Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | d8k.htm |

Broadridge

Financial Solutions, Inc.

May 2010

Investor Presentation

Richard J. Daly

Chief Executive Officer

Exhibit 99.1 |

2

Forward-Looking Statements

This presentation and other written or oral statements made from time to time by representatives of

Broadridge may contain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature,

such as our fiscal year 2010 financial guidance, and which may be identified by the use of words

like “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other

words of similar meaning, are forward-looking statements. These statements are based on

management’s expectations and assumptions and are subject to risks and uncertainties that

may cause actual results to differ materially from those expressed. These risks and

uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our

Annual Report on Form 10-K for the fiscal year ended June 30, 2009 (the “2009 Annual

Report”), as they may be updated in any future reports filed with the Securities and

Exchange Commission. Any forward-looking statements are qualified in their entirety by

reference to the factors discussed in the 2009 Annual Report. These risks include: the success

of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; the

pricing of Broadridge’s products and services; changes in laws affecting the investor

communication services provided by Broadridge; changes in laws regulating registered securities

clearing firms and broker-dealers; declines in trading volume, market prices, or the

liquidity of the securities markets; any material breach of Broadridge security affecting its

clients’ customer information; the failure of our outsourced data center services provider to

provide the anticipated levels of service; any significant slowdown or failure of

Broadridge’s systems; Broadridge’s failure to keep pace with changes in technology

and demands of its clients; availability of skilled technical employees; the impact of new

acquisitions and divestitures; competitive conditions; and overall market and economic conditions.

Broadridge disclaims any obligation to update any forward-looking statements, whether as a

result of new information, future events or otherwise.

This presentation may include certain non-GAAP (generally accepted accounting principles)

financial measures in describing Broadridge’s performance. Management believes that such

non-GAAP measures, when presented in conjunction with comparable GAAP measures provide

investors a more complete understanding of Broadridge’s underlying operational results.

These non-GAAP measures are indicators that management uses to provide additional

meaningful comparisons between current results and prior reported results, and as a basis for planning

and forecasting for future periods. These measures should be considered in addition to and not

substitute for the measures of financial performance prepared in accordance with GAAP. The

reconciliations of such measures to the comparable GAAP figures are included in this

presentation.

|

3

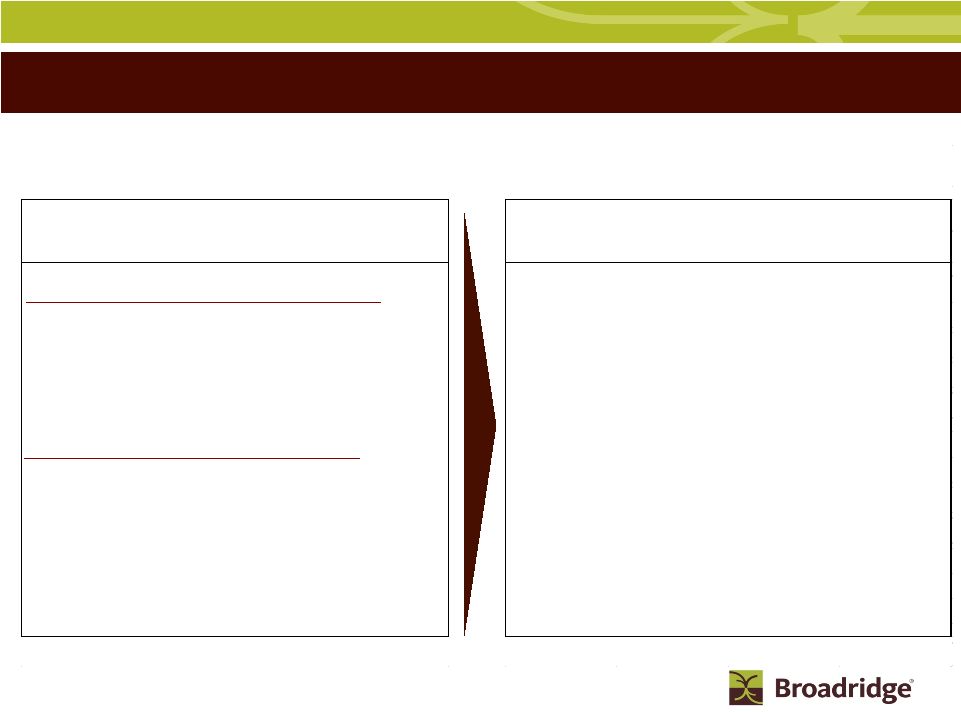

Use of Material Contained Herein

The information contained in this presentation is being provided

for your

convenience and information only. This information is accurate as of the date

of its initial presentation. If you plan to use this information for

any purpose, verification of its continued accuracy is your

responsibility. Broadridge assumes no duty to update or revise the

information contained in this

presentation. You may reproduce information contained in this presentation

provided you do not alter, edit, or delete any of the content and provided

you identify the source of the information as Broadridge Financial

Solutions, Inc., which owns the copyright.

Broadridge and the Broadridge logo are registered trademarks of Broadridge

Financial Solutions, Inc. Ridge is a trademark of Broadridge Financial

Solutions, Inc.

©

2010 Broadridge Financial Solutions, Inc. |

4

Agenda

Broadridge Overview and Summary

Business Overview

Business Expansion Strategy Overview

Financial Overview

Conclusion |

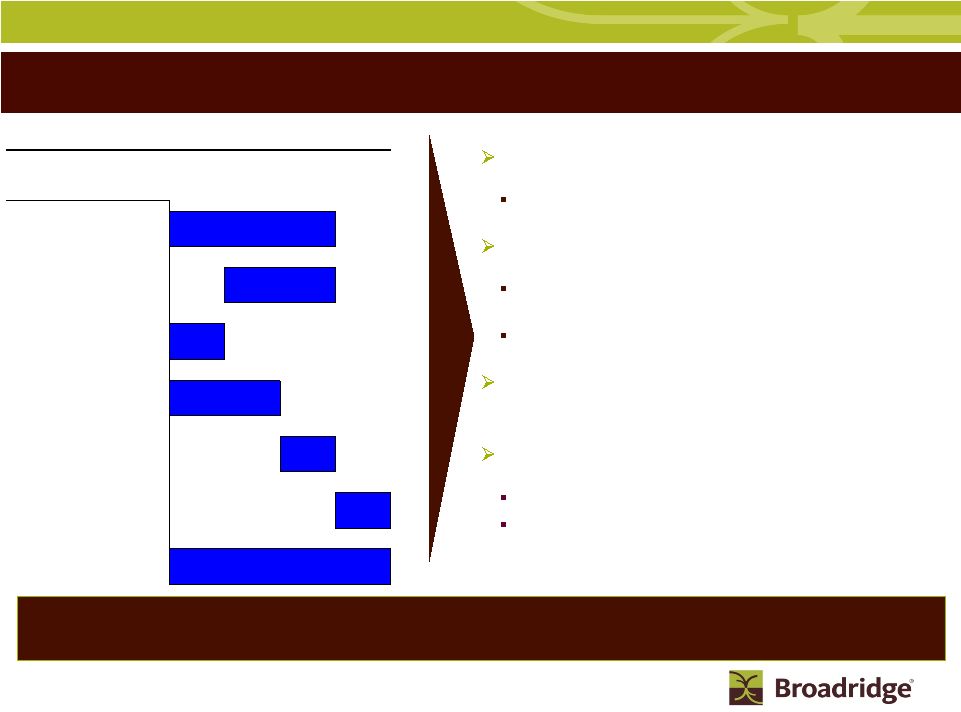

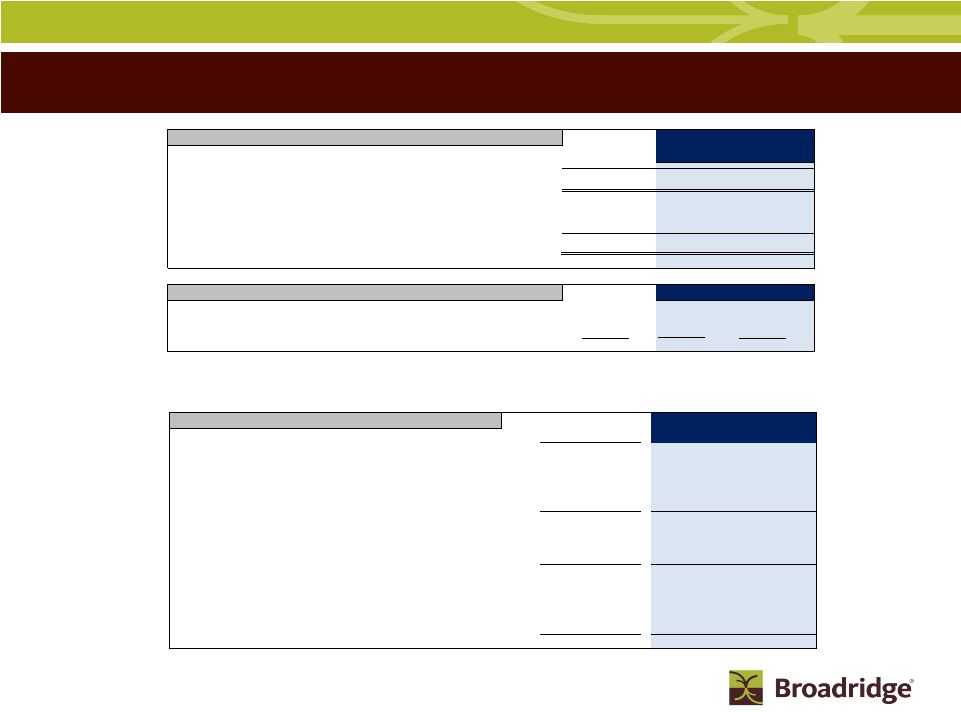

Broadridge: Investment Thesis

Generate

very strong and

highly predictable

free cash flows

Strong core Investor

Communications business

which generates over 70% of

annual revenues and earnings

Market leader with high

client retention rates

driven by product innovation

Approximately 80%

in recurring annual revenues

Dependable mid-single-digit

revenue growth business

(5% CAGR since 2002)

Highly experienced

management team

(averaging 14 years)

focused on delivering

shareholder return

Scalable business model

with core business

generating margin expansion

(>16% margins, averaging ~50bps

annual growth last 3 fiscal years)

Averaged over $250M per year

during the last 3 fiscal years

Aim to invest in existing businesses and acquisitions to generate mid to

high-single-digit revenue growth and return excess cash to shareholders

|

6

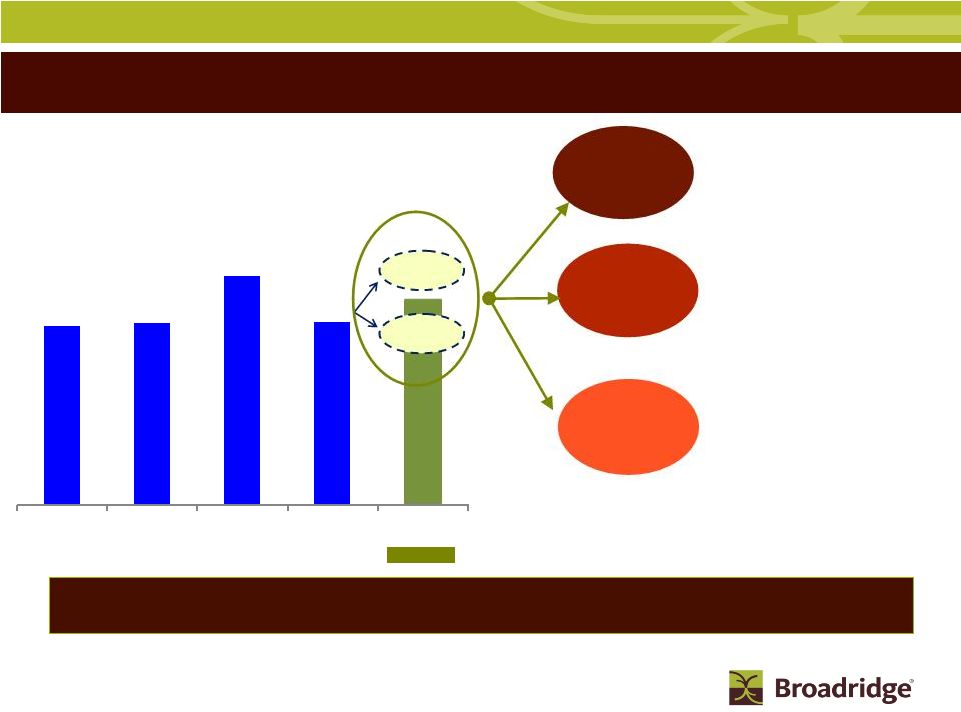

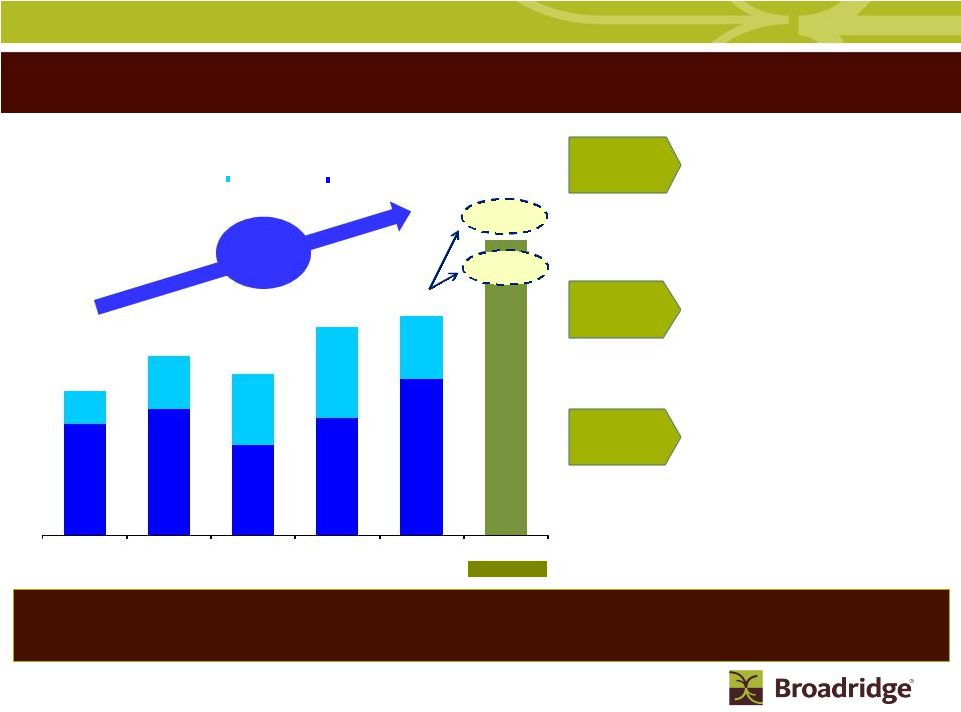

$252

Forecast

$290

$251

$248

Broadridge: Free Cash Flow & Capital Allocation

Note: Free Cash Flow excludes financing activities in the Clearing and Outsourcing

Solutions segment •Doubled annual dividend

from $0.28 to $0.56 per

share for FY10, or

approximately 35% payout

of FY09 GAAP net earnings

•Authorized repurchase of

up to 10 million shares, or

approximately 7% of the

shares outstanding

•Strategic acquisitions to

leverage the Broadridge

brand and distribution

channels

Strong predictable free cash flow allows for flexible capital allocation

options (1) Free cash flow is a Non-GAAP financial measure

and is defined as net cash flow provided by operating activities excluding Ridge Clearing financing activities, less capital

expenditures and intangibles. A reconciliation to the nearest GAAP

numbers are provided in the Appendix. FY06

FY07

FY08

FY09

FY10

Free Cash Flow

(Non-GAAP)

(1)

($ in millions)

High: $270

Low: $235

Dividends

Stock

Repurchases

Acquisitions |

7

Broadridge

Mission

Partner with

Financial Institutions

to:

Reduce

Risk & Cost

Increase

Performance

•

Enable the financial services

industry to achieve higher levels

of performance by allowing firms

to focus on their core business

•

Help clients manage their

regulatory compliance risk by

improving

clients’

processing,

communication accuracy and

data security

•

Deliver cost savings to financial

institutions through outsourcing

their non-differentiating back-

office processes

•

Develop long lasting relationships

with world class companies built

on mutual success

Our

Mission

is

To

Reduce

Clients’

Risk

While

Lowering

Their

Total

Cost

of

Ownership |

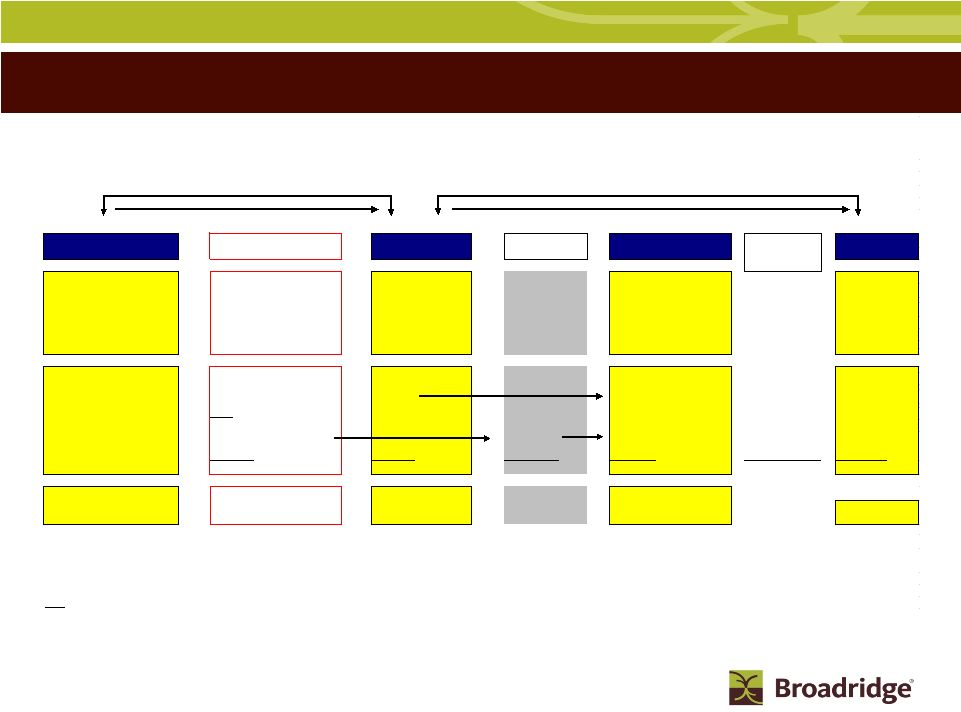

8

Individual (Retail) and Institutional

Clients

Broker-Dealers, Banks, Mutual Funds, Corporate Issuers

Integrated Solutions Spanning the Investment Lifecycle

Investment

Decision

(Pre-Trade)

Trade Processing

&

Books and Records

Asset

Servicing

(Post-Trade)

New Accounts

Welcome Kits

Proxy

Fulfillment

Archival

Confirms

Across the

investment

lifecycle...

...By partnering

with the world’s

leading financial

institutions...

...And delivering

broad and

innovative

global solutions

Investor Communications

Proxy management, corporate governance, and stockholder

communications Securities Processing

Global trade processing for equities, options,

mutual funds, and fixed income securities

and operations outsourcing solutions

Processing

Reporting

Statements

...Broadridge

touches

investors... |

9

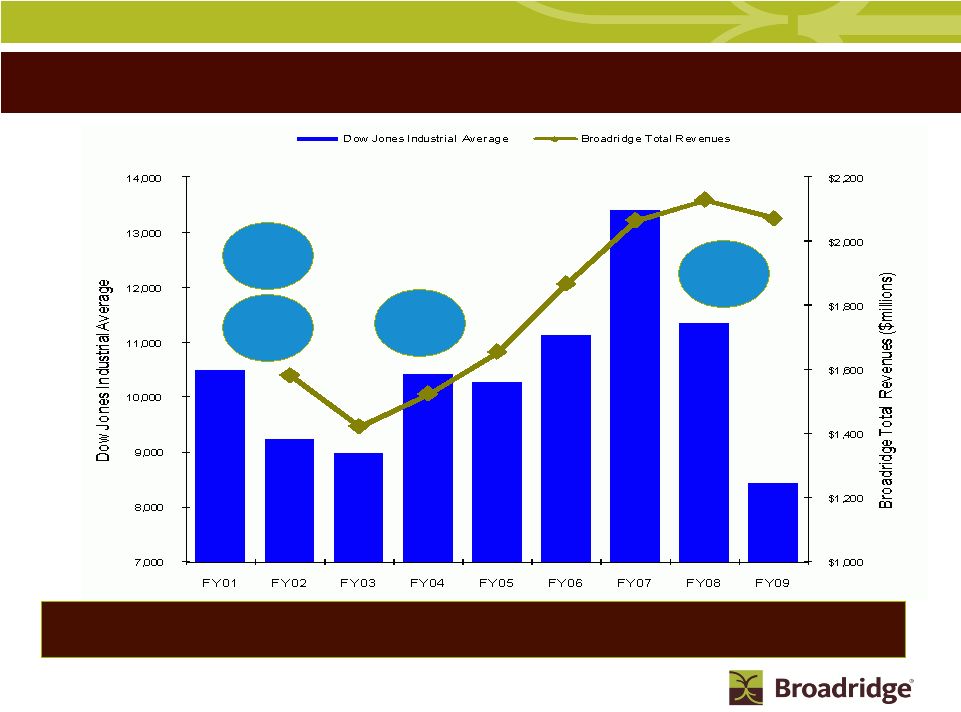

Resilient and Predictable Business Model

Business is resilient and largely independent of the stock market being at its highs

or lows……….predictable revenue stream drives predictable free

cash flow Shareholder Positions

Images and Pieces

Processed

Revenue Drivers

A Market Leader

with

High Retention Rates

Recurring Revenue

Complex Proprietary

Processing Platforms

High

Client

Satisfaction

and

Highly

Engaged

Associates

Investor Communication

Solutions

Securities Processing

Solutions

Indispensable Provider for

Mission Critical Processing

Processing Fees

(Trades Per Day)

# of Accounts |

10

Business is Resilient in Changing Markets

Our revenue growth has been resilient through various economic and

market cycles

Stock Market

Rebounds

Decimalization

of Trades

Internet Bubble

Impact

Financial

Crisis

Note: Fiscal year is based on June 30

year end th |

11

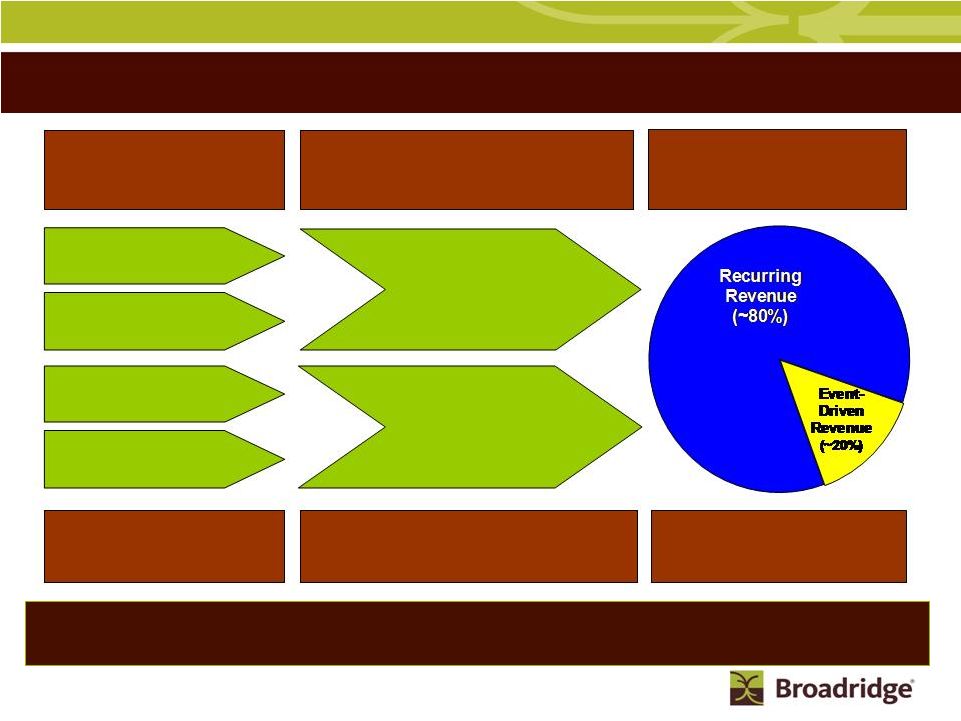

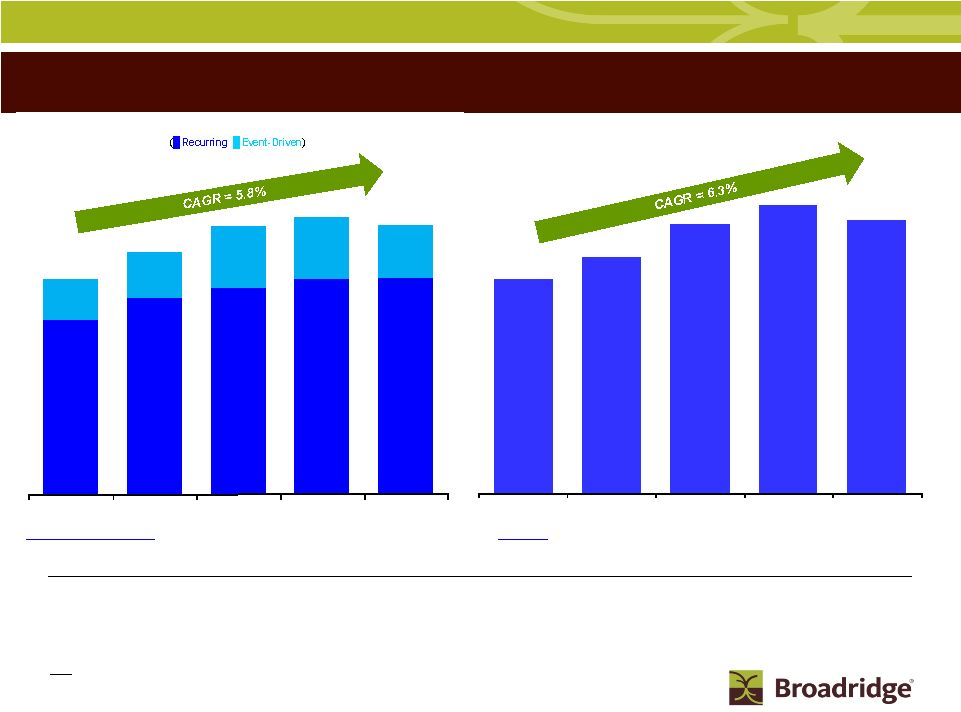

Revenue Growth Drivers

Low

double-digit

revenue

growth

in

robust

markets

and

flat

to

slightly

negative

growth

in severe

down markets. Historically, growth from Sales is consistent in all markets

cycles. Average historical growth of 5%, which included two severe

down market cycles

(1)

In high growth economic cycles revenue growth averages 10-

12% and flat to negative 3% in severe down markets

Historical sales growth component consistent in all market

cycles

ICS sales expected to be driven by market share gains in

transaction reporting and registered proxy

SPS sales expected to be driven by our unique Operations

Outsourcing offering

ICS internal growth is driven by stock record growth for equities

and mutual funds and SPS is driven by trades per day (TPD),

which is somewhat offset by price concessions

Event-driven revenue activity declines in severe down markets

and rebounds to new highs in robust markets.

Last trough to peak cycle had 20% CAGR (FY03-FY07)

Mutual Fund Proxy is the most volatile component of event-

driven revenue activity

FY02 -

FY09 (%)

Average Revenue

Growth From:

+ Acquisitions

1%

= Total Revenue Growth

5%

= Net New Business

1%

+ Internal Growth

(2)

2%

+ Event-Driven

1%

Sales

4%

-

Losses

(3%)

(1) Average annual growth rate over 7 years, which contemplates up

and down economic cycles (2) Internal growth

represents “same client” additional market driven growth |

12

Business Expansion Focus

Closed Sales

(Fee Only $ in millions)

Event-Driven (ED)

Recurring (RC)

$100

$145

$125

$112

$152

Forecast (1)

$77

$88

$63

$82

$109

$23

$37

$49

$63

$43

FY05

FY06

FY07

FY08

FY09

FY10

High: $205

Low: $185

Broadridge

is well-positioned and on the high ground as a result of our recurring revenue

base, great value propositions, new initiatives, free cash flow and solid

balance sheet Closed

Sales

Challenges

Long-Term

Growth

•Strong

and growing pipeline with large opportunities in all segments

•Winning

a meaningful percentage of each year’s market-driven sales

activity

•Growth

in recurring closed sales >30% in FY09, representing the second

consecutive year of record sales

•Leverage

our core capabilities and unique communications network

•Investments

in the business have started to introduce new and exciting

opportunities

•Meaningful

growth opportunities in the mutual fund area via data hub

strategy

•Accelerating

Operations Outsourcing by leveraging our unique multi-tier

capabilities

•SPS

business, despite retaining its market leadership position, faces

challenges of price compression and how to monetize its

unique opportunities for growth

•Overcoming

conversion decision hurdles for large clients and industry

consolidation CAGR = 11%

ED = 17%

RC = 9%

(1)

Financial guidance provided in Broadridge’s February 4, 2010

earnings release |

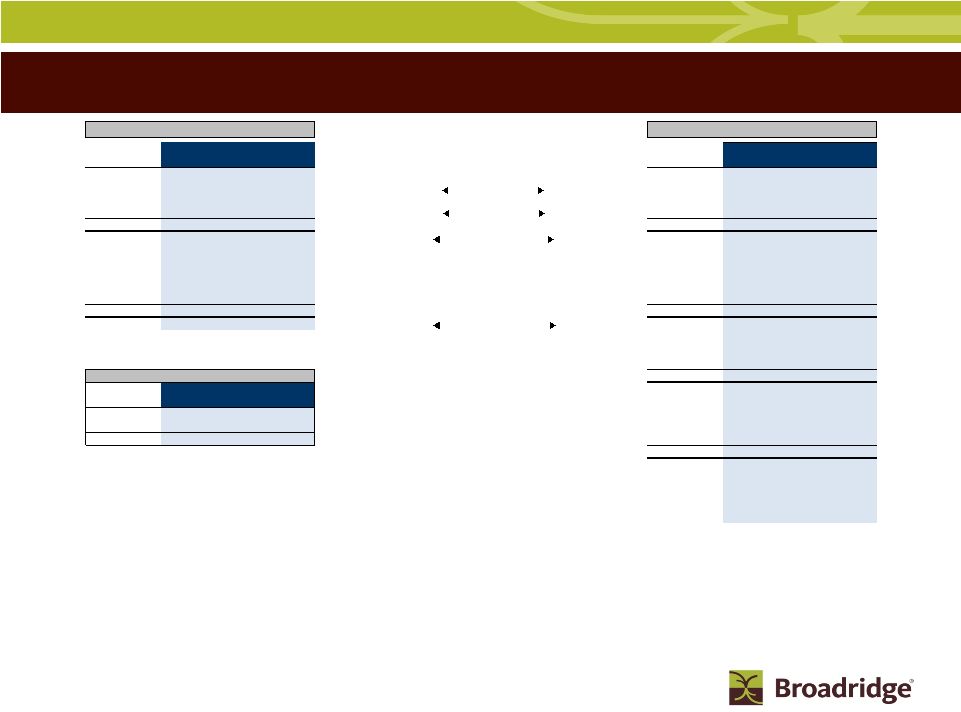

13

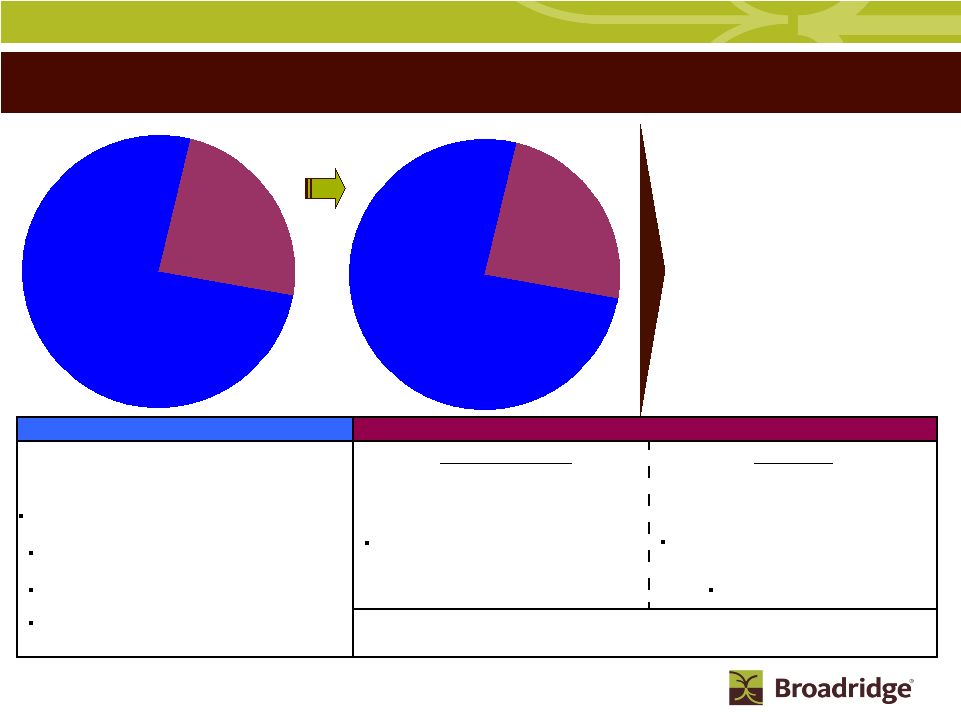

This is Broadridge

•We

are a market leader in processing and distributing shareholder

communications, and provider of choice for mission-critical

securities processing solutions

•Over

40 years of experience and a solid customer base with long standing

relationships

•Our

core business is resilient and largely independent of the stock

market being at its highs or lows

•Strong

and predictable Free Cash Flow of ~$250M in each of the last 3

fiscal years FY10 Forecast Segment Revenues

(1)

FY10 Forecast Segment Margins

Investor

Communications

$1,671-1,688M

(76%)

Securities

Processing

$531-533M

(24%)

Investor

Communications

$279-285M

Margin: 16.7-16.9%

Securities

Processing

$87-94M

Margin: 16.4-17.7%

Outsourcing

Innovative industry service provider of

outsourcing of critical back-office labor

functions that are integrated with our

processing technology platform:

Operations Outsourcing offering -

growth opportunity to expand existing

relationships and add new clients

Outsourcing

(~5%)

Investor Communications

(2)

Securities Processing

Leading global back-office processing service

bureau, as 8 of top 10 U.S. broker-dealers use

equity and fixed income components of our

technology

processing

platform

(3)

:

Hosted

applications

for

self-clearing

firms

using

Broadridge’s

service

bureau

for:

•Equity

(~80%)

•Fixed

Income (~15%)

World’s largest processor and provider of investor

communications with over one billion

communications processed annually:

Primary

business

unit

is

a

clear

market

leader

with

over

70%

of

Broadridge

revenues

and

pre-tax

earnings

Proxy

communications and vote processing and

interim

communications

(~65%)

Transaction

reporting

and

fulfillment

services

(~30%)

Other

(~5%)

Securities Processing

(2)

Only service provider offering service bureau and operations outsourcing

on a single multi-entity and multi-currency

platform (1) Based on financial guidance provided during

Broadridge’s May 10 2010 earnings release call. Segment financials do not include FX and other corporate expense

(2) Percentages represent revenue contribution within each reporting

segment (3) Based on SIFMA’s 2007-2008 Annual

Yearbook’s top member firm list ranked by capital. This top 10 list does not include the impact of the Lehman Brothers

(declared bankruptcy), Merrill Lynch (acquired by Bank of

America) and Bear Stearns (acquired by JP Morgan) transactions, all of which occurred in 2008 |

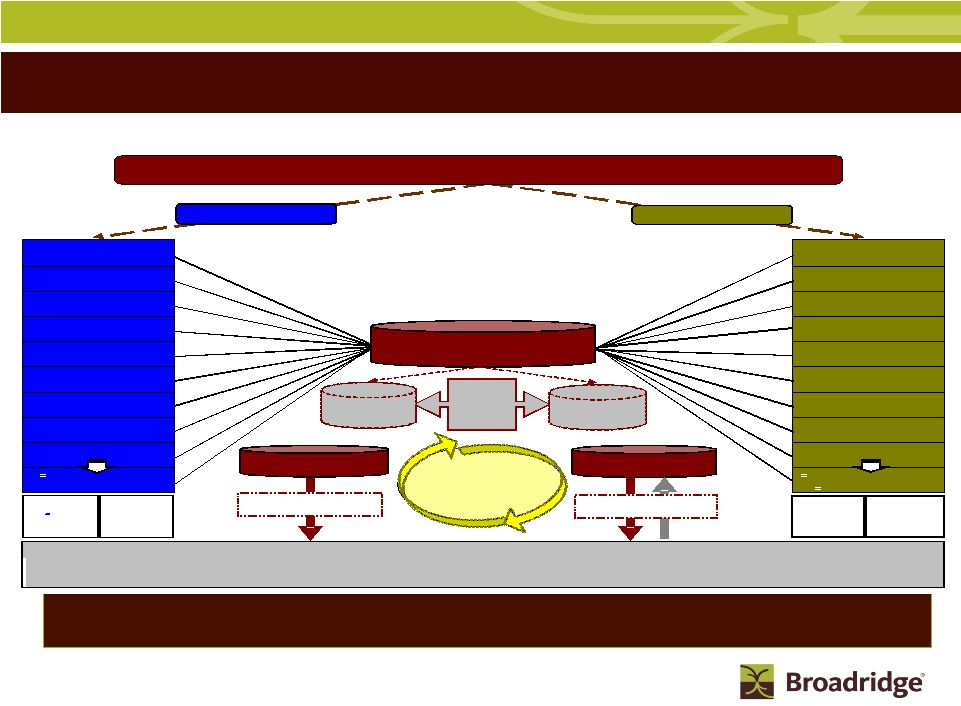

14

ICS Unique Business Systems Processing Model

Proxy and Interim processing system is the “plumbing”

supporting the voting

process for corporate governance

PROXY & INTERIMS PROCESSING OVERVIEW

"THE PLUMBING"

Broker/Bank 1

Issuer 1 / Fund 1

Broker/Bank 2

Issuer 2 / Fund 2

Broker/Bank 3

Issuer 3 / Fund 3

Broker/Bank 4

Issuer 4 / Fund 4

Broker/Bank 5

Issuer 5 / Fund 5

Broker/Bank 6

Issuer 6 / Fund 6

Broker/Bank 7

Issuer 7 / Fund 7

Broker/Bank 8

Issuer 8 / Fund 8

Broker/Bank 9

Issuer 9 / Fund 9

Brokers/Banks

800+

(1)

Issuers 10,000+

(3)

Funds 700+

(4)

ANNUAL CORPORATE ISSUER AND MUTUAL FUND EVENTS

Approximately 12,000 Events Per Year

(Annual Corporate Issuer Shareholder Meetings and Mutual Fund Proxy Meetings)

Proxy Distribution

Over 40% of

accounts

require

special

processing

Vote Processing

Managing

350M

active

positions

(2)

Majority of

all shares

are held in

street

-

side

Shareholder

Preferences

Database

Shareholder

Consent

Database

Equity and Mutual Fund Shareholders

Broadridge

manages

>1,500

Corporate

Issuers

Broadridge

processes on

average 70%

of U.S. shares

outstanding

Electronic or

Physical Vote Return

Data Hub and Platform

Electronic or

Physical Delivery

Street-side Processing

Registered Processing

> 50% of Hard Copy

Mailings Eliminated

via E

-

Delivery and

Suppressions

85% of Shares Voted

Electronically

BROADRIDGE

Proxy Processing System

Over 8 million lines of code and approximately 500,000 function points

Supported by 150+ dedicated programmers

(1)

Represents Broadridge’s estimated total number of brokerage firms

and banks in the U.S. and international markets

(2)

Represents Broadridge’s estimated total number of positions

managed by U.S. brokers and banks

(3)

Represents Broadridge’s estimated total number of corporate

issuers in the U.S. (4)

Represents total number of Fund Sponsors in the U.S. who

manage over 16,000 funds including Mutual Funds, Closed-end Funds, ETFs

and UITs, according to the Investment Company Institute’s 2009

Investment Company Year Book |

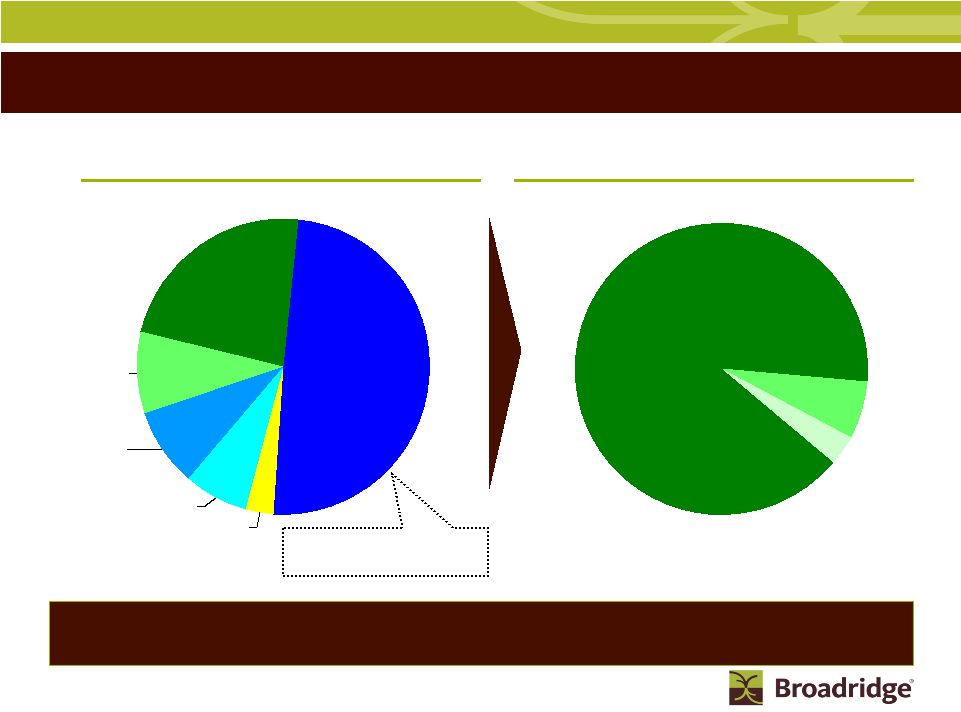

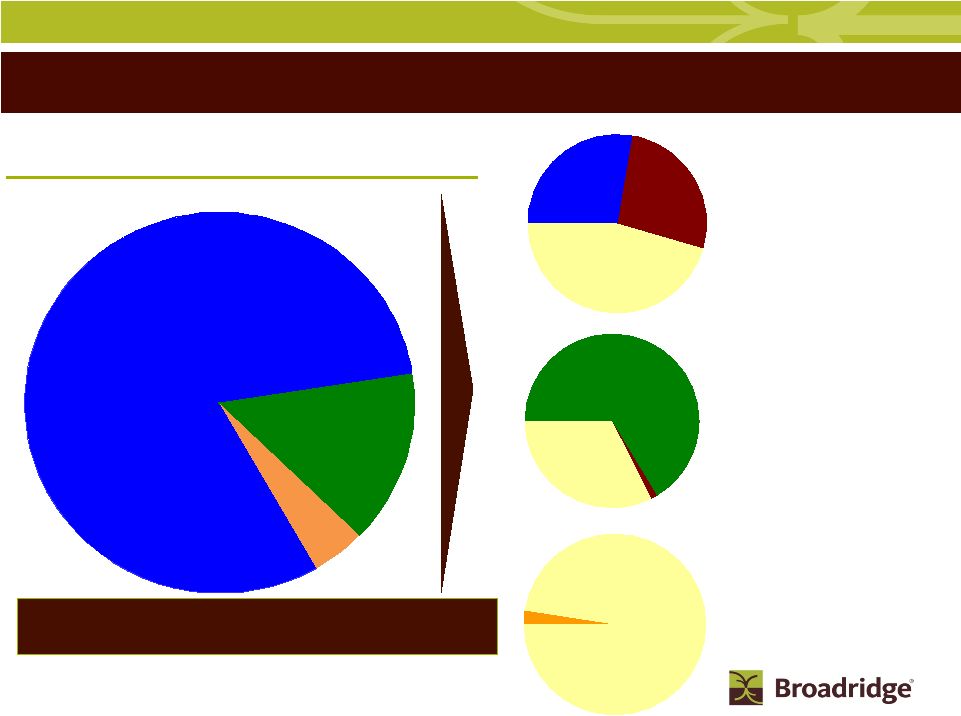

15

Distribution

$757M (49%)

Other

$46M (3%)

Fulfillment

$110M (7%)

Transaction

Reporting

$132M (9%)

Interims

$136M (9%)

Proxy

$350M (23%)

ICS FY09 Product Revenues

ICS Product and Client Revenue Overview:

We have a strong and diverse product

offering…

ICS is highly resilient due to our deep customer relationships with our

Bank/Broker-Dealer clients

Primarily

Postage

Increase in electronic

distribution reduces postage

revenue and increases profits

Bank/Broker-

Dealer

$1,383M

(90%)

Mutual Fund

$96M (6%)

Corporate

Issuer

$52M (4%)

ICS FY09 Client Revenues

…and we have deep and longstanding

client relationships |

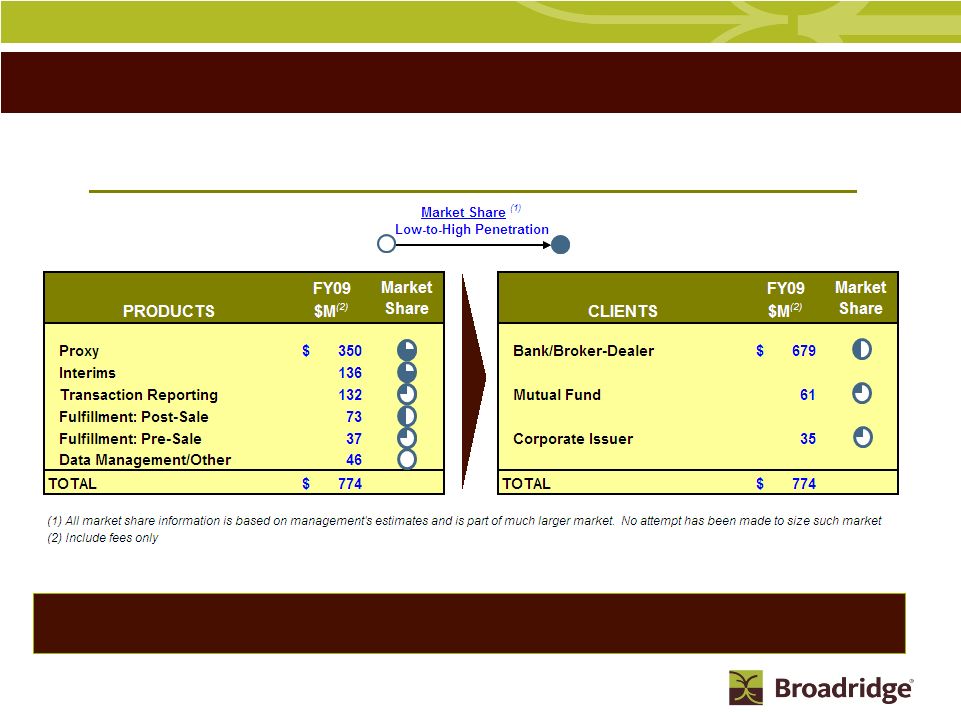

16

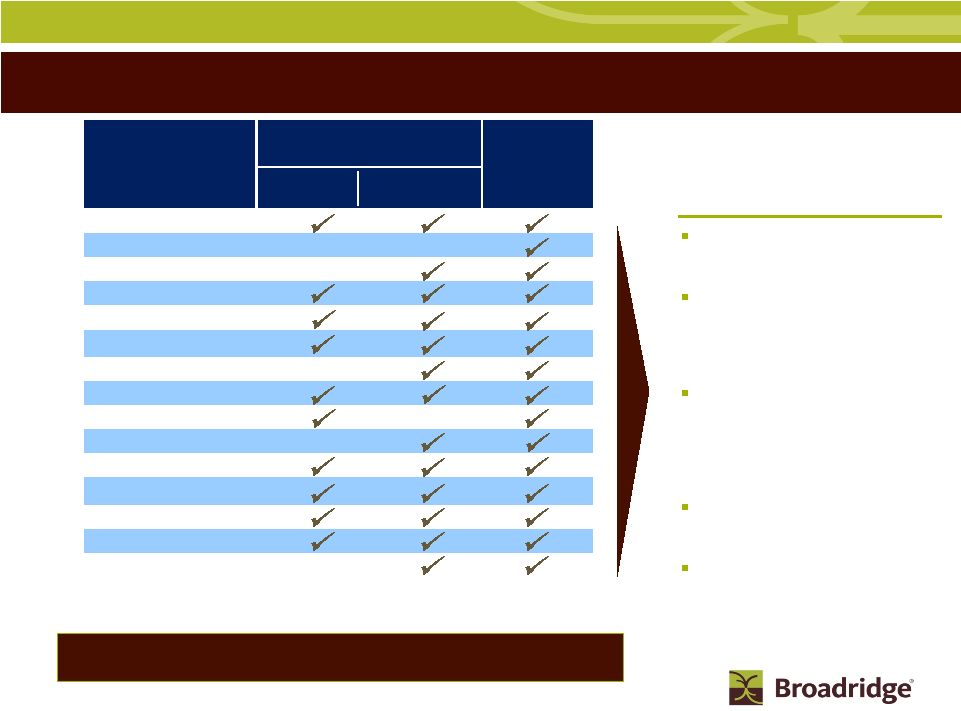

ICS Market Share Overview by Products and Markets

Product depth and relationships with Bank/Broker-Dealers provide high client

retention with large potential upside

We have deep penetration in our core business and clients, yet

large potential to grow market share |

17

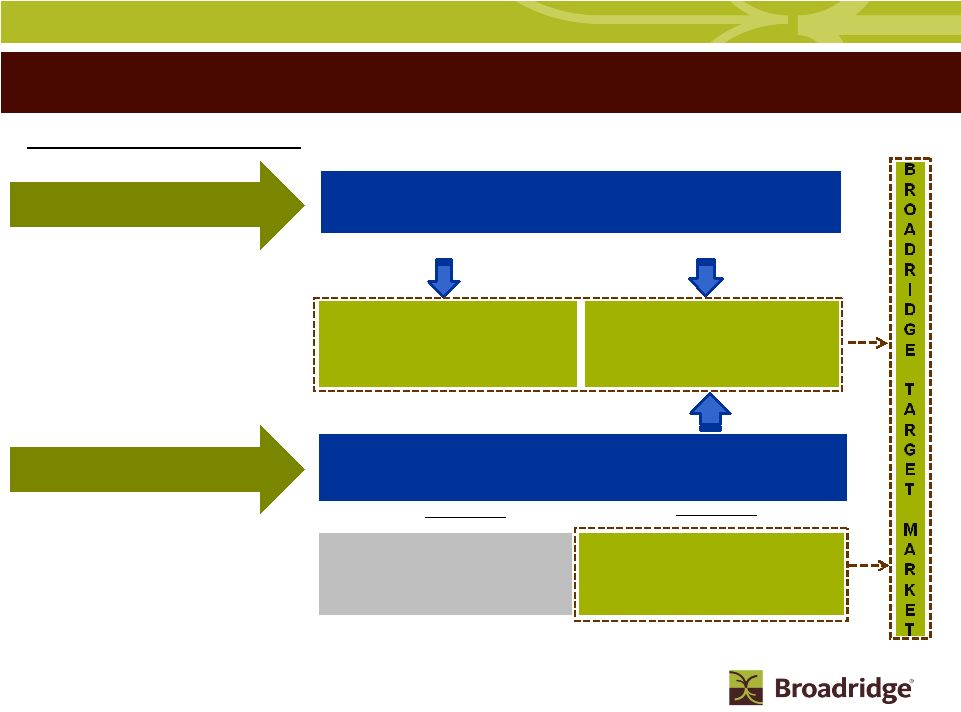

Securities Processing & Outsourcing –

Target Market Landscape

How Firms Clear Trades

Fully-Disclosed Broker/Dealer Firms

(Firms that clear their trades through another B/D firm that then clears through

DTC) Self-Clearing Broker-Dealer Firms

(Firms that clear trades directly through the DTC)

Trade Clearing Method #1

Traditional B/D Firms

•Primarily clear

trades for accounts that their firm manages

(e.g., Bank of America)

Clearing B/D Firms

•Primary

business is clearing trades for other B/D

firms (e.g., Penson/Pershing/Fidelity)

Firms that need the balance sheet of

another firm to operate and clear

(Small –

Medium Firms)

Firms that have the capital to be self-

clearing, but need the technology and

people expertise of another firm

(Medium –

Large Firms)

Type of Self-Clearing Firms

Firm Type #1

Firm Type #2

Trade Clearing Method #2 |

18

Broadridge -

Revenue Summary for Penson Transaction

We expect the Outsourcing business to be at scale at the completion of the Penson

conversion

Outsourcing Revenue

Related to client contracts sold

~$35-40M

Broadridge

Clearing & Outsourcing

After Penson Transaction

Penson

Existing

Outsourcing Revenue

~$25M

Acquired Revenue -

~ $75M

100+ Correspondents

Total Revenues Before Penson

~100M

Total Revenues After Penson

~$90-100M

Broadridge

Clearing & Outsourcing

Before Penson Transaction

BR Sells clearing

client contracts

New

Outsourcing Revenue

~$30-35M

Clearing Related Revenue

~ $75M

Outsourcing processing services

for Acquired Client Contracts

Outsourcing processing services

for Existing Penson Clients

Existing

Outsourcing Revenue

~$25M

Signs 10-Year

Outsourcing Contract

12-18 month

conversion

Starts at deal

closing |

19

SPS FY09 Product Revenues

High client retention rates (>95%)

with growth opportunity coming

from firms that perform

processing

in-house

•

BR market share represents

51% of firms that outsource

back-office processing

•

In-house processing firms

account for 40% of industry

total trade volume

•

In-house processing firms are

comprised of small to large

brokerage firms

Fixed-Income platform is the

industry standard

•

BR processes for 10 of the 18

primary dealers of fixed income

•

BR’s clients account for

approximately 66% of the Fixed-

Income trading volume

•

BR processes on average

approximately $3.5 trillion in

trades daily

BR is the only provider of Operations

Outsourcing for self-clearing firms

•

$1 Billion market potential is

based on U.S. self-clearing and

fully-disclosed firms

•

Revenue target of ~$90-100M

upon completion of the Penson

conversion in FY12

Securities Processing Market Share Overview (2)

M

A

R

K

E

T

S

H

A

R

E

Broadridge

is the platform of choice for

firms outsourcing their securities processing

Equity Processing

by # of Firms

(191 total)

Fixed Income

Annual trade volume

(226M)

Broadridge

53 (28%)

Competitors

51 (27%)

In-house

87 (45%)

Broadridge

150M (66%)

Competitors

2M (1%)

In-house

74M (33%)

Equity

(~81%)

Transactions, $260M

Non-transactions, $192M

Fixed Income

(~14%)

Transactions, $52M

Non-transactions, $29M

Outsourcing

(~5%)

$25M

We service 8 of the top 10 largest financial institutions

with

a

strong

potential

to

increase

market

share

(1)

Broadridge

$25M (2%)

Untapped

Market

~$1 Billion

(98%)

Outsourcing

Market

(~$1 Billion total)

(1) Based on SIFMA’s

2007-2008 Annual Yearbook ranked by capital. This top 10 list

included Lehman

Brothers (declared bankruptcy), Merrill Lynch (acquired by Bank of

America), and Bear Stearns (acquired by JP Morgan). All

transactions mentioned occurred during 2008 (2) All market share

information is based on management’s 2008 estimates and is part of much larger market. No

attempt has been made to size such market

|

20

Securities Processing Solutions Top 15 Clients

Broadridge

has faired well

during the recent industry

consolidations and financial

crisis

The top 15 SPS clients generate

approximately 70% of the SPS

segment’s revenues

11 of 15 top clients have multi-

years remaining under their

existing agreements; contract

extensions for additional clients

are in progress

Closed contract with Barclays to

handle new trade volume as

result of Lehman purchase and

executed direct contract with

Neuberger Berman for

processing

Closed contract with JP Morgan

for Bear Stearns fixed income

processing

Bank of America/Merrill Lynch

transaction resulted in loss of

equity processing business and

win of fixed income processing

business

SPS client relationships are stable in volatile market

Alliance Bernstein

Bank of America/Merrill Lynch*

Barclays Capital Services

BMO Nesbitt Burns

BNP Paribas

CIBC World Markets

Deutsche Bank

E*Trade Group

Edward Jones

HSBC Securities

J.P. Morgan Chase

Jefferies & Company

Royal Bank of Canada

Scotia Capital

UBS Securities

Note: The above schedule is an alphabetical listing of the top 15 SPS clients based

on FY09 revenues * Bank of America/Merrill Lynch includes loss of equity

processing business as previously disclosed Equity Processing

Fixed

Income

Processing

Retail

Institutional

Top

Clients |

21

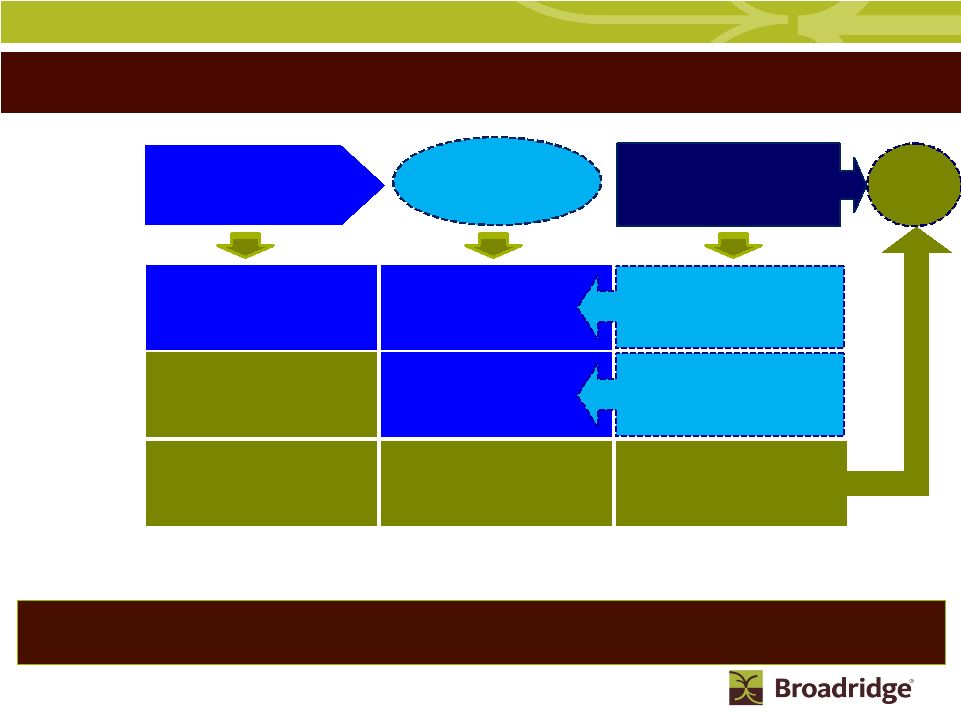

Business Expansion Strategy

Focused on core processing and communication businesses and making

investments in business that leverage these strong industry positions

Offer New

Solutions

Leverage

Industry

Position

Margin

Improvement

Foundation

Five Pillars

•

Improve world class

service scores for

every product every

year

•

Zero losses to

competition

•

Be “indispensable”

•

Increase total

sales year-over-

year

•

Increase existing

client penetration

•

Value

propositions with

“teeth”

•

Improve margins in all

products every year

Data center

Leverage

technology

Smart/Off-shoring

Strict financial

controls

Challenge the status

quo

•

Create (build or buy)

unique solutions

enabled by our heritage

Global outsourcing

Electronic delivery

solutions

Global proxy

Mutual Funds

Global Processing

Expansion

CULTURE

Trusting / Engaging / Accountable / Client-Centric / Committed /

Caring / Passionate/ Ethical “A Great Place to

Work” Vision

Be Indispensable!

Accelerate

Sales

•

More than 2 dozen new

products introduced since

spin-off

Virtual Shareholder

meeting

The Investor Network/

Shareholder Forum

Know-On-Pay

12b-1/ 22c-2 reporting

Compliance

Client On-boarding

Data aggregation/

analytics

Client

Retention

We enable the financial services industry

to achieve superior levels of performance through our passion to deliver

extraordinary value to our clients, shareholders, and associates

Successful execution of strategy is expected to accelerate average revenue growth forecast

from mid-single digits to high single-digits |

22

$352

$371

$347

$304

$275

FY09

FY08

FY07

FY06

FY05

Earnings Before Interest andTaxes

as adjusted

(1)(2)

($ in Millions)

`

Financial Performance is Driven by Recurring Revenues

Recurring

Revenues:

81%

81% 77%

78% 80%

Margins:

16.0%

15.7% 16.2% 16.8%

16.4%

$1,717

$2,149

$1,726

$1,724

$1,651

$1,565

$1,393

$423

$483

$487

$368

$324

FY09

FY08

FY07

FY06

FY05

Net Revenues

-

($ in Millions)

(1)

The comparison between the results of operations for fiscal 2006 and prior periods is affected by the

impact of our adoption of SFAS No.123R effective July 1, 2005. See the Selected

Financial Data table in our 2009 Annual Report on Form 10-K for additional information (2)

Earnings before provision for interest and income taxes, as adjusted, is a Non-GAAP

financial measure. In fiscal 2009, it excludes a one-time gain of $8.4 million on purchase

of senior notes. In fiscal 2008 and fiscal 2007, it excludes $13.7 million and $14.0 million,

respectively, of one-time transition expenses. We believe that this measure is useful

to investors because it excludes the impact of certain transactions or events that we expect to occur

infrequently in order to provide meaningful comparisons between current results and previously

reported results. Management, therefore, believes such Non-GAAP measure provides a useful means for evaluating Broadridge's comparative operating

performance

Note: Historical financials have not been adjusted for the pending disposition of the clearing

services business |

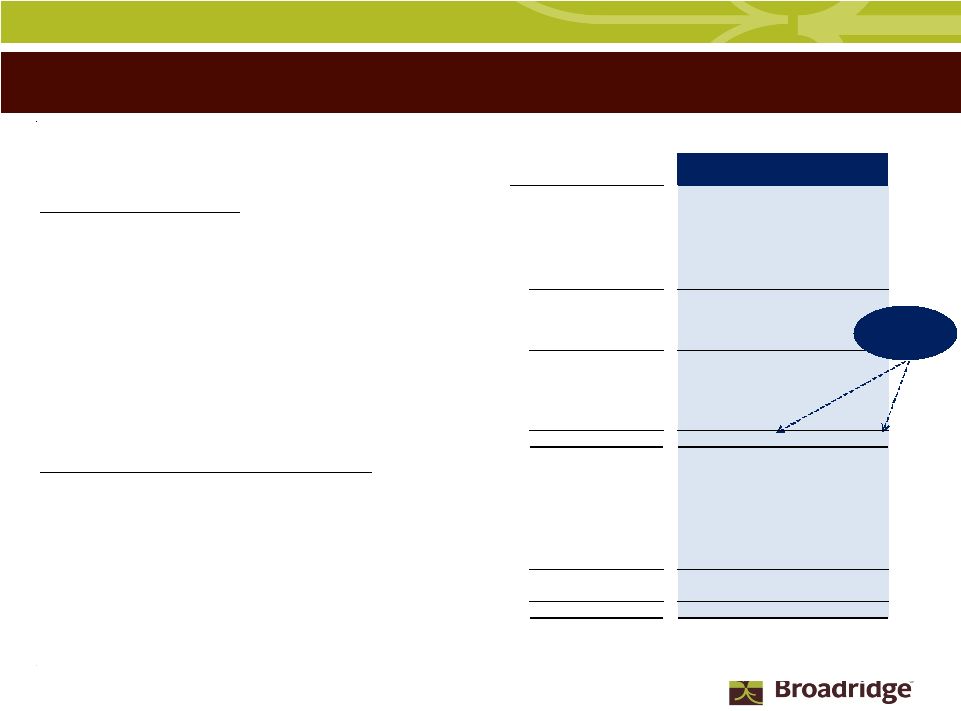

23

Broadridge

FY10 Guidance from Continuing Operations

(a) FY09 Actual Interest & Other reflects the effect of the one-time gain from the purchase of

the 6.125% Senior Notes of approximately $8M. (b) FY09 Actual Tax Rate of 35.5% is attributable

to the FY08 portion of the approved certification for a state tax credit program of $4M.

Excluding the one-time tax credit the FY09 Full Year tax rate would

be 36.7%. FY10 Low & High Ranges Tax Rates of 34.6% &

34.7% respectively is attributable to the release of a valuation allowance on a deferred tax asset relating to tax loss carryforwards of

approximately $8M. Excluding the year-to-date tax benefit the

FY10 Low & High Tax Rate would be 36.7% (c) FY09 Actual Diluted EPS Before 1-Times

(Non-GAAP) excludes the approximately $8M gain on purchase of $125M of Senior Notes (gain reflected in Interest & Other); $0.04 impact to EPS

and the FY08 portion of the approved certification for a state tax

credit program (gain reflected in Income Taxes); $0.03 impact to EPS.

FY10 Low & High Ranges Diluted EPS Before 1-Times (Non-GAAP)

of $1.52 & $1.58 respectively excludes the release of a valuation allowance on a deferred tax asset

relating to tax loss carryforwards of approximately $8M (gain reflected

in Income Taxes); $0.06 impact to EPS. Revenue

($ in millions)

EBIT

FY09

FY10 Range

FY09

FY10 Range

Actual

Low

High

Actual

Low

High

$1,531

$1,671

$1,688

ICS

$249

$279

$285

-3%

9%

10%

Growth % / Margin %

16.3%

16.7%

16.9%

$559

$531

$533

SPS

$134

$87

$94

5%

-5%

-5%

Growth % / Margin %

23.9%

16.4%

17.7%

$2,090

$2,202

$2,222

Total Segments

$383

$366

$379

-1%

5%

6%

Growth % / Margin %

18.3%

16.6%

17.1%

$1

$2

$2

Other

($29)

($18)

($23)

($18)

$4

$6

FX

*

($2)

($0)

$4

$2,073

$2,208

$2,230

Total Broadridge

$352

$348

$361

-3%

7%

7%

Growth % / Margin %

17.0%

15.8%

16.2%

Interest & Other

(a)

($6)

($11)

($11)

Closed Sales

Total EBT

$346

$337

$350

FY10 Range

Margin %

16.7%

15.3%

15.7%

Segments

Low

High

ICS

$125

$135

Income Taxes

($123)

($116)

($122)

SPS

$60

$70

Tax Rate

(b)

35.5%

34.6%

34.7%

Total

$185

$205

Total Net Earnings

$223

$220

$228

Margin %

10.8%

10.0%

10.3%

Diluted Shares

142

139

139

Diluted EPS (GAAP)

$1.58

$1.58

$1.64

Diluted EPS Before 1-Times (Non-GAAP)

(c)

$1.51

$1.52

$1.58

*

Includes impact of FX P&L Margin and FX Transaction Activity

|

24

Focused on Capital Stewardship and Long-Term Shareholder Value

Cash Level on

Balance Sheet

•

We expect to keep approximately $100M of cash on hand

Strong Predictable

FCF Allows for

Flexible Capital

Allocation

Options

•

Investing for organic growth

•

Tuck-in acquisitions to sustain organic growth expand product offering

•

Continue to grow dividend payout

•

Pursue stock repurchases to offset any dilution from equity compensation plan

and opportunistic repurchases versus scheduled steady repurchases

Manage to a

Debt to EBITDA

Ratio 1:1

Debt

Mid-single-digit

organic revenue

growth

•

Capitalize on fundamentals driving long-term market growth

•

Invest in and drive new sales of existing solutions

•

Rollout new solutions to enable client efficiencies and facilitate client

growth •

Capture the global securities processing opportunity

Improve Margins

•

Initiatives to sustain and drive continued efficiencies and enhance our

scalability Aim to invest through existing businesses and acquisitions to

generate mid to high single-digit revenue growth and return excess cash

to shareholders Maintain investment grade rating with rating agencies as this is important to our

large clients and

prospects |

25

Summary

Broadridge is a dependable mid-single-digit revenue grower

with a scalable business model providing opportunity for margin

expansion

We expect to continue to invest in our existing businesses and

execute strategic acquisitions to generate mid to high single-

digit average revenue growth

We expect to generate strong free cash flows and aim to return

cash to shareholders through dividends, repurchasing shares to

offset dilution and to opportunistically repurchase shares

|

26

Appendix

Appendix |

27

Penson

Update

Evolution of the Penson

Deal

FY09 Actual results to Continuing Operations GAAP

(1)

(2)

(3)

(4)

(5)

(6)

(7)

Pre-Penson

Transaction

-

Discontinued Operations

=

+

Penson

Phase 1

=

FY10 Proforma

+

Penson

Phase 2

=

FY12 Proforma

(FY09 Reported)

(FY09 GAAP)

(A)

(Subtotal)

Converting FY11

Q3 or Q4

(B)

Revenue

$100M

-

=

$25M

+

$30M

=

$55M

+

$25M -

$35M

=

$80M-$90M

($75M Clearing Related)

$75M Contracts Sold to

Penson

(Existing Outsourcing)

($25M Existing Outsourcing)

($25M Existing Outsourcing)

($30M Penson

Phase #1)

Expense

$110M

-

$75M Allocated Expenses

=

$35M

$35M

Note:

$25M

Expenses eliminated

$50M

Remaining expenses

$50M

$50M

to be re-allocated

once Penson

live

$75M

$35M

+

$50M

=

$85M

+

$5M

=

$90M

Operating Losses

($10M)

-

$0M

=

($10M)

+

($20M)

=

($30M)

+

$20M-$30M

=

($10M) -to-

($0M)

Continuing Operations

(B)

-

Phase

2

is

related

to

outsourcing

services

to

support

the

existing

Penson

clients

once

converted

onto

the

Broadridge

processing

platform.

As

a

result,

there

are

less

expenses

necessary

for

Penson

Phase

2.

Note: $ amounts have been rounded for illustrative purposes only

(A)

-

Phase

1

is

related

to

outsourcing

services

to

support

the

client

contracts

acquired

by

Penson

from

Broadridge.

Revenue

amount

originally

expected

to

be

$40M

was

reduced

due

primarily

to

loss

of

Neuberger

contract.

FY09 GAAP Continuing Operations to Fully Converted Penson Phases 1 & 2

|

28

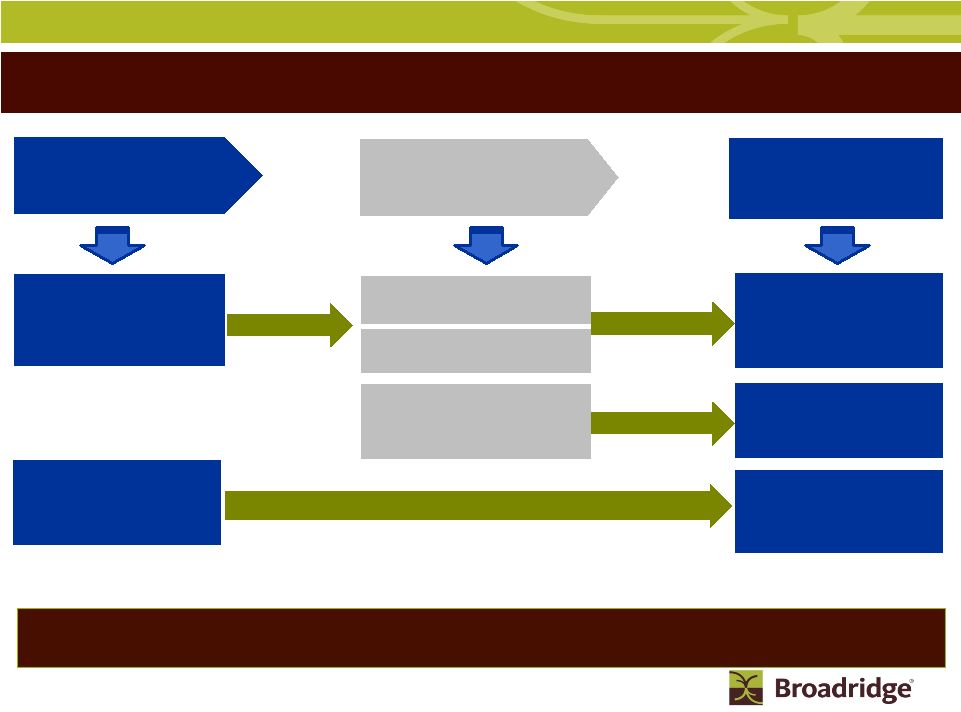

Securities Processing

Self-Clearing with

Service Bureau

Outsourcing

Self-Clearing with Ops.

Outsourcing & Service

Bureau

Broadridge’s Simplified Securities Processing Model

Clearing

Fully-Disclosed Clearing

Financing

Activities and

Compliance

Technology &

Data Center

Operational

Infrastructure

Client

Responsibility

Client

Responsibility

Client

Responsibility

Provided by

Broadridge

Provided by

Broadridge

Provided by

Broadridge

Provided by

Clearing Firm

(Previously provided by Ridge)

Target

Large

Broker-Dealer Firms

Large ~ Medium

Broker-Dealer Firms

Medium ~ Small

Broker-Dealer Firms

Outsourced to

Broadridge

(Previously provided by Ridge)

Outsourced to

Broadridge

(Previously provided by Ridge)

Third Party

Clearing

Clients

Outsourcing business has high growth potential and our simplified processing model

continues to allow us to serve the entire investment process

|

29

Free Cash Flow (Non-GAAP) –

YTD and FY10 Forecast

Unaudited

(In millions)

Low

High

Cash Flow -

Continuing Operations

Net earnings from continuing operations (GAAP)

109

$

220

$

228

$

Depreciation and amortization (includes other LT assets)

43

60

58

Stock-based compensation expense

21

30

28

Other

(16)

(15)

(10)

Subtotal

157

295

304

Working capital changes

21

(5)

8

Long-term assets & liabilities changes

3

-

3

Net cash flow provided by continuing operating activities

181

290

315

Cash Flows From Investing Activities

Capital expenditures & purchased intangibles

(29)

(55)

(45)

Free cash flow (Non-GAAP)

152

$

235

$

270

$

Cash Flows From Other Investing and Financing Activities

Acquisitions

(11)

(11)

(11)

Freed-up Clearing capital

(b)

10

210

240

Long-term debt repayment

-

-

-

Dividends paid

(48)

(67)

(67)

Other

5

5

5

Stock repurchases net of options proceeds

(103)

(103)

(103)

Net change in cash and cash equivalents

5

269

334

Cash and cash equivalents, at the beginning of year

173

173

173

Cash and cash equivalents, at the end of period

178

$

442

$

507

$

(a) Guidance does not include effect of any future acquisitions,

additional debt or share repurchases

(b) Assumes Penson

transaction will close in Q4 2010

March 2010

Nine Months Ended

FY10 Range

(a)

Free Cash Flow

$235-270M |

30

Historical Free Cash Flow Non-GAAP to GAAP Reconciliation

Reconciliation of Non-GAAP to GAAP Measures

Free Cash Flow

($ in millions)

(Unaudited)

FY06

FY07

FY08

FY09

Actual

Actual

Actual

Actual

Net cash flow provided by operating activities (GAAP)

426

$

161

$

482

$

359

$

Securities

clearing

activities

(a)

159

(128)

146

77

Net cash flow provided by operating activities, excluding

securities clearing activities

267

289

336

282

Capital expenditures & Intangibles

(41)

(38)

(46)

(30)

Discontinued

Operations

(b)

22

-

-

-

Free

cash

flow

(b)

248

$

251

$

290

$

252

$

(a) Cash and securities segregated for regulatory purposes, securities deposited

with clearing organizations and securities receivables and securities payables

(b)

FY06

excludes

loss

from

discontinued

operations

of

$14M,

net

of

income

taxes

and

include

proceeds

from

sale

of

businessess

of $8M |

31

Reconciliation of Non-GAAP to GAAP Measures

EBIT Reconciliation

FY09

FY10 Range

($ in millions)

Actual

Low

High

EBIT (Non-GAAP)

*

$352

$348

$361

Margin %

17.0%

15.8%

16.2%

Interest & Other

($6)

($11)

($11)

Total EBT (GAAP)

$346

$337

$350

Margin %

16.7%

15.3%

15.7%

EPS Reconciliation

Low

High

Diluted EPS from continuing operations (GAAP)

$1.58

$1.58

$1.64

Tax Restructuring

**

($0.07)

($0.06)

($0.06)

Diluted EPS before 1-Times (Non-GAAP)

$1.51

$1.52

$1.58

* Includes impact of FX Transaction Activity

** Includes one-time gain on purchase of Senior Notes and one-time state

tax credit benefit Free Cash Flow Reconciliation

(In millions)

Low

High

Net earnings from continuing operations (GAAP)

109

$

220

$

228

$

Depreciation and amortization (includes other LT assets)

43

60

58

Stock-based compensation expense

21

30

28

Other

(16)

(15)

(10)

Subtotal

157

295

304

Working capital changes

21

(5)

8

Long-term assets & liabilities changes

3

-

3

Net cash flow provided by continuing operating activities

181

290

315

Cash Flows From Investing Activities

Capital expenditures & purchased intangibles

(29)

(55)

(45)

Free cash flow (Non-GAAP)

152

$

235

$

270

$

March 2010

Nine Months Ended

FY10 Range |

32

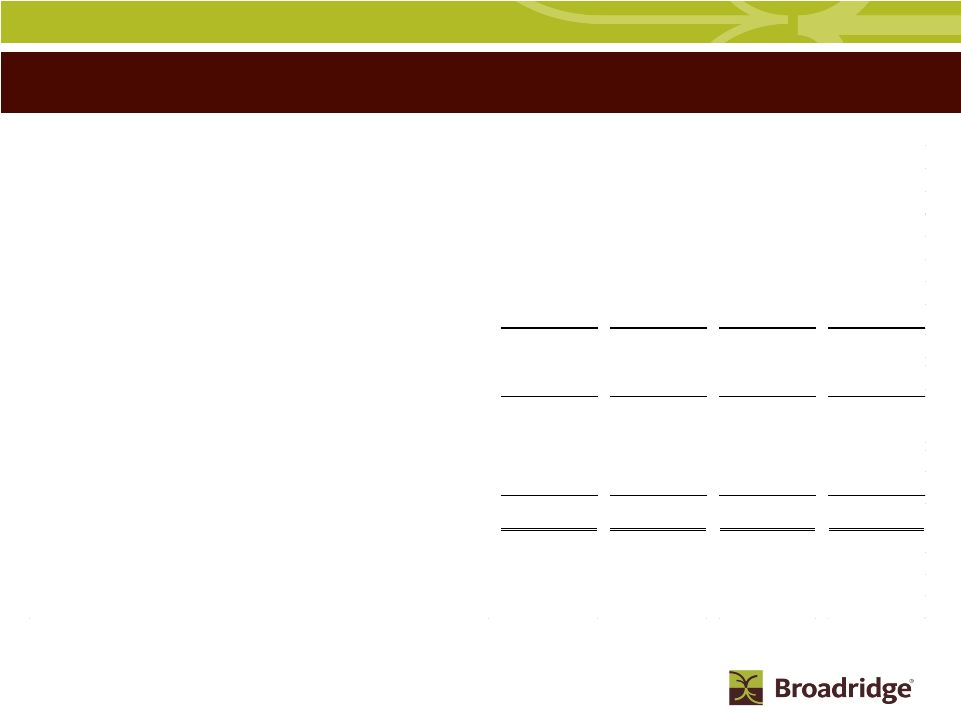

Closed Sales-To-Revenue Overview

General Conversion Time Frames

Closed Sales-to-Revenue Conversion

General Time Frames

Investor Communication Solutions

Registered Mutual Fund Sales

1 to 6 Months

Registered Equity Sales

Issuer's Next Annual Meeting

Transaction Reporting

(1)

and Fulfillment Sales

3 to 9 Months

Global Proxy Sales

1 to 6 Months

Securities Processing Solutions

Small Broker-Dealer Firms

3 to 6 Months

Mid-sized Broker-Dealer Firms

6 to 9 Months

Large Broker-Dealer Firms

9 to18+ Months

Outsourcing

Mid-sized Broker-Dealer Firms

6 to 9 Months

Large Broker-Dealer Firms

9 to18+ Months

(1) Transaction Reporting sales are comprised primarily of production of statements

and confirms Segment Sales Categories |

33

Broadridge

ICS Key Statistics

$ in millions

RC= Recurring

ED= Event-Driven

FY07

FY08

FY09

Type

Fee

Revenues

(1)

Proxy

Equities

227.0

$

256.0

$

268.4

$

RC

Stock Record Position Growth

0%

2%

-2%

Pieces

289.9

297.8

288.0

Mutual Funds

78.8

$

92.1

$

55.0

$

ED

Pieces

127.3

176.6

73.5

Contests/Specials

28.5

$

19.7

$

26.9

$

ED

Pieces

31.9

21.2

30.8

Total Proxy

334.3

$

367.8

$

350.3

$

Total Pieces

449.1

495.6

392.3

Notice and Access Opt-in %

NA

28%

50%

Suppression %

44%

49%

50%

Interims

Mutual Funds

(Annual/Semi-Annual Reports/Annual Prospectuses)

69.7

$

73.9

$

78.1

$

RC

Position Growth

9%

9%

4%

Pieces

366.3

401.1

440.5

Mutual Funds

(Supplemental Prospectuses) & Other

51.2

$

48.9

$

58.0

$

ED

Pieces

332.8

301.3

349.6

Total Interims

120.9

$

122.8

$

136.1

$

Total Pieces

699.1

702.4

790.1

Transaction

Transaction Reporting

129.6

$

124.7

$

132.0

$

RC

Reporting

Fulfillment

Post-Sale Fulfillment

59.9

$

70.4

$

72.9

$

RC

Pre-Sale Fulfillment

37.4

$

37.5

$

36.6

$

ED

Total Fulfillment

97.3

$

107.9

$

109.5

$

Other

Other

(2)

49.9

$

44.2

$

46.3

$

ED

Communications

Total Fee Revenues

732.0

$

767.4

$

774.2

$

Total Distribution Revenues

820.2

$

807.8

$

756.8

$

Total Revenues (Non-GAAP)

1,552.2

$

1,575.2

$

1,531.0

$

Transfer price adjustment

2.0

-

-

Total Revenues (GAAP)

1,554.2

$

1,575.2

$

1,531.0

$

Total RC Fees

486.3

$

525.0

$

551.4

$

Total ED Fees

245.7

$

242.4

$

222.8

$

(2) Other includes pieces of 18.6M for FY07, 12.6M for FY08 and 14.4M for FY09

primarily related to corporate actions (1) These items represent fee revenues

only and exclude distribution revenues which are set out separately. The historical numbers have been adjusted to

exclude distribution revenues |

34

Broadridge

SPS Key Statistics

$ in millions

RC= Recurring

ED= Event-Driven

FY07

FY08

FY09

Type

Equity

Transaction-Based

Equity Trades

262.9

$

261.5

$

260.4

$

RC

Trade Volume (Average Trades per Day in '000)

(1)(2)

1,454

1,559

1,648

Non-Transaction

Other Equity Services

172.9

$

177.2

$

191.7

$

RC

Total Equity

435.8

$

438.7

$

452.1

$

Fixed Income

Transaction-Based

Fixed Income Trades

45.2

$

51.1

$

52.3

$

RC

Trade Volume (Average Trades per Day in '000)

195

237

294

Non-Transaction

Other Fixed Income Services

22.9

$

24.6

$

29.4

$

RC

Total Fixed Income

68.1

$

75.7

$

81.7

$

Total Revenues (Non-GAAP)

503.9

$

514.4

$

533.8

$

Transfer price adjustment

6.0

-

-

Total Revenues (GAAP)

509.9

$

514.4

$

533.8

$

Outsourcing

Outsourcing

23.5

$

19.1

$

25.1

$

RC

# of Clients

4

5

6

Combined Revenues with Outsourcing (Non-GAAP)

533.4

$

533.5

$

558.9

$

(1) As of 1Q09, Equity Trade volume adjusted to exclude trades processed under

fixed priced contracts. Management believes excluding this trade

volume presents a stronger correlation between trade volume and Equity Trade revenue

(2)

As

of

2Q09,

Equity

Trade

volume

excluded

trades

per

day

for

Lehman

Brothers,

Inc.

to

reflect

the

loss

of

the

Lehman

business

and to

provide a better historical comparison |

35

Broadridge

ICS Definitions

Refers to the proxy services we provide in connection with annual stockholder meetings for publicly traded corporate issuers. Annual meetings of public

companies include shares held in "street name" (meaning that they are held of record by

brokers or banks, which in turn hold the shares on behalf of their clients, the ultimate

beneficial owners) and shares held in "registered name" (shares registered directly in the names of their owners).

Refers to the proxy services we provide for funds,

classes or trusts of an investment company. Open-ended mutual funds are not required to have

annual meetings. As a result, mutual fund proxy services provided to open-ended mutual funds

are driven by a "triggering event." These triggering events can be a change in

directors, fee structures, investment restrictions, or mergers of funds.

Refers to the proxy services we provide when a separate agenda is put forth

by one or more stockholders that is in opposition to the proposals presented by management of

the company which is separately distributed and tabulated from the company’s proxy materials.

Refers to the proxy services we provide in connection with stockholder meetings held outside of the

normal annual meeting cycle and are primarily drive by special events (e.g., mergers and

acquisitions in which the company being acquired is a public company and needs to solicit the approval of its stockholders).

Refers to the services we provide investment companies in connection with information they

are required by regulation to distribute periodically to their investors. These reports contain

pertinent information such as holdings, fund performance, and other required disclosure.

Refers primarily to information required to be provided by

mutual funds to supplement information previously provided in an annual mutual fund prospectus

(e.g., change in portfolio managers, closing funds or class of shares to investors, or restating or clarifying items in the original

prospectus). The events could occur at any time throughout the year.

Refers to communications provided by corporate issuers and investment companies to investors

including newsletters, notices, tax information, marketing materials and other information not

required to be distributed by regulation. Refers primarily to the printing and distribution of account statements, trade confirmations and tax

reporting documents to account holders, including electronic delivery and archival services.

Refers primarily to the distribution of prospectuses, offering documents,

and required regulatory disclosure information to investors in connection with purchases of

securities. Refers to the distribution of marketing

literature, welcome kits, enrollment kits, and investor information to prospective investors, existing

stockholders and other targeted recipients on behalf of broker-dealers, mutual fund companies and

401(k) administrators. Refers to the services we provide in connection with the distribution of communications material not

included in the above definitions such as non-objecting beneficial owner (NOBO) lists, and

corporate actions such as mergers, acquisitions, and tender offer transactions.

Proxy

Equities –

Mutual Funds –

Contests –

Specials –

Mutual Funds (Annual/Semi-Annual Reports/Annual Prospectus) –

Interims

Mutual Funds (Supplemental Prospectus) –

Other –

Transaction Reporting

Fulfillment

Transaction Reporting –

Post-Sale Fulfillment –

Pre-Sale Fulfillment –

Other –

Other Communications |