2.6%

2.0%

1.9%

1.9%

1.7%

1.7%

1.4%

WFC

USB

PNC

BBT

FITB

MTB

HBAN

KEY

MI

CMA

STI

RF

ZION

Peer average: 2.7%

1Q10 core PPNR / average loans (annualized)*

Core PPNR trend

Fifth

Third’s

pre-tax,

pre-provision

net

revenue

(PPNR)

to

loans

higher

than

most

regional

bank

peers

Core PPNR reconciliation

Credit

adjusted

PPNR

/

Average

Loans

Source: SNL and company reports. Core PPNR excludes securities gains/losses,

gains/losses from debt extinguishments, leveraged lease gains/losses, gains from asset

sales, goodwill impairment charges, divested fees and expenses related to FTPS, and

other non-recurring items where appropriate. Credit-related adjustments include

mortgage

repurchase

expenses,

provision

for

unfunded

commitments

expense,

derivative

valuation

adjustments,

OREO

expenses

and

other

workout

related

expenses.

94

57

111

73

91

483

564

535

562

3

8

45

30

1

$0

$100

$200

$300

$400

$500

$600

$700

1Q09

2Q09

3Q09

4Q09

1Q10

Core

Fee Income Credit Items

Noninterest Expense Credit Items

569

1Q09

2Q09

3Q09

4Q09

1Q10

Reported PPNR (GAAP)

$511

$2,393

$844

$562

$568

Adjustments:

Gain on sale of Visa shares

-

-

(244)

-

-

BOLI charge

54

-

-

-

-

Gain from sale of processing interest

-

(1,764)

6

-

-

Divested merchant and EFT revenue

(155)

(169)

-

-

-

Class B Visa swap fair value adjustment

-

-

-

-

9

Securities gains/losses

24

(5)

(8)

(2)

(14)

Visa litigation reserve expense

-

-

(73)

-

-

Other litigation reserve expense

-

-

-

22

4

FTPS Warrants

-

-

-

(20)

2

Seasonal pension expense

-

-

10

-

-

FDIC special assessment

-

55

-

-

-

Divested merchant and EFT expense (estimated)

49

54

-

-

-

Core PPNR

$483

$564

$535

$562

$569

Credit Related Items:

OREO write-downs, FV adjs, & G/L on loan sales

3

8

45

30

1

Problem asset work-out expenses

94

57

111

73

91

Credit adjusted PPNR

$580

$629

$691

$665

$661 |

7

Fifth Third Bank | All Rights Reserved

Stable income and expense in difficult environment

Core fee income ($M)

Core expenses ($M)

•

Strong mortgage banking results continued in 1Q10,

resulting in $3.5B of originations and $152M in net

revenue

•

Investment advisory revenue up 5% from previous qtr

•

Card and processing revenue sequential decrease 4%

–

Debit interchange: $46M 1Q10; $177M 2009

–

Credit interchange: $21M 1Q10; $85M 2009

•

Corporate banking revenue down 8% sequentially

driven by declines in business lending fees, foreign

exchange revenue, and institutional sales

•

Credit-related costs affected fee income by $1M in

1Q10 compared with $30M the previous quarter

•

Sequential increase in core expenses driven by

elevated credit costs and seasonal benefits expense

partially offset by disciplined discretionary expense

control

•

Core efficiency ratio of 62.4% in 1Q10, an improvement

from 65.1% in 1Q09

•

Credit-related costs affected non-interest expenses by

$91M in 1Q10 compared with $73M the previous

quarter

•

Total expense related to mortgage repurchases ~$39M

in 1Q10 compared with $18M in 4Q09 and $6M in 1Q09

* Refer to slide 6 for itemized effects of non-core fees and expenses

620

645

605

629

624

624

653

650

659

625

$0

$100

$200

$300

$400

$500

$600

$700

1Q09

2Q09

3Q09

4Q09

1Q10

Core

Fee Income Excluding Credit Items

913

912

938

945

952

819

856

828

872

861

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

1Q09

2Q09

3Q09

4Q09

1Q10

Core

Noninterest Expense Excluding Credit Items |

8

Fifth Third Bank | All Rights Reserved

Net interest income

Core NII and NIM*

•

Trends in net interest income and net

interest margin favorably compare with

peers

–

NIM up 8 bps in 1Q10 vs. 4Q09

•

Expect continued margin benefit

through 2010 from CD maturities and

improved loan spreads

(bps)

Reported NIM and YOY growth versus peers

Peers include: BBT, CMA, HBAN, KEY, MI, MTB, PNC, RF, STI, USB, WFC, ZION

Source: SNL and company reports

*

Core

results

exclude

$6M

charge

related

to

leveraged

lease

litigation

in

1Q09.

Also

excluded

are

$41M,

$35M,

$27M,

$24M,

and

$19M

in

loan

discount accretion from the First Charter acquisition in 1Q09, 2Q09, 3Q09, 4Q09,

and 1Q10 respectively. Yields and rates*

($Ms)

$746

$801

$847

$859

$882

2.92%

3.13%

3.33%

3.45%

3.55%

2.0%

2.5%

3.0%

3.5%

4.0%

1Q09

2Q09

3Q09

4Q09

1Q10

$400

$500

$600

$700

$800

$900

Net interest income (right axis)

NIM

3.63%

57 bps

3.60%

36 bps

NIM

NIM growth

FITB

Peer average

1.0%

2.0%

3.0%

4.0%

5.0%

1Q09

2Q09

3Q09

4Q09

1Q10

0

100

200

300

400

Spread (right axis)

Asset yield

Liability rate |

9

Fifth Third Bank | All Rights Reserved

Balance sheet:

Continued growth in core funding

•

Extended $18B of new and renewed credit in 1Q10

•

CRE loans down 4% sequentially and 12% from the previous year

–

New homebuilder/developer, non-owner occupied CRE suspended 2008

•

C&I loans down 1% sequentially and 12% from the previous year largely due

to lower line utilization and soft demand*

•

Strong

mortgage

originations

-

$1.5B in residential mortgage loans held-for-

sale warehouse (not carried in loans held-for investment)

•

Core deposit to loan ratio of 97%, up from 80% in 1Q09

•

Everyday Great Rates strategy continues to drive core deposit growth

–

DDAs

up 4% sequentially and 21% from the previous year

–

Commercial core deposits up 20% sequentially and 46% from the previous

year

–

Retail

core

deposits

up

1%

sequentially

and

3%

from

the

previous

year

Average loan growth ($B)^

Average core deposit growth ($B)

84

82

80

78

78

67

69

70

72

76

Average wholesale funding ($B)

35

31

26

20

22

•

Reduced wholesale funding by $1.9 billion sequentially and $14.7

billion from

the previous year

–

Non-core deposits down 14% sequentially and 40% from the previous year

–

Short term borrowings down 52% sequentially and 84% from the previous

year

–

Long-term debt up 10% sequentially and down 8% from the previous year

•

Portion of excess core funding invested in agency mortgage-backed securities

(balance sheet hedges added to mitigate interest rate risk)

^ Excludes loans held-for-sale

* Excludes the impact of $724M in C&I balances that were consolidated on

January 1, 2010 Note: Numbers may not sum due to rounding

50

49

48

45

45

34

33

33

32

33

1Q09

2Q09

3Q09

4Q09

1Q10

Commercial Loans

Consumer Loans

30

32

32

34

38

21

21

21

22

23

16

16

17

16

15

1Q09

2Q09

3Q09

4Q09

1Q10

Demand/IBT

Savings/MMDA

Consumer CD/Core foreign

12

12

10

8

7

10

8

6

4

2

13

11

10

10

11

1Q09

2Q09

3Q09

4Q09

1Q19

Non-core deposits

ST borrowings

LT debt |

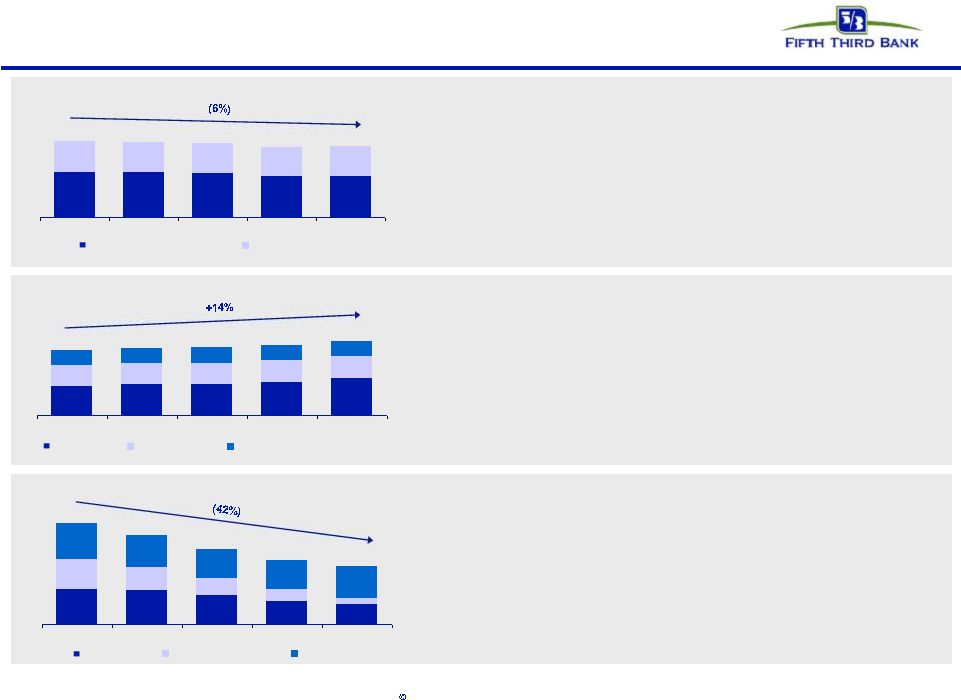

Improving credit results

Source: SNL and company reports. NPA and NCO ratios exclude loans

held-for-sale and covered assets for peers where appropriate. * 4Q08

net charge-offs included $800M in NCOs related to commercial losses moved to held-for-sale

NPA ratio vs. peers

Net charge-off ratio vs. peers*

Loans 90+ days delinquent % vs. peers

Loans 30-89 days delinquent % vs. peers

10

Fifth Third Bank | All Rights Reserved |

11

Fifth Third Bank | All Rights Reserved

Manageable commercial real estate exposure

CRE / Assets

Source: SNL and company reports.

Peer average: 215%

CRE / (TCE + Reserves)

Peer average: 18%

12%

12%

11%

11%

8%

33%

30%

24%

24%

24%

15%

14%

MI

MTB

ZION

RF

CMA

KEY

HBAN

FITB

STI

USB

BBT

WFC

PNC

473%

312%

295%

264%

209%

173%

168%

154%

147%

143%

136%

123%

117%

MTB

MI

RF

ZION

CMA

USB

HBAN

KEY

STI

BBT

FITB

WFC

PNC

13%

CRE exposure lower than peer average; problems relatively more manageable given capital and

reserves |

12

Fifth Third Bank | All Rights Reserved

$1,500

$1,750

$2,000

$2,250

$2,500

$2,750

$3,000

$3,250

$3,500

$3,750

$4,000

$4,250

$4,500

$4,750

$5,000

$5,250

$5,500

Updated credit loss expectations vs. SCAP scenarios

Realized credit losses have been significantly below SCAP submissions; expected to

continue 2008

2009

2010

*

Red SCAP line represents more adverse scenario as adjusted by supervisors for

additional assumed two-year losses. Supervisory estimates of total two-year losses

under more adverse scenario were not allocated by period. Estimate allocates total

two-year supervisory losses using the allocation under Fifth Third’s submission.

** Source for macroeconomic assumptions: Moody’s Economy.com. Assumptions as

of March 2010. Fifth Third

capitalized for this

level of credit

losses under SCAP

(plus surplus raised

vs. buffer)

$4.1B

$5.0B

$2.8B

Moody’s Weaker

Recovery / Mild

Second Recession

Case** Assumptions

(Mar. 2010)

Moody’s Base

Case** Assumptions

(Mar. 2010)

SCAP Baseline Scenario

(Submitted; Mar 2009)

SCAP Adverse Scenario*

(Supervisory; Mar 2009)

Actual

$2.6B

Actual

$2.7B

$2.9B

Fifth Third’s realized credit losses

have been significantly below its

SCAP submitted baseline and

more adverse scenarios

–

In SCAP submissions, we

incorporated significant

conservatism, given then

prevailing negative economic

and industry trends and

extreme uncertainty in

potential loss outcomes

–

Economic and credit market

conditions are much

improved versus those

expected in spring 2009

Base and stress scenarios reflect

Moody’s Base Case and Moody’s

Weaker Recover / Mild Second

Recession Case (as of March

2010)**

Our current expectation is for

2010 losses to be lower than 2009 |

13

Fifth Third Bank | All Rights Reserved

Strong reserve position

Coverage ratios are strong relative to peers

Industry leading reserve level

1.

FITB

4.91%

2.

KEY

4.34%

3.

ZION

4.05%

4.

HBAN

4.00%

5.

RF

3.61%

6.

MI

3.57%

7.

PNC

3.38%

8.

WFC

3.22%

9.

USB

2.80%

10.

STI

2.79%

11.

BBT

2.65%

12.

CMA

2.42%

13.

MTB

1.75%

Peer Average

3.21%

Reserves / Loans

490

626

756

708

582

196

283

415

68

8

4.88%

4.91%

3.31%

4.28%

4.69%

0%

1%

2%

3%

4%

5%

1Q09

2Q09

3Q09

4Q09

1Q10

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

Net Charge-offs

Additional Provision

Reserves

139%

122%

161%

90%

78%

141%

Reserves / NPLs

Reserves / NPAs

Reserves / Annualized NCOs

FITB

Peer Average

Source: SNL and company reports. NPAs/NPLs exclude held-for-sale portion for all banks and

covered assets for BBT, USB, and ZION. |

14

Fifth Third Bank | All Rights Reserved

Robust capital position

Source: SNL and company reports.

* MTB Tier 1 common ratio as of 12/31/09.

Strong capital ratios relative to peers, particularly considering reserve

levels 11.7%

10.4%

10.3%

10.0%

9.9%

9.9%

9.9%

9.6%

8.7%

8.3%

8.2%

7.9%

7.4%

BBT

CMA

PNC

FITB

WFC

KEY

USB

STI

HBAN

ZION

RF

MTB

MI

16.8%

15.9%

14.3%

14.1%

13.7%

12.7%

12.5%

12.2%

12.2%

12.0%

11.9%

10.6%

8.6%

KEY

CMA

FITB

MI

WFC

RF

STI

BBT

ZION

HBAN

PNC

USB

MTB

(TCE + reserves) / Loans

Peer average: 12.8%

Peer average w/

TARP: 11.1%

Peer average

w/o TARP: 9.4%

Tier 1 capital ratio (with and without TARP)

8.9%

11.1%

13.1%

12.0%

11.2%

13.4%

12.9%

11.7%

Tangible common equity ratio

9.7%

8.0%

7.4%

6.8%

6.7%

6.4%

6.3%

6.2%

6.1%

5.8%

5.4%

5.4%

5.3%

CMA

MI

KEY

WFC

STI

FITB

ZION

BBT

RF

HBAN

MTB

USB

PNC

Peer average: 6.6%

Tier 1 common ratio

9.6%

8.7%

7.9%

7.7%

7.5%

7.3%

7.1%

7.1%

7.1%

7.1%

7.0%

6.5%

5.7%

CMA

BBT

PNC

STI

KEY

MI

RF

USB

WFC

ZION

FITB

HBAN

MTB*

Peer average: 7.4% |

15

Fifth Third Bank | All Rights Reserved

Strong liquidity profile

Net loans and leases / core deposits

Source: 3/31/2010 Company Y9C reports

*Noncore funding dependence as of 12/31/09 as 3/31/10 BHCPR reports not yet

available •

Over the past year, Fifth Third has reduced its net noncore funding reliance by 20%,

more than any peer other than Comerica*

–

Fifth

Third

has

the

2

nd

lowest

net

noncore

funding

dependence

among

its

peers*

•

Fifth Third has no holding company debt maturing in the next year and less than 1% of

consolidated Bancorp debt, lower than peers

Peer average: 104%

92%

94%

98%

98%

99%

102%

105%

106%

107%

107%

111%

112%

116%

PNC

HBAN

RF

FITB

ZION

STI

MI

KEY

BBT

WFC

MTB

CMA

USB |

16

Fifth Third Bank | All Rights Reserved

Strong liquidity profile

Retail Brokered CD maturities: $813M in 2010; $31M in 2011

3/31 unused avail. capacity $27B ($18.5B in Fed and $8.7B in FHLB)

FHLB borrowings $2.6B; Q1 avg. core deposits $76B; equity $14B

All market borrowings by Fifth Third Bank

Holding Company cash at 3/31/10: $1.35B

—

Total Fed deposits ~$4.0B

Expected cash obligations over the next 12 months (assuming no

TARP repayment)

—

$0 debt maturities

—

~$39M common dividends

—

~$205M preferred dividends (~$35M Series G, ~$170M TARP)

—

~$237M interest and other expenses

Cash currently sufficient to satisfy all fixed obligations* over

the

next

24 months without accessing capital markets/subsidiary

dividends

Bank unsecured debt maturities ($M –

excl. Brokered CDs)

Heavily core funded

Holding company unsecured debt maturities ($M)

* Debt maturities, common and preferred dividends, interest and other expenses

$52

$500

$500

0

0

0

2010

2011

2012

2013

2014

2015 on

0

0

0

$750

0

$5.0B

2010

2011

2012

2013

2014

2015 on

Fifth Third Bancorp

Fifth Third Capital Trust |

17

Fifth Third Bank | All Rights Reserved

2010 developments

Fifth Third response

Macro themes

•

Sluggish loan demand

•

Deposits to grow but

expect some diminution

as later liquidity drawn

down by deposits to

support expansion in

spending

•

Additional consumer

regulation

•

Higher interest rates late

2010 / early 2011

•

TARP repayment

•

Leverage existing customer relationships at the local level to

offer our full portfolio of products and services across all of

our lines of business

•

Invest in sales force expansion initiatives to increase

resources and branch hours while maintaining focus on

a near-term return to

profitability •

Reorient fee structure of products and services to offer a clearer

and higher value proposition to our clients and create more

sustainable, consistent growth

•

Maintain excess liquidity, neutral to modest asset sensitive

positioning

•

Remain committed to repayment in a manner that is in the best

interest of all constituents, including shareholders |

18

Fifth Third Bank | All Rights Reserved

Continuing to invest for the future

18

Fifth Third Bank | All Rights Reserved |

19

Fifth Third Bank | All Rights Reserved

Summary

Fifth Third continues to execute on its strategic initiatives and

is focused on being well-positioned for the turn of the cycle.

•

Dedicated to serving the needs

of families and businesses for

more than 150 years

•

Businesses creating new and

profitable opportunities to

enhance value

•

Trends in NII and NIM

favorably compare with peers

•

Ongoing expense control

•

Continued shift back toward

core funding

Core franchise remains strong

•

Strong reserve coverage of

problem loans

•

Aggressive management has

mitigated areas of highest risk

•

Significantly enhanced SAG

and workout resources, while

continuing prudent lending

practices

•

Significantly improved credit

trends in 1Q10

Aggressive management of

credit issues

•

Successfully completed June

2008 capital plan and SCAP

capital actions

•

Actions exceeded SCAP Tier 1

common equity commitment

by 80%

•

Current capital levels able to

withstand significant additional

economic deterioration as

demonstrated by the SCAP

assessment

Robust capital levels |

20

Ó

Fifth Third Bank | All Rights Reserved

Cautionary statement

This report may contain statements that we believe are “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175

promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6

promulgated thereunder. These statements relate to our financial condition, results of operations,

plans, objectives, future performance or business. They usually can be identified by the use of

forward-looking language such as “will likely result,” “may,” “are expected to,” “is

anticipated,” “estimate,” “forecast,” “projected,” “intends

to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,”

“objective,” “continue,” “remain,” or similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or

similar verbs. You should not place undue reliance on these statements, as they are subject to risks

and uncertainties, including but not limited to the risk factors set forth in our most recent

Annual Report on Form 10-K and our most recent quarterly report on Form 10-Q. When considering

these forward-looking statements, you should keep in mind these risks and uncertainties, as well

as any cautionary statements we may make. Moreover, you should treat these statements as

speaking only as of the date they are made and based only on information then actually known to

us.

There are a number of important factors that could cause future results to differ materially from

historical performance and these forward-looking statements. Factors that might cause such

a difference include, but are not limited to: (1) general economic conditions and weakening in the

economy, specifically the real estate market, either nationally or in the states in which Fifth Third,

one or more acquired entities and/or the combined company do business, are less favorable than

expected; (2) deteriorating credit quality; (3) political developments, wars or other

hostilities may disrupt or increase volatility in securities markets or other economic conditions; (4)

changes in the interest rate environment reduce interest margins; (5) prepayment speeds, loan

origination and sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to

maintain required capital levels and adequate sources of funding and liquidity; (7) maintaining

capital requirements may limit Fifth Third’s operations and potential growth; (8) changes

and trends in capital markets; (9) problems encountered by larger or similar financial institutions may

adversely affect the banking industry and/or Fifth Third (10) competitive pressures among depository

institutions increase significantly; (11) effects of critical accounting policies and judgments;

(12) changes in accounting policies or procedures as may be required by the Financial Accounting

Standards Board (FASB) or other regulatory agencies; (13) legislative or regulatory changes or

actions, or significant litigation, adversely affect Fifth Third, one or more acquired entities

and/or the combined company or the businesses in which Fifth Third, one or more acquired entities

and/or the combined company are engaged; (14) ability to maintain favorable ratings from rating

agencies; (15) fluctuation of Fifth Third’s stock price; (16) ability to attract and

retain key personnel; (17) ability to receive dividends from its subsidiaries; (18) potentially dilutive effect of future

acquisitions on current shareholders’ ownership of Fifth Third; (19) effects of accounting or

financial results of one or more acquired entities; (20) difficulties in separating Fifth Third

Processing Solutions from Fifth Third; (21) loss of income from any sale or potential sale of businesses that

could have an adverse effect on Fifth Third’s earnings and future growth; (22) ability to secure

confidential information through the use of compute systems and telecommunications networks; and

(23) the impact of reputational risk created by these developments on such matters as business

generation and retention, funding and liquidity.

You should refer to our periodic and current reports filed with the Securities and Exchange

Commission, or “SEC,” for further information on other factors, which could cause

actual results to be significantly different from those expressed or implied by these forward-looking statements. |