Attached files

| file | filename |

|---|---|

| EX-31 - Benda Pharmaceutical, Inc. | v185527_ex31.htm |

| EX-32 - Benda Pharmaceutical, Inc. | v185527_ex32.htm |

U.S.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

|

x

|

ANNUAL

REPORT UNDER PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

|

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934 FOR THE TRANSITION PERIOD FROM ______________ TO

______________

|

Commission

File Number: 0-16397

BENDA

PHARMACEUTICAL, INC.

(Exact

name of small business issuer as specified in its charter)

|

Delaware

|

41-2185030

|

|

|

(State

or other jurisdiction of incorporation or

organization)

|

(IRS

Employer Identification No.)

|

Taibei

Mingju, 4th

Floor,

6 Taibei

Road, Wuhan, Hubei Province, 430015, PRC

(Address

of principal executive offices)

+86

(27) 85494916

(Issuer’s

telephone number)

SECURITIES

REGISTERED UNDER SECTION 12(b) OF THE EXCHANGE ACT: NONE

SECURITIES

REGISTERED UNDER SECTION 12(g) OF THE EXCHANGE ACT:

Common

Stock, Par Value $.001 Per Share

(Title of

Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ¨ No x

Check

whether the issuer: (1) filed all reports required to be filed by Section 13 or

15(d) of the Exchange Act during the past 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. YES x NO

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of

this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not

be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference Part III of this Form 10-K or

any amendment to this Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer

|

¨

|

Accelerated

filer

|

¨

|

|

|

Non-accelerated

filer

(Do

not check if a smaller reporting company)

|

¨

|

Smaller

reporting company

|

x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). YES ¨ NO x

As of May

17, 2010, 105,155,355 shares of the registrant's Common Stock were outstanding.

The aggregate market value of the voting common equity held by non-affiliates

(based on the closing bid price of such stock as reported on May 13, 2010 by the

Over-the-Counter Bulletin Board) was approximately $1,525,209.

Documents Incorporated by

Reference:

None.

|

Item

Number and Caption

|

Page

|

|

|

PART

I

|

||

|

Item

1.

|

Description

of Business

|

1

|

|

Item

1A.

|

Risk

Factors

|

|

|

Item

2.

|

Description

of Properties

|

46

|

|

Item

3.

|

Legal

Proceedings

|

48

|

|

Item

4.

|

(Removed

and Reserved)

|

49

|

|

PART

II

|

||

|

Item

5.

|

Market

for Common Equity and Related Stockholder Matters

|

49

|

|

Item

6.

|

Selected

Financial Data

|

|

|

Item

7.

|

Management's

Discussion and Analysis or Plan of Operations

|

51

|

|

Item

7A

|

Quantitative

and Qualitative Disclosures About Market Risk

|

|

|

Item

8.

|

Financial

Statements

|

60

|

|

Item

9.

|

Changes

in and Disagreements With Accountants on Accounting and Financial

Disclosure

|

61

|

|

Item 9A(T).

|

Controls

and Procedures

|

62

|

|

PART

III

|

||

|

Item

10.

|

Directors,

Executive Officers, and Corporate Governance

|

62

|

|

Item

11.

|

Executive

Compensation

|

66

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

67

|

|

Item

13.

|

Certain

Relationships and Related Transactions and Director

Independence

|

69

|

|

Item

14.

|

Principal

Accountant Fees and Services

|

74

|

|

PART

IV

|

77

|

|

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

|

ITEM 1. DESCRIPTION OF

BUSINESS.

Summary

Benda

Pharmaceutical, Inc. (“we”, “us”, “our”, “Benda” or the “Company”), through our

wholly owned subsidiary Ever Leader Holdings Limited (“Ever Leader”), is a

pharmaceutical company that identifies, discovers, develops and manufactures

both conventional medications and Traditional Chinese Medicines (“TCMs”) for the

treatment of some of the largest common ailments and diseases (e.g., common

cold, diabetes, cancer). We are also dedicated to the development, manufacturing

and commercialization of gene therapy products.

Benda

owns all of the capital stock of Ever Leader Holdings Limited, a holding company

incorporated under the laws of Hong Kong SAR on October 29, 2005. Ever Leader

owns 95% of the issued and outstanding capital stock of Hubei Tongji Benda Ebei

Pharmaceutical Co., Ltd. (“Benda Ebei”), a Sino-Foreign Equity Joint Venture

company incorporated under the laws of the PRC. Benda Ebei owns: (i) 95% of the

issued and outstanding capital stock of Jiangling Benda Pharmaceutical Co., Ltd.

(“Jiangling Benda”), a company formed under the laws of the PRC; (ii) 95% of the

issued and outstanding capital stock of Yidu Benda Chemical Co., Ltd. (“Yidu

Benda”), a company incorporated under the laws of the PRC; (iii) 75% of the

issued and outstanding capital stock of Beijing Shusai Pharyngitis Research Co.,

Ltd. (“BJ Shusai”), a company incorporated under the laws of the PRC; and (iv)

60.13% of the issued and outstanding capital stock of Shenzhen SiBiono Gene

Technology Co., Ltd. (“SiBiono”), a company incorporated under the laws of the

PRC.

We

distribute our high value, branded medicines, through agents who sell them to

hospitals that administer them to patients. We sell generics to medical

wholesalers for resale to hospitals. The company sells its Over the Counter

(“OTC”) medicines to wholesalers specializing in selling to retail chain drug

stores. Our “Active Pharmaceutical Ingredients” (“APIs”) are typically sold to

large drug manufacturers under long-term supply contracts. The bulk chemicals

are purchased by other Chinese drug companies.

History and Recent

Developments

We were

organized as a Minnesota corporation on February 17, 1982. The technology on

which our original products were based, including Spread Spectrum Technology,

permit data and telemetry to be transmitted simultaneously over telephone wire

without interfering with normal voice service. Our products were known as

data/voice multiplexing (“DVM”) equipment and were aimed at operating telephone

companies in the telecommunications market. Our lack of financial resources

caused us to pursue a plan of dissolution as approved by our Board of Directors

and approved by our shareholders on November 30, 1993.

During

fiscal 1994, we began implementing a plan of voluntary dissolution pursuant to

Minnesota law that was approved by our shareholders at a Special Shareholders’

Meeting held on November 30, 1993. Under our plan of dissolution, most of our

assets were sold during 1994 with some payments deferred into 1995 and beyond.

The recovery period ran through 1997. During fiscal 1995, most of the tangible

asset sales were collected and only technology licenses remained to be

collected. During fiscal 1996, we continued to collect license fees and payments

on one equipment lease. The results of the plan of dissolution were successful

and all liabilities and expenses were either paid or were covered in

reserves.

1

On

November 17, 2000, a Special Meeting of the shareholders of the Company was held

at which time the plan of dissolution was revoked. Pursuant to the proposal for

revocation, a liquidating dividend of approximately $212,000 was paid pro-rata

to our shareholders in August 2001. We have been inactive since

1994.

On

October 7, 2005, we and Applied Spectrum Technologies, Inc., a Delaware

corporation (“Applied - Delaware”) entered into a certain Agreement and Plan of

Merger (“Plan of Merger”). Pursuant to the Plan of Merger, subject to

stockholder approval, we were to merge with and into Applied - Delaware for the

purposes of the redomestication from the State of Minnesota to the State of

Delaware (the “Merger”). On October 24, 2005, we filed a Definitive Proxy

Statement pursuant to Section 14(a) of the Securities Exchange Act of 1934, as

amended, with the Securities and Exchange Commission for the purpose of voting

on the Merger.

On

November 14, 2005, the holders of a majority of our outstanding shares of common

stock approved the Merger. The Merger was completed on November 17, 2005, and

the Articles of Merger were filed with the States of Minnesota and Delaware on

November 17, 2005.

On

December 14, 2005, Norwood Venture Corp. (“Norwood”), a former shareholder of

the Company and KI Equity Partners III, LLC (“KI Equity”) entered into a certain

securities purchase agreement, as amended, under which KI Equity agreed to

purchase and Norwood agreed to sell an aggregate of 2,281,302 shares of common

stock of the Company, representing approximately 77.2% of the Company’s

outstanding shares of common stock, to KI Equity at a price of $175,000. The

closing of the transactions under the Purchase Agreement occurred on December

29, 2005.

Kevin R.

Keating, our former President and sole officer and director who resigned on

November 15, 2006, is the father of Timothy J. Keating, the majority member of

Keating Investments, LLC. Keating Investments, LLC is the managing member of KI

Equity Partners III, LLC, which is the party that acquired the controlling

interest in us pursuant to the Purchase Agreement. Keating Investments, LLC is

also the managing member and 90% owner of Keating Securities, LLC, a registered

broker-dealer. Kevin R. Keating is not affiliated with and has no equity

interest in Keating Investments, LLC, KI Equity Partners III, LLC or Keating

Securities, LLC and disclaims any beneficial interest in the shares of Applied

Spectrum’s common stock to be acquired by KI Equity Partners III,

LLC.

We did

not become engaged in the pharmaceutical business until November of 2006. Before

closing a share exchange transaction in November 2006, we were a shell company

with nominal assets and operations, whose sole business was to identify,

evaluate and investigate various companies with the intent that, if such

investigation warrants, a business combination be negotiated and completed

pursuant to which we (formerly known as Applied Spectrum Technologies, Inc.)

would acquire a target company with an operating business with the intent of

continuing the acquired company's business as a publicly held entity. We entered

in an Exchange Agreement dated September 7, 2006 (the “Exchange Agreement”) with

KI Equity Partners II, LLC (“KI Equity”), Ever Leader, a company incorporated

under the laws of Hong Kong, and the owners of 100% of the capital shares of

Ever Leader. The closing of the Exchange Agreement occurred on November 15,

2006. At the closing of the Exchange Agreement, we acquired all of Ever Leader's

capital shares (the “Ever Leader Shares”) from the Ever Leader Shareholders, and

the Ever Leader Shareholders transferred and contributed all of their Ever

Leader Shares to us. In exchange, we issued 64,942,360 shares of our Common

Stock to the Ever Leader Shareholders.

As a

result of the closing of the Exchange Agreement, Ever Leader became our wholly

owned subsidiary and we adopted Ever Leader’s main operational business. The

Exchange transaction, for accounting and financial reporting purposes, is deemed

to be a reverse acquisition, where we (the legal acquirer) are considered the

accounting acquiree and Ever Leader (the legal acquiree) is considered the

accounting acquirer, and thus the historical financial statements of Ever Leader

are the financial statements of Benda.

2

Financing

The

closing of the Exchange Agreement described above was contingent on a minimum of

$10,000,000 (or such lesser amount as mutually agreed to by Ever Leader and the

placement agent) being subscribed for, and funded into escrow, by certain

accredited and institutional investors ("Investors") in a private placement

offering for the purchase of Units, each Unit consisting of 54,087 shares of our

Common Stock ("Common Stock") and 54,087 common stock purchase warrants promptly

after the closing of the Exchange transaction under terms and conditions

approved by our board of directors immediately following the Exchange (the

“Financing”). The closing of the Financing was contingent on the closing of the

Exchange transaction, and the Exchange transaction was contingent on the closing

of the Financing. On November 15, 2006, we completed this private placement

offering. We received gross proceeds of approximately $12 million in connection

with the Financing from the Investors. Pursuant to Subscription Agreements

entered into with these Investors, we sold 480 Units for a total of 25,961,760

shares of its Common Stock and warrants to purchase an additional 25,961,760

shares of our common stock to the Investors. The price per Unit in the Financing

was $25,000.

Keating

Securities, LLC (“Placement Agent”), an affiliate of Keating Investments, LLC,

acted as placement agent in connection with the Financing. For their services,

the Placement Agents received a commission equal to 7.5% of the gross proceeds

from the offering and a non-accountable expense allowance equal to 1.5% of the

gross proceeds. In addition, the Placement Agents received, for nominal

consideration, warrants to purchase 10% of the number of shares of common stock

sold in connection with the Financing, which in the aggregate totaled 2,596,176

shares of our common stock at an exercise price of $0.555 per share. The

warrants are fully vested and have a term of five years. The Placement Agent

warrants will have registration rights similar to the registration rights

afforded to the holders of Common Stock and Warrants subscribed for in the

Financing. We also paid for the out-of-pocket expenses incurred by the Placement

Agent and all purchasers in the amount of $100,000.

In order

to finance the acquisition of a majority of the shares of Shenzhen SiBiono

GeneTech Co., Ltd. (“SiBiono”), on April 5, 2007, we entered into an Investment

Agreement (“April Financing”) with certain accredited and institutional

investors (“Investors”) who had also participated in the subscription for

$12,000,000 of our common stock pursuant to certain Securities Purchase

Agreements dated November 15, 2006 (“November Financing”). Pursuant to the

Investment Agreement, the Investors purchased a total of 252 Units for

$7,560,000 with each Unit consisting of (i) a convertible promissory note in the

principal amount of Thirty Thousand Dollars ($30,000) which shall be convertible

into 54,087 shares of the Company's common stock, par value $0.001 per share,

and (ii) a warrant to acquire 54,087 shares of Common Stock at an exercise price

of $0.555 per share. The Notes bear an interest rate of four percent per annum

until the Buyer elects to exercise the right to convert, and matured on March

28, 2009. The Notes have reached the Maturity Date. We have not repaid the

principal amounts of the Notes as of the date of this annual

report.

In March

2007 the Company and the Investors entered into a Modification Agreement

amending the November Financing Documents to allow for certain issuances of the

Company's securities, including additional purchases of the Company's equity

securities pursuant to the Investment Agreement; shares issuances required under

the Equity Transfer Agreements; and issuances of options pursuant to an approved

Qualified Employment Stock Option Plan. All of the investors in the November

Financing had the right to participate in the purchase of additional units under

the Investment Agreement and all of such investors either participated in the

Investment Agreement or have waived their right to participate in such. In

addition, those investors that did not participate in the Investment Agreement

also waived their right to object to the changes to the Warrants, Registration

Rights Agreement and Make Good Agreement which were set forth in the

Modification Agreement.

On or

prior to forty five (45) days from the Closing Date of the Investment Agreement,

we were required to deliver to the Buyers our financial statements for the years

ending December 31, 2005 and December 31, 2006, audited by Kempisty &

Company Certified Public Accountants, P.C., prepared in accordance with GAAP,

during each year involved and fairly presenting in all material respects our

financial position as of the dates thereof and the results of our operations and

cash flows for each such year then ended. Such financial statements for the

years ending December 31, 2005 and December 31, 2006 were filed with our Form

10KSB for the year ending December 31, 2006 filed with the Securities and

Exchange Commission on May 4, 2007. In addition, on or prior to seventy five

(75) days from the Closing Date, we are also required to deliver to the Buyers

audited financial statements for SiBiono for the required time periods for the

Form 8-K filing required by the Securities and Exchange Commission. Such

financial statements were filed with our Amendment No. 1 to Form 8K filed June

15, 2007.

Shenzhen

SiBiono GeneTech Co., Ltd.

On April

5, 2007, Hubei Tongji Benda Ebei Pharmaceutical Co., Ltd., a Sino-Foreign Equity

Joint Venture company incorporated under the laws of the PRC (“Benda Ebei”), of

which Ever Leader Holdings Limited, a company incorporated under the laws of

Hong Kong SAR ("Ever Leader") and a wholly owned subsidiary of Benda

Pharmaceutical, Inc. (the “Company”), owns 95% of the outstanding common stock,

has entered into Equity Transfer Agreements with certain shareholders of

Shenzhen SiBiono Gene Technology Co., Ltd. (“SiBiono”), a corporation

established and validly existing under the law of the PRC, to purchase a total

of approximately 57.57% of the shares of SiBiono's common stock for total

consideration of RMB60,000,000 due and payable on or before April 30,

2007.

3

In

connection with the Equity Transfer Agreements, we entered into a Financial

Consultancy Agreement with Super Pioneer International Limited (“Super Pioneer”)

for financial consultancy services rendered by Super Pioneer. Pursuant to the

Financial Consultancy Agreement, we agreed to issue 2,100,000 shares of our

common stock to Super Pioneer within three months from the date of the

agreement. Super Pioneer agreed to lock up the shares for a period of twelve

months from the date of the issuance of the shares (the “Lock-up Period”).

Within three months from the Lock-up Period, in the event that the public

trading price of our shares did not reach $3.6 per share and we are not listed

in the capital market of NASDAQ or AMEX, Super Pioneer shall have the option to

require us to redeem 1,960,000 shares of the stock owned by Super Pioneer at a

price of $3.6 per share. Such option shall expire within one month from the last

date of the three month period.

On June

11, 2007, Benda Ebei entered into Equity Transfer Agreements with Yaojin Wang

and Huimin Zhang, shareholders of SiBiono, for the purchase of an additional

2.56% of the shares of SiBiono's common stock for total consideration of

RMB2,560,000 due and payable on or before June 30, 2007. Accordingly, Benda Ebei

holds a total of 60.13% of the shares of SiBiono's common stock.

In

connection with the Equity Transfer Agreements, we entered into Technical

Consultancy Agreements with Yaojin Wang and Huimin Zhang for technical

consultancy services rendered by Yaojin Wang and Huimin Zhang. Pursuant to the

Technical Consultancy Agreements, we agreed to issue 33,585 shares of our common

stock to Yaojin Wang and 55,975 shares of our common stock to Huimin Zhang

within three months from the date of the agreement. Yaojin Wang and Huimin Zhang

agreed to lock up their shares for a period of twelve months from the date of

the issuance of the shares (the “Lock-up Period”). Within three months from the

Lock-up Period, in the event that the public trading price of our shares did not

reach $3.6 per share and we are not listed in the capital market of NASDAQ or

AMEX, Yaojin Wang and Huimin Zhang shall have the option to require us to redeem

the shares of the stock owned by Yaojin Wang and Huimin Zhang at a price of $3.6

per share. Such option shall expire within one month from the last date of the

three month period. The redemption requests were made to the Company in January

2008 and the company has already obtained oral consent from Super Pioneer, Wang

and Zhang that the payment would be deferred to the year of 2010.

Business

Our

operations are headquartered in Wuhan, Hubei Province, China. We are a mid-sized

Chinese pharmaceutical company that identifies, discovers, develops and

manufactures both conventional medications, Traditional Chinese Medicines

(“TCMs”) for the treatment of some of the largest common ailments and diseases

(e.g., common cold, diabetes, cancer), gene therapy product for the treatment of

cancer and Herbal TCM Oral Liquid for the treatment of anti-respiratory tract

infections.

We

currently have five core operating companies:

|

·

|

Yidu

Benda develops, manufactures and sells bulk chemicals (or

pharmaceutical intermediated), which are the raw materials used to make

“Active Pharmaceutical Ingredients”

(“APIs”).

|

|

·

|

Jiangling

Benda

develops, manufactures and sells APIs, which are one of the two

components of any capsules, tablets and fluids that are pharmaceutically

active. An API is the substance in a drug that produces the desired

medicinal effect. The “excipient” is the inert material that holds the API

(such as gelatin or water).

|

|

·

|

Benda Ebei

develops, manufactures and sells (a) conventional finished

medicines, which are non-patented, branded, proprietary small volume

injection solutions (vials) used for a variety of treatments including

hepatitis; and (b) Traditional Chinese Medicines (“TCMs”), which are

herb-based and natural medicines used in TCM therapies (via our newly

formed subsidiary Beijing Shusai). Some of the medicines we produce are of

our own origination and protected from competition by certificates issued

by China’s State Food and Drug Administration (“SFDA”).

There are no differences between the regulatory processes for

conventional medicines and Traditional Chinese Medicines. Traditional

Chinese Medicines are ready-make medicines, which are produced according

certain curing principles and prescriptions and can be used immediately,

such as pills, medicinal granules and

capsules.

|

|

·

|

BJ

Shusai

develops, manufactures and sell herbal TCM oral liquid for the treatment

of anti-respiration tract infections. However due to the fact that the

SFDA experienced an overhaul in its policies and regulatory systems in an

effort to fight against corruption in Chinese pharmaceutical industry,

thus BJ Shusai’s operation has been adversely affected by this recent

policy changes which prohibits some state-owned hospitals from forming

alliances with private companies. The management could not estimate that

such situation could be resolved in the coming

future.

|

|

·

|

SiBiono

develops, manufactures and sells gene therapy products. As a pioneer in

gene therapy in China, SiBiono's mission is to develop innovative gene

therapy products for the improvement of human health and life quality. The

Company has developed two core technology platforms: Viral Vector Gene

Delivery System and Non-Viral Vector Gene Delivery System focusing on

development of gene therapy product for cancer and cardiovascular

diseases. SiBiono’s flagship product, Gendicine is the commercialized gene

therapy for the treatment of

cancer.

|

4

Each core

Benda operating company has its own manufacturing facility located near Wuhan,

in Hubei Province and Shenzhen, in Guangdong Province. Good Manufacturing

Practices (“GMP”) certification was first issued to Benda Ebei on November 11,

2003 and renew on December 3, 2009 for the production of injection vials. On

November 26, 2007, Benda Ebei received a GMP certificate for the production of

tablets. Benda Ebei was designated a High and New Technology Enterprise by the

Science and Technology Bureau of Hubei Province on July 6, 2005 for a period of

two years. This designation represents formal recognition by the provincial

government that a company has developed or acquired new technology of

significance, and triggers a number of government support and incentive

policies, including availability of land for expansion, research grants and

discounts on bank loan interest. The designation expired on July 6, 2007;

however, we have passed the re-examination and the new designation was received

on August 2007. Although we have not received any support from the government to

date, such a designation may be useful in obtaining incentives in the

future.

Our Yidu

Benda facility produces bulk chemical intermediates for raw material medicine

and does not require GMP certification. Yidu Benda was temporarily closed mid

January to upgrade its waste water treatment system to comply with new

environmental standards enforced by PRC local government. Yidu Benda has

completed its upgrading of the waste water system and passed the government’s

verification and testing of equipments in October 2007. It is now permitted for

the testing on actual production process. Once the actual products are produced,

then the environmental government bodies will re-test the production results.

The management could not estimate the exact timing for obtaining the final

approval on the actual production process. Furthermore, the management is

searching for new products to be produced in Yidu Benda which with higher profit

margin.

Our

Jiangling Benda facility was closed for renovation in July 2004 to comply with

GMP standards. The Jiangling Benda plant reopened on August 10, 2007 and has

been producing Ribose, the only product that does not require GMP approval.

Jiangling Benda also plans to produce three other types of active pharmaceutical

ingredients and they are Ribavirin, Asarin and Levofloxacin which need to have

GMP Certificate. On April 9, 2008, Jiangling Benda received the approved GMP

Certificate which authorizing the production of Ribavrin. The other two

products, Asarin and Levolfozacin, are still under the stage of GMP certificate

approving process. The management could not estimate the exact timing for

obtaining those certificates.

On

October 16, 2003, SiBiono successfully obtained a New Drug License from the

State Food & Drug Administration of China (SFDA), and then, in April 4,

2004, SiBiono obtained “Manufacture Certificate” and “Certificate of GMP for

Pharmaceutical Product”, so far being fully qualified for the market launch of

Recombinant Human Ad-p53 Injection, trademarked as Gendicine ® in

China. Gendicine ® is the

commercialized gene therapy product approved in the PRC government agency. On

May 19, 2008, SiBiono received an official notice from the PRC State of SFDA in

which it mentioned that during the random inspection performed by the PRC State

of SFDA on April 8 to April 10, 2008, the PRC State of SFDA discovered there

were several production procedures that did not meet the requirement stated in

GMP, thus it required SiBiono to perform necessary improvements in order to

fulfill the GMP requirements and the PRC State of SFDA collected back the

distributed GMP certificate until the necessary improvements being carried out

and passed the examination that conducted by SFDA. On June 10, 2008, SiBiono

received another official notice from Guangdong Province SFDA and they demanded

the same requirements as stated in the official notice which issued by the PRC

State of SFDA dated on May 19, 2008. On November 24, 2008, SiBiono received

another official notice from Guangdong Province SFDA which mentioned that after

the examination conducted by Shenzhen City SFDA, the Guangdong Province SFDA

consent SiBiono to carry out production on a trial basis. It further required

SiBiono strictly to follow the requirements of GMP to organize trail production

and follow the procedures to apply for GMP Certificate verification. On July 14,

2009, SiBiono obtained the final approved GMP Certificate, in order words, the

SFDA allows SiBiono to resume its production and sales.

5

Good

Manufacturing Practices (“GMP”) is an internationally-recognized standard for

pharmaceutical plant design and construction. GMP has been defined as “that part

of quality assurance which ensures that products are consistently produced and

controlled to the quality standards appropriate for their intended use and as

required by the marketing authorization” (World Health Organization). GMP covers

all aspects of the manufacturing process: defined manufacturing process;

validated critical manufacturing steps; suitable premises, storage, transport;

qualified and trained production and quality control personnel; adequate

laboratory facilities; approved written procedures and instructions; records to

show all steps of defined procedures taken; full traceability of a product

through batch processing records and distribution records; and systems for

recall and investigation of complaints. The validity of the GMP approval lasts

for five years upon the issuing date and when the expiration date is

approaching, the manufacturing company needs to make an application for the

renewal.

We

distribute our high value, branded medicines, through agents who sell them to

hospitals that administer them to patients. We sell generics to medical

wholesalers for resale to hospitals. We sell our Over the Counter (“OTC”)

medicines to wholesalers specializing in selling to retail chain drug stores.

Our APIs are typically sold to large drug manufacturers under long-term supply

contracts. Our bulk chemicals are purchased by other Chinese drug

companies.

History

and Corporate Organization

Ever

Leader was incorporated in Hong Kong on October 29, 2005 for the purpose of

functioning as an off-shore holding company to obtain ownership interests in

various entities (collectively “Benda”) that were previously owned, either

directly or indirectly, by Mr. Yiqing Wan (“Wan”) and his wife, Ms. Wei Xu

(“Xu”).

The

following paragraphs summarize the original ownership structure of various

entities owned by Wan and Xu and the subsequent reorganization and transfer of

ownership interests in these entities, either directly or indirectly, to Ever

Leader.

Ownership

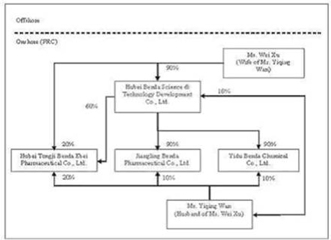

Structure Prior to Reorganization

Hubei

Benda Science and Technology Development Co., Ltd. (“Benda Science”) was

incorporated in the Province of Hubei, PRC in October of 2002, primarily

functioning as a holding company with ownership interests in various entities

operated by Wan and Xu. Wan and Xu are the sole owners of Benda Science, with

ownership interests of 10% and 90%, respectively.

Benda

Ebei was incorporated in the Province of Hubei, PRC in April of 2001. Benda Ebei

has registered capital of $2,419,404 which is fully paid up. Prior to the

reorganization of Benda as further described in the paragraphs below, Benda

Science, Wan, and Xu were the sole owners of Benda Ebei, with ownership

interests of 60%, 20%, and 20%, respectively. Benda Ebei develops, manufactures,

and sells small volume injection solutions (vials) and other conventional

medicines.

Jiangling

Benda was incorporated in the Province of Hubei, PRC in October of 2001.

Jiangling Benda has registered capital of $967,738 which is fully paid. Prior to

the reorganization of Benda, Benda Science and Wan were the sole owners of

Jiangling Benda, with ownership interests of 90% and 10%, respectively.

Jiangling Benda develops, manufactures and sells active pharmaceutical

ingredients (“APIs”). Jiangling Benda’s primary production facility was closed

for upgrades and renovations in July 2004 in order to secure a GMP certification

from the Chinese SFDA. The Jiangling Benda plant reopened on August 10, 2007 and

has been producing Ribose, the only product that does not require GMP approval.

Jiangling Benda also plans to produce three other types of active pharmaceutical

ingredients and they are Ribavirin, Asarin and Levofloxacin which need to have

GMP Certificate. On April 9, 2008, Jiangling Benda received the approved GMP

Certificate which authorizes the production of Ribavrin. The other two products, Asarin and Levolfozacin, are

still undergoing the GMP certificate approving process. The management cannot estimate the

exact timing for obtaining those

certificates.

6

Yidu

Benda was incorporated in the Province of Hubei, PRC in March of 2002. Yidu

Benda has registered capital of $4,233,854 which is fully paid. Prior to the

reorganization of Benda, Benda Science and Wan were the sole owners of Yidu

Benda, with ownership interests of 90% and 10%, respectively. Yidu Benda

develops, manufactures and sells bulk chemicals (or pharmaceutical

intermediates) for use in the production of APIs. The organization and ownership

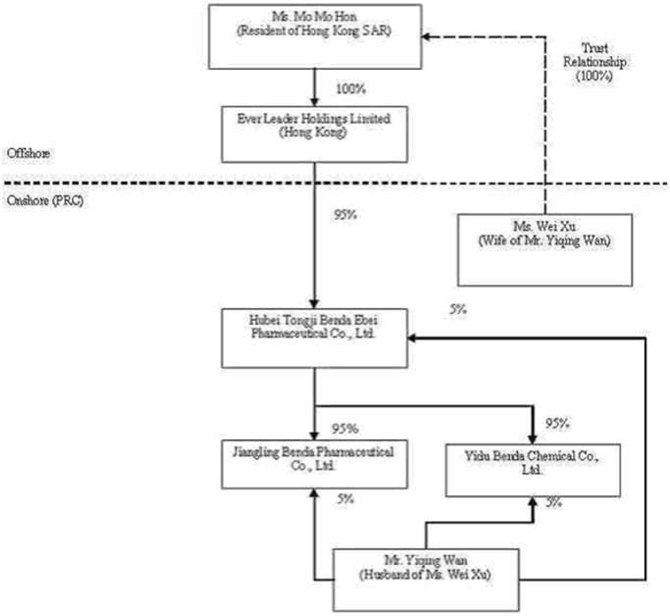

structure of Benda prior to reorganization is as follows:

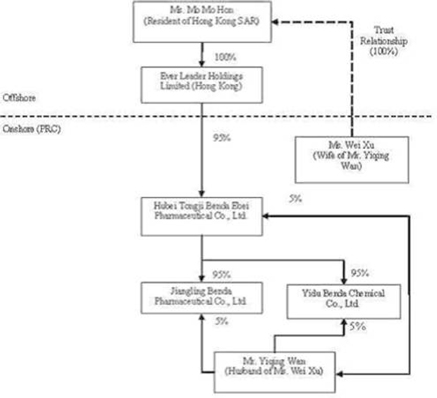

Reorganization

and Revised Ownership Structure

As

previously stated in the paragraphs above, Ever Leader was incorporated in Hong

Kong on October 29, 2005 for the purpose of functioning as an off-shore holding

company to obtain ownership interests in various Benda entities that were

previously owned, either directly or indirectly, by Wan and Xu. Ms. Mo Mo Hon

(“Hon”), a Hong Kong SAR resident, was the sole registered shareholder of Ever

Leader, holding the single issued and outstanding share of Ever Leader in trust

for Xu.

Pursuant

to three separate Equity Transfer Agreements entered into in November of 2005

among Ever Leader, Benda Science, Xu, and Wan, Ever Leader obtained a 95%

ownership interest in Benda Ebei in exchange for a commitment to pay $2,298,434

in aggregate consideration to Benda Science, Wan, and Xu. The $2,298,434

acquisition price represented 95% of the $2,419,404 of registered capital of

Benda Ebei, but was not representative of the fair value of the assets acquired

or liabilities assumed. Specifically, as transfers of ownership interests in PRC

entities to offshore holding companies for zero or nominal consideration is

prohibited by the Chinese Government (regardless of whether these PRC entities

and offshore holding companies are directly or indirectly owned and controlled

by the same individual or individuals), an amount equal to 95% of the value of

the registered capital of Benda Ebei was established for purposes of the

transfer of the 95% ownership interest in Benda Ebei (directly and indirectly

100% owned and controlled by Wan and Xu) to Ever Leader (beneficially 100% owned

and controlled by Xu). As a result of each of these entities being 100% directly

and indirectly controlled by Wan and Xu, this transaction has been accounted for

as a combination of entities under common control (see additional discussion of

accounting treatment in the paragraphs that follow), with Ever Leader’s

commitment to pay $2,298,434 in aggregate consideration to Benda Science, Wan

and Xu being reflected as a current liability at both December 31,2005 and 2004,

with corresponding reductions to paid-in capital.

7

Pursuant

to an Equity Transfer Agreement entered into on December 3, 2005 among Benda

Ebei, Benda Science, and Wan, Benda Science transferred and assigned its 90%

ownership interest in Jiangling Benda to Benda Ebei and Wan transferred and

assigned a 5% ownership interest in Jiangling Benda to Benda Ebei (for zero

consideration as Benda Ebei and Jiangling Benda were both directly and

indirectly 100% owned and controlled by Wan and Xu).

Pursuant

to a second Equity Transfer Agreement entered into on December 4, 2005 among

Benda Ebei, Benda Science, and Wan, Benda Science transferred and assigned its

90% ownership interest in Yidu Benda to Benda Ebei and Wan transferred and

assigned a 5% ownership interest in Yidu Benda to Benda Ebei (for zero

consideration as Benda Ebei and Yidu Benda were both directly and indirectly

100% owned and controlled by Wan and Xu).

The

organization and ownership structure of the Company subsequent to the

consummation of the reorganization as summarized in the paragraphs above is as

follows:

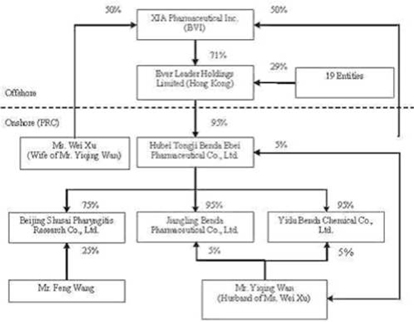

In July

of 2006, Benda Ebei invested approximately $112,500 for a 75% ownership interest

in Beijing Shusai, with the remaining 25% owned by an unrelated PRC individual.

Beijing Shusai, a PRC limited liability company, was incorporated on June 15,

2006 and commenced primary operations in July 2006. Benda Ebei is setting up

self-operated and franchised Pharyngitis Clinics in leading hospitals throughout

major cities in China. It is currently operating two clinics for the Pharyngitis

Killer therapy in Beijing, PRC.

8

On

September 5, 2006, Ever Leader increased its number of authorized shares of

common stock from 10,000 to 1,000,000 and effected a 100 to 1 stock split,

resulting in Hon (the original sole registered shareholder of Ever Leader

holding one share in trust for Xu) receiving 99 additional shares in the

Company.

On

September 5, 2006, Ever Leader transferred and assigned 711,202 shares of common

stock to Xia Pharmaceutical, Inc. (“XIA”), an offshore holding company

incorporated in the British Virgin Islands (“BVI”) that is 100% owned and

controlled by Wan and Xu.

On

September 5, 2006, Ever Leader issued 288,698 shares of common stock to 19

entities (some of whom are considered related parties) at par value.

Additionally, Hon transferred and assigned her ownership interest in her 100

shares of Ever Leader to one of these entities.

The

organization and ownership structure of the Company subsequent to the

consummation of the reorganization as summarized in the paragraphs above is as

follows:

9

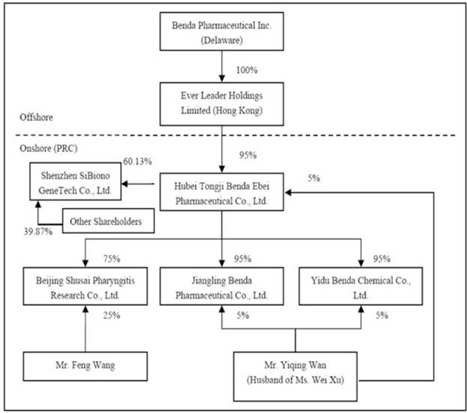

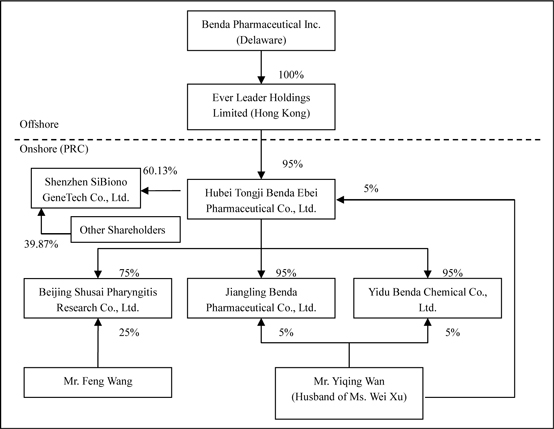

The

organizational chart after the acquisition of SiBiono would be stated as

follows:

PRINCIPAL

PRODUCTS

In

2009, our

revenues were principally derived from sales of products listed in Figure

1. We have SFDA approval for all medicines and active

pharmaceutical ingredients that we market. Sales of herbal TCM’s and bulk

chemicals do not require SFDA approval. Our medicines have undergone

pharmacological experiments in order to research the medicines’ effect and

mechanism on organisms. On the other side, the experiments also research the

organisms’ effect on the medicine. It includes pharmacodynamics and

pharmacokinetics. Pharmacological experiments and clinical trials have

similarities. Clinical trials are part of pharmacological experiments. However,

pharmacological experiments mainly use animals as research subjects, while

clinical trials generally utilize patients as research subjects. Pharmacological

experiments are carried out by regulations of non-clinical medicine research and

quality control issued by SFDA.

Main

Products

|

Manufacturer

|

Product

|

Type

|

Function

|

|||

|

Benda

Ebei

|

Jixuening

injection vial

|

Generic

|

Haemostatic

(stops bleeding)

|

|||

|

Benda

Ebei

|

Xujing

injection vial

|

Generic

|

Haemostatic

|

|||

|

Benda

Ebei

|

Nokeqing

injection vial

|

Generic

|

Used

to treat hepatitis

|

|||

|

Benda

Ebei

|

Yidingshu

injection vial

|

Generic

|

Vitamin

to treat lack of Riboflavin

|

|||

|

Benda

Ebei

|

Shusai-A

injection vial

|

Generic

|

Anti-inflammatory

analgesic

|

|||

|

Benda

Ebei

|

Suzheng-B

injection vial

|

Generic

|

Vitamin;

complementary medicine used to treat hepatitis

|

|||

|

Benda

Ebei

|

Ribavirin

injection vial利巴韦林

|

Generic

|

Anti-virus,

to treat acute upper respiratory tract infection

|

|||

|

Benda

Ebei

|

Gentamycin

Sulfate Injection vial

|

Generic

|

Broad

spectrum antibiotic

|

|||

|

Benda

Ebei

|

Vitamin

B6 injection vial

|

Generic

|

Vitamin;

complementary medicine used to treat hepatitis

|

|||

|

Benda

Ebei

|

Inosine

injection vial

|

Generic

|

Nutrition,

complementary medicine used to treat hepatitis

|

|||

|

Benda

Ebei

|

Vitamin

C injection vial

|

Generic

|

To

treat deficiency of vitamin C

|

|||

|

Jiangling

Benda

|

Ribavirin

API (1)

|

API

|

Ribavirin

drug manufacture.

|

|||

|

Jiangling

Benda

|

Asarin

API (1)

|

API

|

Asarin

manufacture to treat acute upper respiratory system

infection

|

|||

|

Jiangling

Benda

|

Levofloxacin

Mesylate API (1)

|

API

|

Broad

spectrum antibiotic drug manufacture

|

|||

|

Jiangling

Benda

|

Ribose

|

API

|

Used

to manufacture antibiotic drug

|

|||

|

Yidu

Benda

|

Triazol

carboxylic acid methyl ester (“TCA”)

|

Bulk chemical

|

Ribavirin

manufacture, anti-virus

|

|||

|

SiBiono

|

Gendicine

|

Gene

Therapy

|

Treatment

of

cancer

|

10

|

(1)

|

Jiangling

Benda facility was closed for renovation in July 2004 to comply with GMP

standards. The Jiangling Benda plant reopened on August 10, 2007 and has

been producing Ribose, the only product that does not require GMP

approval. Jiangling Benda also plans to produce three other types of

active pharmaceutical ingredients and they are Ribavirin, Asarin and

Levofloxacin which need to have GMP Certificate. On April 9,

2008, Jiangling Benda received the approved GMP Certificate which

authorizes the production of Ribavrin. The

other two products, Asarin and Levolfozacin, are still undergoing

the GMP

certificate approving process.

The management cannot

estimate the exact timing for obtaining those

certificates.

|

SFDA

Compared to the FDA

The SFDA

approval process is similar to the FDA approval process. They both require three

phases of clinical trials.

|

·

|

Phase

I: Test the safety of drugs. 20-80 cases are required by FDA, while 20-30

cases are required by SFDA.

|

|

·

|

Phase

II: Test the efficacy of drugs. Several hundred cases are required by FDA,

while 100 cases are required by

SFDA.

|

11

|

·

|

Phase

III: Expand the sample group and further test the safety and effectiveness

of drugs. Several hundreds, even thousands are required by FDA, while 300

hundred cases are required by SFDA.

|

Before a

drug can be sold in China, the drug needs to undergo the above three phases,

namely pre-clinical trial, clinical trial and finally, GMP approval. The

approval of a drug by SFDA does not guarantee the approval by FDA. However,

drugs approved by SFDA can be exempted from certain steps in US clinical trials

before applying for FDA.

Benda Ebei

Products

Of our

branded medicines, the Shusai-A Nefopam Hydrochloride solution, sold in

injection vials, is particularly noteworthy. According to a pharmacological

experiment, Nefopam Hydrochloride has an analgesic effect 10.4 times greater

than that of aspirin. Furthermore, it is not addictive and causes no known side

effects.

Pharmacological

experiments research the medicines’ effect and mechanism on organisms. On the

other side, the experiments also research the organisms’ effect on the medicine.

It includes pharmacodynamics and pharmacokinetics. Pharmacological experiments

and clinical trials have similarities. Clinical trials are part of

pharmacological experiments. However, pharmacological experiments mainly use

animals as research subjects, while clinical trials generally utilize patients

as research subjects. Pharmacological experiments are carried out by regulations

of non-clinical medicine research and quality control issued by

SFDA.

The

chemical name of this product is Nefopam hydrochloride. It mainly contains:

5-Methyl-1-Phenyl-3,4,5,6-Tetrahydrocannabinol-1H-2,5-benzoxazocine, fenazoxine

hydrochloride. It is a new type of Non-narcotic analgesics which has the

function of low-grade Antipyretic and muscle relaxants. Its chemical structure

belongs to O-methyl benzene ring of diphenhydramine, so it does not have the

attribute of Non-steroidal anti-inflammatory drugs, nor Opioid receptor agonist.

It is effective for middle-grade and heavy-grade pain. Intramuscular injecting

20mg of Nefopam hydrochloride equals to intramuscular injecting 12mg morphine.

It has light effectiveness on respiration inhibition. It has no inhibition on

circulatory system. It has no tolerance or dependence. It can be rapidly oral

absorbed, Tmax 1-3 hours, and it has obvious effect while first pass. T1/2 4-8

hours, the binding rate of plasma protein is 71%-76%. It is metabolized by liver

to lose its pharmacological activities. Most of it will be excreted through

kidney. The prototype drug will be less than 5% and only a little will be

excreted along with excretion. It is used for pain-killing after operation,

cancer pain, and acute pain. It is also used for visceral smooth muscle cramps

such as acute gastritis, in-biliary ascariasis, ureterolithiasis.

The

clinical trials were conducted in 1993, instructed by Doctor Guozhong, Peng.

Ebei plant paid for all clinical trial expenses. It passed the clinical trials

in 6 clinical institutes including the provincial hospital of Hebei, the second

and the forth hospital attached Hebei School of Medicine, Bethune international

peace hospital and etc. The efficacy rate is around 80% for all 374 cases

examined. There is no follow up results.

Generics

are common, low-cost, medicines used by doctors in hospitals nationwide. Our

generics have been marketed for more than 10 years and are generally used by

low-income patients in rural and country districts. The profit margins for our

generics, which constitute about 3 per cent of Benda Ebei’s current sales

volume, are lower than those of our branded products. However, our generic

products are an effective means for promoting our corporate name, image and

brands nationwide.

Jiangling Benda

Products

Jiangling

Benda produces and plans to produce four types of active pharmaceutical

ingredients and they are Ribavirin, Asarin, Levofloxacin and Ribose whereas the

production of Ribose does not require the GMP certificate, but the production of

the other three products do require the GMP certificate.

12

|

·

|

Ribavirin

has been used to produce antivirus medicine to treat SARS and SARS-like

illnesses. Ribavirin is also used to treat severe virus pneumonia in

infants and young children and a viral liver infection known as hepatitis

C. It can be used in patients who have hepatitis C or human

immunodeficiency virus (“HIV”) infection. Alliance Pharm, Inc. is advising

us on modifications to our production processes in our effort to achieve

U.S. FDA certification. Currently, there is only one other pharmaceutical

company in PRC that has received U.S. FDA certification to produce

Ribavirin API. On April 9, 2008, Jiangling Benda received the

approved GMP Certificate from the SFDA which authorizing the production of

Ribavrin.

|

|

·

|

Asarin

is used to treat infections of the upper respiratory system. Our Asarin

API is synthesized chemically rather than being extracted from natural raw

materials, making it a cost effective and price competitive product.

Benda’s Asarin received SFDA approval as a new API on December 27, 2005.

We plan to extend our reach further down the value chain and manufacture

consumer-ready Asarin medicines, in injection, vial and pill form, from

our Asarin API. We have already filed for SFDA approval for these three

types of finished Asarin

products.

|

|

·

|

Levofloxacin

Mesylate is a synthetic broad spectrum antibacterial agent for oral and

intravenous administration. Benda’s Levofloxacin received SFDA approval as

new drug ingredient on March 5,

2006.

|

|

·

|

Ribose

is a kind of active pharmaceutical ingredient and which is used to

manufacture antibiotic drug and which does not the approval from

SFDA.

|

Yidu Benda

Product

Yidu

plans to produce one type of bulk chemicals:

|

·

|

Triazol

carboxylic acid methyl ester (“TCA”). This is our main bulk chemical

product.

|

Due to a

government order issued by the local government on January 10, 2007, our Yidu

Benda plant has been shut down since the middle of January 2007 for improvement

of our waste water treatment systems. The order requires us to finish the

improvement and be compliant by June 30, 2007. On September 25, and October 1,

2007, Yidu Benda had passed the environmental assessment and safety assessment

by the Yichang Environmental Protection Bureau and Yichang Safety Supervision

Bureau These two bureaus have issued “Environmental Influence Report” and

“Safety Assessment Report” in November and December of 2007, respectively.

Yichang Environmental Protection Bureau issued an approval document, (Document

Number: Yichang Environmental Audit [2007] No. 111) and permitted the trial

production of Yidu Benda on December 28, 2007, at which time Yidu Benda resumed

full production. The related government agencies through trial production

physically inspect the products produced by the newly installed production

facilities. The main purpose for doing so is to ensure that the quality of the

products is such that there will be no harm to the environment. In addition,

Yidu Benda had also passed the examinations conducted by Yichang Public Security

Bureau, Yichang Lightning Protection Institute and Yichang Special Equipment

Inspection and Test Institute, in terms of the fire apparatus and facilities,

lightning protection and static proof facilities etc. It is now permitted for

the testing on actual production process. Once the actual products are produced,

then the environmental government bodies will re-test the production results.

The

management could not estimate the exact timing for obtaining the final

approval on

the actual production process. Furthermore, the management is searching for

new

products to

be produced in

Yidu Benda which with higher profit margin.

SiBiono

Product

SiBiono

is a gene therapy company dedicated to the development, manufacturing and

commercialization of gene therapy products. As a pioneer in gene therapy in

China, SiBiono's mission is to develop innovative gene therapy products for the

improvement of human health and life quality. The Company has developed two core

technology platforms: Viral Vector Gene Delivery System and Non-Viral Vector

Gene Delivery System focusing on development of gene therapy product for cancer

and cardiovascular diseases.

On

October 16, 2003, SiBiono successfully obtained a New Drug License from the

State Food & Drug Administration of China (SFDA), and then, in April 4,

2004, SiBiono obtained “Manufacture Certificate” and “Certificate of GMP for

Pharmaceutical Product”, so far being fully qualified for the market launch of

Recombinant Human Ad-p53 Injection, trademarked as Gendicine

® in China. Gendicine ® is the

first ever commercialized gene therapy product approved in the world by a

government agency. Gendicine is recognized by the world's first class journals

as a major milestone in the field of gene research and biotechnology and is

expect to make important contribution to mankind's endeavor for improving human

health.

13

MARKETING

AND DISTRIBUTION METHODS OF PRODUCTS AND SERVICES

Prescription

Medicines

Two types

of distribution channels exist in the Chinese medicine industry.

For high

value branded medicines: Pharmaceutical Manufacturers à Agents à Sub Agents à Medicine

Representatives à

Hospitals or Pharmacies à Patients

For low

value generics: Pharmaceutical Manufacturers à Wholesalers à Secondary

Wholesalers à

Hospitals or Pharmacies à Patients

The major

difference between an agent and a wholesaler is that the agent has exclusive

product sales rights from each manufacturer in each region, which is generally a

province. Sometimes manufacturers have several wholesalers in a

region.

The table

below illustrates price markups along the distribution channel for a typical

Benda Ebei branded drug, Shusai-A.

Shusai-A

Price Markup Pattern

|

Purchase

Price per

piece in

RMB

|

Price

Markup

|

|||||||

|

Patients

|

40.00 | 54 | % | |||||

|

Retail/Hospitals

|

26.00 | 622 | % | |||||

|

Medicine Reps

|

[3.60 | ] | 29 | % | ||||

|

Sub-agents

|

2.80 | 56 | % | |||||

|

Agents

|

1.80 | |||||||

|

Benda

Ebei

|

n/a | |||||||

The

highest price markup along the distribution channel is on sales by medicine reps

to hospitals because such markups finance kick-backs paid by the reps to

doctors. This unfortunate, but common, practice is condemned by PRC’s patients

and medical industry regulators, but no effective method has been found to stamp

it out. In reality, there are “kick-backs” phenomena which are paid by the reps

to doctors, not by our company to doctors. However, in the normal course of

business, sales commission would be incurred between our company and clients,

such as agents or wholesalers etc., in order to have a sense of incentive to

them. This sales commission scheme is fully disclosed in the sales contracts and

is also allowed by the relevant PRC regulations.

Benda

Ebei sells its products to agents or wholesalers. This method minimizes the need

for a direct sales force and distances Benda Ebei from questionable kick-backs

and potential legal consequences.

Active

Pharmaceutical Ingredients (“APIs”)

Our APIs

are purchased by other Chinese drug companies on an order-by-order basis. The

domestic industry is tight-knit and API marketing still relies on word-of-mouth,

reputation, and personal contacts. Although we have temporarily closed the

Jiangling plant to complete renovation and obtain GMP certification, we have

maintained relationships with all our former clients and expect to bring on

other drug companies as new customers.

Jiangling

Plant is primarily engaged in producing Ribose, a bulk chemical which does not

require GMP approval and Active Pharmaceutical Ingredients (API) which need GMP

approval.

Jiangling

Benda was re-opened in August 2007. The products that are planned to be produced

in Jiangling Benda are as follows:

a)

Ribavirin API (Anti-virus)

b) Asarin

API (Antibiotic)

c)

Levofloxacin (Antibiotic)

d)

Ribose

These

four products are classified as API whereas the production of Ribavirin, Asarin

and Levofloxacin need to obtain GMP approval, however the production of Ribose

does not need the GMP approval. Currently, Jiangling Benda only produces Ribose

and which is a kind of API.

14

Bulk

chemicals

We market

our bulk chemicals by cultivating strong, long-term relationships with loyal

customers. We usually supply customers pursuant to annual renewable contracts.

Customers usually start by buying small quantities and gradually increasing

order sizes. We also enjoy long-standing relationships with a number of

important exporters. These sales contracts are signed annually.

Beijing

Shusai Pharyngitis Research Co., Ltd.

Beijing

Shusai Pharyngitis Research Co., Ltd, a recently established subsidiary of Benda

Ebei, handles our Pharyngitis Killer therapy operation, promotion, and

distribution. Key functional departments are as follows:

|

·

|

Training.

Trains doctors, doctor assistants, and medical

workers.

|

|

·

|

Advisory.

Advises each clinic on how best to apply the Pharyngitis Killer

treatment.

|

|

·

|

Business

Development. Extend the footprint of Pharyngitis clinics and implement

patient outreach programs.

|

|

·

|

Marketing.

Formulate and execute marketing

plans.

|

|

·

|

Finance.

Provide internal financial services to support business

operations.

|

|

·

|

Logistics.

Ensure no bottlenecks or shortages in product supply to the

clinics.

|

Special

Marketing Initiatives

|

(1)

|

Qiweiben Capsule

Initiative. Benda Ebei intends to develop a series of products

based on the Qiweiben Capsule and designed to treat diabetes. They will be

sold through diabetes recovery centers and regional

distributors.

|

|

(2)

|

Jixuening Initiative.

We plan to develop a group of haemostatic medicines based on our core

Jixuening brand. Benda Ebei’s Jixuening has been listed in the Catalog of Basic Medicines Covered

by Social Medical

Security.

|

|

(3)

|

Analgesic Initiative.

The treatment of pain attracts more attention from PRC’s medical community

and hospitals around the country that are setting up pain clinics. Our

Shusai-A and Lappaconitine Hydrobromide products are uniquely powerful

pain killers and are not addictive. We plan to leverage their popularity

to promote our other pain killers and thereby build a series of pain

killer medicines.

|

15

|

(4)

|

Asarin Initiative. We

intend to form a group of medicines, based on Asarin, which will be

designed to cure upper respiratory tract

infection.

|

STATUS

OF PUBLICLY ANNOUNCED NEW

PRODUCTS/SERVICES

We expect

that the following products in our development pipeline will generate growth in

our revenues in the next few years. We expect to begin mass production for

products once we receive SFDA’s approval.

The

registration of a medicine must first be undertaken at the provincial level.

First, you need to make an application in the provincial Food and Drug

administration, then you must pass the on-the-spot examination of the provincial

registration office and the initial inspection of information experts. After

that, you can apply for the experts’ technological evaluation of National

Medicine Analysis and Judgment center. Only after you received the technological

evaluation, your registration can be transferred to SFDA to have administrative

ratification. After the ratification, you will be issued new license and

ratification number. In most situations, after the application and record of

provincial Food and Drug administration, the company’s products will not be

examined again by National Medicine Analysis and Judgment center, which is

similar to the first step of technological check.

Due to

the restructuring of SFDA, the process of approval new drug has been on hold

since the beginning of 2007. We do not know how long it will take to resume the

approval process.

The

Company can only obtain the license for the new medicine and the production

license after the completion of the clinical experiments. The procedures of

obtaining new drug certificate with the SFDA are as follows:

1. Submit

the application to the Province SFDA;

2. Then

the Province SFDA will perform the physical inspection;

3. If we

pass the physical inspection, the related application would be transferred to

the State SFDA;

4. After

ratification, the new drug license and ratification number would be

issued.

Development

Status of Key Products in Our Pipeline

|

Name of Product

|

Type

|

Main Function

|

Status

|

|||

|

Pharyngitis

Killer

|

Herbal

TCM Oral Liquid and Treatment

|

Anti-respiratory

tract infections

|

Market

launch underway; SFDA Certificate not necessary

|

|||

|

Qiweiben

Capsule

|

Branded

TCM

|

Diabetes

treatment

|

New

Medicine Application is accepted by SFDA; awaiting for SFDA approval and

production permit。

|

|||

|

Yan

Long Anti-cancer Oral Liquid

|

Branded

TCM

|

Treatment

of cancers of the digestive tract

|

Awaiting

for SFDA approval (1)

|

|||

|

500mg:5ml

Tranexamic Acid Injection vial

|

Generic

|

Haemostatic

|

SFDA

production approval H20044601 received; Put in production

line.

|

|||

|

200mg:2ml

Ribavirin Injection vial

|

Generic

|

Antibiotic

|

SFDA

production approval H42021048 received; Put in production

line.

|

16

|

1000mg:2.5mlVitamin

C Injection vial

|

Generic

|

Vitamin

|

Achieved

State acceptance and hearing Y0405945; SFDA production approval H20067577

received; Put in production line.

|

|||

|

0.1g:2ml

Lomefloxacin Aspartate Injection vial

|

Generic

|

Antibiotic

|

SFDA

production approval H20056701 received; Put in production

line.

|

|||

|

0.2g:5ml

Lomefloxacin Aspartate Injection vial

|

Generic

|

Antibiotic

|

SFDA

production approval H20056702 received; Put in production

line.

|

|||

|

Lappaconitine

Hydrobromide Injection vial

|

Branded

Medicine

|

Analgesic

|

SFDA

production approval H20055966 received; Put in production

line.

|

|||

|

Asarin

Injection vial

|

Generic

|

Treatment

of upper respiratory infection

|

Filing

completed at provincial bureau level; filed with SFDA in May

2006

|

|||

|

Asarin

pill

|

Generic

|

Treatment

of upper respiratory infection

|

Filing

completed at provincial bureau level; filed with SFDA in August 2006; Need

further bio-clinical trial.

|

|||

|

Asarin

granular medicine

|

Generic

|

Treatment

of upper respiratory infection

|

Filing

completed at provincial bureau level; filing with SFDA in September

2006

|

|||

|

Asarin

oral liquid

|

Generic

|

Treatment

of upper respiratory infection

|

Filing

completed at provincial bureau level; filing with SFDA in September 2006;

Need further bio-clinical trial.

|

|||

|

Lysine

Hydrochloride Injection vial

|

Generic

|

Amino

acid

|

Filing

completed at provincial bureau level; filed with SFDA in July 2006; Need

further bio-clinical trial.

|

|||

|

Arginine

Monohydrochloride Injection vial

|

Generic

|

Amino

acid

|

Filing

completed at provincial bureau level; filed with SFDA in July 2006; Need

further bio-clinical trial.

|

|||

|

100mg:5ml

Levofloxacin Hydrochloride Injection vial

|

Generic

|

Antibiotic

|

Filing

completed at provincial bureau level; filed with SFDA in July 2006; Need

further bio-clinical trial.

|

|||

|

500mg:5ml

Levofloxacin Hydrochloride Injection vial

|

Generic

|

Antibiotic

|

Filing

completed at provincial bureau level; filed with SFDA in July 2006; Need

further bio-clinical trial.

|

|||

|

a-Asarin raw

medicines

|

API

|

Upper

respiratory infection

|

SFDA

production approval H20059540 received; prepare for

production.

|

|||

|

Levofloxacin

mesylate API

|

API

|

Antivirus

|

Filing

completed at provincial bureau level; SFDA approval received; prepare for

production.

|

|||

|

GCLE

|

Bulk

chemical

|

Production

of Antibiotics

|

As

it is a chemical product, it does not need SFDA

approval.

|

17

(1)

Yanlong oral solution has finished its earlier stage of research, and the

Company is in the process of applying for SFDA’s permission of clinical trials.

The new drug certificate will only be issued after the clinical

trials.

New

Branded Medicines

Our

upcoming branded medicines include Qiweiben capsule and Yanlong anti-cancer oral

liquid, which are proprietary traditional Chinese medicines, and Pharyngitis

Killer Therapy, which is a combination of herb-based traditional Chinese

medicine and treatments. We expect these products to have a significant positive

impact on our future operational results.

Our New Branded Traditional Chinese

Medicines

|

Features

|

Pharyngitis

Killer

|

Qiweiben

Capsule

|

Yan

Long Anti-cancer Oral Liquid

|

|||

|

Targeted IP/ Formula Protection Period (1)

|

Not Applicable (2)

|

7+7 years (7)

|

7+7 years (7)

|

|||

|

Our Ownership

|

75% (3)

|

100%

|

100% with

reservation (4)

|

|||

|

Completion Date Of Clinical

Tests

|

Not Applicable

|

Pening (6)

|

Pending

(6)

|

|||

|

New Medicine Certification

Date

|

Not Applicable

|

Pening (6)

|

Pending (6)

|

|||

|

Expected installation of GMP quality production

line (5)

|

Not Applicable

|

Pending (6)

|

Pending (6)

|

|||

|

Expected SFDA Production

Certification

|

Not Applicable

|

Pending (6)

|

Pending (6)

|

|||

|

Expected Commencement of

Production

|

Launched June 2006

|

Pending (6)

|

Pending

(6)

|

(1) The

first protection period will commence when the proprietary TCM protection

application is approved. The second protection period can be applied for when

the first protection period is expired.

(2) TCM

therapies do not require SFDA approval. We chose not to apply for patent

protection for this product’s formula due to our concerns about disclosures

required in the patent application process.

(3) Benda

owns 75% of Beijing Shusai Pharyngitis Research Co., Ltd., a company that owns

all product and market exploitation rights to Pharyngitis Killer

Therapy.

(4) The

inventor of Yanlong Anti-cancer oral liquid, Mr. Yan Li, has reserved the right

to sell the product to one hospital in Hong Kong, one hospital in Taiwan and one

hospital in Shenzhen province.

(5) GMP

certification is expected once the facility installation for the products below

referenced products and examination by the related local government agency is

completed.

18

In order

to produce

Qiwweiben, the following table shows the production facilities are

purchased and installed, and they are all located in Benda Ebei and waiting for

the government agency for inspection:

|

No.

|

|

Equipment

|

|

Model No.

|

|

Quantity

|

|

1

|

Muller

|

300A

|

2

|

|||

|

2

|

powder

shifter

|

ZS-350

|

2

|

|||

|

3

|

powder

shifter

|

XS-650

|

1

|

|||

|

4

|

3D

mixer blender

|

HD-1000

|

1

|

|||

|

5

|

Ultrasonic

spray drier

|

FL-120

|

1

|

|||

|

6

|

Wet

mixer granulator

|

GHL-250

|

1

|

|||

|

7

|

Slot

shape Mixer

|

CHL-150

|

2

|

|||

|

8

|

granule

drier

|

TC-Z-Ⅱ

|

1

|

|||

|

9

|

Capsule

filling machine

|

NJP-1200

|

1

|

|||

|

10

|

Capsule

polishing machine

|

YPJ-Ⅱ

|

1

|

|||

|

11

|

fast

packing machine

|

DPH-250D

|

1

|

In order

to produce Yanlong Anti-cancer Oral Liquid, the following table shows the

production facilities are purchased and installed, and they are all located in

Benda Ebei and waiting for the government agency for inspection:

|

No.

|

Equipment

|

Model No.

|

Category

|

|||

|

1

|

Solution

Preparation Reservoir

|

PLG-1.0

|

||||

|

2

|

Fluid

Storage Reservoir

|

ZYG-1.0

|

||||

|

3

|

High

Level Reservoir

|

N/A,

general machinery

|

Liquefy

|

|||

|

4

|

Micro-filters

|

N/A,

general machinery

|

System

|

|||

|

5

|

Filters

for Sugar Syrup

|

N/A,

general machinery

|

||||

|

6

|

Sugar

Dissolving Reservoir

|

HTG-0.5

|

||||

|