Attached files

EXHIBIT

10.16

INDUSTRIAL

SPACE LEASE

(GROSS)

THIS LEASE, dated January 1,

2010, for reference purposes only, is made by and between ROBERT D. DUCOTE and GAIL H. DUCOTE (“Landlord”),

and MERIX CORPORATION

(“Tenant”), to be effective and binding upon the parties as of the date of the

last designated signatories to this Lease shall have executed this Lease (the

“Effective Date of this Lease”).

ARTICLE

1

REFERENCES

|

1.1

|

REFERENCES:

All references in this Lease (subject to any further clarification

contained in this Lease) to the following terms shall have the following

meaning or refer to the respective address, person, date, time period,

amount, percentage, calendar year or fiscal year as below set

forth:

|

| A. |

Tenant’s

Address for Notice:

|

355

Turtle Creek Court

San

Jose, CA. 95125

|

|||||

| B. |

Tenant’s

Representative:

Phone

number:

|

John

R. Johnston

503-992-4280,

503-805-7972FAX

|

|||||

| C. |

Landlord’s

Address for Notice:

|

18781

Westview Drive

Saratoga,

CA. 95070

|

|||||

| D. |

Landlord’s

Representative:

Phone

Number:

|

Robert

Ducote

873-2300,

257-7144FAX

|

|||||

| E. |

Intended

Commencement Date:

|

January

1, 2010

|

|||||

| F. |

Intended

Term:

|

30

Months

|

|||||

| G. |

Lease

Expiration Date:

|

June

30, 2012

|

|||||

| H. |

Tenant’s

Punch List Period:

|

Fifteen

(15) days

|

|||||

| I. |

First

Month’s Prepaid Rent:

|

$ | 13,500.00 | ||||

| J. |

Last

Month’s Prepaid Rent:

|

$ | 807.61 | ||||

| K. |

Tenant’s

Security Deposit:

|

Not

applicable

|

|||||

| L. |

Late

Charge Amount:

|

$ | 100.00 | ||||

| M. |

Real

Property Tax Base Year:

|

2010-2011 | |||||

| N. |

Insurance

Base Year:

|

2010-2011 | |||||

| O. |

Tenant’s

Required Liability Coverage:

|

$ | 500,000.00 | ||||

| P. |

Tenant’s

Number of Parking Spaces:

|

Entire

lot for 355 Turtle Creek Court

|

|||||

Initial

_____ _____ _____

|

Q.

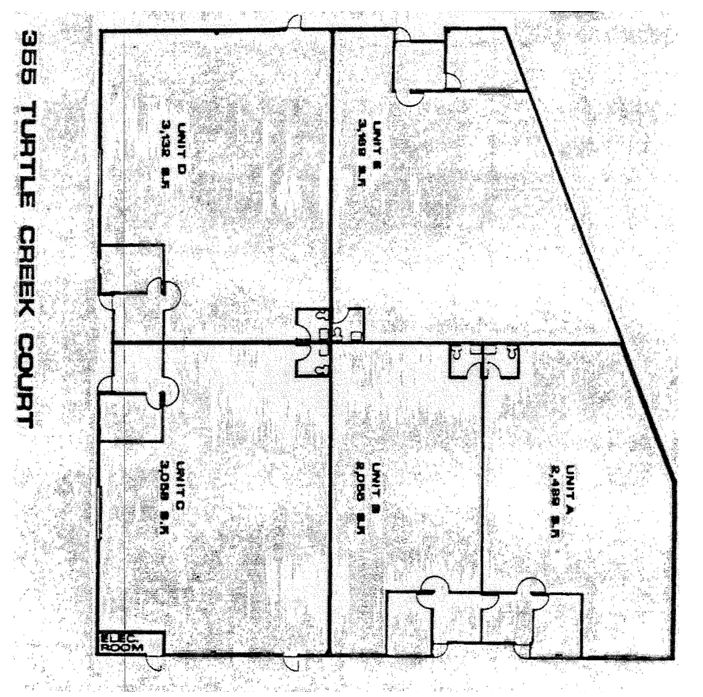

|

Project

and Building: That certain real property situated in the City of San Jose,

County of Santa Clara, State of California, as presently improved with one

(1) building, which real property is shown on the Site Plan attached

hereto as Exhibit “A” and is commonly known as or otherwise described as

follows:

|

“A one

story concrete tilt-up building consisting of approximately 13,990 square feet

located at 355 Turtle Creek Court, San Jose, CA 95125”

|

R.

|

Leased

Premises: That certain interior space within the Building, which space is

shown outlined in red on the Floor Plan attached hereto as Exhibit “B”

consisting of approximately 13,990 square feet and, for purposes of this

Lease, agreed to contain said number of square feet. The Leased Premises

are commonly known as or otherwise described as

follows:

|

“Approximately

13,990 square feet of office and warehouse space consisting of that one story

concrete tilt-up building located at 355 Turtle Creek Court, San Jose, CA 95125,

in its entirety”

|

S.

|

Base

Monthly Rent: The term “Base Monthly Rent” shall mean the following:

Without prior demand, Tenant shall pay monthly rent on or before the tenth

day of each month as follows:

|

MONTHS

1-30: THIRTEEN THOUSAND FIVE HUNDRED and NO/100 DOLLARS

($13,500.00)

|

T.

|

Permitted

Use: The term “Permitted Use” shall mean the following: Office use and

machining and fabrication of electronic components. Such use shall not

include the manufacture, use, or storage of industrial solvents, excepting

ordinary janitorial cleaning solutions and then only in quantities

necessary for routine janitorial cleaning of the demised premises.

Notwithstanding the foregoing sentence, such solvents may be used or

stored on the premises if and only if Tenant obtains written authorization

executed by Landlord specifying the solvent or solvents permitted to be

used or stored and the permissible quantities of each

solvent.

|

|

U.

|

Exhibits:

The term “Exhibits” shall mean the Exhibits to this Lease, which is

described as follows:

|

Exhibit

“A” - Site Plan showing the Project and delineating the building in which the

Leased Premises are located.

|

V.

|

Addenda:

The term “Addenda” shall mean the Addendum or (Addenda) to this

Lease.

|

|

|

Initial

_____ _____ _____

|

|

|

ARTICLE

2

|

|

|

LEASED

PREMISES TERM AND POSSESSION

|

|

2.1

|

DEMISE

OF LEASED PREMISES: Landlord hereby leases to Tenant and tenant hereby

leases from Landlord for Tenant’s own use in the conduct of Tenant’s

business and not for purposes of speculating in real estate, for the Lease

Term and upon the terms and subject to the conditions of this Lease, that

certain interior space described in Article 1 as the Leased Premises,

reserving and excepting to Landlord the exclusive right to all profits to

be derived from any assignments or sub-lettings by Tenant during the Lease

Term by reason of the appreciation in the fair market rental value of the

Leased Premises. Landlord further reserves the right to install,

maintains, use and replace ducts, wires, conduits and pipes leading

through the Leased Premises in locations which will not materially

interfere with Tenant’s use of the Lease Premises. Tenant’s Lease of the

Leased Premises, together with the appurtenant right to use the Common

Areas as described in Paragraph 2.2 below, shall be conditioned upon and

be subject to the continuing compliance by Tenant with (i) ail the terms

and conditions of this Lease, (ii) all Laws governing the use of the

Leased Premises and the Project, (iii) all Private Restrictions, easements

and other matters now of public record respecting the use of the Leased

Premises and the Project, and (iv) all reasonable rules and regulations

from time to time established by

Landlord.

|

|

2.2

|

RIGHT

TO USE COMMON AREAS: As an appurtenant right to Tenant’s right to the use

of the Leased Premises, Tenant shall have the non-exclusive right to use

the Common Areas in conjunction with other tenants of the Project and

their invitees, subject to the limitations on such use as set forth in

Article 4, and solely for the purposes for which they were designed and

intended. Tenant’s right to use the Common Areas shall terminate

concurrently with any termination of this

Lease.

|

|

2.3

|

LEASE

COMMENCEMENT DATE AND LEASE TERM: The term of this Lease shall begin, and

the Lease Commencement Date shall be deemed to have occurred, on the

Intended Commencement Date (as set forth in Article 1) unless either (i)

Landlord is unable to deliver possession of the Leased Premises to Tenant

on the Intended Commencement Date, in which case the Lease Commencement

Date shall be as determined pursuant to Paragraph 2.7 below (the “Lease

Commencement Date”). The term of this Lease shall end on the Lease

Expiration Date (as set forth in Article 1), irrespective of whatever date

the Lease Commencement Date is determined to be pursuant to the foregoing

sentence. The Lease Term shall be that period of time commencing on the

Lease Commencement Date and ending on the Lease Expiration Date (the

“Lease Term”).

|

|

2.4

|

DELIVERY

OF POSSESSION: Landlord shall deliver to Tenant possession of the Leased

Premises on or before the Intended Commencement Date (as set forth in

Article 1) in their presently existing condition, broom clean, unless

Landlord shall have agreed, as a condition to Tenant’s obligation, to

accept possession of the Leased Premises, pursuant to an Addenda attached

to and made a part of this Lease to modify existing interior improvements

or to make, construct and/or install additional specified improvements

within the Leased Premises, in which case Landlord shall deliver to Tenant

possession of the Leased Premises on or before the Intended Commencement

Date as so modified and/or improved. If Landlord is unable to so deliver

possession of the Leased Premises to Tenant on or before the Intended

Commencement Date, for whatever reason, Landlord shall not be in default

under this Lease, nor shall this Lease be void, voidable or cancelable by

Tenant until the lapse of one hundred twenty days after the Intended

Commencement Date (the “delivery grace period”); however, the Lease

Commencement Date shall not be deemed to have occurred until such date as

Landlord notifies Tenant that the Leased Premises are Ready for Occupancy.

Additionally, the delivery grace period above set forth shall be extended

for such number of days as Landlord may be delayed in delivering

possession of the Leased Premises to Tenant by reason of Force Majeure or

the actions of Tenant. If Landlord is unable to deliver possession of the

Leased Premises to Tenant within the described delivery grace period

(including any extensions thereof by reason of Force Majeure of the

actions of Tenant), then Tenant’s sole remedy shall be to cancel and

terminate this Lease, and in no event shall Landlord be liable to Tenant

for such delay. Tenant may not cancel this Lease at any time after the

date Landlord notifies Tenant the Lease Premises are Ready for

Occupancy.

|

|

|

Initial

_____ _____ _____

|

|

2.5

|

ACCEPTANCE

OF POSSESSION: Tenant acknowledges that it has inspected the Leased

Premises and is willing to accept them in their existing condition, broom

clean, unless Landlord shall have agreed, as a condition to Tenant’s

obligation to accept possession of the Leased Premises, pursuant to an

Addenda attached to and made a part of this Lease to modify existing

interior improvements or to make, construct and/or install additional

specified improvements within the Leased Premises, in which case Tenant

agrees to accept possession of the Lease Premises when Landlord has

substantially completed such modifications or improvements and the Lease

Premises are Ready for Occupancy. If Landlord shall have so modified

existing improvements or constructed additional improvements within the

Leased Premises for Tenant, Tenant shall, with Tenant’s punch list Period

(as set forth in Article 1) which shall commence on the date that Landlord

notifies Tenant that the Leased Premises are Ready for Occupancy, submit

to Landlord a punch list of all incomplete and/or improper worked

performed by Landlord. Upon the expiration of Tenant’s punch list Period,

Tenant shall be conclusively deemed to have accepted the Leased Premises

in their then-existing condition as so delivered by landlord to Tenant,

except as to those items reasonably set forth in Tenant’s punch list,

provided that such punch list was submitted to Landlord with Tenant’s

Punch list Period. Additionally, Landlord agrees to place in good working

order all existing plumbing, lighting, heating, ventilating and air

conditioning systems within the Leased Premises and all man doors and

roll-up truck doors serving the Leased Premises to the extent that such

systems and/or items are not in good operating condition as of the date

Tenant accepts possession of the Leased Premises; provided that, an only

if, Tenant notifies Landlord in writing of such failures or deficiencies

within five business days from the date Tenant so accepts possession of

the Lease Premises.

|

|

2.6

|

SURRENDER

OF POSSESSION: Immediately prior to the expiration or upon the sooner

termination of this Lease, tenant shall remove all of Tenant’s signs from

the exterior of the Building and shall remove all of Tenant’s equipment,

trade fixtures, furniture, supplies, wall decorations and other personal

property from the Leased Premises, and shall vacate and surrender the

Leased Premises to Landlord in the same condition, broom clean, as existed

at the Lease Commencement Date, reasonable wear and tear expected. Tenant

shall repair all damage to the Leased Premises caused by Tenant’s removal

of tenant’s property and all damage to the exterior of the Building caused

by Tenant’s removal of Tenant’s signs. Tenant shall patch and refinish, to

Landlord’s reasonable satisfaction, all penetrations made by Tenant or its

employees to the floor, walls or ceiling of the Lease Premises, whether

such penetrations were made with Landlord’s approval or not. Tenant shall

repair or replace all stained or damaged ceiling tiles, wall coverings and

floor coverings to the reasonable satisfaction of Landlord. Tenant shall

repair all damage caused by Tenant to the exterior surface of the Building

and the paved surfaces of the outside areas adjoining the Leased Premises

and, where necessary, replace or resurface same. Additionally, Tenant

shall, prior to the expiration or sooner termination of this Lease, remove

any improvements constructed or installed by Tenant which Landlord

requests be so removed by Tenant and repair all damage caused by such

removal. If the Leased Premises are not surrendered to Landlord in the

condition required by this Paragraph at the expiration or sooner

termination of this Lease, Landlord may, at Tenant’s expense, so remove

Tenant’s signs, property and/or improvements not so removed and make such

repairs and replacements not so made or hire, at Tenant’s expense,

independent contractors to perform such work. Tenant shall be liable to

Landlord for all costs incurred by Landlord in returning the Leased

Premises to the required condition, plus interest on all costs incurred

from the date paid by Landlord at the then maximum rate of interest not

prohibited by Law until paid, payable by Tenant to Landlord within tent

days after receipt of a statement therefore from Landlord. Tenant shall

indemnify Landlord against loss or liability resulting from delay by

Tenant in so surrendering the Leased Premises, including, without

limitation, any claims made by any succeeding tenant or any losses to

Landlord due to the lost opportunities to lease succeeding

tenants.

|

|

2.7

|

EARLY

OCCUPANCY: If Tenant enters into possession of the Lease Premises prior to

the Intended Commencement Date (or permits its contractors to enter the

Leased Premises prior to the Intended Commencement Date), unless otherwise

agreed in writing by Landlord, the Lease Commencement Date shall be deemed

to have occurred on such sooner date, and Tenant shall be obligated to

perform all its obligations under this Lease, including the obligation to

pay rent, from that sooner date.

|

|

|

Initial

_____ _____ _____

|

ARTICLE

3

RENT,

LATE CHARGES AND SECURITY DEPOSITS

|

3.1

|

BASE

MONTHLY RENT: Commencing on the Lease Commencement Date (as determined

pursuant to Paragraph 2.3 above) and continuing throughout the Lease Term,

Tenant shall pay to Landlord, without prior demand therefore, in advance

on the first day of each calendar month, as base monthly rent, the amount

set forth as “Base Monthly Rent” in Article 1 (the “Base Monthly

Rent”).

|

|

3.2

|

ADDITIONAL

RENT: Commencing on the Lease Commencement Date (as determined pursuant to

Paragraph 2.3 above) and continuing throughout the Lease Term, Tenant

shall pay to Landlord as additional rent (the “Additional Rent”) the

following amounts:

|

|

|

A.

|

Tenant’s

Proportionate Share of all increases in Landlord’s Insurance Costs and

Real Property Taxes over those paid during the period set forth in Article

1 as the “Insurance Base Year” and the “Real Property Tax Base Year”,

respectively, plus an accounting fee equal to five percent of such

increase. Payment shall be made by whichever of the following methods is

from time to time designated by

Landlord:

|

|

|

(1)

|

Landlord

may bill to Tenant, on a periodic basis not more frequent than monthly,

Tenant’s Proportionate Share of any increases in Landlord’s Insurance

Costs or Real Property Taxes, as paid or incurred by Landlord during the

current period over those paid or incurred in the same period during the

applicable Base Year, and Tenant shall pay such share of such increases,

together with an accounting fee equal to five percent of the amount

billed, within ten days after receipt of a written bill therefore from

Landlord; or

|

|

|

(2)

|

Landlord

may deliver to Tenant Landlord’s reasonable estimate of the increase in

Landlord’s Insurance Costs and/or Real Property Taxes it anticipates will

be paid or incurred for the ensuing calendar or fiscal year, as the case

requires, over those paid or incurred during the applicable Base Year, and

Tenant shall pay its Proportionate Share of the estimated increases for

such year, together with an accounting fee equal to five percent of the

amount billed, in equal monthly installments during such year with the

installments of Base Monthly Rent. Landlord reserves the right to change

from time to time the method of billing Tenant its Proportionate Share of

such increases or the periodic basis on which such increases are

billed.

|

|

|

B.

|

Landlord’s

share of the consideration received by Tenant upon certain assignments and

subletting as required by Article

7;

|

|

|

C.

|

Any

legal fees and costs that Tenant is obligated to pay or reimburse to

Landlord pursuant to Article 13;

and

|

|

|

D.

|

Any

other charges or reimbursements due Landlord from Tenant pursuant to the

terms of this Lease.

|

|

|

E.

|

For

the purposes of this Lease, the term “Additional Rent” shall not include

an accounting fee equal to five percent (5%) of the increase in the

Tenant’s Proportionate Share in any increases in Landlord’s Insurance

Costs or Real Property Taxes. No such charge shall be imposed on the

Tenant during the term of the

Lease.

|

|

|

Initial

_____ _____ _____

|

|

3.3.

|

YEAR-END

ADJUSTMENTS: If Landlord shall have elected to charge Tenant its

Proportionate Share of the increases in Landlord’s Insurance Costs and/or

Real Property Taxes on an estimated basis in accordance with the

provisions of Paragraph 3.2A(2) above, Landlord shall furnish to Tenant

within three months following the end of the applicable calendar or fiscal

year, as the case may be, a statement setting forth (i) the amount of

Landlord’s Insurance Costs and/or Real Property Taxes paid or incurred

during the just ended calendar or fiscal year, as appropriate, (ii) the

amount of Landlord’s Insurance Costs and/or Real Property Taxes paid or

incurred during the applicable Base Year, and (iii) Tenant’s Proportionate

Share of the increases, if any, in Landlord’s Insurance Costs and/or Real

Property Taxes for the just ended fiscal or calendar year, as appropriate.

If Tenant shall have paid more than its Proportionate Share of such

increases for the previous year, Landlord shall, at its election, either

(i) credit the amount of such overpayment toward the next ensuing payment

or payments of Additional Rent that would otherwise be due or (ii) refund

in cash to Tenant the amount of such overpayment. If such year-end

statement shall show that Tenant did not pay its Proportionate Share of

any such increases in full, then Tenant shall pay to Landlord the amount

of such underpayment, together with the accounting fee applicable thereto,

within ten days from Landlord’s billing of same to Tenant. The provisions

of this Paragraph shall survive the expiration or sooner termination of

this Lease.

|

|

3.4

|

LATE

CHARGE AND INTEREST ON RENT IN DEFAULT: Tenant acknowledges that the late

payment by Tenant of any monthly installment of Base Monthly Rent or any

Additional Rent will cause Landlord to incur certain costs and expenses

not contemplated under this Lease, the exact amounts of which are

extremely difficult or impractical to fix. Such costs and expenses will

include, without limitation, administration and collection costs and

processing and accounting expenses. Therefore, if any installment of Base

Monthly Rent is not received by Landlord from Tenant with six calendar

days after the same becomes due, Tenant shall immediately pay to Landlord

a late charge in an amount equal to the amount set forth in Article 1 as

the “Late Charge Amount”, and if any Additional Rent is not received by

Landlord within six calendar days after same becomes due, Tenant shall

immediately pay to Landlord a late charge in an amount equal to ten

percent of the Additional Rent not so paid. Landlord and Tenant agree that

this late charge represents a reasonable estimate of such costs and

expenses and is fair compensation to Landlord for its loss suffered by

reason of Tenant’s failure to make timely payment. In no event shall this

provision for a late charge be deemed to grant to Tenant a grace period or

extension of time within which to pay any rental installment or prevent

Landlord from exercising any right or remedy available to Landlord upon

Tenant’s failure to pay each rental installment due under this Lease when

due, including the right to terminate this Lease. If any rent remains

delinquent for a period in excess of six calendar days, then, in addition

to such late charge, Tenant shall pay to Landlord interest on any rent

that is not so paid from said sixth day at the then maximum interest rate

not prohibited by Law until paid.

|

|

3.5

|

PAYMENT

OF RENT: All rent shall be paid in lawful money of the United States,

without any abatement, deduction or offset for any reason whatsoever, to

Landlord at such address as Landlord may designate from time to time.

Tenant’s obligation to pay Base Monthly Rent and all Additional Rent shall

be prorated at the commencement and expiration of the Lease Term. The

failure of Tenant to pay any of the Additional Rent as required pursuant

to this Lease when due shall be treated the same as a failure by Tenant to

pay Base Monthly Rent when due, and Landlord shall have the same rights

and remedies against Tenant as Landlord would have if Tenant failed to pay

the Base Monthly Rent when due.

|

|

3.6

|

PREPAID

RENT: Tenant has paid to Landlord the amount set forth in Article 1 as

“First Month’s Prepaid Rent” as prepayment of rent for credit against the

first installment(s) of Base Monthly Rent due hereunder. Additionally,

Tenant has paid to Landlord the Monthly Rent due hereunder, subject,

however, to the provisions of Paragraph 3.7

below.

|

|

|

Initial

_____ _____ _____

|

|

3.7

|

SECURITY

DEPOSIT: Tenant has deposited with Landlord the amount set forth in

Article 1 as the “Security Deposit” as security for the performance by

Tenant of the terms of this Lease to be performed by Tenant, and not as

prepayment of rent. Landlord may apply such portion or portions of the

Security Deposit as are reasonably necessary for the following purposes:

(i) to remedy any default by Tenant in the payment of Base Monthly Rent or

Additional Rent or a late charge or interest on default rent; (ii) to

repair damage to the Lease Premises caused by Tenant; (iii) to clean and

repair the Lease Premises following their surrender to Landlord if not

surrendered in the condition required pursuant to the provisions of

Article 2; and (iv) to remedy any other default of Tenant to the extent

permitted by Law including, without limitation, paying in full on Tenant’s

behalf any sums claimed by material-men or contractors of Tenant to be

owing to them by Tenant for work done or improvements made at Tenant’s

request to the Lease Premises. In this regard, Tenant hereby waives any

restriction on the uses to which the Security Deposit may be applied as

contained in Section 1950.7(c) of the California Civil Code and/or any

successor statute. In the event the Security Deposit or any portion

thereof is so used, Tenant shall pay to Landlord, promptly upon demand, an

amount in cash sufficient to restore the Security Deposit to the full

original sum if Tenant fails to promptly restore the Security Deposit and

if Tenant shall have paid to promptly restore the Security Deposit and if

Tenant shall have paid to Landlord any sums as “Last Month’s Prepaid Rent”

Landlord may, in addition to any other remedy Landlord may have under this

Lease reduce the amount of Tenant’s Last Month’s Prepaid Rent by

transferring all or portions of such Last Month’s Prepaid Rent to Tenant’s

Security Deposit until such Security Deposit is restored to the amount set

forth in Article 1. Landlord shall not be deemed a trustee of the Security

Deposit. Landlord may use the Security Deposit in Landlord’s ordinary

business and shall not be required to segregate it from its general

accounts. Tenant shall not be entitled to any interest on the Security

Deposit. If Landlord transfers the Building during the Lease Term,

Landlord may pay the Security Deposit to any subsequent owner in

conformity with the provisions of Section 1905.7 of the California Civil

Code and/or any successor statute. In which event the transferring

landlord shall be released from all liability for the return of the

Security Deposit. Tenant specifically grants to Landlord (and hereby

waives the provisions of California Civil Code Section to the contrary) a

period of sixty days following a surrender of the Leased Premises by

Tenant to Landlord within which to restore the Security Deposit (less

permitted deductions) to Tenant, if being agreed between Landlord and

Tenant that sixty days is a reasonable period of time within which to

inspect the Lease Premises, make required repairs, receive and verify

workmen’s billings therefore, and prepare a final accounting with respect

to such deposit. In no event shall the Security Deposit, or any portion

thereof, be considered prepaid

rent.

|

For the

purposes of this Lease, paragraph 3.7 “Security Deposit” above, shall not be applicable

during this Lease Term.

ARTICLE

4

USE

OF LEASED PREMISES AND COMMON AREAS

|

4.1

|

PERMITTED

USE: Tenant shall be entitled to use the Leased Premises solely for the

“Permitted use” as set forth in Article 1 and for no other purpose

whatsoever. Tenant shall continuously and without interruption use the

Lease Premises for such purpose for the entire Lease Term. Any

discontinuance of such use for a period of thirty consecutive calendar

days shall be, at Landlord’s election, a default by Tenant under the terms

of this Lease. Subject to the limitations contained in this Article 4,

Tenant shall have the right to use the Common Areas, in conjunction with

other tenants and during normal business hours, solely for the purposes

for which they were intended and for no other purposes whatsoever. Tenant

shall not have the right to use the exterior surfaces of exterior walls,

the area beneath the floor or the area above the ceiling of the Leased

Premises.

|

|

|

Initial

_____ _____ _____

|

|

4.2

|

GENERAL

LIMITATIONS ON USE: Tenant shall not do or permit anything to be done in

or about the Leased Premises, the Building, the Common Areas or the

Project which does or could (i) interfere with the rights of other tenants

or occupants of the Building or the Project, (ii) jeopardize the

structural integrity of the Building or (iii) cause damage to any part of

the Building or the Project. Tenant shall not operate any equipment within

the Leased Premises which does or could (i) injure, vibrate or shake the

Leased Premises or the building, (ii) damage, overload or impair the

efficient operation of any electrical, plumbing, heating, ventilating or

air conditioning systems within or servicing the Lease Premises or the

Building or (iii) damage or impair the efficient operation of the

sprinkler system (if any) within or servicing the Leased Premises or the

Building. Tenant shall not install any equipment or antennas on or make

any penetrations of the exterior walls or roof of the Building. Tenant

shall not affix any equipment to or make any penetrations or cuts in the

floor, ceiling or walls of the Leased Premises. Tenant shall not place any

loads upon the floors, walls ceilings or roof systems, which could

endanger the structural integrity of the Building or damage its floors,

foundations or supporting structural components. Tenant shall not place

any explosive, flammable or harmful fluids or other waste materials in the

drainage systems of the Building or the Project. Tenant shall not drain or

discharge any fluids in the landscaped areas or across the paved areas o

the Project. Tenant shall not use any area located outside the Leased

Premises for the storage of its materials, supplies, inventory or

equipment, and all such materials, supplies, inventory and equipment shall

at all times be stored within the Leased Premises. Tenant shall not commit

nor permit to be committed any waste in or about the Leased Premises, the

Common Areas or the Project.

|

|

4.3

|

NOISE

AND EMISSIONS: All noise generated by Tenant in its use of the Leased

Premises shall be confined or muffled so that it does not interfered with

the businesses or annoy other tenants of the Building or the Project. All

dust, fumes odors and other emissions generated by Tenant’s use of the

Leased Premises shall be sufficiently dissipated in accordance with sound

environmental practices and exhausted from the Leased Premises in such a

manner so as not to interfere with the businesses of or annoy other

tenants of the Building or the Project, or cause any damage to the Leased

Premises or the Building or any component part thereof or the property of

other tenants of the Building of the

Project.

|

|

4.4

|

TRASH

DISPOSAL: Tenant shall provide trash and garbage disposal facilities

inside the Leased Premises for all of its trash, garbage and waste

requirements (other than general office waste which may be disposed of in

the trash bins provided by Landlord), and shall cause such trash, garbage

and waste to be regularly removed from the Leased Premises at Tenant’s

sole cost. Tenant shall keep all areas outside the Leased Premises and all

fire corridors and mechanical equipment rooms in or about the Leased

Premises free and clear of all trash, garbage, waste and boxes containing

same at all times.

|

|

|

Initial

_____ _____ _____

|

|

4.5

|

PARKING:

Tenant is allocated, and Tenant and its employees and invitees shall have

the non-exclusive right to use, not more than the number of parking spaces

set forth in Article 1 as “Tenant’s Number of Parking Spaces”. Tenant

shall not, at any time, use or permit its employees or invitees to use

more parking spaces than the number so allocated to Tenant. Tenant shall

not have the exclusive right to use any specific parking space, and

Landlord reserves the right to designate from time to time the location of

the parking spaces allocated for Tenant’s use. In the event Landlord

elects or is required by any Law to limit or control parking within the

Project, whether by validation of parking tickets or any other method,

Tenant agrees to participate in such validation or other program as

reasonably established by Landlord. Tenant shall not, at any time, park or

permit to be parked any trucks or vehicles adjacent to entryways or

loading areas within the Project so as to interfere in any way with the

use of such areas, nor shall Tenant, at any time, park or permit the

parking of Tenant’s trucks or other vehicles, or the trucks and vehicles

of Tenant’s suppliers or others, in any portion of the Common Areas not

designated by Landlord for such use by Tenant. Tenant shall not, at any

time, park or permit to be parked any recreational vehicles, inoperative

vehicles or equipment on any portion of the common parking area or other

Common Areas of the Project. Tenant agrees to assume responsibility for

compliance by its employees and invitees with the parking provisions

contained herein. If Tenant or its employees park any vehicle within the

Project in violation of these provisions, then Landlord may charge Tenant,

as Additional Rent, and Tenant agrees to pay, as Additional Rent, Ten

Dollars per day for each day or partial day that each such vehicle is

parked in any area other than that designated. Tenant hereby authorizes

Landlord, at Tenant’s sole expense, to tow away from the Project and store

until redeemed by its owner any vehicle belonging to Tenant or Tenant’s

employees parked in violation of these

provisions.

|

|

4.6

|

SIGNS:

Tenant shall not place or install on or within any portion of the Leased

Premises, the Building, the Common Areas or the Project any sign (other

than a business identification sign first approved by Landlord in

accordance with this Paragraph), advertisements, banners, placards or

pictures which are visible from the exterior of the Leased Premises.

Tenant shall not place or install on or within any portion of the Leased

Premises, the Building, the Common Areas or the Project any business

identification sign which is visible from the exterior of the Leased

Premises until Landlord shall have first approved in writing the location,

sized, content, design, method of attachment and material to be used in

the making of such sign. Any signs, once approved by Landlord, shall be

installed only in strict compliance with Landlord’s approval, at Tenant’s

expense, using a person first approved by Landlord to install same.

Landlord may remove any signs (not first approved in writing by Landlord),

advertisements, banners, placards or pictures so placed by Tenant on or

with the Leased Premises, the Building, the Common Areas or the Project

and charge to tenant the cost of such removal, together with any costs

incurred by landlord to repair any damage caused thereby, including any

cost incurred to restore the surface upon which such sign was so affixed

to its original condition. Tenant shall remove any such signs, repair any

damage caused thereby, and restore the surface upon which the sign was

affixed to its original condition, all to Landlord’s reasonable

satisfaction, upon the termination of this

Lease.

|

|

4.7

|

COMPLIANCE

WITH LAWS AND PRIVATE RESTRICTIONS: Tenant shall not use or permit any

person to use the Leased Premises in any manner, which violates any Laws

or Private Restrictions. Tenant shall abide by and shall promptly observe

and comply with, at its sole cost and expense, all Laws and Private

Restrictions respecting the use and occupancy of the Lease Premises, the

Building, the Common Areas or the Project and shall defend with competent

counsel, indemnify and hold Landlord harmless from any claims, damages or

liability resulting from Tenant’s failure to do

so.

|

|

|

Initial

_____ _____ _____

|

|

4.8

|

COMPLIANCE

WITH INSURANCE REQUIREMENTS: With respect to any insurance policies

carried by Landlord in accordance with the provisions of this Lease,

Tenant shall not conduct (nor permit any other person to conduct) any

activities with the Leased Premises, or store, keep or use anything with

the Leased Premises with (i) is prohibited under the terms of any of such

policies, (ii) could result in the termination of the coverage afforded

under any of such policies, (iii) could give to the insurance carriers the

right to cancel any of such policies, or (iv) could cause an increase in

the rates (over standard rates) charged for the coverage afforded under

any such policies. Tenant shall comply with all requirements of any

insurance company, insurance underwriter, or Board of Fire Underwriters

which are necessary to maintain, at standard rates, the insurance

coverage’s carried by either Landlord or Tenant pursuant to this

Lease.

|

|

4.9

|

LANDLORD’S

RIGHT TO ENTER: Landlord and its agents shall have the right to enter the

Leased Premises during normal business hours and subject to Tenant’s

reasonable security measures for the purpose of (i) inspecting the same;

(ii) supplying any services to be provided by Landlord to Tenant; (iii)

showing the Leased Premises to prospective purchasers, mortgagees or

tenants; (iv) making necessary alternations, additions or repairs; (v)

performing any of Tenant’s obligations when Tenant has failed to do so

after giving Tenant reasonable written notice of its intent to do so; and

(vi) posting notices of non-responsibility. Additionally, Landlord shall

have the right to enter the Leased Premises at times of emergency. Any

entry into the Leased Premises or portions thereof obtained by Landlord in

accordance with this Paragraph shall not under any circumstances be

construed or deemed to be a forcible or unlawful entry into, or a detainer

of, the Leased Premises, or an eviction, actual or constructive, of Tenant

from the Leased Premises or any portion

thereof.

|

|

4.10

|

CONTROL

OF COMMON AREAS: Landlord shall at all times have exclusive control of the

Common Areas. Landlord shall have the right, without the same constituting

an actual or constructive eviction and without entitling Tenant to any

reduction in or abatement of rent, to: (i) temporarily closed any part of

the Common Areas to whatever extent required in the opinion of Landlord’s

counsel to prevent a dedication thereof or the accrual of any prescriptive

rights therein: (ii) temporarily close all or any part of the Common Areas

to perform maintenance or for any other reason deemed sufficient by

Landlord; (iii) change the shape, size, location, number and extent of

improvements within the Common Areas including, without limitation,

changing the location of driveways, entrances, exits, parking spaces,

parking areas, sidewalks, directional or locator signs, or the direction

of the flow of traffic; and (iv) to make additions to the Common Areas

including, without limitation, the construction of parking structures.

Landlord shall have the right to change the name or address of the

Building. Tenant in its use of the Common Areas, shall keep the Common

Areas free and clear of all obstructions created or permitted by Tenant.

If, in the opinion of Landlord, unauthorized persons are using any of the

Common Areas by reason of, or under claim of, the express or implied

authority or consent of Tenant, then Tenant, upon demand of Landlord,

shall restrain, to the fullest extent then allowed by Law, such

unauthorized use, and shall initiate such appropriate proceedings as may

be required to so restrain such use. Nothing contained herein shall affect

the right of Landlord at any time to remove any unauthorized person from

the Common Areas or to prohibit the use of the Common Areas by

unauthorized persons, including without limitation, the right to prohibit

mobile food and beverage vendors. In exercising any such right regarding

the Common Areas, Landlord shall make a reasonable effort to minimize any

disruption to Tenant’s business.

|

|

4.11

|

RULES

AND REGULATIONS: Landlord shall have the right from time to time to

establish reasonable rules and regulations and/or amendments or additions

thereto respecting the use within the Project and the use of the Common

Areas for the care and orderly management of the Project and the safety of

its tenants, occupants and invitees. Upon delivery to Tenant of a copy of

such rules and regulations or any amendments or additions thereto, Tenant

shall comply with such rules and regulations. A violation by Tenant of any

of such rules and regulations shall constitute a default by Tenant under

this Lease. If there is a conflict between the rules and regulations and

any of the provisions of this Lease, the provisions of this Lease shall

prevail. Landlord shall not be responsible or liable to Tenant for the

violation of such rules and regulations by any other tenant of the

Project.

|

|

|

Initial

_____ _____ _____

|

|

4.12

|

ENVIRONMENTAL

PROTECTION: Landlord may voluntarily cooperate in a reasonable manner with

the efforts of all governmental agencies in reducing actual or potential

environmental damage. Tenant shall not be entitled to terminate this Lease

or to any reduction or abatement of rent by reason of such compliance or

cooperation. Tenant agrees at all times to cooperate fully with Landlord

and to abide by all rules and regulations and requirements which Landlord

may reasonably prescribe in order to comply with the requirements and

recommendations of governmental agencies regulating, or otherwise involved

in, the protection of the

environment.

|

ARTICLE

5

REPAIRS,

MAINTENANCE, SERVICES AND UTILITIES

|

5.1

|

REPAIRS

AND MAINTENANCE: Except in the case of damage to or destruction of the

Leased Premises, the Building or the Project caused by an Act of God or

other peril, in which case the provisions of Article 10 shall control, the

parties shall have the following obligations and responsibilities with

respect to the repair and maintenance of the Leased Premises, the Building

and the Common Areas.

|

|

|

A.

|

Tenant’s

Obligation: Tenant shall, at all times during the Leased Term and at its

sole cost and expense, regularly clean and continuously keep and maintain

in good order, condition and repair the Leased Premises and every part

thereof and all appurtenances thereto, including, without limiting the

generality of the foregoing, (i) all interior walls, floors and ceilings,

(ii) all windows, doors and skylights, (iii) all electrical wiring,

conduits, connectors and fixtures, (iv) all plumbing, pipes, sinks,

toilets, faucets and drains, (v) all lighting fixtures, bulbs and lamps,

(vi) all heating, ventilating and air conditioning equipment located

within the Leased Premises or located outside the Leased Premises (e.g.

rooftop compressors) and serving the Leased Premises (other tan Common

HVAC as defined in Subparagraph B below), and all entranceways to the

Leased Premises. Tenant, if requested to do so by Landlord, shall have at

Tenant’s sole cost and expense, a licensed heating, ventilating and air

conditioning contractor to regularly and periodically inspect (not less

frequently than every three months) and perform required maintenance on

the heating, ventilating and air conditioning equipment and systems

serving the Leased Premises, or alternately, Landlord may so contract in

its own name for such regular and periodic inspections of and maintenance

on such heating, ventilating and air conditioning equipment and systems

and charge to Tenant, as Additional Rent, the cost thereof. Tenant shall,

at its sole cost and expense, repair all damage to the Building, the

Common Areas or the Project caused by the activities of Tenant, its

employees, invitees or contractors promptly following written notice from

Landlord to so repair such damage. If Tenant shall fail to perform the

required maintenance or fail to make repairs required of it pursuant to

Paragraph within a reasonable period of time following notice from

Landlord to do so, then Landlord may, at its election and without waiving

any other remedy it may otherwise have under this Lease or at Law, perform

such maintenance or make such repairs and charge to Tenant, as Additional

Rent, the costs so incurred by Landlord for same. All glass within or a

part of the Leased Premises, both interior and exterior, is at the sole

risk of Tenant and any broken glass shall promptly be replaced by Tenant

at Tenant’s expense with glass of the same kind, size and

quality.

|

|

|

Initial

_____ _____ _____

|

|

|

B.

|

Landlord’s

Obligation: Landlord shall, at all times during the Lease Term, maintain

in good condition and repair; (i) the exterior and structural parts of the

Building (including the foundation, sub-flooring, load- bearing and

exterior walls, and roof); (ii) the Common Areas; and (iii) the electrical

and plumbing systems located outside the Leased Premises which service the

Building. Additionally, to the extent that the Building contains central

heating, ventilating and or air conditioning systems located outside the

Leased Premises and designed to service, and then servicing, more than a

single tenant within the Building, (“Common HVAC”), Landlord shall

maintain in good operating condition and repair such Common HVAC equipment

and systems.

|

|

5.2

|

SERVICES

AND UTILITIES: The parties shall have the following responsibilities and

obligations with respect to obtaining and paying the cost of providing the

following utilities and other services to the Leased

Premises.

|

|

|

A.

|

Gas

and Electric: Tenant shall arrange, at its sole expense and in its own

name, for the supply of gas and electricity to the Leased Premises. In the

event that such services are not separately metered, Tenant shall, at its

sole expense, cause such meters to be installed. Tenant shall be

responsible for determining if the local supplier of gas and/or

electricity can supply the needs of Tenant and whether or not the existing

gas and/or electrical distribution systems within the Building and the

Leased Premises are adequate for Tenant’s needs. Tenant shall pay all

charges for gas and electricity as so supplied to the Leased

Premises.

|

|

|

B.

|

Water:

Landlord shall provide the Leased Premises with water and Tenant shall

pay, as Additional Rent, the cost to Landlord of providing water to the

Leased Premises; provided, however, to the

extent that Landlord shall be providing water to the Leased Premises for

the use of more than a single tenant, Tenant shall be responsible to pay

as Additional Rent only so much of the cost to Landlord of providing water

to the Leased Premises as is related to Tenant’s water usage. The costs of

Tenant’s water usage shall include any costs to Landlord in keeping

account of such usage and all governmental fees, public charges or the

like (such as sewer usage fees) attributable to or based upon

usage.

|

|

|

C.

|

Security

Services: Tenant acknowledges that Landlord is not responsible for the

security of the Leased Premises or the protection of Tenant’s property or

Tenant’s employees, invitees or contractors, and that to the extent Tenant

determines that such security or protection services are advisable or

necessary, Tenant shall arrange for an pay the costs of providing

same.

|

|

|

D.

|

Trash

Disposal: Landlord will provide one trash bin or each building within the

Project for use by the tenants of such building for disposal of general

office waste only and for no other purpose. In no event shall Tenant use

the trash bins provided by Landlord for disposal of any of its industrial

waste, garbage or trash, and in no event shall Landlord be required to

provide extra bins for such purpose to because other tenants of the

Building or the Project are using such bins for such

purpose.

|

|

|

Initial

_____ _____ _____

|

|

5.3

|

ENERGY

AND RESOURCE CONSUMPTION: Landlord may voluntarily cooperate in a

reasonable manner with the efforts to governmental agencies and/or utility

suppliers in reducing energy or other resource consumption within the

Project. Tenant shall not be entitled to terminate this Lease or to any

reduction in or abatement of rent by reason of such compliance or

cooperation. Tenant agrees at all times to cooperate fully with Landlord

and to abide by all reasonable rules established by Landlord (i) in order

to maximize the efficient operation of the electrical, heating,

ventilating and air conditioning systems and all other energy or other

resource consumption systems within the Project and/or (ii) in order to

comply with the requirements and recommendations of utility suppliers and

governmental agencies regulating the consumption of energy and/or other

resources.

|

|

5.4

|

LIMITATION

OF LANDLORD’S LIABILITY: Landlord shall not be liable to Tenant for injury

to Tenant, its employees, agents, invitees or contractors, damage to

Tenant’s property or loss of Tenant’s business or profits, nor shall

Tenant be entitled to terminate this Lease or to any reduction in or

abatement of rent by reason of (i) Landlord’s failure to perform any

maintenance or repairs to the Project until Tenant shall have first

notified Landlord, in writing, of the need for such maintenance or

repairs, and then only after Landlord shall have had a reasonable period

of time following its receipt of such notice within which to perform such

maintenance or repairs, or (ii) any failure, interruption, rationing or

other curtailment in the supply of water, electric current, gas or other

utility service to the Leased Premises, the Building or the Project from

whatever cause (other than Landlord’s gross negligence or willful

misconduct), or (iii) the unauthorized intrusion or entry into the Leased

Premises by third parties (other than

Landlord).

|

ARTICLE

6

ALTERATIONS

AND IMPROVEMENTS

|

6.1

|

BY

TENANT: Tenant shall not make any alterations to or modifications of the

Leased Premises or construct any improvements to or within the Leased

Premises without Landlord’s prior written approval, and then not until

Landlord shall have first approved, in writing, the plans and

specifications therefore, which approval shall not be unreasonably

withheld. All such modifications, alterations or improvements, once so

approved, shall be made, constructed or installed by Tenant at Tenant’s

expense, using a licensed contractor first approved by Landlord, in

substantial compliance with the Landlord-approved plans and specifications

therefore. All work undertaken by Tenant shall be done in accordance with

all Laws and in good and workmanlike manner using new materials of good

quality. Tenant shall not commence the making of any such modifications or

alterations or the construction of any such improvements until (i) all

required governmental approvals and permits shall have been obtained, (ii)

all requirements regarding insurance imposed by this Lease have been

satisfied, (iii) Tenant shall have given Landlord at least five business

days prior to written notice of its intention to commence such work so

that Landlord may post and file notices of non-responsibility, and (iv) if

requested by Landlord, Tenant shall have obtained contingent liability and

broad form builder’s risk insurance in an amount satisfactory to Landlord

to cover any perils relating the proposed work not covered by insurance

carried by Tenant pursuant to Article 9. In no event shall Tenant make any

modifications, alterations or improvements to the Common Areas or any

areas outside the Leased Premises. As used in the Article, the term

“modifications”, alterations and/or improvements” shall include, without

limitation, the installation of additional electrical outlets, overhead

lighting fixtures, drains, sinks, partitions, doorways, or the

like.

|

|

|

Initial

_____ _____ _____

|

|

6.2

|

OWNERSHIP

OF IMPROVEMENTS: All modifications, alternations and improvements made or

added to the Leased Premises by Tenant (other than Tenant’s inventory,

equipment, movable furniture, wall decorations and trade fixtures) shall

be deemed real property and a part of the Leased Premises, but shall

remain the property of Tenant during the Lease Term. Any such

modifications, alterations or improvements, once completed, shall not be

altered or removed from the Leased Premises during the Lease Term without

Landlord’s written approval first obtained in accordance with the

provisions of Paragraph 6.1 above. At the expiration or sooner termination

of this Lease, all such modifications, alterations and improvements (other

than Tenant’s inventory, equipment, movable furniture, wall decorations

and trade fixtures) shall automatically become the property of the

Landlord and shall be surrendered to Landlord as part of the Leased

Premises as required pursuant to Article unless Landlord shall require

Tenant to remove any of such modifications, alterations or improvements in

accordance with the Provision of Article 2, in which case Tenant shall so

remove same. Landlord shall have no obligation to reimburse to Tenant all

or any portion of the cost or value of any such modifications, alterations

or improvements so surrendered to Landlord. All modifications, alterations

or improvements which are installed or constructed on or attached to the

Leased Premises by Landlord at Landlord’s expense shall be deemed real

property and a part of the Leased Premises and shall be the property of

Landlord. All lighting, plumbing, electrical, heating, ventilating and air

conditioning fixtures, partitioning, window coverings, wall coverings and

floor coverings installed by Tenant shall be deemed improvements to the

Leased Premises and not trade fixtures of

Tenant.

|

|

6.3

|

ALTERATIONS

REQUIRED BY LAW: Tenant shall make all modifications, alterations, and

improvements to the Leased Premises, at its sole cost, that are required

by Law because of (i) Tenant’s use or occupancy of the Leased Premises,

(ii) Tenant’s application for any permit or governmental approval, or

(iii) Tenant’s making of any modifications, alterations, or improvements

to or within the Leased Premises.

|

|

6.4

|

LIENS:

Tenant shall keep the Leased Premises, the Building and the Project free

from any liens and shall pay value due all bills arising out of any work

performed, materials furnished, or obligations incurred by Tenant, its

agents, employees or contractors related to the Leased Premises, if any

such claim of lien is recorded against Tenant’s interest in this Lease,

the Leased Premises, the Building or the Project, Tenant shall bond

against, discharge or otherwise cause such lien to be entirely released

within ten days after the same has been so

recorded.

|

ARTICLE

7

ASSIGNMENT

AND SUBLETTING BY TENANT

|

7.1

|

BY

TENANT: Tenant shall neither assign this Lease nor sublet the Lease

Premises without obtaining the written consent of the Landlord to do so,

however, that Landlord shall not arbitrarily or unreasonably refuse to

grant consent to such assignment or subletting, and provided further that

a consent to one assignment or subletting by Landlord shall not be deemed

a consent to any subsequent assignment or subletting. Any assignment or

subletting without the consent of the Landlord shall be void and shall, at

the option of the Landlord, terminate this Lease. The acceptance of rent

by Landlord from any person or entity other than the Tenant, or the

acceptance of rent by Landlord from Tenant with knowledge of a violation

of the provisions of this paragraph, shall not be deemed a waiver by

Landlord of any provision of this Article or this Lease or to be a consent

to any assignment or subletting by

Tenant.

|

|

7.2

|

MERGER

OR REORGANIZATION: If Tenant is a corporation, any dissolution, merger,

consolidation or other reorganization of Tenant, or the sale or other

transfer in the aggregate over the Lease Term of a controlling percentage

of the capital stock of Tenant shall not be deemed a voluntary assignment

of Tenant’s interest in this Lease. However, should Tenant dissolve,

merge, consolidate, or otherwise reorganize, Tenant shall notify Landlord

in writing of the proposed change in its status fifteen (15) days prior to

the effective date of such dissolution or

reorganization.

|

|

|

Initial

_____ _____ _____

|

|

7.3

|

LANDLORD’S

CONSENT: If Tenant shall desire to assign its interest under this Lease or

to sublet the Leased Premises, Tenant must first notify Landlord, in

writing, of its intent to so assign or sublet, specifying in detail the

terms of such assignment or subletting, including, by way of illustration

but not of limitation, the name of the proposed assignee or sublessee, the

proposed assignee’s sublessee’s intended use of the leased premises, a

current financial statement of such proposed assignee or sublessee, and

the form of documents to be used in effectuating such assignment or

subletting. Land lord shall have a period of fifteen (15) days following

receipt of such notice to either (i) consent to such assignment or

subletting, or (ii) refuse to consent to such requested assignment or

subletting, provided that such consent shall not be unreasonably or

arbitrarily refused. During said fifteen (15) day period, Tenant covenants

and agrees to supply Landlord, upon request, all necessary or relevant

information which Landlord may reasonably request respecting such proposed

assignment or subletting and/or the proposed assignee or

sublessee.

|

|

7.4

|

CONDITIONS

TO LANDLORD’S CONSENT: If Landlord elects to consent to such requested

assignment or subletting, such consent shall be expressly conditioned upon

the occurrence of each of the conditions set forth below. Any purported

assignment or subletting made prior to the full and complete satisfaction

of each of the following conditions shall be void and shall, at the option

of Landlord, constitute a material default of this Lease permitting

Landlord to terminate this Lease unless such default is cured by Tenant

satisfying each condition within five (5) days of receipt of written

notice of the default. The conditions are as

follows:

|

|

|

A.

|

Landlord

having approved in form and substance the assignment or sublease

agreement, which approval shall not be unreasonably

withheld.

|

|

|

B.

|

Each

such sublessee or assignee having agreed in writing satisfactory to

Landlord to assume, to be bound by, and to perform the obligations of this

Lease to be performed by Tenant.

|

|

|

C.

|

Tenant

having delivered to Landlord a complete and fully executed duplicate

original of each sublease agreement or assignment

agreement.

|

|

|

D.

|

Tenant

and Tenant’s sublessee shall have entered into a written agreement with

and for the benefit of Landlord satisfactory to Landlord whereby Tenant

and Tenant’s sublessee jointly agree to pay to Landlord one hundred

percent of all excess rentals to be paid by such sublessee as and when

such excess rentals are so paid.

|

|

7.5

|

EXCESS

RENTALS DEFINED: The term “excess rentals” shall mean all consideration to

be paid by the sublessee to Tenant or to any other on Tenant’s behalf or

for Tenant’s benefit for the sublease of the Leased Premises in excess of

the rent due Landlord under the terms of this Lease for the same period,

less any commissions paid by Tenant to a licensed real estate broker for

arranging such sublease. Tenant agrees that the portion of any excess

rentals arising from any subletting by Tenant, which is to be paid to

Landlord pursuant to this Article, now is and shall then be the property

of Landlord and not the property of

Tenant.

|

|

7.6

|

EFFECT

OF LANDLORD’S CONSENT: No assignment or subletting, even with the consent

of Landlord, shall relieve Tenant of it’s primary obligation to pay rent

and to perform all of the other obligations to be performed by Tenant

hereunder. Consent by Landlord to one or more assignments or sublettings

by Tenant shall not be deemed to be a consent to any subsequent assignment

or subletting.

|

|

|

Initial

_____ _____ _____

|

|

7.7

|

GOOD

FAITH: The rights granted to Tenant by this Article are granted in

consideration of Tenant’s express covenant that all pertinent allocations

which are made by Tenant between the value of this Lease and the value of

any of Tenant’s personal property which may be conveyed or leased

generally concurrently with and which may reasonably be considered a part

of the same transaction as the permitted assignment or subletting shall be

made fairly, honestly and in good faith. If Tenant shall breach this

Covenant of Good Faith, Landlord may immediately declare Tenant to be in

default under the terms of this Lease and terminate this Lease and/or

exercise any other rights and remedies Landlord would have under the terms

of this Lease in the case of a material default by Tenant under this

Lease.

|

|

7.8

|

EFFECT

OF LANDLORD’S CONSENT: No subletting, assignment or encumbrance, even with

the consent of Landlord shall relieve Tenant of its personal and primary

obligation to pay rent and to perform all of the other obligations to be

performed by Tenant hereunder. Consent by Landlord to one or more

assignments or encumbrances of Tenant’s interest in this Lease or to one

or more subletting of the Leased Premises shall not be deemed to be a

consent to any subsequent assignment, encumbrance or subletting. If

Landlord shall have been ordered by a court of competent jurisdiction to

consent to a requested assignment or subletting, or such an assignment or

subletting shall have been ordered over the objection of Landlord, such

assignment or subletting shall not be binding between the assignee (or

sub-lessee) and Landlord until such a time as all conditions set forth in

Paragraph 7.4 above have been fully satisfied (to the extent not then

satisfied) by the assignee or sub-lessee, including, without limitation,

the payment to Landlord of all agreed assignment considerations and/or

excess rentals then due Landlord.

|

ARTICLE

8

LIMITATION

ON LANDLORD’S LIABILITY AND INDEMNITY

|

8.1

|

LIMITATION

ON LANDLORD’S LIABILITY AND RELEASE: Landlord shall not be liable to

Tenant for, and Tenant hereby releases Landlord and its partners and

officers from, any and all liability, whether in contract, tort or any

other basis, for any injury to or any damage sustained by Tenant, its

agents, employees, contractors or invitees; any damage to Tenant’s

property; or any loss to Tenant’s business, loss of Tenant’s profits or

other financial loss of Tenant resulting from or attributable to the

condition of, the management of, the maintenance of, or the protection of

the Leased Premises, the Building, the Project or the Common Areas,

including, without limitation, any such injury, damage or loss resulting

from (i) the failure, interruption, rationing or other curtailment or

cessation in the supply of electricity, water, gas or other utility

service to the Project, the Building or the Leased Premises; (ii) the

vandalism or forcible entry into the Building or the Leased Premises;

(iii) the penetration of water into or onto any portion of the Leased

Premises through roof leaks or otherwise; (iv) the failure to provide

security and/or adequate lighting in or about the Project, the Building or

the Leased Premises; (v) the existence of any design or construction

defects within the Project, the Building or the Leased Premises; (vi) the

failure of any mechanical systems to function properly (such as the HVAC

systems); or (vii) the blockage of access to any portion of the Project,

the Building or the Leased Premises, except to the extent such damage was

proximately caused by Landlord’s active negligence, willful misconduct, or

Landlord’s failure to perform an obligation expressly undertaken pursuant

to this Lease but only if Tenant shall have given Landlord prior written

notice to perform such obligation and Landlord shall have failed to

perform such obligation within a reasonable period of time following

receipt of written notice from Tenant to so perform such obligation. In

this regard, Tenant acknowledges that it is fully apprised of the

provisions of Law relating to releases, and particularly to those

provisions contained in Section 1542 of the California Civil Code, which

read as follows:

|

“A

general release does not extend to claims which the creditor does not know or

suspect to exist in his favor at the time of executing the release, which if

known by him must have materially affected his settlement with the

debtor.”

Initial

_____ _____ _____

Notwithstanding

such statutory provision, and for the purpose of implementing a full and

complete release and discharge, Tenant hereby (i) waives the benefit of such

statutory provision and (ii) acknowledges that, subject to the exceptions

specifically set forth herein, the release and discharge set forth in this

Paragraph is a full and complete settlement and release and discharge of all

claims and is intended to include in its effect, without limitation, all claims

which Tenant, as of the date hereof, does not know of our suspect to exist in

its favor.

|

8.2

|

TENANT’S

INDEMNIFICATION OF LANDLORD: Tenant shall defend, with counsel

satisfactory to Landlord, any claims made or legal actions filed or

threatened by third parties against Landlord with respect to the death,

bodily injury, personal injury, damage to property or interference with

contractual or property rights suffered by any third party (including

other tenants within the Project) which (i) occurred within the Leased

Premises or (ii) resulted from Tenant’s use or occupancy of the Leased

Premises or the Common Areas or (iii) resulted from Tenant’s activities in

or about the Leased Premises, the Building or the Project, and Tenant

shall indemnify and hold Landlord, Landlord’s principals, employees and

agents harmless from any loss, including loss of rents by reason of vacant

space which otherwise would have been leased but for such activities,

liability, penalties, or expense whatsoever (including any legal fees

incurred by Landlord with respect to defending such claims) resulting

therefrom, except to the extent proximately caused by the active

negligence or willful misconduct of Landlord. This indemnity agreement

shall survive until the latter to occur of (i) the date of the expiration,

or sooner termination, of this Lease, or (ii) the date Tenant actually

vacates the Leased Premises. Notwithstanding the foregoing, Tenant shall

be under no duty to indemnify and hold Landlord harmless, nor defend

Landlord, against any liability, claims, or damages arising because of

Landlord’s failure to make any repairs required by this Lease or to take

any action required by this Lease or to take any action required of

Landlord by this Lease, provided that the Landlord has been properly

notified by Tenant of the required repair or action. The term “properly

notified” shall mean notice as prescribed in Paragraph 13.10 of this

Lease.

|

ARTICLE

9

INSURANCE

|

9.1

|

TENANT’S

INSURANCE: Tenant shall maintain insurance complying with all of the

following:

|

|

|

A.

|

Tenant

shall procure pay for and keep in full force and effect, at all times

during the Lease Term, the

following:

|

|

|

(1)

|

Comprehensive

general liability insurance insuring Tenant against liability for personal

injury, bodily injury, death and damage to property occurring within the

Leased Premises, or resulting from Tenant’s use or occupancy of the Leased

Premises or the Common Areas, or resulting from Tenant’s activities in or

about the Leased Premises, with combined single limit coverage of not less

than the amount of Tenant’s Required Liability Coverage (as set forth in

Article 1), which insurance shall contain a “broad form liability”

endorsement insuring Tenant’s performance of Tenant’s obligation to

indemnify Landlord as contained in Article

8.2.

|

|

|

(2)

|

Fire

and property damage insurance in so-called “fire and extended coverage”

form insuring Tenant against loss from physical damage to Tenant’s

personal property, inventory, trade fixtures and improvements within the

Leased Premises with coverage for the full actual replacement cost

thereof:

|

|

|

(3)

|

Pressure

vessel insurance, if applicable;

|

Initial

_____ _____ _____

|

|

(4)

|

Product

liability insurance (including, without limitation, if food and/or

beverages are distributed, sold and/or consumed within the Leased

Premises, to the extent obtainable, coverage for liability arising out of

the distribution, sale or consumption of food and/or beverages (including

alcoholic beverages, if applicable) at the Leased Premises) for not less

than Tenant’s Required Liability Coverage (as set forth in Article

1);

|

|

|

(5)

|

Workers’

compensation insurance and any other employee benefit insurance sufficient

to comply with all Laws; and

|

|

|

(6)

|

With

respect to making of alterations or the construction of improvements or

the like undertaken by Tenant, contingent liability and builder’s risk

insurance, in an amount and with coverage satisfactory to

Landlord.

|

|

|

B.

|

Each

policy of liability insurance required to be carried by Tenant pursuant to

this Paragraph or actually carried by Tenant with respect to the Leased

Premises (i) shall, except with respect to insurance required by

Subparagraph A (6) above, name Landlord, and such others as are designated

by Landlord, as additional insured; (ii) shall be primary insurance

providing that the insurer shall be liable for the full amount of the

loss, up to and including the total amount of liability set forth in the

declaration of coverage, without the right of contribution from or prior

payment by any other insurance coverage of Landlord; (iii) shall be in a

form satisfactory to Landlord; (iv) shall be carried with companies

reasonably acceptable to Landlord; (v) shall provide that such policy

shall not be subject to cancellation, lapse or change except after at

least thirty days prior written notice to Landlord; and (vi) shall contain

a so-called “severability” or “cross liability” endorsement. Each policy

of property insurance maintained by tenant with respect to the Leased

Premises or any property therein (i) shall provide that such policy shall

not be subject to cancellation, lapse or change except after at least

thirty days prior written notice to Landlord and (ii) shall contain a

waiver and/or a permission to waive by the insurer of any right of

subrogation against Landlord, its principals, employees, agents and

contractors, which might arise by reason of any payment under such policy

or by reason of any act or omission of Landlord, its principals,

employees, agents or contractors.

|

|

|

C.

|

Prior

to the time Tenant or any of its contractors enters the Leased Premises,

Tenant shall deliver to the Landlord, with respect to each policy of

insurance required to be carried by Tenant pursuant to this Article, a

copy of such policy (appropriately authenticated by the insurer as having

been issued, premium paid, providing the coverage required by this

Paragraph and containing the provisions specified herein. With respect to

each renewal or replacement of any such insurance, the requirements of

this Paragraph must be complied with not less than thirty days prior to

the expiration or cancellation of the policy being renewed or replaced.

Landlord may, at any time and from time to time, inspect and/or copy any

and all insurance policies required to be carried by Tenant pursuant to

this Article. If Landlord’s Lender, insurance broker or advisor or counsel

reasonably determines at any time that the amount of coverage set forth in

Paragraph 9.1A for any policy of insurance Tenant is required to carry