Attached files

| file | filename |

|---|---|

| 8-K - WILLIS GROUP HOLDINGS PUBLIC LIMITED COMPANY 8-K - WILLIS TOWERS WATSON PLC | a6292561.htm |

Exhibit 99.1

WILLIS GROUP HOLDINGS FACT BOOK FOR THE QUARTER ENDED MARCH 31, 2010

Leading global insurance broker Broad range of professional insurance, reinsurance, risk management, financial and human resource consulting and actuarial services Global distribution capabilities to meet risk management needs of large multinational and middle market clients More than 400 offices in 120 countries, with approximately 17,000 employees 2009 total revenues $3.3 billion Strong sales culture and relentless focus on cost control Market capitalization $5.5 billion (as of May 14, 2010) Willis snapshot

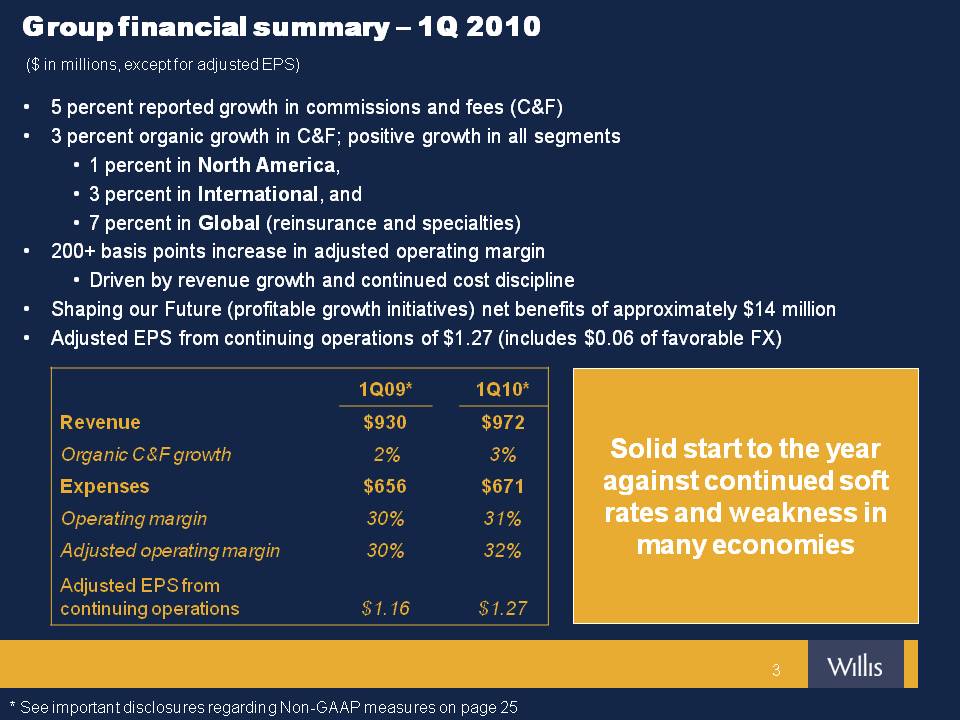

Group financial summary – 1Q 2010 5 percent reported growth in commissions and fees (C&F) 3 percent organic growth in C&F positive growth in all segments 1 percent in North America, 3 percent in International, and 7 percent in Global (reinsurance and specialties) 200+ basis points increase in adjusted operating margin Driven by revenue growth and continued cost discipline Shaping our Future (profitable growth initiatives) net benefits of approximately $14 million Adjusted EPS from continuing operations of $1.27 (includes $0.06 of favorable FX) Solid start to the year against continued soft rates and weakness in many economies ($ in millions, except for adjusted EPS) * See important disclosures regarding Non-GAAP measures on page 25 1Q09* 1Q10* Revenue $930 $972 Organic C&F growth 2% 3% Expenses $656 $671 Operating margin 30% 31% Adjusted operating margin 30% 32% Adjusted EPS from continuing operations $1.16 $1.27

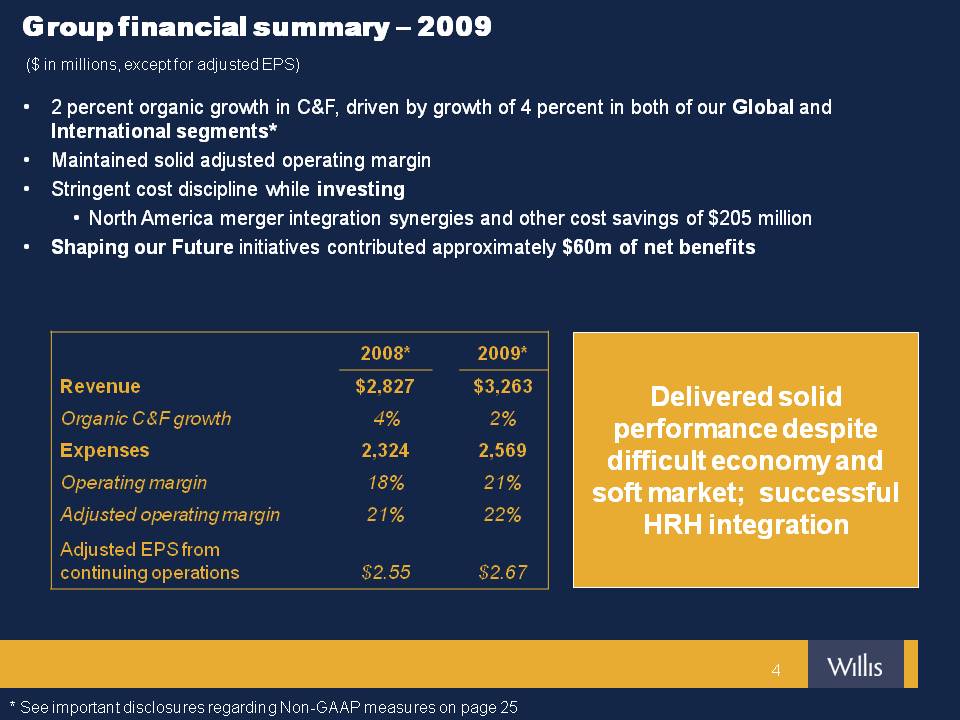

Group financial summary – 2009 2 percent organic growth in C&F, driven by growth of 4 percent in both of our Global and International segments* Maintained solid adjusted operating margin Stringent cost discipline while investing North America merger integration synergies and other cost savings of $205 million Shaping our Future initiatives contributed approximately $60m of net benefits Delivered solid performance despite difficult economy and soft market; successful HRH integration ($ in millions, except for adjusted EPS) * See important disclosures regarding Non-GAAP measures on page 25 2009 $3,263 2% 2,569 21% 22% $2.67 2008* $2,827 4% 2,324 18% 21% $2.55 Revenue Organic C&F growth Expenses Operating margin Adjusted operating margin Adjusted EPS from continuing operations

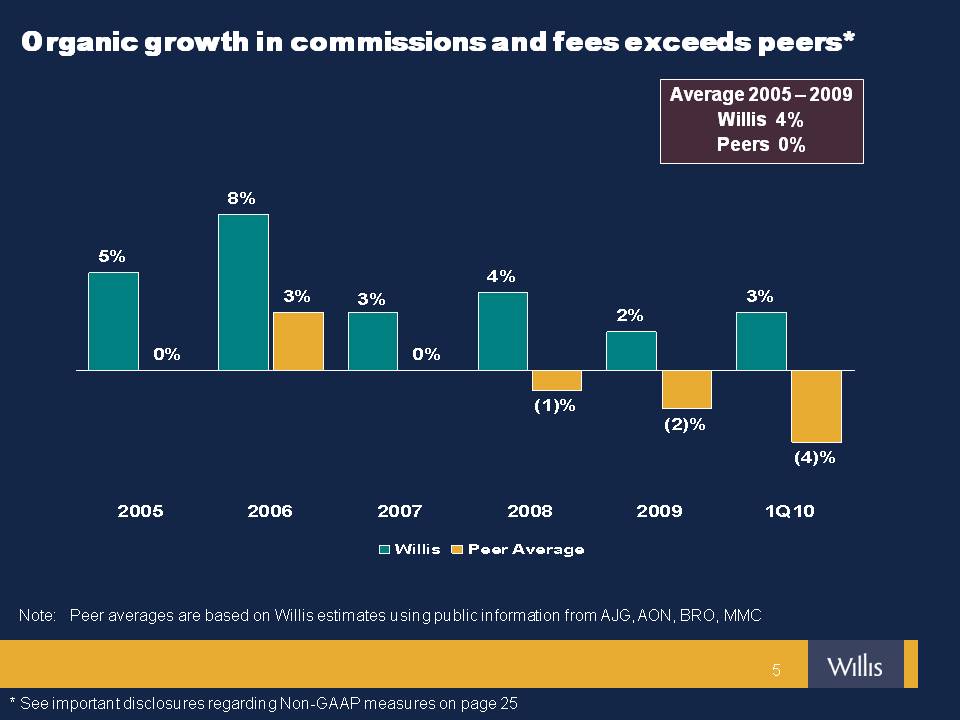

Organic growth in commissions and fees exceeds peers* Average 2005 – 2009 Willis 4% Peers 0% Note: Peer averages are based on Willis estimates using public information from AJG, AON, BRO, MMC * See important disclosures regarding Non-GAAP measures on page 25 5% 8% 3% 3% 4% 2% 3% 0% 0% (1)% (2)% (4)% 2005 2006 2007 2008 2009 1Q10 Willis Peer Average

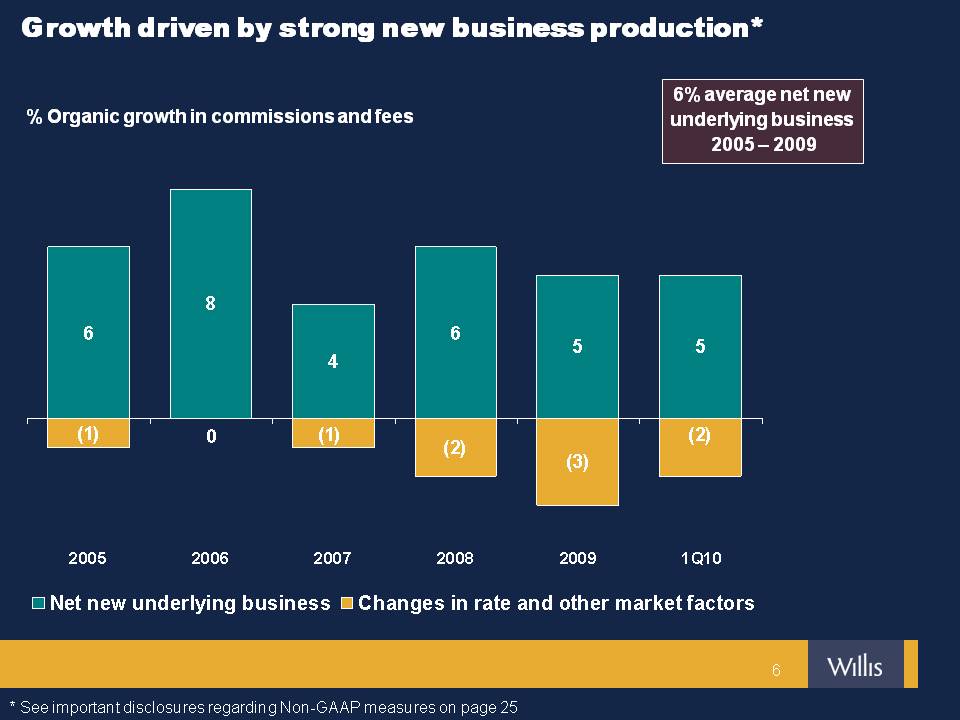

Growth driven by strong new business production* % Organic growth in commissions and fees * See important disclosures regarding Non-GAAP measures on page 25 6% average net new underlying business 2005 – 2009 Net new underlying business Changes in rate and other market factors 2005 6 (1) 2006 8 0 2007 4 (1) 2008 6 (2) 2009 5 (3) 1Q10 5 (2)

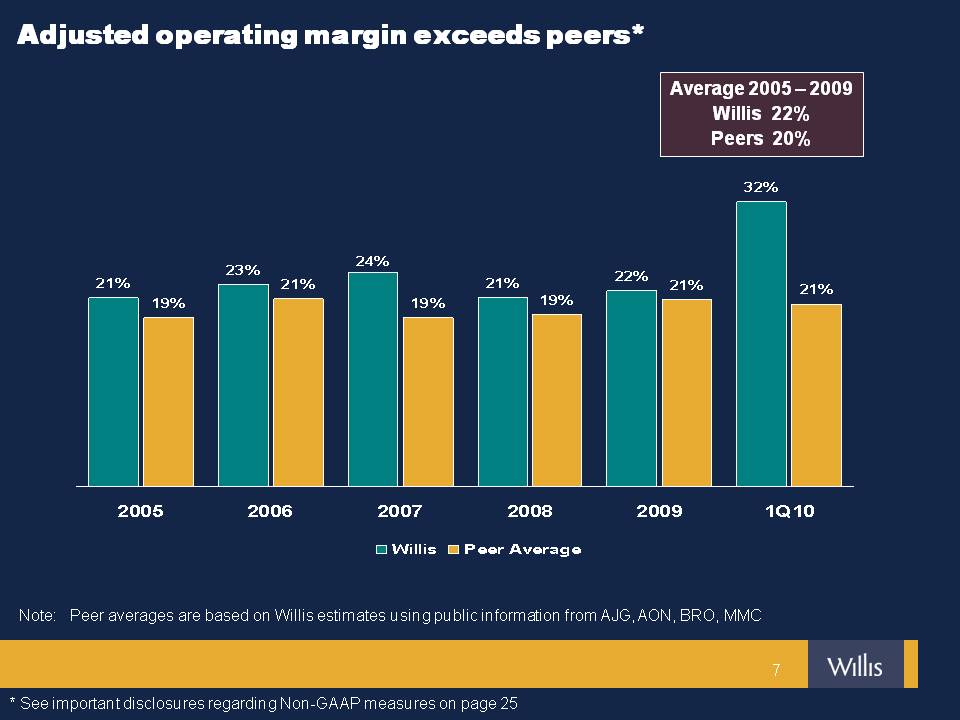

Adjusted operating margin exceeds peers* Average 2005 – 2009 Willis 22% Peers 20% * See important disclosures regarding Non-GAAP measures on page 25 Note: Peer averages are based on Willis estimates using public information from AJG, AON, BRO, MMC 2005 2006 2007 2008 2009 1Q10 Willis 21% 23% 24% 21% 22% 32% Peer Average 19% 21% 19% 19% 21% 21%

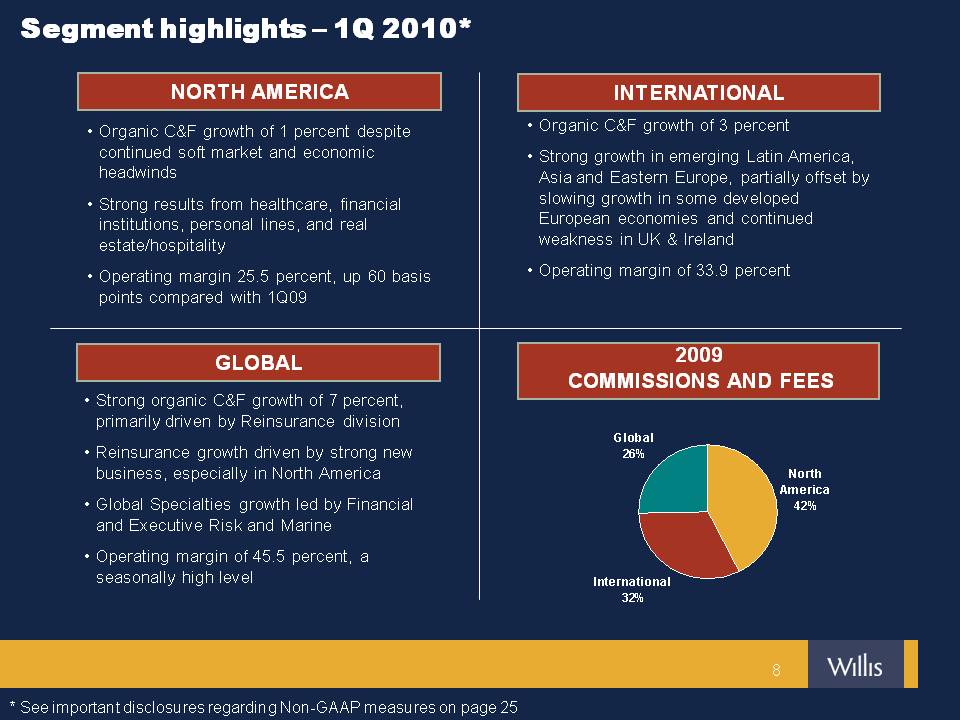

Segment highlights – 1Q 2010* NORTH AMERICA INTERNATIONAL Organic C&F growth of 1 percent despite continued soft market and economic headwinds Strong results from healthcare, financial institutions, personal lines, and real estate/hospitality Operating margin 25.5 percent, up 60 basis points compared with 1Q09 Organic C&F growth of 3 percent Strong growth in emerging Latin America, Asia and Eastern Europe, partially offset by slowing growth in some developed European economies and continued weakness in UK & Ireland Operating margin of 33.9 percent GLOBAL Strong organic C&F growth of 7 percent, primarily driven by Reinsurance division Reinsurance growth driven by strong new business, especially in North America Global Specialties growth led by Financial and Executive Risk and Marine Operating margin of 45.5 percent, a seasonally high level 2009 COMMISSIONS AND FEES * See important disclosures regarding Non-GAAP measures on page 25 Global 25% North America 43% International 32%

Willis North America overview Extensive retail platform with leading positions in major markets Distribution network for all core businesses Client centric approach Able to leverage industry and specialty practice group expertise across network Major practice groups include: Employee Benefits (approximately 20 percent of 2009 North America C&F) Construction (approximately 10 percent of 2009 North America C&F) Financial and Executive Risk CAPPPS (Captives/Programs) Segment overview 2009 commissions and fees 2009 = $1,368 million CAPPPS+ 10% Other Regions 4% Northeast 19% Western 12% South Central 11% Midwest 18% Southeast 12% Atlantic 14%

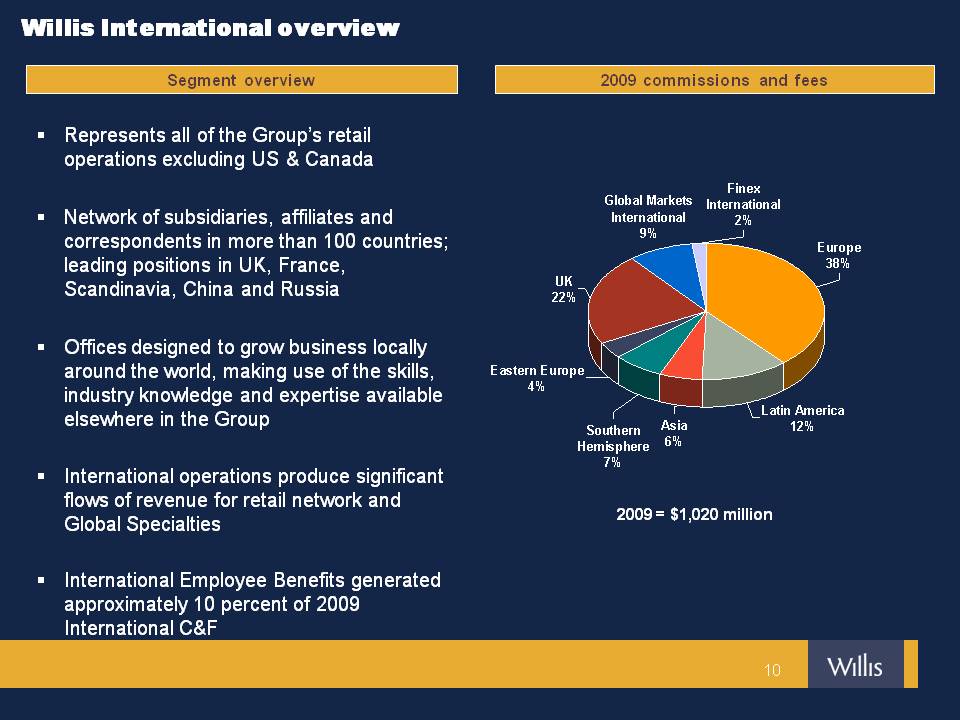

Represents all of the Group’s retail operations excluding US & Canada Network of subsidiaries, affiliates and correspondents in more than 100 countries; leading positions in UK, France, Scandinavia, China and Russia Offices designed to grow business locally around the world, making use of the skills, industry knowledge and expertise available elsewhere in the Group International operations produce significant flows of revenue for retail network and Global Specialties International Employee Benefits generated approximately 10 percent of 2009 International C&F Segment overview 2009 commissions and fees 2009 = $1,020 million Title: Willis International overview Global Markets International 9% Finex International 2% Europe 38% UK 22% Eastern Europe 4% Southern Hemisphere 7% Asia 6% Latin America 12%

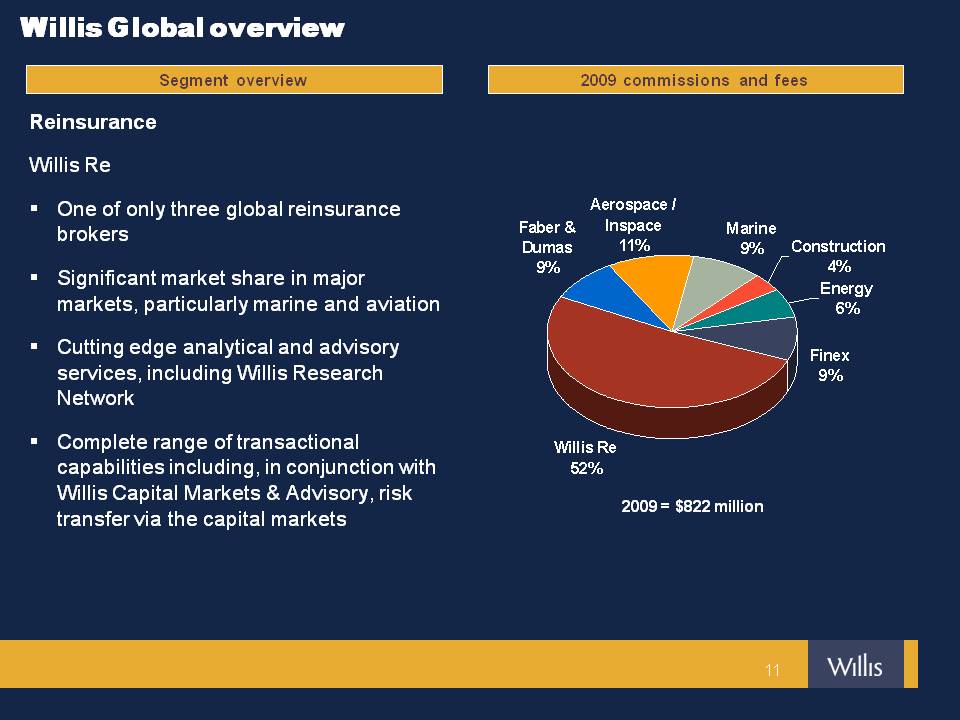

Reinsurance Willis Re One of only three global reinsurance brokers Significant market share in major markets, particularly marine and aviation Cutting edge analytical and advisory services, including Willis Research Network Complete range of transactional capabilities including, in conjunction with Willis Capital Markets & Advisory, risk transfer via the capital markets Segment overview 2009 commissions and fees 2009 = $822 million Willis Global overview Aerospace / Inspace 11% Marine 9% Construction 4% Energy 6% Finex 9% Faber & Dumas 9% Willis Re 52%

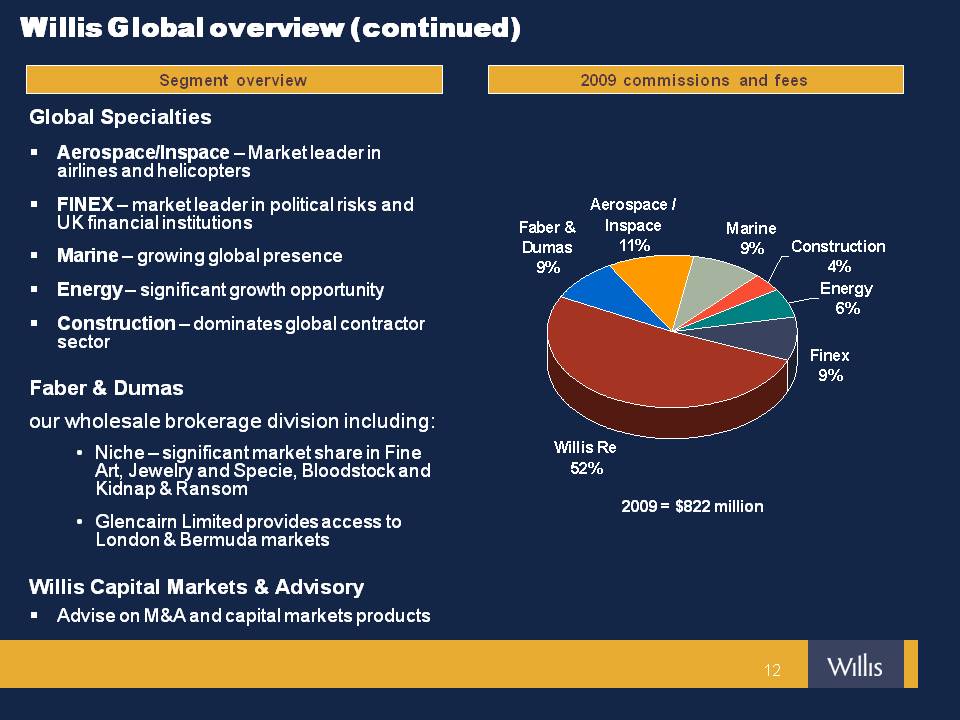

Global Specialties Aerospace/Inspace – Market leader in airlines and helicopters FINEX – market leader in political risks and UK financial institutions Marine – growing global presence Energy – significant growth opportunity Construction – dominates global contractor sector Faber & Dumas our wholesale brokerage division including: Niche – significant market share in Fine Art, Jewelry and Specie, Bloodstock and Kidnap & Ransom Glencairn Limited provides access to London & Bermuda markets Willis Capital Markets & Advisory Advise on M&A and capital markets products Segment overview 2009 commissions and fees 2009 = $822 million Willis Global overview (continued) Aerospace / Inspace 11% Marine 9% Construction 4% Energy 6% Finex 9% Faber & Dumas 9% Willis Re 52%

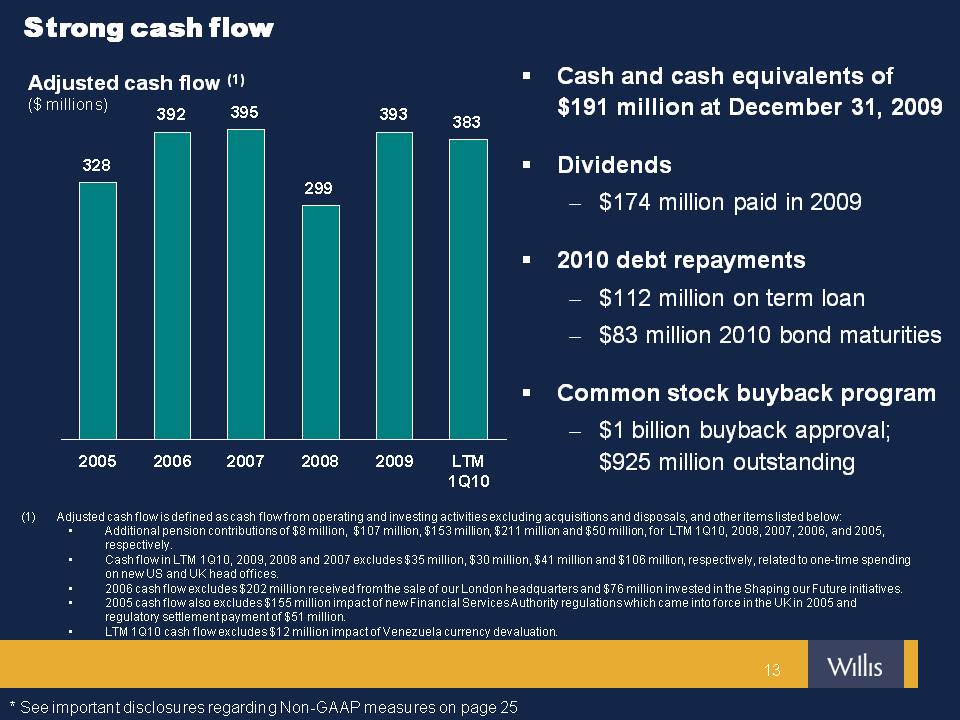

Adjusted cash flow is defined as cash flow from operating and investing activities excluding acquisitions and disposals, and other items listed below: Additional pension contributions of $8 million, $107 million, $153 million, $211 million and $50 million, for LTM 1Q10, 2008, 2007, 2006, and 2005, respectively.Cash flow in LTM 1Q10, 2009, 2008 and 2007 excludes $35 million, $30 million, $41 million and $106 million, respectively, related to one-time spending on new US and UK head offices.2006 cash flow excludes $202 million received from the sale of our London headquarters and $76 million invested in the Shaping our Future initiatives. 2005 cash flow also excludes $155 million impact of new Financial Services Authority regulations which came into force in the UK in 2005 and regulatory settlement payment of $51 million. LTM 1Q10 cash flow excludes $12 million impact of Venezuela currency devaluation. Cash and cash equivalents of $191 million at December 31, 2009 Dividends $174 million paid in 2009 2010 debt repayments $112 million on term loan $83 million 2010 bond maturities Common stock buyback program $1 billion buyback approval; $925 million outstanding Adjusted cash flow (1) ($ millions) Strong cash flow * See important disclosures regarding Non-GAAP measures on page 25 2005 2006 2007 2008 2009 LTM 1Q10 Cash flow 328 392 395 299 393 383

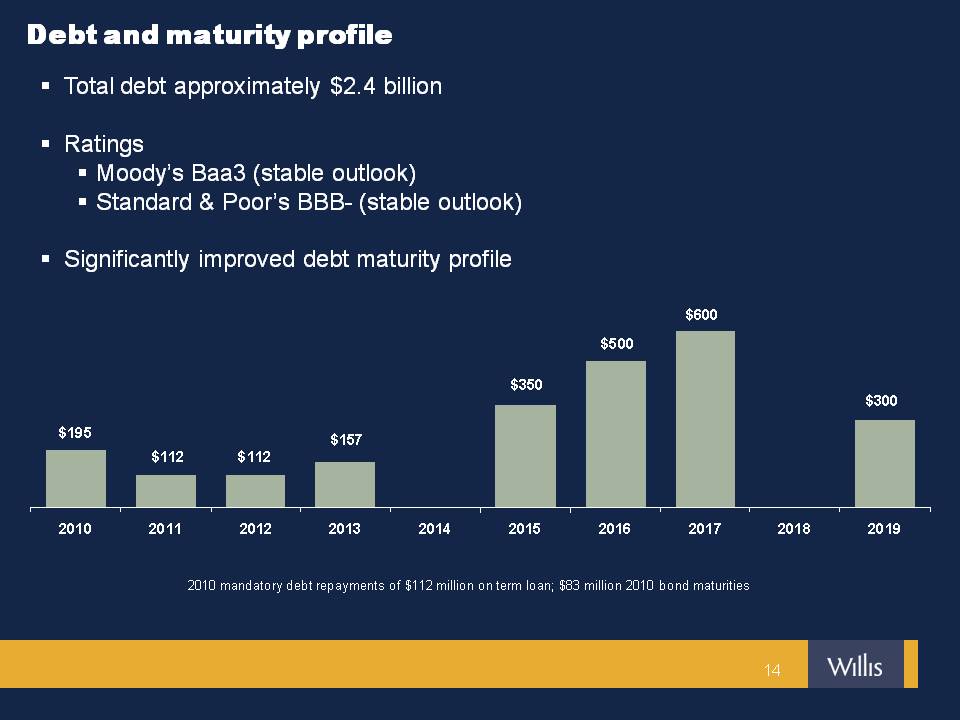

Debt and maturity profile Total debt approximately $2.4 billion Ratings Moody’s Baa3 (stable outlook) Standard & Poor’s BBB- (stable outlook) Significantly improved debt maturity profile 2010 mandatory debt repayments of $112 million on term loan; $83 million 2010 bond maturities 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Term loan 195 112 112 157 350 500 600 300 Bonds

2010 Focus

The Willis Cause Continue to drive industry leading revenue growth Continue to execute Shaping our Future Funding for Growth - incremental savings to fund growth initiatives Main priorities * See important disclosures regarding forward-looking statements on page 24

We thoroughly understand our clients’ needs and their industries We develop client solutions with the best markets, price and terms We relentlessly deliver quality client service We get claims paid quickly The Willis Cause WITH INTEGRITY * See important disclosures regarding forward-looking statements on page 24

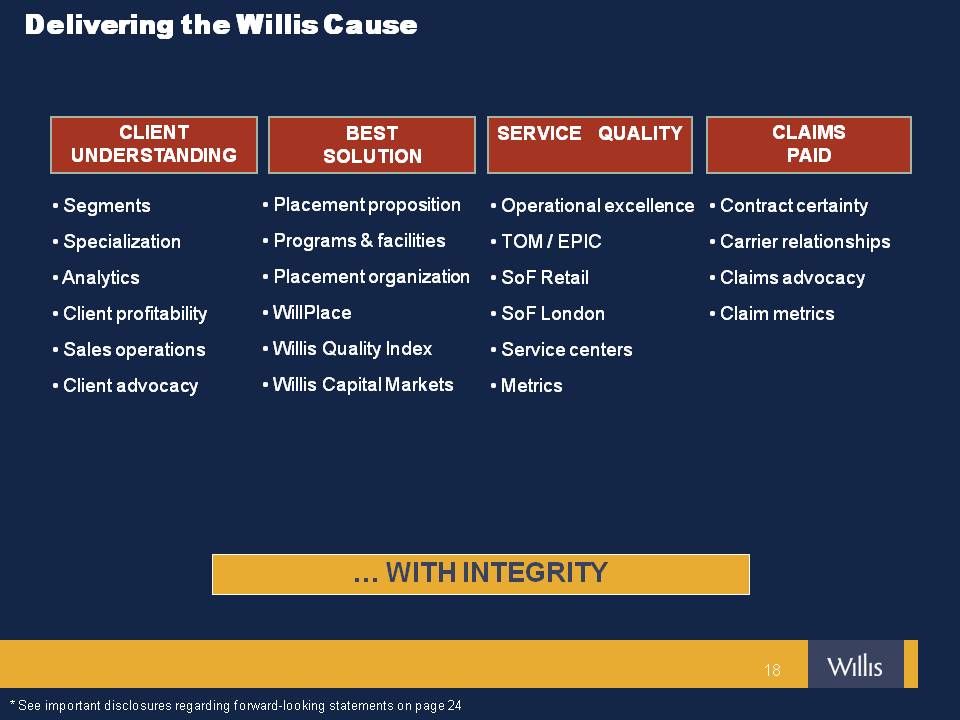

Delivering the Willis Cause CLIENT UNDERSTANDING SERVICE QUALITY CLAIMS PAID Segments Specialization Analytics Client profitability Sales operations Client advocacy Placement proposition Programs & facilities Placement organization WillPlace Willis Quality Index Willis Capital Markets Operational excellence TOM / EPIC SoF Retail SoF London Service centers Metrics Contract certainty Carrier relationships Claims advocacy Claim metrics … WITH INTEGRITY BEST SOLUTION * See important disclosures regarding forward-looking statements on page 24

Further develop aggressive sales culture Further enhance Client Advocacy Continue to make strategic hires Reinsurance International Specialty lines (Energy, Marine, Aerospace) Build on already strong client retention Monitor specific growth metrics for all regions, countries and lines Improve tracking of the sales pipeline Driving growth Despite industry leading growth, we believe there is an opportunity to further drive top line growth * See important disclosures regarding forward-looking statements on page 24

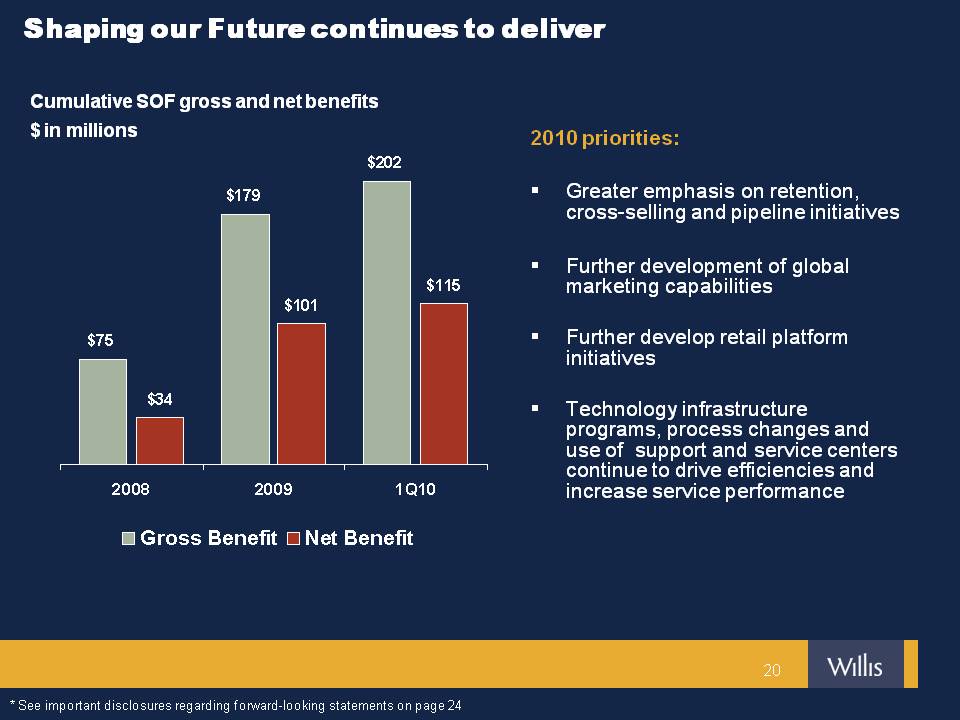

Shaping our Future continues to deliver 2010 priorities: Greater emphasis on retention, cross-selling and pipeline initiatives Further development of global marketing capabilities Further develop retail platform initiatives Technology infrastructure programs, process changes and use of support and service centers continue to drive efficiencies and increase service performance Cumulative SOF gross and net benefits $ in millions * See important disclosures regarding forward-looking statements on page 24 2008 2009 1Q10 Gross Benefit 75 179 202 Costs 41 Net Benefit 34 101 115

Funding for Growth 2010 Generate incremental savings in 2010 to invest in new producers and growth initiatives Drive incremental growth and create a real sales culture through best practice in growth drivers Out-recruiting competitors with producer pipelines Developing new products or packages Developing new clients with existing products Systematic and scientific cross-sell campaigns Drive new business growth and higher retention levels Closely manage savings and only invest when savings achieved STRATEGY EXECUTION RESULTS * See important disclosures regarding forward-looking statements on page 24

Wrap up – 1Q10 Willis 1Q10 performance* Industry leading 3 percent organic C&F growth; positive organic growth in all segments 200+ basis points increase in adjusted operating margin driven by revenue growth and continued cost discipline Delivered Shaping our Future net benefits of approximately $14 million Adjusted earnings per share from continuing operations of $1.27 (includes $0.06 of favorable FX) Willis 2010 The Willis Cause Solid underlying business fundamentals in place Economic environment continues to present challenges Continue to drive industry leading revenue growth Focus on Funding for Growth – incremental savings to be invested in growth initiatives * See important disclosures regarding forward-looking statements and important disclosures regarding Non-GAAP measures on page 24

Appendix

Important disclosures regarding forward-looking statements This presentation contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the safe harbors created by those laws. These forward-looking statements include information about possible or assumed future results of our operations. All statements, other than statements of historical facts, included in this document that address activities, events or developments that we expect or anticipate may occur in the future, including such things as our outlook, future capital expenditures, growth in commissions and fees, business strategies, competitive strengths, goals, the benefits of new initiatives, growth of our business and operations, plans, and references to future successes are forward-looking statements. Also, when we use the words such as ‘anticipate’, ‘believe’, ‘estimate’, ‘expect’, ‘intend’, ‘plan’, ‘probably’, or similar expressions, we are making forward-looking statements. There are important uncertainties, events and factors that could cause our actual results or performance to differ materially from those in the forward-looking statements contained in this document, including the following: the impact of any regional, national or global political, economic, business, competitive, market and regulatory conditions on our global business operations; the impact of current financial market conditions on our results of operations and financial condition, including as a result of any insolvencies or other difficulties experienced by our clients, insurance companies or financial institutions; our ability to continue to manage our significant indebtedness; our ability to compete effectively in our industry; our ability to implement or realize anticipated benefits of the Shaping Our Future, Right Sizing Willis, Funding for Growth initiatives or any other new initiatives; material changes in commercial property and casualty markets generally or the availability of insurance products or changes in premiums resulting from a catastrophic event, such as a hurricane, or otherwise; the volatility or declines in other insurance markets and the premiums on which our commissions are based, but which we do not control; our ability to retain key employees and clients and attract new business; the timing or ability to carry out share repurchases or take other steps to manage our capital and the limitations in our long-term debt agreements that may restrict our ability to take these actions; any fluctuations in exchange and interest rates that could affect expenses and revenue; rating agency actions that could inhibit ability to borrow funds or the pricing thereof; a significant decline in the value of investments that fund our pension plans or changes in our pension plan funding obligations; our ability to achieve the expected strategic benefits of transactions; changes in the tax or accounting treatment of our operations; any potential impact from the new US healthcare reform legislation; the potential costs and difficulties in complying with a wide variety of foreign laws and regulations and any related changes, given the global scope of our operations; our involvements in and the results of any regulatory investigations, legal proceedings and other contingencies; underwriting and advisory risks we assume in connection with our non-core capital markets and advisory operations; our exposure to potential liabilities arising from errors and omissions and other potential claims against us; and the interruption or loss of our information processing systems or failure to maintain secure information systems. The foregoing list of factors is not exhaustive and new factors may emerge from time to time that could also affect actual performance and results. For additional information see also Part I, Item 1A “Risk Factors” included in Willis’ Form 10-K for the year ended December 31, 2009, and our subsequent filings with the Securities and Exchange Commission. Copies are available online at http://www.sec.gov or on request from the Company. Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of these assumptions, and therefore also the forward-looking statements based on these assumptions, could themselves prove to be inaccurate. In light of the significant uncertainties inherent in the forward-looking statements included in this presentation, our inclusion of this information is not a representation or guarantee by us that our objectives and plans will be achieved. Our forward-looking statements speak only as of the date made and we will not update these forward-looking statements unless the securities laws require us to do so. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this presentation may not occur, and we caution you against unduly relying on these forward-looking statements.

This presentation contains references to "non-GAAP financial measures" as defined in Regulation G of SEC rules. We present these measures because we believe they are of interest to the investment community and they provide additional meaningful methods of evaluating certain aspects of the Company’s operating performance from period to period on a basis that may not be otherwise apparent on a generally accepted accounting principles (GAAP) basis. These financial measures should be viewed in addition to, not in lieu of, the Company’s condensed consolidated income statements and balance sheet as of the relevant date. Consistent with Regulation G, a description of such information is provided below and a reconciliation of certain of such items to GAAP information can be found in our periodic filings with the SEC. Our method of calculating these non-GAAP financial measures may differ from other companies and therefore comparability may be limited. Important disclosures regarding Non-GAAP measures Adjusted earnings per share from continuing operations (Adjusted EPS from continuing operations) is defined as adjusted net income from continuing operations per diluted share. Adjusted net income from continuing operations is defined as net income from continuing operations, excluding certain items as set out on page 27.Adjusted operating income is defined as operating income, excluding certain items as set out on page 26. Adjusted operating margin is defined as the percentage of adjusted operating income to total revenues.Adjusted cash flow is defined as cash flow from operating and investing activities excluding acquisitions and disposals and certain items as set out on page 13. Organic commissions & fees growth excludes: (i) the impact of foreign currency translation; (ii) the first twelve months of net commission and fee revenues generated from acquisitions; (iii) the net commission and fee revenues related to operations disposed of in each period presented; (iv) in North America, legacy contingent commissions assumed as part of the HRH acquisition and that had not been converted into higher standard commission; and (v) investment income and other income from reported revenues, as set out on pages 28 and 29. Reconciliations to GAAP measures are provided for selected non-GAAP measures.

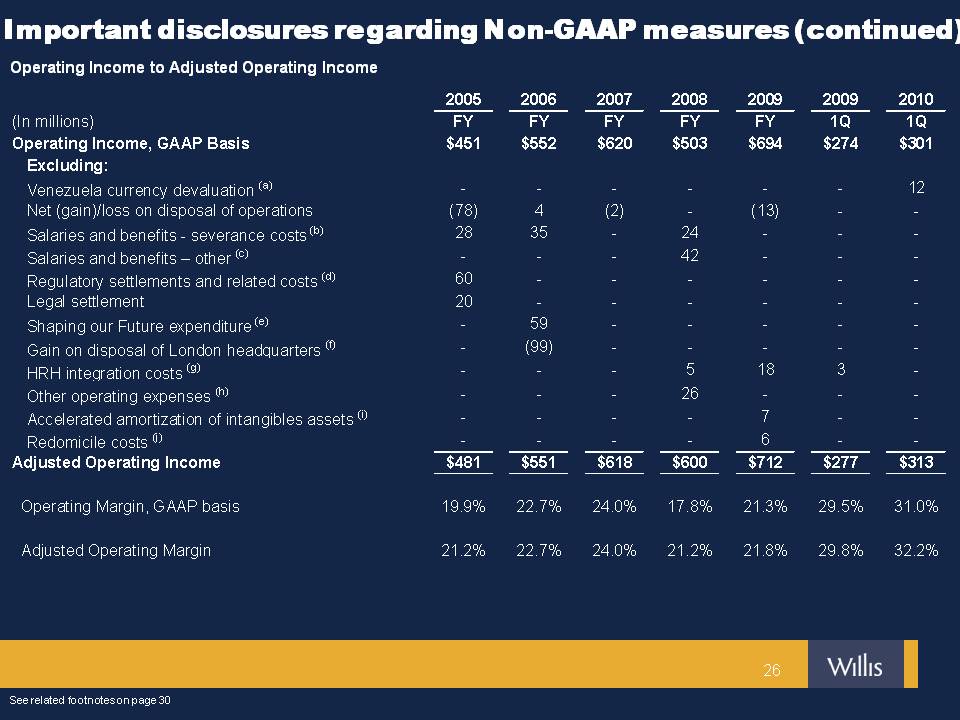

Important disclosures regarding Non-GAAP measures (continued) See related footnotes on page 30 Operating Income to Adjusted Operating Income

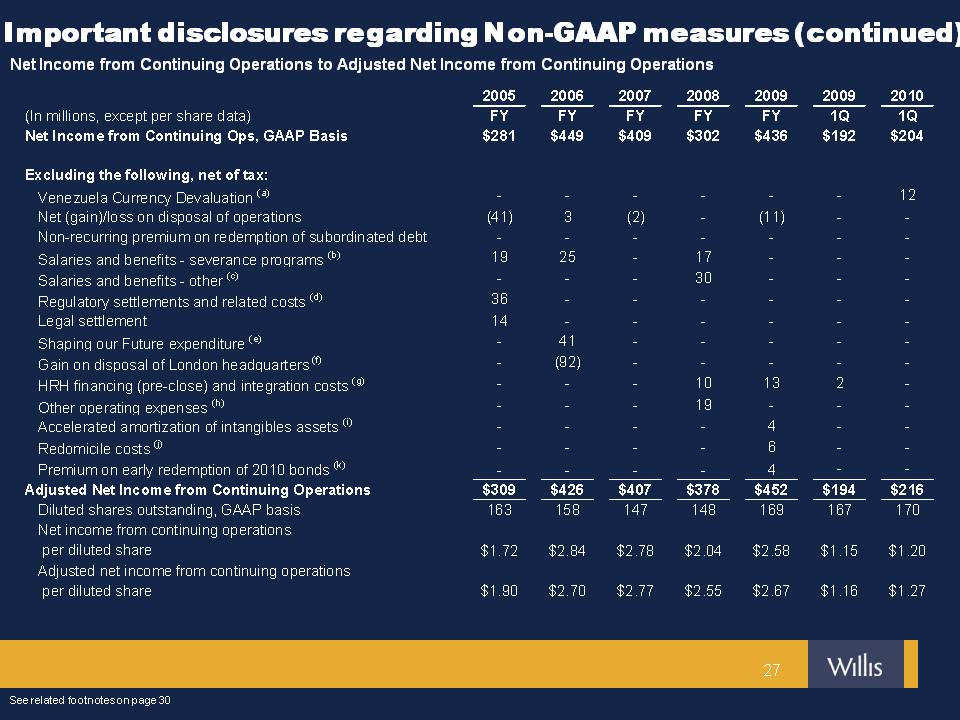

Important disclosures regarding Non-GAAP measures (continued) See related footnotes on page 30 Net Income from Continuing Operations to Adjusted Net Income from Continuing Operations

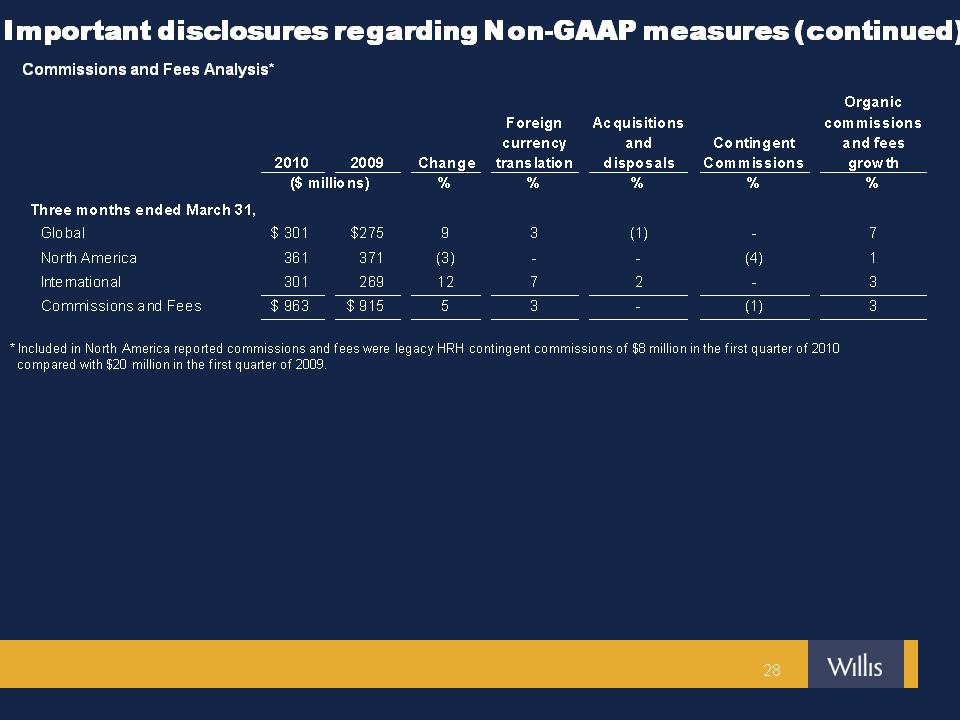

Commissions and Fees Analysis* Important disclosures regarding Non-GAAP measures (continued) * Included in North America reported commissions and fees were legacy HRH contingent commissions of $8 million in the first quarter of 2010 compared with $20 million in the first quarter of 2009.

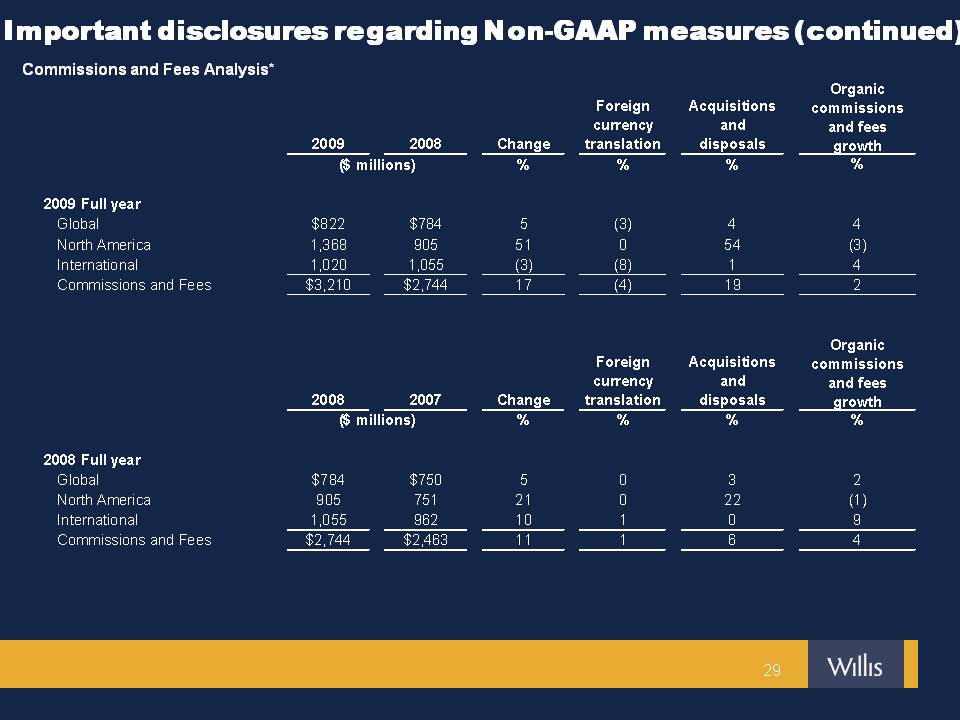

Commissions and Fees Analysis* Important disclosures regarding Non-GAAP measures (continued)

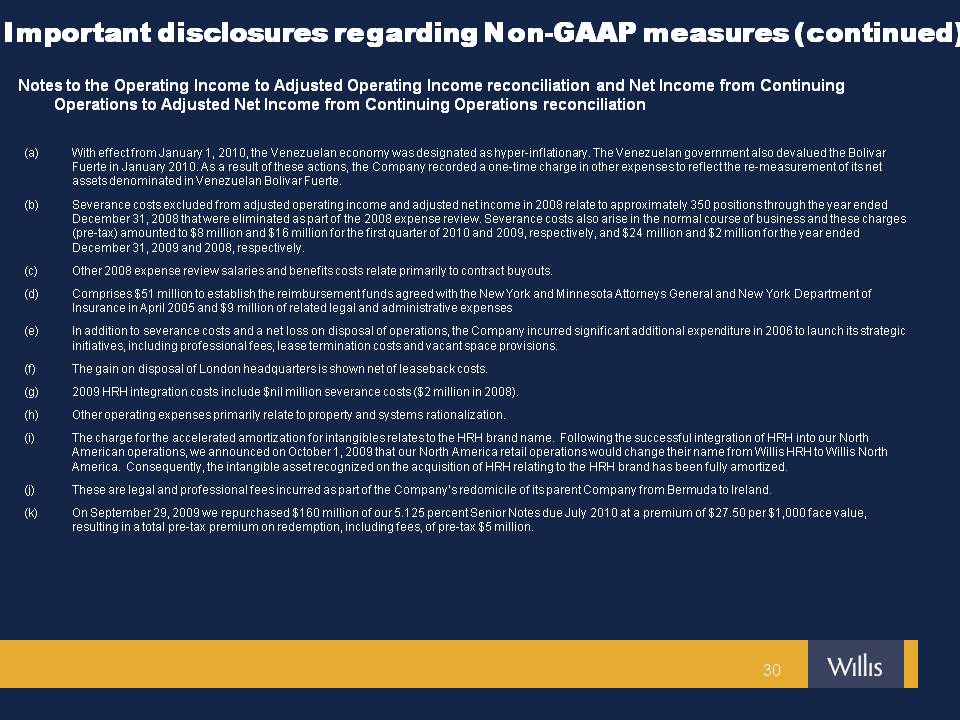

Important disclosures regarding Non-GAAP measures (continued) Notes to the Operating Income to Adjusted Operating Income reconciliation and Net Income from Continuing Operations to Adjusted Net Income from Continuing Operations reconciliation With effect from January 1, 2010, the Venezuelan economy was designated as hyper-inflationary. The Venezuelan government also devalued the Bolivar Fuerte in January 2010. As a result of these actions, the Company recorded a one-time charge in other expenses to reflect the re-measurement of its net assets denominated in Venezuelan Bolivar Fuerte. Severance costs excluded from adjusted operating income and adjusted net income in 2008 relate to approximately 350 positions through the year ended December 31, 2008 that were eliminated as part of the 2008 expense review. Severance costs also arise in the normal course of business and these charges (pre-tax) amounted to $8 million and $16 million for the first quarter of 2010 and 2009, respectively, and $24 million and $2 million for the year ended December 31, 2009 and 2008, respectively. Other 2008 expense review salaries and benefits costs relate primarily to contract buyouts. Comprises $51 million to establish the reimbursement funds agreed with the New York and Minnesota Attorneys General and New York Department of Insurance in April 2005 and $9 million of related legal and administrative expenses In addition to severance costs and a net loss on disposal of operations, the Company incurred significant additional expenditure in 2006 to launch its strategic initiatives, including professional fees, lease termination costs and vacant space provisions. The gain on disposal of London headquarters is shown net of lease back costs. 2009 HRH integration costs include $nil million severance costs ($2 million in 2008). Other operating expenses primarily relate to property and systems rationalization. The charge for the accelerated amortization for intangibles relates to the HRH brand name. Following the successful integration of HRH into our North American operations, we announced on October 1, 2009 that our North America retail operations would change their name from Willis HRH to Willis North America. Consequently, the intangible asset recognized on the acquisition of HRH relating to the HRH brand has been fully amortized. These are legal and professional fees incurred as part of the Company’s redomicile of its parent Company from Bermuda to Ireland. On September 29, 2009 we repurchased $160 million of our 5.125 percent Senior Notes due July 2010 at a premium of $27.50 per $1,000 face value, resulting in a total pre-tax premium on redemption, including fees, of pre-tax $5 million.

WILLIS GROUP HOLDINGS FACT BOOK FOR THE QUARTER ENDED MARCH 31, 2010